|

|

市場調査レポート

商品コード

1357249

防火システムTIC (試験・検査・認証) の世界市場 (~2028年):サービスタイプ・システムタイプ・用途・地域別Fire Protection System Testing, Inspection, and Certification Market by Service Type, System Type, Application and Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 防火システムTIC (試験・検査・認証) の世界市場 (~2028年):サービスタイプ・システムタイプ・用途・地域別 |

|

出版日: 2023年09月27日

発行: MarketsandMarkets

ページ情報: 英文 270 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の防火システムTIC (試験・検査・認証) の市場規模は、2023年の5億3,300万米ドルから、予測期間中は3.5%のCAGRで推移し、2028年には6億3,300万米ドルの規模に成長すると予測されています。

世界規模での厳しい火災安全規制とコンプライアンス要件により、安全基準の遵守を確実にするための定期的なTICサービスが必要とされています。企業や個人における火災安全に対する意識の高まりが積極的な対策を促し、防火システムの信頼性を検証するためのTICサービスに対する需要を増加させています。また、IoTやスマートセンサーなどの先進技術がこれらのシステムに統合されたことで、その適切な動作を検証するTICサービスの必要性がさらに高まっています。さらに、保険の義務化、賠償責任の考慮、環境持続可能性への注目も市場の拡大に寄与しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2019-2028年 |

| 基準年 | 2022年 |

| 予測期間 | 2023-2028年 |

| 単位 | 米ドル |

| セグメント | サービスタイプ・システムタイプ・用途・地域 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

システムタイプ別で見ると、消火システムの部門が最大のシェアを占める見込みです。スプリンクラーやガスベースの消火システムを含むこれらのシステムは、火災を迅速かつ効率的に消火する上で極めて重要な役割を果たしており、火災安全にとって不可欠なものとなっています。そのため、適切な機能と安全基準の遵守を検証するTICサービスの需要は堅調で、消火システムはTIC市場の要として確立されています。

用途別では、鉱業の部門が予測期間中に高い成長率を示す見通しです。鉱業は、その高リスク環境から、厳格な安全規制や重要資産の保護が必要とされており、大きな成長が見込まれています。採鉱作業には可燃性物質、重機械、遠隔地が含まれるため、火災の危険にさらされやすいです。安全規制の遵守と資産の保護を確実にするため、鉱業企業は防火システムの有効性と信頼性を検証するTICサービスへの依存度を高めており、この分野の大幅な成長の可能性に寄与しています。

地域別では、北米が予測期間中に大きな成長率を示すと予測されています。同地域での強固な産業インフラ、厳格な防火規制、防火の重要性に対する意識の高まりが、TICサービスの需要拡大に寄与しています。さらに、製造業、ヘルスケア、商業不動産など多様な産業が、コンプライアンスと安全性を確保するための防火システムの定期的な試験・検査の必要性を高めています。北米では防火安全性が引き続き重視され、建設やインフラ整備が進んでいるため、TIC市場の活況が期待されており、世界の防火システムTIC市場において注目すべき成長地域となっています。

当レポートでは、世界の防火システムTIC (試験・検査・認証) の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許動向、ケーススタディ、法規制環境、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステムマッピング

- 価格分析

- 顧客の事業に影響を与える動向/ディスラプション

- 技術分析

- IoT

- クラウドベースソリューション

- ビデオ画像による煙および火炎検出システム

- AI

- 自動テスト技術

- ポーターのファイブフォース分析

- 主要なステークホルダーと購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 主要な会議とイベント

- 規制機関、政府機関、その他の組織

- 規制状況

第6章 防火システムTIC (試験・検査・認証) 市場:サービスタイプ別

- 試験

- 検査

- 認証

第7章 防火システムTIC (試験・検査・認証) 市場:システムタイプ別

- 火災警報器

- 火災検知システム

- 消火システム

- スプリンクラーシステム

- カードアクセスシステム

- その他

第8章 防火システムTIC (試験・検査・認証) 市場:用途別

- 工業・製造

- 石油&ガス・ガソリン

- エネルギー・電力

- サプライチェーン・物流

- データセンター

- 鉱業

- 農業・林業

- 医療・ヘルスケア

- 建設・インフラ

- その他

第9章 防火システムTIC (試験・検査・認証) 市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第10章 競合情勢

- 主要企業の採用戦略

- 市場シェア分析

- 収益分析

- 主要企業の評価マトリックス

- スタートアップ/中小企業の企業評価マトリックス

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- SGS SA

- BUREAU VERITAS

- DEKRA

- TUV RHEINLAND

- TUV SUD

- DNV AS

- INTERTEK GROUP PLC

- TUV NORD GROUP

- UL LLC

- EUROFINS SCIENTIFIC

- KIWA

- API NATIONAL SERVICE GROUP

- その他の企業

- LLOYD'S REGISTER GROUP SERVICES LIMITED

- SAI GLOBAL PTY LTD

- APPLUS+

- ELEMENT MATERIALS TECHNOLOGY

- WARRINGTONFIRE(SUBSIDIARY OF ELEMENT MATERIALS TECHNOLOGY)

- RINA S.P.A.

- NEPTUNE FIRE PROTECTION ENGINEERING(SUBSIDIARY OF VERTEX)

- THE BRITISH STANDARDS INSTITUTION

- VDS SCHADENVERHUTUNG GMBH

- EFECTIS

- HOHENSTEIN

- VDE TESTING AND CERTIFICATION INSTITUTE

- BRE GROUP

- APAVE INTERNATIONAL

- SESOTEC GMBH

第12章 付録

The global fire protection system testing, inspection, and certification (TIC) market was valued at USD 533 million in 2023 and is projected to reach USD 633 million by 2028; it is expected to register a CAGR of 3.5% during the forecast period. A confluence of factors drives the market. Stringent fire safety regulations and compliance requirements on a global scale necessitate regular TIC services to ensure adherence to safety standards. Growing awareness of fire safety among businesses and individuals prompts proactive measures and increases the demand for TIC services to verify the reliability of fire protection systems. The integration of advanced technologies like IoT and smart sensors into these systems further underscores the need for TIC services to validate their proper operation. Insurance mandates, liability considerations, and a focus on environmental sustainability also contribute to the market's expansion.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2028 |

| Base Year | 2022 |

| Forecast Period | 2023-2028 |

| Units Considered | USD |

| Segments | Service Type, System Type, Application, Region |

| Regions covered | North America, Europe, APAC, RoW |

The fire suppression system is expected to hold the largest share in the overall fire protection system testing, inspection, and certification (TIC) market

Among the different system types within the Fire Protection System Testing, Inspection, and Certification (TIC) market, fire suppression systems are poised to dominate with the largest market share. These systems, including sprinkler and gas-based suppression systems, play a pivotal role in swiftly and efficiently extinguishing fires, making them integral to fire safety. As a result, the demand for TIC services to verify their proper functioning and adherence to safety standards is robust, establishing fire suppression systems as a cornerstone in the TIC market.

The mining application segment is expected to grow at a significant growth rate during the forecast period

The mining industry is expected to experience significant growth in the Fire Protection System Testing, Inspection, and Certification (TIC) market due to its inherent high-risk environment, stringent safety regulations, and the critical need to protect valuable assets. Mining operations involve combustible materials, heavy machinery, and remote locations, making them vulnerable to fire hazards. To ensure compliance with safety regulations and safeguard assets, mining companies increasingly rely on TIC services to verify the effectiveness and reliability of their fire protection systems, contributing to the substantial growth potential in this sector.

North America is projected to have a significant growth rate during the forecast period

Due to several key factors, North America is poised to witness significant growth in the Fire Protection System Testing, Inspection, and Certification (TIC) market. The region's robust industrial infrastructure, stringent fire safety regulations, and heightened awareness of the importance of fire protection contribute to a growing demand for TIC services. Additionally, diverse industries, including manufacturing, healthcare, and commercial real estate, drive the need for regular testing and inspection of fire protection systems to ensure compliance and safety. As North America continues to emphasize fire safety and experiences ongoing construction and infrastructure development, the TIC market is expected to thrive, making it a noteworthy growth area in the global fire protection system TIC market.

Breakdown of profiles of primary participants:

- By Company Type: Tier 1 = 30%, Tier 2 = 50%, and Tier 3 = 20%

- By Designation: C-level Executives = 25%, Directors = 35%, and Others = 40%

- By Region: North America = 35%, Europe = 30%, Asia Pacific = 25%, and Rest of the World = 10%

The major companies in the fire protection system testing, inspection, and certification (TIC) market are SGS SA (Switzerland), Bureau Veritas (France), DEKRA (Germany), TUV SUD (Germany), and TUV Rheinland (Germany).

Research Coverage

The report segments the fire protection system testing, inspection, and certification (TIC) market and forecasts its size, by value, based on region ( North America, Europe, Asia Pacific, and Rest of the World), service type (testing, inspection, certification), system type (fire alarm devices, fire detection systems, fire suppression systems, sprinkler systems, card access systems, others), and application (industrial & manufacturing, oil & gas and petroleum, energy & power, supply chain & logistics, data centre, mining, agriculture & forestry, medical & healthcare, construction & infrastructure, others).

The report also comprehensively reviews market drivers, restraints, opportunities, and challenges in the fire protection system testing, inspection, and certification (TIC) market. The report also covers qualitative aspects in addition to the quantitative aspects of these markets.

Reasons to Buy the Report:

- Analysis of key drivers (growing demand for quality and inspection equipment in precision manufacturing, increased need for interoperability testing owing to growing deployment of iot and connected devices, strict regulatory standards imposed by governments to ensure product safety and environmental protection), restraints (lack of highly skilled calibration and maintenance technicians, high competition due to increased price sensitivity), opportunities (the advent of 5G technology and deployment of LTE and LTE-Advanced (4G) networks), and challenges (built-in self-calibration feature of electrical & electronic instrument) influencing the growth of the fire protection system testing, inspection, and certification (TIC) market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the fire protection system testing, inspection, and certification (TIC) market

- Market Development: Comprehensive information about lucrative markets - the report analyses the fire protection system testing, inspection, and certification (TIC) market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the fire protection system testing, inspection, and certification (TIC) market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like SGS SA (Switzerland), Bureau Veritas (France), DEKRA (Germany), TUV SUD (Germany), TUV Rheinland (Germany), DNV GL (Norway), Intertek Group plc (UK), TUV NORD Group (Germany), UL LLC (US), Eurofins Scientific (Luxembourg), Kiwa (Netherlands), APi National Service Group (APi NSG) (US), Applus+ (Spain), Element Materials Technology (UK), SAI Global Australia PTY Ltd (Australia), Lloyds Register Group Services Limited (UK), Warringtonfire (Cheshire), Rina S.p.A (Italy), BRE Group (UK), and The British Standards Institution (England).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 REGIONAL SCOPE

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- FIGURE 3 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: RESEARCH APPROACH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of major secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Breakdown of primaries

- 2.1.3.2 Breakdown of primary interviews

- 2.1.3.3 Key industry insights

- 2.1.3.4 Key data from primary sources

- 2.2 MARKET SIZE ESTIMATION

- 2.3 FACTOR ANALYSIS

- 2.3.1 SUPPLY-SIDE ANALYSIS

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY-SIDE ANALYSIS) - REVENUES GENERATED BY COMPANIES FROM FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- 2.3.2 DEMAND-SIDE ANALYSIS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (DEMAND-SIDE ANALYSIS) - FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET SHARE IN EACH REGION

- 2.3.3 BOTTOM-UP APPROACH

- 2.3.3.1 Approach to estimate market size using bottom-up analysis

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.4 TOP-DOWN APPROACH

- 2.3.4.1 Approach to estimate market size using top-down analysis

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 9 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: DATA TRIANGULATION

- 2.5 RISK ASSESSMENT

- 2.6 RISK FACTOR ANALYSIS

- 2.7 RECESSION IMPACT

- 2.8 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.8.1 ASSUMPTIONS

- 2.8.2 LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 10 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, 2019-2028 (USD MILLION)

- FIGURE 11 OIL & GAS AND PETROLEUM SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 12 TESTING SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 13 SPRINKLER SYSTEMS TO GROW AT FASTEST RATE FROM 2023 TO 2028

- FIGURE 14 ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET

- FIGURE 15 ADVENT OF BUILDING AUTOMATION AND GROWING FIRE SAFETY CONCERNS TO DRIVE MARKET

- 4.2 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE

- FIGURE 16 TESTING SEGMENT TO COMMAND LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.3 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SYSTEM TYPE

- FIGURE 17 FIRE SUPPRESSION SYSTEMS SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE FROM 2023 TO 2028

- 4.4 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION

- FIGURE 18 INDUSTRIAL & MANUFACTURING SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.5 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY REGION

- FIGURE 19 MARKET IN ASIA PACIFIC TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growth of construction industry in urban areas demanding fire protection systems

- 5.2.1.2 Rising number of fire-related material and human losses

- FIGURE 21 HOME STRUCTURE FIRES IN US, 2011-2020

- 5.2.1.3 Strict government regulations pertaining to fire protection

- 5.2.1.4 Integration of wireless technology into fire detection systems

- FIGURE 22 ANALYSIS OF IMPACT OF DRIVERS ON TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lack of uniformity in global testing, inspection, and certification standards

- 5.2.2.2 Varying standards across geographies leading to high costs

- FIGURE 23 ANALYSIS OF IMPACT OF RESTRAINTS ON FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption of water mist systems

- 5.2.3.2 Increasing adoption of foam-based fire detection systems to minimize negative impact on environment

- 5.2.3.3 Growing popularity of IoT-integrated smoke detectors

- 5.2.3.4 Periodic revision of regulatory norms in various countries

- FIGURE 24 ANALYSIS OF IMPACT OF OPPORTUNITIES ON FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET

- 5.2.4 CHALLENGES

- 5.2.4.1 Slower adoption of advanced technologies by small and medium-sized testing, inspection, and certification companies

- FIGURE 25 ANALYSIS OF IMPACT OF CHALLENGES ON FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION MARKET

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 26 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM MAPPING

- TABLE 1 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: KEY PLAYERS IN ECOSYSTEM

- 5.5 PRICING ANALYSIS

- 5.5.1 PRICING FOR TIC SERVICES OFFERED BY KEY PLAYERS (USD/HOUR)

- FIGURE 27 PRICING FOR TIC SERVICES OFFERED BY KEY PLAYERS (USD/HOUR)

- TABLE 2 PRICING FOR TIC SERVICES OFFERED BY KEY PLAYERS (USD/HOUR)

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND INSPECTION MARKET

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 INTERNET OF THINGS (IOT)

- 5.7.2 CLOUD-BASED SOLUTIONS

- 5.7.3 VIDEO IMAGE SMOKE AND FLAME DETECTION SYSTEMS

- 5.7.4 ARTIFICIAL INTELLIGENCE

- 5.7.5 AUTOMATION TESTING TECHNOLOGY

- TABLE 3 MAJOR TRENDS IN FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 IMPACT ANALYSIS OF PORTER'S FIVE FORCES

- TABLE 4 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: DEGREE OF COMPETITION

- 5.8.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 THREAT OF NEW ENTRANTS

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- 5.9.2 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 6 KEY BUYING CRITERIA, BY APPLICATION

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 TESTING, INSPECTION, AND CERTIFICATION SERVICES FOR ENERGY INDUSTRY

- TABLE 7 APPLUS+ RTD IMPROVES FIELD SERVICE DELIVERY FOR ENERGY INDUSTRY WITH MOBILE REACH PLATFORM

- 5.10.2 TESTING, INSPECTION, AND CERTIFICATION SERVICES FOR OFFSHORE WIND ENERGY

- TABLE 8 LLOYD OFFERED COMPREHENSIVE DESIGN APPRAISAL AND CERTIFICATION SERVICES FOR TENNET'S OFFSHORE SUBSTATION

- 5.11 TRADE ANALYSIS

- FIGURE 33 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 853110, BY COUNTRY, 2018-2022 (USD MILLION)

- FIGURE 34 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 853110, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.12 PATENT ANALYSIS

- FIGURE 35 MAJOR PATENT APPLICANTS AND OWNERS, 2013-2022

- FIGURE 36 GEOGRAPHICAL ANALYSIS OF PATENTS GRANTED FOR FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) SERVICES, 2013-2022

- TABLE 9 LIST OF FEW PATENTS IN FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION MARKET, 2020-2022

- 5.13 KEY CONFERENCES & EVENTS, 2023-2024

- TABLE 10 FIRE PROTECTION SYSTEM MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.14 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 CODES AND STANDARDS RELATED TO FIRE PROTECTION SYSTEMS

- TABLE 15 CODES AND STANDARDS RELATED TO FIRE DETECTION

- TABLE 16 CODES AND STANDARDS RELATED TO FIRE SUPPRESSION

6 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE

- 6.1 INTRODUCTION

- FIGURE 37 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE

- TABLE 17 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- FIGURE 38 TESTING SERVICES SEGMENT TO CAPTURE LARGEST SHARE OF FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET DURING FORECAST PERIOD

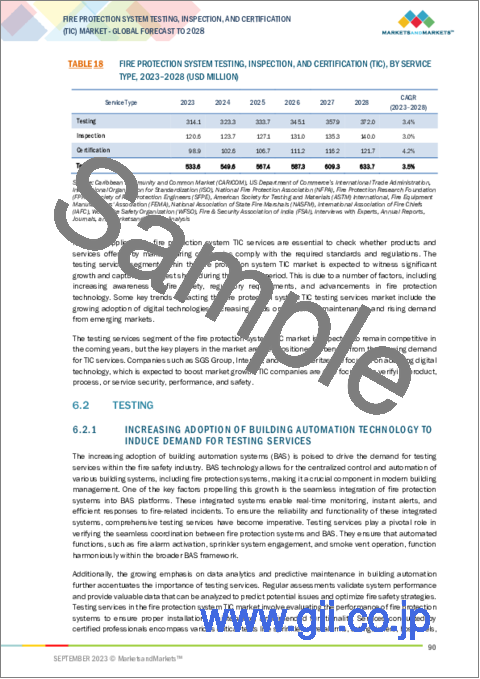

- TABLE 18 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC), BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 6.2 TESTING

- 6.2.1 INCREASING ADOPTION OF BUILDING AUTOMATION TECHNOLOGY TO INDUCE DEMAND FOR TESTING SERVICES

- TABLE 19 TESTING: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SYSTEM TYPE, 2019-2022 (USD MILLION)

- TABLE 20 TESTING: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SYSTEM TYPE, 2023-2028 (USD MILLION)

- TABLE 21 TESTING: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 22 TESTING: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 23 TESTING: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 24 TESTING: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 INSPECTION

- 6.3.1 EMERGENCE OF NEW PRACTICES LIKE VIRTUAL INSPECTIONS TO GENERATE DEMAND FOR INSPECTION SERVICES

- TABLE 25 INSPECTION: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SYSTEM TYPE, 2019-2022 (USD MILLION)

- TABLE 26 INSPECTION: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SYSTEM TYPE, 2023-2028 (USD MILLION)

- TABLE 27 INSPECTION: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 28 INSPECTION: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 29 INSPECTION: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 30 INSPECTION: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4 CERTIFICATION

- 6.4.1 GROWING CONSUMER AWARENESS OF PRODUCT QUALITY AND SAFETY TO BOOST DEMAND FOR CERTIFICATION SERVICES

- TABLE 31 CERTIFICATION: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SYSTEM TYPE, 2019-2022 (USD MILLION)

- TABLE 32 CERTIFICATION: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SYSTEM TYPE, 2023-2028 (USD MILLION)

- TABLE 33 CERTIFICATION: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 34 CERTIFICATION: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 35 CERTIFICATION: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 36 CERTIFICATION: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY REGION, 2023-2028 (USD MILLION)

7 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SYSTEM TYPE

- 7.1 INTRODUCTION

- FIGURE 39 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SYSTEM TYPE

- TABLE 37 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SYSTEM TYPE, 2019-2022 (USD MILLION)

- FIGURE 40 FIRE SUPPRESSION SYSTEMS TO CAPTURE LARGEST SHARE OF FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET DURING FORECAST PERIOD

- TABLE 38 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC), BY SYSTEM TYPE, 2023-2028 (USD MILLION)

- 7.2 FIRE ALARM DEVICES

- 7.2.1 PROVIDE EARLY WARNING IN EVENT OF FIRES

- TABLE 39 FIRE ALARM DEVICES: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 40 FIRE ALARM DEVICES: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 7.3 FIRE DETECTION SYSTEMS

- 7.3.1 DETECT PRESENCE OF FIRE, SMOKE, OR HEAT WITHIN BUILDINGS OR FACILITIES

- TABLE 41 FIRE DETECTION SYSTEMS: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 42 FIRE DETECTION SYSTEMS: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 7.4 FIRE SUPPRESSION SYSTEMS

- 7.4.1 PREVENT SPREAD OF FIRE

- TABLE 43 FIRE SUPPRESSION SYSTEMS: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 44 FIRE SUPPRESSION SYSTEMS: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 7.5 SPRINKLER SYSTEMS

- 7.5.1 AID IN SAFE EVACUATION BY RESPONDING SELECTIVELY TO SPECIFIC FIRE LOCATIONS

- TABLE 45 SPRINKLER SYSTEMS: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 46 SPRINKLER SYSTEMS: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 7.6 CARD ACCESS SYSTEMS

- 7.6.1 REDUCE RISK OF HUMAN ERROR IN FIRE PROTECTION SYSTEMS

- TABLE 47 CARD ACCESS SYSTEMS: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 48 CARD ACCESS SYSTEMS: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 7.7 OTHERS

- TABLE 49 OTHERS: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 50 OTHERS: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

8 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 41 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION

- TABLE 51 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- FIGURE 42 INDUSTRIAL & MANUFACTURING SEGMENT TO COMMAND LARGEST SHARE OF FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET DURING FORECAST PERIOD

- TABLE 52 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.2 INDUSTRIAL & MANUFACTURING

- 8.2.1 COMPLEXITY OF FIRE HAZARDS IN MANUFACTURING AND INDUSTRIAL SECTORS TO BOOST NEED FOR STRICT FIRE PROTECTION MEASURES

- TABLE 53 INDUSTRIAL & MANUFACTURING: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 54 INDUSTRIAL & MANUFACTURING: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 8.3 OIL & GAS AND PETROLEUM

- 8.3.1 HIGH RISK OF ACCIDENTS AND RELIABILITY NEEDS IN OIL, GAS, AND PETROLEUM OPERATIONS TO BOOST DEMAND FOR FIRE PROTECTION TIC SERVICES

- TABLE 55 OIL & GAS AND PETROLEUM: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 56 OIL & GAS AND PETROLEUM: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 8.4 ENERGY & POWER

- 8.4.1 HIGH RISK OF FIRE ASSOCIATED WITH ENERGY CREATION, DISTRIBUTION, AND CONSUMPTION TO CREATE DEMAND FOR TIC SERVICES

- TABLE 57 ENERGY & POWER: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 58 ENERGY & POWER: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 8.5 SUPPLY CHAIN & LOGISTICS

- 8.5.1 MANDATORY REQUIREMENT FOR FIRE PROTECTION SYSTEMS IN LOGISTICS INDUSTRY TO DRIVE MARKET

- TABLE 59 SUPPLY CHAIN & LOGISTICS: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 60 SUPPLY CHAIN & LOGISTICS: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 8.6 DATA CENTER

- 8.6.1 HIGH DATA FLOW AND INCREASED POWER DENSITY OF SERVERS TO INDUCE DEMAND FOR FIRE PROTECTION TIC SERVICES

- TABLE 61 DATA CENTER: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 62 DATA CENTER: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 8.7 MINING

- 8.7.1 NEED TO PREVENT FIRE HAZARDS IN MINING OPERATIONS POSED BY FLAMMABLE MATERIALS TO DRIVE DEMAND FOR TIC SERVICES

- TABLE 63 MINING: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 64 MINING: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 8.8 AGRICULTURE & FORESTRY

- 8.8.1 NEED TO MANAGE RISK OF WILDFIRES IN REMOTE AGRICULTURAL AND FORESTRY OPERATIONS TO DRIVE MARKET

- TABLE 65 AGRICULTURE & FORESTRY: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 66 AGRICULTURE & FORESTRY: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 8.9 MEDICAL & HEALTHCARE

- 8.9.1 FOCUS ON MAINTAINING SAFE ENVIRONMENT IN HEALTHCARE FACILITIES TO DRIVE ADOPTION OF FIRE PROTECTION SYSTEM TIC SERVICES

- TABLE 67 MEDICAL & HEALTHCARE: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 68 MEDICAL & HEALTHCARE: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 8.10 CONSTRUCTION & INFRASTRUCTURE

- 8.10.1 NEED TO ENSURE SAFETY AND RELIABILITY OF BUILDINGS AND INFRASTRUCTURE PROJECTS TO FUEL MARKET GROWTH

- TABLE 69 CONSTRUCTION & INFRASTRUCTURE: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 70 CONSTRUCTION & INFRASTRUCTURE: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 8.11 OTHERS

- TABLE 71 OTHER APPLICATIONS: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 72 OTHER APPLICATIONS: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

9 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 43 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY REGION

- FIGURE 44 CHINA TO REGISTER HIGHEST CAGR IN GLOBAL FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 73 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 74 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC), BY REGION, 2023-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 46 NORTH AMERICA: RECESSION SCENARIO-BASED ANALYSIS, 2022-2028

- FIGURE 47 NORTH AMERICA: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET SNAPSHOT

- TABLE 75 NORTH AMERICA: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SYSTEM TYPE, 2019-2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SYSTEM TYPE, 2023-2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.2.2 US

- 9.2.2.1 Government mandates to adopt fire protection systems in buildings to drive market

- TABLE 83 US: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 84 US: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 9.2.3 CANADA

- 9.2.3.1 Growing adoption of latest advancements in fire protection systems to boost demand for TIC services

- TABLE 85 CANADA: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 86 CANADA: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 9.2.4 MEXICO

- 9.2.4.1 Rising investments in enhancing warehouse infrastructure to drive demand for fire protection systems

- 9.3 EUROPE

- 9.3.1 EUROPE: RECESSION IMPACT

- FIGURE 48 EUROPE: RECESSION SCENARIO-BASED ANALYSIS

- FIGURE 49 EUROPE: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET SNAPSHOT

- TABLE 87 EUROPE: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 88 EUROPE: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 89 EUROPE: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 90 EUROPE: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 91 EUROPE: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SYSTEM TYPE, 2019-2022 (USD MILLION)

- TABLE 92 EUROPE: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SYSTEM TYPE, 2023-2028 (USD MILLION)

- TABLE 93 EUROPE: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 94 EUROPE: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.3.2 UK

- 9.3.2.1 Growing adoption of wireless fire detection systems to drive market

- TABLE 95 UK: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 96 UK: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 9.3.3 GERMANY

- 9.3.3.1 Increase in number of fire safety regulations and standards to contribute to market growth

- TABLE 97 GERMANY: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 98 GERMANY: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 9.3.4 FRANCE

- 9.3.4.1 New government rules mandating installation of sprinklers in homes to support market growth

- TABLE 99 FRANCE: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 100 FRANCE: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 9.3.5 ITALY

- 9.3.5.1 Rising government efforts to enforce adherence to fire safety regulations to drive market

- 9.3.6 SPAIN

- 9.3.6.1 Growing awareness of fire safety among businesses and individuals to foster market growth

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 50 ASIA PACIFIC: RECESSION SCENARIO-BASED ANALYSIS

- FIGURE 51 ASIA PACIFIC: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET SNAPSHOT

- TABLE 101 ASIA PACIFIC: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 102 ASIA PACIFIC: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 103 ASIA PACIFIC: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 104 ASIA PACIFIC: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 105 ASIA PACIFIC: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SYSTEM TYPE, 2019-2022 (USD MILLION)

- TABLE 106 ASIA PACIFIC: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SYSTEM TYPE, 2023-2028 (USD MILLION)

- TABLE 107 ASIA PACIFIC: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 108 ASIA PACIFIC: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.4.2 CHINA

- 9.4.2.1 Rising adoption of fire protection systems to favor market growth

- TABLE 109 CHINA: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 110 CHINA: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 9.4.3 JAPAN

- 9.4.3.1 Growing sales of sprinklers, fire extinguishers, and fire alarms to propel market growth

- TABLE 111 JAPAN: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 112 JAPAN: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Government initiatives to minimize fire damages to human lives and properties to drive market

- TABLE 113 SOUTH KOREA: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 114 SOUTH KOREA: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 9.4.5 INDIA

- 9.4.5.1 Growing emphasis on fire safety in commercial and corporate sectors to support market growth

- 9.4.6 AUSTRALIA

- 9.4.6.1 Stringent regulations in mining industries to increase uptake of TIC services

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 REST OF THE WORLD (ROW)

- 9.5.1 ROW: RECESSION IMPACT

- FIGURE 52 ROW: RECESSION SCENARIO-BASED ANALYSIS, 2022-2028

- FIGURE 53 ROW: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET SNAPSHOT

- TABLE 115 ROW: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 116 ROW: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 117 ROW: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 118 ROW: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 119 ROW: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SYSTEM TYPE, 2019-2022 (USD MILLION)

- TABLE 120 ROW: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY SYSTEM TYPE, 2023-2028 (USD MILLION)

- TABLE 121 ROW: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 122 ROW: FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.5.2 MIDDLE EAST & AFRICA

- 9.5.2.1 Demand from oil and petroleum industries to drive market

- 9.5.3 SOUTH AMERICA

- 9.5.3.1 Rising manufacturing activities to boost demand for fire protection system TIC services

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 123 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 MARKET SHARE ANALYSIS

- FIGURE 54 FIRE PROTECTION SYSTEM TESTING INSPECTION AND CERTIFICATION (TIC) MARKET: MARKET SHARE ANALYSIS, 2022

- TABLE 124 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: MARKET SHARE ANALYSIS

- 10.4 REVENUE ANALYSIS

- FIGURE 55 REVENUE SHARE ANALYSIS OF TOP 5 PLAYERS, 2018-2022

- 10.5 EVALUATION MATRIX FOR MAJOR PLAYERS

- 10.5.1 STARS

- 10.5.2 PERVASIVE PLAYERS

- 10.5.3 EMERGING LEADERS

- 10.5.4 PARTICIPANTS

- FIGURE 56 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: EVALUATION MATRIX FOR KEY COMPANIES, 2022

- 10.5.5 COMPANY FOOTPRINT ANALYSIS

- TABLE 125 COMPANY FOOTPRINT

- TABLE 126 COMPANY SERVICE TYPE FOOTPRINT

- TABLE 127 COMPANY APPLICATION FOOTPRINT

- TABLE 128 COMPANY REGION FOOTPRINT

- 10.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES), 2022

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- FIGURE 57 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- TABLE 129 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- 10.6.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 130 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.7 COMPETITIVE SCENARIOS AND TRENDS

- 10.7.1 PRODUCT/SERVICE LAUNCHES

- TABLE 131 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: PRODUCT LAUNCHES, JANUARY 2019- JUNE 2023

- 10.7.2 DEALS

- TABLE 132 FIRE PROTECTION SYSTEM TESTING, INSPECTION, AND CERTIFICATION (TIC) MARKET: DEALS, FEBRUARY 2019-AUGUST 2023

- 10.7.3 OTHER DEVELOPMENTS

- TABLE 133 OTHER DEVELOPMENTS, MARCH 2019-OCTOBER 2022

11 COMPANY PROFILES

(Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 11.1 KEY PLAYERS

- 11.1.1 SGS SA

- TABLE 134 SGS SA: COMPANY OVERVIEW

- FIGURE 58 SGS SA: COMPANY SNAPSHOT

- TABLE 135 SGS SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 136 SGS SA: PRODUCT/SOLUTION/SERVICE LAUNCHES

- TABLE 137 SGS SA: DEALS

- TABLE 138 SGS SA: OTHER DEVELOPMENTS

- 11.1.2 BUREAU VERITAS

- TABLE 139 BUREAU VERITAS: COMPANY OVERVIEW

- FIGURE 59 BUREAU VERITAS: COMPANY SNAPSHOT

- TABLE 140 BUREAU VERITAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 141 BUREAU VERITAS: PRODUCT/SOLUTION/SERVICE LAUNCHES

- TABLE 142 BUREAU VERITAS: DEALS

- TABLE 143 BUREAU VERITAS: OTHER DEVELOPMENTS

- 11.1.3 DEKRA

- TABLE 144 DEKRA: COMPANY OVERVIEW

- FIGURE 60 DEKRA: COMPANY SNAPSHOT

- TABLE 145 DEKRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 DEKRA: PRODUCT/SOLUTION/SERVICE LAUNCHES

- TABLE 147 DEKRA: DEALS

- TABLE 148 DEKRA: OTHER DEVELOPMENTS

- 11.1.4 TUV RHEINLAND

- TABLE 149 TUV RHEINLAND: COMPANY OVERVIEW

- FIGURE 61 TUV RHEINLAND: COMPANY SNAPSHOT

- TABLE 150 TUV RHEINLAND: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 TUV RHEINLAND: PRODUCT/SOLUTION/SERVICE LAUNCHES

- TABLE 152 TUV RHEINLAND: DEALS

- TABLE 153 TUV RHEINLAND: OTHER DEVELOPMENTS

- 11.1.5 TUV SUD

- TABLE 154 TUV SUD: COMPANY OVERVIEW

- FIGURE 62 TUV SUD: COMPANY SNAPSHOT

- TABLE 155 TUV SUD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 TUV SUD: DEALS

- 11.1.6 DNV AS

- TABLE 157 DNV AS: COMPANY OVERVIEW

- FIGURE 63 DNV AS: COMPANY SNAPSHOT

- TABLE 158 DNV AS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 DNV AS: PRODUCT/SOLUTION/SERVICE LAUNCHES

- TABLE 160 DNV AS: DEALS

- TABLE 161 DNV AS: OTHER DEVELOPMENTS

- 11.1.7 INTERTEK GROUP PLC

- TABLE 162 INTERTEK GROUP PLC: COMPANY OVERVIEW

- FIGURE 64 INTERTEK GROUP PLC: COMPANY SNAPSHOT

- TABLE 163 INTERTEK GROUP PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 164 INTERTEK GROUP PLC: PRODUCT/SOLUTION/SERVICE LAUNCHES

- TABLE 165 INTERTEK GROUP PLC: DEALS

- TABLE 166 INTERTEK GROUP PLC: OTHER DEVELOPMENTS

- 11.1.8 TUV NORD GROUP

- TABLE 167 TUV NORD GROUP: COMPANY OVERVIEW

- FIGURE 65 TUV NORD GROUP: COMPANY SNAPSHOT

- TABLE 168 TUV NORD GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 TUV NORD GROUP: PRODUCT/SOLUTION/SERVICE LAUNCHES

- TABLE 170 TUV NORD GROUP: DEALS

- 11.1.9 UL LLC

- TABLE 171 UL LLC: COMPANY OVERVIEW

- TABLE 172 UL LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 173 UL LLC: PRODUCT/SOLUTION/SERVICE LAUNCHES

- TABLE 174 UL LLC: DEALS

- TABLE 175 UL LLC: OTHER DEVELOPMENTS

- 11.1.10 EUROFINS SCIENTIFIC

- TABLE 176 EUROFINS SCIENTIFIC: COMPANY OVERVIEW

- FIGURE 66 EUROFINS SCIENTIFIC: COMPANY SNAPSHOT

- TABLE 177 EUROFINS SCIENTIFIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.11 KIWA

- TABLE 178 KIWA: COMPANY OVERVIEW

- TABLE 179 KIWA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 180 KIWA: PRODUCT/SOLUTION/SERVICE LAUNCHES

- 11.1.12 API NATIONAL SERVICE GROUP

- TABLE 181 API NATIONAL SERVICE GROUP: COMPANY OVERVIEW

- TABLE 182 API NATIONAL SERVICE GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.2 OTHER PLAYERS

- 11.2.1 LLOYD'S REGISTER GROUP SERVICES LIMITED

- 11.2.2 SAI GLOBAL PTY LTD

- 11.2.3 APPLUS+

- 11.2.4 ELEMENT MATERIALS TECHNOLOGY

- 11.2.5 WARRINGTONFIRE (SUBSIDIARY OF ELEMENT MATERIALS TECHNOLOGY)

- 11.2.6 RINA S.P.A.

- 11.2.7 NEPTUNE FIRE PROTECTION ENGINEERING (SUBSIDIARY OF VERTEX)

- 11.2.8 THE BRITISH STANDARDS INSTITUTION

- 11.2.9 VDS SCHADENVERHUTUNG GMBH

- 11.2.10 EFECTIS

- 11.2.11 HOHENSTEIN

- 11.2.12 VDE TESTING AND CERTIFICATION INSTITUTE

- 11.2.13 BRE GROUP

- 11.2.14 APAVE INTERNATIONAL

- 11.2.15 SESOTEC GMBH

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS

- 12.6 AUTHOR DETAILS