|

|

市場調査レポート

商品コード

1341047

害虫駆除の世界市場:駆除方法別、害虫タイプ別、適用形態別、用途別、地域別-2028年までの予測Pest Control Market by Control Method, Pest Type, Mode of Application, Application and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 害虫駆除の世界市場:駆除方法別、害虫タイプ別、適用形態別、用途別、地域別-2028年までの予測 |

|

出版日: 2023年08月22日

発行: MarketsandMarkets

ページ情報: 英文 329 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

害虫駆除の市場規模は2023年の249億米ドルから2028年には328億米ドルに達すると予測され、金額ベースで予測期間中のCAGRは5.7%と見込まれています。

世界経済の相互接続性と国境を越えた物品の移動は、新たな地域への害虫の拡散を促進しています。この現象は、侵入種のイントロダクションと定着を防ぐための包括的な有害生物管理戦略の必要性につながっています。気候パターンの変化は、有害生物の行動、分布、個体群動態に影響を与える可能性があります。害虫が新しい条件に適応するにつれ、回復力が増し、防除が困難になることもあります。そのため、害虫駆除製品やサービスに対する需要が高まっています。

害虫駆除市場における住宅用途の拡大は、都市化の進展と住宅密度の上昇に起因しています。都市部が成長し続け、人口密度が高まるにつれて、住宅空間は害虫の侵入を受けやすくなります。密接な居住区や共有設備は害虫の急速な拡散につながる可能性があり、健康的な生活環境を維持するために効果的な害虫駆除対策が必要となるため、住宅用途は予測期間を通じて拡大しています。

世界化と国際貿易により、シロアリは以前は被害を受けていなかった地域への拡散が促進され、シロアリの拡大に寄与しています。シロアリは、木製品、家具、その他の物品の移動を通じて、不注意にも新しい地域に運ばれる可能性があります。さらに、都市部における建築物の増加もシロアリの増殖を助長する環境となっています。このため、シロアリ害虫駆除製品は予測期間中に成長すると予想されます。

その有効性と利便性から、害虫駆除市場ではトラップの需要が急増しています。害虫駆除市場のトラップ分野は、害虫の監視と駆除におけるその有効性により成長しています。トラップはまた、害虫駆除に的を絞った環境に優しいアプローチを提供し、化学薬品への依存を減らし、持続可能な害虫駆除の実践を促進します。

ソフトウェア&サービスセグメントは、プラットフォームを実装し、それらに関連する活動を実行しながら、デジタル害虫駆除ソリューションにおいて不可欠な役割を果たしています。さらに、様々な企業が先進技術を活用し、それらの技術を害虫駆除管理に統合しています。各社が提供するソフトウェアやサービスは、害虫の侵入の監視強化や早期発見、害虫の遠隔管理、その他様々な利点に役立ちます。

アジア太平洋では、害虫駆除の市場がいくつかの理由で拡大しています。アジア諸国における急速な都市化が激化し、その結果蔓延する害虫に対抗するために害虫駆除サービスの需要が高まっています。さらに、アジア太平洋では熱帯から温帯まで気候が多様化しているため、さまざまな種類の害虫が増殖しています。したがって、害虫が条件の変化に適応するにつれて、効果的な害虫管理戦略の必要性が高まっています。

当レポートでは、世界の害虫駆除市場について調査し、駆除方法別、害虫タイプ別、適用形態別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- マクロ経済指標

- 市場力学

第6章 業界の動向

- イントロダクション

- サプライチェーン分析

- 技術分析

- アジア太平洋地域におけるIoTの導入

- アジア太平洋の中小規模の害虫駆除会社のソーシャルメディア上での購買行動

- 平均販売価格の傾向

- エコシステム分析

- 購入者に影響を与える動向/混乱

- ポーターのファイブフォース分析

- 特許分析

- ケーススタディ分析

- 規制の枠組み

第7章 害虫駆除市場、用途別

- イントロダクション

- 商用

- 住宅

- 家畜

- 産業用

- その他

第8章 害虫駆除市場、適用形態別

- イントロダクション

- 粉末

- スプレー

- ペレット

- トラップ

- 餌

第9章 害虫駆除市場、害虫タイプ別

- イントロダクション

- 昆虫

- げっ歯類

- シロアリ

- 野生動物

- その他

第10章 害虫駆除市場、駆除方法別

- イントロダクション

- 化学的

- 機械式

- 生物学的

- ソフトウェアとサービス

第11章 害虫駆除市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- 南米

- その他の地域

第12章 競合情勢

- 概要

- 市場シェア分析、2022年

- 主要プレーヤーが採用した戦略

- 主要企業のセグメント別収益分析

- 主要企業の企業評価マトリックス、2022年

- スタートアップ/中小企業の企業評価マトリックス、2022年

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- BAYER AG

- CORTEVA AGRISCIENCE

- BASF

- SUMITOMO CHEMICAL CO. LTD.

- SYNGENTA AG

- RENTOKIL INITIAL PLC

- ANTICIMEX

- ROLLINS, INC.

- ATGC BIOTECH PVT. LTD.

- ECOLAB INC.

- FMC CORPORATION

- DE SANGOSSE

- BELL LABORATORIES INC.

- PELGAR INTERNATIONAL

- FORT PRODUCTS LIMITED

- その他の企業

- JT EATON & C0. INC.

- BRANDENBURG

- GHARDA CHEMICALS LIMITED

- WOODSTREAM CORPORATION

- V3 SMART TECHNOLOGIES

- CHEMRON

- GAIAGEN TECHNOLOGIES PRIVATE LIMITED

- AGRI PHERO SOLUTIONZ

- GREENZONE

- SHREE PESTICIDE PVT LTD.

第14章 隣接市場および関連市場

第15章 付録

According to MarketsandMarkets, the pest control market is projected to reach USD 32.8 billion by 2028 from an estimated 24.9 billion in 2023, at a CAGR of 5.7% during the forecast period in terms of value. The interconnected nature of the global economy and the movement of goods across borders has facilitated the spread of pests to new regions. This phenomenon has led to the need for comprehensive pest management strategies to prevent the introduction and establishment of invasive species. Changing climate patterns can influence pest behaviors, distribution, and population dynamics. As pests adapt to new conditions, they can become more resilient and challenging to control. Thus, there is a growing demand for pest control management products and services.

"By application segment, the residential segment is projected to have a high growth rate during the forecast period."

The expansion of residential applications in the pest control market can be attributed to increasing urbanization and rising house density. As urban areas continue to grow and population density increases, residential spaces become more susceptible to pest infestations. Close living quarters and shared amenities can lead to the rapid spread of pests, necessitating effective pest control measures to maintain healthy living conditions, therefore the residential application is expanding across the forecast period.

"By pest type segment, the termite segment will exhibit high demand during the forecast period."

Globalization and international trade have facilitated the spread of termites to previously unaffected areas, contributing to their expansion. Termites can inadvertently be transported to new regions through the movement of wooden goods, furniture, and other items. Moreover, rising construction in urban areas has also made environments conducive to the proliferation of termites. Thus, the pest control products for termite pest types are anticipated to grow during the forecast period.

"By mode of application, traps are projected to have high demand during the forecast period."

Due to its effectiveness and convenience, the market for pest control is seeing a surge in demand for traps. The trap segment of the pest control market is growing due to its effectiveness in monitoring and controlling pests. Traps also provide a targeted and eco-friendly approach to pest management, reducing the reliance on chemicals and promoting sustainable pest management practices.

"By control method segment, software, and services are projected to have high growth rate during the forecast period."

The software & services segment plays an integral part in digital pest control solutions while implementing platforms and executing activities related to them. Additionally, various companies are also utilizing advanced technologies and integrating those technologies with pest control management. The software and services offered by the companies help in enhanced monitoring and early detection of pest infestation, remote management of pests, and various other advantages.

"Asia Pacific will significantly contribute towards market growth during the forecast period."

In Asia Pacific, the market for pest control is expanding for several reasons, including rapid urbanization in Asian countries intensifies, the demand for pest control services rising to combat the resulting infestations. Additionally, climate diversity from tropical to temperate in the Asia Pacific allows for the proliferation of various pest species. Therefore, as pests adapt to changing conditions, the need for effective pest management strategies increases.

Break-up of Primaries:

By Company Type: Tier1-65%, Tier 2-25%, Tier 3- 10%

By Designation: C-level -20%, D- level - 40%, and Others - 40%

By Region: Europe - 12%, Asia Pacific - 46%, North America - 19%, RoW - 12%, South America-11%

Leading players profiled in this report:

- Bayer AG (Germany)

- Corteva Agriscience (US)

- BASF SE (Germany)

- Sumitomo Chemical Co. Ltd. (Japan)

- Syngenta AG (Switzerland), Rentokil Initial plc (UK)

- Anticimex (Sweden)

- Rollins, Inc. (US)

- ATGC Biotech Pvt Ltd. (India)

- Ecolab Inc. (US)

- FMC Corporation (US)

- De Sangosse (France)

- Bell Laboratories (US)

- PelGar International (UK)

- Fort Products Limited (UK)

The study includes an in-depth competitive analysis of these key players in the pest control market with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the pest control market by pest type, application, mode of application, control method, and by region. In terms of insights, this report has focused on various levels of analyses-the competitive landscape, end-use analysis, and company profiles, which together comprise and discuss views on the emerging & high-growth segments of the global pest control market, high-growth regions, countries, government initiatives, drivers, restraints, opportunities, and challenges.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall pest control market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increase in instances of vector-borne disease outbreaks to encourage public health initiatives), restraints (High registration costs and interminable time for product approval), opportunities (Emergence of biological pest control solutions), and challenges (Growth in pest resistance against chemical compounds) influencing the growth of the pest control market.

- Product Development/production: Detailed insights on research & development activities, and new product & service launches in the pest control market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the pest control market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the pest control market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players include Bayer AG (Germany), Corteva Agriscience (US), BASF SE (Germany), Sumitomo Chemical Co. Ltd. (Japan), and Syngenta AG (Switzerland), are among others in the pest control market strategies. The report also helps stakeholders understand the pest control service market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- FIGURE 1 MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES, 2018-2022

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 RECESSION IMPACT ANALYSIS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.2.2 Breakdown of primary interviews

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 4 PEST CONTROL MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 PEST CONTROL MARKET SIZE ESTIMATION (DEMAND SIDE)

- 2.2.2 DEMAND SIDE

- 2.2.3 SUPPLY SIDE

- 2.2.4 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 PEST CONTROL MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 PEST CONTROL MARKET SIZE ESTIMATION, BY TYPE (SUPPLY SIDE)

- 2.3 GROWTH RATE FORECAST ASSUMPTIONS

- 2.4 DATA TRIANGULATION

- FIGURE 8 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- TABLE 2 RESEARCH ASSUMPTIONS

- TABLE 3 LIMITATIONS AND RISK ASSESSMENT

- 2.6 MACROINDICATORS OF RECESSION

- FIGURE 9 INDICATORS OF RECESSION

- FIGURE 10 WORLD INFLATION RATE: 2011-2021

- FIGURE 11 GLOBAL GDP: 2011-2021 (USD TRILLION)

- FIGURE 12 RECESSION INDICATORS AND THEIR IMPACT ON PEST CONTROL MARKET

- FIGURE 13 PEST CONTROL MARKET: EARLIER FORECAST VS. RECESSION FORECAST

3 EXECUTIVE SUMMARY

- TABLE 4 PEST CONTROL MARKET SNAPSHOT, 2023 VS. 2028

- FIGURE 14 PEST CONTROL MARKET, BY PEST TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 PEST CONTROL MARKET, BY APPLICATION, 2023 VS. 2028

- FIGURE 16 PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 PEST CONTROL MARKET, BY CONTROL METHOD, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PEST CONTROL MARKET

- FIGURE 19 INCREASING DEMAND FOR DISEASE PREVENTION AND PROTECTION TO DRIVE MARKET

- 4.2 PEST CONTROL MARKET: GROWTH RATE OF MAJOR REGIONAL SUBMARKETS

- FIGURE 20 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.3 NORTH AMERICA: PEST CONTROL MARKET, BY APPLICATION & COUNTRY

- FIGURE 21 HARDWARE OFFERING SEGMENT AND CHINA TO ACCOUNT FOR SIGNIFICANT SHARES IN 2023

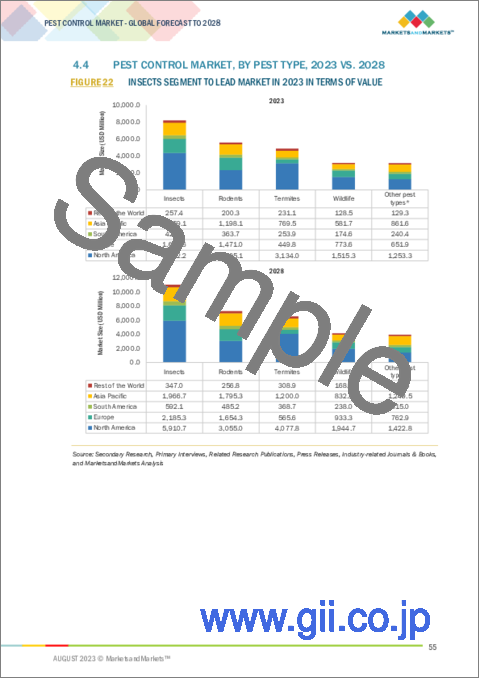

- 4.4 PEST CONTROL MARKET, BY PEST TYPE, 2023 VS. 2028

- FIGURE 22 INSECTS SEGMENT TO LEAD MARKET IN 2023 IN TERMS OF VALUE

- FIGURE 23 SPRAYS SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD IN TERMS OF VALUE

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 INCREASING POPULATION DENSITY

- TABLE 5 POPULATION DENSITY, BY TOP 5 COUNTRIES, 2020

- FIGURE 24 GLOBAL POPULATION, 2010-2022

- 5.2.2 EFFECTS OF RAPID URBANIZATION ON PEST POPULATION

- FIGURE 25 URBAN POPULATION (% OF TOTAL POPULATION), 2010-2022

- 5.2.3 GROWTH OPPORTUNITIES IN ASIA PACIFIC AND SOUTH AMERICA

- FIGURE 26 PESTICIDE USAGE IN AGRICULTURE, BY REGION, 2019-2020 (TONNES)

- 5.3 MARKET DYNAMICS

- FIGURE 27 MARKET DYNAMICS: PEST CONTROL MARKET

- 5.3.1 DRIVERS

- 5.3.1.1 Increasing instances of vector-borne disease outbreaks to encourage public health initiatives

- TABLE 6 GEOGRAPHICAL DISTRIBUTION OF DISEASES TRANSMITTED BY INSECTS AND TICKS

- 5.3.1.2 Impact of climate change on pest proliferation

- 5.3.1.3 Rising adoption of digital applications and technology

- 5.3.2 RESTRAINTS

- 5.3.2.1 High registration costs and interminable time for product approval

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Emergence of biological pest control solutions

- 5.3.3.2 Increasing usage of Artificial Intelligence (AI) in pest control

- 5.3.4 CHALLENGES

- 5.3.4.1 Growth in pest resistance against chemical compounds

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.2.1 PEST CONTROL MANUFACTURERS

- FIGURE 28 PEST CONTROL MANUFACTURERS (B2C PLAYERS): SUPPLY CHAIN

- 6.2.2 RESEARCH & TESTING

- 6.2.3 MANUFACTURING

- 6.2.4 PACKAGING

- 6.2.5 DISTRIBUTION, MARKETING, AND SALES

- 6.2.6 PEST CONTROL SOFTWARE & SERVICE PROVIDERS

- FIGURE 29 PEST CONTROL SOFTWARE & SERVICE PROVIDERS (B2B PLAYERS): SUPPLY CHAIN

- 6.2.7 RESEARCH & PRODUCT DEVELOPMENT

- 6.2.8 RAW MATERIALS & MANUFACTURING

- 6.2.9 ASSEMBLY

- 6.3 TECHNOLOGY ANALYSIS

- 6.3.1 INTERNET OF THINGS (IOT)

- 6.3.2 CRISPR

- 6.3.3 ARTIFICIAL INTELLIGENCE (AI)

- 6.4 IOT ADOPTION IN ASIA PACIFIC

- TABLE 7 ASIA PACIFIC PEST CONTROL MARKET: IOT ADOPTION (2020)

- 6.5 BUYING BEHAVIOR ON SOCIAL MEDIA OF SMALL- AND MEDIUM-SIZED PEST CONTROL COMPANIES IN ASIA PACIFIC

- 6.6 AVERAGE SELLING PRICE TREND

- FIGURE 30 PEST CONTROL MARKET: PRICING ANALYSIS, BY MODE OF APPLICATION, 2018-2022 (USD/KG)

- 6.7 ECOSYSTEM ANALYSIS

- TABLE 8 ECOSYSTEM ANALYSIS

- 6.7.1 MANUFACTURERS

- 6.7.2 SOFTWARE & SERVICE PROVIDERS

- 6.7.3 END-USER COMPANIES

- 6.7.4 VALUE-ADDED SERVICE PROVIDERS

- 6.8 TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 31 YCC: REVENUE SHIFT FOR PEST CONTROL MARKET

- 6.9 PORTER'S FIVE FORCES ANALYSIS

- 6.9.1 PEST CONTROL MARKET: PORTER'S FIVE FORCES ANALYSIS

- 6.9.2 THREAT OF NEW ENTRANTS

- 6.9.3 THREAT OF SUBSTITUTES

- 6.9.4 BARGAINING POWER OF SUPPLIERS

- 6.9.5 BARGAINING POWER OF BUYERS

- 6.9.6 INTENSITY OF COMPETITIVE RIVALRY

- 6.10 PATENT ANALYSIS

- FIGURE 32 LIST OF TOP PATENTS IN MARKET FOR LAST TEN YEARS

- TABLE 9 KEY PATENTS FILED IN PEST CONTROL MARKET, 2022-2023

- 6.11 CASE STUDY ANALYSIS

- 6.11.1 USE CASE 1: ANTICIMEX'S IOT SOLUTION HELPED CREATE DIGITAL CONNECTED TRAPS

- 6.11.2 USE CASE 2: RENTOKIL USED IOT SOLUTIONS TO INCREASE ITS CUSTOMER BASE AND IMPROVE CUSTOMER RETENTION

- 6.12 REGULATORY FRAMEWORK

- 6.12.1 NORTH AMERICA

- 6.12.1.1 US

- TABLE 10 US: REGISTRATION FEE FOR INSECTICIDES

- 6.12.1.2 Canada

- TABLE 11 CANADA: REGISTRATION FEE FOR PEST CONTROL PRODUCTS (OTHER THAN SEMIOCHEMICAL OR MICROBIAL AGENT)

- TABLE 12 CANADA: REGISTRATION FEE FOR SEMIOCHEMICAL OR MICROBIAL AGENT-BASED PEST CONTROL PRODUCTS

- TABLE 13 CANADA: REGISTRATION FEE FOR OTHER APPLICATIONS OF PEST CONTROL PRODUCTS

- 6.12.2 EUROPE

- 6.12.2.1 Confederation of European Pest Management Association (CEPA)

- 6.12.2.2 European Food Safety Authority (EFSA)

- 6.12.2.3 European Committee for Standardization (CEN)

- 6.12.2.4 Biocidal Product Regulation (BPR)

- 6.12.2.5 Commission Implementing Regulation (EU) 2017/1376

- 6.12.2.6 UK

- 6.12.3 ASIA PACIFIC

- 6.12.3.1 India

- 6.12.3.1.1 Insecticides Act

- 6.12.3.1.2 Central Insecticides Board (CIB)

- 6.12.3.1.3 Insecticides Rules

- 6.12.3.1.4 Pesticide Management Bill

- 6.12.3.2 China

- 6.12.3.2.1 New chemical substance notification in china

- 6.12.3.2.2 Standardization administration of china (SAC)

- 6.12.3.2.3 Regulation pesticide administration (RPA)

- 6.12.3.3 Australia

- 6.12.3.1 India

- 6.12.4 SOUTH AMERICA

- 6.12.4.1 Brazil

- 6.12.4.2 Argentina

- 6.12.5 REST OF THE WORLD

- 6.12.5.1 South Africa

- 6.12.5.2 UAE

- 6.12.1 NORTH AMERICA

7 PEST CONTROL MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 33 PEST CONTROL MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- TABLE 14 PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 15 PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 7.2 COMMERCIAL

- 7.2.1 STRONG GOVERNMENT REGULATIONS AND HYGIENE REQUIREMENTS TO DRIVE MARKET

- TABLE 16 COMMERCIAL: PEST CONTROL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 17 COMMERCIAL: PEST CONTROL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 RESIDENTIAL

- 7.3.1 RISING CONSUMER AWARENESS AND URBAN LIFESTYLE TO PROPEL MARKET

- TABLE 18 RESIDENTIAL: PEST CONTROL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 19 RESIDENTIAL: PEST CONTROL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 LIVESTOCK

- 7.4.1 NEED FOR PRECAUTIONARY MEASURES TO PREVENT DISEASES TO STRENGTHEN MARKET

- TABLE 20 LIVESTOCK: PEST CONTROL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 21 LIVESTOCK: PEST CONTROL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 INDUSTRIAL

- 7.5.1 ADOPTION OF REGIONAL LAWS PERTAINING TO HYGIENIC WORK ENVIRONMENT TO DRIVE MARKET EXPANSION

- TABLE 22 INDUSTRIAL: PEST CONTROL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 23 INDUSTRIAL: PEST CONTROL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.6 OTHER APPLICATIONS

- TABLE 24 OTHER APPLICATIONS: PEST CONTROL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 25 OTHER APPLICATIONS: PEST CONTROL MARKET, BY REGION, 2023-2028 (USD MILLION)

8 PEST CONTROL MARKET, BY MODE OF APPLICATION

- 8.1 INTRODUCTION

- FIGURE 34 PEST CONTROL MARKET SHARE, BY MODE OF APPLICATION, 2023 VS. 2028 (VALUE)

- TABLE 26 PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018-2022 (USD MILLION)

- TABLE 27 PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023-2028 (USD MILLION)

- TABLE 28 PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018-2022 (TONS)

- TABLE 29 PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023-2028 (TONS)

- 8.2 POWDER

- 8.2.1 INCREASED DEMAND FOR POWDER APPLICATIONS TO DRIVE MARKET

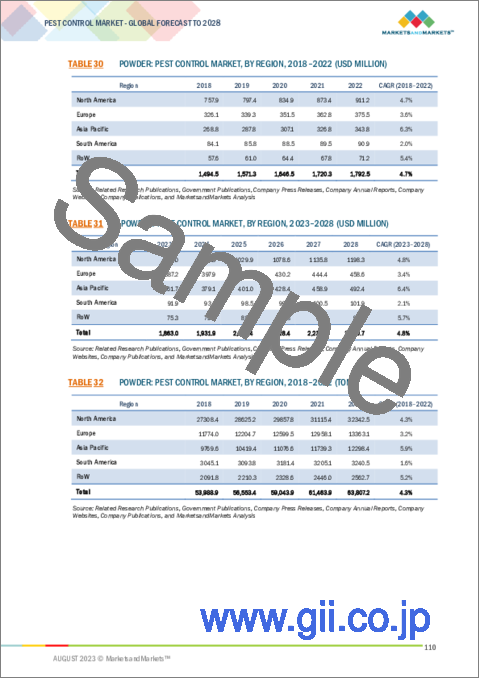

- TABLE 30 POWDER: PEST CONTROL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 31 POWDER: PEST CONTROL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 32 POWDER: PEST CONTROL MARKET, BY REGION, 2018-2022 (TONS)

- TABLE 33 POWDER: PEST CONTROL MARKET, BY REGION, 2023-2028 (TONS)

- 8.3 SPRAYS

- 8.3.1 HIGH DEMAND FOR LIQUID FORMULATIONS TO PROPEL DEMAND FOR SPRAY APPLICATIONS

- TABLE 34 SPRAYS: PEST CONTROL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 35 SPRAYS: PEST CONTROL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 36 SPRAYS: PEST CONTROL MARKET, BY REGION, 2018-2022 (TONS)

- TABLE 37 SPRAYS: PEST CONTROL MARKET, BY REGION, 2023-2028 (TONS)

- 8.4 PELLETS

- 8.4.1 INCREASING USE OF PELLETS IN URBAN AREAS FOR WILDLIFE CONTROL TO BOOST MARKET

- TABLE 38 PELLETS: PEST CONTROL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 39 PELLETS: PEST CONTROL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 40 PELLETS: PEST CONTROL MARKET, BY REGION, 2018-2022 (TONS)

- TABLE 41 PELLETS: PEST CONTROL MARKET, BY REGION, 2023-2028 (TONS)

- 8.5 TRAPS

- 8.5.1 NEED FOR INNOVATIVE TOOLS TO IMPROVE AGRICULTURE TO DRIVE MARKET

- TABLE 42 TRAPS: PEST CONTROL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 43 TRAPS: PEST CONTROL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 44 TRAPS: PEST CONTROL MARKET, BY REGION, 2018-2022 (TONS)

- TABLE 45 TRAPS: PEST CONTROL MARKET, BY REGION, 2023-2028 (TONS)

- 8.6 BAITS

- 8.6.1 INCREASING PRESENCE OF RODENTS AND TERMITES CONTROL TO DRIVE DEMAND FOR BAITS

- TABLE 46 BAITS: PEST CONTROL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 47 BAITS: PEST CONTROL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 48 BAITS: PEST CONTROL MARKET, BY REGION, 2018-2022 (TONS)

- TABLE 49 BAITS: PEST CONTROL MARKET, BY REGION, 2023-2028 (TONS)

9 PEST CONTROL MARKET, BY PEST TYPE

- 9.1 INTRODUCTION

- FIGURE 35 PEST CONTROL MARKET, BY PEST TYPE, 2023 VS. 2028 (USD MILLION)

- TABLE 50 PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 51 PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- 9.2 INSECTS

- 9.2.1 CLIMATE CHANGE AND INCREASED URBANIZATION TO BOLSTER GROWTH

- TABLE 52 INSECTS: PEST CONTROL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 53 INSECTS: PEST CONTROL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3 RODENTS

- 9.3.1 LACK OF HYGIENE AND WASTE MANAGEMENT ISSUES TO INCREASE RODENT POPULATION IN URBAN AREAS

- TABLE 54 RODENTS: PEST CONTROL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 55 RODENTS: PEST CONTROL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4 TERMITES

- 9.4.1 ADOPTION OF NEW TECHNOLOGIES TO BOLSTER GROWTH IN TERMITE CONTROL SOLUTIONS

- TABLE 56 TERMITES: PEST CONTROL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 57 TERMITES: PEST CONTROL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5 WILDLIFE

- 9.5.1 INCREASED SUBURBAN ACTIVITY AND WILDLIFE HABITAT DESTRUCTION TO LEAD TO INCREASED DEMAND FOR WILDLIFE PEST CONTROL

- TABLE 58 WILDLIFE: PEST CONTROL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 59 WILDLIFE: PEST CONTROL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.6 OTHER PEST TYPES

- TABLE 60 OTHER PEST TYPES: PEST CONTROL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 61 OTHER PEST TYPES: PEST CONTROL MARKET, BY REGION, 2023-2028 (USD MILLION)

10 PEST CONTROL MARKET, BY CONTROL METHOD

- 10.1 INTRODUCTION

- FIGURE 36 PEST CONTROL MARKET, BY CONTROL METHOD, 2023 VS. 2028 (USD MILLION)

- TABLE 62 PEST CONTROL MARKET, BY CONTROL METHOD, 2018-2022 (USD MILLION)

- TABLE 63 PEST CONTROL MARKET, BY CONTROL METHOD, 2023-2028 (USD MILLION)

- 10.2 CHEMICAL

- 10.2.1 INCREASING PEST-CAUSING DISEASES TO DRIVE DEMAND FOR CHEMICAL CONTROL METHODS

- TABLE 64 CHEMICAL: PEST CONTROL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 65 CHEMICAL: PEST CONTROL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 66 CHEMICAL: PEST CONTROL MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 67 CHEMICAL: PEST CONTROL MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.2.2 INSECTICIDES

- 10.2.3 RODENTICIDES

- TABLE 68 ACUTE TOXICITY CLASSIFICATION - RODENTICIDES

- 10.2.4 OTHER CHEMICALS

- 10.3 MECHANICAL

- 10.3.1 DEMAND FOR ADVANCED MECHANICAL CONTROL METHODS TO PREVENT PEST-CAUSING DISEASES TO SPUR MARKET

- TABLE 69 MECHANICAL: PEST CONTROL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 70 MECHANICAL: PEST CONTROL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 71 MECHANICAL: PEST CONTROL MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 72 MECHANICAL: PEST CONTROL MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3.2 TRAPPING

- TABLE 73 TRAPPING MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 74 TRAPPING MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.3.2.1 Light traps

- 10.3.2.2 Adhesive traps

- 10.3.2.3 Malaise traps

- 10.3.3 MESH SCREENS

- 10.3.4 ULTRASONIC VIBRATIONS

- 10.4 BIOLOGICAL

- 10.4.1 NEED FOR BIOLOGICAL CONTROL METHODS TO PREVENT PEST-CAUSING DISEASES TO DRIVE MARKET

- TABLE 75 BIOLOGICAL: PEST CONTROL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 76 BIOLOGICAL: PEST CONTROL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 77 BIOLOGICAL: PEST CONTROL MARKET, BY TYPE, 2018-2022 (USD MILLION)

- TABLE 78 BIOLOGICAL: PEST CONTROL MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 10.4.2 MICROBIALS

- 10.4.3 PLANT EXTRACTS

- 10.4.4 PREDATORY INSECTS

- 10.5 SOFTWARE & SERVICES

- 10.5.1 INCREASING TECHNOLOGICAL ADVANCEMENTS IN SOFTWARE & SERVICES TO DRIVE GROWTH

- TABLE 79 SOFTWARE & SERVICE: PEST CONTROL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 80 SOFTWARE & SERVICE: PEST CONTROL MARKET, BY REGION, 2023-2028 (USD MILLION)

11 PEST CONTROL MARKET, BY REGION

- 11.1 INTRODUCTION

- TABLE 81 PEST CONTROL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 82 PEST CONTROL MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

- 11.2.1 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 38 INFLATION: COUNTRY-LEVEL DATA (2017-2021)

- FIGURE 39 NORTH AMERICAN PEST CONTROL MARKET: RECESSION IMPACT ANALYSIS

- TABLE 83 NORTH AMERICA: PEST CONTROL MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: PEST CONTROL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: PEST CONTROL MARKET, BY CONTROL METHOD, 2018-2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: PEST CONTROL MARKET, BY CONTROL METHOD, 2023-2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018-2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023-2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018-2022 (TONS)

- TABLE 92 NORTH AMERICA: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023-2028 (TONS)

- TABLE 93 NORTH AMERICA: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.1.1 US

- 11.2.1.1.1 Presence of strong service providers and pesticide suppliers in US to drive market

- 11.2.1.1 US

- TABLE 95 TOP 5 CITIES WITH CHANGE IN NUMBER OF DISEASE DANGER DAYS SINCE 1970

- TABLE 96 US: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 97 US: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 98 US: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 99 US: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.1.2 Canada

- 11.2.1.2.1 Increasing demand for rodent and wildlife control methods to contribute to market growth

- 11.2.1.2 Canada

- TABLE 100 CANADA: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 101 CANADA: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 102 CANADA: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 103 CANADA: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.1.3 Mexico

- 11.2.1.3.1 Rising temperatures and urbanization to drive growth

- 11.2.1.3 Mexico

- TABLE 104 MEXICO: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 105 MEXICO: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 106 MEXICO: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 107 MEXICO: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 40 INFLATION: COUNTRY-LEVEL DATA (2017-2021)

- FIGURE 41 EUROPEAN PEST CONTROL MARKET: RECESSION IMPACT ANALYSIS

- TABLE 108 EUROPE: PEST CONTROL MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 109 EUROPE: PEST CONTROL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 110 EUROPE: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 111 EUROPE: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 112 EUROPE: PEST CONTROL MARKET, BY CONTROL METHOD, 2018-2022 (USD MILLION)

- TABLE 113 EUROPE: PEST CONTROL MARKET, BY CONTROL METHOD, 2023-2028 (USD MILLION)

- TABLE 114 EUROPE: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018-2022 (USD MILLION)

- TABLE 115 EUROPE: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023-2028 (USD MILLION)

- TABLE 116 EUROPE: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018-2022 (TONS)

- TABLE 117 EUROPE: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023-2028 (TONS)

- TABLE 118 EUROPE: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 119 EUROPE: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.1.1 Germany

- 11.3.1.1.1 Focus on strong government initiatives to control pest infestation to drive market

- 11.3.1.1 Germany

- TABLE 120 GERMANY: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 121 GERMANY: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 122 GERMANY: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 123 GERMANY: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.1.2 France

- 11.3.1.2.1 Taking initiatives to combat rodent infestations to bolster growth

- 11.3.1.2 France

- TABLE 124 FRANCE: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 125 FRANCE: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 126 FRANCE: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 127 FRANCE: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.1.3 UK

- 11.3.1.3.1 Increasing hygiene standards and growing health consciousness among consumers to propel market

- 11.3.1.3 UK

- TABLE 128 UK: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 129 UK: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 130 UK: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 131 UK: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.1.4 Spain

- 11.3.1.4.1 Increasing insect population due to temperature rise in Spain to foster growth

- 11.3.1.4 Spain

- TABLE 132 SPAIN: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 133 SPAIN: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 134 SPAIN: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 135 SPAIN: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.1.5 Italy

- 11.3.1.5.1 Growing construction to minimize pest entry to boost market

- 11.3.1.5 Italy

- TABLE 136 ITALY: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 137 ITALY: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 138 ITALY: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 139 ITALY: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.1.6 Rest of Europe

- TABLE 140 REST OF EUROPE: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 141 REST OF EUROPE: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 142 REST OF EUROPE: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 143 REST OF EUROPE: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 42 INFLATION: COUNTRY-LEVEL DATA (2017-2021)

- FIGURE 43 ASIA PACIFIC PEST CONTROL MARKET: RECESSION IMPACT ANALYSIS, 2022

- TABLE 144 ASIA PACIFIC: PEST CONTROL MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 145 ASIA PACIFIC: PEST CONTROL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 148 ASIA PACIFIC: PEST CONTROL MARKET, BY CONTROL METHOD, 2018-2022 (USD MILLION)

- TABLE 149 ASIA PACIFIC: PEST CONTROL MARKET, BY CONTROL METHOD, 2023-2028 (USD MILLION)

- TABLE 150 ASIA PACIFIC: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018-2022 (USD MILLION)

- TABLE 151 ASIA PACIFIC: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023-2028 (USD MILLION)

- TABLE 152 ASIA PACIFIC: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018-2022 (TONS)

- TABLE 153 ASIA PACIFIC: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023-2028 (TONS)

- TABLE 154 ASIA PACIFIC: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 155 ASIA PACIFIC: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.1.1 China

- 11.4.1.1.1 Need for infrastructure development and urbanization to bolster growth

- 11.4.1.1 China

- TABLE 156 CHINA: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 157 CHINA: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 158 CHINA: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 159 CHINA: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.1.2 India

- 11.4.1.2.1 Focus on increasing disease outbreaks and strong government policies to drive market

- 11.4.1.2 India

- TABLE 160 INDIA: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 161 INDIA: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 162 INDIA: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 163 INDIA: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.1.3 Australia

- 11.4.1.3.1 Growing invasive species and delicate ecosystems to strengthen market

- 11.4.1.3 Australia

- TABLE 164 AUSTRALIA: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 165 AUSTRALIA: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 166 AUSTRALIA: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 167 AUSTRALIA: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.1.4 Japan

- 11.4.1.4.1 Increased habitat destruction and urban activities to boost growth

- 11.4.1.4 Japan

- TABLE 168 JAPAN: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 169 JAPAN: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 170 JAPAN: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 171 JAPAN: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.1.5 Rest of Asia Pacific

- TABLE 172 REST OF ASIA PACIFIC: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 174 REST OF ASIA PACIFIC: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5 SOUTH AMERICA

- 11.5.1 SOUTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 44 INFLATION: COUNTRY-LEVEL DATA (2017-2021)

- FIGURE 45 SOUTH AMERICAN PEST CONTROL MARKET: RECESSION IMPACT ANALYSIS

- TABLE 176 SOUTH AMERICA: PEST CONTROL MARKET, BY COUNTRY, 2018-2022 (USD MILLION)

- TABLE 177 SOUTH AMERICA: PEST CONTROL MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 178 SOUTH AMERICA: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 179 SOUTH AMERICA: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 180 SOUTH AMERICA: PEST CONTROL MARKET, BY CONTROL METHOD, 2018-2022 (USD MILLION)

- TABLE 181 SOUTH AMERICA: PEST CONTROL MARKET, BY CONTROL METHOD, 2023-2028 (USD MILLION)

- TABLE 182 SOUTH AMERICA: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018-2022 (USD MILLION)

- TABLE 183 SOUTH AMERICA: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023-2028 (USD MILLION)

- TABLE 184 SOUTH AMERICA: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018-2022 (TONS)

- TABLE 185 SOUTH AMERICA: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023-2028 (TONS)

- TABLE 186 SOUTH AMERICA: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 187 SOUTH AMERICA: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.1.1 Brazil

- 11.5.1.1.1 High rates of urbanization and habitat destruction to foster market growth

- 11.5.1.1 Brazil

- TABLE 188 BRAZIL: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 189 BRAZIL: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 190 BRAZIL: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 191 BRAZIL: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.1.2 Argentina

- 11.5.1.2.1 Rising disease outbreaks and rodent population to foster growth

- 11.5.1.2 Argentina

- TABLE 192 ARGENTINA: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 193 ARGENTINA: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 194 ARGENTINA: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 195 ARGENTINA: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.1.3 Rest of South America

- TABLE 196 REST OF SOUTH AMERICA: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 197 REST OF SOUTH AMERICA: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 198 REST OF SOUTH AMERICA: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 199 REST OF SOUTH AMERICA: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.6 REST OF THE WORLD (ROW)

- 11.6.1 ROW: RECESSION IMPACT ANALYSIS

- FIGURE 46 INFLATION: COUNTRY-LEVEL DATA (2017-2021)

- FIGURE 47 PEST CONTROL MARKET: RECESSION IMPACT ANALYSIS

- TABLE 200 ROW: PEST CONTROL MARKET, BY REGION, 2018-2022 (USD MILLION)

- TABLE 201 ROW: PEST CONTROL MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 202 ROW: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 203 ROW: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 204 ROW: PEST CONTROL MARKET, BY CONTROL METHOD, 2018-2022 (USD MILLION)

- TABLE 205 ROW: PEST CONTROL MARKET, BY CONTROL METHOD, 2023-2028 (USD MILLION)

- TABLE 206 ROW: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018-2022 (USD MILLION)

- TABLE 207 ROW: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023-2028 (USD MILLION)

- TABLE 208 ROW: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018-2022 (TONS)

- TABLE 209 ROW: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023-2028 (TONS)

- TABLE 210 ROW: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 211 ROW: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.6.1.1 Middle East

- 11.6.1.1.1 Focus on government initiatives and outreach programs to control pest infestation to drive growth

- 11.6.1.1 Middle East

- TABLE 212 MIDDLE EAST: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 213 MIDDLE EAST: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 214 MIDDLE EAST: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 215 MIDDLE EAST: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.6.1.2 Africa

- 11.6.1.2.1 Growing locusts attacks and associated losses to drive market

- 11.6.1.2 Africa

- TABLE 216 AFRICA: PEST CONTROL MARKET, BY PEST TYPE, 2018-2022 (USD MILLION)

- TABLE 217 AFRICA: PEST CONTROL MARKET, BY PEST TYPE, 2023-2028 (USD MILLION)

- TABLE 218 AFRICA: PEST CONTROL MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 219 AFRICA: PEST CONTROL MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS, 2022

- TABLE 220 PEST CONTROL MARKET: DEGREE OF COMPETITION

- 12.3 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

- FIGURE 48 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2018-2022 (USD BILLION)

- 12.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 49 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- 12.5.5 PRODUCT FOOTPRINT

- TABLE 221 COMPANY FOOTPRINT, BY PEST TYPE

- TABLE 222 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 223 COMPANY FOOTPRINT, BY REGION

- TABLE 224 OVERALL COMPANY FOOTPRINT

- 12.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 STARTING BLOCKS

- 12.6.3 RESPONSIVE COMPANIES

- 12.6.4 DYNAMIC COMPANIES

- FIGURE 50 COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES, 2022

- 12.6.5 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 225 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 226 PEST CONTROL MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 12.7 COMPETITIVE SCENARIO

- 12.7.1 PRODUCT LAUNCHES

- TABLE 227 PEST CONTROL: PRODUCT LAUNCHES

- 12.7.2 DEALS

- TABLE 228 PEST CONTROL: DEALS

- 12.7.3 OTHERS

- TABLE 229 PEST CONTROL: OTHERS

13 COMPANY PROFILES

(Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 13.1 KEY PLAYERS (MANUFACTURERS & SERVICE PROVIDERS)

- 13.1.1 BAYER AG

- TABLE 230 BAYER AG: BUSINESS OVERVIEW

- FIGURE 51 BAYER AG: COMPANY SNAPSHOT

- TABLE 231 BAYER AG: PRODUCTS OFFERED

- TABLE 232 BAYER AG: PRODUCT LAUNCHES

- TABLE 233 BAYER AG: DEALS

- 13.1.2 CORTEVA AGRISCIENCE

- TABLE 234 CORTEVA AGRISCIENCE: BUSINESS OVERVIEW

- FIGURE 52 CORTEVA AGRISCIENCE: COMPANY SNAPSHOT

- TABLE 235 CORTEVA AGRISCIENCE: PRODUCTS OFFERED

- TABLE 236 CORTEVA AGRISCIENCE: DEALS

- TABLE 237 CORTEVA AGRISCIENCE: OTHERS

- 13.1.3 BASF

- TABLE 238 BASF: BUSINESS OVERVIEW

- FIGURE 53 BASF: COMPANY SNAPSHOT

- TABLE 239 BASF: PRODUCTS OFFERED

- TABLE 240 BASF: PRODUCT LAUNCHESES

- TABLE 241 BASF: DEALS

- 13.1.4 SUMITOMO CHEMICAL CO. LTD.

- TABLE 242 SUMITOMO CHEMICAL CO. LTD.: BUSINESS OVERVIEW

- FIGURE 54 SUMITOMO CHEMICAL CO. LTD.: COMPANY SNAPSHOT

- TABLE 243 SUMITOMO CHEMICAL CO. LTD.: PRODUCTS OFFERED

- TABLE 244 SUMITOMO CHEMICAL CO. LTD: PRODUCT LAUNCHES

- TABLE 245 SUMITOMO CHEMICAL CO. LTD: DEALS

- 13.1.5 SYNGENTA AG

- TABLE 246 SYNGENTA AG: BUSINESS OVERVIEW

- FIGURE 55 SYNGENTA AG: COMPANY SNAPSHOT

- TABLE 247 SYNGENTA AG: PRODUCTS OFFERED

- TABLE 248 SYNGENTA AG: PRODUCT LAUNCHES

- TABLE 249 SYNGENTA AG: DEALS

- 13.1.6 RENTOKIL INITIAL PLC

- TABLE 250 RENTOKIL INITIAL PLC: BUSINESS OVERVIEW

- FIGURE 56 RENTOKIL INITIAL PLC: COMPANY SNAPSHOT

- TABLE 251 RENTOKIL INITIAL PLC: PRODUCTS & SERVICES OFFERED

- TABLE 252 RENTOKIL INITIAL PLC: PRODUCT LAUNCHES

- TABLE 253 RENTOKIL INITIAL PLC: DEALS

- 13.1.7 ANTICIMEX

- TABLE 254 ANTICIMEX: BUSINESS OVERVIEW

- FIGURE 57 ANTICIMEX: COMPANY SNAPSHOT

- TABLE 255 ANTICIMEX: PRODUCTS & SERVICES OFFERED

- TABLE 256 ANTICIMEX: DEALS

- 13.1.8 ROLLINS, INC.

- TABLE 257 ROLLINS, INC.: BUSINESS OVERVIEW

- FIGURE 58 ROLLINS, INC.: COMPANY SNAPSHOT

- TABLE 258 ROLLINS, INC.: SERVICES OFFERED

- TABLE 259 ROLLINS, INC.: DEALS

- TABLE 260 ROLLINS, INC.: OTHERS

- 13.1.9 ATGC BIOTECH PVT. LTD.

- TABLE 261 ATGC BIOTECH PVT. LTD.: BUSINESS OVERVIEW

- TABLE 262 ATGC BIOTECH PVT. LTD.: PRODUCTS OFFERED

- 13.1.10 ECOLAB INC.

- TABLE 263 ECOLAB INC.: BUSINESS OVERVIEW

- FIGURE 59 ECOLAB INC.: COMPANY SNAPSHOT

- TABLE 264 ECOLAB INC.: SERVICES OFFERED

- TABLE 265 ECOLAB INC.: DEALS

- 13.1.11 FMC CORPORATION

- TABLE 266 FMC CORPORATION: BUSINESS OVERVIEW

- FIGURE 60 FMC CORPORATION: COMPANY SNAPSHOT

- TABLE 267 FMC CORPORATION: PRODUCTS OFFERED

- TABLE 268 FMC CORPORATION: DEALS

- 13.1.12 DE SANGOSSE

- TABLE 269 DE SANGOSSE: BUSINESS OVERVIEW

- TABLE 270 DE SANGOSSE: PRODUCTS OFFERED

- 13.1.13 BELL LABORATORIES INC.

- TABLE 271 BELL LABORATORIES INC.: BUSINESS OVERVIEW

- TABLE 272 BELL LABORATORIES INC.: PRODUCTS OFFERED

- TABLE 273 BELL LABORATORIES INC.: PRODUCT LAUNCHES

- 13.1.14 PELGAR INTERNATIONAL

- TABLE 274 PELGAR INTERNATIONAL: BUSINESS OVERVIEW

- TABLE 275 PELGAR INTERNATIONAL: PRODUCTS OFFERED

- TABLE 276 PELGAR INTERNATIONAL: PRODUCT LAUNCHES

- 13.1.15 FORT PRODUCTS LIMITED

- TABLE 277 FORT PRODUCTS LIMITED: BUSINESS OVERVIEW

- TABLE 278 FORT PRODUCTS LIMITED: PRODUCTS OFFERED

- 13.2 OTHER PLAYERS (MANUFACTURERS & SERVICE PROVIDERS)

- 13.2.1 JT EATON & C0. INC.

- TABLE 279 JT EATON & CO., INC.: BUSINESS OVERVIEW

- TABLE 280 JT EATON & CO., INC.: PRODUCTS OFFERED

- 13.2.2 BRANDENBURG

- TABLE 281 BRANDENBURG: BUSINESS OVERVIEW

- TABLE 282 BRANDENBURG: PRODUCTS OFFERED

- 13.2.3 GHARDA CHEMICALS LIMITED

- TABLE 283 GHARDA CHEMICALS LIMITED: BUSINESS OVERVIEW

- TABLE 284 GHARDA CHEMICALS LIMITED: PRODUCTS OFFERED

- 13.2.4 WOODSTREAM CORPORATION

- TABLE 285 WOODSTREAM CORPORATION: BUSINESS OVERVIEW

- TABLE 286 WOODSTREAM CORPORATION: PRODUCTS OFFERED

- 13.2.5 V3 SMART TECHNOLOGIES

- TABLE 287 V3 SMART TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 288 V3 SMART TECHNOLOGIES: SERVICES OFFERED

- 13.2.6 CHEMRON

- 13.2.7 GAIAGEN TECHNOLOGIES PRIVATE LIMITED

- 13.2.8 AGRI PHERO SOLUTIONZ

- 13.2.9 GREENZONE

- 13.2.10 SHREE PESTICIDE PVT LTD.

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

14 ADJACENT & RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 INSECT PEST CONTROL MARKET

- 14.2.1 LIMITATIONS

- 14.2.2 MARKET DEFINITION

- 14.2.3 MARKET OVERVIEW

- 14.2.4 INSECT PEST CONTROL MARKET, BY INSECT TYPE

- TABLE 289 INSECT PEST CONTROL MARKET, BY INSECT TYPE, 2017-2026 (USD MILLION)

- 14.2.5 INSECT PEST CONTROL MARKET, BY REGION

- TABLE 290 INSECT PEST CONTROL MARKET, BY REGION, 2017-2026 (USD MILLION)

- 14.3 RODENTICIDES MARKET

- 14.3.1 LIMITATIONS

- 14.3.2 MARKET DEFINITION

- 14.3.3 MARKET OVERVIEW

- 14.3.4 RODENTICIDES MARKET, BY TYPE

- TABLE 291 RODENTICIDES MARKET, BY TYPE, 2016-2027 (USD MILLION)

- 14.3.5 RODENTICIDES MARKET, BY REGION

- TABLE 292 RODENTICIDES MARKET, BY REGION, 2016-2027 (USD MILLION)

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS