|

|

市場調査レポート

商品コード

1378212

モバイル脅威対策の世界市場:オファリング別、オペレーティングシステム別、展開形態別、組織規模別、脅威タイプ別、業界別、地域別-2028年までの予測Mobile Threat Defense Market by Offering, Operating System (iOS, Android, Other OS), Deployment Mode (On-premises and Cloud), Organization Size, Application (Phishing, Ransomware, Malware), Vertical, Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| モバイル脅威対策の世界市場:オファリング別、オペレーティングシステム別、展開形態別、組織規模別、脅威タイプ別、業界別、地域別-2028年までの予測 |

|

出版日: 2023年11月03日

発行: MarketsandMarkets

ページ情報: 英文 258 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 検討単位 | 金額(米ドル)100万/10億 |

| セグメント別 | オファリング別、オペレーティングシステム別、展開形態別、組織規模別、用途別、業界別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

世界のモバイル脅威対策の市場規模は、2023年には26億米ドル規模になると予測され、予測期間中のCAGRは22.9%で拡大し、2028年には72億米ドルに達すると予測されています。

モバイルに依存する労働力の増加や、日常生活におけるスマートフォンやタブレットの遍在に後押しされたモバイルデバイスの普及は、モバイル脅威対策市場の基本的な促進要因です。モバイルデバイスのユビキタスな利用は、生産性の向上に新たな機会をもたらすだけでなく、サイバー脅威によるリスクの増大を招いています。モバイル特有の脆弱性とモバイルデバイスの着実な利用拡大が顕著な、この進化する脅威情勢により、企業は機密データを保護し、規制コンプライアンスを確保し、従業員と顧客の信頼を維持するために、包括的なMTDソリューションを求める必要に迫られています。

モバイル脅威対策市場では、サービス分野が予測期間中に最も大きな成長率を記録すると予測されています。この成長は、いくつかの重要な要因によるものです。組織は、MTDソリューションを効果的に導入、最適化、管理するための専門サービスの必要性を認識するようになっています。モバイルセキュリティの脅威が複雑化し、脅威の状況が進化しているため、これらのソリューションの導入と維持において、専門家によるガイダンスとサポートに対する需要が生じています。企業がモバイルデバイスの利用を拡大し、これらのデバイスで処理される機密データの量が増加するにつれて、MTD市場におけるマネージドサービスのニーズが高まっています。

マネージドサービスプロバイダーは、企業に代わってモバイルの脅威を積極的に監視、検出、対応し、社内管理の負担を軽減することができます。サービス分野は、MTD戦略をそれぞれのニーズに合わせて調整しようとする企業にとっても重要です。プロフェッショナル・サービスは、独自のセキュリティ要件や業界特有の規制に対応するMTDソリューションのカスタマイズを支援することで、全体的な有効性を高めることができます。MTD市場におけるサービス分野の成長は、堅牢なテクノロジーソリューションだけでなく、モバイルセキュリティの複雑な状況を効果的にナビゲートする専門家のガイダンスとサポートの重要性を裏付けています。

当レポートでは、世界のモバイル脅威対策市場について調査し、オファリング別、オペレーティングシステム別、展開形態別、組織規模別、脅威タイプ別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 業界の動向

第6章 モバイル脅威対策市場、オファリング別

- イントロダクション

- ソリューション

- サービス

第7章 モバイル脅威対策市場、オペレーティングシステム別

- イントロダクション

- IOS

- ANDROID

- その他

第8章 モバイル脅威対策市場、展開形態別

- イントロダクション

- オンプレミス

- クラウド

第9章 モバイル脅威対策市場、組織規模別

- イントロダクション

- 大企業

- 中小企業

第10章 モバイル脅威対策市場、脅威タイプ別

- イントロダクション

- フィッシング

- ランサムウェア

- マルウェア

- DDOS

- APT

- その他

第11章 モバイル脅威対策市場、業界別

- イントロダクション

- 銀行、金融サービス、保険

- IT・通信

- 小売・電子商取引

- ヘルスケア・ライフサイエンス

- 政府・防衛

- 製造業

- その他

第12章 モバイル脅威対策市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第13章 競合情勢

- 主要参入企業の戦略/有力企業

- 市場ランキング

- 収益分析

- 市場シェア分析

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオと動向

- モバイル脅威対策製品のベンチマーク

- 主要なモバイル脅威対策ベンダーの評価と財務指標

第14章 企業プロファイル

- 主要参入企業

- CISCO

- SAP

- BROADCOM

- VMWARE

- CITRIX SYSTEMS

- KASPERSKY LABS

- IVANTI

- ZOHO

- SOLARWINDS

- MICRO FOCUS

- BLACKBERRY

- ZIMPERIUM

- MATRIX42

- SOPHOS

- JAMF

- スタートアップ/中小企業

- ESPER

- LOOKOUT

- PRADEO

- GUARDSQUARE

- UPSTREAM SECURITY

- NEXTHINK

- SNYK

- BARRACUDA NETWORKS

- ZIMBRA

- APPGUARD

- CELLTRUST

- SENTINELONE

- CYBEREASON

第15章 隣接市場

第16章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) Million/Billion |

| Segments | By offering, OS, deployment mode, organization size, application, and vertical |

| Regions covered | North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

The global mobile threat defense market is estimated to be worth USD 2.6 billion in 2023 and is projected to reach USD 7.2 billion by 2028, at a CAGR of 22.9% during the forecast period.

The proliferation of mobile devices, driven by an increasingly mobile-dependent workforce and the omnipresence of smartphones and tablets in daily life, is a fundamental driver of the mobile threat defense market. The ubiquitous use of mobile devices not only presents new opportunities for productivity but also invites greater risk from cyber threats. This evolving threat landscape, marked by mobile-specific vulnerabilities and the steady growth of mobile device usage, compels organizations to seek comprehensive MTD solutions to protect sensitive data, ensure regulatory compliance, and maintain the trust of their employees and customers.

"By offering, the services segment to register the highest growth rate during the forecast period"

In the mobile threat defense market, the services segment is anticipated to record the most significant growth rate during the forecast period. This growth is attributed to several key factors. Organizations are increasingly recognizing the need for professional services to effectively implement, optimize, and manage MTD solutions. The complexity of mobile security threats and the evolving threat landscape have created a demand for expert guidance and support in deploying and maintaining these solutions. As organizations expand their use of mobile devices and the volume of sensitive data processed on these devices grows, there is a growing need for managed services in the MTD market. Managed services providers can proactively monitor, detect, and respond to mobile threats on behalf of organizations, alleviating the burden of in-house management. The services segment is also crucial for organizations seeking to tailor their MTD strategies to their specific needs. Professional services can assist in customizing MTD solutions to address unique security requirements and industry-specific regulations, thereby enhancing their overall effectiveness. The growth of the services segment in the MTD market underscores the importance of not only having robust technology solutions but also expert guidance and support to navigate the intricate landscape of mobile security effectively.

"By deployment mode, the cloud segment to register the highest growth rate during the forecast period"

The cloud segment's rapid growth within the mobile threat defense market can be attributed to several key factors. First and foremost, the shift towards cloud-based solutions has become a prevailing trend across various industries. Organizations are drawn to the flexibility and scalability that cloud-based deployment offers, enabling them to easily adjust their MTD solutions as their mobile device fleets expand or contract. The global adoption of remote and hybrid work models has accelerated the migration to cloud-based MTD solutions. With employees accessing corporate data from various locations and devices, cloud-based MTD allows for seamless protection and monitoring of mobile devices, regardless of their physical location. The cloud's ability to provide real-time updates and threat intelligence is another critical driver for its high growth rate. This ensures that organizations can stay ahead of the evolving threat landscape, an essential feature in the ever-changing world of cybersecurity. The cost-effectiveness of cloud-based solutions, with reduced on-premises hardware and maintenance expenses, is a compelling factor for businesses, particularly in challenging economic environments. As a result, the cloud segment is expected to maintain a remarkable growth rate as it aligns with the dynamic security needs and modernization strategies of organizations across the globe.

"Asia Pacific to register the highest growth rate during the forecast period"

Asia Pacific is poised to register the most substantial growth rate during the forecast period in the context of the mobile threat defense market. Several key factors contribute to this notable growth trajectory. The Asia Pacific region is experiencing rapid digital transformation and economic expansion, fostering an environment where mobile devices are increasingly integrated into both personal and professional life. This surge in mobile device usage amplifies the vulnerability landscape, making the region a focal point for advanced mobile security solutions. The evolving regulatory standards and data protection requirements in many Asia Pacific countries necessitate the implementation of robust MTD strategies. Organizations operating in the region are recognizing the importance of safeguarding sensitive data, both to comply with regulations and to maintain customer trust. The growth in remote work and the escalating sophistication of mobile-specific threats in the Asia Pacific region have also contributed to the heightened demand for MTD solutions. As organizations grapple with securing remote endpoints and protecting against advanced threats, MTD solutions become increasingly vital. The Asia Pacific region's expanding smartphone user base, diverse business landscape, and dynamic cybersecurity challenges position it as a central driver of growth in the MTD market. As a result, the region is expected to experience the highest growth rate during the forecast period, reflecting its pivotal role in shaping the global mobile threat defense landscape.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The breakdown of the primaries is as follows:

- By Company Type: Tier 1 - 20%, Tier 2 - 57%, and Tier 3 - 33%

- By Designation: C-level - 40%, Managers and Others - 60%

- By Region: North America - 35%, Europe - 20%, Asia Pacific - 45%.

The major players in the mobile threat defense market are Cisco Systems (California), SAP (Germany), Broadcom (California), VMware (California), Citrix Systems (Florida), Kaspersky Labs (Russia), Ivanti (Utah), Micro Focus (United Kingdom), ZOHO (India), SolarWinds (Texas), Zimperium (Texas), Matrix42 (Germany), Sophos (United Kingdom), Blackberry (Canada), Esper (California), Lookout (California), Wandera (California), Pradeo (France), ZecOps (Israel), GuardSquare (Belgium), Upstream Security (Israel), Nexthink (Switzerland), Snyk (United Kingdom), Barracuda Networks (California), Zimbra (Texas), Bromium (California), AppGuard (Maryland), CellTrust (Arizona), SentinelOne (California).

The study includes an in-depth competitive analysis of these key players in the mobile threat defense market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study covers the MTD market size across segments. It aims at estimating the market size and the growth potential of this market across different segments by offering, by OS, by deployment mode, by organization size, by application, by vertical, and by region. The study also includes an in-depth competitive analysis of the key market players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Reasons to buy this report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall mobile threat defense market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- As businesses recognize the pivotal role of mobile threat defense, there is a mounting demand for comprehensive mobile threat defense solutions. These encompass a range of tools enabling organizations to achieve authentic and secure connectivity. While challenges like the need for alignment and technology integration are acknowledged, the report underscores the dynamic landscape of mobile threat defense-centric technologies and evolving market trends, the report also offers valuable insights into the future trajectory of the mobile threat defense market.

- Product Development/Innovation: Detailed insights on coming technologies, R&D activities, and product & solution launches in the mobile threat defense market

- Market Development: Comprehensive information about lucrative markets - the report analyses the mobile threat defense market across varied regions.

- Market Diversification: Exhaustive information about new products & solutions being developed, untapped geographies, recent developments, and investments in the mobile threat defense market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Cisco Systems (California), SAP (Germany), Broadcom (California), VMware (California), Citrix Systems (Florida), Kaspersky Labs (Russia), Ivanti (Utah), Micro Focus (United Kingdom), ZOHO (India), SolarWinds (Texas), Zimperium (Texas), Matrix42 (Germany), Sophos (United Kingdom), Blackberry (Canada), Esper (California), Lookout (California), Wandera (California), Pradeo (France), ZecOps (Israel), GuardSquare (Belgium), Upstream Security (Israel), Nexthink (Switzerland), Snyk (United Kingdom), Barracuda Networks (California), Zimbra (Texas), Bromium (California), AppGuard (Maryland), CellTrust (Arizona), SentinelOne (California).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2020-2022

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 MOBILE THREAT DEFENSE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key insights from industry experts

- 2.2 DATA TRIANGULATION AND MARKET BREAKUP

- FIGURE 2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY, APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS AND SERVICES IN MOBILE THREAT DEFENSE MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1, SUPPLY-SIDE ANALYSIS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 1-BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF SOLUTIONS AND SERVICES IN MOBILE THREAT DEFENSE MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 2-BOTTOM-UP (DEMAND SIDE)

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 RECESSION IMPACT

- FIGURE 7 MOBILE THREAT DEFENSE MARKET: RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 8 MOBILE THREAT DEFENSE MARKET TO WITNESS FAST GROWTH DURING FORECAST PERIOD

- FIGURE 9 MOBILE THREAT DEFENSE MARKET: FASTEST-GROWING SEGMENTS, 2023-2028

- FIGURE 10 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

4 PREMIUM INSIGHTS

- 4.1 BRIEF OVERVIEW OF MOBILE THREAT DEFENSE MARKET

- FIGURE 11 INCREASING INSTANCES OF MALWARE AND FILE-BASED ATTACKS AND STRINGENT REGULATORY NORMS TO DRIVE MARKET

- 4.2 MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2023

- FIGURE 12 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- 4.3 MOBILE THREAT DEFENSE MARKET, BY OS, 2023 VS. 2028

- FIGURE 13 ANDROID SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- 4.4 MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2023 VS. 2028

- FIGURE 14 CLOUD SEGMENT TO HOLD LARGER MARKET DURING FORECAST PERIOD

- 4.5 MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2023 VS. 2028

- FIGURE 15 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET DURING FORECAST PERIOD

- 4.6 MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2023 VS. 2028

- FIGURE 16 IT & TELECOM SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- 4.7 MARKET INVESTMENT SCENARIO

- FIGURE 17 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENT

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MOBILE THREAT DEFENSE MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Growing sophistication of mobile threats

- 5.2.1.2 Increasing adoption of mobile devices

- 5.2.1.3 Increasing productivity of employees and enterprises through BYOD

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complexity of integrating mobile threat defense solutions across wide spectrum of mobile device types

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing adoption of BYOD devices

- 5.2.4 CHALLENGES

- 5.2.4.1 Increasing complexity of advanced threats

- 5.2.4.2 Lack of awareness regarding mobile security and related cyber threats

- 5.3 INDUSTRY TRENDS

- 5.3.1 BRIEF HISTORY OF MOBILE THREAT DEFENSE

- FIGURE 19 BRIEF HISTORY OF MOBILE THREAT DEFENSE

- 5.3.1.1 2000s

- 5.3.1.2 2010s

- 5.3.1.3 2020s

- 5.3.1.4 2022

- 5.3.2 ECOSYSTEM/MARKET MAP

- TABLE 3 MOBILE THREAT DEFENSE MARKET: ECOSYSTEM

- FIGURE 20 MOBILE THREAT DEFENSE MARKET: ECOSYSTEM

- 5.3.3 CASE STUDY ANALYSIS

- 5.3.3.1 Case Study 1: Laclede Gas Company protected corporate data in BYOD and CYOD environments with Symantec

- 5.3.3.2 Case study 2: European financial institution deployed Promon SHIELD to offer cybersecurity on mobile and desktop devices

- 5.3.3.3 Case study 3: Quest Diagnostics installed Symantec Mobility Suite to capture test data and send it securely to lab to ensure compliance

- 5.3.4 VALUE CHAIN ANALYSIS

- FIGURE 21 VALUE CHAIN ANALYSIS: MOBILE THREAT DEFENSE MARKET

- 5.3.5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.5.1 North America

- 5.3.5.1.1 US

- 5.3.5.2 Europe

- 5.3.5.3 Asia Pacific

- 5.3.5.3.1 India

- 5.3.5.3.2 China

- 5.3.5.4 Middle East & Africa

- 5.3.5.4.1 UAE

- 5.3.5.5 Latin America

- 5.3.5.5.1 Brazil

- 5.3.5.5.2 Mexico

- 5.3.5.1 North America

- 5.3.6 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 PORTER'S FIVE FORCES IMPACT ON MOBILE THREAT DEFENSE MARKET

- FIGURE 22 MOBILE THREAT DEFENSE MARKET: PORTER'S FIVE FORCES MODEL

- 5.3.6.1 Threat of new entrants

- 5.3.6.2 Threat of substitutes

- 5.3.6.3 Bargaining power of buyers

- 5.3.6.4 Bargaining power of suppliers

- 5.3.6.5 Intensity of competitive rivalry

- 5.3.7 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 23 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.3.8 MOBILE THREAT DEFENSE TOOLS, FRAMEWORKS, AND TECHNIQUES

- 5.3.9 PRICING ANALYSIS

- 5.3.9.1 Average selling price trend of key players, by mobile threat defense solution

- FIGURE 24 AVERAGE SELLING PRICE TREND OF KEY PLAYERS MARKET FOR TOP 3 MOBILE THREAT DEFENSE SOLUTIONS

- TABLE 6 AVERAGE SELLING PRICES OF KEY PLAYERS, BY SOLUTION

- 5.3.9.2 Indicative pricing analysis of mobile threat defense offerings

- TABLE 7 INDICATIVE PRICING LEVELS OF MOBILE THREAT DEFENSE OFFERINGS

- 5.3.10 PATENT ANALYSIS

- 5.3.10.1 Methodology

- FIGURE 25 LIST OF MAJOR PATENTS FOR MOBILE THREAT DEFENSE

- TABLE 8 LIST OF MAJOR PATENTS

- 5.3.11 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.3.11.1 Key stakeholders in buying criteria

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- 5.3.11.2 Buying criteria

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 10 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.3.12 KEY CONFERENCES & EVENTS, 2023-2024

- TABLE 11 DETAILED LIST OF CONFERENCES & EVENTS, 2023-2024

- 5.3.13 BEST PRACTICES IN MOBILE THREAT DEFENSE MARKET

- 5.3.13.1 Choose comprehensive MTD solution

- 5.3.13.2 Integrate MTD with existing security solutions

- 5.3.13.3 Keep MTD solution up to date

- 5.3.14 CURRENT AND EMERGING BUSINESS MODELS

- 5.3.14.1 On-premises MTD model

- 5.3.14.2 Cloud-based MTD model

- 5.3.14.3 Subscription-based model

- 5.3.15 TECHNOLOGY ANALYSIS

- 5.3.15.1 Key technologies

- 5.3.15.1.1 Artificial Intelligence (AI) and Machine Learning (ML)

- 5.3.15.1.2 Zero Trust Security in Mobile Threat Defense

- 5.3.15.1.3 Mobile Application Management (MAM)

- 5.3.15.1.4 Mobile Device Management (MDM)

- 5.3.15.2 Adjacent technologies

- 5.3.15.2.1 Identity and Access Management (IAM)

- 5.3.15.2.2 Endpoint Detection and Response (EDR)

- 5.3.15.2.3 Unified Endpoint Management (UEM)

- 5.3.15.2.4 Cloud Access Security Broker (CASB)

- 5.3.15.1 Key technologies

- 5.3.16 FUTURE LANDSCAPE OF MOBILE THREAT DEFENSE MARKET

- 5.3.16.1 Mobile threat defense technology roadmap till 2030

- 5.3.16.1.1 Short-term roadmap (2023-2025)

- 5.3.16.1.2 Mid-term roadmap (2026-2028)

- 5.3.16.1.3 Long-term roadmap (2029-2030)

- 5.3.16.1 Mobile threat defense technology roadmap till 2030

6 MOBILE THREAT DEFENSE MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 28 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 6.1.1 OFFERING: MOBILE THREAT DEFENSE MARKET DRIVERS

- TABLE 12 MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 13 MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 SOLUTIONS

- 6.2.1 MTD SOLUTION TO SAFEGUARD ORGANIZATIONS AND INDIVIDUAL USERS FROM SECURITY THREATS

- TABLE 14 SOLUTIONS: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 15 SOLUTIONS: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SERVICES

- 6.3.1 MTD SERVICES TO PROVIDE FLEXIBLE AND INTEGRATED SOLUTIONS PRIORITIZING REAL-TIME THREAT DETECTION, COMPLIANCE ADHERENCE, AND USER AWARENESS

- TABLE 16 MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 17 MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 18 SERVICES: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 19 SERVICES: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 PROFESSIONAL SERVICES

- TABLE 20 PROFESSIONAL SERVICES: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 21 PROFESSIONAL SERVICES: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.3 MANAGED SERVICES

- TABLE 22 MANAGED SERVICES: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 23 MANAGED SERVICES: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

7 MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM

- 7.1 INTRODUCTION

- FIGURE 29 ANDROID SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 7.1.1 OPERATING SYSTEM: MOBILE THREAT DEFENSE MARKET DRIVERS

- TABLE 24 MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2018-2022 (USD MILLION)

- TABLE 25 MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2023-2028 (USD MILLION)

- 7.2 IOS

- 7.2.1 MTD IN IOS TO COUNTERACT SECURITY THREATS, PREVENT DATA LEAKAGE, AND ENSURE ADHERENCE TO DATA PRIVACY REGULATIONS

- TABLE 26 IOS: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 27 IOS: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 ANDROID

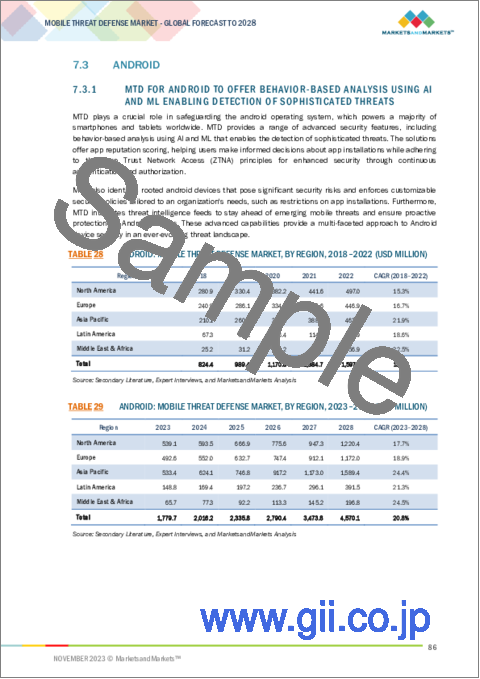

- 7.3.1 MTD FOR ANDROID TO OFFER BEHAVIOR-BASED ANALYSIS USING AI AND ML ENABLING DETECTION OF SOPHISTICATED THREATS

- TABLE 28 ANDROID: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 29 ANDROID: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 OTHER OPERATING SYSTEMS

- TABLE 30 OTHER OPERATING SYSTEMS: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 31 OTHER OPERATING SYSTEMS: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

8 MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE

- 8.1 INTRODUCTION

- FIGURE 30 CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- 8.1.1 DEPLOYMENT MODE: MOBILE THREAT DEFENSE MARKET DRIVERS

- TABLE 32 MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 33 MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- 8.2 ON-PREMISES

- 8.2.1 ON-PREMISES DEPLOYMENT MODE TO OFFER GREATER CONTROL AND CUSTOMIZATION OVER MOBILE DEVICE SECURITY AND SENSITIVE DATA

- TABLE 34 ON-PREMISES: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 35 ON-PREMISES: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 CLOUD

- 8.3.1 CLOUD DEPLOYMENT TO OFFER EASY CONFIGURATION, UPDATE, AND ENFORCEMENT OF SECURITY POLICIES WITHOUT COMPLEX ON-PREMISES INFRASTRUCTURE

- TABLE 36 CLOUD: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 37 CLOUD: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

9 MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE

- 9.1 INTRODUCTION

- FIGURE 31 LARGE ENTERPRISES SEGMENT TO DOMINATE DURING FORECAST PERIOD

- 9.1.1 ORGANIZATION SIZE: MOBILE THREAT DEFENSE MARKET DRIVERS

- TABLE 38 MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 39 MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- 9.2 LARGE ENTERPRISES

- 9.2.1 INCREASING ADOPTION OF MTD SOLUTIONS TO SAFEGUARD DATA IN LARGE ENTERPRISES

- TABLE 40 LARGE ENTERPRISES: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 41 LARGE ENTERPRISES: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 SMALL AND MEDIUM-SIZED ENTERPRISES

- 9.3.1 SMES TO INCREASINGLY INVEST IN MOBILE THREAT DETECTION TOOLS TO IDENTIFY AND MITIGATE SECURITY RISKS

- TABLE 42 SMALL AND MEDIUM-SIZED ENTERPRISES: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 43 SMALL AND MEDIUM-SIZED ENTERPRISES: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

10 MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE

- 10.1 INTRODUCTION

- FIGURE 32 RANSOMWARE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 10.1.1 THREAT TYPE: MOBILE THREAT DEFENSE MARKET DRIVERS

- TABLE 44 MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2018-2022 (USD MILLION)

- TABLE 45 MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2023-2028 (USD MILLION)

- 10.2 PHISHING

- 10.2.1 MTD TO LEVERAGE ADVANCED ALGORITHMS AND MACHINE LEARNING TO COUNTER INCREASING PHISHING ATTACKS

- TABLE 46 PHISHING: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 47 PHISHING: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 RANSOMWARE

- 10.3.1 MTD TO MONITOR FILE BEHAVIOR, SYSTEM ACCESS, AND NETWORK ACTIVITY TO IDENTIFY RANSOMWARE

- TABLE 48 RANSOMWARE: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 49 RANSOMWARE: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4 MALWARE

- 10.4.1 MTD FOR MALWARE THREATS TO MONITOR DEVICE BEHAVIOR, NETWORK TRAFFIC, AND APPLICATION ACTIVITY

- TABLE 50 MALWARE: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 51 MALWARE: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.5 DDOS

- 10.5.1 MTD TO EMPLOY ADVANCED TRAFFIC MONITORING AND ANALYSIS TO DETECT POTENTIAL DDOS ATTACKS

- TABLE 52 DDOS: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 53 DDOS: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.6 APT

- 10.6.1 MTD TO DEPLOY ADVANCED THREAT DETECTION TECHNIQUES AND CONTINUOUS MONITORING FOR APT THREAT DETECTION

- TABLE 54 APT: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 55 APT: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.7 OTHER THREAT TYPES

- TABLE 56 OTHER THREAT TYPES: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 57 OTHER THREAT TYPES: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

11 MOBILE THREAT DEFENSE MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- FIGURE 33 RETAIL & ECOMMERCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 11.1.1 VERTICAL: MOBILE THREAT DEFENSE MARKET DRIVERS

- TABLE 58 MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 59 MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 11.2.1 MTD SOLUTIONS TO SAFEGUARD MOBILE DEVICES AND PROTECT SENSITIVE CUSTOMER INFORMATION

- TABLE 60 BANKING, FINANCIAL SERVICES, AND INSURANCE: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 61 BANKING, FINANCIAL SERVICES, AND INSURANCE: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3 IT & TELECOM

- 11.3.1 MTD SOLUTIONS TO OFFER REAL-TIME THREAT DETECTION AND MITIGATION AND SAFEGUARD AGAINST MALWARE, PHISHING ATTACKS, AND NETWORK VULNERABILITIES

- TABLE 62 IT & TELECOM: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 63 IT & TELECOM: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.4 RETAIL & ECOMMERCE

- 11.4.1 MTD TO OFFER REAL-TIME THREAT DETECTION AND MITIGATION CAPABILITIES TO SAFEGUARD AGAINST THREATS

- TABLE 64 RETAIL & ECOMMERCE: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 65 RETAIL & ECOMMERCE: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.5 HEALTHCARE & LIFE SCIENCES

- 11.5.1 MTD TO SECURE BOTH EMPLOYEE DEVICES AND PATIENT-RELATED APPLICATIONS

- TABLE 66 HEALTHCARE & LIFE SCIENCES: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 67 HEALTHCARE & LIFE SCIENCES: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.6 GOVERNMENT & DEFENSE

- 11.6.1 MTD TO ENSURE CONFIDENTIALITY AND SECURITY OF DATA

- TABLE 68 GOVERNMENT & DEFENSE: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 69 GOVERNMENT & DEFENSE: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.7 MANUFACTURING

- 11.7.1 MTD TO ENSURE MOBILE DEVICE SECURITY IN MANUFACTURING OPERATIONS

- TABLE 70 MANUFACTURING: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 71 MANUFACTURING: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.8 OTHER VERTICALS

- TABLE 72 OTHER VERTICALS: MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 73 OTHER VERTICALS: MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

12 MOBILE THREAT DEFENSE MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 34 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 74 MOBILE THREAT DEFENSE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 75 MOBILE THREAT DEFENSE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: RECESSION IMPACT

- 12.2.2 NORTH AMERICA: MOBILE THREAT DEFENSE MARKET DRIVERS

- FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 76 NORTH AMERICA: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2018-2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2023-2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2018-2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2023-2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: MOBILE THREAT DEFENSE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: MOBILE THREAT DEFENSE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.2.3 US

- 12.2.3.1 Tech-reliant population, pervasive mobile device usage, and regulatory compliance to fuel demand for MTD solutions

- TABLE 92 US: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 93 US: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 94 US: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 95 US: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 96 US: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 97 US: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 98 US: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 99 US: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 100 US: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2018-2022 (USD MILLION)

- TABLE 101 US: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2023-2028 (USD MILLION)

- TABLE 102 US: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 103 US: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 104 US: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2018-2022 (USD MILLION)

- TABLE 105 US: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2023-2028 (USD MILLION)

- 12.2.4 CANADA

- 12.2.4.1 Rising mobile threat awareness and maintenance of regulatory compliance to drive market

- TABLE 106 CANADA: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 107 CANADA: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 108 CANADA: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 109 CANADA: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 110 CANADA: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 111 CANADA: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 112 CANADA: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 113 CANADA: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 114 CANADA: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2018-2022 (USD MILLION)

- TABLE 115 CANADA: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2023-2028 (USD MILLION)

- TABLE 116 CANADA: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 117 CANADA: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 118 CANADA: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2018-2022 (USD MILLION)

- TABLE 119 CANADA: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2023-2028 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 EUROPE: RECESSION IMPACT

- 12.3.2 EUROPE: MOBILE THREAT DEFENSE MARKET DRIVERS

- TABLE 120 EUROPE: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 121 EUROPE: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 122 EUROPE: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 123 EUROPE: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 124 EUROPE: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 125 EUROPE: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 126 EUROPE: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 127 EUROPE: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 128 EUROPE: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2018-2022 (USD MILLION)

- TABLE 129 EUROPE: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2023-2028 (USD MILLION)

- TABLE 130 EUROPE: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 131 EUROPE: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 132 EUROPE: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2018-2022 (USD MILLION)

- TABLE 133 EUROPE: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2023-2028 (USD MILLION)

- TABLE 134 EUROPE: MOBILE THREAT DEFENSE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 135 EUROPE: MOBILE THREAT DEFENSE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.3.3 UK

- 12.3.3.1 Strong focus on cyber resilience and vigilance to fuel demand for MTD solutions

- TABLE 136 UK: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 137 UK: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 138 UK: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 139 UK: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 140 UK: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 141 UK: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 142 UK: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 143 UK: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 144 UK: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2018-2022 (USD MILLION)

- TABLE 145 UK: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2023-2028 (USD MILLION)

- TABLE 146 UK: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 147 UK: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 148 UK: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2018-2022 (USD MILLION)

- TABLE 149 UK: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2023-2028 (USD MILLION)

- 12.3.4 GERMANY

- 12.3.4.1 Robust business sector and tech-reliant workforce leading to mobile security to drive market

- TABLE 150 GERMANY: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 151 GERMANY: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 152 GERMANY: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 153 GERMANY: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 154 GERMANY: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 155 GERMANY: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 156 GERMANY: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 157 GERMANY: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 158 GERMANY: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2018-2022 (USD MILLION)

- TABLE 159 GERMANY: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2023-2028 (USD MILLION)

- TABLE 160 GERMANY: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 161 GERMANY: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 162 GERMANY: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2018-2022 (USD MILLION)

- TABLE 163 GERMANY: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2023-2028 (USD MILLION)

- 12.3.5 FRANCE

- 12.3.5.1 Increasing dependency on mobile devices and need for data protection to drive market

- TABLE 164 FRANCE: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 165 FRANCE: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 166 FRANCE: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 167 FRANCE: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 168 FRANCE: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 169 FRANCE: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 170 FRANCE: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 171 FRANCE: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 172 FRANCE: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2018-2022 (USD MILLION)

- TABLE 173 FRANCE: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2023-2028 (USD MILLION)

- TABLE 174 FRANCE: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 175 FRANCE: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 176 FRANCE: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2018-2022 (USD MILLION)

- TABLE 177 FRANCE: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2023-2028 (USD MILLION)

- 12.3.6 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: RECESSION IMPACT

- 12.4.2 ASIA PACIFIC: MOBILE THREAT DEFENSE MARKET DRIVERS

- FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 178 ASIA PACIFIC: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 179 ASIA PACIFIC: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 181 ASIA PACIFIC: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 182 ASIA PACIFIC: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 183 ASIA PACIFIC: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 184 ASIA PACIFIC: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 185 ASIA PACIFIC: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 186 ASIA PACIFIC: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2018-2022 (USD MILLION)

- TABLE 187 ASIA PACIFIC: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2023-2028 (USD MILLION)

- TABLE 188 ASIA PACIFIC: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 189 ASIA PACIFIC: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 190 ASIA PACIFIC: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2018-2022 (USD MILLION)

- TABLE 191 ASIA PACIFIC: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2023-2028 (USD MILLION)

- TABLE 192 ASIA PACIFIC: MOBILE THREAT DEFENSE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 193 ASIA PACIFIC: MOBILE THREAT DEFENSE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.4.3 CHINA

- 12.4.3.1 Need for robust security measures to safeguard sensitive data from evolving cyber threats to drive market

- TABLE 194 CHINA: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 195 CHINA: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 196 CHINA: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 197 CHINA: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 198 CHINA: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 199 CHINA: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 200 CHINA: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 201 CHINA: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 202 CHINA: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2018-2022 (USD MILLION)

- TABLE 203 CHINA: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2023-2028 (USD MILLION)

- TABLE 204 CHINA: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 205 CHINA: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 206 CHINA: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2018-2022 (USD MILLION)

- TABLE 207 CHINA: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2023-2028 (USD MILLION)

- 12.4.4 JAPAN

- 12.4.4.1 Need for protecting sensitive data and preventing advanced mobile threats to fuel demand for MTD solutions

- TABLE 208 JAPAN: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 209 JAPAN: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 210 JAPAN: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 211 JAPAN: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 212 JAPAN: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 213 JAPAN: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 214 JAPAN: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 215 JAPAN: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 216 JAPAN: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2018-2022 (USD MILLION)

- TABLE 217 JAPAN: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2023-2028 (USD MILLION)

- TABLE 218 JAPAN: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 219 JAPAN: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 220 JAPAN: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2018-2022 (USD MILLION)

- TABLE 221 JAPAN: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2023-2028 (USD MILLION)

- 12.4.5 INDIA

- 12.4.5.1 Need for threat detection, data protection, and privacy features to boost demand for MTD solutions

- TABLE 222 INDIA: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 223 INDIA: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 224 INDIA: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 225 INDIA: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 226 INDIA: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 227 INDIA: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 228 INDIA: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 229 INDIA: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 230 INDIA: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2018-2022 (USD MILLION)

- TABLE 231 INDIA: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2023-2028 (USD MILLION)

- TABLE 232 INDIA: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 233 INDIA: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 234 INDIA: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2018-2022 (USD MILLION)

- TABLE 235 INDIA: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2023-2028 (USD MILLION)

- 12.4.6 REST OF ASIA PACIFIC

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 12.5.2 MIDDLE EAST & AFRICA: MOBILE THREAT DEFENSE MARKET DRIVERS

- TABLE 236 MIDDLE EAST & AFRICA: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 237 MIDDLE EAST & AFRICA: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 238 MIDDLE EAST & AFRICA: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 239 MIDDLE EAST & AFRICA: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 240 MIDDLE EAST & AFRICA: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 241 MIDDLE EAST & AFRICA: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 242 MIDDLE EAST & AFRICA: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 244 MIDDLE EAST & AFRICA: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2018-2022 (USD MILLION)

- TABLE 245 MIDDLE EAST & AFRICA: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2023-2028 (USD MILLION)

- TABLE 246 MIDDLE EAST & AFRICA: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 247 MIDDLE EAST & AFRICA: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 248 MIDDLE EAST & AFRICA: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2018-2022 (USD MILLION)

- TABLE 249 MIDDLE EAST & AFRICA: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2023-2028 (USD MILLION)

- TABLE 250 MIDDLE EAST & AFRICA: MOBILE THREAT DEFENSE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 251 MIDDLE EAST & AFRICA: MOBILE THREAT DEFENSE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.5.3 KSA

- 12.5.3.1 Tech-savvy population, technological advancements, and need for robust mobile security measures to drive market

- TABLE 252 KSA: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 253 KSA: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 254 KSA: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 255 KSA: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 256 KSA: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 257 KSA: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 258 KSA: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 259 KSA: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 260 KSA: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2018-2022 (USD MILLION)

- TABLE 261 KSA: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2023-2028 (USD MILLION)

- TABLE 262 KSA: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 263 KSA: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 264 KSA: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2018-2022 (USD MILLION)

- TABLE 265 KSA: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2023-2028 (USD MILLION)

- 12.5.4 UAE

- 12.5.4.1 Rapidly advanced technology ecosystem and regulatory framework emphasizing data protection to drive market

- TABLE 266 UAE: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 267 UAE: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 268 UAE: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 269 UAE: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 270 UAE: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 271 UAE: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 272 UAE: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 273 UAE: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 274 UAE: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2018-2022 (USD MILLION)

- TABLE 275 UAE: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2023-2028 (USD MILLION)

- TABLE 276 UAE: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 277 UAE: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 278 UAE: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2018-2022 (USD MILLION)

- TABLE 279 UAE: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2023-2028 (USD MILLION)

- 12.5.5 SOUTH AFRICA

- 12.5.5.1 Technological awareness and growing focus on mobile security to propel market

- TABLE 280 SOUTH AFRICA: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 281 SOUTH AFRICA: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 282 SOUTH AFRICA: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 283 SOUTH AFRICA: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 284 SOUTH AFRICA: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 285 SOUTH AFRICA: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 286 SOUTH AFRICA: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 287 SOUTH AFRICA: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 288 SOUTH AFRICA: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2018-2022 (USD MILLION)

- TABLE 289 SOUTH AFRICA: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2023-2028 (USD MILLION)

- TABLE 290 SOUTH AFRICA: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 291 SOUTH AFRICA: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 292 SOUTH AFRICA: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2018-2022 (USD MILLION)

- TABLE 293 SOUTH AFRICA: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2023-2028 (USD MILLION)

- 12.5.6 REST OF MIDDLE EAST & AFRICA

- 12.6 LATIN AMERICA

- 12.6.1 LATIN AMERICA: RECESSION IMPACT

- 12.6.2 LATIN AMERICA: MOBILE THREAT DEFENSE MARKET DRIVERS

- TABLE 294 LATIN AMERICA: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 295 LATIN AMERICA: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 296 LATIN AMERICA: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 297 LATIN AMERICA: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 298 LATIN AMERICA: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 299 LATIN AMERICA: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 300 LATIN AMERICA: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 301 LATIN AMERICA: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 302 LATIN AMERICA: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2018-2022 (USD MILLION)

- TABLE 303 LATIN AMERICA: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2023-2028 (USD MILLION)

- TABLE 304 LATIN AMERICA: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 305 LATIN AMERICA: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 306 LATIN AMERICA: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2018-2022 (USD MILLION)

- TABLE 307 LATIN AMERICA: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2023-2028 (USD MILLION)

- TABLE 308 LATIN AMERICA: MOBILE THREAT DEFENSE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 309 LATIN AMERICA: MOBILE THREAT DEFENSE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 12.6.3 BRAZIL

- 12.6.3.1 Dynamic digital landscape, tech-savvy population, expanding mobile workforce, and regulatory compliance to drive market

- TABLE 310 BRAZIL: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 311 BRAZIL: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 312 BRAZIL: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 313 BRAZIL: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 314 BRAZIL: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 315 BRAZIL: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 316 BRAZIL: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 317 BRAZIL: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 318 BRAZIL: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2018-2022 (USD MILLION)

- TABLE 319 BRAZIL: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2023-2028 (USD MILLION)

- TABLE 320 BRAZIL: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 321 BRAZIL: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 322 BRAZIL: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2018-2022 (USD MILLION)

- TABLE 323 BRAZIL: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2023-2028 (USD MILLION)

- 12.6.4 MEXICO

- 12.6.4.1 Focus on securing mobile devices and rising mobile workforce to boost demand for MTD solutions

- TABLE 324 MEXICO: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 325 MEXICO: MOBILE THREAT DEFENSE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 326 MEXICO: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 327 MEXICO: MOBILE THREAT DEFENSE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 328 MEXICO: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2018-2022 (USD MILLION)

- TABLE 329 MEXICO: MOBILE THREAT DEFENSE MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 330 MEXICO: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2018-2022 (USD MILLION)

- TABLE 331 MEXICO: MOBILE THREAT DEFENSE MARKET, BY ORGANIZATION SIZE, 2023-2028 (USD MILLION)

- TABLE 332 MEXICO: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2018-2022 (USD MILLION)

- TABLE 333 MEXICO: MOBILE THREAT DEFENSE MARKET, BY OPERATING SYSTEM, 2023-2028 (USD MILLION)

- TABLE 334 MEXICO: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 335 MEXICO: MOBILE THREAT DEFENSE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 336 MEXICO: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2018-2022 (USD MILLION)

- TABLE 337 MEXICO: MOBILE THREAT DEFENSE MARKET, BY THREAT TYPE, 2023-2028 (USD MILLION)

- 12.6.5 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE

- 13.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 338 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN MTD MARKET

- 13.2 MARKET RANKING

- FIGURE 37 MARKET RANKING IN 2022

- 13.3 REVENUE ANALYSIS

- FIGURE 38 REVENUE ANALYSIS OF KEY MOBILE THREAT DEFENSE VENDORS IN PAST FIVE YEARS

- 13.4 MARKET SHARE ANALYSIS

- FIGURE 39 MOBILE THREAT DEFENSE MARKET (GLOBAL) SHARE, 2022

- TABLE 339 DEGREE OF COMPETITION

- 13.5 COMPANY EVALUATION MATRIX

- 13.5.1 DEFINITIONS AND METHODOLOGY

- TABLE 340 EVALUATION CRITERIA

- 13.5.2 STARS

- 13.5.3 EMERGING LEADERS

- 13.5.4 PERVASIVE PLAYERS

- 13.5.5 PARTICIPANTS

- FIGURE 40 MOBILE THREAT DEFENSE MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- 13.5.6 PRODUCT FOOTPRINT

- TABLE 341 PRODUCT FOOTPRINT

- TABLE 342 VERTICAL FOOTPRINT

- TABLE 343 REGION FOOTPRINT

- 13.6 START-UP/SME EVALUATION MATRIX

- 13.6.1 DEFINITIONS AND METHODOLOGY

- 13.6.2 PROGRESSIVE COMPANIES

- 13.6.3 RESPONSIVE COMPANIES

- 13.6.4 DYNAMIC COMPANIES

- 13.6.5 STARTING BLOCKS

- FIGURE 41 MOBILE THREAT DEFENSE MARKET (GLOBAL): START-UP/SME EVALUATION MATRIX, 2022

- 13.6.6 COMPETITIVE BENCHMARKING

- TABLE 344 MOBILE THREAT DEFENSE MARKET: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 345 MOBILE THREAT DEFENSE MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UP/SMES]

- 13.7 COMPETITIVE SCENARIO AND TRENDS

- 13.7.1 PRODUCT LAUNCHES

- TABLE 346 MOBILE THREAT DEFENSE MARKET: PRODUCT LAUNCHES, JUNE 2022-SEPTEMBER 2023

- 13.7.2 DEALS

- TABLE 347 MOBILE THREAT DEFENSE MARKET: DEALS, JANUARY 2019-SEPTEMBER 2023

- 13.8 MOBILE THREAT DEFENSE PRODUCT BENCHMARKING

- TABLE 348 COMPARATIVE ANALYSIS OF PROMINENT MOBILE THREAT DEFENSE OFFERINGS

- 13.9 VALUATION AND FINANCIAL METRICS OF KEY MOBILE THREAT DEFENSE VENDORS

- FIGURE 42 VALUATION AND FINANCIAL METRICS OF KEY MOBILE THREAT DEFENSE VENDORS

14 COMPANY PROFILES

- 14.1 MAJOR PLAYERS

- (Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and Competitive threats)**

- 14.1.1 CISCO

- TABLE 349 CISCO: COMPANY OVERVIEW

- FIGURE 43 CISCO: COMPANY SNAPSHOT

- TABLE 350 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 351 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 352 CISCO: DEALS

- 14.1.2 SAP

- TABLE 353 SAP: COMPANY OVERVIEW

- FIGURE 44 SAP: COMPANY SNAPSHOT

- TABLE 354 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.3 BROADCOM

- TABLE 355 BROADCOM: COMPANY OVERVIEW

- FIGURE 45 BROADCOM: COMPANY SNAPSHOT

- TABLE 356 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 357 BROADCOM: DEALS

- 14.1.4 VMWARE

- TABLE 358 VMWARE: COMPANY OVERVIEW

- FIGURE 46 VMWARE: COMPANY SNAPSHOT

- TABLE 359 VMWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 360 VMWARE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 361 VMWARE: DEALS

- 14.1.5 CITRIX SYSTEMS

- TABLE 362 CITRIX SYSTEMS: COMPANY OVERVIEW

- FIGURE 47 CITRIX SYSTEMS: COMPANY SNAPSHOT

- TABLE 363 CITRIX SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 364 CITRIX SYSTEMS: DEALS

- 14.1.6 KASPERSKY LABS

- TABLE 365 KASPERSKY LAB: COMPANY OVERVIEW

- TABLE 366 KASPERSKY LAB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.7 IVANTI

- TABLE 367 IVANTI: COMPANY OVERVIEW

- TABLE 368 IVANTI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 369 IVANTI: DEALS

- 14.1.8 ZOHO

- TABLE 370 ZOHO: COMPANY OVERVIEW

- TABLE 371 ZOHO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 14.1.9 SOLARWINDS

- TABLE 372 SOLARWINDS: COMPANY OVERVIEW

- FIGURE 48 SOLARWINDS: COMPANY SNAPSHOT

- TABLE 373 SOLARWINDS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 374 SOLARWINDS: DEALS

- 14.1.10 MICRO FOCUS

- TABLE 375 MICRO FOCUS: COMPANY OVERVIEW

- TABLE 376 MICRO FOCUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 377 MICRO FOCUS: DEALS

- 14.1.11 BLACKBERRY

- 14.1.12 ZIMPERIUM

- 14.1.13 MATRIX42

- 14.1.14 SOPHOS

- 14.1.15 JAMF

- 14.2 START-UPS/SMES

- 14.2.1 ESPER

- 14.2.2 LOOKOUT

- 14.2.3 PRADEO

- 14.2.4 GUARDSQUARE

- 14.2.5 UPSTREAM SECURITY

- 14.2.6 NEXTHINK

- 14.2.7 SNYK

- 14.2.8 BARRACUDA NETWORKS

- 14.2.9 ZIMBRA

- 14.2.10 APPGUARD

- 14.2.11 CELLTRUST

- 14.2.12 SENTINELONE

- 14.2.13 CYBEREASON

- *Details on Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Right to win, Strategic choices, and Weaknesses and Competitive threats might not be captured in case of unlisted companies.

15 ADJACENT MARKETS

- 15.1 INTRODUCTION TO ADJACENT MARKETS

- TABLE 378 ADJACENT MARKETS AND FORECASTS

- 15.1.1 LIMITATIONS

- 15.2 MOBILE SECURITY MARKET

- TABLE 379 SMALL AND MEDIUM-SIZED ENTERPRISES: MOBILE SECURITY MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 380 LARGE ENTERPRISES: MOBILE SECURITY MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 381 CLOUD: MOBILE SECURITY MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 382 ON-PREMISES: MOBILE SECURITY MARKET, BY REGION, 2017-2024 (USD MILLION)

- 15.3 MOBILE APPLICATION SECURITY MARKET

- TABLE 383 ON-PREMISES MARKET: MOBILE APPLICATION SECURITY MARKET, BY REGION, 2013-2020 (USD MILLION)

- TABLE 384 CLOUD MARKET: MOBILE APPLICATION SECURITY MARKET, BY REGION, 2013-2020 (USD MILLION)

- TABLE 385 LARGE ENTERPRISES MARKET: MOBILE APPLICATION SECURITY MARKET, BY REGION, 2013-2020 (USD MILLION)

- TABLE 386 SMB MARKET: MOBILE APPLICATION SECURITY MARKET, BY REGION, 2013-2020 (USD MILLION)

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS