|

|

市場調査レポート

商品コード

1408627

栄養補助食品添加剤の世界市場:製品由来別、調製別、機能性別、最終製品別、製剤別、機能性用途別、地域別-2028年までの予測Nutraceutical Excipients Market by Product Source (Organic Chemicals, Inorganic Chemicals), Functionality (Binders, Colorants, Flavors & Sweeteners), End Product, Formulation, Functionality Application and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 栄養補助食品添加剤の世界市場:製品由来別、調製別、機能性別、最終製品別、製剤別、機能性用途別、地域別-2028年までの予測 |

|

出版日: 2024年01月08日

発行: MarketsandMarkets

ページ情報: 英文 379 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 対象単位 | 金額(米ドル)、数量(キロトン) |

| セグメント別 | 機能性別、製品由来別、調製別、機能性用途別、最終製品別、地域別 |

| 対象地域 | 北米、南米、欧州、アジア太平洋、RoW |

世界の栄養補助食品添加剤の市場規模は、2023年に42億米ドルとなりました。

同市場は、2028年には61億米ドルに達すると予測されており、予測期間中のCAGRは7.7%になると見込まれています。栄養補助食品添加剤のカスタマイズは増加傾向にあり、独自の調製ニーズに応えています。企業は技術革新を進め、様々な用途に適した添加剤を生み出しており、メーカーは多様な消費者の要求に合わせた栄養補助食品を製造できるようになっています。添加剤技術の絶え間ない進歩は、特定の機能性が求められる特殊な添加剤の開発を促進しています。市場の需要は、溶解性の向上、味覚マスキングの改善、放出制御、優れた吸収率を持つ添加剤に集中しており、市場の拡大に拍車をかけています。

養補助食品添加剤市場はパーソナライゼーションの動向の高まりを目の当たりにしており、消費者は個々の健康ニーズや嗜好に沿ったオーダーメイドの製品を求めるようになっています。個別化された栄養補助食品への志向の高まりは、特定の調製に適応できるカスタマイズされた添加剤への需要に拍車をかけています。このようなカスタマイズされた添加剤は、調製メーカーが多用途のサプリメントや機能性食品を作る上で極めて重要であり、投与量、放出メカニズム、標的栄養素の送達に柔軟性を提供します。これらの添加剤は、独自の健康懸念に対処するため、あるいは消費者の嗜好に沿うよう精密に調整された製品の開発を可能にし、最終製品の有効性と魅力を高める。パーソナライゼーションに向けたこの進化は、栄養補助食品業界におけるカスタマイズされた健康ソリューションの重要性を強調しており、目の肥えた消費者の間で個別化されたウェルネス・アプローチへの要望を反映しています。

栄養補助食品添加剤の機能性カテゴリーにおける結合剤のセグメントは、錠剤の溶出特性を制御する極めて重要な役割のため、2番目に大きなセグメントとして浮上しています。この制御は、錠剤が消化器官内で有効成分をどのように分散・送達するかに影響し、栄養補助食品製品のバイオアベイラビリティと有効性に直接影響します。結合剤は調製において汎用性があるため、即時放出や徐放など、さまざまな放出プロファイルの錠剤を製造することができ、多様な有効成分に対応することができます。さらに、結合剤は錠剤の安定性に大きく寄与し、早期の崩壊や破損を防ぐことで、錠剤の構造的完全性を確保します。

栄養補助食品添加剤市場の機能性用途セグメントにおいて、徐放性添加剤が主導的な地位を占めているのは、栄養補助食品調製内の有効成分の放出を複雑に制御する能力に起因しています。この制御により、徐放性、遅延性、または標的放出を含むカスタマイズされた放出プロファイルが容易になり、それによって体内での制御された一貫した栄養送達が保証されます。さらに、これらの添加剤は、有効成分の制御された効率的な放出を組織化することによって栄養素の生物学的利用能を最適化し、最終的に栄養素の体内吸収と利用を高める。有効成分の持続的かつ安定的な放出を促進するその役割は、栄養補助食品の有効性を高めることに大きく貢献しています。この持続的な送達は、体内の栄養素レベルを最適に維持し、優れた健康成果を促進し、栄養補助食品添加剤の機能性用途カテゴリーにおける最重要セグメントとしての地位を確固たるものにしています。

欧州の人々の健康志向の高まりは、正確な健康上の利点を提供する機能性食品や栄養補助食品に対する需要の拡大を促進しています。欧州の人口のかなりの部分が50歳以上の高齢者であり、慢性疾患にかかりやすいことから、予防と治療の両方の目的で栄養補助食品への関心が高まっています。研究開発の継続的な進歩により、機能性の向上、生物学的利用能の強化、標的栄養素の送達を特徴とする革新的な添加剤が出現しています。こうした進歩は、消費者にとっての栄養補助食品の有効性と魅力を高めています。さらに、養補助食品添加剤市場におけるパーソナライゼーションの動向は激化しています。消費者は、特定のニーズや嗜好に沿ったオーダーメイドの製品を積極的に求めており、個別の調製に適応するカスタマイズ可能な添加剤に対する需要の高まりを促しています。

当レポートでは、世界の栄養補助食品添加剤市場について調査し、製品由来別、調製別、機能性別、最終製品別、製剤別、機能性用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

第6章 業界の動向

- イントロダクション

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- 価格分析

- 特許分析

- 生態系/市場マップ

- 貿易シナリオ

- 2023年から2024年の主要な会議とイベント

- 関税と規制状況

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

第7章 養補助食品添加剤市場、製品由来別

- イントロダクション

- 有機化学薬品

- 無機化学薬品

- その他

第8章 養補助食品添加剤市場、最終製品別

- イントロダクション

- プロバイオティクス

- プレバイオティクス

- タンパク質とアミノ酸

- ビタミン

- ミネラル

- オメガ3脂肪酸

- その他

第9章 養補助食品添加剤市場、調製別

- イントロダクション

- ドライ

- 液体

- その他

第10章 養補助食品添加剤市場、機能性別

- イントロダクション

- 結合剤

- 充填剤と希釈剤

- 崩壊剤

- コーティング剤

- 香料および甘味料

- 防腐剤

- 潤滑剤と流動促進剤

- 懸濁剤および増粘剤

- 着色剤

- 乳化剤

- その他

第11章 養補助食品添加剤市場、用途別

- イントロダクション

- 味のマスキング

- 安定化

- 放出調節

- 溶解性と生物学的利用能の向上

- その他

第12章 養補助食品添加剤市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 南米

- その他の地域

第13章 競合情勢

- 概要

- 市場シェア分析

- 主要参入企業の戦略/秘策

- 収益分析

- 主要企業の年間収益VS.成長

- 主要企業のEBIT/EBITDA

- 主要な市場参入企業の世界スナップショット

- 企業評価マトリックス(主要企業)

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ

第14章 企業プロファイル

- 主要参入企業

- INTERNATIONAL FLAVORS & FRAGRANCES INC

- KERRY GROUP PLC

- INGREDION

- SENSIENT TECHNOLOGIES CORPORATION

- ASSOCIATED BRITISH FOODS PLC

- BASF SE

- ROQUETTE FRERES

- MEGGLE GROUP GMBH

- CARGILL, INCORPORATED

- ASHLAND

- AZELIS GROUP

- IMCD

- HILMAR CHEESE COMPANY, INC.

- SEPPIC

- BIOGRUND GMBH

- その他の企業

- INNOPHOS

- DAICEL CORPORATION

- ALSIANO A/S

- JRS PHARMA

- COLORCON

- PANCHAMRUT CHEMICALS

- OMYA

- GATTEFOSSE

- FUJI CHEMICAL INDUSTRIES CO., LTD

- JIGS CHEMICAL

第15章 隣接市場および関連市場

第16章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD), volume (KT) |

| Segments | By Functionality, Product Source, Formulation, Functionality Application, End Product, and Region |

| Regions covered | North America, South America, Europe, Asia Pacific, and RoW |

The global market for nutraceutical excipients is estimated at USD 4.2 billion in 2023 and is projected to reach USD 6.1 billion by 2028, at a CAGR of 7.7% during the forecast period. Customization of nutraceutical excipients is on the rise, meeting unique formulation needs. Companies are innovating, creating excipients suited for varied applications, enabling manufacturers to craft tailored nutraceuticals for diverse consumer requirements. Continuous advancements in excipient technologies are facilitating the development of specialized excipients, sought after for specific functionalities. The market demand focuses on excipients with enhanced solubility, improved taste-masking, controlled release, and superior absorption rates, fueling market expansion.

"The growing trend of personalization will propel the nutraceutical excipients market forward."

The nutraceutical market is witnessing a surge in the trend of personalization, wherein consumers increasingly seek tailored products aligning with their individual health needs and preferences. This growing inclination towards personalized nutraceuticals has spurred a demand for customized excipients capable of adapting to specific formulations. These tailored excipients are pivotal in allowing formulators to create versatile supplements or functional foods, offering flexibility in dosage, release mechanisms, and targeted nutrient delivery. They enable the development of products precisely tailored to address unique health concerns or align with the preferences of consumers, thereby elevating the effectiveness and attractiveness of the final product. This evolution towards personalization underscores the importance of customized health solutions in the nutraceutical industry, reflecting the desire for individualized wellness approaches among discerning consumers.

"In 2022, binders stood as the second-largest segment within the by functionality of nutraceutical excipients. "

The segment of binders in the functionality category of nutraceutical excipients emerges as the second largest due to its pivotal role in controlling the tablet's dissolution properties. This control influences how the tablet disperses and delivers active ingredients within the digestive system, directly impacting the bioavailability and efficacy of the nutraceutical product. Binders' versatile nature in formulations allows for crafting tablets with varying release profiles, be it immediate or sustained release, accommodating a diverse range of active ingredients. Additionally, binders significantly contribute to tablet stability, preventing premature disintegration or breakage, thereby ensuring the tablet's structural integrity, a critical factor influencing its shelf life and effectiveness.

"Within the functionality application segment, modified-release segment holds the most substantial share."

The leading position of modified-release excipients in the functionality application segment of the nutraceutical excipients market is attributed to their ability to intricately regulate the release of active ingredients within nutraceutical formulations. This control facilitates customized release profiles, encompassing sustained, delayed, or targeted release, thereby ensuring a controlled and consistent nutrient delivery in the body. Furthermore, these excipients optimize the bioavailability of nutrients by orchestrating a controlled and efficient release of active ingredients, ultimately enhancing the body's absorption and utilization of nutrients. Their role in facilitating a sustained and steady release of active ingredients significantly contributes to bolstering the effectiveness of nutraceuticals. This sustained delivery maintains optimal nutrient levels in the body, promoting superior health outcomes and solidifying their position as the foremost segment within the functionality application category of nutraceutical excipients.

"The nutraceutical excipients market in Europe is anticipated to maintain consistent growth throughout the forecast period."

Growing health consciousness among Europeans is driving an escalating demand for functional foods and dietary supplements offering precise health advantages. With a substantial portion of the European population aged over 50, prone to chronic ailments, there's an increased inclination towards nutraceuticals for both preventive and therapeutic purposes. Ongoing advancements in research and development efforts are resulting in the emergence of innovative excipients characterized by improved functionality, enhanced bioavailability, and targeted nutrient delivery. These advancements are amplifying the effectiveness and attractiveness of nutraceuticals to consumers. Moreover, the surge in the personalization trend within the nutraceutical market is intensifying. Consumers are actively seeking tailored products aligned with their specific needs and preferences, prompting a heightened demand for customizable excipients adaptable to distinct formulations.

The Break-up of Primaries:

By Value Chain: Manufacturers - 80%, Suppliers - 20%

By Designation: CXOs - 44%, Managers - 34%, Executives - 22%

By Region: North America - 35%, Europe - 30%, APAC - 20%, South America - 10%, RoW - 5%

Research Coverage:

The report segments the nutraceutical excipients market based on formulation, functionality, functionality application, product source, end product, and region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the nutraceutical excipients market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, services; key strategies; Contracts, partnerships, and agreements. new product launches, mergers and acquisitions, and recent developments associated with the nutraceutical excipients market. Competitive analysis of upcoming startups in the nutraceutical excipients market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall nutraceutical excipients market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities. The report provides insights on the following pointers:

- Analysis of key drivers (Increased focus on preventive care is encouraging investments in products/solutions, which, in turn, is driving the demand for nutraceutical excipients, advancements in nanotechnology equipped with new features to drive the growth of the nutraceutical excipients market, rise in demand for fortified food products due to the increase in health consciousness among consumers, and introduction of mandates on food fortification by government organizations), restraints (Decrease in returns on R&D investments and high costs of clinical trials and registration) opportunities (High use of excipients with multifunctional properties is witnessed as an emerging trend among key players), and challenges (Consumer skepticism associated with nutraceutical products due to rural and semi-urban consumer perception on dietary supplements as pharmaceutical drugs and their false claims).

- Product Development/Innovation: Detailed insights on, research & development activities, and new product launches in the nutraceutical excipients market

- Market Development: Comprehensive information about lucrative markets - the report analyses the nutraceutical excipients market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the nutraceutical excipients market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like International Flavors & Fragrances Inc (US), Kerry Group plc (Ireland), Ingredion (US), Sensient Technologies Corporation (US), Associated British Foods plc (UK), BASF SE (Germany), Roquette Freres (France), MEGGLE GmbH & Co. KG (Germany), Cargill, Incorporated (US), Ashland (US), IMCD (Netherlands), Hilmar Cheese Company, Inc (US), Air Liquide (France), Azelis Group (Luxembourg), Biogrund GmbH (Germany), Innophos (US), JRS PHARMA (Germany), Omya AG (Switzerland), Daicel Corporation (Japan), Alsiano A/S (Denmark), Colorcon (US), Fuji Chemical Industries Co., Ltd (Japan), Jigs Chemical (India), Panchamrut Chemicals (India), and GATTEFOSSE (France) among others in the nutraceutical excipients market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.1.1 MARKET DEFINITION

- 1.2 MARKET SCOPE

- 1.2.1 MARKET SEGMENTATION

- FIGURE 1 NUTRACEUTICAL EXCIPIENTS MARKET SEGMENTATION

- 1.2.2 INCLUSIONS & EXCLUSIONS

- TABLE 1 NUTRACEUTICAL EXCIPIENTS MARKET: INCLUSIONS & EXCLUSIONS

- 1.2.3 REGIONS COVERED

- 1.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES CONSIDERED, 2019-2022

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 RECESSION IMPACT ANALYSIS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 NUTRACEUTICAL EXCIPIENTS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key insights from industry experts

- 2.1.2.3 Breakdown of primary profiles

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 BOTTOM-UP APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 5 DATA TRIANGULATION AND MARKET BREAKUP

- 2.4 ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS & ASSOCIATED RISKS

- 2.6 RECESSION IMPACT ANALYSIS

- 2.7 RECESSION MACRO-INDICATORS

- FIGURE 6 RECESSION MACRO-INDICATORS

- FIGURE 7 GLOBAL INFLATION RATE, 2011-2022

- FIGURE 8 GLOBAL GDP, 2011-2022 (USD TRILLION)

- FIGURE 9 RECESSION INDICATORS AND THEIR IMPACT ON NUTRACEUTICAL EXCIPIENTS MARKET

- FIGURE 10 GLOBAL NUTRACEUTICAL EXCIPIENTS MARKET: EARLIER FORECAST VS. RECESSION FORECAST

3 EXECUTIVE SUMMARY

- TABLE 3 NUTRACEUTICAL EXCIPIENTS MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 11 NUTRACEUTICAL EXCIPIENTS MARKET, BY PRODUCT SOURCE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 NUTRACEUTICAL EXCIPIENTS MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 BRIEF OVERVIEW OF NUTRACEUTICAL EXCIPIENTS MARKET

- FIGURE 17 HEALTH-CONSCIOUS CONSUMERS, PREVENTIVE HEALTHCARE, AND PERSONALIZED NUTRITION TRENDS TO DRIVE MARKET GROWTH

- 4.2 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY AND KEY COUNTRY

- FIGURE 18 COATING AGENTS ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICAN NUTRACEUTICAL EXCIPIENTS MARKET IN 2022

- 4.3 NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION

- FIGURE 19 NORTH AMERICA TO DOMINATE NUTRACEUTICAL EXCIPIENTS MARKET FROM 2023 TO 2028 (USD MILLION)

- 4.4 NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION

- FIGURE 20 DRY SEGMENT ESTIMATED TO BE LARGEST THROUGHOUT FORECAST PERIOD (USD MILLION)

- 4.5 NUTRACEUTICAL EXCIPIENTS MARKET, BY PRODUCT SOURCE

- FIGURE 21 ORGANIC CHEMICALS TO BE LARGEST SEGMENT DURING FORECAST PERIOD (USD MILLION)

- 4.6 NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION

- FIGURE 22 MODIFIED RELEASE TO HOLD LARGEST SHARE IN NUTRACEUTICAL EXCIPIENTS MARKET DURING FORECAST PERIOD (USD MILLION)

- 4.7 NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT

- FIGURE 23 PROBIOTICS TO BE LARGEST SEGMENT DURING FORECAST PERIOD (USD MILLION)

- FIGURE 24 CHINA, INDIA, AND SOUTH KOREA TO GROW AT HIGH RATES DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 GLOBAL POPULATION WITNESSING HIGH PREVALENCE OF OBESITY

- 5.2.2 AGING POPULATION BECOMING MORE AWARE OF BENEFITS OF NUTRACEUTICALS

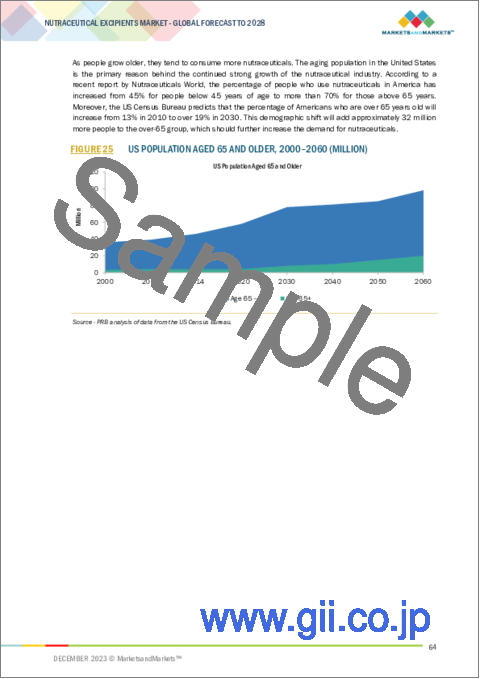

- FIGURE 25 US POPULATION AGED 65 AND OLDER, 2000-2060 (MILLION)

- 5.3 MARKET DYNAMICS

- FIGURE 26 NUTRACEUTICAL EXCIPIENTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.3.1 DRIVERS

- 5.3.1.1 Increased focus on preventive care to encourage investments in products/solutions

- FIGURE 27 NUMBER OF AMERICANS WITH CHRONIC CONDITIONS

- 5.3.1.2 Advancements in nanotechnology equipped with new features relating to nutraceutical excipients

- 5.3.1.3 Rise in demand for fortified food products due to increased health consciousness

- 5.3.1.4 Mandates on food fortification by government organizations

- TABLE 4 PREVALENCE OF THREE MAJOR MICRONUTRIENT DEFICIENCIES, BY REGION

- 5.3.2 RESTRAINTS

- 5.3.2.1 Decrease in returns on R&D investments and high costs of clinical trials and registration

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Multi-functionalities of excipients aiding in saving costs and processing time

- 5.3.3.2 Rising awareness of micronutrient deficiencies

- 5.3.4 CHALLENGES

- 5.3.4.1 Consumer skepticism associated with nutraceutical products due to rural and semi-urban consumers' perception of dietary supplements as pharmaceutical drugs

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- FIGURE 28 NUTRACEUTICAL EXCIPIENTS MARKET: VALUE CHAIN ANALYSIS

- 6.2.1 SOURCING OF RAW MATERIALS

- 6.2.2 MANUFACTURING

- 6.2.3 DISTRIBUTION, MARKETING, AND SALES

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 29 REVENUE SHIFT FOR NUTRACEUTICAL EXCIPIENTS MARKET

- 6.4 TECHNOLOGY ANALYSIS

- 6.4.1 FOOD MICROENCAPSULATION

- 6.4.1.1 Encapsulation of omega-3 to mask odor

- 6.4.2 INNOVATIVE AND DISRUPTIVE TECH

- 6.4.2.1 Robotics as key technological trend to lead to innovations

- 6.4.2.2 3D printing to uplift future of nutraceutical excipients market with high-end products

- 6.4.1 FOOD MICROENCAPSULATION

- 6.5 PRICING ANALYSIS

- FIGURE 30 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END PRODUCT, 2019-2022 (USD/TON)

- TABLE 5 NORTH AMERICA: AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END PRODUCT, 2018-2022 (USD/TON)

- TABLE 6 EUROPE: AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END PRODUCT, 2018-2022 (USD/TON)

- TABLE 7 ASIA PACIFIC: AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END PRODUCT, 2018-2022 (USD/TON)

- TABLE 8 SOUTH AMERICA: AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END PRODUCT, 2018-2022 (USD/TON)

- TABLE 9 ROW: AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END PRODUCT, 2018-2022 (USD/TON)

- 6.6 PATENT ANALYSIS

- FIGURE 31 LIST OF MAJOR PATENTS GRANTED FOR NUTRACEUTICAL EXCIPIENTS

- FIGURE 32 REGIONAL ANALYSIS OF PATENTS GRANTED FOR NUTRACEUTICAL EXCIPIENTS MARKET, 2012-2022

- 6.6.1 LIST OF MAJOR PATENTS

- 6.7 ECOSYSTEM/MARKET MAP

- 6.7.1 UPSTREAM

- 6.7.1.1 Excipient Manufacturers

- 6.7.1.2 Technology Providers

- 6.7.2 DOWNSTREAM

- 6.7.2.1 Regulatory Bodies

- 6.7.2.2 Nutraceutical Manufacturers

- FIGURE 33 NUTRACEUTICAL EXCIPIENTS MARKET: ECOSYSTEM

- TABLE 10 NUTRACEUTICAL EXCIPIENTS MARKET: ECOSYSTEM

- 6.7.1 UPSTREAM

- 6.8 TRADE SCENARIO

- TABLE 11 IMPORT DATA OF VITAMINS FOR KEY COUNTRIES, 2022 (VALUE & VOLUME)

- TABLE 12 EXPORT DATA OF VITAMINS FOR KEY COUNTRIES, 2022 (VALUE & VOLUME)

- TABLE 13 IMPORT DATA OF AMINO ACIDS FOR KEY COUNTRIES, 2022 (VALUE & VOLUME)

- TABLE 14 EXPORT DATA OF AMINO ACIDS FOR KEY COUNTRIES, 2022 (VALUE & VOLUME)

- 6.9 KEY CONFERENCES & EVENTS, 2023-2024

- TABLE 15 NUTRACEUTICAL EXCIPIENTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS, 2023-2024

- 6.10 TARIFF AND REGULATORY LANDSCAPE

- 6.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10.2 REGULATORY FRAMEWORK

- 6.10.2.1 ORGANIZATIONS/REGULATIONS GOVERNING NUTRACEUTICAL EXCIPIENTS MARKET

- TABLE 21 DEFINITIONS & REGULATIONS FOR NUTRACEUTICAL EXCIPIENTS WORLDWIDE

- 6.10.2.2 North America

- 6.10.2.2.1 Canada

- 6.10.2.2.2 US

- 6.10.2.2.3 Mexico

- 6.10.2.3 European Union (EU)

- 6.10.2.4 Asia Pacific

- 6.10.2.4.1 Japan

- 6.10.2.4.2 China

- 6.10.2.4.3 India

- 6.10.2.4.4 Australia & New Zealand

- 6.10.2.5 Rest of the World (RoW)

- 6.10.2.5.1 Israel

- 6.10.2.5.2 Brazil

- 6.10.2.6 Probiotics

- 6.10.2.6.1 Introduction

- 6.10.2.6.2 National/International bodies for safety standards and regulations

- 6.10.2.2 North America

- TABLE 22 DEFINITIONS & REGULATIONS FOR NUTRACEUTICALS WORLDWIDE

- 6.10.2.6.3 Codex alimentarius commission (CAC)

- 6.10.2.6.4 North America: regulatory environment analysis

- 6.10.2.6.4.1 US

- 6.10.2.6.4.2 Canada

- 6.10.2.6.5 Asia Pacific: Regulatory environment analysis

- 6.10.2.6.5.1 Japan

- 6.10.2.6.5.2 India

- 6.10.2.6.6 South America: Regulatory Environment Analysis

- 6.10.2.6.6.1 Brazil

- 6.10.2.7 PREBIOTICS

- 6.10.2.7.1 Introduction

- 6.10.2.7.2 Asia Pacific

- 6.10.2.7.2.1 Japan

- 6.10.2.7.2.2 Australia & New Zealand

- 6.10.2.7.2.3 South Korea

- 6.10.2.7.2.4 India

- TABLE 23 SCHEDULE - XI OF FOOD SAFETY AND STANDARDS REGULATIONS, 2015, FOR LIST OF APPROVED PREBIOTIC EXCIPIENTS

- 6.10.2.7.3 North America

- 6.10.2.7.3.1 US

- 6.10.2.7.3.2 Canada

- 6.10.2.7.3 North America

- TABLE 24 LIST OF ACCEPTED DIETARY FIBERS BY CANADIAN REGULATORY AUTHORITIES & THEIR SOURCES

- 6.10.2.7.4 European Union

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- TABLE 25 PORTER'S FIVE FORCES IMPACT ON NUTRACEUTICAL EXCIPIENTS MARKET

- 6.11.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.11.2 BARGAINING POWER OF SUPPLIERS

- 6.11.3 BARGAINING POWER OF BUYERS

- 6.11.4 THREAT OF SUBSTITUTES

- 6.11.5 THREAT OF NEW ENTRANTS

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 TYPES

- TABLE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 PRODUCT SOURCES (%)

- 6.12.2 BUYING CRITERIA

- TABLE 27 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR FOR TOP 3 TYPES

- FIGURE 35 KEY CRITERIA FOR SELECTING SUPPLIER/VENDOR FOR TOP 3 TYPES

- 6.13 CASE STUDY ANALYSIS

- 6.13.1 USE CASE 1: FRUNUTTA STARTED OFFERING EASY-TO-USE AND EFFICIENT-TO-TAKE VITAMIN AND MINERAL PILLS THAT DISSOLVE INSTANTLY

- 6.13.2 USE CASE 2: EXCIPIENTS OF CHOICE FOR TASTE MASKING TECHNOLOGY WITH HOT MELT EXTRUSION

7 NUTRACEUTICAL EXCIPIENTS MARKET, BY PRODUCT SOURCE

- 7.1 INTRODUCTION

- FIGURE 36 NUTRACEUTICAL EXCIPIENTS MARKET, BY PRODUCT SOURCE, 2023 VS. 2028 (USD MILLION)

- 7.2 ORGANIC CHEMICALS

- TABLE 28 ORGANIC EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 29 ORGANIC EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 30 ORGANIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 31 ORGANIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2.1 OLEOCHEMICALS

- TABLE 32 OLEOCHEMICALS: NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 33 OLEOCHEMICALS: NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- 7.2.1.1 Fatty alcohols

- 7.2.1.1.1 Need for enhancing texture and creaminess likely to propel demand

- 7.2.1.2 Mineral stearates

- 7.2.1.2.1 Mineral stearates to reduce friction and avoid equipment clogging during manufacturing of nutraceuticals

- 7.2.1.3 Glycerin

- 7.2.1.3.1 Glycerin to help improve smoothness and lubrication process

- 7.2.1.4 Other oleochemicals

- 7.2.1.1 Fatty alcohols

- 7.2.2 CARBOHYDRATES

- TABLE 34 CARBOHYDRATES: NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 35 CARBOHYDRATES: NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- 7.2.2.1 Sugars

- TABLE 36 SUGARS: NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 37 SUGARS: NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- 7.2.2.1.1 Actual sugars

- 7.2.2.1.1.1 Rising diabetic population to fuel need for low-glycemic index alternatives like xylitol and isomaltulose

- 7.2.2.1.2 Sugar alcohols

- 7.2.2.1.2.1 Various advantageous and unique properties of sugar alcohols to make them attractive option

- 7.2.2.1.3 Artificial sweeteners

- 7.2.2.1.3.1 Emerging trends in utilization of natural sweeteners in nutraceutical products to drive demand

- 7.2.2.2 Cellulose

- 7.2.2.1.1 Actual sugars

- TABLE 38 CELLULOSE: NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 39 CELLULOSE: NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- 7.2.2.2.1 Microcrystalline cellulose

- 7.2.2.2.1.1 Rising nutraceutical trend to bolster microcrystalline cellulose demand for superior tablet integrity

- 7.2.2.2.2 Cellulose ethers

- 7.2.2.2.2.1 Cellulose ethers help streamline nutraceutical rheology

- 7.2.2.2.3 CMC & croscarmellose sodium

- 7.2.2.2.3.1 Enhanced mouthfeel and fast-acting properties to help propel market growth

- 7.2.2.2.4 Cellulose esters

- 7.2.2.2.4.1 Rising demand for cellulose esters to provide technical edge in nutraceuticals

- 7.2.2.3 Starch

- 7.2.2.2.1 Microcrystalline cellulose

- TABLE 40 STARCH: NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 41 STARCH: NUTRACEUTICAL EXCIPIENTS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- 7.2.2.3.1 Modified starch

- 7.2.2.3.1.1 Technical advancements to fuel modified starch demand in nutraceuticals excipients industry

- 7.2.2.3.2 Dried starch

- 7.2.2.3.2.1 Capabilities such as disintegration enhancement and bulking effects to drive market

- 7.2.2.3.3 Converted starch

- 7.2.2.3.3.1 Properties such as increased solubility to boost nutrient absorption

- 7.2.2.3.1 Modified starch

- 7.2.3 PETROCHEMICALS

- TABLE 42 PETROCHEMICALS EXCIPIENTS MARKET, BY, SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 43 PETROCHEMICALS EXCIPIENTS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- 7.2.3.1 Glycols

- 7.2.3.1.1 Humectant & solvent properties to drive demand

- 7.2.3.2 Povidones

- 7.2.3.2.1 Film-forming function to provide controlled release of active ingredients

- 7.2.3.3 Mineral hydrocarbons

- 7.2.3.3.1 Properties such as anti-foaming & lubrication to help in nutraceutical manufacturing

- 7.2.3.4 Acrylic polymers

- 7.2.3.4.1 Diverse functions of acrylic polymers in nutraceuticals to propel growth

- 7.2.3.5 Other petrochemical excipients

- 7.2.3.1 Glycols

- 7.2.4 PROTEINS

- 7.2.4.1 Expanding utilization of proteins as carriers for microparticles and nanoparticles to propel market growth

- 7.2.5 OTHER ORGANIC CHEMICALS

- 7.3 INORGANIC CHEMICALS

- TABLE 44 INORGANIC EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 45 INORGANIC EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 46 INORGANIC CHEMICALS EXCIPIENTS MARKET, BY SUBTYPE, 2018-2022 (USD MILLION)

- TABLE 47 INORGANIC CHEMICALS EXCIPIENTS MARKET, BY SUBTYPE, 2023-2028 (USD MILLION)

- 7.3.1 CALCIUM PHOSPHATE

- 7.3.1.1 Nutraceutical production to be optimized by utilizing GMO-free calcium phosphates as GRAS excipients

- 7.3.2 METAL OXIDES

- 7.3.2.1 Metal oxides to help meet rising demand for iron-enriched nutraceuticals

- 7.3.3 HALITES

- 7.3.3.1 Halites to ensure taste improvement and salting-out techniques

- 7.3.4 CALCIUM CARBONATE

- 7.3.4.1 Focus on R&D of calcium carbonate to help launch new products

- 7.3.5 CALCIUM SULFATE

- 7.3.5.1 Improved flowability to drive demand for calcium sulfate

- 7.3.6 OTHER INORGANIC CHEMICALS

- 7.4 OTHER CHEMICALS

- TABLE 48 OTHER CHEMICALS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 49 OTHER CHEMICALS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

8 NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT

- 8.1 INTRODUCTION

- TABLE 50 NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2018-2022 (USD MILLION)

- TABLE 51 NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2023-2028 (USD MILLION)

- FIGURE 37 NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2023 VS. 2028

- 8.2 PROBIOTICS

- 8.2.1 INCREASING INCLINATION OF CONSUMERS TOWARD IMMUNITY-ENHANCING PRODUCTS POST-COVID-19 TO DRIVE MARKET GROWTH

- TABLE 52 PROBIOTICS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 53 PROBIOTICS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 PREBIOTICS

- 8.3.1 INCREASE IN DIGESTIVE ISSUES AMONG CONSUMERS RESULTING IN ACIDITY AND INFLAMMATORY ISSUES, TO ENCOURAGE CONSUMPTION OF PREBIOTICS AS PREVENTIVE MEASURE

- TABLE 54 PREBIOTICS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 55 PREBIOTICS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 PROTEINS & AMINO ACIDS

- 8.4.1 INCREASED POPULARITY OF PROTEINS AND AMINO ACIDS AMONG YOUTH TO DRIVE GROWTH OF NUTRACEUTICAL EXCIPIENTS MARKET

- TABLE 56 PROTEINS & AMINO ACIDS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 57 PROTEINS & AMINO ACIDS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 VITAMINS

- 8.5.1 PREVALENCE OF VITAMIN DEFICIENCIES AMONG CONSUMERS TO DRIVE MARKET GROWTH FOR NUTRACEUTICAL EXCIPIENTS

- TABLE 58 VITAMINS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 59 VITAMINS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 60 LIST OF NUTRIENTS AND THEIR RELEVANCE

- 8.6 MINERALS

- 8.6.1 BENEFITS OFFERED FOR OPTIMAL FUNCTIONING OF BRAIN AND HEART TO DRIVE GROWTH OF NUTRACEUTICAL EXCIPIENTS MARKET

- TABLE 61 MINERALS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 62 MINERALS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.7 OMEGA-3 FATTY ACIDS

- 8.7.1 INCREASE IN HEART DISEASES TO DRIVE DEMAND FOR OMEGA-3 FATTY ACIDS SUPPLEMENTS

- TABLE 63 OMEGA-3 FATTY ACIDS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 64 OMEGA-3 FATTY ACIDS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.8 OTHER END PRODUCTS

- TABLE 65 OTHER END PRODUCTS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 66 OTHER END PRODUCTS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

9 NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION

- 9.1 INTRODUCTION

- TABLE 67 NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2018-2022 (USD MILLION)

- TABLE 68 NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2023-2028 (USD MILLION)

- FIGURE 38 NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2023 VS. 2028

- 9.2 DRY

- TABLE 69 DRY: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 70 DRY: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2.1 TABLETS

- 9.2.1.1 Easy to carry and portable nature to make them attractive option

- 9.2.2 CAPSULES

- 9.2.2.1 Quick-dissolving capsule shells for targeted absorption to be ideal for nutraceuticals designed to act in specific areas of digestive tract

- 9.3 LIQUID

- 9.3.1 POTENTIAL GROWTH OPPORTUNITIES FOR LIQUID NUTRACEUTICAL EXCIPIENTS DUE TO INNOVATIONS IN FORMULATIONS TO DRIVE GROWTH

- TABLE 71 LIQUID: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 72 LIQUID: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 OTHER FORMULATIONS

- TABLE 73 OTHER FORMULATIONS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 74 OTHER FORMULATIONS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

10 NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY

- 10.1 INTRODUCTION

- TABLE 75 NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 76 NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- FIGURE 39 NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023 VS. 2028

- 10.2 BINDERS

- 10.2.1 INCREASED ACCEPTABILITY AND USE OF BINDING AGENTS IN PRODUCTS TO DRIVE GROWTH OF NUTRACEUTICAL EXCIPIENTS MARKET

- TABLE 77 BINDERS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 78 BINDERS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 FILLERS & DILUENTS

- 10.3.1 USE OF ACTIVE INGREDIENTS IN NUTRACEUTICAL PRODUCTS TO ENCOURAGE USE OF FILLERS AND DILUENTS AS EXCIPIENTS

- TABLE 79 FILLERS & DILUENTS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 80 FILLERS & DILUENTS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4 DISINTEGRANTS

- 10.4.1 HIGH CONSUMPTION OF DIETARY SUPPLEMENTS IN FORM OF ORAL DOSAGES OR TABLETS TO DRIVE GROWTH OF DISINTEGRANTS SEGMENT

- TABLE 81 DISINTEGRANTS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 82 DISINTEGRANTS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.5 COATING AGENTS

- 10.5.1 PROTECTION FROM MOISTURE AND BACTERIA TO DRIVE DEMAND

- TABLE 83 COATING AGENTS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 84 COATING AGENTS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.6 FLAVORING AGENTS & SWEETENERS

- 10.6.1 INCREASE IN NEED FOR MASKING STRONG AND UNAPPEALING FLAVORS TO DRIVE GROWTH OF SEGMENT

- TABLE 85 FLAVORING AGENTS & SWEETENERS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 86 FLAVORING AGENTS & SWEETENERS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.7 PRESERVATIVES

- 10.7.1 INHIBITION OF MICROBIAL GROWTH AND MAINTAINING PRODUCT QUALITY AND SAFETY TO DRIVE DEMAND FOR PRESERVATIVES

- TABLE 87 PRESERVATIVES: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 88 PRESERVATIVES: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.8 LUBRICANTS & GLIDANTS

- 10.8.1 INCREASE IN NEED FOR REDUCING FRICTION AND KEEPING FORMULATION INTACT DURING PRODUCTION PROCESS TO DRIVE GROWTH OF SEGMENT

- TABLE 89 LUBRICANTS & GLIDANTS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 90 LUBRICANTS & GLIDANTS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.9 SUSPENDING & VISCOSITY AGENTS

- 10.9.1 PREVENTING SETTLING TO HELP MAINTAIN HOMOGENEITY AND STABILITY OF PRODUCT

- TABLE 91 SUSPENDING & VISCOSITY AGENTS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 92 SUSPENDING & VISCOSITY AGENTS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.10 COLORANTS

- 10.10.1 NEED FOR VISUAL APPEAL AND PRODUCT DIFFERENTIATION TO FUEL DEMAND FOR COLORANTS

- TABLE 93 COLORANTS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 94 COLORANTS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.11 EMULSIFYING AGENTS

- 10.11.1 NEED FOR REDUCING SURFACE TENSION BETWEEN DIFFERENT COMPONENTS TO DRIVE DEMAND FOR EMULSIFYING AGENTS

- TABLE 95 EMULSIFYING AGENTS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 96 EMULSIFYING AGENTS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.12 OTHER FUNCTIONALITIES

- TABLE 97 OTHER FUNCTIONALITIES: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 98 OTHER FUNCTIONALITIES: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

11 NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION

- 11.1 INTRODUCTION

- TABLE 99 NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 100 NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATI0N, 2023-2028 (USD MILLION)

- FIGURE 40 NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2023 VS. 2028

- 11.2 TASTE MASKING

- 11.2.1 CREATING DIFFERENTIATION TO BE KEY IN THIS COMPETITIVE MARKET

- TABLE 101 TASTE MASKING: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 102 TASTE MASKING: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3 STABILIZERS

- 11.3.1 MAINTAINING DESIRABLE PROPERTIES UNTIL CONSUMPTION TO DRIVE DEMAND FOR STABILIZERS

- TABLE 103 STABILIZERS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 104 STABILIZERS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.4 MODIFIED RELEASE

- 11.4.1 NEED FOR SLOWER AND STEADIER RELEASE OF COMPOUNDS TO PROPEL GROWTH OF MODIFIED-RELEASE APPLICATION IN NUTRACEUTICAL EXCIPIENTS MARKET

- TABLE 105 MODIFIED RELEASE: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 106 MODIFIED RELEASE: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.5 SOLUBILITY & BIOAVAILABILITY ENHANCEMENT

- 11.5.1 CHALLENGES RELATED TO POOR SOLUBILITY AND LIMITED ABSORPTION OF BIOACTIVE COMPOUNDS TO DRIVE DEMAND

- TABLE 107 SOLUBILITY & BIOAVAILABILITY ENHANCEMENT: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 108 SOLUBILITY & BIOAVAILABILITY ENHANCEMENT: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.6 OTHER FUNCTIONALITY APPLICATIONS

- TABLE 109 OTHER FUNCTIONALITY APPLICATIONS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 110 OTHER FUNCTIONALITY APPLICATIONS: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

12 NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 41 NORTH AMERICA TO BE LARGEST MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 42 CHINA, INDIA, AND SOUTH KOREA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 111 NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 112 NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.2 NORTH AMERICA

- FIGURE 43 NORTH AMERICA: MARKET SNAPSHOT

- 12.2.1 RECESSION IMPACT ANALYSIS

- FIGURE 44 NORTH AMERICAN NUTRACEUTICAL EXCIPIENTS MARKET: RECESSION IMPACT ANALYSIS

- TABLE 113 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 114 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 115 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY PRODUCT SOURCE, 2018-2022 (USD MILLION)

- TABLE 116 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY PRODUCT SOURCE, 2023-2028 (USD MILLION)

- TABLE 117 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 118 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- TABLE 119 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2018-2022 (USD MILLION)

- TABLE 120 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2023-2028 (USD MILLION)

- TABLE 121 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2018-2022 (USD MILLION)

- TABLE 122 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2023-2028 (USD MILLION)

- TABLE 123 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 124 NORTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2023-2028 (USD MILLION)

- 12.2.2 US

- 12.2.2.1 High concentration of key players, various nutrition awareness programs, and increase in preventive healthcare trends in US

- TABLE 125 US: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 126 US: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- 12.2.3 CANADA

- 12.2.3.1 Demand for quality and cost-competition: Two key factors for manufacturers to consider in Canada

- TABLE 127 CANADA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 128 CANADA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- 12.2.4 MEXICO

- 12.2.4.1 Increase in foreign direct investments and rise in awareness regarding healthier lifestyles associated with dietary supplements

- TABLE 129 MEXICO: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 130 MEXICO: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 RECESSION IMPACT ANALYSIS

- FIGURE 45 EUROPEAN NUTRACEUTICAL EXCIPIENTS MARKET: RECESSION IMPACT ANALYSIS

- TABLE 131 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 132 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 133 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY PRODUCT SOURCE, 2018-2022 (USD MILLION)

- TABLE 134 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY PRODUCT SOURCE, 2023-2028 (USD MILLION)

- TABLE 135 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 136 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- TABLE 137 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2018-2022 (USD MILLION)

- TABLE 138 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2023-2028 (USD MILLION)

- TABLE 139 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2018-2022 (USD MILLION)

- TABLE 140 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2023-2028 (USD MILLION)

- TABLE 141 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 142 EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2023-2028 (USD MILLION)

- 12.3.2 GERMANY

- 12.3.2.1 Demand for nutraceutical excipients likely to increase to serve health-conscious consumers

- TABLE 143 GERMANY: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 144 GERMANY: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- 12.3.3 FRANCE

- 12.3.3.1 Innovations in product formulations to cater to increased consumer demands

- TABLE 145 FRANCE: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 146 FRANCE: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- 12.3.4 UK

- 12.3.4.1 Growth of functional/fortified food & beverage industry in UK to drive demand for nutraceutical excipients

- TABLE 147 UK: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 148 UK: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- 12.3.5 ITALY

- 12.3.5.1 Growing trend of online OTC and food supplement purchases in Italy

- TABLE 149 ITALY: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 150 ITALY: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- 12.3.6 SPAIN

- 12.3.6.1 Growth of food supplements, sports nutrition, and healthcare care markets likely to create favorable environment for nutraceutical excipients

- TABLE 151 SPAIN: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 152 SPAIN: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- 12.3.7 REST OF EUROPE

- TABLE 153 REST OF EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 154 REST OF EUROPE: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- 12.4 ASIA PACIFIC

- FIGURE 46 ASIA PACIFIC: MARKET SNAPSHOT

- 12.4.1 RECESSION IMPACT ANALYSIS

- FIGURE 47 ASIA PACIFIC NUTRACEUTICAL EXCIPIENTS MARKET: RECESSION IMPACT ANALYSIS

- TABLE 155 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 156 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 157 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY PRODUCT SOURCE, 2018-2022 (USD MILLION)

- TABLE 158 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY PRODUCT SOURCE, 2023-2028 (USD MILLION)

- TABLE 159 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 160 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- TABLE 161 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2018-2022 (USD MILLION)

- TABLE 162 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2023-2028 (USD MILLION)

- TABLE 163 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2018-2022 (USD MILLION)

- TABLE 164 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2023-2028 (USD MILLION)

- TABLE 165 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 166 ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2023-2028 (USD MILLION)

- 12.4.2 CHINA

- 12.4.2.1 Rise in preference for nutraceutical products and innovations in dietary supplement formulations and fortified food products

- TABLE 167 CHINA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 168 CHINA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- 12.4.3 JAPAN

- 12.4.3.1 Manufacturers should think beyond pills & innovation to tap this growing market in Japan

- TABLE 169 JAPAN: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 170 JAPAN: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- 12.4.4 INDIA

- 12.4.4.1 Government policies and importance of nutraceuticals in daily life

- TABLE 171 INDIA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 172 INDIA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Rapid growth of supplements industry in South Korea

- TABLE 173 SOUTH KOREA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 174 SOUTH KOREA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- 12.4.6 REST OF ASIA PACIFIC

- TABLE 175 REST OF ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- 12.5 SOUTH AMERICA

- 12.5.1 RECESSION IMPACT ANALYSIS

- FIGURE 48 SOUTH AMERICAN NUTRACEUTICAL EXCIPIENTS MARKET: RECESSION IMPACT ANALYSIS

- TABLE 177 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 178 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 179 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY PRODUCT SOURCE, 2018-2022 (USD MILLION)

- TABLE 180 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY PRODUCT SOURCE, 2023-2028 (USD MILLION)

- TABLE 181 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 182 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- TABLE 183 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2018-2022 (USD MILLION)

- TABLE 184 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2023-2028 (USD MILLION)

- TABLE 185 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2018-2022 (USD MILLION)

- TABLE 186 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2023-2028 (USD MILLION)

- TABLE 187 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 188 SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2023-2028 (USD MILLION)

- 12.5.2 BRAZIL

- 12.5.2.1 Growth in awareness regarding benefits of functional foods and rise in aging population in Brazil

- TABLE 189 BRAZIL: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 190 BRAZIL: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- 12.5.3 ARGENTINA

- 12.5.3.1 Country's focus on prevention healthcare system to be positive sign for nutraceutical excipients market

- TABLE 191 ARGENTINA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 192 ARGENTINA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- 12.5.4 REST OF SOUTH AMERICA

- TABLE 193 REST OF SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 194 REST OF SOUTH AMERICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- 12.6 REST OF THE WORLD (ROW)

- 12.6.1 RECESSION IMPACT ANALYSIS

- FIGURE 49 ROW NUTRACEUTICAL EXCIPIENTS MARKET: RECESSION IMPACT ANALYSIS

- TABLE 195 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 196 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 197 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY PRODUCT SOURCE, 2018-2022 (USD MILLION)

- TABLE 198 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY PRODUCT SOURCE, 2023-2028 (USD MILLION)

- TABLE 199 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 200 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- TABLE 201 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2018-2022 (USD MILLION)

- TABLE 202 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY FORMULATION, 2023-2028 (USD MILLION)

- TABLE 203 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2018-2022 (USD MILLION)

- TABLE 204 ROW NUTRACEUTICAL EXCIPIENTS MARKET, BY END PRODUCT, 2023-2028 (USD MILLION)

- TABLE 205 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 206 ROW: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY APPLICATION, 2023-2028 (USD MILLION)

- 12.6.2 MIDDLE EAST

- 12.6.2.1 Rise in obesity and other health-related concerns in Middle East

- TABLE 207 MIDDLE EAST: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 208 MIDDLE EAST: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

- 12.6.3 AFRICA

- 12.6.3.1 Intra-African trade policies and investments by global nutraceutical players

- TABLE 209 AFRICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2018-2022 (USD MILLION)

- TABLE 210 AFRICA: NUTRACEUTICAL EXCIPIENTS MARKET, BY FUNCTIONALITY, 2023-2028 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 MARKET SHARE ANALYSIS

- TABLE 211 NUTRACEUTICAL EXCIPIENTS MARKET: DEGREE OF COMPETITION, 2022

- 13.3 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 212 STRATEGIES ADOPTED BY KEY PLAYERS

- 13.4 REVENUE ANALYSIS

- FIGURE 50 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS, 2020-2022 (USD BILLION)

- 13.5 KEY PLAYER ANNUAL REVENUE VS. GROWTH

- FIGURE 51 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020-2022 (%)

- 13.6 KEY PLAYERS' EBIT/EBITDA

- FIGURE 52 EBITDA, 2022 (USD BILLION)

- 13.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 53 NUTRACEUTICAL EXCIPIENTS MARKET: GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS, 2022

- 13.8 COMPANY EVALUATION MATRIX (KEY PLAYERS)

- 13.8.1 STARS

- 13.8.2 EMERGING LEADERS

- 13.8.3 PERVASIVE PLAYERS

- 13.8.4 PARTICIPANTS

- FIGURE 54 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2022

- 13.8.5 COMPANY FOOTPRINT

- TABLE 213 COMPANY FOOTPRINT, BY FUNCTIONALITY

- TABLE 214 COMPANY FOOTPRINT, BY PRODUCT SOURCE

- TABLE 215 COMPANY FOOTPRINT, BY REGION

- TABLE 216 OVERALL COMPANY FOOTPRINT

- 13.9 STARTUP/SME EVALUATION MATRIX

- 13.9.1 PROGRESSIVE COMPANIES

- 13.9.2 RESPONSIVE COMPANIES

- 13.9.3 DYNAMIC COMPANIES

- 13.9.4 STARTING BLOCKS

- FIGURE 55 STARTUP/SME EVALUATION MATRIX, 2022

- 13.9.5 COMPETITIVE BENCHMARKING

- TABLE 217 NUTRACEUTICAL EXCIPIENTS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 218 NUTRACEUTICAL EXCIPIENTS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 219 COMPANY FOOTPRINT, BY FUNCTIONALITY (STARTUPS)

- 13.10 COMPETITIVE SCENARIO

- 13.10.1 NEW PRODUCT LAUNCHES

- TABLE 220 NUTRACEUTICAL EXCIPIENTS MARKET: NEW PRODUCT LAUNCHES, 2019-2023

- 13.10.2 DEALS

- TABLE 221 NUTRACEUTICAL EXCIPIENTS MARKET: DEALS, 2019-2023

- 13.10.3 OTHERS

- TABLE 222 NUTRACEUTICAL EXCIPIENTS MARKET: OTHERS, 2019-2023

14 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 14.1 KEY PLAYERS

- 14.1.1 INTERNATIONAL FLAVORS & FRAGRANCES INC

- TABLE 223 INTERNATIONAL FLAVORS & FRAGRANCES INC: BUSINESS OVERVIEW

- FIGURE 56 INTERNATIONAL FLAVORS & FRAGRANCES INC: COMPANY SNAPSHOT

- TABLE 224 INTERNATIONAL FLAVORS & FRAGRANCES INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 INTERNATIONAL FLAVORS & FRAGRANCES INC: PRODUCT LAUNCHES

- TABLE 226 INTERNATIONAL FLAVORS & FRAGRANCES INC: DEALS

- 14.1.2 KERRY GROUP PLC

- TABLE 227 KERRY GROUP PLC: BUSINESS OVERVIEW

- FIGURE 57 KERRY GROUP PLC: COMPANY SNAPSHOT

- TABLE 228 KERRY GROUP PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 KERRY GROUP PLC: DEALS

- 14.1.3 INGREDION

- TABLE 230 INGREDION: BUSINESS OVERVIEW

- FIGURE 58 INGREDION: COMPANY SNAPSHOT

- TABLE 231 INGREDION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 INGREDION: DEALS

- 14.1.4 SENSIENT TECHNOLOGIES CORPORATION

- TABLE 233 SENSIENT TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

- FIGURE 59 SENSIENT TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- TABLE 234 SENSIENT TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 SENSIENT TECHNOLOGIES CORPORATION: DEALS

- 14.1.5 ASSOCIATED BRITISH FOODS PLC

- TABLE 236 ASSOCIATED BRITISH FOODS PLC: BUSINESS OVERVIEW

- FIGURE 60 ASSOCIATED BRITISH FOODS PLC: COMPANY SNAPSHOT

- TABLE 237 ASSOCIATED BRITISH FOODS PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 ASSOCIATED BRITISH FOODS PLC: PRODUCT LAUNCHES

- 14.1.6 BASF SE

- TABLE 239 BASF SE: BUSINESS OVERVIEW

- FIGURE 61 BASF SE: COMPANY SNAPSHOT

- TABLE 240 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 BASF SE: DEALS

- TABLE 242 BASF SE: OTHERS

- 14.1.7 ROQUETTE FRERES

- TABLE 243 ROQUETTE FRERES: BUSINESS OVERVIEW

- TABLE 244 ROQUETTE FRERES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 ROQUETTE FRERES: PRODUCT LAUNCHES

- TABLE 246 ROQUETTE FRERES: DEALS

- TABLE 247 ROQUETTE FRERES: OTHERS

- 14.1.8 MEGGLE GROUP GMBH

- TABLE 248 MEGGLE GROUP GMBH: BUSINESS OVERVIEW

- TABLE 249 MEGGLE GROUP GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.9 CARGILL, INCORPORATED

- TABLE 250 CARGILL, INCORPORATED: BUSINESS OVERVIEW

- FIGURE 62 CARGILL, INCORPORATED: COMPANY SNAPSHOT

- TABLE 251 CARGILL, INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 CARGILL, INCORPORATED: DEALS

- TABLE 253 CARGILL, INCORPORATED: OTHERS

- 14.1.10 ASHLAND

- TABLE 254 ASHLAND: BUSINESS OVERVIEW

- FIGURE 63 ASHLAND: COMPANY SNAPSHOT

- TABLE 255 ASHLAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 ASHLAND: PRODUCT LAUNCHES

- TABLE 257 ASHLAND: OTHERS

- 14.1.11 AZELIS GROUP

- TABLE 258 AZELIS GROUP: BUSINESS OVERVIEW

- FIGURE 64 AZELIS GROUP: COMPANY SNAPSHOT

- TABLE 259 AZELIS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 AZELIS GROUP: DEALS

- TABLE 261 AZELIS GROUP: OTHERS

- 14.1.12 IMCD

- TABLE 262 IMCD: BUSINESS OVERVIEW

- FIGURE 65 IMCD: COMPANY SNAPSHOT

- TABLE 263 IMCD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 IMCD: DEALS

- TABLE 265 IMCD: OTHERS

- 14.1.13 HILMAR CHEESE COMPANY, INC.

- TABLE 266 HILMAR CHEESE COMPANY, INC: BUSINESS OVERVIEW

- TABLE 267 HILMAR CHEESE COMPANY, INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.14 SEPPIC

- TABLE 268 SEPPIC: BUSINESS OVERVIEW

- TABLE 269 SEPPIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 SEPPIC: PRODUCT LAUNCHES

- 14.1.15 BIOGRUND GMBH

- TABLE 271 BIOGRUND GMBH: BUSINESS OVERVIEW

- TABLE 272 BIOGRUND GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2 OTHER PLAYERS

- 14.2.1 INNOPHOS

- TABLE 273 INNOPHOS: BUSINESS OVERVIEW

- TABLE 274 INNOPHOS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 275 INNOPHOS: PRODUCT LAUNCHES

- 14.2.2 DAICEL CORPORATION

- TABLE 276 DAICEL CORPORATION: BUSINESS OVERVIEW

- FIGURE 66 DAICEL CORPORATION: COMPANY SNAPSHOT

- TABLE 277 DAICEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2.3 ALSIANO A/S

- TABLE 278 ALSIANO A/S: BUSINESS OVERVIEW

- TABLE 279 ALSIANO A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.2.4 JRS PHARMA

- TABLE 280 JRS PHARMA: BUSINESS OVERVIEW

- TABLE 281 JRS PHARMA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 282 JRS PHARMA: OTHERS

- 14.2.5 COLORCON

- TABLE 283 COLORCON: BUSINESS OVERVIEW

- TABLE 284 COLORCON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 COLORCON: PRODUCT LAUNCHES

- TABLE 286 COLORCON: DEALS

- TABLE 287 COLORCON: OTHERS

- 14.2.6 PANCHAMRUT CHEMICALS

- TABLE 288 PANCHAMRUT CHEMICALS: BUSINESS OVERVIEW

- 14.2.7 OMYA

- TABLE 289 OMYA: BUSINESS OVERVIEW

- 14.2.8 GATTEFOSSE

- TABLE 290 GATTEFOSSE: BUSINESS OVERVIEW

- 14.2.9 FUJI CHEMICAL INDUSTRIES CO., LTD

- TABLE 291 FUJI CHEMICAL INDUSTRIES CO., LTD: BUSINESS OVERVIEW

- 14.2.10 JIGS CHEMICAL

- TABLE 292 JIGS CHEMICAL: BUSINESS OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 ADJACENT & RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 FUNCTIONAL FOOD INGREDIENTS MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.3.3 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE

- 15.3.3.1 Introduction

- TABLE 293 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE, 2016-2020 (USD MILLION)

- TABLE 294 FUNCTIONAL FOOD INGREDIENTS MARKET, BY TYPE, 2021-2026 (USD MILLION)

- 15.4 NUTRACEUTICAL INGREDIENTS MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

- 15.4.3 NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE

- 15.4.3.1 Introduction

- TABLE 295 NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017-2021 (USD MILLION)

- TABLE 296 NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022-2027 (USD MILLION)

- TABLE 297 NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2017-2021 (KT)

- TABLE 298 NUTRACEUTICAL INGREDIENTS MARKET, BY TYPE, 2022-2027 (KT)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS