|

|

市場調査レポート

商品コード

1700507

医療用チューブ市場:用途別、素材別、構造別、地域別 - 2030年までの予測Medical Tubing Market by Material, Application, Structure - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 医療用チューブ市場:用途別、素材別、構造別、地域別 - 2030年までの予測 |

|

出版日: 2025年03月27日

発行: MarketsandMarkets

ページ情報: 英文 253 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

医療用チューブの市場規模は、2025年の125億3,000万米ドルから2030年には184億1,000万米ドルに達すると予測され、予測期間中のCAGRは8.0%になるとみられています。

医療用チューブ市場の拡大は、心血管疾患、がん、呼吸器疾患などの慢性疾患の増加によるものです。これらの疾患の多くは、治療や管理効果を高めるためにチューブを使用するカテーテル、輸液装置、人工呼吸器などの医療機器を必要とします。例えば、喘息や結核のような呼吸器疾患の有病率の増加が、人工呼吸器用チューブシステムの需要を促進しています。また、慢性疾患や手術を受けやすい高齢者人口の増加も大きな理由です。高齢者人口の増加により、低侵襲手術のニーズが高まり、医療用チューブはドラッグデリバリーや輸液システムの重要な要素となっています。さらに、製品の発売や合併を含む企業の戦略的な動きが、市場のカバー範囲と認知度を広げています。最後に、厳格な規制要件とヘルスケア・インフラへの政府支出は、様々な用途に高品質のチューブ製品を提供することで市場の成長を促進しています。これらすべての要因が相まって、医療用チューブ市場は今後数年間で長期的な成長が見込まれます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2022年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル)、数量(キロトン) |

| セグメント | 用途別、素材別、構造別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、中東・アフリカ |

ゴムは柔軟性、耐久性、生体適合性に優れ、多くの医療用途に適しているため、医療用チューブ材料として2番目に急成長しています。シリコーン、ラテックス、熱可塑性エラストマー(TPE)などの天然ゴムや合成ゴムは、過酷な温度、化学薬品、複数の滅菌サイクルに対して優れた耐性を発揮します。このため、ゴム・チューブはカテーテル、呼吸療法装置、蠕動ポンプ、手術用ドレナージ・システムなどに最適です。シリコーンゴムは、その優れた生体適合性により、特に大規模に使用されており、移植可能で長期的な医療用途に選択される材料と考えられています。加えて、ゴム製品は弾力性が高いため、医療用チューブは完全性を失うことなく曲げ伸ばしに耐えることができ、患者の快適性と機器の性能を向上させることができます。心血管系疾患や呼吸器系疾患などの慢性疾患の蔓延が拡大していることが、ゴムチューブを組み込んだ医療機器への需要を高めています。加えて、抗菌コーティングや引張強度の向上など、ゴム配合の進歩がクリティカルケアへの応用に貢献しています。ヘルスケアの技術革新が進む中、ゴムチューブは引き続き最有力候補であり、医療用チューブ市場で2番目に急成長している素材です。

編組チューブは、強度、柔軟性、汎用性に優れ、高度な医療用途に幅広く対応できるため、医療用チューブ構造で2番目に急成長しています。ポリマー・チューブの内側にステンレス鋼やナイロンなどの補強編組層を挿入した構造は、非補強型チューブに比べ高圧力やキンクに対する耐性が高いです。このため、耐久性と正確な流体供給が最優先されるカテーテル、内視鏡、心臓血管機器などの高性能用途に最も適しています。性能を損なうことなく複雑な解剖学的経路を通過できるチューブを必要とする低侵襲手術のニーズが高まっていることも、編組チューブの用途を大幅に拡大しています。編組チューブは滅菌処理に耐え、ストレス条件下でも構造的完全性を維持できるため、医療分野の厳格な安全要件を満たすのにも役立ちます。慢性疾患の増加、高齢化、高度な診断・治療機器へのニーズも、市場の成長を後押ししています。新しい編組技術と材料科学により、より柔軟性が増し、特定の医療ニーズを満たすためのカスタマイズが可能になっています。シングル・ルーメン・チューブは、簡便性と遍在性という点で、その元凶といえるかもしれないが、高性能な用途を持つ編組チューブの優れた機械的特性と生体適合性により、現代ヘルスケアのニーズの変化に対応する急成長市場として位置づけられています。

カテーテル・カニューレ市場は、その需要の背後にある多くの主要な促進要因のおかげで、医療用チューブ市場で2番目に急成長している用途です。世界のヘルスケアシステムが低侵襲的介入に重点を置く中、カテーテル・カニューレは、従来の手術に代わる、より安全で外傷の少ない選択肢を提供するツールとして選ばれつつあります。これらの柔らかいチューブは、心臓血管への介入、排尿、静脈内治療など、正確さと患者の快適さが最も重要な用途で重要な役割を果たしています。また、高齢化社会を中心に、心血管疾患、糖尿病、腎障害などの慢性疾患の有病率が高まっていることも、カテーテル治療の拡大に拍車をかけています。心臓疾患や尿失禁の治療におけるカテーテル治療の需要は、自動的に特殊チューブの需要を増加させます。また、シリコーンやポリウレタンをはじめとする生体適合性材料の改良により、カテーテル・カニューレの機能性、寿命、安全性が向上したことも、技術の進歩に寄与しています。また、外来治療や在宅ヘルスケアへの移行により、輸液ポンプのようなポータブル機器への応用が増加しています。このセグメントは、特に新興セクターにおけるヘルスケアへの投資の増加によって、インフラの強化や医療サービスの充実が使い捨てチューブや滅菌チューブの需要を高めています。

中東・アフリカは、医療投資の増加、医療インフラの強化、ハイテク医療機器への需要の高まりにより、医療用チューブの市場で2番目に急成長しています。特にサウジアラビア、アラブ首長国連邦、南アフリカなどの地域政府は、ヘルスケアの近代化に多額の投資を行っており、病院、診療所、診断センターなどで使用される優れた医療用チューブの需要を生み出しています。医療施設の成長と医療フリーゾーンや製造センターの設立が相まって、医療用チューブや関連機器の現地生産や流通が増加しています。糖尿病、心血管疾患、呼吸器疾患といった慢性疾患の増加により、ドラッグデリバリー・システム、カテーテル、呼吸器用デバイスにおける医療用チューブの使用が増加しています。また、同地域では高齢者人口が増加しており、高度な治療が求められているため、医療用チューブをベースとしたアプリケーションの利用が促進されています。インスリンポンプや酸素療法機器など、在宅ヘルスケアやウェアラブル医療機器への移行も市場成長の主な要因です。世界の医療機器メーカーは、提携や合弁事業、地域生産拠点の設立などを通じて、中東・アフリカ地域への進出を拡大しています。このような成長により、より質の高い医療用チューブ製品が増え、輸入品への依存度が低下し、その結果、ヘルスケアが安価に提供されるようになります。生分解性医療用チューブや抗菌性医療用チューブなどの医療用チューブ技術は、医療従事者が感染対策や環境に配慮することを優先し続ける中、MEAでさらに普及しています。

当レポートでは、世界の医療用チューブ市場について調査し、用途別、素材別、構造別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- マクロ経済指標

- 世界のGDP動向

第6章 業界動向

- イントロダクション

- バリューチェーン分析

- 規制状況

- 規則

- 標準

- 規制機関、政府機関、その他の組織

- 貿易分析

- エコシステム分析

- 顧客ビジネスに影響を与える動向/混乱

- ケーススタディ分析

- 技術分析

- 2025年の主な会議とイベント

- 特許分析

- AI/生成AIが医療用チューブ市場に与える影響

- 価格分析

- 投資と資金調達のシナリオ

第7章 医療用チューブ市場(用途別)

- イントロダクション

- バルク使い捨てチューブ

- カテーテルとカニューレ

- ドラッグデリバリーシステム

- その他

第8章 医療用チューブ市場(素材別)

- イントロダクション

- プラスチック

- ゴム

- 特殊ポリマー

- その他

第9章 医療用チューブ市場(構造別)

- イントロダクション

- シングルルーメン

- 共押し出し

- マルチルーメン

- テーパーまたはバンプチューブ

- 編組チューブ

第10章 医療用チューブ市場(地域別)

- イントロダクション

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- 英国

- スペイン

- イタリア

- オランダ

- その他

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- エジプト

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

第11章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年~2025年

- 収益分析、2024年

- 市場シェア分析、2024年

- 企業評価と財務指標

- ブランド比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2023年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- SAINT-GOBAIN

- FREUDENBERG MEDICAL

- THE LUBRIZOL CORPORATION

- W. L. GORE & ASSOCIATES, INC.

- NORDSON CORPORATION

- TE CONNECTIVITY

- ELKEM ASA

- TRELLEBORG AB

- RAUMEDIC AG

- TEKNOR APEX

- SPECTRUM PLASTICS GROUP

- ZEUS COMPANY LLC

- その他の企業

- ATAG SPA

- DAVIS STANDARD

- FBK MEDICAL TUBING

- PROTERIAL CABLE AMERICA, INC.

- ICO RALLY

- ICU MEDICAL, INC.

- KRATON CORPORATION

- MICROLUMEN INC.

- MDC INDUSTRIES

- NEWAGE INDUSTRIES

- OPTINOVA

- PARKER HANNIFIN CORP.

- TEEL PLASTICS

- VESTA INC.

- SMOOTH-BOR PLASTICS

第13章 付録

List of Tables

- TABLE 1 LIST OF KEY SECONDARY SOURCES

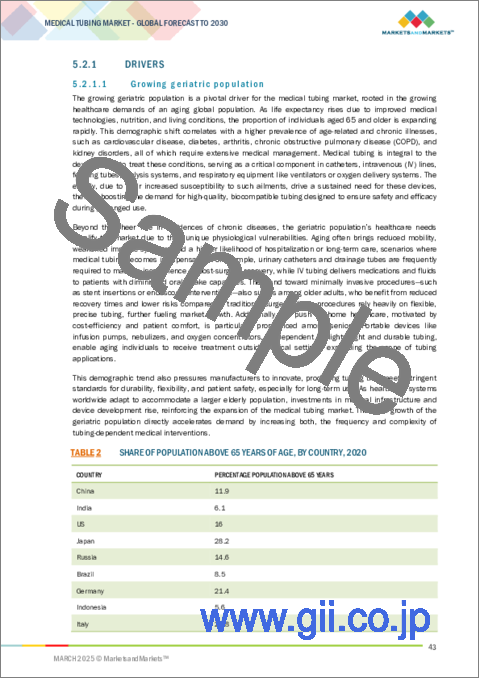

- TABLE 2 SHARE OF POPULATION ABOVE 65 YEARS OF AGE, BY COUNTRY, 2020

- TABLE 3 LIST OF STANDARDS AND REGULATIONS FOR MEDICAL TUBING

- TABLE 4 CAPITAL HEALTHCARE EXPENDITURE, 2020-2023 (USD MILLION)

- TABLE 5 HEALTHCARE SPENDING, 2023 (USD MILLION)

- TABLE 6 MEDICAL TUBING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- TABLE 8 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 9 TRENDS OF PER CAPITA GDP, BY KEY COUNTRY, 2020-2023 (USD)

- TABLE 10 GDP GROWTH ESTIMATE AND PROJECTION, BY KEY COUNTRY, 2024-2027 (USD)

- TABLE 11 HEALTH EXPENDITURE AS PERCENTAGE OF GDP, BY KEY COUNTRY, 2019-2022

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 IMPORT SCENARIO FOR HS CODE 3917-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 16 EXPORT SCENARIO FOR HS CODE 3917-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 17 ROLE OF COMPANIES IN MEDICAL TUBING ECOSYSTEM

- TABLE 18 MEDICAL TUBING MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2025

- TABLE 19 TOP 10 PATENT OWNERS DURING LAST ELEVEN YEARS, 2015-2024

- TABLE 20 MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 21 MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 22 MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 23 MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 24 MEDICAL TUBING MARKET, BY MATERIAL, 2021-2024 (KILOTON)

- TABLE 25 MEDICAL TUBING MARKET, BY MATERIAL, 2025-2030 (KILOTON)

- TABLE 26 MEDICAL TUBING MARKET, BY MATERIAL, 2021-2024 (USD MILLION)

- TABLE 27 MEDICAL TUBING MARKET, BY MATERIAL, 2025-2030 (USD MILLION)

- TABLE 28 MEDICAL TUBING MARKET, BY STRUCTURE, 2021-2024 (KILOTON)

- TABLE 29 MEDICAL TUBING MARKET, BY STRUCTURE, 2025-2030 (KILOTON)

- TABLE 30 MEDICAL TUBING MARKET, BY STRUCTURE, 2021-2024 (USD MILLION)

- TABLE 31 MEDICAL TUBING MARKET, BY STRUCTURE, 2025-2030 (USD MILLION)

- TABLE 32 MEDICAL TUBING MARKET, BY REGION, 2021-2024 (KILOTON)

- TABLE 33 MEDICAL TUBING MARKET, BY REGION, 2025-2030 (KILOTON)

- TABLE 34 MEDICAL TUBING MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 35 MEDICAL TUBING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 36 NORTH AMERICA: MEDICAL TUBING MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 37 NORTH AMERICA: MEDICAL TUBING MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 38 NORTH AMERICA: MEDICAL TUBING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 39 NORTH AMERICA: MEDICAL TUBING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 40 NORTH AMERICA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 41 NORTH AMERICA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 42 NORTH AMERICA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 43 NORTH AMERICA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 44 US: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 45 US: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 46 US: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 47 US: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 48 CANADA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 49 CANADA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 50 CANADA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 51 CANADA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 52 MEXICO: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 53 MEXICO: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 54 MEXICO: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 55 MEXICO: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 56 EUROPE: MEDICAL TUBING MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 57 EUROPE: MEDICAL TUBING MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 58 EUROPE: MEDICAL TUBING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 59 EUROPE: MEDICAL TUBING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 60 EUROPE: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 61 EUROPE: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 62 EUROPE: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 63 EUROPE: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 64 GERMANY: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 65 GERMANY: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 66 GERMANY: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 67 GERMANY: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 68 FRANCE: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 69 FRANCE: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 70 FRANCE: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 71 FRANCE: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 72 UK: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 73 UK: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 74 UK: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 75 UK: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 76 SPAIN: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 77 SPAIN: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 78 SPAIN: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 79 SPAIN: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 80 ITALY: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 81 ITALY: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 82 ITALY: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 83 ITALY: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 84 NETHERLANDS: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 85 NETHERLANDS: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 86 NETHERLANDS: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 87 NETHERLANDS: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 88 REST OF EUROPE: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 89 REST OF EUROPE: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 90 REST OF EUROPE: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 91 REST OF EUROPE: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 92 ASIA PACIFIC: MEDICAL TUBING MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 93 ASIA PACIFIC: MEDICAL TUBING MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 94 ASIA PACIFIC: MEDICAL TUBING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 95 ASIA PACIFIC: MEDICAL TUBING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 96 ASIA PACIFIC: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 97 ASIA PACIFIC: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 98 ASIA PACIFIC: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 99 ASIA PACIFIC: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 100 CHINA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 101 CHINA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 102 CHINA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 103 CHINA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 104 JAPAN: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 105 JAPAN: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 106 JAPAN: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 107 JAPAN: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 108 INDIA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 109 INDIA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 110 INDIA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 111 INDIA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 112 SOUTH KOREA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 113 SOUTH KOREA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 114 SOUTH KOREA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 115 SOUTH KOREA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 116 REST OF ASIA PACIFIC: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 117 REST OF ASIA PACIFIC: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 118 REST OF ASIA PACIFIC: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 119 REST OF ASIA PACIFIC: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: MEDICAL TUBING MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 121 MIDDLE EAST & AFRICA: MEDICAL TUBING MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 122 MIDDLE EAST & AFRICA: MEDICAL TUBING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: MEDICAL TUBING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 125 MIDDLE EAST & AFRICA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 126 MIDDLE EAST & AFRICA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 128 SAUDI ARABIA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 129 SAUDI ARABIA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 130 SAUDI ARABIA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 131 SAUDI ARABIA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 132 UAE: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 133 UAE: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 134 UAE: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 135 UAE: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 136 SOUTH AFRICA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 137 SOUTH AFRICA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 138 SOUTH AFRICA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 139 SOUTH AFRICA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 140 EGYPT: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 141 EGYPT: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 142 EGYPT: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 143 EGYPT: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 144 REST OF MIDDLE EAST & AFRICA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 145 REST OF MIDDLE EAST & AFRICA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 146 REST OF MIDDLE EAST & AFRICA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 147 REST OF MIDDLE EAST & AFRICA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 148 SOUTH AMERICA: MEDICAL TUBING MARKET, BY COUNTRY, 2021-2024 (KILOTON)

- TABLE 149 SOUTH AMERICA: MEDICAL TUBING MARKET, BY COUNTRY, 2025-2030 (KILOTON)

- TABLE 150 SOUTH AMERICA: MEDICAL TUBING MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 151 SOUTH AMERICA: MEDICAL TUBING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 152 SOUTH AMERICA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 153 SOUTH AMERICA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 154 SOUTH AMERICA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 155 SOUTH AMERICA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 156 BRAZIL: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 157 BRAZIL: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 158 BRAZIL: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 159 BRAZIL: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 160 ARGENTINA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 161 ARGENTINA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 162 ARGENTINA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 163 ARGENTINA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 164 REST OF SOUTH AMERICA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (KILOTON)

- TABLE 165 REST OF SOUTH AMERICA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (KILOTON)

- TABLE 166 REST OF SOUTH AMERICA: MEDICAL TUBING MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 167 REST OF SOUTH AMERICA: MEDICAL TUBING MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 168 MEDICAL TUBING MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2025

- TABLE 169 MEDICAL TUBING MARKET: DEGREE OF COMPETITION, 2024

- TABLE 170 MEDICAL TUBING MARKET: REGION FOOTPRINT

- TABLE 171 MEDICAL TUBING MARKET: STRUCTURE FOOTPRINT

- TABLE 172 MEDICAL TUBING MARKET: MATERIAL FOOTPRINT

- TABLE 173 MEDICAL TUBING MARKET: APPLICATION FOOTPRINT

- TABLE 174 MEDICAL TUBING MARKET: KEY STARTUPS/SMES

- TABLE 175 MEDICAL TUBING MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 176 MEDICAL TUBING MARKET: PRODUCT LAUNCHES, JANUARY 2020-MARCH 2025

- TABLE 177 MEDICAL TUBING MARKET: DEALS, JANUARY 2020-MARCH 2025

- TABLE 178 MEDICAL TUBING MARKET: OTHER DEVELOPMENTS, JANUARY 2020-MARCH 2025

- TABLE 179 SAINT-GOBAIN: COMPANY OVERVIEW

- TABLE 180 SAINT-GOBAIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 181 SAINT-GOBAIN: DEALS, JANUARY 2020-MARCH 2025

- TABLE 182 FREUDENBERG MEDICAL: COMPANY OVERVIEW

- TABLE 183 FREUDENBERG MEDICAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 FREUDENBERG MEDICAL: PRODUCT LAUNCHES, JANUARY 2020-MARCH 2025

- TABLE 185 FREUDENBERG MEDICAL: DEALS, JANUARY 2020-MARCH 2025

- TABLE 186 FREUDENBERG MEDICAL: EXPANSIONS, JANUARY 2020-MARCH 2025

- TABLE 187 THE LUBRIZOL CORPORATION: COMPANY OVERVIEW

- TABLE 188 THE LUBRIZOL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 THE LUBRIZOL CORPORATION: DEALS, JANUARY 2020-MARCH 2025

- TABLE 190 THE LUBRIZOL CORPORATION: EXPANSIONS, JANUARY 2020-MARCH 2025

- TABLE 191 W. L. GORE & ASSOCIATES, INC.: COMPANY OVERVIEW

- TABLE 192 W. L. GORE & ASSOCIATES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 NORDSON CORPORATION: COMPANY OVERVIEW

- TABLE 194 NORDSON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 NORDSON CORPORATION: DEALS, JANUARY 2020-MARCH 2025

- TABLE 196 TE CONNECTIVITY: COMPANY OVERVIEW

- TABLE 197 TE CONNECTIVITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 TE CONNECTIVITY: PRODUCT LAUNCHES, JANUARY 2020-MARCH 2025

- TABLE 199 ELKEM ASA: COMPANY OVERVIEW

- TABLE 200 ELKEM ASA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 ELKEM ASA: DEALS, JANUARY 2020-MARCH 2025

- TABLE 202 ELKEM ASA: EXPANSIONS, JANUARY 2020-MARCH 2025

- TABLE 203 TRELLEBORG AB: COMPANY OVERVIEW

- TABLE 204 TRELLEBORG AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 TRELLEBORG AB: DEALS, JANUARY 2020-MARCH 2025

- TABLE 206 TRELLEBORG AB: OTHER DEVELOPMENTS, JANUARY 2020-MARCH 2025

- TABLE 207 RAUMEDIC AG: COMPANY OVERVIEW

- TABLE 208 RAUMEDIC AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 RAUMEDIC AG: PRODUCT LAUNCHES, JANUARY 2020-MARCH 2025

- TABLE 210 RAUMEDIC AG: DEALS, JANUARY 2020-MARCH 2025

- TABLE 211 RAUMEDIC AG: EXPANSIONS, JANUARY 2020-MARCH 2025

- TABLE 212 TEKNOR APEX: COMPANY OVERVIEW

- TABLE 213 TEKNOR APEX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 TEKNOR APEX: PRODUCT LAUNCHES, JANUARY 2020-MARCH 2025

- TABLE 215 TEKNOR APEX: DEALS, JANUARY 2020-MARCH 2025

- TABLE 216 SPECTRUM PLASTICS GROUP: COMPANY OVERVIEW

- TABLE 217 SPECTRUM PLASTICS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 SPECTRUM PLASTICS GROUP: DEALS, JANUARY 2020-MARCH 2025

- TABLE 219 SPECTRUM PLASTICS GROUP: EXPANSIONS, JANUARY 2020-MARCH 2025

- TABLE 220 ZEUS COMPANY LLC: COMPANY OVERVIEW

- TABLE 221 ZEUS COMPANY LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 ZEUS COMPANY LLC: PRODUCT LAUNCHES, JANUARY 2020-MARCH 2025

- TABLE 223 ZEUS COMPANY LLC: EXPANSIONS, JANUARY 2020-MARCH 2025

- TABLE 224 ATAG SPA: COMPANY OVERVIEW

- TABLE 225 DAVIS STANDARD: COMPANY OVERVIEW

- TABLE 226 FBK MEDICAL TUBING: COMPANY OVERVIEW

- TABLE 227 PROTERIAL CABLE AMERICA, INC.: COMPANY OVERVIEW

- TABLE 228 ICO RALLY: COMPANY OVERVIEW

- TABLE 229 ICU MEDICAL, INC.: COMPANY OVERVIEW

- TABLE 230 KRATON CORPORATION: COMPANY OVERVIEW

- TABLE 231 MICROLUMEN INC.: COMPANY OVERVIEW

- TABLE 232 MDC INDUSTRIES: COMPANY OVERVIEW

- TABLE 233 NEWAGE INDUSTRIES: COMPANY OVERVIEW

- TABLE 234 OPTINOVA: COMPANY OVERVIEW

- TABLE 235 PARKER HANNIFIN CORP.: COMPANY OVERVIEW

- TABLE 236 TEEL PLASTICS: COMPANY OVERVIEW

- TABLE 237 VESTA INC.: COMPANY OVERVIEW

- TABLE 238 SMOOTH-BOR PLASTICS: COMPANY OVERVIEW

List of Figures

- FIGURE 1 MEDICAL TUBING MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 MEDICAL TUBING MARKET: RESEARCH DESIGN

- FIGURE 3 MEDICAL TUBING MARKET: BOTTOM-UP APPROACH

- FIGURE 4 MEDICAL TUBING MARKET: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: MEDICAL TUBING MARKET, TOP-DOWN APPROACH

- FIGURE 6 DEMAND-SIDE FORECAST PROJECTIONS

- FIGURE 7 MEDICAL TUBING MARKET: DATA TRIANGULATION

- FIGURE 8 RUBBERS TO BE FASTEST-GROWING MATERIAL SEGMENT IN MEDICAL TUBING MARKET DURING FORECAST PERIOD

- FIGURE 9 CATHETERS & CANNULAS APPLICATION TO LEAD OVERALL MARKET DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO REGISTER HIGHEST GROWTH IN MEDICAL TUBING MARKET DURING FORECAST PERIOD

- FIGURE 12 SPECIALTY POLYMERS SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 BULK DISPOSABLE TUBING SEGMENT TO LEAD OVERALL MARKET BY 2030

- FIGURE 14 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN MEDICAL TUBING MARKET

- FIGURE 16 MEDICAL TUBING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 18 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 19 MEDICAL TUBING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 20 IMPORT DATA FOR HS CODE 3917-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 21 EXPORT DATA RELATED TO HS CODE 3917-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2020-2024 (USD MILLION)

- FIGURE 22 MEDICAL TUBING MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS IN MEDICAL TUBING MARKET

- FIGURE 24 MEDICAL TUBING MARKET: GRANTED PATENTS, 2015-2024

- FIGURE 25 NUMBER OF PATENTS PER YEAR, 2015-2024

- FIGURE 26 LEGAL STATUS OF PATENTS, 2015-2024

- FIGURE 27 TOP JURISDICTION, BY DOCUMENT, 2015-2024

- FIGURE 28 TOP 10 PATENT APPLICANTS, 2015-2024

- FIGURE 29 AVERAGE SELLING PRICE, BY REGION, 2021-2024 (USD/KG)

- FIGURE 30 AVERAGE SELLING PRICE FOR TOP THREE APPLICATIONS, BY KEY PLAYER, 2024 (USD/KG)

- FIGURE 31 AVERAGE SELLING PRICE TREND, BY MATERIAL, 2021-2024 (USD/KG)

- FIGURE 32 MEDICAL TUBING, INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 33 CATHETERS & CANNULAS TO BE LARGEST APPLICATION OF MEDICAL TUBING MARKET DURING FORECAST PERIOD

- FIGURE 34 RUBBERS SEGMENT TO DOMINATE MEDICAL TUBING MARKET DURING FORECAST PERIOD

- FIGURE 35 MULTI-LUMEN SEGMENT TO DOMINATE MEDICAL TUBING MARKET DURING FORECAST PERIOD

- FIGURE 36 INDIA TO BE FASTEST-GROWING MARKET FOR MEDICAL TUBING DURING FORECAST PERIOD

- FIGURE 37 NORTH AMERICA: MEDICAL TUBING MARKET SNAPSHOT

- FIGURE 38 EUROPE: MEDICAL TUBING MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: MEDICAL TUBING MARKET SNAPSHOT

- FIGURE 40 MEDICAL TUBING MARKET: REVENUE ANALYSIS OF KEY COMPANIES, 2021-2023

- FIGURE 41 MEDICAL TUBING MARKET SHARE ANALYSIS, 2024

- FIGURE 42 MEDICAL TUBING MARKET: COMPANY VALUATION OF LEADING COMPANIES, 2024

- FIGURE 43 MEDICAL TUBING MARKET: FINANCIAL METRICS OF LEADING COMPANIES, 2024

- FIGURE 44 BRAND COMPARISON

- FIGURE 45 COMPANY EVALUATION MATRIX, KEY PLAYERS, 2024

- FIGURE 46 MEDICAL TUBING MARKET: COMPANY FOOTPRINT

- FIGURE 47 MEDICAL TUBING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 48 SAINT-GOBAIN: COMPANY SNAPSHOT

- FIGURE 49 FREUDENBERG GROUP: COMPANY SNAPSHOT

- FIGURE 50 NORDSON CORPORATION: COMPANY SNAPSHOT

- FIGURE 51 TE CONNECTIVITY: COMPANY SNAPSHOT

- FIGURE 52 ELKEM ASA: COMPANY SNAPSHOT

- FIGURE 53 TRELLEBORG AB: COMPANY SNAPSHOT

The medical tubing market is projected to reach USD 18.41 billion by 2030 from USD 12.53 billion in 2025, at a CAGR of 8.0% during the forecast period. The expansion in the medical tubing market is due to rise in cases of chronic disease, including cardiovascular conditions, cancer, and respiratory conditions. Many of these illnesses demand medical equipment like catheters, infusion equipment, and ventilators that involve tubing for treatment and management effectiveness. For example, increasing prevalence of respiratory conditions such as asthma and tuberculosis has promoted demand for ventilator tubing systems. The rise in the elderly population, also more prone to chronic diseases and surgery, is another major reason. This increase in the old age population led to an uptrend in need for minimally invasive procedures with medical tubing featuring a key element in drug administration and fluid delivery systems. Moreover, companies' strategic moves, including product launches and mergers, are broadening market coverage and visibility. Finally, rigorous regulatory requirements and government spending on healthcare infrastructure are driving market growth by providing high-quality tubing products for various applications. All these factors together put the medical tubing market in line for long-term growth in the next few years.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | Material, Application, Structure, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

"Rubber is the second fastest-growing material in the medical tubing market during the forecast period."

Rubber is the second fastest-growing medical tubing material because of its better flexibility, durability, and biocompatibility, which make it suitable for numerous medical applications. Natural and synthetic rubbers, including silicone, latex, and thermoplastic elastomers (TPE), provide good resistance to harsh temperatures, chemicals, and multiple sterilization cycles. This makes rubber tubing ideally suited to be used in catheters, respiratory therapy units, peristaltic pumps, and surgery drainage systems. Silicone rubber is specifically used on a large scale owing to its superior biocompatibility, for which it is considered a material of choice for implantable and long-term medical uses. In addition, rubber products have higher resilience that allows medical tubing to withstand bending and stretching without loss of integrity, hence offering enhanced patient comfort and device performance. The growing prevalence of chronic conditions, such as cardiovascular and respiratory diseases, has fueled the demand for medical devices that incorporate rubber tubing. In addition, advances in rubber formulations, including antimicrobial coatings and increased tensile strength, have contributed to its applications in critical care. With advances in healthcare innovation, rubber tubing continues to be a top contender, thus qualifying it as the second fastest-growing material in the medical tubing market.

"Braided tubing is the second fastest-growing structure in the medical tubing market during the forecast period."

Braided tubing is the second fastest-growing medical tubing structure because of its excellent combination of strength, flexibility, and versatility that can address a broad spectrum of sophisticated medical uses. Its structure, with a reinforcing braided layer commonly composed of materials such as stainless steel or nylon inserted inside polymer tubing, provides the best resistance to high pressure and kinking than its non-reinforced counterparts. This makes it most appropriate for high-performance applications such as catheters, endoscopes, and cardiovascular devices, where durability and precise fluid delivery are of the highest priority. The growing need for minimally invasive procedures, which require tubing that can navigate through intricate anatomical pathways without compromising performance, significantly enhances its application. Braided tubing can withstand sterilization processes and maintain structural integrity under stress conditions also helps in meeting the strict safety requirements of the medical sector. Rising prevalence of chronic diseases, coupled with the aging population and their requirement for advanced diagnostic and therapeutic equipment, also fuels its market growth. New braiding technology and material science enable it to be even more flexible and enable customization to fulfill particular medical needs. While single-lumen tubing may be the culprit by way of simplicity and ubiquity, the greater mechanical properties and biocompatibility of braided tubing with high-performance uses position it as a fast-rising market that responds well to shifting needs of modern healthcare.

"Catheters & cannulas is the second fastest-growing structure in the medical tubing market during the forecast period."

The catheters & cannulas market is the second fastest-growing application of the medical tubing market owing to a number of major driving factors behind its demand. As the global healthcare systems focus on minimally invasive interventions, catheters & cannulas are becoming the tools of choice, providing safer and less traumatic alternatives to conventional surgeries. These soft tubes play a vital role in uses such as cardiovascular interventions, urinary drainage, and intravenous therapy, where accuracy and patient comfort are of utmost importance. Growing prevalence of chronic illness, including cardiovascular conditions, diabetes, and renal disorders, mainly in aging communities, also catalyzes such expansion. Demand for catheterization in treatment of heart problems or urinary incontinence automatically increases demand for special tubing. Advancements in technology also are contributing factors with improved biocompatible materials, including silicone and polyurethane, improving functionality, longevity, and safety for catheters & cannulas. Besides, the move towards outpatient treatment and home healthcare increases their application in portable equipment, like infusion pumps. The segment is helped by the increasing investments in healthcare, particularly in sectors that are emerging, as enhanced infrastructure and availability of medical services increase the demand for disposable and sterile tubing.

"The Middle East and Africa (MEA) market is projected to register the second fastest growing market for medical tubing during the forecast period."

Middle East & Africa (MEA) is the second fastest-growing market for medical tubing owing to mounting healthcare investment, enhancing medical infrastructure, and rising demand for high-tech medical devices. Regional governments, specifically those of Saudi Arabia, UAE, and South Africa, are greatly investing in the modernization of healthcare, generating the demand for superior medical tubing for usage in hospitals, clinics, and diagnostic centers. The growth of healthcare facilities, coupled with the creation of medical free zones and manufacturing centers, is increasing local production and distribution of medical tubing and associated devices. The increasing incidence of chronic diseases like diabetes, cardiovascular diseases, and respiratory diseases has boosted the use of medical tubing in drug delivery systems, catheters, and respiratory devices. The increased geriatric population in the region also demands advanced medical treatment, thereby propelling the use of medical tubing-based applications. The transition towards home healthcare and wearable medical devices, including insulin pumps and oxygen therapy devices, is another key driver for market growth. Worldwide medical device companies are expanding their reach in the MEA region through collaborations, joint ventures, and establishing regional production units. All this growth increases the number of better-quality medical tubing products available and reduces dependency on imports, and consequently healthcare becomes affordable. Medical tubing technologies such as biodegradable and antimicrobial medical tubing grow more popular in MEA as healthcare professionals continue to prioritize infection control and eco-friendliness.

Extensive primary interviews were conducted to determine and verify the market size for several segments and sub-segments and the information gathered through secondary research.

The break-up of primary interviews is given below:

- By Department: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, and Executives: 35%

- By Region: North America: 25%, Europe: 45%, Asia Pacific: 20%, South America: 5%, Middle East & Africa 5%

Saint-Gobain (France), Freudenberg Medical (US), W. L. Gore & Associates, Inc. (US), The Lubrizol Corporation (US), Nordson Corporation (US), TE Connectivity (Switzerland), Elkem ASA (Norway), Trelleborg AB (Sweden), RAUMEDIC AG (Germany), Teknor Apex (US), Spectrum Plastics Group (US) Zeus Company LLC (US) among others are some of the key players in the medical tubing market.

The study includes an in-depth competitive analysis of these key players in the authentication and brand

protection market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study covers the medical tubing market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on material, application, structure, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the medical tubing market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall medical tubing market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increase in geriatric population, Increasing demand for minimally invasive medical procedures, Stringent quality standards and regulations, Advancements in extrusion technology), restraints (Limited material compatibility), opportunities (Customization and innovation in polymers and tubing structure, Increasing government expenditure for upgrading and developing healthcare infrastructure), challenges (High cost of producing and marketing medical tubing products).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the medical tubing market

- Market Development: Comprehensive information about lucrative markets - the report analyses the medical tubing market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the medical tubing market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Saint-Gobain (France), Freudenberg Medical (US), W. L. Gore & Associates, Inc. (US), The Lubrizol Corporation (US), Nordson Corporation (US), TE Connectivity (Switzerland), Elkem ASA (Norway), Trelleborg AB (Sweden), RAUMEDIC AG (Germany), Teknor Apex (US), Spectrum Plastics Group (US) Zeus Company LLC (US) among others are the top manufacturers covered in the medical tubing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants-demand and supply side

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS AND RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MEDICAL TUBING MARKET

- 4.2 MEDICAL TUBING MARKET, BY MATERIAL

- 4.3 MEDICAL TUBING MARKET, BY APPLICATION

- 4.4 MEDICAL TUBING MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing geriatric population

- 5.2.1.2 Increasing demand for minimally invasive medical procedures

- 5.2.1.3 Advancements in extrusion technology

- 5.2.1.4 Stringent quality standards and regulations

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited material compatibility

- 5.2.2.2 Environmental and disposal concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in biocompatible and smart materials

- 5.2.3.2 Increasing government expenditure to upgrade and develop healthcare infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 High production costs and marketing complexities

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.3 REGULATORY LANDSCAPE

- 6.3.1 REGULATIONS

- 6.3.1.1 North America

- 6.3.1.2 Asia Pacific

- 6.3.1.3 Europe

- 6.3.2 STANDARDS

- 6.3.2.1 ISO standard

- 6.3.2.2 Food and drug administration (FDA)

- 6.3.2.3 ASTM (American society for testing and materials) standards

- 6.3.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.3.1 REGULATIONS

- 6.4 TRADE ANALYSIS

- 6.4.1 IMPORT SCENARIO (HS CODE 3917)

- 6.4.2 EXPORT SCENARIO (HS CODE 3917)

- 6.5 ECOSYSTEM ANALYSIS

- 6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.7 CASE STUDY ANALYSIS

- 6.7.1 FREUDENBERG MEDICAL TO PROVIDE SPECIALTY BALLOON CATHETERS

- 6.7.2 W. L. GORE & ASSOCIATES, INC. PROVIDES GORE STA-PURE PUMP TUBING

- 6.8 TECHNOLOGY ANALYSIS

- 6.8.1 KEY TECHNOLOGIES

- 6.8.1.1 Extrusion technology

- 6.8.1.2 Advanced material technologies

- 6.8.2 COMPLEMENTARY TECHNOLOGIES

- 6.8.2.1 Smart technologies and connectivity

- 6.8.2.2 Surface treatment and modification

- 6.8.1 KEY TECHNOLOGIES

- 6.9 KEY CONFERENCES AND EVENTS, 2025

- 6.10 PATENT ANALYSIS

- 6.10.1 METHODOLOGY

- 6.10.2 DOCUMENT TYPES

- 6.10.3 PUBLICATION TRENDS IN LAST 11 YEARS

- 6.10.4 INSIGHTS

- 6.10.5 LEGAL STATUS OF PATENTS

- 6.10.6 JURISDICTION ANALYSIS

- 6.10.7 TOP APPLICANTS

- 6.11 IMPACT OF AI/GEN AI ON MEDICAL TUBING MARKET

- 6.12 PRICING ANALYSIS

- 6.12.1 AVERAGE SELLING PRICE, BY REGION, 2021-2024

- 6.12.2 AVERAGE SELLING PRICE FOR TOP THREE APPLICATIONS, BY KEY PLAYER, 2024

- 6.12.3 AVERAGE SELLING PRICE TREND, BY MATERIAL, 2021-2024

- 6.13 INVESTMENT AND FUNDING SCENARIO

7 MEDICAL TUBING MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 BULK DISPOSABLE TUBING

- 7.2.1 DEMAND FROM HOSPITALS, HOME HEALTHCARE PROVIDERS, AND EMERGENCY CARE PROVIDERS TO BOOST MARKET

- 7.2.2 DIALYSIS TUBING

- 7.2.2.1 Growing aging population to drive demand

- 7.2.3 INTRAVENOUS TUBING

- 7.2.3.1 Technological advancements to drive market

- 7.3 CATHETERS & CANNULAS

- 7.3.1 RISING CARDIOVASCULAR DISEASES AND DEMAND FOR MINIMALLY INVASIVE SURGICAL PROCEDURES TO FUEL MARKET GROWTH

- 7.3.2 CATHETERS

- 7.3.2.1 Increase in chronic diseases contributing to significant demand

- 7.3.2.2 Cardiovascular catheters

- 7.3.2.2.1 Growing elderly population and high incidence of cardiovascular diseases to propel market

- 7.3.2.3 IV catheters

- 7.3.2.3.1 Demand for direct delivery of medication and nutrients into bloodstream to fuel growth

- 7.3.2.4 Urinary catheters

- 7.3.2.4.1 Rising incidences of urinary tract infections and growing need for advanced technologies to drive demand

- 7.3.3 CANNULAS

- 7.3.3.1 Evolving healthcare sector and stringent regulatory requirements to support market growth

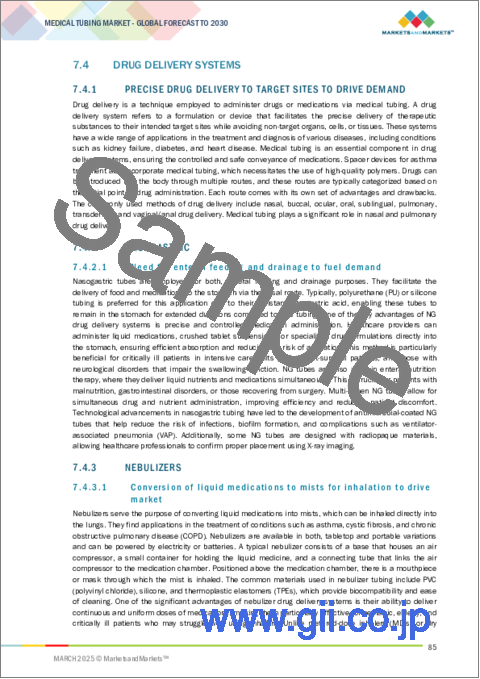

- 7.4 DRUG DELIVERY SYSTEMS

- 7.4.1 PRECISE DRUG DELIVERY TO TARGET SITES TO DRIVE DEMAND

- 7.4.2 NASOGASTRIC

- 7.4.2.1 Need for enteral feeding and drainage to fuel demand

- 7.4.3 NEBULIZERS

- 7.4.3.1 Conversion of liquid medications to mists for inhalation to drive market

- 7.5 OTHER APPLICATIONS

- 7.5.1 PERISTALTIC PUMP TUBING

- 7.5.1.1 Wide demand for minimizing contamination to boost market

- 7.5.2 GAS SUPPLY TUBING

- 7.5.2.1 Increasing minimally invasive surgeries to support market growth

- 7.5.3 SMOKE EVACUATION TUBING

- 7.5.3.1 Popularity of cosmetic procedures and medical tourism to drive market

- 7.5.1 PERISTALTIC PUMP TUBING

8 MEDICAL TUBING MARKET, BY MATERIAL

- 8.1 INTRODUCTION

- 8.2 PLASTICS

- 8.2.1 BIOCOMPATIBILITY, CHEMICAL STABILITY, AND COST-EFFECTIVENESS TO BOOST MARKET

- 8.2.2 POLYVINYL CHLORIDE (PVC)

- 8.2.3 POLYOLEFIN

- 8.2.3.1 Polyethylene (PE)

- 8.2.3.2 Polypropylene (PP)

- 8.2.4 POLYAMIDE

- 8.2.5 POLYTETRAFLUOROETHYLENE (PTFE)

- 8.2.6 POLYETHER ETHER KETONE (PEEK)

- 8.2.7 POLYCARBONATE (PC)

- 8.3 RUBBERS

- 8.3.1 SIGNIFICANT DURABILITY AND RESILIENCE TO DRIVE DEMAND

- 8.3.2 THERMOPLASTIC ELASTOMER (TPE)

- 8.3.3 THERMOPLASTIC POLYURETHANE (TPU)

- 8.3.4 SILICONE

- 8.3.5 POLYURETHANE (PU)

- 8.3.6 ETHYLENE PROPYLENE DIENE MONOMER (EPDM)

- 8.3.7 LATEX

- 8.4 SPECIALTY POLYMERS

- 8.4.1 DEMAND FOR SPECIALIZED TREATMENT TO BOOST MARKET

- 8.4.2 BIOABSORBABLE POLYMERS

- 8.4.3 ETHYLENE VINYL ACETATE (EVA)

- 8.5 OTHER MATERIALS

9 MEDICAL TUBING MARKET, BY STRUCTURE

- 9.1 INTRODUCTION

- 9.2 SINGLE-LUMEN

- 9.2.1 DEMAND FOR ADMINISTRATION OF FLUIDS AND MEDICATION, AIRWAY MANAGEMENT, AND PATIENT NUTRITION TO DRIVE MARKET

- 9.3 CO-EXTRUDED

- 9.3.1 DURABILITY, LUBRICITY, OPACITY, RADIOPACITY, AND TENSILE STRENGTH TO BOOST MARKET

- 9.4 MULTI-LUMEN

- 9.4.1 NON-TOXICITY, BIOCOMPATIBILITY, AND INERTNESS TO FUEL MARKET DEMAND

- 9.5 TAPERED OR BUMP TUBING

- 9.5.1 ENHANCED FUNCTIONALITIES IN CVC, PICC, AND DRUG DELIVERY CATHETERS TO DRIVE MARKET

- 9.6 BRAIDED TUBING

- 9.6.1 GOOD STRENGTH, STEERABILITY, AND PRESSURE RESISTANCE TO PROPEL MARKET

10 MEDICAL TUBING MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 High disposable income and strong healthcare infrastructure to drive market

- 10.2.2 CANADA

- 10.2.2.1 Aging population and increasing healthcare expenditure to support market growth

- 10.2.3 MEXICO

- 10.2.3.1 High investments and low manufacturing costs to fuel demand

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Advanced medical facilities and R&D investments to propel market

- 10.3.2 FRANCE

- 10.3.2.1 Rising elderly population to fuel market growth

- 10.3.3 UK

- 10.3.3.1 Innovation, technological advancements, and investments to drive market

- 10.3.4 SPAIN

- 10.3.4.1 Growing aging population and improvements in healthcare system to increase consumption

- 10.3.5 ITALY

- 10.3.5.1 Growing geriatric population and strong focus on research and innovation to drive market

- 10.3.6 NETHERLANDS

- 10.3.6.1 Rising homecare treatment to increase demand

- 10.3.7 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Investments in manufacturing medical devices to support market

- 10.4.2 JAPAN

- 10.4.2.1 Implementation of AI and big data technologies in healthcare industry to increase demand

- 10.4.3 INDIA

- 10.4.3.1 Government initiatives, high purchasing power, and rising manufacturing output to fuel demand

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Medical tourism to lead to market growth

- 10.4.5 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Government initiatives to support market growth

- 10.5.1.2 UAE

- 10.5.1.2.1 Government funding and rapidly developing private health sector to drive market

- 10.5.1.1 Saudi Arabia

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Increasing awareness, testing, and treatment programs to drive market

- 10.5.3 EGYPT

- 10.5.3.1 Technological advancements and improving healthcare sector to fuel demand

- 10.5.4 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Growing healthcare system to increase consumption

- 10.6.2 ARGENTINA

- 10.6.2.1 Rising prevalence of chronic diseases, aging population, and advances in medical sector to drive market

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 11.3 REVENUE ANALYSIS, 2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.4.1 SAINT-GOBAIN

- 11.4.2 FREUDENBERG MEDICAL

- 11.4.3 THE LUBRIZOL CORPORATION

- 11.4.4 W. L. GORE & ASSOCIATES, INC.

- 11.4.5 TE CONNECTIVITY

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND COMPARISON

- 11.6.1 MEDICAL TUBING MARKET: BRAND COMPARISON

- 11.6.2 BIO-SIL TUBING

- 11.6.3 HELIXFLEX

- 11.6.4 ISOPLAST ETPU MEDICAL TUBING

- 11.6.5 GORE STA-PURE PUMP TUBING SERIES PFL

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Structure footprint

- 11.7.5.4 Material footprint

- 11.7.5.5 Application footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 SAINT-GOBAIN

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 FREUDENBERG MEDICAL

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 THE LUBRIZOL CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 W. L. GORE & ASSOCIATES, INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Right to win

- 12.1.4.3.2 Strategic choices

- 12.1.4.3.3 Weaknesses and competitive threats

- 12.1.5 NORDSON CORPORATION

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 TE CONNECTIVITY

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.4 MnM view

- 12.1.7 ELKEM ASA

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.7.3.2 Expansions

- 12.1.7.4 MnM view

- 12.1.8 TRELLEBORG AB

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.8.3.2 Other developments

- 12.1.8.4 MnM view

- 12.1.9 RAUMEDIC AG

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.9.3.2 Deals

- 12.1.9.3.3 Expansions

- 12.1.9.4 MnM view

- 12.1.10 TEKNOR APEX

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Deals

- 12.1.10.4 MnM view

- 12.1.11 SPECTRUM PLASTICS GROUP

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.11.3.2 Expansions

- 12.1.11.4 MnM view

- 12.1.12 ZEUS COMPANY LLC

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches

- 12.1.12.3.2 Expansions

- 12.1.12.4 MnM view

- 12.1.1 SAINT-GOBAIN

- 12.2 OTHER PLAYERS

- 12.2.1 ATAG SPA

- 12.2.2 DAVIS STANDARD

- 12.2.3 FBK MEDICAL TUBING

- 12.2.4 PROTERIAL CABLE AMERICA, INC.

- 12.2.5 ICO RALLY

- 12.2.6 ICU MEDICAL, INC.

- 12.2.7 KRATON CORPORATION

- 12.2.8 MICROLUMEN INC.

- 12.2.9 MDC INDUSTRIES

- 12.2.10 NEWAGE INDUSTRIES

- 12.2.11 OPTINOVA

- 12.2.12 PARKER HANNIFIN CORP.

- 12.2.13 TEEL PLASTICS

- 12.2.14 VESTA INC.

- 12.2.15 SMOOTH-BOR PLASTICS

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS