|

|

市場調査レポート

商品コード

1378213

DNAデータストレージの世界市場:タイプ別、技術別、エンドユーザー別、地域別-2030年までの予測DNA Data Storage Market by Type (Cloud, On-Premises), Technology (Sequence-based DNA Data Storage, Structure-based DNA Data Storage), End Users (Government, Healthcare & Biotechnology, Media & Telecommunication) and Geography - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| DNAデータストレージの世界市場:タイプ別、技術別、エンドユーザー別、地域別-2030年までの予測 |

|

出版日: 2023年11月06日

発行: MarketsandMarkets

ページ情報: 英文 159 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2022年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | タイプ別、技術別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

DNAデータストレージの市場規模は、2024年から2030年にかけて87.7%のCAGRで成長し、2024年の7,600万米ドルから2030年には33億4,800万米ドルに達すると予測されています。

ビッグデータアプリケーションに対する需要の高まりは、DNAデータストレージ市場の主要な促進要因の1つです。ビッグデータアプリケーションは、科学研究からビジネス分析に至るまで、膨大な量のデータを生成します。従来のストレージソリューションでは、この膨大な量のデータを効率的に処理するのに苦労しています。また、ビッグデータアプリケーションでは、リアルタイムの分析と意思決定のために、高速で効率的なデータ検索が必要となります。DNAデータストレージは、このような大規模なデータセットに対応できる、非常に高密度でスケーラブルなストレージメディアを提供することで、ソリューションを提供します。さらに、一度最適化されれば、保存された情報への迅速なアクセスが可能となり、大規模データセットの迅速な検索が不可欠なアプリケーションに適しています。

技術としてのシーケンスベースのDNAデータストレージは、膨大な量のデジタル情報を保存するためにDNA分子のユニークな特性を活用しています。シーケンスベースのDNAデータストレージは、DNA塩基配列にデータがエンコードされたDNAデータストレージの一種です。塩基配列ベースのDNAデータストレージは、磁気テープや光学記憶装置といった従来のデータストレージ方法に対して、多くの潜在的な利点を有しています。しかし、これは新しい技術であり、まだ開発途上です。しかし、データの保存方法に革命を起こす可能性を秘めています。塩基配列に基づくDNAデータストレージは、歴史的記録や科学的データのような長期間のデータ保存に利用できます。また、遠隔地やアクセスしにくい場所でのデータ保存にも利用できます。

国家安全保障と防衛の観点から、政府部門は大量の機密・機密データに依存しています。DNAデータストレージは、機密情報の安全な保管を保証し、不正アクセスから保護すると同時に、必要なときに効率的に取り出すことができます。また、重要な国家安全保障データのバックアップコピーの作成にも活用できます。その安定性により、自然災害やサイバー攻撃が発生した場合でも、重要な情報は無傷のまま保たれます。さらに、法執行機関は犯罪捜査のために法医学的DNAサンプルの膨大なデータベースを保持しています。DNAデータストレージは、これらのデータベースの効率的な保存を容易にし、法医学的分析に必要な遺伝子情報の完全性を保証します。政府保健機関は、疾病サーベイランスや公衆衛生調査にゲノムデータを利用しています。大規模なゲノム・データセットのアーカイブが可能になり、継続的な健康調査への取り組みが支援されます。

米国は予測期間中、北米地域のDNAデータストレージ市場で最大のシェア市場規模を保持すると予想されています。米国には大規模なデータセンターが存在するため、耐久性、安全性、拡張性に優れたデータストレージソリューションに対する需要が生じています。DNAデータストレージは、データセンターがこうした需要を満たすのに役立ちます。DNAデータストレージは、従来のデータストレージソリューションよりもエネルギー効率が高いです。そのため、データセンターはエネルギーコストを削減することができます。DNAデータストレージは従来のデータストレージソリューションよりも耐久性に優れているため、データセンターはハードウェアの交換費用を削減できます

当レポートでは、世界のDNAデータストレージ市場について調査し、タイプ別、技術別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- 生態系/市場マップ

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 技術分析

- 貿易分析

- 特許分析

- 規制状況

- 2023年~2024年の主要な会議とイベント

- 価格分析

第6章 DNAデータストレージ市場、タイプ別

- イントロダクション

- クラウド

- オンプレミス

第7章 DNAデータストレージ市場、技術別

- イントロダクション

- シーケンスベース

- 構造ベース

第8章 DNAデータストレージ市場、エンドユーザー別

- イントロダクション

- 政府

- ヘルスケアとバイオテクノロジー

- メディアと通信

- その他

第9章 DNAデータストレージ市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第10章 競合情勢

- 概要

- 市場ランキング分析、2022年

- 上位3社の収益分析、2020~2022年

- 企業評価マトリックス、2022年

- スタートアップ/中小企業(SMES)の評価マトリックス、2022年

- 競争シナリオと動向

第11章 企業プロファイル

- 主要参入企業

- ILLUMINA, INC.

- MICROSOFT

- IRIDIA, INC.

- TWIST BIOSCIENCE

- CATALOG

- THERMO FISHER SCIENTIFIC INC.

- MICRON TECHNOLOGY, INC.

- HELIXWORKS TECHNOLOGIES, LTD.

- AGILENT TECHNOLOGIES, INC.

- BECKMAN COUTLER, INC.

- EUROFINS SCIENTIFIC

- SIEMENS

- その他の企業

- OXFORD NANOPORE TECHNOLOGIES PLC

- EVONETIX

- QUANTUM CORPORATION

- MOLECULAR ASSEMBLIES

- BGI GROUP GUANGDONG ICP

第12章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2022 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Type, Technology, End Users and Geography |

| Regions covered | North America, Europe, Asia Pacific, RoW |

The DNA Data storage market is projected to grow from USD 76 million in 2024 and is expected to reach USD 3,348 million by 2030, growing at a CAGR of 87.7% from 2024 to 2030. The rising demand for big data applications is one of the key driving factors for the DNA data storage market. Big data applications generate vast amounts of data, ranging from scientific research to business analytics. Traditional storage solutions struggle to handle this massive volume of data efficiently. Also, Big data applications require fast and efficient data retrieval for real-time analytics and decision-making. DNA data storage provides a solution by offering an incredibly dense and scalable storage medium capable of accommodating these large datasets. Moreover, once optimized, it can offer rapid access to stored information, making it suitable for applications where quick retrieval of large datasets is essential.

"Sequence-based DNA data storage in the DNA data storage market to witness significant growth during the forecast period."

Sequence-based DNA data storage as a technology leverages the unique properties of DNA molecules to store vast amounts of digital information. Sequence-based DNA data storage is a type of DNA data storage in which data is encoded in the sequence of DNA bases. Sequence-based DNA data storage has a number of potential advantages over traditional data storage methods, such as magnetic tape and optical discs. Although, it is a new technology, and it is still under development. However, it has the potential to revolutionize the way data is stored. Sequence-based DNA data storage could be used to store data for long periods of time, such as historical records and scientific data. It could also be used to store data in remote or inaccessible locations.

"The Government sector is expected to witness significant growth in the DNA data storage market growth during the forecast period."

In terms of national security and defense, the government sector relies on large volumes of classified and sensitive data. DNA data storage can ensure the secure storage of classified information, protecting it from unauthorized access while allowing for efficient retrieval when needed. It can also be utilized for creating backup copies of critical national security data. Its stability ensures that essential information remains intact even in the event of natural disasters or cyber-attacks. Moreover, Law enforcement agencies maintain a huge database of forensic DNA samples for criminal investigations. DNA data storage facilitates the efficient storage of these databases, ensuring the integrity of genetic information for forensic analysis. Government health agencies use genomic data for disease surveillance and public health research. It allows archiving of large genomic datasets, supporting ongoing health research efforts.

"US is expected to hold the largest market size in North America region during the forecast period."

US is expected to hold the largest share market size of the DNA data storage market in North America during the forecast period. The presence of large data centres in the US creates a demand for data storage solutions that are durable, secure, and scalable. DNA data storage can help data centres meet these demands. DNA data storage is more energy-efficient than traditional data storage solutions. This can help data centres reduce their energy costs. DNA data storage is more durable than traditional data storage solutions, meaning that data centres can reduce their spending on hardware replacement. Several US companies such as Illumina, Inc. (US), Microsoft (US), Iridia, Inc. (US), Twist Bioscience (US), Catalog (US), Thermo Fisher Scientific Inc. (US), and Micron Technology, Inc. (US), are investing heavily in DNA data storage to develop and innovate new technology in this market.

- By Company Type: Tier 1 - 52%, Tier 2 - 31%, and Tier 3 - 17%

- By Designation: C-level Executives - 47%, Directors -31%, and Others - 22%

- By Region: North America -36%, Europe - 29%, Asia Pacific- 30%, and RoW - 5%

The report profiles key DNA data storage market players with their respective market ranking analysis. Prominent players profiled in this report include Illumina, Inc. (US), Microsoft (US), Iridia, Inc. (US), Twist Bioscience (US), Catalog (US), and Thermo Fisher Scientific Inc. (US). Micron Technology, Inc. (US), Helixworks Technologies Ltd (Ireland), Agilent Technologies, Inc. (US), Beckman Coulter (US), Eurofins Scientific (Luxembourg), Siemens (Germany), Oxford Nanopore Technologies (UK), Evonetix (UK), Quantum Corporation (US), Molecular Assemblies (US), and BGI GROUP GUANGDONG ICP (China), are among a few other key companies in the DNA data storage market.

Report Coverage

The report defines, describes, and forecasts the DNA data storage market based on type, technology, end-user, and region. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the DNA data storage market. It also analyzes competitive developments such as collaborations, acquisitions, expansions, contracts, partnerships, and actions carried out by the key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants in the market with information on the closest approximations of the revenue for the overall DNA data storage market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provide them with information on key drivers, restraints, opportunities, and challenges.

The report will provide insights into the following pointers:

- Analysis of key drivers (Increasing demand for data storage), restraints (Higher establishment cost), opportunities (Increasing application of DNA data storage market), and challenges (Standardization and Interoperability of DNA data storage market) of the DNA data storage market.

- Product development /Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the DNA data storage market.

- Market Development: Comprehensive information about lucrative markets; the report analyses the DNA data storage market across various regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the DNA data storage market.

- Competitive Assessment: In-depth assessment of market share, growth strategies, and services, offering of leading players like Illumina, Inc. (US), Microsoft (US), Iridia, Inc. (US), Twist Bioscience (US), Catalog (US) among others in the DNA data storage market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 DNA DATA STORAGE MARKET: SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.4.1 USD EXCHANGE RATES

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 DNA DATA STORAGE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- FIGURE 3 DNA DATA STORAGE MARKET: RESEARCH APPROACH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Key data from secondary sources

- 2.1.2.2 List of major secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 List of key primary respondents

- 2.1.3.5 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- FIGURE 4 DNA DATA STORAGE MARKET: BOTTOM-UP APPROACH

- FIGURE 5 DNA DATA STORAGE MARKET: BOTTOM-UP APPROACH (DEMAND SIDE)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- FIGURE 6 DNA DATA STORAGE MARKET: TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON DNA DATA STORAGE MARKET

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 8 CLOUD-BASED DNA DATA STORAGE TO HOLD LARGER MARKET SHARE IN 2030

- FIGURE 9 SEQUENCE-BASED SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

- FIGURE 10 HEALTHCARE & BIOTECHNOLOGY SEGMENT TO DOMINATE MARKET IN 2024

- FIGURE 11 DNA DATA STORAGE MARKET IN ASIA PACIFIC TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 GROWTH OPPORTUNITIES FOR PLAYERS IN DNA DATA STORAGE MARKET

- FIGURE 12 INCREASING DEMAND FOR DATA STORAGE SOLUTIONS TO BOOST MARKET

- 4.2 DNA DATA STORAGE MARKET, BY TYPE

- FIGURE 13 ON-PREMISES DNA DATA STORAGE MARKET TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- 4.3 DNA DATA STORAGE MARKET, BY END USER

- FIGURE 14 HEALTHCARE & BIOTECHNOLOGY SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- 4.4 DNA DATA STORAGE MARKET, BY TECHNOLOGY

- FIGURE 15 SEQUENCE-BASED SEGMENT TO DOMINATE MARKET IN 2030

- 4.5 DNA DATA STORAGE MARKET IN NORTH AMERICA, BY END USER AND COUNTRY

- FIGURE 16 HEALTHCARE & BIOTECHNOLOGY AND US TO ACCOUNT FOR LARGEST MARKET SHARES IN NORTH AMERICA IN 2024

- 4.6 DNA DATA STORAGE MARKET, BY COUNTRY

- FIGURE 17 SOUTH KOREA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 DNA DATA STORAGE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- FIGURE 19 DRIVERS

- 5.2.1.1 Increasing demand for data storage solutions

- 5.2.1.2 Technological advancements in DNA synthesis and sequencing

- 5.2.1.3 Rising data security and privacy concerns

- 5.2.2 RESTRAINTS

- FIGURE 20 RESTRAINTS

- 5.2.2.1 High cost of establishing DNA data storage facilities

- 5.2.2.2 Slower read-write speed of DNA data storage solutions than traditional electronic storage systems

- 5.2.3 OPPORTUNITIES

- FIGURE 21 OPPORTUNITIES

- 5.2.3.1 Pressing need for robust and long-term archival data preservation solutions

- 5.2.3.2 Increasing number of AI and ML applications

- 5.2.3.3 Growing penetration of big data across industries

- 5.2.4 CHALLENGES

- FIGURE 22 CHALLENGES

- 5.2.4.1 Standardization and interoperability issues associated with DNA data storage solutions

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 23 DNA DATA STORAGE MARKET: VALUE CHAIN ANALYSIS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5 ECOSYSTEM/MARKET MAP

- FIGURE 25 ECOSYSTEM ANALYSIS

- TABLE 1 ROLE OF PARTICIPANTS IN ECOSYSTEM

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 DNA DATA STORAGE MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 DNA DATA STORAGE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS (%)

- 5.7.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 4 KEY BUYING CRITERIA FOR TOP THREE END USERS

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 RESEARCH CONDUCTED AT FUNG INSTITUTE FOR ENGINEERING LEADERSHIP (COLLEGE OF ENGINEERING) PROVIDED INSIGHT INTO MAXIMUM STORAGE CAPACITY OF DNA DATA STORAGE SOLUTIONS

- 5.8.2 TWIST BIOSCIENCE'S RESEARCH HELPED STORE AND RETRIEVE HUMAN GENOME DATA USING DNA DATA STORAGE SOLUTIONS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 DNA origami

- 5.9.1.2 Nanopore sequencing

- 5.9.1 KEY TECHNOLOGIES

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO

- FIGURE 29 IMPORT DATA FOR HS CODE 847170-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022

- TABLE 5 IMPORT DATA FOR HS CODE 847170-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD)

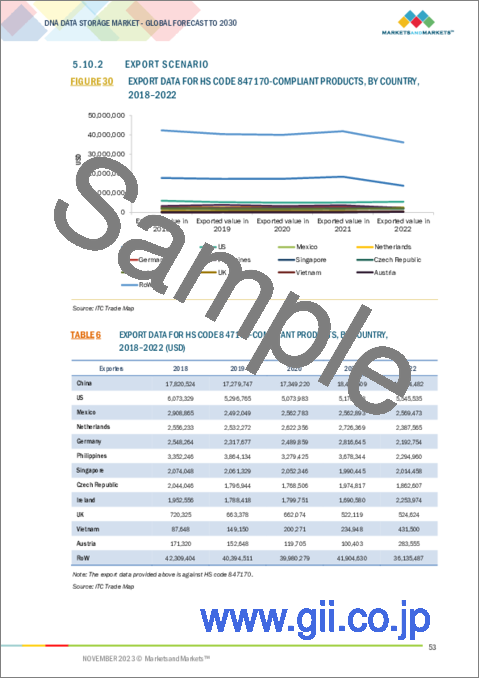

- 5.10.2 EXPORT SCENARIO

- FIGURE 30 EXPORT DATA FOR HS CODE 847170-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022

- TABLE 6 EXPORT DATA FOR HS CODE 847170-COMPLIANT PRODUCTS, BY COUNTRY, 2018-2022 (USD)

- 5.11 PATENT ANALYSIS

- TABLE 7 PATENT REGISTRATIONS RELATED TO DNA DATA STORAGE MARKET

- FIGURE 31 PATENTS PUBLISHED IN DNA DATA STORAGE FIELD BETWEEN 2012 AND 2022

- TABLE 8 NUMBER OF PATENTS REGISTERED IN DNA DATA STORAGE MARKET FROM 2012 TO 2022

- FIGURE 32 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS FROM 2012 TO 2022

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY COMPLIANCE

- 5.12.1.1 Regulations

- 5.12.1.2 Standards

- 5.12.1 REGULATORY COMPLIANCE

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 9 DNA DATA STORAGE MARKET: LIST OF CONFERENCES AND EVENTS

- 5.14 PRICING ANALYSIS

- 5.14.1 PRICING ANALYSIS OF DNA DATA STORAGE SOLUTIONS

6 DNA DATA STORAGE MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 33 CLOUD SEGMENT TO HOLD LARGER SHARE OF DNA DATA STORAGE MARKET IN 2030

- TABLE 10 DNA DATA STORAGE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- 6.2 CLOUD

- 6.2.1 INCREASING IMPLEMENTATION OF ROBUST DATA SECURITY MEASURES TO DRIVE SEGMENTAL GROWTH

- TABLE 11 CLOUD: DNA DATA STORAGE MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 12 CLOUD: DNA DATA STORAGE MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 13 CLOUD: DNA DATA STORAGE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 6.3 ON-PREMISES

- 6.3.1 RISING ADOPTION OF DNA DATA STORAGE SOLUTIONS BY GOVERNMENTS AND RESEARCH ORGANIZATIONS TO SUPPORT SEGMENTAL GROWTH

- TABLE 14 ON-PREMISES: DNA DATA STORAGE MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 15 ON-PREMISES: DNA DATA STORAGE MARKET, BY END USER, 2024-2030 (USD MILLION)

- TABLE 16 ON-PREMISES: DNA DATA STORAGE MARKET, BY REGION, 2024-2030 (USD MILLION)

7 DNA DATA STORAGE MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- FIGURE 34 SEQUENCE-BASED SEGMENT TO EXHIBIT HIGHER CAGR IN DNA DATA STORAGE MARKET DURING FORECAST PERIOD

- TABLE 17 DNA DATA STORAGE MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- 7.2 SEQUENCE-BASED

- 7.2.1 PRESSING NEED FOR EFFICIENT AND HIGH-CAPACITY DATA STORAGE SYSTEMS TO PROPEL SEGMENTAL GROWTH

- TABLE 18 SEQUENCE-BASED: DNA DATA STORAGE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 19 SEQUENCE-BASED: DNA DATA STORAGE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 7.3 STRUCTURE-BASED

- 7.3.1 CAPABILITIES SUCH AS CREATIVE AND CUSTOMIZED INFORMATION STORAGE TO BOOST SEGMENTAL GROWTH

- TABLE 20 STRUCTURE-BASED: DNA DATA STORAGE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 21 STRUCTURE-BASED: DNA DATA STORAGE MARKET, BY REGION, 2024-2030 (USD MILLION)

8 DNA DATA STORAGE MARKET, BY END USER

- 8.1 INTRODUCTION

- FIGURE 35 MEDIA & TELECOMMUNICATIONS SEGMENT TO EXHIBIT HIGHEST CAGR IN DNA DATA STORAGE MARKET DURING FORECAST PERIOD

- TABLE 22 DNA DATA STORAGE MARKET, BY END USER, 2024-2030 (USD MILLION)

- 8.2 GOVERNMENT

- 8.2.1 NEED FOR RELIABLE AND SECURE METHOD OF ARCHIVING SENSITIVE INFORMATION TO FUEL MARKET GROWTH

- TABLE 23 GOVERNMENT: DNA DATA STORAGE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 24 GOVERNMENT: DNA DATA STORAGE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 8.3 HEALTHCARE & BIOTECHNOLOGY

- 8.3.1 NEED FOR SECURE STORAGE OF EXTENSIVE GENOMIC DATA TO BOOST DEMAND

- TABLE 25 HEALTHCARE & BIOTECHNOLOGY: DNA DATA STORAGE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 26 HEALTHCARE & BIOTECHNOLOGY: DNA DATA STORAGE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- 8.4 MEDIA & TELECOMMUNICATIONS

- 8.4.1 NEED FOR LONG-TERM CONTENT PRESERVATION COMPLIANT WITH DATA RETENTION REGULATIONS TO DRIVE MARKET

- FIGURE 36 NORTH AMERICA TO HOLD LARGEST MARKET SHARE FOR MEDIA & TELECOMMUNICATIONS SEGMENT IN 2024

- TABLE 27 MEDIA & TELECOMMUNICATIONS: DNA DATA STORAGE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 28 MEDIA & TELECOMMUNICATIONS: DNA DATA STORAGE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 8.5 OTHERS

- TABLE 29 OTHERS: DNA DATA STORAGE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 30 OTHERS: DNA DATA STORAGE MARKET, BY REGION, 2024-2030 (USD MILLION)

9 DNA DATA STORAGE MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 37 DNA DATA STORAGE MARKET IN ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 31 DNA DATA STORAGE MARKET, BY REGION, 2024-2030 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 IMPACT OF RECESSION ON DNA DATA STORAGE MARKET IN NORTH AMERICA

- FIGURE 38 NORTH AMERICA: DNA DATA STORAGE MARKET SNAPSHOT

- TABLE 32 NORTH AMERICA: DNA DATA STORAGE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 33 NORTH AMERICA: DNA DATA STORAGE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 34 NORTH AMERICA: DNA DATA STORAGE MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 35 NORTH AMERICA: DNA DATA STORAGE MARKET, BY END USER, 2024-2030 (USD MILLION)

- 9.2.2 US

- 9.2.2.1 Increasing demand for long-term data storage solutions to propel market

- TABLE 36 US: DNA DATA STORAGE MARKET, BY END USER, 2024-2030 (USD MILLION)

- 9.2.3 CANADA

- 9.2.3.1 Favorable government support and funding in research and development of next-generation technology to drive market

- TABLE 37 CANADA: DNA DATA STORAGE MARKET, BY END USER, 2024-2030 (USD MILLION)

- 9.2.4 MEXICO

- 9.2.4.1 Rising investments by government and private sectors in DNA data storage technology to boost market

- TABLE 38 MEXICO: DNA DATA STORAGE MARKET, BY END USER, 2024-2030 (USD MILLION)

- 9.3 EUROPE

- 9.3.1 IMPACT OF RECESSION ON DNA DATA STORAGE MARKET IN EUROPE

- FIGURE 39 EUROPE: DNA DATA STORAGE MARKET SNAPSHOT

- TABLE 39 EUROPE: DNA DATA STORAGE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 40 EUROPE: DNA DATA STORAGE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 41 EUROPE: DNA DATA STORAGE MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 42 EUROPE: DNA DATA STORAGE MARKET, BY END USER, 2024-2030 (USD MILLION)

- 9.3.2 UK

- 9.3.2.1 Ongoing research and advancements in biotechnology field to contribute to market growth

- TABLE 43 UK: DNA DATA STORAGE MARKET, BY END USER, 2024-2030 (USD MILLION)

- 9.3.3 GERMANY

- 9.3.3.1 Presence of significant research institutes and scientific communities to drive market

- TABLE 44 GERMANY: DNA DATA STORAGE MARKET, BY END USER, 2024-2030 (USD MILLION)

- 9.3.4 FRANCE

- 9.3.4.1 Increased funding toward development of DNA data storage solutions to support market growth

- TABLE 45 FRANCE: DNA DATA STORAGE MARKET, BY END USER, 2024-2030 (USD MILLION)

- 9.3.5 REST OF EUROPE

- TABLE 46 REST OF EUROPE: DNA DATA STORAGE MARKET, BY END USER, 2024-2030 (USD MILLION)

- 9.4 ASIA PACIFIC

- 9.4.1 IMPACT OF RECESSION ON DNA DATA STORAGE MARKET IN ASIA PACIFIC

- FIGURE 40 ASIA PACIFIC: DNA DATA STORAGE MARKET SNAPSHOT

- TABLE 47 ASIA PACIFIC: DNA DATA STORAGE MARKET, BY COUNTRY, 2024-2030 (USD MILLION)

- TABLE 48 ASIA PACIFIC: DNA DATA STORAGE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 49 ASIA PACIFIC: DNA DATA STORAGE MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 50 ASIA PACIFIC: DNA DATA STORAGE MARKET, BY END USER, 2024-2030 (USD MILLION)

- 9.4.2 CHINA

- 9.4.2.1 Significant progress in developing and commercializing DNA data storage solutions to fuel market growth

- TABLE 51 CHINA: DNA DATA STORAGE MARKET, BY END USER, 2024-2030 (USD MILLION)

- 9.4.3 JAPAN

- 9.4.3.1 Need to store substantial volume of data generated on genomics research to drive market

- TABLE 52 JAPAN: DNA DATA STORAGE MARKET, BY END USER, 2024-2030 (USD MILLION)

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Presence of renowned research institutions in biotechnology and related fields to contribute to market growth

- TABLE 53 SOUTH KOREA: DNA DATA STORAGE MARKET, BY END USER, 2024-2030 (USD MILLION)

- 9.4.5 REST OF ASIA PACIFIC

- TABLE 54 REST OF ASIA PACIFIC: DNA DATA STORAGE MARKET, BY END USER, 2024-2030 (USD MILLION)

- 9.5 ROW

- 9.5.1 IMPACT OF RECESSION ON DNA DATA STORAGE MARKET IN ROW

- TABLE 55 ROW: DNA DATA STORAGE MARKET, BY REGION, 2024-2030 (USD MILLION)

- TABLE 56 ROW: DNA DATA STORAGE MARKET, BY TYPE, 2024-2030 (USD MILLION)

- TABLE 57 ROW: DNA DATA STORAGE MARKET, BY TECHNOLOGY, 2024-2030 (USD MILLION)

- TABLE 58 ROW: DNA DATA STORAGE MARKET, BY END USER, 2024-2030 (USD MILLION)

- 9.5.2 MIDDLE EAST & AFRICA

- 9.5.2.1 Data privacy and security concerns to propel market

- TABLE 59 MIDDLE EAST & AFRICA: DNA DATA STORAGE MARKET, BY END USER, 2024-2030 (USD MILLION)

- 9.5.3 SOUTH AMERICA

- 9.5.3.1 R&D activities on biotechnology and genomics to fuel market growth

- TABLE 60 SOUTH AMERICA: DNA DATA STORAGE MARKET, BY END USER, 2024-2030 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- TABLE 61 DNA DATA STORAGE MARKET: KEY GROWTH STRATEGIES ADOPTED BY TOP PLAYERS FROM 2021 TO 2023

- 10.2 MARKET RANKING ANALYSIS, 2022

- TABLE 62 DNA DATA STORAGE MARKET: MARKET RANKING ANALYSIS, 2022

- 10.3 REVENUE ANALYSIS OF TOP THREE COMPANIES, 2020-2022

- FIGURE 41 REVENUE ANALYSIS OF TOP THREE COMPANIES IN DNA DATA STORAGE MARKET, 2020-2022

- 10.4 COMPANY EVALUATION MATRIX, 2022

- 10.4.1 STARS

- 10.4.2 EMERGING LEADERS

- 10.4.3 PERVASIVE PLAYERS

- 10.4.4 PARTICIPANTS

- FIGURE 42 DNA DATA STORAGE MARKET: COMPANY EVALUATION MATRIX, 2022

- 10.4.5 COMPANY FOOTPRINT

- TABLE 63 DNA DATA STORAGE MARKET: OVERALL COMPANY FOOTPRINT

- TABLE 64 DNA DATA STORAGE MARKET: TYPE FOOTPRINT

- TABLE 65 DNA DATA STORAGE MARKET: END USER FOOTPRINT

- TABLE 66 DNA DATA STORAGE MARKET: REGION FOOTPRINT

- 10.5 START-UPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022

- 10.5.1 PROGRESSIVE COMPANIES

- 10.5.2 RESPONSIVE COMPANIES

- 10.5.3 DYNAMIC COMPANIES

- 10.5.4 STARTING BLOCKS

- FIGURE 43 DNA DATA STORAGE MARKET: START-UPS/SMES EVALUATION MATRIX, 2022

- TABLE 67 DNA DATA STORAGE MARKET: LIST OF KEY START-UPS/SMES

- 10.5.5 COMPETITIVE BENCHMARKING

- TABLE 68 DNA DATA STORAGE MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 10.6 COMPETITIVE SCENARIOS AND TRENDS

- 10.6.1 PRODUCT LAUNCHES

- TABLE 69 PRODUCT LAUNCHES, 2021-2023

- 10.6.2 DEALS

- TABLE 70 DEALS, 2021-2023

- 10.6.3 OTHERS

- TABLE 71 OTHERS, 2021-2023

11 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 11.1 KEY PLAYERS

- 11.1.1 ILLUMINA, INC.

- TABLE 72 ILLUMINA, INC.: COMPANY OVERVIEW

- FIGURE 44 ILLUMINA, INC.: COMPANY SNAPSHOT

- TABLE 73 ILLUMINA, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 74 ILLUMINA, INC.: DEALS

- TABLE 75 ILLUMINA, INC.: OTHERS

- 11.1.2 MICROSOFT

- TABLE 76 MICROSOFT: COMPANY OVERVIEW

- FIGURE 45 MICROSOFT: COMPANY SNAPSHOT

- TABLE 77 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 78 MICROSOFT: DEALS

- 11.1.3 IRIDIA, INC.

- TABLE 79 IRIDIA, INC.: COMPANY OVERVIEW

- TABLE 80 IRIDIA, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 81 IRIDIA, INC.: OTHERS

- 11.1.4 TWIST BIOSCIENCE

- TABLE 82 TWIST BIOSCIENCE: COMPANY OVERVIEW

- FIGURE 46 TWIST BIOSCIENCE: COMPANY SNAPSHOT

- TABLE 83 TWIST BIOSCIENCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.5 CATALOG

- TABLE 84 CATALOG: COMPANY OVERVIEW

- TABLE 85 CATALOG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 86 CATALOG: DEALS

- TABLE 87 CATALOG: OTHERS

- 11.1.6 THERMO FISHER SCIENTIFIC INC.

- TABLE 88 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- FIGURE 47 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT

- TABLE 89 THERMO FISHER SCIENTIFIC INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 90 THERMO FISHER SCIENTIFIC INC.: DEALS

- 11.1.7 MICRON TECHNOLOGY, INC.

- TABLE 91 MICRON TECHNOLOGY, INC.: COMPANY OVERVIEW

- FIGURE 48 MICRON TECHNOLOGY, INC.: COMPANY SNAPSHOT

- TABLE 92 MICRON TECHNOLOGY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 93 MICRON TECHNOLOGY INC.: PRODUCT LAUNCHES

- 11.1.8 HELIXWORKS TECHNOLOGIES, LTD.

- TABLE 94 HELIXWORKS TECHNOLOGIES, LTD.: COMPANY OVERVIEW

- TABLE 95 HELIXWORKS TECHNOLOGIES, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.9 AGILENT TECHNOLOGIES, INC.

- TABLE 96 AGILENT TECHNOLOGIES INC.: COMPANY OVERVIEW

- FIGURE 49 AGILENT TECHNOLOGIES INC.: COMPANY SNAPSHOT

- TABLE 97 AGILENT TECHNOLOGIES INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 98 AGILENT TECHNOLOGIES INC.: DEALS

- 11.1.10 BECKMAN COUTLER, INC.

- TABLE 99 BECKMAN COUTLER, INC.: COMPANY OVERVIEW

- TABLE 100 BECKMAN COUTLER, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 101 BECKMAN COUTLER, INC.: DEALS

- 11.1.11 EUROFINS SCIENTIFIC

- TABLE 102 EUROFINS SCIENTIFIC: COMPANY OVERVIEW

- FIGURE 50 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

- TABLE 103 EUROFINS SCIENTIFIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.12 SIEMENS

- TABLE 104 SIEMENS: COMPANY OVERVIEW

- FIGURE 51 SIEMENS: COMPANY SNAPSHOT

- TABLE 105 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.2 OTHER PLAYERS

- 11.2.1 OXFORD NANOPORE TECHNOLOGIES PLC

- 11.2.2 EVONETIX

- 11.2.3 QUANTUM CORPORATION

- 11.2.4 MOLECULAR ASSEMBLIES

- 11.2.5 BGI GROUP GUANGDONG ICP

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS