|

|

市場調査レポート

商品コード

1371233

ポリエステル繊維の世界市場:形態別、グレード別、製品タイプ別、用途別、地域別-2028年までの予測Polyester Fiber Market by Form (Solid and Hollow), Grade (PET Polyester Fiber and Pcdt Polyester Fiber), Product type (PFY and PSF), Application (Textile & Apparel, Home Furnishing, Automotive), and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| ポリエステル繊維の世界市場:形態別、グレード別、製品タイプ別、用途別、地域別-2028年までの予測 |

|

出版日: 2023年10月20日

発行: MarketsandMarkets

ページ情報: 英文 236 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のポリエステル繊維の市場規模は2023年に1,022億米ドルとなるとみられ、2028年には1,516億米ドルに達すると予測されています。

2023年から2028年にかけて、8.2%のCAGRで拡大すると見込まれています。ポリエステル繊維の需要増加は、数多くの重要な要因に起因しています。まず、ポリエステル繊維の汎用性の高さから、繊維や衣服から工業用途や技術用途に至るまで、広範な用途の有力候補となっています。耐久性に優れ、シワになりにくく、メンテナンスが簡単なポリエステル繊維は、ファッションや家庭用家具の分野で好まれています。さらに、ポリエステルは綿など他の繊維との相性がよく、繊維製品の性能を高めるのに役立っています。さらに、ポリエステルはコストパフォーマンスに優れ、生産が比較的容易であるため、メーカーが選ぶ素材として確固たる地位を築いています。環境に対する意識が高まる中、ポリエステルはリサイクル可能であり、持続可能性への取り組みも進んでいるため、その人気はますます高まっています。その結果、ポリエステル繊維の需要は、その適応性、耐久性、環境に配慮した技術革新に後押しされ、幅広い産業分野で伸び続けています。

2022年、ポリエステル繊維の市場は繊維・アパレル用途が独占しました。ポリエステル繊維は世界のカオリン市場をリードする用途分野であり、今後も成長を続けると予想されます。ポリエステル繊維は、卓越した耐久性、耐シワ性、色保持性などの特性を兼ね備えているため、繊維製品および衣料品に適しています。この適応性は、日常着から高性能スポーツウェアまで、幅広いアイテムに及んでいます。繊維・アパレル産業はポリエステル繊維の潜在能力を効果的に活用し、多様な消費者の嗜好やファッション動向に対応するさまざまなスタイルを生み出し、ポリエステル繊維を紛れもない業界のリーダーにしています。さらに、世界人口の急激な増加と、目の前に広がる急速な都市化によって、手頃な価格でスタイリッシュな衣料品への需要が急増しています。ポリエステル繊維は、その費用対効果、メンテナンスの容易さ、適応性により、この需要の急増に対応する上で申し分のない位置にあります。

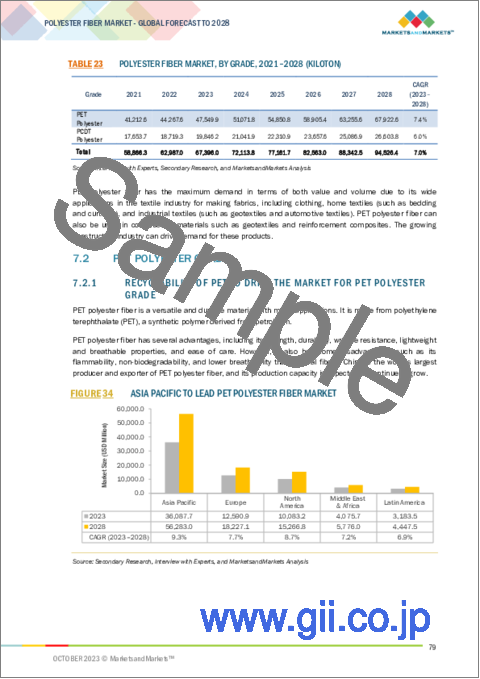

予測期間を通じて、PETポリエステル繊維分野が最も大きく成長すると予測されます。PETポリエステル繊維は、その汎用性と費用対効果により、多くの用途で好まれています。顕著な強度、耐久性、環境要因への耐性があるため、繊維製品、衣料品、家庭用家具、産業分野で使用されています。さらに、世界の持続可能性の目標に沿ったリサイクル性の高さも評価されています。技術が進歩し、環境への配慮がより重要になるにつれ、PETポリエステル繊維の需要は伸び続けることが予想され、世界の繊維産業の基本的な構成要素となっています。

固形ポリエステル繊維は、2022年の世界ポリエステル繊維市場の最大セグメントです。また、このセグメントは予測期間中に最も高いCAGRを示すと予想されます。これは主に、その顕著な適応性と卓越した品質によるものです。固形ポリエステル繊維は、織物や衣料品から工業用途や技術用途まで幅広い用途に使用できるため、消費者主導の現代社会で高い人気を誇っています。その評判は、時の試練に耐え、摩耗や引き裂きに耐えることができる耐久性と弾力性によって築かれ、長持ちし、強度を保つ必要のある製品で高く評価されています。

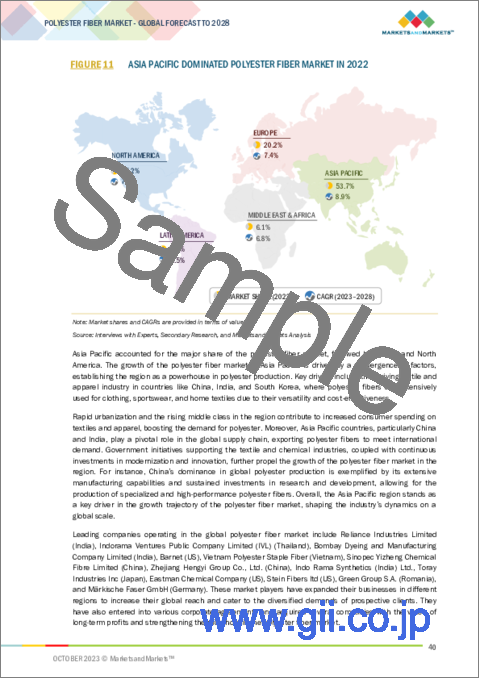

人口動態の変化、新興経済国の経済状況の向上、近代化の継続的な動向により、アジア太平洋はポリエステルにとって非常に有望な市場となっています。アジア太平洋の進化し続ける消費者情勢は、繊維産業に対する政府の支援と相まって、同地域がポリエステル繊維の世界需要に大きく貢献する地域であることを確固たるものにしています。

当レポートでは、世界のポリエステル繊維市場について調査し、形態別、グレード別、製品タイプ別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 主要な利害関係者と購入基準

- 技術分析

- 生態系マッピング

- バリューチェーン分析

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向と混乱

- 貿易分析

- 規制状況

- 主要な会議とイベント

- 特許分析

第6章 ポリエステル繊維市場、形態別

- イントロダクション

- ソリッドフォーム

- 中空フォーム

第7章 ポリエステル繊維市場、グレード別

- イントロダクション

- ペットポリエステルグレード

- PCDTポリエステルグレード

第8章 ポリエステル繊維市場、製品タイプ別

- イントロダクション

- ポリエステルフィラメント糸

- ポリエステル短繊維

第9章 ポリエステル繊維市場、用途別

- イントロダクション

- テキスタイル、アパレル

- 家財道具

- 自動車、輸送

- 産業

- その他

第10章 ポリエステル繊維市場、地域別

- イントロダクション

- アジア太平洋

- 北米

- 欧州

- 中東・アフリカ

- ラテンアメリカ

第11章 競合情勢

- 主要参入企業の戦略

- 収益分析

- 市場シェア分析

- 企業評価マトリックス

- 新興企業/中小企業の評価マトリックス

- 競合シナリオと動向

第12章 企業プロファイル

- 主要参入企業

- RELIANCE INDUSTRIES LIMITED

- INDORAMA VENTURES PUBLIC COMPANY LIMITED

- THE BOMBAY DYEING AND MANUFACTURING COMPANY LIMITED

- BARNET

- VNPOLYFIBER(VIETNAM POLYESTER STAPLE FIBER)

- SARLA PERFORMANCE FIBERS LIMITED

- MARKISCHE FASER GMBH

- EASTMAN CHEMICAL COMPANY

- TORAY INDUSTRIES INC.

- STEIN FIBERS LTD.

- GREEN GROUP S.A.

- KAYAVLON IMPEX PVT. LTD.

- DIYOU FIBER(M)SDN BHD.

- SWICOFIL AG

- SINOPEC YIZHENG CHEMICAL FIBER LIMITED LIABILITY COMPANY

- ALPEK S.A.B. DE C.V.

- ZHEJIANG HENGYI GROUP CO., LTD.

- JIANGNAN TEXTILE(SHANGHAI)CO., LTD.

- DONGGUAN YUEXIN INDUSTRIAL CO., LTD.

- XIAMEI(GUANGZHOU)SYNTHETIC FIBER CO., LTD.

第13章 付録

Polyester fiber's estimated global market size is USD 102.2 billion in 2023, and it is anticipated to reach USD 151.6 billion by 2028. Between 2023 and 2028, this growth is anticipated to occur at a Compound Annual Growth Rate (CAGR) of 8.2%. The increasing demand for polyester fiber can be attributed to a multitude of significant factors. Firstly, the sheer versatility of polyester fiber renders it a prime candidate for an extensive array of applications, spanning from textiles and attire to industrial and technological uses. Its durability, resistance to creases, and straightforward maintenance have collectively catapulted it to being a favored choice within the fashion and home furnishings sectors. Moreover, polyester's compatibility with other fibers, such as cotton, serves to enhance the performance of textile products. Furthermore, its cost-effectiveness and relative ease of production have firmly established it as the material of choice for manufacturers. In a world increasingly conscientious of the environment, polyester's recyclability and ongoing sustainability initiatives have bolstered its ascent in popularity, as more ecologically-friendly variants continue to emerge. Consequently, the demand for polyester fiber continues to grow across a wide number of industries, propelled by its adaptability, endurance, and eco-conscious innovations.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million/Billion), Volume (Kilotons) |

| Segments | By Form, By Grade, By Product Type, By Application and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

"Textile & Apparel is the largest application segment in terms volume and value."

In 2022, the market for polyester fiber was dominated by the textile & apparel application. It will be the leading the application segment in the global kaolin market and it is expected to keep growing in the near future. Polyester fiber's distinctive combination of attributes, such as exceptional durability, resistance to wrinkles, and color retention, render it a prime selection for textiles and clothing. This adaptability extends to a wide array of items, from everyday attire to high-performance sportswear. The textile and apparel industry has effectively harnessed polyester fiber's potential, creating an array of styles that cater to diverse consumer preferences and fashion trends, making it the industry's undeniable leader. Moreover, the global population's exponential growth, coupled with the rapid urbanization unfolding before us, has given rise to a burgeoning demand for affordable and stylish clothing. Polyester fiber is impeccably positioned to meet this surge in demand, owing to its cost-effectiveness, ease of maintenance, and adaptability.

"PET polyester fiber segment is to witness the highest growth rate during the forecast period."

Throughout the forecast period, the PET polyester fiber segment is anticipated to grow most significantly. PET polyester fiber is preferred across many applications due to its versatility and cost-effectiveness. It's used in textiles, clothing, home furnishings, and industry because of its remarkable strength, durability, and resistance to environmental factors. Moreover, it's recognized for its recyclability, which aligns with global sustainability goals. As technology advances and environmental concerns become more important, the demand for PET polyester fiber is expected to keep growing, making it a fundamental component of the global fiber industry.

"Solid form of polyester fiber is to be the leading segment during the forecast period."

Solid polyester fiber is the largest segment of global polyester fiber market in 2022. The segment is also expected to witness the highest CAGR during the forecasted period. This is primarily due to its remarkable adaptability and exceptional qualities. Solid polyester fiber can be used in a wide variety of applications, from textiles and clothing to industrial and technical uses, making it highly sought after in today's consumer-driven world. Its reputation is built on its durability and resilience, as it can withstand the test of time and endure wear and tear, which is highly valued in products that need to last and remain strong.

"Asia Pacific is the leading market for polyester fiber."

An extensive analysis of the Asia Pacific polyester fiber market has been conducted, taking into account South Korea, China, Japan, India, Australia and the rest of the region. Due to demographic changes, increasing economic conditions in emerging economies, and the continued trend of modernization, this region presents a very promising market for polyester. The Asia-Pacific region's ever-evolving consumer landscape, combined with government support for the textile industry, firmly establishes the region as a significant contributor to the global demand for polyester fiber.

Breakdown of Profiles of Primary Interviews:

- By Company Type- Tier 1- 40%, Tier 2- 33%, and Tier 3- 27%

- By Designation- C Level- 50%, Director Level- 30%, and Others- 20%

- By Region- North America- 15%, Europe- 50%, Asia Pacific (APAC) - 20%, Latin America-10%, Middle East & Africa (MEA)-5%,

The report provides a comprehensive analysis of company profiles listed below:

- Zhejiang Hengyi Group Co., Ltd. (China)

- Reliance Industries Ltd. (India)

- Indorama Venture Public Company Ltd. (Thailand)

- Toray Industries Ltd. (Japan)

- Sinopec Yizheng Chemical Fiber Limited Liablity Company (China)

- Alpek S.A.B DE C.V. (Mexico)

- Diyou Fiber (M) Sdn Bhd (Malaysia)

- Bombay Dyeing (India)

- Green Group SA (Romania)

Research Coverage

This report covers the polyester fiber market by form, grade, product type, application and region. It aims at estimating the size and future growth potential of the market across various segments. The report also includes an in-depth competitive analysis of the key market players, along with their profiles and key growth strategies.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall polyester fiber market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Cost effectiveness), restraints (Competition from substitute products), opportunities (Growth by evolving fashion trends and active lifestyles), and challenges (Microplastic pollution due to excessive use) influencing the growth of the polyester fiber market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the polyester fiber market

- Market Development: Comprehensive information about lucrative markets - the report analyses the polyester fiber market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the polyester fiber market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players in the polyester fiber market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 POLYESTER FIBER MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.7.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 POLYESTER FIBER MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key industry insights

- 2.2 RECESSION IMPACT

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.4 BASE NUMBER CALCULATION

- 2.4.1 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- 2.4.2 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- 2.5 MARKET FORECAST APPROACH

- 2.5.1 SUPPLY-SIDE

- 2.5.2 DEMAND- SIDE

- 2.6 DATA TRIANGULATION

- FIGURE 5 POLYESTER FIBER MARKET: DATA TRIANGULATION

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH ASSUMPTIONS

- 2.9 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 6 POLYESTER FILAMENT YARN TO BE FASTER-GROWING POLYESTER FIBER DURING FORECAST PERIOD

- FIGURE 7 SOLID FORM SEGMENT TO LEAD POLYESTER FIBER MARKET

- FIGURE 8 PET POLYESTER TO LEAD POLYESTER FIBER MARKET

- FIGURE 9 HOME FURNISHING TO BE SECOND-FASTEST-GROWING APPLICATION OF POLYESTER FIBER

- FIGURE 10 CHINA TO BE LARGEST COUNTRY IN POLYESTER FIBER MARKET

- FIGURE 11 ASIA PACIFIC DOMINATED POLYESTER FIBER MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN POLYESTER FIBER MARKET

- FIGURE 12 HIGH DEMAND FROM TEXTILE & APPAREL INDUSTRY TO DRIVE MARKET

- 4.2 POLYESTER FIBER MARKET, BY TYPE

- FIGURE 13 POLYESTER FILAMENT YARN DOMINATED OVERALL MARKET

- 4.3 POLYESTER FIBER MARKET, BY GRADE AND REGION

- FIGURE 14 ASIA PACIFIC TO BE LARGEST POLYESTER FIBER MARKET

- 4.4 POLYESTER FIBER MARKET, BY APPLICATION

- FIGURE 15 TEXTILE & APPAREL TO LEAD POLYESTER FIBER MARKET

- 4.5 POLYESTER FIBER MARKET, BY KEY COUNTRY

- FIGURE 16 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN POLYESTER FIBER MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Polyester fiber's adaptability to various applications

- 5.2.1.2 Cost effectiveness

- 5.2.2 RESTRAINTS

- 5.2.2.1 Polyester fiber's limited breathability

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth by evolving fashion trends and active lifestyles

- 5.2.3.2 Various customization needs

- 5.2.4 CHALLENGES

- 5.2.4.1 Microplastic pollution due to excessive use

- 5.2.4.2 Quality concern due to complex process

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 POLYESTER FIBER MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 1 POLYESTER FIBER MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 SUPPLY CHAIN ANALYSIS

- TABLE 2 POLYESTER FIBER MARKET: COMPANIES AND THEIR ROLE IN ECOSYSTEM

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE, BY APPLICATION (KEY PLAYERS)

- FIGURE 19 AVERAGE SELLING PRICE BY KEY PLAYERS FOR TOP THREE APPLICATIONS (USD/KG)

- 5.6 AVERAGE SELLING PRICE, BY FORM

- FIGURE 20 AVERAGE SELLING PRICE BASED ON FORM (USD/KG)

- 5.7 AVERAGE SELLING PRICE, BY GRADE

- FIGURE 21 AVERAGE SELLING PRICE BASED ON GRADE (USD/KG)

- 5.8 AVERAGE SELLING PRICE, BY PRODUCT TYPE

- FIGURE 22 AVERAGE SELLING PRICE BASED ON PRODUCT TYPE (USD/KG)

- 5.9 AVERAGE SELLING PRICE, BY REGION

- TABLE 3 POLYESTER FIBER AVERAGE SELLING PRICE, BY REGION

- 5.10 KEY STAKEHOLDERS AND BUY ING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- 5.10.2 BUYING CRITERIA

- FIGURE 24 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 5 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 5.11 TECHNOLOGY ANALYSIS

- TABLE 6 COMPARATIVE STUDY OF POLYESTER FIBER PRODUCT TYPE

- 5.12 ECOSYSTEM MAPPING

- 5.13 VALUE CHAIN ANALYSIS

- FIGURE 25 VALUE CHAIN ANALYSIS: POLYESTER FIBER MARKET

- 5.14 CASE STUDY ANALYSIS

- 5.15 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.16 TRADE ANALYSIS

- 5.16.1 TOP 25 EXPORTING COUNTRIES IN 2022

- TABLE 7 TOP 25 EXPORTING COUNTRIES IN 2022

- 5.16.2 TOP 25 IMPORTING COUNTRIES IN 2022

- TABLE 8 TOP 25 IMPORTING COUNTRIES IN 2022

- 5.17 REGULATORY LANDSCAPE

- 5.17.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.17.2 STANDARDS IN POLYESTER FIBER MARKET

- TABLE 13 CURRENT STANDARD CODES FOR POLYESTER FIBER

- 5.18 KEY CONFERENCES AND EVENTS

- TABLE 14 POLYESTER FIBER MARKETS: KEY CONFERENCES AND EVENTS, 2023-2024

- 5.19 PATENT ANALYSIS

- 5.19.1 INTRODUCTION

- 5.19.2 METHODOLOGY

- 5.19.3 DOCUMENT TYPES

- TABLE 15 POLYESTER FIBER MARKET: GLOBAL PATENT COUNT

- FIGURE 26 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 27 GLOBAL PATENT PUBLICATION TREND, 2017-2022

- 5.19.4 INSIGHTS

- 5.19.5 LEGAL STATUS

- FIGURE 28 POLYESTER FIBER MARKET: LEGAL STATUS OF PATENTS

- 5.19.6 JURISDICTION ANALYSIS

- FIGURE 29 GLOBAL JURISDICTION ANALYSIS

- 5.19.7 TOP APPLICANTS

- FIGURE 30 JIANGSU HENGLI CHEMICAL FIBRE CO LTD TO REGISTER HIGHEST PATENT COUNT

- 5.19.8 PATENTS BY JIANGSU HENGLI CHEMICAL FIBRE CO LTD

- 5.19.9 PATENTS BY HUVIS CORP.

- 5.19.10 PATENTS BY TORAY INDUSTRIES

- 5.19.11 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

6 POLYESTER FIBER MARKET, BY FORM TYPE

- 6.1 INTRODUCTION

- FIGURE 31 SOLID FORM TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 16 POLYESTER FIBER MARKET, BY FORM TYPE, 2021-2028 (USD MILLION)

- TABLE 17 POLYESTER FIBER MARKET, BY FORM TYPE, 2021-2028 (KILOTON)

- 6.2 SOLID FORM

- 6.2.1 EASE OF RECYCLING TO DRIVE DAMAND

- FIGURE 32 ASIA PACIFIC TO LEAD SOLID POLYESTER FIBER MARKET

- TABLE 18 SOLID POLYESTER FIBER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 19 SOLID POLYESTER FIBER MARKET, BY REGION, 2021-2028 (KILOTON)

- 6.3 HOLLOW FORM

- 6.3.1 CONTINUOUS DEVELOPMENT AND INNOVATION TO DRIVE MARKET

- TABLE 20 HOLLOW POLYESTER FIBER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 21 HOLLOW POLYESTER FIBER MARKET, BY REGION, 2021-2028 (KILOTON)

7 POLYESTER FIBER MARKET, BY GRADE

- 7.1 INTRODUCTION

- FIGURE 33 PET GRADE TO LEAD POLYESTER FIBER MARKET DURING FORECAST PERIOD

- TABLE 22 POLYESTER FIBER MARKET, BY GRADE, 2021-2028 (USD MILLION)

- TABLE 23 POLYESTER FIBER MARKET, BY GRADE, 2021-2028 (KILOTON)

- 7.2 PET POLYESTER GRADE

- 7.2.1 RECYCLABILITY OF PET TO DRIVE THE MARKET FOR PET POLYESTER GRADE

- FIGURE 34 ASIA PACIFIC TO LEAD PET POLYESTER FIBER MARKET

- TABLE 24 PET POLYESTER FIBER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 25 PET POLYESTER FIBER MARKET, BY REGION, 2021-2028 (KILOTON)

- 7.3 PCDT POLYESTER GRADE

- 7.3.1 CONTINUOUS DEVELOPMENT AND INNOVATION TO DRIVE MARKET

- TABLE 26 PCDT POLYESTER FIBER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 27 PCDT POLYESTER FIBER MARKET, BY REGION, 2021-2028 (KILOTON)

8 POLYESTER FIBER MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- FIGURE 35 POLYESTER FILAMENT YARN TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 28 POLYESTER FIBER MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 29 POLYESTER FIBER MARKET, BY PRODUCT TYPE, 2021-2028 (KILOTON)

- 8.2 POLYESTER FILAMENT YARN

- 8.2.1 EXTENSIVE USE IN TEXTILE INDUSTRY DUE TO STRENGTH, DURABILITY, AND EXCEPTIONAL COLORFASTNESS TO DRIVE MARKET

- FIGURE 36 ASIA PACIFIC TO LEAD POLYESTER FILAMENT YARN MARKET

- TABLE 30 POLYESTER FILAMENT YARN: POLYESTER FIBER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 31 POLYESTER FILAMENT YARN: POLYESTER FIBER MARKET, BY REGION, 2021-2028 (KILOTON)

- 8.3 POLYESTER STAPLE FIBER

- 8.3.1 DEMAND FOR ELEVATING TEXTILE EXCELLENCE TO DRIVE MARKET

- TABLE 32 POLYESTER STAPLE FIBER: POLYESTER FIBER MARKET, REGION, 2021-2028 (USD MILLION)

- TABLE 33 POLYESTER STAPLE FIBER: POLYESTER FIBER MARKET, REGION, 2021-2028 (KILOTON)

9 POLYESTER FIBER MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 37 TEXTILE & APPAREL SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 34 POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 35 POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 9.2 TEXTILE & APPAREL

- 9.2.1 HIGH DEMAND FOR TEXTILE GOODS TO DRIVE MARKET

- FIGURE 38 ASIA PACIFIC TO BE LARGEST MARKET FOR TEXTILE AND APPAREL SEGMENT

- TABLE 36 TEXTILE & APPAREL: POLYESTER FIBER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 37 TEXTILE & APPAREL: POLYESTER FIBER MARKET, BY REGION, 2021-2028 (KILOTON)

- 9.3 HOME FURNISHING

- 9.3.1 RISING DEMAND FOR COMFORTABLE AND STYLISH HOME FURNISHINGS TO DRIVE DEMAND

- TABLE 38 HOME FURNISHING: POLYESTER FIBER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 39 HOME FURNISHING: POLYESTER FIBER MARKET, BY REGION, 2021-2028 (KILOTON)

- 9.4 AUTOMOTIVE & TRANSPORTATION

- 9.4.1 SUNLIGHT AND CHEMICAL RESISTANCE OF POLYESTER FIBERS TO DRIVE DEMAND

- TABLE 40 AUTOMOTIVE & TRANSPORTATION: POLYESTER FIBER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 41 AUTOMOTIVE & TRANSPORTATION: POLYESTER FIBER MARKET, BY REGION, 2021-2028 (KILOTON)

- 9.5 INDUSTRIAL

- 9.5.1 STRENGTH AND DURABILITY OF POLYESTER FIBER TO DRIVE MARKET

- TABLE 42 INDUSTRIAL: POLYESTER FIBER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 43 INDUSTRIAL: POLYESTER FIBER MARKET, BY REGION, 2021-2028 (KILOTON)

- 9.6 OTHERS

- TABLE 44 OTHER APPLICATIONS: POLYESTER FIBER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 45 OTHER APPLICATIONS: POLYESTER FIBER MARKET, BY REGION, 2021-2028 (KILOTON)

10 POLYESTER FIBER MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 39 CHINA TO BE FASTEST-GROWING POLYESTER FIBER MARKET DURING FORECAST PERIOD

- 10.1.1 POLYESTER FIBER MARKET, BY REGION

- TABLE 46 POLYESTER FIBER MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 47 POLYESTER FIBER MARKET, BY REGION, 2021-2028 (KILOTON)

- 10.2 ASIA PACIFIC

- 10.2.1 RECESSION IMPACT

- FIGURE 40 ASIA PACIFIC: POLYESTER FIBER MARKET SNAPSHOT

- 10.2.2 ASIA PACIFIC: POLYESTER FIBER MARKET, BY FORM

- TABLE 48 ASIA PACIFIC: POLYESTER FIBER MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 49 ASIA PACIFIC: POLYESTER FIBER MARKET, BY FORM, 2021-2028 (KILOTON)

- 10.2.3 ASIA PACIFIC: POLYESTER FIBER MARKET, BY GRADE

- TABLE 50 ASIA PACIFIC: POLYESTER FIBER MARKET, BY GRADE, 2021-2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: POLYESTER FIBER MARKET, BY GRADE, 2021-2028 (KILOTON)

- 10.2.4 ASIA PACIFIC: POLYESTER FIBER MARKET, BY PRODUCT TYPE

- TABLE 52 ASIA PACIFIC: POLYESTER FIBER MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 53 ASIA PACIFIC: POLYESTER FIBER MARKET, BY PRODUCT TYPE, 2021-2028 (KILOTON)

- 10.2.5 ASIA PACIFIC: POLYESTER FIBER MARKET, BY APPLICATION

- TABLE 54 ASIA PACIFIC: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 55 ASIA PACIFIC: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.2.6 ASIA PACIFIC: POLYESTER FIBER MARKET, BY COUNTRY

- TABLE 56 ASIA PACIFIC: POLYESTER FIBER MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 57 ASIA PACIFIC: POLYESTER FIBER MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- 10.2.6.1 China

- 10.2.6.1.1 Increased consumer spending on clothing, textiles, and home furnishings to drive market

- 10.2.6.1.2 China: Polyester fiber market, by application

- 10.2.6.1 China

- TABLE 58 CHINA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 59 CHINA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.2.6.2 Japan

- 10.2.6.2.1 Expanding textile and apparel sector to drive market

- 10.2.6.2.2 Japan: Polyester fiber market, by application

- 10.2.6.2 Japan

- TABLE 60 JAPAN: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 61 JAPAN: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.2.6.3 India

- 10.2.6.3.1 Rapid expansion of domestic polyester fiber industry to drive market

- 10.2.6.3.2 India: Polyester fiber market, by application

- 10.2.6.3 India

- TABLE 62 INDIA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 63 INDIA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.2.6.4 South Korea

- 10.2.6.4.1 Growing use of polyester fiber in textile industry to drive market

- 10.2.6.4.2 South Korea: Polyester fiber market, by application

- 10.2.6.4 South Korea

- TABLE 64 SOUTH KOREA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 65 SOUTH KOREA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.2.6.5 Australia

- 10.2.6.5.1 Growing demand for sustainable textile & apparel sector to drive market

- 10.2.6.5.2 Australia: Polyester fiber market, by application

- 10.2.6.5 Australia

- TABLE 66 AUSTRALIA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 67 AUSTRALIA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.2.6.6 Rest of Asia Pacific

- 10.2.6.6.1 Rest of Asia Pacific: Polyester fiber market, by application

- 10.2.6.6 Rest of Asia Pacific

- TABLE 68 REST OF ASIA PACIFIC: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 69 REST OF ASIA PACIFIC: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.3 NORTH AMERICA

- 10.3.1 RECESSION IMPACT

- FIGURE 41 NORTH AMERICA: POLYESTER FIBER MARKET SNAPSHOT

- 10.3.2 NORTH AMERICA: POLYESTER FIBER MARKET, BY FORM

- TABLE 70 NORTH AMERICA: POLYESTER FIBER MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: POLYESTER FIBER MARKET, BY FORM, 2021-2028 (KILOTON)

- 10.3.3 NORTH AMERICA: POLYESTER FIBER MARKET, BY GRADE

- TABLE 72 NORTH AMERICA: POLYESTER FIBER MARKET, BY GRADE, 2021-2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: POLYESTER FIBER MARKET, BY GRADE, 2021-2028 (KILOTON)

- 10.3.4 NORTH AMERICA: POLYESTER FIBER MARKET, BY PRODUCT TYPE

- TABLE 74 NORTH AMERICA: POLYESTER FIBER MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: POLYESTER FIBER MARKET, BY PRODUCT TYPE, 2021-2028 (KILOTON)

- 10.3.5 NORTH AMERICA: POLYESTER FIBER MARKET, BY APPLICATION

- TABLE 76 NORTH AMERICA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.3.6 NORTH AMERICA: POLYESTER FIBER MARKET, BY COUNTRY

- TABLE 78 NORTH AMERICA: POLYESTER FIBER MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: POLYESTER FIBER MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- 10.3.6.1 US

- 10.3.6.1.1 High demand from textile & apparel, automotive, and industrial applications

- 10.3.6.1.2 US: Polyester fiber market, by application

- 10.3.6.1 US

- TABLE 80 US: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 81 US: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.3.6.2 Canada

- 10.3.6.2.1 Increasing demand from textile & apparel industry to drive market

- 10.3.6.2.2 Canada: Polyester fiber market, by application

- 10.3.6.2 Canada

- TABLE 82 CANADA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 83 CANADA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.4 EUROPE

- 10.4.1 RECESSION IMPACT

- FIGURE 42 EUROPE: POLYESTER FIBER MARKET SNAPSHOT

- 10.4.2 EUROPE: POLYESTER FIBER MARKET, BY FORM

- TABLE 84 EUROPE: POLYESTER FIBER MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 85 EUROPE: POLYESTER FIBER MARKET, BY FORM, 2021-2028 (KILOTON)

- 10.4.3 EUROPE: POLYESTER FIBER MARKET, BY GRADE

- TABLE 86 EUROPE: POLYESTER FIBER MARKET, BY GRADE, 2021-2028 (USD MILLION)

- TABLE 87 EUROPE: POLYESTER FIBER MARKET, BY GRADE, 2021-2028 (KILOTON)

- 10.4.4 EUROPE: POLYESTER FIBER MARKET, BY PRODUCT TYPE

- TABLE 88 EUROPE: POLYESTER FIBER MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 89 EUROPE: POLYESTER FIBER MARKET, BY PRODUCT TYPE, 2021-2028 (KILOTON)

- 10.4.5 EUROPE: POLYESTER FIBER MARKET, BY APPLICATION

- TABLE 90 EUROPE: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 91 EUROPE: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.4.6 EUROPE: POLYESTER FIBER MARKET, BY COUNTRY

- TABLE 92 EUROPE: POLYESTER FIBER MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 93 EUROPE: POLYESTER FIBER MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- 10.4.6.1 Germany

- 10.4.6.1.1 Growing automotive and textile industry to drive market

- 10.4.6.1.2 Germany: Polyester fiber market, by application

- 10.4.6.1 Germany

- TABLE 94 GERMANY: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 95 GERMANY: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.4.6.2 UK

- 10.4.6.2.1 Adaptability, durability, and cost-effectiveness features to drive market

- 10.4.6.2.2 UK: Polyester fiber market, by application

- 10.4.6.2 UK

- TABLE 96 UK: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 97 UK: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.4.6.3 Italy

- 10.4.6.3.1 Durability, affordability, and adaptability features to drive market

- 10.4.6.3.2 Italy: Polyester fiber market, by application

- 10.4.6.3 Italy

- TABLE 98 ITALY: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 99 ITALY: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.4.6.4 France

- 10.4.6.4.1 Growing textile and fashion industry to drive market

- 10.4.6.4.2 France: Polyester fiber market, by application

- 10.4.6.4 France

- TABLE 100 FRANCE: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 101 FRANCE: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.4.6.5 SPAIN

- 10.4.6.5.1 Growing textile and automotive industry to drive market

- 10.4.6.5.2 Spain: Polyester fiber market, by application

- 10.4.6.5 SPAIN

- TABLE 102 SPAIN: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 103 SPAIN: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.4.6.6 Russia

- 10.4.6.6.1 Resistance to wrinkles and vibrant color retention properties to drive market

- 10.4.6.6.2 Russia: Polyester fiber market, by application

- 10.4.6.6 Russia

- TABLE 104 RUSSIA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 105 RUSSIA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.4.6.7 Rest of Europe

- 10.4.6.7.1 Rest of Europe: Polyester fiber market, by application

- 10.4.6.7 Rest of Europe

- TABLE 106 REST OF EUROPE: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 107 REST OF EUROPE: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 RECESSION IMPACT

- 10.5.2 MIDDLE EAST & AFRICA: POLYESTER FIBER MARKET, BY FORM

- TABLE 108 MIDDLE EAST & AFRICA: POLYESTER FIBER MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 109 MIDDLE EAST & AFRICA: POLYESTER FIBER MARKET, BY FORM, 2021-2028 (KILOTON)

- 10.5.3 MIDDLE EAST & AFRICA: POLYESTER FIBER MARKET, BY GRADE

- TABLE 110 MIDDLE EAST & AFRICA: POLYESTER FIBER MARKET, BY GRADE, 2021-2028 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: POLYESTER FIBER MARKET, BY GRADE, 2021-2028 (KILOTON)

- 10.5.4 MIDDLE EAST & AFRICA: POLYESTER FIBER MARKET, BY PRODUCT TYPE

- TABLE 112 MIDDLE EAST & AFRICA: POLYESTER FIBER MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: POLYESTER FIBER MARKET, BY PRODUCT TYPE, 2021-2028 (KILOTON)

- 10.5.5 MIDDLE EAST & AFRICA: POLYESTER FIBER MARKET, BY APPLICATION

- TABLE 114 MIDDLE EAST & AFRICA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.5.6 MIDDLE EAST & AFRICA: POLYESTER FIBER MARKET, BY COUNTRY

- TABLE 116 MIDDLE EAST & AFRICA: POLYESTER FIBER MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: POLYESTER FIBER MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- 10.5.6.1 Saudi Arabia

- 10.5.6.1.1 Growing automotive industry to drive market

- 10.5.6.1.2 Saudi Arabia: Polyester fiber market, by application

- 10.5.6.1 Saudi Arabia

- TABLE 118 SAUDI ARABIA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 119 SAUDI ARABIA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.5.6.2 South Africa

- 10.5.6.2.1 Growing population and economy to drive market

- 10.5.6.2.2 South Africa: Polyester fiber market, by application

- 10.5.6.2 South Africa

- TABLE 120 SOUTH AFRICA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 121 SOUTH AFRICA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.5.6.3 Iran

- 10.5.6.3.1 Diverse range of packaging alternatives for various industrial sectors to drive market

- 10.5.6.3.2 Iran: Polyester fiber market, by application

- 10.5.6.3 Iran

- TABLE 122 IRAN: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 123 IRAN: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.5.6.4 Rest of Middle East & Africa

- 10.5.6.4.1 Rest of Middle East & Africa: Polyester fiber market, by application

- 10.5.6.4 Rest of Middle East & Africa

- TABLE 124 REST OF MIDDLE EAST & AFRICA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 125 REST OF MIDDLE EAST & AFRICA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.6 LATIN AMERICA

- 10.6.1 RECESSION IMPACT

- 10.6.2 LATIN AMERICA: POLYESTER FIBER MARKET, BY FORM

- TABLE 126 LATIN AMERICA: POLYESTER FIBER MARKET, BY FORM, 2021-2028 (USD MILLION)

- TABLE 127 LATIN AMERICA: POLYESTER FIBER MARKET, BY FORM, 2021-2028 (KILOTON)

- 10.6.3 LATIN AMERICA: POLYESTER FIBER MARKET, BY GRADE

- TABLE 128 LATIN AMERICA: POLYESTER FIBER MARKET, BY GRADE, 2021-2028 (USD MILLION)

- TABLE 129 LATIN AMERICA: POLYESTER FIBER MARKET, BY GRADE, 2021-2028 (KILOTON)

- 10.6.4 LATIN AMERICA: POLYESTER FIBER MARKET, BY PRODUCT TYPE

- TABLE 130 LATIN AMERICA: POLYESTER FIBER MARKET, BY PRODUCT TYPE, 2021-2028 (USD MILLION)

- TABLE 131 LATIN AMERICA: POLYESTER FIBER MARKET, BY PRODUCT TYPE, 2021-2028 (KILOTON)

- 10.6.5 LATIN AMERICA: POLYESTER FIBER MARKET, BY APPLICATION

- TABLE 132 LATIN AMERICA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 133 LATIN AMERICA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.6.6 LATIN AMERICA: POLYESTER FIBER MARKET, BY COUNTRY

- TABLE 134 LATIN AMERICA: POLYESTER FIBER MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 135 LATIN AMERICA: POLYESTER FIBER MARKET SIZE, BY COUNTRY, 2021-2028 (KILOTON)

- 10.6.6.1 Mexico

- 10.6.6.1.1 Growing use of polyester fibers in geotextiles and roofing materials to drive market

- 10.6.6.1.2 Mexico: Polyester fiber market, by application

- 10.6.6.1 Mexico

- TABLE 136 MEXICO: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 137 MEXICO: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.6.6.2 Brazil

- 10.6.6.2.1 Growing tourism sector to drive market

- 10.6.6.2.2 Brazil: Polyester fiber market, by application

- 10.6.6.2 Brazil

- TABLE 138 BRAZIL: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 139 BRAZIL: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- 10.6.6.3 Rest of Latin America

- 10.6.6.3.1 Rest of Latin America: Polyester fiber market, by application

- 10.6.6.3 Rest of Latin America

- TABLE 140 REST OF LATIN AMERICA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 141 REST OF LATIN AMERICA: POLYESTER FIBER MARKET, BY APPLICATION, 2021-2028 (KILOTON)

11 COMPETITIVE LANDSCAPE

- 11.1 KEY PLAYER STRATEGIES

- TABLE 142 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 11.2 REVENUE ANALYSIS

- 11.3 MARKET SHARE ANALYSIS

- FIGURE 43 SHARES OF TOP COMPANIES IN POLYESTER FIBER MARKET

- TABLE 143 DEGREE OF COMPETITION: POLYESTER FIBER MARKET

- 11.4 COMPANY EVALUATION MATRIX

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- FIGURE 44 POLYESTER FIBER MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- 11.4.5 COMPANY FOOTPRINT

- TABLE 144 COMPANY PRODUCT FOOTPRINT

- TABLE 145 COMPANY FORM FOOTPRINT

- TABLE 146 COMPANY GRADE FOOTPRINT

- TABLE 147 COMPANY PRODUCT TYPE FOOTPRINT

- TABLE 148 COMPANY APPLICATION FOOTPRINT

- TABLE 149 COMPANY REGION FOOTPRINT

- 11.5 START-UP/SME EVALUATION MATRIX

- 11.5.1 PROGRESSIVE COMPANIES

- 11.5.2 RESPONSIVE COMPANIES

- 11.5.3 DYNAMIC COMPANIES

- 11.5.4 STARTING BLOCKS

- FIGURE 45 POLYESTER FIBER MARKET: START-UP/SME EVALUATION MATRIX, 2022

- 11.5.5 COMPETITIVE BENCHMARKING

- TABLE 150 POLYESTER FIBER MARKET: KEY START-UPS/SMES

- TABLE 151 POLYESTER FIBER MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES

- 11.6 COMPETITIVE SCENARIO AND TRENDS

- TABLE 152 POLYESTER FIBER MARKET: DEALS, 2018-2023

- TABLE 153 POLYESTER FIBER MARKET: OTHERS, 2018-2023

12 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 12.1 KEY COMPANIES

- 12.1.1 RELIANCE INDUSTRIES LIMITED

- TABLE 154 RELIANCE INDUSTRIES LIMITED: COMPANY OVERVIEW

- FIGURE 46 RELIANCE INDUSTRIES LIMITED: COMPANY SNAPSHOT

- TABLE 155 RELIANCE INDUSTRIES LIMITED: DEALS

- 12.1.2 INDORAMA VENTURES PUBLIC COMPANY LIMITED

- TABLE 156 INDORAMA VENTURES PUBLIC COMPANY LIMITED: COMPANY OVERVIEW

- FIGURE 47 INDORAMA VENTURES PUBLIC COMPANY LIMITED: COMPANY SNAPSHOT

- TABLE 157 INDORAMA VENTURES PUBLIC COMPANY LIMITED: DEALS

- 12.1.3 THE BOMBAY DYEING AND MANUFACTURING COMPANY LIMITED

- TABLE 158 THE BOMBAY DYEING AND MANUFACTURING COMPANY LIMITED: COMPANY OVERVIEW

- FIGURE 48 THE BOMBAY DYEING AND MANUFACTURING COMPANY LIMITED: COMPANY SNAPSHOT

- 12.1.4 BARNET

- TABLE 159 BARNET: COMPANY OVERVIEW

- TABLE 160 BARNET: OTHERS

- 12.1.5 VNPOLYFIBER (VIETNAM POLYESTER STAPLE FIBER)

- TABLE 161 VNPOLYFIBER (VIETNAM POLYESTER STAPLE FIBER): COMPANY OVERVIEW

- 12.1.6 SARLA PERFORMANCE FIBERS LIMITED

- TABLE 162 SARLA PERFORMANCE FIBERS LIMITED: COMPANY OVERVIEW

- FIGURE 49 SARLA PERFORMANCE FIBERS LIMITED: COMPANY SNAPSHOT

- TABLE 163 SARLA PERFORMANCE FIBERS LIMITED: OTHER DEALS

- 12.1.7 MARKISCHE FASER GMBH

- TABLE 164 MARKISCHE FASER GMBH: COMPANY OVERVIEW

- TABLE 165 MARKISCHE FASER GMBH: DEALS

- 12.1.8 EASTMAN CHEMICAL COMPANY

- TABLE 166 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- FIGURE 50 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- TABLE 167 EASTMAN CHEMICAL COMPANY: DEALS

- TABLE 168 EASTMAN CHEMICAL COMPANY: OTHER DEALS

- 12.1.9 TORAY INDUSTRIES INC.

- TABLE 169 TORAY INDUSTRIES INC.: COMPANY OVERVIEW

- FIGURE 51 TORAY INDUSTRIES INC.: COMPANY SNAPSHOT

- TABLE 170 TORAY INDUSTRIES INC.: OTHER DEALS

- 12.1.10 STEIN FIBERS LTD.

- TABLE 171 STEIN FIBERS LTD.: COMPANY OVERVIEW

- TABLE 172 STEIN FIBERS LTD.: DEALS

- 12.1.11 GREEN GROUP S.A.

- TABLE 173 GREEN GROUP S.A.: COMPANY OVERVIEW

- TABLE 174 GREEN GROUP S.A.: DEALS

- TABLE 175 GREEN GROUP S.A.: OTHER DEALS

- 12.1.12 KAYAVLON IMPEX PVT. LTD.

- TABLE 176 KAYAVLON IMPEX PVT. LTD.: COMPANY OVERVIEW

- 12.1.13 DIYOU FIBER (M) SDN BHD.

- TABLE 177 DIYOU FIBER (M) SDN BHD.: COMPANY OVERVIEW

- 12.1.14 SWICOFIL AG

- TABLE 178 SWICOFIL AG: COMPANY OVERVIEW

- 12.1.15 SINOPEC YIZHENG CHEMICAL FIBER LIMITED LIABILITY COMPANY

- TABLE 179 SINOPEC YIZHENG CHEMICAL FIBER LIMITED LIABILITY COMPANY: COMPANY OVERVIEW

- FIGURE 52 SINOPEC YIZHENG CHEMICAL FIBER LIMITED LIABILITY COMPANY: COMPANY SNAPSHOT

- TABLE 180 SINOPEC YIZHENG CHEMICAL FIBER LIMITED LIABILITY COMPANY: PRODUCT DEVELOPMENTS

- 12.1.16 ALPEK S.A.B. DE C.V.

- TABLE 181 ALPEK S.A.B. DE C.V.: COMPANY OVERVIEW

- FIGURE 53 ALPEK S.A.B. DE C.V.: COMPANY SNAPSHOT

- TABLE 182 ALPEK S.A.B. DE C.V.: DEALS

- TABLE 183 ALPEK S.A.B. DE C.V.: OTHER DEALS

- 12.1.17 ZHEJIANG HENGYI GROUP CO., LTD.

- TABLE 184 ZHEJIANG HENGYI GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 185 ZHEJIANG HENGYI GROUP CO., LTD.: PRODUCT DEVELOPMENTS

- TABLE 186 ZHEJIANG HENGYI GROUP CO., LTD.: DEALS

- TABLE 187 ZHEJIANG HENGYI GROUP CO., LTD.: OTHER DEALS

- 12.1.18 JIANGNAN TEXTILE (SHANGHAI) CO., LTD.

- TABLE 188 JIANGNAN TEXTILE (SHANGHAI) CO., LTD.: COMPANY OVERVIEW

- 12.1.19 DONGGUAN YUEXIN INDUSTRIAL CO., LTD.

- TABLE 189 DONGGUAN YUEXIN INDUSTRIAL CO., LTD.: COMPANY OVERVIEW

- 12.1.20 XIAMEI (GUANGZHOU) SYNTHETIC FIBER CO., LTD.

- TABLE 190 XIAMEI (GUANGZHOU) SYNTHETIC FIBER CO., LTD.: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS