|

|

市場調査レポート

商品コード

1384287

マルチフィルム市場:タイプ別、用途別、要素別、地域別-2028年までの予測Mulch Films Market by Type (Clear/Transparent, Black Mulch, Colored Mulch, Photo-selective Mulch, Degradable Mulch), Application (Agricultural and Horticulture), Element (LLDPE, LDPE, HDPE, EVA, PLA, PHA) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| マルチフィルム市場:タイプ別、用途別、要素別、地域別-2028年までの予測 |

|

出版日: 2023年11月10日

発行: MarketsandMarkets

ページ情報: 英文 265 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2023年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 検討単位 | 金額(米ドル) |

| セグメント別 | タイプ別、用途別、要素別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、その他の地域 |

マルチフィルムの市場規模は、予測期間中にCAGR 6.5%で拡大し、2023年の78億米ドルから2028年には106億米ドルに成長すると予測されています。

世界の人口が増え続けるなか、何十億もの人々の栄養ニーズを満たすための食糧需要が高まっています。現在の世界人口は約79億人で、2050年には98億人に達すると予測されています。この課題に対処するため、農業界は生産性と効率を高めなければなりません。マルチフィルムは、これに対する持続可能で効果的な解決策を提供します。マルチフィルムは、土壌を保護する覆いを作るために使用され、土壌の温度調節、保湿、雑草の生育抑制に役立ちます。これらの利点は、ひいては作物の収量向上につながります。これは農業の生産性を高め、増大する食糧需要を満たすのに役立つと思われます。

マルチフィルムにおけるブラックマルチセグメントは、アジア太平洋における独占的なセグメントの一つとして浮上しており、この成長はいくつかの要因に起因することができ、この地域の農業風景に特に適しています。ブラックマルチフィルムは、雑草の成長を効果的に制御する能力により人気を博しています。除草にかかる人件費が比較的高いアジアの農業では、雑草が大きな課題となります。ブラックマルチフィルムは、日光を遮り雑草の生育を防ぐことで、労力を要する除草の必要性を減らすだけでなく、土壌水分を節約し、作物全体の健康状態を向上させる。さらに、MDPIが2022年に発表した「農業における持続可能な節水・節土慣行としてのマルチング」の研究報告によると、黒色プラスチックマルチは土壌水分の質を保ちながら、水生産性、米の収量、品質を高めることができます。

果物、野菜、観賞用植物の栽培を含む園芸は、作物の品質と精密農業に重きを置いています。例えば、イチゴのような高価値作物の栽培では、園芸用に特別に設計されたマルチフィルムを使用することで、いくつかの利点が生まれています。マルチフィルムは地温を調整し、水分を保存し、土壌の圧縮を防ぐことで、作物の生育に最適な環境を作り出します。雑草との競合によって貴重な園芸作物が損なわれないようにするためです。

さらに、マルチフィルムは果物や野菜を土との直接接触から守り、腐敗や病気のリスクを軽減します。園芸用マルチフィルムが提供する精密さと制御性は、高品質な農産物、有機農業、持続可能な慣行に対する需要の高まりに合致しており、マルチフィルム市場の盛んな分野となっています。消費者がますます新鮮で栄養価の高い農産物を求めるようになるにつれ、園芸用途はマルチフィルムの採用から大きな恩恵を受けることになります。

当レポートでは、世界のマルチフィルム市場について調査し、タイプ別、用途別、要素別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

第6章 業界の動向

- イントロダクション

- バリューチェーン分析

- 技術分析

- 特許分析

- 生態系と市場マップ

- 貿易分析

- 顧客のビジネスに影響を与える動向/混乱

- 主要な会議とイベント

- 関税と規制状況

- ケーススタディ分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

第7章 マルチフィルム市場、タイプ別

- イントロダクション

- クリア/透明

- ブラックマルチ

- カラードマルチ

- 光選択性マルチ

- 分解性マルチ

- その他

第8章 マルチフィルム市場、要素別

- イントロダクション

- LLDPE

- LDPE

- HDPE

- EVA

- PLA

- PHA

- その他

第9章 マルチフィルム市場、用途別

- イントロダクション

- 農場

- 園芸

第10章 マルチフィルム市場、地域別

- イントロダクション

- 北米

- アジア太平洋

- 欧州

- 南米

- その他の地域

第11章 競合情勢

- 概要

- 主要参入企業の戦略/有力企業

- 収益分析

- 市場シェア分析

- 主要企業の年間収益VS.成長

- 主要企業のEBITDA

- 主要な市場参入企業の世界スナップショット

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- BASF SE

- BERRY GLOBAL INC.

- DOW

- KURARAY

- EXXON MOBIL CORPORATION

- RKW GROUP

- INTERGRO, INC.

- PLASTIKA KRITIS S.A.

- EPI(EUROPE)LTD

- KOTHARI GROUP

- CAPTAIN POLYPLAST LTD.

- TILAK POLYPACK PVT. LTD

- IRIS POLYMERS

- 生分解性マルチフィルムメーカー

- NOVAMONT S.P.A.

- ARMANDO ALVAREZ GROUP

- ACHILLES CORPORATION

- COVERFIELDS

- FKUR

- WALKI GROUP OY

- TURFQUICK AB SWEDEN

- FILMORGANIC

- KINGFA SCIENCE & TECHNOLOGY(INDIA)LIMITED

- GROWIT INDIA PRIVATE LIMITED

第13章 隣接市場および関連市場

第14章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) |

| Segments | By Type, Application, Element, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and ROW |

The Mulch Films market is projected to grow from USD 7.8 Billion in 2023 to USD 10.6 Billion by 2028, at a CAGR of 6.5% during the forecast period. As the world's population continues to increase, there is an escalating demand for food to meet the nutritional needs of billions of people. The current global population is nearly 7.9 billion and is projected to reach 9.8 billion by 2050. To address this challenge, the agricultural industry has to enhance productivity and efficiency. Mulch films provide a sustainable and effective solution to this. They are used to create a protective cover over the soil, helping to regulate soil temperature, conserve moisture, and suppress weed growth. These benefits, in turn, lead to improved crop yields. This may help boost agricultural productivity and help fulfill the growing demand for food.

"The black mulch in mulch films type segment is expected to be one of the dominant segments in the Asia Pacific region."

The Black mulch segment in mulch films has emerged as one of the dominant segments in the Asia Pacific region, and this growth can be attributed to several factors, making it particularly suitable for the agricultural landscape in this area. Black mulch films have gained popularity due to their ability to control weed growth effectively. Weeds can be a significant challenge in Asian agriculture, where labor costs for weeding are relatively high. Black mulch films, by blocking sunlight and preventing weed growth, not only reduce the need for labor-intensive weeding but also conserve soil moisture, enhancing overall crop health. Moreover, according to MDPI study report of "Mulching as a Sustainable Water and Soil Saving Practice in Agriculture" made in 2022, Black plastic mulch could boost water productivity, rice yield, and quality while also conserving soil moisture quality.

"Horticulture is one of the segments that is projected to grow in the application segment during the forecast period."

Horticulture, which includes the cultivation of fruits, vegetables, and ornamental plants, places a premium on crop quality and precision farming. For instance, in the cultivation of high-value crops like strawberries, the use of mulch films, specifically designed for horticultural purposes, has resulted in several advantages. Mulch films regulate soil temperature, conserve moisture, and prevent soil compaction, creating an environment conducive to optimal crop growth. The enhanced weed control capabilities of mulch films are particularly vital in horticulture, as they ensure that valuable horticultural crops are not compromised by weed competition.

Furthermore, mulch films also protect the fruit or vegetable from direct contact with the soil, reducing the risk of spoilage and disease. The precision and control offered by mulch films in horticulture align with the increasing demand for high-quality produce, organic farming, and sustainable practices, making it a thriving segment in the mulch films market. As consumers increasingly seek fresh and nutritious produce, horticultural applications stand to benefit significantly from the adoption of mulch films.

The break-up of the profile of primary participants in the controlled-release fertilizers market:

- By Company Type: Tier 1 - 20%, Tier 2 - 45%, and Tier 3 - 35%

- By Designation: C Level - 22%, Director Level - 28%, Others-50%

- By Region: Asia Pacific - 28%, Europe - 21%, North America - 32%, South America - 7%, and Rest of the World - 12%

Prominent companies include BASF SE (Germany), Berry Global Inc (US), Dow (US), Kuraray (Japan), Exxon Mobil Corporation (US), and RKW Group (Germany) among others.

Research Coverage:

This research report categorizes the mulch films market by Type (Clear/Transparent, Black mulch, Colored mulch, Photo-selective Mulch, Degradable mulch, and Others), Application (Agricultural Farms, and Horticulture), Element (LLDPE, LDPE, HDPE, EVA, PLA, PHA, and Others) and Region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the mulch films market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, mergers and acquisitions, and recent developments associated with the mulch films market. Competitive analysis of upcoming startups in the mulch films market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall mulch films market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Rising demand for greenhouse applications coupled with rising environmental concerns, Rapid urbanization and industrialization, Increasing crop productivity demand, and Increasing advancement in farming techniques), restraints (Competing farming techniques, and, Implementation of additional pest and disease management measures for farmers), opportunity (Increasing demand for environmentally friendly and biodegradable mulch films, Expanding horticulture and specialty crop production, and, Utilization of mulch films in high-tunnel and greenhouse farming), and challenges (Installation and maintenance of mulch films, and Raising environmental sustainability concerns) influencing the growth of the mulch films market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the mulch films market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the mulch films market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the mulch films market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like BASF SE (Germany), Berry Global Inc (US), Dow (US), Kuraray (Japan), Exxon Mobil Corporation (US), and RKW Group (Germany) among others in the mulch films market strategies. The report also helps stakeholders understand the mulch films market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS & EXCLUSIONS

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES, 2018-2022

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 MULCH FILMS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key insights from industry experts

- 2.1.2.3 Breakdown of primary profiles

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 MULCH FILMS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 MULCH FILMS MARKET SIZE ESTIMATION: TOP-DOWN APPROACH (BASED ON GLOBAL MARKET)

- 2.3 DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- FIGURE 7 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS & RISK ASSESSMENT

- FIGURE 8 LIMITATIONS & RISK MANAGEMENT

- 2.6 RECESSION IMPACT ANALYSIS

- 2.6.1 MACRO INDICATORS OF RECESSION

- FIGURE 9 INDICATORS OF RECESSION

- FIGURE 10 GLOBAL INFLATION RATE, 2012-2022

- FIGURE 11 GLOBAL GROSS DOMESTIC PRODUCT, 2012-2022 (USD TRILLION)

- FIGURE 12 RECESSION INDICATORS AND THEIR IMPACT ON MULCH FILMS MARKET

- FIGURE 13 GLOBAL MULCH FILMS MARKET: CURRENT FORECAST VS. RECESSION IMPACT FORECAST

3 EXECUTIVE SUMMARY

- TABLE 3 MULCH FILMS MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 14 MULCH FILMS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 MULCH FILMS MARKET, BY ELEMENT, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 MULCH FILMS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 MULCH FILMS MARKET SHARE (VALUE), BY REGION, 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MULCH FILMS MARKET

- FIGURE 18 INCREASE IN AGRICULTURAL PRODUCTION TO DRIVE MARKET

- 4.2 ASIA PACIFIC: MULCH FILMS MARKET, BY TYPE AND COUNTRY

- FIGURE 19 BLACK MULCH SEGMENT AND CHINA TO ACCOUNT FOR MARKET SHARES IN 2023

- 4.3 MULCH FILMS MARKET: REGIONAL SUBMARKETS

- FIGURE 20 CHINA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- 4.4 MULCH FILMS MARKET, BY TYPE

- FIGURE 21 BLACK MULCH TO REMAIN LARGEST MARKET TYPE ACROSS REGIONS DURING FORECAST PERIOD

- 4.5 MULCH FILMS MARKET, BY ELEMENT

- FIGURE 22 LLDPE SEGMENT TO BE LARGEST ELEMENT IN MULCH FILMS DURING FORECAST PERIOD

- 4.6 MULCH FILMS MARKET, BY APPLICATION

- FIGURE 23 HORTICULTURE TO ACCOUNT FOR LARGER APPLICATION TO MULCH FILMS DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 RISE IN POPULATION AND SCARCITY OF ARABLE LAND

- FIGURE 24 POPULATION GROWTH, 1950-2025 (BILLION)

- FIGURE 25 PER CAPITA ARABLE LAND, 1960-2025 (HA)

- 5.2.2 GROWTH OF AGRICULTURAL SECTOR

- 5.3 MARKET DYNAMICS

- FIGURE 26 MULCH FILMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.3.1 DRIVERS

- 5.3.1.1 Rise in demand for greenhouse applications coupled with growth in environmental concerns

- 5.3.1.2 Rapid urbanization and industrialization

- FIGURE 27 NUMBER OF PEOPLE LIVING IN URBAN AND RURAL AREAS, 1960-2020 (BILLION)

- FIGURE 28 URBAN POPULATION (PERCENTAGE OF TOTAL POPULATION), BY GROUP OF ECONOMIES, 2011 VS. 2021

- 5.3.1.3 Increase in demand for crop productivity

- 5.3.1.4 Advancements in farming techniques

- 5.3.2 RESTRAINTS

- 5.3.2.1 Presence of sustainable competing farming techniques

- 5.3.2.2 Implementation of additional pest and disease management measures for farmers

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Greater demand for environmentally friendly and biodegradable mulch films

- 5.3.3.2 Expanding horticulture and specialty crop production

- 5.3.3.3 Utilization of mulch films in high-tunnel and greenhouse farming

- 5.3.4 CHALLENGES

- 5.3.4.1 Installation and maintenance of mulch films

- 5.3.4.2 Growth in environmental sustainability concerns

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- FIGURE 29 VALUE CHAIN ANALYSIS OF MULCH FILMS MARKET

- 6.2.1 RAW MATERIAL SUPPLIERS

- 6.2.2 MANUFACTURING

- 6.2.3 DISTRIBUTION

- 6.2.4 MARKETING AND SALES

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 MULTI-LAYER PLASTIC FILMS

- 6.4 PATENT ANALYSIS

- FIGURE 30 PATENTS GRANTED FOR MULCH FILMS MARKET, 2013-2022

- TABLE 4 KEY PATENTS PERTAINING TO MULCH FILMS MARKET, 2020-2023

- 6.5 ECOSYSTEM AND MARKET MAP

- 6.5.1 DEMAND SIDE

- 6.5.2 SUPPLY SIDE

- FIGURE 31 MULCH FILMS MARKET MAP

- TABLE 5 MULCH FILMS MARKET: SUPPLY CHAIN (ECOSYSTEM)

- 6.6 TRADE ANALYSIS

- TABLE 6 TOP 10 EXPORTERS AND IMPORTERS OF MULCH FILMS, 2022 (USD THOUSAND)

- TABLE 7 TOP 10 EXPORTERS AND IMPORTERS OF MULCH FILMS, 2022 (TONS)

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 32 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 6.8 KEY CONFERENCES & EVENTS

- TABLE 8 MULCH FILMS MARKET: CONFERENCES & EVENTS, 2023-2024

- 6.9 TARIFF AND REGULATORY LANDSCAPE

- 6.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.9.2 REGULATORY LANDSCAPE

- 6.9.2.1 North America

- 6.9.2.1.1 US

- 6.9.2.1.2 Canada

- 6.9.2.2 Europe

- 6.9.2.2.1 Germany

- 6.9.2.2.2 France

- 6.9.2.3 Asia Pacific

- 6.9.2.3.1 China

- 6.9.2.4 South America

- 6.9.2.4.1 Brazil

- 6.9.2.4.2 Rest of South America

- 6.9.2.5 RoW

- 6.9.2.5.1 Middle East

- 6.9.2.5.2 South Africa

- 6.9.2.1 North America

- 6.10 CASE STUDY ANALYSIS

- 6.10.1 SOIL-BIODEGRADABLE ECOVIO INTRODUCED Y BASF FOR SUSTAINABLE AGRICULTURE

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 MULCH FILMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.11.1 THREAT OF NEW ENTRANTS

- 6.11.2 THREAT OF SUBSTITUTES

- 6.11.3 BARGAINING POWER OF SUPPLIERS

- 6.11.4 BARGAINING POWER OF BUYERS

- 6.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 34 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY TYPES

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY TYPES

- 6.12.2 BUYING CRITERIA

- FIGURE 35 KEY BUYING CRITERIA FOR TOP TYPES

- TABLE 16 KEY BUYING CRITERIA FOR MULCH FILM TYPES

7 MULCH FILMS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 36 BLACK MULCH SEGMENT TO DOMINATE MULCH FILMS MARKET IN 2023 (USD MILLION)

- TABLE 17 MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 18 MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 19 MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 20 MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- 7.2 CLEAR/TRANSPARENT

- 7.2.1 USE OF CLEAR PLASTIC MULCHES IN COOLER REGIONS

- TABLE 21 CLEAR/TRANSPARENT MULCH FILMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 22 CLEAR/TRANSPARENT MULCH FILMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 23 CLEAR/TRANSPARENT MULCH FILMS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 24 CLEAR/TRANSPARENT MULCH FILMS MARKET, BY REGION, 2023-2028 (KT)

- 7.3 BLACK MULCH

- 7.3.1 INCREASED PRODUCTION OF LEAFY VEGETABLES THAT USE INEXPENSIVE BLACK MULCHES

- TABLE 25 BLACK MULCH FILMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 26 BLACK MULCH FILMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 27 BLACK MULCH FILMS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 28 BLACK MULCH FILMS MARKET, BY REGION, 2023-2028 (KT)

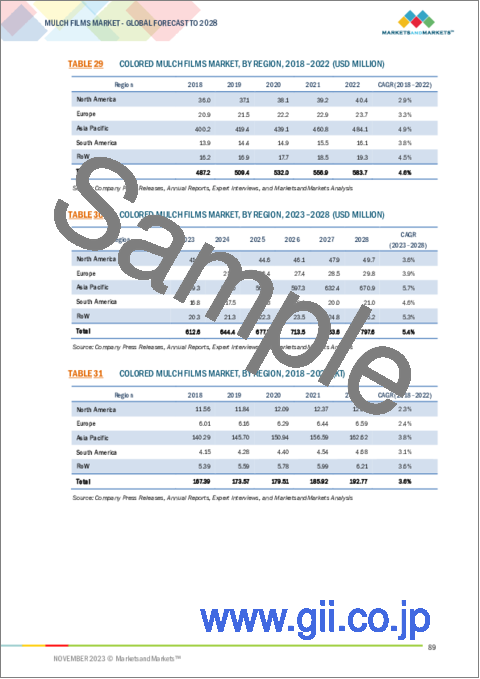

- 7.4 COLORED MULCH

- 7.4.1 COLORED MULCHES FOR IMPROVED CROP PRODUCTION

- TABLE 29 COLORED MULCH FILMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 30 COLORED MULCH FILMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 31 COLORED MULCH FILMS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 32 COLORED MULCH FILMS MARKET, BY REGION, 2023-2028 (KT)

- 7.5 PHOTO-SELECTIVE MULCH

- 7.5.1 ADOPTION OF PHOTO-SELECTIVE MULCH FILMS FOR SUSTAINABLE AGRICULTURE

- TABLE 33 PHOTO-SELECTIVE MULCH FILMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 34 PHOTO-SELECTIVE MULCH FILMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 35 PHOTO-SELECTIVE MULCH FILMS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 36 PHOTO-SELECTIVE MULCH FILMS MARKET, BY REGION, 2023-2028 (KT)

- 7.6 DEGRADABLE MULCH

- 7.6.1 INCREASE IN USE OF BIODEGRADABLE MULCH FILMS

- TABLE 37 DEGRADABLE MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 38 DEGRADABLE MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 39 DEGRADABLE MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 40 DEGRADABLE MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 41 DEGRADABLE MULCH FILMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 42 DEGRADABLE MULCH FILMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 43 DEGRADABLE MULCH FILMS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 44 DEGRADABLE MULCH FILMS MARKET, BY REGION, 2023-2028 (KT)

- 7.6.1.1 Biodegradable Mulch

- TABLE 45 BIODEGRADABLE MULCH FILMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 46 BIODEGRADABLE MULCH FILMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 47 BIODEGRADABLE MULCH FILMS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 48 BIODEGRADABLE MULCH FILMS MARKET, BY REGION, 2023-2028 (KT)

- 7.6.1.2 Photodegradable Mulch

- TABLE 49 PHOTODEGRADABLE MULCH FILMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 50 PHOTODEGRADABLE MULCH FILMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 51 PHOTODEGRADABLE MULCH FILMS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 52 PHOTODEGRADABLE MULCH FILMS MARKET, BY REGION, 2023-2028 (KT)

- 7.7 OTHER TYPES

- TABLE 53 OTHER MULCH FILM TYPES MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 54 OTHER MULCH FILM TYPES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 55 OTHER MULCH FILM TYPES MARKET, BY REGION, 2018-2022 (KT)

- TABLE 56 OTHER MULCH FILM TYPES MARKET, BY REGION, 2023-2028 (KT)

8 MULCH FILMS MARKET, BY ELEMENT

- 8.1 INTRODUCTION

- FIGURE 37 LLDPE-BASED MULCH FILMS TO ACCOUNT FOR LARGEST MARKET BY 2028

- TABLE 57 MULCH FILMS MARKET, BY ELEMENT, 2018-2022 (USD MILLION)

- TABLE 58 MULCH FILMS MARKET, BY ELEMENT, 2023-2028 (USD MILLION)

- 8.2 LLDPE

- 8.2.1 SOIL TEMPERATURE REGULATION TO IMPROVE CROP YIELDS

- TABLE 59 LLDPE-BASED MULCH FILMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 60 LLDPE-BASED MULCH FILMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 LDPE

- 8.3.1 GROWTH IN AWARENESS AMONG FARMERS LED TO INCREASED USE OF LDPE MULCH FILMS

- TABLE 61 LDPE-BASED MULCH FILMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 62 LDPE-BASED MULCH FILMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 HDPE

- 8.4.1 EXTENSIVE USE WITH VARIEGATED APPLICATIONS IN AGRICULTURE

- TABLE 63 HDPE-BASED MULCH FILMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 64 HDPE-BASED MULCH FILMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 EVA

- 8.5.1 INCREASE IN AWARENESS OF ENVIRONMENTAL BENEFITS OF EVA MULCH FILMS

- TABLE 65 EVA-BASED MULCH FILMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 66 EVA-BASED MULCH FILMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.6 PLA

- 8.6.1 TECHNOLOGICALLY ADVANCED PLA MULCH FILMS OFFER PERFORMANCE WITH SUSTAINABILITY

- TABLE 67 PLA-BASED MULCH FILMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 68 PLA-BASED MULCH FILMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.7 PHA

- 8.7.1 RISE IN ADOPTION OF SUSTAINABLE AGRICULTURE AMONG FARMERS

- TABLE 69 PHA-BASED MULCH FILMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 70 PHA-BASED MULCH FILMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.8 OTHER ELEMENTS

- TABLE 71 OTHER MULCH FILM ELEMENTS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 72 OTHER MULCH FILM ELEMENTS MARKET, BY REGION, 2023-2028 (USD MILLION)

9 MULCH FILMS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 38 HORTICULTURAL APPLICATION SET TO DOMINATE MULCH FILMS MARKET, 2023 VS. 2028 (USD MILLION)

- TABLE 73 MULCH FILMS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 74 MULCH FILMS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.2 AGRICULTURAL FARMS

- 9.2.1 DEMAND FOR IMPROVED YIELDS OF HIGH-VALUE CROPS

- TABLE 75 MULCH FILMS MARKET IN AGRICULTURAL FARMS, BY REGION, 2018-2022 (USD MILLION)

- TABLE 76 MULCH FILMS MARKET IN AGRICULTURAL FARMS, BY REGION, 2023-2028 (USD MILLION)

- 9.3 HORTICULTURE

- 9.3.1 HIGH PREFERENCE FOR COLORED MULCH IN COMMERCIAL HORTICULTURE

- TABLE 77 MULCH FILMS MARKET IN HORTICULTURE, BY REGION, 2018-2022 (USD MILLION)

- TABLE 78 MULCH FILMS MARKET IN HORTICULTURE, BY REGION, 2023-2028 (USD MILLION)

10 MULCH FILMS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 39 INDIA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- TABLE 79 MULCH FILMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 80 MULCH FILMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 81 MULCH FILMS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 82 MULCH FILMS MARKET, BY REGION, 2023-2028 (KT)

- 10.2 NORTH AMERICA

- FIGURE 40 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 83 NORTH AMERICA: MULCH FILMS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: MULCH FILMS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: MULCH FILMS MARKET, BY COUNTRY, 2018-2022 (KT)

- TABLE 86 NORTH AMERICA: MULCH FILMS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 87 NORTH AMERICA: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 90 NORTH AMERICA: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 91 NORTH AMERICA: MULCH FILMS MARKET, BY ELEMENT, 2018-2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: MULCH FILMS MARKET, BY ELEMENT, 2023-2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: MULCH FILMS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: MULCH FILMS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 41 NORTH AMERICA: MULCH FILMS MARKET: RECESSION IMPACT ANALYSIS

- 10.2.2 US

- 10.2.2.1 Rise in demand for mulch films from food and dairy industries

- TABLE 95 US: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 96 US: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 97 US: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 98 US: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- 10.2.3 CANADA

- 10.2.3.1 Need to reduce water usage, control weed growth, and improve soil quality

- TABLE 99 CANADA: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 100 CANADA: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 101 CANADA: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 102 CANADA: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- 10.2.4 MEXICO

- 10.2.4.1 Skilled and cost-effective labor force and free trade agreements

- TABLE 103 MEXICO: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 104 MEXICO: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 105 MEXICO: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 106 MEXICO: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- 10.3 ASIA PACIFIC

- FIGURE 42 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 107 ASIA PACIFIC: MULCH FILMS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 108 ASIA PACIFIC: MULCH FILMS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 109 ASIA PACIFIC: MULCH FILMS MARKET, BY COUNTRY, 2018-2022 (KT)

- TABLE 110 ASIA PACIFIC: MULCH FILMS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 111 ASIA PACIFIC: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 114 ASIA PACIFIC: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 115 ASIA PACIFIC: MULCH FILMS MARKET, BY ELEMENT, 2018-2022 (USD MILLION)

- TABLE 116 ASIA PACIFIC: MULCH FILMS MARKET, BY ELEMENT, 2023-2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: MULCH FILMS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 118 ASIA PACIFIC: MULCH FILMS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.3.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 43 ASIA PACIFIC: MULCH FILMS MARKET: RECESSION IMPACT ANALYSIS

- 10.3.2 CHINA

- 10.3.2.1 Massive industrial growth & urbanization and growth in focus on increasing agricultural output

- TABLE 119 CHINA: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 120 CHINA: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 121 CHINA: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 122 CHINA: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- 10.3.3 INDIA

- 10.3.3.1 Promotion of agro-textile sector by government and increase in food demand

- TABLE 123 INDIA: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 124 INDIA: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 125 INDIA: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 126 INDIA: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- 10.3.4 JAPAN

- 10.3.4.1 Advanced crop technologies and need to save labor and time

- TABLE 127 JAPAN: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 128 JAPAN: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 129 JAPAN: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 130 JAPAN: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- 10.3.5 AUSTRALIA & NEW ZEALAND

- 10.3.5.1 Effectiveness of mulch films in promoting growth of avocado trees

- TABLE 131 AUSTRALIA & NEW ZEALAND: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 132 AUSTRALIA & NEW ZEALAND: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 133 AUSTRALIA & NEW ZEALAND: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 134 AUSTRALIA & NEW ZEALAND: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- 10.3.6 REST OF ASIA PACIFIC

- TABLE 135 REST OF ASIA PACIFIC: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 138 REST OF ASIA PACIFIC: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- 10.4 EUROPE

- TABLE 139 EUROPE: MULCH FILMS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 140 EUROPE: MULCH FILMS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 141 EUROPE: MULCH FILMS MARKET, BY COUNTRY, 2018-2022 (KT)

- TABLE 142 EUROPE: MULCH FILMS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 143 EUROPE: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 144 EUROPE: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 145 EUROPE: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 146 EUROPE: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 147 EUROPE: MULCH FILMS MARKET, BY ELEMENT, 2018-2022 (USD MILLION)

- TABLE 148 EUROPE: MULCH FILMS MARKET, BY ELEMENT, 2023-2028 (USD MILLION)

- TABLE 149 EUROPE: MULCH FILMS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 150 EUROPE: MULCH FILMS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.4.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 44 EUROPE: MULCH FILMS MARKET: RECESSION IMPACT ANALYSIS

- 10.4.2 GERMANY

- 10.4.2.1 Favorable EU regulations for select plastics and new recycling initiatives for mulch films

- TABLE 151 GERMANY: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 152 GERMANY: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 153 GERMANY: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 154 GERMANY: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- 10.4.3 FRANCE

- 10.4.3.1 Over 1 million hectares covered in mulch films, especially black

- TABLE 155 FRANCE: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 156 FRANCE: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 157 FRANCE: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 158 FRANCE: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- 10.4.4 UK

- 10.4.4.1 Need to enhance crop yields, improve crop quality, and reduce weed control costs

- TABLE 159 UK: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 160 UK: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 161 UK: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 162 UK: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- 10.4.5 ITALY

- 10.4.5.1 Adoption of eco-friendly films and various government initiatives to promote mulch films

- TABLE 163 ITALY: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 164 ITALY: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 165 ITALY: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 166 ITALY: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- 10.4.6 SPAIN

- 10.4.6.1 Implementation of plastic waste recycling, reduction of plastic usage, and landfilling in cooperation

- TABLE 167 SPAIN: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 168 SPAIN: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 169 SPAIN: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 170 SPAIN: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- 10.4.7 REST OF EUROPE

- TABLE 171 REST OF EUROPE: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 172 REST OF EUROPE: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 173 REST OF EUROPE: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 174 REST OF EUROPE: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- 10.5 SOUTH AMERICA

- TABLE 175 SOUTH AMERICA: MULCH FILMS MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 176 SOUTH AMERICA: MULCH FILMS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 177 SOUTH AMERICA: MULCH FILMS MARKET, BY COUNTRY, 2018-2022 (KT)

- TABLE 178 SOUTH AMERICA: MULCH FILMS MARKET, BY COUNTRY, 2023-2028 (KT)

- TABLE 179 SOUTH AMERICA: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 180 SOUTH AMERICA: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 181 SOUTH AMERICA: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 182 SOUTH AMERICA: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 183 SOUTH AMERICA: MULCH FILMS MARKET, BY ELEMENT, 2018-2022 (USD MILLION)

- TABLE 184 SOUTH AMERICA: MULCH FILMS MARKET, BY ELEMENT, 2023-2028 (USD MILLION)

- TABLE 185 SOUTH AMERICA: MULCH FILMS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 186 SOUTH AMERICA: MULCH FILMS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.5.1 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 45 SOUTH AMERICA: MULCH FILMS MARKET: RECESSION IMPACT ANALYSIS

- 10.5.2 BRAZIL

- 10.5.2.1 High adoption of intensive agricultural practices, expansion of irrigated agriculture, and greater demand for high-quality fruits and vegetables

- TABLE 187 BRAZIL: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 188 BRAZIL: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 189 BRAZIL: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 190 BRAZIL: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- 10.5.3 REST OF SOUTH AMERICA

- TABLE 191 REST OF SOUTH AMERICA: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 192 REST OF SOUTH AMERICA: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 193 REST OF SOUTH AMERICA: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 194 REST OF SOUTH AMERICA: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- 10.6 REST OF THE WORLD (ROW)

- TABLE 195 ROW: MULCH FILMS MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 196 ROW: MULCH FILMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 197 ROW: MULCH FILMS MARKET, BY REGION, 2018-2022 (KT)

- TABLE 198 ROW: MULCH FILMS MARKET, BY REGION, 2023-2028 (KT)

- TABLE 199 ROW: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 200 ROW: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 201 ROW: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 202 ROW: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- TABLE 203 ROW: MULCH FILMS MARKET, BY ELEMENT, 2018-2022 (USD MILLION)

- TABLE 204 ROW: MULCH FILMS MARKET, BY ELEMENT, 2023-2028 (USD MILLION)

- TABLE 205 ROW: MULCH FILMS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 206 ROW: MULCH FILMS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 10.6.1 ROW: RECESSION IMPACT ANALYSIS

- FIGURE 46 ROW: MULCH FILMS MARKET: RECESSION IMPACT ANALYSIS

- 10.6.2 AFRICA

- 10.6.2.1 Availability of affordable and versatile mulch films

- TABLE 207 AFRICA: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 208 AFRICA: MULCH FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 209 AFRICA: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 210 AFRICA: MULCH FILMS MARKET, BY TYPE, 2023-2028 (KT)

- 10.6.3 MIDDLE EAST

- 10.6.3.1 Need to conserve soil moisture, reduce weed growth, enhance soil fertility, and improve crop yields

- TABLE 211 MIDDLE EAST: MULCH FILMS MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 212 MIDDLE EAST: MULCH FILMS MARKET SIZE, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 213 MIDDLE EAST: MULCH FILMS MARKET, BY TYPE, 2018-2022 (KT)

- TABLE 214 MIDDLE EAST: MULCH FILMS MARKET SIZE, BY TYPE, 2023-2028 (KT)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 215 STRATEGIES ADOPTED BY KEY PLAYERS IN MULCH FILMS MARKET

- 11.3 REVENUE ANALYSIS

- FIGURE 47 REVENUE ANALYSIS OF KEY MARKET PLAYERS, 2018-2022 (USD BILLION)

- 11.4 MARKET SHARE ANALYSIS

- TABLE 216 MULCH FILMS MARKET: INTENSITY OF COMPETITIVE RIVALRY, 2022

- 11.5 KEY PLAYERS' ANNUAL REVENUE VS. GROWTH

- FIGURE 48 ANNUAL REVENUE, 2022 (USD BILLION) VS. REVENUE GROWTH, 2020-2022

- 11.6 KEY PLAYERS' EBITDA

- FIGURE 49 EBITDA, 2022 (USD BILLION)

- 11.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 50 GLOBAL SNAPSHOT OF KEY PARTICIPANTS IN MULCH FILMS MARKET, 2022

- 11.8 COMPANY EVALUATION MATRIX

- 11.8.1 STARS

- 11.8.2 EMERGING LEADERS

- 11.8.3 PERVASIVE PLAYERS

- 11.8.4 PARTICIPANTS

- FIGURE 51 COMPANY EVALUATION MATRIX, 2022

- 11.8.5 COMPANY FOOTPRINT

- TABLE 217 COMPANY FOOTPRINT, BY TYPE

- TABLE 218 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 219 COMPANY FOOTPRINT, BY ELEMENT

- TABLE 220 COMPANY FOOTPRINT, BY REGION

- TABLE 221 OVERALL COMPANY FOOTPRINT

- 11.9 STARTUP/SME EVALUATION MATRIX

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 RESPONSIVE COMPANIES

- 11.9.3 DYNAMIC COMPANIES

- 11.9.4 STARTING BLOCKS

- FIGURE 52 STARTUP/SME EVALUATION MATRIX, 2022

- 11.9.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 222 DETAILED LIST OF KEY STARTUPS/SMES

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 DEALS

- TABLE 223 MULCH FILMS MARKET: DEALS, 2018-2023

- 11.10.2 OTHERS

- TABLE 224 MULCH FILMS MARKET: OTHERS, 2018-2023

12 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1 KEY PLAYERS

- 12.1.1 BASF SE

- TABLE 225 BASF SE: BUSINESS OVERVIEW

- FIGURE 53 BASF SE: COMPANY SNAPSHOT

- TABLE 226 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 227 BASF SE: DEALS

- TABLE 228 BASF SE: OTHERS

- 12.1.2 BERRY GLOBAL INC.

- TABLE 229 BERRY GLOBAL INC.: BUSINESS OVERVIEW

- FIGURE 54 BERRY GLOBAL INC.: COMPANY SNAPSHOT

- TABLE 230 BERRY GLOBAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 231 BERRY GLOBAL INC.: DEALS

- 12.1.3 DOW

- TABLE 232 DOW: BUSINESS OVERVIEW

- FIGURE 55 DOW: COMPANY SNAPSHOT

- TABLE 233 DOW: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 DOW: DEALS

- 12.1.4 KURARAY

- TABLE 235 KURARAY: BUSINESS OVERVIEW

- FIGURE 56 KURARAY: COMPANY SNAPSHOT

- TABLE 236 KURARAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.5 EXXON MOBIL CORPORATION

- TABLE 237 EXXON MOBIL CORPORATION: BUSINESS OVERVIEW

- FIGURE 57 EXXON MOBIL CORPORATION: COMPANY SNAPSHOT

- TABLE 238 EXXON MOBIL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 EXXON MOBIL CORPORATION: OTHERS

- 12.1.6 RKW GROUP

- TABLE 240 RKW GROUP: BUSINESS OVERVIEW

- TABLE 241 RKW GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 RKW GROUP: OTHERS

- 12.1.7 INTERGRO, INC.

- TABLE 243 INTERGRO, INC.: BUSINESS OVERVIEW

- TABLE 244 INTERGRO, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.8 PLASTIKA KRITIS S.A.

- TABLE 245 PLASTIKA KRITIS S.A.: BUSINESS OVERVIEW

- TABLE 246 PLASTIKA KRITIS S.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.9 EPI (EUROPE) LTD

- TABLE 247 EPI (EUROPE) LTD: BUSINESS OVERVIEW

- TABLE 248 EPI (EUROPE) LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.10 KOTHARI GROUP

- TABLE 249 KOTHARI GROUP: BUSINESS OVERVIEW

- TABLE 250 KOTHARI GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.11 CAPTAIN POLYPLAST LTD.

- TABLE 251 CAPTAIN POLYPLAST LTD.: BUSINESS OVERVIEW

- TABLE 252 CAPTAIN POLYPLAST LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.12 TILAK POLYPACK PVT. LTD

- TABLE 253 TILAK POLYPACK PVT. LTD: BUSINESS OVERVIEW

- TABLE 254 TILAK POLYPACK PVT. LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.13 IRIS POLYMERS

- TABLE 255 IRIS POLYMERS: BUSINESS OVERVIEW

- TABLE 256 IRIS POLYMERS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2 BIODEGRADABLE MULCH FILM MANUFACTURERS

- 12.2.1 NOVAMONT S.P.A.

- TABLE 257 NOVAMONT S.P.A.: BUSINESS OVERVIEW

- TABLE 258 NOVAMONT S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 259 NOVAMONT S.P.A.: DEALS

- 12.2.2 ARMANDO ALVAREZ GROUP

- TABLE 260 ARMANDO ALVAREZ GROUP: BUSINESS OVERVIEW

- TABLE 261 ARMANDO ALVAREZ GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.3 ACHILLES CORPORATION

- TABLE 262 ACHILLES CORPORATION: BUSINESS OVERVIEW

- TABLE 263 ACHILLES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.4 COVERFIELDS

- TABLE 264 COVERFIELDS: BUSINESS OVERVIEW

- TABLE 265 COVERFIELDS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2.5 FKUR

- TABLE 266 FKUR: BUSINESS OVERVIEW

- TABLE 267 FKUR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 FKUR: DEALS

- 12.2.6 WALKI GROUP OY

- 12.2.7 TURFQUICK AB SWEDEN

- 12.2.8 FILMORGANIC

- 12.2.9 KINGFA SCIENCE & TECHNOLOGY (INDIA) LIMITED

- 12.2.10 GROWIT INDIA PRIVATE LIMITED

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- TABLE 269 ADJACENT MARKET

- 13.2 LIMITATIONS

- 13.3 AGRICULTURAL FILMS MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- TABLE 270 AGRICULTURAL FILMS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 271 AGRICULTURAL FILMS MARKET, BY TYPE, 2023-2028 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS