|

|

市場調査レポート

商品コード

1359924

データセンタートランスフォーメーションの世界市場 (~2028年):サービスタイプ ・ティアタイプ・データセンタータイプ・データセンター規模・地域別Data Center Transformation Market by Service Type (Consolidation Services, Optimization Services, Automation Services, and Infrastructure Management Services), Tier Type, Data Center Type, Data Center Size and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| データセンタートランスフォーメーションの世界市場 (~2028年):サービスタイプ ・ティアタイプ・データセンタータイプ・データセンター規模・地域別 |

|

出版日: 2023年10月06日

発行: MarketsandMarkets

ページ情報: 英文 338 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

データセンタートランスフォーメーション市場の市場規模は、2023年の115億米ドルから、予測期間中は10.5%のCAGRで推移し、2028年には189億米ドルの規模に成長すると予測されています。

クラウドの採用とハイブリダイゼーションの増加が、データセンタートランスフォーメーション市場の成長を牽引しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2017-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 米ドル |

| 部門別 | サービスタイプ・ティアタイプ・データセンタータイプ・データセンター規模・産業別 |

| 対象地域 | 北米・欧州・アジア太平洋・ラテンアメリカ・中東&アフリカ |

ティアタイプ別では、ティア3の部門が予測期間中もっとも高いCAGRを維持する見通しです。ティア3データセンターは、大企業が広く利用する高度な機能を提供します。Uptime Instituteが言及しているように、ティア3データセンターは稼働率が高く、99.982%の可用性が保証され、ダウンタイムも年間わずか1.56時間と短いです。これらのデータセンターの特徴はN+1冗長レベルで、システム障害時に最低1台のバックアップ機器の可用性を保証します。また、ティア3データセンターは、少なくとも72時間の停電対策が可能です。

産業別では、ヘルスケア産業が予測期間中に最大のCAGRを示す見通しです。ヘルスケア業界では、バイオ医療データの生成が急激に増加しています。ヘルスケア業界では、このようなデータの増加をサポートし、システムのアップグレードに対応するために、データセンターインフラを拡張する必要があります。また、紙ベースの医療記録から電子カルテ(EHR)への移行に伴い、患者データを安全に保管・管理し、権限を与えられた医療従事者がアクセスできるようにするための堅牢なデータセンターインフラが必要とされています。さらに、遠隔医療や遠隔患者モニタリングソリューションの導入により、リアルタイムのビデオ診察とデータ収集・分析を促進し、患者によりアクセスしやすく効率的な医療サービスを提供するためのデータセンターが不可欠とされています。

当レポートでは、世界のデータセンタートランスフォーメーションの市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許動向、ケーススタディ、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要・産業動向

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- サプライチェーン分析

- エコシステム分析

- 技術分析

- 参考価格分析

- 特許分析

- ポーターのファイブフォース分析

- 規制状況

- クラウドプロバイダーによる採用傾向

- 購入者に影響を与える動向/混乱

- 主要なステークホルダーと購入基準

- ビジネスモデル分析

- 主要な会議とイベント

第6章 データセンタートランスフォーメーション市場:サービスタイプ別

- 統合サービス

- 市場促進要因

- ケーススタディ

- 移行

- 仮想化

- 保管・管理

- エネルギー効率

- 最適化サービス

- 市場促進要因

- ケーススタディ

- エネルギー効率の最適化

- 災害復旧と事業継続性の最適化

- スケーラビリティと柔軟性

- 自動化サービス

- 市場促進要因

- ケーススタディ

- 監視・警告

- 報告・文書化

- キャパシティプランニング

- インフラ管理サービス

- 市場促進要因

- ケーススタディ

- 資産運用管理

- キャパシティプランニング

- 電力監視

- 環境モニタリング

第7章 データセンタートランスフォーメーション市場:階層タイプ別

- ティア1

- ティア2

- ティア3

- ティア4

第8章 データセンタートランスフォーメーション市場:データセンタータイプ別

- クラウドデータセンター

- コロケーションデータセンター

- エンタープライズデータセンター

第9章 データセンタートランスフォーメーション市場:データセンター規模別

- 小規模

- 中規模

- 大規模

第10章 データセンタートランスフォーメーション市場:産業別

- IT・通信

- BFSI

- ヘルスケア

- 製造

- 政府・防衛

- 輸送

- 小売

- エネルギー・ユーティリティ

- その他

第11章 データセンタートランスフォーメーション市場:地域別

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第12章 競合情勢

- 概要

- 主要企業の採用した戦略/有力企業

- 収益分析

- 市場シェア分析

- 主要企業の市場ランキング

- ブランドの比較/ベンダー製品の情勢

- 主要参入企業のスナップショット

- 主要企業の企業評価マトリックス

- スタートアップ/中小企業の企業評価マトリクス

- ベンダーの評価と財務指標

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- IBM

- MICROSOFT

- DELL TECHNOLOGIES

- CISCO

- SCHNEIDER ELECTRIC

- NTT

- HCLTECH

- ACCENTURE

- ATOS

- WIPRO

- TCS

- その他の企業

- COGNIZANT

- HITACHI

- NETAPP

- MINDTECK

- BYTES TECHNOLOGY GROUP

- GENERAL DATATECH(GDT)

- INSIGHT ENTERPRISES

- INKNOWTECH

- TECH MAHINDRA

- NETSCOUT

- RAHI SYSTEMS

- BLUE MANTIS

- DYNTEK

- SOFTCHOICE

- SME/スタートアップ

- GREENFIELD SOFTWARE

- HYPERVIEW

- VAPOR IO

- FLEXISCALE

- LIQUIDSTACK

- RACKBANK DATACENTERS

第14章 隣接/関連市場

第15章 付録

The market size of the data center transformation market is projected to grow from USD 11.5 billion in 2023 to USD 18.9 billion by 2028 at a CAGR of 10.5% during the forecast period. The rise in cloud adoption and hybridization drives the growth of the data center transformation market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2017-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | (USD Billion/Million) |

| Segments | By Service Type, Tier Type, Data Center Type, Data Center Size, Verticals |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

"As per tier type, the tier 3 segment holds the highest CAGR during the forecast period."

The data center transformation market by tier type bifurcates into tier 1, tier 2, tier 3, and tier 4. During the forecast period, 2023-2028, the tier 3 segment holds the highest CAGR. Tier 3 data centers provide advanced functionalities that large companies widely utilize. As mentioned by Uptime Institute, tier 3 data centers have higher uptime, a guaranteed 99.982% availability, and experience a low downtime of only 1.56 hours per year. These data centers are characterized by the N+1 redundancy level, which guarantees the availability of a minimum of one backup equipment in case of system failure. Tier 3 data centers can also provide at least 72-hour power outage protection.

"As per vertical, the healthcare vertical holds the highest CAGR during the forecast period."

The verticals studied in the report are IT & telecom, BFSI, healthcare, manufacturing, government & defense, transportation, retail, energy & utilities, and other verticals (education and media & entertainment). During the forecast period, 2023-2028, the healthcare vertical segment holds the highest CAGR. The healthcare industry has witnessed an exponential increase in the generation of biomedical data. The healthcare industry needs to expand its data center infrastructure to support this increasing data and accommodate system upgrades. The shift from paper-based medical records to electronic health records (EHRs) requires robust data center infrastructure to securely store and manage patient data, ensuring accessibility to authorized healthcare providers. Adopting telemedicine and remote patient monitoring solutions relies on data centers to facilitate real-time video consultations, data collection, and analysis, offering patients more accessible and efficient healthcare services. Healthcare organizations increasingly leverage data analytics and big data for medical research, patient outcomes analysis, and population health management. Data center transformation is essential to support these data-intensive activities.

"As per region, Europe holds the second-largest market share during the forecast period."

The data center transformation market includes an analysis of five regions. Europe holds the second-largest market share in 2023 and will have similar dominance over the forecast period. Europe has diverse business needs, as several large retailers and manufacturing companies demand robust and scalable IT infrastructure solutions. The region has always been a challenging market for cloud providers due to the stringent regulations and security standards regarding user data privacy. In Europe, there is a growing demand for hyperscale data center facilities and data center colocation owing to the availability of green power and favorable climatic conditions. As per findings, the Netherlands has the most advanced hyperscale data center facilities and hosts online services of major cloud providers.

The breakup of the profiles of the primary respondents is below:

- By Company: Tier I: 30%, Tier II: 45%, and Tier III: 25%

- By Designation: C-Level Executives: 50%, Director Level: 35%, and Others: 15%

- By Region: North America: 50%, Asia Pacific: 15%, Europe: 30%, Rest of World: 5%

Note: Others include sales managers, marketing managers, and product managers

Note: The rest of the World consists of the Middle East & Africa, and Latin America

Note: Tier 1 companies have revenues of more than USD 100 million; tier 2 companies' revenue ranges from USD 10 million to USD 100 million; and tier 3 companies' revenue is less than 10 million

Source: Secondary Literature, Expert Interviews, and MarketsandMarkets Analysis

The key technology vendors in the market include Dell (US), Microsoft (US), IBM (US), Schneider Electric (France), Cisco (US), NTT (Japan), HCLTech (India), Accenture (Ireland), Cognizant (India), Google (US), Wipro (India), Atos (France), TCS (India), Hitachi (Japan), NetApp (US), Mindteck (India), Bytes Technology Group (UK), General Datatech (US), Insight Enterprises (US), Tech Mahindra (India), NETSCOUT (US), Dyntek (US), Softchoice (Canada), InKnowTech (India), Rahi Systems (US), Blue Mantis (UK), GreenField Software (India), Hyperview (Canada), FlexiScale (UK), LiquidStack (US), RackBank Datacenters (India), and Vapor IO (US). Most key players have adopted partnerships and product developments to cater to the demand for data center transformation.

Research coverage:

The market study covers the data center transformation market across segments. The study aims to estimate the market size and the growth potential of the data center transformation market across different market segments, including service type, tier type, data center type, data center size, verticals, and region analysis. It includes an in-depth competitive intelligence analysis of the key players in the market, company profiles, observations related to products, services, business offerings, recent developments, and key market strategies.

Reasons to buy this report:

The report provides insights on the following pointers:

- Analysis of key drivers (Leveraging digital transformation to drive data center evolution, Indispensable requirements to improve data center uptime and energy efficiency, Proliferation of data center colocation facilities globally, Rising necessity to tackle significant network congestion within data centers, Increasing cloud adoption and hybridization, Rapid data explosion drives the market growth), restraints (Data security and privacy concerns, Complexity related to transformation), opportunities (Rise in number of data center facilities, Data center consolidation and optimization to drive the demand for data center transformation services, Growing demand for AI and Automation)and challenges (Downtime and disruption challenge, Need to partner with other vendors for data center expertise) influencing the growth of the data center transformation market

- Product Development/Innovation: Detailed insights on the latest technologies in the data center transformation market

- Market Development: In-depth information about lucrative markets - the report analyses the data center transformation market across various regions.

- Market Diversification: Comprehensive information about new products & services, recent developments, untapped geographies, and investments in the data center transformation market.

- Competitive Assessment: Detailed assessment of growth strategies, market shares, and service offerings of leading players. The critical technology vendors in the market include Google (US), Microsoft (US), IBM (US), Schneider Electric (France), and TCS (India), among others, in the data center transformation market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2022

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 DATA CENTER TRANSFORMATION MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 MARKET FORECAST: FACTOR IMPACT ANALYSIS

- TABLE 2 FACTOR ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 2 DATA CENTER TRANSFORMATION MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 DATA CENTER TRANSFORMATION MARKET: RESEARCH FLOW

- 2.3.3 MARKET ESTIMATION APPROACHES

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 8 BOTTOM-UP APPROACH FROM SUPPLY SIDE: COLLECTIVE REVENUE OF VENDORS

- FIGURE 9 DEMAND-SIDE APPROACH: REVENUE GENERATED FROM DIFFERENT VERTICALS

- FIGURE 10 DEMAND-SIDE APPROACH: DATA CENTER TRANSFORMATION MARKET

- 2.4 DATA TRIANGULATION

- FIGURE 11 DATA CENTER TRANSFORMATION MARKET: DATA TRIANGULATION

- 2.5 RECESSION IMPACT AND RESEARCH ASSUMPTIONS

- 2.5.1 RECESSION IMPACT

- 2.5.2 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- TABLE 3 DATA CENTER TRANSFORMATION MARKET SIZE AND GROWTH, 2017-2022 (USD MILLION, Y-O-Y %)

- TABLE 4 DATA CENTER TRANSFORMATION MARKET SIZE AND GROWTH, 2023-2028 (USD MILLION, Y-O-Y %)

- FIGURE 12 GLOBAL DATA CENTER TRANSFORMATION MARKET TO WITNESS SIGNIFICANT GROWTH

- FIGURE 13 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 14 FASTEST-GROWING SEGMENTS OF DATA CENTER TRANSFORMATION MARKET

4 PREMIUM INSIGHTS

- 4.1 OVERVIEW OF DATA CENTER TRANSFORMATION MARKET

- FIGURE 15 DIGITAL TRANSFORMATION, CLOUD ADOPTION, NEED FOR COST/ENERGY EFFICIENCY, AND LEGACY MODERNIZATION TO BOOST DATA CENTER TRANSFORMATION MARKET GROWTH

- 4.2 DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023 VS. 2028

- FIGURE 16 CONSOLIDATION SERVICES SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- 4.3 DATA CENTER TRANSFORMATION MARKET, BY TIER TYPE, 2023 VS. 2028

- FIGURE 17 TIER 4 SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- 4.4 DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER TYPE, 2023 VS. 2028

- FIGURE 18 ENTERPRISE DATA CENTER SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- 4.5 DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023 VS. 2028

- FIGURE 19 LARGE DATA CENTERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- 4.6 DATA CENTER TRANSFORMATION MARKET, BY VERTICAL, 2023-2028

- FIGURE 20 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- 4.7 DATA CENTER TRANSFORMATION MARKET: REGIONAL SCENARIO, 2023-2028

- FIGURE 21 ASIA PACIFIC EXPECTED TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 22 MARKET DYNAMICS: DATA CENTER TRANSFORMATION MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Leveraging digital transformation to drive data center evolution

- FIGURE 23 SPENDING ON DIGITAL TRANSFORMATION TECHNOLOGIES AND SERVICES WORLDWIDE, 2017-2026 (USD TRILLION)

- 5.2.1.2 Increase in cloud adoption and hybridization

- 5.2.1.3 Indispensable requirements to improve data center uptime and energy efficiency

- 5.2.1.4 Proliferation of data center colocation facilities globally

- 5.2.1.5 Data explosion

- 5.2.1.6 Rise in necessity to tackle significant network congestion within data centers

- 5.2.2 RESTRAINTS

- 5.2.2.1 Data security and privacy concerns

- 5.2.2.2 Complexity related to transformation

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise in number of data center facilities

- FIGURE 24 INDIA: DATA CENTER MARKET INVESTMENT, 2019-2025 (USD BILLION)

- 5.2.3.2 Growing demand for AI and automation

- FIGURE 25 ABOUT 50% OF RESPONDENTS CHOSE SOFTWARE-DEFINED POWER, 2022

- 5.2.3.3 Data center consolidation and optimization

- 5.2.4 CHALLENGES

- 5.2.4.1 Downtime and disruption challenge

- 5.2.4.2 Need to partner with other vendors for data center expertise

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 CARHARTT DELIVERED CLOUD-FIRST STRATEGY WITH IBM TURBONOMIC

- 5.3.2 THAI GOVERNMENT USED SCHNEIDER TO REDUCE CARBON EMISSION FOOTPRINTS AND POWER USAGE FOR BETTER ENERGY EFFICIENCY

- 5.3.3 ANIMAL LOGIC SELECTED SCHNEIDER'S PREFABRICATED SYSTEM FOR ENHANCING ITS PLANNING AND OPERATIONAL PERFORMANCE

- 5.3.4 SEAMLESS CLOUD MIGRATION INCREASED SCALABILITY AND LOWERED RISK FOR GLOBAL TECH PROVIDER GDT

- 5.3.5 PRODUCTIVITY AND CUSTOMER EXPERIENCE ENHANCED WITH GDT'S DATA CENTER SOLUTIONS

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 26 DATA CENTER TRANSFORMATION MARKET: SUPPLY CHAIN

- 5.5 ECOSYSTEM ANALYSIS

- FIGURE 27 DATA CENTER TRANSFORMATION MARKET: ECOSYSTEM

- 5.6 TECHNOLOGICAL ANALYSIS

- 5.6.1 VIRTUALIZATION

- 5.6.2 CLOUD COMPUTING

- 5.6.3 AI & MACHINE LEARNING

- 5.6.4 SOFTWARE-DEFINED INFRASTRUCTURE (SDI)

- 5.7 INDICATIVE PRICING ANALYSIS

- 5.8 PATENT ANALYSIS

- FIGURE 28 NUMBER OF PATENTS PUBLISHED, 2012-2022

- FIGURE 29 TOP FIVE PATENT OWNERS (GLOBAL)

- TABLE 5 US: TOP 10 PATENT APPLICANTS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 DATA CENTER TRANSFORMATION MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 IMPACT OF PORTER'S FIVE FORCES

- 5.9.1 THREAT FROM NEW ENTRANTS

- 5.9.2 THREAT FROM SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGULATORY LANDSCAPE

- 5.10.2.1 North America

- 5.10.2.2 Europe

- 5.10.2.3 Asia Pacific

- 5.10.2.4 Middle East & Africa

- 5.10.2.5 Latin America

- 5.11 DATA CENTER TRANSFORMATION: ADOPTION TREND BY CLOUD PROVIDERS

- TABLE 11 LIST OF MAJOR CLOUD PROVIDERS

- 5.12 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 31 DATA CENTER TRANSFORMATION MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- 5.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VERTICALS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VERTICALS

- 5.13.2 BUYING CRITERIA

- FIGURE 33 KEY BUYING CRITERIA FOR VERTICALS

- TABLE 13 KEY BUYING CRITERIA FOR VERTICALS

- 5.14 BUSINESS MODEL ANALYSIS

- FIGURE 34 DATA CENTER TRANSFORMATION MARKET: BUSINESS MODELS

- 5.14.1 ON-PREMISES BUSINESS MODEL

- 5.14.2 CLOUD-BASED BUSINESS MODEL

- 5.14.3 HYBRID BUSINESS MODEL

- 5.15 KEY CONFERENCES AND EVENTS

- TABLE 14 DATA CENTER TRANSFORMATION MARKET: KEY CONFERENCES AND EVENTS, 2023 & 2024

6 DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE

- 6.1 INTRODUCTION

- FIGURE 35 AUTOMATION SERVICES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 15 DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 16 DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 6.2 CONSOLIDATION SERVICES

- 6.2.1 CONSOLIDATING MULTIPLE DATA CENTERS INTO FEWER DATA CENTERS TO AID IN COST REDUCTION AND IMPROVED EFFICIENCY

- 6.2.2 CONSOLIDATION SERVICES: DATA CENTER TRANSFORMATION MARKET DRIVERS

- 6.2.3 CASE STUDY

- 6.2.4 MIGRATION

- 6.2.5 VIRTUALIZATION

- 6.2.6 STORAGE AND MANAGEMENT

- 6.2.7 ENERGY EFFICIENCY

- TABLE 17 CONSOLIDATION SERVICES: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 18 CONSOLIDATION SERVICES: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 OPTIMIZATION SERVICES

- 6.3.1 DATA CENTER OPTIMIZATION TO MAXIMIZE EFFICIENCY AND PERFORMANCE OF EXISTING DATA CENTER INFRASTRUCTURE, REGARDLESS OF NUMBER OF FACILITIES

- 6.3.2 OPTIMIZATION SERVICES: DATA CENTER TRANSFORMATION MARKET DRIVERS

- 6.3.3 CASE STUDY

- 6.3.4 ENERGY EFFICIENCY OPTIMIZATION

- 6.3.5 DISASTER RECOVERY AND BUSINESS CONTINUITY OPTIMIZATION

- 6.3.6 SCALABILITY AND FLEXIBILITY

- TABLE 19 OPTIMIZATION SERVICES: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 20 OPTIMIZATION SERVICES: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4 AUTOMATION SERVICES

- 6.4.1 DATA CENTER TRANSFORMATION POWERED BY AI TO ENSURE OPTIMIZED RESOURCE ALLOCATION AND IMPROVED ENERGY EFFICIENCY

- 6.4.2 AUTOMATION SERVICES: DATA CENTER TRANSFORMATION MARKET DRIVERS

- 6.4.3 CASE STUDY

- 6.4.4 MONITORING AND ALERTS

- 6.4.5 REPORTING AND DOCUMENTATION

- 6.4.6 CAPACITY PLANNING

- TABLE 21 AUTOMATION SERVICES: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 22 AUTOMATION SERVICES: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.5 INFRASTRUCTURE MANAGEMENT SERVICES

- 6.5.1 INFRASTRUCTURE MANAGEMENT SERVICES TO HELP ORGANIZATIONS MONITOR AND MANAGE ALL DATA CENTER RESOURCES

- 6.5.2 INFRASTRUCTURE MANAGEMENT SERVICES: DATA CENTER TRANSFORMATION MARKET DRIVERS

- 6.5.3 CASE STUDY 1

- 6.5.4 CASE STUDY 2

- 6.5.5 ASSET MANAGEMENT

- 6.5.6 CAPACITY PLANNING

- 6.5.7 POWER MONITORING

- 6.5.8 ENVIRONMENTAL MONITORING

- TABLE 23 INFRASTRUCTURE MANAGEMENT SERVICES: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 24 INFRASTRUCTURE MANAGEMENT SERVICES: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

7 DATA CENTER TRANSFORMATION MARKET, BY TIER TYPE

- 7.1 INTRODUCTION

- TABLE 25 DATA CENTER TRANSFORMATION MARKET: TYPES OF DATA CENTER TIERS

- FIGURE 36 TIER 3 SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 26 DATA CENTER TRANSFORMATION MARKET, BY TIER TYPE, 2017-2022 (USD MILLION)

- TABLE 27 DATA CENTER TRANSFORMATION MARKET, BY TIER TYPE, 2023-2028 (USD MILLION)

- 7.2 TIER 1

- 7.2.1 AFFORDABILITY OF TIER 1 TO DRIVE GROWTH

- 7.2.2 TIER 1: DATA CENTER TRANSFORMATION MARKET DRIVERS

- TABLE 28 TIER 1: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 29 TIER 1: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 TIER 2

- 7.3.1 TIER 2 DATA CENTERS TO BE ATTRACTIVE OPTION FOR MID-SIZED ORGANIZATIONS

- 7.3.2 TIER 2: DATA CENTER TRANSFORMATION MARKET DRIVERS

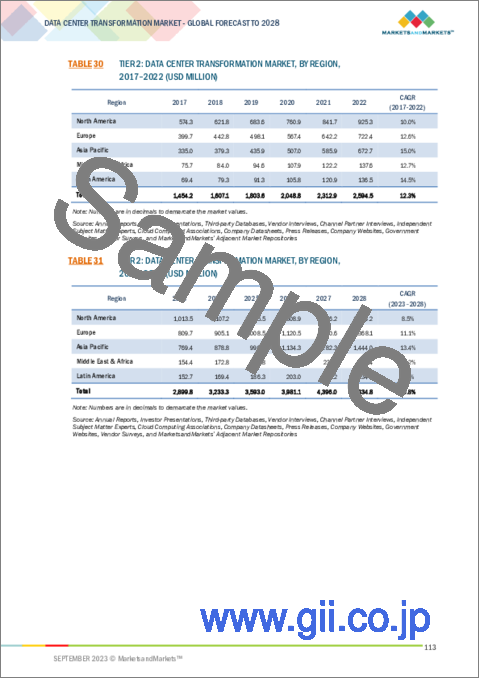

- TABLE 30 TIER 2: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 31 TIER 2: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 TIER 3

- 7.4.1 TIER 3 DATA CENTERS TO BE SUITABLE FOR BUSINESSES THAT REQUIRE HIGH LEVEL OF RELIABILITY BUT CAN TOLERATE LIMITED DOWNTIME

- 7.4.2 TIER 3: DATA CENTER TRANSFORMATION MARKET DRIVERS

- TABLE 32 TIER 3: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 33 TIER 3: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 TIER 4

- 7.5.1 TIER 4 DATA CENTERS TO BE FAULT-TOLERANT AND CAPABLE OF WITHSTANDING WIDE RANGE OF POTENTIAL DISRUPTIONS

- 7.5.2 TIER 4: DATA CENTER TRANSFORMATION MARKET DRIVERS

- TABLE 34 TIER 4: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 35 TIER 4: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

8 DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER TYPE

- 8.1 INTRODUCTION

- FIGURE 37 CLOUD DATA CENTER TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 36 DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER TYPE, 2017-2022 (USD MILLION)

- TABLE 37 DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER TYPE, 2023-2028 (USD MILLION)

- 8.2 CLOUD DATA CENTER

- 8.2.1 CLOUD SERVICE PROVIDERS TO HOST DATA AND APPLICATIONS

- 8.2.2 CLOUD DATA CENTER: DATA CENTER TRANSFORMATION MARKET DRIVERS

- TABLE 38 CLOUD DATA CENTER: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 39 CLOUD DATA CENTER: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 COLOCATION DATA CENTER

- 8.3.1 COLOCATION FACILITIES TO RENT SPACE TO MULTIPLE ORGANIZATIONS TO HOST THEIR DATA CENTERS

- 8.3.2 COLOCATION DATA CENTER: DATA CENTER TRANSFORMATION MARKET DRIVERS

- TABLE 40 COLOCATION DATA CENTER: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 41 COLOCATION DATA CENTER: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4 ENTERPRISE DATA CENTER

- 8.4.1 BUILDING AND MAINTAINING ENTERPRISE DATA CENTER TO INVOLVE SIGNIFICANT CAPITAL EXPENDITURE

- 8.4.2 ENTERPRISE DATA CENTER: DATA CENTER TRANSFORMATION MARKET DRIVERS

- TABLE 42 ENTERPRISE DATA CENTER: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 43 ENTERPRISE DATA CENTER: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

9 DATA CENTER TRANSFORMATION, BY DATA CENTER SIZE

- 9.1 INTRODUCTION

- FIGURE 38 SMALL DATA CENTERS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 44 DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 45 DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- 9.2 SMALL DATA CENTERS

- 9.2.1 NEED FOR EDGE COMPUTING, COST-EFFICIENCY, SCALABILITY, RAPID DEPLOYMENT, AND COMPLIANCE CONSIDERATIONS TO DRIVE SMALL DATA CENTERS GROWTH

- 9.2.2 SMALL DATA CENTERS: DATA CENTER TRANSFORMATION MARKET DRIVERS

- TABLE 46 SMALL DATA CENTERS: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 47 SMALL DATA CENTERS: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 MID-SIZED DATA CENTERS

- 9.3.1 MID-SIZED DATA CENTERS TO HELP MEET DIVERSE NEEDS OF ORGANIZATIONS

- 9.3.2 MID-SIZED DATA CENTERS: DATA CENTER TRANSFORMATION MARKET DRIVERS

- TABLE 48 MID-SIZED DATA CENTERS: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 49 MID-SIZED DATA CENTERS: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 LARGE DATA CENTERS

- 9.4.1 NEED FOR MASSIVE DATA PROCESSING, CLOUD COMPUTING DEMANDS, SCALABILITY, HIGH AVAILABILITY, AND COST EFFICIENCY TO DRIVE MARKET

- 9.4.2 LARGE DATA CENTERS: DATA CENTER TRANSFORMATION MARKET DRIVERS

- TABLE 50 LARGE DATA CENTERS: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 51 LARGE DATA CENTERS: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

10 DATA CENTER TRANSFORMATION MARKET, BY VERTICAL

- 10.1 INTRODUCTION

- FIGURE 39 BFSI VERTICAL TO ACCOUNT FOR LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 52 DATA CENTER TRANSFORMATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 53 DATA CENTER TRANSFORMATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 10.2 IT & TELECOM

- 10.2.1 IT & TELECOM TO EMBRACE MODERNIZATION AND DATA CENTER INFRASTRUCTURE AND TECHNOLOGIES TO MEET EVOLVING DEMAND

- 10.2.2 IT & TELECOM: DATA CENTER TRANSFORMATION MARKET DRIVERS

- TABLE 54 IT & TELECOM: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 55 IT & TELECOM: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 BFSI

- 10.3.1 NEED FOR REAL-TIME PROCESSING, DATA SECURITY, DATA ANALYTICS, COMPLIANCE, AND IMPROVED CUSTOMER EXPERIENCES TO BOOST DEMAND

- 10.3.2 BFSI: DATA CENTER TRANSFORMATION MARKET DRIVERS

- TABLE 56 BFSI: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 57 BFSI: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4 HEALTHCARE

- 10.4.1 NEED TO EMBRACE DIGITAL HEALTH TECHNOLOGIES, SAFEGUARD PATIENT DATA, COMPLY WITH REGULATIONS, AND ADVANCE MEDICAL RESEARCH TO DRIVE MARKET

- 10.4.2 HEALTHCARE: DATA CENTER TRANSFORMATION MARKET DRIVERS

- TABLE 58 HEALTHCARE: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 59 HEALTHCARE: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.5 MANUFACTURING

- 10.5.1 NEED FOR REAL-TIME DATA PROCESSING, OPERATIONAL OPTIMIZATION, AND LEVERAGING BENEFITS OF IIOT FOR SMARTER, MORE EFFICIENT PRODUCTION PROCESSES TO PROPEL MARKET

- 10.5.2 MANUFACTURING: DATA CENTER TRANSFORMATION MARKET DRIVERS

- TABLE 60 MANUFACTURING: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 61 MANUFACTURING: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.6 GOVERNMENT & DEFENSE

- 10.6.1 NEED FOR REAL-TIME PROCESSING, DATA SECURITY, AND IMPROVED PUBLIC SERVICE DELIVERY TO FUEL DEMAND FOR DATA CENTER TRANSFORMATION

- 10.6.2 GOVERNMENT & DEFENSE: DATA CENTER TRANSFORMATION MARKET DRIVERS

- TABLE 62 GOVERNMENT & DEFENSE: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 63 GOVERNMENT & DEFENSE: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.7 TRANSPORTATION

- 10.7.1 NEED TO ADOPT SMART TRANSPORTATION SYSTEMS, INTEGRATE IOT DEVICES, IMPROVE EFFICIENCY, ENHANCE PASSENGER EXPERIENCE, AND SUPPORT GROWTH OF ELECTRIC VEHICLES TO DRIVE MARKET

- 10.7.2 TRANSPORTATION: DATA CENTER TRANSFORMATION MARKET DRIVERS

- TABLE 64 TRANSPORTATION: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 65 TRANSPORTATION: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.8 RETAIL

- 10.8.1 NEED FOR FASTER, MORE PERSONALIZED ONLINE EXPERIENCES AND DATA-DRIVEN DECISION-MAKING TO DRIVE MARKET

- 10.8.2 RETAIL: DATA CENTER TRANSFORMATION MARKET DRIVERS

- TABLE 66 RETAIL: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 67 RETAIL: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.9 ENERGY & UTILITIES

- 10.9.1 NEED TO ADOPT SMART GRID TECHNOLOGIES, INTEGRATE RENEWABLE ENERGY SOURCES, AND ENHANCE GRID RESILIENCE TO DRIVE MARKET

- 10.9.2 ENERGY & UTILITIES: DATA CENTER TRANSFORMATION MARKET DRIVERS

- TABLE 68 ENERGY & UTILITIES: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 69 ENERGY & UTILITIES: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.10 OTHER VERTICALS

- 10.10.1 OTHER VERTICALS: DATA CENTER TRANSFORMATION MARKET DRIVERS

- TABLE 70 OTHER VERTICALS: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 71 OTHER VERTICALS: DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

11 DATA CENTER TRANSFORMATION MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 40 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 72 DATA CENTER TRANSFORMATION MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 73 DATA CENTER TRANSFORMATION MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: DATA CENTER TRANSFORMATION MARKET DRIVERS

- 11.2.2 NORTH AMERICA: RECESSION IMPACT

- 11.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

- 11.2.3.1 US Securities and Exchange Commission

- 11.2.3.2 International Organization for Standardization 27001

- 11.2.3.3 California Consumer Privacy Act

- 11.2.3.4 Health Insurance Portability and Accountability Act of 1996

- 11.2.3.5 Sarbanes-Oxley Act of 2002

- FIGURE 41 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 74 NORTH AMERICA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 75 NORTH AMERICA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: DATA CENTER TRANSFORMATION MARKET, BY TIER TYPE, 2017-2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: DATA CENTER TRANSFORMATION MARKET, BY TIER TYPE, 2023-2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER TYPE, 2017-2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER TYPE, 2023-2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: DATA CENTER TRANSFORMATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: DATA CENTER TRANSFORMATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: DATA CENTER TRANSFORMATION MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: DATA CENTER TRANSFORMATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.2.4 US

- 11.2.4.1 Presence of several data center transformation providers to drive market

- TABLE 86 US: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 87 US: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 88 US: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 89 US: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- 11.2.5 CANADA

- 11.2.5.1 Growing innovations and IT infrastructure to drive market

- TABLE 90 CANADA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 91 CANADA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 92 CANADA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 93 CANADA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 EUROPE: DATA CENTER TRANSFORMATION MARKET DRIVERS

- 11.3.2 EUROPE: RECESSION IMPACT

- 11.3.3 EUROPE: REGULATORY LANDSCAPE

- 11.3.3.1 General Data Protection Regulation

- 11.3.3.2 European Cybersecurity Act

- TABLE 94 EUROPE: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 95 EUROPE: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 96 EUROPE: DATA CENTER TRANSFORMATION MARKET, BY TIER TYPE, 2017-2022 (USD MILLION)

- TABLE 97 EUROPE: DATA CENTER TRANSFORMATION MARKET, BY TIER TYPE, 2023-2028 (USD MILLION)

- TABLE 98 EUROPE: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER TYPE, 2017-2022 (USD MILLION)

- TABLE 99 EUROPE: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER TYPE, 2023-2028 (USD MILLION)

- TABLE 100 EUROPE: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 101 EUROPE: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- TABLE 102 EUROPE: DATA CENTER TRANSFORMATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 103 EUROPE: DATA CENTER TRANSFORMATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 104 EUROPE: DATA CENTER TRANSFORMATION MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 105 EUROPE: DATA CENTER TRANSFORMATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.3.4 UK

- 11.3.4.1 Increasing demand for digital services, sustainability initiatives, data privacy regulations, and advancements in technology to drive market in UK

- TABLE 106 UK: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 107 UK: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 108 UK: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 109 UK: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- 11.3.5 GERMANY

- 11.3.5.1 Increasing digitalization to fuel growth of data center transformation services

- TABLE 110 GERMANY: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 111 GERMANY: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 112 GERMANY: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 113 GERMANY: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- 11.3.6 FRANCE

- 11.3.6.1 Government initiatives to support adoption of cloud technologies

- TABLE 114 FRANCE: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 115 FRANCE: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 116 FRANCE: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 117 FRANCE: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- 11.3.7 REST OF EUROPE

- TABLE 118 REST OF EUROPE: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 119 REST OF EUROPE: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 120 REST OF EUROPE: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 121 REST OF EUROPE: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: DATA CENTER TRANSFORMATION MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: RECESSION IMPACT

- 11.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

- 11.4.3.1 Personal Data Protection Act

- 11.4.3.2 Singapore Standard SS 564

- 11.4.3.3 Internet Data Center in China

- FIGURE 42 ASIA PACIFIC: REGIONAL SNAPSHOT

- TABLE 122 ASIA PACIFIC: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: DATA CENTER TRANSFORMATION MARKET, BY TIER TYPE, 2017-2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: DATA CENTER TRANSFORMATION MARKET, BY TIER TYPE, 2023-2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER TYPE, 2017-2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER TYPE, 2023-2028 (USD MILLION)

- TABLE 128 ASIA PACIFIC: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 129 ASIA PACIFIC: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- TABLE 130 ASIA PACIFIC: DATA CENTER TRANSFORMATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 131 ASIA PACIFIC: DATA CENTER TRANSFORMATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 132 ASIA PACIFIC: DATA CENTER TRANSFORMATION MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 133 ASIA PACIFIC: DATA CENTER TRANSFORMATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.4.4 CHINA

- 11.4.4.1 Rapid digitalization, economic growth, and increasing data consumption to fuel market growth

- TABLE 134 CHINA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 135 CHINA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 136 CHINA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 137 CHINA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- 11.4.5 JAPAN

- 11.4.5.1 Rising demand for data center transformation to drive market

- TABLE 138 JAPAN: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 139 JAPAN: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 140 JAPAN: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 141 JAPAN: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- 11.4.6 INDIA

- 11.4.6.1 Need for modernization and innovation in data center infrastructure to drive market growth

- TABLE 142 INDIA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 143 INDIA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 144 INDIA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 145 INDIA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- 11.4.7 REST OF ASIA PACIFIC

- TABLE 146 REST OF ASIA PACIFIC: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 147 REST OF ASIA PACIFIC: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 148 REST OF ASIA PACIFIC: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 149 REST OF ASIA PACIFIC: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: DATA CENTER TRANSFORMATION MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 11.5.3 MIDDLE EAST & AFRICA: REGULATORY LANDSCAPE

- 11.5.3.1 Personal Data Protection Law

- 11.5.3.2 Cloud Computing Regulatory Framework

- TABLE 150 MIDDLE EAST & AFRICA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: DATA CENTER TRANSFORMATION MARKET, BY TIER TYPE, 2017-2022 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: DATA CENTER TRANSFORMATION MARKET, BY TIER TYPE, 2023-2028 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER TYPE, 2017-2022 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER TYPE, 2023-2028 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: DATA CENTER TRANSFORMATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: DATA CENTER TRANSFORMATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 160 MIDDLE EAST & AFRICA: DATA CENTER TRANSFORMATION MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 161 MIDDLE EAST & AFRICA: DATA CENTER TRANSFORMATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.5.4 SAUDI ARABIA

- 11.5.4.1 Increasing government initiatives, data demands, and evolving digital landscape to drive market

- TABLE 162 SAUDI ARABIA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 163 SAUDI ARABIA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 164 SAUDI ARABIA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 165 SAUDI ARABIA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- 11.5.5 UNITED ARAB EMIRATES (UAE)

- 11.5.5.1 UAE data center transformation market to thrive due to government initiatives, economic diversification, and the increasing digital demands of businesses

- TABLE 166 UAE: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 167 UAE: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 168 UAE: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 169 UAE: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- 11.5.6 SOUTH AFRICA

- 11.5.6.1 Dynamic technology landscape in South Africa to foster innovation in data center design, management, and energy efficiency

- TABLE 170 SOUTH AFRICA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 171 SOUTH AFRICA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 172 SOUTH AFRICA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 173 SOUTH AFRICA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- 11.5.7 REST OF MIDDLE EAST & AFRICA

- TABLE 174 REST OF MIDDLE EAST & AFRICA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 175 REST OF MIDDLE EAST & AFRICA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 176 REST OF MIDDLE EAST & AFRICA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 177 REST OF MIDDLE EAST & AFRICA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: DATA CENTER TRANSFORMATION MARKET DRIVERS

- 11.6.2 LATIN AMERICA: RECESSION IMPACT

- 11.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

- 11.6.4 FEDERAL LAW ON PROTECTION OF PERSONAL DATA HELD BY INDIVIDUALS

- TABLE 178 LATIN AMERICA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 179 LATIN AMERICA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 180 LATIN AMERICA: DATA CENTER TRANSFORMATION MARKET, BY TIER TYPE, 2017-2022 (USD MILLION)

- TABLE 181 LATIN AMERICA: DATA CENTER TRANSFORMATION MARKET, BY TIER TYPE, 2023-2028 (USD MILLION)

- TABLE 182 LATIN AMERICA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER TYPE, 2017-2022 (USD MILLION)

- TABLE 183 LATIN AMERICA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER TYPE, 2023-2028 (USD MILLION)

- TABLE 184 LATIN AMERICA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 185 LATIN AMERICA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- TABLE 186 LATIN AMERICA: DATA CENTER TRANSFORMATION MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 187 LATIN AMERICA: DATA CENTER TRANSFORMATION MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 188 LATIN AMERICA: DATA CENTER TRANSFORMATION MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 189 LATIN AMERICA: DATA CENTER TRANSFORMATION MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.6.5 BRAZIL

- 11.6.5.1 Presence of several data center transformation players to accelerate market growth

- TABLE 190 BRAZIL: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 191 BRAZIL: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 192 BRAZIL: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 193 BRAZIL: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- 11.6.6 MEXICO

- 11.6.6.1 Increasing government support, digitalization efforts, economic growth, and increasing data requirements drive market

- TABLE 194 MEXICO: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 195 MEXICO: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 196 MEXICO: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 197 MEXICO: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

- 11.6.7 REST OF LATIN AMERICA

- TABLE 198 REST OF LATIN AMERICA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 199 REST OF LATIN AMERICA: DATA CENTER TRANSFORMATION MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 200 REST OF LATIN AMERICA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2017-2022 (USD MILLION)

- TABLE 201 REST OF LATIN AMERICA: DATA CENTER TRANSFORMATION MARKET, BY DATA CENTER SIZE, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

- FIGURE 43 OVERVIEW OF STRATEGIES BY KEY DATA CENTER TRANSFORMATION VENDORS

- 12.3 REVENUE ANALYSIS

- FIGURE 44 HISTORICAL FIVE-YEAR SEGMENTAL REVENUE ANALYSIS OF KEY DATA CENTER TRANSFORMATION PROVIDERS, 2018-2022 (USD MILLION)

- 12.4 MARKET SHARE ANALYSIS

- FIGURE 45 MARKET SHARE ANALYSIS, 2022

- TABLE 202 DATA CENTER TRANSFORMATION MARKET: DEGREE OF COMPETITION

- 12.5 MARKET RANKING OF KEY PLAYERS

- FIGURE 46 MARKET RANKING OF KEY DATA CENTER TRANSFORMATION PLAYERS, 2022

- 12.6 BRANDS COMPARISON/VENDOR PRODUCT LANDSCAPE

- TABLE 203 BRANDS COMPARISON/VENDOR PRODUCT LANDSCAPE

- 12.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 47 DATA CENTER TRANSFORMATION MARKET: GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- 12.8 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

- FIGURE 48 COMPANY EVALUATION MATRIX FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- 12.8.1 STARS

- 12.8.2 EMERGING LEADERS

- 12.8.3 PERVASIVE PLAYERS

- 12.8.4 PARTICIPANTS

- FIGURE 49 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- 12.8.5 COMPANY FOOTPRINT FOR KEY PLAYERS

- TABLE 204 COMPANY FOOTPRINT FOR KEY PLAYERS, BY REGION

- TABLE 205 COMPANY FOOTPRINT FOR KEY PLAYERS, BY SERVICE TYPE

- TABLE 206 OVERALL COMPANY FOOTPRINT FOR KEY PLAYERS

- 12.9 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES

- FIGURE 50 COMPANY EVALUATION MATRIX FOR SMES/STARTUPS: CRITERIA WEIGHTAGE

- 12.9.1 PROGRESSIVE COMPANIES

- 12.9.2 RESPONSIVE COMPANIES

- 12.9.3 DYNAMIC COMPANIES

- 12.9.4 STARTING BLOCKS

- FIGURE 51 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- 12.9.5 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES

- TABLE 207 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 208 COMPANY FOOTPRINT FOR STARTUPS/SMES, BY REGION

- 12.10 VALUATION AND FINANCIAL METRICS OF DATA CENTER TRANSFORMATION VENDORS

- FIGURE 52 VALUATION AND FINANCIAL METRICS OF DATA CENTER TRANSFORMATION VENDORS

- 12.11 COMPETITIVE SCENARIO

- 12.11.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 209 DATA CENTER TRANSFORMATION MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2020-2023

- 12.11.2 DEALS

- TABLE 210 DATA CENTER TRANSFORMATION MARKET: DEALS, 2020-2023

- TABLE 211 DATA CENTER TRANSFORMATION MARKET: OTHERS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- (Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View)**

- 13.2.1 IBM

- TABLE 212 IBM: BUSINESS OVERVIEW

- FIGURE 53 IBM: COMPANY SNAPSHOT

- TABLE 213 IBM: PRODUCTS/SERVICES OFFERED

- TABLE 214 IBM: PRODUCT LAUNCHES

- TABLE 215 IBM: DEALS

- TABLE 216 IBM: OTHERS

- 13.2.2 MICROSOFT

- TABLE 217 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 54 MICROSOFT: COMPANY SNAPSHOT

- TABLE 218 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 MICROSOFT: PRODUCT LAUNCHES

- TABLE 220 MICROSOFT: DEALS

- TABLE 221 MICROSOFT: OTHERS

- 13.2.3 DELL TECHNOLOGIES

- TABLE 222 DELL TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 55 DELL TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 223 DELL TECHNOLOGIES: PRODUCTS/SERVICES OFFERED

- TABLE 224 DELL TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 225 DELL TECHNOLOGIES: DEALS

- 13.2.4 CISCO

- TABLE 226 CISCO: BUSINESS OVERVIEW

- FIGURE 56 CISCO: COMPANY SNAPSHOT

- TABLE 227 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 229 CISCO: DEALS

- TABLE 230 CISCO: OTHERS

- 13.2.5 SCHNEIDER ELECTRIC

- TABLE 231 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

- FIGURE 57 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 232 SCHNEIDER ELECTRIC: PRODUCTS/SERVICES OFFERED

- TABLE 233 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 234 SCHNEIDER ELECTRIC: DEALS

- 13.2.6 NTT

- TABLE 235 NTT: BUSINESS OVERVIEW

- FIGURE 58 NTT: COMPANY SNAPSHOT

- TABLE 236 NTT: PRODUCTS/SERVICES OFFERED

- TABLE 237 NTT: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 238 NTT: DEALS

- TABLE 239 NTT: OTHERS

- 13.2.7 HCLTECH

- TABLE 240 HCLTECH: BUSINESS OVERVIEW

- FIGURE 59 HCLTECH: COMPANY SNAPSHOT

- TABLE 241 HCLTECH: PRODUCTS/SERVICES OFFERED

- TABLE 242 HCLTECH: DEALS

- 13.2.8 ACCENTURE

- TABLE 243 ACCENTURE: BUSINESS OVERVIEW

- FIGURE 60 ACCENTURE: COMPANY SNAPSHOT

- TABLE 244 ACCENTURE: PRODUCTS/SOLUTIONS OFFERED

- TABLE 245 ACCENTURE: PRODUCT LAUNCHES AND ENHANCEMENTS

- 13.2.9 ATOS

- TABLE 246 ATOS: BUSINESS OVERVIEW

- FIGURE 61 ATOS: COMPANY SNAPSHOT

- TABLE 247 ATOS: PRODUCTS/SOLUTIONS OFFERED

- TABLE 248 ATOS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 249 ATOS: DEALS

- 13.2.10 GOOGLE

- TABLE 250 GOOGLE: BUSINESS OVERVIEW

- FIGURE 62 GOOGLE: COMPANY SNAPSHOT

- TABLE 251 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 GOOGLE: DEALS

- TABLE 253 GOOGLE: OTHERS

- 13.2.11 WIPRO

- TABLE 254 WIPRO: BUSINESS OVERVIEW

- FIGURE 63 WIPRO: COMPANY SNAPSHOT

- TABLE 255 WIPRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 256 WIPRO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 257 WIPRO: DEALS

- 13.2.12 TCS

- TABLE 258 TCS: BUSINESS OVERVIEW

- FIGURE 64 TCS: COMPANY SNAPSHOT

- TABLE 259 TCS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 260 TCS: DEALS

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

- 13.3 OTHER PLAYERS

- 13.3.1 COGNIZANT

- 13.3.2 HITACHI

- 13.3.3 NETAPP

- 13.3.4 MINDTECK

- 13.3.5 BYTES TECHNOLOGY GROUP

- 13.3.6 GENERAL DATATECH (GDT)

- 13.3.7 INSIGHT ENTERPRISES

- 13.3.8 INKNOWTECH

- 13.3.9 TECH MAHINDRA

- 13.3.10 NETSCOUT

- 13.3.11 RAHI SYSTEMS

- 13.3.12 BLUE MANTIS

- 13.3.13 DYNTEK

- 13.3.14 SOFTCHOICE

- 13.4 SMES/STARTUP PLAYERS

- 13.4.1 GREENFIELD SOFTWARE

- 13.4.2 HYPERVIEW

- 13.4.3 VAPOR IO

- 13.4.4 FLEXISCALE

- 13.4.5 LIQUIDSTACK

- 13.4.6 RACKBANK DATACENTERS

14 ADJACENT/RELATED MARKETS

- 14.1 INTRODUCTION

- 14.1.1 RELATED MARKETS

- 14.1.2 LIMITATIONS

- 14.2 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET

- TABLE 261 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY COMPONENT, 2017-2020 (USD MILLION)

- TABLE 262 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY COMPONENT, 2021-2026 (USD MILLION)

- TABLE 263 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY APPLICATION, 2017-2020 (USD MILLION)

- TABLE 264 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY APPLICATION, 2021-2026 (USD MILLION)

- TABLE 265 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2017-2020 (USD MILLION)

- TABLE 266 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY DEPLOYMENT MODEL, 2021-2026 (USD MILLION)

- TABLE 267 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY DATA CENTER TYPE, 2017-2020 (USD MILLION)

- TABLE 268 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY DATA CENTER TYPE, 2021-2026 (USD MILLION)

- TABLE 269 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY VERTICAL, 2017-2020 (USD MILLION)

- TABLE 270 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY VERTICAL, 2021-2026 (USD MILLION)

- TABLE 271 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 272 DATA CENTER INFRASTRUCTURE MANAGEMENT MARKET, BY REGION, 2021-2026 (USD MILLION)

- 14.3 DATA CENTER COLOCATION MARKET

- TABLE 273 DATA CENTER COLOCATION MARKET, BY TYPE, 2015-2022 (USD BILLION)

- TABLE 274 DATA CENTER COLOCATION MARKET, BY END USER, 2015-2022 (USD BILLION)

- TABLE 275 DATA CENTER COLOCATION MARKET, BY INDUSTRY, 2015-2022 (USD MILLION)

- TABLE 276 DATA CENTER COLOCATION MARKET, BY REGION, 2015-2022 (USD BILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS