|

|

市場調査レポート

商品コード

1374760

ベクトルデータベースの世界市場:オファリング別、技術別、業界別、地域別-2028年までの予測Vector Database Market by Offering (Solutions and Services), Technology (NLP, Computer Vision, and Recommendation Systems), Vertical (Media & Entertainment, IT & ITeS, Healthcare & Life Sciences) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| ベクトルデータベースの世界市場:オファリング別、技術別、業界別、地域別-2028年までの予測 |

|

出版日: 2023年10月26日

発行: MarketsandMarkets

ページ情報: 英文 255 Pages

納期: 即納可能

|

全表示

- 概要

- 目次

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019年~2028年 |

| 基準年年 | 2022 |

| 予測期間 | 2023年~2028年 |

| 検討単位 | 100万/10億(米ドル) |

| セグメント | オファリング別、技術別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

世界のベクトルデータベースの市場規模は2023年の15億米ドルから、予測期間中に23.3%のCAGRで拡大し、2028年までに43億米ドルに成長すると予測されています。

ベクトルデータベースは、機械翻訳やチャットボットなどのNLPアプリケーションを強化します。これらは、言語の翻訳やテキストの生成に不可欠な、類似したフレーズや文書を素早く特定することができます。

ベクトルデータベースにおける展開・統合サービスとは、ベクトルデータベースモデルとアルゴリズムを既存のビジネスシステム、ソフトウェア、インフラストラクチャにシームレスに統合することを指します。これらのサービスは、ベクトルデータベースソリューションが既存のITシステムを統合し、異なるプラットフォーム間でデータがスムーズに流れることを保証します。これらのサービスには、AIアルゴリズムのカスタマイズ、データパイプラインの設計、クラウドインフラストラクチャのセットアップ、セキュリティとコンプライアンスのコンサルティングなどが含まれます。これらのサービスにより、企業は既存のオペレーションやプロセスへの影響を最小限に抑えながら、ベクトルデータベースのパワーを活用できるようになります。データベースがワークロードの増加に対応できるように、レプリケーション、ロードバランシング、シャーディングメカニズムの設定など、高可用性とスケーラビリティのための展開戦略を検討します。

メディアとエンターテインメント業界は、AIとML技術の出現により、近年大きな変化を経験しています。ベクターデータベースは、アルゴリズムとモデルを使用して、人間が作成したものと同様の画像、ビデオ、音楽などの新しくユニークなコンテンツを作成するもので、この業界におけるAIの最も有望で急速に発展している分野の1つです。映画やテレビの制作、音楽、ゲーム、広告など、メディアやエンターテインメント業界のさまざまな分野で利用されています。

アジア太平洋は、高い個人消費、インターネットの普及、ML、AI、LLMなどの先端技術の採用の高まりにより、広範な成長機会に恵まれるとみられています。小売・eヘルスケア、BFSI、ヘルスケア・ライフサイエンス産業は、同地域の市場成長に大きく貢献するとみられています。これらの産業は、特に中国、インド、韓国において、消費者の意識の向上と様々な分野での新技術の採用が増加しているため、市場にとって大きな成長の可能性があります。同地域におけるプレーヤー数の拡大が、アジア太平洋におけるベクターデータベース市場の成長を促進します。技術に裏打ちされた経済構造が急速に発展しているため、アジア太平洋は予測期間中、ベクターデータベースの需要において最も急成長する地域となると予測されています。

さらに、アジア太平洋は今後5年間に大きな成長機会を提供します。クラウドドリブンでクラウドに対応した先進的なソリューションに対する需要の高まりは、アジア太平洋におけるベクトルデータベースソリューションの需要増をもたらし、その結果、産業界全体で投資と技術進歩が増加しています。アジア太平洋の企業は、顧客の要求に応えるためにベクターデータベースを急速に採用しており、アジア太平洋の市場は力強い成長を遂げています。同地域の競合は細分化されており、市場ベンダーは同地域でのプレゼンス拡大を目指しています。アジア太平洋の企業は、情報、セキュリティ意識、技術的専門知識において、北米や欧州の企業よりも劣っています。ベクターのデータベースは、アジア太平洋の企業が商品や資材を販売・発送する方法を改善するのに役立ちます。

当レポートでは、世界のベクトルデータベース市場について調査し、オファリング別、技術別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- ケーススタディ分析

- ポーターのファイブフォース分析

- 価格分析

- 特許分析

- 技術分析

- 規制状況

- 2023年~2024年の主要な会議とイベント

- 主要な利害関係者と購入基準

- バリューチェーン分析

- エコシステム分析

- 買い手/クライアントのビジネスに影響を与える動向/混乱

- ベクターデータベース市場:ビジネスモデル分析

第6章 ベクターデータベース市場、オファリング別

- イントロダクション

- ソリューション

- サービス

第7章 ベクターデータベース市場、技術別

- イントロダクション

- 自然言語処理

- コンピュータビジョン

- 推薦システム

第8章 ベクトルデータベース市場、業界別

- イントロダクション

- BFSI

- 小売・eコマース

- ヘルスケア・ライフサイエンス

- IT・ITES

- メディア・エンターテイメント

- 製造業

- 政府・防衛

- その他

第9章 ベクターデータベース市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第10章 競合情勢

- 概要

- 主要参入企業が採用した戦略

- 収益分析

- 市場シェア分析

- ブランドの比較/ベンダー製品の情勢

- 主要な市場参入企業の世界スナップショット

- 企業評価マトリックス

- 新興企業/中小企業の評価マトリックス

- ベクターデータベースベンダーの評価と財務指標

- 主要な市場の発展

第11章 企業プロファイル

- イントロダクション

- 主要参入企業

- MICROSOFT

- ALIBABA CLOUD

- ELASTIC

- MONGODB

- REDIS

- SINGLESTORE

- DATASTAX

- ZILLIZ

- PINECONE

- AWS

- その他の企業

- KX

- MILVUS

- GSI TECHNOLOGY

- CLARIFAI

- KINETICA

- ROCKSET

- QDRANT

- ACTIVELOOP

- WEAVIATE

- OPENSEARCH

- VESPA

- MARQO AI

- CLICKHOUSE

第12章 隣接市場および関連市場

第13章 付録

Report Description

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Million/Billion (USD) |

| Segments | By Offering, Technology, Vertical, and region |

| Regions covered | North America, Europe, Asia Pacific, and Rest of the World |

MarketsandMarkets forecasts the global vector database market size is expected to grow from USD 1.5 billion in 2023 to USD 4.3 billion by 2028 at a CAGR of 23.3% during the forecast period. Vector databases power NLP applications such as machine translation and chatbots. These applications can quickly identify similar phrases and documents, which are essential for translating languages and generating text.

"Deployment & Integration service segment to hold the largest market size during the forecast period."

Deployment and integration services in vector databases refer to seamlessly integrating vector database models and algorithms into existing business systems, software, and infrastructure. These services ensure that vector database solutions integrate existing IT systems and that data flows smoothly between different platforms. These services may include customization of AI algorithms, data pipeline design, cloud infrastructure setup, and security and compliance consulting. These services ensure businesses can leverage vector databases' power while minimizing the impact on existing operations and processes. Consider deployment strategies for high availability and scalability, including setting up replication, load balancing, and sharding mechanisms to ensure that the database can handle increasing workloads; this helps to monitor and optimize the vector database for improved performance.

"Media & Entertainment vertical to hold the largest market size during the forecast period."

The media and entertainment industry has experienced significant changes in recent years due to the emergence of AI and ML technologies. Vector database, which uses algorithms and models to create new and unique content like images, videos, and music similar to that produced by humans, is one of the most promising and rapidly developing areas of AI in this industry. It is used in various sectors of the media and entertainment industry, including film and television production, music, gaming, and advertising.

Media and entertainment companies are utilizing vector databases to produce captivating and exclusive content more efficiently and timely than traditional methods. For example, virtual sets and characters for films and TV shows are being created using a vector database, resulting in savings on production costs. The music industry also uses vector databases to develop fresh and inventive sounds and styles. The real-time generation of game worlds and characters in gaming makes the player experience more immersive. Additionally, a vector database is employed in advertising to generate personalized and targeted content that connects with specific audiences.

"Vector Database market in Asia Pacific to grow at the highest CAGR during the forecast period."

The vector database market in the Asia Pacific includes analysis of China, Japan, ANZ, and the Rest of Asia Pacific. The region will experience extensive growth opportunities due to high consumer spending, internet penetration, and the rising adoption of advanced technologies, such as ML, AI, and LLMs. Retail & eCommerce, BFSI, healthcare & life sciences industries will contribute substantially to the market growth in the region. These industries offer significant growth potential for the market due to the increasing awareness among consumers and the rising adoption of new technologies in various sectors, especially in China, India, and South Korea. The expanding number of players in the region will drive the growth of the vector database market in Asia Pacific. Owing to a rapidly increasing technology-backed economic structure, Asia Pacific will emerge as the fastest-growing region in vector database demand during the forecast period.

Moreover, Asia Pacific provides significant growth opportunities over the next five years. The rising demand for advanced solutions that are cloud-driven and cloud-supported has resulted in the increasing demand for vector database solutions in Asia Pacific, resulting in increasing investments and technological advancements across industries. The market in Asia Pacific is experiencing strong growth as Asia Pacific organizations are rapidly adopting vector databases to meet the demands of their customers. The competition in this region is fragmented, and market vendors are looking to expand their presence there, which would result in infrastructure improvement and business-strategic benefits. Asia Pacific enterprises are less proficient than North American and European enterprises in information, security awareness, and technical expertise. Vector database can help improve how Asia Pacific organizations sell and ship their goods and materials.

Further, our team conducted in-depth interviews with the Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Chief Operating Officers (COOs), Chief Technology Officers (CTOs), Vice Presidents (VPs), Managing Directors (MDs), domain heads, technology and innovation directors, and related key executives from various prominent companies and organizations operating in the vector database market.

- By Company - Tier 1-30%, Tier 2-45%, and Tier 3-25%

- By Designation - C-Level Executives-50%, Director Level-35%, and Others-15%

- By Region - North America-50%, Europe-30%, Asia Pacific-15%, RoW - 5%

The key players in the vector database market are Microsoft (US), Elastic (US), Alibaba Cloud (China), MongoDB (US), Redis (US), SingleStore (US), Zilliz (US), Pinecone (US), Google (US), AWS (US), Milvus (US), Weaviate (Netherlands), and Qdrant (Berlin). The study includes an in-depth competitive analysis of these key players in the Vector Database market with their company profiles, recent developments, and key market strategies.

Research Coverage

The research study covered inputs, insights, trends, and happenings from secondary sources, primary sources, stakeholders' interviews, and surveys. Secondary sources include information from databases and repositories such as D&B Hoovers, Bloomberg, Factiva, and CoinDesk. We fetched primary data from supply-side industry experts who hold the chair of Chief Executive Officer (CEO), Chief Technological Officer (CTO), Chief Operating Officer (COO), Vice-President (VP) of IT, and Managing Director (MD), among others. We also reached out to a few startups during our primary interviews. Additionally, we have taken information and statistical and historical data from a few government associations, public sources, webinar and seminar transcripts, journals, conferences, and events.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall vector database market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities. The report incorporates a critical section comprising the company profiles in the market, in which it has exhaustively evaluated the vendors in terms of product portfolio offerings and business strategies followed; this will give a holistic view of the current standing of the key players in the market and the ongoing developments encompassing partnerships, agreements, collaborations, mergers and acquisitions, joint ventures, new product or service launches, and business expansions. This evaluation will help the buyers understand how the major vendors are achieving service differentiation, and buyers can understand the need gap analysis for the existing services and new services needed to cater to these newly developed solutions for this market. The report can help the buyers understand significant benefits as well as driving factors that are becoming key growth drivers of the development of buyers in these services.

The report provides insights on the following pointers.

- Analysis of key drivers (advancements in AI and ML, increasing usage of LLMs, considerable investments in vector database), restraints (privacy and security of the data stored on databases), opportunities (demand of real-time analytics, need for semantic search), and challenges (lack of technical expertise, need to strict adherence to regulatory and compliance policies) influencing the growth of the vector database market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the vector database market

- Market Development: Comprehensive information about lucrative markets - the report analyses the vector database market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the vector database market

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, like include Microsoft (US), Elastic (US), Alibaba Cloud (China), MongoDB (US), Redis (US), SingleStore (US), Zilliz (US), Pinecone (US), Google (US), AWS (US), Milvus (US), Weaviate (Netherlands), and Qdrant (Berlin) Datastax (US), KX (US), GSI Technology (US), Clarifai (US), Kinetica (US), Rockset (US), Activeloop (US), OpenSearch (US), Vespa (Norway), Marqo AI (Australia), and Clickhouse (US) in the vector database market. The report also helps stakeholders understand the competitive analysis of these market players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2022

- 1.6 STAKEHOLDERS

- 1.7 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 VECTOR DATABASE MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key insights from industry experts

- 2.2 DATA TRIANGULATION

- FIGURE 2 VECTOR DATABASE MARKET: DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 VECTOR DATABASE MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 6 VECTOR DATABASE MARKET: RESEARCH FLOW

- 2.3.3 MARKET ESTIMATION APPROACHES

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 9 BOTTOM-UP APPROACH FROM SUPPLY SIDE: COLLECTIVE REVENUE OF VENDORS

- FIGURE 10 DEMAND-SIDE APPROACH: REVENUE GENERATED FROM DIFFERENT VERTICALS

- FIGURE 11 DEMAND-SIDE APPROACH: VECTOR DATABASE MARKET

- 2.4 MARKET FORECAST

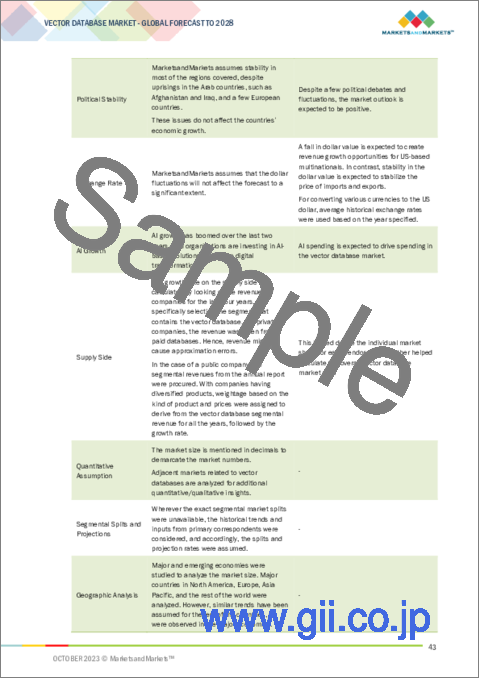

- TABLE 2 FACTOR ANALYSIS

- 2.5 IMPACT OF RECESSION ON GLOBAL VECTOR DATABASE MARKET

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- TABLE 3 VECTOR DATABASE MARKET SIZE AND GROWTH, 2019-2022 (USD MILLION, Y-O-Y %)

- TABLE 4 VECTOR DATABASE MARKET SIZE AND GROWTH, 2023-2028 (USD MILLION, Y-O-Y %)

- FIGURE 12 GLOBAL VECTOR DATABASE MARKET TO WITNESS SIGNIFICANT GROWTH

- FIGURE 13 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 14 FASTEST-GROWING SEGMENTS OF VECTOR DATABASE MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR COMPANIES IN VECTOR DATABASE MARKET

- FIGURE 15 MACHINE LEARNING AND ARTIFICIAL INTELLIGENCE TO DRIVE GROWTH OF VECTOR DATABASE MARKET

- 4.2 VECTOR DATABASE MARKET, BY OFFERING, 2023 VS. 2028

- FIGURE 16 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SHARE IN 2023

- 4.2.1 VECTOR DATABASE MARKET, BY SOLUTION, 2023 VS. 2028

- FIGURE 17 VECTOR SEARCH SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- 4.2.2 VECTOR DATABASE MARKET, BY SERVICE, 2023 VS. 2028

- FIGURE 18 PROFESSIONAL SERVICES SEGMENT TO HOLD LARGER MARKET SHARE IN 2023

- 4.3 VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2023 VS. 2028

- FIGURE 19 DEPLOYMENT & INTEGRATION SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- 4.4 VECTOR DATABASE MARKET, BY TECHNOLOGY, 2023 VS. 2028

- FIGURE 20 NLP SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- 4.5 VECTOR DATABASE MARKET, BY VERTICAL, 2023 VS. 2028

- FIGURE 21 MEDIA & ENTERTAINMENT VERTICAL TO HOLD LARGEST MARKET SHARE IN 2023

- 4.6 VECTOR DATABASE MARKET: REGIONAL SCENARIO, 2023-2028

- FIGURE 22 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 23 MARKET DYNAMICS: VECTOR DATABASE MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Advancements in AI and ML

- 5.2.1.2 Increasing usage of large language models

- 5.2.1.3 Growing demand for solutions to process low-latency queries

- 5.2.1.4 Increasing demand for automating repetitive database management processes

- 5.2.1.5 Huge investments in vector database

- FIGURE 24 VECTOR DATABASE INVESTMENTS BY COMPANIES IN 2022-2023 (USD MILLION)

- 5.2.2 RESTRAINTS

- 5.2.2.1 Privacy and security of data stored on databases

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for real-time analytics

- 5.2.3.2 Rising demand for semantic search

- 5.2.3.3 Data complexity and diversity

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of technical expertise

- 5.2.4.2 Need for strict adherence to regulatory and compliance policies

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 CASE STUDY 1: MONGODB ATLAS HELPED TO MANAGE DATABASE PROPERLY

- 5.3.2 CASE STUDY 2: CHIPPER CASH DECREASED FRAUDULENT ACTIVITIES BY USING PINECONE

- 5.3.3 CASE STUDY 3: SMARTNEWS HANDLED LARGE VECTOR DATA BY USING MILVUS

- 5.3.4 CASE STUDY 4: ACI SAVED MILLIONS OF DOLLARS OF CUSTOMERS BY USING DATASTAX

- 5.3.5 CASE STUDY 5: BEIERSDORF HELPED SUMMARIZE DOCUMENTS BY USING AZURE COGNITIVE SEARCH

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 VECTOR DATABASE MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 IMPACT OF PORTER'S FIVE FORCES ON VECTOR DATABASE MARKET

- 5.4.1 THREAT OF NEW ENTRANTS

- 5.4.2 THREAT OF SUBSTITUTES

- 5.4.3 BARGAINING POWER OF SUPPLIERS

- 5.4.4 BARGAINING POWER OF BUYERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE (ASP) TREND OF KEY PLAYERS, BY SOLUTION

- FIGURE 26 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOLUTION (USD MILLION/MONTH)

- 5.5.2 INDICATIVE PRICING ANALYSIS OF VECTOR DATABASE SOLUTIONS

- TABLE 6 INDICATIVE PRICING ANALYSIS OF VECTOR DATABASE SOLUTIONS

- 5.6 PATENT ANALYSIS

- FIGURE 27 NUMBER OF PATENTS PUBLISHED, 2012-2022

- FIGURE 28 TOP FIVE PATENT OWNERS (GLOBAL)

- TABLE 7 TOP TEN PATENT OWNERS (US)

- TABLE 8 PATENTS IN VECTOR DATABASE MARKET, 2023

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 NLP

- 5.7.1.2 Computer Vision

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Cloud

- 5.7.2.2 IoT

- 5.7.2.3 Big Data

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Deep Learning Models

- 5.7.3.2 Machine Learning Frameworks

- 5.7.3.3 Generative AI

- 5.7.1 KEY TECHNOLOGIES

- 5.8 REGULATORY LANDSCAPE

- 5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.2 THE EUROPEAN UNION (EU) - ARTIFICIAL INTELLIGENCE ACT (AIA)

- 5.8.3 INTERIM ADMINISTRATIVE MEASURES FOR GENERATIVE ARTIFICIAL INTELLIGENCE SERVICES

- 5.8.4 GENERAL DATA PROTECTION REGULATION

- 5.8.5 NATIONAL ARTIFICIAL INTELLIGENCE INITIATIVE ACT (NAIIA)

- 5.8.6 INFORMATION SECURITY TECHNOLOGY - PERSONAL INFORMATION SECURITY SPECIFICATION GB/T 35273-2017

- 5.8.7 THE ARTIFICIAL INTELLIGENCE AND DATA ACT (AIDA)

- 5.8.8 GENERAL DATA PROTECTION LAW

- 5.8.9 LAW NO 13 OF 2016 ON PROTECTING PERSONAL DATA

- 5.8.10 NIST SPECIAL PUBLICATION 800-144 - GUIDELINES ON SECURITY AND PRIVACY IN PUBLIC CLOUD COMPUTING

- 5.9 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 14 VECTOR DATABASE MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2023-2024

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MAJOR VERTICALS

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR MAJOR VERTICALS (%)

- 5.10.2 BUYING CRITERIA

- FIGURE 30 KEY BUYING CRITERIA FOR MAJOR VERTICALS

- TABLE 16 KEY BUYING CRITERIA FOR MAJOR VERTICALS

- 5.11 VALUE CHAIN ANALYSIS

- FIGURE 31 VECTOR DATABASE MARKET: VALUE CHAIN

- 5.12 ECOSYSTEM ANALYSIS

- FIGURE 32 VECTOR DATABASE MARKET: ECOSYSTEM

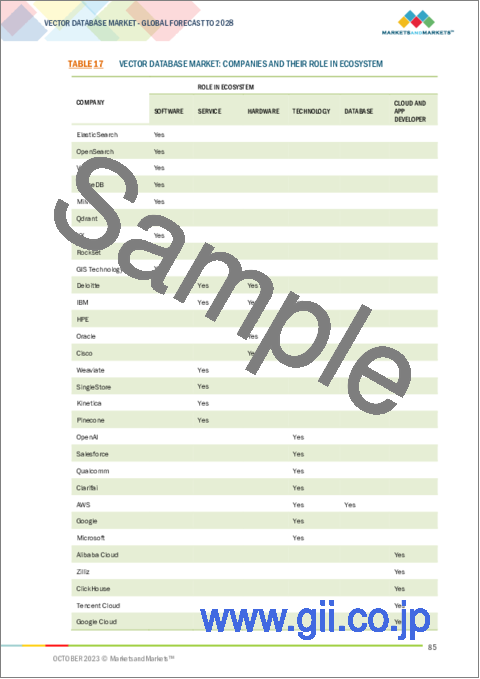

- TABLE 17 VECTOR DATABASE MARKET: COMPANIES AND THEIR ROLE IN ECOSYSTEM

- 5.13 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS' BUSINESSES

- FIGURE 33 VECTOR DATABASE MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS' BUSINESSES

- 5.14 VECTOR DATABASE MARKET: BUSINESS MODEL ANALYSIS

- FIGURE 34 VECTOR DATABASE MARKET: BUSINESS MODELS

- 5.14.1 SUBSCRIPTION MODEL

- 5.14.2 MANAGED SERVICE MODEL

6 VECTOR DATABASE MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: VECTOR DATABASE MARKET DRIVERS

- FIGURE 35 SOLUTIONS SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 18 VECTOR DATABASE MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 19 VECTOR DATABASE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 SOLUTIONS

- FIGURE 36 VECTOR SEARCH SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 20 SOLUTIONS: VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 21 SOLUTIONS: VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 22 VECTOR DATABASE MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 23 VECTOR DATABASE MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- 6.2.1 VECTOR GENERATION

- 6.2.1.1 Rise of AI and ML to lead to development of new and sophisticated vector-generation algorithms

- TABLE 24 VECTOR GENERATION: VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 25 VECTOR GENERATION: VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.1.1.1 Word Embeddings

- 6.2.1.1.2 Image Embeddings

- 6.2.1.1.3 Others

- 6.2.2 VECTOR SEARCH

- 6.2.2.1 Statistical models to provide powerful ways to capture complex patterns in data and generate precise outputs

- TABLE 26 VECTOR SEARCH: VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 27 VECTOR SEARCH: VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2.1.1 Exact Vector Search

- 6.2.2.1.2 Semantic Search

- 6.2.2.1.3 Approximate Nearest Neighbor Search

- 6.2.2.1.4 Others

- 6.2.3 STORAGE AND RETRIEVAL VECTORS

- 6.2.3.1 Deep learning models to excel at generative tasks requiring fine-grained details

- TABLE 28 STORAGE AND RETRIEVAL VECTORS: VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 29 STORAGE AND RETRIEVAL VECTORS: VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.3.1.1 Text Vectors

- 6.2.3.1.2 Image Vectors

- 6.2.3.1.3 Geospatial Vectors

- 6.3 SERVICES

- FIGURE 37 MANAGED SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING THE FORECAST PERIOD

- TABLE 30 SERVICES: VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 31 SERVICES: VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 32 VECTOR DATABASE MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 33 VECTOR DATABASE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Professional services to offer specialized expertise in vector databases to meet specific needs

- FIGURE 38 DEPLOYMENT & INTEGRATION TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 34 PROFESSIONAL SERVICES: VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 35 PROFESSIONAL SERVICES: VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 36 VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2019-2022 (USD MILLION)

- TABLE 37 VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- 6.3.1.1.1 Consulting

- TABLE 38 CONSULTING: VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 39 CONSULTING: VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1.1.2 Deployment & Integration

- TABLE 40 DEPLOYMENT & INTEGRATION: VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 41 DEPLOYMENT & INTEGRATION: VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1.1.3 Training, Support, and Maintenance

- TABLE 42 TRAINING, SUPPORT, AND MAINTENANCE: VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 43 TRAINING, SUPPORT, AND MAINTENANCE: VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Managed services to provide end-to-end management for vector databases and help businesses focus on core competencies

- TABLE 44 MANAGED SERVICES: VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 45 MANAGED SERVICES: VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

7 VECTOR DATABASE MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.1.1 TECHNOLOGY: VECTOR DATABASE MARKET DRIVERS

- FIGURE 39 COMPUTER VISION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 46 VECTOR DATABASE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 47 VECTOR DATABASE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 7.2 NATURAL LANGUAGE PROCESSING

- 7.2.1 VECTOR DATABASE TO BE USED FOR DOCUMENT RETRIEVAL, SEMANTIC SEARCH, SENTIMENT ANALYSIS, AND CHATBOTS IN NLP

- TABLE 48 NLP: VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 49 NLP: VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.1.1 Semantic Search

- 7.2.1.2 Document/Text Retrieval

- 7.2.1.3 Sentiment Analysis

- 7.2.1.4 Chatbots & Virtual Assistants

- 7.2.1.5 Others

- 7.3 COMPUTER VISION

- 7.3.1 COMPUTER VISION AND VECTOR DATABASES TO OFFER POWERFUL SOLUTIONS FOR APPLICATIONS THAT INVOLVE PROCESSING AND UNDERSTANDING VISUAL CONTENT EFFICIENTLY

- TABLE 50 COMPUTER VISION: VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 51 COMPUTER VISION: VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.1.1 Image Retrieval

- 7.3.1.2 Object Detection

- 7.3.1.3 Face/Image Recognition

- 7.3.1.4 Others

- 7.4 RECOMMENDATION SYSTEMS

- 7.4.1 ENHANCED ACCURACY AND EFFICIENCY OF CONTENT RECOMMENDATIONS TO DRIVE MARKET GROWTH

- TABLE 52 RECOMMENDATION SYSTEMS: VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 53 RECOMMENDATION SYSTEMS: VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4.1.1 Collaborative Filtering

- 7.4.1.2 Content-based Filtering

- 7.4.1.3 Session-based Recommendations

- 7.4.1.4 Others

8 VECTOR DATABASE MARKET, BY VERTICAL

- 8.1 INTRODUCTION

- 8.1.1 VERTICAL: VECTOR DATABASE MARKET DRIVERS

- FIGURE 40 MEDIA & ENTERTAINMENT TO RECORD LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 54 VECTOR DATABASE MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 55 VECTOR DATABASE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.2 BFSI

- 8.2.1 VECTOR DATABASE TO OPTIMIZE OPERATIONS, IMPROVE CUSTOMER EXPERIENCE, AND MANAGE RISKS

- 8.2.2 BFSI: VECTOR DATABASE USE CASES

- TABLE 56 BFSI: VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 57 BFSI: VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.2.1 Risk Assessment

- 8.2.2.2 Customer Segmentation

- 8.2.2.3 Fraud Detection/Risk Management

- 8.2.2.4 Others

- 8.3 RETAIL & E-COMMERCE

- 8.3.1 VECTOR DATABASE TO HELP RETAIL SECTOR OPTIMIZE INVENTORY PLANNING WHILE REDUCING SHELF SHRINKAGE

- 8.3.2 RETAIL & E-COMMERCE: VECTOR DATABASE USE CASES

- TABLE 58 RETAIL & E-COMMERCE: VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 59 RETAIL & E-COMMERCE: VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3.2.1 Product Recommendations

- 8.3.2.2 Inventory Management

- 8.3.2.3 Others

- 8.4 HEALTHCARE & LIFE SCIENCES

- 8.4.1 VECTOR DATABASES TO HELP IN DIAGNOSING DISEASES AND CREATING NEW DRUGS

- 8.4.2 HEALTHCARE & LIFE SCIENCES: VECTOR DATABASE USE CASES

- TABLE 60 HEALTHCARE & LIFE SCIENCES: VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 61 HEALTHCARE & LIFE SCIENCES: VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4.2.1 Medical Imaging

- 8.4.2.2 EHR

- 8.4.2.3 Others

- 8.5 IT & ITES

- 8.5.1 VECTOR DATABASE TO HELP IMPROVE CYBERSECURITY, MINIMIZE COSTS, AND ENHANCE USER EXPERIENCE

- 8.5.2 IT & ITES: VECTOR DATABASE USE CASES

- TABLE 62 IT & ITES: VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 63 IT & ITES: VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5.2.1 IT Operations and Monitoring

- 8.5.2.2 Search and Content Recommendation

- 8.5.2.3 Customer Support and Chatbots

- 8.5.2.4 Others

- 8.6 MEDIA & ENTERTAINMENT

- 8.6.1 VECTOR DATABASE TO PRODUCE CAPTIVATING AND EXCLUSIVE CONTENT EFFICIENTLY THAN TRADITIONAL METHODS

- 8.6.2 MEDIA & ENTERTAINMENT: VECTOR DATABASE USE CASES

- TABLE 64 MEDIA & ENTERTAINMENT: VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 65 MEDIA & ENTERTAINMENT: VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.6.2.1 Content Recommendation

- 8.6.2.2 Content Metadata Management

- 8.6.2.3 Content Similarity Search

- 8.6.2.4 Others

- 8.7 MANUFACTURING

- 8.7.1 VECTOR DATABASE TO IMPROVE PROTOTYPE DESIGN AND CAPACITY PLANNING IN SMART FACTORIES

- 8.7.2 MANUFACTURING: VECTOR DATABASE USE CASES

- TABLE 66 MANUFACTURING: VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 67 MANUFACTURING: VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.7.2.1 Quality Control and Inspection

- 8.7.2.2 Predictive Maintenance

- 8.7.2.3 Others

- 8.8 GOVERNMENT & DEFENSE

- 8.8.1 VECTOR DATABASE TOOLS TO DETECT THREAT AND ENHANCE SURVEILLANCE

- 8.8.2 GOVERNMENT & DEFENSE: VECTOR DATABASE USE CASES

- TABLE 68 GOVERNMENT & DEFENSE: VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 69 GOVERNMENT & DEFENSE: VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.8.2.1 Geospatial Intelligence

- 8.8.2.2 Image Analysis and Recognition

- 8.8.2.3 Others

- 8.9 OTHER VERTICALS

- TABLE 70 OTHER VERTICALS: VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 71 OTHER VERTICALS: VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

9 VECTOR DATABASE MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 41 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 72 VECTOR DATABASE MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 73 VECTOR DATABASE MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: VECTOR DATABASE MARKET DRIVERS

- 9.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 42 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 74 NORTH AMERICA: VECTOR DATABASE MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: VECTOR DATABASE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: VECTOR DATABASE MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: VECTOR DATABASE MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: VECTOR DATABASE MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: VECTOR DATABASE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2019-2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: VECTOR DATABASE MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: VECTOR DATABASE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: VECTOR DATABASE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: VECTOR DATABASE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.2.3 US

- 9.2.3.1 Rising demand for vector database majorly contributing to US revenue

- TABLE 88 US: VECTOR DATABASE MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 89 US: VECTOR DATABASE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 90 US: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 91 US: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 9.2.4 CANADA

- 9.2.4.1 Increasing investments in cutting-edge technologies to fuel market growth

- TABLE 92 CANADA: VECTOR DATABASE MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 93 CANADA: VECTOR DATABASE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 94 CANADA: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 95 CANADA: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 9.3 EUROPE

- 9.3.1 EUROPE: VECTOR DATABASE MARKET DRIVERS

- 9.3.2 EUROPE: RECESSION IMPACT

- TABLE 96 EUROPE: VECTOR DATABASE MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 97 EUROPE: VECTOR DATABASE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 98 EUROPE: VECTOR DATABASE MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 99 EUROPE: VECTOR DATABASE MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 100 EUROPE: VECTOR DATABASE MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 101 EUROPE: VECTOR DATABASE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 102 EUROPE: VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2019-2022 (USD MILLION)

- TABLE 103 EUROPE: VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 104 EUROPE: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 105 EUROPE: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 106 EUROPE: VECTOR DATABASE MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 107 EUROPE: VECTOR DATABASE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 108 EUROPE: VECTOR DATABASE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 109 EUROPE: VECTOR DATABASE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Increasing focus on digitalization to drive market growth

- TABLE 110 UK: VECTOR DATABASE MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 111 UK: VECTOR DATABASE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 112 UK: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 113 UK: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 9.3.4 GERMANY

- 9.3.4.1 German government ready to become global tech leader by galvanizing AI research, development, and applications

- TABLE 114 GERMANY: VECTOR DATABASE MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 115 GERMANY: VECTOR DATABASE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 116 GERMANY: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 117 GERMANY: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 9.3.5 FRANCE

- 9.3.5.1 Increasing research and educational excellence to drive demand for chatbots, data retrieval, and image retrieval

- TABLE 118 FRANCE: VECTOR DATABASE MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 119 FRANCE: VECTOR DATABASE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 120 FRANCE: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 121 FRANCE: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 9.3.6 ITALY

- 9.3.6.1 Italian researchers to build deep learning model that can perform source separation and music generation

- TABLE 122 ITALY: VECTOR DATABASE MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 123 ITALY: VECTOR DATABASE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 124 ITALY: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 125 ITALY: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 9.3.7 REST OF EUROPE

- TABLE 126 REST OF EUROPE: VECTOR DATABASE MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 127 REST OF EUROPE: VECTOR DATABASE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 128 REST OF EUROPE: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 129 REST OF EUROPE: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: VECTOR DATABASE MARKET DRIVERS

- 9.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 43 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 130 ASIA PACIFIC: VECTOR DATABASE MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: VECTOR DATABASE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: VECTOR DATABASE MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: VECTOR DATABASE MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: VECTOR DATABASE MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 135 ASIA PACIFIC: VECTOR DATABASE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 136 ASIA PACIFIC: VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2019-2022 (USD MILLION)

- TABLE 137 ASIA PACIFIC: VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 138 ASIA PACIFIC: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 139 ASIA PACIFIC: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 140 ASIA PACIFIC: VECTOR DATABASE MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 141 ASIA PACIFIC: VECTOR DATABASE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 142 ASIA PACIFIC: VECTOR DATABASE MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 143 ASIA PACIFIC: VECTOR DATABASE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 9.4.3 CHINA

- 9.4.3.1 Rising number of local players producing vector databases to propel market

- TABLE 144 CHINA: VECTOR DATABASE MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 145 CHINA: VECTOR DATABASE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 146 CHINA: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 147 CHINA: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 9.4.4 JAPAN

- 9.4.4.1 Tokyo-1 to accelerate Japan's pharma industry

- TABLE 148 JAPAN: VECTOR DATABASE MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 149 JAPAN: VECTOR DATABASE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 150 JAPAN: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 151 JAPAN: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 9.4.5 AUSTRALIA & NEW ZEALAND

- 9.4.5.1 Australia & New Zealand to explore AI and big data analytics' potential more broadly

- TABLE 152 ANZ: VECTOR DATABASE MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 153 ANZ: VECTOR DATABASE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 154 ANZ: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 155 ANZ: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 9.4.6 REST OF ASIA PACIFIC

- TABLE 156 REST OF ASIA PACIFIC: VECTOR DATABASE MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: VECTOR DATABASE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 9.5 REST OF THE WORLD

- 9.5.1 MIDDLE EAST & AFRICA

- 9.5.2 LATIN AMERICA

- TABLE 160 REST OF THE WORLD: VECTOR DATABASE MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 161 REST OF THE WORLD: VECTOR DATABASE MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 162 REST OF THE WORLD: VECTOR DATABASE MARKET, BY SOLUTION, 2019-2022 (USD MILLION)

- TABLE 163 REST OF THE WORLD: VECTOR DATABASE MARKET, BY SOLUTION, 2023-2028 (USD MILLION)

- TABLE 164 REST OF THE WORLD: VECTOR DATABASE MARKET, BY SERVICE, 2019-2022 (USD MILLION)

- TABLE 165 REST OF THE WORLD: VECTOR DATABASE MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 166 REST OF THE WORLD: VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2019-2022 (USD MILLION)

- TABLE 167 REST OF THE WORLD: VECTOR DATABASE MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 168 REST OF THE WORLD: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2019-2022 (USD MILLION)

- TABLE 169 REST OF THE WORLD: VECTOR DATABASE MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 170 REST OF THE WORLD: VECTOR DATABASE MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 171 REST OF THE WORLD: VECTOR DATABASE MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 172 OVERVIEW OF STRATEGIES BY KEY VECTOR DATABASE VENDORS

- 10.3 REVENUE ANALYSIS

- FIGURE 44 HISTORICAL FIVE-YEAR SEGMENTAL REVENUE ANALYSIS OF KEY VECTOR DATABASE PROVIDERS

- 10.4 MARKET SHARE ANALYSIS

- FIGURE 45 MARKET SHARE ANALYSIS, 2022

- TABLE 173 VECTOR DATABASE MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 10.5 BRANDS COMPARISON/VENDOR PRODUCT LANDSCAPE

- TABLE 174 BRANDS COMPARISON/VENDOR PRODUCT LANDSCAPE

- 10.6 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 46 VECTOR DATABASE MARKET: GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- 10.7 COMPANY EVALUATION MATRIX

- FIGURE 47 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- FIGURE 48 COMPANY EVALUATION MATRIX

- 10.7.5 COMPANY FOOTPRINT

- TABLE 175 COMPANY REGIONAL FOOTPRINT

- TABLE 176 COMPANY OFFERING FOOTPRINT

- TABLE 177 COMPANY FOOTPRINT

- 10.8 START-UP/SME EVALUATION MATRIX

- FIGURE 49 SME/START-UP EVALUATION MATRIX: CRITERIA WEIGHTAGE

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- FIGURE 50 START-UP/SME EVALUATION MATRIX

- 10.8.5 COMPETITIVE BENCHMARKING

- TABLE 178 DETAILED LIST OF KEY START-UPS/SMES

- TABLE 179 COMPANY FOOTPRINT FOR START-UPS/SMES, BY REGION

- 10.9 VALUATION AND FINANCIAL METRICS OF VECTOR DATABASE VENDORS

- FIGURE 51 VALUATION AND FINANCIAL METRICS OF VECTOR DATABASE VENDORS

- 10.10 KEY MARKET DEVELOPMENTS

- 10.10.1 PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

- TABLE 180 VECTOR DATABASE MARKET: PRODUCT LAUNCHES

- 10.10.2 DEALS

- TABLE 181 VECTOR DATABASE MARKET: DEALS

11 COMPANY PROFILES

- 11.1 INTRODUCTION

- 11.2 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 11.2.1 MICROSOFT

- TABLE 182 MICROSOFT: COMPANY OVERVIEW

- FIGURE 52 MICROSOFT: COMPANY SNAPSHOT

- TABLE 183 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 184 MICROSOFT: PRODUCT LAUNCHES

- TABLE 185 MICROSOFT: DEALS

- 11.2.2 ALIBABA CLOUD

- TABLE 186 ALIBABA CLOUD: COMPANY OVERVIEW

- FIGURE 53 ALIBABA CLOUD: COMPANY SNAPSHOT

- TABLE 187 ALIBABA CLOUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 188 ALIBABA CLOUD: PRODUCT LAUNCHES

- TABLE 189 ALIBABA CLOUD: DEALS

- TABLE 190 ALIBABA CLOUD: OTHERS

- 11.2.3 ELASTIC

- TABLE 191 ELASTIC: COMPANY OVERVIEW

- FIGURE 54 ELASTIC: COMPANY SNAPSHOT

- TABLE 192 ELASTIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 193 ELASTIC: PRODUCT LAUNCHES

- TABLE 194 ELASTIC: DEALS

- 11.2.4 MONGODB

- TABLE 195 MONGODB: COMPANY OVERVIEW

- FIGURE 55 MONGODB: COMPANY SNAPSHOT

- TABLE 196 MONGODB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 MONGODB: PRODUCT LAUNCHES

- TABLE 198 MONGODB: DEALS

- 11.2.5 REDIS

- TABLE 199 REDIS: COMPANY OVERVIEW

- TABLE 200 REDIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 REDIS: PRODUCT LAUNCHES

- TABLE 202 REDIS: DEALS

- 11.2.6 SINGLESTORE

- TABLE 203 SINGLESTORE: COMPANY OVERVIEW

- TABLE 204 SINGLESTORE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 SINGLESTORE: PRODUCT LAUNCHES

- 11.2.7 DATASTAX

- TABLE 206 DATASTAX: COMPANY OVERVIEW

- TABLE 207 DATASTAX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 DATASTAX: PRODUCT LAUNCHES

- 11.2.8 ZILLIZ

- TABLE 209 ZILLIZ: COMPANY OVERVIEW

- TABLE 210 ZILLIZ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 ZILLIZ: PRODUCT LAUNCHES

- 11.2.9 PINECONE

- TABLE 212 PINECONE: COMPANY OVERVIEW

- TABLE 213 PINECONE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 PINECONE: PRODUCT LAUNCHES

- 11.2.10 GOOGLE

- TABLE 215 GOOGLE: COMPANY OVERVIEW

- FIGURE 56 GOOGLE: COMPANY SNAPSHOT

- TABLE 216 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 GOOGLE: PRODUCT LAUNCHES

- TABLE 218 GOOGLE: DEALS

- 11.2.11 AWS

- TABLE 219 AWS: COMPANY OVERVIEW

- FIGURE 57 AWS: COMPANY SNAPSHOT

- TABLE 220 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 AWS: PRODUCT LAUNCHES

- TABLE 222 AWS: DEALS

- 11.3 OTHER PLAYERS

- 11.3.1 KX

- 11.3.2 MILVUS

- 11.3.3 GSI TECHNOLOGY

- 11.3.4 CLARIFAI

- 11.3.5 KINETICA

- 11.3.6 ROCKSET

- 11.3.7 QDRANT

- 11.3.8 ACTIVELOOP

- 11.3.9 WEAVIATE

- 11.3.10 OPENSEARCH

- 11.3.11 VESPA

- 11.3.12 MARQO AI

- 11.3.13 CLICKHOUSE

*Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.1.1 RELATED MARKETS

- 12.2 GENERATIVE AI MARKET

- TABLE 223 GENERATIVE AI MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 224 GENERATIVE AI MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- TABLE 225 GENERATIVE AI MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 226 GENERATIVE AI MARKET, BY REGION, 2023-2030 (USD MILLION)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS