|

|

市場調査レポート

商品コード

1345519

建物検査用赤外線サーモグラフィの世界市場:波長別、製品タイプ別、ソリューション別、プラットフォーム別、建物タイプ別、用途別-2028年までの予測Infrared Thermography Market for Building Inspection by Product, Solution, Platform, Building Type - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 建物検査用赤外線サーモグラフィの世界市場:波長別、製品タイプ別、ソリューション別、プラットフォーム別、建物タイプ別、用途別-2028年までの予測 |

|

出版日: 2023年08月31日

発行: MarketsandMarkets

ページ情報: 英文 217 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

建物検査用赤外線サーモグラフィの市場規模は、2023年の4億4,500万米ドルから2028年には6億600万米ドルに達すると予測され、2023年から2028年までのCAGRは6.4%と見込まれています。

家電産業における赤外線カメラの普及と、自動車産業における赤外線画像アプリケーションの台頭が、市場の前に横たわる主な機会です。

サーマルモジュールは、優れた画質を提供するために使用されるいくつかのシステムで重要な役割を果たしています。サーマルモジュールは、より高度なアセンブリやプラットフォームに簡単かつ効率的に統合できるように設計・製造されています。サーマルモジュールは、(i)温度測定能力、(ii)完全な暗闇での視認性、という2つの主な利点を備えています。小型、軽量、低消費電力で、異なる光条件下でも同じ画像が得られます。検査用途に適しており、UAV、望遠鏡、照準器に組み込まれています。技術の進歩に伴い、サーマルモジュールメーカーは世界の需要に応えるため、低コストで小型のコアを開発しています。

サーマルスコープは、精密な建物検査に不可欠なツールとして登場しました。温度変化を検出することで、断熱の問題、水漏れ、電気的異常などの隠れた問題を明らかにします。これらのスコープは、迅速で非破壊的な評価を提供し、予防的なメンテナンスと費用対効果の高い修理を可能にします。赤外線サーモグラフィは、診断、獣医学、建築・建設検査、捜索・救助、狩猟、林業、空港警備、国境管理などに使用されています。

赤外線サーモグラフィを使った建物の水分検査では、赤外線カメラを使って表面の温度変化を検出し、水分の蓄積や漏れの可能性がある場所を特定します。水分は熱特性に影響を与えるため、湿った部分は乾燥した部分とは異なる温度を示します。検査中、これらのカメラは壁、天井、床などの建築部材をスキャンし、異常を強調する視覚画像を作成します。

北米市場は、2023年に赤外線イメージング市場で最大のシェアを占めました。北米地域には大手サービスプロバイダーが存在し、さらにビル所有者が予知保全の導入に注力していることから、この地域は赤外線サーモグラフィ検査の有力な市場となっています。全体として、建築・建設業界における需要の増加、建物検査における採用の増加、技術の進歩、主要メーカーの存在が、北米の建物検査における赤外線サーモグラフィの成長につながりました。

当レポートでは、世界の建物検査用赤外線サーモグラフィ市場について調査し、波長別、製品タイプ別、ソリューション別、プラットフォーム別、建物タイプ別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- 生態系マッピング

- 顧客のビジネスに影響を与える動向と混乱

- 価格分析

- 技術分析

- ポーターのファイブフォース分析

- 購入プロセスおよび購入基準における主要な利害関係者

- ケーススタディ分析

- 貿易分析

- 特許分析

- 2023年~2024年の主要な会議とイベント

- 料金分析

- 基準と規制状況

第6章 建物検査用赤外線サーモグラフィ市場、波長別

- イントロダクション

- 短波赤外線(SWIR)

- 中波赤外線(MWIR)

- 長波赤外線(LWIR)

第7章 建物検査用赤外線サーモグラフィ市場、プラットフォーム別

- イントロダクション

- ハードウェア

- ソフトウェア

第8章 赤外線サーモグラフィ市場、製品タイプ別

- イントロダクション

- サーマルカメラ

- サーマルスコープ

- サーマルモジュール

第9章 建物検査用赤外線サーモグラフィ市場、ソリューション別

- イントロダクション

- 無人赤外線システム

- ハンドヘルドサーマルカメラ

- 固定マウントカメラ

第10章 建物検査用赤外線サーモグラフィ市場、建物タイプ別

- イントロダクション

- 産業用

- 商業用

- 住宅用

第11章 建物検査用赤外線サーモグラフィ市場、用途別

- イントロダクション

- エネルギー監査

- 電気および空調システムの検査

- 構造解析

- 絶縁検査

- フレア/火災検知

- その他

第12章 建物検査用赤外線サーモグラフィ市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第13章 競合情勢

- 概要

- 市場評価の枠組み

- 市場シェア分析、2022年

- 建物検査用赤外線サーモグラフィ市場の主要企業の収益分析

- 主要企業評価マトリックス、2022年

- 主要企業の競合ベンチマーキング

- スタートアップ/中小企業(SMES)の評価マトリックス、2022年

- 競争シナリオと動向

第14章 企業プロファイル

- イントロダクション

- 主要参入企業

- TELEDYNE FLIR LLC

- FLUKE CORPORATION

- AXIS COMMUNICATIONS AB

- SKF

- JENOPTIK AG

- KEYSIGHT TECHNOLOGIES

- R. STAHL AG

- OPGAL OPTRONIC INDUSTRIES LTD.

- RAYTEK DIRECT

- XENICS NV.

- HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.

- その他の企業

- AMETEK LAND(LAND INSTRUMENTS INTERNATIONAL LTD)

- INFRATEC GMBH

- SEEK THERMAL

- INFRARED CAMERAS INC.

- TESTO SE & CO. KGAA

- C-THERMAL

- SATIR

- THERMOTEKNIX SYSTEMS LTD.

- COX CO., LTD.

- NEW IMAGING TECHNOLOGIES(NIT)

- ZHEJIANG DALI TECHNOLOGY CO., LTD.

- HGH

- SIERRA-OLYMPIA TECH.

- OPTOTHERM, INC.

第15章 付録

The infrared thermography market for building inspection is projected to reach USD 606 million by 2028 from USD 445 million in 2023, at a CAGR of 6.4% from 2023 to 2028. Penetration of infrared cameras in the consumer electronics industry and emerging infrared imaging applications in automotive sector are the major opportunities that lie in front of the market.

Increasing demand for thermal modules to propel market growth.

Thermal modules play a key role in several systems used for delivering superior image quality. They are designed and manufactured for easy and efficient integration in higher-level assemblies and platforms. They offer two main advantages- (i) the ability to measure temperature (ii) vision in complete darkness. They are available in small sizes, are lightweight, and consume low power and produce the same image under different light conditions. They are suitable for inspection applications and are integrated into UAVs, telescopes, and aimers. Along with technological advancements, thermal module manufacturers have been developing low-cost and smaller cores to cater to the global demand.

High adoption of thermal scopes accelerating market growth.

Thermal scopes have emerged as essential tools for precise building inspection. By detecting temperature variations, they unveil hidden problems like insulation issues, water leaks, and electrical anomalies. These scopes provide rapid, non-destructive assessments, enabling proactive maintenance and cost-effective repairs. These scopes are used in diagnostics and veterinary, building and construction checks, search and rescue, hunting, forestry, airport security, and border control.

Increased usage of thermal cameras for moisture detection in buildings

Moisture inspection using thermal imaging in buildings involves the use of infrared cameras to detect temperature variations on surfaces, revealing potential areas of moisture accumulation or leaks. As moisture affects thermal properties, wet regions display different temperatures than dry areas. During the inspection, these cameras scan building components like walls, ceilings, and floors, creating visual images that highlight anomalies.

North America is expected to account for largest market share during the forecast period.

The market in North America accounted for the largest share of the infrared imaging market in 2023. The presence of major service providers in the North American region and moreover, the focus of the building owners towards adopting predictive maintenance, makes this region a prominent market for infrared thermographic inspections. Overall, the combination of increasing demand in the building and construction industry, increased adoption in building inspection, technological advancements, and the presence of major producers has led to the growth of infrared thermography in building inspection in North America.

The break-up of profile of primary participants in the infrared thermography market for building inspection-

- By Company Type: Tier 1 - 38%, Tier 2 - 28%, Tier 3 - 34%

- By Designation Type: C Level - 40%, Director Level - 30%, Others - 30%

- By Region Type: North America - 35%, Europe - 20%, Asia Pacific - 35%, Rest of the World - 10%

The major players of infrared thermography market for building inspection are Teledyne FLIR LLC (US), Fluke Corporation (US), Axis Communications AB (Sweden) and many more.

Research Coverage

The report segments the infrared market and forecasts its size based on Product Type, Solution Type, Application, Building Type and Region. The report also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing market growth. The report also covers qualitative aspects in addition to the quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall infrared imaging market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Market Dynamics: Analysis of key drivers (Increasing adoption of non-destructive testing; Increasing emphasis on energy efficiency and sustainability; Cost-effectiveness and time efficiency), restraints (Export restriction imposed on thermal imaging products; Initial investment and training costs), opportunities (Integration with Building Information Modeling (BIM); Growing demand for smart buildings), and challenges (Data analysis and reporting complexity; Environmental and safety regulations for buildings are not strictly enforced in emerging economies).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the infrared thermography market for building inspection

- Market Development: Comprehensive information about lucrative markets - the report analyses the infrared thermography market for building inspection across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the infrared thermography market for building inspection

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players like Teledyne FLIR LLC (US), JENOPTIK AG (Germany), SKF (Sweden), Fluke Corporation (US), Raytheon Technologies Corporation (US), Axis Communications AB (Sweden), Inc, Xenics nv (Belgium), Zhejiang Dali Technology Co.,Ltd. (China), OPGAL Optronics Industries Ltd (Israel), InfraTec GmbH (Germany), Seek Thermal (US), Infrared Cameras Inc. (US) and Allied Vision Technologies GmbH (Germany) among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 SUMMARY OF CHANGES

- 1.7 STAKEHOLDERS

- 1.7.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 Major secondary sources

- 2.1.2.2 Secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Breakdown of primaries

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 PROCESS FLOW OF MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- FIGURE 4 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 5 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH (SUPPLY SIDE)-REVENUE GENERATED FROM SALES OF INFRARED THERMOGRAPHY PRODUCTS FOR BUILDING INSPECTION

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.4 ASSUMPTIONS FOR RESEARCH STUDY

- 2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

- TABLE 1 RESEARCH ASSUMPTIONS

- 2.5.1 RESEARCH LIMITATIONS

- 2.6 RISK ASSESSMENT

- 2.7 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION

3 EXECUTIVE SUMMARY

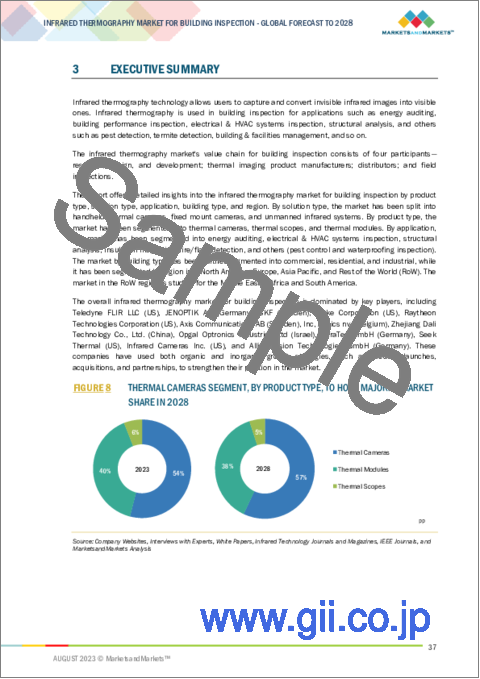

- FIGURE 8 THERMAL CAMERAS SEGMENT, BY PRODUCT TYPE, TO HOLD MAJORITY MARKET SHARE IN 2028

- FIGURE 9 HANDHELD THERMAL CAMERAS SEGMENT, BY SOLUTION TYPE, HELD LARGEST MARKET SHARE IN 2023

- FIGURE 10 COMMERCIAL SEGMENT, BY BUILDING TYPE, TO DOMINATE MARKET IN 2023

- FIGURE 11 ELECTRICAL & HVAC SYSTEMS INSPECTION SEGMENT, BY APPLICATION, TO HOLD LARGEST MARKET SHARE IN 2028

- FIGURE 12 ASIA PACIFIC TO BE FASTEST-GROWING INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION

- FIGURE 13 INCREASING ADOPTION OF INFRARED THERMOGRAPHY TECHNOLOGY IN ASIA PACIFIC TO DRIVE MARKET

- 4.2 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION

- FIGURE 14 UNMANNED INFRARED SYSTEMS TO REGISTER HIGHEST CAGR IN INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION DURING FORECAST PERIOD

- 4.3 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY PRODUCT TYPE

- FIGURE 15 THERMAL CAMERAS SEGMENT TO DOMINATE INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN 2028

- 4.4 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY AND APPLICATION

- FIGURE 16 US AND ELECTRICAL & HVAC SYSTEMS INSPECTION APPLICATION TO HOLD LARGEST SHARES OF MARKET IN NORTH AMERICA IN 2028

- 4.5 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE

- FIGURE 17 INDUSTRIAL SEGMENT TO RECORD HIGHEST CAGR FROM 2023 TO 2028

- 4.6 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY COUNTRY

- FIGURE 18 CHINA TO REGISTER HIGHEST CAGR IN INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 19 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- FIGURE 20 DRIVERS AND THEIR IMPACT ON INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION

- 5.2.1.1 Increasing adoption of non-destructive testing methods

- 5.2.1.2 Growing emphasis on energy efficiency and sustainability of buildings

- 5.2.1.3 Cost-effectiveness and time efficiency of infrared thermography

- 5.2.2 RESTRAINTS

- FIGURE 21 RESTRAINTS AND THEIR IMPACT ON INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION

- 5.2.2.1 Export restrictions imposed on thermal imaging products

- 5.2.2.2 High initial investment and training costs related to infrared thermography

- 5.2.3 OPPORTUNITIES

- FIGURE 22 OPPORTUNITIES AND THEIR IMPACT ON INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION

- 5.2.3.1 Integration with Building Information Modeling (BIM)

- 5.2.3.2 Growing demand for smart buildings

- 5.2.4 CHALLENGES

- FIGURE 23 CHALLENGES AND THEIR IMPACT ON INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION

- 5.2.4.1 Data analysis and reporting complexities associated with infrared thermography for building inspection

- 5.2.4.2 Uneven enforcement of environmental and safety regulations in emerging economies

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 24 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM MAPPING

- FIGURE 25 ECOSYSTEM ANALYSIS

- FIGURE 26 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: KEY PLAYERS IN ECOSYSTEM

- 5.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 27 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR MARKET PLAYERS

- 5.6 PRICING ANALYSIS

- TABLE 2 AVERAGE SELLING PRICE OF INFRARED THERMOGRAPHY PRODUCTS OFFERED BY TOP COMPANIES (USD)

- 5.6.1 AVERAGE SELLING PRICE OF INFRARED THERMOGRAPHY PRODUCTS OFFERED BY KEY PLAYERS

- FIGURE 28 AVERAGE SELLING PRICE OF UNCOOLED CAMERAS, BY KEY PLAYER

- 5.6.2 AVERAGE SELLING PRICE TREND

- TABLE 3 INDICATIVE SELLING PRICE OF THERMAL IMAGING CAMERAS, BY REGION

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 USE OF IR IMAGING TO ANALYZE ORGANIC COMPOSTS

- 5.7.2 VIBRATIONAL SPECTROSCOPIC TECHNIQUES FOR TEA QUALITY AND SAFETY ANALYSES

- 5.7.3 ADVANCEMENTS IN AI-BASED INFRARED IMAGING

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 29 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: PORTER'S FIVE FORCES ANALYSIS, 2022

- TABLE 4 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: PORTER'S FIVE FORCES ANALYSIS, 2020

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS IN BUYING PROCESS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 30 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY BUILDING TYPE

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY BUILDING TYPE

- 5.9.2 BUYING CRITERIA

- FIGURE 31 KEY BUYING CRITERIA, BY BUILDING TYPE

- TABLE 6 KEY BUYING CRITERIA, BY BUILDING TYPE

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 ROCKWOOL GROUP USED TELEDYNE FLIR'S THERMAL IMAGING TECHNOLOGY TO EVALUATE INSULATION EFFECTIVENESS AND PROVIDE COMPREHENSIVE BUILDING ANALYSIS

- 5.10.1.1 VICENZA COURT HIRED SERVICES OF THERMAL IMAGING EXPERTS FROM MULTITES SRL TO RESOLVE CONSTRUCTION DISPUTE

- 5.10.2 HIGHLAND HELICOPTERS DEPLOYED THERMAL CAMERAS FROM INFRATEC TO COMBAT WILDFIRES

- 5.10.1 ROCKWOOL GROUP USED TELEDYNE FLIR'S THERMAL IMAGING TECHNOLOGY TO EVALUATE INSULATION EFFECTIVENESS AND PROVIDE COMPREHENSIVE BUILDING ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO OF MAGNETIC OR OPTICAL READERS

- TABLE 7 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 902750, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.11.2 EXPORT SCENARIO OF MAGNETIC OR OPTICAL READERS

- TABLE 8 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 902750, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.12 PATENT ANALYSIS

- FIGURE 32 NUMBER OF PATENTS GRANTED FROM 2013 TO 2022

- TABLE 9 PATENTS PERTAINING TO INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, 2020-2022

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 10 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: LIST OF CONFERENCES AND EVENTS

- 5.14 TARIFF ANALYSIS

- TABLE 11 MFN TARIFF FOR HS CODE 902750-COMPLIANT PRODUCTS EXPORTED BY US

- TABLE 12 MFN TARIFF FOR HS CODE 902750-COMPLIANT PRODUCTS EXPORTED BY CHINA

- TABLE 13 MFN TARIFF FOR HS CODE 902750-COMPLIANT PRODUCTS EXPORTED BY INDIA

- 5.15 STANDARDS AND REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

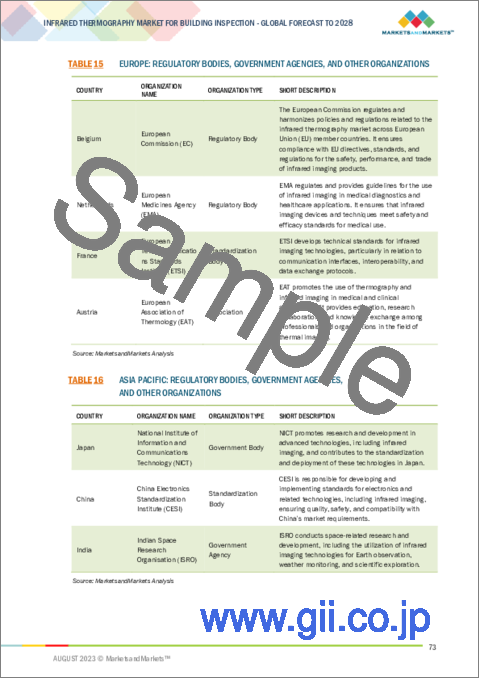

- TABLE 15 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 REGULATORY LANDSCAPE

- 5.15.3 GOVERNMENT REGULATIONS

- 5.15.3.1 US

- 5.15.3.2 Europe

- 5.15.3.3 India

6 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY WAVELENGTH

- 6.1 INTRODUCTION

- FIGURE 33 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY WAVELENGTH

- 6.2 SHORT-WAVE INFRARED (SWIR)

- 6.2.1 INCREASED DEPLOYMENT OF SWIR FOR NON-DESTRUCTIVE TESTING IN SEMICONDUCTOR AND ELECTRONICS INDUSTRY TO DRIVE SEGMENT

- 6.3 MID-WAVE INFRARED (MWIR)

- 6.3.1 BETTER IMAGE GENERATION CAPACITY OF MWIR TO DRIVE SEGMENTAL LANDSCAPE

- 6.4 LONG-WAVE INFRARED (LWIR)

- 6.4.1 SIGNIFICANT USE OF LWIR CAMERAS IN FIREFIGHTING TO FUEL SEGMENT GROWTH

7 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY PLATFORM

- 7.1 INTRODUCTION

- 7.2 HARDWARE

- 7.2.1 IR LENS SYSTEMS

- 7.2.1.1 Precise inspections facilitated by enhanced optics and wider coverage of IR lens systems to drive segment

- 7.2.2 UNCOOLED IR DETECTORS

- 7.2.2.1 Need for energy conservation and predictive maintenance in building inspection to propel segment

- 7.2.3 OTHERS

- 7.2.1 IR LENS SYSTEMS

- 7.3 SOFTWARE

- 7.3.1 PREDICTIVE MAINTENANCE CAPABILITIES OF SOFTWARE USING AI ALGORITHMS AND MACHINE LEARNING TECHNOLOGIES TO FUEL MARKET GROWTH

8 INFRARED THERMOGRAPHY MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- FIGURE 34 THERMAL CAMERAS SEGMENT, BY PRODUCT TYPE, TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 18 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY PRODUCT TYPE, 2019-2022 (USD MILLION)

- TABLE 19 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY PRODUCT TYPE, 2023-2028 (USD MILLION)

- 8.2 THERMAL CAMERAS

- 8.2.1 ABILITY TO OPERATE IN DIFFERENT LIGHTING CONDITIONS TO FUEL MARKET

- 8.3 THERMAL SCOPES

- 8.3.1 ADOPTION IN VARIOUS APPLICATIONS TO BOOST MARKET

- 8.4 THERMAL MODULES

- 8.4.1 ADOPTION IN NON-CONTACT PATROL INSPECTIONS TO PROPEL MARKET

9 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY SOLUTION TYPE

- 9.1 INTRODUCTION

- FIGURE 35 HANDHELD THERMAL CAMERAS SEGMENT, BY SOLUTION TYPE, TO DOMINATE MARKET IN 2028

- TABLE 20 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY SOLUTION TYPE, 2019-2022 (USD MILLION)

- TABLE 21 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY SOLUTION TYPE, 2023-2028 (USD MILLION)

- 9.2 UNMANNED INFRARED SYSTEMS

- 9.2.1 REQUIREMENT FOR EFFICIENT AND COMPREHENSIVE BUILDING INSPECTIONS IN REMOTE OR HAZARDOUS AREAS TO DRIVE MARKET

- 9.3 HANDHELD THERMAL CAMERAS

- 9.3.1 EASE OF HANDLING AND PORTABILITY TO PROPEL MARKET

- 9.4 FIXED MOUNT CAMERAS

- 9.4.1 NEED FOR CONTINUOUS MONITORING AND AUTOMATION ACROSS INDUSTRIES TO FUEL SEGMENT GROWTH

10 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE

- 10.1 INTRODUCTION

- FIGURE 36 COMMERCIAL SEGMENT, BY BUILDING TYPE, TO LEAD MARKET IN 2028

- TABLE 22 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2019-2022 (USD MILLION)

- TABLE 23 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2023-2028 (USD MILLION)

- 10.2 INDUSTRIAL

- 10.2.1 INCREASING NEED FOR PREDICTIVE MAINTENANCE TO DRIVE MARKET

- 10.3 COMMERCIAL

- 10.3.1 RISING AWARENESS OF ENERGY CONSERVATION TO PROPEL MARKET

- 10.4 RESIDENTIAL

- 10.4.1 INCREASING DEMAND FOR ENERGY-EFFICIENT HOMES AND SMART BUILDINGS TO FUEL MARKET GROWTH

11 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION

- 11.1 INTRODUCTION

- FIGURE 37 ENERGY AUDITING SEGMENT, BY APPLICATION, TO RECORD HIGHEST CAGR IN INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION DURING FORECAST PERIOD

- TABLE 24 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 25 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2 ENERGY AUDITING

- 11.2.1 INCREASING FOCUS ON SUSTAINABLE PRACTICES TO DRIVE DEMAND FOR ENERGY AUDITING

- TABLE 26 BENEFITS OF ENERGY AUDITING

- TABLE 27 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2019-2022 (USD MILLION)

- TABLE 28 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2023-2028 (USD MILLION)

- TABLE 29 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2019-2022 (USD MILLION)

- TABLE 30 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2023-2028 (USD MILLION)

- TABLE 31 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD THOUSAND)

- TABLE 32 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 33 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2019-2022 (USD THOUSAND)

- TABLE 34 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 35 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD THOUSAND)

- TABLE 36 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 37 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2019-2022 (USD THOUSAND)

- TABLE 38 ENERGY AUDITING: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2023-2028 (USD THOUSAND)

- 11.3 ELECTRICAL & HVAC SYSTEMS INSPECTION

- 11.3.1 NEED TO MAINTAIN SAFE AND RELIABLE ELECTRICAL INFRASTRUCTURE IN BUILDINGS TO FUEL SEGMENT GROWTH

- TABLE 39 BENEFITS OF ELECTRICAL & HVAC SYSTEMS INSPECTION

- TABLE 40 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2019-2022 (USD MILLION)

- TABLE 41 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2023-2028 (USD MILLION)

- TABLE 42 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2019-2022 (USD MILLION)

- TABLE 43 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2023-2028 (USD MILLION)

- TABLE 44 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD THOUSAND)

- TABLE 45 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 46 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2019-2022 (USD THOUSAND)

- TABLE 47 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 48 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD THOUSAND)

- TABLE 49 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 50 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2019-2022 (USD THOUSAND)

- TABLE 51 ELECTRICAL & HVAC SYSTEMS INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2023-2028 (USD THOUSAND)

- 11.4 STRUCTURAL ANALYSIS

- 11.4.1 INCREASING EMPHASIS ON MAINTAINING SAFETY AND DURABILITY OF BUILDINGS TO PROPEL SEGMENT

- TABLE 52 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2019-2022 (USD MILLION)

- TABLE 53 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2023-2028 (USD MILLION)

- TABLE 54 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2019-2022 (USD MILLION)

- TABLE 55 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2023-2028 (USD MILLION)

- TABLE 56 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD THOUSAND)

- TABLE 57 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 58 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2019-2022 (USD THOUSAND)

- TABLE 59 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 60 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD THOUSAND)

- TABLE 61 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 62 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2019-2022 (USD THOUSAND)

- TABLE 63 STRUCTURAL ANALYSIS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2023-2028 (USD THOUSAND)

- 11.5 INSULATION INSPECTION

- 11.5.1 RISING FOCUS ON DEVELOPING ENERGY-EFFICIENT BUILDINGS TO CREATE DEMAND FOR INSULATION INSPECTION

- TABLE 64 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2019-2022 (USD MILLION)

- TABLE 65 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2023-2028 (USD MILLION)

- TABLE 66 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2019-2022 (USD MILLION)

- TABLE 67 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2023-2028 (USD MILLION)

- TABLE 68 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD THOUSAND)

- TABLE 69 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 70 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2019-2022 (USD THOUSAND)

- TABLE 71 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 72 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD THOUSAND)

- TABLE 73 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 74 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2019-2022 (USD THOUSAND)

- TABLE 75 INSULATION INSPECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2023-2028 (USD THOUSAND)

- 11.6 FLARE/FIRE DETECTION

- 11.6.1 NEED TO ENHANCE FIRE SAFETY MEASURES TO BOOST DEMAND FOR INFRARED THERMOGRAPHY

- TABLE 76 BENEFITS OF FIRE/FLARE DETECTION

- TABLE 77 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2019-2022 (USD MILLION)

- TABLE 78 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2023-2028 (USD MILLION)

- TABLE 79 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2019-2022 (USD MILLION)

- TABLE 80 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2023-2028 (USD MILLION)

- TABLE 81 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD THOUSAND)

- TABLE 82 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 83 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2019-2022 (USD THOUSAND)

- TABLE 84 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 85 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD THOUSAND)

- TABLE 86 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 87 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2019-2022 (USD THOUSAND)

- TABLE 88 FIRE/FLARE DETECTION: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2023-2028 (USD THOUSAND)

- 11.7 OTHERS

- TABLE 89 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2019-2022 (USD MILLION)

- TABLE 90 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY BUILDING TYPE, 2023-2028 (USD MILLION)

- TABLE 91 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2019-2022 (USD MILLION)

- TABLE 92 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2023-2028 (USD MILLION)

- TABLE 93 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2019-2022 (USD THOUSAND)

- TABLE 94 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 95 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2019-2022 (USD THOUSAND)

- TABLE 96 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 97 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2019-2022 (USD THOUSAND)

- TABLE 98 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC, BY COUNTRY, 2023-2028 (USD THOUSAND)

- TABLE 99 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2019-2022 (USD THOUSAND)

- TABLE 100 OTHERS: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ROW, BY REGION, 2023-2028 (USD THOUSAND)

12 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION

- 12.1 INTRODUCTION

- FIGURE 38 ASIA PACIFIC TO WITNESS HIGHEST CAGR IN INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION DURING FORECAST PERIOD

- TABLE 101 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2019-2022 (USD MILLION)

- TABLE 102 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2023-2028 (USD MILLION)

- 12.2 NORTH AMERICA

- FIGURE 39 NORTH AMERICA: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION SNAPSHOT

- TABLE 103 NORTH AMERICA: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 104 NORTH AMERICA INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 105 NORTH AMERICA: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 106 NORTH AMERICA: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.2.1 US

- 12.2.1.1 Increased adoption of green building practices to fuel market growth

- 12.2.2 CANADA

- 12.2.2.1 Rising investments by government in R&D of thermal imaging to drive market

- 12.2.3 MEXICO

- 12.2.3.1 Growing number of industrial and manufacturing facilities to boost market

- 12.2.4 RECESSION IMPACT ON INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN NORTH AMERICA

- 12.3 EUROPE

- FIGURE 40 EUROPE: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION SNAPSHOT

- TABLE 107 EUROPE: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 108 EUROPE: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 109 EUROPE: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 110 EUROPE: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3.1 UK

- 12.3.1.1 Increasing use of thermal cameras for HVAC system monitoring to propel market

- 12.3.2 GERMANY

- 12.3.2.1 Adoption in automotive and healthcare sectors to drive market

- 12.3.3 FRANCE

- 12.3.3.1 Growing urbanization to support market growth

- 12.3.4 REST OF EUROPE

- 12.3.5 RECESSION IMPACT ON INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN EUROPE

- 12.4 ASIA PACIFIC

- FIGURE 41 ASIA PACIFIC: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION SNAPSHOT

- TABLE 111 ASIA PACIFIC: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 112 ASIA PACIFIC: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 113 ASIA PACIFIC: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 114 ASIA PACIFIC: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4.1 CHINA

- 12.4.1.1 Growing adoption of small and low-cost thermal imaging products to fuel market growth

- 12.4.2 JAPAN

- 12.4.2.1 Extensive use of infrared thermography in disaster relief and recovery projects to propel market

- 12.4.3 INDIA

- 12.4.3.1 Favorable government initiatives and foreign direct investments to boost market

- 12.4.4 REST OF ASIA PACIFIC

- 12.4.5 RECESSION IMPACT ON INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION IN ASIA PACIFIC

- 12.5 REST OF THE WORLD (ROW)

- TABLE 115 ROW: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2019-2022 (USD MILLION)

- TABLE 116 ROW: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY REGION, 2023-2028 (USD MILLION)

- TABLE 117 ROW: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 118 ROW: INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.5.1 SOUTH AMERICA

- 12.5.1.1 Temperature variability in region to foster market growth

- 12.5.2 MIDDLE EAST & AFRICA

- 12.5.2.1 Thriving oil & gas industry to contribute to market growth

- 12.5.3 RECESSION IMPACT ON INFRARED THERMOGRAPHIC MARKET FOR BUILDING INSPECTION IN ROW

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 MARKET EVALUATION FRAMEWORK

- TABLE 119 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION

- 13.3 MARKET SHARE ANALYSIS, 2022

- TABLE 120 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: MARKET SHARE ANALYSIS (2022)

- 13.4 REVENUE ANALYSIS OF KEY PLAYERS IN INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION

- FIGURE 42 FIVE-YEAR REVENUE ANALYSIS OF KEY PLAYERS IN INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION

- 13.5 KEY COMPANY EVALUATION MATRIX, 2022

- 13.5.1 STARS

- 13.5.2 PERVASIVE PLAYERS

- 13.5.3 EMERGING LEADERS

- 13.5.4 PARTICIPANTS

- FIGURE 43 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION (GLOBAL): KEY COMPANY EVALUATION MATRIX, 2022

- 13.6 COMPETITIVE BENCHMARKING OF KEY PLAYERS

- 13.6.1 COMPANY FOOTPRINT, BY PLATFORM

- 13.6.2 COMPANY FOOTPRINT, BY REGION

- 13.6.3 OVERALL COMPANY FOOTPRINT

- 13.7 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX, 2022

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- FIGURE 44 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION (GLOBAL): STARTUPS/SMES EVALUATION MATRIX, 2022

- 13.7.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 121 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: LIST OF KEY STARTUPS/SMES

- TABLE 122 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (PLATFORM FOOTPRINT)

- TABLE 123 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES (REGION FOOTPRINT)

- 13.8 COMPETITIVE SCENARIOS AND TRENDS

- TABLE 124 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: PRODUCT LAUNCHES, 2021-2023

- TABLE 125 INFRARED THERMOGRAPHY MARKET FOR BUILDING INSPECTION: DEALS, 2021-2023

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 14.2.1 TELEDYNE FLIR LLC

- TABLE 126 TELEDYNE FLIR LLC: BUSINESS OVERVIEW

- FIGURE 45 TELEDYNE FLIR LLC: COMPANY SNAPSHOT

- TABLE 127 TELEDYNE FLIR LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 128 TELEDYNE FLIR LLC: PRODUCT LAUNCHES

- TABLE 129 TELEDYNE FLIR LLC: DEALS

- 14.2.2 FLUKE CORPORATION

- TABLE 130 FLUKE CORPORATION: BUSINESS OVERVIEW

- FIGURE 46 FLUKE CORPORATION: COMPANY SNAPSHOT

- TABLE 131 FLUKE CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 132 FLUKE CORPORATION: PRODUCT LAUNCHES

- 14.2.3 AXIS COMMUNICATIONS AB

- TABLE 133 AXIS COMMUNICATIONS AB: BUSINESS OVERVIEW

- FIGURE 47 AXIS COMMUNICATIONS AB: COMPANY SNAPSHOT

- TABLE 134 AXIS COMMUNICATIONS AB: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 135 AXIS COMMUNICATIONS AB: PRODUCT LAUNCHES

- 14.2.4 SKF

- TABLE 136 SKF: BUSINESS OVERVIEW

- FIGURE 48 SKF: COMPANY SNAPSHOT

- TABLE 137 SKF: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 138 SKF: DEALS

- 14.2.5 JENOPTIK AG

- TABLE 139 JENOPTIK AG: BUSINESS OVERVIEW

- FIGURE 49 JENOPTIK AG: COMPANY SNAPSHOT

- TABLE 140 JENOPTIK AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 141 JENOPTIK AG: DEALS

- 14.2.6 KEYSIGHT TECHNOLOGIES

- TABLE 142 KEYSIGHT TECHNOLOGIES: BUSINESS OVERVIEW

- FIGURE 50 KEYSIGHT TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 143 KEYSIGHT TECHNOLOGIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.2.7 R. STAHL AG

- TABLE 144 R. STAHL AG: BUSINESS OVERVIEW

- FIGURE 51 R. STAHL AG: COMPANY SNAPSHOT

- TABLE 145 R. STAHL AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.2.8 OPGAL OPTRONIC INDUSTRIES LTD.

- TABLE 146 OPGAL OPTRONIC INDUSTRIES LTD.: BUSINESS OVERVIEW

- TABLE 147 OPGAL OPTRONIC INDUSTRIES LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 148 OPGAL OPTRONIC INDUSTRIES LTD.: PRODUCT LAUNCHES

- 14.2.9 RAYTEK DIRECT

- TABLE 149 RAYTEK DIRECT: BUSINESS OVERVIEW

- TABLE 150 RAYTEK DIRECT: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.2.10 XENICS NV.

- TABLE 151 XENICS NV.: BUSINESS OVERVIEW

- TABLE 152 XENICS NV.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 153 XENICS NV.: PRODUCT LAUNCHES

- TABLE 154 XENICS NV.: DEALS

- 14.2.11 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.

- TABLE 155 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: BUSINESS OVERVIEW

- FIGURE 52 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- TABLE 156 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 14.3 OTHER PLAYERS

- 14.3.1 AMETEK LAND (LAND INSTRUMENTS INTERNATIONAL LTD)

- 14.3.2 INFRATEC GMBH

- 14.3.3 SEEK THERMAL

- 14.3.4 INFRARED CAMERAS INC.

- 14.3.5 TESTO SE & CO. KGAA

- 14.3.6 C-THERMAL

- 14.3.7 SATIR

- 14.3.8 THERMOTEKNIX SYSTEMS LTD.

- 14.3.9 COX CO., LTD.

- 14.3.10 NEW IMAGING TECHNOLOGIES (NIT)

- 14.3.11 ZHEJIANG DALI TECHNOLOGY CO., LTD.

- 14.3.12 HGH

- 14.3.13 SIERRA-OLYMPIA TECH.

- 14.3.14 OPTOTHERM, INC.

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS