|

|

市場調査レポート

商品コード

1386013

ゼロトラストアーキテクチャの世界市場:オファリング別、組織規模別、展開形態別、業界別、地域別-2028年までの予測Zero Trust Architecture Market by Offering (Solutions and Services), Organization Size (SMEs and Large Enterprises), Deployment Mode (Cloud and On-Premises), Vertical (BFSI, IT & ITeS, Healthcare) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| ゼロトラストアーキテクチャの世界市場:オファリング別、組織規模別、展開形態別、業界別、地域別-2028年までの予測 |

|

出版日: 2023年11月13日

発行: MarketsandMarkets

ページ情報: 英文 288 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2017年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 検討単位 | 金額(100万米ドル/10億米ドル) |

| セグメント別 | オファリング別、組織規模別、展開入形態別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

世界のゼロトラストアーキテクチャの市場規模は、2023年の173億米ドルから2028年には385億米ドルに成長し、予測期間中の年間平均成長率(CAGR)は17.3%になると予測されます。

ゼロトラストアーキテクチャ市場は、いくつかの重要な要因によって牽引されています。その1つが、高度なマルウェアやランサムウェアによる脅威の進展であり、ネットワーク・セグメンテーションのような強固なセキュリティ対策が必要となっています。デジタルトランスフォーメーションとクラウドの採用が組み合わさることで攻撃対象が拡大し、ゼロトラストの「決して信用せず、常に検証する」アプローチが不可欠となっています。さらに、GDPRやHIPAAなどの規制コンプライアンス要件がゼロトラストの採用をさらに後押しし、プライバシー基準の遵守を保証し、監査を容易にします。従来の境界セキュリティ・モデルからの移行は、強化された保護、継続的な検証、改善されたガバナンスを提供し、極めて重要な市場力となっています。

IT &ITeS業種は、ゼロトラストアーキテクチャ市場で最大の市場シェアを誇っているが、その主な理由は、顧客の財務情報、知的財産、企業秘密など、膨大な量の機密データを取り扱っているためです。このようなデータはサイバー犯罪者にとって格好の標的であり、極めて重要な保護ツールとなっています。さらに、多様なデバイス、アプリケーション、ネットワークを特徴とする複雑なIT環境は、従来のセキュリティ手法にとって課題となっています。ゼロトラストは、このような複雑なセットアップにおけるセキュリティを簡素化します。さらに、PCI DSSやGDPRのような厳格なコンプライアンス要件は、IT &ITeS組織の標準であり、包括的なセキュリティ・コンプライアンスを達成するのに役立ちます。さらに、クラウド・コンピューティングの導入が進むと、効率性と俊敏性には有利になるもの、新たなセキュリティリスクが発生します。このような総合的な優位性が、ゼロトラストアーキテクチャ市場におけるIT・ITサービス業界の優位性をさらに強固なものにしています。

大企業がゼロトラストアーキテクチャ市場を独占しているのは、多様なデバイス、アプリケーション、ネットワークが入り組んだIT環境にあるためです。この複雑さが従来のセキュリティ対策に課題を投げかけており、ゼロトラストアーキテクチャはこのような環境におけるセキュリティを合理化する理想的なソリューションとなっています。このような大企業は、価値の高いデータや資産を扱っているため、サイバー脅威の格好の標的となっています。ゼロトラストアーキテクチャは、機密性の高い顧客の金融情報、知的財産、企業秘密を保護します。さらに、大企業は多くの場合、PCI DSS、HIPAA、GDPRなどの厳しいコンプライアンス要件に直面しており、包括的に満たすことができます。ゼロトラスト・アーキテクチャが軽減する新たなセキュリティ・リスクを導入するクラウド・コンピューティングの導入が加速する中、こうした企業は多額のセキュリティ予算を持っているため、包括的なゼロトラスト・アーキテクチャ・ソリューションに投資することができます。

当レポートでは、世界のゼロトラストアーキテクチャ市場について調査し、オファリング別、組織規模別、展開形態別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- ケーススタディ分析

- バリューチェーン分析

- 生態系

- ポーターのファイブフォース分析

- 価格分析

- 技術分析

- 特許分析

- 顧客のビジネスに影響を与える動向と混乱

- 事業の型

- 規制状況

- 主要な利害関係者と購入基準

- 2023年~2024年の主要な会議とイベント

第6章 ゼロトラストアーキテクチャ市場、オファリング別

- イントロダクション

- ソリューション

- サービス

第7章 ゼロトラストアーキテクチャ市場、組織規模別

- イントロダクション

- 中小企業

- 大企業

第8章 ゼロトラストアーキテクチャ市場、展開形態別

- イントロダクション

- オンプレミス

- クラウド

第9章 ゼロトラストアーキテクチャ市場、業界別

- イントロダクション

- 銀行、金融サービス、保険(BFSI)

- 政府と防衛

- ITとITES

- ヘルスケア

- 小売と電子商取引

- エネルギーと公共事業

- その他

第10章 ゼロトラストアーキテクチャ市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第11章 競合情勢

- 主要参入企業の戦略

- 収益分析

- 市場シェア分析

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオと動向

第12章 企業プロファイル

- 主要参入企業

- KEY PLAYERS

- PALO ALTO NETWORKS

- VMWARE

- ZSCALER

- AKAMAI

- MICROSOFT

- CISCO

- IBM

- CITRIX

- CHECK POINT

- TRELLIX

- FORCEPOINT

- CROWDSTRIKE

- CLOUDFLARE

- FORTINET

- その他の企業

- NETSKOPE

- PERIMETER 81

- TWINGATE

- APPGATE

- ZERO NETWORKS

- VERSA

- AXIS SECURITY

- IVANTI

- NORDLAYER

- GOODACCESS

第13章 隣接市場

第14章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2017-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million/USD Billion) |

| Segments | By Offering, Organization Size, Deployment Mode, Vertical, And Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The global zero trust architecture market size is projected to grow from USD 17.3 billion in 2023 to USD 38.5 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 17.3% during the forecast period. Several key factors drive the zero trust architecture market. One of the drivers is the development of a threat landscape marked by advanced malware and ransomware, necessitating robust security measures like network segmentation. Combining digital transformation and cloud adoption expands the attack surface, making zero trust's "never trust, always verify" approach essential. Furthermore, regulatory compliance requirements, like GDPR and HIPAA, further boost zero trust adoption, ensuring adherence to privacy standards and facilitating audits. This shift from traditional perimeter security models offers enhanced protection, continuous verification, and improved governance, making it a pivotal market force.

"By vertical, the IT & ITeS segment accounts for a larger market share."

The IT & ITeS vertical boasts the largest market share in the zero trust architecture market, primarily because it handles vast amounts of sensitive data, including customer financial information, intellectual property, and trade secrets. This data is a prime target for cybercriminals, making it a crucial safeguard tool. Moreover, the vertical's complex IT environments, characterized by diverse devices, applications, and networks, pose challenges for traditional security methods. Zero trust simplifies security in such intricate setups. Furthermore, stringent compliance requirements, like PCI DSS and GDPR, are standard for IT & ITeS organizations and aid in achieving comprehensive security compliance. Additionally, although beneficial for efficiency and agility, the rising adoption of cloud computing introduces new security risks, which helps mitigate them. This collective advantage further solidifies the IT & ITeS vertical's dominance in the zero trust architecture market.

"By Organization size, the large enterprises segment accounts for a larger market share."

Large enterprises dominate the zero trust architecture market due to the intricate IT environments, replete with diverse devices, applications, and networks. This complexity poses challenges for traditional security measures, making zero trust architecture an ideal solution for streamlining security in such settings. These large corporations handle substantial high-value data and assets, making them attractive targets for cyber threats. Zero trust architecture protects sensitive customer financial information, intellectual property, and trade secrets. Moreover, large enterprises often face stringent compliance requirements, including PCI DSS, HIPAA, and GDPR, which help them meet comprehensively. With substantial security budgets, these organizations can invest in comprehensive zero trust architecture solutions, a vital advantage as they increasingly adopt cloud computing, introducing new security risks that zero trust architecture mitigates.

"US to grow at the highest CAGR for North America zero trust architecture market"

The US is experiencing significant growth in the zero trust architecture market due to the high demand from large and sophisticated organizations like government agencies, financial institutions, and healthcare providers. This demand is driven by the escalating cyberattack threats and the need to enhance security. Furthermore, a robust regulatory landscape, exemplified by the Cybersecurity Maturity Model Certification (CMMC) program, compels organizations to adopt zero trust principles. The availability of innovative solutions from leading vendors like Palo Alto Networks, Microsoft, and Zscaler further fuels this growth. Moreover, the widespread awareness of zero trust security, supported by factors like increasing cyberattacks and the NIST Cybersecurity Framework, sustains this upward trajectory.

Breakdown of primaries

The study contains various industry experts' insights, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level - 45%, Directors - 35%, and Managers - 20%

- By Region: North America - 35%, Asia Pacific - 30%, Europe - 25%, Middle East & Africa - 5%, Latin America - 5%

Major vendors in the global zero trust architecture market include Palo Alto Networks (US), VMware (US), Zscaler (US), Akamai (US), Microsoft (US), Cisco (US), IBM (US), Citrix (US), Check Point (US), Trellix (US), Forcepoint (US), CrowdStrike (US), Cloudflare (US), Fortinet (US), Google (US), Netskope (US), Perimeter 81 (US), Twingate (US), Appgate (US), Zero Networks (Israel), Versa Networks (US), Axis Security (US), Ivanti (US), NordLayer (US), and GoodAccess (Czech Republic).

The study includes an in-depth competitive analysis of the key players in the zero trust architecture market, their company profiles, recent developments, and key market strategies.

Research Coverage

The report segments the zero trust architecture market. It forecasts its size by Offering (Solutions and Services), Organization Size (Small and Medium-Sized Enterprises and Large Enterprises), Deployment Mode (Cloud and On-premises), Vertical (Banking, Financial Services and Insurance (BFSI), Government and Defense, IT & ITeS, Healthcare, Retail and eCommerce, Energy and Utilities, other Verticals), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America).

The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall zero trust architecture market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (evolution of cyber threats spurs growth of robust network segmentation, digital transformation and cloud adoption drive zero trust architecture demand, rising emphasis on regulatory compliance driving the adoption of zero trust architecture, shifting from perimeter security to embrace zero trust architecture drives the market), restraints (legacy systems impact zero trust adoption and complexity and cost of implementation), opportunities (growth in IoT adoption creates opportunities for zero trust architecture, expanding possibilities in zero trust architecture and services, and MSS demand drives zero trust architecture growth opportunity), and challenges (diminishing strength of conventional security models and fragmented security operations in zero trust architecture)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the zero trust architecture market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the zero trust architecture market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the zero trust architecture market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players Palo Alto Networks (US), VMware (US), Zscaler (US), Akamai (US), and Microsoft (US), among others, in the zero trust architecture market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- TABLE 1 ZERO TRUST ARCHITECTURE VS. ZERO TRUST SECURITY

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES, 2018-2022

- 1.6 STAKEHOLDERS

- 1.7 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 ZERO TRUST ARCHITECTURE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primaries

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 ZERO TRUST ARCHITECTURE MARKET ESTIMATION: RESEARCH FLOW

- 2.3.1 TOP-DOWN APPROACH

- FIGURE 4 APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOFTWARE/SERVICES OF ZERO TRUST ARCHITECTURE VENDORS

- FIGURE 5 APPROACH 1 (SUPPLY-SIDE ANALYSIS)

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 2): BOTTOM-UP (DEMAND SIDE) - PRODUCTS/SOLUTIONS/SERVICES

- 2.4 MARKET FORECAST

- TABLE 3 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS AND RISK ASSESSMENT

- 2.7 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- TABLE 4 ZERO TRUST ARCHITECTURE MARKET GROWTH, 2017-2022 (USD MILLION)

- TABLE 5 ZERO TRUST ARCHITECTURE MARKET GROWTH, 2023-2028 (USD MILLION)

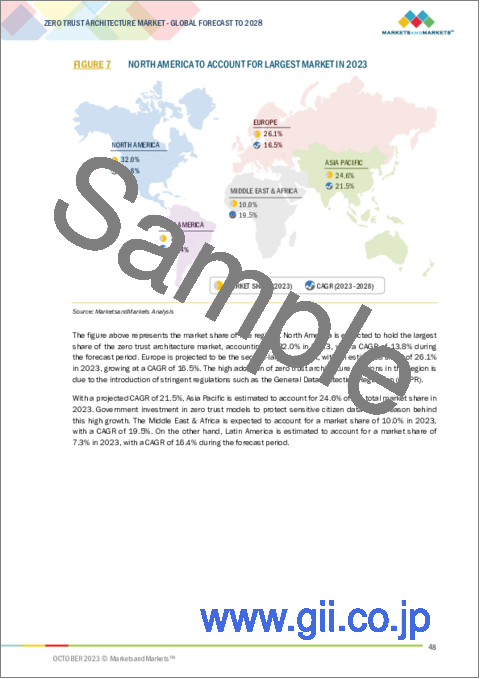

- FIGURE 7 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ZERO TRUST ARCHITECTURE MARKET

- FIGURE 8 INCREASING INSTANCES OF SOPHISTICATED CYBERATTACKS AND NEED FOR ADHERENCE TO REGULATORY COMPLIANCE TO DRIVE MARKET GROWTH

- 4.2 ZERO TRUST ARCHITECTURE MARKET, BY OFFERING

- FIGURE 9 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 4.3 ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE

- FIGURE 10 LARGE ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 4.4 ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE

- FIGURE 11 CLOUD TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 4.5 ZERO TRUST ARCHITECTURE MARKET: TOP 3 VERTICALS AND REGION

- FIGURE 12 IT & ITES SEGMENT AND NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- 4.6 MARKET INVESTMENT SCENARIO

- FIGURE 13 ASIA PACIFIC TO EMERGE AS LUCRATIVE MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: ZERO TRUST ARCHITECTURE MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Evolution of cyber threats spurs growth of robust network segmentation

- 5.2.1.2 Digital transformation and cloud adoption drive zero trust architecture demand

- 5.2.1.3 Rising emphasis on regulatory compliance driving adoption of zero trust architecture

- 5.2.1.4 Shift from perimeter security to embrace zero trust architecture drives market

- 5.2.2 RESTRAINTS

- 5.2.2.1 Legacy systems impact zero trust adoption

- 5.2.2.2 Complexity and cost of implementation

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth in IoT adoption creates opportunities for zero trust architecture

- 5.2.3.2 Expanding opportunities in zero trust architecture and services

- 5.2.3.3 MSS demand drives zero trust architecture growth opportunity

- 5.2.4 CHALLENGES

- 5.2.4.1 Diminishing strength of conventional security models

- 5.2.4.2 Fragmented security operations in zero trust architecture

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 DELOITTE'S CUSTOMIZED SOLUTION HELPED A MAJOR INDUSTRIAL ORGANIZATION IN ACHIEVING ZERO TRUST ARCHITECTURE

- 5.3.2 OPTIV EMPOWERED NATIONAL LAW FIRM TO ACHIEVE ZERO TRUST SUCCESS

- 5.3.3 CHILDREN'S HOSPITAL ENHANCED RESILIENCE WITH COLORTOKENS' ZERO-TRUST SOLUTION

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 15 VALUE CHAIN: ZERO TRUST ARCHITECTURE MARKET

- 5.4.1 COMPONENT

- 5.4.2 PLANNING AND DESIGNING

- 5.4.3 INTEGRATION & DEPLOYMENT

- 5.4.4 COMPLIANCE AND AUDITING

- 5.4.5 END USERS

- 5.5 ECOSYSTEM

- TABLE 6 ECOSYSTEM ANALYSIS: ZERO TRUST ARCHITECTURE MARKET

- FIGURE 16 ECOSYSTEM: ZERO TRUST ARCHITECTURE MARKET

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 PORTER'S FIVE FORCES ANALYSIS: ZERO TRUST ARCHITECTURE MARKET

- TABLE 7 PORTER'S FIVE FORCES MODEL: IMPACT ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 BARGAINING POWER OF SUPPLIERS

- 5.6.3 BARGAINING POWER OF BUYERS

- 5.6.4 THREAT OF SUBSTITUTES

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND OF KEY PLAYER, BY OFFERING

- FIGURE 18 AVERAGE SELLING PRICE TREND OF KEY PLAYERS: TOP 3 OFFERINGS

- TABLE 8 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING

- 5.7.2 INDICATIVE PRICING ANALYSIS, BY OFFERING

- TABLE 9 CLOUDFLARE: INDICATIVE PRICING ANALYSIS

- TABLE 10 INSTASAFE: INDICATIVE PRICING ANALYSIS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 ARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML)

- 5.8.2 IAM

- 5.8.3 CLOUD-NATIVE ZERO TRUST

- 5.8.4 NETWORK SEGMENTATION

- 5.9 PATENT ANALYSIS

- FIGURE 19 ZERO TRUST ARCHITECTURE MARKET: PATENT ANALYSIS

- FIGURE 20 REGIONAL ANALYSIS OF PATENTS FOR ZERO TRUST ARCHITECTURE MARKET, 2022

- TABLE 11 LIST OF FEW PATENTS IN ZERO TRUST ARCHITECTURE, 2022-23

- 5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 21 ZERO TRUST ARCHITECTURE MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.11 BUSINESS MODEL

- TABLE 12 BUSINESS MODEL

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD (PCI-DSS)

- 5.12.2 GENERAL DATA PROTECTION REGULATION (GDPR)

- 5.12.3 CALIFORNIA CONSUMER PRIVACY ACT (CCPA)

- 5.12.4 GRAMM-LEACH-BLILEY ACT OF 1999 (GLBA)

- 5.12.5 PERSONAL INFORMATION PROTECTION AND ELECTRONIC DOCUMENTS ACT (PIPEDA)

- 5.12.6 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)

- 5.12.7 THE INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO) STANDARD 27001

- 5.12.8 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- 5.13.2 BUYING CRITERIA

- FIGURE 23 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 17 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- 5.14 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 18 CONFERENCES AND EVENTS, 2023-2024

6 ZERO TRUST ARCHITECTURE MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: ZERO TRUST ARCHITECTURE MARKET DRIVERS

- FIGURE 24 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET DURING FORECAST PERIOD

- TABLE 19 ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 20 ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 SOLUTIONS

- 6.2.1 FOCUS ON OPTIMIZING OPERATIONAL EFFICIENCY WITH ZERO TRUST ARCHITECTURE MODEL TO DRIVE MARKET

- TABLE 21 SOLUTIONS: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 22 SOLUTIONS: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2 IDENTITY AND ACCESS MANAGEMENT (IAM)

- 6.2.3 MICRO-SEGMENTATION

- 6.2.4 ZERO TRUST NETWORK ACCESS (ZTNA)

- 6.2.5 CONTINUOUS MONITORING

- 6.2.6 LEAST PRIVILEGE ACCESS

- 6.3 SERVICES

- 6.3.1 COMPREHENSIVE SERVICES TO EMPOWER ZERO TRUST ARCHITECTURE IMPLEMENTATION

- TABLE 23 SERVICES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 24 SERVICES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

7 ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE

- 7.1 INTRODUCTION

- 7.1.1 ORGANIZATION SIZE: ZERO TRUST ARCHITECTURE MARKET DRIVERS

- FIGURE 25 LARGE ENTERPRISES TO DOMINATE DURING FORECAST PERIOD

- TABLE 25 ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 26 ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 7.2 SMALL- AND MEDIUM-SIZED ENTERPRISES

- 7.2.1 SMES' DIGITAL TRANSFORMATION TO SPUR ZERO TRUST ARCHITECTURE ADOPTION

- TABLE 27 SMES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 28 SMES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 LARGE ENTERPRISES

- 7.3.1 TRANSFORMATIVE ADOPTION OF ZERO TRUST ARCHITECTURE IN LARGE ENTERPRISES TO CONTRIBUTE TO GROWTH

- TABLE 29 LARGE ENTERPRISES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 30 LARGE ENTERPRISES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

8 ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE

- 8.1 INTRODUCTION

- 8.1.1 DEPLOYMENT MODE: ZERO TRUST ARCHITECTURE MARKET DRIVERS

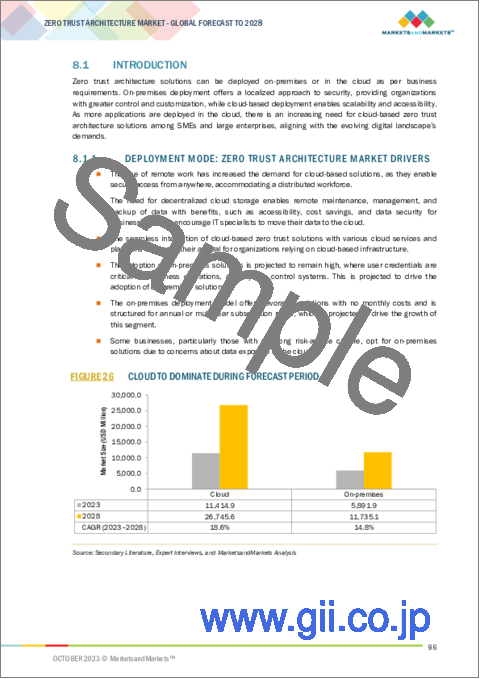

- FIGURE 26 CLOUD TO DOMINATE DURING FORECAST PERIOD

- TABLE 31 ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 32 ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- 8.2 ON-PREMISES

- 8.2.1 CONTROL AND COMPLIANCE EASILY ACHIEVED THROUGH ON-PREMISES ZERO TRUST DEPLOYMENT

- TABLE 33 ON-PREMISES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 34 ON-PREMISES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 CLOUD

- 8.3.1 EMBRACING CLOUD DEPLOYMENT FOR ZERO TRUST DUE TO ADVANTAGES SUCH AS SECURITY AND SCALABILITY

- TABLE 35 CLOUD: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 36 CLOUD: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

9 ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.1.1 VERTICAL: ZERO TRUST ARCHITECTURE MARKET DRIVERS

- FIGURE 27 RETAIL & ECOMMERCE SEGMENT TO ACHIEVE HIGHEST GROWTH RATE DURING FORECAST PERIOD

- TABLE 37 ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 38 ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

- 9.2.1 INCREASING DEMAND TO ADOPT ADVANCED SOLUTIONS AMID RISING CYBER THREATS TO DRIVE DEMAND FOR ZTA SOLUTIONS

- TABLE 39 BFSI: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 40 BFSI: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 GOVERNMENT & DEFENSE

- 9.3.1 ZERO TRUST ARCHITECTURE TO ENHANCE CYBERSECURITY RESILIENCE IN GOVERNMENT & DEFENSE VERTICAL

- TABLE 41 GOVERNMENT & DEFENSE: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 42 GOVERNMENT & DEFENSE: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 IT & ITES

- 9.4.1 RISING COMPLEXITIES IN CYBERSECURITY TO PROPEL MARKET

- TABLE 43 IT & ITES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 44 IT & ITES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 HEALTHCARE

- 9.5.1 INCREASING CYBER THREATS TO BOOST POPULARITY OF ZERO TRUST FRAMEWORK

- TABLE 45 HEALTHCARE: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 46 HEALTHCARE: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6 RETAIL & ECOMMERCE

- 9.6.1 ZERO TRUST ARCHITECTURE TO SECURE RETAIL AND ECOMMERCE IN DIGITAL TRANSFORMATION

- TABLE 47 RETAIL & ECOMMERCE: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 48 RETAIL & ECOMMERCE: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.7 ENERGY & UTILITIES

- 9.7.1 DEMAND FOR HEIGHTENED CRITICAL INFRASTRUCTURE SECURITY TO FUEL ADOPTION OF ZERO TRUST ARCHITECTURE SOLUTIONS

- TABLE 49 ENERGY & UTILITIES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 50 ENERGY & UTILITIES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.8 OTHER VERTICALS

- TABLE 51 OTHER VERTICALS: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 52 OTHER VERTICALS: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

10 ZERO TRUST ARCHITECTURE MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 28 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 53 ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 54 ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET DRIVERS

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- 10.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

- FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 55 NORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 56 NORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 58 NORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.2.4 US

- 10.2.4.1 Rising cybersecurity concerns to prompt US government's zero trust initiatives

- TABLE 65 US: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 66 US: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 67 US: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 68 US: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 69 US: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 70 US: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 71 US: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 72 US: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.2.5 CANADA

- 10.2.5.1 Initiatives taken by government to drive adoption of zero trust architecture

- TABLE 73 CANADA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 74 CANADA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 75 CANADA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 76 CANADA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 77 CANADA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 78 CANADA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 79 CANADA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 80 CANADA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: ZERO TRUST ARCHITECTURE MARKET DRIVERS

- 10.3.2 EUROPE: RECESSION IMPACT

- 10.3.3 EUROPE: REGULATORY LANDSCAPE

- TABLE 81 EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 82 EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 83 EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 84 EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 85 EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 86 EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 87 EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 88 EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 89 EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 90 EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.4 UK

- 10.3.4.1 UK enterprises to embrace zero trust for enhanced cybersecurity

- TABLE 91 UK: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 92 UK: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 93 UK: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 94 UK: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 95 UK: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 96 UK: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 97 UK: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 98 UK: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.3.5 GERMANY

- 10.3.5.1 Germany to accelerate adoption of zero trust amid digital growth

- TABLE 99 GERMANY: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 100 GERMANY: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 101 GERMANY: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 102 GERMANY: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 103 GERMANY: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 104 GERMANY: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 105 GERMANY: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 106 GERMANY: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.3.6 FRANCE

- 10.3.6.1 Need for robust cybersecurity to drive zero trust adoption in France

- TABLE 107 FRANCE: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 108 FRANCE: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 109 FRANCE: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 110 FRANCE: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 111 FRANCE: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 112 FRANCE: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 113 FRANCE: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 114 FRANCE: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.3.7 ITALY

- 10.3.7.1 Zero trust architecture adoption in Italy to soar amid cloud security focus

- TABLE 115 ITALY: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 116 ITALY: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 117 ITALY: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 118 ITALY: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 119 ITALY: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 120 ITALY: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 121 ITALY: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 122 ITALY: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.3.8 REST OF EUROPE

- TABLE 123 REST OF EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 124 REST OF EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 125 REST OF EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 126 REST OF EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 127 REST OF EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 128 REST OF EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 129 REST OF EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 130 REST OF EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- 10.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

- FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 131 ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 132 ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 134 ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 136 ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 137 ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 138 ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 139 ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 140 ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4.4 CHINA

- 10.4.4.1 Enhancing mobile security and networking with zero trust to drive market growth

- TABLE 141 CHINA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 142 CHINA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 143 CHINA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 144 CHINA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 145 CHINA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 146 CHINA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 147 CHINA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 148 CHINA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.4.5 JAPAN

- 10.4.5.1 Increasing cyberattack threats to drive demand for zero trust

- TABLE 149 JAPAN: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 150 JAPAN: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 151 JAPAN: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 152 JAPAN: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 153 JAPAN: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 154 JAPAN: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 155 JAPAN: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 156 JAPAN: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.4.6 INDIA

- 10.4.6.1 Increasing economic growth and digital advancement to drive adoption of zero trust in India

- TABLE 157 INDIA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 158 INDIA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 159 INDIA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 160 INDIA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 161 INDIA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 162 INDIA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 163 INDIA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 164 INDIA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.4.7 REST OF ASIA PACIFIC

- TABLE 165 REST OF ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.5.3 MIDDLE EAST & AFRICA: REGULATORY LANDSCAPE

- TABLE 173 MIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.5.4 MIDDLE EAST

- 10.5.4.1 Rise in cloud-first strategy to drive adoption of zero trust

- TABLE 183 MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 184 MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 185 MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 186 MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 187 MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 188 MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 189 MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 190 MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 191 MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 192 MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5.5 GCC

- 10.5.5.1 Evolving digital landscape in GCC to contribute to market growth

- TABLE 193 GCC: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 194 GCC: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 195 GCC: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 196 GCC: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 197 GCC: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 198 GCC: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 199 GCC: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 200 GCC: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.5.6 REST OF MIDDLE EAST

- TABLE 201 REST OF MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 202 REST OF MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 203 REST OF MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 204 REST OF MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 205 REST OF MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 206 REST OF MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 207 REST OF MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 208 REST OF MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.5.7 AFRICA

- 10.5.7.1 Zero trust architecture to gain momentum in African industries

- TABLE 209 AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 210 AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 211 AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 212 AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 213 AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 214 AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 215 AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 216 AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET DRIVERS

- 10.6.2 LATIN AMERICA: RECESSION IMPACT

- 10.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

- TABLE 217 LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 218 LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 219 LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 220 LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 221 LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 222 LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 223 LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 224 LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 225 LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 226 LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.6.4 BRAZIL

- 10.6.4.1 Zero trust adoption to soar in Brazil amid surge in pandemic-driven cyberattacks

- TABLE 227 BRAZIL: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 228 BRAZIL: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 229 BRAZIL: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 230 BRAZIL: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 231 BRAZIL: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 232 BRAZIL: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 233 BRAZIL: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 234 BRAZIL: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.6.5 MEXICO

- 10.6.5.1 Mexico to embrace zero trust and XDR for cybersecurity advancement

- TABLE 235 MEXICO: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 236 MEXICO: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 237 MEXICO: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 238 MEXICO: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 239 MEXICO: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 240 MEXICO: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 241 MEXICO: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 242 MEXICO: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.6.6 REST OF LATIN AMERICA

- TABLE 243 REST OF LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 244 REST OF LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 245 REST OF LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017-2022 (USD MILLION)

- TABLE 246 REST OF LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 247 REST OF LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 248 REST OF LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 249 REST OF LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 250 REST OF LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2 REVENUE ANALYSIS

- FIGURE 31 TOP 5 PLAYERS HAVE DOMINATED THE MARKET IN LAST 5 YEARS

- 11.3 MARKET SHARE ANALYSIS

- FIGURE 32 SHARE OF LEADING COMPANIES IN ZERO TRUST ARCHITECTURE MARKET

- TABLE 251 ZERO TRUST ARCHITECTURE MARKET: DEGREE OF COMPETITION

- 11.4 COMPANY EVALUATION MATRIX

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- FIGURE 33 ZERO TRUST ARCHITECTURE MARKET: COMPANY EVALUATION MATRIX, 2022

- 11.4.5 COMPANY FOOTPRINT

- FIGURE 34 PRODUCT FOOTPRINT

- TABLE 252 VERTICAL FOOTPRINT

- TABLE 253 REGION FOOTPRINT

- TABLE 254 COMPANY FOOTPRINT

- 11.5 START-UP/SME EVALUATION MATRIX

- 11.5.1 PROGRESSIVE COMPANIES

- 11.5.2 RESPONSIVE COMPANIES

- 11.5.3 DYNAMIC COMPANIES

- 11.5.4 STARTING BLOCKS

- FIGURE 35 ZERO TRUST ARCHITECTURE MARKET: START-UP/SME EVALUATION MATRIX, 2022

- 11.5.5 COMPETITIVE BENCHMARKING

- TABLE 255 ZERO TRUST ARCHITECTURE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 256 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES: VERTICAL FOOTPRINT

- TABLE 257 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES: REGION FOOTPRINT

- 11.6 COMPETITIVE SCENARIO AND TRENDS

- 11.6.1 PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 258 ZERO TRUST ARCHITECTURE MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, 2021-2023

- 11.6.2 DEALS

- TABLE 259 ZERO TRUST ARCHITECTURE MARKET: DEALS, 2021-2023

12 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent developments & MnM View)**

- 12.1 KEY PLAYERS

- 12.1.1 PALO ALTO NETWORKS

- TABLE 260 PALO ALTO NETWORKS: BUSINESS OVERVIEW

- FIGURE 36 PALO ALTO NETWORKS: COMPANY SNAPSHOT

- TABLE 261 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 PALO ALTO NETWORKS: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 263 PALO ALTO NETWORKS: DEALS

- 12.1.2 VMWARE

- TABLE 264 VMWARE: BUSINESS OVERVIEW

- FIGURE 37 VMWARE: COMPANY SNAPSHOT

- TABLE 265 VMWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 VMWARE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 267 VMWARE: DEALS

- 12.1.3 ZSCALER

- TABLE 268 ZSCALER: BUSINESS OVERVIEW

- FIGURE 38 ZSCALER: COMPANY SNAPSHOT

- TABLE 269 ZSCALER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 ZSCALER: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 271 ZSCALER: DEALS

- 12.1.4 AKAMAI

- TABLE 272 AKAMAI: BUSINESS OVERVIEW

- FIGURE 39 AKAMAI: COMPANY SNAPSHOT

- TABLE 273 AKAMAI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 AKAMAI: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 275 AKAMAI: DEALS

- 12.1.5 MICROSOFT

- TABLE 276 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 40 MICROSOFT: COMPANY SNAPSHOT

- TABLE 277 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 278 MICROSOFT: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 279 MICROSOFT: DEALS

- 12.1.6 CISCO

- TABLE 280 CISCO: BUSINESS OVERVIEW

- FIGURE 41 CISCO: COMPANY SNAPSHOT

- TABLE 281 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 282 CISCO: DEALS

- 12.1.7 IBM

- TABLE 283 IBM: BUSINESS OVERVIEW

- FIGURE 42 IBM: COMPANY SNAPSHOT

- TABLE 284 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 IBM: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 286 IBM: DEALS

- 12.1.8 CITRIX

- TABLE 287 CITRIX: BUSINESS OVERVIEW

- TABLE 288 CITRIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 CITRIX: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 290 CITRIX: DEALS

- 12.1.9 CHECK POINT

- TABLE 291 CHECK POINT: BUSINESS OVERVIEW

- FIGURE 43 CHECK POINT: COMPANY SNAPSHOT

- TABLE 292 CHECK POINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 CHECK POINT: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 294 CHECK POINT: DEALS

- 12.1.10 TRELLIX

- TABLE 295 TRELLIX: BUSINESS OVERVIEW

- TABLE 296 TRELLIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 TRELLIX: PRODUCT LAUNCHES & ENHANCEMENTS

- 12.1.11 FORCEPOINT

- TABLE 298 FORCEPOINT: BUSINESS OVERVIEW

- TABLE 299 FORCEPOINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 300 FORCEPOINT: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 301 FORCEPOINT: DEALS

- 12.1.12 CROWDSTRIKE

- TABLE 302 CROWDSTRIKE: BUSINESS OVERVIEW

- FIGURE 44 CROWDSTRIKE: COMPANY SNAPSHOT

- TABLE 303 CROWDSTRIKE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 304 CROWDSTRIKE: DEALS

- 12.1.13 CLOUDFLARE

- TABLE 305 CLOUDFLARE: BUSINESS OVERVIEW

- FIGURE 45 CLOUDFLARE: COMPANY SNAPSHOT

- TABLE 306 CLOUDFLARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 307 CLOUDFLARE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 308 CLOUDFLARE: DEALS

- 12.1.14 FORTINET

- TABLE 309 FORTINET: BUSINESS OVERVIEW

- FIGURE 46 FORTINET: COMPANY SNAPSHOT

- TABLE 310 FORTINET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 311 FORTINET: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 312 FORTINET: DEALS

- 12.1.15 GOOGLE

- TABLE 313 GOOGLE: BUSINESS OVERVIEW

- FIGURE 47 GOOGLE: COMPANY SNAPSHOT

- TABLE 314 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 315 GOOGLE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 316 GOOGLE: DEALS

- *Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 12.2 OTHER KEY PLAYERS

- 12.2.1 NETSKOPE

- 12.2.2 PERIMETER 81

- 12.2.3 TWINGATE

- 12.2.4 APPGATE

- 12.2.5 ZERO NETWORKS

- 12.2.6 VERSA

- 12.2.7 AXIS SECURITY

- 12.2.8 IVANTI

- 12.2.9 NORDLAYER

- 12.2.10 GOODACCESS

13 ADJACENT MARKETS

- 13.1 INTRODUCTION

- TABLE 317 ADJACENT MARKETS AND FORECASTS

- 13.2 LIMITATIONS

- 13.3 ZERO TRUST ARCHITECTURE ECOSYSTEM AND ADJACENT MARKETS

- 13.4 IDENTITY AND ACCESS MANAGEMENT (IAM) MARKET

- 13.4.1 IDENTITY AND ACCESS MANAGEMENT (IAM) MARKET, BY OFFERING

- TABLE 318 IDENTITY AND ACCESS MANAGEMENT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 319 IDENTITY AND ACCESS MANAGEMENT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 320 SOLUTIONS: IDENTITY AND ACCESS MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 321 SOLUTIONS: IDENTITY AND ACCESS MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 322 SERVICES: IDENTITY AND ACCESS MANAGEMENT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 323 SERVICES: IDENTITY AND ACCESS MANAGEMENT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 13.5 CYBER SECURITY MARKET

- 13.5.1 CYBER SECURITY MARKET, BY COMPONENT

- TABLE 324 CYBER SECURITY MARKET, BY COMPONENT, 2016-2021 (USD MILLION)

- TABLE 325 CYBER SECURITY MARKET, BY COMPONENT, 2022-2027 (USD MILLION)

- TABLE 326 HARDWARE: CYBER SECURITY MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 327 HARDWARE: CYBER SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 328 SOFTWARE: CYBER SECURITY MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 329 SOFTWARE: CYBER SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 330 SERVICES: CYBER SECURITY MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 331 SERVICES: CYBER SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS