|

|

市場調査レポート

商品コード

1347840

システムインテグレーションサービスの世界市場:サービスタイプ別、業界別、地域別-2028年までの予測System Integration Services Market by Service Type (Infrastructure Integration Services, Enterprise Application Integration Services, and Consulting Services), Vertical (BFSI, Government & Defense, and Healthcare) and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| システムインテグレーションサービスの世界市場:サービスタイプ別、業界別、地域別-2028年までの予測 |

|

出版日: 2023年09月11日

発行: MarketsandMarkets

ページ情報: 英文 287 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のシステムインテグレーションサービスの市場規模は、2023年の4,830億米ドルから2028年には6,656億米ドルに成長し、予測期間中の年間平均成長率(CAGR)は6.6%になると予測されています。

企業はオンプレミスのソリューションから、モバイルアクセシビリティやその他の直感的なサービスを提供するクラウドベースのシステムインテグレーションサービスへと徐々にシフトしています。このモデルの手頃な価格は、あらゆる規模の企業を対象とすることで、特定のデータベース要件に対応しています。これらのサービスは通常、低コストのオプションと迅速なサービス展開を提供します。

エンドユーザーは、ITインフラストラクチャのニーズ、特にシステム統合において、コンサルティングサービスを求めることが多くなっています。コンサルティング会社や専門家は、ITシステム、アプリケーション、テクノロジーを統合することで、まとまりのある効率的なエコシステムを構築しようとする組織に、専門的な専門知識とガイダンスを提供します。これらのコンサルティングサービスは、組織が複雑なシステム統合プロジェクトを効果的に計画、設計、実装、管理できるように支援します。コンサルタントは、利害関係者と緊密に連携し、ビジネス目標、既存のITインフラ、アプリケーション環境、統合ニーズを理解します。コンサルタントは、組織固有の要件、予算、将来の成長計画に基づいて、適切な統合ツール、ミドルウェア、API、その他の技術を選択する支援を行います。コンサルティングサービス分野は、中東やラテンアメリカなどの発展途上地域で導入が急増し、最も高い成長率を示すと予測されています。システム統合コンサルティング・サービスは、組織が多様なITシステムの統合に伴う複雑さや課題を克服する上で、重要な役割を果たしています。この市場における重要なコンサルティング・サービス・プロバイダーには、Accenture、Infosys、Deloitte、Cisco、HCLTech、IBM、HPEなどがあります。

銀行・保険業界はデジタル革命の瀬戸際にあります。銀行・保険業界はデジタル革命の瀬戸際にあり、競争に勝ち残るためには新たな課題への取り組みが不可欠です。このような課題には、満足のいく顧客サービスの提供、業務効率の改善、コスト削減、規制への対応などが含まれます。コンサルティング・サービスは、保険ソフトウェア・ソリューションが、強固なセキュリティ、効率的なオペレーション、優れた顧客サービス、ROIの向上をどのように実現できるかを顧客に理解してもらうことができます。BFSI部門は規制が厳しく、データ主導の意思決定のために顧客データに依存しています。データのセキュリティを確保するために、アクセス権管理、認証設定、データ漏洩防止が採用されています。統合されたITサービスにより、データが悪用されることはありません。銀行はプライベート・クラウド上でlaaSやPaaSモデルを利用し、カード、資産管理、投資管理などのサービス向けに、デジタルID、行動バイオメトリクス、プッシュ通知、電子財布、QR決済などの機能を提供できます。

アジア太平洋の国々は、競争力を強化し業務効率を向上させるため、デジタルトランスフォーメーションを積極的に取り入れています。新しいデジタル技術と既存システムをシームレスに統合するシステムインテグレーションサービスの需要は高いです。データセキュリティとプライバシーに対する懸念が高まる中、企業は強固なサイバーセキュリティ対策を導入し、データ保護規制へのコンプライアンスを確保するため、システムインテグレーターの支援を求めています。

当レポートでは、世界のシステムインテグレーションサービス市場について調査し、サービスタイプ別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ケーススタディ分析

- エコシステム

- バリューチェーン分析

- 技術分析

- 特許分析

- 価格分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 規制状況

- 購入者に影響を与える動向/混乱

- 2023年の主な会議とイベント

- システムインテグレーションサービス市場:ビジネスモデル分析

- 生成AIの影響:システムインテグレーションサービス市場

第6章 システムインテグレーションサービス市場、サービスタイプ別

- イントロダクション

- インフラインテグレーションサービス

- エンタープライズアプリケーションインテグレーションサービス

- コンサルティングサービス

第7章 システムインテグレーションサービス市場、業界別

- イントロダクション

- 銀行、金融サービス、保険(BFSI)

- 小売と電子商取引

- ITと通信

- 政府と防衛

- ヘルスケア

- 製造業

- その他

第8章 システムインテグレーションサービス市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- ラテンアメリカ

第9章 競合情勢

- 概要

- 主要参入企業が採用した戦略

- 過去の収益分析

- 市場シェア分析

- 主要企業の市場ランキング

- ブランドの比較/ベンダー製品の情勢

- 主要な市場参入企業の世界スナップショット

- 主要企業の競合ベンチマーキング

- 主要企業の企業評価クアドラント、2022年

- スタートアップ/中小企業向けの企業評価クアドラント、2022年

- スタートアップ/中小企業向けの競合ベンチマーキング

- システムインテグレーションサービスベンダーの評価と財務指標

- 競合シナリオ

第10章 企業プロファイル

- 主要参入企業

- ACCENTURE

- CAPGEMINI

- CISCO

- HCLTECH

- HPE

- IBM

- INFOSYS

- ORACLE

- ATOS

- MICROSOFT

- DELOITTE

- TCS

- WIPRO

- COGNIZANT

- DXC TECHNOLOGY

- その他の企業

- DELL

- FUJITSU

- ASPIRE SYSTEMS

- CGI

- ITRANSITION

- CELIGO

- 3INSYS

- WORK HORSE INTEGRATIONS

- DOCINFUSION

- FLOWGEAR

- JITTERBIT

- SNAPLOGIC

- TRAY.IO

- WORKATO

第11章 隣接市場および関連市場

第12章 付録

The global system integration services market is expected to grow from 483.0 Billion in 2023 to USD 665.6 Billion by 2028 at a Compound Annual Growth Rate (CAGR) of 6.6% during the forecast period. Companies are gradually shifting away from on-premises solutions towards cloud-based system integration services that provide mobile accessibility and other intuitive services. The model's affordability addresses specific database requirements by targeting businesses of all sizes. These services typically offer low-cost options and rapid service deployment.

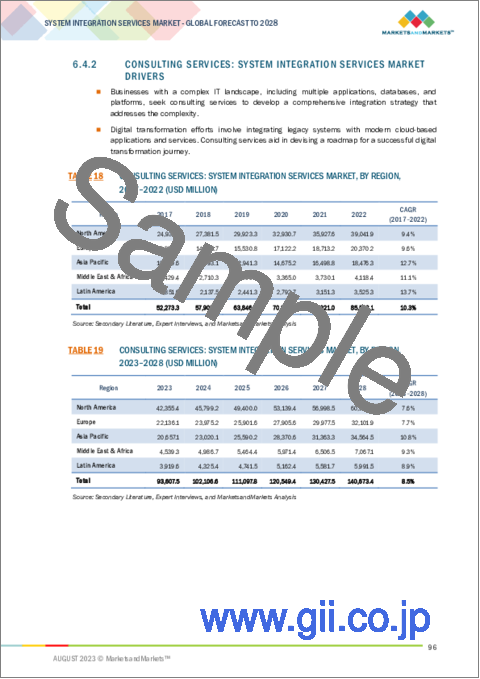

"Consulting Services segment to have significant growth during the forecast period."

End users often seek consulting services for their IT infrastructure needs, particularly in system integration. Consulting firms or professionals provide specialized expertise and guidance to organizations seeking to create a cohesive and efficient ecosystem by integrating their IT systems, applications, and technologies. These consulting services help organizations plan, design, implement, and manage complex system integration projects effectively. Consultants work closely with stakeholders to understand their business objectives, existing IT infrastructure, application landscape, and integration needs. They assist in selecting appropriate integration tools, middleware, APIs, and other technologies based on the organization's specific requirements, budget, and future growth plans. The consulting service sector is projected to grow at the highest rate, with developing regions such as the Middle East and Latin America seeing a surge in adoption. System integration consulting services play a crucial role in helping organizations overcome the complexities and challenges associated with integrating diverse IT systems. Significant consulting services providers in this market include Accenture, Infosys, Deloitte, Cisco, HCLTech, IBM, and HPE.

"BFSI vertical to hold the largest market share during the forecast period."

The banking and insurance industries are on the brink of a digital revolution. They must stay current with the competition; tackling new challenges is essential. These include providing satisfactory customer service, improving operational efficiency, reducing costs, and complying with regulations. Consulting services can help clients understand how insurance software solutions can help them achieve strong security, efficient operations, excellent customer service, and better RoI. The BFSI sector is heavily regulated and relies on client data for data-driven decisions. Access rights management, authentication setup, and data leakage prevention are employed to ensure data security. Integrated IT services ensure that data is not misused. Banks can use the laaS and PaaS models on the private cloud to provide features such as digital identity, behavioral biometrics, push alerts, e-wallets, and QR payments for services such as cards, wealth management, and investment management.

"System Integration Services market in Asia Pacific to grow at the highest CAGR during the forecast period."

The Asia Pacific region is home to some of the world's fastest-growing economies, such as China, Japan, and India. These economies are witnessing rapid growth in the number of businesses, leading to increased demand for system integration services. Asia Pacific Telecommunity is an international organization which making efforts to bring ICT and telecommunications facilities to people at affordable prices and address issues related to improving productivity, increasing efficiency, and bridging the digital divide within countries in the region. The growth in 5G infrastructure, and 5G network is likely to boost the adoption of cloud services and system integration in the region. According to GSMA, by 2025, there will be 400 million 5G connections across the region. 5G infrastructure's ability is to support next-generation offerings, such as cloud services, AI, IoT, big data and edge computing. The Asia Pacific region encompasses diverse economies and industries, and its increasing technology adoption has driven the expansion of the system integration services sector.

Countries in the Asia Pacific region are actively embracing digital transformation to enhance competitiveness and improve operational efficiency. System integration services are in high demand to seamlessly integrate new digital technologies with existing systems. With growing concerns about data security and privacy, businesses seek assistance from system integrators to implement robust cybersecurity measures and ensure compliance with data protection regulations.

Further, our team conducted in-depth interviews with the Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Chief Operating Officers (COOs), Chief Technology Officers (CTOs), Vice Presidents (VPs), Managing Directors (MDs), domain heads, technology and innovation directors, and related key executives from various prominent companies and organizations operating in the System Integration Services market.

- By Company - Tier 1-20%, Tier 2-34%, and Tier 3-46%

- By Designation - C-Level Executives-35%, Directors-25%, and Others-40%

- By Region - North America-62%, Europe-11%, Asia Pacific-22%, RoW - 5%

System Integration Services vendors include Accenture (Ireland), Capgemini (France), Cisco (US), HCLTech (India), HPE (US), IBM (US), Oracle (US), Infosys (India), Atos (France), Microsoft (US), Deloitte (UK), TCS (India), Wipro (India), Cognizant (US), DXC Technology (US), Dell (US), Fujitsu (Japan), Aspire Systems (India), CGI (Canada), Itransition (US), Celigo (US), 3Insys (US), Work Horse Integrations (US), DocInfusion (India), Flowgear (South Africa), Jitterbit (US), SnapLogic (US), Tray.io (US), and Workato (US). The study includes an in-depth competitive analysis of these key players in the System Integration Services market with their company profiles, recent developments, and key market strategies.

Research Coverage

The research study covered inputs, insights, trends, and happenings from secondary sources, primary sources, stakeholders' interviews, and surveys. Secondary sources include information from databases and repositories such as D&B Hoovers, Bloomberg, Factiva, and CoinDesk. We fetched primary data fetched from supply-side industry experts who hold the chair of Chief Executive Officer (CEO), Chief Technological Officer (CTO), Chief Operating Officer (COO), Vice-President (VP) of IT, and Managing Director (MD), among others. A few of our critical primary respondents are Accenture, Cisco, and HCLTech, among others. We also reached out to a few startups during our primary interviews. Additionally, we have taken information and statistical and historical data from a few government associations, public sources, webinar and seminar transcripts, journals, conferences, and events.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall system integration services market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities. The report incorporates a critical section comprising the company profiles in the market, in which it has exhaustively evaluated the vendors in terms of product portfolio offerings and business strategies followed; this will give a holistic view of the current standing of the key players in the market and the ongoing developments encompassing partnerships, agreements, collaborations, mergers and acquisitions, joint ventures, new product or service launches, and business expansions. This evaluation will help the buyers understand how the major vendors are achieving service differentiation, and buyers can understand the need gap analysis for the existing services and new services needed to cater to these newly developed solutions for this market. The report can help the buyers to understand significant benefits as well as driving factors that are becoming key growth drivers of the development of buyers in these services.

The report provides insights on the following pointers.

- Analysis of key drivers (rising demand for robust IT infrastructure, increasing internet and IoT expansion), restraints (increase in regulations, concerns over privacy), opportunities (AI/ML implementation), and challenges (lack of skills and expertise, integration issues) influencing the growth of the system integration services market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the system integration services market

- Market Development: Comprehensive information about lucrative markets - the report analyses the system integration services market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the system integration services market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, like include Accenture (Ireland), Capgemini (France), Cisco (US), HCLTech (India), HPE (US), IBM (US), Oracle (US), Infosys (India), Atos (France), Microsoft (US), Deloitte (UK), TCS (India), Wipro (India), Cognizant (US), DXC Technology (US), Dell (US), Fujitsu (Japan), Aspire Systems (India), CGI (Canada), Itransition (US), Celigo (US), 3Insys (US), Work Horse Integrations (US), DocInfusion (India), Flowgear (South Africa), Jitterbit (US), SnapLogic (US), Tray.io (US), and Workato (US) in the system integration services market. The report also helps stakeholders understand the competitive analysis of these market players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2017-2022

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 SYSTEM INTEGRATION SERVICES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primary profiles

- 2.1.2.2 Key industry insights

- 2.2 DATA TRIANGULATION

- FIGURE 2 SYSTEM INTEGRATION SERVICES MARKET: DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- FIGURE 5 SYSTEM INTEGRATION SERVICES MARKET: RESEARCH FLOW

- 2.3.3 MARKET ESTIMATION APPROACHES

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - SUPPLY-SIDE APPROACH: ILLUSTRATION OF VENDOR REVENUE ESTIMATION

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: SUPPLY-SIDE ANALYSIS

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY - DEMAND-SIDE APPROACH: REVENUE GENERATED FROM DIFFERENT VERTICALS

- 2.4 MARKET FORECAST: FACTOR IMPACT ANALYSIS

- TABLE 2 FACTOR ANALYSIS

- 2.5 RECESSION IMPACT AND RESEARCH ASSUMPTIONS

- 2.5.1 RECESSION IMPACT

- 2.5.2 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- TABLE 3 SYSTEM INTEGRATION SERVICES MARKET SIZE AND GROWTH, 2017-2022 (USD MILLION, Y-O-Y %)

- TABLE 4 SYSTEM INTEGRATION SERVICES MARKET SIZE AND GROWTH, 2023-2028 (USD MILLION, Y-O-Y %)

- FIGURE 9 GLOBAL SYSTEM INTEGRATION SERVICES MARKET TO WITNESS SIGNIFICANT GROWTH

- 3.1 OVERVIEW OF RECESSION IMPACT

- FIGURE 10 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 11 FASTEST-GROWING SEGMENTS OF SYSTEM INTEGRATION SERVICES MARKET

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR COMPANIES IN SYSTEM INTEGRATION SERVICES MARKET

- FIGURE 12 DEMAND FOR AUTOMATION AND STREAMLINING OF BUSINESS TO DRIVE GROWTH OF SYSTEM INTEGRATION SERVICES MARKET

- 4.2 SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023 VS. 2028

- FIGURE 13 INFRASTRUCTURE INTEGRATION SERVICES SEGMENT TO HOLD LARGEST MARKET SHARE IN 2023

- 4.3 SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023 VS. 2028

- FIGURE 14 BFSI VERTICAL TO HOLD LARGEST MARKET SHARE IN 2023

- 4.4 SYSTEM INTEGRATION SERVICES MARKET: REGIONAL SCENARIO, 2023-2028

- FIGURE 15 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 SYSTEM INTEGRATION SERVICES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for robust and efficient IT infrastructure

- 5.2.1.2 Increasing internet ubiquity and IoT expansion

- 5.2.1.3 Demand for tailor-made system integration services

- 5.2.1.4 Cost and risk reduction

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increase in regulations and compliances

- 5.2.2.2 Concerns associated with privacy and data security

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Implementation of AI and ML in system integration

- FIGURE 17 GLOBAL AI ADOPTION RATES, BY KEY COUNTRY/REGION, 2022

- 5.2.3.2 Increase in dependency of SMEs on system integration services

- 5.2.3.3 Growing demand for system integrators

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of technical knowledge and expertise

- 5.2.4.2 Integration issues of legacy infrastructure and complex & diverse IT networks

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 CASE STUDY 1: DIR MANAGED STATE'S CENTRALIZED IT INFRASTRUCTURE, INCLUDING DATA CENTER, NETWORKING, WEB SERVICES, AND SECURITY

- 5.3.2 CASE STUDY 2: BY APPLYING SAP CONNECTOR AND MANY MORE SOLUTIONS, LICENSING COST WAS DECREASED

- 5.3.3 CASE STUDY 3: "GUIDED TOURS" WERE DEVELOPED TO MAKE EASY TRANSITION FOR END USERS TO SERVICENOW PLATFORM

- 5.3.4 CASE STUDY 4: ATOS DESIGNED FULLY INTEGRATED SAP SOLUTION FOR CLUB

- 5.3.5 CASE STUDY 5: TWO OPERATIONS OPERATED WITH MORE EFFICIENCY DUE TO HMLR'S INTEGRATION OF ITS HCM AND PAYROLL PLATFORMS

- 5.4 ECOSYSTEM

- FIGURE 18 SYSTEM INTEGRATION SERVICES MARKET: ECOSYSTEM

- TABLE 5 SYSTEM INTEGRATION SERVICES MARKET: COMPANIES AND THEIR ROLE IN ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 19 SYSTEM INTEGRATION SERVICES MARKET: VALUE CHAIN

- 5.6 TECHNOLOGICAL ANALYSIS

- 5.6.1 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 5.6.2 BIG DATA

- 5.6.3 INTERNET OF THINGS

- 5.6.4 CLOUD

- 5.7 PATENT ANALYSIS

- FIGURE 20 NUMBER OF PATENT DOCUMENTS PUBLISHED DURING 2012-2022

- FIGURE 21 TOP FIVE PATENT OWNERS (GLOBAL)

- TABLE 6 TOP 10 PATENT APPLICANTS

- 5.8 PRICING ANALYSIS

- TABLE 7 PRICING ANALYSIS OF SYSTEM INTEGRATION SERVICES

- 5.8.1 AVERAGE SELLING PRICE TREND

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 22 SYSTEM INTEGRATION SERVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 SYSTEM INTEGRATION SERVICES MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 23 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- 5.10.2 BUYING CRITERIA

- FIGURE 24 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 10 KEY BUYING CRITERIA FOR TOP THREE END USERS

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 NORTH AMERICA

- 5.11.3 EUROPE

- 5.11.4 ASIA PACIFIC

- 5.11.5 MIDDLE EAST & AFRICA

- 5.11.6 LATIN AMERICA

- 5.11.7 REGULATORY IMPLICATIONS AND INDUSTRY STANDARDS

- 5.11.8 GENERAL DATA PROTECTION REGULATION

- 5.11.9 SEC RULE 17A-4

- 5.11.10 ISO/IEC 27001

- 5.11.11 SYSTEM AND ORGANIZATION CONTROLS 2 TYPE II COMPLIANCE

- 5.11.12 FINANCIAL INDUSTRY REGULATORY AUTHORITY

- 5.11.13 FREEDOM OF INFORMATION ACT

- 5.11.14 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

- 5.12 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 25 SYSTEM INTEGRATION SERVICES MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- 5.13 KEY CONFERENCES AND EVENTS IN 2023

- TABLE 11 SYSTEM INTEGRATION SERVICES MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.14 SYSTEM INTEGRATION SERVICES MARKET: BUSINESS MODEL ANALYSIS

- FIGURE 26 SYSTEM INTEGRATION SERVICES MARKET: BUSINESS MODELS

- 5.14.1 SUBSCRIPTION-BASED BUSINESS MODEL

- 5.14.2 PROJECT-BASED BUSINESS MODEL

- 5.14.3 VALUE-BASED BUSINESS MODEL

- 5.15 IMPACT OF GENERATIVE AI: SYSTEM INTEGRATION SERVICES MARKET

- 5.15.1 PROFESSIONAL SERVICES: GENERATIVE AI

- 5.15.2 SYSTEM INTEGRATION SERVICES: GENERATIVE AI

- 5.15.3 OPPORTUNITIES

- 5.15.3.1 Increasing demand for automated data generation

- 5.15.3.2 Automatic code generation

- 5.15.3.3 Low-code/No-code development

- 5.15.3.4 Security product integration

- 5.15.3.5 Predictive integration

- 5.15.3.6 Demand for efficient prototyping and testing

- 5.15.3.7 Real-time adaptability and self-healing

- 5.15.3.8 Generative AI consulting

- 5.15.4 CHALLENGES

- 5.15.4.1 Lack of expertise and training

- 5.15.4.2 Privacy and security concerns

- 5.15.4.3 Legal issues

- 5.15.4.4 Dependency on training data

6 SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE

- 6.1 INTRODUCTION

- FIGURE 27 INFRASTRUCTURE INTEGRATION SERVICES SEGMENT TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 12 SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 13 SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- 6.2 INFRASTRUCTURE INTEGRATION SERVICES

- 6.2.1 INFRASTRUCTURE INTEGRATION SERVICES TO ENSURE THAT ORGANIZATIONS' IT RESOURCES WORK SEAMLESSLY

- 6.2.2 INFRASTRUCTURE INTEGRATION SERVICES: SYSTEM INTEGRATION SERVICES MARKET DRIVERS

- TABLE 14 INFRASTRUCTURE INTEGRATION SERVICES: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 15 INFRASTRUCTURE INTEGRATION SERVICES: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 ENTERPRISE APPLICATION INTEGRATION SERVICES

- 6.3.1 NEED FOR COHESIVE COMMUNICATION AND COLLABORATION BETWEEN SOFTWARE APPLICATIONS TO DRIVE SEGMENT

- 6.3.2 ENTERPRISE APPLICATION INTEGRATION SERVICES: SYSTEM INTEGRATION SERVICES MARKET DRIVERS

- TABLE 16 ENTERPRISE APPLICATION INTEGRATION SERVICES: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 17 ENTERPRISE APPLICATION INTEGRATION SERVICES: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.4 CONSULTING SERVICES

- 6.4.1 ORGANIZATIONS SEEK EXPERT GUIDANCE AND SUPPORT TO INTEGRATE IT SYSTEMS AND APPLICATIONS

- 6.4.2 CONSULTING SERVICES: SYSTEM INTEGRATION SERVICES MARKET DRIVERS

- TABLE 18 CONSULTING SERVICES: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 19 CONSULTING SERVICES: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

7 SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL

- 7.1 INTRODUCTION

- FIGURE 28 BFSI VERTICAL TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

- TABLE 20 SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 21 SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 7.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

- 7.2.1 RISING NEED FOR DIGITAL TRANSFORMATION AND IMPROVED CUSTOMER EXPERIENCE TO DRIVE GROWTH OF BFSI SEGMENT

- 7.2.2 BFSI: SYSTEM INTEGRATION SERVICES MARKET DRIVERS

- TABLE 22 BFSI: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 23 BFSI: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 RETAIL & ECOMMERCE

- 7.3.1 RISING USE OF TECHNOLOGY IN RETAIL AND ECOMMERCE TO ADDRESS MARKET VOLATILITY

- 7.3.2 RETAIL & ECOMMERCE: SYSTEM INTEGRATION SERVICES MARKET DRIVERS

- TABLE 24 RETAIL & ECOMMERCE: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 25 RETAIL & ECOMMERCE: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 IT & TELECOMMUNICATIONS

- 7.4.1 GROWING TRENDS IN MOBILE DATA CONSUMPTION AND INCREASED USAGE OF SMARTPHONES AND TABLETS WORLDWIDE TO DRIVE MARKET

- 7.4.2 IT & TELECOMMUNICATIONS: SYSTEM INTEGRATION SERVICES MARKET DRIVERS

- TABLE 26 IT & TELECOMMUNICATIONS: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 27 IT & TELECOMMUNICATIONS: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 GOVERNMENT & DEFENSE

- 7.5.1 RISING DEMAND FOR TRANSFORMATION OF GOVERNMENT INFRASTRUCTURE TO DRIVE MARKET GROWTH

- 7.5.2 GOVERNMENT & DEFENSE: SYSTEM INTEGRATION SERVICES MARKET DRIVERS

- TABLE 28 GOVERNMENT & DEFENSE: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 29 GOVERNMENT & DEFENSE: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 HEALTHCARE

- 7.6.1 DEMAND FOR MANAGING MEDICATIONS AND SUPPLIES, ENGAGING PATIENTS, AND HOSTING WEBSITES TO DRIVE MARKET GROWTH

- 7.6.2 HEALTHCARE: SYSTEM INTEGRATION SERVICES MARKET DRIVERS

- TABLE 30 HEALTHCARE: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 31 HEALTHCARE: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.7 MANUFACTURING

- 7.7.1 DEMAND FOR CONNECTING AND COORDINATING VARIOUS MANUFACTURING SYSTEMS, PROCESSES, TECHNOLOGIES, AND DATA SOURCES TO OPTIMIZE PRODUCTION

- 7.7.2 MANUFACTURING: SYSTEM INTEGRATION SERVICES MARKET DRIVERS

- TABLE 32 MANUFACTURING: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 33 MANUFACTURING: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.8 OTHER VERTICALS

- 7.8.1 OTHER VERTICALS: SYSTEM INTEGRATION SERVICES MARKET DRIVERS

- TABLE 34 OTHER VERTICALS: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 35 OTHER VERTICALS: SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

8 SYSTEM INTEGRATION SERVICES MARKET, BY REGION

- 8.1 INTRODUCTION

- FIGURE 29 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 36 SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 37 SYSTEM INTEGRATION SERVICES MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2 NORTH AMERICA

- 8.2.1 NORTH AMERICA: SYSTEM INTEGRATION SERVICES MARKET DRIVERS

- 8.2.2 NORTH AMERICA: RECESSION IMPACT

- 8.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

- 8.2.3.1 US SECURITIES AND EXCHANGE COMMISSION

- 8.2.3.2 INTERNATIONAL ORGANIZATION FOR STANDARDIZATION 27001

- 8.2.3.3 CALIFORNIA CONSUMER PRIVACY ACT

- 8.2.3.4 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996

- 8.2.3.5 SARBANES-OXLEY ACT OF 2002

- FIGURE 30 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 38 NORTH AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 39 NORTH AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 40 NORTH AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 41 NORTH AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 42 NORTH AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 43 NORTH AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.2.4 US

- 8.2.4.1 Presence of several system integration service providers in US to drive market

- TABLE 44 US: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 45 US: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 46 US: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 47 US: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.2.5 CANADA

- 8.2.5.1 Canada's robust IT infrastructure and increasing adoption of advanced technologies to contribute to market growth

- TABLE 48 CANADA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 49 CANADA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 50 CANADA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 51 CANADA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.3 EUROPE

- 8.3.1 EUROPE: SYSTEM INTEGRATION SERVICES MARKET DRIVERS

- 8.3.2 EUROPE: RECESSION IMPACT

- 8.3.3 EUROPE: REGULATORY LANDSCAPE

- 8.3.3.1 General data protection regulation

- 8.3.3.2 European cybersecurity act

- TABLE 52 EUROPE: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 53 EUROPE: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 54 EUROPE: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 55 EUROPE: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 56 EUROPE: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 57 EUROPE: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.3.4 UK

- 8.3.4.1 UK's advanced technological infrastructure and widespread adoption of digital technologies to contribute to market growth

- TABLE 58 UK: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 59 UK: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 60 UK: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 61 UK: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.3.5 GERMANY

- 8.3.5.1 Increasing digitalization to fuel growth of system integration services in Germany

- TABLE 62 GERMANY: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 63 GERMANY: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 64 GERMANY: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 65 GERMANY: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.3.6 FRANCE

- 8.3.6.1 Government initiatives in France to support adoption of cloud technologies

- TABLE 66 FRANCE: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 67 FRANCE: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 68 FRANCE: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 69 FRANCE: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.3.7 REST OF EUROPE

- TABLE 70 REST OF EUROPE: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 71 REST OF EUROPE: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 72 REST OF EUROPE: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 73 REST OF EUROPE: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.4 ASIA PACIFIC

- 8.4.1 ASIA PACIFIC: SYSTEM INTEGRATION SERVICES MARKET DRIVERS

- 8.4.2 ASIA PACIFIC: RECESSION IMPACT

- 8.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

- 8.4.3.1 Personal data protection act

- 8.4.3.2 Singapore standard SS 564

- 8.4.3.3 Internet data center in China

- FIGURE 31 ASIA PACIFIC: REGIONAL SNAPSHOT

- TABLE 74 ASIA PACIFIC: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 75 ASIA PACIFIC: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 76 ASIA PACIFIC: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 77 ASIA PACIFIC: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 78 ASIA PACIFIC: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 79 ASIA PACIFIC: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.4.4 CHINA

- 8.4.4.1 Increasing digital transformation to fuel market growth in China

- TABLE 80 CHINA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 81 CHINA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 82 CHINA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 83 CHINA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.4.5 JAPAN

- 8.4.5.1 Rising demand for system integration services in Japan to drive market

- TABLE 84 JAPAN: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 85 JAPAN: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 86 JAPAN: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 87 JAPAN: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.4.6 INDIA

- 8.4.6.1 Rapid increase in SMEs adopting integration services in India to drive market growth

- TABLE 88 INDIA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 89 INDIA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 90 INDIA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 91 INDIA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.4.7 REST OF ASIA PACIFIC

- TABLE 92 REST OF ASIA PACIFIC: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 95 REST OF ASIA PACIFIC: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.5 MIDDLE EAST & AFRICA

- 8.5.1 MIDDLE EAST & AFRICA: SYSTEM INTEGRATION SERVICES MARKET DRIVERS

- 8.5.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 8.5.3 MIDDLE EAST & AFRICA: REGULATORY LANDSCAPE

- 8.5.3.1 PERSONAL DATA PROTECTION LAW

- 8.5.3.2 CLOUD COMPUTING REGULATORY FRAMEWORK

- TABLE 96 MIDDLE EAST & AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 97 MIDDLE EAST & AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 98 MIDDLE EAST & AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 99 MIDDLE EAST & AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 100 MIDDLE EAST & AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.5.4 KINGDOM OF SAUDI ARABIA

- 8.5.4.1 Strong presence of global and local system integration service vendors in Saudi Arabia to drive market

- TABLE 102 KSA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 103 KSA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 104 KSA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 105 KSA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.5.5 UNITED ARAB EMIRATES (UAE)

- 8.5.5.1 Government initiatives in UAE to present opportunities for adoption of system integration services

- TABLE 106 UAE: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 107 UAE: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 108 UAE: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 109 UAE: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.5.6 SOUTH AFRICA

- 8.5.6.1 IT services industry to experience growth in South Africa, with system integration services being critical component of this expansion

- TABLE 110 SOUTH AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 111 SOUTH AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 112 SOUTH AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 113 SOUTH AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.5.7 REST OF MIDDLE EAST & AFRICA

- TABLE 114 REST OF MIDDLE EAST & AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 115 REST OF MIDDLE EAST & AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 116 REST OF MIDDLE EAST & AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 117 REST OF MIDDLE EAST & AFRICA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.6 LATIN AMERICA

- 8.6.1 LATIN AMERICA: SYSTEM INTEGRATION SERVICES MARKET DRIVERS

- 8.6.2 LATIN AMERICA: RECESSION IMPACT

- 8.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

- 8.6.4 FEDERAL LAW ON PROTECTION OF PERSONAL DATA HELD BY INDIVIDUALS

- TABLE 118 LATIN AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 119 LATIN AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 120 LATIN AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 121 LATIN AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 122 LATIN AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 123 LATIN AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 8.6.5 BRAZIL

- 8.6.5.1 Presence of major system integration services players in Brazil to accelerate market growth

- TABLE 124 BRAZIL: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 125 BRAZIL: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 126 BRAZIL: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 127 BRAZIL: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.6.6 MEXICO

- 8.6.6.1 Mexico's active adoption of digital transformation and technological advancements to drive market growth

- TABLE 128 MEXICO: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 129 MEXICO: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 130 MEXICO: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 131 MEXICO: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 8.6.7 REST OF LATIN AMERICA

- TABLE 132 REST OF LATIN AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2017-2022 (USD MILLION)

- TABLE 133 REST OF LATIN AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 134 REST OF LATIN AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 135 REST OF LATIN AMERICA: SYSTEM INTEGRATION SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS/RIGHT TO WIN

- TABLE 136 OVERVIEW OF STRATEGIES ADOPTED BY KEY SYSTEM INTEGRATION SERVICE VENDORS

- 9.3 HISTORICAL REVENUE ANALYSIS

- FIGURE 32 HISTORICAL FIVE-YEAR SEGMENTAL REVENUE ANALYSIS OF KEY SYSTEM INTEGRATION SERVICE PROVIDERS

- 9.4 MARKET SHARE ANALYSIS

- FIGURE 33 MARKET SHARE ANALYSIS, 2022

- TABLE 137 SYSTEM INTEGRATION SERVICES MARKET: DEGREE OF COMPETITION

- 9.5 MARKET RANKING OF KEY PLAYERS

- FIGURE 34 MARKET RANKING OF KEY SYSTEM INTEGRATION SERVICE PLAYERS, 2022

- 9.6 BRAND COMPARISON/VENDOR PRODUCT LANDSCAPE

- TABLE 138 BRAND COMPARISON/VENDOR PRODUCT LANDSCAPE

- 9.7 GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- FIGURE 35 SYSTEM INTEGRATION SERVICES MARKET: GLOBAL SNAPSHOT OF KEY MARKET PARTICIPANTS

- 9.8 COMPETITIVE BENCHMARKING FOR KEY PLAYERS

- 9.8.1 EVALUATION CRITERIA FOR KEY COMPANIES

- TABLE 139 COMPANY FOOTPRINT, BY REGION

- TABLE 140 COMPANY FOOTPRINT, BY SERVICE TYPE

- TABLE 141 COMPANY FOOTPRINT, BY VERTICAL

- 9.9 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- FIGURE 36 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS: CRITERIA WEIGHTAGE

- 9.9.1 STARS

- 9.9.2 EMERGING LEADERS

- 9.9.3 PERVASIVE PLAYERS

- 9.9.4 PARTICIPANTS

- FIGURE 37 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- 9.10 COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES, 2022

- FIGURE 38 COMPANY EVALUATION QUADRANT FOR SMES/STARTUPS: CRITERIA WEIGHTAGE

- 9.10.1 PROGRESSIVE COMPANIES

- 9.10.2 RESPONSIVE COMPANIES

- 9.10.3 DYNAMIC COMPANIES

- 9.10.4 STARTING BLOCKS

- FIGURE 39 COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES, 2022

- 9.11 COMPETITIVE BENCHMARKING FOR STARTUPS/SMES

- 9.11.1 EVALUATION CRITERIA FOR STARTUPS/SMES

- TABLE 142 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 143 COMPANY FOOTPRINT FOR STARTUPS/SMES, BY REGION

- TABLE 144 COMPANY FOOTPRINT FOR STARTUPS/SMES, BY SERVICE TYPE

- TABLE 145 COMPANY FOOTPRINT FOR STARTUPS/SMES, BY VERTICAL

- 9.12 VALUATION AND FINANCIAL METRICS OF SYSTEM INTEGRATION SERVICE VENDORS

- FIGURE 40 FINANCIAL METRICS OF SYSTEM INTEGRATION SERVICE VENDORS

- 9.13 COMPETITIVE SCENARIO

- 9.13.1 PRODUCT LAUNCHES AND PRODUCT ENHANCEMENTS

- TABLE 146 SYSTEM INTEGRATION SERVICES MARKET: PRODUCT LAUNCHES

- 9.13.2 DEALS

- TABLE 147 SYSTEM INTEGRATION SERVICES MARKET: DEALS

10 COMPANY PROFILES

- 10.1 INTRODUCTION

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)**

- 10.2 KEY PLAYERS

- 10.2.1 ACCENTURE

- TABLE 148 ACCENTURE: BUSINESS OVERVIEW

- FIGURE 41 ACCENTURE: COMPANY SNAPSHOT

- TABLE 149 ACCENTURE: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 150 ACCENTURE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 151 ACCENTURE: DEALS

- 10.2.2 CAPGEMINI

- TABLE 152 CAPGEMINI: BUSINESS OVERVIEW

- FIGURE 42 CAPGEMINI: COMPANY SNAPSHOT

- TABLE 153 CAPGEMINI: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 154 CAPGEMINI: DEALS

- 10.2.3 CISCO

- TABLE 155 CISCO: BUSINESS OVERVIEW

- FIGURE 43 CISCO: COMPANY SNAPSHOT

- TABLE 156 CISCO: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 157 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 158 CISCO: DEALS

- 10.2.4 HCLTECH

- TABLE 159 HCLTECH: BUSINESS OVERVIEW

- FIGURE 44 HCLTECH: COMPANY SNAPSHOT

- TABLE 160 HCLTECH: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 161 HCLTECH: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 162 HCLTECH: DEALS

- TABLE 163 HCLTECH: OTHERS

- 10.2.5 HPE

- TABLE 164 HPE: BUSINESS OVERVIEW

- FIGURE 45 HPE: COMPANY SNAPSHOT

- TABLE 165 HPE: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 166 HPE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 167 HPE: DEALS

- 10.2.6 IBM

- TABLE 168 IBM: BUSINESS OVERVIEW

- FIGURE 46 IBM: COMPANY SNAPSHOT

- TABLE 169 IBM: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 170 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 171 IBM: DEALS

- 10.2.7 INFOSYS

- TABLE 172 INFOSYS: BUSINESS OVERVIEW

- FIGURE 47 INFOSYS: COMPANY SNAPSHOT

- TABLE 173 INFOSYS: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 174 INFOSYS: DEALS

- 10.2.8 ORACLE

- TABLE 175 ORACLE: BUSINESS OVERVIEW

- FIGURE 48 ORACLE: COMPANY SNAPSHOT

- TABLE 176 ORACLE: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 177 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 178 ORACLE: DEALS

- 10.2.9 ATOS

- TABLE 179 ATOS: BUSINESS OVERVIEW

- FIGURE 49 ATOS: COMPANY SNAPSHOT

- TABLE 180 ATOS: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 181 ATOS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 182 ATOS: DEALS

- TABLE 183 ATOS: OTHERS

- 10.2.10 MICROSOFT

- TABLE 184 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 50 MICROSOFT: COMPANY SNAPSHOT

- TABLE 185 MICROSOFT: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 186 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 187 MICROSOFT: DEALS

- 10.2.11 DELOITTE

- TABLE 188 DELOITTE: BUSINESS OVERVIEW

- FIGURE 51 DELOITTE: COMPANY SNAPSHOT

- TABLE 189 DELOITTE: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 190 DELOITTE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 191 DELOITTE: DEALS

- 10.2.12 TCS

- TABLE 192 TCS: BUSINESS OVERVIEW

- FIGURE 52 TCS: COMPANY SNAPSHOT

- TABLE 193 TCS: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 194 TCS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 195 TCS: DEALS

- 10.2.13 WIPRO

- TABLE 196 WIPRO: BUSINESS OVERVIEW

- FIGURE 53 WIPRO: COMPANY SNAPSHOT

- TABLE 197 WIPRO: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 198 WIPRO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 199 WIPRO: DEALS

- 10.2.14 COGNIZANT

- TABLE 200 COGNIZANT: BUSINESS OVERVIEW

- FIGURE 54 COGNIZANT: COMPANY SNAPSHOT

- TABLE 201 COGNIZANT: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 202 COGNIZANT: DEALS

- 10.2.15 DXC TECHNOLOGY

- TABLE 203 DXC TECHNOLOGY: BUSINESS OVERVIEW

- FIGURE 55 DXC TECHNOLOGY: COMPANY SNAPSHOT

- TABLE 204 DXC TECHNOLOGY: SOLUTIONS/SERVICES/PLATFORMS OFFERED

- TABLE 205 DXC TECHNOLOGY: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 206 DXC TECHNOLOGY: DEALS

- 10.3 OTHER COMPANIES

- 10.3.1 DELL

- 10.3.2 FUJITSU

- 10.3.3 ASPIRE SYSTEMS

- 10.3.4 CGI

- 10.3.5 ITRANSITION

- 10.3.6 CELIGO

- 10.3.7 3INSYS

- 10.3.8 WORK HORSE INTEGRATIONS

- 10.3.9 DOCINFUSION

- 10.3.10 FLOWGEAR

- 10.3.11 JITTERBIT

- 10.3.12 SNAPLOGIC

- 10.3.13 TRAY.IO

- 10.3.14 WORKATO

*Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, MnM view (Key strengths/Right to win, Strategic choices made, Weakness/competitive threats)** might not be captured in case of unlisted companies.

11 ADJACENT AND RELATED MARKETS

- 11.1 INTRODUCTION

- 11.1.1 RELATED MARKETS

- 11.2 CLOUD PROFESSIONAL SERVICES MARKET

- TABLE 207 CLOUD PROFESSIONAL SERVICES MARKET, BY SERVICE TYPE, 2019-2022 (USD MILLION)

- TABLE 208 CLOUD PROFESSIONAL SERVICES MARKET, BY SERVICE TYPE, 2023-2028 (USD MILLION)

- TABLE 209 CLOUD PROFESSIONAL SERVICES MARKET, BY SERVICE MODEL, 2019-2022 (USD MILLION)

- TABLE 210 CLOUD PROFESSIONAL SERVICES MARKET, BY SERVICE MODEL, 2023-2028 (USD MILLION)

- TABLE 211 CLOUD PROFESSIONAL SERVICES MARKET, BY VERTICAL, 2019-2022 (USD MILLION)

- TABLE 212 CLOUD PROFESSIONAL SERVICES MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 11.3 NORTH AMERICA IT SERVICES MARKET

- TABLE 213 NORTH AMERICA IT SERVICES MARKET, BY SERVICE TYPE, 2017-2021 (USD BILLION)

- TABLE 214 NORTH AMERICA IT SERVICES MARKET, BY SERVICE TYPE, 2022-2027 (USD BILLION)

- TABLE 215 NORTH AMERICA IT SERVICES MARKET, BY DEPLOYMENT MODE, 2017-2021 (USD BILLION)

- TABLE 216 NORTH AMERICA IT SERVICES MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD BILLION)

- TABLE 217 NORTH AMERICA IT SERVICES MARKET, BY VERTICAL, 2017-2021 (USD BILLION)

- TABLE 218 NORTH AMERICA IT SERVICES MARKET, BY VERTICAL, 2022-2027 (USD BILLION)

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS