|

|

市場調査レポート

商品コード

1695347

PFAS検査の世界市場 (~2030年):製品タイプ (装置 (LC-MS・GC・NMR)・消耗品 (溶剤・試薬)・ソフトウェア)・技術 (LC-MS-MS・CIC)・手法 (EPA・ISO・DIN・ASTM)・用途 (水・飲食料品・土壌・大気・血液/血清) 別PFAS Testing Market by Product Type (Instrument (LC-MS, GC, NMR), Consumables (Coloumns, Solvents, Reagents), Software), Technique (LC- MS-MS, CIC), Method (EPA, ISO, DIN, ASTM), Application (Water, F&B, Soil, Air, Blood/Serum) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| PFAS検査の世界市場 (~2030年):製品タイプ (装置 (LC-MS・GC・NMR)・消耗品 (溶剤・試薬)・ソフトウェア)・技術 (LC-MS-MS・CIC)・手法 (EPA・ISO・DIN・ASTM)・用途 (水・飲食料品・土壌・大気・血液/血清) 別 |

|

出版日: 2025年03月05日

発行: MarketsandMarkets

ページ情報: 英文 332 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のPFAS検査の市場規模は、2024年の4億2,920万米ドルから、予測期間中はCAGR 14.5%で推移し、2030年には9億6,950万米ドルの規模に成長すると予測されています。

質量分析とクロマトグラフィのハイエンド技術は汚染物質の検出精度と効率を飛躍的に高めています。一方で、PFAS検査市場の発展を妨げる主な要因として、飲料水以外のマトリックス中のPFASを分析するための、規制当局に認められた標準的なラボ検査がない点があります。標準化された検査法がないことにより、データの不正確さと規制上の問題が起こり、農業、包装、廃水管理を含む多くの産業によるPFAS検出の受け入れを遅らせることとなります。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022-2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2030年 |

| 単位 | 金額 (米ドル) |

| セグメント | 製品タイプ・技術・手法・用途・地域 |

| 対象地域 | 北米・欧州・アジア太平洋・ラテンアメリカ・中東&アフリカ |

"技術別では、LC-MS-MS (液体クロマトグラフィタンデム質量分析) のセグメントが2023年に最大シェアを示す"

液体クロマトグラフィ (LC) と高度なタンデム質量分析の組み合わせは、サンプル分析を大幅に簡素化し、高速化しました。これにより、最小限のサンプル調製またはサンプル調製なしでハイスループット分析が可能になり、精度と感度の向上とともに処理時間が短縮されました。こうした進歩が同セグメントの拡大を後押しし、医薬品、臨床診断、環境モニタリング、食品安全分析など、多くの産業で幅広く応用されています。

"手法別では、EPAのセグメントが2023年に最大シェアを示す"

EPAセグメントは予測期間中、市場シェアで市場をリードすると予測されています。この成長は、癌、肝臓病、免疫系機能不全のようないくつかの病気と関連しているPFAS化学汚染物質によって引き起こされる健康被害に対する意識の高まりが主な原因です。世界中の規制機関が過フルオロアルキル物質 (PFAS) およびポリフルオロアルキル物質 (PFAS) に対してより厳しい制限を課しているため、正確で効果的な検査プロトコルの需要が高まっています。EPA537、EPA533、EPA8327など、EPAが検証した検査手法は、高感度で特異性が高く、水、土壌、その他の環境媒体中の複数のPFAS化合物を分析できるため、業界内の基準となっています。このように環境保護と公衆衛生が重視されるようになったことで、EPAに基づくPFAS検査ソリューションの普及がさらに進むと考えられています。

"北米市場は2022年に大きなシェアを占める"

北米は、厳しい政府規制の存在、強力な法執行メカニズム、PFAS汚染の有害な影響に関する消費者の高い意識により、2024年の市場で大きな収益シェアを占めました。環境調査、修復、取り締まり活動への支出の増加が、この地域における新しいPFAS検査技術の採用を増加させています。米国環境保護庁 (EPA) とカナダ環境保護庁 (Environment Canada) は、最大汚染物質レベル (MCL) レベルや、PFAS飲料水、土壌、工業廃水モニタリングの義務化という形で、厳しい規制を制定しています。さらに、癌、内分泌かく乱、発達障害との関連など、PFASへの曝露による健康への影響に対する関心の高まりが、正確で高スループットの検査システムに対する需要をさらに高めています。研究施設や、質量分析などの高度な分析手法への投資が増え、近い将来には政府が後援するPFAS浄化活動も増えることから、北米はPFAS検査市場において今後何年も優位を維持する見通しです。

当レポートでは、世界のPFAS検査の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 規制分析

- 規制状況

- 規制ガイドライン

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- 貿易分析

- 特許分析

- 価格分析

- 技術分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 主な会議とイベント

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向/混乱

- 投資と資金調達のシナリオ

- アンメットニーズの分析

- AI/生成AIがPFAS検査市場に与える影響

第6章 PFAS検査市場:製品タイプ別

- 機器

- 液体クロマトグラフィ質量分析 (LC-MS)

- ガスクロマトグラフィ質量分析 (GC-MS)

- スタンドアロン質量分析

- 核磁気共鳴分光

- その他

- 消耗品

- サンプル調製製品

- クロマトグラフィカラム

- リファレンス材料および分析標準

- 溶剤

- メンブレン&シリンジフィルター

- 試薬

- その他

- ソフトウェア・サービス

第7章 PFAS検査市場:技術別

- 液体クロマトグラフィタンデム質量分析 (LC-MS/MS)

- ガスクロマトグラフィ質量分析 (GC-MS)

- 核磁気共鳴分光 (NMR分光)

- 質量分析

- 燃焼イオンクロマトグラフィ

- 酵素免疫測定法 (ELISA)

- その他

第8章 PFAS検査市場:手法別

- EPA

- DIN

- ISO

- ASTM

- その他

第9章 PFAS検査市場:用途別

- 水質検査

- 地下水および飲料水検査

- 廃水検査

- 土壌検査

- 食品・飲料検査

- 血液/血清検査

- 空気モニタリング

- 微生物検査

- その他

第10章 PFAS検査市場:地域別

- 北米

- マクロ経済見通し

- 米国

- カナダ

- 欧州

- マクロ経済見通し

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- マクロ経済見通し

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- その他

- ラテンアメリカ

- マクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- マクロ経済見通し

- GCC諸国

- その他

第11章 競合情勢

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 市場ランキング分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

- 企業評価と財務指標

- ブランド/製品比較

第12章 企業プロファイル

- 主要企業

- AGILENT TECHNOLOGIES, INC.

- DANAHER CORPORATION

- WATERS CORPORATION.

- THERMO FISHER SCIENTIFIC INC.

- SHIMADZU CORPORATION

- MERCK KGAA

- PERKINELMER INC.

- LGC LIMITED

- BIOTAGE

- MACHEREY-NAGEL GMBH & CO. KG

- ACCUSTANDARD

- WELLINGTON LABORATORIES INC.

- CAMBRIDGE ISOTOPE LABORATORIES, INC.

- CHIRON AS

- METROHM INULA GMBH

- その他の企業

- RESTEK CORPORATION

- MICROSAIC

- EVONIK

- LCTECH

- ABSOLUTE STANDARDS INC.

- CYTIVA

- AVANTOR, INC.

- GREYHOUND CHROMATOGRAPHY AND ALLIED CHEMICALS LTD.

- LANXESS

- THE CHEMOURS COMPANY

第13章 付録

List of Tables

- TABLE 1 PFAS TESTING MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 PFAS TESTING MARKET: RISK ANALYSIS

- TABLE 3 WASTEWATER, DRINKING WATER, AND WATER SUPPLY INFRASTRUCTURE: FEDERAL FUNDING FOR PROJECTS AND PROGRAMS

- TABLE 4 RESEARCH GRANTS FOR UNDERSTANDING PFAS UPTAKE AND BIOACCUMULATION IN PLANTS AND ANIMALS IN AGRICULTURAL, RURAL, AND TRIBAL COMMUNITIES

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 PFAS TESTING MARKET: ROLE IN ECOSYSTEM

- TABLE 10 IMPORT SCENARIO FOR FLUOROPOLYMERS OF VINYL CHLORIDE OR OF OTHER HALOGENATED OLEFINS IN PRIMARY FORMS (HS CODE 390469), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 11 EXPORT SCENARIO FOR FLUOROPOLYMERS OF VINYL CHLORIDE OR OTHER HALOGENATED OLEFINS IN PRIMARY FORMS (HS CODE 390469), BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 12 AVERAGE SELLING PRICE TREND OF LC-MS INSTRUMENTS, BY KEY PLAYER, 2022-2024 (USD THOUSAND)

- TABLE 13 AVERAGE SELLING PRICE OF INSTRUMENTS, BY REGION, 2022-2024, (USD THOUSAND)

- TABLE 14 PORTER'S FIVE FORCES ANALYSIS: PFAS TESTING MARKET

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PFAS PRODUCT (%)

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR CHROMATOGRAPHY ACCESSORIES & CONSUMABLES

- TABLE 17 LIST OF KEY CONFERENCES & EVENTS IN PFAS TESTING MARKET, JANUARY 2025-DECEMBER 2026

- TABLE 18 INNOVATIVE COREDFN ADAPTATION FOR PFAS ANALYSIS IN BEDROCK

- TABLE 19 MAINTAINING MEDICAL DEVICE INTEGRITY AMIDST PFAS REGULATIONS

- TABLE 20 PER- AND POLYFLUOROALKYL SUBSTANCES (PFAS) IN UNITED STATES TAPWATER: COMPARISON OF UNDERSERVED PRIVATE-WELL AND PUBLIC-SUPPLY EXPOSURES AND ASSOCIATED HEALTH IMPLICATIONS

- TABLE 21 PFAS TESTING MARKET: LIST OF UNMET NEEDS

- TABLE 22 PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 23 PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 24 PFAS TESTING INSTRUMENTS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 25 NORTH AMERICA: PFAS TESTING INSTRUMENTS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 26 EUROPE: PFAS TESTING INSTRUMENTS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 27 ASIA PACIFIC: PFAS TESTING INSTRUMENTS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 28 PFAS TESTING INSTRUMENTS MARKET FOR LC-MS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 29 NORTH AMERICA: PFAS TESTING INSTRUMENTS MARKET FOR LC-MS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 30 EUROPE: PFAS TESTING INSTRUMENTS MARKET FOR LC-MS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 31 ASIA PACIFIC: PFAS TESTING INSTRUMENTS MARKET FOR LC-MS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 32 PFAS TESTING INSTRUMENTS MARKET FOR GC-MS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 33 NORTH AMERICA: PFAS TESTING INSTRUMENTS MARKET FOR GC-MS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 34 EUROPE: PFAS TESTING INSTRUMENTS MARKET FOR GC-MS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 35 ASIA PACIFIC: PFAS TESTING INSTRUMENTS MARKET FOR GC-MS, BY COUNTRY, 2022-2030 (USD MILLION)

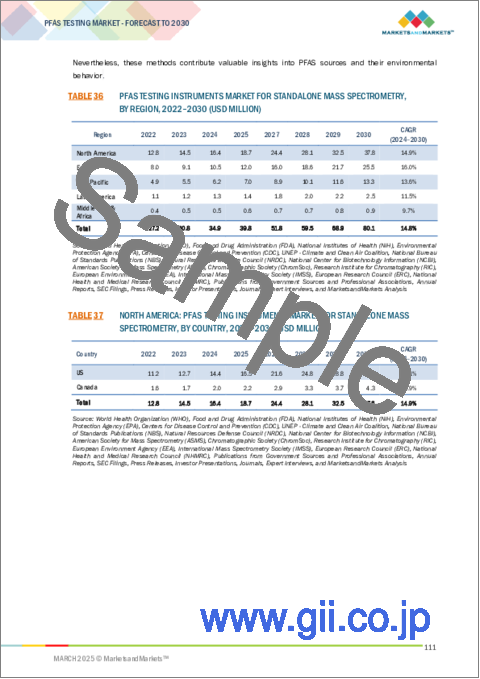

- TABLE 36 PFAS TESTING INSTRUMENTS MARKET FOR STANDALONE MASS SPECTROMETRY, BY REGION, 2022-2030 (USD MILLION)

- TABLE 37 NORTH AMERICA: PFAS TESTING INSTRUMENTS MARKET FOR STANDALONE MASS SPECTROMETRY, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 38 EUROPE: PFAS TESTING INSTRUMENTS MARKET FOR STANDALONE MASS SPECTROMETRY, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 39 ASIA PACIFIC: PFAS TESTING INSTRUMENTS MARKET FOR STANDALONE MASS SPECTROMETRY, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 40 PFAS TESTING INSTRUMENTS MARKET NUCLEAR MAGNETIC RESONANCE SPECTROSCOPY, BY REGION, 2022-2030 (USD MILLION)

- TABLE 41 NORTH AMERICA: PFAS TESTING INSTRUMENTS MARKET NUCLEAR MAGNETIC RESONANCE SPECTROSCOPY, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 42 EUROPE: PFAS TESTING INSTRUMENTS MARKET NUCLEAR MAGNETIC RESONANCE SPECTROSCOPY, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 43 ASIA PACIFIC: PFAS TESTING INSTRUMENTS MARKET NUCLEAR MAGNETIC RESONANCE SPECTROSCOPY, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 44 OTHER PFAS TESTING INSTRUMENTS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 45 NORTH AMERICA: OTHER PFAS TESTING INSTRUMENTS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 46 EUROPE: OTHER PFAS TESTING INSTRUMENTS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 47 ASIA PACIFIC: OTHER PFAS TESTING INSTRUMENTS MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 48 PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 49 PFAS TESTING CONSUMABLES MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 50 NORTH AMERICA: PFAS TESTING CONSUMABLES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 51 EUROPE: PFAS TESTING CONSUMABLES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 52 ASIA PACIFIC: PFAS TESTING CONSUMABLES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 53 PFAS TESTING CONSUMABLES MARKET FOR SAMPLE PREPARATION PRODUCTS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 54 NORTH AMERICA: PFAS TESTING CONSUMABLES MARKET FOR SAMPLE PREPARATION PRODUCTS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 55 EUROPE: PFAS TESTING CONSUMABLES MARKET FOR SAMPLE PREPARATION PRODUCTS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 56 ASIA PACIFIC: PFAS TESTING CONSUMABLES MARKET FOR SAMPLE PREPARATION PRODUCTS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 57 PFAS TESTING CONSUMABLES MARKET FOR CHROMATOGRAPHY COLUMNS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 58 NORTH AMERICA: PFAS TESTING CONSUMABLES MARKET FOR CHROMATOGRAPHY COLUMNS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 59 EUROPE: PFAS TESTING CONSUMABLES MARKET FOR CHROMATOGRAPHY COLUMNS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 60 ASIA PACIFIC: PFAS TESTING CONSUMABLES MARKET FOR CHROMATOGRAPHY COLUMNS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 61 PFAS TESTING CONSUMABLES MARKET FOR CHROMATOGRAPHY COLUMNS, BY REGION, 2024 (MILLION UNITS)

- TABLE 62 PFAS TESTING CONSUMABLES MARKET FOR REFERENCE MATERIALS & ANALYTICAL STANDARDS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 63 NORTH AMERICA: PFAS TESTING CONSUMABLES MARKET FOR REFERENCE MATERIALS & ANALYTICAL STANDARDS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 64 EUROPE: PFAS TESTING CONSUMABLES MARKET FOR REFERENCE MATERIALS & ANALYTICAL STANDARDS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 65 ASIA PACIFIC: PFAS TESTING CONSUMABLES MARKET FOR REFERENCE MATERIALS & ANALYTICAL STANDARDS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 66 PFAS TESTING CONSUMABLES MARKET FOR SOLVENTS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: PFAS TESTING CONSUMABLES MARKET FOR SOLVENTS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 68 EUROPE: PFAS TESTING CONSUMABLES MARKET FOR SOLVENTS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 69 ASIA PACIFIC: PFAS TESTING CONSUMABLES MARKET FOR SOLVENTS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 70 PFAS TESTING CONSUMABLES MARKET FOR MEMBRANE & SYRINGE FILTERS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 71 NORTH AMERICA: PFAS TESTING CONSUMABLES MARKET FOR MEMBRANE & SYRINGE FILTERS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 72 EUROPE: PFAS TESTING CONSUMABLES MARKET FOR MEMBRANE & SYRINGE FILTERS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 73 ASIA PACIFIC: PFAS TESTING CONSUMABLES MARKET FOR MEMBRANE & SYRINGE FILTERS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 74 PFAS TESTING CONSUMABLES MARKET FOR REAGENTS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 75 NORTH AMERICA: PFAS TESTING CONSUMABLES MARKET FOR REAGENTS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 76 EUROPE: PFAS TESTING CONSUMABLES MARKET FOR REAGENTS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 77 ASIA PACIFIC: PFAS TESTING CONSUMABLES MARKET FOR REAGENTS, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 78 OTHER PFAS TESTING CONSUMABLES MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 79 NORTH AMERICA: OTHER PFAS TESTING CONSUMABLES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 80 EUROPE: OTHER PFAS TESTING CONSUMABLES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 81 ASIA PACIFIC: OTHER PFAS TESTING CONSUMABLES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 82 PFAS TESTING SOFTWARE & SERVICES MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 83 NORTH AMERICA: PFAS TESTING SOFTWARE & SERVICES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 84 EUROPE: PFAS TESTING SOFTWARE & SERVICES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 85 ASIA PACIFIC: PFAS TESTING SOFTWARE & SERVICES MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 86 PFAS TESTING MARKET, BY TECHNIQUE, 2022-2030 (USD MILLION)

- TABLE 87 PFAS TESTING TECHNIQUES MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 88 PFAS TESTING MARKET FOR LC-MS/MS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 89 PFAS TESTING MARKET FOR GC-MS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 90 PFAS TESTING MARKET FOR NMR SPECTROSCOPY, BY REGION, 2022-2030 (USD MILLION)

- TABLE 91 PFAS TESTING MARKET FOR MASS SPECTROMETRY, BY REGION, 2022-2030 (USD MILLION)

- TABLE 92 PFAS TESTING MARKET FOR COMBUSTION ION CHROMATOGRAPHY, BY REGION, 2022-2030 (USD MILLION)

- TABLE 93 PFAS TESTING MARKET FOR ELISA, BY REGION, 2022-2030 (USD MILLION)

- TABLE 94 PFAS TESTING MARKET FOR OTHER TECHNIQUES, BY REGION, 2022-2030 (USD MILLION)

- TABLE 95 PFAS TESTING MARKET, BY METHOD, 2022-2030 (USD MILLION)

- TABLE 96 PFAS TESTING METHODS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 97 APPLICATIONS OF EPA METHODS FOR PFAS TESTING ACROSS VARIOUS SAMPLE TYPES

- TABLE 98 PFAS TESTING MARKET FOR EPA METHODS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 99 APPLICATIONS OF DIN METHODS FOR PFAS TESTING ACROSS VARIOUS SAMPLE TYPES

- TABLE 100 PFAS TESTING MARKET FOR DIN METHODS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 101 APPLICATIONS OF ISO METHODS FOR PFAS TESTING ACROSS VARIOUS SAMPLE TYPES

- TABLE 102 PFAS TESTING MARKET FOR ISO METHODS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 103 APPLICATIONS OF ASTM METHODS FOR PFAS TESTING ACROSS VARIOUS SAMPLE TYPES

- TABLE 104 PFAS TESTING MARKET FOR ASTM METHODS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 105 APPLICATIONS OF OTHER METHODS FOR PFAS TESTING ACROSS VARIOUS SAMPLE TYPES

- TABLE 106 PFAS TESTING MARKET FOR OTHER METHODS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 107 PFAS TESTING MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 108 PFAS TESTING APPLICATIONS MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 109 PFAS TESTING MARKET FOR WATER TESTING APPLICATIONS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 110 PFAS TESTING MARKET FOR GROUND & POTABLE WATER TESTING APPLICATIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 111 PFAS TESTING MARKET FOR WASTEWATER TESTING APPLICATIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 112 PFAS TESTING MARKET FOR SOIL TESTING APPLICATIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 113 PFAS TESTING MARKET FOR FOOD & BEVERAGE TESTING APPLICATIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 114 PFAS TESTING MARKET FOR BLOOD/SERUM TESTING APPLICATIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 115 PFAS TESTING MARKET FOR AIR MONITORING APPLICATIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 116 PFAS TESTING MARKET FOR MICROBIAL TESTING APPLICATIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 117 PFAS TESTING MARKET FOR OTHER APPLICATIONS, BY REGION, 2022-2030 (USD MILLION)

- TABLE 118 PFAS TESTING MARKET, BY REGION, 2022-2030 (USD MILLION)

- TABLE 119 NORTH AMERICA: PFAS TESTING MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 120 NORTH AMERICA: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 121 NORTH AMERICA: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 122 NORTH AMERICA: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 123 NORTH AMERICA: PFAS TESTING MARKET, BY TECHNIQUE, 2022-2030 (USD MILLION)

- TABLE 124 NORTH AMERICA: PFAS TESTING MARKET, BY METHOD, 2022-2030 (USD MILLION)

- TABLE 125 NORTH AMERICA: PFAS TESTING MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 126 NORTH AMERICA: PFAS TESTING MARKET FOR WATER TESTING APPLICATIONS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 127 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- TABLE 128 US: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 129 US: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 130 US: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 131 CANADA: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 132 CANADA: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 133 CANADA: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 134 EUROPE: PFAS TESTING MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 135 EUROPE: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 136 EUROPE: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 137 EUROPE: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 138 EUROPE: PFAS TESTING MARKET, BY TECHNIQUE, 2022-2030 (USD MILLION)

- TABLE 139 EUROPE: PFAS TESTING MARKET, BY METHOD, 2022-2030 (USD MILLION)

- TABLE 140 EUROPE: PFAS TESTING MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 141 EUROPE: PFAS TESTING MARKET FOR WATER TESTING APPLICATIONS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 142 MACROECONOMIC OUTLOOK FOR EUROPE

- TABLE 143 GERMANY: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 144 GERMANY: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 145 GERMANY: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 146 UK: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 147 UK: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 148 UK: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 149 FRANCE: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 150 FRANCE: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 151 FRANCE: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 152 ITALY: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 153 ITALY: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 154 ITALY: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 155 SPAIN: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 156 SPAIN: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 157 SPAIN: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 158 REST OF EUROPE: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 159 REST OF EUROPE: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 160 REST OF EUROPE: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 161 ASIA PACIFIC: PFAS TESTING MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 162 ASIA PACIFIC: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 163 ASIA PACIFIC: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 164 ASIA PACIFIC: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 165 ASIA PACIFIC: PFAS TESTING MARKET, BY TECHNIQUE, 2022-2030 (USD MILLION)

- TABLE 166 ASIA PACIFIC: PFAS TESTING MARKET, BY METHOD, 2022-2030 (USD MILLION)

- TABLE 167 ASIA PACIFIC: PFAS TESTING MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 168 ASIA PACIFIC: PFAS TESTING MARKET FOR WATER TESTING APPLICATIONS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 169 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- TABLE 170 JAPAN: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 171 JAPAN: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 172 JAPAN: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 173 CHINA: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 174 CHINA: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 175 CHINA: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 176 INDIA: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 177 INDIA: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 178 INDIA: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 179 AUSTRALIA: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 180 AUSTRALIA: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 181 AUSTRALIA: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 182 SOUTH KOREA: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 183 SOUTH KOREA: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 184 SOUTH KOREA: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 185 REST OF ASIA PACIFIC: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 186 REST OF ASIA PACIFIC: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 187 REST OF ASIA PACIFIC: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 188 LATIN AMERICA: PFAS TESTING MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 189 LATIN AMERICA: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 190 LATIN AMERICA: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 191 LATIN AMERICA: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 192 LATIN AMERICA: PFAS TESTING MARKET, BY TECHNIQUE, 2022-2030 (USD MILLION)

- TABLE 193 LATIN AMERICA: PFAS TESTING MARKET, BY METHOD, 2022-2030 (USD MILLION)

- TABLE 194 LATIN AMERICA: PFAS TESTING MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 195 LATIN AMERICA: PFAS TESTING MARKET FOR WATER TESTING APPLICATIONS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 196 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- TABLE 197 BRAZIL: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 198 BRAZIL: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 199 BRAZIL: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 200 MEXICO: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 201 MEXICO: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 202 MEXICO: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 203 REST OF LATIN AMERICA: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 204 REST OF LATIN AMERICA: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 205 REST OF LATIN AMERICA: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: PFAS TESTING MARKET, BY COUNTRY, 2022-2030 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: PFAS TESTING MARKET, BY TECHNIQUE, 2022-2030 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: PFAS TESTING MARKET, BY METHOD, 2022-2030 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: PFAS TESTING MARKET, BY APPLICATION, 2022-2030 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: PFAS TESTING MARKET FOR WATER TESTING APPLICATIONS, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 214 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- TABLE 215 GCC COUNTRIES: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 216 GCC COUNTRIES: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 217 GCC COUNTRIES: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 218 REST OF MIDDLE EAST & AFRICA: PFAS TESTING MARKET, BY PRODUCT TYPE, 2022-2030 (USD MILLION)

- TABLE 219 REST OF MIDDLE EAST & AFRICA: PFAS TESTING INSTRUMENTS MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 220 REST OF MIDDLE EAST & AFRICA: PFAS TESTING CONSUMABLES MARKET, BY TYPE, 2022-2030 (USD MILLION)

- TABLE 221 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN PFAS TESTING MARKET

- TABLE 222 PFAS TESTING MARKET: DEGREE OF COMPETITION

- TABLE 223 PFAS TESTING MARKET: REGION FOOTPRINT

- TABLE 224 PFAS TESTING MARKET: PRODUCT TYPE FOOTPRINT

- TABLE 225 PFAS TESTING MARKET: TECHNIQUE FOOTPRINT

- TABLE 226 PFAS TESTING MARKET: METHOD FOOTPRINT

- TABLE 227 PFAS TESTING MARKET: APPLICATION FOOTPRINT

- TABLE 228 PFAS TESTING MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 229 PFAS TESTING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 230 PFAS TESTING MARKET: PRODUCT LAUNCHES, JANUARY 2021-MARCH 2024

- TABLE 231 PFAS TESTING MARKET: DEALS, JANUARY 2021-MAY 2024

- TABLE 232 PFAS TESTING MARKET: EXPANSIONS, JANUARY 2021-MAY 2024

- TABLE 233 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 234 AGILENT TECHNOLOGIES, INC.: PRODUCTS OFFERED

- TABLE 235 AGILENT TECHNOLOGIES, INC.: PRODUCT LAUNCHES, JANUARY 2021-DECEMBER 2024

- TABLE 236 AGILENT TECHNOLOGIES, INC.: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 237 AGILENT TECHNOLOGIES, INC.: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 238 DANAHER CORPORATION: COMPANY OVERVIEW

- TABLE 239 PHENOMENEX INC.: PRODUCTS OFFERED

- TABLE 240 SCIEX: PRODUCTS OFFERED

- TABLE 241 DANAHER CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-DECEMBER 2024

- TABLE 242 DANAHER CORPORATION: DEALS, JANUARY 2021-MARCH 2024

- TABLE 243 WATERS CORPORATION: COMPANY OVERVIEW

- TABLE 244 WATERS CORPORATION: PRODUCTS OFFERED

- TABLE 245 WATERS CORPORATION: PRODUCT LAUNCHES, JANUARY 2021-DECEMBER 2024

- TABLE 246 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- TABLE 247 THERMO FISHER SCIENTIFIC INC.: PRODUCTS OFFERED

- TABLE 248 THERMO FISHER SCIENTIFIC INC.: PRODUCT LAUNCHES, JANUARY 2021-DECEMBER 2024

- TABLE 249 SHIMADZU CORPORATION: COMPANY OVERVIEW

- TABLE 250 SHIMADZU CORPORATION: PRODUCTS OFFERED

- TABLE 251 SHIMADZU CORPORATION: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 252 MERCK KGAA: COMPANY OVERVIEW

- TABLE 253 MERCK KGAA: PRODUCTS OFFERED

- TABLE 254 MERCK KGAA: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 255 PERKINELMER INC.: COMPANY OVERVIEW

- TABLE 256 PERKINELMER INC.: PRODUCTS OFFERED

- TABLE 257 LGC LIMITED: COMPANY OVERVIEW

- TABLE 258 LGC LIMITED: PRODUCTS OFFERED

- TABLE 259 LGC LIMITED: PRODUCT LAUNCHES, JANUARY 2021-DECEMBER 2024

- TABLE 260 LGC LIMITED: DEALS, JANUARY 2021-DECEMBER 2024

- TABLE 261 LGC LIMITED: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 262 BIOTAGE: COMPANY OVERVIEW

- TABLE 263 BIOTAGE: PRODUCTS OFFERED

- TABLE 264 BIOTAGE: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 265 MACHEREY-NAGEL GMBH & CO. KG: COMPANY OVERVIEW

- TABLE 266 MACHEREY-NAGEL GMBH & CO. KG: PRODUCTS OFFERED

- TABLE 267 MACHEREY-NAGEL GMBH & CO. KG: PRODUCT LAUNCHES, JANUARY 2021-DECEMBER 2024

- TABLE 268 ACCUSTANDARD: COMPANY OVERVIEW

- TABLE 269 ACCUSTANDARD: PRODUCTS OFFERED

- TABLE 270 ACCUSTANDARD: PRODUCT LAUNCHES, JANUARY 2021-DECEMBER 2024

- TABLE 271 WELLINGTON LABORATORIES INC.: COMPANY OVERVIEW

- TABLE 272 WELLINGTON LABORATORIES INC.: PRODUCTS OFFERED

- TABLE 273 WELLINGTON LABORATORIES INC.: PRODUCT LAUNCHES, JANUARY 2021-DECEMBER 2024

- TABLE 274 CAMBRIDGE ISOTOPE LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 275 CAMBRIDGE ISOTOPE LABORATORIES, INC.: PRODUCTS OFFERED

- TABLE 276 CAMBRIDGE ISOTOPE LABORATORIES, INC.: EXPANSIONS, JANUARY 2021-DECEMBER 2024

- TABLE 277 CHIRON AS: COMPANY OVERVIEW

- TABLE 278 CHIRON AS: PRODUCTS OFFERED

- TABLE 279 METROHM INULA GMBH: COMPANY OVERVIEW

- TABLE 280 METROHM INULA GMBH: PRODUCTS OFFERED

List of Figures

- FIGURE 1 PFAS TESTING MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 PFAS TESTING MARKET: YEARS CONSIDERED

- FIGURE 3 PFAS TESTING MARKET: RESEARCH DESIGN

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- FIGURE 6 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS, 2023

- FIGURE 7 PFAS TESTING MARKET: MARKET SIZE ESTIMATION METHODOLOGY

- FIGURE 8 PFAS TESTING MARKET: GROWTH PROJECTIONS BASED ON REVENUE IMPACT OF KEY MACROINDICATORS

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 PFAS TESTING MARKET, BY PRODUCT TYPE, 2024 VS. 2030 (USD MILLION)

- FIGURE 11 PFAS TESTING MARKET SHARE, BY TECHNIQUE, 2024 VS. 2030

- FIGURE 12 PFAS TESTING MARKET, BY METHOD, 2024 VS. 2030

- FIGURE 13 PFAS TESTING MARKET, BY APPLICATION, 2024 VS. 2030 (USD MILLION)

- FIGURE 14 GEOGRAPHICAL SNAPSHOT OF PFAS TESTING MARKET

- FIGURE 15 INCREASING GLOBAL ENVIRONMENTAL POLLUTION TO PROPEL MARKET GROWTH

- FIGURE 16 INSTRUMENTS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 LC-MS/MS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 18 EPA SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 19 EUROPE TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 20 PFAS TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 PFAS TESTING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 22 PFAS TESTING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 PFAS TESTING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 24 PFAS TESTING MARKET: IMPORT SCENARIO FOR (HS CODE 390469), 2019-2023

- FIGURE 25 PFAS TESTING MARKET: EXPORT SCENARIO FOR (HS CODE 390469), 2019-2023

- FIGURE 26 PATENT DETAILS FOR PFAS TESTING MARKET (JANUARY 2014-DECEMBER 2024)

- FIGURE 27 AVERAGE SELLING PRICE TREND OF PFAS INSTRUMENTS, BY TYPE, 2023 (USD THOUSAND)

- FIGURE 28 AVERAGE SELLING PRICE TREND OF PFAS INSTRUMENTS, BY REGION, 2022-2024 (USD THOUSAND)

- FIGURE 29 PFAS TESTING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY PRODUCT

- FIGURE 31 KEY BUYING CRITERIA FOR CHROMATOGRAPHY ACCESSORIES AND CONSUMABLES

- FIGURE 32 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 33 PFAS TESTING MARKET: INVESTMENT AND FUNDING SCENARIO, 2020-2023

- FIGURE 34 NUMBER OF DEALS IN MARKET, BY KEY PLAYER, 2020-2023

- FIGURE 35 VALUE OF DEALS IN MARKET, BY KEY PLAYER, 2020-2023 (USD)

- FIGURE 36 NORTH AMERICA: PFAS TESTING MARKET SNAPSHOT

- FIGURE 37 ASIA PACIFIC: PFAS TESTING MARKET SNAPSHOT

- FIGURE 38 REVENUE ANALYSIS OF TOP FIVE PLAYERS IN PFAS TESTING MARKET, 2019-2023

- FIGURE 39 MARKET SHARE ANALYSIS OF KEY PLAYERS IN PFAS TESTING MARKET, 2023

- FIGURE 40 RANKING OF KEY PLAYERS IN PFAS TESTING MARKET FOR TOTAL MARKET, 2023

- FIGURE 41 PFAS TESTING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 42 PFAS TESTING MARKET: COMPANY FOOTPRINT

- FIGURE 43 PFAS TESTING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 44 EV/EBITDA OF KEY VENDORS

- FIGURE 45 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 46 PFAS TESTING MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 47 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2024)

- FIGURE 48 DANAHER CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 49 WATERS CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 50 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2023)

- FIGURE 51 SHIMADZU CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 52 MERCK KGAA: COMPANY SNAPSHOT (2023)

- FIGURE 53 PERKINELMER INC.: COMPANY SNAPSHOT (2023)

- FIGURE 54 LGC LIMITED: COMPANY SNAPSHOT (2024)

- FIGURE 55 BIOTAGE: COMPANY SNAPSHOT (2023)

The global market for PFAS testing is anticipated to grow from USD 429.2 million in 2024 to USD 969.5 million in 2030 at a CAGR of 14.5% over the forecast period of 2024 to 2030. The high-end technologies of mass spectrometry and chromatography are drastically enhancing contaminant detection accuracy and efficiency. But a key restraint on the development of the PFAS testing market is the unavailability of standard, regulator-accepted laboratory test methods for analysis of PFAS in matrices other than drinking water. The unavailability of standardized test methods causes data inaccuracy and regulatory issues, and as such, slows down the acceptance of PFAS detection by many industries including agriculture, packaging, and wastewater management.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million) |

| Segments | Product Type, Techniques, Methods, Application, Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

"The technique segment to hold the largest share of the market in 2023."

Based on technique, PFAS testing is divided into liquid chromatography-mass spectrometry-mass spectrometry (LC-MS-MS), gas chromatography-mass spectrometry (GC/MS), mass spectrometry, NMR spectroscopy, combustion chromatography, ELISA, and other methods. The liquid chromatography-mass spectrometry-mass spectrometry (LC-MS-MS) segment held the largest market share of the PFAS testing market in 2023. The coupling of liquid chromatography (LC) and advanced tandem mass spectrometers has significantly eased and accelerated sample analysis. This marriage makes high-throughput analysis possible with minimal or no sample preparation, reducing processing time with increased accuracy and sensitivity. Therefore, these advancements have driven expansion of this market segment, forcing wider application in a number of industries, including pharmaceuticals, clinical diagnostics, environmental monitoring, and food safety analysis.

"The EPA segment to hold the largest share of the market in 2023."

Based on the method, the market for PFAS testing is divided into EPA, DIN, ISO, ASTM and other tests. The EPA segment is anticipated to lead the market for PFAS testing based on market share during the forecast period. The growth is largely attributed to the rising awareness of health hazards caused by PFAS chemical contaminants that are associated with several diseases like cancer, liver disease, and immune system dysfunction.With regulatory agencies across the globe imposing tighter limits on per- and polyfluoroalkyl substances (PFAS), there is increased demand for precise and effective testing protocols. EPA-validated testing methodologies, including EPA 537, EPA 533, and EPA 8327, have become the benchmark within the industry because they are highly sensitive, specific, and can analyze multiple PFAS compounds in water, soil, and other environmental media. This increasing emphasis on environmental protection and public health is likely to further drive the uptake of EPA-based PFAS testing solutions.

"The market in the North America region is expected to hold a significant market share for PFAS testing in 2022."

The market for PFAS testing encompasses five significant geographies-North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America commanded a major revenue share of the PFAS testing market in 2024 on account of the presence of strict government regulations, strong enforcement mechanisms, and higher awareness among consumers about the harmful effects of PFAS contamination. An increase in expenditure on environmental study, remediation, and enforcement activities has increased the adoption of new PFAS testing technology in the area. The U.S. Environmental Protection Agency (EPA) and Environment Canada have instituted stringent regulations in the form of maximum contaminant level (MCL) levels and mandatory PFAS drinking water, soil, and industrial effluent monitoring.Furthermore, growing interests in the health effects of exposure to PFAS, such as its association with cancer, endocrine disruption, and developmental disorder, have driven further demands for accurate and high-throughput test systems. With the more investments in lab facilities, advanced analytical methods like mass spectrometry, and more government-sponsored PFAS clean-up activities in the near future, North America is certain to continue its dominance in the market for PFAS testing for many years to come.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side- 70% and Demand Side 30%

- By Designation: Managers - 45%, CXO & Directors - 30%, and Executives - 25%

- By Region: North America -40%, Europe -25%, Asia-Pacific -25%, Latin America -5% and Middle East & Africa- 5%

List of key Companies Profiled in the Report:

The prominent players in the PFAS testing market are Merck KGaA (Germany), Agilent Technologies (US), LGC Limited (UK), Waters Corporation (US), Biotage (Sweden), AccuStandard, Inc. (US), PerkinElmer, Inc. (US), Thermo Fisher Scientific, Inc. (US), Phenomenex (US), MACHEREY-NAGEL GmbH & Co. KG (Germany), and Shimadzu Corporation (Japan), among others.

Research Coverage:

This report studies the PFAS testing market based on product type, technique,method, application, and region. It also covers the factors affecting market growth, analyzes the various opportunities and challenges in the market, and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to five main regions (and the respective countries in these regions.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants by providing them with the closest approximations of the revenue numbers for the overall PFAS testing market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges

The report provides insights on the following pointers:

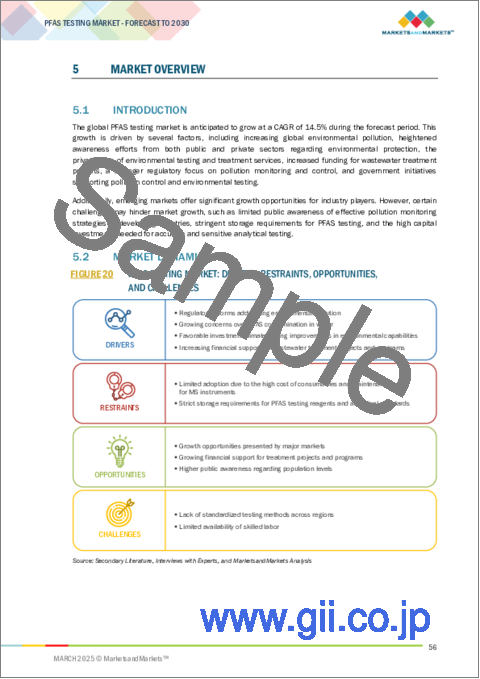

- Analysis of key drivers (regulatory reforms addressing environmental pollution, higher public awareness regarding population levels, a favorable investment climate driving improvements in environmental capabilities,increasing financial support wastewater treatment projects and programs), restraints (the limited availability of skilled labor, strict storage requirements for pfas testing reagents and analytical standards), opportunities (growth opportunities presented by major markets, growing financial support for treatment projects and programs), and challenges (lack of standardized testing methods across regions).

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product approvals/launches in the PFAS testing market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the PFAS testing market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players. A detailed analysis of the key industry players has been done to provide insights into their key strategies, product launches/ approvals, pipeline analysis, acquisitions, partnerships, agreements, collaborations, other recent developments, investment and funding activities, brand/product comparative analysis, and vendor valuation and financial metrics of the PFAS testing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Indicative list of secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

- 2.2.2 END USER-BASED MAPPING MARKET ESTIMATION

- 2.3 GROWTH FORECASTING MODEL

- 2.4 DATA TRIANGULATION & MARKET BREAKDOWN

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 PFAS TESTING MARKET OVERVIEW

- 4.2 PFAS TESTING MARKET, BY PRODUCT TYPE, 2024 VS. 2030 (USD MILLION)

- 4.3 PFAS TESTING MARKET, BY TECHNIQUE, 2024 VS. 2030 (USD MILLION)

- 4.4 PFAS TESTING MARKET, BY METHOD, 2024 VS. 2030 (USD MILLION)

- 4.5 PFAS TESTING MARKET, BY REGION, 2023

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Regulatory reforms addressing environmental pollution

- 5.2.1.2 Growing concerns over PFAS contamination in water

- 5.2.1.3 Favorable investment climate driving improvements in environmental capabilities

- 5.2.1.4 Increasing financial support for wastewater treatment projects and programs

- 5.2.2 RESTRAINTS

- 5.2.2.1 Strict storage requirements for PFAS testing reagents and analytical standards

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth opportunities presented by major markets

- 5.2.3.2 Growing financial support for treatment projects and programs

- 5.2.3.3 Higher public awareness regarding population levels

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of standardized testing methods across regions

- 5.2.4.2 Limited availability of skilled labor

- 5.2.1 DRIVERS

- 5.3 REGULATORY ANALYSIS

- 5.3.1 REGULATORY LANDSCAPE

- 5.3.2 REGULATORY GUIDELINES

- 5.3.2.1 North America

- 5.3.2.1.1 US

- 5.3.2.1.1.1 Water quality guidelines

- 5.3.2.1.1.2 Air quality guidelines

- 5.3.2.1.1.3 Food quality guidelines

- 5.3.2.1.2 Canada

- 5.3.2.1.2.1 Water quality guidelines

- 5.3.2.1.2.2 Air quality guidelines

- 5.3.2.1.2.3 Food quality guidelines

- 5.3.2.1.1 US

- 5.3.2.2 Europe

- 5.3.2.2.1 UK

- 5.3.2.2.1.1 Water quality guidelines

- 5.3.2.2.1.2 Air quality guidelines

- 5.3.2.2.1.3 Food quality guidelines

- 5.3.2.2.2 France

- 5.3.2.2.2.1 Water quality guidelines

- 5.3.2.2.2.2 Air quality guidelines

- 5.3.2.2.2.3 Food quality guidelines

- 5.3.2.2.3 Germany

- 5.3.2.2.3.1 Water quality guidelines

- 5.3.2.2.3.2 Air quality guidelines

- 5.3.2.2.3.3 Food quality guidelines

- 5.3.2.2.1 UK

- 5.3.2.3 Asia Pacific

- 5.3.2.3.1 China

- 5.3.2.3.1.1 Water quality guidelines

- 5.3.2.3.1.2 Air quality guidelines

- 5.3.2.3.1.3 Food quality guidelines

- 5.3.2.3.2 Japan

- 5.3.2.3.2.1 Water quality guidelines

- 5.3.2.3.2.2 Air quality guidelines

- 5.3.2.3.2.3 Food quality guidelines

- 5.3.2.3.3 India

- 5.3.2.3.3.1 Water quality guidelines

- 5.3.2.3.3.2 Air quality guidelines

- 5.3.2.3.3.3 Food quality guidelines

- 5.3.2.3.1 China

- 5.3.2.4 Latin America

- 5.3.2.4.1 Brazil

- 5.3.2.4.1.1 Water quality guidelines

- 5.3.2.4.1.2 Air quality guidelines

- 5.3.2.4.1.3 Food quality guidelines

- 5.3.2.4.1 Brazil

- 5.3.2.5 Middle East & Africa

- 5.3.2.5.1 UAE

- 5.3.2.5.1.1 Water quality guidelines

- 5.3.2.5.1.2 Air quality guidelines

- 5.3.2.5.1.3 Food quality guidelines

- 5.3.2.5.1 UAE

- 5.3.2.1 North America

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 R&D

- 5.4.2 RAW MATERIAL PROCUREMENT & PRODUCT DEVELOPMENT

- 5.4.3 MARKETING, SALES, AND DISTRIBUTION

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 5.5.3 END USERS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (HS CODE 390469)

- 5.7.2 EXPORT SCENARIO (HS CODE 390469)

- 5.8 PATENT ANALYSIS

- 5.9 PRICING ANALYSIS

- 5.9.1 AVERAGE SELLING PRICE TREND OF LC-MS INSTRUMENTS, BY KEY PLAYER, 2024

- 5.9.2 AVERAGE SELLING PRICE TREND OF PFAS INSTRUMENTS, BY TYPE, 2023

- 5.9.3 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Chromatography

- 5.10.1.2 Mass spectrometry

- 5.10.1.3 Ion chromatography

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Total organic fluorine (TOF) analysis

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Environmental monitoring technologies

- 5.10.3.2 Water treatment and filtration technologies

- 5.10.1 KEY TECHNOLOGIES

- 5.11 PORTER'S FIVE FORCE ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 KEY BUYING CRITERIA

- 5.13 KEY CONFERENCES & EVENTS IN 2025-2026

- 5.14 CASE STUDY ANALYSIS

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.16 INVESTMENT & FUNDING SCENARIO

- 5.17 UNMET NEEDS ANALYSIS

- 5.18 IMPACT OF AI/GEN AI ON PFAS TESTING MARKET

6 PFAS TESTING MARKET, BY PRODUCT TYPE

- 6.1 INTRODUCTION

- 6.2 INSTRUMENTS

- 6.2.1 LIQUID CHROMATOGRAPHY-MASS SPECTROMETRY (LC-MS)

- 6.2.1.1 Advancements in LC-MS to boost market

- 6.2.2 GAS CHROMATOGRAPHY-MASS SPECTROMETRY (GC-MS)

- 6.2.2.1 Strict regulations, environmental concerns, and rising demand for PFAS testing to drive segmental growth

- 6.2.3 STANDALONE MASS SPECTROMETRY

- 6.2.3.1 Stringent regulations to drive adoption of mass spectrometry

- 6.2.4 NUCLEAR MAGNETIC RESONANCE SPECTROSCOPY

- 6.2.4.1 Advancements in drug discovery and structural analysis to drive NMR instrument growth

- 6.2.5 OTHER INSTRUMENTS

- 6.2.1 LIQUID CHROMATOGRAPHY-MASS SPECTROMETRY (LC-MS)

- 6.3 CONSUMABLES

- 6.3.1 SAMPLE PREPARATION PRODUCTS

- 6.3.1.1 Rising demand for high-quality analytical results to drive growth of sample preparation products

- 6.3.2 CHROMATOGRAPHY COLUMNS

- 6.3.2.1 Increasing demand for high-performance separation in chromatography to drive market growth

- 6.3.3 REFERENCE MATERIALS & ANALYTICAL STANDARDS

- 6.3.3.1 Stringent regulatory standards and quality control requirements to drive propel growth

- 6.3.4 SOLVENTS

- 6.3.4.1 Growing demand for high-purity solvents in analytical testing and pharmaceutical applications to fuel growth

- 6.3.5 MEMBRANE & SYRINGE FILTERS

- 6.3.5.1 Increasing demand for sample purification and contamination control in laboratories to boost market

- 6.3.6 REAGENTS

- 6.3.6.1 Rising demand for high-quality reagents in diagnostics, research, and pharmaceutical applications to favor growth

- 6.3.7 OTHER CONSUMABLES

- 6.3.1 SAMPLE PREPARATION PRODUCTS

- 6.4 SOFTWARE & SERVICES

7 PFAS TESTING MARKET, BY TECHNIQUE

- 7.1 INTRODUCTION

- 7.2 LIQUID CHROMATOGRAPHY WITH TANDEM MASS SPECTROMETRY (LC-MS/MS)

- 7.2.1 PREFERRED ANALYTICAL TECHNIQUE FOR DETECTION AND ANALYSIS OF PFAS COMPOUNDS TO DRIVE MARKET GROWTH

- 7.3 GAS CHROMATOGRAPHY-MASS SPECTROMETRY (GC-MS)

- 7.3.1 HIGH COST OF GC INSTRUMENTS AND CONSUMABLES TO LIMIT WIDESPREAD ADOPTION AMONG END USERS

- 7.4 NUCLEAR MAGNETIC RESONANCE SPECTROSCOPY (NMR SPECTROSCOPY)

- 7.4.1 DEMAND FOR HIGH-SPEED, ACCURATE, AND RELIABLE DETECTION CAPABILITIES TO FAVOR GROWTH

- 7.5 MASS SPECTROMETRY

- 7.5.1 AUTOMATED TECHNIQUES WITH MULTI-ANALYTE PFAS DETECTION CAPABILITIES TO CONTRIBUTE TO GROWTH

- 7.6 COMBUSTION ION CHROMATOGRAPHY

- 7.6.1 SHORTAGE OF TRAINED PROFESSIONALS TO OPERATE CHROMATOGRAPHY INSTRUMENTS TO RESTRAIN MARKET GROWTH

- 7.7 ENZYME-LINKED IMMUNOSORBENT ASSAYS (ELISA)

- 7.7.1 COST-EFFECTIVE SAMPLE PREPARATION AND USER-FRIENDLY METHODS TO DRIVE ADOPTION

- 7.8 OTHER TECHNIQUES

8 PFAS TESTING MARKET, BY METHOD

- 8.1 INTRODUCTION

- 8.2 EPA

- 8.2.1 GROWING NEED TO MONITOR AND LIMIT PFAS CONTAMINATION IN DRINKING WATER TO DRIVE MARKET GROWTH

- 8.3 DIN

- 8.3.1 GROWING CONCERNS ABOUT AIR AND WATER POLLUTION TO DRIVE MARKET GROWTH

- 8.4 ISO

- 8.4.1 INCREASING DISCHARGE OF INDUSTRIAL WASTEWATER AND EFFLUENTS TO BOOST GROWTH

- 8.5 ASTM

- 8.5.1 GOVERNMENT REGULATIONS AIMED AT CONTROLLING WATER POLLUTION TO FAVOR MARKET GROWTH

- 8.6 OTHER METHODS

9 PFAS TESTING MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 WATER TESTING

- 9.2.1 GROUND & POTABLE WATER TESTING

- 9.2.1.1 Rising demand for water quality testing driven by PFAS contamination to boost market

- 9.2.2 WASTEWATER TESTING

- 9.2.2.1 Rising demand for wastewater and irrigation water testing to propel market

- 9.2.1 GROUND & POTABLE WATER TESTING

- 9.3 SOIL TESTING

- 9.3.1 GROWING DEMAND FOR SOIL TESTING TO DRIVE MARKET GROWTH

- 9.4 FOOD & BEVERAGE TESTING

- 9.4.1 GROWING DEMAND FOR ADVANCED ANALYTICAL METHODS IN FOOD & BEVERAGE INDUSTRY TO FUEL GROWTH

- 9.5 BLOOD/SERUM TESTING

- 9.5.1 EFFORTS BY REGULATORY AGENCIES TO MONITOR AND RESTRICT PFAS CONTAMINATION TO CREATE OPPORTUNITIES FOR MARKET PLAYERS

- 9.6 AIR MONITORING

- 9.6.1 COLLABORATIVE REGULATORY ACTIONS DRIVING ENVIRONMENTAL REMEDIATION TO AID GROWTH

- 9.7 MICROBIAL TESTING

- 9.7.1 GROWING RESEARCH FUNDING TO DRIVE GROWTH

- 9.8 OTHER APPLICATIONS

10 PFAS TESTING MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 US to dominate North American PFAS testing market

- 10.2.3 CANADA

- 10.2.3.1 Increasing government funding to drive adoption of PFAS testing instruments

- 10.3 EUROPE

- 10.4 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Germany to dominate market for PFAS testing in Europe

- 10.4.2 UK

- 10.4.2.1 Favorable funding & investment scenario to drive market growth.

- 10.4.3 FRANCE

- 10.4.3.1 Rising industrial contaminants & pollution to support market growth

- 10.4.4 ITALY

- 10.4.4.1 High levels of water pollution to offer growth opportunities

- 10.4.5 SPAIN

- 10.4.5.1 Strict food regulations and high agricultural imports to drive market growth in Spain

- 10.4.6 REST OF EUROPE

- 10.4.1 GERMANY

- 10.5 ASIA PACIFIC

- 10.5.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.5.2 JAPAN

- 10.5.2.1 Rising awareness about analytical technologies to support market growth

- 10.5.3 CHINA

- 10.5.3.1 Increasing R&D expenditure to drive market growth

- 10.5.4 INDIA

- 10.5.4.1 Rising funding programs to drive market

- 10.5.5 AUSTRALIA

- 10.5.5.1 Growing government regulation to support adoption and development of analytical technologies

- 10.5.6 SOUTH KOREA

- 10.5.6.1 Increasing alliances & investments in research to drive market

- 10.5.7 REST OF ASIA PACIFIC

- 10.6 LATIN AMERICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.6.2 BRAZIL

- 10.6.2.1 Brazil to dominate Latin American market during forecast period

- 10.6.3 MEXICO

- 10.6.3.1 Strong pharmaceutical industry and increased government support to augment market

- 10.6.4 REST OF LATIN AMERICA

- 10.7 MIDDLE EAST & AFRICA

- 10.7.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.7.2 GCC COUNTRIES

- 10.7.2.1 Lack of regulations for PFAS substances to restrict market growth

- 10.7.3 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN PFAS TESTING MARKET

- 11.3 REVENUE ANALYSIS, 2019-2023

- 11.4 MARKET SHARE ANALYSIS, 2023

- 11.5 MARKET RANKING ANALYSIS, 2023

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 11.6.5.1 Company footprint

- 11.6.5.2 Region footprint

- 11.6.5.3 Product type footprint

- 11.6.5.4 Technique footprint

- 11.6.5.5 Method footprint

- 11.6.5.6 Application footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES, 2023

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.7.5.2 Competitive benchmarking of key startups/SMEs

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 PRODUCT LAUNCHES

- 11.8.2 DEALS

- 11.8.3 EXPANSIONS

- 11.9 COMPANY VALUATION & FINANCIAL METRICS

- 11.10 BRAND/PRODUCT COMPARISON

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 AGILENT TECHNOLOGIES, INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.3.3 Expansions

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 DANAHER CORPORATION

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 WATERS CORPORATION.

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses & competitive threats

- 12.1.4 THERMO FISHER SCIENTIFIC INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 SHIMADZU CORPORATION

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Expansions

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 MERCK KGAA

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Expansions

- 12.1.7 PERKINELMER INC.

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.8 LGC LIMITED

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Deals

- 12.1.8.3.3 Expansions

- 12.1.9 BIOTAGE

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Expansions

- 12.1.10 MACHEREY-NAGEL GMBH & CO. KG

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.11 ACCUSTANDARD

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product launches

- 12.1.12 WELLINGTON LABORATORIES INC.

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches

- 12.1.13 CAMBRIDGE ISOTOPE LABORATORIES, INC.

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Expansions

- 12.1.14 CHIRON AS

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.15 METROHM INULA GMBH

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.1 AGILENT TECHNOLOGIES, INC.

- 12.2 OTHER COMPANIES

- 12.2.1 RESTEK CORPORATION

- 12.2.2 MICROSAIC

- 12.2.3 EVONIK

- 12.2.4 LCTECH

- 12.2.5 ABSOLUTE STANDARDS INC.

- 12.2.6 CYTIVA

- 12.2.7 AVANTOR, INC.

- 12.2.8 GREYHOUND CHROMATOGRAPHY AND ALLIED CHEMICALS LTD.

- 12.2.9 LANXESS

- 12.2.10 THE CHEMOURS COMPANY

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS