|

|

市場調査レポート

商品コード

1384296

プラスチック添加剤の世界市場:タイプ別、プラスチックタイプ別、用途別、地域別-2028年までの予測Plastic Additives Market by Type, Plastic Type, Application, and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| プラスチック添加剤の世界市場:タイプ別、プラスチックタイプ別、用途別、地域別-2028年までの予測 |

|

出版日: 2023年11月15日

発行: MarketsandMarkets

ページ情報: 英文 281 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2017年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 対象ユニット | 金額(100万米ドル)および数量(キロトン) |

| セグメント | タイプ別、プラスチックタイプ別、用途別、地域別 |

| 対象地域 | アジア太平洋、北米、欧州、中東・アフリカ、南米 |

プラスチック添加剤の市場規模は、2023年の435億米ドルからCAGR 5.6%と堅調な伸びを示し、2028年には570億米ドルに達すると予測され、大きな成長が見込まれています。

プラスチック添加剤の使用を含む様々な要因によって、幅広い産業でプラスチックが従来の材料に取って代わりつつあります。プラスチック添加剤は、プラスチックの特性を改善し、より幅広い用途に適したものにするために不可欠です。プラスチックには、金属、木材、ガラスといった従来の素材にはない利点がいくつかあります。より軽く、耐久性に優れ、再利用が可能で、多くの場合、製造や輸送のコストが低いです。また、プラスチックは様々な特性を持つように設計できるため、幅広い用途に適しています。

プラスチック添加剤市場は、いくつかの主要促進要因によって大幅な成長を遂げています。中でも可塑剤は、最も広く採用されているプラスチック添加剤として際立っています。可塑剤は、プラスチックの柔軟性、耐久性、加工性を向上させる上で重要な役割を果たしています。可塑剤は、包装、建設、自動車、消費財など、多様な分野で用途を見出しています。可塑剤は、プラスチック包装材料の柔軟性を高め、取り扱いを容易にするために包装に使用されます。この特性は、食品包装のような用途で特に重要であり、プラスチックは食品を傷つけずにその輪郭に沿う必要があります。可塑剤は、玩具、レクリエーション用品、医療機器など、さまざまな消費財に使用されています。可塑剤の柔軟性を高める特性は、これらの製品の全体的な品質と機能に貢献しています。

汎用プラスチックは、最も一般的で広く使用されているプラスチックのカテゴリーです。バルクプラスチックや汎用プラスチックとしても知られる汎用プラスチックは、広く生産され、日常の様々な用途に使用されるポリマーのカテゴリーを指します。汎用プラスチックは、様々な方法でプラスチック添加剤を取り入れることで、その特性を高めることができます。例えば、プラスチック添加剤は、汎用プラスチックの弾力性、柔軟性、耐熱性、耐薬品性を高めるために利用できます。さらに、これらの添加剤は、汎用プラスチックの色、加工性、リサイクル性といった要素を強化するためにも利用できます。

アジア太平洋は、重要な世界的製造大国として際立っています。その産業部門は幅広いプラスチック製品に大きく依存しており、製造工程でプラスチック添加剤を使用する必要があります。さらに、中国はアジア太平洋において最大のプラスチック添加剤市場です。これは、中国の巨大で繁栄する産業経済と、拡大する顧客基盤によるものです。さらに、中国はプラスチック添加剤の生産において重要な役割を担っており、世界市場における競争優位性をもたらしています。

当レポートでは、世界のプラスチック添加剤市場について調査し、タイプ別、プラスチックタイプ別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- マクロ経済指標

第6章 業界の動向

- サプライチェーン分析

- 主要な利害関係者と購入基準

- 価格分析

- 顧客のビジネスに影響を与える動向/混乱

- 生態系マップ

- 技術分析

- ケーススタディ

- 貿易分析

- 関税と規制状況

- 2023年~2024年の主な会議とイベント

- 特許分析

第7章 プラスチック添加剤市場、タイプ別

- イントロダクション

- 可塑剤

- 安定剤

- 難燃剤

- 衝撃性改良剤

- 発泡剤

- 核剤

- その他

第8章 プラスチック添加剤市場、プラスチックタイプ別

- イントロダクション

- 汎用プラスチック

- エンジニアリングプラスチック

- 高性能プラスチック

第9章 プラスチック添加剤市場、用途別

- イントロダクション

- 梱包

- 消費財

- 建設

- 自動車

- その他

第10章 プラスチック添加剤市場、地域別

- イントロダクション

- アジア太平洋

- 欧州

- 北米

- 中東・アフリカ

- 南米

第11章 競合情勢

- 主要参入企業の戦略

- 主要市場参入企業のランキング

- 市場シェア分析

- 主要参入企業5社の収益分析

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオと動向

第12章 企業プロファイル

- 主要企業

- SONGWON INDUSTRIAL CO., LTD.

- ALBEMARLE CORPORATION

- BASF SE

- CLARIANT AG

- DOW INC.

- NOURYON

- LANXESS AG

- EVONIK INDUSTRIES AG

- KANEKA CORPORATION

- COVESTRO AG

- その他の企業

- ADEKA CORPORATION

- PMC GROUP, INC.

- ASTRA POLYMERS COMPOUNDING CO. LTD.

- BAERLOCHER GROUP

- PERFORMANCE ADDITIVES

- GRAFE ADVANCED POLYMERS GMBH

- MILLIKEN & COMPANY

- AVIENT CORPORATION

- SABO S.P.A.

- SAKAI CHEMICAL INDUSTRY CO. LTD.

- BROADVIEW TECHNOLOGIES, INC.

- VALTRIS SPECIALTY CHEMICALS

- ARGUS ADDITIVE PLASTICS GMBH

- SYNERGY POLY ADDITIVES PVT. LTD

- AMPACET CORPORATION

第13章 隣接市場および関連市場

第14章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2017-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Type, Plastic Type, Application and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

The plastic additives market is poised for significant growth, with a projected value of USD 57.0 billion by 2028, exhibiting a robust CAGR of 5.6% from its 2023 value of USD 43.5 billion. Plastics are replacing conventional materials in a wide range of industries, driven by a variety of factors, including the use of plastic additives. Plastic additives are essential for improving the properties of plastics and making them more suitable for a wider range of applications. Plastic has several advantages over traditional materials, such as metals, wood, and glass. They are lighter, more durable, reusable, and often less expensive to produce and transport. Plastics can also be engineered to have a wide range of properties, making them suitable for a wide variety of applications.

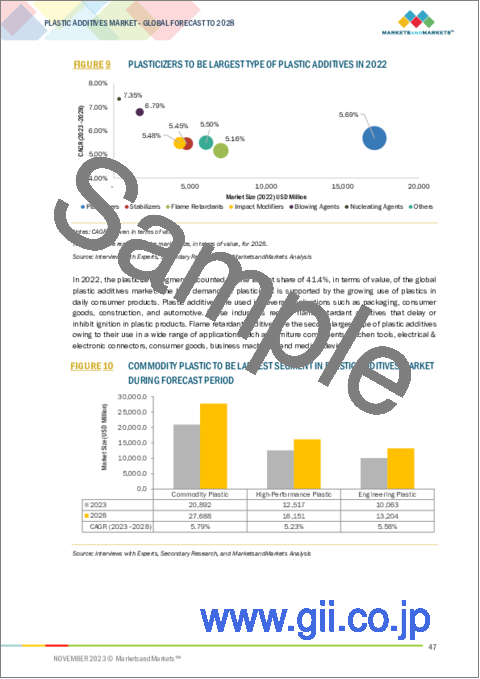

"Plasticizers segment was the largest type of plastic additives in 2022, in terms of value."

The plastic additives market is witnessing substantial growth due to several key drivers. Among these, plasticizers stand out as the most widely employed form of plastic additive. They play a crucial role in enhancing the pliability, durability, and processing ease of plastics. Plasticizers find applications in diverse sectors, including packaging, construction, automotive, and consumer goods. Plasticizers are used in packaging to make plastic packaging materials more pliable and simpler to handle. This property is especially important in applications such as food packaging, where the plastic must conform to the contour of the food product while protecting it from any injury. Plasticizers are used in a variety of consumer goods, including toys, recreational equipment, and medical devices. Their flexibility-enhancing characteristics contribute to the overall quality and functioning of these products.

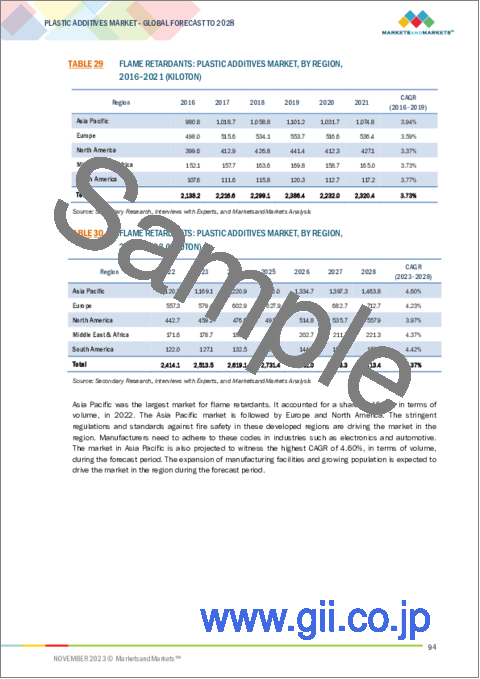

"Commodity plastics segment was the largest plastic type for plastic additives market in 2022, in terms of value."

Commodity plastics are the most popular and widely used category of plastics. Commodity plastics, also known as bulk plastics or general-purpose plastics, refer to a category of polymers that are widely produced and used in a variety of everyday applications. Commodity plastics benefit from the incorporation of plastic additives in various ways to enhance their characteristics. For instance, plastic additives can be harnessed to augment the resilience, flexibility, heat resistance, and chemical resistance of commodity plastics. Moreover, these additives can also be employed to enhance factors like the color, processability, and recyclability of commodity plastics.

"Packaging segment is projected to be the largest application of plastic additives during the forecasted period, in terms of value"

Packaging has emerged as the dominating application within the plastic additives market in 2022, influenced by several convincing variables. Plastic packaging remains the most common type of packaging worldwide, owing to its lightweight, resilient, and cost-effective characteristics. Plastic additives play an important part in many different types of plastic packaging, including food and beverage packaging, pharmaceutical packaging, and personal care packaging.

"Asia Pacific was the largest plastic additives market in 2022, in terms of value."

The Asia Pacific area stands out as a critical global manufacturing powerhouse. Its industrial sector is highly dependent on a wide range of plastic items, necessitating the usage of plastic additives in their manufacturing processes. Additionally, China is the Asia Pacific region's largest market for plastic additives. This is due to China's enormous and flourishing industrial economy, as well as its expanding customer base. Furthermore, China plays an important role in the production of plastic additives, giving it a competitive advantage in the worldwide market.

In the meticulous process of determining and verifying market sizes for multiple segments and subsegments, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees are as follows:

- By Company Type: Tier 1 - 69%, Tier 2 - 23%, and Tier 3 - 8%

- By Designation: - Director Level - 27%, C-Level - 25%, and Others - 48%

- By Region: North America - 32%, Europe - 28%, Asia Pacific - 21%, South America - 12%, and Middle East & Africa - 7%,

The key market players illustrated in the report include BASF SE (Germany), Clariant AG (Switzerland), Albemarle Corporation (US), Songwon Industrial Co., Ltd. (South Korea), Nouryon (Netherland), LANXESS AG (Germany), Evonik Industries AG (Germany), Kaneka Corporation (Japan), and Dow Inc. (US).

Research Coverage

This report segments the market for plastic additives on the basis of type, plastic type, application, and region, and provides estimations for the overall value (USD Million) of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and mergers & acquisition associated with the market for bio-based leather.

Reasons to buy this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the plastic additives market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Replacement of conventional materials by plastics, Reusable property of plastics), restraints (Stringent government regulations governing the plastic industry), opportunities (Cost-effectiveness and commercialization of plastics, Increased usage of plastics in packaging applications), and challenges (Effects of plastic on the environment)

- Market Penetration: Comprehensive information on plastic additives offered by top players in the global plastic additives market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the plastic additives

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for plastic additives across regions

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global plastic additives market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the plastic additives market

- Impact of recession on plastic additives

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 PLASTIC ADDITIVES MARKET: INCLUSIONS AND EXCLUSIONS

- 1.2.2 PLASTIC ADDITIVES: MARKET DEFINITION AND INCLUSIONS, BY TYPE

- 1.2.3 PLASTIC ADDITIVES: MARKET DEFINITION AND INCLUSIONS, BY PLASTIC TYPE

- 1.2.4 PLASTIC ADDITIVES: MARKET DEFINITION AND INCLUSIONS, BY APPLICATION

- 1.3 MARKET SCOPE

- 1.3.1 PLASTIC ADDITIVES: MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 PLASTIC ADDITIVES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews: Demand and supply-side

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE SHARE OF MAJOR PLAYERS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1-BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2-BOTTOM-UP (DEMAND SIDE): PRODUCTS SOLD AND THEIR AVERAGE SELLING PRICE

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3-TOP-DOWN

- 2.3 DATA TRIANGULATION

- FIGURE 6 PLASTIC ADDITIVES MARKET: DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY SIDE

- FIGURE 7 MARKET CAGR PROJECTIONS FROM SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- FIGURE 8 MARKET GROWTH PROJECTIONS FROM DEMAND-SIDE DRIVERS AND OPPORTUNITIES

- 2.5 RECESSION IMPACT ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS

- 2.8 RISK ASSESSMENT

- TABLE 1 PLASTIC ADDITIVES MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 9 PLASTICIZERS TO BE LARGEST TYPE OF PLASTIC ADDITIVES IN 2022

- FIGURE 10 COMMODITY PLASTIC TO BE LARGEST SEGMENT IN PLASTIC ADDITIVES MARKET DURING FORECAST PERIOD

- FIGURE 11 PACKAGING APPLICATION TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 SIGNIFICANT OPPORTUNITIES IN PLASTIC ADDITIVES MARKET

- FIGURE 13 ATTRACTIVE OPPORTUNITIES FOR PLAYERS TO DRIVE PLASTIC ADDITIVES MARKET DURING FORECAST PERIOD

- 4.2 PLASTIC ADDITIVES MARKET, BY REGION

- FIGURE 14 ASIA PACIFIC TO BE LARGEST MARKET FOR PLASTIC ADDITIVES DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY COUNTRY AND APPLICATION

- FIGURE 15 CHINA AND PACKAGING ACCOUNTED FOR LARGEST MARKET SHARES IN ASIA PACIFIC

- 4.4 PLASTIC ADDITIVES MARKET, BY APPLICATION

- FIGURE 16 PACKAGING TO BE LARGEST APPLICATION OF PLASTIC ADDITIVES MARKET

- 4.5 PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE VS REGION

- FIGURE 17 COMMODITY PLASTIC TYPE TO BE DOMINANT SEGMENT ACROSS REGIONS

- 4.6 PLASTIC ADDITIVES MARKET, BY KEY COUNTRY

- FIGURE 18 CHINA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PLASTIC ADDITIVES MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for plastics in end-use industries

- TABLE 2 GLOBAL VEHICLE PRODUCTION, BY COUNTRY, 2017-2022 (UNITS)

- 5.2.1.2 Reusable property of plastics

- TABLE 3 GLOBAL RECYCLED PLASTIC CONSUMPTION, BY REGION, 2018-2022 (KILOTON)

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent government regulations governing plastic industry

- TABLE 4 REGULATIONS AGAINST PLASTIC WASTE, 2018-2021

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Cost-effectiveness and commercialization of plastics

- 5.2.3.2 Increasing use of plastics in packaging application

- 5.2.4 CHALLENGES

- 5.2.4.1 Detrimental effects of plastics on environment

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 20 PLASTIC ADDITIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 5 PLASTIC ADDITIVES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 MACROECONOMIC INDICATORS

- 5.4.1 GDP TRENDS AND FORECAST

- TABLE 6 GDP TRENDS AND FORECAST, BY MAJOR ECONOMY, 2021-2028 (USD BILLION)

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- FIGURE 21 PLASTIC ADDITIVES MARKET: SUPPLY CHAIN

- 6.1.1 RAW MATERIALS

- 6.1.2 MANUFACTURING OF PLASTIC ADDITIVES

- 6.1.3 DISTRIBUTION

- 6.1.4 END USERS

- 6.2 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP-THREE APPLICATIONS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- 6.2.2 BUYING CRITERIA

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 6.3 PRICING ANALYSIS

- 6.3.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY APPLICATION

- FIGURE 24 AVERAGE SELLING PRICE TREND OF KEY PLAYERS FOR TOP-THREE APPLICATIONS

- TABLE 9 AVERAGE SELLING PRICE TREND OF KEY PLAYERS FOR TOP THREE APPLICATIONS, USD/KG

- 6.3.2 AVERAGE SELLING PRICE TREND, BY REGION

- FIGURE 25 AVERAGE SELLING PRICE TREND OF PLASTIC ADDITIVES, BY REGION

- TABLE 10 AVERAGE SELLING PRICE OF PLASTIC ADDITIVES, BY REGION (USD/KG)

- 6.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4.1 REVENUE SHIFTS AND REVENUE POCKETS FOR PLASTIC ADDITIVES MARKET

- FIGURE 26 PLASTIC ADDITIVES MARKET: CHANGING REVENUE MIX

- 6.5 ECOSYSTEM MAP

- FIGURE 27 PLASTIC ADDITIVES MARKET: ECOSYSTEM MAP

- TABLE 11 PLASTIC ADDITIVES MARKET: ECOSYSTEM

- 6.6 TECHNOLOGY ANALYSIS

- 6.7 CASE STUDIES

- 6.7.1 VOLVO CARS TO AIM FOR 25 PERCENT RECYCLED PLASTICS FROM 2025

- 6.7.2 LYONDELLBASELL TO USE PLASTIC WASTE-DERIVED RAW MATERIALS TO PRODUCE POLYMERS

- 6.7.3 BASF JOINS DIGITAL WATERMARK INITIATIVE FOR EFFICIENT RECYCLING OF PACKAGING MATERIALS

- 6.8 TRADE ANALYSIS

- 6.8.1 IMPORT SCENARIO

- FIGURE 28 PLASTIC ADDITIVES IMPORT, BY KEY COUNTRY (2013-2022)

- TABLE 12 IMPORTS OF PLASTIC ADDITIVES, BY REGION, 2013-2022 (USD MILLION)

- 6.8.2 EXPORT SCENARIO

- FIGURE 29 PLASTIC ADDITIVES EXPORT, BY KEY COUNTRY (2013-2022)

- TABLE 13 EXPORTS OF PLASTIC ADDITIVES, BY REGION, 2013-2022 (USD MILLION)

- 6.9 TARIFF AND REGULATORY LANDSCAPE

- 6.9.1 REGULATIONS RELATED TO PLASTIC ADDITIVES MARKET

- 6.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10 KEY CONFERENCES & EVENTS IN 2023-2024

- TABLE 14 PLASTIC ADDITIVES MARKET: KEY CONFERENCES & EVENTS

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPES

- TABLE 15 GRANTED PATENTS ACCOUNTED FOR 11% OF ALL PATENTS BETWEEN 2012 AND 2022

- FIGURE 30 PATENTS REGISTERED FOR PLASTIC ADDITIVES, 2012-2022

- FIGURE 31 PATENTS PUBLICATION TRENDS FOR PLASTIC ADDITIVES, 2012-2022

- 6.11.3 JURISDICTION ANALYSIS

- FIGURE 32 MAXIMUM PATENTS FILED BY COMPANIES IN CHINA

- 6.11.4 TOP APPLICANTS

- FIGURE 33 LG CHEMICAL LTD. REGISTERED MAXIMUM NUMBER OF PATENTS BETWEEN 2012 AND 2022

- TABLE 16 TOP 10 PATENT OWNERS IN US, 2012-2022

7 PLASTIC ADDITIVES MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 34 PLASTICIZERS TO ACCOUNT FOR LARGEST SHARE IN PLASTIC ADDITIVES MARKET

- TABLE 17 PLASTIC ADDITIVES MARKET, BY TYPE, 2016-2021 (KILOTON)

- TABLE 18 PLASTIC ADDITIVES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 19 PLASTIC ADDITIVES MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 20 PLASTIC ADDITIVES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 7.2 PLASTICIZERS

- 7.2.1 INCREASING MANUFACTURING OF PVC IN DEVELOPING REGIONS TO DRIVE MARKET

- TABLE 21 PLASTICIZERS: PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (KILOTON)

- TABLE 22 PLASTICIZERS: PLASTIC ADDITIVES MARKET, BY REGION, 2022-2028 (KILOTON)

- TABLE 23 PLASTICIZERS: PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 24 PLASTICIZERS: PLASTIC ADDITIVES MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.2.2 PHTHALATE

- 7.2.3 NON-PHTHALATE

- 7.3 STABILIZERS

- 7.3.1 GROWTH OF PACKAGING INDUSTRY TO DRIVE MARKET

- TABLE 25 STABILIZERS: PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (KILOTON)

- TABLE 26 STABILIZERS: PLASTIC ADDITIVES MARKET, BY REGION, 2022-2028 (KILOTON)

- TABLE 27 STABILIZERS: PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 28 STABILIZERS: PLASTIC ADDITIVES MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.3.2 UV STABILIZERS

- 7.3.3 ANTIOXIDANTS

- 7.3.4 OTHERS

- 7.3.4.1 Heat stabilizers

- 7.3.4.2 Light stabilizers

- 7.4 FLAME RETARDANTS

- 7.4.1 STRINGENT FIRE SAFETY RULES IN DEVELOPED REGIONS TO INCREASE DEMAND

- TABLE 29 FLAME RETARDANTS: PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (KILOTON)

- TABLE 30 FLAME RETARDANTS: PLASTIC ADDITIVES MARKET, BY REGION, 2022-2028 (KILOTON)

- TABLE 31 FLAME RETARDANTS: PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 32 FLAME RETARDANTS: PLASTIC ADDITIVES MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.4.2 HALOGENATED FLAME RETARDANTS

- 7.4.2.1 Brominated flame retardants

- 7.4.2.2 Chlorinated flame retardants

- 7.4.3 HALOGEN-FREE FLAME RETARDANTS

- 7.4.3.1 Phosphorus

- 7.4.3.2 Aluminum trihydroxide

- 7.4.3.3 Nitrogen

- 7.5 IMPACT MODIFIERS

- 7.5.1 GROWING DEMAND FROM AUTOMOTIVE INDUSTRY TO DRIVE MARKET

- TABLE 33 IMPACT MODIFIERS: PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (KILOTON)

- TABLE 34 IMPACT MODIFIERS: PLASTIC ADDITIVES MARKET, BY REGION, 2022-2028 (KILOTON)

- TABLE 35 IMPACT MODIFIERS: PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 36 IMPACT MODIFIERS: PLASTIC ADDITIVES MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.6 BLOWING AGENTS

- 7.6.1 GLOBAL SHIFT TOWARD ELECTRIC VEHICLES TO INCREASE DEMAND

- TABLE 37 BLOWING AGENTS: PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (KILOTON)

- TABLE 38 BLOWING AGENTS: PLASTIC ADDITIVES MARKET, BY REGION, 2022-2028 (KILOTON)

- TABLE 39 BLOWING AGENTS: PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 40 BLOWING AGENTS: PLASTIC ADDITIVES MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.7 NUCLEATING AGENTS

- 7.7.1 HIGH DEMAND FROM CONSUMER GOODS APPLICATION TO DRIVE MARKET

- TABLE 41 NUCLEATING AGENTS: PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (KILOTON)

- TABLE 42 NUCLEATING AGENTS: PLASTIC ADDITIVES MARKET, BY REGION, 2022-2028 (KILOTON)

- TABLE 43 NUCLEATING AGENTS: PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 44 NUCLEATING AGENTS: PLASTIC ADDITIVES MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.8 OTHER TYPES

- TABLE 45 OTHER TYPES: PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (KILOTON)

- TABLE 46 OTHER TYPES: PLASTIC ADDITIVES MARKET, BY REGION, 2022-2028 (KILOTON)

- TABLE 47 OTHER TYPES: PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 48 OTHER TYPES: PLASTIC ADDITIVES MARKET, BY REGION, 2022-2028 (USD MILLION)

- 7.8.1 ANTIMICROBIALS

- 7.8.2 ANTISTATIC AGENTS

- 7.8.3 FILLERS

8 PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE

- 8.1 INTRODUCTION

- FIGURE 35 COMMODITY PLASTIC TYPE TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- TABLE 49 PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2016-2021 (KILOTON)

- TABLE 50 PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2022-2028 (KILOTON)

- TABLE 51 PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2016-2021 (USD MILLION)

- TABLE 52 PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2022-2028 (USD MILLION)

- 8.2 COMMODITY PLASTICS

- 8.2.1 HIGH DEMAND FOR CONSUMER GOODS IN EMERGING ECONOMIES TO DRIVE MARKET

- TABLE 53 COMMODITY PLASTICS: PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (KILOTON)

- TABLE 54 PLASTIC ADDITIVES MARKET FOR COMMODITY PLASTICS, BY REGION, 2022-2028 (KILOTON)

- TABLE 55 COMMODITY PLASTICS: PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 56 COMMODITY PLASTICS: PLASTIC ADDITIVES MARKET, BY REGION, 2022-2028 (USD MILLION)

- 8.2.2 POLYETHYLENE

- 8.2.3 POLYPROPYLENE

- 8.2.4 POLYSTYRENE

- 8.2.5 POLYPHENYLENE ETHERS

- 8.3 ENGINEERING PLASTICS

- 8.3.1 GLOBAL GROWTH OF AUTOMOTIVE INDUSTRY TO INCREASE DEMAND FOR PLASTIC ADDITIVES

- TABLE 57 ENGINEERING PLASTICS: PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (KILOTON)

- TABLE 58 ENGINEERING PLASTICS: PLASTIC ADDITIVES MARKET, BY REGION, 2022-2028 (KILOTON)

- TABLE 59 ENGINEERING PLASTICS: PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 60 ENGINEERING PLASTICS: PLASTIC ADDITIVES MARKET, BY REGION, 2022-2028 (USD MILLION)

- 8.3.2 POLYAMIDES

- 8.3.3 THERMOPLASTIC POLYESTERS

- 8.3.4 POLYCARBONATE

- 8.3.5 ACRYLONITRILE BUTADIENE STYRENE

- 8.3.6 POLYACETAL

- 8.3.7 OTHERS

- 8.4 HIGH-PERFORMANCE PLASTICS

- 8.4.1 STRINGENT REGULATIONS FOR LIGHTWEIGHT VEHICLES IN DEVELOPED COUNTRIES TO DRIVE MARKET

- TABLE 61 HIGH-PERFORMANCE PLASTICS: PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (KILOTON)

- TABLE 62 HIGH-PERFORMANCE PLASTICS: PLASTIC ADDITIVES MARKET, BY REGION, 2022-2028 (KILOTON)

- TABLE 63 HIGH-PERFORMANCE PLASTICS: PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 64 HIGH-PERFORMANCE PLASTICS: PLASTIC ADDITIVES MARKET, BY REGION, 2022-2028 (USD MILLION)

- 8.4.2 HIGH-PERFORMANCE POLYAMIDES

- 8.4.3 POLYPHENYLENE SULFIDE

- 8.4.4 LIQUID CRYSTAL POLYMERS

- 8.4.5 POLYIMIDE

9 PLASTIC ADDITIVES MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 36 PACKAGING TO BE LARGEST APPLICATION FOR PLASTIC ADDITIVES DURING FORECAST PERIOD

- TABLE 65 PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 66 PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 67 PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 68 PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 9.2 PACKAGING

- 9.2.1 GROWING POPULATION IN DEVELOPING ECONOMIES TO DRIVE DEMAND

- 9.2.2 FILM WRAPS

- 9.2.3 PLASTIC BAGS

- 9.2.4 INDUSTRIAL AND HOUSEHOLD CHEMICAL CONTAINERS

- TABLE 69 PLASTIC ADDITIVES MARKET IN PACKAGING APPLICATION, BY REGION, 2016-2021 (KILOTON)

- TABLE 70 PLASTIC ADDITIVES MARKET IN PACKAGING APPLICATION, BY REGION, 2022-2028 (KILOTON)

- TABLE 71 PLASTIC ADDITIVES MARKET IN PACKAGING APPLICATION, BY REGION, 2016-2021 (USD MILLION)

- TABLE 72 PLASTIC ADDITIVES MARKET IN PACKAGING APPLICATION, BY REGION, 2022-2028 (USD MILLION)

- 9.3 CONSUMER GOODS

- 9.3.1 INCREASING USE OF PLASTIC ADDITIVES IN PERSONAL CARE ITEMS AND COSMETICS TO DRIVE SEGMENT

- 9.3.2 ELECTRONICS AND ELECTRONIC COMPONENTS

- 9.3.3 FOOD STORAGE CONTAINERS

- 9.3.4 PERSONAL CARE PRODUCTS

- TABLE 73 PLASTIC ADDITIVES MARKET IN CONSUMER GOODS APPLICATION, BY REGION, 2016-2021 (KILOTON)

- TABLE 74 PLASTIC ADDITIVES MARKET IN CONSUMER GOODS APPLICATION, BY REGION, 2022-2028 (KILOTON)

- TABLE 75 PLASTIC ADDITIVES MARKET IN CONSUMER GOODS APPLICATION, BY REGION, 2016-2021 (USD MILLION)

- TABLE 76 PLASTIC ADDITIVES MARKET IN CONSUMER GOODS APPLICATION, BY REGION, 2022-2028 (USD MILLION)

- 9.4 CONSTRUCTION

- 9.4.1 INCREASING USE OF PLASTIC IN CONSTRUCTION SECTOR TO DRIVE MARKET

- 9.4.2 DOORS

- 9.4.3 ROOFING

- 9.4.4 FLOORING

- 9.4.5 PIPING

- TABLE 77 PLASTIC ADDITIVES MARKET IN CONSTRUCTION APPLICATION, BY REGION, 2016-2021 (KILOTON)

- TABLE 78 PLASTIC ADDITIVES MARKET IN CONSTRUCTION APPLICATION, BY REGION, 2022-2028 (KILOTON)

- TABLE 79 PLASTIC ADDITIVES MARKET IN CONSTRUCTION APPLICATION, BY REGION, 2016-2021 (USD MILLION)

- TABLE 80 PLASTIC ADDITIVES MARKET IN CONSTRUCTION APPLICATION, BY REGION, 2022-2028 (USD MILLION)

- 9.5 AUTOMOTIVE

- 9.5.1 HIGH DEMAND FOR PLASTIC-MOLDED PARTS TO DRIVE MARKET

- 9.5.2 AIR DAMS

- 9.5.3 CAR BUMPERS

- 9.5.4 ROCKER PANELS

- 9.5.5 CONSOLES

- TABLE 81 PLASTIC ADDITIVES MARKET IN AUTOMOTIVE APPLICATION, BY REGION, 2016-2021 (KILOTON)

- TABLE 82 PLASTIC ADDITIVES MARKET IN AUTOMOTIVE APPLICATION, BY REGION, 2022-2028 (KILOTON)

- TABLE 83 PLASTIC ADDITIVES MARKET IN AUTOMOTIVE APPLICATION, BY REGION, 2016-2021 (USD MILLION)

- TABLE 84 PLASTIC ADDITIVES MARKET IN AUTOMOTIVE APPLICATION, BY REGION, 2022-2028 (USD MILLION)

- 9.6 OTHER APPLICATIONS

- 9.6.1 PHARMACEUTICAL AND MEDICAL

- 9.6.2 SPORTS EQUIPMENT

- TABLE 85 PLASTIC ADDITIVES MARKET IN OTHER APPLICATIONS, BY REGION, 2016-2021 (KILOTON)

- TABLE 86 PLASTIC ADDITIVES MARKET IN OTHER APPLICATIONS, BY REGION, 2022-2028 (KILOTON)

- TABLE 87 PLASTIC ADDITIVES MARKET IN OTHER APPLICATIONS, BY REGION, 2016-2021 (USD MILLION)

- TABLE 88 PLASTIC ADDITIVES MARKET IN OTHER APPLICATIONS, BY REGION, 2022-2028 (USD MILLION)

10 PLASTIC ADDITIVES MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 37 ASIA PACIFIC TO LEAD PLASTIC ADDITIVES MARKET DURING FORECAST PERIOD

- TABLE 89 PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (KILOTON)

- TABLE 90 PLASTIC ADDITIVES MARKET, BY REGION, 2022-2028 (KILOTON)

- TABLE 91 PLASTIC ADDITIVES MARKET, BY REGION, 2016-2021 (USD MILLION)

- TABLE 92 PLASTIC ADDITIVES MARKET, BY REGION, 2022-2028 (USD MILLION)

- 10.2 ASIA PACIFIC

- FIGURE 38 ASIA PACIFIC: PLASTIC ADDITIVES MARKET SNAPSHOT

- 10.2.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 39 CHINA TO BE LARGEST MARKET FOR PLASTIC ADDITIVES IN ASIA PACIFIC DURING FORECAST PERIOD

- 10.2.2 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY APPLICATION

- TABLE 93 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 94 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 95 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 96 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.2.3 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE

- TABLE 97 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2016-2021 (KILOTON)

- TABLE 98 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2022-2028 (KILOTON)

- TABLE 99 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2016-2021 (USD MILLION)

- TABLE 100 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2022-2028 (USD MILLION)

- 10.2.4 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY TYPE

- TABLE 101 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY TYPE, 2016-2021 (KILOTON)

- TABLE 102 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 103 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 104 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 10.2.5 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY COUNTRY

- TABLE 105 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2016-2021 (KILOTON)

- TABLE 106 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- TABLE 107 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 108 ASIA PACIFIC: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 10.2.5.1 China

- 10.2.5.1.1 Demand for innovative and resilient plastics to drive market

- 10.2.5.1 China

- TABLE 109 CHINA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 110 CHINA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 111 CHINA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 112 CHINA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.2.5.2 Japan

- 10.2.5.2.1 High demand for premium packaging solutions to drive market

- 10.2.5.2 Japan

- TABLE 113 JAPAN: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 114 JAPAN: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 115 JAPAN: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 116 JAPAN: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.2.5.3 India

- 10.2.5.3.1 Favorable government policies to fuel demand for plastic additives

- 10.2.5.3 India

- TABLE 117 INDIA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 118 INDIA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 119 INDIA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 120 INDIA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.2.5.4 South Korea

- 10.2.5.4.1 Rising need from cosmetics sector to increase market demand for plastic additives

- 10.2.5.4 South Korea

- TABLE 121 SOUTH KOREA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 122 SOUTH KOREA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 123 SOUTH KOREA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 124 SOUTH KOREA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.2.5.5 Australia & New Zealand

- 10.2.5.5.1 Government investments in various end-use industries to drive market

- 10.2.5.5 Australia & New Zealand

- TABLE 125 AUSTRALIA & NEW ZEALAND: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 126 AUSTRALIA & NEW ZEALAND: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 127 AUSTRALIA & NEW ZEALAND: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 128 AUSTRALIA & NEW ZEALAND: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.3 EUROPE

- FIGURE 40 EUROPE: PLASTIC ADDITIVES MARKET SNAPSHOT

- 10.3.1 EUROPE: RECESSION IMPACT

- FIGURE 41 GERMANY TO DOMINATE EUROPEAN PLASTIC ADDITIVES MARKET DURING FORECAST PERIOD

- 10.3.2 EUROPE: PLASTIC ADDITIVES MARKET, BY APPLICATION

- TABLE 129 EUROPE: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 130 EUROPE: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 131 EUROPE: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 132 EUROPE: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.3.3 EUROPE: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE

- TABLE 133 EUROPE: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2016-2021 (KILOTON)

- TABLE 134 EUROPE: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2022-2028 (KILOTON)

- TABLE 135 EUROPE: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2016-2021 (USD MILLION)

- TABLE 136 EUROPE: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2022-2028 (USD MILLION)

- 10.3.4 EUROPE: PLASTIC ADDITIVES MARKET, BY TYPE

- TABLE 137 EUROPE: PLASTIC ADDITIVES MARKET, BY TYPE, 2016-2021 (KILOTON)

- TABLE 138 EUROPE: PLASTIC ADDITIVES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 139 EUROPE: PLASTIC ADDITIVES MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 140 EUROPE: PLASTIC ADDITIVES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 10.3.5 EUROPE: PLASTIC ADDITIVES MARKET, BY COUNTRY

- TABLE 141 EUROPE: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2016-2021 (KILOTON)

- TABLE 142 EUROPE: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- TABLE 143 EUROPE: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 144 EUROPE: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 10.3.5.1 Germany

- 10.3.5.1.1 Presence of developed automotive industry to propel market

- 10.3.5.1 Germany

- TABLE 145 GERMANY: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 146 GERMANY: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 147 GERMANY: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 148 GERMANY: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.3.5.2 Italy

- 10.3.5.2.1 High consumption of packaged food and aerated drinks to boost demand for packaging

- 10.3.5.2 Italy

- TABLE 149 ITALY: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 150 ITALY: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 151 ITALY: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 152 ITALY: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.3.5.3 France

- 10.3.5.3.1 Demand for lightweight and electric vehicles to drive market

- 10.3.5.3 France

- TABLE 153 FRANCE: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 154 FRANCE: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 155 FRANCE: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 156 FRANCE: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.3.5.4 UK

- 10.3.5.4.1 Regulations related to food handling, rising environmental concerns, and growing population to propel market

- 10.3.5.4 UK

- TABLE 157 UK: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 158 UK: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 159 UK: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 160 UK: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.3.5.5 Spain

- 10.3.5.5.1 Increasing demand for advanced plastic products to drive market

- 10.3.5.5 Spain

- TABLE 161 SPAIN: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 162 SPAIN: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 163 SPAIN: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 164 SPAIN: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.4 NORTH AMERICA

- FIGURE 42 NORTH AMERICA: PLASTIC ADDITIVES MARKET SNAPSHOT

- FIGURE 43 US TO BE LARGEST PLASTIC ADDITIVES MARKET IN NORTH AMERICA

- 10.4.1 NORTH AMERICA: RECESSION IMPACT

- 10.4.2 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY APPLICATION

- TABLE 165 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 166 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 167 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 168 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.4.3 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE

- TABLE 169 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2016-2021 (KILOTON)

- TABLE 170 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2022-2028 (KILOTON)

- TABLE 171 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2016-2021 (USD MILLION)

- TABLE 172 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2022-2028 (USD MILLION)

- 10.4.4 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY TYPE

- TABLE 173 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY TYPE, 2016-2021 (KILOTON)

- TABLE 174 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 175 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 176 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 10.4.5 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY COUNTRY

- TABLE 177 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2016-2021 (KILOTON)

- TABLE 178 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- TABLE 179 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 180 NORTH AMERICA: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 10.4.5.1 US

- 10.4.5.1.1 Presence of major players to drive innovation in market

- 10.4.5.1 US

- TABLE 181 US: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 182 US: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 183 US: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 184 US: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.4.5.2 Mexico

- 10.4.5.2.1 High growth of manufacturing sector to drive demand

- 10.4.5.2 Mexico

- TABLE 185 MEXICO: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 186 MEXICO: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 187 MEXICO: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 188 MEXICO: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.4.5.3 Canada

- 10.4.5.3.1 Technology-driven economy to drive market

- 10.4.5.3 Canada

- TABLE 189 CANADA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 190 CANADA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 191 CANADA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 192 CANADA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.5 MIDDLE EAST & AFRICA

- FIGURE 44 SAUDI ARABIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 10.5.1 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.5.2 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET, BY APPLICATION

- TABLE 193 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 194 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 195 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.5.3 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE

- TABLE 197 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2016-2021 (KILOTON)

- TABLE 198 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2022-2028 (KILOTON)

- TABLE 199 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2016-2021 (USD MILLION)

- TABLE 200 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2022-2028 (USD MILLION)

- 10.5.4 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET, BY TYPE

- TABLE 201 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET, BY TYPE, 2016-2021 (KILOTON)

- TABLE 202 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 203 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 10.5.5 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET, BY COUNTRY

- TABLE 205 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2016-2021 (KILOTON)

- TABLE 206 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- TABLE 207 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 10.5.5.1 Saudi Arabia

- 10.5.5.1.1 Growing consumer goods industry to increase demand for plastic additives

- 10.5.5.1 Saudi Arabia

- TABLE 209 SAUDI ARABIA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 210 SAUDI ARABIA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 211 SAUDI ARABIA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 212 SAUDI ARABIA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.5.5.2 Iran

- 10.5.5.2.1 Government investments in non-oil sectors to boost market

- 10.5.5.2 Iran

- TABLE 213 IRAN: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 214 IRAN: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 215 IRAN: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 216 IRAN: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.5.5.3 South Africa

- 10.5.5.3.1 Increasing economic growth to develop market

- 10.5.5.3 South Africa

- TABLE 217 SOUTH AFRICA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 218 SOUTH AFRICA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 219 SOUTH AFRICA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 220 SOUTH AFRICA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.6 SOUTH AMERICA

- FIGURE 45 BRAZIL TO DOMINATE PLASTIC ADDITIVES MARKET IN SOUTH AMERICA

- 10.6.1 SOUTH AMERICA: RECESSION IMPACT

- 10.6.2 SOUTH AMERICA: PLASTIC ADDITIVES MARKET, BY APPLICATION

- TABLE 221 SOUTH AMERICA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 222 SOUTH AMERICA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 223 SOUTH AMERICA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 224 SOUTH AMERICA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.6.3 SOUTH AMERICA: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE

- TABLE 225 SOUTH AMERICA: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2016-2021 (KILOTON)

- TABLE 226 SOUTH AMERICA: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2022-2028 (KILOTON)

- TABLE 227 SOUTH AMERICA: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2016-2021 (USD MILLION)

- TABLE 228 SOUTH AMERICA: PLASTIC ADDITIVES MARKET, BY PLASTIC TYPE, 2022-2028 (USD MILLION)

- 10.6.4 SOUTH AMERICA: PLASTIC ADDITIVES MARKET, BY TYPE

- TABLE 229 SOUTH AMERICA: PLASTIC ADDITIVES MARKET, BY TYPE, 2016-2021 (KILOTON)

- TABLE 230 SOUTH AMERICA: PLASTIC ADDITIVES MARKET, BY TYPE, 2022-2028 (KILOTON)

- TABLE 231 SOUTH AMERICA: PLASTIC ADDITIVES MARKET, BY TYPE, 2016-2021 (USD MILLION)

- TABLE 232 SOUTH AMERICA: PLASTIC ADDITIVES MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 10.6.5 SOUTH AMERICA: PLASTIC ADDITIVES MARKET, BY COUNTRY

- TABLE 233 SOUTH AMERICA: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2016-2021 (KILOTON)

- TABLE 234 SOUTH AMERICA: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2022-2028 (KILOTON)

- TABLE 235 SOUTH AMERICA: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2016-2021 (USD MILLION)

- TABLE 236 SOUTH AMERICA: PLASTIC ADDITIVES MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 10.6.5.1 Brazil

- 10.6.5.1.1 Growing presence of major manufacturers in country to drive market

- 10.6.5.1 Brazil

- TABLE 237 BRAZIL: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 238 BRAZIL: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 239 BRAZIL: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 240 BRAZIL: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.6.5.2 Argentina

- 10.6.5.2.1 Growth of cosmetics and food industries to fuel demand for plastics additives

- 10.6.5.2 Argentina

- TABLE 241 ARGENTINA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (KILOTON)

- TABLE 242 ARGENTINA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (KILOTON)

- TABLE 243 ARGENTINA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2016-2021 (USD MILLION)

- TABLE 244 ARGENTINA: PLASTIC ADDITIVES MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.1.1 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.1.1.1 Overview of strategies adopted by key plastic additive manufacturers

- 11.1.1 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.2 RANKING OF KEY MARKET PLAYERS

- FIGURE 46 RANKING OF TOP FIVE PLAYERS IN PLASTIC ADDITIVES MARKET, 2022

- 11.3 MARKET SHARE ANALYSIS

- TABLE 245 PLASTIC ADDITIVES MARKET: INTENSITY OF COMPETITIVE RIVALRY

- FIGURE 47 BASF SE: LEADING PLAYER IN PLASTIC ADDITIVES MARKET

- 11.4 REVENUE ANALYSIS OF TOP FIVE PLAYERS

- FIGURE 48 REVENUE ANALYSIS OF KEY COMPANIES IN PAST FIVE YEARS

- 11.5 COMPANY EVALUATION MATRIX

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 49 COMPANY EVALUATION MATRIX FOR PLASTIC ADDITIVES MARKET (TIER 1)

- 11.5.5 COMPANY FOOTPRINT

- TABLE 246 PLASTIC ADDITIVES MARKET: COMPANY FOOTPRINT

- TABLE 247 PLASTIC ADDITIVES MARKET: TYPE FOOTPRINT

- TABLE 248 PLASTIC ADDITIVES MARKET: APPLICATION FOOTPRINT

- TABLE 249 PLASTIC ADDITIVES MARKET: COMPANY REGION FOOTPRINT

- 11.6 STARTUP/SME EVALUATION MATRIX

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 50 STARTUP/SME EVALUATION MATRIX FOR PLASTIC ADDITIVES MARKET

- 11.6.5 COMPETITIVE BENCHMARKING

- TABLE 250 PLASTIC ADDITIVES MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 251 PLASTIC ADDITIVES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.7 COMPETITIVE SCENARIO AND TRENDS

- 11.7.1 PRODUCT LAUNCHES

- TABLE 252 PLASTIC ADDITIVES MARKET: PRODUCT LAUNCHES (2018-2022)

- 11.7.2 DEALS

- TABLE 253 PLASTIC ADDITIVES MARKET: DEALS (2018-2022)

- 11.7.3 OTHER DEVELOPMENTS

- TABLE 254 PLASTIC ADDITIVES MARKET: EXPANSIONS (2018-2022)

12 COMPANY PROFILES

- 12.1 KEY COMPANIES

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1.1 SONGWON INDUSTRIAL CO., LTD.

- TABLE 255 SONGWON INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- FIGURE 51 SONGWON INDUSTRIAL CO., LTD.: COMPANY SNAPSHOT

- TABLE 256 SONGWON INDUSTRIAL CO., LTD.: DEALS

- TABLE 257 SONGWON INDUSTRIAL CO., LTD.: PRODUCT LAUNCHES

- TABLE 258 SONGWON INDUSTRIAL CO., LTD.: OTHER DEVELOPMENTS

- 12.1.2 ALBEMARLE CORPORATION

- TABLE 259 ALBEMARLE CORPORATION: COMPANY OVERVIEW

- FIGURE 52 ALBEMARLE CORPORATION: COMPANY SNAPSHOT

- 12.1.3 BASF SE

- TABLE 260 BASF SE: COMPANY OVERVIEW

- FIGURE 53 BASF SE: COMPANY SNAPSHOT

- TABLE 261 BASF SE: PRODUCT LAUNCH

- TABLE 262 BASF SE: OTHER DEVELOPMENTS

- 12.1.4 CLARIANT AG

- TABLE 263 CLARIANT AG: COMPANY OVERVIEW

- FIGURE 54 CLARIANT AG: COMPANY SNAPSHOT

- TABLE 264 CLARIANT AG: PRODUCT LAUNCH

- TABLE 265 CLARIANT AG: OTHER DEVELOPMENTS

- 12.1.5 DOW INC.

- TABLE 266 DOW INC.: COMPANY OVERVIEW

- FIGURE 55 DOW INC.: COMPANY SNAPSHOT

- 12.1.6 NOURYON

- TABLE 267 NOURYON: COMPANY OVERVIEW

- FIGURE 56 NOURYON: COMPANY SNAPSHOT

- 12.1.7 LANXESS AG

- TABLE 268 LANXESS AG: COMPANY OVERVIEW

- FIGURE 57 LANXESS AG: COMPANY SNAPSHOT

- TABLE 269 LANXESS AG: DEALS

- 12.1.8 EVONIK INDUSTRIES AG

- TABLE 270 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- FIGURE 58 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- 12.1.9 KANEKA CORPORATION

- TABLE 271 KANEKA CORPORATION: COMPANY OVERVIEW

- FIGURE 59 KANEKA CORPORATION: COMPANY SNAPSHOT

- 12.1.10 COVESTRO AG

- TABLE 272 COVESTRO AG: COMPANY OVERVIEW

- FIGURE 60 COVESTRO AG: COMPANY SNAPSHOT

- TABLE 273 COVESTRO AG: DEALS

- 12.2 OTHER PLAYERS

- 12.2.1 ADEKA CORPORATION

- TABLE 274 ADEKA CORPORATION: COMPANY OVERVIEW

- 12.2.2 PMC GROUP, INC.

- TABLE 275 PMC GROUP, INC.: COMPANY OVERVIEW

- 12.2.3 ASTRA POLYMERS COMPOUNDING CO. LTD.

- TABLE 276 ASTRA POLYMERS COMPOUNDING CO. LTD.: COMPANY OVERVIEW

- 12.2.4 BAERLOCHER GROUP

- TABLE 277 BAERLOCHER GROUP: COMPANY OVERVIEW

- 12.2.5 PERFORMANCE ADDITIVES

- TABLE 278 PERFORMANCE ADDITIVES: COMPANY OVERVIEW

- 12.2.6 GRAFE ADVANCED POLYMERS GMBH

- TABLE 279 GRAFE ADVANCED POLYMERS GMBH: COMPANY OVERVIEW

- 12.2.7 MILLIKEN & COMPANY

- TABLE 280 MILLIKEN & COMPANY: COMPANY OVERVIEW

- 12.2.8 AVIENT CORPORATION

- TABLE 281 AVIENT CORPORATION: COMPANY OVERVIEW

- 12.2.9 SABO S.P.A.

- TABLE 282 SABO S.P.A.: COMPANY OVERVIEW

- 12.2.10 SAKAI CHEMICAL INDUSTRY CO. LTD.

- TABLE 283 SAKAI CHEMICAL INDUSTRY CO. LTD.: COMPANY OVERVIEW

- 12.2.11 BROADVIEW TECHNOLOGIES, INC.

- TABLE 284 BROADVIEW TECHNOLOGIES, INC.: COMPANY OVERVIEW

- 12.2.12 VALTRIS SPECIALTY CHEMICALS

- TABLE 285 VALTRIS SPECIALTY CHEMICALS: COMPANY OVERVIEW

- 12.2.13 ARGUS ADDITIVE PLASTICS GMBH

- TABLE 286 ARGUS ADDITIVE PLASTICS GMBH: COMPANY OVERVIEW

- 12.2.14 SYNERGY POLY ADDITIVES PVT. LTD

- TABLE 287 SYNERGY POLY ADDITIVES PVT. LTD: COMPANY OVERVIEW

- 12.2.15 AMPACET CORPORATION

- TABLE 288 AMPACET CORPORATION: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 COMMODITY PLASTICS MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.4 COMMODITY PLASTICS MARKET, BY REGION

- TABLE 289 COMMODITY PLASTICS MARKET SIZE, BY REGION, 2015-2022 (MILLION TON)

- TABLE 290 COMMODITY PLASTICS MARKET SIZE, BY REGION, 2015-2022 (USD BILLION)

- 13.4.1 ASIA PACIFIC

- TABLE 291 ASIA PACIFIC: COMMODITY PLASTICS MARKET SIZE, BY COUNTRY, 2015-2022 (MILLION TON)

- TABLE 292 ASIA PACIFIC: COMMODITY PLASTICS MARKET SIZE, BY COUNTRY, 2015-2022 (USD BILLION)

- 13.4.2 EUROPE

- TABLE 293 EUROPE: COMMODITY PLASTICS MARKET SIZE, BY COUNTRY, 2015-2022 (MILLION TON)

- TABLE 294 EUROPE: COMMODITY PLASTICS MARKET SIZE, BY COUNTRY, 2015-2022 (USD BILLION)

- 13.4.3 NORTH AMERICA

- TABLE 295 NORTH AMERICA: COMMODITY PLASTICS MARKET SIZE, BY COUNTRY, 2015-2022 (MILLION TON)

- TABLE 296 NORTH AMERICA: COMMODITY PLASTICS MARKET SIZE, BY COUNTRY, 2015-2022 (USD BILLION)

- 13.4.4 MIDDLE EAST & AFRICA

- TABLE 297 MIDDLE EAST & AFRICA: COMMODITY PLASTICS MARKET SIZE, BY COUNTRY, 2015-2022 (MILLION TON)

- TABLE 298 MIDDLE EAST & AFRICA: COMMODITY PLASTICS MARKET SIZE, BY COUNTRY, 2015-2022 (USD BILLION)

- 13.4.5 SOUTH AMERICA

- TABLE 299 SOUTH AMERICA: COMMODITY PLASTICS MARKET SIZE, BY COUNTRY, 2015-2022 (MILLION TON)

- TABLE 300 SOUTH AMERICA: COMMODITY PLASTICS MARKET SIZE, BY COUNTRY, 2015-2022 (USD BILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS