|

|

市場調査レポート

商品コード

1364764

着床前遺伝子検査の世界市場:処置別、技術別、製品別、用途別、周期タイプ別、エンドユーザー別、地域別 - 予測(~2028年)Preimplantation Genetic Testing Market by Procedure (Diagnosis, Screening), Technology (NGS, PCR, FISH, CGH, SNP), Product (Consumable, Instrument), Application (Aneuploid, HLA Typing), Type of Cycle, End User, and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 着床前遺伝子検査の世界市場:処置別、技術別、製品別、用途別、周期タイプ別、エンドユーザー別、地域別 - 予測(~2028年) |

|

出版日: 2023年10月10日

発行: MarketsandMarkets

ページ情報: 英文 238 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の着床前遺伝子検査の市場規模は、2023年に7億米ドル、2028年までに12億米ドルに達し、予測期間にCAGRで11.4%の成長が予測されています。

この市場成長は主に、不妊治療クリニックや体外受精センターの増加、新たな診断技術の開発への官民投資の活発化によって促進されています。しかし、体外受精に対する不利な政府規制や医療改革が市場成長を抑制しています。

「技術別では、次世代シーケンシングセグメントが予測期間にもっとも高い市場シェアとなります。」

「異数性用途セグメントが予測期間にもっとも高いCAGRとなります。」

異数性の検出に向けた着床前遺伝子スクリーニングの使用は、胚着床の可能性を高め、流産率を低下させ、染色体異常の子供を持つ可能性を低下させます。これらの利点が、異数性の検出に向けた着床前遺伝子検査の需要を促進しています。

「地域別では、アジア太平洋セグメントが予測期間に市場でもっとも高い成長率を占めます。」

アジア太平洋の新興国における急速な経済成長により、中国やインドのような国々の可処分所得水準が過去10年間で大きく増加し、このことは市場にとって大きな可能性を持っています。

当レポートでは、世界の着床前遺伝子検査市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- 着床前遺伝子検査市場の概要

- 着床前遺伝子検査市場:地域別(2023年~2028年)

- 北米の着床前遺伝子検査市場:製品別、国別(2021年)

- 着床前遺伝子検査市場:地域の成長機会

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 価格分析

- バリューチェーン分析

- サプライチェーン分析

- ポーターのファイブフォース分析

- エコシステム市場マップ

- 規制分析

- 北米

- 欧州

- アジア太平洋

- 特許分析

- 顧客のビジネスに影響を与える動向/混乱

- 主な会議とイベント(2023年~2024年)

- 技術分析

- 主なステークホルダーと購入基準

- 貿易分析

第6章 移植前遺伝子検査市場:処置タイプ別

- イントロダクション

- 着床前遺伝子スクリーニング

- 着床前遺伝子診断

第7章 着床前遺伝子検査市場:技術別

- イントロダクション

- 次世代シーケンシング

- ポリメラーゼ連鎖反応

- 蛍光in situハイブリダイゼーション

- 比較ゲノムハイブリダイゼーション

- 一塩基多型

第8章 着床前遺伝子検査市場:製品・サービス別

- イントロダクション

- 試薬、消耗品

- 器具

- ソフトウェア、サービス

第9章 着床前遺伝子検査市場:用途別

- イントロダクション

- 異数性

- 構造的染色体異常

- 単一遺伝子疾患

- X連鎖性疾患

- HLAタイピング

- 性別識別

第10章 着床前遺伝子検査市場:サイクルタイプ別

- イントロダクション

- 新鮮・非ドナー

- 凍結・非ドナー

- 凍結・ドナー

- 新鮮・ドナー

第11章 着床前遺伝子検査市場:エンドユーザー別

- イントロダクション

- 不妊クリニック

- 病院

- 診断研究所

- その他のエンドユーザー

第12章 着床前遺伝子検査市場:地域別

- イントロダクション

- 北米

- 北米の不況の影響

- 米国

- カナダ

- 欧州

- 欧州の不況の影響

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋の不況の影響

- 中国

- 日本

- インド

- その他のアジア太平洋

- その他の地域

- ラテンアメリカの不況の影響

- 中東・アフリカの不況の影響

第13章 競合情勢

- 概要

- 主要企業が採用した主な戦略

- 主要企業の収益の分析

- 市場シェア分析

- 主要企業の評価マトリクス

- スタートアップ/中小企業の評価マトリクス

- 企業フットプリント分析

- 競合ベンチマーキング

- 競合シナリオと動向

第14章 企業プロファイル

- 主要企業

- ILLUMINA, INC.

- THERMO FISHER SCIENTIFIC INC.

- AGILENT TECHNOLOGIES, INC.

- REVVITY

- THE COOPER COMPANIES, INC.

- ABBOTT

- TAKARA BIO INC.

- QIAGEN

- VITROLIFE

- OXFORD NANOPORE TECHNOLOGIES PLC

- その他の企業

- OXFORD GENE TECHNOLOGY IP LIMITED

- YIKON GENOMICS

- SHIVA SCIENTIFIC COMPANY

- NANJING SUPERYEARS GENE TECHNOLOGY CO., LTD.

- MEDICOVER GENETICS

- MEDGENOME

- FULGENT GENETICS

- INVICTA GENETICS

- GENEA LIMITED

- SCIEGENE CORPORATION

- BIOARRAY S.L.

- UNIMED BIOTECH (SHANGHAI) CO., LTD.

- GENEMIND BIOSCIENCES CO., LTD.

- BERRY GENOMICS

- BANGKOK GENOMICS INNOVATION

第15章 付録

The global preimplantation genetic testing market is projected to reach USD 1.2 Billion by 2028 from USD 0.7 Billion in 2023, at a CAGR of 11.4% during the forecast period. The growth of this market is majorly driven by the rising number of fertility clinics and IVF centers and a boost in public-private investments in the development of novel diagnostic techniques. However, unfavorable government regulations and healthcare reforms for IVF procedures restrain the growth of the preimplantation genetic testing market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Value (USD) billion |

| Segments | Procedure Type, Technology, Product, Application, Type Of Cycle, and End User |

| Regions covered | North America, Europe, Asia Pacific, and Rest of the World |

"The next generation sequencing segment accounted for the highest market share in the preimplantation genetic testing market, by technology, during the forecast period."

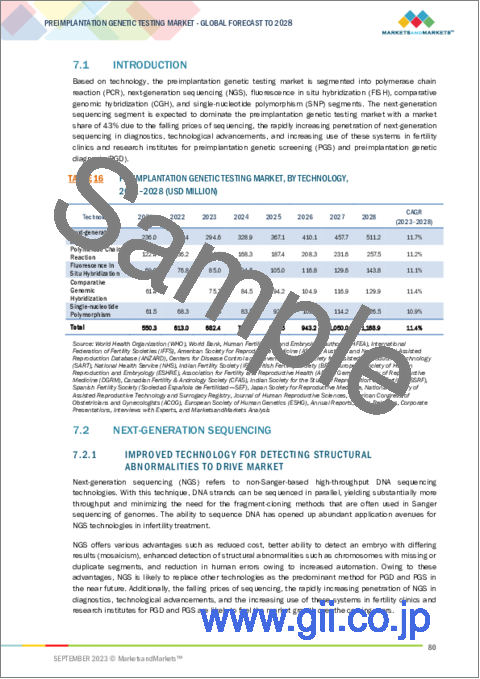

Based on the type segment, the preimplantation genetic testing market is categorized into PCR, NGS, FISH, CGH, and SNP. The ability to sequence DNA has opened up abundant application avenues for NGS technologies in infertility treatment. NGS offers various advantages such as reduced cost, better ability to detect an embryo with differing results (mosaicism), and enhanced detection of structural abnormalities such as chromosomes with missing or duplicate segments.

"Aneuploidy application segment accounted for the highest CAGR during the forecast period."

Based on application, the preimplantation genetic testing market is segmented into aneuploidy, structural chromosomal abnormalities, single gene disorders, X-linked disorders, HLA typing, and gender identification. The use of preimplantation genetic screening for aneuploidy detection increases the chance of an embryo implantation, decreases the miscarriage rate, and reduces the chance of having a child with a chromosome abnormality. These advantages are driving the demand for preimplantation genetic testing for detecting aneuploidy.

"The Asia Pacific segment accounted for the highest growth rate in the preimplantation genetic testing systems market, by region, during the forecast period."

Based on the region, the global preimplantation genetic testing market is categorized into North America, Europe, Asia Pacific, and Rest of the World. Asia Pacific is expected to witness a high growth rate during the forecast period. As a result of the rapid economic growth in the emerging countries in Asia-Pacific, the disposable income levels in the region's countries such as China and India have witnessed a notable increase in the last decade which holds massive potential for the Asia Pacific preimplantation genetic testing market.

Breakdown of supply-side primary interviews, by company type, designation, and region:

- By Company Type: Tier 1 (50%), Tier 2 (33%), and Tier 3 (17%)

- By Designation: C-level (17%), Director-level (50%), and Others (33%)

- By Region: North America (34%), Europe (35%), Asia- Pacific (26%), and Rest of the World (5%)

Prominent companies include Illumina, Inc. (US), Thermo Fisher Scientific Inc. (US), Agilent Technologies, Inc. (US), Revvity (US), The Cooper Companies, Inc. (US), Abbott (US), Takara Bio Inc. (Japan), Qiagen (Germany), Vitrolife (Sweden), Oxford Nanopore Technologies Plc (UK), Oxford Gene Technology IP Limited (UK), Yikon Genomics (China), Shiva Scientific Company (India), Nanjing Superyears Gene Technology Co. Ltd. (China), Medicover Genetics (Germany), Medgenome (India), Fulgent Genetics (US), Invicta Genetics (Poland), Genea Limited (Australia), Scigene Corporation (US), Bioarray S.L. (Spain), Unimed Biotech (Shanghai) Co. Ltd. (China), Genemind Biosciences Co. Ltd. (China), Berry Genomics (China), and Bangkok Genomics Innovation (Thailand).

Research Coverage

This research report categorizes the preimplantation genetic testing market by procedure type (preimplantation genetic screening, and preimplantation genetic diagnosis), by technology (next-generation sequencing, polymerase chain reaction, fluorescence in situ hybridization, comparative genomic hybridization, single-nucleotide polymorphism), by product and service (reagents and consumables, instruments, and software and services), by application (aneuploidy, structural chromosomal abnormalities, single gene disorders, x-linked disorders, HLA typing, and gender identification), by type of cycle (fresh non-donor, frozen non-donor, fresh donor, and frozen donor), by end user (fertility clinics, hospitals, diagnostic laboratories, and other end users), and region (North America, Europe, Asia Pacific, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the preimplantation genetic testing market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. New product & service launches, mergers and acquisitions, and recent developments associated with the preimplantation genetic testing market. Competitive analysis of upcoming startups in the preimplantation genetic testing market ecosystem is covered in this report.

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall preimplantation genetic testing market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (declining rate of fertility worldwide, the rise of fertility tourism in emerging economies, increasing number of fertility clinics and IVF centers, increasing public-private investments in development of novel diagnostic techniques, high risk of chromosomal abnormalities with advancing maternal age), restraints (high procedural cost in preimplantation genetic testing, and unfavorable government regulation and healthcare reforms for IVF procedures), opportunities (improving healthcare infrastructure and rising medical tourism in emerging economies, and Use of fertility treatment options by single parents and same-sex couples), and challenges (socio-ethical concerns surrounding preimplantation genetic testing, and procedural limitation of preimplantation genetic testing with advancing age) influencing the growth of the preimplantation genetic testing market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the preimplantation genetic testing market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the preimplantation genetic testing market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the preimplantation genetic testing market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Illumina, Inc. (US), Thermo Fisher Scientific Inc. (US), and Agilent Technologies, Inc. (US), among others in the preimplantation genetic testing market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS CONSIDERED

- FIGURE 1 PREIMPLANTATION GENETIC TESTING MARKET SEGMENTATION

- 1.4.2 YEARS CONSIDERED

- 1.4.3 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN: PREIMPLANTATION GENETIC TESTING MARKET

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 3 PRIMARY SOURCES

- 2.1.2.1 Key industry insights

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach 1: Company revenue estimation approach

- FIGURE 5 COMPANY REVENUE ESTIMATION APPROACH

- 2.2.1.2 Approach 2: Presentations of companies and primary interviews

- 2.2.1.3 Approach 4: Usage-based market estimation

- FIGURE 6 MARKET SIZE ESTIMATION, BY PRODUCT UTILIZATION METHODOLOGY

- 2.2.1.4 Growth forecast

- 2.2.1.5 CAGR projections

- FIGURE 7 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 8 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET ESTIMATION AND DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- 2.4 STUDY ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

- TABLE 1 RISK ASSESSMENT: PREIMPLANTATION GENETIC TESTING MARKET

- 2.7 RECESSION IMPACT ANALYSIS: PREIMPLANTATION GENETIC TESTING MARKET

3 EXECUTIVE SUMMARY

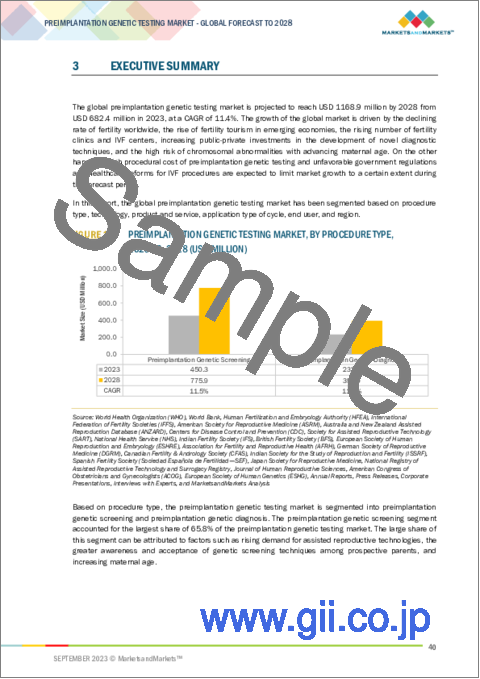

- FIGURE 10 PREIMPLANTATION GENETIC TESTING MARKET, BY PROCEDURE TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 PREIMPLANTATION GENETIC TESTING MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT AND SERVICE, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 PREIMPLANTATION GENETIC TESTING MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 PREIMPLANTATION GENETIC TESTING MARKET, BY TYPE OF CYCLE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 PREIMPLANTATION GENETIC TESTING MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 PREIMPLANTATION GENETIC TESTING MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 PREIMPLANTATION GENETIC TESTING MARKET OVERVIEW

- FIGURE 17 RISING MATERNAL AGE AND DECLINING FERTILITY RATES TO DRIVE MARKET

- 4.2 PREIMPLANTATION GENETIC TESTING MARKET, BY REGION (2023-2028)

- FIGURE 18 ASIA PACIFIC TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- 4.3 NORTH AMERICA: PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT AND COUNTRY (2021)

- FIGURE 19 US AND REAGENTS AND CONSUMABLES SEGMENT COMMANDED LARGEST MARKET SHARE IN 2022

- 4.4 PREIMPLANTATION GENETIC TESTING MARKET: REGIONAL GROWTH OPPORTUNITIES

- FIGURE 20 ASIA PACIFIC COUNTRIES TO GROW AT HIGHEST RATE DURING STUDY PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: PREIMPLANTATION GENETIC TESTING MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Decline in fertility rates

- TABLE 2 FERTILITY RATE, TOTAL (BIRTHS PER WOMAN), BY COUNTRY

- 5.2.1.2 Rise of fertility tourism in emerging economies

- 5.2.1.3 Increasing number of fertility clinics and IVF centers

- 5.2.1.4 Increasing public-private investments to develop novel diagnostic techniques

- 5.2.1.5 High risk of chromosomal abnormalities with advancing maternal age

- TABLE 3 GLOBAL INCIDENCE RATE OF TRISOMY

- 5.2.2 RESTRAINTS

- 5.2.2.1 High procedural cost

- 5.2.2.2 Unfavorable government regulations and healthcare reforms for IVF procedures

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Improving healthcare infrastructure and rising medical tourism in emerging economies

- 5.2.3.2 Use of fertility treatments by single parents and same-sex couples

- 5.2.4 CHALLENGES

- 5.2.4.1 Socio-ethical concerns surrounding preimplantation genetic testing

- 5.2.4.2 Age-related procedural challenges

- 5.3 PRICING ANALYSIS

- TABLE 4 INDICATIVE PRICING OF PREIMPLANTATION GENETIC TESTING PRODUCTS

- TABLE 5 AVERAGE SELLING PRICE OF PREIMPLANTATION GENETIC TESTING SYSTEMS

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 22 VALUE CHAIN ANALYSIS: MAJOR VALUE ADDED DURING MANUFACTURING AND ASSEMBLY PHASES

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 23 SUPPLY CHAIN ANALYSIS: DIRECT DISTRIBUTION TO BE PREFERRED STRATEGY OF PROMINENT COMPANIES

- 5.6 PORTER'S FIVE FORCES ANALYSIS

- 5.6.1 THREAT OF NEW ENTRANTS

- 5.6.2 THREAT OF SUBSTITUTES

- 5.6.3 BARGAINING POWER OF SUPPLIERS

- 5.6.4 BARGAINING POWER OF BUYERS

- 5.6.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.7 ECOSYSTEM MARKET MAP

- FIGURE 24 ECOSYSTEM MARKET MAP: PREIMPLANTATION GENETIC TESTING MARKET

- TABLE 6 ROLE IN ECOSYSTEM: PREIMPLANTATION GENETIC TESTING MARKET

- FIGURE 25 KEY PLAYERS IN PREIMPLANTATION GENETIC TESTING MARKET

- 5.8 REGULATORY ANALYSIS

- TABLE 7 INDICATIVE LIST OF REGULATORY AUTHORITIES GOVERNING PREIMPLANTATION GENETIC TESTING MARKET

- 5.8.1 NORTH AMERICA

- 5.8.1.1 US

- 5.8.1.2 Canada

- 5.8.2 EUROPE

- 5.8.2.1 UK

- 5.8.2.2 France

- 5.8.3 ASIA PACIFIC

- 5.8.3.1 Japan

- 5.8.3.2 India

- 5.9 PATENT ANALYSIS

- 5.9.1 PATENT TRENDS FOR PREIMPLANTATION GENETIC TESTING

- FIGURE 26 PATENT TRENDS FOR PREIMPLANTATION GENETIC TESTING, JANUARY 2013-AUGUST 2023

- 5.9.2 JURISDICTION AND TOP APPLICANT ANALYSIS

- FIGURE 27 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTIONS) FOR PREIMPLANTATION GENETIC TESTING PATENTS, JANUARY 2013-AUGUST 2023

- 5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.10.1 REVENUE SHIFT FOR PREIMPLANTATION GENETIC TESTING PRODUCTS

- FIGURE 28 REVENUE SHIFT FOR PREIMPLANTATION GENETIC TESTING PRODUCTS

- 5.11 KEY CONFERENCES AND EVENTS IN 2023-2024

- TABLE 8 DETAILED LIST OF CONFERENCES AND EVENTS (JANUARY 2023-DECEMBER 2024)

- 5.12 TECHNOLOGY ANALYSIS

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF PREIMPLANTATION GENETIC TESTING PRODUCTS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PREIMPLANTATION GENETIC TESTING PRODUCTS (%)

- 5.13.2 BUYING CRITERIA

- FIGURE 30 KEY BUYING CRITERIA FOR END USERS OF PREIMPLANTATION GENETIC TESTING MARKET

- TABLE 10 KEY BUYING CRITERIA FOR END USERS OF PREIMPLANTATION GENETIC TESTING PRODUCTS

- 5.14 TRADE ANALYSIS

- TABLE 11 IMPORT DATA FOR HS CODE 901849, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 12 EXPORT DATA FOR HS CODE 901849, BY COUNTRY, 2018-2022 (USD MILLION)

6 PREIMPLANTATION GENETIC TESTING MARKET, BY PROCEDURE TYPE

- 6.1 INTRODUCTION

- TABLE 13 PREIMPLANTATION GENETIC TESTING MARKET, BY PROCEDURE TYPE, 2021-2028 (USD MILLION)

- 6.2 PREIMPLANTATION GENETIC SCREENING

- 6.2.1 INCREASING MATERNAL AGE TO DRIVE MARKET

- TABLE 14 PREIMPLANTATION GENETIC TESTING MARKET FOR PREIMPLANTATION GENETIC SCREENING, BY REGION, 2021-2028 (USD MILLION)

- 6.3 PREIMPLANTATION GENETIC DIAGNOSIS

- 6.3.1 RISING AWARENESS ABOUT CHROMOSOMAL ABNORMALITIES IN FETUSES TO DRIVE MARKET

- TABLE 15 PREIMPLANTATION GENETIC TESTING MARKET FOR PREIMPLANTATION GENETIC DIAGNOSIS, BY REGION, 2021-2028 (USD MILLION)

7 PREIMPLANTATION GENETIC TESTING MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- TABLE 16 PREIMPLANTATION GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 7.2 NEXT-GENERATION SEQUENCING

- 7.2.1 IMPROVED TECHNOLOGY FOR DETECTING STRUCTURAL ABNORMALITIES TO DRIVE MARKET

- TABLE 17 PREIMPLANTATION GENETIC TESTING MARKET FOR NEXT-GENERATION SEQUENCING, BY REGION, 2021-2028 (USD MILLION)

- 7.3 POLYMERASE CHAIN REACTION

- 7.3.1 INCREASED USAGE IN CLINICAL AND RESEARCH APPLICATIONS AND HIGH PREVALENCE OF GENETIC DISEASES TO DRIVE MARKET

- TABLE 18 PREIMPLANTATION GENETIC TESTING MARKET FOR POLYMERASE CHAIN REACTION, BY REGION, 2021-2028 (USD MILLION)

- 7.4 FLUORESCENCE IN SITU HYBRIDIZATION

- 7.4.1 ADVANCES IN FLUORESCENCE MICROSCOPY AND DIGITAL IMAGING TO DRIVE MARKET

- TABLE 19 PREIMPLANTATION GENETIC TESTING MARKET FOR FLUORESCENCE IN SITU HYBRIDIZATION, BY REGION, 2021-2028 (USD MILLION)

- 7.5 COMPARATIVE GENOMIC HYBRIDIZATION

- 7.5.1 LOW COST, LESS LABOR REQUIREMENT, AND ONGOING TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET

- TABLE 20 PREIMPLANTATION GENETIC TESTING MARKET FOR COMPARATIVE GENOMIC HYBRIDIZATION, BY REGION, 2021-2028 (USD MILLION)

- 7.6 SINGLE-NUCLEOTIDE POLYMORPHISM

- 7.6.1 TIME-CONSUMING, EXPENSIVE, AND LABOR-INTENSIVE METHOD TO LIMIT MARKET

- TABLE 21 PREIMPLANTATION GENETIC TESTING MARKET FOR SINGLE-NUCLEOTIDE POLYMORPHISM, BY REGION, 2021-2028 (USD MILLION)

8 PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT AND SERVICE

- 8.1 INTRODUCTION

- TABLE 22 PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT AND SERVICE, 2021-2028 (USD MILLION)

- 8.2 REAGENTS AND CONSUMABLES

- 8.2.1 REAGENTS AND CONSUMABLES SEGMENT TO DOMINATE PREIMPLANTATION GENETIC TESTING MARKET

- TABLE 23 PREIMPLANTATION GENETIC TESTING MARKET FOR REAGENTS AND CONSUMABLES, BY REGION, 2021-2028 (USD MILLION)

- 8.3 INSTRUMENTS

- 8.3.1 ONGOING TECHNOLOGICAL ADVANCEMENTS AND INCREASING FERTILITY CLINICS TO DRIVE MARKET

- TABLE 24 PREIMPLANTATION GENETIC TESTING MARKET FOR INSTRUMENTS, BY REGION, 2021-2028 (USD MILLION)

- 8.4 SOFTWARE AND SERVICES

- 8.4.1 RISING AWARENESS ABOUT DATA ANALYSIS TO DRIVE MARKET

- TABLE 25 PREIMPLANTATION GENETIC TESTING MARKET FOR SOFTWARE AND SERVICES, BY REGION, 2021-2028 (USD MILLION)

9 PREIMPLANTATION GENETIC TESTING MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- TABLE 26 PREIMPLANTATION GENETIC TESTING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 9.2 ANEUPLOIDY

- 9.2.1 ANEUPLOIDY SEGMENT TO COMMAND LARGEST MARKET SHARE

- TABLE 27 PREIMPLANTATION GENETIC TESTING MARKET FOR ANEUPLOIDY, BY REGION, 2021-2028 (USD MILLION)

- 9.3 STRUCTURAL CHROMOSOMAL ABNORMALITIES

- TABLE 28 PREIMPLANTATION GENETIC TESTING MARKET FOR STRUCTURAL CHROMOSOMAL ABNORMALITIES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 29 PREIMPLANTATION GENETIC TESTING MARKET FOR STRUCTURAL CHROMOSOMAL ABNORMALITIES, BY TYPE, 2021-2028 (USD MILLION)

- 9.3.1 TRANSLOCATIONS

- 9.3.1.1 Rising incidence of translocation chromosomal abnormalities during IVF treatments to drive segment

- TABLE 30 TRANSLOCATIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.3.2 DELETIONS

- 9.3.2.1 Advancements in genetic testing to drive segment

- TABLE 31 DELETIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.3.3 DUPLICATIONS

- 9.3.3.1 Rising cases of duplication of chromosomal abnormalities and increasing maternal age to drive segment

- TABLE 32 DUPLICATIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.3.4 INVERSIONS

- 9.3.4.1 Risk of unexplained male-factor infertility and multiple miscarriages to limit segment

- TABLE 33 INVERSIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.4 SINGLE GENE DISORDERS

- 9.4.1 INCREASING AWARENESS ABOUT GENETIC TESTING TO DRIVE MARKET

- TABLE 34 PREIMPLANTATION GENETIC TESTING MARKET FOR SINGLE GENE DISORDERS, BY REGION, 2021-2028 (USD MILLION)

- 9.5 X-LINKED DISORDERS

- 9.5.1 MEDICAL ADVANCEMENTS AND INCREASED RESEARCH ON GENETIC DISORDERS TO DRIVE MARKET

- TABLE 35 PREIMPLANTATION GENETIC TESTING MARKET FOR X-LINKED DISORDERS, BY REGION, 2021-2028 (USD MILLION)

- 9.6 HLA TYPING

- 9.6.1 RISING NUMBER OF COUPLES WITH CHILDREN AFFECTED BY HEMATOLOGICAL DISEASES TO DRIVE MARKET

- TABLE 36 PREIMPLANTATION GENETIC TESTING MARKET FOR HLA TYPING, BY REGION, 2021-2028 (USD MILLION)

- 9.7 GENDER IDENTIFICATION

- 9.7.1 INCREASED FOCUS ON SEX DISCRIMINATION TO LIMIT MARKET

- TABLE 37 PREIMPLANTATION GENETIC TESTING MARKET FOR GENDER IDENTIFICATION, BY REGION, 2021-2028 (USD MILLION)

10 PREIMPLANTATION GENETIC TESTING MARKET, BY TYPE OF CYCLE

- 10.1 INTRODUCTION

- TABLE 38 PREIMPLANTATION GENETIC TESTING MARKET, BY TYPE OF CYCLE, 2021-2028 (USD MILLION)

- 10.2 FRESH NON-DONOR

- 10.2.1 HIGH RATES OF SUCCESSFUL PREGNANCY AMONG YOUNG WOMEN TO DRIVE MARKET

- TABLE 39 PREIMPLANTATION GENETIC TESTING MARKET FOR FRESH NON-DONORS, BY REGION, 2021-2028 (USD MILLION)

- 10.3 FROZEN NON-DONOR

- 10.3.1 LONG-TERM STORAGE OF FROZEN EGGS AND EASY SCHEDULING TO DRIVE MARKET

- TABLE 40 PREIMPLANTATION GENETIC TESTING MARKET FOR FROZEN NON-DONOR, BY REGION, 2021-2028 (USD MILLION)

- 10.4 FROZEN DONOR

- 10.4.1 BETTER AFFORDABILITY, HIGHER AVAILABILITY, AND EASIER IMPLANTATION TO DRIVE MARKET

- TABLE 41 PREIMPLANTATION GENETIC TESTING MARKET FOR FROZEN DONOR, BY REGION, 2021-2028 (USD MILLION)

- 10.5 FRESH DONOR

- 10.5.1 REAL-TIME GENETIC TESTING RESULTS AND EASY EMBRYO TRANSFER TO DRIVE MARKET

- TABLE 42 PREIMPLANTATION GENETIC TESTING MARKET FOR FRESH DONOR, BY REGION, 2021-2028 (USD MILLION)

11 PREIMPLANTATION GENETIC TESTING MARKET, BY END USER

- 11.1 INTRODUCTION

- TABLE 43 PREIMPLANTATION GENETIC TESTING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 11.2 FERTILITY CLINICS

- 11.2.1 HIGH SUCCESS RATE OF TREATMENT TO DRIVE MARKET

- TABLE 44 PREIMPLANTATION GENETIC TESTING MARKET FOR FERTILITY CLINICS, BY REGION, 2021-2028 (USD MILLION)

- 11.3 HOSPITALS

- 11.3.1 RISING NUMBER OF HOSPITALS FOR ART PROCEDURES TO DRIVE MARKET

- TABLE 45 PREIMPLANTATION GENETIC TESTING MARKET FOR HOSPITALS, BY REGION, 2021-2028 (USD MILLION)

- 11.4 DIAGNOSTIC LABORATORIES

- 11.4.1 IMPROVED CLINICAL EFFICACY AND INCREASED RESEARCH FUNDING TO DRIVE MARKET

- TABLE 46 PREIMPLANTATION GENETIC TESTING MARKET FOR DIAGNOSTIC LABORATORIES, BY REGION, 2021-2028 (USD MILLION)

- 11.5 OTHER END USERS

- TABLE 47 PREIMPLANTATION GENETIC TESTING MARKET FOR OTHER END USERS, BY REGION, 2021-2028 (USD MILLION)

12 PREIMPLANTATION GENETIC TESTING MARKET, BY REGION

- 12.1 INTRODUCTION

- TABLE 48 PREIMPLANTATION GENETIC TESTING MARKET, BY REGION, 2021-2028 (USD MILLION)

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 31 NORTH AMERICA: PREIMPLANTATION GENETIC TESTING MARKET SNAPSHOT

- TABLE 49 NORTH AMERICA: PREIMPLANTATION GENETIC TESTING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 50 NORTH AMERICA: PREIMPLANTATION GENETIC TESTING MARKET, BY PROCEDURE TYPE, 2021-2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: PREIMPLANTATION GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT AND SERVICE, 2021-2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: PREIMPLANTATION GENETIC TESTING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: PREIMPLANTATION GENETIC TESTING MARKET FOR STRUCTURAL CHROMOSOMAL ABNORMALITIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: PREIMPLANTATION GENETIC TESTING MARKET, BY TYPE OF CYCLE, 2021-2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: PREIMPLANTATION GENETIC TESTING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.2.2 US

- 12.2.2.1 US to dominate North American preimplantation genetic testing market during forecast period

- TABLE 57 US: PREIMPLANTATION GENETIC TESTING MARKET, BY PROCEDURE TYPE, 2021-2028 (USD MILLION)

- TABLE 58 US: PREIMPLANTATION GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 59 US: PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT AND SERVICE, 2021-2028 (USD MILLION)

- TABLE 60 US: PREIMPLANTATION GENETIC TESTING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 61 US: PREIMPLANTATION GENETIC TESTING MARKET FOR STRUCTURAL CHROMOSOMAL ABNORMALITIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 62 US: PREIMPLANTATION GENETIC TESTING MARKET, BY TYPE OF CYCLE, 2021-2028 (USD MILLION)

- TABLE 63 US: PREIMPLANTATION GENETIC TESTING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.2.3 CANADA

- 12.2.3.1 Increasing government and non-government funding for curbing rising infertility rates to drive market

- TABLE 64 CANADA: PREIMPLANTATION GENETIC TESTING MARKET, BY PROCEDURE TYPE, 2021-2028 (USD MILLION)

- TABLE 65 CANADA: PREIMPLANTATION GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 66 CANADA: PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT AND SERVICE, 2021-2028 (USD MILLION)

- TABLE 67 CANADA: PREIMPLANTATION GENETIC TESTING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 68 CANADA: PREIMPLANTATION GENETIC TESTING MARKET FOR STRUCTURAL CHROMOSOMAL ABNORMALITIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 69 CANADA: PREIMPLANTATION GENETIC TESTING MARKET, BY TYPE OF CYCLE, 2021-2028 (USD MILLION)

- TABLE 70 CANADA: PREIMPLANTATION GENETIC TESTING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 EUROPE: RECESSION IMPACT

- TABLE 71 EUROPE: PREIMPLANTATION GENETIC TESTING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 72 EUROPE: PREIMPLANTATION GENETIC TESTING MARKET, BY PROCEDURE TYPE, 2021-2028 (USD MILLION)

- TABLE 73 EUROPE: PREIMPLANTATION GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 74 EUROPE: PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT AND SERVICE, 2021-2028 (USD MILLION)

- TABLE 75 EUROPE: PREIMPLANTATION GENETIC TESTING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 76 EUROPE: PREIMPLANTATION GENETIC TESTING MARKET FOR STRUCTURAL CHROMOSOMAL ABNORMALITIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 77 EUROPE: PREIMPLANTATION GENETIC TESTING MARKET, BY TYPE OF CYCLE, 2021-2028 (USD MILLION)

- TABLE 78 EUROPE: PREIMPLANTATION GENETIC TESTING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.3.2 GERMANY

- 12.3.2.1 Low fertility rate and low cost of infertility treatment to drive market

- TABLE 79 GERMANY: PREIMPLANTATION GENETIC TESTING MARKET, BY PROCEDURE TYPE, 2021-2028 (USD MILLION)

- TABLE 80 GERMANY: PREIMPLANTATION GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 81 GERMANY: PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT AND SERVICE, 2021-2028 (USD MILLION)

- TABLE 82 GERMANY: PREIMPLANTATION GENETIC TESTING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 83 GERMANY: PREIMPLANTATION GENETIC TESTING MARKET FOR STRUCTURAL CHROMOSOMAL ABNORMALITIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 84 GERMANY: PREIMPLANTATION GENETIC TESTING MARKET, BY TYPE OF CYCLE, 2021-2028 (USD MILLION)

- TABLE 85 GERMANY: PREIMPLANTATION GENETIC TESTING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.3.3 FRANCE

- 12.3.3.1 Rising government funding for genomics research and increasing median age for first-time pregnancies to drive market

- TABLE 86 FRANCE: PREIMPLANTATION GENETIC TESTING MARKET, BY PROCEDURE TYPE, 2021-2028 (USD MILLION)

- TABLE 87 FRANCE: PREIMPLANTATION GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 88 FRANCE: PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT AND SERVICE, 2021-2028 (USD MILLION)

- TABLE 89 FRANCE: PREIMPLANTATION GENETIC TESTING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 90 FRANCE: PREIMPLANTATION GENETIC TESTING MARKET FOR STRUCTURAL CHROMOSOMAL ABNORMALITIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 91 FRANCE: PREIMPLANTATION GENETIC TESTING MARKET, BY TYPE OF CYCLE, 2021-2028 (USD MILLION)

- TABLE 92 FRANCE: PREIMPLANTATION GENETIC TESTING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.3.4 UK

- 12.3.4.1 Increasing IVF cycles and growing genetic abnormalities to drive market

- TABLE 93 UK: PREIMPLANTATION GENETIC TESTING MARKET, BY PROCEDURE TYPE, 2021-2028 (USD MILLION)

- TABLE 94 UK: PREIMPLANTATION GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 95 UK: PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT AND SERVICE, 2021-2028 (USD MILLION)

- TABLE 96 UK: PREIMPLANTATION GENETIC TESTING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 97 UK: PREIMPLANTATION GENETIC TESTING MARKET FOR STRUCTURAL CHROMOSOMAL ABNORMALITIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 98 UK: PREIMPLANTATION GENETIC TESTING MARKET, BY TYPE OF CYCLE, 2021-2028 (USD MILLION)

- TABLE 99 UK: PREIMPLANTATION GENETIC TESTING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.3.5 ITALY

- 12.3.5.1 Technological advancements in fertility treatment and decline in fertility rates among women to drive market

- TABLE 100 ITALY: PREIMPLANTATION GENETIC TESTING MARKET, BY PROCEDURE TYPE, 2021-2028 (USD MILLION)

- TABLE 101 ITALY: PREIMPLANTATION GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 102 ITALY: PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT AND SERVICE, 2021-2028 (USD MILLION)

- TABLE 103 ITALY: PREIMPLANTATION GENETIC TESTING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 104 ITALY: PREIMPLANTATION GENETIC TESTING MARKET FOR STRUCTURAL CHROMOSOMAL ABNORMALITIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 105 ITALY: PREIMPLANTATION GENETIC TESTING MARKET, BY TYPE OF CYCLE, 2021-2028 (USD MILLION)

- TABLE 106 ITALY: PREIMPLANTATION GENETIC TESTING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.3.6 SPAIN

- 12.3.6.1 Low cost of fertility treatment to drive market

- TABLE 107 SPAIN: PREIMPLANTATION GENETIC TESTING MARKET, BY PROCEDURE TYPE, 2021-2028 (USD MILLION)

- TABLE 108 SPAIN: PREIMPLANTATION GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 109 SPAIN: PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT AND SERVICE, 2021-2028 (USD MILLION)

- TABLE 110 SPAIN: PREIMPLANTATION GENETIC TESTING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 111 SPAIN: PREIMPLANTATION GENETIC TESTING MARKET FOR STRUCTURAL CHROMOSOMAL ABNORMALITIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 112 SPAIN: PREIMPLANTATION GENETIC TESTING MARKET, BY TYPE OF CYCLE, 2021-2028 (USD MILLION)

- TABLE 113 SPAIN: PREIMPLANTATION GENETIC TESTING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.3.7 REST OF EUROPE

- TABLE 114 REST OF EUROPE: PREIMPLANTATION GENETIC TESTING MARKET, BY PROCEDURE TYPE, 2021-2028 (USD MILLION)

- TABLE 115 REST OF EUROPE: PREIMPLANTATION GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 116 REST OF EUROPE: PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT AND SERVICE, 2021-2028 (USD MILLION)

- TABLE 117 REST OF EUROPE: PREIMPLANTATION GENETIC TESTING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 118 REST OF EUROPE: PREIMPLANTATION GENETIC TESTING MARKET FOR STRUCTURAL CHROMOSOMAL ABNORMALITIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 119 REST OF EUROPE: PREIMPLANTATION GENETIC TESTING MARKET, BY TYPE OF CYCLE, 2021-2028 (USD MILLION)

- TABLE 120 REST OF EUROPE: PREIMPLANTATION GENETIC TESTING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 32 ASIA PACIFIC: PREIMPLANTATION GENETIC TESTING MARKET SNAPSHOT

- TABLE 121 ASIA PACIFIC: PREIMPLANTATION GENETIC TESTING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: PREIMPLANTATION GENETIC TESTING MARKET, BY PROCEDURE TYPE, 2021-2028 (USD MILLION)

- TABLE 123 ASIA PACIFIC: PREIMPLANTATION GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT AND SERVICE, 2021-2028 (USD MILLION)

- TABLE 125 ASIA PACIFIC: PREIMPLANTATION GENETIC TESTING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: PREIMPLANTATION GENETIC TESTING MARKET FOR STRUCTURAL CHROMOSOMAL ABNORMALITIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 127 ASIA PACIFIC: PREIMPLANTATION GENETIC TESTING MARKET, BY TYPE OF CYCLE, 2021-2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: PREIMPLANTATION GENETIC TESTING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.4.2 CHINA

- 12.4.2.1 Decreasing fertility rates and abolishment of one-child policy to drive market

- TABLE 129 CHINA: PREIMPLANTATION GENETIC TESTING MARKET, BY PROCEDURE TYPE, 2021-2028 (USD MILLION)

- TABLE 130 CHINA: PREIMPLANTATION GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 131 CHINA: PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT AND SERVICE, 2021-2028 (USD MILLION)

- TABLE 132 CHINA: PREIMPLANTATION GENETIC TESTING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 133 CHINA: PREIMPLANTATION GENETIC TESTING MARKET FOR STRUCTURAL CHROMOSOMAL ABNORMALITIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 134 CHINA: PREIMPLANTATION GENETIC TESTING MARKET, BY TYPE OF CYCLE, 2021-2028 (USD MILLION)

- TABLE 135 CHINA: PREIMPLANTATION GENETIC TESTING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.4.3 JAPAN

- 12.4.3.1 Rising adoption of IVF among infertile couples to drive market

- TABLE 136 JAPAN: PREIMPLANTATION GENETIC TESTING MARKET, BY PROCEDURE TYPE, 2021-2028 (USD MILLION)

- TABLE 137 JAPAN: PREIMPLANTATION GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 138 JAPAN: PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT AND SERVICE, 2021-2028 (USD MILLION)

- TABLE 139 JAPAN: PREIMPLANTATION GENETIC TESTING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 140 JAPAN: PREIMPLANTATION GENETIC TESTING MARKET FOR STRUCTURAL CHROMOSOMAL ABNORMALITIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 141 JAPAN: PREIMPLANTATION GENETIC TESTING MARKET, BY TYPE OF CYCLE, 2021-2028 (USD MILLION)

- TABLE 142 JAPAN: PREIMPLANTATION GENETIC TESTING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.4.4 INDIA

- 12.4.4.1 Rising medical tourism and increasing fertility clinics to drive market

- TABLE 143 INDIA: PREIMPLANTATION GENETIC TESTING MARKET, BY PROCEDURE TYPE, 2021-2028 (USD MILLION)

- TABLE 144 INDIA: PREIMPLANTATION GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 145 INDIA: PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT AND SERVICE, 2021-2028 (USD MILLION)

- TABLE 146 INDIA: PREIMPLANTATION GENETIC TESTING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 147 INDIA: PREIMPLANTATION GENETIC TESTING MARKET FOR STRUCTURAL CHROMOSOMAL ABNORMALITIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 148 INDIA: PREIMPLANTATION GENETIC TESTING MARKET, BY TYPE OF CYCLE, 2021-2028 (USD MILLION)

- TABLE 149 INDIA: PREIMPLANTATION GENETIC TESTING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.4.5 REST OF ASIA PACIFIC

- TABLE 150 REST OF ASIA PACIFIC: PREIMPLANTATION GENETIC TESTING MARKET, BY PROCEDURE TYPE, 2021-2028 (USD MILLION)

- TABLE 151 REST OF ASIA PACIFIC: PREIMPLANTATION GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 152 REST OF ASIA PACIFIC: PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT AND SERVICE, 2021-2028 (USD MILLION)

- TABLE 153 REST OF ASIA PACIFIC: PREIMPLANTATION GENETIC TESTING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 154 REST OF ASIA PACIFIC: PREIMPLANTATION GENETIC TESTING MARKET FOR STRUCTURAL CHROMOSOMAL ABNORMALITIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 155 REST OF ASIA PACIFIC: PREIMPLANTATION GENETIC TESTING MARKET, BY TYPE OF CYCLE, 2021-2028 (USD MILLION)

- TABLE 156 REST OF ASIA PACIFIC: PREIMPLANTATION GENETIC TESTING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 12.5 REST OF THE WORLD

- 12.5.1 LATIN AMERICA: RECESSION IMPACT

- 12.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 157 REST OF THE WORLD: PREIMPLANTATION GENETIC TESTING MARKET, BY PROCEDURE TYPE, 2021-2028 (USD MILLION)

- TABLE 158 REST OF THE WORLD: PREIMPLANTATION GENETIC TESTING MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 159 REST OF THE WORLD: PREIMPLANTATION GENETIC TESTING MARKET, BY PRODUCT AND SERVICE, 2021-2028 (USD MILLION)

- TABLE 160 REST OF THE WORLD: PREIMPLANTATION GENETIC TESTING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 161 REST OF THE WORLD: PREIMPLANTATION GENETIC TESTING MARKET FOR STRUCTURAL CHROMOSOMAL ABNORMALITIES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 162 REST OF THE WORLD: PREIMPLANTATION GENETIC TESTING MARKET, BY TYPE OF CYCLE, 2021-2028 (USD MILLION)

- TABLE 163 REST OF THE WORLD: PREIMPLANTATION GENETIC TESTING MARKET, BY END USER, 2021-2028 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- TABLE 164 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN PREIMPLANTATION GENETIC TESTING MARKET

- 13.3 REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 33 REVENUE ANALYSIS OF KEY PLAYERS IN PREIMPLANTATION GENETIC TESTING MARKET

- 13.4 MARKET SHARE ANALYSIS

- TABLE 165 DEGREE OF COMPETITION: PREIMPLANTATION GENETIC TESTING MARKET

- 13.5 COMPANY EVALUATION MATRIX OF KEY PLAYERS

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- FIGURE 34 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

- 13.6 COMPANY EVALUATION MATRIX FOR START-UPS/SMES

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 STARTING BLOCKS

- 13.6.3 RESPONSIVE COMPANIES

- 13.6.4 DYNAMIC COMPANIES

- FIGURE 35 COMPANY EVALUATION MATRIX FOR START-UPS/SMES

- 13.7 COMPANY FOOTPRINT ANALYSIS

- TABLE 166 OVERALL FOOTPRINT

- TABLE 167 PRODUCT FOOTPRINT

- TABLE 168 REGIONAL FOOTPRINT

- 13.8 COMPETITIVE BENCHMARKING

- TABLE 169 DETAILED LIST OF KEY START-UPS/SMES IN PREIMPLANTATION GENETIC TESTING MARKET

- 13.9 COMPETITIVE SCENARIOS AND TRENDS

- 13.9.1 KEY PRODUCT LAUNCHES AND APPROVALS

- TABLE 170 KEY PRODUCT LAUNCHES AND APPROVALS, 2020-2023

- 13.9.2 KEY DEALS

- TABLE 171 KEY DEALS, 2020-2023

- 13.9.3 OTHER KEY DEVELOPMENTS

- TABLE 172 OTHER KEY DEVELOPMENTS, 2020-2023

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 14.1.1 ILLUMINA, INC.

- TABLE 173 ILLUMINA, INC.: COMPANY OVERVIEW

- FIGURE 36 ILLUMINA, INC.: COMPANY SNAPSHOT (2022)

- 14.1.2 THERMO FISHER SCIENTIFIC INC.

- TABLE 174 THERMO FISHER SCIENTIFIC INC.: COMPANY OVERVIEW

- FIGURE 37 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2022)

- 14.1.3 AGILENT TECHNOLOGIES, INC.

- TABLE 175 AGILENT TECHNOLOGIES, INC.: COMPANY OVERVIEW

- FIGURE 38 AGILENT TECHNOLOGIES, INC.: COMPANY SNAPSHOT (2022)

- 14.1.4 REVVITY

- TABLE 176 REVVITY: COMPANY OVERVIEW

- FIGURE 39 REVVITY: COMPANY SNAPSHOT (2022)

- 14.1.5 THE COOPER COMPANIES, INC.

- TABLE 177 THE COOPER COMPANIES, INC.: COMPANY OVERVIEW

- FIGURE 40 THE COOPER COMPANIES INC.: COMPANY SNAPSHOT (2022)

- 14.1.6 ABBOTT

- TABLE 178 ABBOTT: COMPANY OVERVIEW

- FIGURE 41 ABBOTT: COMPANY SNAPSHOT (2022)

- 14.1.7 TAKARA BIO INC.

- TABLE 179 TAKARA BIO INC.: COMPANY OVERVIEW

- FIGURE 42 TAKARA BIO INC.: COMPANY SNAPSHOT (2022)

- 14.1.8 QIAGEN

- TABLE 180 QIAGEN.: COMPANY OVERVIEW

- FIGURE 43 QIAGEN: COMPANY SNAPSHOT (2022)

- 14.1.9 VITROLIFE

- TABLE 181 VITROLIFE.: COMPANY OVERVIEW

- FIGURE 44 VITROLIFE: COMPANY SNAPSHOT (2022)

- 14.1.10 OXFORD NANOPORE TECHNOLOGIES PLC

- TABLE 182 OXFORD NANOPORE TECHNOLOGIES: COMPANY OVERVIEW

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 14.2 OTHER PLAYERS

- 14.2.1 OXFORD GENE TECHNOLOGY IP LIMITED

- 14.2.2 YIKON GENOMICS

- 14.2.3 SHIVA SCIENTIFIC COMPANY

- 14.2.4 NANJING SUPERYEARS GENE TECHNOLOGY CO., LTD.

- 14.2.5 MEDICOVER GENETICS

- 14.2.6 MEDGENOME

- 14.2.7 FULGENT GENETICS

- 14.2.8 INVICTA GENETICS

- 14.2.9 GENEA LIMITED

- 14.2.10 SCIEGENE CORPORATION

- 14.2.11 BIOARRAY S.L.

- 14.2.12 UNIMED BIOTECH (SHANGHAI) CO., LTD.

- 14.2.13 GENEMIND BIOSCIENCES CO., LTD.

- 14.2.14 BERRY GENOMICS

- 14.2.15 BANGKOK GENOMICS INNOVATION

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS