|

|

市場調査レポート

商品コード

1340762

動物遠隔医療の世界市場 (~2028年):タイプ・コンポーネント・用途・動物タイプ・地域別Veterinary Telemedicine Market by Type, Component, Application, Animal Type & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 動物遠隔医療の世界市場 (~2028年):タイプ・コンポーネント・用途・動物タイプ・地域別 |

|

出版日: 2023年08月21日

発行: MarketsandMarkets

ページ情報: 英文 173 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の動物遠隔医療の市場規模は、2023年の5億3,000万米ドルから、予測期間中は18.3%のCAGRで推移し、2028年には12億3,000万米ドルの規模に成長すると予測されています。

同市場の成長は、ペットの医療支出の増加が大きく影響しています。動物遠隔医療は、アクセスしやすく効率的な医療を求めるペットの飼い主にとって、便利で費用対効果の高いソリューションとして台頭してきました。通信技術を活用することで、ペットの飼い主は獣医師と遠隔でつながることができ、専門家の指導を受けながら、実際に訪問する必要性を減らすことができます。この遠隔医療アプローチは、利便性と時間の節約を提供し、タイムリーな介入と慢性疾患の継続的なモニタリングを可能にします。ペットの飼い主がペットの健康を優先し、便利なヘルスケアソリューションを求め続けているため、動物遠隔医療の需要は拡大し、ペットケアへの支出全体をさらに促進すると予想されています。

用途別で見ると、診断・治療の部門が2022年に主要なシェアを示しています。これはケアへのアクセスの増加、獣医師による遠隔医療の導入の増加、移動時間とコストの削減に起因しています。技術が向上し続け、より多くの獣医師が遠隔医療を使いこなすようになれば、この分野はさらに普及すると考えられています。

動物タイプ別では、コンパニオンアニマルの部門が主要シェアを示しています。これは、コンパニオンアニマルとしての小動物の飼育頭数の増加、ペットケア支出の増加、ペット保険需要の増加、コンパニオンアニマルとしての小動物のための動物遠隔医療機器/サービスの技術進歩に起因しています。

また、地域別では、アジア太平洋地域が予測期間中に最大のCAGRを示す見通しです。同市場の高成長は、コンパニオンアニマルの増加や、インド、中国、タイなどのアジア太平洋諸国における主要企業の成長などに起因しています。

当レポートでは、世界の動物遠隔医療の市場を調査し、市場概要、市場への影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、技術・特許の動向、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 産業動向

- 規制分析

- 規制機関・政府機関・その他の組織

- バリューチェーン分析

- エコシステム市場マップ

- ポーターのファイブフォース分析

- 特許分析

- 技術分析

- 価格モデルの分析

- 主要な会議とイベント

- 主なステークホルダーと購入基準

第6章 動物遠隔医療市場:タイプ別

- インターネット

- 電話

第7章 動物遠隔医療市場:コンポーネント別

- ソフトウェア・サービス

- ハードウェア

第8章 動物遠隔医療市場:用途別

- 診断・治療

- 薬の処方

- フォローアップケア

- 専門家への相談

- 教育

第9章 動物遠隔医療市場:動物タイプ別

- コンパニオンアニマル

- 家畜

- その他

第10章 動物遠隔医療市場:地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- 市場シェア分析

- 企業フットプリント分析

- 企業評価マトリックス

- 競合ベンチマーキング

第12章 企業プロファイル

- 主要企業

- VETTRIAGE

- JUSTANSWER

- AIRVET

- FIRSTVET

- VETSTER

- TELEVET

- ANIPANION

- VITUSVET

- WHISKERS WORLDWIDE

- WELLHAVEN PET HEALTH

- ASKVET

- PETRIAGE

- PETDESK

- PAWSQUAD

- BI X GMBH

- GUARDIANVETS

- TELETAILS

- ACTIV4PETS

- BABELBARK

- LINKYVET

- VETCHAT

- VETCT

- VETOCLOCK

- VETNOW

- VETSOURCE

第13章 付録

The global veterinary telemedicine market is projected to reach USD 1,230 million by 2028 from USD 530 million in 2023, at a CAGR of 18.3%. Growth in this market is largely driven by the increase in pet healthcare spending. Veterinary telemedicine has emerged as a convenient and cost-effective solution for pet owners seeking accessible and efficient healthcare options. By leveraging telecommunication technologies, pet owners can connect with veterinarians remotely, reducing the need for physical visits while still receiving expert guidance. This telemedicine approach offers convenience, saves time, and allows for timely interventions and ongoing monitoring of chronic conditions. As pet owners continue to prioritize their pets' health and seek convenient healthcare solutions, the demand for veterinary telemedicine is expected to grow, further driving the overall expenditure on pet care.

"The diagnosis and treatment segment holds the major share of the veterinary telemedicine market"

In 2022, the diagnosis and treatment segment holds the major share of the veterinary telemedicine market. A large share of the diagnosis and treatment segment can be attributed to the increased access to care, increasing adoption of telemedicine by veterinarians and reducing travel time and costs. The diagnosis and treatment segment in the veterinary telemedicine market is expected to continue to grow in the coming years. As the technology continues to improve and more veterinarians become comfortable using telemedicine, it is likely that this segment will become even more popular.

"The companion animals segment holds the major share of the veterinary telemedicine market"

The companion animals segment holds the major share of the veterinary telemedicine market. A large share of the companion animals' segment can be attributed to the increase in the small companion animal population, growing pet care expenditure, the growing demand for pet insurance, and technological advancements in veterinary telemedicine devices/services for small companion animals. Telemedicine allows pet owners to connect with licensed veterinarians remotely through various communication channels, including video calls, phone calls, and online messaging platforms. It enables pet owners to seek advice, get prescriptions, and even receive follow-up care without the need for in-person visits.

"Asia Pacific will grow at highest CAGR during the forecast period"

In 2022, Asia Pacific will grow at highest CAGR during the forecast period. The high growth in this market can majorly be attributed to the rising companion animal population and the expansion of key players in the veterinary telemedicine market in several Asia Pacific countries such as India, China, and Thailand. The growing trend of pet ownership in APAC countries has resulted in increased pet healthcare expenditures. This can also be attributed to the growing disposable income levels in APAC countries, due to which the willingness to spend on animal healthcare and well-being is rising.

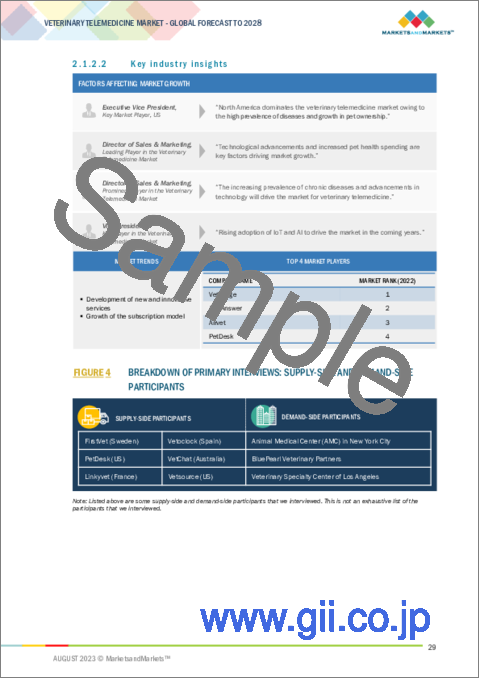

The break-up of the profile of primary participants in the veterinary telemedicine market (Supply Side):

- By Company Type: Tier 1 - 34%, Tier 2 - 38%, and Tier 3 - 28%

- By Designation: C Level - 26%, Director Level - 35%, Others-39%

- By Region: North America - 17%, Europe - 39%, Asia Pacific - 28%, Middle East - 8%, and Latin America - 8%

The break-up of the profile of primary participants in the veterinary telemedicine market (Demand Side):

- By End User: Veterinary Hospitals- 55%, Veterinary Clinics- 32%, Others-13%

- By Designation: Doctors-35%, Hospital Directors & Managers-27%, Critical Care Specialist-22%, Others-16%

- By Region: North America-17%, Europe-39%, Asia Pacific-28%, Latin America-8%, Middle East & Africa-8%

The prominent players in the veterinary telemedicine market include Vettriage (US), JustAnswer (US), Airvet (US), PetDesk (US), Pawsquad (UK), FirstVet (Sweden), Vetster (Canada), TeleVet (US), Anipanion (US), VitusVet (US), Whiskers Worldwide (US), WellHaven Pet Health (Canada), AskVet (US), Petriage (US), BI X GmbH (Germany), GuardianVets (US), TeleTails (US), Activ4Pets (US), BabelBark (US), Linkyvet (France), VetChat (Australia), VetCT (US), VetoClock (Spain), VetNow (US), Vetsource (US).

Research Coverage:

The report analyzes the veterinary telemedicine market and aims at estimating the market size and future growth potential of this market based on various segments such as type, component, application, animal type and region. The report also includes a product/service portfolio matrix of various veterinary telemedicine services available in the market. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product/service offerings, and key market strategies.

Reasons to Buy the Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall veterinary telemedicine market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

This report provides insights into the following pointers:

- Analysis of key drivers (increasing pet ownership, increasing prevalence of chronic diseases in animals, rising adoption of iot and ai by pet owners, increase in pet healthcare spending) restraints (high costs associated with the services, lack of awareness and accessibility to services), opportunities (the advancement of technology, increased access to specialists), and challenges (lack of reimbursement, acceptance by veterinarians) influencing the growth of the veterinary telemedicine market

- Product/Service Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product/service launches in the veterinary telemedicine market

- Market Development: Comprehensive information on the lucrative emerging markets by type, component, application, animal type and region.

- Market Diversification: Exhaustive information about new products/services or product/service enhancements, growing geographies, recent developments, and investments in the global veterinary telemedicine market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product/service offerings, competitive leadership mapping, and capabilities of leading players like Vettriage (US), JustAnswer (US), Airvet (US), PetDesk (US), Pawsquad (UK) in the global veterinary telemedicine market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 TYPE

- 1.2.2 COMPONENT

- 1.2.3 APPLICATION

- 1.2.4 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 VETERINARY TELEMEDICINE MARKET SEGMENTATION

- 1.4 YEARS CONSIDERED

- 1.5 SCOPE-RELATED LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 3 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 7 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 8 REVENUE SHARE ANALYSIS ILLUSTRATION: VETTRIAGE

- FIGURE 9 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR VETERINARY TELEMEDICINE MARKET (2023-2028)

- FIGURE 10 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 11 TOP-DOWN APPROACH

- FIGURE 12 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 13 DATA TRIANGULATION METHODOLOGY

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

- TABLE 1 RISK ASSESSMENT: VETERINARY TELEMEDICINE MARKET

- 2.8 RECESSION IMPACT

3 EXECUTIVE SUMMARY

- FIGURE 14 VETERINARY TELEMEDICINE MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2023 VS. 2028 (USD MILLION)

- FIGURE 16 VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 GEOGRAPHICAL SNAPSHOT OF VETERINARY TELEMEDICINE MARKET

4 PREMIUM INSIGHTS

- 4.1 VETERINARY TELEMEDICINE MARKET OVERVIEW

- FIGURE 19 INCREASING PET OWNERSHIP TO DRIVE MARKET

- 4.2 ASIA PACIFIC: VETERINARY TELEMEDICINE MARKET, BY TYPE AND COUNTRY (2022)

- FIGURE 20 INTERNET SEGMENT HELD LARGEST SHARE OF ASIA PACIFIC MARKET IN 2022

- 4.3 VETERINARY TELEMEDICINE MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 21 ASIA PACIFIC COUNTRIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- 4.4 VETERINARY TELEMEDICINE MARKET: REGIONAL MIX

- FIGURE 22 NORTH AMERICA WILL CONTINUE TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.5 VETERINARY TELEMEDICINE MARKET: DEVELOPED VS. DEVELOPING MARKETS

- FIGURE 23 DEVELOPING MARKETS TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 24 VETERINARY TELEMEDICINE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing pet ownership

- TABLE 2 EUROPE: PET POPULATION, BY COUNTRY, 2014-2022 (MILLION)

- 5.2.1.2 Increasing prevalence of chronic diseases in animals

- 5.2.1.3 Rising adoption of IoT and AI by pet owners

- 5.2.1.4 Increase in pet healthcare spending

- FIGURE 25 US: PET INDUSTRY EXPENDITURE, 2010-2021 (USD BILLION)

- TABLE 3 US: BREAKDOWN OF PET INDUSTRY EXPENDITURE, 2020 VS. 2021 (USD BILLION)

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost associated with veterinary telemedicine services

- 5.2.2.2 Lack of awareness and accessibility to services

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in technology

- 5.2.3.2 Increased access to specialists

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of reimbursement

- 5.3 INDUSTRY TRENDS

- 5.3.1 DEVELOPMENT OF NEW AND INNOVATIVE SERVICES

- 5.3.2 GROWTH OF SUBSCRIPTION MODEL

- 5.4 REGULATORY ANALYSIS

- 5.4.1 NORTH AMERICA

- 5.4.1.1 US

- 5.4.1.2 Canada

- 5.4.2 EUROPE

- 5.4.3 ASIA PACIFIC

- 5.4.4 LATIN AMERICA

- 5.4.1 NORTH AMERICA

- 5.5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 26 VETERINARY TELEMEDICINE MARKET: VALUE CHAIN ANALYSIS

- 5.7 ECOSYSTEM MARKET MAP

- FIGURE 27 VETERINARY TELEMEDICINE MARKET: ECOSYSTEM ANALYSIS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 5 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 PATENT ANALYSIS

- 5.9.1 PATENT PUBLICATION TRENDS FOR VETERINARY TELEMEDICINE

- FIGURE 28 VETERINARY TELEMEDICINE MARKET: GLOBAL PATENT PUBLICATION TRENDS (2015-2023)

- 5.9.2 VETERINARY TELEMEDICINE MARKET: TOP APPLICANTS

- FIGURE 29 TOP APPLICANTS FOR VETERINARY TELEMEDICINE PATENTS (2015-2023)

- 5.9.3 JURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR PATENTS

- FIGURE 30 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR VETERINARY TELEMEDICINE (2015-2023)

- 5.10 TECHNOLOGY ANALYSIS

- 5.11 PRICING MODEL ANALYSIS

- TABLE 6 AVERAGE SELLING PRICE OF VETERINARY TELEMEDICINE DEVICES AND SERVICES OFFERED BY LEADING PLAYERS

- 5.12 KEY CONFERENCES AND EVENTS

- 5.12.1 LIST OF KEY CONFERENCES AND EVENTS (2023-2025)

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VETERINARY TELEMEDICINE DEVICES AND SERVICES

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR VETERINARY TELEMEDICINE DEVICES AND SERVICES

- 5.13.2 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA FOR VETERINARY TELEMEDICINE DEVICES AND SERVICES

- TABLE 8 KEY BUYING CRITERIA FOR VETERINARY TELEMEDICINE DEVICES AND SERVICES

6 VETERINARY TELEMEDICINE MARKET, BY TYPE

- 6.1 INTRODUCTION

- TABLE 9 VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 6.2 INTERNET

- 6.2.1 FASTEST-GROWING SEGMENT OF MARKET

- TABLE 10 INTERNET-BASED VETERINARY TELEMEDICINE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3 TELEPHONE

- 6.3.1 OLDEST AND MOST ESTABLISHED SEGMENT

- TABLE 11 TELEPHONE-BASED VETERINARY TELEMEDICINE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

7 VETERINARY TELEMEDICINE MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- TABLE 12 VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- 7.2 SOFTWARE & SERVICES

- 7.2.1 GROWING ADOPTION OF MOBILE DEVICES TO DRIVE MARKET

- TABLE 13 VETERINARY TELEMEDICINE SOFTWARE & SERVICES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 HARDWARE

- 7.3.1 ESSENTIAL COMPONENT OF VETERINARY TELEMEDICINE

- TABLE 14 VETERINARY TELEMEDICINE HARDWARE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

8 VETERINARY TELEMEDICINE MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- TABLE 15 VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.2 DIAGNOSIS AND TREATMENT

- 8.2.1 INCREASING DEMAND FOR CONVENIENT AND ACCESSIBLE VETERINARY CARE TO DRIVE MARKET

- TABLE 16 VETERINARY TELEMEDICINE MARKET FOR DIAGNOSIS AND TREATMENT, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3 PRESCRIPTION OF MEDICATION

- 8.3.1 CONVENIENT OPTION FOR PET OWNERS TO SEEK VETERINARY CARE REMOTELY

- TABLE 17 VETERINARY TELEMEDICINE MARKET FOR PRESCRIPTION OF MEDICATION, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.4 FOLLOW-UP CARE

- 8.4.1 ESSENTIAL COMPONENT OF VETERINARY TELEMEDICINE

- TABLE 18 VETERINARY TELEMEDICINE MARKET FOR FOLLOW-UP CARE, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.5 CONSULTATION WITH SPECIALISTS

- 8.5.1 RESULTS IN FASTER ACCESS TO SPECIALIZED OPINIONS

- TABLE 19 VETERINARY TELEMEDICINE MARKET FOR CONSULTATION WITH SPECIALISTS, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.6 EDUCATION

- 8.6.1 EXPANDS ACCESS TO QUALITY EDUCATIONAL RESOURCES FOR VETERINARY PROFESSIONALS

- TABLE 20 VETERINARY TELEMEDICINE MARKET FOR EDUCATION, BY COUNTRY, 2021-2028 (USD MILLION)

9 VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE

- 9.1 INTRODUCTION

- TABLE 21 VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 9.2 COMPANION ANIMALS

- 9.2.1 RISING PET ADOPTION TO DRIVE MARKET

- TABLE 22 POPULATION OF SMALL COMPANION ANIMALS, BY COUNTRY, 2012-2020 (MILLION)

- TABLE 23 VETERINARY TELEMEDICINE MARKET FOR COMPANION ANIMALS, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.3 LIVESTOCK

- 9.3.1 GROWING FOCUS ON REGULAR CHECKUPS TO SUPPORT MARKET GROWTH

- TABLE 24 VETERINARY TELEMEDICINE MARKET FOR LIVESTOCK, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.4 OTHER ANIMALS

- TABLE 25 VETERINARY TELEMEDICINE MARKET FOR OTHER ANIMALS, BY COUNTRY, 2021-2028 (USD MILLION)

10 VETERINARY TELEMEDICINE MARKET, BY REGION

- 10.1 INTRODUCTION

- TABLE 26 VETERINARY TELEMEDICINE MARKET, BY REGION, 2021-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: RECESSION IMPACT

- FIGURE 33 NORTH AMERICA: VETERINARY TELEMEDICINE MARKET SNAPSHOT

- TABLE 27 NORTH AMERICA: VETERINARY TELEMEDICINE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 28 NORTH AMERICA: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 29 NORTH AMERICA: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Large population of companion animals to drive market

- FIGURE 34 US: POPULATION OF DOGS, 2012-2023 (MILLION)

- FIGURE 35 US: PET INDUSTRY EXPENDITURE, 2018-2022 (USD BILLION)

- TABLE 32 US: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 33 US: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 34 US: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 35 US: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Rising pet and livestock population to support market growth

- TABLE 36 CANADA: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 37 CANADA: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 38 CANADA: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 39 CANADA: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPE: RECESSION IMPACT

- TABLE 40 EUROPE: VETERINARY TELEMEDICINE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 41 EUROPE: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 42 EUROPE: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 43 EUROPE: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 44 EUROPE: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Increasing awareness about pet healthcare to drive market

- TABLE 45 GERMANY: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 46 GERMANY: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 47 GERMANY: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 48 GERMANY: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.3.3 FRANCE

- 10.3.3.1 Rising pet ownership to support market growth

- TABLE 49 FRANCE: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 50 FRANCE: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 51 FRANCE: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 52 FRANCE: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.3.4 UK

- 10.3.4.1 Growing pet adoption to drive demand for veterinary telemedicine

- TABLE 53 UK: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 54 UK: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 55 UK: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 56 UK: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.3.5 ITALY

- 10.3.5.1 Rising demand for poultry and pork meat to support market growth

- TABLE 57 ITALY: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 58 ITALY: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 59 ITALY: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 60 ITALY: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.3.6 SPAIN

- 10.3.6.1 Increasing number of veterinary practices to drive market

- TABLE 61 SPAIN: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 62 SPAIN: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 63 SPAIN: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 64 SPAIN: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.3.7 REST OF EUROPE

- TABLE 65 REST OF EUROPE: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 66 REST OF EUROPE: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 67 REST OF EUROPE: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 68 REST OF EUROPE: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 36 ASIA PACIFIC: VETERINARY TELEMEDICINE MARKET SNAPSHOT

- TABLE 69 ASIA PACIFIC: VETERINARY TELEMEDICINE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 70 ASIA PACIFIC: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 71 ASIA PACIFIC: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 72 ASIA PACIFIC: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.4.2 JAPAN

- 10.4.2.1 Increasing expenditure on pet healthcare to drive market

- TABLE 74 JAPAN: PRODUCTION AND CONSUMPTION OF ANIMAL-DERIVED FOOD PRODUCTS, 2000 VS. 2030 (THOUSAND METRIC TONS)

- TABLE 75 JAPAN: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 76 JAPAN: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 77 JAPAN: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 78 JAPAN: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Fastest-growing veterinary telemedicine market in Asia Pacific

- TABLE 79 CHINA: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 80 CHINA: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 81 CHINA: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 82 CHINA: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.4.4 INDIA

- 10.4.4.1 Rising demand for meat and dairy products to support market growth

- TABLE 83 INDIA: PRODUCTION AND CONSUMPTION OF ANIMAL-DERIVED FOOD PRODUCTS, 2000 VS. 2030 (THOUSAND METRIC TONS)

- TABLE 84 INDIA: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 85 INDIA: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 86 INDIA: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 87 INDIA: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.4.5 REST OF ASIA PACIFIC

- TABLE 88 REST OF ASIA PACIFIC: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 89 REST OF ASIA PACIFIC: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 90 REST OF ASIA PACIFIC: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.5 LATIN AMERICA

- 10.5.1 GROWING VETERINARY HEALTHCARE EXPENDITURE TO DRIVE MARKET

- 10.5.2 LATIN AMERICA: RECESSION IMPACT

- TABLE 92 LATIN AMERICA: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 93 LATIN AMERICA: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 94 LATIN AMERICA: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 95 LATIN AMERICA: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 GROWING PREVALENCE OF ANIMAL DISEASES TO PROPEL MARKET

- 10.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

- TABLE 96 MIDDLE EAST & AFRICA: VETERINARY TELEMEDICINE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 97 MIDDLE EAST & AFRICA: VETERINARY TELEMEDICINE MARKET, BY COMPONENT, 2021-2028 (USD MILLION)

- TABLE 98 MIDDLE EAST & AFRICA: VETERINARY TELEMEDICINE MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 99 MIDDLE EAST & AFRICA: VETERINARY TELEMEDICINE MARKET, BY ANIMAL TYPE, 2021-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 MARKET SHARE ANALYSIS

- FIGURE 37 VETERINARY TELEMEDICINE MARKET SHARE, BY KEY PLAYER (2022)

- 11.3 COMPANY FOOTPRINT ANALYSIS

- 11.3.1 COMPANY FOOTPRINT, BY TYPE

- 11.3.2 COMPANY FOOTPRINT, BY REGION

- 11.4 COMPANY EVALUATION MATRIX

- 11.4.1 STARS

- 11.4.2 EMERGING LEADERS

- 11.4.3 PERVASIVE PLAYERS

- 11.4.4 PARTICIPANTS

- FIGURE 38 VETERINARY TELEMEDICINE MARKET: COMPANY EVALUATION MATRIX

- 11.5 COMPETITIVE BENCHMARKING

- TABLE 100 VETERINARY TELEMEDICINE MARKET: KEY STARTUPS/SMES

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1.1 VETTRIAGE

- TABLE 101 VETTRIAGE: BUSINESS OVERVIEW

- 12.1.2 JUSTANSWER

- TABLE 102 JUSTANSWER: BUSINESS OVERVIEW

- 12.1.3 AIRVET

- TABLE 103 AIRVET: BUSINESS OVERVIEW

- 12.1.4 FIRSTVET

- TABLE 104 FIRSTVET: BUSINESS OVERVIEW

- 12.1.5 VETSTER

- TABLE 105 VETSTER: BUSINESS OVERVIEW

- 12.1.6 TELEVET

- TABLE 106 TELEVET: BUSINESS OVERVIEW

- 12.1.7 ANIPANION

- TABLE 107 ANIPANION: BUSINESS OVERVIEW

- 12.1.8 VITUSVET

- TABLE 108 VITUSVET: BUSINESS OVERVIEW

- 12.1.9 WHISKERS WORLDWIDE

- TABLE 109 WHISKERS WORLDWIDE: BUSINESS OVERVIEW

- 12.1.10 WELLHAVEN PET HEALTH

- TABLE 110 WELLHAVEN PET HEALTH: BUSINESS OVERVIEW

- 12.1.11 ASKVET

- TABLE 111 ASKVET: BUSINESS OVERVIEW

- 12.1.12 PETRIAGE

- TABLE 112 PETRIAGE: BUSINESS OVERVIEW

- 12.1.13 PETDESK

- TABLE 113 PETDESK: BUSINESS OVERVIEW

- 12.1.14 PAWSQUAD

- TABLE 114 PAWSQUAD: BUSINESS OVERVIEW

- 12.1.15 BI X GMBH

- TABLE 115 BI X GMBH: BUSINESS OVERVIEW

- 12.1.16 GUARDIANVETS

- TABLE 116 GUARDIANVETS: BUSINESS OVERVIEW

- 12.1.17 TELETAILS

- TABLE 117 TELETAILS: BUSINESS OVERVIEW

- 12.1.18 ACTIV4PETS

- TABLE 118 ACTIV4PETS: BUSINESS OVERVIEW

- 12.1.19 BABELBARK

- TABLE 119 BABELBARK: BUSINESS OVERVIEW

- 12.1.20 LINKYVET

- TABLE 120 LINKYVET: BUSINESS OVERVIEW

- 12.1.21 VETCHAT

- TABLE 121 VETCHAT: BUSINESS OVERVIEW

- 12.1.22 VETCT

- TABLE 122 VETCT: BUSINESS OVERVIEW

- 12.1.23 VETOCLOCK

- TABLE 123 VETOCLOCK: BUSINESS OVERVIEW

- 12.1.24 VETNOW

- TABLE 124 VETNOW: BUSINESS OVERVIEW

- 12.1.25 VETSOURCE

- TABLE 125 VETSOURCE: BUSINESS OVERVIEW

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS