|

|

市場調査レポート

商品コード

1389902

自動車用コーティングの世界市場:樹脂タイプ別、車両タイプ別、技術タイプ別、コートタイプ別、地域別 - 予測(~2028年)Automotive Coatings Market by Resin Type (Polyurethane, Epoxy, Acrylic), Vehicle Type (Passenger Cars, Commercial Vehicles), Technology Type (Solvent-based, Water-based, Powder-based), Coat Type (Clearcoat, Basecoat) & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用コーティングの世界市場:樹脂タイプ別、車両タイプ別、技術タイプ別、コートタイプ別、地域別 - 予測(~2028年) |

|

出版日: 2023年11月21日

発行: MarketsandMarkets

ページ情報: 英文 315 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

レポートの概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 単位 | 100万米ドル/10億米ドル |

| セグメント | 樹脂タイプ別、技術別、車両タイプ別、コートタイプ別、地域別 |

| 対象地域 | アジア太平洋、欧州、北米、中東・アフリカ、南米 |

世界の自動車用コーティングの市場規模は、2023年に155億米ドル、2028年までに190億米ドルに達し、CAGRで4.1%の成長が予測されています。

アジア太平洋は2022年に市場の金額ベースで最大のシェアを占めると推定されます。

「北米が金額ベースで市場の第2位のシェアを占める可能性が高いです。」

この地域は自動車産業が確立されており生産台数が多く、技術革新と先進のコーティング技術に力を入れており、優れた美観と耐久性を備えた自動車に対する消費者の需要が高まっています。さらに、同地域の厳しい環境規制が環境に優しいコーティングの採用を促進し、市場全体の成長に寄与しています。道路の建設やメンテナンスを含む継続的なインフラプロジェクトは、商用車や公共交通機関に使用されるコーティングの需要に寄与し、市場をさらに強化しています。この地域は、自動車部門における技術革新の最前線にあります。電気自動車(EV)やスマートコーティングなどの進歩により、繊細な電子部品を保護し、先進の機能性を提供する特殊コーティングのニーズが高まっています。

自動車用コーティング部門における主要企業や業界のリーダーのプレゼンスと、研究開発活動への注力の高まりが、世界市場の継続的な成長と競争力を確実なものとしています。

「ベースコートが市場でもっとも急成長しているコートタイプです。」

技術の進歩により、高性能ベースコートの配合が開発され、カラーマッチングや塗布効率、全体的なコーティング品質の向上が可能となっています。カスタマイズ可能で美観に優れた車両の仕上げを求める消費者の選好が急増し、幅広いカラーと特殊効果を提供する革新的なベースコートオプションの需要が高まっています。さらに、ベースコートは車両の望ましい外観を実現する上で重要な役割を果たし、その視覚的魅力に大きく寄与しています。消費者が自動車の外観の美しさをますます優先するようになっていることから、自動車メーカーはこうした要求に応えるため、ベースコート技術の機能強化に力を入れています。さらに、環境への配慮から、厳しい環境規制に合わせて揮発性有機化合物(VOC)のレベルを下げた環境に優しいベースコートの配合の開発が進んでいます。このようなコーティングソリューションの持続可能性へのシフトは、先進のベースコートの人気上昇に寄与しています。

「中国が予測期間に最大の市場になる見込みです。」

中国の中産階級がより裕福になり、自動車所有率が上昇しています。中国で自動車を購入する消費者が増えるにつれて、自動車を保護し外観を向上させる自動車用コーティングの需要も比例して増加しています。中国はコーティング技術の著しい進歩を見せてきました。スマートコーティングや電気自動車向けのコーティングなど、コーティングの革新が同国の自動車用コーティング市場全体の成長に寄与しています。中国では都市化やインフラ開発が進んでおり、商用車や公共交通機関への需要が高まっています。このため、新車用とメンテナンス用の両方で自動車用コーティングのニーズがさらに高まっています。

当レポートでは、世界の自動車用コーティング市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 自動車用コーティング市場の企業にとって魅力的な機会

- 自動車用コーティング市場:技術別

- 自動車用コーティング市場、先進国 VS. 新興経済国

- アジア太平洋の自動車用コーティング市場:技術別、国別

- 自動車用コーティング市場:主要国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- マクロ経済指標

- イントロダクション

- GDPの動向と予測

- 世界の自動車産業の動向

第6章 産業の動向

- サプライチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- エコシステムマップ

- ケーススタディ

- 技術分析

- 主なステークホルダーと購入基準

- 価格分析

- 平均販売価格の動向:地域別

- 平均販売価格の動向:樹脂タイプ別

- 平均販売価格の動向:コートタイプ別

- 平均販売価格の動向:技術別

- 平均販売価格の動向:車両タイプ別

- 主要企業の平均販売価格の動向:樹脂タイプ別

- 貿易分析

- 塗料・コーティングの輸出シナリオ

- 塗料・コーティングの輸入シナリオ

- 市場成長に影響を与える世界経済のシナリオ

- 景気低迷の影響

- ロシア・ウクライナ戦争

- 欧州の不況

- 欧州のエネルギー危機

- アジア太平洋の不況の影響

- 関税と規制情勢

- 自動車用コーティングに関する規制

- 規制機関、政府機関、その他の組織

- 特許分析

- 主な会議とイベント(2023年~2024年)

第7章 自動車用コーティング市場:車両タイプ別

- イントロダクション

- 乗用車

- 商用車

第8章 自動車用コーティング市場:樹脂タイプ別

- イントロダクション

- ポリウレタン

- エポキシ

- アクリル

- その他のタイプ

第9章 自動車用コーティング市場:技術別

- イントロダクション

- 溶剤系

- 水性

- 粉体

第10章 自動車用コーティング市場:コートタイプ別

- イントロダクション

- 電着コート

- プライマー

- ベースコート

- クリアコート

第11章 自動車用コーティング市場:地域別

- イントロダクション

- 北米

- 景気後退の影響

- 米国

- カナダ

- メキシコ

- 欧州

- 景気後退の影響

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

- イタリア

- トルコ

- その他の欧州

- アジア太平洋

- 景気後退の影響

- 中国

- 日本

- 韓国

- インド

- タイ

- インドネシア

- マレーシア

- その他のアジア太平洋

- 南米

- 景気後退の影響

- ブラジル

- アルゼンチン

- その他の南米

- 中東・アフリカ

- 景気後退の影響

- 南アフリカ

- モロッコ

- その他の中東・アフリカ

第12章 競合情勢

- 主要企業の戦略

- 市場シェア分析

- 収益分析

- 市場ランキング分析

- 企業の評価マトリクス

- スタートアップ/中小企業の評価マトリクス

- 競合シナリオと動向

第13章 企業プロファイル

- 主要企業

- PPG INDUSTRIES, INC.

- BASF SE

- AXALTA COATING SYSTEMS

- KANSAI PAINT CO., LTD

- NIPPON PAINT HOLDINGS CO., LTD.

- KCC CORPORATION

- THE SHERWIN-WILLIAMS COMPANY

- AKZO NOBEL N.V.

- JOTUN A/S

- RPM INTERNATIONAL

- その他の企業

- US PAINTS

- ASIAN PAINTS LTD.

- BERGER PAINTS INDIA LTD.

- BECKERS GROUP

- SHANGHAI KINLITA CHEMICAL CO., LTD.

- KAPCI COATINGS

- NATIONAL PAINTS FACTORIES CO. LTD.

- RED SPOT PAINT AND VARNISH CO., INC.

- CONCEPT PAINTS

- GUANGZHOU ZHENROUMEI CHEMICAL COATINGS LIMITED

- QINGYUAN BAOHONG PAINT CO., LTD.

- WEG S.A.

- TITAN COATINGS INTERNATIONAL

- APV ENGINEERED COATINGS

- GRAND POLYCOATS

第14章 隣接市場と関連市場

- イントロダクション

- 市場の制限

- 塗料・コーティング市場の定義

- 塗料・コーティング市場の概要

- 塗料・コーティング市場:技術別

- 塗料・コーティング市場:樹脂タイプ別

- 塗料・コーティング市場:最終用途産業別

- 塗料・コーティング市場:地域別

第15章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD million/billion) |

| Segments | By Resin Type, By Technology, By Vehicle Type, By Coat Type, By Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa and South America |

The automotive coatings market size is projected to reach USD 19.0 billion by 2028 at a CAGR of 4.1% from USD 15.5 billion in 2023. Asia pacific is estimated to account for the largest share in terms of value of the automotive coatings market in 2022.

" North America is likely to account for the second largest share of automotive coatings market in terms of value."

The region has a well-established automotive industry with high production volumes, a strong focus on innovation and advanced coating technologies, and a growing consumer demand for vehicles with superior aesthetics and durability. Additionally, stringent environmental regulations in the region are driving the adoption of eco-friendly coatings, contributing to the overall market growth. Ongoing infrastructure projects, including road construction and maintenance, contribute to the demand for coatings used in commercial vehicles and public transportation, further bolstering the automotive coatings market. The region is at the forefront of technological innovations in the automotive sector. Advancements such as electric vehicles (EVs) and smart coatings are driving the need for specialized coatings that protect sensitive electronic components and offer advanced functionalities.

The presence of key players and industry leaders in the automotive coatings sector, along with an increasing focus on research and development initiatives, ensures the continuous growth and competitiveness of the global market.

" Basecoat is projected to be the fastest growing coat type segment of automotive coatings market."

Advancements in technology have led to the development of high-performance basecoat formulations, allowing for improved color matching, application efficiency, and overall coating quality. consumer preferences for customizable and aesthetically pleasing vehicle finishes have surged, driving the demand for innovative basecoat options that offer a wide range of colors and special effects. Additionally, the basecoat plays a crucial role in achieving the desired appearance of the vehicle, contributing significantly to its visual appeal. As consumers increasingly prioritize the exterior aesthetics of their vehicles, automotive manufacturers are focusing on enhancing the capabilities of basecoat technologies to meet these demands. Furthermore, environmental concerns have led to the development of eco-friendly basecoat formulations with reduced levels of volatile organic compounds (VOCs), aligning with stringent environmental regulations. This shift toward sustainability in coating solutions contributes to the rising popularity of advanced basecoats.

"China, by country is forecasted to be the largest market of automotive coatings during the forecast period."

The rising affluence of the Chinese middle class has led to increased vehicle ownership. As more consumers in China purchase cars, there is a proportional increase in the demand for automotive coatings to protect and enhance the appearance of these vehicles. China has witnessed significant advancements in coating technologies. Innovations in coatings, such as smart coatings and those tailored for electric vehicles, contribute to the overall growth of the automotive coatings market in the country. Ongoing urbanization and infrastructure development projects in China contribute to the demand for commercial vehicles and public transportation. This further boosts the need for automotive coatings for both new vehicles and maintenance purposes.

Breakdown of Primary Interviews:

- By Company Type: Tier 1 - 33%, Tier 2 - 40%, and Tier 3 - 27%

- By Designation: C Level - 33%, D Level - 27%, and Others - 40%

- By Region: North America - 27%, Europe - 20%, Asia Pacific - 33%, Middle East & Africa - 7% and South America - 13%

The key companies profiled in this report are BASF SE (Germany), PPG Industries, Inc. (US), Axalta coating Systems (US), Akzo Nobel N.V. (Netherlands), and Kansai Paint Co., Ltd (Japan).

Research Coverage:

The automotive coatings market has been segmented based on Resin Type (Polyurethane, Epoxy, Acrylic, and Others), Vehicle Type (Passenger cars, Commercial Vehicles), Technology (Solvent-based, Water-based, Powder-based), Coat Type (Clearcoat, Basecoat, Primer, E-Coat), and by Region (Asia Pacific, North America, Europe, Middle East & Africa, and South America).

This report provides insights on the following pointers:

- Analysis of key drivers (Growing automotive and EV sales to drive coatings industry, Green, environment-friendly, and healthier coating systems) restraints (Volatility of raw material prices, Revocation of government subsidiaries on EVs), opportunities (Process optimization, Advancement in coating technology), and challenges (Stringent regulatory policies) influencing the growth of the automotive coatings market.

- Product Development/Innovation: Detailed insight of upcoming technologies, research & development activities, and new product launch in the automotive coatings market.

- Market Development: Comprehensive information about markets - the report analyses the automotive coatings market across varied regions.

- Market Diversification: Exclusive information about the new products & service untapped geographies, recent developments, and investments in automotive coatings market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like BASF SE (Germany), PPG Industries, Inc. (US), Axalta coating Systems (US), Akzo Nobel N.V. (Netherlands), and Kansai Paint Co., Ltd (Japan) among other in the automotive coatings market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.2.2 DEFINITION AND INCLUSIONS, BY RESIN TYPE

- 1.2.3 DEFINITION AND INCLUSIONS, BY TECHNOLOGY

- 1.2.4 DEFINITION AND INCLUSIONS, BY COAT TYPE

- 1.2.5 DEFINITION AND INCLUSIONS, BY VEHICLE TYPE

- 1.3 MARKET SCOPE

- FIGURE 1 AUTOMOTIVE COATINGS MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 AUTOMOTIVE COATINGS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Primary data sources

- 2.1.2.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 AUTOMOTIVE COATINGS MARKET SIZE ESTIMATION, BY TECHNOLOGY

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 AUTOMOTIVE COATINGS MARKET SIZE ESTIMATION, BY REGION

- FIGURE 6 AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY

- 2.3 MARKET FORECAST

- 2.3.1 SUPPLY-SIDE FORECAST

- FIGURE 7 AUTOMOTIVE COATINGS MARKET: SUPPLY-SIDE FORECAST

- FIGURE 8 METHODOLOGY FOR SUPPLY-SIDE SIZING OF AUTOMOTIVE COATINGS MARKET

- 2.4 FACTOR ANALYSIS

- FIGURE 9 FACTOR ANALYSIS OF AUTOMOTIVE COATINGS MARKET

- 2.5 DATA TRIANGULATION

- FIGURE 10 AUTOMOTIVE COATINGS MARKET: DATA TRIANGULATION

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS

- 2.8 GROWTH FORECAST

- 2.9 RISK ASSESSMENT

- TABLE 1 AUTOMOTIVE COATINGS MARKET: RISK ASSESSMENT

- 2.10 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- TABLE 2 AUTOMOTIVE COATINGS MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 11 POLYURETHANE RESIN SEGMENT TO DOMINATE AUTOMOTIVE COATINGS MARKET

- FIGURE 12 SOLVENT-BASED TECHNOLOGY TO LEAD AUTOMOTIVE COATINGS MARKET

- FIGURE 13 CLEARCOAT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE COATINGS MARKET

- FIGURE 15 GROWTH OF AUTOMOTIVE SECTOR TO DRIVE MARKET IN ASIA PACIFIC

- 4.2 AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY

- FIGURE 16 SOLVENT-BASED COATINGS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

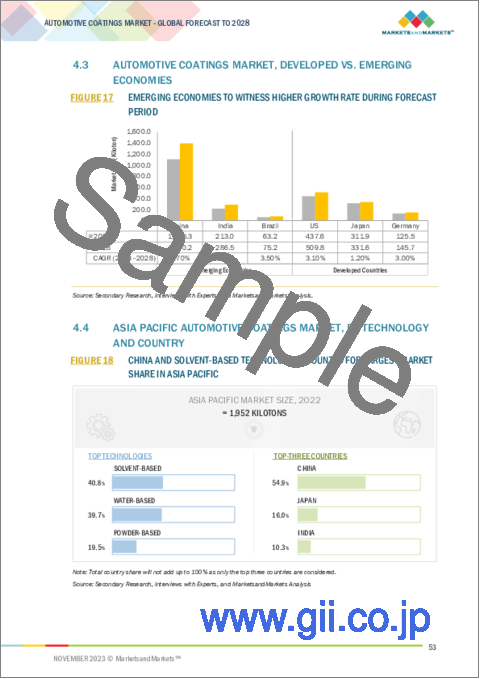

- 4.3 AUTOMOTIVE COATINGS MARKET, DEVELOPED VS. EMERGING ECONOMIES

- FIGURE 17 EMERGING ECONOMIES TO WITNESS HIGHER GROWTH RATE DURING FORECAST PERIOD

- 4.4 ASIA PACIFIC AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY AND COUNTRY

- FIGURE 18 CHINA AND SOLVENT-BASED TECHNOLOGY ACCOUNTED FOR LARGEST MARKET SHARE IN ASIA PACIFIC

- 4.5 AUTOMOTIVE COATINGS MARKET, BY KEY COUNTRY

- FIGURE 19 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN AUTOMOTIVE COATINGS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growing automotive and EV sales

- 5.2.1.2 Green, environment-friendly, and healthier coating systems

- 5.2.1.3 Technological advancements in powder-based coatings

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatility of raw material prices

- 5.2.2.2 Environmental regulations in developed countries

- 5.2.2.3 Revocation of government subsidies on EVs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing use of powder-based coatings in automotive industry

- 5.2.3.2 Advancements in coating technology

- 5.2.3.3 Process optimization

- 5.2.4 CHALLENGES

- 5.2.4.1 Changes in consumer demand

- 5.2.4.2 Stringent regulatory policies

- 5.2.4.3 Environmental challenges concerning wastewater discharge

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 AUTOMOTIVE COATINGS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 21 PORTER'S FIVE FORCES ANALYSIS: AUTOMOTIVE COATINGS MARKET

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 MACROECONOMIC INDICATORS

- 5.4.1 INTRODUCTION

- 5.4.2 GDP TRENDS AND FORECAST

- TABLE 4 GDP PERCENTAGE (%) CHANGE OF KEY COUNTRIES, 2020-2028

- 5.4.3 TRENDS IN GLOBAL AUTOMOTIVE INDUSTRY

- TABLE 5 AUTOMOTIVE INDUSTRY PRODUCTION (2021-2022)

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- FIGURE 22 AUTOMOTIVE COATINGS: SUPPLY CHAIN ANALYSIS

- TABLE 6 AUTOMOTIVE COATINGS MARKET: SUPPLY CHAIN

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 23 REVENUE SHIFT FOR AUTOMOTIVE COATINGS MANUFACTURERS

- 6.3 ECOSYSTEM MAP

- FIGURE 24 AUTOMOTIVE COATINGS MARKET: ECOSYSTEM

- 6.4 CASE STUDY

- 6.5 TECHNOLOGY ANALYSIS

- 6.6 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP INDUSTRIES (%)

- 6.6.2 BUYING CRITERIA

- FIGURE 26 KEY BUYING CRITERIA FOR AUTOMOTIVE COATINGS

- TABLE 8 KEY BUYING CRITERIA FOR AUTOMOTIVE COATINGS

- 6.7 PRICING ANALYSIS

- 6.7.1 AVERAGE SELLING PRICE TREND, BY REGION

- FIGURE 27 AVERAGE SELLING PRICE TREND, BY REGION, 2020-2028

- TABLE 9 AVERAGE SELLING PRICE OF AUTOMOTIVE COATINGS, BY REGION, 2020-2028

- 6.7.2 AVERAGE SELLING PRICE TREND, BY RESIN TYPE

- FIGURE 28 AVERAGE SELLING PRICE TREND, BY RESIN TYPE, 2020-2028

- TABLE 10 AVERAGE SELLING PRICE OF AUTOMOTIVE COATINGS, BY RESIN TYPE, 2020-2028

- 6.7.3 AVERAGE SELLING PRICE TREND, BY COAT TYPE

- FIGURE 29 AVERAGE SELLING PRICE TREND, BY COAT TYPE, 2020-2028

- TABLE 11 AVERAGE SELLING PRICE OF AUTOMOTIVE COATINGS, BY COAT TYPE, 2020-2028

- 6.7.4 AVERAGE SELLING PRICE TREND, BY TECHNOLOGY

- FIGURE 30 AVERAGE SELLING PRICE TREND, BY TECHNOLOGY, 2020-2028

- TABLE 12 AVERAGE SELLING PRICE OF AUTOMOTIVE COATINGS, BY TECHNOLOGY, 2020-2028

- 6.7.5 AVERAGE SELLING PRICE TREND, BY VEHICLE TYPE

- FIGURE 31 AVERAGE SELLING PRICE TREND, BY VEHICLE TYPE, 2022

- TABLE 13 AVERAGE SELLING PRICE OF AUTOMOTIVE COATINGS, BY VEHICLE TYPE, 2020-2028

- 6.7.6 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY RESIN TYPE

- FIGURE 32 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY RESIN TYPE, 2022

- TABLE 14 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY RESIN TYPE, 2022

- 6.8 TRADE ANALYSIS

- 6.8.1 EXPORT SCENARIO OF PAINTS AND COATINGS

- FIGURE 33 AUTOMOTIVE COATINGS EXPORT, BY KEY COUNTRY, 2018-2022 (TON)

- FIGURE 34 AUTOMOTIVE COATINGS EXPORT, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 15 COUNTRY-WISE EXPORT DATA, 2018-2022 (USD THOUSAND)

- TABLE 16 COUNTRY-WISE EXPORT DATA, 2018-2022 (TON)

- 6.8.2 IMPORT SCENARIO OF PAINTS AND COATINGS

- FIGURE 35 AUTOMOTIVE COATINGS IMPORT, BY KEY COUNTRY, 2018-2022 (TON)

- FIGURE 36 AUTOMOTIVE COATINGS IMPORT, BY KEY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 17 COUNTRY-WISE IMPORT DATA, 2018-2022 (USD THOUSAND)

- TABLE 18 COUNTRY-WISE IMPORT DATA, 2018-2022 (TON)

- 6.9 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTH

- 6.9.1 IMPACT OF SLOWDOWN

- 6.9.2 RUSSIA-UKRAINE WAR

- 6.9.3 EUROPE RECESSION

- 6.9.4 ENERGY CRISIS IN EUROPE

- 6.9.5 ASIA PACIFIC RECESSION IMPACT

- 6.10 TARIFF AND REGULATORY LANDSCAPE

- 6.10.1 REGULATIONS RELATED TO AUTOMOTIVE COATINGS

- 6.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11 PATENT ANALYSIS

- FIGURE 37 NUMBER OF PATENTS GRANTED FOR AUTOMOTIVE COATINGS MARKET, 2013-2023

- FIGURE 38 REGIONAL ANALYSIS OF PATENTS GRANTED FOR AUTOMOTIVE COATINGS MARKET

- TABLE 22 PATENTS IN AUTOMOTIVE COATINGS MARKET, 2023

- 6.12 KEY CONFERENCES & EVENTS IN 2023-2024

- TABLE 23 AUTOMOTIVE COATINGS MARKET: KEY CONFERENCES & EVENTS, 2023-2024

7 AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE

- 7.1 INTRODUCTION

- FIGURE 39 PASSENGER CARS TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 24 AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 25 AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 26 AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2018-2022 (KILOTON)

- TABLE 27 AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2023-2028 (KILOTON)

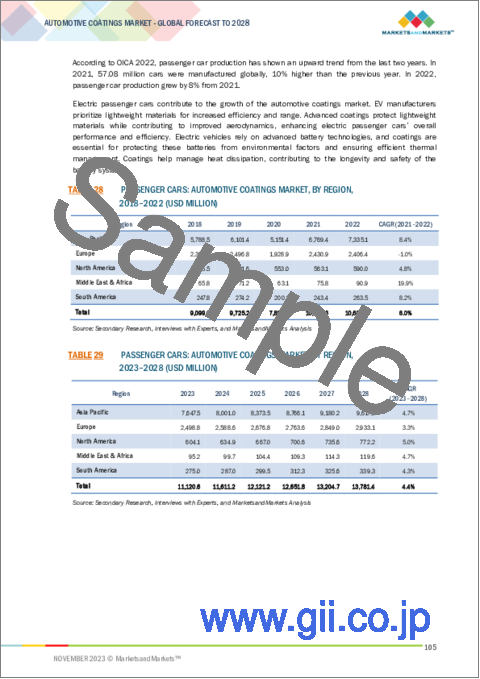

- 7.2 PASSENGER CARS

- 7.2.1 CONSUMER DEMAND FOR PERSONALIZED TRANSPORTATION FUEL TO DRIVE MARKET

- TABLE 28 PASSENGER CARS: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 29 PASSENGER CARS: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 30 PASSENGER CARS: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 31 PASSENGER CARS: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (KILOTON)

- 7.3 COMMERCIAL VEHICLES

- 7.3.1 RISING GLOBAL TRADE AND SURGE IN E-COMMERCE TO PROPEL DEMAND FOR COMMERCIAL VEHICLES

- TABLE 32 COMMERCIAL VEHICLES: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 33 COMMERCIAL VEHICLES: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 34 COMMERCIAL VEHICLES: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 35 COMMERCIAL VEHICLES: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (KILOTON)

8 AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE

- 8.1 INTRODUCTION

- FIGURE 40 POLYURETHANE RESIN TO DOMINATE AUTOMOTIVE COATINGS MARKET

- TABLE 36 AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2018-2022 (USD MILLION)

- TABLE 37 AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 38 AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2018-2022 (KILOTON)

- TABLE 39 AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2023-2028 (KILOTON)

- 8.2 POLYURETHANE

- 8.2.1 GOOD ELASTICITY AT LOW TEMPERATURES TO BOOST MARKET

- TABLE 40 POLYURETHANE: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 41 POLYURETHANE: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 42 POLYURETHANE: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 43 POLYURETHANE: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (KILOTON)

- 8.3 EPOXY

- 8.3.1 HIGH ADHESION AND RUST RESISTANCE TO DRIVE MARKET

- TABLE 44 EPOXY: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 45 EPOXY: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 46 EPOXY: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 47 EPOXY: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (KILOTON)

- 8.4 ACRYLIC

- 8.4.1 RESISTANCE TO ABRASION AND CHEMICAL ATTACK TO FUEL MARKET

- TABLE 48 ACRYLIC: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 49 ACRYLIC: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 50 ACRYLIC: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 51 ACRYLIC: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (KILOTON)

- 8.5 OTHER TYPES

- TABLE 52 OTHER TYPES: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 53 OTHER TYPES: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 54 OTHER TYPES: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 55 OTHER TYPES: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (KILOTON)

9 AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- FIGURE 41 SOLVENT-BASED TECHNOLOGY TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 56 AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 57 AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 58 AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2018-2022 (KILOTON)

- TABLE 59 AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2023-2028 (KILOTON)

- 9.2 SOLVENT-BASED

- 9.2.1 HIGH DURABILITY AND LOW SENSITIVITY TO DRIVE MARKET

- TABLE 60 SOLVENT-BASED: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 61 SOLVENT-BASED: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 62 SOLVENT-BASED: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 63 SOLVENT-BASED: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (KILOTON)

- 9.3 WATER-BASED

- 9.3.1 NEED FOR ECO-FRIENDLY AND LOW CLEARCOAT TO BOOST MARKET

- TABLE 64 WATER-BASED: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 65 WATER-BASED: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 66 WATER-BASED: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 67 WATER-BASED: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (KILOTON)

- 9.4 POWDER-BASED

- 9.4.1 ABRASION AND CORROSION RESISTANCE TO DRIVE MARKET

- TABLE 68 POWDER-BASED: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 69 POWDER-BASED: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 70 POWDER-BASED: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 71 POWDER-BASED: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (KILOTON)

10 AUTOMOTIVE COATINGS MARKET, BY COAT TYPE

- 10.1 INTRODUCTION

- FIGURE 42 CLEARCOAT SEGMENT TO LEAD AUTOMOTIVE COATINGS MARKET

- TABLE 72 AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 73 AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 74 AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 75 AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 10.2 E-COAT

- 10.2.1 SUPERIOR ADHESIVE PROPERTIES TO DRIVE MARKET

- TABLE 76 E-COAT: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 77 E-COAT: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 78 E-COAT: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 79 E-COAT: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (KILOTON)

- 10.3 PRIMER

- 10.3.1 PROTECTION AGAINST DEFORMATION AND CHIPPING TO BOOST MARKET

- TABLE 80 PRIMER: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 81 PRIMER: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 82 PRIMER: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 83 PRIMER: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (KILOTON)

- 10.4 BASECOAT

- 10.4.1 REDUCED DOWNTIME AND MAINTENANCE OF VEHICLES TO DRIVE MARKET

- TABLE 84 BASECOAT: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 85 BASECOAT: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 86 BASECOAT: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 87 BASECOAT: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (KILOTON)

- 10.5 CLEARCOAT

- 10.5.1 PROTECTION AGAINST SCRATCHES AND UV RAYS TO BOOST DEMAND

- TABLE 88 CLEARCOAT: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 89 CLEARCOAT: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 90 CLEARCOAT: AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 91 CLEARCOAT: AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (KILOTON)

11 AUTOMOTIVE COATINGS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 43 ASIA PACIFIC TO EMERGE AS STRATEGIC LOCATION FOR AUTOMOTIVE COATINGS MARKET

- TABLE 92 AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 93 AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 94 AUTOMOTIVE COATINGS MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 95 AUTOMOTIVE COATINGS MARKET, BY REGION, 2023-2028 (KILOTON)

- 11.2 NORTH AMERICA

- 11.2.1 RECESSION IMPACT

- FIGURE 44 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET SNAPSHOT

- TABLE 96 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 98 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 99 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 100 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2018-2022 (USD MILLION)

- TABLE 101 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 102 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2018-2022 (KILOTON)

- TABLE 103 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2023-2028 (KILOTON)

- TABLE 104 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 105 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 106 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2018-2022 (KILOTON)

- TABLE 107 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2023-2028 (KILOTON)

- TABLE 108 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 109 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 110 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 111 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- TABLE 112 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 113 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 114 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2018-2022 (KILOTON)

- TABLE 115 NORTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2023-2028 (KILOTON)

- 11.2.2 US

- 11.2.2.1 Growing automotive industry to propel market

- TABLE 116 US: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 117 US: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 118 US: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 119 US: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.2.3 CANADA

- 11.2.3.1 Increased demand for water-based coatings in automotive refinish to drive market

- TABLE 120 CANADA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 121 CANADA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 122 CANADA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 123 CANADA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.2.4 MEXICO

- 11.2.4.1 Favorable trade agreements to fuel market

- TABLE 124 MEXICO: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 125 MEXICO: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 126 MEXICO: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 127 MEXICO: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.3 EUROPE

- 11.3.1 RECESSION IMPACT

- FIGURE 45 EUROPE: AUTOMOTIVE COATINGS MARKET SNAPSHOT

- TABLE 128 EUROPE: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 129 EUROPE: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 130 EUROPE: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 131 EUROPE: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 132 EUROPE: AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2018-2022 (USD MILLION)

- TABLE 133 EUROPE: AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 134 EUROPE: AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2018-2022 (KILOTON)

- TABLE 135 EUROPE: AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2023-2028 (KILOTON)

- TABLE 136 EUROPE: AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 137 EUROPE: AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 138 EUROPE: AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2018-2022 (KILOTON)

- TABLE 139 EUROPE: AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2023-2028 (KILOTON)

- TABLE 140 EUROPE: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 141 EUROPE: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 142 EUROPE: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 143 EUROPE: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- TABLE 144 EUROPE: AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 145 EUROPE: AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 146 EUROPE: AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2018-2022 (KILOTON)

- TABLE 147 EUROPE: AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2023-2028 (KILOTON)

- 11.3.2 GERMANY

- 11.3.2.1 Presence of major distribution channels to increase demand for automotive coatings

- TABLE 148 GERMANY: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 149 GERMANY: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 150 GERMANY: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 151 GERMANY: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.3.3 UK

- 11.3.3.1 Sustainable investment in automotive R&D to drive market

- TABLE 152 K: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 153 UK: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 154 UK: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 155 UK: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.3.4 FRANCE

- 11.3.4.1 Government initiatives and technological advancements to drive market

- TABLE 156 FRANCE: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 157 FRANCE: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 158 FRANCE: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 159 FRANCE: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.3.5 RUSSIA

- 11.3.5.1 Presence of large oil reserves to boost market

- TABLE 160 RUSSIA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 161 RUSSIA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 162 RUSSIA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 163 RUSSIA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.3.6 SPAIN

- 11.3.6.1 New investments and sustainable approaches to drive market

- TABLE 164 SPAIN: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 165 SPAIN: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 166 SPAIN: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 167 SPAIN: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.3.7 ITALY

- 11.3.7.1 High disposable income and rising FII investments to fuel market

- TABLE 168 ITALY: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 169 ITALY: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 170 ITALY: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 171 ITALY: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.3.8 TURKEY

- 11.3.8.1 New manufacturing facilities to boost demand for automotive coatings

- TABLE 172 TURKEY: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 173 TURKEY: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 174 TURKEY: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 175 TURKEY: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.3.9 REST OF EUROPE

- TABLE 176 REST OF EUROPE: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 177 REST OF EUROPE: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 178 REST OF EUROPE: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 179 REST OF EUROPE: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.4 ASIA PACIFIC

- 11.4.1 RECESSION IMPACT

- FIGURE 46 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET SNAPSHOT

- TABLE 180 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 181 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 182 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 183 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 184 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2018-2022 (USD MILLION)

- TABLE 185 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 186 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2018-2022 (KILOTON)

- TABLE 187 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2023-2028 (KILOTON)

- TABLE 188 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 189 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 190 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2018-2022 (KILOTON)

- TABLE 191 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2023-2028 (KILOTON)

- TABLE 192 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 193 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 194 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 195 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- TABLE 196 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 197 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 198 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2018-2022 (KILOTON)

- TABLE 199 ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2023-2028 (KILOTON)

- 11.4.2 CHINA

- 11.4.2.1 Significant investments by global manufacturers to boost market

- TABLE 200 CHINA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 201 CHINA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 202 CHINA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 203 CHINA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.4.3 JAPAN

- 11.4.3.1 Well-established automobile industry to drive market

- TABLE 204 JAPAN: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 205 JAPAN: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 206 JAPAN: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 207 JAPAN: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Technology-driven economy approach to boost demand for automotive coatings

- TABLE 208 SOUTH KOREA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 209 SOUTH KOREA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 210 SOUTH KOREA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 211 SOUTH KOREA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.4.5 INDIA

- 11.4.5.1 Rapid economic growth and increasing disposable income to drive market

- TABLE 212 INDIA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 213 INDIA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 214 INDIA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 215 INDIA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.4.6 THAILAND

- 11.4.6.1 High-capacity automobile production to drive market

- TABLE 216 THAILAND: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 217 THAILAND: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 218 THAILAND: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 219 THAILAND: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.4.7 INDONESIA

- 11.4.7.1 Effective government policies and presence of global players to drive market

- TABLE 220 INDONESIA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 221 INDONESIA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 222 INDONESIA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 223 INDONESIA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.4.8 MALAYSIA

- 11.4.8.1 Manufacture of superior-quality products to boost market

- TABLE 224 MALAYSIA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 225 MALAYSIA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 226 MALAYSIA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 227 MALAYSIA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.4.9 REST OF ASIA PACIFIC

- TABLE 228 REST OF ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 229 REST OF ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 230 REST OF ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 231 REST OF ASIA PACIFIC: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.5 SOUTH AMERICA

- 11.5.1 RECESSION IMPACT

- FIGURE 47 BRAZIL TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- TABLE 232 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 233 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 234 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 235 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 236 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2018-2022 (USD MILLION)

- TABLE 237 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 238 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2018-2022 (KILOTON)

- TABLE 239 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2023-2028 (KILOTON)

- TABLE 240 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 241 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 242 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2018-2022 (KILOTON)

- TABLE 243 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2023-2028 (KILOTON)

- TABLE 244 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 245 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 246 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 247 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- TABLE 248 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 249 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 250 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2018-2022 (KILOTON)

- TABLE 251 SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2023-2028 (KILOTON)

- 11.5.2 BRAZIL

- 11.5.2.1 Expansion of production capacity and established distribution channels to propel market

- TABLE 252 BRAZIL: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 253 BRAZIL: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 254 BRAZIL: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 255 BRAZIL: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.5.3 ARGENTINA

- 11.5.3.1 High vehicle production to boost demand for automotive coatings

- TABLE 256 ARGENTINA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 257 ARGENTINA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 258 ARGENTINA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 259 ARGENTINA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.5.4 REST OF SOUTH AMERICA

- TABLE 260 REST OF SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 261 REST OF SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 262 REST OF SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 263 REST OF SOUTH AMERICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 RECESSION IMPACT

- FIGURE 48 SOUTH AFRICA TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- TABLE 264 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 265 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 266 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 267 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 268 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2018-2022 (USD MILLION)

- TABLE 269 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2023-2028 (USD MILLION)

- TABLE 270 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2018-2022 (KILOTON)

- TABLE 271 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY RESIN TYPE, 2023-2028 (KILOTON)

- TABLE 272 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 273 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 274 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2018-2022 (KILOTON)

- TABLE 275 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY TECHNOLOGY, 2023-2028 (KILOTON)

- TABLE 276 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 277 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 278 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 279 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- TABLE 280 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2018-2022 (USD MILLION)

- TABLE 281 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- TABLE 282 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2018-2022 (KILOTON)

- TABLE 283 MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY VEHICLE TYPE, 2023-2028 (KILOTON)

- 11.6.2 SOUTH AFRICA

- 11.6.2.1 Growth of various manufacturing industries to drive market

- TABLE 284 SOUTH AFRICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 285 SOUTH AFRICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 286 SOUTH AFRICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 287 SOUTH AFRICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.6.3 MOROCCO

- 11.6.3.1 Increasing foreign investments to drive market

- TABLE 288 MOROCCO: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 289 MOROCCO: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 290 MOROCCO: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 291 MOROCCO: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

- 11.6.4 REST OF MIDDLE EAST & AFRICA

- TABLE 292 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (USD MILLION)

- TABLE 293 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (USD MILLION)

- TABLE 294 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2018-2022 (KILOTON)

- TABLE 295 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE COATINGS MARKET, BY COAT TYPE, 2023-2028 (KILOTON)

12 COMPETITIVE LANDSCAPE

- 12.1 KEY PLAYER STRATEGIES

- 12.1.1 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 296 OVERVIEW OF STRATEGIES ADOPTED BY KEY AUTOMOTIVE COATING PLAYERS (2018-2023)

- 12.2 MARKET SHARE ANALYSIS

- FIGURE 49 MARKET SHARE ANALYSIS, BY KEY PLAYERS (2022)

- TABLE 297 AUTOMOTIVE COATINGS MARKET: DEGREE OF COMPETITION, 2022

- 12.3 REVENUE ANALYSIS

- FIGURE 50 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2018-2022

- 12.4 MARKET RANKING ANALYSIS

- FIGURE 51 MARKET RANKING ANALYSIS, 2022

- 12.5 COMPANY EVALUATION MATRIX

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 52 AUTOMOTIVE COATINGS MARKET: COMPANY EVALUATION MATRIX, 2022

- 12.5.5 COMPANY FOOTPRINT

- FIGURE 53 PRODUCT FOOTPRINT (25 COMPANIES)

- TABLE 298 APPLICATION FOOTPRINT (25 COMPANIES)

- TABLE 299 REGION FOOTPRINT (25 COMPANIES)

- TABLE 300 COMPANY OVERALL FOOTPRINT (25 COMPANIES)

- 12.6 START-UP/SME EVALUATION MATRIX

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- FIGURE 54 AUTOMOTIVE COATINGS MARKET: START-UP/SME EVALUATION MATRIX, 2022

- 12.6.5 COMPETITIVE BENCHMARKING

- TABLE 301 AUTOMOTIVE COATINGS MARKET: KEY START-UPS/SMES

- TABLE 302 AUTOMOTIVE COATINGS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES]

- 12.7 COMPETITIVE SCENARIO AND TRENDS

- 12.7.1 AUTOMOTIVE COATINGS MARKET: PRODUCT LAUNCHES

- TABLE 303 AUTOMOTIVE COATINGS MARKET: PRODUCT LAUNCHES, 2018-2023

- 12.7.2 AUTOMOTIVE COATINGS MARKET: DEALS

- TABLE 304 AUTOMOTIVE COATINGS MARKET: DEALS, 2018-2023

- 12.7.3 AUTOMOTIVE COATINGS MARKET: OTHER DEVELOPMENTS

- TABLE 305 AUTOMOTIVE COATINGS MARKET: OTHER DEVELOPMENTS, 2018-2023

13 COMPANY PROFILES

- (Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 13.1 KEY PLAYERS

- 13.1.1 PPG INDUSTRIES, INC.

- TABLE 306 PPG INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 55 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 307 PPG INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 308 PPG INDUSTRIES, INC.: DEALS

- TABLE 309 PPG INDUSTRIES, INC.: OTHER DEVELOPMENTS

- 13.1.2 BASF SE

- TABLE 310 BASF SE.: COMPANY OVERVIEW

- FIGURE 56 BASF SE: COMPANY SNAPSHOT

- TABLE 311 BASF SE: DEALS

- TABLE 312 BASF SE: OTHERS

- 13.1.3 AXALTA COATING SYSTEMS

- TABLE 313 AXALTA COATING SYSTEMS: COMPANY OVERVIEW

- FIGURE 57 AXALTA COATING SYSTEMS: COMPANY SNAPSHOT

- TABLE 314 AXALTA COATING SYSTEMS: PRODUCT LAUNCHES

- TABLE 315 AXALTA COATING SYSTEMS: DEALS

- TABLE 316 AXALTA COATING SYSTEMS: OTHER DEVELOPMENTS

- 13.1.4 KANSAI PAINT CO., LTD

- TABLE 317 KANSAI PAINT CO., LTD.: COMPANY OVERVIEW

- FIGURE 58 KANSAI PAINT CO., LTD.: COMPANY SNAPSHOT

- TABLE 318 KANSAI PAINT CO., LTD.: DEALS

- 13.1.5 NIPPON PAINT HOLDINGS CO., LTD.

- TABLE 319 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY OVERVIEW

- FIGURE 59 NIPPON PAINT HOLDINGS CO., LTD.: COMPANY SNAPSHOT

- 13.1.6 KCC CORPORATION

- TABLE 320 KCC CORPORATION: COMPANY OVERVIEW

- FIGURE 60 KCC CORPORATION: COMPANY SNAPSHOT

- 13.1.7 THE SHERWIN-WILLIAMS COMPANY

- TABLE 321 THE SHERWIN-WILLIAMS COMPANY: COMPANY OVERVIEW

- FIGURE 61 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

- TABLE 322 THE SHERWIN-WILLIAMS COMPANY: PRODUCT LAUNCHES

- TABLE 323 THE SHERWIN WILLIAMS COMPANY: DEALS

- 13.1.8 AKZO NOBEL N.V.

- TABLE 324 AKZO NOBEL N.V.: COMPANY OVERVIEW

- FIGURE 62 AKZO NOBEL N.V.: COMPANY SNAPSHOT

- TABLE 325 AKZO NOBEL N.V.: DEALS

- 13.1.9 JOTUN A/S

- TABLE 326 JOTUN A/S: COMPANY OVERVIEW

- FIGURE 63 JOTUN A/S: COMPANY SNAPSHOT

- TABLE 327 JOTUN A/S: OTHER DEVELOPMENTS

- 13.1.10 RPM INTERNATIONAL

- TABLE 328 RPM INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 64 RPM INTERNATIONAL: COMPANY SNAPSHOT

- TABLE 329 RPM INTERNATIONAL INC.: DEALS

- TABLE 330 RPM INTERNATIONAL INC.: OTHER DEVELOPMENTS

- 13.2 OTHER COMPANIES

- 13.2.1 US PAINTS

- TABLE 331 US PAINTS: BUSINESS OVERVIEW

- 13.2.2 ASIAN PAINTS LTD.

- TABLE 332 ASIAN PAINTS LTD.: BUSINESS OVERVIEW

- 13.2.3 BERGER PAINTS INDIA LTD.

- TABLE 333 BERGER PAINTS INDIA LTD.: BUSINESS OVERVIEW

- 13.2.4 BECKERS GROUP

- TABLE 334 BECKERS GROUP: BUSINESS OVERVIEW

- 13.2.5 SHANGHAI KINLITA CHEMICAL CO., LTD.

- TABLE 335 SHANGHAI KINLITA CHEMICAL CO., LTD.: BUSINESS OVERVIEW

- 13.2.6 KAPCI COATINGS

- TABLE 336 KAPCI COATINGS: BUSINESS OVERVIEW

- 13.2.7 NATIONAL PAINTS FACTORIES CO. LTD.

- TABLE 337 NATIONAL PAINTS FACTORIES CO. LTD.: BUSINESS OVERVIEW

- 13.2.8 RED SPOT PAINT AND VARNISH CO., INC.

- TABLE 338 RED SPOT PAINT AND VARNISH CO., INC.: BUSINESS OVERVIEW

- 13.2.9 CONCEPT PAINTS

- TABLE 339 CONCEPT PAINTS: BUSINESS OVERVIEW

- 13.2.10 GUANGZHOU ZHENROUMEI CHEMICAL COATINGS LIMITED

- TABLE 340 GUANGZHOU ZHENROUMEI CHEMICAL COATINGS LIMITED: BUSINESS OVERVIEW

- 13.2.11 QINGYUAN BAOHONG PAINT CO., LTD.

- TABLE 341 QINGYUAN BAOHONG PAINT CO., LTD.: BUSINESS OVERVIEW

- 13.2.12 WEG S.A.

- TABLE 342 WEG S.A.: BUSINESS OVERVIEW

- 13.2.13 TITAN COATINGS INTERNATIONAL

- TABLE 343 TITAN COATINGS INTERNATIONAL: BUSINESS OVERVIEW

- 13.2.14 APV ENGINEERED COATINGS

- TABLE 344 APV ENGINEERED COATINGS: BUSINESS OVERVIEW

- 13.2.15 GRAND POLYCOATS

- TABLE 345 GRAND POLYCOATS: BUSINESS OVERVIEW

- *Details on Business Overview, Products/Services/Solutions Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 MARKET LIMITATIONS

- 14.3 PAINTS & COATINGS MARKET DEFINITION

- 14.3.1 PAINTS & COATINGS MARKET OVERVIEW

- 14.3.2 PAINTS & COATINGS MARKET, BY TECHNOLOGY

- TABLE 346 INDUSTRIAL: PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2017-2020 (USD MILLION)

- TABLE 347 INDUSTRIAL: PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2021-2027 (USD MILLION)

- TABLE 348 INDUSTRIAL: PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2017-2020 (KILOTON)

- TABLE 349 INDUSTRIAL: PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2021-2027 (KILOTON)

- TABLE 350 DECORATIVE: PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2017-2020 (USD MILLION)

- TABLE 351 DECORATIVE: PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2021-2027 (USD MILLION)

- TABLE 352 DECORATIVE: PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2017-2020 (KILOTON)

- TABLE 353 DECORATIVE: PAINTS & COATINGS MARKET, BY TECHNOLOGY, 2021-2027 (KILOTON)

- 14.3.3 PAINTS & COATINGS MARKET, BY RESIN TYPE

- TABLE 354 PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017-2020 (USD MILLION)

- TABLE 355 PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021-2027 (USD MILLION)

- TABLE 356 PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017-2020 (KILOTON)

- TABLE 357 PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021-2027 (KILOTON)

- TABLE 358 DECORATIVE PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017-2020 (USD MILLION)

- TABLE 359 DECORATIVE PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021-2027 (USD MILLION)

- TABLE 360 DECORATIVE PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017-2020 (KILOTON)

- TABLE 361 DECORATIVE PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021-2027 (KILOTON)

- TABLE 362 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017-2020 (USD MILLION)

- TABLE 363 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021-2027 (USD MILLION)

- TABLE 364 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2017-2020 (KILOTON)

- TABLE 365 INDUSTRIAL PAINTS & COATINGS MARKET, BY RESIN TYPE, 2021-2027 (KILOTON)

- 14.3.4 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY

- TABLE 366 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2017-2020 (USD MILLION)

- TABLE 367 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2021-2027 (USD MILLION)

- TABLE 368 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2017-2020 (KILOTON)

- TABLE 369 PAINTS & COATINGS MARKET, BY END-USE INDUSTRY, 2021-2027 (KILOTON)

- 14.3.5 PAINTS & COATINGS MARKET, BY REGION

- TABLE 370 PAINTS & COATINGS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 371 PAINTS & COATINGS MARKET, BY REGION, 2021-2027 (USD MILLION)

- TABLE 372 PAINTS & COATINGS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 373 PAINTS & COATINGS MARKET, BY REGION, 2021-2027 (KILOTON)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS