|

|

市場調査レポート

商品コード

1374763

高高度疑似衛星の世界市場:プラットフォーム別、用途別、エンドユーザー別、地域別-2028年までの予測High Altitude Pseudo Satellite Market by Platform (Airships, Balloons and UAVs), Application (Communication, Earth Observation & Remote Sensing, Others (ISR, Monitoring, Search and Rescue, Navigation)), End User and Region - Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 高高度疑似衛星の世界市場:プラットフォーム別、用途別、エンドユーザー別、地域別-2028年までの予測 |

|

出版日: 2023年10月31日

発行: MarketsandMarkets

ページ情報: 英文 151 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント | プラットフォーム別、用途別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

高高度擬似衛星の市場規模は、2023年に8,500万米ドルと評価され、2023年から2028年までのCAGRは17.2%になるとみられており、2028年には1億8900万米ドルに達すると予測されています。

これらの衛星は、インターネットや通信サービスを提供するための通信や接続性、気象パターンや自然災害、環境変化などの地球観測など、さまざまなニーズを満たすシステムであるため、大きな需要が見られています。これらのプラットフォームは、様々な産業や用途に費用対効果が高く柔軟なソリューションを提供します。

飛行船は、Lighter Than Air(LTA)カテゴリー内の高高度疑似衛星に分類され、横方向の軌道管理を可能にする技術を持っています。飛行船は、卓越風を利用し、気圧平衡を維持するために、飛行高度60,000フィート(FL600)を上回ったり、下回ったりする能力を有しています。フランスを拠点とするタレス・アレニア社のストラトバスは、監視能力を拡大し、特定の場所の上空に長時間留まる能力を提供することで、情報・監視・偵察(ISR)活動を支援し、フランス軍の防衛能力を強化しています。

エンドユーザー別では、商業用HAPSは幅広い用途があります。HAPSは農業モニタリングに利用され、広大な農地の作物、土壌状態、気象パターンを監視します。この収集されたデータは、農家が十分な情報に基づいた意思決定を行うのを助け、農作業を最適化し、結果として作物の収量と資源効率を高めることを可能にします。さらに、HAPSは信号の精度と信頼性を向上させることで、GPSやナビゲーションシステムの強化にも貢献しています。また、都市計画やインフラ整備のための高解像度3D地図の作成にも役立っています。

この地域の優位性は、主に米国に所在する大手企業の存在に起因しています。これらの業界大手は、高高度疑似衛星市場で使用される技術を革新・強化するため、研究開発に一貫して投資を行っています。このような進歩は衛星打ち上げコストの削減をもたらし、高高度疑似衛星をより経済的に実行可能なものにしています。その結果、高高度疑似衛星の手頃な価格と信頼性の向上が、北米地域における同市場の成長を後押しする極めて重要な要因となっています。

当レポートでは、世界の高高度疑似衛星市場について調査し、プラットフォーム別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向と混乱

- 生態系マッピング

- ポーターのファイブフォース分析

- 価格分析

- 規制状況

- 使用事例分析

- 2023年~2024年の主要な会議とイベント

- 主要な利害関係者と購入基準

第6章 業界の動向

- イントロダクション

- 技術動向

- メガトレンドの影響

- サプライチェーン分析

- イノベーションと特許登録

- 高高度擬似衛星市場のロードマップ

第7章 高高度擬似衛星市場、プラットフォーム別

- イントロダクション

- 飛行船

- バルーン

- 無人航空機(UAVS)

第8章 高高度擬似衛星市場、用途別

- イントロダクション

- 通信

- 地球観測とリモートセンシング

- その他

第9章 高高度擬似衛星市場、エンドユーザー別

- イントロダクション

- 商業

- 政府と防衛

第10章 高高度擬似衛星市場、地域別

- イントロダクション

- 景気後退の影響分析

- 北米

- 欧州

- アジア太平洋

- その他の地域

第11章 競合情勢

- イントロダクション

- 主要参入企業が採用した戦略、2020年~2023年

- 市場ランキング分析、2022年

- 企業評価マトリックス、2022年

- 新興企業/中小企業評価マトリックス、2022年

- 競合シナリオ

第12章 企業プロファイル

- 主要参入企業

- AIRBUS

- AEROVIRONMENT, INC.

- PRISMATIC LTD.

- THALES

- HAPSMOBILE INC.

- AURORA FLIGHT SCIENCES

- HEMERIA

- AEROSTAR

- UAVOS INC

- CAPGEMINI

- SIERRA NEVADA CORPORATION

- SWIFT ENGINEERING

- SKYDWELLER

- SCEYE INC

- STRATOSPHERIC PLATFORMS LTD.

- その他の企業

- COMPOSITE TECHNOLOGY TEAM

- ILC DOVER LP

- KRAUS HAMDANI AEROSPACE, INC.

- ATLAS

- ELSON SPACE ENGINEERING

- AVEALTO

- STRATOSYST S.R.O.

- AIRSTAR AEROSPACE

- TAO TRANS ATMOSPHERIC OPERATIONS

- ZERO 2 INFINITY S.L.

第13章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million) |

| Segments | By Platform, Application, End User and Region |

| Regions covered | North America, Europe, Asia Pacific, and Rest of the World |

The high altitude pseudo satellite market is valued at USD 85 million in 2023 and is projected to reach USD 189 million by 2028, at a CAGR of 17.2% from 2023 to 2028. The demand for these satellites has witnessed significant demand as these systems meets a range of needs, including communication and connectivity to provide internet and communication services, Earth observation, including weather patterns, natural disasters, and environmental changes. These platforms provide cost-effective and flexible solutions for various industries and applications.

"Airships platform to be fastest growing segment for the High altitude pseudo satellite market during the forecast period."

Airships, categorized as High Altitude Pseudo Satellites within the Lighter Than Air (LTA) category, possess technology enabling them to manage their lateral trajectory. They have the capability to operate above or below the 60,000 ft flying altitude (FL600) to harness prevailing winds and maintain pressure equilibrium. Thales Alenia's Stratobus, based in France, provides an extended range of surveillance capabilities and the capacity to remain suspended over specific locations for extended periods, supporting intelligence, surveillance, and reconnaissance (ISR) operations, thereby enhancing the defense capabilities of the French military..

"Other (ISR, Monitoring, Search and Rescue, Navigation) Application Segment To Grow At Highest CAGR of 22.1% during the forecast period."

Other segment of High-Altitude Pseudo Satellites (HAPS) offer a diverse range of applications that extend beyond merely delivering internet connectivity. They are increasingly finding utility in various sectors, including Intelligence, Surveillance, and Reconnaissance (ISR), monitoring, search and rescue, as well as navigation.

For example, the PHASA 35 HAPS developed by Prismatic Ltd (UK) serves as a consistent and stable platform suitable for tasks such as monitoring, maritime surveillance, agricultural monitoring, communication, and security applications. The ApusDuo HAPS, created by UAVOS Inc. (US), is well-suited for maritime surveillance, border patrol missions, communication services, and forest fire detection and monitoring..

"Commercial end user segment to have higher growth for the High altitude pseudo satellite market during the forecast period."

Based on end user, the market segmented into commercial, and government & defense. Commercial HAPS have a wide range of applications. They can be utilized for agricultural monitoring, which involves overseeing crops, soil conditions, and weather patterns across extensive farmlands. This collected data aids farmers in making well-informed decisions, allowing them to optimize their agricultural practices and consequently increase crop yields and resource efficiency. Additionally, HAPS contribute to the enhancement of GPS and navigation systems by improving the precision and dependability of signals. They are also valuable in the creation of high-resolution 3D maps for urban planning and infrastructure development.

"North America is anticipated to dominate the High Altitude Pseudo Satellite market in 2023"

The regional supremacy can be attributed to the presence of major companies, mainly situated in the United States. These industry leaders consistently channel investments into research and development to innovate and enhance technologies used in the High Altitude Pseudo Satellite market. Such advancements have resulted in cost reduction for satellite launches, making High Altitude Pseudo Satellites more economically viable. Consequently, the increased affordability and reliability of High Altitude Pseudo Satellites are pivotal factors propelling the growth of this market within the North American region.

Breakdown of primaries

The research incorporates input from a wide spectrum of industry professionals, encompassing component suppliers, Tier1 firms, and OEMs. The composition of the primary sources is outlined as follows:

- By Company Type: Tier 1-35%; Tier 2-45%; and Tier 3-20%

- By Designation: C Level-35%; Directors-25%; and Others-40%

- By Region: North America-45%; Europe-15%; Asia Pacific-25%; and Rest of the World -15%

AeroVironment, Inc. (US), Prismatic Ltd. (UK), Airbus (France), Thales Group (France), and SoftBank Group Corp. (Japan) are some of the leading players operating in the High altitude pseudo satellite market.

Research Coverage

The study covers the high altitude pseudo satellite market across various segments and subsegments. It aims at estimating the size and growth potential of this market across different segments based on platform, application, end user and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key benefits of buying this report: This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall high altitude pseudo satellite market and its subsegments. The report covers the entire ecosystem of the high altitude pseudo satellite industry. It will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers and several factors, such as Russia-Ukraine Conflict, defense expenditure, and others that could contribute to an increase in high altitude pseudo satellite market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the high altitude pseudo satellite market

- Market Development: Comprehensive information about lucrative markets - the report analyses the high altitude pseudo satellite market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in high altitude pseudo satellite market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like AeroVironment, Inc. (US), Prismatic Ltd. (UK), Airbus (France), Thales Group (France), SoftBank Group Corp. (Japan) in the High altitude pseudo satellite market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- FIGURE 4 KEY INDUSTRY INSIGHTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

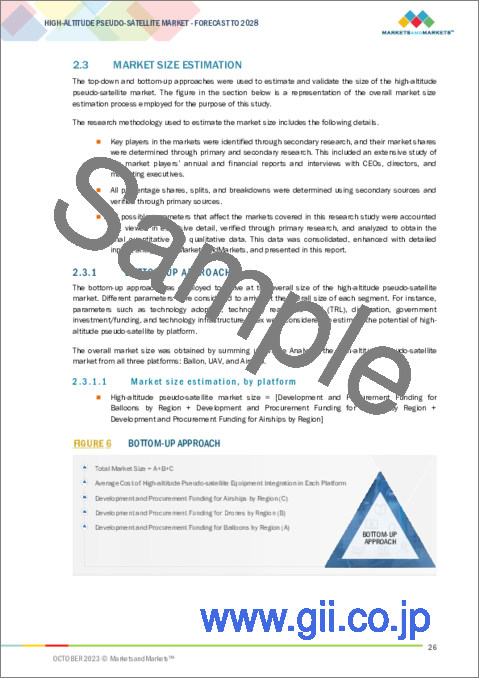

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation, by platform

- FIGURE 6 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- FIGURE 9 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 10 UAVS TO LEAD HIGH-ALTITUDE PSEUDO-SATELLITE MARKET DURING FORECAST PERIOD

- FIGURE 11 EARTH OBSERVATION & REMOTE SENSING TO SURPASS COMMUNICATION SEGMENT DURING FORECAST PERIOD

- FIGURE 12 COMMERCIAL SEGMENT TO HOLD LARGEST MARKET SHARE IN 2028

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HIGH-ALTITUDE PSEUDO-SATELLITE MARKET

- FIGURE 13 INCREASED GOVERNMENT FUNDING FOR INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE CAPABILITIES

- 4.2 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET, BY PLATFORM

- FIGURE 14 AIRSHIPS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- 4.3 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET, BY APPLICATION

- FIGURE 15 OTHERS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- 4.4 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET, BY END USER

- FIGURE 16 COMMERCIAL SEGMENT TO SECURE LEADING MARKET POSITION DURING FORECAST PERIOD

- 4.5 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET, BY REGION

- FIGURE 17 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Need for global connectivity

- 5.2.1.2 Rising adoption of composite materials in high-altitude pseudo-satellites

- 5.2.1.3 Increasing use of high-altitude pseudo-satellites in emergency services

- 5.2.1.4 Versatility of payload integration techniques

- TABLE 2 KEY INFORMATION ON HIGH-ALTITUDE PSEUDO-SATELLITES

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited durability due to extreme atmospheric conditions

- 5.2.2.2 Stringent government regulations for deployment of satellite communication systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Need for high-speed communication networks in remote areas

- 5.2.3.2 Growing scientific exploration through high-altitude pseudo-satellites

- 5.2.4 CHALLENGES

- 5.2.4.1 Issues pertaining to energy storage

- 5.2.4.2 Limitations associated with thermal management

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 19 VALUE CHAIN ANALYSIS

- 5.4 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 20 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.5 ECOSYSTEM MAPPING

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 START-UPS

- 5.5.4 END USERS

- FIGURE 21 ECOSYSTEM MAPPING

- TABLE 3 ROLE OF COMPANIES IN ECOSYSTEM

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 IMPACT OF PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 PRICING ANALYSIS

- TABLE 5 AVERAGE SELLING PRICE OF HIGH-ALTITUDE PSEUDO-SATELLITES, BY PLATFORM, 2022 (USD MILLION/UNIT)

- 5.8 REGULATORY LANDSCAPE

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9 USE CASE ANALYSIS

- 5.9.1 ENVIRONMENTAL MONITORING AND DISASTER MANAGEMENT

- 5.9.2 COMMUNICATION AND CONNECTIVITY

- 5.9.3 SURVEILLANCE AND SECURITY

- 5.10 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 10 KEY CONFERENCES AND EVENTS, 2023-2024

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 STAKEHOLDERS IN BUYING PROCESS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING HIGH-ALTITUDE PSEUDO-SATELLITES, BY END USER

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING HIGH-ALTITUDE PSEUDO-SATELLITES, BY END USER (%)

- 5.11.2 BUYING CRITERIA

- FIGURE 24 KEY BUYING CRITERIA FOR HIGH-ALTITUDE PSEUDO-SATELLITES, BY END USER

- TABLE 12 KEY BUYING CRITERIA FOR HIGH-ALTITUDE PSEUDO-SATELLITES, BY END USER

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 IMPROVED SOLAR PANELS

- 6.2.2 GUST LOAD ALLEVIATION

- 6.2.3 LITHIUM-ION BATTERIES

- 6.2.4 ADVANCED COMMUNICATION SYSTEMS

- 6.2.5 HYDROGEN FUEL CELLS

- 6.2.6 MINIATURIZED PAYLOADS

- 6.2.7 AUTONOMOUS OPERATIONS AND ARTIFICIAL INTELLIGENCE

- 6.2.8 USE OF ADVANCED MATERIALS

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 REMOTE CONNECTIVITY THROUGH HIGH-ALTITUDE PSEUDO-SATELLITES

- 6.3.2 INTERNET OF THINGS

- 6.3.3 BEAMFORMING

- 6.4 SUPPLY CHAIN ANALYSIS

- FIGURE 25 SUPPLY CHAIN ANALYSIS

- 6.5 INNOVATIONS AND PATENT REGISTRATIONS

- TABLE 13 KEY PATENTS

- 6.6 ROADMAP OF HIGH-ALTITUDE PSEUDO-SATELLITE MARKET

- FIGURE 26 DEVELOPMENT POTENTIAL OF HIGH-ALTITUDE PSEUDO-SATELLITES, 1983-2030

7 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET, BY PLATFORM

- 7.1 INTRODUCTION

- FIGURE 27 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET, BY PLATFORM, 2023-2028

- TABLE 14 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET, BY PLATFORM, 2020-2022 (USD MILLION)

- TABLE 15 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 7.2 AIRSHIPS

- 7.2.1 BOOST IN SURVEILLANCE AND RECONNAISSANCE ACTIVITIES TO DRIVE GROWTH

- 7.3 BALLOONS

- 7.3.1 OPTIMIZED EFFICIENCY AND SECURITY TO DRIVE GROWTH

- 7.4 UNMANNED AERIAL VEHICLES (UAVS)

- 7.4.1 HIGH PAYLOAD CARRYING CAPACITY TO DRIVE GROWTH

8 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 28 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET, BY APPLICATION, 2023-2028

- TABLE 16 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET, BY APPLICATION, 2020-2022 (USD MILLION)

- TABLE 17 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.2 COMMUNICATION

- 8.2.1 HIGH DEMAND FOR INTERNET FROM RURAL AND REMOTE AREAS TO DRIVE GROWTH

- 8.3 EARTH OBSERVATION & REMOTE SENSING

- 8.3.1 NEED FOR REAL-TIME IMAGERY IN DISASTER RESPONSE TO DRIVE GROWTH

- 8.4 OTHERS

9 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET, BY END USER

- 9.1 INTRODUCTION

- FIGURE 29 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET, BY END USER, 2023-2028

- TABLE 18 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET, BY END USER, 2020-2022 (USD MILLION)

- TABLE 19 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET, BY END USER, 2023-2028 (USD MILLION)

- 9.2 COMMERCIAL

- 9.2.1 RISE IN URBAN PLANNING AND INFRASTRUCTURE DEVELOPMENT TO DRIVE GROWTH

- 9.3 GOVERNMENT & DEFENSE

- 9.3.1 PREDOMINANT USE IN SECURITY AND SURVEILLANCE MISSIONS TO DRIVE GROWTH

10 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 30 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET, BY REGION, 2023-2028

- TABLE 20 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 21 HIGH-ALTITUDE PSEUDO-SATELLITE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 RECESSION IMPACT ANALYSIS

- TABLE 22 RECESSION IMPACT ANALYSIS

- 10.3 NORTH AMERICA

- 10.3.1 PESTLE ANALYSIS

- 10.3.2 US

- 10.3.2.1 Advancements in satellite technology to drive growth

- 10.3.3 CANADA

- 10.3.3.1 Increased government investments in high-altitude pseudo-satellite infrastructure to drive growth

- 10.4 EUROPE

- 10.4.1 PESTLE ANALYSIS

- 10.4.2 UK

- 10.4.2.1 Large-scale presence of key players to drive growth

- 10.4.3 FRANCE

- 10.4.3.1 Booming high-altitude technologies to drive growth

- 10.4.4 GERMANY

- 10.4.4.1 Rapid development of new satellite technologies to drive growth

- 10.4.5 ITALY

- 10.4.5.1 Widespread applications of high-altitude pseudo-satellites to drive growth

- 10.4.6 SPAIN

- 10.4.6.1 Boost in tracking, monitoring, and surveillance activities to drive growth

- 10.4.7 REST OF EUROPE

- 10.5 ASIA PACIFIC

- 10.5.1 PESTLE ANALYSIS

- 10.5.2 CHINA

- 10.5.2.1 Rising popularity of satellite broadband to drive growth

- 10.5.3 INDIA

- 10.5.3.1 Government initiatives to improve defense capabilities to drive growth

- 10.5.4 JAPAN

- 10.5.4.1 Expanding rural connectivity to drive growth

- 10.5.5 SOUTH KOREA

- 10.5.5.1 Financial and regulatory support for development of high-altitude pseudo-satellites to drive growth

- 10.5.6 AUSTRALIA

- 10.5.6.1 Increasing investments in development of satellite Internet to drive growth

- 10.6 REST OF THE WORLD

- 10.6.1 PESTLE ANALYSIS

- 10.6.2 LATIN AMERICA

- 10.6.2.1 Need for advanced high-altitude pseudo-satellites to drive growth

- 10.6.3 MIDDLE EAST & AFRICA

- 10.6.3.1 Increasing demand for high-speed Internet to drive growth

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2023

- TABLE 23 STRATEGIES ADOPTED BY KEY PLAYERS, 2020-2023

- 11.3 MARKET RANKING ANALYSIS, 2022

- FIGURE 31 MARKET RANKING OF KEY PLAYERS, 2022

- 11.4 COMPANY EVALUATION MATRIX, 2022

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- FIGURE 32 COMPANY EVALUATION MATRIX, 2022

- 11.4.5 COMPANY FOOTPRINT

- TABLE 24 COMPANY FOOTPRINT

- TABLE 25 END USER FOOTPRINT

- TABLE 26 PLATFORM FOOTPRINT

- TABLE 27 REGION FOOTPRINT

- 11.5 START-UP/SME EVALUATION MATRIX, 2022

- 11.5.1 PROGRESSIVE COMPANIES

- 11.5.2 RESPONSIVE COMPANIES

- 11.5.3 DYNAMIC COMPANIES

- 11.5.4 STARTING BLOCKS

- FIGURE 33 START-UP/SME EVALUATION MATRIX, 2022

- 11.5.5 COMPETITIVE BENCHMARKING

- TABLE 28 KEY START-UPS/SMES

- TABLE 29 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- 11.6 COMPETITIVE SCENARIO

- 11.6.1 MARKET EVALUATION FRAMEWORK

- 11.6.2 PRODUCT LAUNCHES

- TABLE 30 PRODUCT LAUNCHES, 2020-2023

- 11.6.3 DEALS

- TABLE 31 DEALS, 2020-2023

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths, Strategic choices, and Weaknesses and Competitive threats)**

- 12.1.1 AIRBUS

- TABLE 32 AIRBUS: COMPANY OVERVIEW

- FIGURE 34 AIRBUS: COMPANY SNAPSHOT

- TABLE 33 AIRBUS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 34 AIRBUS: PRODUCT LAUNCHES

- TABLE 35 AIRBUS: DEALS

- 12.1.2 AEROVIRONMENT, INC.

- TABLE 36 AEROVIRONMENT, INC.: COMPANY OVERVIEW

- FIGURE 35 AEROVIRONMENT, INC.: COMPANY SNAPSHOT

- TABLE 37 AEROVIRONMENT, INC.: PRODUCT/SOLUTIONS/SERVICES OFFERED

- TABLE 38 AEROVIRONMENT, INC.: PRODUCT LAUNCHES

- 12.1.3 PRISMATIC LTD.

- TABLE 39 PRISMATIC LTD.: COMPANY OVERVIEW

- FIGURE 36 PRISMATIC LTD.: COMPANY SNAPSHOT

- TABLE 40 PRISMATIC LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 41 PRISMATIC LTD.: PRODUCT LAUNCHES

- 12.1.4 THALES

- TABLE 42 THALES: COMPANY OVERVIEW

- FIGURE 37 THALES: COMPANY SNAPSHOT

- TABLE 43 THALES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 44 THALES: DEALS

- 12.1.5 HAPSMOBILE INC.

- TABLE 45 HAPSMOBILE INC.: COMPANY OVERVIEW

- TABLE 46 HAPSMOBILE INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 47 HAPSMOBILE INC.: PRODUCT LAUNCHES

- TABLE 48 HAPSMOBILE INC.: DEALS

- 12.1.6 AURORA FLIGHT SCIENCES

- TABLE 49 AURORA FLIGHT SCIENCES: COMPANY OVERVIEW

- FIGURE 38 AURORA FLIGHT SCIENCES: COMPANY SNAPSHOT

- TABLE 50 AURORA FLIGHT SCIENCES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.7 HEMERIA

- TABLE 51 HEMERIA: COMPANY OVERVIEW

- TABLE 52 HEMERIA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.8 AEROSTAR

- TABLE 53 AEROSTAR: COMPANY OVERVIEW

- TABLE 54 AEROSTAR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 55 AEROSTAR: PRODUCT LAUNCHES

- TABLE 56 AEROSTAR: DEALS

- 12.1.9 UAVOS INC

- TABLE 57 UAVOS INC: COMPANY OVERVIEW

- TABLE 58 UAVOS INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 59 UAVOS INC: PRODUCT LAUNCHES

- 12.1.10 CAPGEMINI

- TABLE 60 CAPGEMINI: COMPANY OVERVIEW

- FIGURE 39 CAPGEMINI: COMPANY SNAPSHOT

- TABLE 61 CAPGEMINI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 62 CAPGEMINI: PRODUCT LAUNCHES

- 12.1.11 SIERRA NEVADA CORPORATION

- TABLE 63 SIERRA NEVADA CORPORATION: COMPANY OVERVIEW

- TABLE 64 SIERRA NEVADA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 65 SIERRA NEVADA CORPORATION: PRODUCT LAUNCHES

- TABLE 66 SIERRA NEVADA CORPORATION: DEALS

- 12.1.12 SWIFT ENGINEERING

- TABLE 67 SWIFT ENGINEERING: COMPANY OVERVIEW

- TABLE 68 SWIFT ENGINEERING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 69 SWIFT ENGINEERING: PRODUCT LAUNCHES

- TABLE 70 SWIFT ENGINEERING: DEALS

- 12.1.13 SKYDWELLER

- TABLE 71 SKYDWELLER: COMPANY OVERVIEW

- TABLE 72 SKYDWELLER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 73 SKYDWELLER: PRODUCT LAUNCHES

- TABLE 74 SKYDWELLER: DEALS

- 12.1.14 SCEYE INC

- TABLE 75 SCEYE INC: COMPANY OVERVIEW

- TABLE 76 SCEYE INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 77 SCEYE INC: PRODUCT LAUNCHES

- TABLE 78 SCEYE INC: DEALS

- 12.1.15 STRATOSPHERIC PLATFORMS LTD.

- TABLE 79 STRATOSPHERIC PLATFORMS LTD.: COMPANY OVERVIEW

- TABLE 80 STRATOSPHERIC PLATFORMS LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 81 STRATOSPHERIC PLATFORMS LTD.: PRODUCT LAUNCHES

- TABLE 82 STRATOSPHERIC PLATFORMS LTD.: DEALS

- 12.2 OTHER PLAYERS

- 12.2.1 COMPOSITE TECHNOLOGY TEAM

- TABLE 83 COMPOSITE TECHNOLOGY TEAM: COMPANY OVERVIEW

- 12.2.2 ILC DOVER LP

- TABLE 84 ILC DOVER LP: COMPANY OVERVIEW

- 12.2.3 KRAUS HAMDANI AEROSPACE, INC.

- TABLE 85 KRAUS HAMDANI AEROSPACE, INC.: COMPANY OVERVIEW

- 12.2.4 ATLAS

- TABLE 86 ATLAS: COMPANY OVERVIEW

- 12.2.5 ELSON SPACE ENGINEERING

- TABLE 87 ELSON SPACE ENGINEERING: COMPANY OVERVIEW

- 12.2.6 AVEALTO

- TABLE 88 AVEALTO: COMPANY OVERVIEW

- 12.2.7 STRATOSYST S.R.O.

- TABLE 89 STRATOSYST S.R.O.: COMPANY OVERVIEW

- 12.2.8 AIRSTAR AEROSPACE

- TABLE 90 AIRSTAR AEROSPACE: COMPANY OVERVIEW

- 12.2.9 TAO TRANS ATMOSPHERIC OPERATIONS

- TABLE 91 TAO TRANS ATMOSPHERIC OPERATIONS: COMPANY OVERVIEW

- 12.2.10 ZERO 2 INFINITY S.L.

- TABLE 92 ZERO 2 INFINITY S.L.: COMPANY OVERVIEW

- *Details on Business overview, Products/Solutions/Services offered, Recent developments, MnM view, Key strengths, Strategic choices, and Weaknesses and Competitive threats might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS