|

|

市場調査レポート

商品コード

1350666

画像誘導放射線治療の世界市場:技術別、手技別、用途別、エンドユーザー別、地域別-2028年までの予測Image-Guided Radiation Therapy Market by Product, Procedure, Application, Enduser & Region - Global Forecasts to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 画像誘導放射線治療の世界市場:技術別、手技別、用途別、エンドユーザー別、地域別-2028年までの予測 |

|

出版日: 2023年09月12日

発行: MarketsandMarkets

ページ情報: 英文 198 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の画像誘導放射線治療の市場規模は、2023年の19億米ドルから2028年には24億米ドルに達し、予測期間中のCAGRは5.2%で成長すると予測されています。

画像誘導放射線治療(IGRT)市場の急成長が予測される背景には、魅力的な利点が数多くあります。特に、IGRTの腫瘍ターゲティングの精度の高さは、健康な組織への付随的なダメージを軽減する能力と相まって、極めて重要な推進力となっています。さらに、世界の癌罹患率の上昇により、先進的な治療法に対する需要が高まっており、IGRTはその最前線のソリューションとして位置づけられています。このような要因が重なることで、市場は堅調な拡大局面を迎えることになり、IGRT採用の展望が今後数年間で形成されることになります。

画像誘導放射線治療市場は、製品別では、4Dゲーティング/4D RT、リニアック(線形加速器)、PET/MRI誘導放射線治療、CTスキャン、門脈画像に区分されます。リニアック(線形加速器)分野は、2022年~2028年の予測期間で最大の市場シェアを記録します。リニアック技術の領域は絶え間ない進化を遂げており、画像モダリティ、線量送達手法、治療検証アプローチを包含する進歩的な技術革新が特徴です。この進化の軌跡は、画像誘導放射線治療(IGRT)の永続的な進歩に大きく寄与しており、それによって市場の存在感と卓越性を高める上で極めて重要な役割を果たしています。

画像誘導放射線治療市場は、用途別に前立腺癌、肺癌、頭頸部癌、乳癌、消化器癌、婦人科癌、その他の用途に区分されます。前立腺癌の世界の増加により、先進的で効果的な治療手法に対するニーズが急増しています。このような枠組みの中で、画像誘導放射線治療(IGRT)は極めて重要な位置を占めており、精度の高い緻密な腫瘍ターゲティングを提供し、治療成績を向上させています。治療の高度化に対する要求の高まりは、IGRTの固有の特性とシームレスに融合しており、前立腺癌放射線療法領域における市場拡大の推進力として、その中心的な地位を立証しています。

手技別では、画像誘導放射線治療市場は3Dコンフォーマル治療、IMRT、定位治療、粒子線治療、陽子線治療に区分されます。予測期間中、画像誘導放射線治療市場において最も大きな年間平均成長率(CAGR)を示したのは定位治療でした。

定位放射線治療には、治療期間の短縮や精度の向上など、放射線治療を受ける患者の快適性を高める特長があります。このような全人的な治療体験の向上は、画像誘導放射線治療(IGRT)を支える患者中心の哲学とシームレスに一致します。これらの特性が融合することで、患者の治療成績が向上するだけでなく、市場情勢におけるIGRTの魅力が増幅され、その結果、採用率が高まり、市場での存在感が高まることになります。

画像誘導放射線治療市場の主要エンドユーザーは病院です。病院のエンドユーザー部門は、予測期間中、画像誘導放射線治療市場で大きな市場シェアを占めると予測されています。病院は、1つの施設内で総合的な医療サービスを提供できることが特徴であり、画像誘導放射線治療(IGRT)を受ける患者に独特の利便性をもたらしています。この利便性は、多様な医療ニーズをひとつ屋根の下に集約することにより、患者が別々の場所で複数の予約を取る必要性を軽減することに由来します。このような戦略的なサービスの統合は、患者の治療を合理化するだけでなく、IGRTの治療オプションとしての魅力を高める。その結果、利便性と包括的ケアのシームレスな連携が、病院内での画像誘導放射線治療市場の発展と隆盛に大きく寄与しています。

当レポートでは、世界の画像誘導放射線治療市場について調査し、技術別、手技別、用途別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- 生態系マッピング

- バリューチェーン分析

- サプライチェーン分析

- 規制分析

- 償還シナリオ

- 価格分析

- 特許分析

- ケーススタディ

- 2023年~2024年の主要な会議とイベント

- 顧客のビジネスに影響を与える動向/混乱

- 主要な利害関係者と購入基準

- 画像誘導放射線治療市場:不況の影響

第6章 画像誘導放射線治療市場、技術別

- イントロダクション

- リニアック

- CTスキャン

- ポータルイメージング

- 4Dゲート/4D放射線治療

- PET/MRIガイド下放射線治療

第7章 画像誘導放射線治療市場、手技別

- イントロダクション

- IMRT

- 3D原体放射線治療

- 定位治療

- 粒子線治療

- 陽子線治療

第8章 画像誘導放射線治療市場、用途別

- イントロダクション

- 乳癌

- 肺癌

- 前立腺癌

- 頭頸部癌

- 婦人科癌

- 消化器癌

- その他

第9章 画像誘導放射線治療市場、エンドユーザー別

- イントロダクション

- 病院

- 独立系放射線治療センター

第10章 画像誘導放射線治療市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- 概要

- 主要参入企業の戦略/有力企業

- 収益シェア分析

- 市場ランキング分析

- 主要企業の企業評価マトリックス(2022年)

- スタートアップ/中小企業の企業評価マトリックス(2022年)

- 企業フットプリント分析

- 競争シナリオと動向

第12章 企業プロファイル

- 主要参入企業

- SIEMENS HEALTHINEERS AG

- HITACHI

- KONINKLIJKE PHILIPS

- ELEKTA

- ACCURAY INCORPORATED

- CANON MEDICAL SYSTEMS CORPORATION

- C-RAD AB

- VIEWRAY, INC.

- IBA WORLDWIDE

- VISION RT LTD.

- PANACEA MEDICAL TECHNOLOGIES

- MEVION MEDICAL SYSTEMS

- GE HEALTHCARE

- その他の企業

- REFLEXION

- ASG SUPERCONDUCTORS

- GALBINO TECHNOLOGY

- IZI MEDICAL

- XSTRAHL

- AEP LINAC

第13章 付録

The global image-guided radiation therapy market is projected to reach USD 2.4 billion by 2028 from USD 1.9 billion in 2023, growing at a CAGR of 5.2% during the forecast period. The projected surge in market growth for image-guided radiation therapy (IGRT) is underpinned by a confluence of compelling advantages. Notably, IGRT's capacity to achieve exceptional precision in tumor targeting, coupled with its ability to mitigate collateral damage to healthy tissues, stands as a pivotal driver. Furthermore, the escalating global incidence of cancer amplifies the demand for advanced treatment modalities, with IGRT positioned as a forefront solution. This convergence of factors is poised to usher in a phase of robust expansion within the market, consequently shaping the landscape of IGRT adoption in the forthcoming forecasting years.

"LINAC (linear accelerator) segment to register largest market share in 2022-2028."

Based on the product, the image-guided radiation therapy market is segmented into 4D gating/ 4D RT, LINAC (linear accelerator), PET/ MRI-guided radiation therapy, CT scanning and portal imaging. LINAC (linear accelerator) segment to register the largest market share over the forecast period of 2022-2028. The realm of LINAC technology is marked by continuous evolution, characterized by progressive innovations encompassing imaging modalities, dose delivery methodologies, and treatment validation approaches. This evolutionary trajectory significantly contributes to the perpetual advancement of image-guided radiation therapy (IGRT), thereby playing a pivotal role in amplifying its market presence and prominence.

"The Prostate cancer application segment to register highest CAGR over the forecast period of 2023-2028."

Based on the application, the image-guided radiation therapy market is segmented into prostate cancer, lung cancer, head & neck cancer, breast cancer, gastrointestinal cancer, gynecological cancer, and other applications. The rising worldwide prevalence of prostate cancer has catalyzed a discernible surge in the need for advanced and effective treatment methodologies. Within this framework, image-guided radiation therapy (IGRT) assumes a pivotal stance, proffering meticulous tumor targeting founded on precision and augmenting therapeutic outcomes. This escalating requirement for elevated treatment sophistication seamlessly converges with the inherent attributes of IGRT, thereby substantiating its central position in propelling market expansion within the sphere of prostate cancer radiation therapy.

"The Stereotactic therapy procedure segment accounted for the highest CAGR of the image-guided radiation therapy market over the forecasting period."

Based on the procedure, the image-guided radiation therapy market is segmented into 3D conformal therapy, IMRT, stereotactic therapy, particle therapy and proton beam therapy. The stereotactic therapy procedure segment exhibited the most substantial Compound Annual Growth Rate (CAGR) within the image-guided radiation therapy market over the projected forecasting period.

Stereotactic therapy possesses distinct qualities, notably its abbreviated treatment duration and elevated precision, which notably elevate the comfort levels of patients undergoing radiation therapy. This enhancement in the holistic treatment experience aligns seamlessly with the patient-centric philosophy that underscores image-guided radiation therapy (IGRT). The convergence of these attributes not only cultivates positive patient outcomes but also amplifies IGRT's appeal within the market landscape, consequently fostering heightened adoption rates and a more pronounced market presence.

"Hospitals' segment to register for the largest market share of the image-guided radiation therapy market in 2022-2028."

The major end users in the image-guided radiation therapy market are hospitals. The hospital end-user segment is estimated to hold a significant market share of the image-guided radiation therapy market during the forecast period. Hospitals, characterized by their capacity to provide a comprehensive array of medical services within a singular facility, confer a distinctive convenience to patients undergoing image-guided radiation therapy (IGRT). This convenience stems from the consolidation of diverse medical needs under one roof, thereby mitigating the necessity for patients to seek multiple appointments at disparate venues. This strategic amalgamation of services not only streamlines patient care but also augments the attractiveness of IGRT as a preferred treatment option. As a result, this seamless alignment of convenience and comprehensive care significantly contributes to the advancement and prominence of the image-guided radiation therapy market within hospital settings.

Technological Advances: Hospitals frequently maintain cutting-edge infrastructure and technological capabilities essential for the successful integration of image-guided radiation therapy (IGRT), thus assuring the ready availability of requisite resources. This pivotal attribute distinctly contributes to the advancement and fortification of the image-guided radiation therapy market.

"Asia Pacific to register significant growth rate in the market during the forecast period."

For the forecasting period 2023-2028, the APAC region is expected to register a significant growth rate in the market during the forecast period. Asia Pacific comprises India, China, Japan, Australia, South Korea, and RoAPAC. The Asia-Pacific (APAC) region has witnessed a significant increase in the market growth rate for image-guided radiation therapy. There are several drivers that contributed to this growth:

The maturing demographic profile observed in APAC countries accentuates the imperative for efficacious cancer treatment modalities characterized by minimized treatment-related adverse effects. This resonance with the precision-driven attributes of image-guided radiation therapy (IGRT) substantiates its pivotal role in enhancing the market landscape.

The incorporation of multilingual patient care offerings within APAC hospitals, combined with the accessibility to advanced treatments like image-guided radiation therapy (IGRT), confers a unique allure to the region, particularly among a diverse patient spectrum. This fusion of linguistic inclusiveness and state-of-the-art medical interventions significantly enhances the region's desirability as a favored healthcare destination, thereby fortifying its competitive position within the healthcare market landscape and concomitantly propelling the prominence of IGRT.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-40%, Tier 2-30%, and Tier 3- 30%

- By Designation: C-level-27%, Director-level-18%, and Others-55%

- By Region: North America-50%, Europe-20%, Asia Pacific-15%, Latin America-10%, and the Middle East & Africa-5%

Prominent players in this market are Siemens Healthineers AG (Germany), Elekta (Sweden), Accuray Incorporated (US), GE Healthcare Company (US), and Hitachi (Japan), among others.

Research Coverage

- The report studies the image-guided radiation therapy market based on products, procedures, applications, end users, and regions.

- The report analyzes factors (such as drivers, restraints, opportunities, and challenges) affecting the market growth.

- The report evaluates the opportunities and challenges in the market for stakeholders and provides details of the competitive landscape for market leaders.

- The report studies micro markets with respect to their growth trends, prospects, and contributions to the global image-guided radiation therapy market.

- The report forecasts the revenue of market segments with respect to five major regions.

Key Benefits of Buying the Report:

The report will help the market leaders/new entrants/smaller firms in this market with investment evaluation viability within the image-guided radiation therapy market through a thorough analysis of comprehensive data, thereby facilitating robust risk assessment and enabling well-informed investment determinations. Benefit from meticulous market segmentation encompassing application, end-user, and regional dimensions, affording tailored insights for precise segment targeting. The report also provides an all-encompassing evaluation of encapsulating pivotal trends, growth catalysts, challenges, and prospects, thereby empowering strategic decision-making with astute discernment.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing prevalence of cancer patient population, Increasing government initiatives for cancer management, advancements in non-invasive treatments through radiation therapy), restraints (Dearth of skilled radiologist/oncologist, high cost of image-guided radiation therapy treatment, Complexity of imaging technology for treatments), opportunities (Expansion of key players in emerging countries, Rising healthcare expenditure across developing countries), and challenges (Availability of alternative technology) influencing the growth of the image-guided radiation therapy market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the image-guided radiation therapy market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the image-guided radiation therapy market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the image-guided radiation therapy market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Siemens Healthineers AG (Germany), Elekta (Sweden), and Accuray Incorporated (US), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 RESEARCH LIMITATIONS

- 1.5 MARKET STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

- 1.6.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY RESEARCH

- 2.1.2.1 Primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY AND DEMAND-SIDE PARTICIPANTS

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 4 RESEARCH METHODOLOGY: HYPOTHESIS BUILDING

- 2.2.1 BOTTOM-UP APPROACH

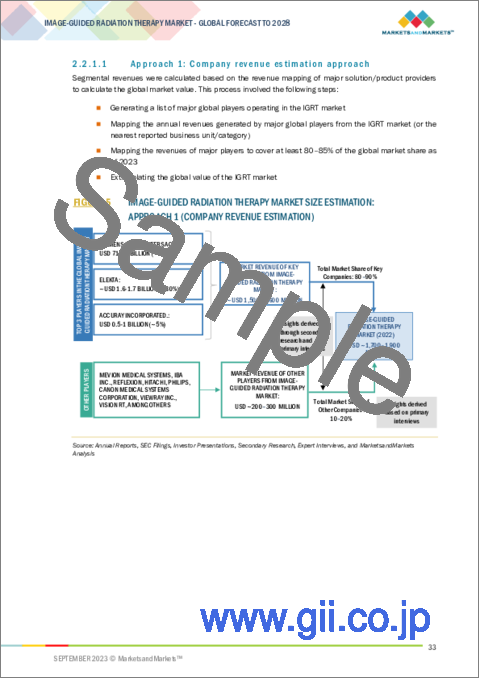

- 2.2.1.1 Approach 1: Company revenue estimation approach

- FIGURE 5 IMAGE-GUIDED RADIATION THERAPY MARKET SIZE ESTIMATION: APPROACH 1 (COMPANY REVENUE ESTIMATION)

- 2.2.1.2 Approach 2: Customer-based market estimation

- FIGURE 6 IMAGE-GUIDED RADIATION THERAPY MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.2.1.3 Approach 3: Top-down approach

- 2.2.1.4 Approach 4: Primary interviews

- FIGURE 7 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION AND MARKET BREAKDOWN

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- 2.4 ASSUMPTIONS AND RISK ASSESSMENT

- TABLE 1 IMAGE-GUIDED RADIATION THERAPY MARKET: ASSUMPTIONS

- TABLE 2 IMAGE-GUIDED RADIATION THERAPY MARKET: LIMITATIONS

- 2.5 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 9 IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 IMAGE-GUIDED RADIATION THERAPY MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 IMAGE-GUIDED RADIATION THERAPY MARKET, BY PROCEDURE, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 IMAGE-GUIDED RADIATION THERAPY MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 IMAGE-GUIDED RADIATION THERAPY MARKET: GEOGRAPHICAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 IMAGE-GUIDED RADIATION THERAPY MARKET OVERVIEW

- FIGURE 14 INCREASING CANCER PATIENT POPULATION AND GROWING NONINVASIVE CANCER TREATMENT TO DRIVE MARKET

- 4.2 REGIONAL MIX: IMAGE-GUIDED RADIATION THERAPY MARKET (2021-2028)

- FIGURE 15 NORTH AMERICA TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- 4.3 NORTH AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY COUNTRY AND END USER, 2022 (USD MILLION)

- FIGURE 16 HOSPITALS DOMINATED IMAGE-GUIDED RADIATION THERAPY MARKET IN 2022

- 4.4 IMAGE-GUIDED RADIATION THERAPY MARKET, BY COUNTRY

- FIGURE 17 MEXICO TO GROW AT HIGHEST RATE IN GLOBAL MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 18 IMAGE-GUIDED RADIATION THERAPY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising adoption of radiotherapy for noninvasive cancer treatment

- 5.2.1.2 Rising cancer patient population

- FIGURE 19 OVERVIEW OF CANCER PATIENT POPULATION: MALE VS. FEMALE

- TABLE 3 RISE IN CANCER CASES, 2020 VS. 2025 VS. 2030

- 5.2.1.3 Initiatives and support for cancer management

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complexity of imaging technology

- 5.2.2.2 Affordability and accessibility of treatment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of key players in emerging economies

- 5.2.3.2 Rising healthcare expenditure across emerging economies

- FIGURE 20 GOVERNMENT HEALTH EXPENDITURE AS % OF GENERAL GOVERNMENT EXPENDITURE (GGE)

- 5.2.4 CHALLENGES

- 5.2.4.1 Availability of alternatives to IGRT

- 5.2.4.2 Dearth of skilled personnel

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 IMAGE-GUIDED RADIATION THERAPY MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 ECOSYSTEM MAPPING

- FIGURE 21 IMAGE-GUIDED RADIATION THERAPY MARKET: ECOSYSTEM MAP

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 RESEARCH & DEVELOPMENT

- 5.5.2 PROCUREMENT AND PRODUCT DEVELOPMENT

- 5.5.3 MARKETING, SALES & DISTRIBUTION, AND POST-SALES SERVICES

- FIGURE 22 IMAGE-GUIDED RADIATION THERAPY MARKET: VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 SMALL & MEDIUM-SIZED COMPANIES

- 5.6.3 END USERS

- FIGURE 23 IMAGE-GUIDED RADIATION THERAPY MARKET: SUPPLY CHAIN ANALYSIS

- 5.7 REGULATORY ANALYSIS

- 5.7.1 US

- TABLE 5 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- 5.7.2 EUROPE

- 5.7.3 JAPAN

- TABLE 6 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

- 5.8 REIMBURSEMENT SCENARIO

- TABLE 7 CPT CODES FOR MAJOR AUTOMATED RADIATION THERAPY TREATMENT MODALITIES

- TABLE 8 HEALTHCARE COMMON PROCEDURE CODING SYSTEM (HCPCS) CODES FOR IGRT

- TABLE 9 REIMBURSEMENT FOR IMAGE-GUIDED RADIATION THERAPY PROCEDURES PER COURSE, 2021 VS. 2022

- TABLE 10 FREESTANDING PER COURSE NATIONAL AVERAGE MEDICARE REIMBURSEMENT, 2021 VS. 2022

- 5.9 PRICING ANALYSIS

- TABLE 11 PRICING ANALYSIS OF AUTOMATED RADIATION SYSTEMS (USD)

- 5.10 PATENT ANALYSIS

- TABLE 12 IMPORT DATA FOR IMAGE-GUIDED RADIATION THERAPY (HS CODE 9022), BY COUNTRY, 2018-2022 (USD THOUSAND)

- TABLE 13 EXPORT DATA FOR IMAGE-GUIDED RADIATION THERAPY (HS CODE 9018), BY COUNTRY, 2018-2022 (USD THOUSAND)

- 5.11 CASE STUDY

- TABLE 14 CASE STUDY: ENABLING MR-GUIDED SBRT TREATMENTS FOR PROSTATE CANCER

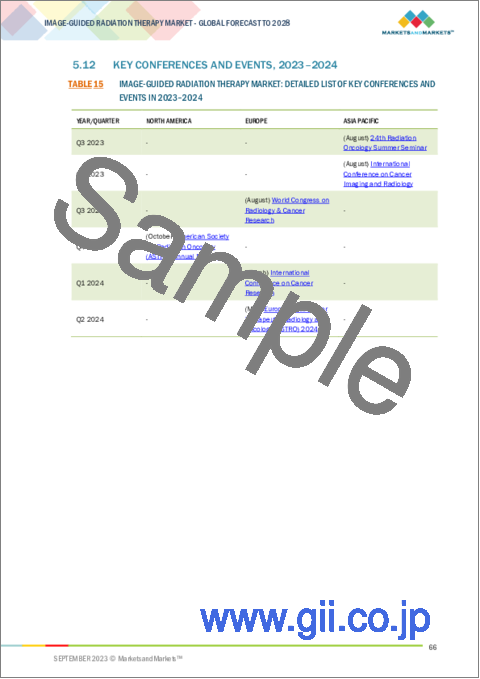

- 5.12 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 15 IMAGE-GUIDED RADIATION THERAPY MARKET: DETAILED LIST OF KEY CONFERENCES AND EVENTS IN 2023-2024

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 24 EMERGING TRENDS AND OPPORTUNITIES AFFECTING FUTURE REVENUE MIX

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR IMAGE-GUIDED RADIATION THERAPY MARKET

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR KEY PRODUCT SEGMENTS (%)

- 5.15 IMAGE-GUIDED RADIATION THERAPY MARKET: RECESSION IMPACT

6 IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE

- 6.1 INTRODUCTION

- TABLE 17 IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- 6.2 LINACS

- 6.2.1 LINACS TO HOLD LARGEST MARKET SHARE TILL 2028

- TABLE 18 LINACS MARKET, BY REGION, 2020-2028 (USD MILLION)

- TABLE 19 LINACS MARKET, BY PROCEDURE, 2020-2028 (USD MILLION)

- TABLE 20 LINACS MARKET, BY APPLICATION, 2020-2028(USD MILLION)

- TABLE 21 LINACS MARKET, BY END USER, 2020-2028 (USD MILLION)

- 6.3 CT SCANNING

- 6.3.1 GROWING NUMBER OF IMAGE-GUIDED AND MINIMALLY INVASIVE MEDICAL PROCEDURES TO BOOST MARKET

- TABLE 22 CT SCANNING MARKET, BY REGION, 2020-2028 (USD MILLION)

- TABLE 23 CT SCANNING MARKET, BY PROCEDURE, 2020-2028 (USD MILLION)

- TABLE 24 CT SCANNING MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 25 CT SCANNING MARKET, BY END USER, 2020-2028 (USD MILLION)

- 6.4 PORTAL IMAGING

- 6.4.1 TRANSITION FROM MANUAL TO ROBOTIC TREATMENT TO SUPPORT MARKET GROWTH

- TABLE 26 PORTAL IMAGING MARKET, BY REGION, 2020-2028 (USD MILLION)

- TABLE 27 PORTAL IMAGING MARKET, BY PROCEDURE, 2020-2028 (USD MILLION)

- TABLE 28 PORTAL IMAGING MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 29 PORTAL IMAGING MARKET, BY END USER, 2020-2028 (USD MILLION)

- 6.5 4D GATING/4D RADIATION THERAPY

- 6.5.1 RISING NUMBER OF CANCER TREATMENTS TO DRIVE MARKET

- TABLE 30 4D GATING/4D RADIATION THERAPY MARKET, BY REGION, 2020-2028 (USD MILLION)

- TABLE 31 4D GATING/4D RADIATION THERAPY MARKET, BY PROCEDURE, 2020-2028 (USD MILLION)

- TABLE 32 4D GATING/4D RADIATION THERAPY MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 33 4D GATING/4D RADIATION THERAPY MARKET, BY END USER, 2020-2028 (USD MILLION)

- 6.6 PET/MRI-GUIDED RADIATION THERAPY

- 6.6.1 LARGE PATIENT POPULATION FOR CANCER TO DRIVE MARKET

- TABLE 34 PET/MRI-GUIDED RADIATION THERAPY MARKET, BY REGION, 2020-2028 (USD MILLION)

- TABLE 35 PET/MRI-GUIDED RADIATION THERAPY MARKET, BY PROCEDURE, 2020-2028 (USD MILLION)

- TABLE 36 PET/MRI-GUIDED RADIATION THERAPY MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 37 PET/MRI-GUIDED RADIATION THERAPY MARKET, BY END USER, 2020-2028 (USD MILLION)

7 IMAGE-GUIDED RADIATION THERAPY MARKET, BY PROCEDURE

- 7.1 INTRODUCTION

- TABLE 38 IMAGE-GUIDED RADIATION THERAPY MARKET, BY PROCEDURE, 2020-2028 (USD MILLION)

- 7.2 IMRT

- 7.2.1 IMRT TO HOLD LARGEST MARKET SHARE OVER FORECAST PERIOD

- TABLE 39 IMRT MARKET, BY REGION, 2020-2028 (USD MILLION)

- 7.3 3D CONFORMAL RADIATION THERAPY

- 7.3.1 ADVANTAGES AND INCREASED ADOPTION OF RADIATION THERAPY TO BOOST ADOPTION

- TABLE 40 3D CONFORMAL RADIATION THERAPY MARKET, BY REGION, 2020-2028 (USD MILLION)

- 7.4 STEREOTACTIC THERAPY

- 7.4.1 HIGH PRECISION AND EASE OF USE FOR SURGEONS TO DRIVE ADOPTION

- TABLE 41 STEREOTACTIC THERAPY MARKET, BY REGION, 2020-2028 (USD MILLION)

- 7.5 PARTICLE THERAPY

- 7.5.1 GOVERNMENT SUPPORT TO BOOST NUMBER OF PARTICLE THERAPY CENTERS

- TABLE 42 PARTICLE THERAPY MARKET, BY REGION, 2020-2028 (USD MILLION)

- 7.6 PROTON BEAM THERAPY

- 7.6.1 RISING ESTABLISHMENT OF PROTON THERAPY CANCER CENTERS TO DRIVE MARKET

- TABLE 43 PROTON BEAM THERAPY MARKET, BY REGION, 2020-2028 (USD MILLION)

8 IMAGE-GUIDED RADIATION THERAPY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- TABLE 44 IMAGE-GUIDED RADIATION THERAPY MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 8.2 BREAST CANCER

- 8.2.1 BREAST CANCER TO HOLD LARGEST SHARE OF APPLICATIONS MARKET

- TABLE 45 IMAGE-GUIDED RADIATION THERAPY MARKET FOR BREAST CANCER, BY REGION, 2020-2028 (USD MILLION)

- 8.3 LUNG CANCER

- 8.3.1 RISING NUMBER OF CLINICAL TRIALS TO SUPPORT GROWTH

- TABLE 46 IMAGE-GUIDED RADIATION THERAPY MARKET FOR LUNG CANCER, BY REGION, 2020-2028 (USD MILLION)

- 8.4 PROSTATE CANCER

- 8.4.1 PREFERENCE FOR NONINVASIVE TREATMENT TO BOOST GROWTH

- TABLE 47 IMAGE-GUIDED RADIATION THERAPY MARKET FOR PROSTATE CANCER, BY REGION, 2020-2028 (USD MILLION)

- 8.5 HEAD & NECK CANCER

- 8.5.1 RISING AWARENESS OF BENEFITS OF NONINVASIVE TREATMENTS TO SUPPORT GROWTH

- TABLE 48 IMAGE-GUIDED RADIATION THERAPY MARKET FOR HEAD & NECK CANCER, BY REGION, 2020-2028 (USD MILLION)

- 8.6 GYNECOLOGICAL CANCER APPLICATIONS

- 8.6.1 GROWING AWARENESS AND NEED FOR EARLY, EFFECTIVE TREATMENT TO SUPPORT ADOPTION

- TABLE 49 IMAGE-GUIDED RADIATION THERAPY MARKET FOR GYNECOLOGICAL CANCER, BY REGION, 2020-2028(USD MILLION)

- 8.7 GASTROINTESTINAL CANCER

- 8.7.1 RISING GI CANCER INCIDENCE TO BOOST MARKET GROWTH

- TABLE 50 IMAGE-GUIDED RADIATION THERAPY MARKET FOR GASTROINTESTINAL CANCER, BY REGION, 2020-2028 (USD MILLION)

- 8.8 OTHER APPLICATIONS

- TABLE 51 IMAGE-GUIDED RADIATION THERAPY MARKET FOR OTHER APPLICATIONS, BY REGION, 2020-2028 (USD MILLION)

9 IMAGE-GUIDED RADIATION THERAPY MARKET, BY END USER

- 9.1 INTRODUCTION

- TABLE 52 IMAGE-GUIDED RADIATION THERAPY MARKET, BY END USER, 2020-2028 (USD MILLION)

- 9.2 HOSPITALS

- 9.2.1 LARGE NUMBER OF SURGICAL AND DIAGNOSTIC PROCEDURES TO PROPEL MARKET

- TABLE 53 IMAGE-GUIDED RADIATION THERAPY MARKET FOR HOSPITALS, BY REGION, 2020-2028 (USD MILLION)

- 9.3 INDEPENDENT RADIOTHERAPY CENTERS

- 9.3.1 LIMITED SURGICAL CAPABILITIES OF AVAILABLE PRODUCTS TO RESTRAIN ADOPTION

- TABLE 54 IMAGE-GUIDED RADIATION THERAPY MARKET FOR INDEPENDENT RADIOTHERAPY CENTERS, BY REGION, 2020-2028 (USD MILLION)

10 IMAGE-GUIDED RADIATION THERAPY MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 55 IMAGE-GUIDED RADIATION THERAPY MARKET, BY REGION, 2020-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 26 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 56 NORTH AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY PROCEDURE, 2020-2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY END USER, 2020-2028 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 US to dominate North American market

- TABLE 61 US: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Rising cancer prevalence and growing awareness to drive market

- TABLE 62 CANADA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT

- TABLE 63 EUROPE: IMAGE-GUIDED RADIATION THERAPY MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 64 EUROPE: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- TABLE 65 EUROPE: IMAGE-GUIDED RADIATION THERAPY MARKET, BY PROCEDURE, 2020-2028 (USD MILLION)

- TABLE 66 EUROPE: IMAGE-GUIDED RADIATION THERAPY MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 67 EUROPE: IMAGE-GUIDED RADIATION THERAPY MARKET, BY END USER, 2020-2028 (USD MILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Germany to dominate market in Europe

- TABLE 68 GERMANY: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- 10.3.3 UK

- 10.3.3.1 High burden of cancer and large volume of radiation therapy procedures to ensure demand

- TABLE 69 UK: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- 10.3.4 FRANCE

- 10.3.4.1 Growth of French healthcare sector to support market growth

- TABLE 70 FRANCE: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- 10.3.5 ITALY

- 10.3.5.1 Increasing geriatric population to aid growth

- TABLE 71 ITALY: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- 10.3.6 SPAIN

- 10.3.6.1 Technological developments in healthcare sector to propel market

- TABLE 72 SPAIN: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- 10.3.7 REST OF EUROPE

- TABLE 73 REST OF EUROPE: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 27 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 74 ASIA PACIFIC: IMAGE-GUIDED RADIATION THERAPY MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 75 ASIA PACIFIC: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- TABLE 76 ASIA PACIFIC: IMAGE-GUIDED RADIATION THERAPY MARKET, BY PROCEDURE, 2020-2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: IMAGE-GUIDED RADIATION THERAPY MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 78 ASIA PACIFIC: IMAGE-GUIDED RADIATION THERAPY MARKET, BY END USER, 2020-2028 (USD MILLION)

- 10.4.2 JAPAN

- 10.4.2.1 Japan to hold largest share of APAC market

- TABLE 79 JAPAN: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Growing prevalence of cancer and developing healthcare infrastructure to aid growth

- TABLE 80 CHINA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- 10.4.4 INDIA

- 10.4.4.1 Increasing target patient population and rising availability of advanced surgical treatments to drive market

- TABLE 81 INDIA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- 10.4.5 AUSTRALIA

- 10.4.5.1 Developing healthcare sector and increasing availability of advanced surgical treatments to favor market

- TABLE 82 AUSTRALIA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Growing target patient population to drive market

- TABLE 83 SOUTH KOREA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- 10.4.7 REST OF ASIA PACIFIC

- TABLE 84 REST OF ASIA PACIFIC: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- 10.5 LATIN AMERICA

- 10.5.1 LATIN AMERICA: RECESSION IMPACT

- TABLE 85 LATIN AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 86 LATIN AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- TABLE 87 LATIN AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY PROCEDURE, 2020-2028 (USD MILLION)

- TABLE 88 LATIN AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 89 LATIN AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY END USER, 2020-2028 (USD MILLION)

- 10.5.2 BRAZIL

- 10.5.2.1 Developing healthcare sector and increasing availability of advanced surgical treatments to boost market growth

- TABLE 90 BRAZIL: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- 10.5.3 MEXICO

- 10.5.3.1 Favorable government initiatives to drive market

- TABLE 91 MEXICO: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- 10.5.4 REST OF LATIN AMERICA

- TABLE 92 REST OF LATIN AMERICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 INCREASING FOCUS OF MARKET PLAYERS ON MIDDLE EASTERN COUNTRIES TO PROPEL MARKET

- 10.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 93 MIDDLE EAST & AFRICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY TECHNIQUE, 2020-2028 (USD MILLION)

- TABLE 94 MIDDLE EAST & AFRICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY PROCEDURE, 2020-2028 (USD MILLION)

- TABLE 95 MIDDLE EAST & AFRICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- TABLE 96 MIDDLE EAST & AFRICA: IMAGE-GUIDED RADIATION THERAPY MARKET, BY END USER, 2020-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- TABLE 97 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN IMAGE-GUIDED RADIATION THERAPY MARKET

- 11.3 REVENUE SHARE ANALYSIS

- FIGURE 28 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN IMAGE-GUIDED RADIATION THERAPY MARKET, 2018-2022 (USD BILLION)

- 11.4 MARKET RANKING ANALYSIS

- FIGURE 29 IMAGE-GUIDED RADIATION THERAPY MARKET (2022)

- 11.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERS (2022)

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 30 IMAGE-GUIDED RADIATION THERAPY MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- 11.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 STARTING BLOCKS

- 11.6.3 RESPONSIVE COMPANIES

- 11.6.4 DYNAMIC COMPANIES

- FIGURE 31 IMAGE-GUIDED RADIATION THERAPY MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/ SMES, 2022

- 11.7 COMPANY FOOTPRINT ANALYSIS

- TABLE 98 TECHNIQUE AND REGIONAL FOOTPRINT ANALYSIS OF TOP PLAYERS IN IMAGE-GUIDED RADIATION THERAPY MARKET

- TABLE 99 FOOTPRINT ANALYSIS OF COMPANIES, BY TECHNIQUE

- TABLE 100 FOOTPRINT ANALYSIS OF COMPANIES, BY REGION

- 11.8 COMPETITIVE SCENARIOS AND TRENDS

- TABLE 101 KEY PRODUCT LAUNCHES AND APPROVALS

- TABLE 102 KEY DEALS

- TABLE 103 OTHER KEY DEVELOPMENTS

12 COMPANY PROFILES

- (Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)**

- 12.1 KEY PLAYERS

- 12.1.1 SIEMENS HEALTHINEERS AG

- TABLE 104 SIEMENS HEALTHINEERS AG: COMPANY OVERVIEW

- FIGURE 32 SIEMENS AG: COMPANY SNAPSHOT (2022)

- 12.1.2 HITACHI

- TABLE 105 HITACHI: COMPANY OVERVIEW

- FIGURE 33 HITACHI: COMPANY SNAPSHOT (2022)

- 12.1.3 KONINKLIJKE PHILIPS

- TABLE 106 KONINKLIJKE PHILIPS: COMPANY OVERVIEW

- FIGURE 34 KONINKLIJKE PHILIPS: COMPANY SNAPSHOT (2022)

- 12.1.4 ELEKTA

- TABLE 107 ELEKTA: COMPANY OVERVIEW

- FIGURE 35 ELEKTA: COMPANY SNAPSHOT (2022)

- 12.1.5 ACCURAY INCORPORATED

- TABLE 108 ACCURAY INCORPORATED: COMPANY OVERVIEW

- FIGURE 36 ACCURAY INCORPORATED: COMPANY SNAPSHOT (2022)

- 12.1.6 CANON MEDICAL SYSTEMS CORPORATION

- TABLE 109 CANON MEDICAL SYSTEMS CORPORATION: COMPANY OVERVIEW

- FIGURE 37 CANON, INC.: COMPANY SNAPSHOT (2022)

- 12.1.7 C-RAD AB

- TABLE 110 C-RAD: COMPANY OVERVIEW

- FIGURE 38 C-RAD: COMPANY SNAPSHOT (2022)

- 12.1.8 VIEWRAY, INC.

- TABLE 111 VIEWRAY, INC.: COMPANY OVERVIEW

- FIGURE 39 VIEWRAY, INC.: COMPANY SNAPSHOT (2022)

- 12.1.9 IBA WORLDWIDE

- TABLE 112 IBA: COMPANY OVERVIEW

- FIGURE 40 IBA: COMPANY SNAPSHOT (2022)

- 12.1.10 VISION RT LTD.

- TABLE 113 VISION RT LTD.: COMPANY OVERVIEW

- 12.1.11 PANACEA MEDICAL TECHNOLOGIES

- TABLE 114 PANACEA MEDICAL TECHNOLOGIES: COMPANY OVERVIEW

- 12.1.12 MEVION MEDICAL SYSTEMS

- TABLE 115 MEVION MEDICAL SYSTEMS: COMPANY OVERVIEW

- 12.1.13 GE HEALTHCARE

- TABLE 116 GE HEALTHCARE: COMPANY OVERVIEW

- FIGURE 41 GE HEALTHCARE: COMPANY SNAPSHOT (2022)

- 12.2 OTHER PLAYERS

- 12.2.1 REFLEXION

- 12.2.2 ASG SUPERCONDUCTORS

- 12.2.3 GALBINO TECHNOLOGY

- 12.2.4 IZI MEDICAL

- 12.2.5 XSTRAHL

- 12.2.6 AEP LINAC

- *Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS