|

|

市場調査レポート

商品コード

1364761

自動車用フィルムの世界市場 (~2028年):フィルムタイプ・用途・車両タイプ・地域別Automotive Films Market by Films Type (Automotive Wrap Films, Automotive Window Films, Paint Protection Films), Application (Interior, Exterior), Vehicle Type (Passenger Vehicles, Commercial Vehicles), and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 自動車用フィルムの世界市場 (~2028年):フィルムタイプ・用途・車両タイプ・地域別 |

|

出版日: 2023年10月09日

発行: MarketsandMarkets

ページ情報: 英文 217 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の自動車用フィルムの市場規模は、2023年の74億米ドルから、予測期間中は5.7%のCAGRで推移し、2028年には97億米ドルの規模に成長すると予測されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 平方フィート・米ドル |

| セグメント | フィルムタイプ・用途・車両タイプ・地域 |

| 対象地域 | アジア太平洋・北米・欧州・中東&アフリカ・南米 |

フィルムタイプ別では、塗装保護フィルムの部門が予測期間中、金額ベースで最速の成長を示す見通しです。塗装保護フィルムは、メンテナンスが簡単で、洗車の必要もなくきれいにすることができます。車の塗装の光沢と仕上がりを向上させ、より新しく、より鮮やかに見せます。また、同フィルムには自己修復機能があり、熱や日光にさらされると、小さな傷やスワールマークを修復します。

車両タイプ別では、乗用車の部門が予測期間中、金額ベースで最大の市場となる見込みです。乗用車では、自動車用フィルムは、ボンネット、サイドミラー、ロッカーパネル、フロントバンパー、ドアハンドルキャビティ、リアフェンダーパネル、ドアエッジなどの傷つきやすい部分に施工され、傷や汚れ、車両の外観を損なう要素から車両を保護します。

地域別では、北米が金額ベースで2022年に最大の規模を示しています。同地域の生活水準の向上が自動車用フィルムの需要を牽引しています。乗用車と商用車の需要の増加、多様な気候条件、安全への懸念、規制要因、消費者の嗜好、先端技術、産業インフラなどが同地域の自動車用フィルム市場を牽引しています。

当レポートでは、世界の自動車用フィルムの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許動向、ケーススタディ、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- ポーターのファイブフォース分析

- 特許分析

- エコシステム

- 技術分析

- 関税と規制状況

- 貿易分析

- マクロ経済指標

- 顧客の事業に影響を与える動向とディスラプション

- 主要な会議とイベント

- 購入決定に影響を与える主な要因

- ケーススタディ分析

- 平均販売価格分析

第6章 自動車用フィルム市場:フィルムタイプ別

- 自動車ラップフィルム

- 自動車ウィンドウフィルム

- 染色フィルム

- 金属化フィルム

- ハイブリッドフィルム

- セラミックフィルム

- 塗装保護フィルム

第7章 自動車用フィルム市場:車両タイプ別

- 乗用車

- 商用車

第8章 自動車用フィルム市場:用途別

- 内装

- 自動車用ダイヤル

- コントロールパネル

- その他

- 外装

- ドア

- フード

- ルーフパネル

- その他

第9章 自動車用フィルム市場:地域別

- アジア太平洋

- 欧州

- 北米

- 南米

- 中東・アフリカ

第10章 競合情勢

- 概要

- 主要企業の採用戦略

- 収益分析

- 主要企業ランキング

- 市場評価マトリックス

- 市場シェア分析

- 企業評価マトリックス(Tier 1)

- スタートアップと中小企業の評価マトリックス

- 競合ベンチマーキング

- 競合情勢・動向

第11章 企業プロファイル

- 主要企業

- 3M

- SAINT-GOBAIN

- EASTMAN CHEMICAL COMPANY

- AVERY DENNISON

- LINTEC CORPORATION

- ERGIS S.A.

- HEXIS S.A.

- JOHNSON WINDOW FILMS

- NEXFIL CO., LTD.

- TORAY INDUSTRIES, INC.

- XPEL, INC.

- その他の企業

- ADS WINDOW FILMS LTD.

- ALL PRO WINDOW FILMS, INC.

- ARLON GRAPHICS LLC

- FILMTACK PTE. LTD.

- FOLIATEC BOHM GMBH & CO. VERTRIEBS-KG

- GARWARE POLYESTER LTD.

- GEOSHIELD

- KAY PREMIUM MARKING FILMS

- MAXPRO WINDOW FILMS

- PRESTIGE FILM TECHNOLOGIES

- PROFILM

- RENOLIT GROUP

- SSA EUROPE GES.M.B.H.

- ZEO FILMS

第12章 付録

The Automotive films market is projected to reach USD 9.7 billion by 2028, at a CAGR of 5.7% from USD 7.4 billion in 2023. The combination of growing market trends, increasing application, consumer demand from emerging economies, and advancements in automotive films technology are driving the adoption and use of automotive films.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | Square foot; Value (USD Million) |

| Segments | Films Type, Application, Vehicle Type, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"Paint protection films accounted for the fastest growth during the forecast period, in terms of value."

Paint protection films are a type of exterior automotive film designed to protect a vehicle's paint from various forms of damage, including stone chips, scratches, tree sap, bird droppings, and UV rays. These films are easy to maintain and clean without the need for washing. It enhances the gloss and finish of a vehicle's paint, making it look newer and more vibrant. Paint protection films have self-healing properties to repair minor scratches and swirl marks when exposed to heat or sunlight.

"Based on vehicle type, passenger vehicles are expected to be the largest market during the forecast period, in terms of value."

The passenger vehicles segment is the largest vehicle type to lead the market during the forecast period. In passenger vehicles, automotive films are installed on vulnerable areas such as hoods, side mirrors, rocker panels, front bumpers, door handle cavities, rear fender panels, and door edges to protect the vehicle from scratches, stains, and elements that may damage the appearance of vehicles.

"Based on region, North America is the largest market for automotive films in 2022, in terms of value."

Based on region, North America is a key market to produce automotive films. The rising standard of living in the region is driving the demand for automotive films. The increasing demand for passenger and commercial vehicles, diverse climatic conditions, safety concerns, regulatory factors, consumer preferences, advanced technology, and industry infrastructure are some of the factors that will drive the automotive films market in this region.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: C-Level - 35%, Director Level - 25%, and Others - 40%

- By Region: North America - 30%, Europe - 20%, Asia Pacific - 40%, Middle East & Africa-5%, and Latin America-5%

The key players in this market are 3M (US), Saint-Gobain (France), Eastman Chemical Company (US), Avery Dennison (US), LINTEC Corporation (Japan), Ergis S.A. (Poland), Toray industries, Inc. (Japan), Johnson Window Films (US), Hexis S.A. (France), XPEL, Inc. (US), and Nexfil Co., Ltd. (South Korea).

Research Coverage

This report segments the automotive films market based on films type, application, vehicle type, and region, and provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products and services, key strategies, new product launches, expansions, and mergers and acquisitions associated with the automotive films market.

Key benefits of buying this report

This research report focuses on various levels of analysis, including industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the automotive films market, high-growth regions, and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (technological advancements, expanding application of automotive films, increasing market trends), restraints (environmental concerns & regulations, health & safety concerns, limited application range), opportunities (growing demand from emerging economies, demand in high performance automotive films, increasing demand from automotive industry) and challenges (competing substitute materials, economic uncertainty).

- Market Penetration: Comprehensive information on the automotive films market offered by top players in the global automotive films market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the automotive films market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for automotive films market across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global automotive films market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the automotive films market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- TABLE 1 AUTOMOTIVE FILMS MARKET: INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- 1.4.1 MARKETS COVERED

- FIGURE 1 AUTOMOTIVE FILMS MARKET SEGMENTATION

- 1.4.2 REGIONS COVERED

- 1.4.3 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 RECESSION IMPACT

- 1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 AUTOMOTIVE FILMS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Primary interviews - demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 3 AUTOMOTIVE FILMS MARKET: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 4 AUTOMOTIVE FILMS MARKET: TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: AUTOMOTIVE FILMS MARKET

- 2.3 FORECAST NUMBER CALCULATION

- FIGURE 6 DEMAND-SIDE FORECAST PROJECTIONS

- 2.4 DATA TRIANGULATION

- FIGURE 7 AUTOMOTIVE FILMS MARKET: DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS AND MARKET RISKS

- 2.8 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 8 PAINT PROTECTION FILMS TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 9 EXTERIOR APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 PASSENGER VEHICLES TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 EMERGING ECONOMIES TO WITNESS HIGH GROWTH IN AUTOMOTIVE FILMS MARKET

- FIGURE 12 NORTH AMERICA TO OFFER ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE FILMS MARKET DURING FORECAST PERIOD

- 4.2 AUTOMOTIVE FILMS MARKET, BY FILM TYPE

- FIGURE 13 PAINT PROTECTION FILMS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 AUTOMOTIVE FILMS MARKET, BY APPLICATION

- FIGURE 14 EXTERIOR APPLICATION TO LEAD MARKET BY 2028

- 4.4 AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE

- FIGURE 15 PASSENGER VEHICLES TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 AUTOMOTIVE FILMS MARKET, BY REGION

- FIGURE 16 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN AUTOMOTIVE FILMS MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN AUTOMOTIVE FILMS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for heat reduction and UV protection in automotive sector

- 5.2.1.2 Technological advancements in automotive films

- 5.2.1.3 Enhanced safety and security

- 5.2.1.4 Growing automotive sector in Asia Pacific

- TABLE 2 ASIA PACIFIC, VEHICLE PRODUCTION STATISTICS, BY COUNTRY, 2021-2022 (UNIT)

- 5.2.2 RESTRAINTS

- 5.2.2.1 Installation complexity of automotive films

- 5.2.2.2 High installation cost of premium automotive films

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing demand for automotive wrap films for advertising

- 5.2.3.2 Growing demand for customized films

- 5.2.4 CHALLENGES

- 5.2.4.1 Government regulations on automotive films

- TABLE 3 MAJOR COUNTRIES WITH TINT LAW REGULATIONS

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 18 OVERVIEW OF AUTOMOTIVE FILMS MARKET VALUE CHAIN

- 5.3.1 RAW MATERIAL SUPPLIERS

- 5.3.2 MANUFACTURERS

- 5.3.3 DISTRIBUTORS

- 5.3.4 END USERS

- TABLE 4 AUTOMOTIVE FILMS MARKET: VALUE CHAIN OF STAKEHOLDERS

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 AUTOMOTIVE FILMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT OF NEW ENTRANTS

- 5.4.2 THREAT OF SUBSTITUTES

- 5.4.3 BARGAINING POWER OF BUYERS

- 5.4.4 BARGAINING POWER OF SUPPLIERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 5 AUTOMOTIVE FILMS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.5 PATENT ANALYSIS

- 5.5.1 INTRODUCTION

- 5.5.2 DOCUMENT TYPES

- FIGURE 20 PATENTS REGISTERED (2012-2022)

- 5.5.3 PUBLICATION TRENDS IN LAST 10 YEARS

- FIGURE 21 NUMBER OF PATENTS IN LAST 10 YEARS

- 5.5.4 INSIGHTS

- 5.5.5 JURISDICTION ANALYSIS

- FIGURE 22 TOP JURISDICTIONS

- 5.5.6 TOP APPLICANTS

- FIGURE 23 TOP APPLICANTS' ANALYSIS

- TABLE 6 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 5.6 ECOSYSTEM

- FIGURE 24 AUTOMOTIVE FILMS MARKET ECOSYSTEM

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 NEW TECHNOLOGIES: AUTOMOTIVE FILMS

- 5.8 TARIFF AND REGULATORY LANDSCAPE

- 5.8.1 REGULATIONS

- 5.8.2 NORTH AMERICA

- TABLE 7 TINT LAWS IN CANADA

- 5.8.3 ASIA PACIFIC

- 5.8.4 EUROPE

- 5.8.5 MIDDLE EAST & AFRICA

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT TRADE ANALYSIS

- TABLE 8 COUNTRY-WISE IMPORT TRADE DATA FOR AUTOMOTIVE FILMS (USD THOUSAND)

- 5.9.2 EXPORT TRADE ANALYSIS

- TABLE 9 COUNTRY-WISE EXPORT TRADE DATA FOR AUTOMOTIVE FILMS (USD THOUSAND)

- 5.10 MACROECONOMIC INDICATORS

- 5.10.1 TRENDS IN AUTOMOTIVE INDUSTRY

- TABLE 10 VEHICLE PRODUCTION STATISTICS, BY COUNTRY, 2021-2022 (UNIT)

- 5.11 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 REVENUE SHIFT AND NEW REVENUE POCKETS IN AUTOMOTIVE FILMS MARKET

- 5.12 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 11 AUTOMOTIVE FILMS MARKET: KEY CONFERENCES AND EVENTS, 2023-2024

- 5.13 KEY FACTORS AFFECTING BUYING DECISIONS

- 5.13.1 QUALITY

- 5.13.2 SERVICE

- FIGURE 26 SUPPLIER SELECTION CRITERION

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 3M'S GRAPHIC FILMS FOR FLEET ADVERTISING PROGRAM IN AUTOMOTIVE INDUSTRY

- 5.14.2 HEXIS S.A. PROVIDES SELF-ADHESIVE FILM SOLUTIONS FOR AUTOMOTIVE INDUSTRY

- 5.15 AVERAGE SELLING PRICE ANALYSIS

- 5.15.1 AVERAGE SELLING PRICE BASED ON REGION

- FIGURE 27 AVERAGE SELLING PRICE, BY REGION (USD/SQUARE FOOT)

- 5.15.2 AVERAGE SELLING PRICE BASED ON FILM TYPE

- TABLE 12 AVERAGE SELLING PRICE BASED ON APPLICATION (USD/SQUARE FOOT)

- 5.15.3 AVERAGE SELLING PRICE TREND, BY KEY PLAYERS

- FIGURE 28 AVERAGE SELLING PRICE TREND, BY KEY PLAYERS (USD/SQUARE FOOT)

6 AUTOMOTIVE FILMS MARKET, BY FILM TYPE

- 6.1 INTRODUCTION

- FIGURE 29 PAINT PROTECTION FILMS TO BE FASTEST-GROWING TYPE DURING FORECAST PERIOD

- TABLE 13 AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 14 AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 15 AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019-2022 (USD MILLION)

- TABLE 16 AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023-2028 (USD MILLION)

- 6.2 AUTOMOTIVE WRAP FILMS

- 6.2.1 ADVERTISEMENT APPLICATION IN COMMERCIAL VEHICLES TO DRIVE MARKET

- 6.3 AUTOMOTIVE WINDOW FILMS

- 6.3.1 PROTECTION FROM UV RAYS AND PASSENGER PRIVACY TO DRIVE DEMAND

- 6.3.2 DYED FILMS

- 6.3.3 METALIZED FILMS

- 6.3.4 HYBRID FILMS

- 6.3.5 CERAMIC FILMS

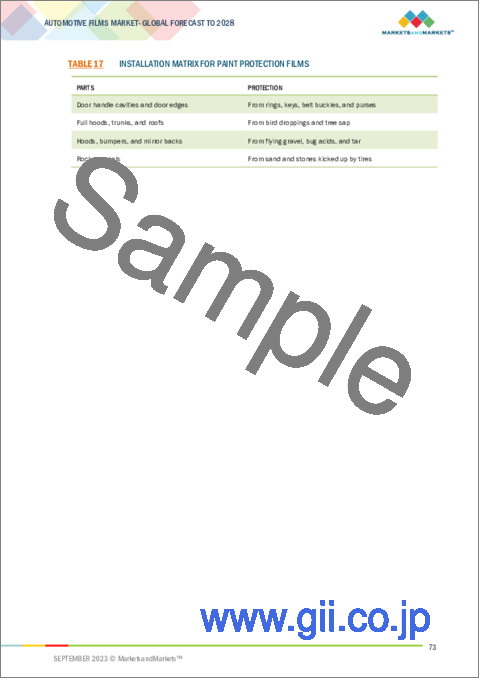

- 6.4 PAINT PROTECTION FILMS

- 6.4.1 EXTERNAL PROTECTION TO VULNERABLE VEHICLE AREAS TO DRIVE DEMAND

- TABLE 17 INSTALLATION MATRIX FOR PAINT PROTECTION FILMS

7 AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE

- 7.1 INTRODUCTION

- FIGURE 30 PASSENGER VEHICLES TO BE LARGEST VEHICLE TYPE DURING FORECAST PERIOD

- TABLE 18 AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 19 AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 20 AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 21 AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 7.2 PASSENGER VEHICLES

- 7.3 COMMERCIAL VEHICLES

8 AUTOMOTIVE FILMS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 31 EXTERIOR APPLICATION TO GROW FASTER DURING FORECAST PERIOD

- TABLE 22 AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE FEET)

- TABLE 23 AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE FEET)

- TABLE 24 AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 25 AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.2 INTERIOR

- 8.2.1 AUTOMOTIVE DIALS

- 8.2.2 CONTROL PANELS

- 8.2.3 OTHERS

- 8.3 EXTERIOR

- 8.3.1 DOORS

- 8.3.2 HOODS

- 8.3.3 ROOF PANELS

- 8.3.4 OTHERS

9 AUTOMOTIVE FILMS MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 32 MEXICO TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- TABLE 26 AUTOMOTIVE FILMS MARKET, BY REGION, 2019-2022 (MILLION SQUARE FEET)

- TABLE 27 AUTOMOTIVE FILMS MARKET, BY REGION, 2023-2028 (MILLION SQUARE FEET)

- TABLE 28 AUTOMOTIVE FILMS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 29 AUTOMOTIVE FILMS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2 ASIA PACIFIC

- FIGURE 33 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET SNAPSHOT

- TABLE 30 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2019-2022 (MILLION SQUARE FEET)

- TABLE 31 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2023-2028 (MILLION SQUARE FEET)

- TABLE 32 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 33 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 34 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 35 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 36 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019-2022 (USD MILLION)

- TABLE 37 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023-2028 (USD MILLION)

- TABLE 38 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE FEET)

- TABLE 39 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE FEET)

- TABLE 40 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 41 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 42 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 43 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 44 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 45 ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.2.1 RECESSION IMPACT ON ASIA PACIFIC

- 9.2.2 CHINA

- 9.2.2.1 Strong automotive industry to drive market

- TABLE 46 CHINA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 47 CHINA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 48 CHINA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 49 CHINA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.2.3 JAPAN

- 9.2.3.1 Large automotive industry to drive market

- TABLE 50 JAPAN: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 51 JAPAN: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 52 JAPAN: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 53 JAPAN: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.2.4 INDIA

- 9.2.4.1 Government initiatives and strong outlook to drive market

- TABLE 54 INDIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 55 INDIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 56 INDIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 57 INDIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.2.5 SOUTH KOREA

- 9.2.5.1 Heavy investments in automotive industry to drive market

- TABLE 58 SOUTH KOREA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 59 SOUTH KOREA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 60 SOUTH KOREA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 61 SOUTH KOREA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.2.6 AUSTRALIA

- 9.2.6.1 Strong emphasis on trade partnerships with other countries to drive market

- TABLE 62 AUSTRALIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 63 AUSTRALIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 64 AUSTRALIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 65 AUSTRALIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.2.7 INDONESIA

- 9.2.7.1 Rising foreign investments to drive market

- TABLE 66 INDONESIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 67 INDONESIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 68 INDONESIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 69 INDONESIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.2.8 REST OF ASIA PACIFIC

- TABLE 70 REST OF ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 71 REST OF ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 72 REST OF ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 73 REST OF ASIA PACIFIC: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.3 EUROPE

- FIGURE 34 EUROPE: AUTOMOTIVE FILMS MARKET SNAPSHOT

- TABLE 74 EUROPE: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2019-2022 (MILLION SQUARE FEET)

- TABLE 75 EUROPE: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2023-2028 (MILLION SQUARE FEET)

- TABLE 76 EUROPE: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 77 EUROPE: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 78 EUROPE: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 79 EUROPE: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 80 EUROPE: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019-2022 (USD MILLION)

- TABLE 81 EUROPE: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023-2028 (USD MILLION)

- TABLE 82 EUROPE: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE FEET)

- TABLE 83 EUROPE: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE FEET)

- TABLE 84 EUROPE: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 85 EUROPE: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 86 EUROPE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 87 EUROPE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 88 EUROPE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 89 EUROPE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.3.1 RECESSION IMPACT ON EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Large automotive sector to drive market

- TABLE 90 GERMANY: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 91 GERMANY: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 92 GERMANY: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 93 GERMANY: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Strong government support to drive market

- TABLE 94 UK: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 95 UK: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 96 UK: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 97 UK: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.3.4 FRANCE

- 9.3.4.1 Established automotive sector to drive market growth

- TABLE 98 FRANCE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 99 FRANCE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 100 FRANCE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 101 FRANCE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.3.5 ITALY

- 9.3.5.1 Strong economic growth to drive market

- TABLE 102 ITALY: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 103 ITALY: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 104 ITALY: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 105 ITALY: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.3.6 SPAIN

- 9.3.6.1 Increased investments and economic growth to drive market

- TABLE 106 SPAIN: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 107 SPAIN: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 108 SPAIN: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 109 SPAIN: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.3.7 REST OF EUROPE

- TABLE 110 REST OF EUROPE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 111 REST OF EUROPE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 112 REST OF EUROPE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 113 REST OF EUROPE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.4 NORTH AMERICA

- FIGURE 35 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 114 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2019-2022 (MILLION SQUARE FEET)

- TABLE 115 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2023-2028 (MILLION SQUARE FEET)

- TABLE 116 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 117 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 118 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 119 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 120 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019-2022 (USD MILLION)

- TABLE 121 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023-2028 (USD MILLION)

- TABLE 122 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE FEET)

- TABLE 123 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE FEET)

- TABLE 124 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 125 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 126 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 127 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 128 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 129 NORTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.4.1 RECESSION IMPACT ON NORTH AMERICA

- 9.4.2 US

- 9.4.2.1 Presence of major manufacturers to increase demand

- TABLE 130 US: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 131 US: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 132 US: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 133 US: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.4.3 CANADA

- 9.4.3.1 Harsh weather conditions to drive market

- TABLE 134 CANADA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 135 CANADA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 136 CANADA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 137 CANADA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.4.4 MEXICO

- 9.4.4.1 Developing manufacturing hub to drive demand

- TABLE 138 MEXICO: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 139 MEXICO: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 140 MEXICO: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 141 MEXICO: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.5 SOUTH AMERICA

- TABLE 142 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2019-2022 (MILLION SQUARE FEET)

- TABLE 143 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2023-2028 (MILLION SQUARE FEET)

- TABLE 144 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 145 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 146 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 147 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 148 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019-2022 (USD MILLION)

- TABLE 149 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023-2028 (USD MILLION)

- TABLE 150 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE FEET)

- TABLE 151 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE FEET)

- TABLE 152 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 153 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 154 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 155 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 156 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 157 SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.5.1 RECESSION IMPACT

- 9.5.2 BRAZIL

- 9.5.2.1 Growing automotive sector to drive market

- TABLE 158 BRAZIL: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 159 BRAZIL: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 160 BRAZIL: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 161 BRAZIL: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.5.3 ARGENTINA

- 9.5.3.1 Rising automotive investment to drive market

- TABLE 162 ARGENTINA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 163 ARGENTINA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 164 ARGENTINA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 165 ARGENTINA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.5.4 REST OF SOUTH AMERICA

- TABLE 166 REST OF SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 167 REST OF SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 168 REST OF SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 169 REST OF SOUTH AMERICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.6 MIDDLE EAST & AFRICA

- TABLE 170 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2019-2022 (MILLION SQUARE FEET)

- TABLE 171 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2023-2028 (MILLION SQUARE FEET)

- TABLE 172 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 175 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023-2023 (MILLION SQUARE FEET)

- TABLE 176 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2019-2022 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY FILM TYPE, 2023-2028 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019-2022 (MILLION SQUARE FEET)

- TABLE 179 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023-2028 (MILLION SQUARE FEET)

- TABLE 180 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 183 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 184 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 185 MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.6.1 RECESSION IMPACT

- 9.6.2 SAUDI ARABIA

- 9.6.2.1 Government support to drive market

- TABLE 186 SAUDI ARABIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 187 SAUDI ARABIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 188 SAUDI ARABIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 189 SAUDI ARABIA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.6.3 UAE

- 9.6.3.1 Strong growth and government investments to boost market

- TABLE 190 UAE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 191 UAE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 192 UAE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 193 UAE: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.6.4 SOUTH AFRICA

- 9.6.4.1 Government initiatives to significantly drive market

- TABLE 194 SOUTH AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 195 SOUTH AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 196 SOUTH AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 197 SOUTH AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

- 9.6.5 REST OF MIDDLE EAST & AFRICA

- TABLE 198 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (MILLION SQUARE FEET)

- TABLE 199 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (MILLION SQUARE FEET)

- TABLE 200 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2019-2022 (USD MILLION)

- TABLE 201 REST OF MIDDLE EAST & AFRICA: AUTOMOTIVE FILMS MARKET, BY VEHICLE TYPE, 2023-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 202 COMPANIES ADOPTED ACQUISITION AS KEY GROWTH STRATEGY BETWEEN 2018 AND 2022

- 10.3 REVENUE ANALYSIS

- TABLE 203 REVENUE ANALYSIS OF KEY COMPANIES (2020 - 2022)

- 10.4 RANKING OF KEY PLAYERS

- FIGURE 36 RANKING OF TOP 5 PLAYERS IN AUTOMOTIVE FILMS MARKET

- 10.5 MARKET EVALUATION MATRIX

- TABLE 204 MARKET EVALUATION MATRIX

- 10.6 MARKET SHARE ANALYSIS

- FIGURE 37 AUTOMOTIVE FILMS MARKET SHARE, BY COMPANY (2022)

- TABLE 205 AUTOMOTIVE FILMS MARKET: DEGREE OF COMPETITION

- 10.7 COMPANY EVALUATION MATRIX (TIER 1)

- 10.7.1 STARS

- 10.7.2 PERVASIVE PLAYERS

- 10.7.3 EMERGING LEADERS

- 10.7.4 PARTICIPANTS

- FIGURE 38 AUTOMOTIVE FILMS MARKET: COMPANY EVALUATION MATRIX FOR TIER 1 COMPANIES, 2023

- 10.8 STARTUPS AND SMES EVALUATION MATRIX

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 STARTING BLOCKS

- 10.8.4 DYNAMIC COMPANIES

- FIGURE 39 AUTOMOTIVE FILMS MARKET: STARTUPS AND SMES EVALUATION MATRIX, 2023

- 10.9 COMPETITIVE BENCHMARKING

- TABLE 206 DETAILED LIST OF COMPANIES

- TABLE 207 AUTOMOTIVE FILMS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY TYPE

- TABLE 208 AUTOMOTIVE FILMS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY VEHICLE TYPE

- TABLE 209 AUTOMOTIVE FILMS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY REGION

- 10.10 COMPETITIVE SITUATION AND TRENDS

- 10.10.1 PRODUCT LAUNCHES/DEVELOPMENT

- TABLE 210 AUTOMOTIVE FILMS: PRODUCT LAUNCHES/DEVELOPMENT, 2018- 2022

- 10.10.2 DEALS

- TABLE 211 AUTOMOTIVE FILMS: DEALS, 2018-2022

- 10.10.3 OTHERS

- TABLE 212 AUTOMOTIVE FILMS: OTHERS, 2018-2022

11 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 11.1 KEY PLAYERS

- 11.1.1 3M

- TABLE 213 3M: COMPANY OVERVIEW

- FIGURE 40 3M: COMPANY SNAPSHOT

- TABLE 214 3M: PRODUCT OFFERINGS

- TABLE 215 3M: DEALS

- TABLE 216 3M: OTHER DEVELOPMENTS

- 11.1.2 SAINT-GOBAIN

- TABLE 217 SAINT-GOBAIN: COMPANY OVERVIEW

- FIGURE 41 SAINT-GOBAIN: COMPANY SNAPSHOT

- TABLE 218 SAINT-GOBAIN: PRODUCT OFFERINGS

- TABLE 219 SAINT GOBAIN: DEALS

- 11.1.3 EASTMAN CHEMICAL COMPANY

- TABLE 220 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- FIGURE 42 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

- TABLE 221 EASTMAN CHEMICAL COMPANY: PRODUCT OFFERINGS

- TABLE 222 EASTMAN CHEMICAL COMPANY: DEALS

- TABLE 223 EASTMAN CHEMICAL COMPANY: OTHER DEVELOPMENTS

- 11.1.4 AVERY DENNISON

- TABLE 224 AVERY DENNISON: COMPANY OVERVIEW

- FIGURE 43 AVERY DENNISON: COMPANY SNAPSHOT

- TABLE 225 AVERY DENNISON: PRODUCT OFFERINGS

- TABLE 226 AVERY DENNISON: PRODUCT LAUNCHES

- 11.1.5 LINTEC CORPORATION

- TABLE 227 LINTEC CORPORATION: COMPANY OVERVIEW

- FIGURE 44 LINTEC CORPORATION: COMPANY SNAPSHOT

- TABLE 228 LINTEC CORPORATION: PRODUCT OFFERINGS

- TABLE 229 LINTEC CORPORATION: DEALS

- 11.1.6 ERGIS S.A.

- TABLE 230 ERGIS S.A.: COMPANY OVERVIEW

- TABLE 231 ERGIS S.A.: PRODUCT OFFERINGS

- TABLE 232 ERGIS S.A.: DEALS

- 11.1.7 HEXIS S.A.

- TABLE 233 HEXIS S.A.: COMPANY OVERVIEW

- TABLE 234 HEXIS S.A.: PRODUCT OFFERINGS

- TABLE 235 HEXIS S.A.: OTHER DEVELOPMENTS

- 11.1.8 JOHNSON WINDOW FILMS

- TABLE 236 JOHNSON WINDOW FILMS: COMPANY OVERVIEW

- TABLE 237 JOHNSON WINDOW FILMS: PRODUCT OFFERINGS

- 11.1.9 NEXFIL CO., LTD.

- TABLE 238 NEXFIL CO., LTD.: COMPANY OVERVIEW

- TABLE 239 NEXFIL CO., LTD.: PRODUCT OFFERINGS

- 11.1.10 TORAY INDUSTRIES, INC.

- TABLE 240 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 45 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 241 TORAY INDUSTRIES, INC.: PRODUCT OFFERINGS

- TABLE 242 TORAY INDUSTRIES, INC.: DEALS

- TABLE 243 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 244 TORAY INDUSTRIES, INC.: OTHER DEVELOPMENTS

- 11.1.11 XPEL, INC.

- TABLE 245 XPEL, INC.: COMPANY OVERVIEW

- FIGURE 46 XPEL, INC.: COMPANY SNAPSHOT

- TABLE 246 XPEL, INC.: PRODUCT OFFERINGS

- TABLE 247 XPEL, INC.: DEALS

- TABLE 248 XPEL, INC.: PRODUCT LAUNCHES

- 11.2 OTHER PLAYERS

- 11.2.1 ADS WINDOW FILMS LTD.

- 11.2.2 ALL PRO WINDOW FILMS, INC.

- 11.2.3 ARLON GRAPHICS LLC

- 11.2.4 FILMTACK PTE. LTD.

- 11.2.5 FOLIATEC BOHM GMBH & CO. VERTRIEBS-KG

- 11.2.6 GARWARE POLYESTER LTD.

- 11.2.7 GEOSHIELD

- 11.2.8 KAY PREMIUM MARKING FILMS

- 11.2.9 MAXPRO WINDOW FILMS

- 11.2.10 PRESTIGE FILM TECHNOLOGIES

- 11.2.11 PROFILM

- 11.2.12 RENOLIT GROUP

- 11.2.13 SSA EUROPE GES.M.B.H.

- 11.2.14 ZEO FILMS

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS