|

|

市場調査レポート

商品コード

1816009

画像診断の世界市場:用途別、モダリティ別、エンドユーザー別、地域別 - 2030年までの予測Diagnostic Imaging Market by Modality (MRI, Ultrasound (3D/4D, Doppler, Contrast), CT, X-Ray (Digital, Portable), Mammography, SPECT, PET), Application (OB/Gyn, CVD, Onco, Neuro) & End User-Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 画像診断の世界市場:用途別、モダリティ別、エンドユーザー別、地域別 - 2030年までの予測 |

|

出版日: 2025年09月15日

発行: MarketsandMarkets

ページ情報: 英文 394 Pages

納期: 即納可能

|

概要

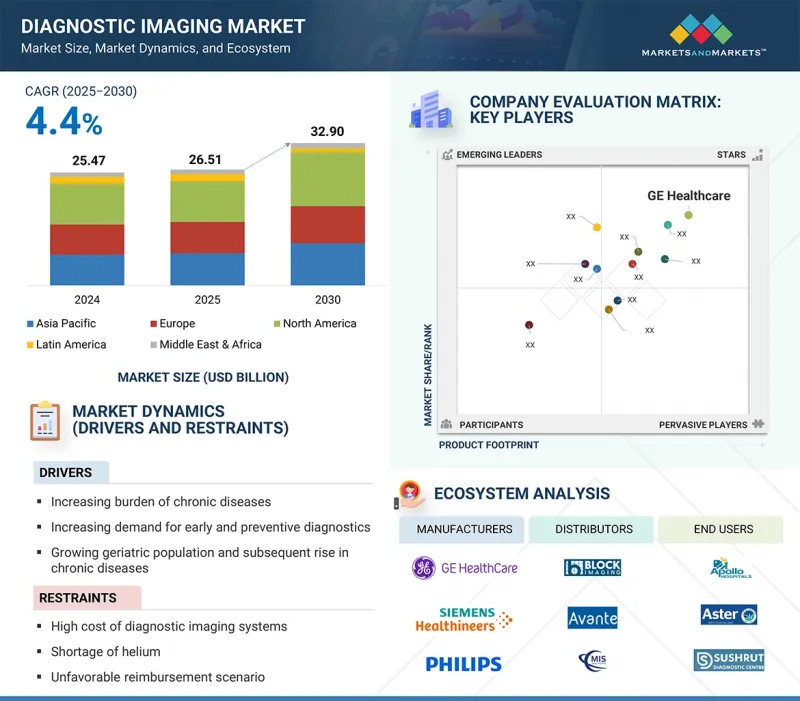

世界の画像診断の市場規模は、2025年の265億1,000万米ドルから2030年には329億米ドルに達すると予測され、2025年から2030年までのCAGRは4.4%になるとみられています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント | 用途別、モダリティ別、エンドユーザー別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ |

市場は非侵襲的技術の利用増加により拡大しています。画像診断市場の拡大は、政府のイニシアティブの高まり、臨床試験、研究開発の重視にもつながっています。

モダリティ別では、画像診断市場はCTスキャナー、MRIシステム、超音波システム、X線画像システム、核画像システム、マンモグラフィシステムに区分されます。2024年の市場シェアは、超音波診断装置が最も大きいです。3Dおよび4D画像診断の進歩は、AI機能や携帯性の向上とともに、ポイントオブケアや救急現場での超音波の使用を強化し、超音波をさらに身近なものにしています。慢性疾患の有病率の上昇と早期かつ正確な診断に対する需要の高まりは、市場における超音波診断システムの優位性を確固たるものにしています。

超音波診断システム市場は、放射線科/一般画像診断、循環器科、産科/婦人科、血管科、泌尿器科、その他に区分されます。2025年から2030年にかけては、放射線科/一般画像診断分野が最大シェアを占めています。この市場の需要を牽引するのは、内科、救急科、一般開業医の間でPOCUS(ポイントオブケア超音波検査)の利用が増加していることです。

アジア太平洋地域の画像診断市場は、予測期間中に最高のCAGRを記録すると予測されています。この成長の主な原動力は、進化するヘルスケアインフラと、同地域における主要参入企業の注力度の高まりです。

病院や診断施設は、特に中国やインドのような急速に発展している国々で、最新の画像診断機器に多額の投資を行っています。これらの要因は、この地域における画像診断市場の拡大に寄与すると予想されます。

当レポートでは、世界の画像診断市場について調査し、用途別、モダリティ別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

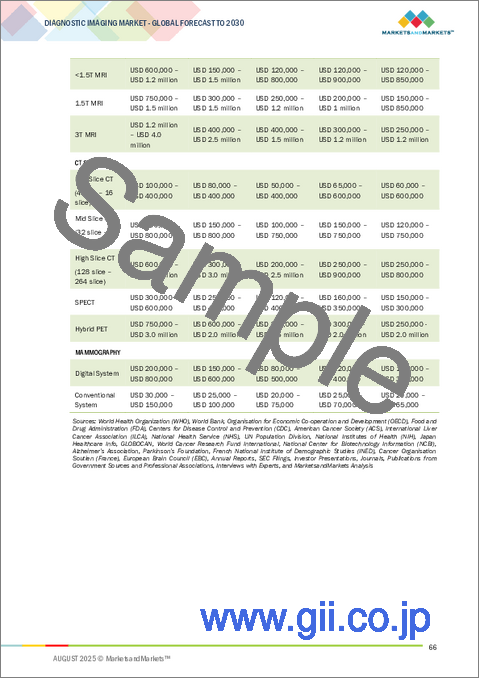

- 価格分析

- バリューチェーン分析

- エコシステム分析

- サプライチェーン分析

- ポーターのファイブフォース分析

- 規制状況

- 顧客ビジネスに影響を与える動向

- 技術分析

- 償還シナリオ

- 貿易分析

- 特許分析

- ケーススタディ分析

- 主要な会議とイベント(2025年~2026年)

- アンメットニーズ

- AIが画像診断市場に与える影響

- 2025年の米国関税の影響

第6章 画像診断市場(用途別)

- イントロダクション

- X線画像システム

- MRIシステム

- 超音波システム

- CTスキャナー

- 核イメージングシステム

- マンモグラフィシステム

第7章 画像診断市場(モダリティ別)

- イントロダクション

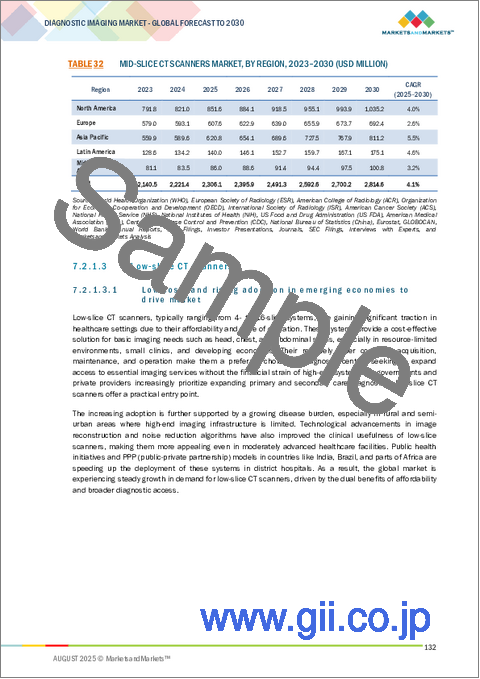

- CTスキャナー

- 超音波システム

- X線画像システム

- MRIシステム

- 核イメージングシステム

- マンモグラフィシステム

第8章 画像診断市場(エンドユーザー別)

- イントロダクション

- 病院

- 画像診断センター

- その他

第9章 画像診断市場(地域別)

- イントロダクション

- 北米

- 北米:マクロ経済見通し

- 米国

- カナダ

- アジア太平洋

- アジア太平洋:マクロ経済見通し

- 日本

- 中国

- インド

- 韓国

- オーストラリア

- その他

- 欧州

- 欧州:マクロ経済見通し

- ドイツ

- 英国

- イタリア

- スペイン

- その他

- ラテンアメリカ

- ラテンアメリカ:マクロ経済見通し

- ブラジル

- メキシコ

- その他

- 中東・アフリカ

- 中東・アフリカ:マクロ経済見通し

- GCC諸国

- その他

第10章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み

- 収益分析、2022年~2024年

- 市場シェア分析

- 2024年の主要参入企業ランキング

- 企業評価と財務指標

- ブランド/製品比較

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第11章 企業プロファイル

- 主要参入企業

- SIEMENS HEALTHINEERS

- GE HEALTHCARE

- KONINKLIJKE PHILIPS N.V.

- FUJIFILM CORPORATION

- CANON

- SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- ESAOTE S.P.A

- SAMSUNG HEALTHCARE

- SHIMADZU CORPORATION

- CARESTREAM HEALTH

- PLANMED OY

- HOLOGIC, INC.

- AGFA-GEVAERT GROUP

- CURVEBEAM AI, LTD.

- UNITED IMAGING HEALTHCARE CO., LTD.

- その他の企業

- ALLENGERS MEDICAL SYSTEMS LTD.

- ANALOGIC CORPORATION

- ASPECT IMAGING LTD.

- BEIJING WANDONG MEDICAL TECHNOLOGY CO., LTD.

- CHISON MEDICAL TECHNOLOGIES CO., LTD.

- KONICA MINOLTA, INC.

- MEDGYN PRODUCTS, INC.

- NEUSOFT MEDICAL SYSTEMS CO., LTD.

- PROMED TECHNOLOGY CO., LTD.

- CMR NAVISCAN

- CLARIUS

- SHENZHEN BASDA MEDICAL APPARATUS CO., LTD.

- SHENZHEN ANKE HIGH-TECH., LTD.

- STERNMED GMBH

- TIME MEDICAL SYSTEMS