|

|

市場調査レポート

商品コード

1371235

AIコードツールの世界市場:オファリング別、技術別、用途別、業界別、地域別-2028年までの予測AI Code Tools Market by Offering (Tools (Technology (ML, NLP, Generative AI), Deployment Mode) and Services), Application (Data Science & Machine Learning, Cloud Services & DevOps, Web Development), Vertical and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| AIコードツールの世界市場:オファリング別、技術別、用途別、業界別、地域別-2028年までの予測 |

|

出版日: 2023年10月23日

発行: MarketsandMarkets

ページ情報: 英文 333 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のAIコードツールの市場規模は2023年に43億米ドルになるとみられ、2028年には126億米ドルに達すると予測されています。

予測期間中のCAGRは24.0%と見込まれています。AIコードツール、特にジェネレーティブAIコーディングツールの急速な採用と進歩の原動力は、それらがソフトウェア開発にもたらす変革的な影響です。これらのツールは、AI支援エンジニアリングワークフローの新時代を切り開き、開発者がより効率的かつ生産的にコーディングできるようにします。ジェネレーティブAIコーディングツールの出現により、開発者は自然言語プロンプトを使用したり、既存のコードを操作したりするだけで、コードの提案や関数全体を受け取ることさえできます。このような技術革新により、コーディングの状況は急速に変化しています。

AIコードツールは、しばしばAIコードジェネレータと呼ばれ、コーディングプロセスに人工知能と機械学習を組み込むことでソフトウェア開発に革命をもたらしました。これらのツールは、開発者がコードを効率的に記述、最適化、管理できるように設計されています。コードの自動補完や提案から、自動テスト、コードレビュー、さらにはコード生成まで、幅広い機能を提供しています。AIコードツールは、開発者の生産性を大幅に向上させ、より速く、より効果的に作業できるようにしました。これらのツールは、ソフトウェア開発をより利用しやすく、効率的で、ミスのないものにすることで、ソフトウェア開発の未来を変える可能性を秘めています。

AIコードツール、特に機械学習の領域では、ディープラーニング、リカレントニューラルネットワーク(RNN)、長短期記憶(LSTM)ネットワークなどのダイナミックな技術セットを包含しています。ディープラーニング技術は、ニューラルネットワークの複雑な層を掘り下げて複雑なパターンを抽出するため、画像認識や自然言語処理などのタスクに最適です。一方、RNNとLSTMは逐次的なデータ分析に優れており、時系列予測や言語モデリングなどのタスクを可能にします。機械学習の領域におけるこれらのAIコードツールは、インテリジェント・システムのバックボーンを形成し、データ駆動型の意思決定や、複雑な実世界データを理解・学習・対応できるアプリケーションの開発を可能にします。

アジア太平洋は、経済力と技術進歩のダイナミックな強国として立ちはだかり、2023年の世界成長の70%に相当する貢献が見込まれ、他の地域を凌ぐ勢いです。同地域は世界人口の50%以上を擁するため、AIがもたらすような技術シフトが同地域の将来を形成すると予想されます。中国、インド、日本など多くのアジア諸国は、情報集約型のAI技術を活用しており、会話型AIはその代表的な技術動向のひとつです。中国、日本、韓国、インド、シンガポールなどの国々は人工知能(AI)に多額の投資を行っており、アジア太平洋を世界で最も急成長しているAI市場として位置づけています。このようにAIが重視されることで、ソフトウェア企業には大きな成長の可能性とイノベーションの機会がもたらされます。

当レポートでは、世界のAIコードツール市場について調査し、オファリング別、技術別、用途別、業界別、企業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要と業界動向

- イントロダクション

- 市場力学

- 業界の動向

第6章 AIコードツール市場、オファリング別

- イントロダクション

- ツール

- 展開モード

- サービス

第7章 AIコードツール市場、技術別

- イントロダクション

- 機械学習

- 自然言語処理

- 生成AI

第8章 AIコードツール市場、用途別

- イントロダクション

- データサイエンスと機械学習

- クラウドサービスとDEVOPS

- ウェブ開発

- モバイルアプリ開発

- ゲーム開発

- 組み込みシステム

- その他

第9章 AIコードツール市場、業界別

- イントロダクション

- BFSI

- ITとITES

- ヘルスケアとライフサイエンス

- 製造業

- 小売と電子商取引

- 電気通信

- 政府と公共部門

- メディアとエンターテイメント

- その他

第10章 AIコードツール市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第11章 競合情勢

- 概要

- 主要参入企業が採用した戦略

- 収益分析

- 主要公開企業の市場シェア分析

- ブランド/製品の比較分析

- 企業評価マトリックス

- スタートアップ/中小企業評価マトリックス、2023年

- 競合シナリオと動向

- 主要ベンダーの評価と財務指標

- 主要ベンダーの年初来価格の総収益と株価ベータ

第12章 企業プロファイル

- イントロダクション

- 主要参入企業

- MICROSOFT

- IBM

- AWS

- META

- SALESFORCE

- OPENAI

- TABNINE

- REPLIT

- SOURCEGRAPH

- MOOLYA

- SNYK

- CIRCLECI

- JETBRAINS

- ADACORE

- WINGWARE

- DATADOG

- LIGHTNING AI

- KODEZI

- SOURCERY

- スタートアップ/中小企業

- CODEWP

- SQLAI.AI

- SINCODE AB

- SEEK AI

- ENZYME

- ASSISTIV AI

- CODIUM

- MUTABLE AI

- JUDINI

- SAFURAI

第13章 隣接市場および関連市場

第14章 付録

The global AI code tools market is valued at USD 4.3 billion in 2023 and is estimated to reach USD 12.6 billion by 2028, registering a CAGR of 24.0% during the forecast period. The driving factor behind the rapid adoption and advancement of AI code tools, particularly generative AI coding tools, lies in the transformative impact they have on software development. These tools are ushering in a new era of AI-assisted engineering workflows, enabling developers to code more efficiently and productively. With the emergence of generative AI coding tools, developers receive code suggestions and even entire functions by simply using natural language prompts or working with existing code. These innovations are quickly altering the coding landscape.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2017-2028 |

| Base Year | 2023 |

| Forecast Period | 2023-2028 |

| Units Considered | USD Billion |

| Segments | By Offering (Tools [Technology (ML, NLP, Generative AI), Deployment Mode] and Services), Application, Vertical, and Region |

| Regions covered | North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America |

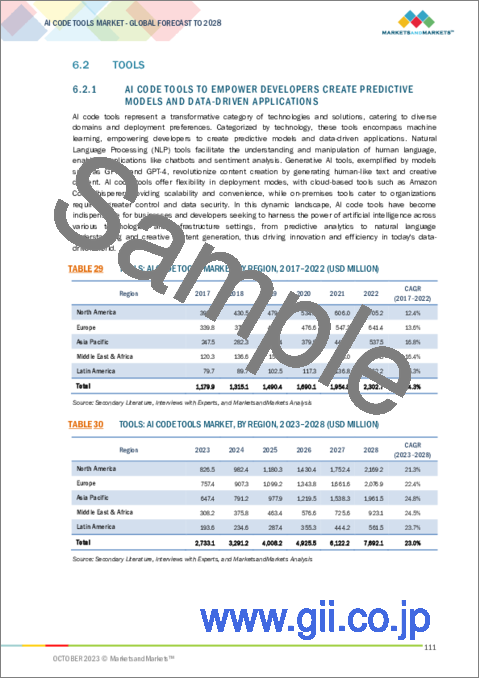

The tools segment is projected to hold the largest market size during the forecast period

AI code tools, often referred to as AI code generators, have revolutionized software development by incorporating artificial intelligence and machine learning into the coding process. These tools are designed to assist developers in writing, optimizing, and managing code efficiently. They offer a wide range of functionalities, from code autocompletion and suggestions to automated testing, code review, and even code generation. AI code tools have significantly increased developers' productivity, enabling them to work faster and more effectively. These tools hold the potential to transform the future of software development by making it more accessible, efficient, and error-free.

By Technology, Machine Learning Segment is registered to grow at the highest CAGR during the forecast period

AI code tools, specifically within the domain of machine learning, encompass a dynamic set of technologies, including deep learning, recurrent neural networks (RNNs), and long short-term memory (LSTM) networks. Deep learning techniques delve into the intricate layers of neural networks to extract complex patterns, making them ideal for tasks like image recognition and natural language processing. RNNs and LSTMs, on the other hand, excel in sequential data analysis, allowing for tasks such as time series forecasting and language modeling. These AI code tools in the realm of machine learning form the backbone of intelligent systems, enabling data-driven decision-making and the development of applications that can understand, learn from, and respond to intricate real-world data.

Asia Pacific is projected to witness the highest CAGR during the forecast period.

The Asia-Pacific region stands as a dynamic powerhouse of economic strength and technological advancement, poised to contribute a substantial 70% of global growth in 2023, surpassing other regions. As the region holds more than 50% of the world's population, any technological shifts like those being heralded by AI are expected to shape the future of the region. Many Asian countries such as China, India, Japan, and others are leveraging information-intensive AI technologies, with conversational AI being one of the leading technology trends. Countries like China, Japan, South Korea, India, and Singapore are heavily investing in artificial intelligence (AI), positioning the APAC region as the world's fastest-growing AI market. This emphasis on AI offers vast growth potential and innovation opportunities for software companies.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the AI code tools market.

- By Company: Tier I: 35%, Tier II: 45%, and Tier III: 20%

- By Designation: C-Level Executives: 35%, Directors: 25%, and Others: 40%

- By Region: North America: 45%, Asia Pacific: 30%, Europe: 20%, RoW: 5%

Major vendors offering AI code tools and services across the globe are IBM (US), Microsoft (US), Google (US), AWS (US), Salesforce (US), Meta (US), OpenAI (US), , Tabnine (Israel), Replit (US), Sourcegraph (US), Moolya (India), Snyk (US), CircleCI (US), JetBrains (Czech Republic), AdaCore (France), WingWare (US), Datadog (US), Lightning AI (US), Kodezi (US), Sourcery.AI (England), CodeWP (US), SinCode AB (Sweden), SQLAI.ai (Germany), Seek AI (US), Enzyme (US), Assistiv.ai (Germany), CodiumAI (Israel), MutableAI (US), Judini (US), and Safurai (Italy).

Research Coverage

The market study covers AI code tools across segments. It aims at estimating the market size and the growth potential across different segments, such as offering, application, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market for AI code tools and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rapid advancements in generative AI is revolutionizing software development, Increased efficiency and productivity with AI code tools, Need to assist developers in tackling complex coding tasks, Transformative shift in the roles of software developers), restraints (Presence of inaccuracies and limitations in AI-generated code poses a significant restraint and Overreliance on AI code tools to hinder the problem-solving abilities), opportunities (Evolution of Application Development with AI-Powered Virtual Developers, Unlocking Innovation through Augmented Software Development (ASD), Emergence of Prompt Engineering in Software Industry), and challenges (Legal and Ethical Complexities in AI Code Tools, Security challenges faced in AI coding tools, Concerns for biasness in the code generated) influencing the growth of the AI code tools market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the AI code tools market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the AI code tools market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in AI code tools market strategies; the report also helps stakeholders understand the pulse of the AI code tools market and provides them with information on key market drivers, restraints, challenges, and opportunities.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as IBM (US), Microsoft (US), Google (US), AWS (US), Salesforce (US), Meta (US), OpenAI (US) among others in the AI code tools market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 AI CODE TOOLS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- TABLE 1 PRIMARY INTERVIEWS

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 AI CODE TOOLS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): FLOWCHART USING REVENUE FROM AI CODE TOOLS/SERVICES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL AI CODE TOOLS / SERVICE COMPANIES

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): REVENUES OF TOP PLAYERS AND SOURCES OF DATA

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 4, BOTTOM-UP (DEMAND-SIDE): OVERALL AI CODE TOOLS SPENDING

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.7 IMPLICATIONS OF RECESSION ON AI CODE TOOLS MARKET

- TABLE 3 IMPACT OF RECESSION ON GLOBAL AI CODE TOOLS MARKET

3 EXECUTIVE SUMMARY

- TABLE 4 AI CODE TOOLS MARKET SIZE AND GROWTH RATE, 2017-2022 (USD MILLION, Y-O-Y)

- TABLE 5 AI CODE TOOLS MARKET SIZE AND GROWTH RATE, 2023-2028 (USD MILLION, Y-O-Y)

- FIGURE 8 TOOLS SEGMENT TO ACCOUNT FOR LARGER SHARE IN 2023

- FIGURE 9 MACHINE LEARNING TECHNOLOGY TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 10 CLOUD DEPLOYMENT TO ACCOUNT FOR LARGER SHARE IN 2023

- FIGURE 11 PROFESSIONAL SERVICES TO ACCOUNT FOR LARGER MARKET SIZE IN 2023

- FIGURE 12 CONSULTING SERVICES TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 13 DATA SCIENCE & MACHINE LEARNING TO ACCOUNT FOR LARGEST APPLICATION IN 2023

- FIGURE 14 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 15 ASIA PACIFIC TO GROW AT HIGHEST CAGR IN AI CODE TOOLS MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN AI CODE TOOLS MARKET

- FIGURE 16 INCREASING DEMAND FOR AUTOMATION AND EFFICIENCY IN SOFTWARE DEVELOPMENT TO PROPEL ADOPTION OF AI CODE TOOLS

- 4.2 AI CODE TOOLS MARKET: TOP THREE APPLICATIONS

- FIGURE 17 DATA SCIENCE & MACHINE LEARNING APPLICATION EXPECTED TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- 4.3 AI CODE TOOLS MARKET, BY OFFERING & VERTICAL

- FIGURE 18 TOOLS AND BFSI VERTICAL TO ACCOUNT FOR LARGEST SHARES IN 2023

- 4.4 AI CODE TOOLS MARKET, BY REGION

- FIGURE 19 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 MARKET DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid advancements in generative AI revolutionizing software development

- 5.2.1.2 Increased efficiency and productivity with AI code tools

- 5.2.1.3 Need to assist developers in tackling complex coding tasks

- 5.2.1.4 Transformative shift in roles of software developers

- 5.2.2 RESTRAINTS

- 5.2.2.1 Presence of inaccuracies and limitations in AI-generated codes

- 5.2.2.2 Overreliance on AI code tools hinder problem-solving abilities

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Evolution of application development with AI-powered virtual developers

- 5.2.3.2 Unlocking innovation through augmented software development (ASD)

- 5.2.3.3 Emergence of prompt engineering in software industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Legal and ethical complexities in AI code tools

- 5.2.4.2 Security challenges faced in AI coding tools

- 5.2.4.3 Concerns for biases in generated code

- 5.3 INDUSTRY TRENDS

- 5.3.1 AI CODE TOOLS: ARCHITECTURE

- FIGURE 21 AI CODE TOOLS ARCHITECTURE

- 5.3.2 AI CODE TOOLS: EVOLUTION

- FIGURE 22 AI CODE TOOLS MARKET EVOLUTION

- 5.3.3 VALUE CHAIN ANALYSIS

- FIGURE 23 AI CODE TOOLS MARKET: VALUE CHAIN ANALYSIS

- 5.3.4 ECOSYSTEM ANALYSIS

- FIGURE 24 AI CODE TOOLS MARKET ECOSYSTEM

- TABLE 6 AI CODE TOOLS MARKET: AI CODE TOOL PROVIDERS

- TABLE 7 AI CODE TOOLS MARKET: SERVICE PROVIDERS

- TABLE 8 AI CODE TOOLS MARKET: INTEGRATORS

- TABLE 9 AI CODE TOOLS MARKET: END USERS

- TABLE 10 AI CODE TOOLS MARKET: REGULATORY BODIES

- 5.3.5 PRICING ANALYSIS

- 5.3.5.1 Selling prices of key players, by application

- FIGURE 25 SELLING PRICES OF KEY PLAYERS FOR TOP THREE APPLICATIONS

- TABLE 11 SELLING PRICES OF KEY PLAYERS FOR TOP THREE APPLICATIONS (USD)

- 5.3.5.2 Indicative pricing analysis of AI code tools

- TABLE 12 AI CODE TOOLS: PRICING LEVELS

- 5.3.6 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 AI CODE TOOLS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.6.1 Threat of new entrants

- 5.3.6.2 Threat of substitutes

- 5.3.6.3 Bargaining power of suppliers

- 5.3.6.4 Bargaining power of buyers

- 5.3.6.5 Intensity of competitive rivalry

- 5.3.7 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS OF AI CODE TOOLS MARKET

- FIGURE 27 AI CODE TOOLS MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

- 5.3.8 TECHNOLOGY ANALYSIS

- FIGURE 28 AI CODE TOOLS MARKET: TECHNOLOGY ANALYSIS

- 5.3.8.1 Key technologies

- 5.3.8.1.1 Machine learning

- 5.3.8.1.2 Natural language processing

- 5.3.8.1.3 Generative AI

- 5.3.8.1.4 Containerization and microservices

- 5.3.8.2 Adjacent technologies

- 5.3.8.2.1 Big data

- 5.3.8.2.2 Predictive analytics

- 5.3.8.2.3 Cloud computing

- 5.3.8.2.4 Cybersecurity

- 5.3.8.2.5 Graph databases

- 5.3.8.1 Key technologies

- 5.3.9 CASE STUDY ANALYSIS

- 5.3.10 IT & ITES

- 5.3.10.1 Case study 1: AI-powered coding assistant, Tabnine, increased productivity at CI&T

- 5.3.10.2 Case study 2: Nutanix addressed Log4j vulnerability using Sourcegraph

- 5.3.11 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 5.3.11.1 Case study 3: Neo Financial transformed developer productivity and codebase management with Sourcegraph

- 5.3.11.2 Case study 4: PayPay achieved scalability and reliability with CircleCI for CI/CD solutions

- 5.3.12 HEALTHCARE & LIFE SCIENCES

- 5.3.12.1 Case study 5: Baracoda accelerated health-related IoT products with CircleCI

- 5.3.12.2 Case study 6: HealthLabs.com achieved enhanced developer productivity and well-being with CircleCI

- 5.3.13 RETAIL & ECOMMERCE

- 5.3.13.1 Case study 7: CircleCI helped Bolt optimize and streamline its build pipelines

- 5.3.13.2 Case study 8: CircleCI helped BRIKL meet customer demands, maintain competitive edge, and drive future growth

- 5.3.14 TRANSPORTATION & LOGISTICS

- 5.3.14.1 Case study 9: Lyft achieved successful transition from monolithic PHP application to microservices architecture with Sourcegraph

- 5.3.15 EDUCATION

- 5.3.15.1 Case study 10: MagicSchool revolutionized education by seamlessly integrating AI into daily workflow of teachers

- 5.3.16 PATENT ANALYSIS

- 5.3.16.1 Methodology

- 5.3.16.2 Document Type

- TABLE 14 PATENTS FILED, 2013-2023

- 5.3.16.3 Innovation and patent applications

- FIGURE 29 TOTAL NUMBER OF PATENTS GRANTED, 2013-2023

- 5.3.16.3.1 Top applicants

- FIGURE 30 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2013-2023

- TABLE 15 TOP 20 PATENT OWNERS, 2013-2023

- TABLE 16 LIST OF PATENTS IN AI CODE TOOLS MARKET, 2021-2023

- 5.3.17 KEY CONFERENCES & EVENTS, 2023-2024

- TABLE 17 DETAILED LIST OF CONFERENCES & EVENTS, 2023-2024

- 5.3.18 TARIFFS AND REGULATORY LANDSCAPE

- 5.3.18.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.3.18.2 North America

- 5.3.18.2.1 US

- 5.3.18.2.2 Canada

- 5.3.18.3 Europe

- 5.3.18.4 Asia Pacific

- 5.3.18.4.1 South Korea

- 5.3.18.4.2 China

- 5.3.18.4.3 India

- 5.3.18.5 Middle East & Africa

- 5.3.18.5.1 UAE

- 5.3.18.5.2 KSA

- 5.3.18.5.3 Bahrain

- 5.3.18.6 Latin America

- 5.3.18.6.1 Brazil

- 5.3.18.6.2 Mexico

- 5.3.18.2 North America

- 5.3.19 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.3.19.1 Key stakeholders in buying process

- FIGURE 31 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- 5.3.19.2 Buying criteria

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 23 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.3.20 BEST PRACTICES IN AI CODE TOOLS MARKET

- 5.3.21 TECHNOLOGY ROADMAP OF AI CODE TOOLS MARKET

- TABLE 24 SHORT-TERM ROADMAP, 2023-2025

- TABLE 25 MID-TERM ROADMAP, 2026-2028

- TABLE 26 LONG-TERM ROADMAP, 2029-2030

- 5.3.22 BUSINESS MODELS OF AI CODE TOOLS MARKET

- 5.3.22.1 Subscription-based services

- 5.3.22.2 Pay-per-use or pay-per-query

- 5.3.22.3 Enterprise licensing and customization

- 5.3.22.4 Open source with premium features

- 5.3.22.5 API and Platform as a Service (PaaS)

- 5.3.23 KEY FUNCTIONALITIES OF AI CODE TOOLS

- 5.3.23.1 Code autocompletion and suggestions

- 5.3.23.2 Code optimization and refactoring

- 5.3.23.3 Code generation

- 5.3.23.4 Automated testing and test generation

- 5.3.23.5 Code review and quality analysis

- 5.3.23.6 Code analytics

- 5.3.23.7 Bug detection and prevention

- 5.3.23.8 Version control

- 5.3.23.9 Documentation generation

6 AI CODE TOOLS MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: AI CODE TOOLS MARKET DRIVERS

- FIGURE 33 SERVICES SEGMENT TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- TABLE 27 AI CODE TOOLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 28 AI CODE TOOLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 TOOLS

- 6.2.1 AI CODE TOOLS TO EMPOWER DEVELOPERS CREATE PREDICTIVE MODELS AND DATA-DRIVEN APPLICATIONS

- TABLE 29 TOOLS: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 30 TOOLS: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2 DEPLOYMENT MODE

- 6.2.2.1 Cloud deployment mode to offer scalability, easy availability, and reduced expenditure

- FIGURE 34 CLOUD SEGMENT TO WITNESS HIGHER CAGR DURING FORECAST PERIOD

- TABLE 31 AI CODE TOOLS MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 32 AI CODE TOOLS MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- 6.2.2.2 Cloud

- 6.2.2.2.1 Cloud solutions to facilitate development of AI applications that can adapt to changing workloads and data demands

- 6.2.2.2 Cloud

- TABLE 33 CLOUD: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 34 CLOUD: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.2.3 On-premises

- 6.2.2.3.1 On-premises AI code tools to provide high level of security and compliance adherence

- 6.2.2.3 On-premises

- TABLE 35 ON-PREMISES: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 36 ON-PREMISES: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SERVICES

- 6.3.1 SERVICES TO SUSTAIN PERFORMANCE OF AI SYSTEMS, MINIMIZE DOWNTIME, AND RESOLVE ISSUES PROMPTLY

- FIGURE 35 PROFESSIONAL SERVICES SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- TABLE 37 AI CODE TOOLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 38 AI CODE TOOLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- 6.3.2 PROFESSIONAL SERVICES

- 6.3.2.1 Professional services to drive innovation, automation, and data-driven decision-making across diverse industries

- FIGURE 36 SUPPORT & MAINTENANCE SEGMENT TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 39 PROFESSIONAL SERVICES: AI CODE TOOLS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 40 PROFESSIONAL SERVICES: AI CODE TOOLS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 41 PROFESSIONAL SERVICES: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 42 PROFESSIONAL SERVICES: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2.2 Consulting

- TABLE 43 CONSULTING: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 44 CONSULTING: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2.3 Training

- TABLE 45 TRAINING: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 46 TRAINING: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2.4 System integration & implementation

- TABLE 47 SYSTEM INTEGRATION & IMPLEMENTATION: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 48 SYSTEM INTEGRATION & IMPLEMENTATION: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2.5 Support & maintenance

- TABLE 49 SUPPORT & MAINTENANCE: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 50 SUPPORT & MAINTENANCE: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.3 MANAGED SERVICES

- 6.3.3.1 Managed services to offer comprehensive approach to AI implementation

- TABLE 51 MANAGED SERVICES: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 52 MANAGED SERVICES: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

7 AI CODE TOOLS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.1.1 TECHNOLOGY: AI CODE TOOLS MARKET DRIVERS

- FIGURE 37 MACHINE LEARNING SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- TABLE 53 TOOLS: AI CODE TOOLS MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 54 TOOLS: AI CODE TOOLS MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- 7.2 MACHINE LEARNING

- 7.2.1 MACHINE LEARNING TECHNIQUES TO ENABLE DATA-DRIVEN DECISION-MAKING

- TABLE 55 MACHINE LEARNING: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 56 MACHINE LEARNING: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.2.2 DEEP LEARNING

- 7.2.2.1 Recurrent neural networks

- 7.2.2.2 Long short-term memory (LSTM)

- 7.3 NATURAL LANGUAGE PROCESSING

- 7.3.1 NLP-BASED AI CODE TOOLS TO TRANSFORM CUSTOMER SERVICE, CONTENT GENERATION, AND INFORMATION RETRIEVAL

- TABLE 57 NATURAL LANGUAGE PROCESSING: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 58 NATURAL LANGUAGE PROCESSING: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3.2 NATURAL LANGUAGE UNDERSTANDING (NLU)

- 7.3.3 NATURAL LANGUAGE INTERFACE FOR CODE

- 7.4 GENERATIVE AI

- 7.4.1 GENERATIVE AI TO AUTOMATE REPETITIVE CODING TASKS AND INCREASE PRODUCTIVITY

- TABLE 59 GENERATIVE AI: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 60 GENERATIVE AI: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4.2 LARGE LANGUAGE MODELS (LLMS)

- 7.4.3 CODE GENERATION MODELS

8 AI CODE TOOLS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 38 DATA SCIENCE & MACHINE LEARNING APPLICATION TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- TABLE 61 AI CODE TOOLS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 62 AI CODE TOOLS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.2 DATA SCIENCE & MACHINE LEARNING

- 8.2.1 AI CODE TOOLS TO AUTOMATE DATA CLEANING AND DATA TRANSFORMATION TASKS, SAVING TIME AND REDUCING RISK OF HUMAN ERRORS

- TABLE 63 DATA SCIENCE & MACHINE LEARNING: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 64 DATA SCIENCE & MACHINE LEARNING: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 CLOUD SERVICES & DEVOPS

- 8.3.1 AI CODE TOOLS TO AUTOMATE AND STREAMLINE DEVOPS PROCESSES

- TABLE 65 CLOUD SERVICES & DEVOPS: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 66 CLOUD SERVICES & DEVOPS: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 WEB DEVELOPMENT

- 8.4.1 AI CODE TOOLS TO ENHANCE EFFICIENCY, SPEED, AND QUALITY OF WEB DEVELOPMENT PROJECTS

- TABLE 67 WEB DEVELOPMENT: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 68 WEB DEVELOPMENT: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5 MOBILE APP DEVELOPMENT

- 8.5.1 AI ALGORITHMS TO ASSIST IN ENHANCED USER EXPERIENCES, PERSONALIZED RECOMMENDATIONS, VOICE RECOGNITION, AND PREDICTIVE ANALYTICS

- TABLE 69 MOBILE APP DEVELOPMENT: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 70 MOBILE APP DEVELOPMENT: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.6 GAMING DEVELOPMENT

- 8.6.1 AI CODE TOOLS TO CREATE IMMERSIVE AND ENGAGING GAMING EXPERIENCES

- TABLE 71 GAME DEVELOPMENT: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 72 GAME DEVELOPMENT: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.7 EMBEDDED SYSTEMS

- 8.7.1 AI-DRIVEN CODE GENERATION TO TRANSFORM FIELD OF EMBEDDED SYSTEM DEVELOPMENT

- TABLE 73 EMBEDDED SYSTEMS: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 74 EMBEDDED SYSTEMS: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.8 OTHER APPLICATIONS

- TABLE 75 OTHER APPLICATIONS: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 76 OTHER APPLICATIONS: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

9 AI CODE TOOLS MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.1.1 VERTICAL: AI CODE TOOLS MARKET DRIVERS

- TABLE 77 MAJOR USE CASES, BY VERTICAL

- FIGURE 39 HEALTHCARE & LIFE SCIENCES VERTICAL TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 78 AI CODE TOOLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 79 AI CODE TOOLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.2 BFSI

- 9.2.1 AUTOMATION OF DOCUMENT PROCESSING AND ANALYSIS TO ENSURE EFFICIENCY AND AGILITY

- TABLE 80 BFSI: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 81 BFSI: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 IT & ITES

- 9.3.1 AI CODE TOOLS TO REDUCE HUMAN ERRORS AND ACCELERATE PROJECT TIMELINES

- TABLE 82 IT & ITES: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 83 IT & ITES: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 HEALTHCARE & LIFE SCIENCES

- 9.4.1 AI CODE TOOLS TO REVOLUTIONIZE DRUG DISCOVERY AND DEVELOPMENT OF PERSONALIZED MEDICINE

- TABLE 84 HEALTHCARE & LIFE SCIENCES: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 85 HEALTHCARE & LIFE SCIENCES: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 MANUFACTURING

- 9.5.1 INTEGRATION OF AI CODE TOOLS TO OPTIMIZE PRODUCTION PROCESSES, REDUCE COSTS, AND ENHANCE PRODUCT QUALITY

- TABLE 86 MANUFACTURING: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 87 MANUFACTURING: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6 RETAIL & ECOMMERCE

- 9.6.1 AI-DRIVEN VIRTUAL HELPERS TO MAKE SHOPPING EXPERIENCE EFFICIENT AND INTERACTIVE

- TABLE 88 RETAIL & ECOMMERCE: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 89 RETAIL & ECOMMERCE: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.7 TELECOMMUNICATIONS

- 9.7.1 AI CODE TOOLS TO OPTIMIZE NETWORK MANAGEMENT, ENHANCE CUSTOMER EXPERIENCES, AND IMPROVE SECURITY MEASURES

- TABLE 90 TELECOMMUNICATIONS: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 91 TELECOMMUNICATIONS: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.8 GOVERNMENT & PUBLIC SECTOR

- 9.8.1 AI APPLICATIONS TO ENHANCE EFFICIENCY, ACCURACY, AND CITIZEN-CENTRIC GOVERNANCE

- TABLE 92 GOVERNMENT & PUBLIC SECTOR: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 93 GOVERNMENT & PUBLIC SECTOR: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.9 MEDIA & ENTERTAINMENT

- 9.9.1 AI CODE TOOLS TO ENHANCE CONTENT PERSONALIZATION, PRODUCTION EFFICIENCY, AND AUDIENCE ENGAGEMENT

- TABLE 94 MEDIA & ENTERTAINMENT: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 95 MEDIA & ENTERTAINMENT: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.10 OTHER VERTICALS

- TABLE 96 OTHER VERTICALS: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 97 OTHER VERTICALS: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

10 AI CODE TOOLS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 40 SOUTH AFRICA TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 ASIA PACIFIC TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 98 AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 99 AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: AI CODE TOOLS MARKET DRIVERS

- 10.2.2 NORTH AMERICA: IMPACT OF RECESSION

- FIGURE 42 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 100 NORTH AMERICA: AI CODE TOOLS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 101 NORTH AMERICA: AI CODE TOOLS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 102 NORTH AMERICA: AI CODE TOOLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 103 NORTH AMERICA: AI CODE TOOLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 104 NORTH AMERICA: AI CODE TOOLS MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 105 NORTH AMERICA: AI CODE TOOLS MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 106 NORTH AMERICA: AI CODE TOOLS MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 107 NORTH AMERICA: AI CODE TOOLS MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 108 NORTH AMERICA: AI CODE TOOLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 109 NORTH AMERICA: AI CODE TOOLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 110 NORTH AMERICA: AI CODE TOOLS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 111 NORTH AMERICA: AI CODE TOOLS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 112 NORTH AMERICA: AI CODE TOOLS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 113 NORTH AMERICA: AI CODE TOOLS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 114 NORTH AMERICA: AI CODE TOOLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 115 NORTH AMERICA: AI CODE TOOLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.2.3 US

- 10.2.3.1 Government policies and increasing number of tech startups to drive market

- 10.2.4 CANADA

- 10.2.4.1 Focus on AI and government investments to fuel market growth

- 10.3 EUROPE

- 10.3.1 EUROPE: AI CODE TOOLS MARKET DRIVERS

- 10.3.2 EUROPE: IMPACT OF RECESSION

- TABLE 116 EUROPE: AI CODE TOOLS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 117 EUROPE: AI CODE TOOLS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 118 EUROPE: AI CODE TOOLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 119 EUROPE: AI CODE TOOLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 120 EUROPE: AI CODE TOOLS MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 121 EUROPE: AI CODE TOOLS MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 122 EUROPE: AI CODE TOOLS MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 123 EUROPE: AI CODE TOOLS MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 124 EUROPE: AI CODE TOOLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 125 EUROPE: AI CODE TOOLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 126 EUROPE: AI CODE TOOLS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 127 EUROPE: AI CODE TOOLS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 128 EUROPE: AI CODE TOOLS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 129 EUROPE: AI CODE TOOLS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 130 EUROPE: AI CODE TOOLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 131 EUROPE: AI CODE TOOLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Robust regulatory frameworks and research excellence to propel market

- 10.3.4 GERMANY

- 10.3.4.1 Highly skilled labor force and strong infrastructure to drive adoption of AI and ML technologies

- 10.3.5 FRANCE

- 10.3.5.1 Increasing funding for AI startups to fuel development of AI ecosystem

- 10.3.6 SPAIN

- 10.3.6.1 Public-private collaboration programs that integrate AI across various vertical sectors to drive digital transformation

- 10.3.7 ITALY

- 10.3.7.1 Agility in adopting latest technological advancements to fuel market growth

- 10.3.8 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: AI CODE TOOLS MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: IMPACT OF RECESSION

- FIGURE 43 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 132 ASIA PACIFIC: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: AI CODE TOOLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 135 ASIA PACIFIC: AI CODE TOOLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 136 ASIA PACIFIC: AI CODE TOOLS MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 137 ASIA PACIFIC: AI CODE TOOLS MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 138 ASIA PACIFIC: AI CODE TOOLS MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 139 ASIA PACIFIC: AI CODE TOOLS MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 140 ASIA PACIFIC: AI CODE TOOLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 141 ASIA PACIFIC: AI CODE TOOLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 142 ASIA PACIFIC: AI CODE TOOLS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 143 ASIA PACIFIC: AI CODE TOOLS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 144 ASIA PACIFIC: AI CODE TOOLS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 145 ASIA PACIFIC: AI CODE TOOLS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: AI CODE TOOLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC: AI CODE TOOLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Government R&D initiatives and global investments to boost market

- 10.4.4 JAPAN

- 10.4.4.1 Robust integration of AI into robotics to boost market

- 10.4.5 INDIA

- 10.4.5.1 India's technological ecosystem supported by government policies and increased R&D investments to fuel market growth

- 10.4.6 ASEAN COUNTRIES

- 10.4.6.1 Competitive wages, improved business regulations, upgraded infrastructure, and growing domestic demand to accelerate growth

- 10.4.7 AUSTRALIA & NEW ZEALAND

- 10.4.7.1 Increasing resilience and investments in software tools to bolster market

- 10.4.8 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: AI CODE TOOLS MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: IMPACT OF RECESSION

- TABLE 148 MIDDLE EAST & AFRICA: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: AI CODE TOOLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: AI CODE TOOLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: AI CODE TOOLS MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: AI CODE TOOLS MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: AI CODE TOOLS MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: AI CODE TOOLS MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: AI CODE TOOLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: AI CODE TOOLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: AI CODE TOOLS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: AI CODE TOOLS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: AI CODE TOOLS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: AI CODE TOOLS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: AI CODE TOOLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: AI CODE TOOLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.5.3 UAE

- 10.5.3.1 Government initiatives aimed at fostering knowledge-based economy to drive market

- 10.5.4 KSA

- 10.5.4.1 Technological advancements and economic diversification through Vision 2030 initiative to accelerate market growth

- 10.5.5 EGYPT

- 10.5.5.1 Rapid adoption of advanced technologies to boost market

- 10.5.6 SOUTH AFRICA

- 10.5.6.1 Increased focus on cloud-based software products to propel market growth

- 10.5.7 REST OF MIDDLE EAST & AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: AI CODE TOOLS MARKET DRIVERS

- 10.6.2 LATIN AMERICA: IMPACT OF RECESSION

- TABLE 164 LATIN AMERICA: AI CODE TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 165 LATIN AMERICA: AI CODE TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 166 LATIN AMERICA: AI CODE TOOLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 167 LATIN AMERICA: AI CODE TOOLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 168 LATIN AMERICA: AI CODE TOOLS MARKET, BY TECHNOLOGY, 2017-2022 (USD MILLION)

- TABLE 169 LATIN AMERICA: AI CODE TOOLS MARKET, BY TECHNOLOGY, 2023-2028 (USD MILLION)

- TABLE 170 LATIN AMERICA: AI CODE TOOLS MARKET, BY DEPLOYMENT MODE, 2017-2022 (USD MILLION)

- TABLE 171 LATIN AMERICA: AI CODE TOOLS MARKET, BY DEPLOYMENT MODE, 2023-2028 (USD MILLION)

- TABLE 172 LATIN AMERICA: AI CODE TOOLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 173 LATIN AMERICA: AI CODE TOOLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 174 LATIN AMERICA: AI CODE TOOLS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 175 LATIN AMERICA: AI CODE TOOLS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 176 LATIN AMERICA: AI CODE TOOLS MARKET, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 177 LATIN AMERICA: AI CODE TOOLS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 178 LATIN AMERICA: AI CODE TOOLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 179 LATIN AMERICA: AI CODE TOOLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.6.3 BRAZIL

- 10.6.3.1 Brazil's vibrant technology ecosystem to drive software development industry

- 10.6.4 MEXICO

- 10.6.4.1 Dynamic private sector and increasing investments in digital transformation to accelerate market growth

- 10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 180 STRATEGIES DEPLOYED BY KEY AI CODE TOOL VENDORS

- 11.3 REVENUE ANALYSIS

- FIGURE 44 BUSINESS SEGMENT REVENUE ANALYSIS FOR KEY COMPANIES, 2020-2022 (USD MILLION)

- 11.4 MARKET SHARE ANALYSIS FOR KEY PUBLIC COMPANIES

- FIGURE 45 MARKET SHARE ANALYSIS FOR KEY PLAYERS, 2022

- TABLE 181 AI CODE TOOLS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 11.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- TABLE 182 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 11.6 COMPANY EVALUATION MATRIX

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 46 COMPANY EVALUATION MATRIX, 2023

- 11.6.5 COMPANY FOOTPRINT OF KEY PLAYERS

- TABLE 183 COMPANY FOOTPRINT OF KEY PLAYERS, 2023

- 11.7 STARTUP/SME EVALUATION MATRIX, 2023

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 47 STARTUP/SME EVALUATION MATRIX, 2023

- 11.7.5 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 184 DETAILED LIST OF KEY SMES/STARTUPS

- TABLE 185 COMPETITIVE BENCHMARKING OF SMES/STARTUPS, 2023

- 11.8 COMPETITIVE SCENARIO AND TRENDS

- 11.8.1 PRODUCT LAUNCHES

- TABLE 186 AI CODE TOOLS MARKET: PRODUCT LAUNCHES, 2020-2023

- 11.8.2 DEALS

- TABLE 187 AI CODE TOOLS MARKET: DEALS, 2020-2023

- 11.8.3 OTHERS

- TABLE 188 AI CODE TOOLS MARKET: OTHERS, 2020-2023

- 11.9 VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 48 VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 11.10 YTD PRICE TOTAL RETURN AND STOCK BETA OF KEY VENDORS

- FIGURE 49 YTD PRICE TOTAL RETURN AND STOCK BETA OF KEY VENDORS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

(Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 12.2.1 MICROSOFT

- TABLE 189 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 50 MICROSOFT: COMPANY SNAPSHOT

- TABLE 190 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 191 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 192 MICROSOFT: DEALS

- 12.2.2 IBM

- TABLE 193 IBM: BUSINESS OVERVIEW

- FIGURE 51 IBM: COMPANY SNAPSHOT

- TABLE 194 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 195 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 196 IBM: DEALS

- TABLE 197 IBM: OTHERS

- 12.2.3 GOOGLE

- TABLE 198 GOOGLE: BUSINESS OVERVIEW

- FIGURE 52 GOOGLE: COMPANY SNAPSHOT

- TABLE 199 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 201 GOOGLE: DEALS

- TABLE 202 GOOGLE: OTHERS

- 12.2.4 AWS

- TABLE 203 AWS: BUSINESS OVERVIEW

- FIGURE 53 AWS: COMPANY SNAPSHOT

- TABLE 204 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 206 AWS: DEALS

- TABLE 207 AWS: OTHERS

- 12.2.5 META

- TABLE 208 META: BUSINESS OVERVIEW

- FIGURE 54 META: COMPANY SNAPSHOT

- TABLE 209 META: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 210 META: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 211 META: DEALS

- 12.2.6 SALESFORCE

- TABLE 212 SALESFORCE: BUSINESS OVERVIEW

- FIGURE 55 SALESFORCE: COMPANY SNAPSHOT

- TABLE 213 SALESFORCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 215 SALESFORCE: DEALS

- TABLE 216 SALESFORCE: OTHERS

- 12.2.7 OPENAI

- TABLE 217 OPENAI: BUSINESS OVERVIEW

- TABLE 218 OPENAI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 OPENAI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 220 OPENAI: DEALS

- TABLE 221 OPENAI: OTHERS

- 12.2.8 TABNINE

- TABLE 222 TABNINE: BUSINESS OVERVIEW

- TABLE 223 TABNINE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 TABNINE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 225 TABNINE: DEALS

- 12.2.9 REPLIT

- TABLE 226 REPLIT: BUSINESS OVERVIEW

- TABLE 227 REPLIT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 REPLIT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 229 REPLIT: DEALS

- TABLE 230 REPLIT: OTHERS

- 12.2.10 SOURCEGRAPH

- TABLE 231 SOURCEGRAPH: BUSINESS OVERVIEW

- TABLE 232 SOURCEGRAPH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 SOURCEGRAPH: PRODUCT LAUNCHES AND ENHANCEMENTS

- 12.2.11 MOOLYA

- TABLE 234 MOOLYA: BUSINESS OVERVIEW

- TABLE 235 MOOLYA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 MOOLYA: PRODUCT LAUNCHES AND ENHANCEMENTS

- 12.2.12 SNYK

- TABLE 237 SNYK: BUSINESS OVERVIEW

- TABLE 238 SNYK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 239 SNYK: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 240 SNYK: DEALS

- TABLE 241 SNYK: OTHERS

- 12.2.13 CIRCLECI

- TABLE 242 CIRCLECI: BUSINESS OVERVIEW

- TABLE 243 CIRCLECI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 CIRCLECI: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 245 CIRCLECI: DEALS

- 12.2.14 JETBRAINS

- TABLE 246 JETBRAINS: BUSINESS OVERVIEW

- TABLE 247 JETBRAINS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 JETBRAINS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 249 JETBRAINS: DEALS

- 12.2.15 ADACORE

- 12.2.16 WINGWARE

- 12.2.17 DATADOG

- 12.2.18 LIGHTNING AI

- 12.2.19 KODEZI

- 12.2.20 SOURCERY

- 12.3 STARTUPS/SMES

- 12.3.1 CODEWP

- 12.3.2 SQLAI.AI

- 12.3.3 SINCODE AB

- 12.3.4 SEEK AI

- 12.3.5 ENZYME

- 12.3.6 ASSISTIV AI

- 12.3.7 CODIUM

- 12.3.8 MUTABLE AI

- 12.3.9 JUDINI

- 12.3.10 SAFURAI

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LOW-CODE DEVELOPMENT PLATFORM MARKET - GLOBAL FORECAST TO 2025

- 13.2.1 MARKET DEFINITION

- 13.2.2 MARKET OVERVIEW

- FIGURE 56 LOW-CODE DEVELOPMENT PLATFORM MARKET SNAPSHOT, 2018-2025

- 13.2.3 LOW-CODE DEVELOPMENT PLATFORM MARKET, BY COMPONENT

- TABLE 250 LOW-CODE DEVELOPMENT PLATFORM MARKET, BY COMPONENT, 2018-2025 (USD MILLION)

- 13.2.4 LOW-CODE DEVELOPMENT PLATFORM MARKET, BY APPLICATION

- TABLE 251 LOW-CODE DEVELOPMENT PLATFORM MARKET, BY APPLICATION TYPE, 2018-2025 (USD MILLION)

- 13.2.5 LOW-CODE DEVELOPMENT PLATFORM MARKET, BY DEPLOYMENT TYPE

- TABLE 252 LOW-CODE DEVELOPMENT PLATFORM MARKET, BY DEPLOYMENT TYPE, 2018-2025 (USD MILLION)

- 13.2.6 LOW-CODE DEVELOPMENT PLATFORM MARKET, BY ORGANIZATION SIZE

- TABLE 253 LOW-CODE DEVELOPMENT PLATFORM MARKET, BY ORGANIZATION SIZE, 2018-2025 (USD MILLION)

- 13.2.7 LOW-CODE DEVELOPMENT PLATFORM MARKET, BY INDUSTRY

- TABLE 254 LOW-CODE DEVELOPMENT PLATFORM MARKET, BY INDUSTRY, 2018-2025 (USD MILLION)

- 13.2.8 LOW-CODE DEVELOPMENT PLATFORM MARKET, BY REGION

- TABLE 255 LOW-CODE DEVELOPMENT PLATFORM MARKET, BY REGION, 2018-2025 (USD MILLION)

- 13.3 GENERATIVE AI MARKET - GLOBAL FORECAST TO 2030

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- TABLE 256 GLOBAL GENERATIVE AI MARKET SIZE AND GROWTH RATE, 2019-2022 (USD MILLION, Y-O-Y %)

- TABLE 257 GLOBAL GENERATIVE AI MARKET SIZE AND GROWTH RATE, 2023-2030 (USD MILLION, Y-O-Y %)

- 13.3.3 GENERATIVE AI MARKET, BY OFFERING

- TABLE 258 GENERATIVE AI MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 259 GENERATIVE AI MARKET, BY OFFERING, 2023-2030 (USD MILLION)

- 13.3.4 GENERATIVE AI MARKET, BY REGION

- TABLE 260 NORTH AMERICA: GENERATIVE AI MARKET, BY OFFERING, 2019-2022 (USD MILLION)

- TABLE 261 NORTH AMERICA: GENERATIVE AI MARKET, BY OFFERING, 2023-2030 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS