|

|

市場調査レポート

商品コード

1342756

アセトニトリルの世界市場:タイプ別、用途別、最終用途産業別、地域別 - 予測(~2028年)Acetonitrile Market by Type (Derivative, Solvent), Application (Organic Synthesis, Analytical Applications, Extraction), End-use Industry (Pharmaceutical, Analytical industry, Agrochemical), Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| アセトニトリルの世界市場:タイプ別、用途別、最終用途産業別、地域別 - 予測(~2028年) |

|

出版日: 2023年08月30日

発行: MarketsandMarkets

ページ情報: 英文 222 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のアセトニトリルの市場規模は、2023年に4億3,900万米ドル、2028年までに5億9,500万米ドルに達し、CAGRで6.2%の成長が予測されています。

現在の用途の拡大、費用対効果、技術革新、新たな用途、バリューチェーンの最適化などが、市場の主な成長促進要因となっています。アクリロニトリルとアセトニトリルの副生物関係は、市場の成長抑制要因の1つです。

"誘導体セグメントは、金額と数量ともにもっとも急成長しているアセトニトリルのタイプセグメントです。"

医薬用途における誘導体または原材料としてのアセトニトリルの使用の増加は、誘導体アセトニトリルセグメントの主な成長促進要因です。アセトニトリル市場は主に、世界中の製薬産業や分析産業からの需要の増加が主な要因によって牽引されています。

"分析用途が2022年にアセトニトリルの用途セグメントをリードします。"

分析用途セグメントが2022年に金額ベースで最大の市場シェアを占めました。

"製薬セグメントは、金額と数量の両方においてアセトニトリルのもっとも急成長している最終用途産業セグメントです。"

最終用途産業別では、製薬セグメントが予測期間に最高の成長率を示す見込みです。製薬産業の成長に向けた政府の取り組みと、さまざまな用途におけるアセトニトリルの使用の増加は、市場の主な促進要因です。

"予測期間中、欧州がアセトニトリルで2番目に大きなシェアを持っています。"

欧州は世界で2番目に大きいアセトニトリルの市場です。ドイツ、フランス、英国が地域におけるアセトニトリルの主要市場です。地域におけるアセトニトリルの需要は、製薬とバイオテクノロジーの研究への高い関心により、ドイツ、英国、フランスなどの西欧諸国によって促進されています。

当レポートでは、世界のアセトニトリル市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

- アセトニトリル市場の企業にとっての魅力的な機会

- アセトニトリル市場:タイプ別、地域別(2022年)

- アセトニトリル市場:用途別(2022年)

- アセトニトリル市場:最終用途産業別(2022年)

- アセトニトリル市場の成長:主要国別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 平均販売価格:タイプ別

- 平均販売価格:用途別

- 平均販売価格の動向

- 主なステークホルダーと購入基準

- 購入プロセスにおける主なステークホルダー

- 購入基準

- 技術分析

- エコシステム:アセトニトリル市場

- バリューチェーン分析

- ケーススタディ分析

- ビジネスに影響を与える動向と混乱

- 輸出入の主要市場

- 中国

- 米国

- 英国

- 日本

- 関税と規制

- 主な会議とイベント(2023年~2024年)

- 特許分析

第6章 アセトニトリル市場:用途別

- イントロダクション

- 有機合成

- 分析用途

- 抽出

- その他

第7章 アセトニトリル市場:タイプ別

- イントロダクション

- 誘導体

- 溶媒

第8章 アセトニトリル市場:最終用途産業別

- イントロダクション

- 製薬

- 分析産業

- 農薬

- その他

第9章 アセトニトリル市場:地域別

- イントロダクション

- 北米

- 北米の景気後退の影響

- 北米のアセトニトリル市場:タイプ別

- 北米のアセトニトリル市場:用途別

- 北米のアセトニトリル市場:最終用途産業別

- 北米のアセトニトリル市場:国別

- 欧州

- 欧州の景気後退の影響

- 欧州のアセトニトリル市場:タイプ別

- 欧州のアセトニトリル市場:用途別

- 欧州のアセトニトリル市場:最終用途産業別

- 欧州のアセトニトリル市場:国別

- アジア太平洋

- アジア太平洋の景気後退の影響

- アジア太平洋のアセトニトリル市場:タイプ別

- アジア太平洋のアセトニトリル市場:用途別

- アジア太平洋のアセトニトリル市場:最終用途産業別

- アジア太平洋のアセトニトリル市場:国別

- 中東・アフリカ

- 中東・アフリカの景気後退の影響

- 中東・アフリカのアセトニトリル市場:タイプ別

- 中東・アフリカのアセトニトリル市場:用途別

- 中東・アフリカのアセトニトリル市場:最終用途産業別

- 中東・アフリカのアセトニトリル市場:国別

- ラテンアメリカ

- ラテンアメリカの景気後退の影響

- ラテンアメリカのアセトニトリル市場:タイプ別

- ラテンアメリカのアセトニトリル市場:用途別

- ラテンアメリカのアセトニトリル市場:最終用途産業別

- ラテンアメリカのアセトニトリル市場:国別

第10章 競合情勢

- イントロダクション

- 市場シェア分析

- 市場ランキング

- 主な市場企業の収益の分析

- 企業の製品フットプリント

- 企業のタイプのフットプリント

- 企業の用途のフットプリント

- 企業の最終用途産業のフットプリント

- 企業の地域フットプリント

- 主要企業の評価マトリクス

- 競合ベンチマーキング

- スタートアップ/中小企業の評価マトリクス

- 競合シナリオ

第11章 企業プロファイル

- 主要企業

- INEOS AG

- ASAHI KASEI CORPORATION

- FORMOSA PLASTIC CORPORATION

- IMPERIAL CHEMICAL CORPORATION

- PETROCHINA CO. LTD.

- SHENGHONG PETROCHEMICAL GROUP CO., LTD

- NOVA MOLECULAR TECHNOLOGIES, INC.

- TEDIA COMPANY, INC.

- AVANTOR PERFORMANCE MATERIALS, LLC

- SHANGHAI SECCO PETROCHEMICAL COMPANY LIMITED

- QINGDAO SHIDA CHEMICAL CO., LTD.

- NANTONG ACETIC ACID CHEMICAL CO., LTD.

- ALKYL AMINES CHEMICAL CO., LTD.

- その他の企業

- BALAJI AMINES LTD.

- TAEKWANG INDUSTRIAL CO., LTD.

- CONNECT CHEMICALS GMBH

- CONCORD TECHNOLOGY (TIANJIN) CO., LTD.

- BIOSOLVE CHIMIE

- GFS CHEMICALS, INC.

- HUNAN CHEM. EUROPE BV

- ALFA AESAR

- HONEYWELL RESEARCH CHEMICALS

- MITSUBISHI CHEMICAL CORPORATION

- PHARMCO-AAPER

- ROBINSON BROTHERS

- STANDARD REAGENTS PVT. LTD.

- KISHIDA CHEMICAL CO., LTD.

- ANQORE

- JINDAL SPECIALITY CHEMICALS

- FUSHUN SHUNENG CHEMICAL CO., LTD.

- SHANDONG JINCHENG PHARMACEUTICAL GROUP CO., LTD.

第12章 付録

The acetonitrile market is projected to grow from USD 439 million in 2023 to USD 595 million by 2028 at a CAGR of 6.2%. Expansions in current applications, cost-effectiveness, Innovations, emerging applications, and value-chain optimizations are some of the key factors driving the growth of the market. The acrylonitrile-acetonitrile by-product relationship is one of the restraining factors that hamper the growth of the market.

''The derivative segment is the fastest-growing type segment of acetonitrile in terms of value and volume.''

Based on type, the acetonitrile market has been segmented into derivative and solvent. As a derivative, acetonitrile is widely used in the pharmaceutical industry for the manufacturing of Vitamin B1 and sulfa pyrimidine. The increasing use of acetonitrile as a derivative or raw material in pharmaceutical applications is the major factor driving the growth of the derivative acetonitrile segment. The acetonitrile market is majorly driven by the rise in demand from the pharmaceutical and analytical industries across the globe.

"'The analytical applications to lead the acetonitrile application segment in 2022.''

The analytical applications segment accounted for the largest market share in terms of value in 2022. Acetonitrile is widely used in analytical applications such as standard preparations, electrochemistry, sample preparations, chromatography solvents, and many more. It can also be used for crystallization and purification processes in the laboratories. Analytical applications is one the largest application type covering all major end-use industries of acetonitrile.

''The pharmaceutical segment is the fastest-growing end-use industry segment of acetonitrile in terms of both value and volume.''

Based on the end-use industry, the pharmaceutical segment is expected to show the highest growth rate during forecasted years. Government initiatives for the growth of the pharmaceutical industry and increasing the use of acetonitrile in various applications are the major factors driving the acetonitrile market. It is the most versatile and cost-effective organic nitrile chemical and is widely used in the pharmaceutical industry across the world.

"Europe region has the second largest share in the acetonitrile during the forecast period."

Europe is the second-largest market for acetonitrile in the world. Germany, France, and the UK are the leading markets for acetonitrile in the region. The demand for acetonitrile in the region is driven by Western European countries such as Germany, the UK, and France due to a high focus on pharmaceutical and biotechnological research. The growth of the European pharmaceutical market can be attributed to innovations in oncology and the development of medical drugs for chronic heart failure, rheumatoid arthritis, and Alzheimer's, as acetonitrile is used in medicinal drugs.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type- Tier 1- 37%, Tier 2- 33%, and Tier 3- 30%

- By Designation- C Level- 33%, Director Level- 27%, Executives- 30% and Others- 10%

- By Region- North America- 22%, Europe- 40%, Asia Pacific - 20%, Latin America- 3%, Middle East & Africa- 15%

The report provides a comprehensive analysis of company profiles:

Prominent companies in the acetonitrile market include INEOS AG (Switzerland.), Asahi Kasei Corporation (Japan), Nova Molecular Technologies (US), PetroChina Co. Ltd. (China), Formosa Plastic Corporation (Taiwan), ShengHong Petrochemical Group Co., Ltd. (China), Avantor Performance Materials LLC (US), Imperial Chemical Corporation (Taiwan), Tedia Company Inc. (US), Avantor Performance Materials, LLC (US), Shanghai Secco Petrochemical Company Limited (China), Qingdao Shida Chemical Co., Ltd. (China), Nantong Acetic Acid Chemical Co., Ltd. (China), and others.

Research Coverage

This report covers the global acetonitrile market and forecasts the market size until 2028. It includes the following market segmentation- Type (Derivative, Solvent), Application (Organic Synthesis, Analytical Applications, Extraction, and Others), End-use Industry (Pharmaceutical, Analytical Industry, Agrochemical, and Others), and Region (North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America).

Porter's Five Forces Analysis, along with the drivers, restraints, opportunities, and challenges, have been discussed in the report. It also provides company profiles and competitive strategies adopted by the major players in the global acetonitrile market.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall acetonitrile market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (High demand for acetonitrile for drug recrystallization), restraints (Increasing demand for other substitute products like prionil), opportunities (Increasing applications in multiple end-use industries), and challenges (requirement of technically strong and skilled laborers) influencing the growth of the acetonitrile market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the acetonitrile market

- Market Development: Comprehensive information about lucrative markets - the report analyses the acetonitrile market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the acetonitrile market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like INEOS AG, Asahi Kasei Corporation, Formosa Plastic Corporation, Imperial Chemical Corporation, Nova Molecular Technologies, Inc., Tedia Company, Inc., PetroChina Co. Ltd., Shanghai Secco Petrochemical Company Limited, Avantor Performance Materials, LLC, Ltd. Nantong Acetic Acid Chemical Co., Ltd., Alkyl Amines Chemicals Ltd., Balaji Amines Ltd. among others in the acetonitrile market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 ACETONITRILE MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- FIGURE 2 ACETONITRILE MARKET: RESEARCH DESIGN

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.2.2 APPROACH 2: DEMAND-SIDE ANALYSIS

- 2.3 IMPACT OF RECESSION

- FIGURE 3 MAJOR FACTORS RESPONSIBLE FOR GLOBAL RECESSION AND THEIR IMPACT ON ACETONITRILE MARKET

- 2.4 FORECAST NUMBER CALCULATION

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 RESEARCH DATA

- 2.5.1 SECONDARY DATA

- 2.5.1.1 Key data from secondary sources

- 2.5.2 PRIMARY DATA

- 2.5.2.1 Key data from primary sources

- 2.5.2.2 Interviews with experts from top acetonitrile manufacturers

- 2.5.2.3 Breakdown of interviews with experts

- 2.5.2.4 Key industry insights

- 2.5.1 SECONDARY DATA

- 2.6 MARKET SIZE ESTIMATION

- 2.6.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.6.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.7 DATA TRIANGULATION

- FIGURE 6 ACETONITRILE MARKET: DATA TRIANGULATION

- 2.8 ASSUMPTIONS

- 2.9 MARKET GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.10 RESEARCH LIMITATIONS

- 2.11 RISKS ASSOCIATED WITH ACETONITRILE MARKET

3 EXECUTIVE SUMMARY

- FIGURE 7 SOLVENT TYPE LED ACETONITRILE MARKET IN 2022

- FIGURE 8 ANALYTICAL APPLICATIONS DOMINATED ACETONITRILE MARKET IN 2022

- FIGURE 9 PHARMACEUTICAL INDUSTRY TO DOMINATE MARKET

- FIGURE 10 ASIA PACIFIC LED ACETONITRILE MARKET IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ACETONITRILE MARKET

- FIGURE 11 SIGNIFICANT GROWTH POTENTIAL IN ACETONITRILE MARKET BETWEEN 2023 AND 2028

- 4.2 ACETONITRILE MARKET, BY TYPE AND REGION, 2022

- FIGURE 12 SOLVENT TYPE AND ASIA PACIFIC WERE LARGEST SEGMENTS

- 4.3 ACETONITRILE MARKET, BY APPLICATION, 2022

- FIGURE 13 ANALYTICAL APPLICATION SEGMENT DOMINATED ACETONITRILE MARKET IN 2022

- 4.4 ACETONITRILE MARKET, BY END-USE INDUSTRY, 2022

- FIGURE 14 PHARMACEUTICAL WAS LARGEST END-USE INDUSTRY OF ACETONITRILE MARKET IN 2022

- 4.5 ACETONITRILE MARKET GROWTH, BY KEY COUNTRIES

- FIGURE 15 CHINA TO BE FASTEST-GROWING ACETONITRILE MARKET DURING 2023-2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTIONS

- 5.2 MARKET DYNAMICS

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ACETONITRILE MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Most-used organic solvent in HPLC applications

- 5.2.1.2 Extensive use in pharmaceutical industry due to versatile properties

- 5.2.2 RESTRAINTS

- 5.2.2.1 Acrylonitrile-acetonitrile by-product relationship

- 5.2.2.2 Increasing demand for substitute product Prionil

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing use of acetonitrile in different applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Environmental concerns and toxicity issues associated with acetonitrile usage

- 5.2.4.2 Requirement of technically skilled staff to handle and use acetonitrile

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 ACETONITRILE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF BUYERS

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 THREAT OF NEW ENTRANTS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 1 ACETONITRILE MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 SUPPLY CHAIN ANALYSIS

- TABLE 2 ACETONITRILE MARKET: COMPANIES AND THEIR ROLE IN ECOSYSTEM

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND FOR END-USE INDUSTRIES, BY KEY PLAYERS

- FIGURE 18 AVERAGE SELLING PRICE TREND FOR TOP 3 END-USE INDUSTRIES (USD/KG), BY KEY PLAYERS

- TABLE 3 AVERAGE SELLING PRICE TREND FOR END-USE INDUSTRIES, BY KEY PLAYERS (USD/KG)

- 5.6 AVERAGE SELLING PRICE, BY TYPE

- FIGURE 19 AVERAGE SELLING PRICES BY TYPE (USD/KG)

- 5.7 AVERAGE SELLING PRICE, BY APPLICATION

- FIGURE 20 AVERAGE SELLING PRICE TREND FOR APPLICATIONS (USD/KG)

- 5.8 AVERAGE SELLING PRICE TREND

- TABLE 4 ACETONITRILE AVERAGE SELLING PRICE TREND IN ACETONITRILE MARKET, BY REGION

- 5.9 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USE INDUSTRIES

- 5.9.2 BUYING CRITERIA

- FIGURE 22 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- TABLE 6 KEY BUYING CRITERIA FOR TOP 3 END-USE INDUSTRIES

- 5.10 TECHNOLOGY ANALYSIS

- TABLE 7 COMPARATIVE STUDY OF ACETONITRILE MANUFACTURING PROCESSES

- 5.11 ECOSYSTEM: ACETONITRILE MARKET

- 5.12 VALUE CHAIN ANALYSIS

- FIGURE 23 VALUE CHAIN ANALYSIS: ACETONITRILE MARKET

- 5.13 CASE STUDY ANALYSIS

- 5.14 TRENDS AND DISRUPTIONS IMPACTING BUSINESS

- 5.15 KEY MARKETS FOR IMPORT/EXPORT

- 5.15.1 CHINA

- 5.15.2 US

- 5.15.3 UK

- 5.15.4 JAPAN

- 5.16 TARIFF AND REGULATIONS

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.2 STANDARDS IN ACETONITRILE MARKET

- TABLE 12 CURRENT STANDARD CODES FOR ACETONITRILE

- 5.17 KEY CONFERENCES & EVENTS, 2023-2024

- TABLE 13 DETAILED LIST OF CONFERENCES & EVENTS, 2023-2024

- 5.18 PATENT ANALYSIS

- 5.18.1 INTRODUCTION

- 5.18.2 METHODOLOGY

- 5.18.3 DOCUMENT TYPE

- TABLE 14 ACETONITRILE MARKET: GLOBAL PATENTS

- FIGURE 24 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 25 GLOBAL PATENT PUBLICATION TREND: 2018-2023

- 5.18.4 INSIGHTS

- 5.18.5 LEGAL STATUS OF PATENTS

- FIGURE 26 ACETONITRILE MARKET: LEGAL STATUS OF PATENTS

- 5.18.6 JURISDICTION ANALYSIS

- FIGURE 27 GLOBAL JURISDICTION ANALYSIS

- 5.18.7 TOP APPLICANTS' ANALYSIS

- FIGURE 28 UPM KYMMENE CORP. REGISTERED HIGHEST NUMBER OF PATENTS

- 5.18.8 PATENTS BY BASF SE

- 5.18.9 PATENTS BY INCYTE CORP.

- 5.18.10 PATENTS BY JANSSEN PHARMACEUTICALS

- 5.18.11 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

6 ACETONITRILE MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- FIGURE 29 ANALYTICAL APPLICATION SEGMENT TO LEAD ACETONITRILE MARKET BETWEEN 2023 AND 2028

- TABLE 15 ACETONITRILE MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 16 ACETONITRILE MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 17 ACETONITRILE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 18 ACETONITRILE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 6.2 ORGANIC SYNTHESIS

- 6.2.1 INCREASING USE OF ACETONITRILE AS A RAW MATERIAL FOR VARIOUS CHEMICALS TO DRIVE MARKET

- FIGURE 30 ASIA PACIFIC TO LEAD ORGANIC SYNTHESIS SEGMENT DURING FORECAST PERIOD

- TABLE 19 ACETONITRILE MARKET IN ORGANIC SYNTHESIS, BY REGION, 2018-2022 (USD MILLION)

- TABLE 20 ACETONITRILE MARKET IN ORGANIC SYNTHESIS, BY REGION, 2018-2022 (KILOTON)

- TABLE 21 ACETONITRILE MARKET IN ORGANIC SYNTHESIS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 22 ACETONITRILE MARKET IN ORGANIC SYNTHESIS, BY REGION, 2023-2028 (KILOTON)

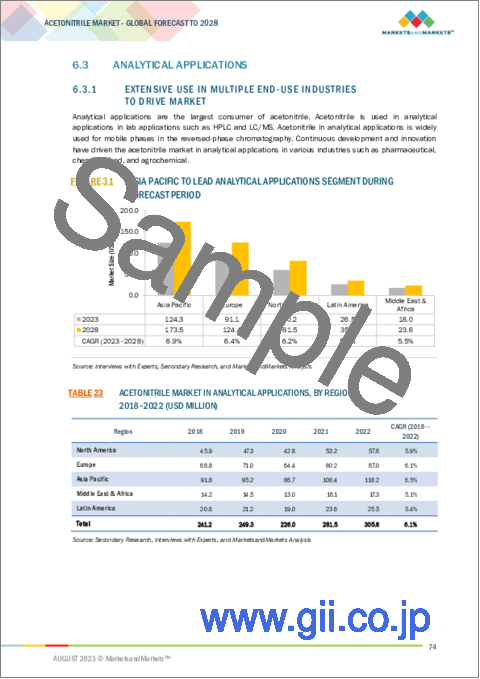

- 6.3 ANALYTICAL APPLICATIONS

- 6.3.1 EXTENSIVE USE IN MULTIPLE END-USE INDUSTRIES TO DRIVE MARKET

- FIGURE 31 ASIA PACIFIC TO LEAD ANALYTICAL APPLICATIONS SEGMENT DURING FORECAST PERIOD

- TABLE 23 ACETONITRILE MARKET IN ANALYTICAL APPLICATIONS, BY REGION, 2018-2022 (USD MILLION)

- TABLE 24 ACETONITRILE MARKET IN ANALYTICAL APPLICATIONS, BY REGION, 2018-2022 (KILOTON)

- TABLE 25 ACETONITRILE MARKET IN ANALYTICAL APPLICATIONS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 26 ACETONITRILE MARKET IN ANALYTICAL APPLICATIONS, BY REGION, 2023-2028 (KILOTON)

- 6.4 EXTRACTION

- 6.4.1 GROWING APPLICATION DUE TO VERSATILE AND COMPATIBILITY PROPERTIES TO DRIVE MARKET

- TABLE 27 ACETONITRILE MARKET IN EXTRACTION, BY REGION, 2018-2022 (USD MILLION)

- TABLE 28 ACETONITRILE MARKET IN EXTRACTION, BY REGION, 2018-2022 (KILOTON)

- TABLE 29 ACETONITRILE MARKET IN EXTRACTION, BY REGION, 2023-2028 (USD MILLION)

- TABLE 30 ACETONITRILE MARKET IN EXTRACTION, BY REGION, 2023-2028 (KILOTON)

- 6.5 OTHERS

- TABLE 31 ACETONITRILE MARKET IN OTHERS, BY REGION, 2018-2022 (USD MILLION)

- TABLE 32 ACETONITRILE MARKET IN OTHERS, BY REGION, 2018-2022 (KILOTON)

- TABLE 33 ACETONITRILE MARKET IN OTHERS, BY REGION, 2023-2028 (USD MILLION)

- TABLE 34 ACETONITRILE MARKET IN OTHERS, BY REGION, 2023-2028 (KILOTON)

7 ACETONITRILE MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 32 SOLVENT SEGMENT TO LEAD ACETONITRILE MARKET DURING FORECAST PERIOD

- TABLE 35 ACETONITRILE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 36 ACETONITRILE MARKET, BY TYPE, 2018-2022 (KILOTON)

- TABLE 37 ACETONITRILE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 38 ACETONITRILE MARKET, BY TYPE, 2023-2028 (KILOTON)

- 7.2 DERIVATIVE

- 7.2.1 EXTENSIVE USE IN PHARMACEUTICAL INDUSTRY TO DRIVE MARKET

- FIGURE 33 ASIA PACIFIC TO LEAD DERIVATIVE SEGMENT DURING FORECAST PERIOD

- 7.2.2 ACETONITRILE MARKET, BY REGION

- TABLE 39 ACETONITRILE DERIVATIVE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 40 ACETONITRILE DERIVATIVE MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 41 ACETONITRILE DERIVATIVE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 42 ACETONITRILE DERIVATIVE MARKET, BY REGION, 2023-2028 (KILOTON)

- 7.3 SOLVENT

- 7.3.1 EXTENSIVE USE DUE TO EXCELLENT SOLVENCY AND LOW BOILING POINT

- FIGURE 34 ASIA PACIFIC TO BE LARGEST SOLVENT ACETONITRILE MARKET

- 7.3.2 ACETONITRILE MARKET, BY REGION

- TABLE 43 ACETONITRILE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 44 ACETONITRILE MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 45 ACETONITRILE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 46 ACETONITRILE MARKET, BY REGION, 2023-2028 (KILOTON)

8 ACETONITRILE MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- FIGURE 35 PHARMACEUTICAL INDUSTRY TO LEAD ACETONITRILE MARKET DURING FORECAST PERIOD

- TABLE 47 ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 48 ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 49 ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 50 ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 8.2 PHARMACEUTICAL

- 8.2.1 WISE USE IN MEDICINES AND SULFA PYRIMIDINE TO DRIVE MARKET

- FIGURE 36 ASIA PACIFIC TO LEAD ACETONITRILE MARKET IN PHARMACEUTICAL INDUSTRY

- 8.2.2 ACETONITRILE MARKET IN PHARMACEUTICAL END-USE INDUSTRY, BY REGION

- TABLE 51 ACETONITRILE MARKET IN PHARMACEUTICAL END-USE INDUSTRY, BY REGION, 2018-2022 (USD MILLION)

- TABLE 52 ACETONITRILE MARKET IN PHARMACEUTICAL END-USE INDUSTRY, BY REGION, 2018-2022 (KILOTON)

- TABLE 53 ACETONITRILE MARKET IN PHARMACEUTICAL END-USE INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- TABLE 54 ACETONITRILE MARKET IN PHARMACEUTICAL END-USE INDUSTRY, BY REGION, 2023-2028 (KILOTON)

- 8.3 ANALYTICAL INDUSTRY

- 8.3.1 CONTINUOUS DEVELOPMENT AND INNOVATION TO DRIVE MARKET

- FIGURE 37 ASIA PACIFIC TO BE LARGEST ACETONITRILE MARKET IN ANALYTICAL INDUSTRY

- 8.3.2 ACETONITRILE MARKET IN ANALYTICAL END-USE INDUSTRY, BY REGION

- TABLE 55 ACETONITRILE MARKET IN ANALYTICAL END-USE INDUSTRY, BY REGION, 2018-2022 (USD MILLION)

- TABLE 56 ACETONITRILE MARKET IN ANALYTICAL END-USE INDUSTRY, BY REGION, 2018-2022 (KILOTON)

- TABLE 57 ACETONITRILE MARKET IN ANALYTICAL END-USE INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- TABLE 58 ACETONITRILE MARKET IN ANALYTICAL END-USE INDUSTRY, BY REGION, 2023-2028 (KILOTON)

- 8.4 AGROCHEMICAL

- 8.4.1 RISING DEMAND FOR AGROCHEMICALS TO DRIVE MARKET

- 8.4.2 ACETONITRILE MARKET IN AGROCHEMICAL END-USE INDUSTRY, BY REGION

- TABLE 59 ACETONITRILE MARKET IN AGROCHEMICAL END-USE INDUSTRY, BY REGION, 2018-2022 (USD MILLION)

- TABLE 60 ACETONITRILE MARKET IN AGROCHEMICAL END-USE INDUSTRY, BY REGION, 2018-2022 (KILOTON)

- TABLE 61 ACETONITRILE MARKET IN AGROCHEMICAL END-USE INDUSTRY, BY REGION, 2023-2028 (USD MILLION)

- TABLE 62 ACETONITRILE MARKET IN AGROCHEMICAL END-USE INDUSTRY, BY REGION, 2023-2028 (KILOTON)

- 8.5 OTHERS

- 8.5.1 ACETONITRILE MARKET IN OTHER END-USE INDUSTRIES, BY REGION

- TABLE 63 ACETONITRILE MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2018-2022 (USD MILLION)

- TABLE 64 ACETONITRILE MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2018-2022 (KILOTON)

- TABLE 65 ACETONITRILE MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2023-2028 (USD MILLION)

- TABLE 66 ACETONITRILE MARKET IN OTHER END-USE INDUSTRIES, BY REGION, 2023-2028 (KILOTON)

9 ACETONITRILE MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 38 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- TABLE 67 ACETONITRILE MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 68 ACETONITRILE MARKET, BY REGION, 2018-2022 (KILOTON)

- TABLE 69 ACETONITRILE MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 70 ACETONITRILE MARKET, BY REGION, 2023-2028 (KILOTON)

- 9.2 NORTH AMERICA

- 9.2.1 IMPACT OF RECESSION IN NORTH AMERICA

- FIGURE 39 NORTH AMERICA: ACETONITRILE MARKET SNAPSHOT

- 9.2.2 NORTH AMERICA: ACETONITRILE MARKET, BY TYPE

- TABLE 71 NORTH AMERICA: ACETONITRILE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 72 NORTH AMERICA: ACETONITRILE MARKET, BY TYPE, 2018-2022 (KILOTON)

- TABLE 73 NORTH AMERICA: ACETONITRILE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 74 NORTH AMERICA: ACETONITRILE MARKET, BY TYPE, 2023-2028 (KILOTON)

- 9.2.3 NORTH AMERICA: ACETONITRILE MARKET, BY APPLICATION

- TABLE 75 NORTH AMERICA: ACETONITRILE MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 76 NORTH AMERICA: ACETONITRILE MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 77 NORTH AMERICA: ACETONITRILE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: ACETONITRILE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 9.2.4 NORTH AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY

- TABLE 79 NORTH AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 81 NORTH AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.2.5 NORTH AMERICA: ACETONITRILE MARKET, BY COUNTRY

- TABLE 83 NORTH AMERICA: ACETONITRILE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: ACETONITRILE MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 85 NORTH AMERICA: ACETONITRILE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: ACETONITRILE MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 9.2.5.1 US

- 9.2.5.1.1 Growing pharmaceutical industry to increase demand

- 9.2.5.1.2 US: Acetonitrile market, by end-use industry

- 9.2.5.1 US

- TABLE 87 US: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 88 US: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 89 US: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 90 US: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.2.5.2 Canada

- 9.2.5.2.1 Increasing R&D expenditure to drive market

- 9.2.5.2.2 Canada: Acetonitrile market, by end-use industry

- 9.2.5.2 Canada

- TABLE 91 CANADA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 92 CANADA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 93 CANADA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 94 CANADA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.3 EUROPE

- 9.3.1 IMPACT OF RECESSION IN EUROPE

- FIGURE 40 EUROPE: ACETONITRILE MARKET SNAPSHOT

- 9.3.2 EUROPE: ACETONITRILE MARKET, BY TYPE

- TABLE 95 EUROPE: ACETONITRILE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 96 EUROPE: ACETONITRILE MARKET, BY TYPE, 2018-2022 (KILOTON)

- TABLE 97 EUROPE: ACETONITRILE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 98 EUROPE: ACETONITRILE MARKET, BY TYPE, 2023-2028 (KILOTON)

- 9.3.3 EUROPE: ACETONITRILE MARKET, BY APPLICATION

- TABLE 99 EUROPE: ACETONITRILE MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 100 EUROPE: ACETONITRILE MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 101 EUROPE: ACETONITRILE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 102 EUROPE: ACETONITRILE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 9.3.4 EUROPE: ACETONITRILE MARKET, BY END-USE INDUSTRY

- TABLE 103 EUROPE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 104 EUROPE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 105 EUROPE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 106 EUROPE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.3.5 EUROPE: ACETONITRILE MARKET, BY COUNTRY

- TABLE 107 EUROPE: ACETONITRILE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 108 EUROPE: ACETONITRILE MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 109 EUROPE: ACETONITRILE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 110 EUROPE: ACETONITRILE MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 9.3.5.1 Germany

- 9.3.5.1.1 Growing pharmaceutical and analytical industries to drive demand

- 9.3.5.1.2 Germany: Acetonitrile market, by end-use industry

- 9.3.5.1 Germany

- TABLE 111 GERMANY: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 112 GERMANY: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 113 GERMANY: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 114 GERMANY: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.3.5.2 France

- 9.3.5.2.1 Strong emphasis on pharmaceutical innovation and precision-driven industries to drive market

- 9.3.5.2.2 France: Acetonitrile market, by end-use industry

- 9.3.5.2 France

- TABLE 115 FRANCE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 116 FRANCE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 117 FRANCE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 118 FRANCE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.3.5.3 UK

- 9.3.5.3.1 Growing investments by major pharmaceutical and analytical industries to drive market

- 9.3.5.3.2 UK: Acetonitrile market, by end-use industry

- 9.3.5.3 UK

- TABLE 119 UK: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 120 UK: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 121 UK: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 122 UK: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.3.5.4 Italy

- 9.3.5.4.1 Advancements in analytical industry to increase demand

- 9.3.5.4.2 Italy: Acetonitrile market, by end-use industry

- 9.3.5.4 Italy

- TABLE 123 ITALY: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 124 ITALY: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 125 ITALY: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 126 ITALY: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.3.5.5 Russia

- 9.3.5.5.1 Government initiatives and key pharmaceutical players to drive market

- 9.3.5.5.2 Russia: Acetonitrile market, by end-use industry

- 9.3.5.5 Russia

- TABLE 127 RUSSIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 128 RUSSIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 129 RUSSIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 130 RUSSIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.3.5.6 Spain

- 9.3.5.6.1 Growing pharmaceutical innovation and sustainability initiatives to increase demand

- 9.3.5.6.2 Spain: Acetonitrile market, by end-use industry

- 9.3.5.6 Spain

- TABLE 131 SPAIN: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 132 SPAIN: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 133 SPAIN: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 134 SPAIN: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.3.5.7 Rest of Europe

- 9.3.5.7.1 Rest of Europe: Acetonitrile market, by end-use industry

- 9.3.5.7 Rest of Europe

- TABLE 135 REST OF EUROPE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 136 REST OF EUROPE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 137 REST OF EUROPE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 138 REST OF EUROPE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.4 ASIA PACIFIC

- 9.4.1 IMPACT OF RECESSION IN ASIA PACIFIC

- FIGURE 41 ASIA PACIFIC: ACETONITRILE MARKET SNAPSHOT

- 9.4.2 ASIA PACIFIC: ACETONITRILE MARKET, BY TYPE

- TABLE 139 ASIA PACIFIC: ACETONITRILE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 140 ASIA PACIFIC: ACETONITRILE MARKET, BY TYPE, 2018-2022 (KILOTON)

- TABLE 141 ASIA PACIFIC: ACETONITRILE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 142 ASIA PACIFIC: ACETONITRILE MARKET, BY TYPE, 2023-2028 (KILOTON)

- 9.4.3 ASIA PACIFIC: ACETONITRILE MARKET, BY APPLICATION

- TABLE 143 ASIA PACIFIC: ACETONITRILE MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 144 ASIA PACIFIC: ACETONITRILE MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 145 ASIA PACIFIC: ACETONITRILE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: ACETONITRILE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 9.4.4 ASIA PACIFIC: ACETONITRILE MARKET, BY END-USE INDUSTRY

- TABLE 147 ASIA PACIFIC: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 148 ASIA PACIFIC: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 149 ASIA PACIFIC: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 150 ASIA PACIFIC: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.4.5 ASIA PACIFIC: ACETONITRILE MARKET, BY COUNTRY

- TABLE 151 ASIA PACIFIC: ACETONITRILE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 152 ASIA PACIFIC: ACETONITRILE MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 153 ASIA PACIFIC: ACETONITRILE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 154 ASIA PACIFIC: ACETONITRILE MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 9.4.5.1 China

- 9.4.5.1.1 Increasing demand for biomedical products to drive market

- 9.4.5.1.2 China: Acetonitrile market, by end-use industry

- 9.4.5.1 China

- TABLE 155 CHINA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 156 CHINA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 157 CHINA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 158 CHINA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.4.5.2 India

- 9.4.5.2.1 Increasing use in pharmaceutical and agrochemical industries to drive market

- 9.4.5.2.2 India: Acetonitrile market, by end-use industry

- 9.4.5.2 India

- TABLE 159 INDIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 160 INDIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 161 INDIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 162 INDIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.4.5.3 Japan

- 9.4.5.3.1 Presence of many players to augment demand for acetonitrile

- 9.4.5.3.2 Japan: Acetonitrile market, by end-use industry

- 9.4.5.3 Japan

- TABLE 163 JAPAN: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 164 JAPAN: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 165 JAPAN: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 166 JAPAN: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.4.5.4 South Korea

- 9.4.5.4.1 Global integration to become technologically advanced industrialized economy to drive growth

- 9.4.5.4.2 South Korea: Acetonitrile market, by end-use industry

- 9.4.5.4 South Korea

- TABLE 167 SOUTH KOREA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 168 SOUTH KOREA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 169 SOUTH KOREA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 170 SOUTH KOREA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.4.5.5 Australia

- 9.4.5.5.1 Increasing focus of government on production of biologics to drive market

- 9.4.5.5.2 Australia: Acetonitrile market, by end-use industry

- 9.4.5.5 Australia

- TABLE 171 AUSTRALIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 172 AUSTRALIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 173 AUSTRALIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 174 AUSTRALIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.4.5.6 Rest of Asia Pacific

- 9.4.5.6.1 Rest of Asia Pacific: Acetonitrile market, by end-use industry

- 9.4.5.6 Rest of Asia Pacific

- TABLE 175 REST OF ASIA PACIFIC: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 176 REST OF ASIA PACIFIC: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 177 REST OF ASIA PACIFIC: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 178 REST OF ASIA PACIFIC: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 IMPACT OF RECESSION IN MIDDLE EAST & AFRICA

- 9.5.2 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY TYPE

- TABLE 179 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY TYPE, 2018-2022 (KILOTON)

- TABLE 181 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY TYPE, 2023-2028 (KILOTON)

- 9.5.3 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY APPLICATION

- TABLE 183 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 184 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 185 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 186 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 9.5.4 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY

- TABLE 187 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 188 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 189 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 190 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.5.5 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY COUNTRY

- TABLE 191 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 192 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 193 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 194 MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 9.5.5.1 South Africa

- 9.5.5.1.1 Investments in generic drugs and medicament to drive market

- 9.5.5.1.2 South Africa: Acetonitrile market, by end-use industry

- 9.5.5.1 South Africa

- TABLE 195 SOUTH AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 196 SOUTH AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 197 SOUTH AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 198 SOUTH AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.5.5.2 UAE

- 9.5.5.2.1 Significant increase in pharmaceutical companies to drive demand

- 9.5.5.2.2 UAE: Acetonitrile market, by end-use industry

- 9.5.5.2 UAE

- TABLE 199 UAE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 200 UAE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 201 UAE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 202 UAE: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.5.5.3 Saudi Arabia

- 9.5.5.3.1 Growing income levels and mandatory medical insurance schemes to increase demand

- 9.5.5.3.2 Saudi Arabia: Acetonitrile market, by end-use industry

- 9.5.5.3 Saudi Arabia

- TABLE 203 SAUDI ARABIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 204 SAUDI ARABIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 205 SAUDI ARABIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 206 SAUDI ARABIA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.5.5.4 Rest of Middle East & Africa

- 9.5.5.4.1 Rest of Middle East & Africa: Acetonitrile market, by end-use industry

- 9.5.5.4 Rest of Middle East & Africa

- TABLE 207 REST OF MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 208 REST OF MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 209 REST OF MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 210 REST OF MIDDLE EAST & AFRICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.6 LATIN AMERICA

- 9.6.1 IMPACT OF RECESSION IN LATIN AMERICA

- 9.6.2 LATIN AMERICA: ACETONITRILE MARKET, BY TYPE

- TABLE 211 LATIN AMERICA: ACETONITRILE MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 212 LATIN AMERICA: ACETONITRILE MARKET, BY TYPE, 2018-2022 (KILOTON)

- TABLE 213 LATIN AMERICA: ACETONITRILE MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 214 LATIN AMERICA: ACETONITRILE MARKET, BY TYPE, 2023-2028 (KILOTON)

- 9.6.3 LATIN AMERICA: ACETONITRILE MARKET, BY APPLICATION

- TABLE 215 LATIN AMERICA: ACETONITRILE MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 216 LATIN AMERICA: ACETONITRILE MARKET, BY APPLICATION, 2018-2022 (KILOTON)

- TABLE 217 LATIN AMERICA: ACETONITRILE MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 218 LATIN AMERICA: ACETONITRILE MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 9.6.4 LATIN AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY

- TABLE 219 LATIN AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 220 LATIN AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 221 LATIN AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 222 LATIN AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.6.5 LATIN AMERICA: ACETONITRILE MARKET, BY COUNTRY

- TABLE 223 LATIN AMERICA: ACETONITRILE MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 224 LATIN AMERICA: ACETONITRILE MARKET, BY COUNTRY, 2018-2022 (KILOTON)

- TABLE 225 LATIN AMERICA: ACETONITRILE MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 226 LATIN AMERICA: ACETONITRILE MARKET, BY COUNTRY, 2023-2028 (KILOTON)

- 9.6.5.1 Mexico

- 9.6.5.1.1 Increasing trade agreements to drive demand

- 9.6.5.1.2 Mexico: Acetonitrile market, by end-use industry

- 9.6.5.1 Mexico

- TABLE 227 MEXICO: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 228 MEXICO: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 229 MEXICO: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 230 MEXICO: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.6.5.2 Brazil

- 9.6.5.2.1 Technological innovation and sustainable practices in pharmaceuticals industry to drive market

- 9.6.5.2.2 Brazil: Acetonitrile market, by end-use industry

- 9.6.5.2 Brazil

- TABLE 231 BRAZIL: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 232 BRAZIL: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 233 BRAZIL: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 234 BRAZIL: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.6.5.3 Argentina

- 9.6.5.3.1 Growing pharmaceutical research and drug synthesis to drive market

- 9.6.5.3.2 Argentina: Acetonitrile market, by end-use industry

- 9.6.5.3 Argentina

- TABLE 235 ARGENTINA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 236 ARGENTINA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 237 ARGENTINA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 238 ARGENTINA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.6.5.4 Rest of Latin America

- 9.6.5.4.1 Rest of Latin America: Acetonitrile market, by end-use industry

- 9.6.5.4 Rest of Latin America

- TABLE 239 REST OF LATIN AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (USD MILLION)

- TABLE 240 REST OF LATIN AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2018-2022 (KILOTON)

- TABLE 241 REST OF LATIN AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 242 REST OF LATIN AMERICA: ACETONITRILE MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 MARKET SHARE ANALYSIS

- FIGURE 42 SHARES OF TOP COMPANIES IN ACETONITRILE MARKET

- TABLE 243 DEGREE OF COMPETITION: ACETONITRILE MARKET

- 10.3 MARKET RANKING

- FIGURE 43 RANKING OF TOP FIVE PLAYERS IN ACETONITRILE MARKET

- 10.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- 10.5 COMPANY PRODUCT FOOTPRINT

- TABLE 244 COMPANY PRODUCT FOOTPRINT

- 10.6 COMPANY TYPE FOOTPRINT

- TABLE 245 COMPANY TYPE FOOTPRINT

- 10.7 COMPANY APPLICATION FOOTPRINT

- TABLE 246 COMPANY APPLICATION FOOTPRINT

- 10.8 COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 247 COMPANY END-USE INDUSTRY FOOTPRINT

- 10.9 COMPANY REGION FOOTPRINT

- TABLE 248 COMPANY REGION FOOTPRINT

- 10.10 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

- 10.10.1 STARS

- 10.10.2 PERVASIVE PLAYERS

- 10.10.3 PARTICIPANTS

- 10.10.4 EMERGING LEADERS

- FIGURE 44 ACETONITRILE MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- 10.11 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 249 ACETONITRILE MARKET: KEY STARTUPS/SMES

- TABLE 250 ACETONITRILE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.12 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES

- 10.12.1 PROGRESSIVE COMPANIES

- 10.12.2 RESPONSIVE COMPANIES

- 10.12.3 DYNAMIC COMPANIES

- 10.12.4 STARTING BLOCKS

- FIGURE 45 ACETONITRILE MARKET: SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2022

- 10.13 COMPETITIVE SCENARIO

- TABLE 251 ACETONITRILE MARKET: DEALS, 2018-2023

- TABLE 252 ACETONITRILE MARKET: OTHERS, 2018-2023

11 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent Developments, MNM view, Right to win, Strategic choices, Weaknesses and competitive threats)**

- 11.1 KEY COMPANIES

- 11.1.1 INEOS AG

- TABLE 253 INEOS AG: COMPANY OVERVIEW

- FIGURE 46 INOES AG: COMPANY SNAPSHOT

- 11.1.2 ASAHI KASEI CORPORATION

- TABLE 254 ASAHI KASEI CORPORATION: COMPANY OVERVIEW

- FIGURE 47 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT

- 11.1.3 FORMOSA PLASTIC CORPORATION

- TABLE 255 FORMOSA PLASTIC CORPORATION: COMPANY OVERVIEW

- FIGURE 48 FORMOSA PLASTIC CORPORATION: COMPANY SNAPSHOT

- 11.1.4 IMPERIAL CHEMICAL CORPORATION

- TABLE 256 IMPERIAL CHEMICAL CORPORATION: COMPANY OVERVIEW

- 11.1.5 PETROCHINA CO. LTD.

- TABLE 257 PETROCHINA CO. LTD.: COMPANY OVERVIEW

- FIGURE 49 PETROCHINA CO. LTD: COMPANY SNAPSHOT

- 11.1.6 SHENGHONG PETROCHEMICAL GROUP CO., LTD

- TABLE 258 SHENGHONG PETROCHEMICAL GROUP CO., LTD.: COMPANY OVERVIEW

- 11.1.7 NOVA MOLECULAR TECHNOLOGIES, INC.

- TABLE 259 NOVA MOLECULAR TECHNOLOGIES, INC.: COMPANY OVERVIEW

- 11.1.8 TEDIA COMPANY, INC.

- TABLE 260 TEDIA COMPANY, INC.: COMPANY OVERVIEW

- 11.1.9 AVANTOR PERFORMANCE MATERIALS, LLC

- TABLE 261 AVANTOR PERFORMANCE MATERIALS, LLC: BUSINESS OVERVIEW

- FIGURE 50 AVANTOR PERFORMANCE MATERIALS, LLC: COMPANY SNAPSHOT

- 11.1.10 SHANGHAI SECCO PETROCHEMICAL COMPANY LIMITED

- TABLE 262 SHANGHAI SECCO PETROCHEMICAL COMPANY LIMITED: BUSINESS OVERVIEW

- 11.1.11 QINGDAO SHIDA CHEMICAL CO., LTD.

- TABLE 263 QINGDAO SHIDA CHEMICAL CO., LTD.: BUSINESS OVERVIEW

- 11.1.12 NANTONG ACETIC ACID CHEMICAL CO., LTD.

- TABLE 264 NANTONG ACETIC ACID CHEMICAL CO., LTD.: BUSINESS OVERVIEW

- 11.1.13 ALKYL AMINES CHEMICAL CO., LTD.

- TABLE 265 ALKYL AMINES CHEMICAL CO., LTD.: BUSINESS OVERVIEW

- FIGURE 51 ALKYL AMINES CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view, Right to win, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

- 11.2 OTHER COMPANIES

- 11.2.1 BALAJI AMINES LTD.

- TABLE 266 BALAJI AMINES LTD.: COMPANY OVERVIEW

- 11.2.2 TAEKWANG INDUSTRIAL CO., LTD.

- TABLE 267 TAEKWANG INDUSTRIAL CO., LTD. COMPANY OVERVIEW

- 11.2.3 CONNECT CHEMICALS GMBH

- TABLE 268 CONNECT CHEMICALS GMBH: COMPANY OVERVIEW

- 11.2.4 CONCORD TECHNOLOGY (TIANJIN) CO., LTD.

- TABLE 269 CONCORD TECHNOLOGY (TIANJIN) CO., LTD.: COMPANY OVERVIEW

- 11.2.5 BIOSOLVE CHIMIE

- TABLE 270 BIOSOLVE CHIMIE: COMPANY OVERVIEW

- 11.2.6 GFS CHEMICALS, INC.

- TABLE 271 GFS CHEMICALS, INC.: COMPANY OVERVIEW

- 11.2.7 HUNAN CHEM. EUROPE BV

- TABLE 272 HUNAN CHEM. EUROPE BV: COMPANY OVERVIEW

- 11.2.8 ALFA AESAR

- TABLE 273 ALFA AESAR.: COMPANY OVERVIEW

- 11.2.9 HONEYWELL RESEARCH CHEMICALS

- TABLE 274 HONEYWELL RESEARCH CHEMICALS: COMPANY OVERVIEW

- 11.2.10 MITSUBISHI CHEMICAL CORPORATION

- TABLE 275 MITSUBISHI CHEMICAL CORPORATION: COMPANY OVERVIEW

- 11.2.11 PHARMCO-AAPER

- TABLE 276 PHARMCO-AAPER: COMPANY OVERVIEW

- 11.2.12 ROBINSON BROTHERS

- TABLE 277 ROBINSON BROTHERS: COMPANY OVERVIEW

- 11.2.13 STANDARD REAGENTS PVT. LTD.

- TABLE 278 STANDARD REAGENTS PVT. LTD.: COMPANY OVERVIEW

- 11.2.14 KISHIDA CHEMICAL CO., LTD.

- TABLE 279 KISHIDA CHEMICAL CO., LTD.: COMPANY OVERVIEW

- 11.2.15 ANQORE

- TABLE 280 ANQORE: COMPANY OVERVIEW

- 11.2.16 JINDAL SPECIALITY CHEMICALS

- TABLE 281 JINDAL SPECIALITY CHEMICALS: COMPANY OVERVIEW

- 11.2.17 FUSHUN SHUNENG CHEMICAL CO., LTD.

- TABLE 282 FUSHUN SHUNENG CHEMICAL CO., LTD: COMPANY OVERVIEW

- 11.2.18 SHANDONG JINCHENG PHARMACEUTICAL GROUP CO., LTD.

- TABLE 283 SHANDONG JINCHENG PHARMACEUTICAL GROUP CO., LTD: COMPANY OVERVIEW

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORT

- 12.5 AUTHOR DETAILS