|

|

市場調査レポート

商品コード

1345518

軍事通信市場:プラットフォーム別、用途別、システム別、販売時点別、地域別-2028年までの予測Military Communications Market by Platform (Land, Naval, Airborne, Unmanned Vehicles), Application, System, Point of Sale (New Installation, Upgrade), and Region (North America, Europe, Asia Pacific, Rest of the World) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 軍事通信市場:プラットフォーム別、用途別、システム別、販売時点別、地域別-2028年までの予測 |

|

出版日: 2023年08月24日

発行: MarketsandMarkets

ページ情報: 英文 239 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

軍事通信とは、命令や指示などの情報を、データを失うことなく、短いスパンで地域を越えて軍人間で伝達することです。

指揮官が目的を達成するために軍や部隊を調整することができるため、軍事作戦の基盤となっています。

世界の軍事通信の市場規模は、2023年には242億米ドル、2028年には354億米ドルに達すると推定され、予測期間中のCAGRは7.9%と見込まれています。さまざまな要因により、軍事通信の世界市場は大きく拡大しています。市場の成長を牽引しているのは、安全で信頼性の高い通信に対する需要の高まり、無人システムの利用拡大、5Gや人工知能などの新技術の開発です。サイバー戦争やその他の干渉の脅威の増大が、より安全で弾力性のある軍事通信システムへの需要を促進しています。

軍事通信市場は陸上、海軍、空中、無人車両にセグメント化されており、予測期間中、陸上が最も急成長するセグメントとなる見込みです。陸上軍事通信システムは、陸上の軍関係者間で情報を送受信するために使用されるシステムです。指揮統制、状況認識、軍事作戦の調整に不可欠です。陸上軍事通信市場の成長を促進する要因には、安全で信頼性の高い通信に対する需要の増加、無人化の進展、世界な通信範囲の必要性、新技術の開発などがあります。陸上軍事通信市場の成長は、現代の地上戦における戦略、作戦、技術的状況の進化を反映したものです。紛争の性質や技術的パラダイムが変化するにつれて、陸上軍事通信分野の要件やソリューションも変化します。

軍事通信市場は軍用SATCOMシステム、軍用無線システム、軍用セキュリティシステム、通信管理システムに区分されます。軍用衛星通信システムはその用途で最大の市場シェアを確保しました。さらに、衛星通信システムは、軍事衛星通信オンザムーブ(SOTM)と軍事衛星通信オンザポーズ(SOTP)にセグメント化されます。SOTMシステムは移動中に通信できるように設計されており、SOTPシステムは静止しているユーザー向けに設計されています。SOTM市場は、軍事、海事、航空などの移動における衛星通信の需要の増加により、より速い速度で成長すると予想されます。SOTMシステムは、ユーザーが移動しながら通信することを可能にします。SOTM市場の成長を促進する要因としては、モバイルアプリにおける衛星通信需要の増加、無人システムの利用拡大、遠隔地における衛星通信需要の増加、新技術の開発などが挙げられます。

インドは世界有数の国防支出国であり、政府は軍の近代化に力を入れています。このため、新しい軍事通信技術への需要が高まっています。

当レポートでは、世界の軍事通信市場について調査し、プラットフォーム別、用途別、システム別、販売時点別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向

- 景気後退の影響分析

- 平均販売価格分析

- ボリュームデータ分析

- エコシステム分析

- バリューチェーン分析

- 貿易分析

- 使用事例分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 関税と規制状況

- 主要な会議とイベント

第6章 業界の動向

- イントロダクション

- 軍事通信市場における主要な技術動向

- メガトレンドの影響

- サプライチェーン分析

- イノベーションと特許登録

第7章 軍事通信市場、プラットフォーム別

- イントロダクション

- 陸軍

- 海軍

- 空軍

- 無人

第8章 軍事通信市場、用途別

- イントロダクション

- コマンドとコントロール

- 諜報、監視、偵察(ISR)

- 日常業務

- 戦闘

第9章 軍事通信市場、システム別

- イントロダクション

- 軍用衛星放送システム

- 軍用無線システム

- 軍事安全保障システム

- 通信管理システム

第10章 軍事通信市場、販売時点別

- イントロダクション

- 新規設置

- アップグレード

第11章 軍事通信市場、地域別

- イントロダクション

- 地域不況の影響分析

- 北米

- 欧州

- アジア太平洋

- その他の地域

第12章 競合情勢

- イントロダクション

- 競合の概要

- 主要企業の市場ランキング分析、2022年

- 主要企業の市場シェア、2022年

- 市場トップ5企業の収益分析、2022年

- 企業の製品フットプリント分析

- 企業評価マトリックス

- 新興企業/中小企業の評価マトリックス

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- LOCKHEED MARTIN CORPORATION

- RAYTHEON TECHNOLOGIES CORPORATION

- NORTHROP GRUMMAN CORPORATION

- GENERAL DYNAMICS CORPORATION

- BAE SYSTEMS

- L3HARRIS TECHNOLOGIES, INC.

- SAAB AB

- ASELSAN A.S.

- ELBIT SYSTEMS

- THALES GROUP

- VIASAT INC.

- RHEINMETALL AG

- LEONARDO S.P.A.

- COBHAM LIMITED

- ISRAEL AEROSPACE INDUSTRIES

- HONEYWELL INTERNATIONAL INC.

- その他の企業

- ROLTA INDIA LTD

- KONGSBERG

- JAPAN RADIO COMPANY

- DATA LINK SOLUTIONS

- VANTAGE ROBOTICS

- RAFAEL ADVANCED DEFENCE SYSTEMS LTD

- FORTEM TECHNOLOGIES

- SHIELD AI

- ANDURIL INDUSTRIES

第14章 付録

Military communications is the transmission of information, such as orders and instructions, between military personnel across regions within a short span of time with no loss of data. It is the foundation of military operations, as it allows commanders to coordinate their forces and troops to achieve their objectives.

The Global Military Communications Market is estimated to be USD 24.2 Billion in 2023 to USD 35.4 by 2028, at a CAGR of 7.9% during the forecast period. Due to a number of factors, the global market for military communications are expanding significantly. The growth of the market is being driven by the increasing demand for secure and reliable communications, the growing use of unmanned systems, and the development of new technologies, such as 5G and artificial intelligence. The increasing threats of cyberwarfare and other forms of interference are driving the demand for more secure and resilient military communications systems.

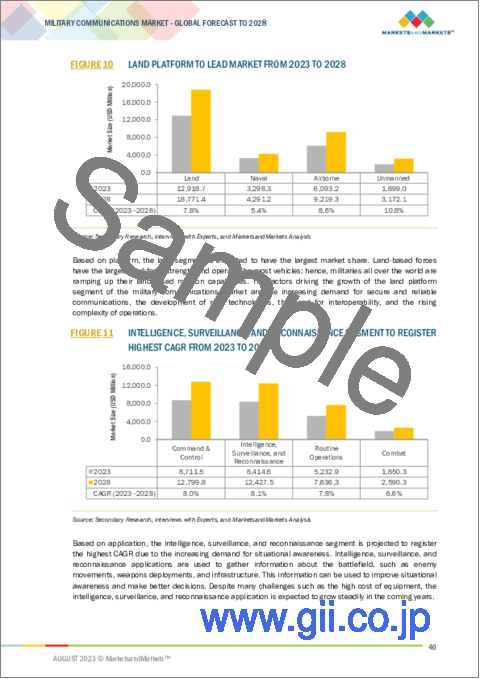

"Land Segment: The largest share of the Military Communications Market by platform application in 2023." Based on Platform, the Military Communications Market has been segmented into Land, Naval, Airborne and unmanned vehicles and Land is expected to be the fastest-growing segment, during the forecast period. Land military communication systems are the systems used to transmit and receive information between military personnel on land. They are essential for command and control, situational awareness, and coordination of military operations. There are a number of factors driving the growth of the land military communications market, including: The increasing demand for secure and reliable communications, growing use of unmanned, need for global coverage, development of new technologies etc. The land military communications market's growth is a reflection of the evolving strategic, operational, and technological landscapes of modern ground warfare. As the nature of conflicts and technological paradigms shift, so too will the requirements and solutions in the land military communications sector.

" Command and Control: The second largest segment of the Military Communications Market by application in 2023"

The application type for military communications market is segmented into command and control, intelligence, surveillance & reconnaissance, routine operations and combat. Command and control is expected to be the fastest-growing segment, during the forecast period. The growth of command and control (C2) military communication is driven by the increasing complexity of modern warfare, the integration of advanced technologies, and the need for effective coordination, decision-making, and response. Modern military operations rely on data from various sources - sensors, intelligence, reconnaissance, etc. C2 systems enable commanders to process this data and make informed decisions rapidly. C2 systems need to seamlessly integrate with different military branches, units, and potentially allied forces during joint operations. Effective C2 MILCOM ensures commanders have an accurate and up-to-date picture of the battlefield, enhancing situational awareness.

" Military Satcom Systems: The largest share of the Military Communications Market by system segment in 2023." Based on System segment, the Military Communications Market has been segmented into Military SATCOM system, military radio system, military security system and communication management System. Based on the numbers, military satcom system secured the largest market share in their usage. Further, satcom system is segmented into military satcom-on-the-move (SOTM) and military satcom-on-the-pause (SOTP) . SOTM systems are designed to allow users to communicate while moving, while SOTP systems are designed for users who are stationary. The SOTM market is expected to grow at a faster rate due to the increasing demand for satellite communications in mobile applications, such as military, maritime, and aviation. SOTM systems allow users to communicate while moving, which is essential for these applications. Some of the factors driving the growth of the SOTM markets are, increasing demand for satellite communications in mobile applications, growing use of unmanned systems, increasing demand for satellite communications in remote areas and development of new technologies.

" Installation Segment: The first largest segment of the Military Communications Market by point of sale in 2023"

Military Communications market is segmented by point of sale into new installations and upgrade out of which, new installations secured a larger market share in 2023. The global military communications point of sale (POS) segment is expected to grow at a CAGR of 7% from 2023 to 2028. The installation segment is expected to grow due to the increasing demand for new POS systems and the need to upgrade existing systems.

There are a few reasons why the installation segment is grown in 2023. First, the increasing demand for new POS systems is driving the growth of the installation segment. As businesses grow and expand, they need to install new POS systems to meet the needs of their customers. Second, the need to upgrade existing POS systems is also driving the growth of the installation segment. As POS systems age, they become outdated and need to be upgraded to meet the latest security and compliance requirements.

The installation segment is also expected to benefit from the increasing use of cloud-based POS systems. Cloud-based POS systems are easier to install and manage than traditional POS systems, which is driving the growth of the installation segment. The growth of the installation segment will create opportunities for businesses that provide installation and maintenance services for POS systems.

"India to account for the largest CAGR in the Military Communications Market in forecasted year"

India, with its strategic geopolitical position, burgeoning economy, and commitment to modernizing its defense forces, has witnessed growth in its military communications market. There are a number of factors driving the growth of the military communications market in India. These include:

The increasing defense budget: India is one of the world's largest defense spenders, and the government is committed to modernizing its military. This is driving demand for new military communications technologies.

Indigenous Development and Production: Under the "Make in India" initiative, there has been a push to develop and manufacture military communication equipment domestically. Numerous private and public sector companies are involved in research, development, and production in this sector.

Collaborations and Joint Ventures: India has engaged in collaborations with countries like Israel, the U.S., Russia, and France to procure advanced communication systems and to co-develop certain technologies.

Break-up of profiles of primary participants in the Military Communications Market: By Company Type: Tier 1 - 55%, Tier 2 - 20%, and Tier 3 - 25% By Designation: C-Level Executives - 10%, Mangers level - 50%, and Academic Expert - 40% By Region: North America - 10%, Europe - 20%, Asia Pacific - 40%, Rest of the world - 30%

Prominent companies in the Military Communications Market are Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Elbit Systems (Israel), L3Harris Technologies Inc. (US), Lockheed Martin Corporation (US), BAE Systems (UK), Saab AB (Sweden), Aselsan A.S (Turkey), Viasat Inc (US), Rheinmetall AG (Germany), Leonardo(Italy), Israel Aerospace Industries (Israel), Cobham Limited(UK), Honeywell International Inc(US) . Research Coverage: The market study covers the military communications market across segments. It aims at estimating the market size and the growth potential of this market across different segments, such as platform, application, system, point of sale and region. The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies. Key benefits of buying this report: This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall military communications market and its subsegments. The report covers the entire ecosystem of the military communications industry and will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers and there are several factors that could contribute to an increase in the Military Communications Market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Military Communications Market.

- Market Development: Comprehensive information about lucrative markets - the report analyses of the Military Communications Market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Military Communications Market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Raytheon Technologies Corporation (US), Northrop Grumman Corporation (US), Thales Group (France), Elbit Systems (Israel), L3Harris Technologies Inc. (US), Lockheed Martin Corporation (US), BAE Systems(UK), Saab AB (Sweden), Aselsan A.S (Turkey), Viasat Inc (US), Rheinmetall AG (Germany), Leonardo(Italy), Israel Aerospace Industries (Israel), Cobham Limited(UK), Honeywell International Inc(US) .

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 MILITARY COMMUNICATIONS MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- TABLE 1 INCLUSIONS AND EXCLUSIONS IN MILITARY COMMUNICATIONS MARKET

- 1.5 CURRENCY AND PRICING

- TABLE 2 USD EXCHANGE RATES

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 MILITARY COMMUNICATIONS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- FIGURE 4 KEY DATA FROM SECONDARY SOURCES

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- FIGURE 5 KEY DATA FROM PRIMARY SOURCES

- 2.1.2.2 Breakdown of primary interviews

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.4 RECESSION IMPACT ANALYSIS

- 2.2.5 IMPACT OF RUSSIA'S INVASION OF UKRAINE

- FIGURE 6 IMPACT OF RUSSIA-UKRAINE WAR

- 2.3 RESEARCH APPROACH AND METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation and methodology

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.1.2 Regional split of military communications market

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 9 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

- FIGURE 10 LAND PLATFORM TO LEAD MARKET FROM 2023 TO 2028

- FIGURE 11 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE SEGMENT TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 12 MILITARY SATCOM SYSTEM TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 13 UPGRADE SEGMENT TO REGISTER HIGHER CAGR FROM 2023 TO 2028

- FIGURE 14 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MILITARY COMMUNICATIONS MARKET

- FIGURE 15 RISE IN DEMAND FOR REAL-TIME INFORMATION SHARING TO DRIVE MARKET

- 4.2 MILITARY COMMUNICATIONS MARKET, BY PLATFORM

- FIGURE 16 LAND SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.3 MILITARY COMMUNICATIONS MARKET, BY APPLICATION

- FIGURE 17 COMMAND & CONTROL TO BE LEADING SEGMENT OF MARKET DURING FORECAST PERIOD

- 4.4 MILITARY COMMUNICATIONS MARKET, BY SYSTEM

- FIGURE 18 MILITARY SATCOM SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE MARKET DURING FORECAST PERIOD

- 4.5 MILITARY COMMUNICATIONS MARKET, BY POINT OF SALE

- FIGURE 19 NEW INSTALLATION SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.6 MILITARY COMMUNICATIONS MARKET, BY COUNTRY

- FIGURE 20 INDIA TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 MILITARY COMMUNICATIONS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing complexity of warfare driving advancements in military communications systems

- 5.2.1.2 Rising adoption of new technologies for military communications

- 5.2.1.3 Growing demand for network-centric warfare and focus on interoperability

- 5.2.1.4 Increasing cyber threats driving development of military communications

- 5.2.1.5 Rise in global defense spending

- TABLE 3 DEFENSE EXPENDITURE OF MAJOR COUNTRIES (USD BILLION)

- FIGURE 22 DEFENSE EXPENDITURE OF MAJOR COUNTRIES IN PERCENTAGE, 2021-2022

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increasing cost of developing and deploying new technologies

- 5.2.2.2 Regulatory and certification requirements and lack of standardized communication protocols

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Use of unmanned systems and autonomous communications

- 5.2.3.2 Cloud-based solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Training and user adoption

- 5.2.4.2 Operating reliably in harsh and remote environments

- 5.3 TRENDS IMPACTING CUSTOMER BUSINESS

- 5.3.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN MILITARY COMMUNICATIONS MARKET

- FIGURE 23 REVENUE SHIFT IN MILITARY COMMUNICATIONS MARKET

- 5.4 RECESSION IMPACT ANALYSIS

- FIGURE 24 MILITARY COMMUNICATIONS MARKET: RECESSION IMPACT ANALYSIS

- 5.5 AVERAGE SELLING PRICE ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SYSTEM

- FIGURE 25 MILITARY COMMUNICATIONS MARKET: AVERAGE SELLING PRICE ANALYSIS

- 5.5.2 INDICATIVE PRICING ANALYSIS

- 5.6 VOLUME DATA ANALYSIS

- TABLE 4 MILITARY COMMUNICATIONS MARKET: NAVAL DELIVERIES IN UNITS

- 5.7 ECOSYSTEM ANALYSIS

- 5.7.1 PROMINENT COMPANIES

- 5.7.2 PRIVATE AND SMALL ENTERPRISES

- 5.7.3 END USERS

- FIGURE 26 MILITARY COMMUNICATIONS MARKET: ECOSYSTEM ANALYSIS

- TABLE 5 MILITARY COMMUNICATIONS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- 5.8 VALUE CHAIN ANALYSIS

- FIGURE 27 MILITARY COMMUNICATIONS MARKET: VALUE CHAIN ANALYSIS

- 5.8.1 PARTS SUPPLIERS

- TABLE 6 END USERS

- 5.9 TRADE ANALYSIS

- TABLE 7 RADAR APPARATUS: COUNTRY-WISE EXPORTS, 2020-2021 (USD THOUSAND)

- TABLE 8 RADAR APPARATUS: COUNTRY-WISE IMPORTS, 2020-2021 (USD THOUSAND)

- 5.10 USE CASE ANALYSIS

- 5.10.1 USE CASE 1: MILITARY COMMUNICATION UNMANNED SYSTEM (MCUS)

- 5.10.2 USE CASE 2: MILITARY CLOUD COMMUNICATIONS

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- TABLE 9 MILITARY COMMUNICATIONS MARKET: IMPACT OF PORTER'S FIVE FORCES

- FIGURE 28 MILITARY COMMUNICATIONS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR 4 PLATFORMS

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR 4 PLATFORMS (%)

- 5.12.2 BUYING CRITERIA

- FIGURE 30 KEY BUYING CRITERIA FOR 4 PLATFORMS

- TABLE 11 KEY BUYING CRITERIA FOR 4 PLATFORMS

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 15 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- TABLE 16 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES

- 5.14 KEY CONFERENCES AND EVENTS

- TABLE 17 MILITARY COMMUNICATIONS MARKET: KEY CONFERENCES AND EVENTS, 2023-2024

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- FIGURE 31 EVOLUTION OF MILITARY COMMUNICATIONS TECHNOLOGY: A ROADMAP FROM 1980 TO 2050

- 6.2 KEY TECHNOLOGICAL TRENDS IN MILITARY COMMUNICATIONS MARKET

- 6.2.1 INTEGRATION OF ADVANCED TECHNOLOGIES

- 6.2.2 WIRELESS COMMUNICATION ADVANCEMENTS

- 6.2.3 SHIFT TO SOFTWARE-DEFINED NETWORKING (SDN)

- 6.2.4 GROWING IMPORTANCE OF CYBERSECURITY

- 6.2.5 SATCOM

- 6.2.6 CLOUD COMPUTING

- 6.2.7 5G

- 6.2.8 COGNITIVE RADIO

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 NETWORK-CENTRIC OPERATIONS

- 6.3.2 RAPID DEVELOPMENT OF UNMANNED SYSTEMS

- 6.3.3 SATCOM-ON-THE-MOVE

- 6.3.4 INTELLIGENT OPTICAL SATELLITE COMMUNICATION

- 6.4 SUPPLY CHAIN ANALYSIS

- FIGURE 32 MILITARY COMMUNICATIONS MARKET: SUPPLY CHAIN ANALYSIS

- 6.5 INNOVATIONS AND PATENT REGISTRATIONS

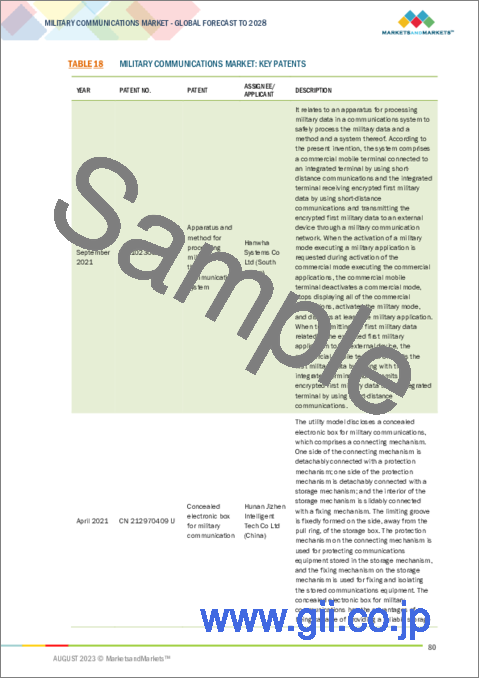

- TABLE 18 MILITARY COMMUNICATIONS MARKET: KEY PATENTS

7 MILITARY COMMUNICATIONS MARKET, BY PLATFORM

- 7.1 INTRODUCTION

- FIGURE 33 MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028

- TABLE 19 MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 20 MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 7.2 LAND

- 7.2.1 COMMAND & CONTROL/GROUND STATION

- 7.2.2 ARMORED VEHICLES

- 7.2.3 COMBAT VEHICLES

- 7.2.4 COMBAT SUPPORT VEHICLES

- 7.2.5 SOLDIERS

- 7.3 NAVAL

- 7.3.1 SHIPS

- 7.3.2 DESTROYERS

- 7.3.3 FRIGATES

- 7.3.4 CORVETTES

- 7.3.5 AMPHIBIOUS VESSELS

- 7.3.6 SURVEY VESSELS

- 7.3.7 PATROL & MINE COUNTERMEASURE VESSELS

- 7.3.8 OFFSHORE SUPPORT VESSELS (OSVS)

- 7.3.9 OTHER SUPPORTING VESSELS

- 7.3.10 SUBMARINES

- 7.4 AIRBORNE

- 7.4.1 FIXED WING

- 7.4.1.1 Fighter aircraft

- 7.4.1.2 Transport aircraft

- 7.4.1.3 Special mission aircraft

- 7.4.2 ROTARY WING

- 7.4.2.1 Attack helicopters

- 7.4.2.2 Maritime helicopters

- 7.4.2.3 Multi-role helicopters

- 7.4.1 FIXED WING

- 7.5 UNMANNED

- 7.5.1 UNMANNED AERIAL VEHICLES (UAVS)

- 7.5.2 UNMANNED GROUND VEHICLES (UGVS)

- 7.5.3 UNMANNED UNDERWATER VEHICLES (UUVS)

8 MILITARY COMMUNICATIONS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 34 MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028

- TABLE 21 MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 22 MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 8.2 COMMAND & CONTROL

- 8.2.1 ENABLING INFORMED DECISIONS AS DECENTRALIZED APPROACH TO DRIVE MARKET

- 8.3 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR)

- 8.3.1 RISE IN CYBER THREATS TO DRIVE MARKET

- 8.4 ROUTINE OPERATIONS

- 8.4.1 ADVANCEMENT IN TECHNOLOGY TO DRIVE MARKET

- 8.5 COMBAT

- 8.5.1 TREND IN MODERN COMBAT SYSTEMS PROGRESSING TOWARD GREATER INTEGRATION AND AUTOMATION TO DRIVE MARKET

9 MILITARY COMMUNICATIONS MARKET, BY SYSTEM

- 9.1 INTRODUCTION

- FIGURE 35 MILITARY COMMUNICATIONS MARKET, BY SYSTEM, 2023-2028

- TABLE 23 MILITARY COMMUNICATIONS MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 24 MILITARY COMMUNICATIONS MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- 9.2 MILITARY SATCOM SYSTEM

- 9.2.1 SATELLITE-ON-THE-MOVE

- 9.2.1.1 Advantages over traditional satellite communications systems to drive market

- 9.2.2 SATTELITE-ON-THE-PAUSE

- 9.2.2.1 Development of robust and reliable communication links in stationary situations to drive market

- 9.2.1 SATELLITE-ON-THE-MOVE

- 9.3 MILITARY RADIO SYSTEM

- 9.3.1 ANALOG RADIO SYSTEM

- 9.3.1.1 Resistance to certain types of jamming compared to digital signals to drive market

- 9.3.2 DIGITAL RADIO SYSTEM

- 9.3.2.1 Range of advanced features to drive market

- 9.3.1 ANALOG RADIO SYSTEM

- 9.4 MILITARY SECURITY SYSTEM

- 9.4.1 DATA ENCRYPTION SYSTEM

- 9.4.1.1 Proper encryption key management to drive market

- 9.4.1 DATA ENCRYPTION SYSTEM

- 9.5 COMMUNICATION MANAGEMENT SYSTEM

- 9.5.1 DYNAMIC SPECTRUM MANAGEMENT AND BATTLEFIELD MANAGEMENT SYSTEM TO DRIVE MARKET

10 MILITARY COMMUNICATIONS MARKET, BY POINT OF SALE

- 10.1 INTRODUCTION

- FIGURE 36 MILITARY COMMUNICATIONS MARKET, BY POINT OF SALE, 2023-2028

- TABLE 25 MILITARY COMMUNICATIONS MARKET, BY POINT OF SALE, 2019-2022 (USD MILLION)

- TABLE 26 MILITARY COMMUNICATIONS MARKET, BY POINT OF SALE, 2023-2028 (USD MILLION)

- 10.2 NEW INSTALLATION

- 10.2.1 DEVELOPMENT OF NEW MISSILES TO DRIVE MARKET.

- 10.3 UPGRADE

- 10.3.1 MODERNIZATION OF MILITARY COMMUNICATIONS SYSTEMS TO DRIVE MARKET

11 MILITARY COMMUNICATIONS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 37 MILITARY COMMUNICATIONS MARKET, BY REGION, 2023-2028

- 11.2 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 27 REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 28 MILITARY COMMUNICATIONS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 29 MILITARY COMMUNICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3 NORTH AMERICA

- 11.3.1 PESTLE ANALYSIS

- 11.3.1.1 Political

- 11.3.1.2 Economic

- 11.3.1.3 Social

- 11.3.1.4 Technological

- 11.3.1.5 Legal

- 11.3.1.6 Environmental

- 11.3.2 RECESSION IMPACT ANALYSIS

- FIGURE 38 NORTH AMERICA: MILITARY COMMUNICATIONS MARKET SNAPSHOT

- TABLE 30 NORTH AMERICA: MILITARY COMMUNICATIONS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 31 NORTH AMERICA: MILITARY COMMUNICATIONS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 33 NORTH AMERICA: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 34 NORTH AMERICA: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 35 NORTH AMERICA: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 36 NORTH AMERICA: MILITARY COMMUNICATIONS MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 37 NORTH AMERICA: MILITARY COMMUNICATIONS MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- 11.3.3 US

- 11.3.3.1 To dominate North American military communications market

- TABLE 38 US: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 39 US: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 40 US: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 41 US: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.4 CANADA

- 11.3.4.1 Increasing demand for secure and reliable communications systems to drive market

- TABLE 42 CANADA: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 43 CANADA: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 44 CANADA: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 45 CANADA: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.1 PESTLE ANALYSIS

- 11.4 EUROPE

- 11.4.1 PESTLE ANALYSIS

- 11.4.1.1 Political

- 11.4.1.2 Economic

- 11.4.1.3 Social

- 11.4.1.4 Technological

- 11.4.1.5 Legal

- 11.4.1.6 Environmental

- 11.4.2 RECESSION IMPACT ANALYSIS

- FIGURE 39 EUROPE: MILITARY COMMUNICATIONS MARKET SNAPSHOT

- TABLE 46 EUROPE: MILITARY COMMUNICATIONS MARKET, COUNTRY, 2019-2022 (USD MILLION)

- TABLE 47 EUROPE: MILITARY COMMUNICATIONS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 48 EUROPE: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 49 EUROPE: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 50 EUROPE: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 51 EUROPE: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 52 EUROPE: MILITARY COMMUNICATIONS MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 53 EUROPE: MILITARY COMMUNICATIONS MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- 11.4.3 UK

- 11.4.3.1 Development of next-generation communications systems to drive market

- TABLE 54 UK: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 55 UK: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 56 UK: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 57 UK: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.4 FRANCE

- 11.4.4.1 Increasing investments in military communication R&D to drive market

- TABLE 58 FRANCE: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 59 FRANCE: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 60 FRANCE: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 61 FRANCE: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.5 GERMANY

- 11.4.5.1 Continuous focus on upgrading battle management and communications systems to drive market

- TABLE 62 GERMANY: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 63 GERMANY: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 64 GERMANY: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 65 GERMANY: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.6 POLAND

- 11.4.6.1 Deployment and modernization of armed forces to drive market

- TABLE 66 POLAND: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 67 POLAND: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 68 POLAND: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 69 POLAND: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.7 ITALY

- 11.4.7.1 Increasing development of secure communications systems to drive market

- TABLE 70 ITALY: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 71 ITALY: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 72 ITALY: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 73 ITALY: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.8 REST OF EUROPE

- TABLE 74 REST OF EUROPE: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 75 REST OF EUROPE: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 76 REST OF EUROPE: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 77 REST OF EUROPE: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.1 PESTLE ANALYSIS

- 11.5 ASIA PACIFIC

- 11.5.1 PESTLE ANALYSIS

- 11.5.1.1 Political

- 11.5.1.2 Economic

- 11.5.1.3 Social

- 11.5.1.4 Technological

- 11.5.1.5 Legal

- 11.5.1.6 Environmental

- 11.5.2 RECESSION IMPACT ANALYSIS

- FIGURE 40 ASIA PACIFIC: MILITARY COMMUNICATIONS MARKET SNAPSHOT

- TABLE 78 ASIA PACIFIC: MILITARY COMMUNICATIONS MARKET, COUNTRY, 2019-2022 (USD MILLION)

- TABLE 79 ASIA PACIFIC: MILITARY COMMUNICATIONS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 81 ASIA PACIFIC: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 83 ASIA PACIFIC: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: MILITARY COMMUNICATIONS MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 85 ASIA PACIFIC: MILITARY COMMUNICATIONS MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- 11.5.3 CHINA

- 11.5.3.1 Military modernization and increase in defense budget to drive market

- TABLE 86 CHINA: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 87 CHINA: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 88 CHINA: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 89 CHINA: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.4 JAPAN

- 11.5.4.1 Enhancement of defense and surveillance capabilities to drive market

- TABLE 90 JAPAN: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 91 JAPAN: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 92 JAPAN: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 93 JAPAN: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.5 INDIA

- 11.5.5.1 Territorial disputes and border tensions to drive market

- TABLE 94 INDIA: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 95 INDIA: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 96 INDIA: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 97 INDIA: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.6 SINGAPORE

- 11.5.6.1 Modernization of defense capabilities to drive market

- TABLE 98 SINGAPORE: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 99 SINGAPORE: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 100 SINGAPORE: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 101 SINGAPORE: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.7 AUSTRALIA

- 11.5.7.1 Defense Joint Project to drive market

- TABLE 102 AUSTRALIA: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 103 AUSTRALIA: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 104 AUSTRALIA: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 105 AUSTRALIA: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.8 REST OF ASIA PACIFIC

- TABLE 106 REST OF ASIA PACIFIC: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.1 PESTLE ANALYSIS

- 11.6 REST OF THE WORLD

- 11.6.1 RECESSION IMPACT ANALYSIS

- TABLE 110 REST OF THE WORLD: MILITARY COMMUNICATIONS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 111 REST OF THE WORLD: MILITARY COMMUNICATIONS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 112 REST OF THE WORLD: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 113 REST OF THE WORLD: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 114 REST OF THE WORLD: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 115 REST OF THE WORLD: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 116 REST OF THE WORLD: MILITARY COMMUNICATIONS MARKET, BY SYSTEM, 2019-2022 (USD MILLION)

- TABLE 117 REST OF THE WORLD: MILITARY COMMUNICATIONS MARKET, BY SYSTEM, 2023-2028 (USD MILLION)

- 11.6.2 MIDDLE EAST & AFRICA

- 11.6.2.1 Border tensions and geopolitical competition to drive market

- TABLE 118 MIDDLE EAST & AFRICA: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.6.3 LATIN AMERICA

- 11.6.3.1 Increasing demand for military UAVs to drive market

- TABLE 122 LATIN AMERICA: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 123 LATIN AMERICA: MILITARY COMMUNICATIONS MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- TABLE 124 LATIN AMERICA: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 125 LATIN AMERICA: MILITARY COMMUNICATIONS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 COMPETITIVE OVERVIEW

- TABLE 126 KEY DEVELOPMENTS BY LEADING PLAYERS IN MILITARY COMMUNICATIONS MARKET BETWEEN 2019 AND 2023

- 12.3 MARKET RANKING ANALYSIS OF KEY PLAYERS, 2022

- 12.4 MARKET SHARE OF KEY PLAYERS, 2022

- 12.5 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2022

- 12.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

- TABLE 127 COMPANY PRODUCT FOOTPRINT

- TABLE 128 COMPANY REGION FOOTPRINT

- 12.7 COMPANY EVALUATION MATRIX

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- FIGURE 41 MILITARY COMMUNICATIONS MARKET: COMPANY EVALUATION MATRIX, 2022

- 12.8 START-UP/SME EVALUATION MATRIX

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- FIGURE 42 MILITARY COMMUNICATIONS MARKET: START-UP/SME COMPANY EVALUATION MATRIX, 2022

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 MARKET EVALUATION FRAMEWORK

- 12.9.2 PRODUCT LAUNCHES

- TABLE 129 PRODUCT LAUNCHES, 2020-2021

- 12.9.3 DEALS

- TABLE 130 DEALS, 2020-2023

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 13.1.1 LOCKHEED MARTIN CORPORATION

- TABLE 131 LOCKHEED MARTIN CORPORATION: COMPANY OVERVIEW

- FIGURE 43 LOCKHEED MARTIN CORPORATION: COMPANY SNAPSHOT

- TABLE 132 LOCKHEED MARTIN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 LOCKHEED MARTIN CORPORATION: PRODUCT LAUNCHES

- TABLE 134 LOCKHEED MARTIN CORPORATION: DEALS

- 13.1.2 RAYTHEON TECHNOLOGIES CORPORATION

- TABLE 135 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY OVERVIEW

- FIGURE 44 RAYTHEON TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

- TABLE 136 RAYTHEON TECHNOLOGIES CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 137 RAYTHEON TECHNOLOGIES CORPORATION: DEALS

- 13.1.3 NORTHROP GRUMMAN CORPORATION

- TABLE 138 NORTHROP GRUMMAN CORPORATION: COMPANY OVERVIEW

- FIGURE 45 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- TABLE 139 NORTHROP GRUMMAN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 140 NORTHROP GRUMMAN COOPERATION: DEALS

- 13.1.4 GENERAL DYNAMICS CORPORATION

- TABLE 141 GENERAL DYNAMICS CORPORATION: COMPANY OVERVIEW

- FIGURE 46 GENERAL DYNAMICS CORPORATION: COMPANY SNAPSHOT

- TABLE 142 GENERAL DYNAMICS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 143 GENERAL DYNAMICS CORPORATION: PRODUCT LAUNCHES

- TABLE 144 GENERAL DYNAMICS CORPORATION: DEALS

- 13.1.5 BAE SYSTEMS

- TABLE 145 BAE SYSTEMS: COMPANY OVERVIEW

- FIGURE 47 BAE SYSTEMS: COMPANY SNAPSHOT

- TABLE 146 BAE SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 147 BAE SYSTEMS: DEALS

- 13.1.6 L3HARRIS TECHNOLOGIES, INC.

- TABLE 148 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 149 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- FIGURE 48 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- TABLE 150 L3HARRIS TECHNOLOGIES, INC.: DEALS

- 13.1.7 SAAB AB

- FIGURE 49 SAAB AB: COMPANY SNAPSHOT

- TABLE 151 SAAB AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 152 SAAB AB: DEALS

- 13.1.8 ASELSAN A.S.

- TABLE 153 ASELSAN A.S.: COMPANY OVERVIEW

- TABLE 154 ASELSAN A.S.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 ASELSAN A.S.: DEALS

- 13.1.9 ELBIT SYSTEMS

- TABLE 156 ELBIT SYSTEMS: COMPANY OVERVIEW

- FIGURE 50 ELBIT SYSTEMS: COMPANY SNAPSHOT

- TABLE 157 ELBIT SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 158 ELBIT SYSTEMS: DEALS

- 13.1.10 THALES GROUP

- TABLE 159 THALES GROUP: COMPANY OVERVIEW

- FIGURE 51 THALES GROUP: COMPANY SNAPSHOT

- TABLE 160 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 161 THALES GROUP: PRODUCT LAUNCHES

- TABLE 162 THALES GROUP: DEALS

- 13.1.11 VIASAT INC.

- TABLE 163 VIASAT INC.: COMPANY OVERVIEW

- TABLE 164 VIASAT INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.12 RHEINMETALL AG

- TABLE 165 RHEINMETALL AG: COMPANY OVERVIEW

- FIGURE 52 RHEINMETALL AG: COMPANY SNAPSHOT

- TABLE 166 RHEINMETALL AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.13 LEONARDO S.P.A.

- TABLE 167 LEONARDO S.P.A.: COMPANY OVERVIEW

- FIGURE 53 LEONARDO S.P.A.: COMPANY SNAPSHOT

- TABLE 168 LEONARDO S.P.A.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 169 LEONARDO S.P.A.: PRODUCT LAUNCHES

- TABLE 170 LEONARDO S.P.A.: DEALS

- 13.1.14 COBHAM LIMITED

- TABLE 171 COBHAM LIMITED: COMPANY OVERVIEW

- TABLE 172 COBHAM LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.15 ISRAEL AEROSPACE INDUSTRIES

- TABLE 173 ISRAEL AEROSPACE INDUSTRIES: COMPANY OVERVIEW

- TABLE 174 ISRAEL AEROSPACE INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 ISRAEL AEROSPACE INDUSTRIES: DEALS

- 13.1.16 HONEYWELL INTERNATIONAL INC.

- TABLE 176 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- FIGURE 54 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- TABLE 177 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 178 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES

- TABLE 179 HONEYWELL INTERNATIONAL INC.: DEALS

- 13.2 OTHER PLAYERS

- 13.2.1 ROLTA INDIA LTD

- TABLE 180 ROLTA INDIA LTD: COMPANY OVERVIEW

- 13.2.2 KONGSBERG

- TABLE 181 KONGSBERG: COMPANY OVERVIEW

- 13.2.3 JAPAN RADIO COMPANY

- TABLE 182 JAPAN RADIO COMPANY: COMPANY OVERVIEW

- 13.2.4 DATA LINK SOLUTIONS

- TABLE 183 DATA LINK SOLUTIONS: COMPANY OVERVIEW

- 13.2.5 VANTAGE ROBOTICS

- TABLE 184 VANTAGE ROBOTICS: COMPANY OVERVIEW

- 13.2.6 RAFAEL ADVANCED DEFENCE SYSTEMS LTD

- TABLE 185 RAFAEL ADVANCED DEFENCE SYSTEMS LTD: COMPANY OVERVIEW

- 13.2.7 FORTEM TECHNOLOGIES

- TABLE 186 FORTEM TECHNOLOGIES: COMPANY OVERVIEW

- 13.2.8 SHIELD AI

- TABLE 187 SHIELD AI: COMPANY OVERVIEW

- 13.2.9 ANDURIL INDUSTRIES

- TABLE 188 ANDURIL INDUSTRIES: COMPANY OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS