|

|

市場調査レポート

商品コード

1371236

製本材料の世界市場:製本タイプ別、材料タイプ別、用途別、地域別-2028年までの予測Bookbinding Materials Market by Binding Type (Adhesive Bonded, Mechanically Bonded), Material Type (Paper Cover Materials, Leather, Adhesives, Cloth/Fabric/Spine Reinforcing Materials, Cover Boards), Application, & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 製本材料の世界市場:製本タイプ別、材料タイプ別、用途別、地域別-2028年までの予測 |

|

出版日: 2023年10月24日

発行: MarketsandMarkets

ページ情報: 英文 216 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

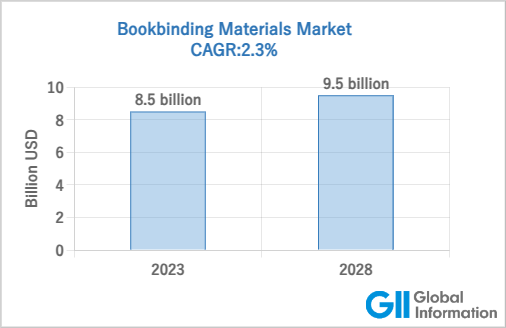

製本材料の市場規模は、2023年の85億米ドルから2028年には95億米ドルに達すると予測されており、CAGRは2.3%と見込まれています。

アジア太平洋は、2022年の製本材料市場の金額ベースで最大のシェアを占めると予測されています。

欧州の出版産業は、豊かな文学的伝統と教育の発展に重点を置いており、高品質で耐久性のある製本材料の需要を牽引しています。教科書、文学、学術出版物を含む印刷物に対する持続的な需要は、欧州各国の製本資材市場を引き続き活性化させています。欧州の環境持続可能性と環境に優しい慣行への強い関心は、リサイクル可能で生分解可能な製本材料への嗜好の高まりにつながり、業界内のさらなる革新と発展を刺激しています。同地域の強固な製造インフラと技術的進歩は、世界の製本材料市場における同地域の重要性をさらに高めています。

教育用書籍は製本材料市場で最も急成長する分野と予測されています。この成長の主な要因は、世界的に識字率向上と教育発展が重視されるようになり、高品質の教科書、ワークブック、参考書への需要が高まっていることです。教育機関や出版社が耐久性に優れ、視覚的にも魅力的な教育資料の制作に投資を続ける中、信頼性が高く革新的な製本材料のニーズが急増すると予想されます。教育コンテンツの急速なデジタル化により、触覚的で没入感のある学習体験を提供する印刷教材の重要性が高まっており、堅牢な製本ソリューションへの需要がさらに高まっています。また、多様な学習ニーズや年齢層に対応した専門教材の開拓も、製本資材市場における教育書籍分野の成長加速に寄与しています。

教育や識字率向上が重視され、出版産業が急速に拡大している中国では、高品質な書籍や教科書、教育資料に対する需要が高まっています。その結果、盛んな出版部門をサポートするため、耐久性があり、見た目に美しい製本材料の必要性が高まっています。特にエレクトロニクス、繊維、パッケージングなどの分野における世界の製造拠点としての中国の地位は、特殊な接着剤、コーティング剤、製本材料の需要を刺激しています。同国の強固な産業インフラと技術進歩は、製本材料市場における優位性をさらに高めています。同国の膨大な人口は、可処分所得の増加や消費者の嗜好の進化と相まって、雑誌、書籍、カタログを含む多様な印刷物への需要を大幅に押し上げています。

当レポートでは、世界の製本材料市場について調査し、製本タイプ別、材料タイプ別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- マクロ経済指標

第6章 業界の動向

- サプライチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- 生態系

- ケーススタディ

- 技術の概要

- 主要な利害関係者と購入基準

- 参考価格分析

- 貿易分析

- 市場の成長に影響を与える世界経済シナリオ

- 関税と規制状況

- 2023年~2024年の主要な会議とイベント

- 特許分析

第7章 製本材料市場、製本タイプ別

- イントロダクション

- 接着製本

- 機械製本

第8章 製本材料市場、材料タイプ別

- イントロダクション

- 紙製カバー素材

- レザー

- 接着剤

- 布/布地/背筋補強材

- エンドシート

- カバーボード

- その他

第9章 製本材料市場、用途別

- イントロダクション

- 教育本

- ハードカバー本とソフトカバー本

- 雑誌とカタログ

- 卒業証書の表紙と卒業アルバム

- ジャーナル

- その他

第10章 製本材料市場、地域別

- イントロダクション

- アジア太平洋

- 北米

- 欧州

- 南米

- 中東・アフリカ

第11章 競合情勢

- 概要

- 主要参入企業が採用した戦略

- 市場ランキング分析

- 市場シェア分析

- 主要企業の収益分析

- 企業評価マトリックス

- 新興企業/中小企業の評価マトリックス

- 競合状況・動向

第12章 企業プロファイル

- 主要参入企業

- HENKEL AG & CO. KGAA

- H.B. FULLER COMPANY

- JOWAT SE

- ARKEMA

- THE DOW CHEMICAL COMPANY

- EASTMAN CHEMICAL COMPANY

- PIDILITE INDUSTRIES LTD.

- WACKER CHEMIE AG

- MONDI GROUP

- その他の企業

- NEENAH PAPER INC.

- LD DAVIS INDUSTRIES

- POWIS PARKER INC.

- ADHESIVES DIRECT UK

- AICA ADTEK SDN BHD

- CHERNG TAY TECHNOLOGY CO., LTD.

- CATTIE ADHESIVES

- SANYHOT ADHESIVOS S.A.

- CHEMLINE INDIA LTD.

- NAN PAO RESIN CHEMICAL CO LTD.

- EOC GROUP

- THE REYNOLDS CO.

- KLEBCHEMIE M. G. BECKER GMBH & CO. KG

- HELMITIN ADHESIVES

- GLUECOM GROUP

- TEXYEAR INDUSTRIAL ADHESIVES PVT LTD

- TOYOCHEM CO., LTD.

- GC ADHESIVES COMPANY

- SCHMEDT GMBH & CO.KG

- UPM GLOBAL

第13章 隣接市場および関連市場

第14章 付録

The bookbinding materials market size is projected to reach USD 9.5 billion by 2028 at a CAGR of 2.3% from USD 8.5 billion in 2023. Asia pacific is estimated to account for the largest share in terms of value of the bookbinding materials market in 2022.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD million/billion) |

| Segments | By Binding Type, By Binding Material, By Application, By Region |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, South America |

" Europe is likely to account for the second largest share of bookbinding materials market in terms of value."

The region's established publishing industry, marked by a rich literary heritage and a strong emphasis on educational development, drives the demand for high-quality and durable bookbinding materials. The sustained demand for printed materials, including textbooks, literature, and academic publications, continues to fuel the market for bookbinding materials across various European countries. Europe's strong focus on environmental sustainability and eco-friendly practices has led to a growing preference for recyclable and biodegradable bookbinding materials, stimulating further innovation and development within the industry. The region's robust manufacturing infrastructure and technological advancements further contribute to its significance in the global bookbinding materials market.

The presence of key players and industry leaders in the bookbinding materials sector, along with an increasing focus on research and development initiatives, ensures the continuous growth and competitiveness of the European market.

" Education books is projected to be the fastest growing application segment of bookbinding materials market."

The growth is primarily fueled by the increasing emphasis on literacy and educational development worldwide, leading to a growing demand for high-quality textbooks, workbooks, and reference materials. As educational institutions and publishing houses continue to invest in the production of durable and visually appealing educational resources, the need for reliable and innovative bookbinding materials is expected to surge. The rapid digitalization of educational content has amplified the importance of printed materials that offer a tactile and immersive learning experience, further driving the demand for robust bookbinding solutions. The development of specialized educational materials catering to diverse learning needs and age groups is also contributing to the accelerated growth of the education books segment within the bookbinding materials market.

"China, by country is forecasted to be the largest market of bookbinding materials during the forecast period."

The country's rapidly expanding publishing industry, driven by a significant emphasis on education and literacy, has led to a substantial demand for high-quality books, textbooks, and educational resources. This has consequently fueled the need for durable and visually appealing bookbinding materials to support the flourishing publishing sector. China's position as a global manufacturing hub, particularly in sectors such as electronics, textiles, and packaging, has stimulated the demand for specialized adhesives, coatings, and binding materials. The country's robust industrial infrastructure and technological advancements further contribute to its dominance in the bookbinding materials market. The country's massive population, coupled with the increasing disposable income and evolving consumer preferences, has significantly bolstered the demand for a diverse range of printed materials, including magazines, books, and catalogs.

Breakdown of Primary Interviews:

- By Company Type: Tier 1 - 33%, Tier 2 - 40%, and Tier 3 - 27%

- By Designation: C Level - 33%, D Level - 27%, and Others - 40%

- By Region: North America - 27%, Europe - 20%, Asia Pacific - 33%, Middle East & Africa - 7% and South America - 13%

The key companies profiled in this report are Henkel AG (Germany), H.B. Fuller (US), Arkema (US), The Dow Chemical Company (US), and UPM Global (Finland).

Research Coverage:

The bookbinding materials market has been segmented based on Binding Type (Adhesive Bonded, Mechanically Bonded), Application (Education Books, Hardcover and Softcover Books, Magazines and Catalogs, Diploma Covers and Yearbooks, Journals, and Others), Material Type (Paper Cover Materials, Leather, Adhesives, Cloth/Fabric/Spine Reinforcing Materials, End sheets, Cover Boards, and Others), and by Region (Asia Pacific, North America, Europe, Middle East & Africa, and South America).

This report provides insights on the following pointers:

- Analysis of key drivers (Increase in demand for physical books, High demand in DIY applications) restraints (Availability of online resource for educational purpose), opportunities (Growing Publishing and education sector), and challenges (Volatility in raw material prices) influencing the growth of the bookbinding materials market.

- Product Development/Innovation: Detailed insight of upcoming technologies, research & development activities, and new product launch in the bookbinding materials market.

- Market Development: Comprehensive information about markets - the report analyses the bookbinding materials market across varied regions.

- Market Diversification: Exclusive information about the new products & service untapped geographies, recent developments, and investments in bookbinding materials market.

Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Henkel AG (Germany), H.B. Fuller (US), Arkema (US), The Dow Chemical Company (US), and UPM Global (Finland) among other in the bookbinding materials market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.2.2 DEFINITION AND INCLUSIONS, BY MATERIAL TYPE

- 1.2.3 DEFINITION AND INCLUSIONS, BY BINDING TYPE

- 1.2.4 DEFINITION AND INCLUSIONS, BY APPLICATION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- FIGURE 2 REGIONAL SCOPE

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 3 BOOKBINDING MATERIALS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of interviews with experts

- 2.1.2.3 Primary data sources

- 2.1.2.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION APPROACH

- 2.2.1 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 5 BOOKBINDING MATERIALS MARKET SIZE ESTIMATION, BY REGION

- FIGURE 6 BOOKBINDING MATERIALS MARKET, BY BINDING TYPE

- FIGURE 7 BOOKBINDING MATERIALS MARKET, BY MATERIAL TYPE

- 2.2.2 BOTTOM-UP APPROACH

- FIGURE 8 BOOKBINDING MATERIALS MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH, BY APPLICATION

- FIGURE 9 BOOKBINDING MATERIALS MARKET SIZE ESTIMATION, BY END-USE INDUSTRY

- 2.3 MARKET FORECAST

- 2.3.1 SUPPLY-SIDE FORECAST

- FIGURE 10 BOOKBINDING MATERIALS MARKET: SUPPLY-SIDE FORECAST

- FIGURE 11 METHODOLOGY FOR SUPPLY-SIDE SIZING OF BOOKBINDING MATERIALS MARKET

- 2.4 FACTOR ANALYSIS

- FIGURE 12 GLOBAL IMPACT ON BOOKBINDING MATERIALS MARKET

- 2.5 DATA TRIANGULATION

- FIGURE 13 BOOKBINDING MATERIALS MARKET: DATA TRIANGULATION

- 2.6 ASSUMPTIONS AND LIMITATIONS

- TABLE 1 ASSUMPTIONS

- TABLE 2 LIMITATIONS

- 2.7 GROWTH RATE ASSUMPTIONS

- 2.8 RISK ASSESSMENT

- TABLE 3 BOOKBINDING MATERIALS MARKET: RISK ASSESSMENT

- 2.9 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- TABLE 4 BOOKBINDING MATERIALS MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 14 ADHESIVE BONDED SEGMENT TO DOMINATE MARKET IN 2023

- FIGURE 15 MAGAZINES AND CATALOGS APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 16 PAPER COVER MATERIALS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 17 ASIA PACIFIC TO BE FASTEST-GROWING BOOKBINDING MATERIALS MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN BOOKBINDING MATERIALS MARKET

- FIGURE 18 INCREASING DEMAND FROM ASIA PACIFIC TO DRIVE MARKET DURING FORECAST PERIOD

- 4.2 BOOKBINDING MATERIALS MARKET, BY BINDING TYPE

- FIGURE 19 ADHESIVE BONDED TO BE LARGER SEGMENT FROM 2023 TO 2028

- 4.3 ASIA PACIFIC: BOOKBINDING MATERIALS MARKET, BY APPLICATION AND COUNTRY, 2023

- FIGURE 20 MAGAZINES AND CATALOGS SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES IN 2023

- 4.4 BOOKBINDING MATERIALS MARKET: DEVELOPED VS. DEVELOPING COUNTRIES

- FIGURE 21 EMERGING ECONOMIES TO WITNESS HIGHER GROWTH

- 4.5 BOOKBINDING MATERIALS MARKET: BY MAJOR COUNTRIES

- FIGURE 22 MEXICO TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN BOOKBINDING MATERIALS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increase in demand for physical books

- 5.2.1.2 High use in DIY applications

- 5.2.2 RESTRAINTS

- 5.2.2.1 Availability of online resources for educational purpose

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing publishing and education sectors

- 5.2.4 CHALLENGES

- 5.2.4.1 Volatility in raw material prices

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 24 BOOKBINDING MATERIALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 BOOKBINDING MATERIALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 THREAT OF SUBSTITUTES

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 MACROECONOMIC INDICATORS

- 5.4.1 INTRODUCTION

- 5.4.2 GDP TREND AND FORECAST

- TABLE 6 GDP PERCENTAGE CHANGE OF KEY COUNTRIES, 2020-2028

- 5.4.3 TREND AND FORECAST OF GLOBAL BOOK INDUSTRY

- FIGURE 25 NUMBER OF BOOKS DEPOSITED IN LEGAL REPOSITORIES, 2018-2021

- FIGURE 26 DISTRIBUTION OF BOOKS DEPOSITED IN LEGAL REPOSITORIES, BY REGION, 2021

- FIGURE 27 NUMBER OF BOOKS DEPOSITED AT SELECTED LEGAL REPOSITORIES, 2021

- TABLE 7 TOTAL PUBLISHING INDUSTRY REVENUE, BY SECTOR (USD MILLION), 2021

- FIGURE 28 DISTRIBUTION OF PUBLISHING INDUSTRY REVENUE BY FORMAT, 2021

- FIGURE 29 CHILDREN'S BOOKS REVENUE (USD MILLION), 2021

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- FIGURE 30 BOOKBINDING MATERIALS MARKET: SUPPLY CHAIN ANALYSIS

- TABLE 8 BOOKBINDING MATERIALS MARKET: SUPPLY CHAIN ANALYSIS

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- FIGURE 31 TRENDS IN END-USE INDUSTRIES IMPACTING BUSINESS OF BOOKBINDING MATERIAL MANUFACTURERS

- 6.3 ECOSYSTEM

- FIGURE 32 ADHESIVE & SEALANT ECOSYSTEM

- 6.4 CASE STUDY

- 6.5 TECHNOLOGY OVERVIEW

- 6.6 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP APPLICATIONS (%)

- 6.6.2 BUYING CRITERIA

- FIGURE 34 KEY BUYING CRITERIA FOR BOOKBINDING MATERIALS

- TABLE 10 KEY BUYING CRITERIA FOR BOOKBINDING MATERIALS

- 6.7 INDICATIVE PRICING ANALYSIS

- FIGURE 35 ADHESIVES AVERAGE SELLING PRICE TREND, BY REGION,2022

- FIGURE 36 ADHESIVES AVERAGE SELLING PRICE TREND, BY COMPANY

- 6.8 TRADE ANALYSIS

- 6.8.1 IMPORT SCENARIO OF OUTER COVER OF BOOKS

- TABLE 11 COUNTRY-WISE IMPORT DATA (USD THOUSAND)

- 6.8.2 EXPORT SCENARIO OF OUTER COVER OF BOOKS

- TABLE 12 COUNTRY-WISE EXPORT DATA (USD THOUSAND)

- 6.9 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTH

- 6.9.1 RECESSION IMPACT

- 6.9.2 RUSSIA-UKRAINE WAR

- 6.9.3 EUROPE RECESSION IMPACT

- 6.9.4 EUROPE ENERGY CRISIS

- 6.9.5 ASIA PACIFIC RECESSION IMPACT

- 6.10 TARIFF AND REGULATORY LANDSCAPE

- 6.10.1 REGULATIONS

- 6.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES & OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 15 BOOKBINDING MATERIALS MARKET: KEY CONFERENCES AND EVENTS, 2023-2024

- 6.12 PATENT ANALYSIS

- 6.12.1 METHODOLOGY

- 6.12.2 PUBLICATION TRENDS

- FIGURE 37 PUBLICATION TRENDS, 2018-2023

- 6.12.3 INSIGHTS

- 6.12.4 JURISDICTION ANALYSIS

- FIGURE 38 JURISDICTION ANALYSIS OF REGISTERED PATENTS, 2018-2023

- 6.12.5 TOP APPLICANTS

- FIGURE 39 NUMBER OF PATENTS, BY COMPANY (2018-2023)

7 BOOKBINDING MATERIALS MARKET, BY BINDING TYPE

- 7.1 INTRODUCTION

- FIGURE 40 ADHESIVE BONDED SEGMENT TO LEAD BOOKBINDING MATERIALS MARKET BETWEEN 2023 AND 2028

- TABLE 16 BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- 7.2 ADHESIVE BONDED

- 7.2.1 COST-EFFECTIVENESS AND OPERATIONAL EFFICIENCY MAKING IT PERFECT CATALYST TO DRIVE DEMAND

- TABLE 17 ADHESIVE BONDED: BOOKBINDING MATERIALS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3 MECHANICALLY BONDED

- 7.3.1 ENHANCED DURABILITY AND STRUCTURAL INTEGRITY TO DRIVE DEMAND

- TABLE 18 MECHANICALLY BONDED: BOOKBINDING MATERIALS MARKET, BY REGION, 2021-2028 (USD MILLION)

8 BOOKBINDING MATERIALS MARKET, BY MATERIAL TYPE

- 8.1 INTRODUCTION

- FIGURE 41 PAPER COVER MATERIALS SEGMENT TO LEAD BOOKBINDING MATERIALS MARKET BETWEEN 2023 AND 2028

- TABLE 19 BOOKBINDING MATERIALS MARKET, BY MATERIAL TYPE, 2021-2028 (USD MILLION)

- 8.2 PAPER COVER MATERIALS

- 8.2.1 DURABILITY AND COST-EFFECTIVENESS TO DRIVE MARKET

- TABLE 20 PAPER COVER MATERIALS: BOOKBINDING MATERIALS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.3 LEATHER

- 8.3.1 STRUCTURAL INTEGRITY TO DRIVE DEMAND

- TABLE 21 LEATHER: BOOKBINDING MATERIALS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.4 ADHESIVES

- 8.4.1 IMPARTING HIGH STRENGTH AND STABILITY TO COVERS TO DRIVE DEMAND

- TABLE 22 ADHESIVE: BOOKBINDING MATERIALS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.5 CLOTH/FABRIC/SPINE REINFORCING MATERIALS

- 8.5.1 INCREASING STRUCTURAL ROBUSTNESS AND LIFESPAN OF BOOKS TO DRIVE MARKET

- TABLE 23 CLOTH/FABRIC/SPINE REINFORCING MATERIALS: BOOKBINDING MATERIALS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.6 END SHEETS

- 8.6.1 ENHANCED STRUCTURAL INTEGRITY OF BOOKS TO DRIVE MARKET

- TABLE 24 END SHEETS: BOOKBINDING MATERIALS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.7 COVER BOARDS

- 8.7.1 STRUCTURAL SUPPORT AND RIGIDITY OF BOOK TO DRIVE DEMAND

- TABLE 25 COVER BOARDS: BOOKBINDING MATERIALS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.8 OTHERS

- TABLE 26 OTHER MATERIALS: BOOKBINDING MATERIALS MARKET, BY REGION, 2021-2028 (USD MILLION)

9 BOOKBINDING MATERIALS MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 42 MAGAZINES AND CATALOGS SEGMENT TO LEAD BOOKBINDING MATERIALS MARKET BETWEEN 2023 AND 2028

- TABLE 27 BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 9.2 EDUCATION BOOKS

- 9.2.1 INCREASING NUMBER OF STUDENTS AND EDUCATIONAL INSTITUTES TO DRIVE MARKET

- TABLE 28 EDUCATION BOOKS: BOOKBINDING MATERIALS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.3 HARDCOVER AND SOFTCOVER BOOKS

- 9.3.1 SOLID READER BASE TO DRIVE SEGMENT

- TABLE 29 HARDCOVER AND SOFTCOVER BOOKS: BOOKBINDING MATERIALS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.4 MAGAZINES AND CATALOGS

- 9.4.1 HIGH DEMAND FOR BOOKS IN EMERGING ECONOMIES TO DRIVE MARKET

- TABLE 30 MAGAZINES AND CATALOGS: BOOKBINDING MATERIALS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.5 DIPLOMA COVERS AND YEARBOOKS

- 9.5.1 GROWTH IN EDUCATION SECTOR TO DRIVE DEMAND

- TABLE 31 DIPLOMA COVERS AND YEARBOOKS: BOOKBINDING MATERIALS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.6 JOURNALS

- 9.6.1 RISING DEMAND FOR DIGITAL FORMATS TO HAMPER MARKET GROWTH

- TABLE 32 JOURNALS: BOOKBINDING MATERIALS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.7 OTHERS

- TABLE 33 OTHERS: BOOKBINDING MATERIALS MARKET, BY REGION, 2021-2028 (USD MILLION)

10 BOOKBINDING MATERIALS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 43 ASIA PACIFIC TO BE THE FASTEST-GROWING BOOKBINDING MATERIALS MARKET BY 2028

- TABLE 34 BOOKBINDING MATERIALS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 35 BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 36 BOOKBINDING MATERIALS MARKET, BY MATERIAL TYPE, 2021-2028 (USD MILLION)

- TABLE 37 BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.2 ASIA PACIFIC

- 10.2.1 RECESSION IMPACT ON ASIA PACIFIC

- FIGURE 44 ASIA PACIFIC: BOOKBINDING MATERIALS MARKET SNAPSHOT

- TABLE 38 ASIA PACIFIC: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 39 ASIA PACIFIC: BOOKBINDING MATERIALS MARKET, BY MATERIAL TYPE, 2021-2028 (USD MILLION)

- TABLE 40 ASIA PACIFIC: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: BOOKBINDING MATERIALS, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.2.2 CHINA

- 10.2.2.1 Sustained demand for physical books to drive market

- TABLE 42 CHINA: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 43 CHINA: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.2.3 JAPAN

- 10.2.3.1 Printed books to continue dominate market

- TABLE 44 JAPAN: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 45 JAPAN: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Growth in publishing industry to fuel market

- TABLE 46 SOUTH KOREA: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 47 SOUTH KOREA: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.2.5 INDIA

- 10.2.5.1 Government initiatives to boost economy to contribute to market growth

- TABLE 48 INDIA: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 49 INDIA: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.2.6 MALAYSIA

- 10.2.6.1 Decline in number of bookstores to affect bookbinding materials market

- TABLE 50 MALAYSIA: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 51 MALAYSIA: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.2.7 REST OF ASIA PACIFIC

- TABLE 52 REST OF ASIA PACIFIC: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 53 REST OF ASIA PACIFIC: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.3 NORTH AMERICA

- 10.3.1 RECESSION IMPACT ON NORTH AMERICA

- FIGURE 45 NORTH AMERICA: BOOKBINDING MATERIALS MARKET SNAPSHOT

- TABLE 54 NORTH AMERICA: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: BOOKBINDING MATERIALS MARKET, BY MATERIAL TYPE, 2021-2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: BOOKBINDING MATERIALS, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.3.2 US

- 10.3.2.1 Need to reduce screen time and eye strain to drive demand

- TABLE 58 US: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 59 US: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.3.3 CANADA

- 10.3.3.1 Growth in softcover book industry to drive market

- TABLE 60 CANADA: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 61 CANADA: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.3.4 MEXICO

- 10.3.4.1 Increasing demand for e-books and e-magazines to adversely impact market growth

- TABLE 62 MEXICO: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 63 MEXICO: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.4 EUROPE

- 10.4.1 RECESSION IMPACT ON EUROPE

- FIGURE 46 EUROPE: BOOKBINDING MATERIALS MARKET SNAPSHOT

- TABLE 64 EUROPE: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 65 EUROPE: BOOKBINDING MATERIALS MARKET, BY MATERIAL TYPE, 2021-2028 (USD MILLION)

- TABLE 66 EUROPE: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 67 EUROPE: BOOKBINDING MATERIALS, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.4.2 GERMANY

- 10.4.2.1 High demand for physical books to drive market

- TABLE 68 GERMANY: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 69 GERMANY: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.4.3 FRANCE

- 10.4.3.1 Decline in printed book production to hamper market growth

- TABLE 70 FRANCE: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 71 FRANCE: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.4.4 ITALY

- 10.4.4.1 Demand from major end-use industries to drive market

- TABLE 72 ITALY: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 73 ITALY: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.4.5 UK

- 10.4.5.1 Physical books reading habit to drive demand

- TABLE 74 UK: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 75 UK: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.4.6 SPAIN

- 10.4.6.1 Investment in book translation industry to drive market

- TABLE 76 SPAIN: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 77 SPAIN: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.4.7 TURKEY

- 10.4.7.1 Moderate demand from end-use industries to drive market

- TABLE 78 TURKEY: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 79 TURKEY: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.4.8 REST OF EUROPE

- TABLE 80 REST OF EUROPE: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 81 REST OF EUROPE: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.5 SOUTH AMERICA

- 10.5.1 RECESSION IMPACT ON SOUTH AMERICA

- FIGURE 47 SOUTH AMERICA: BOOKBINDING MATERIALS MARKET SNAPSHOT

- TABLE 82 SOUTH AMERICA: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 83 SOUTH AMERICA: BOOKBINDING MATERIALS MARKET, BY MATERIAL TYPE, 2021-2028 (USD MILLION)

- TABLE 84 SOUTH AMERICA: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 85 SOUTH AMERICA: BOOKBINDING MATERIALS, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.5.2 BRAZIL

- 10.5.2.1 High demand for physical books to drive market

- TABLE 86 BRAZIL: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 87 BRAZIL: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.5.3 ARGENTINA

- 10.5.3.1 Decline in book exports to slow down market growth

- TABLE 88 ARGENTINA: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 89 ARGENTINA: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.5.4 REST OF SOUTH AMERICA

- TABLE 90 REST OF SOUTH AMERICA: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 91 REST OF SOUTH AMERICA: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 RECESSION IMPACT ON MIDDLE EAST

- FIGURE 48 MIDDLE EAST & AFRICA: BOOKBINDING MATERIALS MARKET SNAPSHOT

- TABLE 92 MIDDLE EAST & AFRICA: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 93 MIDDLE EAST & AFRICA: BOOKBINDING MATERIALS MARKET, BY MATERIAL TYPE, 2021-2028 (USD MILLION)

- TABLE 94 MIDDLE EAST & AFRICA: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 95 MIDDLE EAST & AFRICA: BOOKBINDING MATERIALS, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.6.2 SAUDI ARABIA

- 10.6.2.1 Increase in printed book sales to drive market

- TABLE 96 SAUDI ARABIA: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 97 SAUDI ARABIA: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.6.3 UAE

- 10.6.3.1 Focus on improving access to quality education to drive market

- TABLE 98 UAE: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 99 UAE: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.6.4 REST OF MIDDLE EAST & AFRICA

- TABLE 100 REST OF MIDDLE EAST & AFRICA: BOOKBINDING MATERIALS MARKET, BY BINDING TYPE, 2021-2028 (USD MILLION)

- TABLE 101 REST OF MIDDLE EAST & AFRICA: BOOKBINDING MATERIALS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 102 STRATEGIES ADOPTED BY KEY MANUFACTURERS IN BOOKBINDING MATERIALS MARKET

- 11.3 MARKET RANKING ANALYSIS

- FIGURE 49 RANKING OF KEY PLAYERS

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 50 MARKET SHARE ANALYSIS OF KEY ADHESIVES' PLAYERS, 2022

- TABLE 103 BOOKBINDING MATERIALS MARKET: DEGREE OF COMPETITION

- 11.5 REVENUE ANALYSIS OF KEY COMPANIES

- FIGURE 51 REVENUE ANALYSIS FOR KEY COMPANIES DURING PAST TWO YEARS

- 11.6 COMPANY EVALUATION MATRIX

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 52 BOOKBINDING MATERIALS MARKET: COMPANY EVALUATION MATRIX, 2022

- 11.6.5 COMPANY FOOTPRINT

- TABLE 104 COMPANY APPLICATION FOOTPRINT

- TABLE 105 COMPANY REGION FOOTPRINT

- TABLE 106 COMPANY FOOTPRINT

- 11.7 START-UP/SME EVALUATION MATRIX

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 53 BOOKBINDING MATERIALS MARKET: START-UPS/SMES EVALUATION MATRIX, 2022

- 11.7.5 COMPETITIVE BENCHMARKING

- TABLE 107 BOOKBINDING MATERIALS MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 108 BOOKBINDING MATERIALS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 11.8 COMPETITIVE SITUATIONS AND TRENDS

- 11.8.1 BOOKBINDING MATERIALS MARKET: DEALS, 2016-2023

- TABLE 109 BOOKBINDING MATERIALS MARKET: DEALS, 2016-2023

- 11.8.2 BOOKBINDING MATERIALS MARKET: OTHERS, 2016-2023

- TABLE 110 BOOKBINDING MATERIALS MARKET: OTHERS, 2016-2023

- 11.8.3 BOOKBINDING MATERIALS MARKET: PRODUCT LAUNCHES, 2016-2023

- TABLE 111 BOOKBINDING MATERIALS MARKET: PRODUCT LAUNCHES, 2016-2023

12 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 12.1 KEY COMPANIES

- 12.1.1 HENKEL AG & CO. KGAA

- TABLE 112 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

- FIGURE 54 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

- TABLE 113 HENKEL AG & CO. KGAA: PRODUCT LAUNCHES

- TABLE 114 HENKEL AG & CO. KGAA: DEALS

- TABLE 115 HENKEL AG & CO. KGAA: OTHERS

- 12.1.2 H.B. FULLER COMPANY

- TABLE 116 H.B. FULLER COMPANY: COMPANY OVERVIEW

- FIGURE 55 H.B. FULLER COMPANY: COMPANY SNAPSHOT

- TABLE 117 H.B. FULLER COMPANY: PRODUCT LAUNCHES

- TABLE 118 H.B. FULLER COMPANY: DEALS

- TABLE 119 H.B. FULLER COMPANY: OTHERS

- 12.1.3 JOWAT SE

- TABLE 120 JOWAT SE: COMPANY OVERVIEW

- 12.1.4 ARKEMA

- TABLE 121 ARKEMA: COMPANY OVERVIEW

- FIGURE 56 ARKEMA: COMPANY SNAPSHOT

- TABLE 122 ARKEMA: DEALS

- TABLE 123 ARKEMA: OTHERS

- 12.1.5 THE DOW CHEMICAL COMPANY

- TABLE 124 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

- FIGURE 57 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

- 12.1.6 EASTMAN CHEMICAL COMPANY

- TABLE 125 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- FIGURE 58 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- 12.1.7 PIDILITE INDUSTRIES LTD.

- TABLE 126 PIDILITE INDUSTRIES LTD.: COMPANY OVERVIEW

- FIGURE 59 PIDILITE INDUSTRIES LTD.: COMPANY SNAPSHOT

- 12.1.8 WACKER CHEMIE AG

- TABLE 127 WACKER CHEMIE AG: COMPANY OVERVIEW

- FIGURE 60 WACKER CHEMIE AG.: COMPANY SNAPSHOT

- 12.1.9 MONDI GROUP

- TABLE 128 MONDI GROUP: COMPANY OVERVIEW

- FIGURE 61 MONDI GROUP: COMPANY SNAPSHOT

- TABLE 129 MONDI GROUP: PRODUCTS OFFERED

- 12.2 OTHER COMPANIES

- 12.2.1 NEENAH PAPER INC.

- TABLE 130 NEENAH PAPER INC.: COMPANY OVERVIEW

- 12.2.2 LD DAVIS INDUSTRIES

- TABLE 131 LD DAVIS INDUSTRIES: COMPANY OVERVIEW

- 12.2.3 POWIS PARKER INC.

- TABLE 132 POWIS PARKER INC.: COMPANY OVERVIEW

- 12.2.4 ADHESIVES DIRECT UK

- TABLE 133 ADHESIVES DIRECT UK: COMPANY OVERVIEW

- 12.2.5 AICA ADTEK SDN BHD

- TABLE 134 AICA ADTEK SDN BHD: COMPANY OVERVIEW

- 12.2.6 CHERNG TAY TECHNOLOGY CO., LTD.

- TABLE 135 CHERNG TAY TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- 12.2.7 CATTIE ADHESIVES

- TABLE 136 CATTIE ADHESIVES: COMPANY OVERVIEW

- 12.2.8 SANYHOT ADHESIVOS S.A.

- TABLE 137 SANYHOT ADHESIVOS S.A.: COMPANY OVERVIEW

- 12.2.9 CHEMLINE INDIA LTD.

- TABLE 138 CHEMLINE INDIA LTD.: COMPANY OVERVIEW

- 12.2.10 NAN PAO RESIN CHEMICAL CO LTD.

- TABLE 139 NAN PAO RESIN CHEMICAL CO LTD.: COMPANY OVERVIEW

- 12.2.11 EOC GROUP

- TABLE 140 EOC GROUP: COMPANY OVERVIEW

- 12.2.12 THE REYNOLDS CO.

- TABLE 141 THE REYNOLDS CO.: COMPANY OVERVIEW

- 12.2.13 KLEBCHEMIE M. G. BECKER GMBH & CO. KG

- TABLE 142 KLEBCHEMIE M. G. BECKER GMBH & CO. KG: COMPANY OVERVIEW

- 12.2.14 HELMITIN ADHESIVES

- TABLE 143 HELMITIN ADHESIVES: COMPANY OVERVIEW

- 12.2.15 GLUECOM GROUP

- TABLE 144 GLUECOM GROUP: COMPANY OVERVIEW

- 12.2.16 TEXYEAR INDUSTRIAL ADHESIVES PVT LTD

- TABLE 145 TEXYEAR INDUSTRIAL ADHESIVES PVT LTD: COMPANY OVERVIEW

- 12.2.17 TOYOCHEM CO., LTD.

- TABLE 146 TOYOCHEM CO., LTD.: COMPANY OVERVIEW

- 12.2.18 GC ADHESIVES COMPANY

- TABLE 147 GC ADHESIVES COMPANY: COMPANY OVERVIEW

- 12.2.19 SCHMEDT GMBH & CO.KG

- TABLE 148 SCHMEDT GMBH & CO. KG: COMPANY OVERVIEW

- 12.2.20 UPM GLOBAL

- TABLE 149 UPM GLOBAL: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.1.1 BOOKBINDING ADHESIVES MARKET LIMITATIONS

- 13.2 BOOKBINDING ADHESIVES MARKET DEFINITION

- 13.3 BOOKBINDING ADHESIVES MARKET OVERVIEW

- 13.3.1 BOOKBINDING ADHESIVES MARKET, BY CHEMISTRY

- TABLE 150 BOOKBINDING ADHESIVES MARKET, BY CHEMISTRY, 2020-2027 (USD MILLION)

- TABLE 151 BOOKBINDING ADHESIVES MARKET, BY CHEMISTRY, 2020-2027 (KILOTON)

- 13.3.2 BOOKBINDING ADHESIVES MARKET, BY TECHNOLOGY

- TABLE 152 BOOKBINDING ADHESIVES MARKET, BY TECHNOLOGY, 2020-2027 (USD MILLION)

- TABLE 153 BOOKBINDING ADHESIVES MARKET, BY TECHNOLOGY, 2020-2027 (KILOTON)

- 13.3.3 BOOKBINDING ADHESIVES MARKET, BY APPLICATION

- TABLE 154 BOOKBINDING ADHESIVES MARKET, BY APPLICATION, 2020-2027 (USD MILLION)

- TABLE 155 BOOKBINDING ADHESIVES MARKET, BY APPLICATION, 2020-2027 (KILOTON)

- 13.3.4 BOOKBINDING ADHESIVES MARKET, BY REGION

- TABLE 156 BOOKBINDING ADHESIVES MARKET, BY REGION, 2020-2027 (USD MILLION)

- TABLE 157 BOOKBINDING ADHESIVES MARKET, BY REGION, 2020-2027 (KILOTON)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS