|

|

市場調査レポート

商品コード

1374761

人工知能(AI)ツールキットの世界市場:オファリング別、技術別、業界別、地域別-2028年までの予測Artificial Intelligence (AI) Toolkit Market by Offering (Hardware, Software, Services), Technology (Natural Language Processing, Machine Learning), Vertical (BFSI, Retail & eCommerce, Healthcare & Life Sciences) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 人工知能(AI)ツールキットの世界市場:オファリング別、技術別、業界別、地域別-2028年までの予測 |

|

出版日: 2023年10月27日

発行: MarketsandMarkets

ページ情報: 英文 288 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2017年~2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023年~2028年 |

| 単位 | 金額(米ドル)10億米ドル |

| セグメント | オファリング別、技術別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

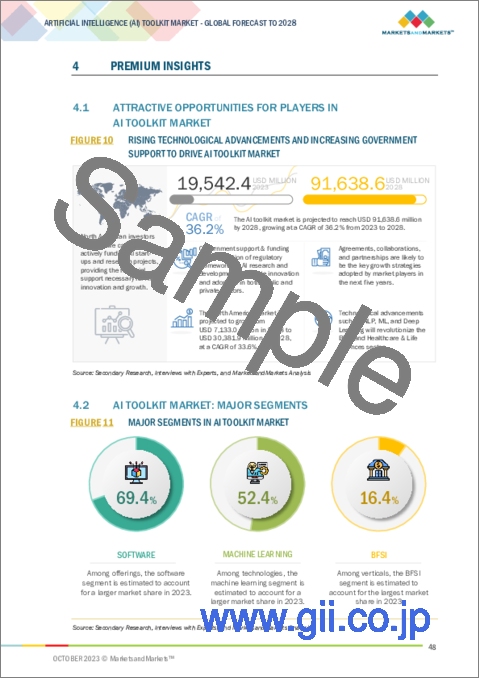

人工知能(AI)ツールキットの市場規模は、2023年に195億米ドルとなり、2028年には916億米ドルに達すると予測され、年間平均成長率(CAGR)は36.2%と見込まれています。

ニュース記事、マーケティング資料、ソーシャルメディアへの投稿を含むコンテンツを生成するAIツールキットは、AIツールキットの展望における重要な市場促進要因となっています。これらのツールキットは、高品質で文脈に関連したコンテンツの制作を大規模に自動化することで、業界全体のコンテンツ制作と配信に革命をもたらしています。これにより、コンテンツ開発が迅速化され、コストが削減され、コンテンツへのアクセシビリティが拡大します。さらに、AIが生成するコンテンツは、テキストベースの資料にとどまらず、AIが生成する音楽、ビデオ、画像、楽曲にまで広がっています。この多面的なアプローチは、クリエイティブな表現とマーケティング戦略に新たな地平を開き、アーティスト、コンテンツ制作者、企業が視聴者とつながるための新たな道を切り開く。品質と関連性を維持しながら多様なコンテンツ・ニーズに応えるAIツールキットの能力は、その採用を促進し、AIツールキット市場のこのセグメントにおける技術革新をさらに促進しています。

コンピュータビジョン分野は、予測期間中に最も速い成長率を記録すると予想されています。産業オートメーションにおけるコンピュータビジョンの活用は、AIツールキット市場の中心的な促進要因です。産業作業において、コンピュータビジョンは、ロボット組立、物体追跡、目視検査作業において極めて重要です。製造工程の精度と効率を高め、製品の品質を向上させ、エラーを減らすことができます。産業界が自動化とスマートな製造方法をますます受け入れるようになるにつれ、コンピュータ・ビジョン機能を組み込んだAIツールキットの需要が急増しています。これらのツールキットは、自動化プロセスへの高度なビジョンシステムの統合を容易にし、イノベーションを促進し、産業用AIツールキット市場の成長を促進します。

予測期間中に最大の市場規模を維持するBFSIセグメントAIツールキットは、銀行・金融サービス・保険(BFSI)セクターにおけるAIツールキット市場の牽引役として極めて重要です。AIツールキットはリアルタイムの不正検知に不可欠であり、金融機関は不正行為を迅速に特定し、軽減することができます。これは、顧客資産と金融機関の財務の健全性の両方を保護する上で最も重要です。AIのパワーを活用することで、これらのツールキットは膨大なデータセットを継続的に分析し、疑わしいパターンやトランザクションを特定し、即座に対処できるようにします。金融詐欺の蔓延がエスカレートするにつれ、詐欺検出におけるAIツールキットの需要は急増し続けており、BFSI分野におけるAIツールキット市場の成長の中心的な要因となっています。

農業に特化したAIツールキットは、農業分野に革命を起こすことで、アジア太平洋のAIツールキット市場を牽引します。これらのツールキットは、精密農業、農場管理、スマート農業技術の開発の進歩に役立っています。この地域は人口が多いため、持続可能な農法への需要が高まっています。AIツールキットは精密農業に力を与え、作物の収量、効率的な資源利用、環境の持続可能性を向上させる。これらのツールは、土壌状態、天候、作物の健康状態に関する貴重な洞察を提供し、データ主導の意思決定を可能にし、資源の浪費を最小限に抑えます。その結果、採用が増加し、食糧安全保障に対応し、アジア太平洋のAIツールキット市場全体を後押ししています。

当レポートでは、世界の人工知能(AI)ツールキット市場について調査し、オファリング別、技術別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 業界の動向

第6章 AIツールキット市場、オファリング別

- イントロダクション

- ソフトウェア

- ハードウェア

- サービス

第7章 AIツールキット市場、技術別

- イントロダクション

- 自然言語処理

- 機械学習

- コンピュータビジョン

- ロボットプロセスオートメーション

第8章 AIツールキット市場、業界別

- イントロダクション

- BFSI

- 小売と電子商取引

- ヘルスケアとライフサイエンス

- 製造業

- 通信

- ITとITES

- メディアとエンターテイメント

- エネルギーと公共事業

- 政府と防衛

- 自動車、輸送、物流

- その他

第9章 AIツールキット市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第10章 競合情勢

- イントロダクション

- 主要参入企業が採用した戦略

- 主要企業の過去の収益分析

- 主要企業の市場シェア分析

- 主要企業の企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合シナリオと動向

- AIツールキット製品のベンチマーク

- 主要なAIツールキットベンダーの評価と財務指標

第11章 企業プロファイル

- 主要参入企業

- NVIDIA CORPORATION

- META

- MICROSOFT

- IBM

- THALES GROUP

- INTEL

- ORACLE

- ADOBE

- SALESFORCE

- H20.AI

- ALTERYX

- KNIME

- DATAROBOT

- ALTAIR

- ATTRI

- DETERMINED AI

- RASA

- OPENAI

- スタートアップ/中小企業

- JASPER

- SUPERANNOTATE

- OBVIOUSLY AI

- FIDDLER AI

- UNION.AI

- REGIE.AI

- SNORKEL AI

- LEVITY AI

第12章 隣接市場および関連市場

第13章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2017-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) Billion |

| Segments | By Offering (Hardware, Software, Services), Technology, Vertical, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. |

The AI toolkit market is estimated at USD 19.5 billion in 2023 to reach USD 91.6 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 36.2%. AI toolkits that generate content, including news articles, marketing materials, and social media posts, stand as a significant market driver in the AI toolkit landscape. These toolkits are revolutionizing content creation and distribution across industries by automating the production of high-quality, contextually relevant content at scale. This expedites content development, reduces costs, and expands content accessibility. Furthermore, AI-generated content extends beyond text-based materials to include AI-generated music, videos, images, and songs. This multifaceted approach opens new horizons for creative expression and marketing strategies, unlocking novel avenues for artists, content creators, and businesses to connect with their audiences. The ability of AI toolkits to cater to diverse content needs while maintaining quality and relevance is propelling their adoption, further driving innovation in this segment of the AI toolkit market.

The computer vision segment is expected to register the fastest growth rate during the forecast period. The utilization of computer vision in industrial automation is a central driver for the AI toolkit market. In industrial operations, computer vision is pivotal in robotic assembly, object tracking, and visual inspection tasks. It enables precision and efficiency in manufacturing processes, enhancing product quality and reducing errors. As industries increasingly embrace automation and smart manufacturing practices, the demand for AI toolkits incorporating computer vision capabilities is surging. These toolkits facilitate the integration of advanced vision systems into automated processes, fostering innovation and driving the growth of the AI toolkit market for industrial applications.

The BFSI segment to hold the largest market size during the forecast period AI toolkits are pivotal in driving the AI toolkit market within the Banking, Financial Services, and Insurance (BFSI) sector. They are indispensable for real-time fraud detection, enabling financial institutions to swiftly identify and mitigate fraudulent activities. This is of paramount importance in safeguarding both customer assets and the institution's financial integrity. By harnessing the power of AI, these toolkits continuously analyze vast datasets to identify suspicious patterns and transactions, allowing for immediate action. As the prevalence of financial fraud escalates, the demand for AI toolkits in fraud detection continues to surge, making it a central driver in the growth of the AI toolkit market in the BFSI sector.

Asia Pacific highest growth rate during the forecast period.

Agriculture-focused AI toolkits drive the Asia Pacific AI toolkit market by revolutionizing the agriculture sector. These toolkits are instrumental in the advancement of precision agriculture, farm management, and the development of smart farming technologies. With the region's substantial population, there's a growing demand for sustainable farming practices. AI toolkits empower precision agriculture, enhancing crop yields, efficient resource utilization, and environmental sustainability. These tools provide valuable insights into soil conditions, weather, and crop health, enabling data-driven decisions and minimizing resource wastage. As a result, adoption is increasing, addressing food security, and propelling the overall AI toolkit market in Asia Pacific.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level -35%, D-level - 25%, and Others - 40%

- By Region: North America - 30%, Europe - 30%, Asia Pacific - 25%, Middle East & Africa - 10%, and Latin America- 5%.

The major players in the AI Toolkit market include Microsoft (US), Google (US), IBM (US), Oracle (US), Thales Group (France), Salesforce (US), Intel (US), Adobe (US), Meta Platforms (US), AWS (US), NVIDIA Corporation (US), H2O.ai (US), Alteryx (US), Altair (US), KNIME (Switzerland), DataRobot (US), Jasper (US), Rasa (US), SuperAnnotate (US), OpenAI (US), Obviously AI (US), Fiddler AI (US), Determined AI (US), Snorkel AI (US), Levity AI (Germany), Union AI (US), Attri AI (US), Regie.ai (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, enhancements, and acquisitions to expand their AI toolkit market footprint.

Research Coverage

The market study covers the AI toolkit market size across different segments. It aims at estimating the market size and the growth potential across different segments, including offering (hardware, software, services), application (natural language processing, machine learning, computer vision, deep learning, robotic process automation, and other applications (speech recognition, anomaly detection, and predictive maintenance) ), vertical (BFSI; retail & eCommerce; healthcare & life sciences; media & entertainment; aerospace & defense; IT & ITeS; telecom; real estate; manufacturing; automotive, transportation, & logistics; and other verticals (education, agriculture, government, and energy & utilities), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the global AI Toolkit market's revenue numbers and subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (evolution of language model concept in AI and growing adoption of AutoML to train high-quality models), restraints (lack of standardization in AI toolkit market and lack of skilled AI professionals), opportunities (growth in data generated by IoT devices creating new opportunities and market penetration of AI toolkit vendors into healthcare and financial services sector), and challenges (concerns related to AI transparency, explainability, and biases and data privacy and security concerns) influencing the growth of the AI toolkit market. Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product and service launches in the AI toolkit market. Market Development: Comprehensive information about lucrative markets - the report analyses the AI Toolkit market across various regions. Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the AI Toolkit market. Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players Microsoft (US), Google (US), IBM (US), Oracle (US), Thales Group (France), Salesforce (US), Intel (US), Adobe (US), Meta Platforms (US), AWS (US), NVIDIA Corporation (US), H2O.ai (US), Alteryx (US), Altair (US), KNIME (Switzerland), DataRobot (US), Jasper (US), Rasa (US), SuperAnnotate (US), OpenAI (US), Obviously AI (US), Fiddler AI (US), Determined AI (US), Snorkel AI (US), Levity AI (Germany), Union AI (US), Attri AI (US), Regie.ai (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS CONSIDERED

- 1.3.3 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2020-2022

- 1.6 STAKEHOLDERS

- 1.7 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakdown of primary profiles

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key insights from industry experts

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE OF OFFERINGS IN AI TOOLKIT MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND-SIDE)

- FIGURE 5 AI TOOLKIT MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 RISK ASSESSMENT

- TABLE 2 RISK ASSESSMENT

- 2.5 RESEARCH ASSUMPTIONS

- TABLE 3 RESEARCH ASSUMPTIONS

- 2.6 STUDY LIMITATIONS

- 2.7 IMPLICATIONS OF RECESSION ON AI TOOLKIT MARKET

3 EXECUTIVE SUMMARY

- FIGURE 8 AI TOOLKIT MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 9 AI TOOLKIT MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AI TOOLKIT MARKET

- FIGURE 10 RISING TECHNOLOGICAL ADVANCEMENTS AND INCREASING GOVERNMENT SUPPORT TO DRIVE AI TOOLKIT MARKET

- 4.2 AI TOOLKIT MARKET: MAJOR SEGMENTS

- FIGURE 11 MAJOR SEGMENTS IN AI TOOLKIT MARKET

- 4.3 AI TOOLKIT MARKET, BY OFFERING

- FIGURE 12 SOFTWARE SEGMENT TO LEAD MARKET IN 2023

- 4.4 AI TOOLKIT MARKET, BY SERVICE

- FIGURE 13 MANAGED SERVICES SEGMENT TO ACHIEVE HIGHER GROWTH DURING FORECAST PERIOD

- 4.5 AI TOOLKIT MARKET, BY VERTICAL

- FIGURE 14 BFSI SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.6 NORTH AMERICA: AI TOOLKIT MARKET, BY COUNTRY AND KEY VERTICAL

- FIGURE 15 US AND BFSI SEGMENT TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 AI TOOLKIT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Evolution of language model concept in AI

- 5.2.1.2 Growing adoption of AutoML to train high-quality models

- 5.2.1.3 Need to accelerate end-to-end ML and data science pipelines using optimized deep learning frameworks

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of skilled AI professionals

- 5.2.2.2 Lack of standardization in AI toolkit market

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth in data generated by IoT devices

- 5.2.3.2 Market penetration of AI toolkit vendors into healthcare and financial services sectors

- 5.2.4 CHALLENGES

- 5.2.4.1 Concerns related to AI transparency and explainability

- 5.2.4.2 Security and privacy concerns

- 5.3 INDUSTRY TRENDS

- 5.3.1 EVOLUTION OF ARTIFICIAL INTELLIGENCE TECHNOLOGY

- 5.3.1.1 Milestones of Artificial Intelligence

- FIGURE 17 MILESTONES OF ARTIFICIAL INTELLIGENCE

- 5.3.2 ECOSYSTEM ANALYSIS

- FIGURE 18 ECOSYSTEM MAP

- TABLE 4 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- 5.3.3 CASE STUDY ANALYSIS

- 5.3.3.1 CarMax deployed Microsoft's Azure OpenAI Service to ensure data security and compliance

- 5.3.3.2 Trifork employed NVIDIA's DeepStream and Jetson Xavier AGX to optimize baggage handling at airports

- 5.3.3.3 Obviously AI offered its accurate revenue predictions to provide organizations with valuable insights for better decision-making

- 5.3.3.4 2X implemented Jasper's multifaceted functionality to offer personalized experience to content team

- 5.3.3.5 Obviously AI's precise sales predictions empowered organizations to allocate resources and make data-driven choices

- 5.3.4 VALUE CHAIN ANALYSIS

- FIGURE 19 VALUE CHAIN ANALYSIS

- 5.3.5 TARIFF AND REGULATORY LANDSCAPE

- 5.3.5.1 Tariff related to electronic integrated circuits and microassemblies

- TABLE 5 TARIFF RELATED TO ELECTRONIC INTEGRATED CIRCUITS AS PROCESSORS AND CONTROLLERS

- 5.3.5.2 Regulatory bodies, government agencies, and other organizations

- TABLE 6 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.5.2.1 North America

- 5.3.5.2.1.1 US

- 5.3.5.2.1.2 Canada

- 5.3.5.2.2 Europe

- 5.3.5.2.3 Asia Pacific

- 5.3.5.2.3.1 South Korea

- 5.3.5.2.3.2 China

- 5.3.5.2.3.3 India

- 5.3.5.2.4 Middle East & Africa

- 5.3.5.2.4.1 UAE

- 5.3.5.2.4.2 KSA

- 5.3.5.2.4.3 Bahrain

- 5.3.5.2.5 Latin America

- 5.3.5.2.5.1 Brazil

- 5.3.5.2.5.2 Mexico

- 5.3.5.2.1 North America

- 5.3.6 PRICING ANALYSIS

- 5.3.6.1 Average selling price trends for key players, by billing cycle

- TABLE 10 AVERAGE SELLING PRICE TRENDS FOR KEY PLAYERS, BY BILLING CYCLE (USD)

- 5.3.6.2 Indicative pricing analysis for key players

- TABLE 11 INDICATIVE PRICING ANALYSIS FOR KEY PLAYERS, BY AI TOOLKIT SOFTWARE (USD)

- 5.3.7 PATENT ANALYSIS

- 5.3.7.1 Methodology

- TABLE 12 PATENTS FILED, 2021-2023

- 5.3.7.2 Innovation and patent applications

- FIGURE 20 NUMBER OF PATENTS GRANTED ANNUALLY, 2021-2023

- 5.3.7.2.1 Top applicants

- FIGURE 21 TOP TEN PATENT APPLICANTS WITH HIGHEST NUMBER OF APPLICATIONS, 2021-2023

- TABLE 13 PATENTS GRANTED IN AI TOOLKIT MARKET, 2021-2023

- 5.3.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 14 IMPACT OF PORTER'S FIVE FORCES ON AI TOOLKIT MARKET

- 5.3.8.1 Threat of new entrants

- 5.3.8.2 Threat of substitutes

- 5.3.8.3 Bargaining power of buyers

- 5.3.8.4 Bargaining power of suppliers

- 5.3.8.5 Intensity of competitive rivalry

- 5.3.9 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.3.9.1 Key stakeholders in buying process

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- 5.3.9.2 Buying criteria

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 16 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.3.10 KEY CONFERENCES & EVENTS

- TABLE 17 LIST OF CONFERENCES & EVENTS, 2023-2024

- 5.3.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 24 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.3.12 HS CODES: ELECTRONIC INTEGRATED CIRCUITS AND MICROASSEMBLIES (8542)

- 5.3.12.1 Export scenario for HS Code: 8542

- FIGURE 25 EXPORT VALUE OF ELECTRONIC INTEGRATED CIRCUITS AND MICROASSEMBLIES, BY KEY COUNTRY, 2015-2022 (USD BILLION)

- 5.3.12.2 Import scenario for HS Code: 8542

- FIGURE 26 IMPORT VALUE OF ELECTRONIC INTEGRATED CIRCUITS AND MICROASSEMBLIES, BY KEY COUNTRY, 2015-2022 (USD BILLION)

- 5.3.13 BEST PRACTICES IN AI TOOLKIT MARKET

- 5.3.13.1 User-friendly interfaces

- 5.3.13.2 Comprehensive documentation

- 5.3.13.3 Training and support

- 5.3.13.4 Sample code and use cases

- 5.3.13.5 Data privacy and security

- 5.3.14 AI TOOLKIT MARKET: CURRENT AND EMERGING BUSINESS MODELS

- 5.3.14.1 Open-source software

- 5.3.14.2 Subscription-based services

- 5.3.14.3 Pay-per-use or consumption-based pricing

- 5.3.14.4 Enterprise licensing

- 5.3.14.5 Platform-as-a-Service

- 5.3.14.6 AI-as-a-Service

- 5.3.15 AI TOOLKIT TOOLS, FRAMEWORKS, AND TECHNIQUES

- 5.3.15.1 AI toolkit tools

- 5.3.15.1.1 Data labeling tools

- 5.3.15.1.2 Data preparation tools

- 5.3.15.1.3 Automated machine learning tools

- 5.3.15.2 AI toolkit frameworks

- 5.3.15.2.1 TensorFlow

- 5.3.15.2.2 PyTorch

- 5.3.15.2.3 Keras

- 5.3.15.2.4 Scikit-learn

- 5.3.15.3 AI toolkit techniques

- 5.3.15.3.1 Supervised learning

- 5.3.15.3.2 Unsupervised learning

- 5.3.15.3.3 Reinforcement learning

- 5.3.15.1 AI toolkit tools

- 5.3.16 TECHNOLOGY ANALYSIS

- 5.3.16.1 Key technologies

- 5.3.16.1.1 Machine Learning

- 5.3.16.1.2 Deep Learning

- 5.3.16.1.3 Natural Language Processing (NLP)

- 5.3.16.1.4 Generative Models

- 5.3.16.2 Complementary technologies

- 5.3.16.2.1 Big Data Technologies

- 5.3.16.2.2 Cloud Computing

- 5.3.16.3 Adjacent technologies

- 5.3.16.3.1 Edge Computing

- 5.3.16.3.2 Blockchain

- 5.3.16.1 Key technologies

- 5.3.17 FUTURE LANDSCAPE OF AI TOOLKIT MARKET

- 5.3.17.1 AI toolkit technology roadmap till 2030

- 5.3.17.1.1 Short-term roadmap (2023-2025)

- 5.3.17.1.2 Mid-term roadmap (2026-2028)

- 5.3.17.1.3 Long-term roadmap (2029-2030)

- 5.3.17.1 AI toolkit technology roadmap till 2030

- 5.3.18 ETHICS OF AI TOOLKIT DEVELOPMENT

- 5.3.18.1 Fairness and biases

- 5.3.18.2 Privacy and security

- 5.3.18.3 Accountability and transparency

- 5.3.1 EVOLUTION OF ARTIFICIAL INTELLIGENCE TECHNOLOGY

6 AI TOOLKIT MARKET, BY OFFERING

- 6.1 INTRODUCTION

- FIGURE 27 SERVICES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 6.1.1 OFFERINGS: AI TOOLKIT MARKET DRIVERS

- TABLE 18 AI TOOLKIT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 19 AI TOOLKIT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 SOFTWARE

- 6.2.1 NEED FOR CUSTOMIZABLE AND USER-FRIENDLY SOFTWARE-BASED SOLUTIONS TO DRIVE MARKET

- TABLE 20 SOFTWARE: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 21 SOFTWARE: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 HARDWARE

- TABLE 22 HARDWARE: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 23 HARDWARE: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 24 AI TOOLKIT MARKET, BY HARDWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 25 AI TOOLKIT MARKET, BY HARDWARE TYPE, 2023-2028 (USD MILLION)

- 6.3.1 PROCESSORS

- 6.3.1.1 Demand for high-end processors to support growth of AI toolkit market

- TABLE 26 PROCESSORS: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 27 PROCESSORS: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 ACCELERATORS

- 6.3.2.1 Focus on enhancing performance and efficiency of AI applications to drive need for accelerators

- TABLE 28 ACCELERATORS: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 29 ACCELERATORS: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2.2 Graphics processing units (GPUs)

- 6.3.2.3 Tensor processing units

- 6.3.2.4 Field programmable processing units

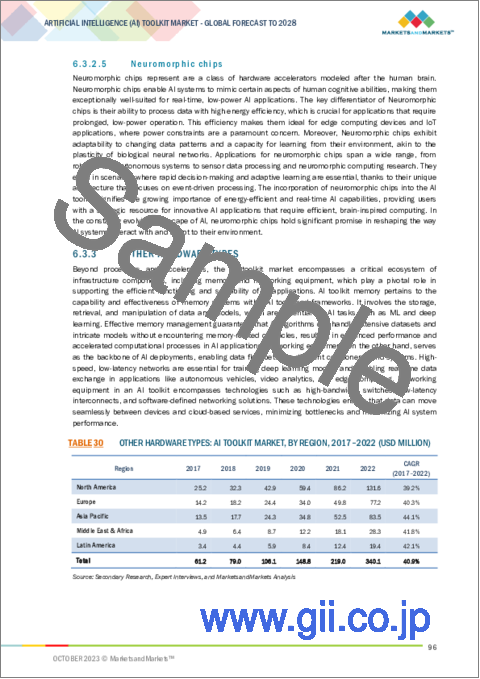

- 6.3.2.5 Neuromorphic chips

- 6.3.3 OTHER HARDWARE TYPES

- TABLE 30 OTHER HARDWARE TYPES: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 31 OTHER HARDWARE TYPES: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4 SERVICES

- TABLE 32 SERVICES: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 33 SERVICES: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 34 AI TOOLKIT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 35 AI TOOLKIT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 6.4.1 PROFESSIONAL SERVICES

- TABLE 36 PROFESSIONAL SERVICES: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 37 PROFESSIONAL SERVICES: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 38 AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 39 AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- 6.4.1.1 Consulting

- 6.4.1.1.1 Demand for expert guidance and strategic direction to drive need for consulting services

- 6.4.1.1 Consulting

- TABLE 40 CONSULTING: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 41 CONSULTING: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.1.2 Deployment & integration

- 6.4.1.2.1 Rising emphasis on effective implementation and utilization of AI solutions to spur growth of deployment and integration services

- 6.4.1.2 Deployment & integration

- TABLE 42 DEPLOYMENT & INTEGRATION: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 43 DEPLOYMENT & INTEGRATION: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.1.3 Support & maintenance

- 6.4.1.3.1 Support and maintenance services ensure continued functionality, reliability, and effectiveness of AI systems and solutions

- 6.4.1.3 Support & maintenance

- TABLE 44 SUPPORT & MAINTENANCE: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 45 SUPPORT & MAINTENANCE: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4.2 MANAGED SERVICES

- 6.4.2.1 Focus on establishing nimble and agile approach to AI implementation to drive growth of managed services

- TABLE 46 MANAGED SERVICES: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 47 MANAGED SERVICES: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

7 AI TOOLKIT MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- FIGURE 28 COMPUTER VISION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 7.1.1 TECHNOLOGIES: AI TOOLKIT MARKET DRIVERS

- TABLE 48 AI TOOLKIT MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 49 AI TOOLKIT MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 7.2 NATURAL LANGUAGE PROCESSING

- 7.2.1 NATURAL LANGUAGE PROCESSING TOOLS FACILITATE INTERACTION BETWEEN COMPUTERS AND HUMAN LANGUAGE

- TABLE 50 NATURAL LANGUAGE PROCESSING: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 51 NATURAL LANGUAGE PROCESSING: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 MACHINE LEARNING

- 7.3.1 NEED TO FACILITATE PREDICTIVE ANALYTICS AND DATA-DRIVEN DECISION-MAKING TO DRIVE MARKET

- TABLE 52 MACHINE LEARNING: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 53 MACHINE LEARNING: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 COMPUTER VISION

- 7.4.1 COMPUTER VISION TOOLS ENABLE MACHINES TO INTERPRET AND ANALYZE IMAGES AND VIDEOS

- TABLE 54 COMPUTER VISION: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 55 COMPUTER VISION: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 ROBOTIC PROCESS AUTOMATION

- 7.5.1 NEED FOR EFFECTIVE DECISION-MAKING PROCESSES IN EXECUTION OF REPETITIVE AND RULE-BASED TASKS TO SPUR GROWTH

- TABLE 56 ROBOTIC PROCESS AUTOMATION: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 57 ROBOTIC PROCESS AUTOMATION: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

8 AI TOOLKIT MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- FIGURE 29 HEALTHCARE & LIFE SCIENCES SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 8.1.1 VERTICALS: AI TOOLKIT MARKET DRIVERS

- TABLE 58 AI TOOLKIT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 59 AI TOOLKIT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.2 BFSI

- 8.2.1 GROWTH OF FRAUDULENT ACTIVITIES IN BFSI SECTOR TO DRIVE DEMAND FOR AI TOOLKITS

- 8.2.2 USE CASES

- 8.2.2.1 Fraud detection & prevention

- 8.2.2.2 Risk assessment

- TABLE 60 BFSI: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 61 BFSI: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 RETAIL & ECOMMERCE

- 8.3.1 AI HELPS TRACK SALES AND PROCESSING DATA TO FORMULATE STRATEGIES IN RETAIL & ECOMMERCE SECTOR

- 8.3.2 USE CASES

- 8.3.2.1 Pricing optimization

- 8.3.2.2 Visual search

- TABLE 62 RETAIL & ECOMMERCE: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 63 RETAIL & ECOMMERCE: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 HEALTHCARE & LIFE SCIENCES

- 8.4.1 AI TOOLKITS OFFER ROBUST ARSENAL OF TOOLS AND TECHNOLOGIES THAT RESHAPE DELIVERY OF HEALTHCARE SERVICES

- 8.4.2 USE CASES

- 8.4.2.1 Medical imaging analysis

- 8.4.2.2 Drug discovery and development

- TABLE 64 HEALTHCARE & LIFE SCIENCES: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 65 HEALTHCARE & LIFE SCIENCES: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 MANUFACTURING

- 8.5.1 DEMAND FOR DEPLOYMENT OF AI-ENHANCED QUALITY CONTROL SYSTEMS IN MANUFACTURING SECTOR TO DRIVE POPULARITY OF AI TOOLKITS

- 8.5.2 USE CASES

- 8.5.2.1 Production scheduling

- 8.5.2.2 Product design and prototyping

- TABLE 66 MANUFACTURING: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 67 MANUFACTURING: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.6 TELECOM

- 8.6.1 AI-BASED AUTOMATED BILLING AND CHATBOTS TRANSFORM TRADITIONAL PROCESSES IN TELECOM SECTOR

- 8.6.2 USE CASES

- 8.6.2.1 Automated billing and invoicing

- 8.6.2.2 Network planning and expansion

- TABLE 68 TELECOM: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 69 TELECOM: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.7 IT & ITES

- 8.7.1 AI-DRIVEN SOLUTIONS AUTONOMOUSLY MONITOR HEALTH OF SERVERS, NETWORKS, AND DATA CENTERS

- 8.7.2 USE CASES

- 8.7.2.1 IT asset management

- 8.7.2.2 Project management

- TABLE 70 IT & ITES: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 71 IT & ITES: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.8 MEDIA & ENTERTAINMENT

- 8.8.1 NEED FOR ACCURATE CONTENT RECOMMENDATION AND PERSONALIZATION TO BOOST ADOPTION OF AI TOOLKITS IN MEDIA & ENTERTAINMENT SECTOR

- 8.8.2 USE CASES

- 8.8.2.1 Content recommendation

- 8.8.2.2 Content moderation

- TABLE 72 MEDIA & ENTERTAINMENT: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 73 MEDIA & ENTERTAINMENT: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.9 ENERGY & UTILITIES

- 8.9.1 AI TOOLKITS HELP ENERGY AND UTILITY COMPANIES MEET DEMAND FOR SUSTAINABILITY AND OPERATIONAL EFFICIENCY

- 8.9.2 USE CASES

- 8.9.2.1 Energy storage optimization

- 8.9.2.2 Grid anomaly detection

- TABLE 74 ENERGY & UTILITIES: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 75 ENERGY & UTILITIES: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.10 GOVERNMENT & DEFENSE

- 8.10.1 INNOVATION, EFFICIENCY, AND SECURITY ACROSS AREAS OF PUBLIC ADMINISTRATION AND NATIONAL DEFENSE TO SPUR GROWTH

- 8.10.2 USE CASES

- 8.10.2.1 Document analysis

- 8.10.2.2 Government services automation

- TABLE 76 GOVERNMENT & DEFENSE: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 77 GOVERNMENT & DEFENSE: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.11 AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS

- 8.11.1 FOCUS ON ENHANCING EFFICIENCY, SAFETY, AND SUSTAINABILITY ACROSS SUPPLY CHAIN OPERATIONS TO PROPEL MARKET GROWTH

- 8.11.2 USE CASES

- 8.11.2.1 Driver assistance systems

- 8.11.2.2 Autonomous vehicles

- TABLE 78 AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 79 AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.12 OTHER VERTICALS

- 8.12.1 USE CASES

- 8.12.1.1 Automated grading

- 8.12.1.2 Safety compliance

- 8.12.1.3 Precision farming

- 8.12.1.4 Language translation

- TABLE 80 OTHER VERTICALS: AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 81 OTHER VERTICALS: AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.12.1 USE CASES

9 AI TOOLKIT MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 82 AI TOOLKIT MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 83 AI TOOLKIT MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: AI TOOLKIT MARKET DRIVERS

- 9.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 30 NORTH AMERICA: AI TOOLKIT MARKET SNAPSHOT

- TABLE 84 NORTH AMERICA: AI TOOLKIT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: AI TOOLKIT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: AI TOOLKIT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: AI TOOLKIT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 90 NORTH AMERICA: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 92 NORTH AMERICA: AI TOOLKIT MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: AI TOOLKIT MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 94 NORTH AMERICA: AI TOOLKIT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: AI TOOLKIT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 96 NORTH AMERICA: AI TOOLKIT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: AI TOOLKIT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.2.3 US

- 9.2.3.1 Robust growth of AI toolkit ecosystem to drive market

- TABLE 98 US: AI TOOLKIT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 99 US: AI TOOLKIT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 100 US: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 101 US: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 102 US: AI TOOLKIT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 103 US: AI TOOLKIT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 104 US: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 105 US: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 106 US: AI TOOLKIT MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 107 US: AI TOOLKIT MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 108 US: AI TOOLKIT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 109 US: AI TOOLKIT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.2.4 CANADA

- 9.2.4.1 Rising government initiatives to support rapidly evolving AI technology to facilitate market growth

- TABLE 110 CANADA: AI TOOLKIT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 111 CANADA: AI TOOLKIT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 112 CANADA: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 113 CANADA: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 114 CANADA: AI TOOLKIT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 115 CANADA: AI TOOLKIT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 116 CANADA: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 117 CANADA: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 118 CANADA: AI TOOLKIT MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 119 CANADA: AI TOOLKIT MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 120 CANADA: AI TOOLKIT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 121 CANADA: AI TOOLKIT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.3 EUROPE

- 9.3.1 EUROPE: AI TOOLKIT MARKET DRIVERS

- 9.3.2 EUROPE: RECESSION IMPACT

- TABLE 122 EUROPE: AI TOOLKIT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 123 EUROPE: AI TOOLKIT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 124 EUROPE: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 125 EUROPE: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 126 EUROPE: AI TOOLKIT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 127 EUROPE: AI TOOLKIT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 128 EUROPE: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 129 EUROPE: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 130 EUROPE: AI TOOLKIT MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 131 EUROPE: AI TOOLKIT MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 132 EUROPE: AI TOOLKIT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 133 EUROPE: AI TOOLKIT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 134 EUROPE: AI TOOLKIT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 135 EUROPE: AI TOOLKIT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Increasing government funding in artificial intelligence to drive market

- TABLE 136 UK: AI TOOLKIT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 137 UK: AI TOOLKIT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 138 UK: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 139 UK: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 140 UK: AI TOOLKIT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 141 UK: AI TOOLKIT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 142 UK: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 143 UK: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 144 UK: AI TOOLKIT MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 145 UK: AI TOOLKIT MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 146 UK: AI TOOLKIT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 147 UK: AI TOOLKIT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.3.4 GERMANY

- 9.3.4.1 Strong emphasis on innovation and technology to boost adoption of AI toolkits

- 9.3.5 FRANCE

- 9.3.5.1 Need for use of advanced solutions to deal with climate change and societal issues to drive popularity of advanced AI toolkits

- 9.3.6 ITALY

- 9.3.6.1 Rising government initiatives to boost development and competitiveness of AI to drive market

- TABLE 148 ITALY: AI TOOLKIT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 149 ITALY: AI TOOLKIT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 150 ITALY: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 151 ITALY: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 152 ITALY: AI TOOLKIT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 153 ITALY: AI TOOLKIT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 154 ITALY: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 155 ITALY: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 156 ITALY: AI TOOLKIT MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 157 ITALY: AI TOOLKIT MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 158 ITALY: AI TOOLKIT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 159 ITALY: AI TOOLKIT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.3.7 SPAIN

- 9.3.7.1 Growing deployment of AI technologies across public and private sectors to drive growth

- 9.3.8 NORDICS

- 9.3.8.1 Tech-savvy population and robust investment in technology companies to drive market

- 9.3.9 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: AI TOOLKIT MARKET DRIVERS

- 9.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 31 ASIA PACIFIC: AI TOOLKIT MARKET SNAPSHOT

- TABLE 160 ASIA PACIFIC: AI TOOLKIT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 161 ASIA PACIFIC: AI TOOLKIT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 162 ASIA PACIFIC: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 163 ASIA PACIFIC: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 164 ASIA PACIFIC: AI TOOLKIT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 165 ASIA PACIFIC: AI TOOLKIT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 166 ASIA PACIFIC: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 167 ASIA PACIFIC: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 168 ASIA PACIFIC: AI TOOLKIT MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 169 ASIA PACIFIC: AI TOOLKIT MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 170 ASIA PACIFIC: AI TOOLKIT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 171 ASIA PACIFIC: AI TOOLKIT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 172 ASIA PACIFIC: AI TOOLKIT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 173 ASIA PACIFIC: AI TOOLKIT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.4.3 CHINA

- 9.4.3.1 Need for nurturing domestic AI capabilities and promoting global expansion of Chinese tech companies to spur market

- TABLE 174 CHINA: AI TOOLKIT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 175 CHINA: AI TOOLKIT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 176 CHINA: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 177 CHINA: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 178 CHINA: AI TOOLKIT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 179 CHINA: AI TOOLKIT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 180 CHINA: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 181 CHINA: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 182 CHINA: AI TOOLKIT MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 183 CHINA: AI TOOLKIT MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 184 CHINA: AI TOOLKIT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 185 CHINA: AI TOOLKIT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.4.4 INDIA

- 9.4.4.1 Rising emphasis on driving innovation, enhancing productivity, and transforming industries to boost popularity of AI-driven toolkits

- 9.4.5 JAPAN

- 9.4.5.1 Need for adequate utilization of data-driven AI across domains to spur market

- 9.4.6 AUSTRALIA & NEW ZEALAND

- 9.4.6.1 Increasing application of AI technology in cybersecurity and farming to drive market

- 9.4.7 SOUTH KOREA

- 9.4.7.1 Emphasis on developing robust digital strategies to encourage market expansion

- 9.4.8 SOUTHEAST ASIA

- 9.4.8.1 Recognition of transformative potential of AI to boost use of AI toolkits

- 9.4.9 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: AI TOOLKIT MARKET DRIVERS

- 9.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 186 MIDDLE EAST & AFRICA: AI TOOLKIT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 187 MIDDLE EAST & AFRICA: AI TOOLKIT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 189 MIDDLE EAST & AFRICA: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: AI TOOLKIT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 191 MIDDLE EAST & AFRICA: AI TOOLKIT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 193 MIDDLE EAST & AFRICA: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: AI TOOLKIT MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 195 MIDDLE EAST & AFRICA: AI TOOLKIT MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 196 MIDDLE EAST & AFRICA: AI TOOLKIT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 197 MIDDLE EAST & AFRICA: AI TOOLKIT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 198 MIDDLE EAST & AFRICA: AI TOOLKIT MARKET, BY COUNTRY/REGION, 2017-2022 (USD MILLION)

- TABLE 199 MIDDLE EAST & AFRICA: AI TOOLKIT MARKET, BY COUNTRY/REGION, 2023-2028 (USD MILLION)

- 9.5.3 GCC COUNTRIES

- 9.5.3.1 Strong partnerships between public and private players to implement AI technology across crucial sectors to drive market

- TABLE 200 GCC COUNTRIES: AI TOOLKIT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 201 GCC COUNTRIES: AI TOOLKIT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 202 GCC COUNTRIES: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 203 GCC COUNTRIES: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 204 GCC COUNTRIES: AI TOOLKIT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 205 GCC COUNTRIES: AI TOOLKIT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 206 GCC COUNTRIES: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 207 GCC COUNTRIES: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 208 GCC COUNTRIES: AI TOOLKIT MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 209 GCC COUNTRIES: AI TOOLKIT MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 210 GCC COUNTRIES: AI TOOLKIT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 211 GCC COUNTRIES: AI TOOLKIT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.5.4 SOUTH AFRICA

- 9.5.4.1 Rising focus on enhancing global health equitably for betterment of healthcare to offer opportunities for players to leverage AI technology

- 9.5.5 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: AI TOOLKIT MARKET DRIVERS

- 9.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 212 LATIN AMERICA: AI TOOLKIT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 213 LATIN AMERICA: AI TOOLKIT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 214 LATIN AMERICA: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 215 LATIN AMERICA: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 216 LATIN AMERICA: AI TOOLKIT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 217 LATIN AMERICA: AI TOOLKIT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 218 LATIN AMERICA: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 219 LATIN AMERICA: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 220 LATIN AMERICA: AI TOOLKIT MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 221 LATIN AMERICA: AI TOOLKIT MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 222 LATIN AMERICA: AI TOOLKIT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 223 LATIN AMERICA: AI TOOLKIT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 224 LATIN AMERICA: AI TOOLKIT MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 225 LATIN AMERICA: AI TOOLKIT MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.6.3 BRAZIL

- 9.6.3.1 Implementation of AI and ML technologies in enterprise-level operations to foster market growth

- TABLE 226 BRAZIL: AI TOOLKIT MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 227 BRAZIL: AI TOOLKIT MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 228 BRAZIL: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2017-2022 (USD MILLION)

- TABLE 229 BRAZIL: AI TOOLKIT MARKET, BY HARDWARE TYPE, 2023-2028 (USD MILLION)

- TABLE 230 BRAZIL: AI TOOLKIT MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 231 BRAZIL: AI TOOLKIT MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 232 BRAZIL: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 233 BRAZIL: AI TOOLKIT MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 234 BRAZIL: AI TOOLKIT MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 235 BRAZIL: AI TOOLKIT MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 236 BRAZIL: AI TOOLKIT MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 237 BRAZIL: AI TOOLKIT MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.6.4 MEXICO

- 9.6.4.1 Special focus on governance, government services, and data infrastructure to boost popularity of AI-driven toolkits

- 9.6.5 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 238 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS

- FIGURE 32 HISTORICAL REVENUE ANALYSIS FOR KEY PLAYERS, 2020-2022 (USD MILLION)

- 10.4 MARKET SHARE ANALYSIS FOR KEY PLAYERS

- TABLE 239 AI TOOLKIT MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 10.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- FIGURE 33 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2023

- 10.5.5 COMPANY FOOTPRINT

- TABLE 240 COMPANY OVERALL FOOTPRINT

- TABLE 241 COMPANY FOOTPRINT, BY OFFERING

- TABLE 242 COMPANY FOOTPRINT, BY KEY VERTICAL

- TABLE 243 COMPANY FOOTPRINT, BY REGION

- 10.6 START-UP/SME EVALUATION MATRIX

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 34 START-UP/SME EVALUATION MATRIX, 2023

- 10.6.5 COMPETITIVE BENCHMARKING

- TABLE 244 DETAILED LIST OF START-UPS/SMES

- TABLE 245 COMPETITIVE BENCHMARKING OF START-UPS/SMES

- 10.7 COMPETITIVE SCENARIO AND TRENDS

- 10.7.1 PRODUCT LAUNCHES

- TABLE 246 AI TOOLKIT MARKET: PRODUCT LAUNCHES, 2021-2023

- 10.7.2 DEALS

- TABLE 247 AI TOOLKIT MARKET: DEALS, 2022-2023

- 10.8 AI TOOLKIT PRODUCT BENCHMARKING

- 10.8.1 PROMINENT AI TOOLKIT SOLUTIONS

- TABLE 248 COMPARATIVE ANALYSIS OF PROMINENT AI TOOLKITS

- 10.8.1.1 Salesforce Einstein

- 10.8.1.2 Vertex AI

- 10.8.1.3 Adobe Firefly

- 10.8.1.4 IBM Watsonx

- 10.8.1.5 Regie.ai

- 10.9 VALUATION AND FINANCIAL METRICS OF KEY AI TOOLKIT VENDORS

- FIGURE 35 VALUATION AND FINANCIAL METRICS OF KEY AI TOOLKIT VENDORS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 11.1.1 NVIDIA CORPORATION

- TABLE 249 NVIDIA CORPORATION: COMPANY OVERVIEW

- FIGURE 36 NVIDIA CORPORATION: COMPANY SNAPSHOT

- TABLE 250 NVIDIA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 251 NVIDIA CORPORATION: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 252 NVIDIA CORPORATION: DEALS

- 11.1.2 META

- TABLE 253 META: COMPANY OVERVIEW

- FIGURE 37 META: COMPANY SNAPSHOT

- TABLE 254 META: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 255 META: DEALS

- 11.1.3 MICROSOFT

- TABLE 256 MICROSOFT: COMPANY OVERVIEW

- FIGURE 38 MICROSOFT: COMPANY SNAPSHOT

- TABLE 257 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 259 MICROSOFT: DEALS

- 11.1.4 IBM

- TABLE 260 IBM: COMPANY OVERVIEW

- FIGURE 39 IBM: COMPANY SNAPSHOT

- TABLE 261 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 263 IBM: DEALS

- 11.1.5 GOOGLE

- TABLE 264 GOOGLE: COMPANY OVERVIEW

- FIGURE 40 GOOGLE: COMPANY SNAPSHOT

- TABLE 265 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 267 GOOGLE: DEALS

- 11.1.6 THALES GROUP

- TABLE 268 THALES GROUP: COMPANY OVERVIEW

- FIGURE 41 THALES GROUP: COMPANY SNAPSHOT

- TABLE 269 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 THALES GROUP: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 271 THALES GROUP: DEALS

- 11.1.7 INTEL

- TABLE 272 INTEL: COMPANY OVERVIEW

- FIGURE 42 INTEL: COMPANY SNAPSHOT

- TABLE 273 INTEL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 INTEL: DEALS

- 11.1.8 ORACLE

- TABLE 275 ORACLE: COMPANY OVERVIEW

- FIGURE 43 ORACLE: COMPANY SNAPSHOT

- TABLE 276 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 ORACLE: DEALS

- 11.1.9 ADOBE

- TABLE 278 ADOBE: COMPANY OVERVIEW

- FIGURE 44 ADOBE: COMPANY SNAPSHOT

- TABLE 279 ADOBE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 280 ADOBE: DEALS

- 11.1.10 SALESFORCE

- TABLE 281 SALESFORCE: COMPANY OVERVIEW

- FIGURE 45 SALESFORCE: COMPANY SNAPSHOT

- TABLE 282 SALESFORCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 283 SALESFORCE: DEALS

- 11.1.11 H20.AI

- 11.1.12 ALTERYX

- 11.1.13 KNIME

- 11.1.14 DATAROBOT

- 11.1.15 ALTAIR

- 11.1.16 ATTRI

- 11.1.17 DETERMINED AI

- 11.1.18 RASA

- 11.1.19 OPENAI

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

- 11.2 START-UPS/SMES

- 11.2.1 JASPER

- 11.2.2 SUPERANNOTATE

- 11.2.3 OBVIOUSLY AI

- 11.2.4 FIDDLER AI

- 11.2.5 UNION.AI

- 11.2.6 REGIE.AI

- 11.2.7 SNORKEL AI

- 11.2.8 LEVITY AI

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 GENERATIVE AI MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- TABLE 284 GENERATIVE AI MARKET SIZE AND GROWTH RATE, 2019-2022 (USD MILLION, Y-O-Y)

- TABLE 285 GENERATIVE AI MARKET SIZE AND GROWTH RATE, 2023-2028 (USD MILLION, Y-O-Y)

- 12.2.3 GENERATIVE AI MARKET, BY OFFERING

- TABLE 286 GENERATIVE AI MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 287 GENERATIVE AI MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 12.2.4 GENERATIVE AI MARKET, BY APPLICATION

- TABLE 288 GENERATIVE AI MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 289 GENERATIVE AI MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.2.5 GENERATIVE AI MARKET, BY VERTICAL

- TABLE 290 GENERATIVE AI MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 291 GENERATIVE AI MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.2.6 GENERATIVE AI MARKET, BY REGION

- TABLE 292 GENERATIVE AI MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 293 GENERATIVE AI MARKET, BY REGION, 2023-2028 (USD MILLION)

- 12.3 CONVERSATIONAL AI MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.3 CONVERSATIONAL AI MARKET, BY OFFERING

- TABLE 294 CONVERSATIONAL AI MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 295 CONVERSATIONAL AI MARKET BY OFFERING, 2023-2028 (USD MILLION)

- 12.3.4 CONVERSATIONAL AI MARKET, BY BUSINESS FUNCTION

- TABLE 296 CONVERSATIONAL AI MARKET, BY BUSINESS FUNCTION, 2018-2022 (USD MILLION)

- TABLE 297 CONVERSATIONAL AI MARKET, BY BUSINESS FUNCTION, 2023-2028 (USD MILLION)

- 12.3.5 CONVERSATIONAL AI MARKET, BY CHANNEL

- TABLE 298 CONVERSATIONAL AI MARKET, BY CHANNEL, 2018-2022 (USD MILLION)

- TABLE 299 CONVERSATIONAL AI MARKET, BY CHANNEL, 2023-2028 (USD MILLION)

- 12.3.6 CONVERSATIONAL AI MARKET, BY CONVERSATIONAL INTERFACE

- TABLE 300 CONVERSATIONAL AI MARKET, BY CONVERSATIONAL INTERFACE, 2018-2022 (USD MILLION)

- TABLE 301 CONVERSATIONAL AI MARKET, BY CONVERSATIONAL INTERFACE, 2023-2028 (USD MILLION)

- 12.3.7 CONVERSATIONAL AI MARKET, BY TECHNOLOGY

- TABLE 302 CONVERSATIONAL AI MARKET, BY TECHNOLOGY, 2018-2022 (USD MILLION)

- TABLE 303 CONVERSATIONAL AI MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 12.3.8 CONVERSATIONAL AI MARKET, BY VERTICAL

- TABLE 304 CONVERSATIONAL AI MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 305 CONVERSATIONAL AI MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.3.9 CONVERSATIONAL AI MARKET, BY REGION

- TABLE 306 CONVERSATIONAL AI MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 307 CONVERSATIONAL AI MARKET, BY REGION, 2023-2028 (USD MILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS