|

|

市場調査レポート

商品コード

1368147

エチレンアミンの世界市場:タイプ別、用途別、最終用途別、地域別-2028年までの予測Ethyleneamines Market by Type (Ethylenediamine, Diethylenetriamine, Triethylenetetramine), Application, End Use (Resin, Paper, Automotive, Adhesive, Water Treatment, Agriculture, Pharmaceutical), and Region - Global Forecasts to 2028 |

||||||

カスタマイズ可能

|

|||||||

| エチレンアミンの世界市場:タイプ別、用途別、最終用途別、地域別-2028年までの予測 |

|

出版日: 2023年10月16日

発行: MarketsandMarkets

ページ情報: 英文 284 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のエチレンアミンの市場規模は、予測期間に4.7%のCAGRで拡大し、2023年の23億米ドルから29億米ドルに成長すると予測されています。

エチレンアミン市場は現在、進化する産業需要と用途に対応して力強い成長とダイナミックなシフトを経験しています。反応性、塩基性、表面活性のユニークなブレンドで知られるエチレンアミンは、さまざまな産業で必須製品の生産に不可欠な中間体となっています。この拡大は、工業化の進展、都市化、高度な化学ソリューションへのニーズの高まりといった要因によって推進されています。

| レポート範囲 | |

|---|---|

| 対象期間 | 2021-2028 |

| 基準年 | 2022 |

| 予測期間 | 2023-2028 |

| 単位 | 金額 (USD Million/Billion) |

| セグメント | タイプ別、用途別、最終用途別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、南米、中近東アフリカ |

これらの汎用性の高い化合物は、農薬、医薬品、水処理、樹脂製造など多くの分野で応用されています。その重要性は、近代的な工業プロセスを推進する機能性製品の生成において、中間体としての役割を果たすことにあります。特に、エチレンジアミン四酢酸(EDTA)製造に代表されるキレート剤の役割は、複雑な化学プロセスにおける重要性を強調しています。

トリエチレンテトラミンは、直鎖、分岐、2つの環状分子を含む、沸点の近い4つのTETAエチレンアミンの混合物です。TETAの主な用途には、エポキシ硬化剤、ポリアミドの製造、石油・燃料添加剤などがあります。TETAはエチレンジアミンやジエチレントリアミンと同様の活性と用途を持ちます。TETAは、エポキシ硬化における架橋剤(硬化剤)、セルロース化学品や製紙助剤の合成における中間体、潤滑油や燃料添加剤に使用されています。

エチレンアミンから誘導されるポリアミノカルボン酸およびその塩は、特定の金属イオンが処理上の課題となったり、緩衝、濃縮、分離、輸送が必要となったりする多様な用途で極めて重要な役割を果たしています。一般にキレート剤またはキラントとして知られるこれらの化合物は、幅広い2価または多価金属と化学量論的錯体を形成することで機能します。

エチレンアミン誘導体であるエチレンジアミン(EDA)の注目すべき工業的用途のひとつは、エチレンジアミン四酢酸(EDTA)の製造における不可欠な役割です。EDTAは、金属イオンの錯形成に有効なキレート剤としてよく知られています。EDTAの工業的製造工程では通常、EDAの水溶液にホルムアルデヒドとシアン化水素、またはシアン化アルカリ金属を加えます。この化学変化によってEDTAが生成されます。

エチレンアミン市場は欧州が最大市場となっています。欧州連合(EU)の化学業界は、課題と機会の両方を特徴とする複雑な情勢を呈しています。数量ベースでは、EUの化学生産量は2020年に2億7,100万トンに達し、純輸入と生産を含む消費量は2億8,900万トンでした。興味深いことに、この生産量は2004年から2020年までの間に10%減少しており、世界の産業拡大動向とは対照的です。この減少の主な要因のひとつは、欧州のエネルギーコストが相対的に高いことであり、これは、より有利なエネルギー価格の恩恵を受けている地域と比較して、業界の競合に影響を与えています。このような状況にもかかわらず、EUの化学品販売総額は大幅な伸びを示し、2000年の3,630億ユーロから2020年には4,990億ユーロへと38%増加しました。

今後を展望すると、世界の化学品生産は、さまざまな川下産業における化学品需要の増加に牽引され、2017年から2030年にかけて倍増すると予想され、著しい拡大が見込まれています。2030年の世界の化学品売上高は6兆2,000億ユーロに達すると予測されています。この進化する情勢の中で、EU-27の化学産業は、販売量で世界第3位となり、重要な位置を占めると予想されます。

当レポートでは、世界のエチレンアミン市場について調査し、タイプ別、用途別、最終用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 物理的特性

- 主要な新興国VS. EU 27ヶ国と米国

- 市場力学

- ポーターのファイブフォース分析

- マクロ経済指標

第6章 業界の動向

- サプライチェーン分析

- 顧客のビジネスに影響を与える動向と混乱

- 生態系マッピング

- ケーススタディ分析

- 技術分析

- 主要な利害関係者と購入基準

- 価格分析

- 貿易分析

- 市場の成長に影響を与える世界経済シナリオ

- 関税と規制状況

- 2023年~2024年の主要な会議とイベント

- 特許分析

第7章 エチレンアミン市場、タイプ別

- イントロダクション

- エチレンジアミン

- ジエチレントリアミン

- トリエチレンテトラミン

- その他

第8章 エチレンアミン市場、用途別

- イントロダクション

- キレート剤

- 腐食防止剤

- 潤滑油および燃料添加剤

- 加工助剤/添加剤

- 繊維添加剤

- 硬化剤

- その他

第9章 エチレンアミン市場、最終用途別

- イントロダクション

- 樹脂

- 紙

- 接着剤

- 自動車

- 水処理

- 農薬

- 医薬品

- パーソナルケア

- 繊維用ケミカル

- その他

第10章 エチレンアミン市場、地域別

- イントロダクション

- 欧州

- アジア太平洋

- 北米

- 中東・アフリカ

- 南米

第11章 競合情勢

- 概要

- 主要参入企業が採用した戦略

- 市場シェア分析

- 主要企業の収益分析

- 企業評価マトリックス、2022年

- 新興企業/中小企業の評価マトリックス、2022年

- 製品ポートフォリオの強み

- 市場ランキング分析

- 競合シナリオ

- 戦略的展開(競合状況・動向)

第12章 企業プロファイル

- 主要参入企業

- HUNTSMAN CORPORATION

- DOW INC

- TOSOH CORPORATION

- NOURYON

- BASF SE

- DIAMINES AND CHEMICALS LTD.

- SABIC

- BALAJI SPECIALITY CHEMICALS LIMITED

- ORIENTAL UNION CHEMICAL CORPORATION

- KANTO CHEMICAL CO., INC.

- その他の企業

- GFS CHEMICALS, INC.

- OAKWOOD PRODUCTS, INC.

第13章 隣接市場および関連市場

第14章 付録

The global ethyleneamines market size is projected to grow from USD 2.3 billion in 2023 to USD 2.9 billion, at a CAGR of 4.7%. The ethyleneamines market is currently experiencing robust growth and dynamic shifts in response to evolving industrial demands and applications. Ethyleneamines, known for their unique blend of reactivity, basicity, and surface activity, have become integral intermediates in the production of essential products across various industries. This expansion is being propelled by factors such as increased industrialization, urbanization, and the growing need for advanced chemical solutions.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million/Billion) |

| Segments | By Type, By Application, By End Use, and By Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Middle East & Africax |

These versatile compounds find application in numerous sectors, including agrochemicals, pharmaceuticals, water treatment, and resin manufacturing. Their significance lies in serving as intermediates in the creation of functional products that drive modern industrial processes. In particular, their role in chelating agents, exemplified by ethylenediaminetetraacetic acid (EDTA) production, underscores their importance in complex chemical processes.

The triethylenetetramine segment is expected to register one of the highest market share during the forecast period

Triethylenetetramine is a mixture of four TETA ethyleneamines with close boiling points including linear, branched, and two cyclic molecules. The major applications of TETA include epoxy curing agents and the production of polyamides and oil and fuel additives. TETA has similar activity and uses to ethylenediamine and diethylenetriamine. TETA finds use as a crosslinker (hardener) in epoxy curing, as an intermediate in the synthesis of cellulose chemicals and paper auxiliaries, and in lube oil and fuel additives.

The chelating agents segment in application is expected to register one of the highest CAGR during the forecast period

Polyaminocarboxylic acids and their salts derived from ethyleneamines play a pivotal role in a diverse array of applications where specific metal ions pose challenges in processing or necessitate buffering, concentrating, separating, or transporting. These compounds, commonly known as chelating agents or chelants, function by forming stoichiometric complexes with a wide range of divalent or polyvalent metals.

One of the notable industrial applications of ethylenediamine (EDA), an ethyleneamine derivative, is its integral role in the production of ethylenediaminetetraacetic acid (EDTA). EDTA is a well-established chelating agent renowned for its efficacy in metal ion complexation. Industrial processes for manufacturing EDTA typically involve the addition of formaldehyde and hydrogen cyanide, or an alkali metal cyanide, to an aqueous solution of EDA. This chemical transformation results in the creation of EDTA.

Europe ethyleneamines market is estimated to capture one of the highest share in terms of volume during the forecast period

Europe has the greatest market for ethyleneamines. The European Union (EU) chemical industry presents an intricate landscape characterized by both challenges and opportunities. In terms of volume, EU chemical production reached 271 million tonnes in 2020, while consumption, which includes net imports and production, stood at 289 million tonnes. Interestingly, this volume-based production fell by 10% in the period from 2004 to 2020, in contrast to the global trend of industry expansion. One key factor contributing to this decline is the relatively high energy costs in Europe, which have impacted the industry's competitiveness when compared to regions benefiting from more favorable energy prices. Despite this, the total value of EU chemical sales demonstrated significant growth, increasing by 38% from Euro 363 billion in 2000 to Euro 499 billion in 2020.

Looking ahead, the global chemical production is poised for a remarkable expansion, with expectations to double from 2017 to 2030, driven by the rising demand for chemicals across various downstream industries. Anticipated world chemical sales in 2030 are projected to reach Euro 6.2 trillion. In this evolving landscape, the EU-27 chemical industry is expected to hold a prominent position, ranking third globally in terms of sales volumes.

The break-up of the profile of primary participants in the ethyleneamines market:

- By Company Type: Tier 1 - 46%, Tier 2 - 43%, and Tier 3 - 27%

- By Designation: C Level - 21%, D Level - 23%, and Others - 56%

- By Region: North America - 37%, Europe - 23%, Asia Pacific- 26%, Middle East & Africa - 10%, and South America - 4%

The key companies profiled in this report are Huntsman Corporation (US), Dow Inc (US), Tosoh Corporation (Japan), Nouryon (Netherlands), BASF SE (Germany), Diamines and Chemicals Ltd (India), SABIC (Saudi Arabia), Balaji Speciality Chemicals Limited (India), Oriental Union Chemical Corporation (Taiwan), Kanto Chemical Co., Inc (Japan), and others.

Research Coverage:

The ethyleneamines market is segmented by Type (Ethylenediamine, Diethylenetriamine, Triethylenetetramine & Others Higher Ethyleneamines), Application (Chelating Agents, and Others), End Use (Chelating Agents, Corrosion Inhibitors, Lube Oil & Fuel Additives, Processing Aids/Additives, Textile Additives, Curing Agents, and Others), End Use (Resin, Paper, Adhesive, Automotive, Water Treatment, Agro Chemicals, Pharmaceuticals, Personal Care, Textile Chemicals, and Others), and Region (North America, Europe, Asia Pacific, the Middle East & Africa, and South America). The study's coverage covers detailed information on the key factors influencing the growth of the ethyleneamines market, such as drivers, constraints, challenges, and opportunities. A thorough examination of the top industry players was carried out in order to provide insights into their company overview, solutions, and services; essential strategies; contracts, partnerships, and agreements. There includes coverage of new product and service launches, mergers and acquisitions, and ongoing developments in the ethyleneamines market. A competitive analysis of emerging companies in the ethyleneamines business ecosystem is included in this study. Reasons to buy this report: The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall ethyleneamines market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing demand for ethyleneamines in emerging economies), restraints (volatility in raw material prices), opportunities (collaboration of distributors in untapped markets), and challenges (stringent regulatory policies).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the ethyleneamines market

- Market Development: Comprehensive information about lucrative markets - the report analyses the ethyleneamines market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the ethyleneamines market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Huntsman Corporation (US), Dow Inc (US), Tosoh Corporation (Japan), Nouryon (Netherlands), BASF SE (Germany). The report also helps stakeholders understand the pulse of the ethyleneamines market and provides them information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.2.2 DEFINITION AND INCLUSIONS, BY TYPE

- 1.2.3 DEFINITION AND INCLUSIONS, BY APPLICATION

- 1.2.4 DEFINITION AND INCLUSIONS, BY END USE

- 1.3 STUDY SCOPE

- FIGURE 1 ETHYLENEAMINES MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 ETHYLENEAMINES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.1.2.3 Primary data sources

- 2.1.2.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 ETHYLENEAMINES MARKET SIZE ESTIMATION, BY REGION

- FIGURE 7 ETHYLENEAMINES MARKET SIZE ESTIMATION, BY TYPE

- 2.3 MARKET FORECAST

- 2.3.1 SUPPLY-SIDE FORECAST

- FIGURE 8 ETHYLENEAMINES MARKET: SUPPLY-SIDE FORECAST

- FIGURE 9 METHODOLOGY FOR SUPPLY-SIDE SIZING OF ETHYLENEAMINES MARKET

- 2.4 FACTOR ANALYSIS

- FIGURE 10 GLOBAL IMPACT ON ETHYLENEAMINES MARKET

- 2.5 DATA TRIANGULATION

- FIGURE 11 ETHYLENEAMINES MARKET: DATA TRIANGULATION

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS

- 2.8 GROWTH RATE ASSUMPTIONS

- 2.9 RISK ASSESSMENT

- TABLE 1 ETHYLENEAMINES MARKET: RISK ASSESSMENT

- 2.10 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- TABLE 2 ETHYLENEAMINES MARKET SNAPSHOT

- FIGURE 12 ETHYLENEDIAMINE TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 13 CURING AGENTS TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 14 RESIN TO BE FASTEST-GROWING END USE DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

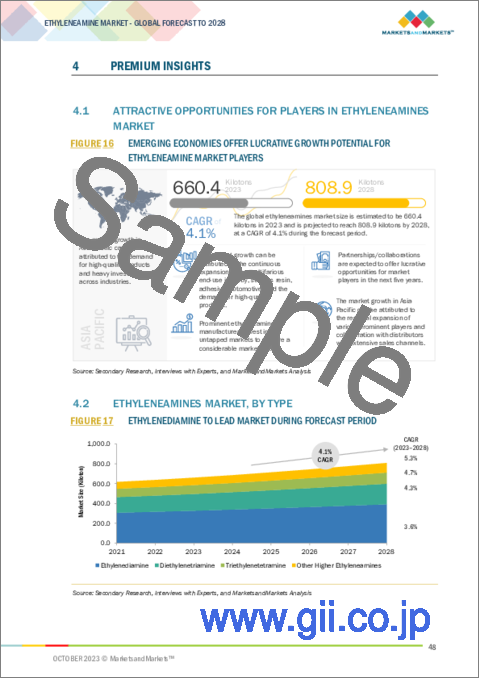

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ETHYLENEAMINES MARKET

- FIGURE 16 EMERGING ECONOMIES OFFER LUCRATIVE GROWTH POTENTIAL FOR ETHYLENEAMINE MARKET PLAYERS

- 4.2 ETHYLENEAMINES MARKET, BY TYPE

- FIGURE 17 ETHYLENEDIAMINE TO LEAD MARKET DURING FORECAST PERIOD

- 4.3 ASIA PACIFIC: ETHYLENEAMINES MARKET, BY TYPE AND COUNTRY

- FIGURE 18 ETHYLENEDIAMINE TYPE SEGMENT AND CHINA ACCOUNTED FOR HIGHEST GROWTH IN 2022

- 4.4 ETHYLENEAMINES MARKET, DEVELOPED VS. EMERGING ECONOMIES

- FIGURE 19 MARKET IN EMERGING ECONOMIES TO GROW FASTER THAN DEVELOPED COUNTRIES

- 4.5 ETHYLENEAMINES MARKET, BY KEY COUNTRY

- FIGURE 20 INDIA TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 PHYSICAL PROPERTIES

- 5.3 KEY EMERGING ECONOMIES VS. EU 27 AND US

- FIGURE 21 AVERAGE CHEMICAL PRODUCTION GROWTH PER ANNUM (2011-2021)

- 5.4 MARKET DYNAMICS

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ETHYLENEAMINES MARKET

- 5.4.1 DRIVERS

- 5.4.1.1 Use of lube oil additives and curing agents in automotive sector

- 5.4.1.2 Wide application of ethyleneamines in end-use industries

- 5.4.1.3 Growth of agriculture and fishing sector in emerging economies

- 5.4.2 RESTRAINTS

- 5.4.2.1 Slow economic growth and supply chain disruptions

- 5.4.3 OPPORTUNITIES

- 5.4.3.1 Supply chain optimization and strategic collaborations

- 5.4.3.2 Environmental regulations and specialty applications

- 5.4.4 CHALLENGES

- 5.4.4.1 Raw material price volatility and safety imperatives

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 ETHYLENEAMINES MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 PORTER'S FIVE FORCES ANALYSIS: ETHYLENEAMINES MARKET

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.2 THREAT OF SUBSTITUTES

- 5.5.3 BARGAINING POWER OF BUYERS

- 5.5.4 BARGAINING POWER OF SUPPLIERS

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.6 MACROECONOMIC INDICATORS

- 5.6.1 INTRODUCTION

- 5.6.2 GDP TRENDS AND FORECAST

- TABLE 4 GDP TRENDS AND FORECAST, PERCENTAGE CHANGE, 2020-2027

- 5.6.3 TRENDS AND FORECAST OF GLOBAL CONSTRUCTION INDUSTRY

- 5.6.4 TRENDS IN AUTOMOTIVE INDUSTRY

- TABLE 5 AUTOMOTIVE INDUSTRY PRODUCTION (2021-2022)

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- FIGURE 24 ETHYLENEAMINES MARKET: SUPPLY CHAIN ANALYSIS

- 6.2 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 TRENDS IN END-USE INDUSTRIES IMPACTING BUSINESS OF ETHYLENEAMINES MANUFACTURERS

- 6.3 ECOSYSTEM MAPPING

- TABLE 6 ETHYLENEAMINES MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 26 ETHYLENEAMINES MARKET: ECOSYSTEM MAP

- 6.4 CASE STUDY ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP TWO END USERS (%)

- 6.6.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA FOR ETHYLENEAMINES

- TABLE 8 KEY BUYING CRITERIA FOR ETHYLENEAMINES

- 6.7 PRICING ANALYSIS

- FIGURE 29 AVERAGE SELLING PRICE TREND, BY REGION, 2022

- FIGURE 30 AVERAGE SELLING PRICE TREND, BY TYPE, 2022

- FIGURE 31 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE, 2023

- 6.8 TRADE ANALYSIS

- 6.8.1 EXPORT SCENARIO OF ETHYLENE

- TABLE 9 COUNTRY-WISE EXPORT DATA FOR ETHYLENE, 2020-2022 (USD THOUSAND)

- 6.8.2 IMPORT SCENARIO OF ETHYLENE

- TABLE 10 COUNTRY-WISE IMPORT DATA FOR ETHYLENE, 2020-2022 (USD THOUSAND)

- 6.8.3 EXPORT SCENARIO OF ETHYLENEDIAMINE

- TABLE 11 COUNTRY-WISE EXPORT DATA FOR ETHYLENEDIAMINE, 2020-2022 (USD THOUSAND)

- 6.8.4 IMPORT SCENARIO OF ETHYLENEDIAMINE

- TABLE 12 COUNTRY-WISE IMPORT DATA FOR ETHYLENEDIAMINE, 2020-2022 (USD THOUSAND)

- 6.9 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTH

- 6.9.1 RUSSIA-UKRAINE WAR

- 6.9.2 CHINA

- 6.9.2.1 China's debt problem

- 6.9.2.2 Australia-China trade war

- 6.9.2.3 Environmental commitments

- 6.9.3 EUROPE

- 6.9.3.1 Energy crisis in Europe

- 6.10 TARIFF AND REGULATORY LANDSCAPE

- 6.10.1 REGULATIONS

- 6.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 16 ETHYLENEAMINES MARKET: KEY CONFERENCES AND EVENTS, 2023-2024

- 6.12 PATENT ANALYSIS

- 6.12.1 METHODOLOGY

- 6.12.2 PUBLICATION TRENDS

- FIGURE 32 PATENTS PUBLISHED, 2018-2023

- 6.12.3 JURISDICTION ANALYSIS

- FIGURE 33 PATENTS PUBLISHED BY JURISDICTION, 2018-2023

- 6.12.4 TOP APPLICANTS

- FIGURE 34 PATENTS PUBLISHED BY MAJOR APPLICANTS, 2018-2023

- TABLE 17 TOP PATENT OWNERS

7 ETHYLENEAMINES MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 35 ETHYLENEDIAMINE TO LEAD ETHYLENEAMINES MARKET DURING FORECAST PERIOD

- TABLE 18 ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 19 ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 20 ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 21 ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 7.2 ETHYLENEDIAMINE

- 7.2.1 WIDE USE IN INDUSTRIAL APPLICATIONS TO DRIVE MARKET

- TABLE 22 ETHYLENEDIAMINE: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 23 ETHYLENEDIAMINE: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 24 ETHYLENEDIAMINE: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 25 ETHYLENEDIAMINE: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

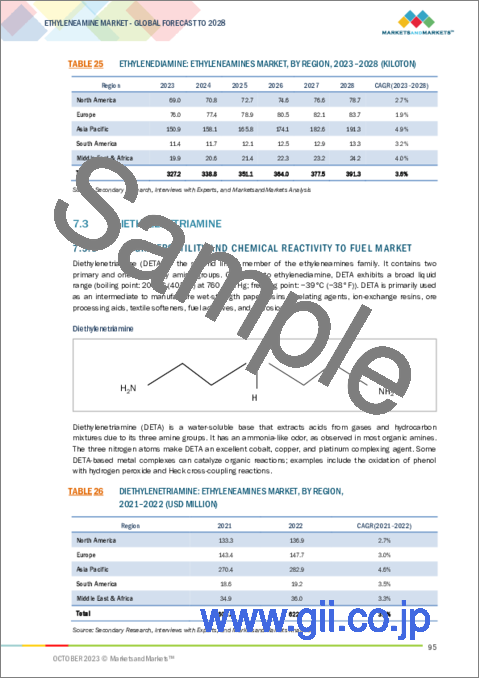

- 7.3 DIETHYLENETRIAMINE

- 7.3.1 HIGH VERSATILITY AND CHEMICAL REACTIVITY TO FUEL MARKET

- TABLE 26 DIETHYLENETRIAMINE: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 27 DIETHYLENETRIAMINE: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 28 DIETHYLENETRIAMINE: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 29 DIETHYLENETRIAMINE: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

- 7.4 TRIETHYLENETETRAMINE

- 7.4.1 INCREASING DEMAND FROM AUTOMOTIVE AND ELECTRONICS SECTOR TO DRIVE MARKET

- TABLE 30 TRIETHYLENETETRAMINE: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 31 TRIETHYLENETETRAMINE: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 32 TRIETHYLENETETRAMINE: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 33 TRIETHYLENETETRAMINE: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

- 7.5 OTHER TYPES

- TABLE 34 OTHER HIGHER ETHYLENEAMINES: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 35 OTHER HIGHER ETHYLENEAMINES: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 36 OTHER HIGHER ETHYLENEAMINES: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 37 OTHER HIGHER ETHYLENEAMINES: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

8 ETHYLENEAMINES MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 36 CURING AGENTS APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 38 ETHYLENEAMINES MARKET, BY APPLICATION, 2021-2022 (USD MILLION)

- TABLE 39 ETHYLENEAMINES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 40 ETHYLENEAMINES MARKET, BY APPLICATION, 2021-2022 (KILOTON)

- TABLE 41 ETHYLENEAMINES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.2 CHELATING AGENTS

- 8.2.1 EFFECTIVE METAL ION BINDING TO DRIVE MARKET

- TABLE 42 CHELATING AGENTS: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 43 CHELATING AGENTS: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 44 CHELATING AGENTS: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 45 CHELATING AGENTS: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

- 8.3 CORROSION INHIBITORS

- 8.3.1 INHIBITORY AND CORROSIVE PROPERTIES TO BOOST MARKET

- TABLE 46 CORROSION INHIBITORS: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 47 CORROSION INHIBITORS: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 48 CORROSION INHIBITORS: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 49 CORROSION INHIBITORS: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

- 8.4 LUBE OIL & FUEL ADDITIVES

- 8.4.1 APPLICATION IN MULTIFARIOUS INDUSTRIES TO DRIVE MARKET

- TABLE 50 LUBE OIL & FUEL ADDITIVES: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 51 LUBE OIL & FUEL ADDITIVES: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 52 LUBE OIL & FUEL ADDITIVES: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 53 LUBE OIL & FUEL ADDITIVES: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

- 8.5 PROCESSING AIDS/ADDITIVES

- 8.5.1 HUGE DEMAND IN EMERGING COUNTRIES TO DRIVE MARKET

- TABLE 54 PROCESSING AIDS/ADDITIVES: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 55 PROCESSING AIDS/ADDITIVES: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 56 PROCESSING AIDS/ADDITIVES: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 57 PROCESSING AIDS/ADDITIVES: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

- 8.6 TEXTILE ADDITIVES

- 8.6.1 RISING DEMAND IN TEXTILE INDUSTRY TO PROPEL MARKET

- TABLE 58 TEXTILE ADDITIVES: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 59 TEXTILE ADDITIVES: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 60 TEXTILE ADDITIVES: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 61 TEXTILE ADDITIVES: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

- 8.7 CURING AGENTS

- 8.7.1 PROMINENT USE IN MULTIFARIOUS END-USE INDUSTRY TO BOOST MARKET

- TABLE 62 CURING AGENTS: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 63 CURING AGENTS: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 64 CURING AGENTS: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 65 CURING AGENTS: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

- 8.8 OTHER APPLICATIONS

- TABLE 66 OTHER APPLICATIONS: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 67 OTHER APPLICATIONS: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 68 OTHER APPLICATIONS: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 69 OTHER APPLICATIONS: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

9 ETHYLENEAMINES MARKET, BY END USE

- 9.1 INTRODUCTION

- FIGURE 37 RESIN SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 70 ETHYLENEAMINES MARKET, BY END USE, 2021-2022 (USD MILLION)

- TABLE 71 ETHYLENEAMINES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 72 ETHYLENEAMINES MARKET, BY END USE, 2021-2022 (KILOTON)

- TABLE 73 ETHYLENEAMINES MARKET, BY END USE, 2023-2028 (KILOTON)

- 9.2 RESIN

- 9.2.1 TECHNOLOGICAL ADVANCEMENTS AND WIDE INDUSTRIAL APPLICATIONS TO DRIVE MARKET

- TABLE 74 RESIN: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 75 RESIN: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 76 RESIN: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 77 RESIN: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

- 9.3 PAPER

- 9.3.1 PRODUCTION OF HIGH-QUALITY AND VERSATILE PAPER PRODUCTS TO DRIVE MARKET

- TABLE 78 PAPER: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 79 PAPER: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 80 PAPER: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 81 PAPER: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

- 9.4 ADHESIVE

- 9.4.1 GROWTH OF MANUFACTURING INDUSTRIES TO BOOST MARKET

- TABLE 82 ADHESIVE: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 83 ADHESIVE: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 84 ADHESIVE: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 85 ADHESIVE: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

- 9.5 AUTOMOTIVE

- 9.5.1 ECONOMIC GROWTH AND INVESTMENT IN ADVANCED MATERIALS TO DRIVE MARKET

- TABLE 86 AUTOMOTIVE: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 87 AUTOMOTIVE: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 88 AUTOMOTIVE: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 89 AUTOMOTIVE: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

- 9.6 WATER TREATMENT

- 9.6.1 WATER QUALITY MONITORING AND GROWING CONCERNS TO FUEL MARKET

- TABLE 90 WATER TREATMENT: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 91 WATER TREATMENT: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 92 WATER TREATMENT: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 93 WATER TREATMENT: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

- 9.7 AGRO CHEMICALS

- 9.7.1 MODERN FARMING PRACTICES TO BOOST DEMAND FOR ETHYLENEBISDITHIOCARBAMATE

- TABLE 94 AGRO CHEMICALS: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 95 AGRO CHEMICALS: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 96 AGRO CHEMICALS: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 97 AGRO CHEMICALS: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

- 9.8 PHARMACEUTICAL

- 9.8.1 HIGH INVESTMENT IN RESEARCH AND DEVELOPMENT TO DRIVE MARKET

- TABLE 98 PHARMACEUTICAL: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 99 PHARMACEUTICAL: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 100 PHARMACEUTICAL: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 101 PHARMACEUTICAL: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

- 9.9 PERSONAL CARE

- 9.9.1 DIVERSE CONSUMER NEEDS AND INNOVATION TO DRIVE MARKET

- TABLE 102 PERSONAL CARE: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 103 PERSONAL CARE: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 104 PERSONAL CARE: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 105 PERSONAL CARE: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

- 9.10 TEXTILE CHEMICALS

- 9.10.1 GROWTH OF TEXTILE AND APPAREL SECTOR TO PROPEL MARKET

- TABLE 106 TEXTILE CHEMICALS: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 107 TEXTILE CHEMICALS: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 108 TEXTILE CHEMICALS: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 109 TEXTILE CHEMICALS: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

- 9.11 OTHER END USES

- TABLE 110 OTHER END USES: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 111 OTHER END USES: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 112 OTHER END USES: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 113 OTHER END USES: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

- TABLE 114 OIL & PETROLEUM: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 115 OIL & PETROLEUM: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 116 OIL & PETROLEUM: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 117 OIL & PETROLEUM: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

- TABLE 118 MINERAL & METAL PROCESSING: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 119 MINERAL & METAL PROCESSING: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 120 MINERAL & METAL PROCESSING: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 121 MINERAL & METAL PROCESSING: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

- TABLE 122 OTHERS: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 123 OTHERS: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 124 OTHERS: ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 125 OTHERS: ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

10 ETHYLENEAMINES MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 38 ASIA PACIFIC TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

- TABLE 126 ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (USD MILLION)

- TABLE 127 ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 128 ETHYLENEAMINES MARKET, BY REGION, 2021-2022 (KILOTON)

- TABLE 129 ETHYLENEAMINES MARKET, BY REGION, 2023-2028 (KILOTON)

- 10.2 EUROPE

- 10.2.1 RECESSION IMPACT ON EUROPE

- FIGURE 39 EUROPE: ETHYLENEAMINES MARKET SNAPSHOT

- TABLE 130 EUROPE: ETHYLENEAMINES MARKET, BY COUNTRY, 2021-2022 (USD MILLION)

- TABLE 131 EUROPE: ETHYLENEAMINES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 132 EUROPE: ETHYLENEAMINES MARKET, BY COUNTRY, 2021-2022 (KILOTON)

- TABLE 133 EUROPE: ETHYLENEAMINES MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 134 EUROPE: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 135 EUROPE: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 136 EUROPE: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 137 EUROPE: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- TABLE 138 EUROPE: ETHYLENEAMINES MARKET, BY APPLICATION, 2021-2022 (USD MILLION)

- TABLE 139 EUROPE: ETHYLENEAMINES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 140 EUROPE: ETHYLENEAMINES MARKET, BY APPLICATION, 2021-2022 (KILOTON)

- TABLE 141 EUROPE: ETHYLENEAMINES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 142 EUROPE: ETHYLENEAMINES MARKET, BY END USE, 2021-2022 (USD MILLION)

- TABLE 143 EUROPE: ETHYLENEAMINES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 144 EUROPE: ETHYLENEAMINES MARKET, BY END USE, 2021-2022 (KILOTON)

- TABLE 145 EUROPE: ETHYLENEAMINES MARKET, BY END USE, 2023-2028 (KILOTON)

- 10.2.2 GERMANY

- 10.2.2.1 Technological advancements to boost market

- TABLE 146 GERMANY: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 147 GERMANY: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 148 GERMANY: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 149 GERMANY: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 10.2.3 UK

- 10.2.3.1 Growth of construction sector to boost demand for ethyleneamines

- TABLE 150 UK: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 151 UK: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 152 UK: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 153 UK: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 10.2.4 FRANCE

- 10.2.4.1 Rising demand for resin and adhesives to drive market

- TABLE 154 FRANCE: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 155 FRANCE: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 156 FRANCE: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 157 FRANCE: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 10.2.5 ITALY

- 10.2.5.1 New project finance rules and investment policies to fuel market

- TABLE 158 ITALY: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 159 ITALY: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 160 ITALY: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 161 ITALY: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 10.2.6 RUSSIA

- 10.2.6.1 Presence of various end-use industries to fuel demand for ethyleneamines

- TABLE 162 RUSSIA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 163 RUSSIA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 164 RUSSIA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 165 RUSSIA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 10.2.7 TURKEY

- 10.2.7.1 Rapid urbanization and rising middle-class population to drive market

- TABLE 166 TURKEY: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 167 TURKEY: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 168 TURKEY: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 169 TURKEY: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 10.2.8 REST OF EUROPE

- TABLE 170 REST OF EUROPE: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 171 REST OF EUROPE: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 172 REST OF EUROPE: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 173 REST OF EUROPE: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 10.3 ASIA PACIFIC

- 10.3.1 RECESSION IMPACT ON ASIA PACIFIC

- FIGURE 40 ASIA PACIFIC: ETHYLENEAMINES MARKET SNAPSHOT

- TABLE 174 ASIA PACIFIC: ETHYLENEAMINES MARKET, BY COUNTRY, 2021-2022 (USD MILLION)

- TABLE 175 ASIA PACIFIC: ETHYLENEAMINES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 176 ASIA PACIFIC: ETHYLENEAMINES MARKET, BY COUNTRY, 2021-2022 (KILOTON)

- TABLE 177 ASIA PACIFIC: ETHYLENEAMINES MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 178 ASIA PACIFIC: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 179 ASIA PACIFIC: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 181 ASIA PACIFIC: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- TABLE 182 ASIA PACIFIC: ETHYLENEAMINES MARKET, BY APPLICATION, 2021-2022 (USD MILLION)

- TABLE 183 ASIA PACIFIC: ETHYLENEAMINES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 184 ASIA PACIFIC: ETHYLENEAMINES MARKET, BY APPLICATION, 2021-2022 (KILOTON)

- TABLE 185 ASIA PACIFIC: ETHYLENEAMINES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 186 ASIA PACIFIC: ETHYLENEAMINES MARKET, BY END USE, 2021-2022 (USD MILLION)

- TABLE 187 ASIA PACIFIC: ETHYLENEAMINES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 188 ASIA PACIFIC: ETHYLENEAMINES MARKET, BY END USE, 2021-2022 (KILOTON)

- TABLE 189 ASIA PACIFIC: ETHYLENEAMINES MARKET, BY END USE, 2023-2028 (KILOTON)

- 10.3.2 CHINA

- 10.3.2.1 Foreign investments to drive market

- TABLE 190 CHINA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 191 CHINA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 192 CHINA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 193 CHINA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 10.3.3 INDIA

- 10.3.3.1 Boom in multifarious end-use industry to drive market

- TABLE 194 INDIA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 195 INDIA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 196 INDIA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 197 INDIA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 10.3.4 JAPAN

- 10.3.4.1 Increase in chemical exports to drive market

- TABLE 198 JAPAN: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 199 JAPAN: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 200 JAPAN: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 201 JAPAN: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 10.3.5 SOUTH KOREA

- 10.3.5.1 Rising demand for construction materials to drive market

- TABLE 202 SOUTH KOREA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 203 SOUTH KOREA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 204 SOUTH KOREA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 205 SOUTH KOREA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 10.3.6 VIETNAM

- 10.3.6.1 Rising foreign investment in various manufacturing facilities to drive market

- TABLE 206 VIETNAM: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 207 VIETNAM: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 208 VIETNAM: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 209 VIETNAM: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 10.3.7 REST OF ASIA PACIFIC

- TABLE 210 REST OF ASIA PACIFIC: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 211 REST OF ASIA PACIFIC: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 213 REST OF ASIA PACIFIC: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 10.4 NORTH AMERICA

- 10.4.1 RECESSION IMPACT ON NORTH AMERICA

- FIGURE 41 NORTH AMERICA: ETHYLENEAMINES MARKET SNAPSHOT

- TABLE 214 NORTH AMERICA: ETHYLENEAMINES MARKET, BY COUNTRY, 2021-2022 (USD MILLION)

- TABLE 215 NORTH AMERICA: ETHYLENEAMINES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 216 NORTH AMERICA: ETHYLENEAMINES MARKET, BY COUNTRY, 2021-2022 (KILOTON)

- TABLE 217 NORTH AMERICA: ETHYLENEAMINES MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 218 NORTH AMERICA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 219 NORTH AMERICA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 220 NORTH AMERICA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 221 NORTH AMERICA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- TABLE 222 NORTH AMERICA: ETHYLENEAMINES MARKET, BY APPLICATION, 2021-2022 (USD MILLION)

- TABLE 223 NORTH AMERICA: ETHYLENEAMINES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 224 NORTH AMERICA: ETHYLENEAMINES MARKET, BY APPLICATION, 2021-2022 (KILOTON)

- TABLE 225 NORTH AMERICA: ETHYLENEAMINES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 226 NORTH AMERICA: ETHYLENEAMINES MARKET, BY END USE, 2021-2022 (USD MILLION)

- TABLE 227 NORTH AMERICA: ETHYLENEAMINES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 228 NORTH AMERICA: ETHYLENEAMINES MARKET, BY END USE, 2021-2022 (KILOTON)

- TABLE 229 NORTH AMERICA: ETHYLENEAMINES MARKET, BY END USE, 2023-2028 (KILOTON)

- 10.4.2 US

- 10.4.2.1 Increased investment in chemical sector to boost market

- TABLE 230 US: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 231 US: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 232 US: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 233 US: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 10.4.3 CANADA

- 10.4.3.1 Significant rise in ethyleneamine end use to propel market

- TABLE 234 CANADA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 235 CANADA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 236 CANADA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 237 CANADA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 10.4.4 MEXICO

- 10.4.4.1 Increasing investment in manufacturing sector to drive market

- TABLE 238 MEXICO: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 239 MEXICO: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 240 MEXICO: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 241 MEXICO: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 RECESSION IMPACT ON MIDDLE EAST & AFRICA

- FIGURE 42 SAUDI ARABIA TO RECORD HIGHEST CAGR BETWEEN 2023 AND 2028

- TABLE 242 MIDDLE EAST & AFRICA: ETHYLENEAMINES MARKET, BY COUNTRY, 2021-2022 (USD MILLION)

- TABLE 243 MIDDLE EAST & AFRICA: ETHYLENEAMINES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 244 MIDDLE EAST & AFRICA: ETHYLENEAMINES MARKET, BY COUNTRY, 2021-2022 (KILOTON)

- TABLE 245 MIDDLE EAST & AFRICA: ETHYLENEAMINES MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 246 MIDDLE EAST & AFRICA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 247 MIDDLE EAST & AFRICA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 248 MIDDLE EAST & AFRICA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 249 MIDDLE EAST & AFRICA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- TABLE 250 MIDDLE EAST & AFRICA: ETHYLENEAMINES MARKET, BY APPLICATION, 2021-2022 (USD MILLION)

- TABLE 251 MIDDLE EAST & AFRICA: ETHYLENEAMINES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 252 MIDDLE EAST & AFRICA: ETHYLENEAMINES MARKET, BY APPLICATION, 2021-2022 (KILOTON)

- TABLE 253 MIDDLE EAST & AFRICA: ETHYLENEAMINES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 254 MIDDLE EAST & AFRICA: ETHYLENEAMINES MARKET, BY END USE, 2021-2022 (USD MILLION)

- TABLE 255 MIDDLE EAST & AFRICA: ETHYLENEAMINES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 256 MIDDLE EAST & AFRICA: ETHYLENEAMINES MARKET, BY END USE, 2021-2022 (KILOTON)

- TABLE 257 MIDDLE EAST & AFRICA: ETHYLENEAMINES MARKET, BY END USE, 2023-2028 (KILOTON)

- 10.5.2 SAUDI ARABIA

- 10.5.2.1 Increased government investment in chemical manufacturing and R&D to propel market

- TABLE 258 SAUDI ARABIA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 259 SAUDI ARABIA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 260 SAUDI ARABIA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 261 SAUDI ARABIA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 10.5.3 UAE

- 10.5.3.1 Increase in industrial activities to drive market

- TABLE 262 UAE: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 263 UAE: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 264 UAE: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 265 UAE: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 10.5.4 REST OF MIDDLE EAST & AFRICA

- TABLE 266 REST OF MIDDLE EAST & AFRICA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 267 REST OF MIDDLE EAST & AFRICA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 268 REST OF MIDDLE EAST & AFRICA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 269 REST OF MIDDLE EAST & AFRICA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 10.6 SOUTH AMERICA

- 10.6.1 RECESSION IMPACT ON SOUTH AMERICA

- FIGURE 43 BRAZIL TO RECORD HIGHEST CAGR BETWEEN 2023 AND 2028

- TABLE 270 SOUTH AMERICA: ETHYLENEAMINES MARKET, BY COUNTRY, 2021-2022 (USD MILLION)

- TABLE 271 SOUTH AMERICA: ETHYLENEAMINES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 272 SOUTH AMERICA: ETHYLENEAMINES MARKET, BY COUNTRY, 2021-2022 (KILOTON)

- TABLE 273 SOUTH AMERICA: ETHYLENEAMINES MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- TABLE 274 SOUTH AMERICA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 275 SOUTH AMERICA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 276 SOUTH AMERICA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 277 SOUTH AMERICA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- TABLE 278 SOUTH AMERICA: ETHYLENEAMINES MARKET, BY APPLICATION, 2021-2022 (USD MILLION)

- TABLE 279 SOUTH AMERICA: ETHYLENEAMINES MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 280 SOUTH AMERICA: ETHYLENEAMINES MARKET, BY APPLICATION, 2021-2022 (KILOTON)

- TABLE 281 SOUTH AMERICA: ETHYLENEAMINES MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- TABLE 282 SOUTH AMERICA: ETHYLENEAMINES MARKET, BY END USE, 2021-2022 (USD MILLION)

- TABLE 283 SOUTH AMERICA: ETHYLENEAMINES MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 284 SOUTH AMERICA: ETHYLENEAMINES MARKET, BY END USE, 2021-2022 (KILOTON)

- TABLE 285 SOUTH AMERICA: ETHYLENEAMINES MARKET, BY END USE, 2023-2028 (KILOTON)

- 10.6.2 BRAZIL

- 10.6.2.1 Rising investments from government to drive market

- TABLE 286 BRAZIL: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 287 BRAZIL: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 288 BRAZIL: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 289 BRAZIL: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 10.6.3 ARGENTINA

- 10.6.3.1 Population growth and improved economic conditions to drive market

- TABLE 290 ARGENTINA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 291 ARGENTINA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 292 ARGENTINA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 293 ARGENTINA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

- 10.6.4 REST OF SOUTH AMERICA

- TABLE 294 REST OF SOUTH AMERICA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (USD MILLION)

- TABLE 295 REST OF SOUTH AMERICA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 296 REST OF SOUTH AMERICA: ETHYLENEAMINES MARKET, BY TYPE, 2021-2022 (KILOTON)

- TABLE 297 REST OF SOUTH AMERICA: ETHYLENEAMINES MARKET, BY TYPE, 2023-2028 (KILOTON)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 298 OVERVIEWS OF STRATEGIES ADOPTED BY KEY MARKET PLAYERS (2018-2023)

- 11.3 MARKET SHARE ANALYSIS

- FIGURE 44 MARKET SHARE ANALYSIS, 2022

- TABLE 299 ETHYLENEAMINES MARKET: INTENSITY OF COMPETITIVE RIVALRY, 2022

- 11.4 REVENUE ANALYSIS OF KEY COMPANIES

- FIGURE 45 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2021-2022

- 11.5 COMPANY EVALUATION MATRIX, 2022

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 46 ETHYLENEAMINES MARKET: COMPANY EVALUATION MATRIX, 2022

- 11.5.5 COMPANY FOOTPRINT

- TABLE 300 COMPANY FOOTPRINT

- 11.6 START-UPS/SMES EVALUATION MATRIX, 2022

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- FIGURE 47 ETHYLENEAMINES MARKET: START-UP/SME EVALUATION MATRIX, 2022

- 11.6.5 COMPETITIVE BENCHMARKING

- TABLE 301 ETHYLENEAMINES MARKET: KEY START-UPS/SMES

- TABLE 302 ETHYLENEAMINES MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SME

- TABLE 303 COMPETITIVE BENCHMARKING: ETHYLENEAMINES MARKET

- 11.7 STRENGTH OF PRODUCT PORTFOLIO

- FIGURE 48 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN ETHYLENEAMINES MARKET

- 11.8 MARKET RANKING ANALYSIS

- FIGURE 49 MARKET RANKING ANALYSIS, 2022

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 MARKET EVALUATION FRAMEWORK

- TABLE 304 STRATEGIC DEVELOPMENTS, BY COMPANY

- TABLE 305 HIGHEST ADOPTED GROWTH STRATEGIES

- TABLE 306 NUMBER OF GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- 11.9.2 MARKET EVALUATION MATRIX

- TABLE 307 COMPANY FOOTPRINT, BY TYPE

- TABLE 308 COMPANY FOOTPRINT: BY REGION

- TABLE 309 COMPANY FOOTPRINT

- 11.10 STRATEGIC DEVELOPMENTS (COMPETITIVE SITUATIONS AND TRENDS)

- 11.10.1 ETHYLENEAMINES MARKET: DEALS, 2018-2023

- TABLE 310 ETHYLENEAMINES MARKET: DEALS, 2018-2023

- 11.10.2 ETHYLENEAMINES MARKET: PRODUCT LAUNCHES, 2018-2023

- TABLE 311 ETHYLENEAMINES MARKET: PRODUCT LAUNCHES, 2018-2023

12 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths, Strategic choices, Weaknesses and competitive threats) **

- 12.1 KEY PLAYERS

- 12.1.1 HUNTSMAN CORPORATION

- TABLE 312 HUNTSMAN CORPORATION: COMPANY OVERVIEW

- FIGURE 50 HUNTSMAN CORPORATION: COMPANY SNAPSHOT

- 12.1.2 DOW INC

- TABLE 313 DOW INC: COMPANY OVERVIEW

- FIGURE 51 DOW INC: COMPANY SNAPSHOT

- 12.1.3 TOSOH CORPORATION

- TABLE 314 TOSOH CORPORATION: COMPANY OVERVIEW

- FIGURE 52 TOSOH CORPORATION: COMPANY SNAPSHOT

- 12.1.4 NOURYON

- TABLE 315 NOURYON: COMPANY OVERVIEW

- TABLE 316 NOURYON: DEALS

- 12.1.5 BASF SE

- TABLE 317 BASF SE: COMPANY OVERVIEW

- FIGURE 53 BASF SE: COMPANY SNAPSHOT

- TABLE 318 BASF SE: DEALS

- 12.1.6 DIAMINES AND CHEMICALS LTD.

- TABLE 319 DIAMINES AND CHEMICALS LTD.: COMPANY OVERVIEW

- FIGURE 54 DIAMINES AND CHEMICALS LTD.: COMPANY SNAPSHOT

- 12.1.7 SABIC

- TABLE 320 SABIC: COMPANY OVERVIEW

- FIGURE 55 SABIC: COMPANY SNAPSHOT

- 12.1.8 BALAJI SPECIALITY CHEMICALS LIMITED

- TABLE 321 BALAJI SPECIALITY CHEMICALS LIMITED: COMPANY OVERVIEW

- FIGURE 56 BALAJI SPECIALITY CHEMICALS LIMITED: COMPANY SNAPSHOT

- 12.1.9 ORIENTAL UNION CHEMICAL CORPORATION

- TABLE 322 ORIENTAL UNION CHEMICAL CORPORATION: COMPANY OVERVIEW

- FIGURE 57 ORIENTAL UNION CHEMICAL CORPORATION: COMPANY SNAPSHOT

- TABLE 323 ORIENTAL UNION CHEMICAL CORPORATION: DEALS

- 12.1.10 KANTO CHEMICAL CO., INC.

- TABLE 324 KANTO CHEMICAL CO., INC.: COMPANY OVERVIEW

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MnM view, Key strengths, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 GFS CHEMICALS, INC.

- TABLE 325 GFS CHEMICALS, INC.: COMPANY OVERVIEW

- 12.2.2 OAKWOOD PRODUCTS, INC.

- TABLE 326 OAKWOOD PRODUCTS, INC.: COMPANY OVERVIEW

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 MARKET DEFINITION

- 13.3 MARKET ANALYSIS, BY TYPE

- TABLE 327 FATTY AMINES MARKET, BY TYPE, 2017-2024 (USD MILLION)

- TABLE 328 FATTY AMINES MARKET, BY TYPE, 2017-2024 (KILOTON)

- 13.4 MARKET ANALYSIS, BY END USE

- TABLE 329 FATTY AMINES MARKET, BY END USE, 2017-2024 (USD MILLION)

- TABLE 330 FATTY AMINES MARKET, BY END USE, 2017-2024 (KILOTON)

- 13.5 MARKET ANALYSIS, BY FUNCTION

- TABLE 331 FATTY AMINES MARKET, BY FUNCTION, 2017-2024 (USD MILLION)

- TABLE 332 FATTY AMINES MARKET, BY FUNCTION, 2017-2024 (KILOTON)

- 13.6 MARKET ANALYSIS, BY REGION

- TABLE 333 FATTY AMINES MARKET, BY REGION, 2017-2024 (USD MILLION)

- TABLE 334 FATTY AMINES MARKET, BY REGION, 2017-2024 (KILOTON)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS