|

|

市場調査レポート

商品コード

1366409

リモートワークセキュリティの世界市場 (~2028年):提供区分 ・セキュリティタイプ ・リモートワークモデル ・産業 ・地域別Remote Work Security Market by Offering (Solutions and Services), Security Type (Endpoint & IoT, Network, Cloud), Remote Work Model (Fully, Hybrid, Temporary), Vertical (BFSI, Retail & eCommerce, IT & ITeS) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| リモートワークセキュリティの世界市場 (~2028年):提供区分 ・セキュリティタイプ ・リモートワークモデル ・産業 ・地域別 |

|

出版日: 2023年10月09日

発行: MarketsandMarkets

ページ情報: 英文 267 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のリモートワークセキュリティの市場規模は、2023年の517億米ドルから、予測期間中は21.3%のCAGRで推移し、2028年には1,360億米ドルの規模に成長すると予測されています。

サイバーセキュリティの脅威の増加は、リモートワークセキュリティ市場の主要な促進要因です。サイバー犯罪者は、リモートワークへの依存度が高まるにつれて、これらのセットアップの脆弱性を特定しています。サイバー犯罪者は、ランサムウェア攻撃、データ漏洩、フィッシング詐欺などを通じてこれらの脆弱性を悪用し、オフィス環境よりも安全性の低いホームネットワークやデバイスを持つリモート従業員を標的にすることが多くなっています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2018-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 金額(米ドル) |

| セグメント別 | セキュリティタイプ・リモートワークモデル・産業・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・中東&アフリカ・ラテンアメリカ |

このようなサイバー攻撃は、財務上の損失、企業の評判低下、規制当局による罰金など、深刻な結果を招く可能性があります。そのため企業は、こうした進化する脅威を特定、防止、対応できる高度なセキュリティソリューションへの投資を迫られています。これには、強力なエンドポイントセキュリティ対策の導入、サイバーセキュリティのベストプラクティスに関する従業員トレーニングの定期的な実施、サイバー犯罪者に勝つための最先端の脅威インテリジェンスと分析ツールの導入が必要です。

「予測期間中、IT&ITeS業界が市場で最大のシェアを示す」

IT &ITeS企業は、膨大な量の機密性の高い顧客データや情報を取り扱っており、サイバー犯罪者にとって魅力的な標的となっています。顧客やパートナーの信頼を維持するため、IT &ITeS企業は厳格なリモートワークセキュリティ対策を確立する必要があります。これには、リモート従業員が必要なシステムやデータに安全にアクセスできるようにすること、強固なデータ暗号化とプライバシープロトコルを導入すること、潜在的なセキュリティ侵害を継続的に監視することなどが含まれます。さらに、業界特有の規制やデータ保護基準の遵守もIT &ITeS組織のリモートワークセキュリティにとって極めて重要です。

「予測期間中、マネージドサービスの部門が最も速い成長を記録する見込み」

マネージドサービスは、分散したワークフォースやデジタル資産を保護する専門的な支援を組織に提供することで、リモートワークのセキュリティを強化します。MSPは、脅威の検出、インシデント対応、セキュリティ監視、継続的なサイバーセキュリティ管理など、さまざまなセキュリティサービスを提供します。MSPと提携することで、企業はセキュリティに関する専門知識、24時間体制の監視、最新の脅威インテリジェンスにアクセスし、リモートワーク環境におけるセキュリティリスクを未然に特定し、軽減することができます。MSPはまた、ファイアウォール、アンチウイルス、VPNなどのセキュリティソリューションの適切な設定と管理を保証し、新たな脅威から身を守るためにシステムの更新とパッチを継続的に適用します。このような協力的なアプローチにより、企業は進化する脅威に対応し、コンプライアンスを維持し、安全で生産性の高いリモートワーク環境を促進することができます。

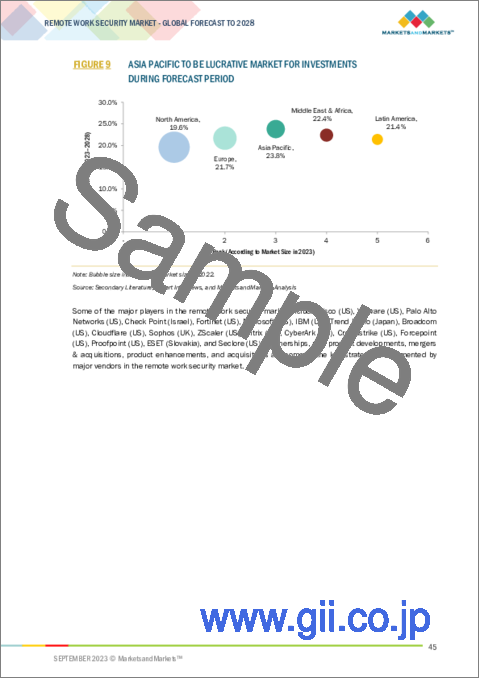

「予測期間中、アジア太平洋地域がもっとも高い成長率を記録する見通し」

アジア太平洋諸国は、脅威の拡大に直面し、セキュリティ支出の必要性の高まりに直面しています。この地域には、中国、日本、インドなどのダイナミックな経済が含まれ、効果的な政府規制と技術の進歩がリモートワークセキュリティの大幅な成長に道を開いています。同地域のリモートワークセキュリティ市場は、リモートワーク、クラウド技術の急速な導入、リモートワーク環境におけるセキュリティ強化の必要性により、拡大傾向にあります。また、COVID-19の流行をきっかけに、企業はリモート従業員を保護するためのセキュリティ管理システムへの大規模な投資を迫られました。さらに、この地域では、重要インフラや政府機関を標的にした高度なサイバー攻撃が急増していることからも、企業によるリモートワークセキュリティ技術への投資の強化は必須となっています。

当レポートでは、世界のリモートワークセキュリティの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許動向、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要・産業動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 技術分析

- リモートワークセキュリティ市場の歴史

- リモートワークのセキュリティツール、フレームワーク、テクニック

- リモートワークセキュリティ市場の成長が隣接するニッチ技術に与える影響

- 市場情勢の展望

- 顧客の事業に影響を与える動向/ディスラプション

- ベストプラクティス

- ケーススタディ分析

- 価格分析

- 特許分析

- 関税と規制状況

- 主要な会議とイベント

第6章 リモートワークセキュリティ市場:提供区分別

- ソリューション

- サービス

- プロフェッショナルサービス

- マネージドサービス

第7章 リモートワークセキュリティ市場:セキュリティタイプ別

- エンドポイント&IoTセキュリティ

- ネットワークセキュリティー

- クラウドセキュリティ

- アプリケーションセキュリティ

第8章 リモートワークセキュリティ市場:リモートワークモデル別

- 完全リモート

- ハイブリッド

- 一時的リモート

第9章 リモートワークセキュリティ市場、業界別

- BFSI

- 通信

- IT・ITES

- 教育

- 小売・Eコマース

- 政府

- メディア&エンターテイメント

- その他

第10章 リモートワークセキュリティ市場:地域別

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第11章 競合情勢

- 主要企業の採用戦略

- 主要企業の市場シェア分析

- 過去の収益分析

- 主要企業の企業評価マトリックス

- 企業のフットプリント

- スタートアップ/中小企業の企業評価マトリクス

- 主要企業のランキング

- 競合ベンチマーキング

- 競合シナリオ

- 製品ベンチマーキング

- 主要なリモートワークセキュリティベンダーの評価と財務指標

第12章 企業プロファイル

- 主要企業

- VMWARE

- CISCO

- FORTINET

- PALO ALTO NETWORKS

- CHECK POINT

- MICROSOFT

- IBM

- TREND MICRO

- BROADCOM

- CLOUDFLARE

- SOPHOS

- ZSCALER

- CITRIX

- CYBERARK

- CROWDSTRIKE

- FORCEPOINT

- PROOFPOINT

- ESET

- SECLORE

- その他の企業

- OPENVPN

- SECURITY ONION

- WALLARM

- VENN

- CYNET SECURITY

- SENTINELONE

- ISSQUARED

- REVBITS

- SECURDEN

- AXIS SECURITY

第13章 隣接市場

第14章 付録

The Remote work security market is estimated at USD 51.7 billion in 2023 to USD 136.0 billion by 2028 at a CAGR of 21.3% from 2023 to 2028. The rise in cybersecurity threats is a major driver of the remote work security market. Cybercriminals have identified vulnerabilities in these setups with the growing reliance on remote work. They exploit these weaknesses through ransomware attacks, data breaches, and phishing schemes, often targeting remote employees with less secure home networks and devices than those in office settings.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2018-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD Million/Billion) |

| Segments | By Offering security type, remote work model, vertical, and region |

| Regions covered | North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

These cyberattacks can result in severe consequences, including financial losses, company reputation harm, and regulatory fines. Consequently, organizations are under pressure to invest in advanced security solutions capable of identifying, preventing, and responding to these evolving threats. This entails implementing strong endpoint security measures, regular employee training in cybersecurity best practices, and adopting state-of-the-art threat intelligence and analysis tools to outmaneuver cybercriminals.

"IT & ITeS vertical to contribute the largest market share in the remote work security market during the forecast period."

IT & ITeS companies handle vast amounts of sensitive client data and proprietary information, making them attractive targets for cyber threats. To maintain the trust of clients and partners, IT & ITeS firms must establish stringent remote work security measures. This includes ensuring remote employees have secure access to the necessary systems and data, implementing robust data encryption and privacy protocols, and continuously monitoring for potential security breaches. Furthermore, compliance with industry-specific regulations and data protection standards is critical to remote work security for IT & ITeS organizations.

"The managed services are expected to register the fastest growth rate during the forecast period."

Managed services enhance remote work security by offering organizations expert assistance safeguarding their dispersed workforces and digital assets. MSPs deliver a spectrum of security services, including threat detection, incident response, security monitoring, and ongoing cybersecurity management. By partnering with MSPs, businesses can access dedicated security expertise, round-the-clock monitoring, and the latest threat intelligence to identify and mitigate security risks in remote work environments proactively. MSPs also ensure the proper configuration and management of security solutions, such as firewalls, antivirus, and VPNs, while continuously updating and patching systems to defend against emerging threats. This collaborative approach helps organizations adapt to evolving threats, maintain compliance, and foster a secure and productive remote work environment.

"Asia Pacific to register the highest growth rate during the forecast period."

The Asia Pacific countries are grappling with the increasing need for security spending as they face a growing threat landscape. The region encompasses dynamic economies like China, Japan, and India, where effective government regulations and technological advancements pave the way for substantial growth in remote work security. APAC's remote work security market is on the rise, driven by the rapid adoption of remote work, cloud technologies, and the imperative to enhance security in remote work setups. The COVID-19 pandemic acted as a catalyst, forcing organizations to invest heavily in security control systems to protect remote employees. Additionally, the region faced a surge in highly sophisticated cyberattacks targeting critical infrastructure and government entities, further compelling organizations to fortify their investments in remote work security technologies.

Breakdown of primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-level -35%, D-level - 25%, and Others - 40%

- By Region: North America - 45%, Europe - 20%, Asia Pacific - 30%, ROW- 5%.

The major players in the Remote work security market are Cisco (US), VMware (US), Palo Alto Networks (US), Check Point (Israel), Fortinet (US), Microsoft (US), IBM (US), Trend Micro (Japan), Broadcom (US), Cloudflare (US), Sophos (UK), ZScaler (US), Citrix (US), CyberArk (US), Crowdstrike (US), Forcepoint (US), Proofpoint (US), ESET (Slovakia), Seclore (US). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, product enhancements, and acquisitions to expand their footprint in the Remote work security market.

Research Coverage

The market study covers the Remote work security market size across different segments. It aims to estimate the market size and the growth potential across different segments, including offerings (solutions and services), security type, remote work model, vertical, and region. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the global Remote work security market's revenue numbers and subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing adoption of remote work, rising cybercrime rates, and growing demand for cloud-based security solutions), restraints (Low readiness to adopt advanced solutions, lack of awareness of remote work security risks, and challenges in managing remote devices and networks), opportunities (Growth of the cloud computing market, increasing demand for mobile security solutions, the rise of the Internet of Things (loT)), and challenges (Securing remote access to corporate resources, protecting sensitive data from unauthorized access, and preventing phishing attacks and other social engineering attacks) influencing the growth of the Remote work security market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Remote work security market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Remote work security market across various regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Remote work security market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Cisco (US), VMware (US), Palo Alto Networks (US), Check Point (Israel), Fortinet (US), Microsoft (US), IBM (US), Trend Micro (Japan), Broadcom (US), Cloudflare (US), Sophos (UK), ZScaler (US), Citrix (US), CyberArk (US), Crowdstrike (US), Forcepoint (US), Proofpoint (US), ESET (Slovakia), Seclore (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2020-2022

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM REMOTE WORK SECURITY OFFERINGS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND-SIDE)

- 2.2.1 TOP-DOWN APPROACH

- FIGURE 4 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- FIGURE 5 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 6 DATA TRIANGULATION

- TABLE 2 FACTOR ANALYSIS

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

- 2.6 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 7 REMOTE WORK SECURITY MARKET, 2021-2028

- FIGURE 8 REMOTE WORK SECURITY MARKET, REGIONAL SHARE, 2023

- FIGURE 9 ASIA PACIFIC TO BE LUCRATIVE MARKET FOR INVESTMENTS DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN REMOTE WORK SECURITY MARKET

- FIGURE 10 INCREASING ADOPTION OF REMOTE WORK AND RISING RATES OF CYBERCRIME TO DRIVE MARKET

- 4.2 NORTH AMERICA: REMOTE WORK SECURITY MARKET, BY OFFERING AND COUNTRY

- FIGURE 11 SOLUTIONS SEGMENT AND US TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- 4.3 ASIA PACIFIC: REMOTE WORK SECURITY MARKET, BY OFFERING AND KEY COUNTRY

- FIGURE 12 SOLUTIONS SEGMENT AND CHINA TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 13 REMOTE WORK SECURITY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising adoption of remote work

- 5.2.1.2 Increasing cases of cybercrime

- 5.2.1.3 Growing demand for cloud-based security solutions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Low readiness to adopt advanced solutions

- 5.2.2.2 Lack of awareness regarding remote work security risks

- 5.2.2.3 Challenges in managing remote devices and networks

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth of cloud computing market

- 5.2.3.2 Increasing demand for mobile security solutions

- 5.2.3.3 Rise of Internet of Things (IoT)

- 5.2.4 CHALLENGES

- 5.2.4.1 Diverse range of devices and networks used by remote workers

- 5.2.4.2 Development of new methods to breach data

- 5.2.4.3 Increasing phishing and other social engineering attacks

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 14 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- FIGURE 15 ECOSYSTEM MAP

- TABLE 3 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 16 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 IMPACT OF PORTER'S FIVE FORCES ON REMOTE WORK SECURITY MARKET

- 5.5.1 COMPETITIVE RIVALRY WITHIN INDUSTRY

- 5.5.2 BARGAINING POWER OF SUPPLIERS

- 5.5.3 BARGAINING POWER OF BUYERS

- 5.5.4 THREAT OF SUBSTITUTES

- 5.5.5 THREAT OF NEW ENTRANTS

- 5.5.6 REMOTE WORK SECURITY MARKET: BUSINESS MODELS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 ARTIFICIAL INTELLIGENCE

- 5.6.2 BLOCKCHAIN

- 5.6.3 ZERO TRUST SECURITY

- 5.6.4 SECURE ACCESS SERVICE EDGE (SASE)

- 5.6.5 ENDPOINT SECURITY

- 5.6.6 CYBERSECURITY MESH

- 5.7 HISTORY OF REMOTE WORK SECURITY MARKET

- FIGURE 17 EVOLUTION OF REMOTE WORK SECURITY MARKET

- 5.7.1 1990S

- 5.7.2 2000S

- 5.7.3 2010S

- 5.7.4 2020S-PRESENT

- 5.8 REMOTE WORK SECURITY TOOLS, FRAMEWORKS, AND TECHNIQUES

- 5.9 IMPACT OF REMOTE WORK SECURITY MARKET GROWTH ON ADJACENT NICHE TECHNOLOGIES

- 5.9.1 SECURED COLLABORATION TOOLS

- 5.9.2 ENDPOINT SECURITY AND DEVICE MANAGEMENT

- 5.9.3 CLOUD SECURITY AND IDENTITY MANAGEMENT

- 5.9.4 VIRTUAL PRIVATE NETWORKS (VPNS)

- 5.9.5 SECURE ACCESS SERVICE EDGE (SASE)

- 5.9.6 ARTIFICIAL INTELLIGENCE (AI) AND AUTOMATION

- 5.9.7 SECURE VIDEO CONFERENCING AND WEBINAR SOLUTIONS

- 5.9.8 SECURE PRINTING SOLUTIONS

- 5.10 FUTURE OF REMOTE WORK SECURITY MARKET LANDSCAPE

- 5.11 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 18 REVENUE SHIFT IN REMOTE WORK SECURITY MARKET

- 5.12 BEST PRACTICES IN REMOTE WORK SECURITY MARKET

- 5.12.1 SECURE REMOTE ACCESS

- 5.12.2 INTERNET ACCESS SECURITY

- 5.12.3 DATA PROTECTION

- 5.12.4 ENDPOINT PROTECTION

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 CASE STUDY 1: MOBILEZONE ADOPTED JEVOTRUST'S VMWARE WORKSPACE ONE UEM TO MODERNIZE ITS DEVICE MANAGEMENT STRATEGY

- 5.13.2 CASE STUDY 2: AUTODESK EMBRACED CLOUD COMPUTING AND CITRIX SOLUTIONS TO FUEL ITS DIGITAL BUSINESS TRANSFORMATION

- 5.13.3 CASE STUDY 3: HENNY PENNY ADOPTED CHECK POINT'S NEXT-GENERATION SECURITY GATEWAYS TO SECURE ITS GLOBAL MANUFACTURING ORGANIZATION

- 5.13.4 CASE STUDY 4: GILLMAN ADOPTED ESET'S ENDPOINT ANTIVIRUS, UTILIZING RIP AND REPLACE FEATURE FOR QUICK, REMOTE DEPLOYMENT

- 5.13.5 CASE STUDY 5: SHILPA MEDICARE LIMITED ADOPTED SECLORE'S RIGHTS MANAGEMENT SECURITY24 TO SAFEGUARD ITS HIGH-QUALITY FORMULATIONS' INTELLECTUAL PROPERTY

- 5.14 PRICING ANALYSIS

- 5.14.1 PRICING MODELS OF OPENVPN

- TABLE 5 PRICING MODELS OF OPENVPN

- 5.14.2 PRICING MODELS OF MICROSOFT

- TABLE 6 PRICING MODELS OF MICROSOFT

- 5.14.3 PRICING MODELS OF VMWARE

- TABLE 7 PRICING MODELS OF VMWARE

- 5.14.4 PRICING MODELS OF CITRIX

- TABLE 8 PRICING MODELS OF CITRIX

- 5.14.5 PRICING MODELS OF CLOUDFLARE

- TABLE 9 PRICING MODELS OF CLOUDFLARE

- 5.15 PATENT ANALYSIS

- FIGURE 19 TOP TEN PATENT OWNERS, 2015-2023

- 5.16 TARIFF AND REGULATORY LANDSCAPE

- 5.16.1 GENERAL DATA PROTECTION REGULATION (GDPR)

- 5.16.2 PAYMENT CARD INDUSTRY-DATA SECURITY STANDARD (PCI-DSS)

- 5.16.3 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)

- 5.16.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.5 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.5.1 Key stakeholders in buying process

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- 5.16.5.2 Buying criteria

- FIGURE 21 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.17 KEY CONFERENCES & EVENTS

- TABLE 13 KEY CONFERENCES & EVENTS, 2023-2024

6 REMOTE WORK SECURITY MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERINGS: REMOTE WORK SECURITY MARKET DRIVERS

- FIGURE 22 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 14 REMOTE WORK SECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 15 REMOTE WORK SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 SOLUTIONS

- 6.2.1 DEMAND FOR REMOTE WORK SECURITY SOLUTIONS TO SAFEGUARD MODERN ORGANIZATIONS TO DRIVE MARKET

- TABLE 16 SOLUTIONS: REMOTE WORK SECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

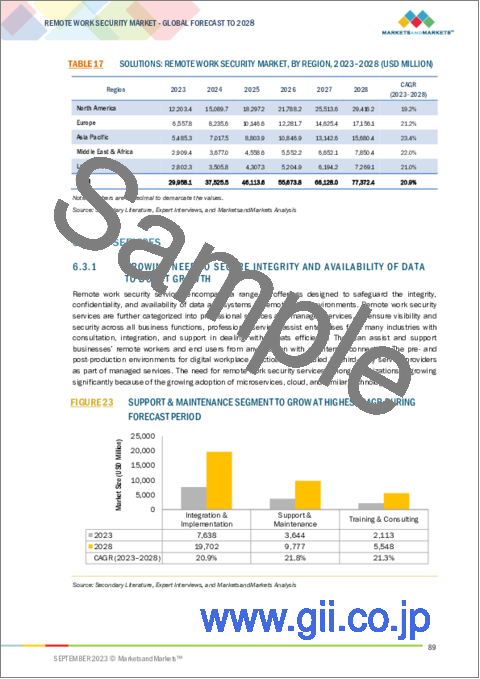

- TABLE 17 SOLUTIONS: REMOTE WORK SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SERVICES

- 6.3.1 GROWING NEED TO SECURE INTEGRITY AND AVAILABILITY OF DATA TO BOOST GROWTH

- FIGURE 23 SUPPORT & MAINTENANCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 18 REMOTE WORK SECURITY MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 19 REMOTE WORK SECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 20 SERVICES: REMOTE WORK SECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 21 SERVICES: REMOTE WORK SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 PROFESSIONAL SERVICES

- TABLE 22 PROFESSIONAL SERVICES: REMOTE WORK SECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 23 PROFESSIONAL SERVICES: REMOTE WORK SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 24 REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 25 REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- 6.3.2.1 Training & consulting

- TABLE 26 TRAINING & CONSULTING: REMOTE WORK SECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 27 TRAINING & CONSULTING: REMOTE WORK SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2.2 Integration & implementation

- TABLE 28 INTEGRATION & IMPLEMENTATION: REMOTE WORK SECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 29 INTEGRATION & IMPLEMENTATION: REMOTE WORK SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2.3 Support & maintenance

- TABLE 30 SUPPORT & MAINTENANCE: REMOTE WORK SECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 31 SUPPORT & MAINTENANCE: REMOTE WORK SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.3 MANAGED SERVICES

- TABLE 32 MANAGED SERVICES: REMOTE WORK SECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 33 MANAGED SERVICES: REMOTE WORK SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

7 REMOTE WORK SECURITY MARKET, BY SECURITY TYPE

- 7.1 INTRODUCTION

- 7.1.1 SECURITY TYPES: REMOTE WORK SECURITY MARKET DRIVERS

- FIGURE 24 ENDPOINT & IOT SECURITY SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 34 REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 35 REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- 7.2 ENDPOINT & IOT SECURITY

- 7.2.1 FOCUS ON ENCOMPASSING ANTIVIRUS SOFTWARE, ANTI-MALWARE TOOLS, FIREWALLS, AND INTRUSION DETECTION SYSTEMS TO PROPEL MARKET

- TABLE 36 ENDPOINT & IOT SECURITY: REMOTE WORK SECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 37 ENDPOINT & IOT SECURITY: REMOTE WORK SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 NETWORK SECURITY

- 7.3.1 GROWING EMPHASIS ON SAFEGUARDING COMMUNICATION CHANNELS, DATA TRANSFERS, AND ACCESS TO COMPANY RESOURCES TO SPUR GROWTH

- TABLE 38 NETWORK SECURITY: REMOTE WORK SECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 39 NETWORK SECURITY: REMOTE WORK SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 CLOUD SECURITY

- 7.4.1 NEED FOR SECURED REMOTE ACCESS WHILE MITIGATING DATA EXPOSURE RISKS WITH CLOUD SECURITY TO ENCOURAGE MARKET EXPANSION

- TABLE 40 CLOUD SECURITY: REMOTE WORK SECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 41 CLOUD SECURITY: REMOTE WORK SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 APPLICATION SECURITY

- 7.5.1 APPLICATION SECURITY SERVICES TO ENABLE REMOTE EMPLOYEES TO WORK CONFIDENTLY WITH SOFTWARE TOOLS

- TABLE 42 APPLICATION SECURITY: REMOTE WORK SECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 43 APPLICATION SECURITY: REMOTE WORK SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

8 REMOTE WORK SECURITY MARKET, BY REMOTE WORK MODEL

- 8.1 INTRODUCTION

- 8.1.1 REMOTE WORK MODELS: REMOTE WORK SECURITY MARKET DRIVERS

- 8.2 FULLY REMOTE

- 8.2.1 NEED FOR FLEXIBILITY AND ACCESS TO GLOBAL TALENT POOL TO BOOST USE OF FULLY REMOTE MODEL

- 8.3 HYBRID

- 8.3.1 DEMAND FROM EMPLOYEES FOR SPACE TO ALIGN THEIR PERSONAL PREFERENCES WITH JOB REQUIREMENTS TO ENCOURAGE GROWTH

- 8.4 TEMPORARY REMOTE

- 8.4.1 RISING NEED FOR MORE FLEXIBILITY TO DRIVE POPULARITY OF TEMPORARY REMOTE MODEL

9 REMOTE WORK SECURITY MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.1.1 VERTICALS: REMOTE WORK SECURITY MARKET DRIVERS

- FIGURE 25 RETAIL & ECOMMERCE SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 44 REMOTE WORK SECURITY MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 45 REMOTE WORK SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 9.2 BFSI

- 9.2.1 USE OF SENSITIVE FINANCIAL DATA IN BFSI SECTOR TO DRIVE NEED FOR RIGOROUS SECURITY MEASURES

- TABLE 46 BFSI: REMOTE WORK SECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 47 BFSI: REMOTE WORK SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 TELECOMMUNICATIONS

- 9.3.1 NEED FOR STRICT REGULATIONS AND COMPLIANCE STANDARDS TO MAINTAIN SECURE REMOTE WORK ENVIRONMENT TO SPUR MARKET GROWTH

- TABLE 48 TELECOMMUNICATIONS: REMOTE WORK SECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 49 TELECOMMUNICATIONS: REMOTE WORK SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 IT & ITES

- 9.4.1 GROWING CYBER THREATS IN IT & ITES SECTOR TO COMPEL ADOPTION OF REMOTE WORK SECURITY SOLUTIONS

- TABLE 50 IT & ITES: REMOTE WORK SECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 51 IT & ITES: REMOTE WORK SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 EDUCATION

- 9.5.1 NEED FOR SEAMLESS AND SECURE ONLINE LEARNING EXPERIENCES TO BOOST MARKET EXPANSION

- TABLE 52 EDUCATION: REMOTE WORK SECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 53 EDUCATION: REMOTE WORK SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6 RETAIL & ECOMMERCE

- 9.6.1 RISING DEMAND TO UPHOLD BRAND REPUTATION IN DIGITAL RETAIL LANDSCAPE TO SPUR GROWTH

- TABLE 54 RETAIL & ECOMMERCE: REMOTE WORK SECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 55 RETAIL & ECOMMERCE: REMOTE WORK SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.7 GOVERNMENT

- 9.7.1 USE OF LARGE VOLUMES OF CONFIDENTIAL INFORMATION IN GOVERNMENT ENTITIES TO DRIVE ADOPTION OF REMOTE SECURITY MEASURES

- TABLE 56 GOVERNMENT: REMOTE WORK SECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 57 GOVERNMENT: REMOTE WORK SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.8 MEDIA & ENTERTAINMENT

- 9.8.1 RISING EMPHASIS ON PROTECTING VALUABLE INTELLECTUAL PROPERTY AND DIGITAL ASSETS TO SPUR POPULARITY OF REMOTE WORK SECURITY SOLUTIONS

- TABLE 58 MEDIA & ENTERTAINMENT: REMOTE WORK SECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 59 MEDIA & ENTERTAINMENT: REMOTE WORK SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.9 OTHER VERTICALS

- TABLE 60 OTHER VERTICALS: REMOTE WORK SECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 61 OTHER VERTICALS: REMOTE WORK SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

10 REMOTE WORK SECURITY MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 26 ASIA PACIFIC TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- TABLE 62 REMOTE WORK SECURITY MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 63 REMOTE WORK SECURITY MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: REMOTE WORK SECURITY MARKET DRIVERS

- 10.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 27 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 64 NORTH AMERICA: REMOTE WORK SECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: REMOTE WORK SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: REMOTE WORK SECURITY MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: REMOTE WORK SECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 71 NORTH AMERICA: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 73 NORTH AMERICA: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: REMOTE WORK SECURITY MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: REMOTE WORK SECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.2.3 US

- 10.2.3.1 Need for prioritizing cybersecurity measures to safeguard remote work environments and protect sensitive data

- TABLE 76 US: REMOTE WORK SECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 77 US: REMOTE WORK SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 78 US: REMOTE WORK SECURITY MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 79 US: REMOTE WORK SECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 80 US: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 81 US: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 82 US: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 83 US: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 84 US: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 85 US: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.2.4 CANADA

- 10.2.4.1 Rising number of government employees embracing hybrid or remote work arrangements to propel market

- 10.3 EUROPE

- 10.3.1 EUROPE: REMOTE WORK SECURITY MARKET DRIVERS

- 10.3.2 EUROPE: RECESSION IMPACT

- TABLE 86 EUROPE: REMOTE WORK SECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 87 EUROPE: REMOTE WORK SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 88 EUROPE: REMOTE WORK SECURITY MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 89 EUROPE: REMOTE WORK SECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 90 EUROPE: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 91 EUROPE: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 92 EUROPE: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 93 EUROPE: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 94 EUROPE: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 95 EUROPE: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 96 EUROPE: REMOTE WORK SECURITY MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 97 EUROPE: REMOTE WORK SECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 Popularity of remote working model and digital technology advancements to drive demand for remote work security services

- TABLE 98 UK: REMOTE WORK SECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 99 UK: REMOTE WORK SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 100 UK: REMOTE WORK SECURITY MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 101 UK: REMOTE WORK SECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 102 UK: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 103 UK: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 104 UK: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 105 UK: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 106 UK: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 107 UK: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.3.4 GERMANY

- 10.3.4.1 Advancements in digital technology and changing work norms to drive market

- TABLE 108 GERMANY: REMOTE WORK SECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 109 GERMANY: REMOTE WORK SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 110 GERMANY: REMOTE WORK SECURITY MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 111 GERMANY: REMOTE WORK SECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 112 GERMANY: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 113 GERMANY: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 114 GERMANY: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 115 GERMANY: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 116 GERMANY: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 117 GERMANY: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.3.5 FRANCE

- 10.3.5.1 Proactive adoption of remote workplace solutions by various government entities to spur growth

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: REMOTE WORK SECURITY MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 28 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 118 ASIA PACIFIC: REMOTE WORK SECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: REMOTE WORK SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: REMOTE WORK SECURITY MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: REMOTE WORK SECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: REMOTE WORK SECURITY MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: REMOTE WORK SECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Ascending rates of cybercrime to boost market expansion

- TABLE 130 CHINA: REMOTE WORK SECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 131 CHINA: REMOTE WORK SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 132 CHINA: REMOTE WORK SECURITY MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 133 CHINA: REMOTE WORK SECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 134 CHINA: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 135 CHINA: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 136 CHINA: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 137 CHINA: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 138 CHINA: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 139 CHINA: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.4.4 JAPAN

- 10.4.4.1 Growing acceptance of flexible work models to propel demand for remote work security solutions

- 10.4.5 INDIA

- 10.4.5.1 Increase in cyber threats and attacks to encourage need for robust security measures

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: REMOTE WORK SECURITY MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 140 MIDDLE EAST & AFRICA: REMOTE WORK SECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: REMOTE WORK SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: REMOTE WORK SECURITY MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: REMOTE WORK SECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 145 MIDDLE EAST & AFRICA: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 146 MIDDLE EAST & AFRICA: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 147 MIDDLE EAST & AFRICA: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 148 MIDDLE EAST & AFRICA: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 149 MIDDLE EAST & AFRICA: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: REMOTE WORK SECURITY MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: REMOTE WORK SECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.5.3 MIDDLE EAST

- 10.5.3.1 Increase in freelancing jobs to drive popularity of remote work security services

- TABLE 152 MIDDLE EAST: REMOTE WORK SECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 153 MIDDLE EAST: REMOTE WORK SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 154 MIDDLE EAST: REMOTE WORK SECURITY MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 155 MIDDLE EAST: REMOTE WORK SECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 156 MIDDLE EAST: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 157 MIDDLE EAST: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 158 MIDDLE EAST: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 159 MIDDLE EAST: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 160 MIDDLE EAST: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 161 MIDDLE EAST: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.5.4 AFRICA

- 10.5.4.1 Increasing adoption of remote working models to encourage market expansion

- TABLE 162 AFRICA: REMOTE WORK SECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 163 AFRICA: REMOTE WORK SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 164 AFRICA: REMOTE WORK SECURITY MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 165 AFRICA: REMOTE WORK SECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 166 AFRICA: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 167 AFRICA: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 168 AFRICA: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 169 AFRICA: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 170 AFRICA: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 171 AFRICA: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: REMOTE WORK SECURITY MARKET DRIVERS

- 10.6.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 172 LATIN AMERICA: REMOTE WORK SECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 173 LATIN AMERICA: REMOTE WORK SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 174 LATIN AMERICA: REMOTE WORK SECURITY MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 175 LATIN AMERICA: REMOTE WORK SECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 176 LATIN AMERICA: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 177 LATIN AMERICA: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 178 LATIN AMERICA: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 179 LATIN AMERICA: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 180 LATIN AMERICA: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 181 LATIN AMERICA: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 182 LATIN AMERICA: REMOTE WORK SECURITY MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 183 LATIN AMERICA: REMOTE WORK SECURITY MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 10.6.3 BRAZIL

- 10.6.3.1 Rapid change in regulatory requirements and adoption of remote working models to boost use of remote work security solutions

- TABLE 184 BRAZIL: REMOTE WORK SECURITY MARKET, BY OFFERING, 2018-2022 (USD MILLION)

- TABLE 185 BRAZIL: REMOTE WORK SECURITY MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 186 BRAZIL: REMOTE WORK SECURITY MARKET, BY SERVICE, 2018-2022 (USD MILLION)

- TABLE 187 BRAZIL: REMOTE WORK SECURITY MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 188 BRAZIL: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2018-2022 (USD MILLION)

- TABLE 189 BRAZIL: REMOTE WORK SECURITY MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 190 BRAZIL: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2018-2022 (USD MILLION)

- TABLE 191 BRAZIL: REMOTE WORK SECURITY MARKET, BY SECURITY TYPE, 2023-2028 (USD MILLION)

- TABLE 192 BRAZIL: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2018-2022 (USD MILLION)

- TABLE 193 BRAZIL: REMOTE WORK SECURITY MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.6.4 MEXICO

- 10.6.4.1 Thriving digital boom and remarkable surge in remote working culture to encourage adoption of remote work security services

- 10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY REMOTE WORK SECURITY TECHNOLOGY VENDORS

- 11.3 MARKET SHARE ANALYSIS FOR KEY PLAYERS

- TABLE 194 REMOTE WORK SECURITY MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 11.4 HISTORICAL REVENUE ANALYSIS

- FIGURE 29 REVENUE ANALYSIS FOR LEADING REMOTE WORK SECURITY PROVIDERS, 2020-2022 (USD MILLION)

- 11.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 30 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- 11.6 COMPANY FOOTPRINT

- TABLE 195 OVERALL COMPANY FOOTPRINT

- TABLE 196 COMPANY FOOTPRINT, BY OFFERING

- TABLE 197 COMPANY FOOTPRINT, BY VERTICAL

- TABLE 198 COMPANY FOOTPRINT, BY REGION

- 11.7 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 31 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- 11.8 RANKING OF KEY PLAYERS

- FIGURE 32 RANKING OF KEY PLAYERS, 2022

- 11.9 COMPETITIVE BENCHMARKING

- TABLE 199 DETAILED LIST OF STARTUPS/SMES

- TABLE 200 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 201 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT LAUNCHES

- TABLE 202 PRODUCT LAUNCHES, 2021-2023

- 11.10.2 DEALS

- TABLE 203 DEALS, 2021-2023

- 11.11 REMOTE WORK SECURITY PRODUCT BENCHMARKING

- 11.11.1 PROMINENT REMOTE WORK SECURITY SOLUTIONS

- TABLE 204 COMPARATIVE ANALYSIS OF PROMINENT REMOTE WORK SECURITY SOLUTIONS

- 11.11.1.1 VMware SASE

- 11.11.1.2 Citrix Secure Private Access

- 11.11.1.3 Zscaler Private Access

- 11.11.1.4 Venn Software

- 11.11.1.5 Check Point Harmony Connect

- 11.12 VALUATION AND FINANCIAL METRICS OF KEY REMOTE WORK SECURITY VENDORS

- FIGURE 33 EBITDA OF KEY PLAYERS, 2023

12 COMPANY PROFILES

(Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 12.1 KEY PLAYERS

- 12.1.1 VMWARE

- TABLE 205 VMWARE: BUSINESS OVERVIEW

- FIGURE 34 VMWARE: COMPANY SNAPSHOT

- TABLE 206 VMWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 VMWARE: PRODUCT LAUNCHES

- TABLE 208 VMWARE: DEALS

- 12.1.2 CISCO

- TABLE 209 CISCO: BUSINESS OVERVIEW

- FIGURE 35 CISCO: COMPANY SNAPSHOT

- TABLE 210 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 CISCO: DEALS

- 12.1.3 FORTINET

- TABLE 212 FORTINET: BUSINESS OVERVIEW

- FIGURE 36 FORTINET: COMPANY SNAPSHOT

- TABLE 213 FORTINET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 FORTINET: PRODUCT LAUNCHES

- TABLE 215 FORTINET: DEALS

- 12.1.4 PALO ALTO NETWORKS

- TABLE 216 PALO ALTO NETWORKS: BUSINESS OVERVIEW

- FIGURE 37 PALO ALTO NETWORKS: COMPANY SNAPSHOT

- TABLE 217 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 PALO ALTO NETWORKS: PRODUCT LAUNCHES

- TABLE 219 PALO ALTO NETWORKS: DEALS

- 12.1.5 CHECK POINT

- TABLE 220 CHECK POINT: BUSINESS OVERVIEW

- FIGURE 38 CHECK POINT: COMPANY SNAPSHOT

- TABLE 221 CHECK POINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 222 CHECK POINT: PRODUCT LAUNCHES

- TABLE 223 CHECK POINT: DEALS

- 12.1.6 MICROSOFT

- TABLE 224 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 39 MICROSOFT: COMPANY SNAPSHOT

- TABLE 225 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 MICROSOFT: PRODUCT LAUNCHES

- TABLE 227 MICROSOFT: DEALS

- 12.1.7 IBM

- TABLE 228 IBM: BUSINESS OVERVIEW

- FIGURE 40 IBM: COMPANY SNAPSHOT

- TABLE 229 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 IBM: PRODUCT LAUNCHES

- TABLE 231 IBM: DEALS

- 12.1.8 TREND MICRO

- TABLE 232 TREND MICRO: BUSINESS OVERVIEW

- FIGURE 41 TREND MICRO: COMPANY SNAPSHOT

- TABLE 233 TREND MICRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 TREND MICRO: PRODUCT LAUNCHES

- TABLE 235 TREND MICRO: DEALS

- 12.1.9 BROADCOM

- TABLE 236 BROADCOM: BUSINESS OVERVIEW

- FIGURE 42 BROADCOM: COMPANY SNAPSHOT

- TABLE 237 BROADCOM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 BROADCOM: DEALS

- 12.1.10 CLOUDFLARE

- TABLE 239 CLOUDFLARE: BUSINESS OVERVIEW

- FIGURE 43 CLOUDFLARE: COMPANY SNAPSHOT

- TABLE 240 CLOUDFLARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 CLOUDFLARE: PRODUCT LAUNCHES

- TABLE 242 CLOUDFLARE: DEALS

- 12.1.11 SOPHOS

- 12.1.12 ZSCALER

- 12.1.13 CITRIX

- 12.1.14 CYBERARK

- 12.1.15 CROWDSTRIKE

- 12.1.16 FORCEPOINT

- 12.1.17 PROOFPOINT

- 12.1.18 ESET

- 12.1.19 SECLORE

- 12.2 OTHER PLAYERS

- 12.2.1 OPENVPN

- 12.2.2 SECURITY ONION

- 12.2.3 WALLARM

- 12.2.4 VENN

- 12.2.5 CYNET SECURITY

- 12.2.6 SENTINELONE

- 12.2.7 ISSQUARED

- 12.2.8 REVBITS

- 12.2.9 SECURDEN

- 12.2.10 AXIS SECURITY

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 ADJACENT MARKETS

- 13.1 INTRODUCTION

- TABLE 243 ADJACENT MARKETS AND FORECASTS

- 13.2 LIMITATIONS

- 13.3 EDGE SECURITY MARKET

- 13.3.1 EDGE SECURITY MARKET, BY ORGANIZATION SIZE

- TABLE 244 EDGE SECURITY MARKET, BY ORGANIZATION SIZE, 2018-2021 (USD MILLION)

- TABLE 245 EDGE SECURITY MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 246 SMALL & MEDIUM-SIZED ENTERPRISES: EDGE SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 247 SMALL & MEDIUM-SIZED ENTERPRISES: EDGE SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 248 LARGE ENTERPRISES: EDGE SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 249 LARGE ENTERPRISES: EDGE SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 13.3.2 EDGE SECURITY MARKET, BY DEPLOYMENT MODE

- TABLE 250 EDGE SECURITY MARKET, BY DEPLOYMENT MODE, 2018-2021 (USD MILLION)

- TABLE 251 EDGE SECURITY MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD MILLION)

- TABLE 252 ON-PREMISES: EDGE SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 253 ON-PREMISES: EDGE SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 254 CLOUD: EDGE SECURITY MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 255 CLOUD: EDGE SECURITY MARKET, BY REGION, 2022-2027 (USD MILLION)

- 13.4 REMOTE WORKPLACE SERVICES MARKET

- 13.4.1 REMOTE WORKPLACE SERVICES MARKET, BY ORGANIZATION SIZE

- TABLE 256 REMOTE WORKPLACE SERVICES MARKET, BY ORGANIZATION SIZE, 2017-2021 (USD MILLION)

- TABLE 257 REMOTE WORKPLACE SERVICES MARKET, BY ORGANIZATION SIZE, 2022-2027 (USD MILLION)

- TABLE 258 SMALL & MEDIUM-SIZED ENTERPRISES: REMOTE WORKPLACE SERVICES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 259 SMALL & MEDIUM-SIZED ENTERPRISES: REMOTE WORKPLACE SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 260 LARGE ENTERPRISES: REMOTE WORKPLACE SERVICES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 261 LARGE ENTERPRISES: REMOTE WORKPLACE SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- 13.4.2 REMOTE WORKPLACE SERVICES MARKET, BY DEPLOYMENT MODE

- TABLE 262 REMOTE WORKPLACE SERVICES MARKET, BY DEPLOYMENT MODE, 2017-2021 (USD MILLION)

- TABLE 263 REMOTE WORKPLACE SERVICES MARKET, BY DEPLOYMENT TYPE, 2022-2027 (USD MILLION)

- TABLE 264 ON-PREMISES: REMOTE WORKPLACE SERVICES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 265 ON-PREMISES: REMOTE WORKPLACE SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

- TABLE 266 CLOUD: REMOTE WORKPLACE SERVICES MARKET, BY REGION, 2017-2021 (USD MILLION)

- TABLE 267 CLOUD: REMOTE WORKPLACE SERVICES MARKET, BY REGION, 2022-2027 (USD MILLION)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS