|

|

市場調査レポート

商品コード

1340759

デジタルデンティストリーの世界市場:製品別、専門性別、用途別、エンドユーザー別、地域別 - 予測(~2028年)Digital Dentistry Market by Product, Specialty, Application, End User & Region - Global Forecast to 2028 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| デジタルデンティストリーの世界市場:製品別、専門性別、用途別、エンドユーザー別、地域別 - 予測(~2028年) |

|

出版日: 2023年08月10日

発行: MarketsandMarkets

ページ情報: 英文 318 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のデジタルデンティストリーの市場規模は、2023年に72億米ドル、2028年までに122億米ドルに達し、予測期間中にCAGRで10.9%の成長が予測されています。

しかし、データプライバシーとセキュリティの問題や、歯科処置に対する償還の欠如が、予測期間中の市場成長を抑制する見込みです。

"市場では機器セグメントが大きなシェアを占めました。"

2022年、市場では機器セグメントが大きなシェアを占めました。また、このセグメントは予測期間中、安定したCAGRで成長すると予測されています。このセグメントの成長は、主に先進のデジタル機器へのシフトの増加、迅速な治療率、即日歯科治療に起因しています。また、発展途上国における口腔内スキャナーや3Dプリンターの採用の拡大も市場成長を後押ししています。最高品質の治療に対する患者の期待と、発展途上国における歯科開業医たちの競合シナリオが、先進技術を利用したソリューションを採用するきっかけとなっています。その結果、ワークフローが改善され、歯科医の利益率が向上し、治療が迅速に行われるようになっています。デジタル機能を備えた機器は、小規模企業が中規模、大規模企業となるための高みに到達することを可能にします。新興国では、歯科技工所や歯科医院は、競合の激しい地域での地位を強化するため、新規設備やリファービッシュ機器に継続的に投資しています。Dental Council of Indiaによると、2020年までに約27万人の歯科医師が登録されました。そのうち3~5%しか政府職員として働いていません。このように、インドにはデジタル機器を採用する資金力を持ち、最終的に市場の成長を左右する民間の診療所や病院が数多く存在します。

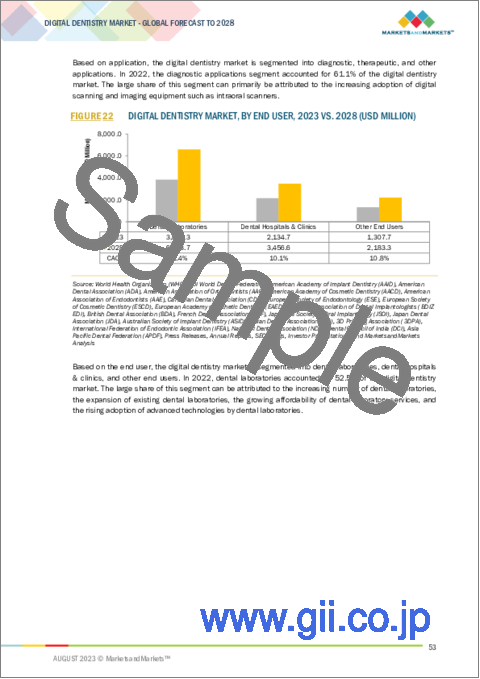

"エンドユーザー別では、歯科技工所セグメントが予測期間中にもっとも高いCAGRで成長します。"

2022年の市場では、歯科技工所が最大のシェアを占めました。これは、歯科処置(欠損した歯の交換や元の大きさや形を維持するための修復処置)の必要とされる件数の増加や、美容手術に対する需要の増加、高品質な歯科製品を開発するための先進技術の採用の増加による、歯科技工所に対する需要の増加や既存の技工所の拡張に起因します。

"アジア太平洋が予測期間中に最高のCAGRで成長する見込みです。"

市場の主な成長促進要因は、老年人口の増加、インドなどのアジアの主要市場におけるデンタルツーリズムの拡大、著名企業のアジア新興国への注目の高まり、歯科支出の増加(および可処分所得の増加)、口腔医療に対する意識の高まり、歯の美しさを維持するための歯科治療への支出意欲などです。

当レポートでは、世界のデジタルデンティストリー市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主要考察

- デジタルデンティストリー市場の概要

- 北米のデジタルデンティストリー市場:製品別、国別(2022年)

- デジタルデンティストリー市場:地理的成長機会

- 地域の構成:デジタルデンティストリー市場(2021年~2028年)

- デジタルデンティストリー市場:新興国 vs. 先進国

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 産業動向

- 米国の個人歯科診療の減少

- 3Dプリンティングの採用の増加

- 米国と英国の歯科診療における高い投資活動

- 技術分析

- クラウドベース歯科ソフトウェア

- AI

- AR

- 先進3Dプリンティング材料

- デジタルスマイルデザイン(DSD)

- サプライチェーン/バリューチェーン分析

- エコシステム分析

- 特許分析

- 隣接する市場

- ポーターのファイブフォース分析

- 規制分析

- 北米の規制

- 欧州の規制

- アジア太平洋の規制

- 中東・アフリカの規制

- ラテンアメリカの規制

- 規制機関、政府機関、その他の組織

- 主な会議とイベント(2023年~2024年)

- 価格分析

- 歯科向けのデジタル機器とソフトウェアの平均販売価格

- デジタルデンティストリーソリューション平均販売価格:タイプ別

- 平均販売価格の動向

- 主なステークホルダーと購入基準

- 購入プロセスにおける主なステークホルダー

- 購入基準

第6章 デジタルデンティストリー市場:製品別

- イントロダクション

- 機器

- スキャン/イメージング機器

- 製造機器

- ソフトウェア

- 歯科診療管理ソフトウェア

- 歯科臨床ソフトウェア

第7章 デジタルデンティストリー市場:専門性別

- イントロダクション

- 歯列矯正

- 補綴

- インプラント

- その他の専門性

第8章 デジタルデンティストリー市場:用途別

- イントロダクション

- 診断

- 治療

- その他の用途

第9章 デジタルデンティストリー市場:エンドユーザー別

- イントロダクション

- 歯科技工所

- 歯科病院、診療所

- その他のエンドユーザー

第10章 デジタルデンティストリー市場:地域別

- イントロダクション

- 北米

- 北米のデジタルデンティストリー市場:不況の影響

- 米国

- カナダ

- 欧州

- 欧州のデジタルデンティストリー市場:不況の影響

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋のデジタルデンティストリー市場:不況の影響

- 日本

- 中国

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋

- ラテンアメリカ

- ラテンアメリカのデジタルデンティストリー市場:不況の影響

- メキシコ

- ブラジル

- その他のラテンアメリカ

- 中東・アフリカ

第11章 競合情勢

- 概要

- 企業が採用した主な戦略

- 収益シェア分析

- 市場シェア分析

- 企業の評価マトリクス

- 競合ベンチマーキング

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- DENTSPLY SIRONA, INC.

- ENVISTA HOLDINGS CORPORATION

- 3M

- IVOCLAR VIVADENT

- PLANMECA OY

- 3SHAPE A/S

- ALIGN TECHNOLOGY, INC.

- J. MORITA CORP.

- 3D SYSTEMS, INC.

- STRAUMANN GROUP

- STRATASYS

- KULZER GMBH (SUBSIDIARY OF MITSUI CHEMICALS GROUP)

- VATECH CO., LTD.

- CARESTREAM DENTAL LLC.

- BEGO GMBH & CO. KG

- DESKTOP METAL, INC.

- ROLAND DG CORPORATION

- DWS SRL

- その他の企業

- MIDMARK CORPORATION

- MEDIT CORP.

- SINOL DENTAL LIMITED

- HUGE DENTAL

- PLANET DDS

- GC CORPORATION

- CARIMA CO., LTD. (BRAND OF ANIWAA PTE. LTD.)

第13章 付録

The global digital dentistry market is projected to reach USD 12.2 billion by 2028 from USD 7.2 billion in 2023, at a CAGR of 10.9% during the forecast period. The increased returns on investment for digital dentistry solutions, increasing demand for same-day dentistry, growing outsourcing of manufacturing to labs rise in demand for cosmetic procedures, increased geriatric patient and patient pool for dental treatment.

However, data privacy and security issues and lack of reimbursement for dental procedures are expected to restrain the growth of this market during the forecast period.

"Equipment segment accounted for a larger share of the digital dentistry market"

In 2022, the equipment segment accounted for a larger share of the digital dentistry market. This segment is also estimated to grow at a stable CAGR during the forecast period. Growth in this segment can primarily be attributed to the increased shift toward digitally advanced equipment, quicker treatment rates, and same-day dentistry. Growing adoption of intraoral scanners and 3D printers, in developing nations, is also boosting the market growth. Patient expectations for the best quality treatment and competitive scenario among dental practitioners in developing nation, has triggered them to adopt technologically advanced solutions. This eventually led to improvement in workflow, increased profit margins for dentists, and quicker treatment. Equipment with digital capabilities allows small-scale businesses to reach greater heights to become mid to large-scale entities. In emerging nations, dental labs and clinics are continuously investing in new or refurbished equipment, to strengthen their position in the highly competitive regions. As per Dental Council of India, nearly 270,000 dentist were registered in 2020. Of which, only 3 to 5% join the government workforce. Thus, India is home to a large number of private clinics and hospitals, that have all the financial capacities to adopt digital equipments, and ultimately influecne the market growth.

"The dental laboratories segment will grow at highest CAGR during the forecast period in the end-user segment"

Based on end users, the dental laboratories segment will grow at highest CAGR during the forecast period. Dental laboratories accounted for the largest share of the digital dentistry market in 2022. This is attributed to the increasing demand for demand laboratories and the expansion of existing laboratories due to the growing number of dental procedures required (to replace missing teeth or restorative procedures to retain original size and shape), increasing demand for cosmetic surgeries, and the rising adoption of advanced technologies to develop high-quality dental products.

Dental laboratories are extensively involved in manufacturing and re-fabricating dental prosthetics, crowns, dentures, veneers, and night guards. Dental laboratories utilize advanced methods to produce dental prosthetics such as removable partial dentures, fixed bridges, crowns, and veneers by taking the impression of a patient's oral soft tissue or teeth. Dental labs purchase prefabricated products from manufacturers and re-fabricate them according to patient requirements. The process of fabrication and customization of dental products is expensive and time-consuming. As a result, dental laboratories are widely focusing on 3D printing to develop high-quality dental products with accuracy, speed, and ease.

"Asia Pacific will grow at highest CAGR during the forecast period"

In 2022, Asia Pacific will grow at highest CAGR during the forecast period. Major factors driving the growth of this market are the growing geriatric population, growing dental tourism in major Asian markets such as India, an increasing focus of prominent players on emerging Asian countries, rising dental expenditure (coupled with the rising disposable income), increasing awareness on oral healthcare, and a willingness to spend on dental care to maintain dental aesthetics.

The break-up of the profile of primary participants in the digital dentistry market:

- By Company Type: Tier 1 - 30%, Tier 2 - 45%, and Tier 3 - 25%

- By Designation: C Level - 25%, Director Level - 30%, Others-45%

- By Region: North America - 20%, Europe -25%, Asia Pacific - 30%, Middle East - 15%.

Latin America - 10%

The prominent players in the Digital dentistry market include Dentsply Sirona (US), Envista Holdings Corporation (US), 3M Company (US), Ivoclar Vivadent AG (Switzerland), Planmeca OY (Finland), 3Shape (Denmark), Align Technologies (US), J Morita Corporation (Japan), 3D Systems, Inc. (US), Straumann Group (Switzerland), Stratasys (US), Kulzer (US), Vatech Co. Ltd. (US), Carestream Dental LLC (US), Bego GMBH & Co. KG (Germany),

Research Coverage:

The report analyzes the Digital dentistry market and aims at estimating the market size and future growth potential of this market based on various segments such as product, specialty areas, applications, end users, and region. The report also includes a product portfolio matrix of various digital dentistry manufactured equipment or software available in the market. The report also provides a competitive analysis of the key players in this market, along with their company profiles, product offerings, and key market strategies.

Reasons to Buy the Report

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall digital dentistry market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

This report provides insights into the following pointers:

- Analysis of key drivers (inclination towards technologically advanced equipment, growing cosmetics and quick dental procedures, increased patient pool), restraints (lack of reimbursement for dental procedures), opportunities (rise in DSO activities and consolidation of dental practices), and challenges (shortage of professionals for usage of advanced techniques) influencing the growth of the digital dentistry market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the Digital dentistry market

- Market Development: Comprehensive information on the lucrative emerging markets by type, application, end user and region.

- Market Diversification: Exhaustive information about new products or product enhancements, growing geographies, recent developments, and investments in the global digital dentistry market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, competitive leadership mapping, and capabilities of leading players like Dentsply Sirona (US), Envista Holdings Corporation (US), 3M Company (US), Ivoclar Vivadent AG (Switzerland), Planmeca OY (Finland), 3Shape (Denmark), Align Technologies (US), J Morita Corporation (Japan), 3D Systems, Inc. (US), Straumann Group (Switzerland), Stratysys (US), Kulzer (US), Vatech Co. Ltd. (US), Carestream Dental LLC (US), Bego GMBH & Co. KG (Germany).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS OF STUDY

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.3.3 CURRENCY

- TABLE 1 STANDARD CURRENCY CONVERSION RATES (UNIT OF USD)

- 1.4 SCOPE-RELATED LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- FIGURE 2 PRIMARY SOURCES

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- FIGURE 3 PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (SUPPLY SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY END USER, DESIGNATION, AND REGION

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 6 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 7 REVENUE SHARE ANALYSIS ILLUSTRATION: DENTSPLY SIRONA INC.

- FIGURE 8 SUPPLY-SIDE ANALYSIS: DENTAL DIGITAL X-RAY MARKET (2022)

- FIGURE 9 SUPPLY-SIDE ANALYSIS: INTRAORAL SCANNERS MARKET (2022)

- FIGURE 10 SUPPLY-SIDE ANALYSIS: LAB SCANNERS MARKET (2022)

- FIGURE 11 SUPPLY-SIDE ANALYSIS: DENTAL 3D PRINTING MARKET (2022)

- FIGURE 12 SUPPLY-SIDE ANALYSIS: DENTAL MILLING EQUIPMENT MARKET (2022)

- FIGURE 13 SUPPLY-SIDE ANALYSIS: DENTAL PMS MARKET (2022)

- FIGURE 14 DEMAND-SIDE ESTIMATION FOR INTRAORAL SCANNERS MARKET

- FIGURE 15 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2023-2028)

- FIGURE 16 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 17 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 18 MARKET DATA TRIANGULATION METHODOLOGY

- 2.4 ASSUMPTIONS

- 2.4.1 MARKET SHARE ASSUMPTIONS

- 2.4.2 RESEARCH ASSUMPTIONS

- TABLE 2 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- TABLE 3 RISK ASSESSMENT

- 2.6 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 19 DIGITAL DENTISTRY MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 20 DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2023 VS. 2028 (USD MILLION)

- FIGURE 21 DIGITAL DENTISTRY MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 22 DIGITAL DENTISTRY MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 23 GEOGRAPHICAL SNAPSHOT OF DIGITAL DENTISTRY MARKET

4 PREMIUM INSIGHTS

- 4.1 DIGITAL DENTISTRY MARKET OVERVIEW

- FIGURE 24 RISING CASES OF DENTAL CARIES AND OTHER DENTAL DISORDERS TO DRIVE ADOPTION OF DIGITAL DENTISTRY

- 4.2 NORTH AMERICA: DIGITAL DENTISTRY MARKET, BY PRODUCT AND COUNTRY (2022)

- FIGURE 25 DIGITAL DENTISTRY EQUIPMENT HELD LARGEST MARKET SHARE IN 2022

- 4.3 DIGITAL DENTISTRY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- FIGURE 26 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- 4.4 REGIONAL MIX: DIGITAL DENTISTRY MARKET (2021-2028)

- FIGURE 27 NORTH AMERICA WILL CONTINUE TO DOMINATE DIGITAL DENTISTRY MARKET IN 2028

- 4.5 DIGITAL DENTISTRY MARKET: EMERGING ECONOMIES VS. DEVELOPED ECONOMIES

- FIGURE 28 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 29 DIGITAL DENTISTRY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 High return on investment from digital dentistry solutions

- FIGURE 30 EXAMPLE OF DENTAL TREATMENT WORKFLOW WITH DIGITAL SOLUTIONS

- 5.2.1.2 Increasing demand for same-day dentistry

- 5.2.1.3 Increasing outsourcing of manufacturing to dental labs

- 5.2.1.4 Rising demand for advanced cosmetic dental procedures

- 5.2.1.5 Increasing patient pool for dental treatments

- 5.2.1.5.1 Rising prevalence of dental caries and other dental disorders

- TABLE 4 US: PEOPLE WITH UNTREATED DENTAL CARIES, BY AGE GROUP, 2019 (PERCENTAGE OF POPULATION)

- FIGURE 31 PREVALENCE OF DENTAL CARIES IN 6-19-YEAR AGE GROUP, BY COUNTRY, 2019 (PERCENTAGE OF POPULATION)

- 5.2.1.5.2 Rising geriatric population and edentulism

- TABLE 5 PROJECTED INCREASE IN NUMBER OF PEOPLE AGED OVER 65 YEARS, BY REGION, 2019-2050 (MILLION)

- 5.2.2 RESTRAINTS

- 5.2.2.1 Data privacy and security issues

- 5.2.2.2 Lack of reimbursement for dental procedures

- TABLE 6 AVERAGE COST OF DENTAL SURGERIES

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Potential for growth in emerging countries

- TABLE 7 AVERAGE PROCEDURAL COST IN TOP TEN DENTAL TOURISM DESTINATIONS (USD)

- 5.2.3.2 Consolidation of dental practices and rising DSO activity

- 5.2.3.3 Increasing popularity of CAD/CAM and 3D printing technology

- 5.2.4 CHALLENGES

- 5.2.4.1 Reluctance to switch to digital dental solutions

- 5.2.4.2 Shortage of professionals trained in usage of digital dental equipment and software

- 5.3 INDUSTRY TRENDS

- 5.3.1 REDUCTION IN NUMBER OF SOLO DENTAL PRACTICES IN US

- 5.3.2 INCREASING ADOPTION OF 3D PRINTING

- 5.3.3 HIGH INVESTMENT ACTIVITY IN DENTAL PRACTICES IN US AND UK

- TABLE 8 EXAMPLES OF RECENT DEALS BACKED BY PRIVATE EQUITY IN US, 2020-2022

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 CLOUD-BASED DENTAL SOFTWARE

- 5.4.2 ARTIFICIAL INTELLIGENCE

- 5.4.3 AUGMENTED REALITY

- 5.4.4 ADVANCED 3D PRINTING MATERIALS

- 5.4.5 DIGITAL SMILE DESIGN (DSD)

- 5.5 SUPPLY/VALUE CHAIN ANALYSIS

- FIGURE 32 DIGITAL DENTISTRY MARKET: STAKEHOLDERS IN VALUE/SUPPLY CHAIN

- 5.6 ECOSYSTEM ANALYSIS

- FIGURE 33 DIGITAL DENTISTRY MARKET: ECOSYSTEM ANALYSIS

- 5.7 PATENT ANALYSIS

- 5.7.1 PATENT PUBLICATION TRENDS FOR DIGITAL DENTISTRY

- FIGURE 34 PATENT PUBLICATION TRENDS (2013-2023)

- 5.7.2 INSIGHTS ON JURISDICTION AND TOP APPLICANT ANALYSIS

- FIGURE 35 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTES) FOR DIGITAL DENTISTRY PATENTS, 2013-2023

- FIGURE 36 TOP 10 APPLICANT COUNTRIES/REGIONS FOR DIGITAL DENTISTRY PATENTS, 2013-2023

- TABLE 9 DIGITAL DENTISTRY MARKET: LIST OF MAJOR PATENTS

- 5.8 ADJACENT MARKETS

- FIGURE 37 DIGITAL DENTISTRY MARKET: ADJACENT MARKETS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 DIGITAL DENTISTRY MARKET: PORTER'S FIVE FORCES

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 REGULATORY ANALYSIS

- 5.10.1 REGULATIONS IN NORTH AMERICA

- 5.10.2 REGULATIONS IN EUROPE

- 5.10.3 REGULATIONS IN ASIA PACIFIC

- 5.10.4 REGULATIONS IN MIDDLE EAST & AFRICA

- 5.10.5 REGULATIONS IN LATIN AMERICA

- 5.10.6 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 16 KEY CONFERENCES AND EVENTS, 2023-2024

- 5.12 PRICING ANALYSIS

- 5.12.1 AVERAGE SELLING PRICE FOR DIGITAL EQUIPMENT AND SOFTWARE IN DENTISTRY

- FIGURE 38 AVERAGE SELLING PRICE OF DIGITAL DENTAL SOLUTIONS, BY TYPE, 2022

- 5.12.2 AVERAGE SELLING PRICE FOR DIGITAL DENTAL SOLUTIONS, BY TYPE

- 5.12.2.1 Dental 3D printers

- TABLE 17 DENTAL 3D PRINTERS: MAJOR BRANDS WITH APPROXIMATE PRICING IN US

- 5.12.2.2 Intraoral scanners

- TABLE 18 AVERAGE COST OF INTRAORAL SCANNERS

- 5.12.2.3 Digital X-rays

- TABLE 19 AVERAGE SELLING PRICE OF TOP TWO TYPES OF DENTAL DIGITAL X-RAY SYSTEMS

- 5.12.2.4 Dental PMS

- TABLE 20 PRICING FOR SOFTDENT DENTAL PMS

- TABLE 21 PRICING FOR TAB32 DENTAL PMS

- 5.12.3 AVERAGE SELLING PRICE TRENDS

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR DIGITAL DENTISTRY PRODUCTS

- TABLE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR DIGITAL DENTISTRY PRODUCTS (%)

- 5.13.2 BUYING CRITERIA

- FIGURE 40 KEY BUYING CRITERIA FOR DIGITAL DENTISTRY PRODUCTS/SOLUTIONS

- TABLE 23 KEY BUYING CRITERIA FOR DIGITAL DENTISTRY PRODUCTS/SOLUTIONS

6 DIGITAL DENTISTRY MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- TABLE 24 DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 25 DIGITAL DENTISTRY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2 EQUIPMENT

- TABLE 26 DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 27 DIGITAL DENTISTRY EQUIPMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.1 SCANNING/IMAGING EQUIPMENT

- TABLE 28 DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 29 DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.1.1 Dental scanners

- TABLE 30 DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 31 DENTAL SCANNERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.1.1.1 Intraoral scanners

- 6.2.1.1.1.1 Increasing demand for digitally connected scanning solutions to drive market

- 6.2.1.1.1 Intraoral scanners

- TABLE 32 INTRAORAL SCANNERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.1.1.2 Lab scanners

- 6.2.1.1.2.1 Increasing consolidation of dental labs and demand for efficient dental lab solutions to drive market

- 6.2.1.1.2 Lab scanners

- TABLE 33 LAB SCANNERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.1.2 Intraoral cameras

- 6.2.1.2.1 Rising adoption of intraoral scanners to decelerate growth

- 6.2.1.2 Intraoral cameras

- TABLE 34 INTRAORAL CAMERAS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

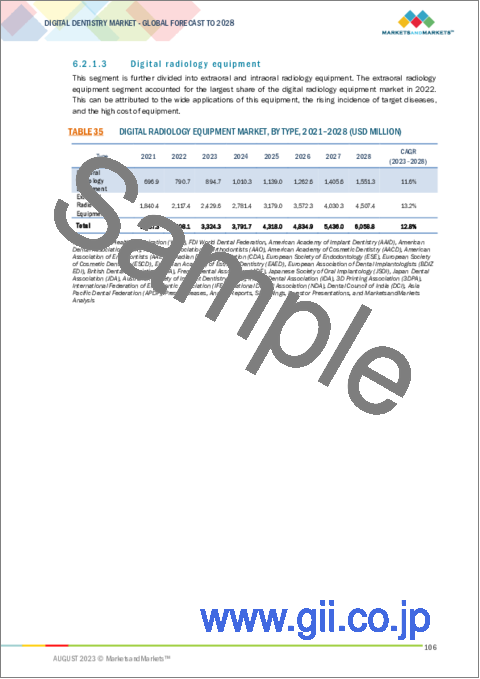

- 6.2.1.3 Digital radiology equipment

- TABLE 35 DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 36 DIGITAL RADIOLOGY EQUIPMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.1.3.1 Extraoral radiology equipment

- 6.2.1.3.1.1 Increasing demand for preventive dental care to drive growth

- 6.2.1.3.1 Extraoral radiology equipment

- TABLE 37 EXTRAORAL RADIOLOGY EQUIPMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.1.3.2 Intraoral radiology equipment

- 6.2.1.3.2.1 Increasing demand for digitally connected intraoral scanning solutions and growing awareness of dental care to drive market

- 6.2.1.3.2 Intraoral radiology equipment

- TABLE 38 INTRAORAL RADIOLOGY EQUIPMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.2 MANUFACTURING EQUIPMENT

- TABLE 39 DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 40 DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.2.1 Dental 3D printers

- 6.2.2.1.1 Need to decrease turnaround time of manufacturing dental prostheses to drive growth

- 6.2.2.1 Dental 3D printers

- TABLE 41 DENTAL 3D PRINTERS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.2.2 Dental milling equipment

- 6.2.2.2.1 Increasing demand for digitization of dental labs to drive market

- 6.2.2.2 Dental milling equipment

- TABLE 42 DENTAL MILLING EQUIPMENT MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3 SOFTWARE

- TABLE 43 DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 44 DIGITAL DENTISTRY SOFTWARE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.1 DENTAL PRACTICE MANAGEMENT SOFTWARE

- 6.3.1.1 Low upfront cost, flexibility, and scalability to drive market

- TABLE 45 DENTAL PRACTICE MANAGEMENT SOFTWARE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.2 DENTAL CLINICAL SOFTWARE

- 6.3.2.1 Increasing demand for CAD/CAM software and dental treatment planning software to drive growth

- TABLE 46 DENTAL CLINICAL SOFTWARE MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

7 DIGITAL DENTISTRY MARKET, BY SPECIALTY

- 7.1 INTRODUCTION

- TABLE 47 DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- 7.2 ORTHODONTICS

- 7.2.1 INCREASING EMPHASIS ON AESTHETICS AND APPEARANCE TO DRIVE MARKET

- TABLE 48 DIGITAL DENTISTRY MARKET FOR ORTHODONTICS, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 PROSTHODONTICS

- 7.3.1 GROWING EDENTULOUS POPULATION TO SUPPORT MARKET GROWTH

- TABLE 49 DIGITAL DENTISTRY MARKET FOR PROSTHODONTICS, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.4 IMPLANTOLOGY

- 7.4.1 ACCURACY AND EFFICIENCY OF DIGITAL IMPLANTOLOGY WORKFLOW TO AID GROWTH

- TABLE 50 DIGITAL DENTISTRY MARKET FOR IMPLANTOLOGY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.5 OTHER SPECIALTIES

- TABLE 51 DIGITAL DENTISTRY MARKET FOR OTHER SPECIALTIES, BY COUNTRY, 2021-2028 (USD MILLION)

8 DIGITAL DENTISTRY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- TABLE 52 DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 8.2 DIAGNOSTIC

- 8.2.1 LARGEST AND FASTEST-GROWING SEGMENT OF MARKET

- TABLE 53 DIGITAL DENTISTRY MARKET FOR DIAGNOSTIC APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3 THERAPEUTIC

- 8.3.1 RISING DEMAND FOR CHAIRSIDE MILLING AND 3D PRINTING EQUIPMENT TO DRIVE GROWTH

- TABLE 54 DIGITAL DENTISTRY MARKET FOR THERAPEUTIC APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.4 OTHER APPLICATIONS

- TABLE 55 DIGITAL DENTISTRY MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

9 DIGITAL DENTISTRY MARKET, BY END USER

- 9.1 INTRODUCTION

- TABLE 56 DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2 DENTAL LABORATORIES

- 9.2.1 RAPID ADOPTION OF ADVANCED TECHNOLOGIES TO PROPEL GROWTH

- TABLE 57 DIGITAL DENTISTRY MARKET FOR DENTAL LABORATORIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.3 DENTAL HOSPITALS & CLINICS

- 9.3.1 GROWING NUMBER OF DENTAL HOSPITALS & CLINICS TO DRIVE MARKET

- TABLE 58 TOP DESTINATIONS FOR COST-EFFECTIVE DENTAL TREATMENT

- TABLE 59 DIGITAL DENTISTRY MARKET FOR DENTAL HOSPITALS & CLINICS, BY COUNTRY, 2021-2028 (USD MILLION)

- 9.4 OTHER END USERS

- TABLE 60 DIGITAL DENTISTRY MARKET FOR OTHER END USERS, BY COUNTRY, 2021-2028 (USD MILLION)

10 DIGITAL DENTISTRY MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 41 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- TABLE 61 DIGITAL DENTISTRY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 62 DIGITAL DENTISTRY MARKET, BY REGION, 2021-2028 (USD MILLION)

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICAN DIGITAL DENTISTRY MARKET: RECESSION IMPACT

- FIGURE 42 NORTH AMERICA: DIGITAL DENTISTRY MARKET SNAPSHOT

- TABLE 63 NORTH AMERICA: DIGITAL DENTISTRY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 65 NORTH AMERICA: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 67 NORTH AMERICA: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 69 NORTH AMERICA: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Presence of prominent market players to boost growth

- TABLE 74 US: MACROECONOMIC INDICATORS

- FIGURE 43 US: RISE IN DENTAL EXPENDITURE, 2010-2030

- TABLE 75 US: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 76 US: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 77 US: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 78 US: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 79 US: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 80 US: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 81 US: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 82 US: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 83 US: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 84 US: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Rising healthcare expenditure and favorable public & private funding to support market growth

- TABLE 85 CANADA: MACROECONOMIC INDICATORS

- TABLE 86 CANADA: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 87 CANADA: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 88 CANADA: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 89 CANADA: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 90 CANADA: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 91 CANADA: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 92 CANADA: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 93 CANADA: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 94 CANADA: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 95 CANADA: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 EUROPEAN DIGITAL DENTISTRY MARKET: RECESSION IMPACT

- TABLE 96 EUROPE: DIGITAL DENTISTRY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 97 EUROPE: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 98 EUROPE: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 99 EUROPE: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 100 EUROPE: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 101 EUROPE: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 102 EUROPE: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 103 EUROPE: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 104 EUROPE: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 105 EUROPE: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 106 EUROPE: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.2 GERMANY

- 10.3.2.1 Favorable regulatory scenario to support market growth

- TABLE 107 GERMANY: MACROECONOMIC INDICATORS

- TABLE 108 GERMANY: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 109 GERMANY: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 110 GERMANY: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 111 GERMANY: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 112 GERMANY: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 113 GERMANY: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 114 GERMANY: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 115 GERMANY: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 116 GERMANY: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 117 GERMANY: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.3 FRANCE

- 10.3.3.1 Rising awareness of dental diseases and increased insurance coverage to drive market

- TABLE 118 FRANCE: MACROECONOMIC INDICATORS

- TABLE 119 FRANCE: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 120 FRANCE: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 121 FRANCE: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 122 FRANCE: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 123 FRANCE: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 124 FRANCE: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 125 FRANCE: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 126 FRANCE: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 127 FRANCE: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 128 FRANCE: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.4 UK

- 10.3.4.1 Favorable coverage under NHS to support market growth

- TABLE 129 UK: MACROECONOMIC INDICATORS

- TABLE 130 UK: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 131 UK: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 132 UK: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 133 UK: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 134 UK: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 135 UK: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 136 UK: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 137 UK: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 138 UK: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 139 UK: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.5 ITALY

- 10.3.5.1 Increasing dental expenditure and low cost of dental treatment to drive market

- TABLE 140 ITALY: MACROECONOMIC INDICATORS

- TABLE 141 ITALY: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 142 ITALY: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 143 ITALY: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 144 ITALY: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 145 ITALY: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 146 ITALY: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 147 ITALY: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 148 ITALY: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 149 ITALY: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 150 ITALY: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.6 SPAIN

- 10.3.6.1 Presence of well-established dental healthcare infrastructure to drive market

- TABLE 151 SPAIN: MACROECONOMIC INDICATORS

- TABLE 152 SPAIN: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 153 SPAIN: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 154 SPAIN: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 155 SPAIN: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 156 SPAIN: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 157 SPAIN: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 158 SPAIN: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 159 SPAIN: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 160 SPAIN: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 161 SPAIN: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.7 REST OF EUROPE

- TABLE 162 REST OF EUROPE: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 163 REST OF EUROPE: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 164 REST OF EUROPE: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 165 REST OF EUROPE: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 166 REST OF EUROPE: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 167 REST OF EUROPE: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 168 REST OF EUROPE: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 169 REST OF EUROPE: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 170 REST OF EUROPE: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 171 REST OF EUROPE: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC DIGITAL DENTISTRY MARKET: RECESSION IMPACT

- FIGURE 44 ASIA PACIFIC: DIGITAL DENTISTRY MARKET SNAPSHOT

- TABLE 172 ASIA PACIFIC: DIGITAL DENTISTRY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 173 ASIA PACIFIC: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 174 ASIA PACIFIC: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 175 ASIA PACIFIC: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 176 ASIA PACIFIC: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 177 ASIA PACIFIC: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 178 ASIA PACIFIC: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 179 ASIA PACIFIC: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 180 ASIA PACIFIC: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 181 ASIA PACIFIC: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 182 ASIA PACIFIC: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.2 JAPAN

- 10.4.2.1 Growing geriatric population to support market growth

- TABLE 183 JAPAN: MACROECONOMIC INDICATORS

- TABLE 184 JAPAN: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 185 JAPAN: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 186 JAPAN: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 187 JAPAN: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 188 JAPAN: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 189 JAPAN: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 190 JAPAN: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 191 JAPAN: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 192 JAPAN: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 193 JAPAN: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.3 CHINA

- 10.4.3.1 Rising prevalence of dental caries to drive market

- TABLE 194 CHINA: MACROECONOMIC INDICATORS

- TABLE 195 CHINA: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 196 CHINA: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 197 CHINA: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 198 CHINA: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 199 CHINA: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 200 CHINA: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 201 CHINA: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 202 CHINA: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 203 CHINA: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 204 CHINA: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.4 INDIA

- 10.4.4.1 Growing awareness of oral health to propel market

- TABLE 205 INDIA: MACROECONOMIC INDICATORS

- TABLE 206 INDIA: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 207 INDIA: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 208 INDIA: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 209 INDIA: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 210 INDIA: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 211 INDIA: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 212 INDIA: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 213 INDIA: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 214 INDIA: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 215 INDIA: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.5 AUSTRALIA

- 10.4.5.1 Favorable government initiatives to support market growth

- TABLE 216 AUSTRALIA: MACROECONOMIC INDICATORS

- TABLE 217 AUSTRALIA: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 218 AUSTRALIA: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 219 AUSTRALIA: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 220 AUSTRALIA: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 221 AUSTRALIA: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 222 AUSTRALIA: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 223 AUSTRALIA: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 224 AUSTRALIA: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 225 AUSTRALIA: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 226 AUSTRALIA: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Rise in disposable income to drive market

- TABLE 227 SOUTH KOREA: MACROECONOMIC INDICATORS

- TABLE 228 SOUTH KOREA: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 229 SOUTH KOREA: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 230 SOUTH KOREA: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 231 SOUTH KOREA: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 232 SOUTH KOREA: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 233 SOUTH KOREA: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 234 SOUTH KOREA: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 235 SOUTH KOREA: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 236 SOUTH KOREA: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 237 SOUTH KOREA: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.7 REST OF ASIA PACIFIC

- TABLE 238 REST OF ASIA PACIFIC: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 239 REST OF ASIA PACIFIC: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 240 REST OF ASIA PACIFIC: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 241 REST OF ASIA PACIFIC: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 242 REST OF ASIA PACIFIC: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 243 REST OF ASIA PACIFIC: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 244 REST OF ASIA PACIFIC: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 245 REST OF ASIA PACIFIC: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 246 REST OF ASIA PACIFIC: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 247 REST OF ASIA PACIFIC: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5 LATIN AMERICA

- 10.5.1 LATIN AMERICAN DIGITAL DENTISTRY MARKET: RECESSION IMPACT

- TABLE 248 LATIN AMERICA: DIGITAL DENTISTRY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 249 LATIN AMERICA: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 250 LATIN AMERICA: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 251 LATIN AMERICA: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 252 LATIN AMERICA: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 253 LATIN AMERICA: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 254 LATIN AMERICA: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 255 LATIN AMERICA: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 256 LATIN AMERICA: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 257 LATIN AMERICA: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 258 LATIN AMERICA: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.2 MEXICO

- 10.5.2.1 Growth in dental tourism to drive market

- TABLE 259 MEXICO: MACROECONOMIC INDICATORS

- TABLE 260 MEXICO: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 261 MEXICO: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 262 MEXICO: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 263 MEXICO: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 264 MEXICO: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 265 MEXICO: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 266 MEXICO: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 267 MEXICO: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 268 MEXICO: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 269 MEXICO: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.3 BRAZIL

- 10.5.3.1 Rising investments in R&D to propel growth

- TABLE 270 BRAZIL: MACROECONOMIC INDICATORS

- TABLE 271 BRAZIL: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 272 BRAZIL: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 273 BRAZIL: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 274 BRAZIL: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 275 BRAZIL: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 276 BRAZIL: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 277 BRAZIL: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 278 BRAZIL: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 279 BRAZIL: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 280 BRAZIL: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.4 REST OF LATIN AMERICA

- TABLE 281 REST OF LATIN AMERICA: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 282 REST OF LATIN AMERICA: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 283 REST OF LATIN AMERICA: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 284 REST OF LATIN AMERICA: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 285 REST OF LATIN AMERICA: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 286 REST OF LATIN AMERICA: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 287 REST OF LATIN AMERICA: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 288 REST OF LATIN AMERICA: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 289 REST OF LATIN AMERICA: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 290 REST OF LATIN AMERICA: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 INCREASING AWARENESS OF ORAL HYGIENE TO DRIVE MARKET

- 10.6.2 MIDDLE EAST AND AFRICAN DIGITAL DENTISTRY MARKET: RECESSION IMPACT

- TABLE 291 MIDDLE EAST AND AFRICA: DIGITAL DENTISTRY MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 292 MIDDLE EAST AND AFRICA: DIGITAL DENTISTRY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 293 MIDDLE EAST AND AFRICA: DIGITAL DENTISTRY SCANNING/IMAGING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 294 MIDDLE EAST AND AFRICA: DENTAL SCANNERS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 295 MIDDLE EAST AND AFRICA: DIGITAL RADIOLOGY EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 296 MIDDLE EAST AND AFRICA: DIGITAL DENTISTRY MANUFACTURING EQUIPMENT MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 297 MIDDLE EAST AND AFRICA: DIGITAL DENTISTRY SOFTWARE MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 298 MIDDLE EAST AND AFRICA: DIGITAL DENTISTRY MARKET, BY SPECIALTY, 2021-2028 (USD MILLION)

- TABLE 299 MIDDLE EAST AND AFRICA: DIGITAL DENTISTRY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 300 MIDDLE EAST AND AFRICA: DIGITAL DENTISTRY MARKET, BY END USER, 2021-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY STRATEGIES ADOPTED BY PLAYERS

- 11.3 REVENUE SHARE ANALYSIS

- FIGURE 45 DENTAL MILLING EQUIPMENT REVENUE SHARE ANALYSIS, BY KEY PLAYER, 2018-2022 (USD MILLION)

- FIGURE 46 DENTAL LAB SCANNERS REVENUE SHARE ANALYSIS, BY KEY PLAYER, 2018-2022 (USD MILLION)

- FIGURE 47 DENTAL 3D PRINTERS REVENUE SHARE ANALYSIS, BY KEY PLAYER, 2018-2022 (USD MILLION)

- FIGURE 48 DENTAL INTRAORAL SCANNERS REVENUE SHARE ANALYSIS, BY KEY PLAYER, 2018-2022 (USD MILLION)

- FIGURE 49 DENTAL PMS REVENUE SHARE ANALYSIS, BY KEY PLAYER, 2018-2022 (USD MILLION)

- FIGURE 50 DENTAL RADIOLOGY REVENUE SHARE ANALYSIS, BY KEY PLAYER, 2018-2022 (USD MILLION)

- 11.4 MARKET SHARE ANALYSIS

- FIGURE 51 DENTAL MILLING EQUIPMENT MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- FIGURE 52 DENTAL LAB SCANNERS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- FIGURE 53 DENTAL 3D PRINTERS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- FIGURE 54 DENTAL INTRAORAL SCANNERS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- FIGURE 55 DENTAL PMS MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- FIGURE 56 DENTAL RADIOLOGY MARKET SHARE ANALYSIS, BY KEY PLAYER, 2022

- 11.5 COMPANY EVALUATION MATRIX

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 57 DIGITAL DENTISTRY MARKET: COMPANY EVALUATION MATRIX (2022)

- 11.6 COMPETITIVE BENCHMARKING

- 11.6.1 COMPANY FOOTPRINT ANALYSIS

- 11.6.2 PRODUCT FOOTPRINT OF COMPANIES

- 11.6.3 REGIONAL FOOTPRINT OF COMPANIES

- 11.7 COMPETITIVE SCENARIO

- 11.7.1 PRODUCT LAUNCHES

- TABLE 301 PRODUCT LAUNCHES (JANUARY 2020-JULY 2023)

- 11.7.2 DEALS

- TABLE 302 DEALS (JANUARY 2020-JULY 2023)

- 11.7.3 OTHER DEVELOPMENTS

- TABLE 303 OTHER DEVELOPMENTS (JANUARY 2020-JULY 2023)

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)**

- 12.1.1 DENTSPLY SIRONA, INC.

- TABLE 304 DENTSPLY SIRONA, INC.: BUSINESS OVERVIEW

- FIGURE 58 DENTSPLY SIRONA, INC.: COMPANY SNAPSHOT (2022)

- 12.1.2 ENVISTA HOLDINGS CORPORATION

- TABLE 305 ENVISTA HOLDINGS CORPORATION: BUSINESS OVERVIEW

- FIGURE 59 ENVISTA HOLDINGS CORPORATION: COMPANY SNAPSHOT (2022)

- 12.1.3 3M

- TABLE 306 3M COMPANY: BUSINESS OVERVIEW

- FIGURE 60 3M: COMPANY SNAPSHOT (2022)

- 12.1.4 IVOCLAR VIVADENT

- TABLE 307 IVOCLAR VIVADENT: BUSINESS OVERVIEW

- 12.1.5 PLANMECA OY

- TABLE 308 PLANMECA OY: BUSINESS OVERVIEW

- 12.1.6 3SHAPE A/S

- TABLE 309 3SHAPE A/S: BUSINESS OVERVIEW

- 12.1.7 ALIGN TECHNOLOGY, INC.

- TABLE 310 ALIGN TECHNOLOGY, INC.: BUSINESS OVERVIEW

- FIGURE 61 ALIGN TECHNOLOGY, INC.: COMPANY SNAPSHOT (2022)

- 12.1.8 J. MORITA CORP.

- TABLE 311 J. MORITA CORP.: BUSINESS OVERVIEW

- 12.1.9 3D SYSTEMS, INC.

- TABLE 312 3D SYSTEMS, INC.: BUSINESS OVERVIEW

- FIGURE 62 3D SYSTEMS, INC.: COMPANY SNAPSHOT (2022)

- 12.1.10 STRAUMANN GROUP

- TABLE 313 STRAUMANN GROUP: BUSINESS OVERVIEW

- FIGURE 63 STRAUMANN GROUP: COMPANY SNAPSHOT (2022)

- 12.1.11 STRATASYS

- TABLE 314 STRATASYS: BUSINESS OVERVIEW

- FIGURE 64 STRATASYS: COMPANY SNAPSHOT (2022)

- 12.1.12 KULZER GMBH (SUBSIDIARY OF MITSUI CHEMICALS GROUP)

- TABLE 315 KULZER GMBH: BUSINESS OVERVIEW

- FIGURE 65 MITSUI CHEMICALS GROUP: COMPANY SNAPSHOT (2021)

- 12.1.13 VATECH CO., LTD.

- TABLE 316 VATECH CO., LTD.: BUSINESS OVERVIEW

- FIGURE 66 VATECH CO., LTD.: COMPANY SNAPSHOT (2022)

- 12.1.14 CARESTREAM DENTAL LLC.

- TABLE 317 CARESTREAM DENTAL LLC.: BUSINESS OVERVIEW

- 12.1.15 BEGO GMBH & CO. KG

- TABLE 318 BEGO GMBH & CO. KG: BUSINESS OVERVIEW

- 12.1.16 DESKTOP METAL, INC.

- TABLE 319 DESKTOP METAL, INC.: BUSINESS OVERVIEW

- FIGURE 67 DESKTOP METAL, INC.: COMPANY SNAPSHOT (2022)

- 12.1.17 ROLAND DG CORPORATION

- TABLE 320 ROLAND DG CORPORATION: BUSINESS OVERVIEW

- FIGURE 68 ROLAND DG CORPORATION: COMPANY SNAPSHOT (2022)

- 12.1.18 DWS SRL

- TABLE 321 DWS SRL: BUSINESS OVERVIEW

- *Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

- 12.2 OTHER COMPANIES

- 12.2.1 MIDMARK CORPORATION

- 12.2.2 MEDIT CORP.

- 12.2.3 SINOL DENTAL LIMITED

- 12.2.4 HUGE DENTAL

- 12.2.5 PLANET DDS

- 12.2.6 GC CORPORATION

- 12.2.7 CARIMA CO., LTD. (BRAND OF ANIWAA PTE. LTD.)

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS