|

|

市場調査レポート

商品コード

1367749

エアゾール缶の世界市場:材質別、製品タイプ別、タイプ別、最終用途分野別、地域別-2028年までの予測Aerosol Cans Market by Material (Aluminium, Plastic), Product Type (1-piece cans, 3-piece cans), Type (Liquefied Gas, Compressed Gas), End-use Sector (Personal care, Healthcare, Household care), & Region-Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| エアゾール缶の世界市場:材質別、製品タイプ別、タイプ別、最終用途分野別、地域別-2028年までの予測 |

|

出版日: 2023年10月12日

発行: MarketsandMarkets

ページ情報: 英文 207 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のエアゾール缶の市場規模は2023年に112億米ドルになるとみられています。

同市場は、2023年~2028年に4.0%のCAGRで拡大し、2026年までに136億米ドルに拡大すると予測されています。この成長軌道は、パーソナルケア、家庭用ケア、自動車、ヘルスケアなどの分野からの需要の急増に大きく影響されています。

| 調査範囲 | |

|---|---|

| 対象範囲 | 2021-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 米ドル, 数量 |

| セグメント | タイプ, 材質, 製品タイプ, 最終用途分野, 地域 |

| 対象地域 | アジア太平洋, 北米, 欧州, 南米, 中東&アフリカ |

エアゾール缶は、ユニークなセルフディスペンサー式加圧パッケージング機構です。これは、エアゾールスプレー、ストリーム、ジェル、フォーム、ローション、ガスなど様々な形で製品を効率的に吐出する、恒久的に固定された連続または計量バルブを備えています。これが可能なのは、内容物が缶内で加圧され、バルブを通して放出され、小さな開口部から押し出されるからです。これらの缶は主に、アルミ、スチール、プラスチック、ガラスなどの材料で作られており、パーソナルケア、家庭用品、ヘルスケア、自動車などの分野で利用されています。

予測期間中、アルミ素材セグメントは世界のエアゾール缶市場を独占しました。アルミは、その多数の有利な特性により、包装用として好んで使用されています。軽量、飛散防止、不浸透性、可鍛性、耐腐食性があり、リサイクル可能なので環境に優しいです。さらに、アルミ製エアゾール缶は揮発性成分を効果的に封じ込めるため、長期間の内容物の保存が可能です。これらの特性を併せ持つアルミは、エアゾール缶市場において優位な地位を占めています。

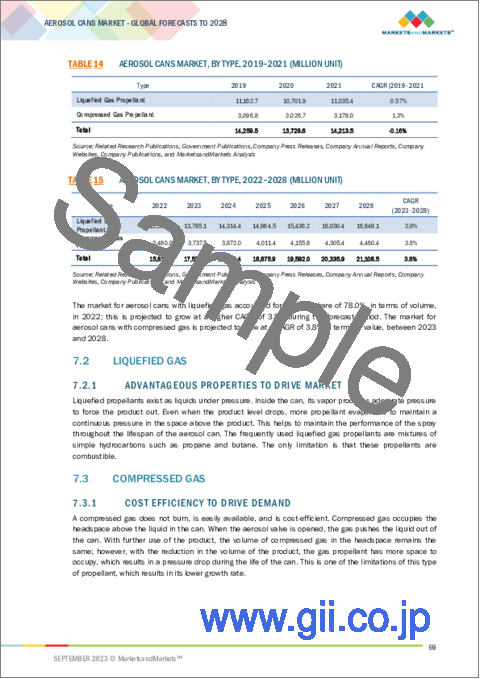

液化ガス推進剤タイプセグメントは、予測期間中、世界のエアゾール缶市場でトップの座を獲得しています。この推進剤の特徴は、製品レベルが低下しても、製品上部の圧力を一定に保つことができることです。この一貫性により、缶のライフサイクルを通じて安定したスプレー性能が保証され、市場における液化ガス推進剤の優位性を裏付けています。

1ピースエアゾール缶セグメントは、予測期間中、世界のエアゾール缶市場の製品タイプカテゴリーをリードしています。その増加は、漏れ、光、空気に対する不浸透性、高い圧力に耐える能力、耐久性、腐食と熱の両方に対する耐性を含む、それが提供する多くの利点に起因しています。

世界のエアゾール缶市場において、パーソナルケア分野は予測期間中フロントランナーとなっています。この分野のエアゾール缶は、デオドラントやシェービングフォームからフェイス&ボディクリームや香水に至るまで、様々な製品の包装に不可欠です。新興国では可処分所得水準が上昇し、消費者はパーソナルケア製品により多くの資金を割くようになっており、エアゾール缶市場の成長を後押ししています。

当レポートでは、世界のエアゾール缶市場について調査し、材質別、製品タイプ別、タイプ別、最終用途分野別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

第6章 業界の動向

- ポーターのファイブフォース分析

- サプライチェーン分析

- バリューチェーン分析

- 輸出入の主要市場(貿易分析)

- マクロ経済の概要

- 技術分析

- 顧客のビジネスに影響を与える動向/混乱

- 関税と規制状況

- ケーススタディ分析

- 2022年~2023年の主要な会議とイベント

- 価格分析

- 生態系マッピング

- 主要な利害関係者と購入基準

- 特許分析

第7章 エアゾール缶市場、タイプ別

- イントロダクション

- 液化ガス

- 圧縮ガス

第8章 エアゾール缶市場、製品タイプ別

- イントロダクション

- 1ピース缶

- 3ピース缶

第9章 エアゾール缶市場、材質別

- イントロダクション

- アルミ

- 鋼鉄

- プラスチック

- その他

第10章 エアゾール缶市場、最終用途分野別

- イントロダクション

- パーソナルケア

- 家事介護

- ヘルスケア

- 自動車

- その他

第11章 エアゾール缶市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- 南米

第12章 競合情勢

- 概要

- 市場ランキング分析

- 市場の主要参入企業の収益分析

- 企業評価マトリックス

- 競合ベンチマーキング

- スタートアップ/中小企業評価マトリックス、2022年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- BALL CORPORATION

- TRIVIUM PACKAGING

- CROWN

- MAUSER PACKAGING SOLUTIONS

- NAMPAK LTD.

- TOYO SEIKAN CO., LTD.

- CCL CONTAINER

- COLEP PACKAGING

- CPMC HOLDINGS LIMITED

- GUANGDONG SIHAI IRON-PRINTING AND TIN-MAKING CO., LTD

- その他の企業

- ALUCON PUBLIC COMPANY LIMITED

- DS CONTAINERS

- JAMESTRONG PACKAGING

- SPRAY PRODUCTS

- ITW SEXTON

- SWAN INDUSTRIES(THAILAND)COMPANY LIMITED

- TUBEX

- G. STAEHLE GMBH U. CO. KG.

- KIAN JOO CAN FACTORY BERHAD

- GRAHAM PACKAGING COMPANY

- MASSILLY HOLDING S.A.S

- BHARAT CONTAINERS

- TECNOCAP S.P.A

- LINHARDT

- MONTEBELLO PACKAGING

第14章 隣接市場

第15章 付録

In 2023, the global aerosol cans market valuation stood at USD 11.2 billion. Projections indicate that this figure will escalate to USD 13.6 billion by 2026, marking a CAGR of 4.0% from 2023 to 2028. This growth trajectory is largely influenced by burgeoning demand from sectors such as personal care, household care, automotive, healthcare, among others.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million/Billion), Volume (Million Units) |

| Segments | Type, Material, Product Type, End-Use Sector, and Region |

| Regions covered | Asia-Pacific, North America, Europe, South America, and Middle East & Africa. |

An aerosol can is a unique, self-dispensing pressurized packaging mechanism. It comes equipped with a permanently affixed continuous or metering valve that efficiently dispenses the product in various forms like aerosol sprays, streams, gels, foams, lotions, or gases. This is possible because the contents are pressurized within the can and released through a valve, propelled out of a small opening. Predominantly, these cans are crafted from materials like aluminum, steel, plastic, and glass, finding utility across sectors like personal care, household care, healthcare, automotive, and more.

"Aluminum is the biggest material segment of the aerosol cans market."

During the forecast period, the aluminum material segment dominated the global aerosol cans market. Aluminum emerges as a favorite for packaging due to its multitude of advantageous properties. It's lightweight, shatterproof, impermeable, malleable, resistant to corrosion, and environmentally friendly since it's recyclable. Moreover, aluminum aerosol cans effectively contain the volatile components, ensuring content preservation over extended durations. These combined attributes underscore aluminum's predominant position in the aerosol cans market.

"Liquefied Gas Propellant is the largest type segment of the aerosol cans market."

The Liquefied Gas Propellant type segment clinched the top spot in the global aerosol cans market during the forecast period. The unique feature of this propellant is its ability to maintain consistent pressure above the product, even as the product level decreases. This consistency ensures a steady spray performance throughout the can's lifecycle, underlining the dominance of liquefied gas propellant in the market.

"1 piece aerosol cans is the largest product type segment of the aerosol cans market."

The 1-piece aerosol cans segment led the product type category in the global aerosol cans market during the forecast period. Its rise is attributed to the multitude of benefits it provides, including its imperviousness to leaks, light, and air, its ability to withstand elevated pressures, its durability, and its resistance to both corrosion and heat.

"Personal Care is the largest end-use sector segment of the aerosol cans market."

In the global aerosol cans market, the personal care segment emerged as the frontrunner during the forecast period. Aerosol cans in this sector are indispensable for packaging a variety of products, from deodorants and shaving foams to face & body creams and perfumes. As disposable income levels rise in emerging economies, consumers are allocating more funds to personal care products, propelling the growth of the aerosol cans market.

"APAC is the speediest-growing market for aerosol cans."

During the forecast period, APAC is anticipated to be the most rapidly expanding market for aerosol cans, boasting the highest CAGR across all regions. The region's growth is driven by rising disposable incomes, particularly in burgeoning economies like China and India. Factors such as industrialization, the ascendancy of the convenience food sector, increased manufacturing activities, enhanced disposable incomes, elevated consumption levels, and retail sales growth have all bolstered the aerosol cans market in APAC. Additionally, the increased expenditure on packaged food and beauty care products has amplified the demand for aerosol cans in the region.

The breakdown of primary interviews is given below:

- By Company Type: Tier 1 - 35%, Tier 2 - 40%, and Tier 3 -25%

- By Designation: C-Level Executives - 40%, Director-Level - 35%, and Others - 25%

- By Region: North America - 20%, Europe - 35%, APAC - 25%, Middle East & Africa - 15%, and South America - 5%

The key companies profiled in this report on the aerosol cans market include Ball Corporation (US), Trivium Packaging (US), Crown (US), Mauser Packaging Solutions (US), Toyo Seikan Co. Ltd. (Japan), Nampak Ltd. (South Africa), CCL Container (US), Colep (Portugal), CPMC Holdings Ltd. (China), Guangdong Sihai Iron-Printing and Tin-Making Co.,Ltd. (China), and others are the key players operating in the aerosol cans market.

Research Coverage

The aerosol cans market has been segmented based on material, type, product type, end-use sector, and region. This report covers the aerosol cans market and forecasts its market size until 2028. It also provides detailed information on company profiles and competitive strategies adopted by the key players to strengthen their position in the aerosol cans market. The report also provides insights into the drivers and restraints in the aerosol cans market along with opportunities and challenges. The report also includes profiles of top manufacturers in the aerosol cans market.

Reasons to Buy the Report

The report is expected to help market leaders/new entrants in the following ways:

1. This report segments the aerosol cans market and provides the closest approximations of revenue numbers for the overall market and its segments across different verticals and regions.

2. This report is expected to help stakeholders understand the pulse of the aerosol cans market and provide information on key market drivers, restraints, challenges, and opportunities influencing the market growth.

3. This report is expected to help stakeholders obtain an in-depth understanding of the competitive landscape of the aerosol cans market and gain insights to improve the position of their businesses. The competitive landscape section includes detailed information on strategies, such as acquisitions, expansions, new product developments, and partnerships/collaborations/agreements.

The report provides insights on the following pointers:

- Analysis of key drivers (Growth of the cosmetic & personal care industry), restraints (Rising Preference for Cost-Effective and Sustainable Packaging Alternatives), opportunities (Untapped Potential in Rapidly Growing Economies), and challenges (Navigating the Maze of Regulatory Compliance) influencing the growth of the aerosol cans market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the aerosol cans market

- Market Development: Comprehensive information about lucrative markets - the report analyses the aerosol cans market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the aerosol cans market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Ball Corporation (US), Trivium Packaging (US), Crown (US), Mauser Packaging Solutions (US), Toyo Seikan Co. Ltd. (Japan), Nampak Ltd. (South Africa), CCL Container (US), Colep (Portugal), CPMC Holdings Ltd. (China), Guangdong Sihai Iron-Printing and Tin-Making Co.,Ltd. (China), and others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 AEROSOL CANS MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 LIMITATIONS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 AEROSOL CANS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- FIGURE 3 KEY INDUSTRY INSIGHTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 SUPPLY-SIDE APPROACH - 1

- FIGURE 5 AEROSOL CANS MARKET: SUPPLY-SIDE APPROACH 1

- 2.2.2 SUPPLY-SIDE APPROACH - 2

- FIGURE 6 AEROSOL CANS MARKET: SUPPLY-SIDE APPROACH 2

- 2.2.3 SUPPLY-SIDE APPROACH - 3

- FIGURE 7 AEROSOL CANS MARKET: SUPPLY-SIDE APPROACH 3

- 2.3 FACTOR ANALYSIS

- 2.3.1 INTRODUCTION

- 2.3.2 DEMAND-SIDE ANALYSIS

- 2.3.3 SUPPLY-SIDE ANALYSIS

- 2.4 MARKET SIZE ESTIMATION

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- FIGURE 10 AEROSOL CANS MARKET: DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 IMPACT OF RECESSION

3 EXECUTIVE SUMMARY

- FIGURE 11 ALUMINUM LEAD AEROSOL CANS MARKET DURING FORECAST PERIOD

- FIGURE 12 1-PIECE AEROSOL CANS SEGMENT TO BE LARGER SEGMENT THROUGH 2028

- FIGURE 13 LIQUEFIED GAS PROPELLANT TO DOMINATE AEROSOL CANS MARKET BY 2028

- FIGURE 14 PERSONAL CARE SEGMENT TO LEAD MARKET FOR AEROSOL CANS THROUGH 2028

- FIGURE 15 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AEROSOL CANS MARKET

- FIGURE 16 EMERGING COUNTRIES OFFER ATTRACTIVE OPPORTUNITIES IN AEROSOL CANS MARKET

- 4.2 EUROPE: AEROSOL CANS MARKET, BY MATERIAL & COUNTRY

- FIGURE 17 EUROPE: UK ACCOUNTED FOR LARGEST SHARE OF AEROSOL CANS MARKET IN 2022

- 4.3 AEROSOL CANS MARKET, BY MATERIAL

- FIGURE 18 ALUMINUM SEGMENT TO LEAD AEROSOL CANS MARKET DURING FORECAST PERIOD

- 4.4 AEROSOL CANS MARKET, BY END-USE SECTOR

- FIGURE 19 PERSONAL CARE TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- 4.5 AEROSOL CANS MARKET, BY TYPE

- FIGURE 20 LIQUEFIED GAS PROPELLANT TO BE FASTER-GROWING SEGMENT DURING FORECAST PERIOD

- 4.6 AEROSOL CANS MARKET, BY PRODUCT TYPE

- FIGURE 21 1-PIECE CANS TO BE FASTER-GROWING SEGMENT DURING FORECAST PERIOD

- 4.7 AEROSOL CANS MARKET, BY KEY COUNTRY

- FIGURE 22 AEROSOL CANS MARKET IN INDIA TO RECORD HIGHEST CAGR FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 23 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN AEROSOL CANS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand from personal care and cosmetic industries

- FIGURE 24 EUROPEAN MARKET FOR COSMETIC PRODUCTS (RSP BASIS) (USD BILLION)

- 5.2.1.2 Recyclability of aerosol cans

- 5.2.1.3 Convenience factors

- 5.2.1.4 Growing automotive industries to drive demand for spray paints

- TABLE 1 PRODUCTION OF MOTOR VEHICLES BY COUNTRY IN EUROPE, 2019-2022 (UNITS)

- 5.2.2 RESTRAINTS

- 5.2.2.1 Availability of alternatives in terms of packaging and price

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging economies offer high growth potential

- 5.2.3.2 Development of eco-friendly packaging

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent government regulations

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 AEROSOL CANS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 THREAT OF NEW ENTRANTS

- 6.1.2 THREAT OF SUBSTITUTES

- 6.1.3 BARGAINING POWER OF SUPPLIERS

- 6.1.4 BARGAINING POWER OF BUYERS

- 6.1.5 RIVALRY AMONG EXISTING COMPETITORS

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- FIGURE 26 AEROSOL CANS: VALUE CHAIN ANALYSIS

- 6.4 KEY MARKETS FOR IMPORT AND EXPORT (TRADE ANALYSIS)

- TABLE 3 CONTAINERS OF IRON OR STEEL, FOR COMPRESSED OR LIQUEFIED GAS (731100) IMPORTS (BY COUNTRY), IN 2022

- TABLE 4 CONTAINERS OF IRON OR STEEL, FOR COMPRESSED OR LIQUEFIED GAS (731100) EXPORTS (BY COUNTRY), IN 2022

- 6.5 MACROECONOMIC OVERVIEW

- 6.5.1 GLOBAL GDP OUTLOOK

- TABLE 5 WORLD GDP GROWTH PROJECTION, 2019-2026 (USD BILLION)

- 6.6 TECHNOLOGY ANALYSIS

- 6.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 GROWING DEMAND FOR AEROSOL CANS IN END-USE SECTORS TO BRING IN CHANGE IN FUTURE REVENUE MIX

- 6.8 TARIFF AND REGULATORY LANDSCAPE

- TABLE 6 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.9 CASE STUDY ANALYSIS

- 6.9.1 INLINE ORIENTING SYSTEM FOR PACKAGING

- 6.9.1.1 Customer container handling challenge

- 6.9.1.2 Solution statement

- 6.9.1 INLINE ORIENTING SYSTEM FOR PACKAGING

- 6.10 KEY CONFERENCES & EVENTS, 2022-2023

- TABLE 7 AEROSOL CANS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 6.11 PRICING ANALYSIS

- 6.11.1 CHANGES IN AEROSOL CANS PRICING IN 2022

- TABLE 8 PRICING ANALYSIS

- 6.12 ECOSYSTEM MAPPING

- FIGURE 28 ECOSYSTEM MAP

- 6.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PERSONAL CARE SECTOR (%)

- 6.13.2 BUYING CRITERIA

- FIGURE 30 KEY BUYING CRITERIA FOR PERSONAL CARE SECTOR

- TABLE 10 KEY BUYING CRITERIA FOR AEROSOL CANS FOR PERSONAL CARE

- 6.14 PATENT ANALYSIS

- 6.14.1 INTRODUCTION

- 6.14.2 METHODOLOGY

- 6.14.3 DOCUMENT TYPES, 2019-2023

- FIGURE 31 DOCUMENT TYPES, 2019-2023

- FIGURE 32 PUBLICATION TRENDS, 2019-2023

- 6.14.4 INSIGHTS

- FIGURE 33 JURISDICTION ANALYSIS, 2019-2023

- 6.14.5 TOP APPLICANTS

- FIGURE 34 TOP APPLICANTS, BY NUMBER OF PATENTS (TILL 2023)

- TABLE 11 LIST OF PATENTS

7 AEROSOL CANS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 35 LIQUEFIED GAS PROPELLANT TO DOMINATE AEROSOL CANS MARKET DURING FORECAST PERIOD

- TABLE 12 AEROSOL CANS MARKET, BY TYPE, 2019-2021 (USD MILLION)

- TABLE 13 AEROSOL CANS MARKET, BY TYPE, 2022-2028 (USD MILLION)

- TABLE 14 AEROSOL CANS MARKET, BY TYPE, 2019-2021 (MILLION UNIT)

- TABLE 15 AEROSOL CANS MARKET, BY TYPE, 2022-2028 (MILLION UNIT)

- 7.2 LIQUEFIED GAS

- 7.2.1 ADVANTAGEOUS PROPERTIES TO DRIVE MARKET

- 7.3 COMPRESSED GAS

- 7.3.1 COST EFFICIENCY TO DRIVE DEMAND

8 AEROSOL CANS MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- FIGURE 36 1-PIECE AEROSOL CANS TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

- TABLE 16 AEROSOL CANS MARKET, BY PRODUCT TYPE, 2019-2021 (USD MILLION)

- TABLE 17 AEROSOL CANS MARKET, BY PRODUCT TYPE, 2022-2028 (USD MILLION)

- TABLE 18 AEROSOL CANS MARKET, BY PRODUCT TYPE, 2019-2021 (MILLION UNIT)

- TABLE 19 AEROSOL CANS MARKET, BY PRODUCT TYPE, 2022-2028 (MILLION UNIT)

- 8.2 1-PIECE CANS

- 8.2.1 RISE IN DEMAND FROM SEVERAL INDUSTRIES TO DRIVE MARKET

- 8.3 3-PIECE CANS

- 8.3.1 LOW COST, SIMPLE MANUFACTURING PROCESS, AND LOW-COST MAKING TO BOOST MARKET

9 AEROSOL CANS MARKET, BY MATERIAL

- 9.1 INTRODUCTION

- FIGURE 37 ALUMINUM SEGMENT TO DOMINATE AEROSOL CANS MARKET DURING FORECAST PERIOD

- TABLE 20 AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 21 AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 22 AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 23 AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 9.2 ALUMINUM

- 9.2.1 MOST PREFERRED MATERIAL TO PRODUCE AEROSOL CANS

- TABLE 24 ALUMINUM AEROSOL CANS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 25 ALUMINUM AEROSOL CANS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 26 ALUMINUM AEROSOL CANS MARKET, BY REGION, 2019-2021 (MILLION UNIT)

- TABLE 27 ALUMINUM AEROSOL CANS MARKET, BY REGION, 2022-2028 (MILLION UNIT)

- 9.3 STEEL

- 9.3.1 PREVENTION OF RUSTING & PROTECTION OF FOOD FLAVORS TO BOOST DEMAND

- TABLE 28 STEEL AEROSOL CANS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 29 STEEL AEROSOL CANS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 30 STEEL AEROSOL CANS MARKET, BY REGION, 2019-2021 (MILLION UNIT)

- TABLE 31 STEEL AEROSOL CANS MARKET, BY REGION, 2022-2028 (MILLION UNIT)

- 9.4 PLASTIC

- 9.4.1 USE IN APPLICATIONS OF HOME & PERSONAL CARE GOODS INDUSTRY TO BOOST DEMAND

- TABLE 32 PLASTIC AEROSOL CANS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 33 PLASTIC AEROSOL CANS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 34 PLASTIC AEROSOL CANS MARKET, BY REGION, 2019-2021 (MILLION UNIT)

- TABLE 35 PLASTIC AEROSOL CANS MARKET, BY REGION, 2022-2028 (MILLION UNIT)

- 9.5 OTHER MATERIALS

- TABLE 36 OTHER MATERIAL AEROSOL CANS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 37 OTHER MATERIAL AEROSOL CANS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 38 OTHER MATERIAL AEROSOL CANS MARKET, BY REGION, 2019-2021 (MILLION UNIT)

- TABLE 39 OTHER MATERIAL AEROSOL CANS MARKET, BY REGION, 2022-2028 (MILLION UNIT)

10 AEROSOL CANS MARKET, BY END-USE SECTOR

- 10.1 INTRODUCTION

- FIGURE 38 PERSONAL CARE TO DOMINATE AEROSOL CANS MARKET DURING FORECAST PERIOD

- TABLE 40 AEROSOL CANS MARKET, BY END-USE SECTOR, 2019-2021 (USD MILLION)

- TABLE 41 AEROSOL CANS MARKET, BY END-USE SECTOR, 2022-2028 (USD MILLION)

- TABLE 42 AEROSOL CANS MARKET, BY END-USE SECTOR, 2019-2021 (MILLION UNIT)

- TABLE 43 AEROSOL CANS MARKET, BY END-USE SECTOR, 2022-2028 (MILLION UNIT)

- 10.2 PERSONAL CARE

- 10.2.1 RISE IN DISPOSABLE INCOME TO DRIVE SPENDING ON PERSONAL CARE PRODUCTS

- TABLE 44 AEROSOL CANS MARKET IN PERSONAL CARE SECTOR, BY REGION, 2019-2021 (USD MILLION)

- TABLE 45 AEROSOL CANS MARKET IN PERSONAL CARE SECTOR, BY REGION, 2022-2028 (USD MILLION)

- TABLE 46 AEROSOL CANS MARKET IN PERSONAL CARE SECTOR, BY REGION, 2019-2021 (MILLION UNIT)

- TABLE 47 AEROSOL CANS MARKET IN PERSONAL CARE SECTOR, BY REGION, 2022-2028 (MILLION UNIT)

- 10.3 HOUSEHOLD CARE

- 10.3.1 WIDE RANGE OF APPLICATIONS IN HOUSEHOLD SECTOR TO DRIVE DEMAND

- TABLE 48 AEROSOL CANS MARKET IN HOUSEHOLD CARE SECTOR, BY REGION, 2019-2021 (USD MILLION)

- TABLE 49 AEROSOL CANS MARKET IN HOUSEHOLD CARE SECTOR, BY REGION, 2022-2028 (USD MILLION)

- TABLE 50 AEROSOL CANS MARKET IN HOUSEHOLD CARE SECTOR, BY REGION, 2019-2021 (MILLION UNIT)

- TABLE 51 AEROSOL CANS MARKET IN HOUSEHOLD CARE SECTOR, BY REGION, 2022-2028 (MILLION UNIT)

- 10.4 HEALTHCARE

- 10.4.1 FAVORABLE FEATURES OF AEROSOL CANS TO BOOST DEMAND

- TABLE 52 AEROSOL CANS MARKET IN HEALTHCARE SECTOR, BY REGION, 2019-2021 (USD MILLION)

- TABLE 53 AEROSOL CANS MARKET IN HEALTHCARE SECTOR, BY REGION, 2022-2028 (USD MILLION)

- TABLE 54 AEROSOL CANS MARKET IN HEALTHCARE SECTOR, BY REGION, 2019-2021 (MILLION UNIT)

- TABLE 55 AEROSOL CANS MARKET IN HEALTHCARE SECTOR, BY REGION, 2022-2028 (MILLION UNIT)

- 10.5 AUTOMOTIVE

- 10.5.1 WIDE RANGE OF APPLICATIONS TO INCREASE DEMAND

- TABLE 56 AEROSOL CANS MARKET IN AUTOMOTIVE SECTOR, BY REGION, 2019-2021 (USD MILLION)

- TABLE 57 AEROSOL CANS MARKET IN AUTOMOTIVE SECTOR, BY REGION, 2022-2028 (USD MILLION)

- TABLE 58 AEROSOL CANS MARKET IN AUTOMOTIVE SECTOR, BY REGION, 2019-2021 (MILLION UNIT)

- TABLE 59 AEROSOL CANS MARKET IN AUTOMOTIVE SECTOR, BY REGION, 2022-2028 (MILLION UNIT)

- 10.6 OTHER END-USE SECTORS

- TABLE 60 AEROSOL CANS MARKET IN OTHER END-USE SECTORS, BY REGION, 2019-2021 (USD MILLION)

- TABLE 61 AEROSOL CANS MARKET IN OTHER END-USE SECTORS, BY REGION, 2022-2028 (USD MILLION)

- TABLE 62 AEROSOL CANS MARKET IN OTHER END-USE SECTORS, BY REGION, 2019-2021 (MILLION UNIT)

- TABLE 63 AEROSOL CANS MARKET IN OTHER END-USE SECTORS, BY REGION, 2022-2028 (MILLION UNIT)

11 AEROSOL CANS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 39 INDIA TO BE FASTEST-GROWING AEROSOL CANS MARKET, 2023 - 2028

- TABLE 64 AEROSOL CANS MARKET, BY REGION, 2019-2021 (USD MILLION)

- TABLE 65 AEROSOL CANS MARKET, BY REGION, 2022-2028 (USD MILLION)

- TABLE 66 AEROSOL CANS MARKET, BY REGION, 2019-2021 (MILLION UNIT)

- TABLE 67 AEROSOL CANS MARKET, BY REGION 2022-2028 (MILLION UNIT)

- 11.2 NORTH AMERICA

- 11.2.1 RECESSION IMPACT

- TABLE 68 NORTH AMERICA: AEROSOL CANS MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 69 NORTH AMERICA: AEROSOL CANS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: AEROSOL CANS MARKET, BY COUNTRY, 2019-2021 (MILLION UNIT)

- TABLE 71 NORTH AMERICA: AEROSOL CANS MARKET, BY COUNTRY, 2022-2028 (MILLION UNIT)

- TABLE 72 NORTH AMERICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2019-2021 (USD MILLION)

- TABLE 73 NORTH AMERICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2022-2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2019-2021 (MILLION UNIT)

- TABLE 75 NORTH AMERICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2022-2028 (MILLION UNIT)

- TABLE 76 NORTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 77 NORTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 79 NORTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.2.2 US

- 11.2.2.1 Increasing demand for deodorants, room fresheners, and perfumes to drive market

- TABLE 80 US: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 81 US: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 82 US: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 83 US: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.2.3 CANADA

- 11.2.3.1 Rising demand for beauty products to drive market

- TABLE 84 CANADA: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 85 CANADA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 86 CANADA: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 87 CANADA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.2.4 MEXICO

- 11.2.4.1 Increasing demand from household care and personal care sectors to drive market

- TABLE 88 MEXICO: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 89 MEXICO: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 90 MEXICO: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 91 MEXICO: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.3 EUROPE

- 11.3.1 RECESSION IMPACT

- FIGURE 40 EUROPE: AEROSOL CANS MARKET SNAPSHOT

- TABLE 92 EUROPE: AEROSOL CANS MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 93 EUROPE: AEROSOL CANS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 94 EUROPE: AEROSOL CANS MARKET, BY COUNTRY, 2019-2021 (MILLION UNIT)

- TABLE 95 EUROPE: AEROSOL CANS MARKET, BY COUNTRY, 2022-2028 (MILLION UNIT)

- TABLE 96 EUROPE: AEROSOL CANS MARKET, BY END-USE SECTOR, 2019-2021 (USD MILLION)

- TABLE 97 EUROPE: AEROSOL CANS MARKET, BY END-USE SECTOR, 2022-2028 (USD MILLION)

- TABLE 98 EUROPE: AEROSOL CANS MARKET, BY END-USE SECTOR, 2019-2021 (MILLION UNIT)

- TABLE 99 EUROPE: AEROSOL CANS MARKET, BY END-USE SECTOR, 2022-2028 (MILLION UNIT)

- TABLE 100 EUROPE: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 101 EUROPE: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 102 EUROPE: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 103 EUROPE: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.3.2 GERMANY

- 11.3.2.1 Growing food & beverages, personal care, and cosmetic industries to drive market

- TABLE 104 GERMANY: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 105 GERMANY: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 106 GERMANY: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 107 GERMANY: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.3.3 UK

- 11.3.3.1 Increased spending on healthcare sector to drive market

- TABLE 108 UK: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 109 UK: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 110 UK: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 111 UK: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.3.4 FRANCE

- 11.3.4.1 Increase in demand for personal care products to drive market

- TABLE 112 FRANCE: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 113 FRANCE: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 114 FRANCE: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 115 FRANCE: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.3.5 SPAIN

- 11.3.5.1 Growth of personal care and cosmetic industries to drive market

- TABLE 116 SPAIN: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 117 SPAIN: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 118 SPAIN: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 119 SPAIN: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.3.6 ITALY

- 11.3.6.1 Increased demand from retail, cosmetics, food, and healthcare industries to drive market

- TABLE 120 ITALY: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 121 ITALY: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 122 ITALY: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 123 ITALY: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.3.7 REST OF EUROPE

- TABLE 124 REST OF EUROPE: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 125 REST OF EUROPE: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 126 REST OF EUROPE: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 127 REST OF EUROPE: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.4 ASIA PACIFIC

- 11.4.1 RECESSION IMPACT

- FIGURE 41 ASIA PACIFIC: AEROSOL CANS MARKET SNAPSHOT

- TABLE 128 ASIA PACIFIC: AEROSOL CANS MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 129 ASIA PACIFIC: AEROSOL CANS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: AEROSOL CANS MARKET, BY COUNTRY, 2019-2021 (MILLION UNIT)

- TABLE 131 ASIA PACIFIC: AEROSOL CANS MARKET, BY COUNTRY, 2022-2028 (MILLION UNIT)

- TABLE 132 ASIA PACIFIC: AEROSOL CANS MARKET, BY END-USE SECTOR, 2019-2021 (USD MILLION)

- TABLE 133 ASIA PACIFIC: AEROSOL CANS MARKET, BY END-USE SECTOR, 2022-2028 (USD MILLION)

- TABLE 134 ASIA PACIFIC: AEROSOL CANS MARKET, BY END-USE SECTOR, 2019-2021 (MILLION UNIT)

- TABLE 135 ASIA PACIFIC: AEROSOL CANS MARKET, BY END-USE SECTOR, 2022-2028 (MILLION UNIT)

- TABLE 136 ASIA PACIFIC: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 137 ASIA PACIFIC: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 138 ASIA PACIFIC: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 139 ASIA PACIFIC: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.4.2 CHINA

- 11.4.2.1 Rise in consumption of home & personal care products to drive market

- TABLE 140 CHINA: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 141 CHINA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 142 CHINA: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 143 CHINA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.4.3 INDIA

- 11.4.3.1 Growing packaging industry to drive market

- TABLE 144 INDIA: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 145 INDIA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 146 INDIA: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 147 INDIA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.4.4 JAPAN

- 11.4.4.1 Growing manufacturing industries to drive market

- TABLE 148 JAPAN: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 149 JAPAN: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 150 JAPAN: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 151 JAPAN: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.4.5 AUSTRALIA

- 11.4.5.1 Government spending on infrastructure projects to drive market

- TABLE 152 AUSTRALIA: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 153 AUSTRALIA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 154 AUSTRALIA: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 155 AUSTRALIA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.4.6 REST OF ASIA PACIFIC

- TABLE 156 REST OF ASIA PACIFIC: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 157 REST OF ASIA PACIFIC: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 158 REST OF ASIA PACIFIC: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 159 REST OF ASIA PACIFIC: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 RECESSION IMPACT

- TABLE 160 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY COUNTRY, 2019-2021 (MILLION UNIT)

- TABLE 163 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY COUNTRY, 2022-2028 (MILLION UNIT)

- TABLE 164 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2019-2021 (USD MILLION)

- TABLE 165 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2022-2028 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2019-2021 (MILLION UNIT)

- TABLE 167 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2022-2028 (MILLION UNIT)

- TABLE 168 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 169 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 170 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 171 MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.5.2 UAE

- 11.5.2.1 Growth in personal care products demand to drive market

- TABLE 172 UAE: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 173 UAE: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 174 UAE: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 175 UAE: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.5.3 SAUDI ARABIA

- 11.5.3.1 Increase in spending on beauty products to drive market

- TABLE 176 SAUDI ARABIA: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 177 SAUDI ARABIA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 178 SAUDI ARABIA: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 179 SAUDI ARABIA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 Growth in the personal care and household care sectors to drive market

- TABLE 180 SOUTH AFRICA: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 181 SOUTH AFRICA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 182 SOUTH AFRICA: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 183 SOUTH AFRICA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.5.5 TURKEY

- 11.5.5.1 Growth of personal care and cosmetic sectors to drive demand

- TABLE 184 TURKEY: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 185 TURKEY: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 186 TURKEY: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 187 TURKEY: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.5.6 REST OF MIDDLE EAST & AFRICA

- TABLE 188 REST OF MIDDLE EAST & AFRICA: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 189 REST OF MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 190 REST OF MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 191 REST OF MIDDLE EAST & AFRICA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.6 SOUTH AMERICA

- 11.6.1 RECESSION IMPACT

- TABLE 192 SOUTH AMERICA: AEROSOL CANS MARKET, BY COUNTRY, 2019-2021 (USD MILLION)

- TABLE 193 SOUTH AMERICA: AEROSOL CANS MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- TABLE 194 SOUTH AMERICA: AEROSOL CANS MARKET, BY COUNTRY, 2019-2021 (MILLION UNIT)

- TABLE 195 SOUTH AMERICA: AEROSOL CANS MARKET, BY COUNTRY, 2022-2028 (MILLION UNIT)

- TABLE 196 SOUTH AMERICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2019-2021 (USD MILLION)

- TABLE 197 SOUTH AMERICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2022-2028 (USD MILLION)

- TABLE 198 SOUTH AMERICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2019-2021 (MILLION UNIT)

- TABLE 199 SOUTH AMERICA: AEROSOL CANS MARKET, BY END-USE SECTOR, 2022-2028 (MILLION UNIT)

- TABLE 200 SOUTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 201 SOUTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 202 SOUTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 203 SOUTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.6.2 BRAZIL

- 11.6.2.1 Increasing demand for processed foods, personal care & household care products, and pharmaceuticals to drive market

- TABLE 204 BRAZIL: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 205 BRAZIL: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 206 BRAZIL: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 207 BRAZIL: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.6.3 ARGENTINA

- 11.6.3.1 High-income economy with rich natural resources and strong industrial base to drive market

- TABLE 208 ARGENTINA: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 209 ARGENTINA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 210 ARGENTINA: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 211 ARGENTINA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

- 11.6.4 REST OF SOUTH AMERICA

- TABLE 212 REST OF SOUTH AMERICA: AEROSOL CANS MARKET BY MATERIAL, 2019-2021 (USD MILLION)

- TABLE 213 REST OF SOUTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (USD MILLION)

- TABLE 214 REST OF SOUTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2019-2021 (MILLION UNIT)

- TABLE 215 REST OF SOUTH AMERICA: AEROSOL CANS MARKET, BY MATERIAL, 2022-2028 (MILLION UNIT)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 COMPANIES ADOPTED ACQUISITIONS, PARTNERSHIPS, AND PRODUCT LAUNCHES AS KEY GROWTH STRATEGIES BETWEEN 2019 AND 2023

- 12.3 MARKET RANKING ANALYSIS

- FIGURE 42 AEROSOL CANS MARKET: MARKET RANK ANALYSIS

- 12.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 43 REVENUE ANALYSIS FOR KEY COMPANIES IN AEROSOL CANS MARKET

- 12.5 COMPANY EVALUATION MATRIX

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PARTICIPANTS

- 12.5.4 PERVASIVE COMPANIES

- FIGURE 44 COMPANY EVALUATION MATRIX, 2022

- 12.6 COMPETITIVE BENCHMARKING

- TABLE 216 AEROSOL CANS MARKET: DETAILED LIST OF PLAYERS

- TABLE 217 AEROSOL CANS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 12.7 STARTUP/SME EVALUATION MATRIX, 2022

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- FIGURE 45 SME EVALUATION MATRIX, 2022

- 12.8 COMPETITIVE SCENARIO

- 12.8.1 DEALS

- TABLE 218 DEALS, 2019-2023

- 12.8.2 PRODUCT LAUNCHES

- TABLE 219 PRODUCT LAUNCHES, 2019-2023

13 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 13.1 KEY PLAYERS

- 13.1.1 BALL CORPORATION

- TABLE 220 BALL CORPORATION: COMPANY OVERVIEW

- FIGURE 46 BALL CORPORATION: COMPANY SNAPSHOT

- TABLE 221 BALL CORPORATION: DEALS

- TABLE 222 BALL CORPORATION: PRODUCT LAUNCH

- TABLE 223 BALL CORPORATION.: OTHER DEVELOPMENTS

- 13.1.2 TRIVIUM PACKAGING

- TABLE 224 TRIVIUM PACKAGING: COMPANY OVERVIEW

- FIGURE 47 TRIVIUM PACKAGING: COMPANY SNAPSHOT

- TABLE 225 TRIVIUM PACKAGING: DEALS

- TABLE 226 TRIVIUM PACKAGING: OTHERS

- 13.1.3 CROWN

- TABLE 227 CROWN: COMPANY OVERVIEW

- FIGURE 48 CROWN: COMPANY SNAPSHOT

- TABLE 228 CROWN: DEALS

- 13.1.4 MAUSER PACKAGING SOLUTIONS

- TABLE 229 MAUSER PACKAGING SOLUTIONS: COMPANY OVERVIEW

- 13.1.5 NAMPAK LTD.

- TABLE 230 NAMPAK LTD.: COMPANY OVERVIEW

- FIGURE 49 NAMPAK LTD: COMPANY SNAPSHOT

- 13.1.6 TOYO SEIKAN CO., LTD.

- TABLE 231 TOYO SEIKAN CO., LTD.: COMPANY OVERVIEW

- 13.1.7 CCL CONTAINER

- TABLE 232 CCL CONTAINER: COMPANY OVERVIEW

- 13.1.8 COLEP PACKAGING

- TABLE 233 COLEP PACKAGING: COMPANY OVERVIEW

- TABLE 234 COLEP PACKAGING: DEALS

- 13.1.9 CPMC HOLDINGS LIMITED

- TABLE 235 CPMC HOLDINGS LIMITED: COMPANY OVERVIEW

- FIGURE 50 CPMC HOLDINGS LTD: COMPANY SNAPSHOT

- 13.1.10 GUANGDONG SIHAI IRON-PRINTING AND TIN-MAKING CO., LTD

- TABLE 236 GUANGDONG SIHAI IRON-PRINTING AND TIN-MAKING CO., LTD: COMPANY OVERVIEW

- TABLE 237 GUANGDONG SIHAI IRON-PRINTING AND TIN-MAKING CO., LTD: OTHERS

- 13.2 OTHER PLAYERS

- 13.2.1 ALUCON PUBLIC COMPANY LIMITED

- TABLE 238 ALUCON PUBLIC COMPANY LIMITED: COMPANY OVERVIEW

- 13.2.2 DS CONTAINERS

- TABLE 239 DS CONTAINERS: COMPANY OVERVIEW

- 13.2.3 JAMESTRONG PACKAGING

- TABLE 240 JAMESTRONG PACKAGING: COMPANY OVERVIEW

- 13.2.4 SPRAY PRODUCTS

- TABLE 241 SPRAY PRODUCTS: COMPANY OVERVIEW

- 13.2.5 ITW SEXTON

- TABLE 242 ITW SEXTON: COMPANY OVERVIEW

- 13.2.6 SWAN INDUSTRIES (THAILAND) COMPANY LIMITED

- TABLE 243 SWAN INDUSTRIES (THAILAND) COMPANY LIMITED: COMPANY OVERVIEW

- 13.2.7 TUBEX

- TABLE 244 TUBEX: COMPANY OVERVIEW

- 13.2.8 G. STAEHLE GMBH U. CO. KG.

- TABLE 245 G. STAEHLE GMBH U. CO. KG.: COMPANY OVERVIEW

- 13.2.9 KIAN JOO CAN FACTORY BERHAD

- TABLE 246 KIAN JOO CAN FACTORY BERHAD: COMPANY OVERVIEW

- 13.2.10 GRAHAM PACKAGING COMPANY

- TABLE 247 GRAHAM PACKAGING COMPANY: COMPANY OVERVIEW

- 13.2.11 MASSILLY HOLDING S.A.S

- TABLE 248 MASSILLY HOLDING S.A.S: COMPANY OVERVIEW

- 13.2.12 BHARAT CONTAINERS

- TABLE 249 BHARAT CONTAINERS: COMPANY OVERVIEW

- 13.2.13 TECNOCAP S.P.A

- TABLE 250 TECNOCAP S.P.A: COMPANY OVERVIEW

- 13.2.14 LINHARDT

- TABLE 251 LINHARDT: COMPANY OVERVIEW

- 13.2.15 MONTEBELLO PACKAGING

- TABLE 252 MONTEBELLO PACKAGING: COMPANY OVERVIEW

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

14 ADJACENT MARKET

- 14.1 FOOD & BEVERAGE METAL CANS

- TABLE 253 FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2023-2028 (USD BILLION)

- TABLE 254 FOOD & BEVERAGE METAL CANS MARKET, BY REGION, 2023-2028 (BILLION UNITS)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS