|

|

市場調査レポート

商品コード

1375845

体温管理システムの世界市場 (~2028年):製品 (加温システム・表面・血管内)・冷却システム・用途 (周術期・急性期・新生児ケア)・専門領域 (循環器科・神経科・小児科・整形外科) 別Temperature Management Systems Market by Product (Warming Systems, Surface, Intravascular), Cooling Systems, Application (Perioperative, Acute, Newborn Care), Medical Speciality (Cardiology, Neurology, Pediatrics, Orthopedics) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 体温管理システムの世界市場 (~2028年):製品 (加温システム・表面・血管内)・冷却システム・用途 (周術期・急性期・新生児ケア)・専門領域 (循環器科・神経科・小児科・整形外科) 別 |

|

出版日: 2023年10月31日

発行: MarketsandMarkets

ページ情報: 英文 233 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

報告書概要

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額 (米ドル) |

| セグメント | 製品・用途・専門領域 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

世界の体温管理システムの市場規模は、2023年の30億米ドルから、予測期間中は4.9%のCAGRで推移し、2028年には39億米ドルの規模に成長すると予測されています。 患者用加温システムと患者用冷却システムの成長は、主に外科手術の増加、低体温症例の増加によってもたらされます。

外科手術の増加により、より多くの病院で患者用加温システムと患者用冷却システムの採用が進むと予想されます。

用途別では、予測期間中、周術期ケアの部門がもっとも高いシェアを示す見通しです。手術中に低体温を維持するために体温管理システムが使用されることから、癌などのさまざまな慢性疾患の有病率の上昇が同部門の成長に寄与しています。新興国における成長機会の増加も周術期ケアを牽引する見通しです。

地域別では、北米地域が予測期間中に最大のシェアを示す見通しです。北米では、手術や外科的処置中に患者の体温を維持するために患者保温・冷却システムを使用することに関する認知度が向上し、市場が発展する見通しであることから、予測期間中に高いシェアが見込まれています。

当レポートでは、世界の体温管理システムの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許動向、ケーススタディ、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- サプライチェーン分析

- ポーターのファイブフォース分析

- 規制分析

- 貿易分析

- 技術分析

- エコシステム分析

- 特許分析

- 主な会議とイベント

- 価格分析

- 顧客の事業に影響を与える動向/ディスラプション

- 主なステークホルダーと購入基準

第6章 体温管理システム市場:製品別

- 患者加温システム

- 表面加温システム

- 血管内加温システム

- 患者冷却システム

- 表面冷却システム

- 血管内冷却システム

- 付属品および患者の加温および冷却システム

第7章 体温管理システム市場:用途別

- 周術期ケア

- 手術室

- 術後ケアユニット

- 術前治療ユニット

- 急性期ケア

- 集中治療室

- 緊急治療室

- 冠状動脈ケアユニット

- 火傷治療センター

- 神経ケアユニット

- カテーテルラボ

- 新生児ケア

- 分娩室

- 新生児集中治療室

- 産後病棟

- その他

第8章 体温管理システム市場:専門領域別

- 一般外科

- 循環器科

- 神経科

- 小児科

- 胸部外科

- 整形外科

- その他

第9章 体温管理システム市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第10章 競合情勢

- 概要

- 主要企業の採用戦略

- 収益シェア分析

- 市場シェア分析

- 企業評価マトリックス

- 中小企業/スタートアップ評価マトリックス

- 競合ベンチマーキング

- 企業フットプリント

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- 3M COMPANY

- GE HEALTHCARE

- DRAGERWERK AG & CO. KGAA

- ECOLAB

- ASAHI KASEI CORPORATION (ZOLL MEDICAL CORPORATION)

- BECTON, DICKINSON AND COMPANY

- ICU MEDICAL, INC.

- GENTHERM INCORPORATED

- INSPIRATION HEALTHCARE GROUP PLC

- MEDTRONIC PLC

- STRYKER CORPORATION

- THE SURGICAL COMPANY

- その他の企業

- ADROIT MEDICAL SYSTEMS

- ATTUNE MEDICAL

- AUGUSTINE SURGICAL, INC.

- BELMONT MEDICAL TECHNOLOGIES

- BIEGLER GMBH

- ENCOMPASS GROUP, LLC

- ENTHERMICS, INC.

- HIRTZ & CO. KG.

- ISTANBUL MEDIKAL LTD.

- LIFE RECOVERY SYSTEMS

- MEDCARE VISIONS GMBH

- TAHATAKSI ALC

- BEIJING ETERNAL MEDICAL TECHNOLOGY CO., LTD.

第12章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) Billion |

| Segments | Product, Application and Medical Speciality |

| Regions covered | North America, Europe, Asia Pacific, and Rest of the World |

The global temperature management systems market is projected to reach USD 3.9 Billion by 2028 from USD 3.0 Billion in 2023, at a CAGR of 4.9% during the forecast period. Growth of patient warming systems and patient cooling systems is mainly driven by the, the rising number of surgical procedures, and the increasing number of hypothermia cases. The increased use of surgical procedure is expected to drive the adoption patient warming systems and patient cooling systems by the more number of hospitals.

"The Perioperative Care segment accounted for the highest market share in the application segment market, by application, during the forecast period."

Based on the application of the segment, the temperature management systems market is categorized as Perioperative care, acute care, newborn care, and other applications. Perioperative care is expected to have the highest growth in the market, which is attributed to the rising prevalence of various chronic diseases like cancer where temperature management systems are used to maintain hypothermia during the operative treatment and. Increasing growth opportunities in emerging economies will drive the Perioperative care.

"The North America segment accounted for the highest market share in temperature management systems market, by region, during the forecast period."

Based on the region, the global temperature management systems market is categorized into North America, Europe, Asia Pacific, and Rest of the world. North America is expected to witness a high market share during the forecast period due to growth development and awareness of the use of patient warming and cooling systems order to maintain the temperature the patient while any operative or surgical procedure. For instance, In 2022, over 1.87 million surgical procedures were performed in the US. Hypothermia is a common condition observed in surgical procedures due to the usage of anesthesia. Mild hypothermia is extremely common during anesthesia and surgery. Mild, treatable cases of hypothermia are more common, especially among groups of people who are at risk. In the United States, between 700 and 1,500 people die every year from hypothermia. This necessitates the use of surface and intravascular warming devices; as a result, the increasing volume of surgical procedures is expected to impact the temperature management systems market in the North America region.

Breakdown of supply-side primary interviews by company type, designation, and region:

- By Company Type: Tier 1 (30%), Tier 2 (44%), and Tier 3 (26%)

- By Designation: C-level (30%), Director-level (33%), and Others (37%)

- By Region: North America (40%), Europe (28%), Asia-Pacific (18%), RoW- (14%),

Prominent companies include 3M Company (US), GE Healthcare (US), Dragerwerk AG & Co. KGAA (Germany), Ecolab (US), Asahi-Kasei Corporation (Japan), Becton, Dickinson and Company (US), ICU Medical (US), Gentherm Incorporated (US), Inspiration Healthcare Group PLC (UK), Medtronic PLC (Ireland), Stryker Corporation (US), The Surgical Company (Netherlands), Adroit Medical Systems (US), Attune Medical (US), Augustine Surgical, Inc (US), Belmont Medical Technologies (US), Biegler GMBH (Austria), Encompass Group, llc (US), Enthermics, INC (US), Hirtz & Co. KG (Germany), Istanbul Medikal ltd. (Istanbul), Life Recovery Systems (US), Medcare Visions (Germany), TahatAksi (Belarus) and Beijing Eternal Medical Technology Co., Ltd (China).

Research Coverage

This research report categorizes the temperature management systems market which is segmented into product used for temperature management and the applications of those products along with the medical speciality segment use in the hospital. The product used for the temperature management is divided into three types Patient Warming Systems i.e. Surface Warming Systems and Intravascular Warming Systems, Patient Cooling Systems i.e. Surface Cooling Systems and Intravascular Cooling Systems and Accessories and Patient warming/cooling systems. The Application segment the classised as the Perioperative Care, Acute Care, Newborn Care and Other applications. Medical specialty segment is classified as General Surgery, Cardiology, Neurology, Pediatrics, Thoracic Surgery, Orthopedic Surgery and Other Medical Specialities, and regional segment is divided as the North America, Europe, Asia Pacific and Rest of world. The scope of the report covers detailed information regarding the major factors like market dynamics such as drivers, restraints, challenges, and opportunities which is influencing the growth of the temperature management systems market. A detailed analysis of the key industry players has been also the companies new launches, developments, mergers and acquisitions associated with the temperature management systems market has been covered. Competitive analysis of upcoming startups in the temperature management systems market ecosystem is covered in this report.

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall temperature management systems market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing prevalence of chronic and infectious diseases, rising number of surgical procedures and Increasing number of hypothermia cases), restraints (High cost of intravascular temperature management systems, Lack of awareness regarding temperature management systems in developing countries and Lack of proper supply chain management) opportunities (Increasing growth opportunities in emerging markets, Growing number of contracts and agreements between market players and Developing healthcare infrastructure) and Challenges (Product recalls and Lack of skilled healthcare professionals) are influencing the growth of the temperature management systems market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the temperature management systems market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the temperature management systems market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the temperature management systems market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, among others, in the temperature management systems market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS OF STUDY

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 TEMPERATURE MANAGEMENT SYSTEMS MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY

- 1.5 STAKEHOLDERS

- 1.6 LIMITATIONS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 3 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 APPROACH 1: COMPANY REVENUE ESTIMATION APPROACH

- FIGURE 5 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION

- 2.2.2 APPROACH 2: NUMBER OF TEMPERATURE MANAGEMENT SYSTEMS

- TABLE 1 REVENUE ESTIMATION APPROACH BY CALCULATING MARKET SIZE OF TEMPERATURE MANAGEMENT SYSTEMS MARKET

- 2.2.3 APPROACH 3: PRESENTATIONS OF COMPANIES AND PRIMARY INTERVIEWS

- 2.2.4 APPROACH 4: PRIMARY INTERVIEWS

- 2.3 GROWTH FORECAST

- FIGURE 6 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 7 TOP-DOWN APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- 2.5 MARKET SHARE ANALYSIS

- 2.6 MARKET ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT

- 2.8 RECESSION IMPACT ON TEMPERATURE MANAGEMENT SYSTEMS MARKET

3 EXECUTIVE SUMMARY

- FIGURE 9 TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY MEDICAL SPECIALTY, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 GEOGRAPHICAL SNAPSHOT OF TEMPERATURE MANAGEMENT SYSTEMS MARKET

4 PREMIUM INSIGHTS

- 4.1 TEMPERATURE MANAGEMENT SYSTEMS MARKET OVERVIEW

- FIGURE 13 INCREASING NUMBER OF HYPOTHERMIA CASES TO DRIVE MARKET

- 4.2 NORTH AMERICA: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY PRODUCT AND COUNTRY, 2022

- FIGURE 14 PATIENT WARMING SYSTEMS HELD LARGEST SHARE OF NORTH AMERICAN MARKET IN 2022

- 4.3 TEMPERATURE MANAGEMENT SYSTEMS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 15 INDIA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- FIGURE 16 TEMPERATURE MANAGEMENT SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing prevalence of chronic and infectious diseases

- 5.2.1.2 Rising number of surgical procedures

- 5.2.1.3 Increasing number of hypothermia cases

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of intravascular temperature management systems

- 5.2.2.2 Lack of awareness regarding temperature management systems in developing countries

- 5.2.2.3 Lack of proper supply chain management

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing growth opportunities in emerging economies

- 5.2.3.2 Growing number of contracts and agreements between market players

- 5.2.3.3 Developing healthcare infrastructure

- 5.2.4 CHALLENGES

- 5.2.4.1 Product recalls

- 5.2.4.2 Lack of skilled healthcare professionals

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 17 VALUE CHAIN ANALYSIS: MAXIMUM VALUE ADDED DURING MANUFACTURING PHASE

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 18 DISTRIBUTION-STRATEGY PREFERRED BY PROMINENT COMPANIES

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 PORTER'S FIVE FORCES ANALYSIS: TEMPERATURE MANAGEMENT SYSTEMS MARKET

- 5.5.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.5.2 BARGAINING POWER OF SUPPLIERS

- 5.5.3 BARGAINING POWER OF BUYERS

- 5.5.4 THREAT OF SUBSTITUTES

- 5.5.5 THREAT OF NEW ENTRANTS

- 5.6 REGULATORY ANALYSIS

- TABLE 4 INDICATIVE LIST OF REGULATORY AUTHORITIES GOVERNING TEMPERATURE MANAGEMENT SYSTEMS MARKET

- 5.6.1 NORTH AMERICA

- 5.6.1.1 US

- TABLE 5 CLASSIFICATIONS OF MEDICAL DEVICES BY US FDA

- FIGURE 19 PREMARKET NOTIFICATION: 510(K) APPROVAL FOR MEDICAL DEVICES

- 5.6.1.2 Canada

- FIGURE 20 CANADA: APPROVAL PROCESS FOR MEDICAL DEVICES

- 5.6.2 EUROPE

- FIGURE 21 CE APPROVAL PROCESS FOR TEMPERATURE MANAGEMENT SYSTEMS

- 5.6.3 ASIA PACIFIC

- 5.6.3.1 Japan

- TABLE 6 JAPAN: CLASSIFICATION OF MEDICAL DEVICES

- 5.6.3.2 China

- TABLE 7 NMPA MEDICAL DEVICES CLASSIFICATION

- 5.6.3.3 India

- 5.7 TRADE ANALYSIS

- 5.7.1 TRADE ANALYSIS FOR TEMPERATURE MANAGEMENT SYSTEMS

- TABLE 8 IMPORT DATA FOR HS CODE 901890, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 901890, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.8 TECHNOLOGY ANALYSIS

- 5.9 ECOSYSTEM ANALYSIS

- FIGURE 22 TEMPERATURE MANAGEMENT SYSTEMS MARKET: ECOSYSTEM ANALYSIS

- 5.9.1 ROLE IN ECOSYSTEM

- FIGURE 23 KEY PLAYERS IN TEMPERATURE MANAGEMENT SYSTEMS ECOSYSTEM

- 5.10 PATENT ANALYSIS

- FIGURE 24 PATENT ANALYSIS FOR TEMPERATURE MANAGEMENT SYSTEMS

- 5.11 KEY CONFERENCES AND EVENTS IN 2023-2024

- TABLE 10 LIST OF CONFERENCES AND EVENTS IN 2023-2024

- 5.12 PRICING ANALYSIS

- TABLE 11 AVERAGE SELLING PRICE OF KEY PRODUCTS IN TEMPERATURE MANAGEMENT SYSTEMS MARKET (2022)

- TABLE 12 AVERAGE SELLING PRICE TRENDS, BY REGION, 2022

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.13.1 REVENUE SHIFT & REVENUE POCKETS FOR TEMPERATURE MANAGEMENT SYSTEM MANUFACTURERS

- FIGURE 25 REVENUE SHIFT FOR TEMPERATURE MANAGEMENT SYSTEMS

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- TABLE 13 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- 5.14.2 BUYING CRITERIA

- FIGURE 27 KEY BUYING CRITERIA FOR TOP END USERS

- TABLE 14 KEY BUYING CRITERIA, BY TOP END USER

6 TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- TABLE 15 TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.2 PATIENT WARMING SYSTEMS

- TABLE 16 PATIENT WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 17 PATIENT WARMING SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.1 SURFACE WARMING SYSTEMS

- TABLE 18 SURFACE WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 19 SURFACE WARMING SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.1.1 Convective warming systems

- 6.2.1.1.1 Rising adoption among hospitals to drive market

- 6.2.1.1 Convective warming systems

- TABLE 20 CONVECTIVE WARMING SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.1.2 Conductive warming systems

- 6.2.1.2.1 Safe, inexpensive, and effective method for warming patients during perioperative procedures

- 6.2.1.2 Conductive warming systems

- TABLE 21 CONDUCTIVE WARMING SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.2.2 INTRAVASCULAR WARMING SYSTEMS

- 6.2.2.1 Technological advancements to aid market growth

- TABLE 22 INTRAVASCULAR WARMING SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3 PATIENT COOLING SYSTEMS

- TABLE 23 PATIENT COOLING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

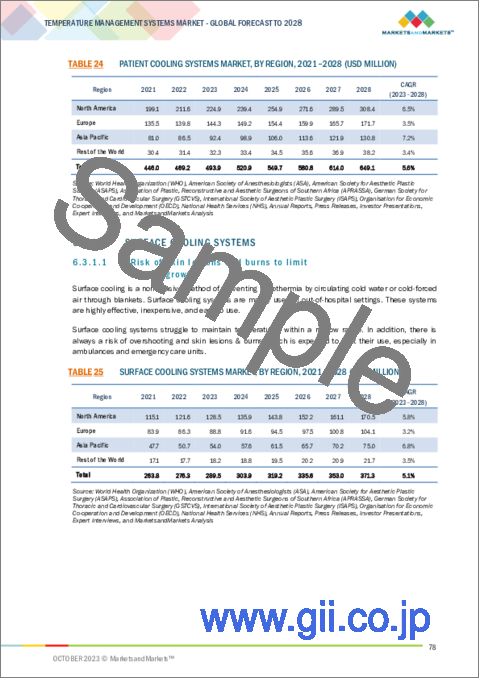

- TABLE 24 PATIENT COOLING SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3.1 SURFACE COOLING SYSTEMS

- 6.3.1.1 Risk of skin lesions and burns to limit market growth

- TABLE 25 SURFACE COOLING SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3.2 INTRAVASCULAR COOLING SYSTEMS

- 6.3.2.1 Increased precision in smaller temperature ranges to drive adoption

- TABLE 26 INTRAVASCULAR COOLING SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.4 ACCESSORIES AND PATIENT WARMING & COOLING SYSTEMS

- 6.4.1 INCREASING DEMAND FOR ACCESSORIES FOR PATIENT WARMING & COOLING SYSTEMS TO DRIVE GROWTH

- TABLE 27 ACCESSORIES AND PATIENT WARMING & COOLING SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

7 TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- TABLE 28 TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 7.2 PERIOPERATIVE CARE

- TABLE 29 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR PERIOPERATIVE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 30 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR PERIOPERATIVE CARE, BY REGION, 2021-2028 (USD MILLION)

- 7.2.1 OPERATING ROOMS

- 7.2.1.1 Increasing number of surgical procedures to drive demand

- TABLE 31 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR OPERATING ROOMS, BY REGION, 2021-2028 (USD MILLION)

- 7.2.2 POSTOPERATIVE CARE UNITS

- 7.2.2.1 Need to monitor hypothermia in surgical patients to support market growth

- TABLE 32 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR POSTOPERATIVE CARE UNITS, BY REGION, 2021-2028 (USD MILLION)

- 7.2.3 PREOPERATIVE CARE UNITS

- 7.2.3.1 Prewarming in preoperative care fails to eliminate initial fall in body temperature

- TABLE 33 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR PREOPERATIVE CARE UNITS, BY REGION, 2021-2028 (USD MILLION)

- 7.3 ACUTE CARE

- TABLE 34 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR ACUTE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 35 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR ACUTE CARE, BY REGION, 2021-2028 (USD MILLION)

- 7.3.1 INTENSIVE CARE UNITS

- 7.3.1.1 Growing prevalence of life-threatening diseases to drive market

- TABLE 36 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR INTENSIVE CARE UNITS, BY REGION, 2021-2028 (USD MILLION)

- 7.3.2 EMERGENCY ROOMS

- 7.3.2.1 Rising number of ER visits to drive growth

- TABLE 37 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR EMERGENCY ROOMS, BY REGION, 2021-2028 (USD MILLION)

- 7.3.3 CORONARY CARE UNITS

- 7.3.3.1 Risks associated with use of intravascular temperature management to hamper market growth

- TABLE 38 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR CORONARY CARE UNITS, BY REGION, 2021-2028 (USD MILLION)

- 7.3.4 BURN CENTERS

- 7.3.4.1 Severe effects of hypothermia on burn victims necessitate temperature management measures

- TABLE 39 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR BURN CENTERS, BY REGION, 2021-2028 (USD MILLION)

- 7.3.5 NEUROLOGICAL CARE UNITS

- 7.3.5.1 Growing prevalence of Alzheimer's, stroke, and other neurological diseases to drive market

- TABLE 40 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR NEUROLOGICAL CARE UNITS, BY REGION, 2021-2028 (USD MILLION)

- 7.3.6 CATH LABS

- 7.3.6.1 High incidence of cardiac arrests to support demand for temperature management

- TABLE 41 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR CATH LABS, BY REGION, 2021-2028 (USD MILLION)

- 7.4 NEWBORN CARE

- TABLE 42 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR NEWBORN CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 43 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR NEWBORN CARE, BY REGION, 2021-2028 (USD MILLION)

- 7.4.1 DELIVERY SUITES

- 7.4.1.1 High birth rate in developing regions to support market growth

- TABLE 44 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR DELIVERY SUITES, BY REGION, 2021-2028 (USD MILLION)

- 7.4.2 NEONATAL INTENSIVE CARE UNITS

- 7.4.2.1 High neonatal death rates increased demand for temperature management systems

- TABLE 45 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR NEONATAL INTENSIVE CARE UNITS, BY REGION, 2021-2028 (USD MILLION)

- 7.4.3 POSTNATAL WARDS

- 7.4.3.1 Increasing recommendations for postnatal care to support market growth

- TABLE 46 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR POSTNATAL WARDS, BY REGION, 2021-2028 (USD MILLION)

- 7.5 OTHER APPLICATIONS

- TABLE 47 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR OTHER APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

8 TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY MEDICAL SPECIALTY

- 8.1 INTRODUCTION

- TABLE 48 TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY MEDICAL SPECIALTY, 2021-2028 (USD MILLION)

- 8.2 GENERAL SURGERY

- 8.2.1 LARGE NUMBER OF GENERAL SURGERIES PERFORMED TO DRIVE MARKET

- TABLE 49 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR GENERAL SURGERY, BY REGION, 2021-2028 (USD MILLION)

- 8.3 CARDIOLOGY

- 8.3.1 HIGH INCIDENCE OF CARDIAC ARRESTS TO PROPEL MARKET

- TABLE 50 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR CARDIOLOGY, BY REGION, 2021-2028 (USD MILLION)

- 8.4 NEUROLOGY

- 8.4.1 INCREASING INCIDENCE OF TRAUMATIC BRAIN INJURY, STROKE, AND TUMOR TO SUPPORT MARKET GROWTH

- TABLE 51 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR NEUROLOGY, BY REGION, 2021-2028 (USD MILLION)

- 8.5 PEDIATRICS

- 8.5.1 INCREASING FOCUS ON REDUCING INFANT MORTALITY TO SUPPORT MARKET GROWTH

- TABLE 52 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR PEDIATRICS, BY REGION, 2021-2028 (USD MILLION)

- 8.6 THORACIC SURGERY

- 8.6.1 INCREASING PREVALENCE OF LUNG DISEASES TO DRIVE ADOPTION

- TABLE 53 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR THORACIC SURGERY, BY REGION, 2021-2028 (USD MILLION)

- 8.7 ORTHOPEDIC SURGERY

- 8.7.1 GROWING NUMBER OF KNEE AND HIP REPLACEMENT PROCEDURES TO PROPEL MARKET

- TABLE 54 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR ORTHOPEDIC SURGERY, BY REGION, 2021-2028 (USD MILLION)

- 8.8 OTHER MEDICAL SPECIALTIES

- TABLE 55 TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR OTHER MEDICAL SPECIALTIES, BY REGION, 2021-2028 (USD MILLION)

9 TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 56 TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 28 NORTH AMERICA: TEMPERATURE MANAGEMENT SYSTEMS MARKET SNAPSHOT

- TABLE 57 NORTH AMERICA: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: PATIENT WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: SURFACE WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: PATIENT COOLING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR PERIOPERATIVE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR ACUTE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR NEWBORN CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY MEDICAL SPECIALTY, 2021-2028 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 Large volume of surgical procedures to support market growth

- TABLE 67 US: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 68 US: PATIENT WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 69 US: SURFACE WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 70 US: PATIENT COOLING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 71 US: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 72 US: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR PERIOPERATIVE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 73 US: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR ACUTE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 74 US: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR NEWBORN CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 75 US: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY MEDICAL SPECIALTY, 2021-2028 (USD MILLION)

- 9.2.2 CANADA

- 9.2.2.1 Increasing incidence of various chronic diseases to drive market

- TABLE 76 CANADA: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 77 CANADA: PATIENT WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 78 CANADA: SURFACE WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 79 CANADA: PATIENT COOLING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 80 CANADA: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 81 CANADA: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR PERIOPERATIVE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 82 CANADA: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR ACUTE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 83 CANADA: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR NEWBORN CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 84 CANADA: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY MEDICAL SPECIALTY, 2021-2028 (USD MILLION)

- 9.3 EUROPE

- TABLE 85 EUROPE: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 86 EUROPE: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 87 EUROPE: PATIENT WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 88 EUROPE: SURFACE WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 89 EUROPE: PATIENT COOLING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 90 EUROPE: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 91 EUROPE: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR PERIOPERATIVE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 92 EUROPE: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR ACUTE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 93 EUROPE: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR NEWBORN CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 94 EUROPE: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY MEDICAL SPECIALTY, 2021-2028 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 High demand for patient warming devices for perioperative care to drive market

- TABLE 95 GERMANY: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 96 GERMANY: PATIENT WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 97 GERMANY: SURFACE WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 98 GERMANY: PATIENT COOLING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 99 GERMANY: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 100 GERMANY: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR PERIOPERATIVE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 101 GERMANY: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR ACUTE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 102 GERMANY: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR NEWBORN CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 103 GERMANY: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY MEDICAL SPECIALTY, 2021-2028 (USD MILLION)

- 9.3.2 UK

- 9.3.2.1 Large number of inpatient surgical procedures to drive market

- TABLE 104 UK: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 105 UK: PATIENT WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 106 UK: SURFACE WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 107 UK: PATIENT COOLING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 108 UK: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 109 UK: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR PERIOPERATIVE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 110 UK: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR ACUTE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 111 UK: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR NEWBORN CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 112 UK: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY MEDICAL SPECIALTY, 2021-2028 (USD MILLION)

- 9.3.3 FRANCE

- 9.3.3.1 Strong healthcare system to support market growth

- TABLE 113 FRANCE: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 114 FRANCE: PATIENT WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 115 FRANCE: SURFACE WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 116 FRANCE: PATIENT COOLING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 117 FRANCE: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 118 FRANCE: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR PERIOPERATIVE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 119 FRANCE: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR ACUTE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 120 FRANCE: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR NEWBORN CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 121 FRANCE: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY MEDICAL SPECIALTY, 2021-2028 (USD MILLION)

- 9.3.4 REST OF EUROPE

- TABLE 122 REST OF EUROPE: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 123 REST OF EUROPE: PATIENT WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 124 REST OF EUROPE: SURFACE WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 125 REST OF EUROPE: PATIENT COOLING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 126 REST OF EUROPE: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 127 REST OF EUROPE: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR PERIOPERATIVE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 128 REST OF EUROPE: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR ACUTE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 129 REST OF EUROPE: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR NEWBORN CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 130 REST OF EUROPE: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY MEDICAL SPECIALTY, 2021-2028 (USD MILLION)

- 9.4 ASIA PACIFIC

- FIGURE 29 ASIA PACIFIC: TEMPERATURE MANAGEMENT SYSTEMS MARKET SNAPSHOT

- TABLE 131 ASIA PACIFIC: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: PATIENT WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: SURFACE WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: PATIENT COOLING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 136 ASIA PACIFIC: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 137 ASIA PACIFIC: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR PERIOPERATIVE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 138 ASIA PACIFIC: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR ACUTE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 139 ASIA PACIFIC: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR NEWBORN CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 140 ASIA PACIFIC: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY MEDICAL SPECIALTY, 2021-2028 (USD MILLION)

- 9.4.1 CHINA

- 9.4.1.1 Increasing disposable income of middle-class population to support market growth

- TABLE 141 CHINA: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 142 CHINA: PATIENT WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 143 CHINA: SURFACE WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 144 CHINA: PATIENT COOLING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 145 CHINA: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 146 CHINA: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR PERIOPERATIVE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 147 CHINA: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR ACUTE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 148 CHINA: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR NEWBORN CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 149 CHINA: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY MEDICAL SPECIALTY, 2021-2028 (USD MILLION)

- 9.4.2 JAPAN

- 9.4.2.1 Rapidly increasing geriatric population to drive market

- TABLE 150 JAPAN: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 151 JAPAN: PATIENT WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 152 JAPAN: SURFACE WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 153 JAPAN: PATIENT COOLING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 154 JAPAN: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 155 JAPAN: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR PERIOPERATIVE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 156 JAPAN: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR ACUTE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 157 JAPAN: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR NEWBORN CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 158 JAPAN: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY MEDICAL SPECIALTY, 2021-2028 (USD MILLION)

- 9.4.3 INDIA

- 9.4.3.1 Growing target patient population to support market growth

- TABLE 159 INDIA: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 160 INDIA: PATIENT WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 161 INDIA: SURFACE WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 162 INDIA: PATIENT COOLING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 163 INDIA: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 164 INDIA: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR PERIOPERATIVE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 165 INDIA: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR ACUTE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 166 INDIA: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR NEWBORN CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 167 INDIA: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY MEDICAL SPECIALTY, 2021-2028 (USD MILLION)

- 9.4.4 REST OF ASIA PACIFIC

- TABLE 168 REST OF ASIA PACIFIC: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: PATIENT WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: SURFACE WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: PATIENT COOLING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR PERIOPERATIVE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 174 REST OF ASIA PACIFIC: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR ACUTE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR NEWBORN CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY MEDICAL SPECIALTY, 2021-2028 (USD MILLION)

- 9.5 REST OF THE WORLD

- TABLE 177 REST OF THE WORLD: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 178 REST OF THE WORLD: PATIENT WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 179 REST OF THE WORLD: SURFACE WARMING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 180 REST OF THE WORLD: PATIENT COOLING SYSTEMS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 181 REST OF THE WORLD: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 182 REST OF THE WORLD: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR PERIOPERATIVE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 183 REST OF THE WORLD: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR ACUTE CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 184 REST OF THE WORLD: TEMPERATURE MANAGEMENT SYSTEMS MARKET FOR NEWBORN CARE, BY FACILITY, 2021-2028 (USD MILLION)

- TABLE 185 REST OF THE WORLD: TEMPERATURE MANAGEMENT SYSTEMS MARKET, BY MEDICAL SPECIALTY, 2021-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 186 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN TEMPERATURE MANAGEMENT SYSTEMS MARKET

- 10.3 REVENUE SHARE ANALYSIS

- FIGURE 30 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN TEMPERATURE MANAGEMENT SYSTEMS MARKET, 2018-2022 (USD MILLION)

- 10.4 MARKET SHARE ANALYSIS

- FIGURE 31 TEMPERATURE MANAGEMENT SYSTEMS MARKET SHARE ANALYSIS, 2022

- TABLE 187 TEMPERATURE MANAGEMENT SYSTEMS MARKET: DEGREE OF COMPETITION

- 10.5 COMPANY EVALUATION MATRIX

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 32 TEMPERATURE MANAGEMENT SYSTEMS MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS (2022)

- 10.6 SME/STARTUP EVALUATION MATRIX

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 33 TEMPERATURE MANAGEMENT SYSTEMS MARKET: SME/STARTUP EVALUATION MATRIX (2022)

- 10.7 COMPETITIVE BENCHMARKING

- TABLE 188 TEMPERATURE MANAGEMENT SYSTEMS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 10.8 COMPANY FOOTPRINT

- TABLE 189 OVERALL FOOTPRINT ANALYSIS OF COMPANIES

- TABLE 190 PRODUCT FOOTPRINT ANALYSIS OF COMPANIES

- TABLE 191 REGIONAL FOOTPRINT ANALYSIS OF COMPANIES

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- TABLE 192 KEY PRODUCT LAUNCHES, JANUARY 2020-SEPTEMBER 2023

- 10.9.2 DEALS

- TABLE 193 KEY DEALS, JANUARY 2020-SEPTEMBER 2023

- 10.9.3 OTHER DEVELOPMENTS

- TABLE 194 OTHER KEY DEVELOPMENTS, JANUARY 2020-SEPTEMBER 2023

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 11.1.1 3M COMPANY

- TABLE 195 3M COMPANY: BUSINESS OVERVIEW

- FIGURE 34 3M COMPANY: COMPANY SNAPSHOT (2022)

- 11.1.2 GE HEALTHCARE

- TABLE 196 GE HEALTHCARE: BUSINESS OVERVIEW

- FIGURE 35 GE HEALTHCARE: COMPANY SNAPSHOT (2022)

- 11.1.3 DRAGERWERK AG & CO. KGAA

- TABLE 197 DRAGERWERK AG & CO. KGAA: BUSINESS OVERVIEW

- FIGURE 36 DRAGERWERK AG & CO. KGAA: COMPANY SNAPSHOT (2022)

- 11.1.4 ECOLAB

- TABLE 198 ECOLAB: BUSINESS OVERVIEW

- FIGURE 37 ECOLAB: COMPANY SNAPSHOT (2022)

- 11.1.5 ASAHI KASEI CORPORATION (ZOLL MEDICAL CORPORATION)

- TABLE 199 ASAHI KASEI CORPORATION: BUSINESS OVERVIEW

- FIGURE 38 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT (2022)

- 11.1.6 BECTON, DICKINSON AND COMPANY

- TABLE 200 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

- FIGURE 39 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2022)

- 11.1.7 ICU MEDICAL, INC.

- TABLE 201 ICU MEDICAL, INC.: BUSINESS OVERVIEW

- FIGURE 40 ICU MEDICAL, INC.: COMPANY SNAPSHOT (2022)

- 11.1.8 GENTHERM INCORPORATED

- TABLE 202 GENTHERM INCORPORATED: BUSINESS OVERVIEW

- FIGURE 41 GENTHERM INCORPORATED: COMPANY SNAPSHOT (2022)

- 11.1.9 INSPIRATION HEALTHCARE GROUP PLC

- TABLE 203 INSPIRATION HEALTHCARE GROUP PLC: BUSINESS OVERVIEW

- FIGURE 42 INSPIRATION HEALTHCARE GROUP PLC: COMPANY SNAPSHOT (2023)

- 11.1.10 MEDTRONIC PLC

- TABLE 204 MEDTRONIC PLC: BUSINESS OVERVIEW

- FIGURE 43 MEDTRONIC PLC: COMPANY SNAPSHOT (2022)

- 11.1.11 STRYKER CORPORATION

- TABLE 205 STRYKER CORPORATION: BUSINESS OVERVIEW

- FIGURE 44 STRYKER CORPORATION: COMPANY SNAPSHOT (2022)

- 11.1.12 THE SURGICAL COMPANY

- TABLE 206 THE SURGICAL COMPANY: BUSINESS OVERVIEW

- 11.2 OTHER PLAYERS

- 11.2.1 ADROIT MEDICAL SYSTEMS

- 11.2.2 ATTUNE MEDICAL

- 11.2.3 AUGUSTINE SURGICAL, INC.

- 11.2.4 BELMONT MEDICAL TECHNOLOGIES

- 11.2.5 BIEGLER GMBH

- 11.2.6 ENCOMPASS GROUP, LLC

- 11.2.7 ENTHERMICS, INC.

- 11.2.8 HIRTZ & CO. KG.

- 11.2.9 ISTANBUL MEDIKAL LTD.

- 11.2.10 LIFE RECOVERY SYSTEMS

- 11.2.11 MEDCARE VISIONS GMBH

- 11.2.12 TAHATAKSI ALC

- 11.2.13 BEIJING ETERNAL MEDICAL TECHNOLOGY CO., LTD.

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS