|

|

市場調査レポート

商品コード

1340758

熱伝導性フィラー分散剤の世界市場 (~2028年):分散剤構造タイプ (シリコーン・非シリコーン)・フィラー材料 (セラミック・金属・炭素ベース)・用途 (断熱接着剤)・エンドユーザー産業・地域別Thermally Conductive Filler Dispersants Market by Dispersant Structure Type (Silicone-Based, Non-Silicone Based), Filler Material (Ceramic, Metal, Carbon-Based), Application (Thermal Insulation Glue), End-Use Industry, & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 熱伝導性フィラー分散剤の世界市場 (~2028年):分散剤構造タイプ (シリコーン・非シリコーン)・フィラー材料 (セラミック・金属・炭素ベース)・用途 (断熱接着剤)・エンドユーザー産業・地域別 |

|

出版日: 2023年08月09日

発行: MarketsandMarkets

ページ情報: 英文 258 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の熱伝導性フィラー分散剤の市場規模は、2023年の3億米ドルから、予測期間中は10.2%のCAGRで推移し、2028年には4億米ドルに成長すると予測されています。

新興市場における導電性フィラー分散剤の需要は、性能を向上させるリチウムイオン電池と高密度電子製品への需要の増加により、増加の一途をたどっています。また、アジア太平洋、北米、中東・アフリカなどの新興国では、小型・高性能・高密度電子製品への需要の高まり、電気自動車の普及、CE製品の成長により、導電性フィラー分散剤の需要が増加しており、予測期間中の成長に拍車をかけています。

分散剤構造タイプ別では、シリコーンの部門が2022年に金額ベースで第2位に位置付けています。シリコーンベースの熱伝導性フィラー分散剤は、エレクトロニクス、自動車、ヘルスケア、航空宇宙、通信などのさまざまな産業で放熱用途に広く使用されています。電子部品の空隙や空洞を充填するために使用されます。また、ヒートシンクや金属ケースと組み合わせることで、重要な電子部品からの熱を放散させます。これらの非粘着性硬化シリコーンは、柔らかく、応力を吸収する界面を形成し、冷却を改善するために凹凸部分を埋めます。

また、フィラー材料別では、金属フィラーの部門が2022年に金額ベースで第3位の位置づけを示しています。銀、銅、アルミニウムなどの金属フィラーは熱伝導率が高く、さまざまな産業における効率的な放熱に不可欠です。これらの材料は熱伝導効率を制御できるため、特定の熱伝導率要件を満たす必要がある用途では重要です。さらに、これらのフィラー材料は直径20μm以下の金属粒子で構成されており、このことは熱伝導性ポリマー複合材料において均一な分散と最適な熱伝導性を達成するために重要な要素です。

また、地域別では、欧州が2022年に第3位の位置付けを示しています。医療機器産業の成長、TIMの技術革新と市場開拓の増加、医療機器とエレクトロニクス産業の生産基盤の拡大が、予測期間中の市場成長を促進すると予想されています。欧州の熱伝導性フィラー分散剤市場では、断熱接着剤が最大の用途です。非常に薄い接着線を広げることができるため使用されており、基板のコプラナリティが許せば、より低い熱抵抗を達成することができます。

当レポートでは、世界の熱伝導性フィラー分散剤の市場を調査し、市場概要、市場への影響因子および市場機会の分析、市場規模の推移・予測、各種区分・地域別の詳細分析、技術・特許の動向、ケーススタディ、法規制環境、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 不況の影響

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- ポーターのファイブフォース分析

- マクロ経済指標

- 関税と規制

- ケーススタディ分析

- 技術分析

- エコシステムマッピング

- 主な会議とイベント

- 購入決定に影響を与える主な要因

- 平均販売価格の分析

- 特許分析

第6章 熱伝導性フィラー分散剤市場:分散剤タイプ別

- シリコーン

- 非シリコーン

- ポリマー

- カルボキシル

- アミン

- その他

第7章 熱伝導性フィラー分散剤市場:フィラー材料別

- セラミックフィラー

- アルミナ (AL2O3)

- 酸化マグネシウム (MGO)

- 水酸化アルミニウム (AL (OH) 3)

- 窒化ホウ素 (BN)

- 金属フィラー

- 窒化アルミニウム (ALN)

- その他

- カーボンベースフィラー

- カーボンファイバー

- カーボンブラック

- 黒鉛

- カーボンナノチューブ

- その他

第8章 熱伝導性フィラー分散剤市場:用途別

- 断熱接着剤

- ポッティング接着剤

- プラスチック

- ゴム

- 放熱性セラミックス

- コーティング

- その他

第9章 熱伝導性フィラー分散剤市場:エンドユーザー産業別

- エレクトロニクス

- リチウムイオン電池

- センサー

- TIM (サーマルインターフェースマテリアル)

- 自動車

- エネルギー

- 建築・建設

- 産業

- 航空宇宙

- その他

第10章 熱伝導性フィラー分散剤市場:地域別

- アジア太平洋

- 北米

- 欧州

- 中東・アフリカ

- 南米

第11章 競合情勢

- 概要

- 主要企業の採用戦略

- 収益分析

- 主要企業ランキング

- 市場シェア分析

- 企業評価マトリックス

- 新興企業と中小企業の評価マトリックス

- 競合ベンチマーキング

- 競合状況・動向

第12章 企業プロファイル

- 主要企業

- BYK

- THE DOW CHEMICAL COMPANY

- SHIN-ETSU CHEMICAL CO., LTD.

- HENKEL AG & CO. KGAA

- MOMENTIVE PERFORMANCE MATERIALS, INC.

- JNC CORPORATION

- KUSUMOTO CHEMICALS, LTD.

- EVONIK INDUSTRIES

- CRODA INTERNATIONAL

- THE LUBRIZOL CORPORATION

- WACKER CHEMIE AG

- その他の企業

- 3M

- PARKER HANNIFIN CORP. (LORD CORPORATION)

- DUPONT (LAIRD TECHNOLOGIES, INC.)

- H.B. FULLER COMPANY

- SANYO CHEMICAL INDUSTRIES, LTD.

- FUJIPOLY AMERICA CORPORATION

- MASTER BOND INC.

- ELECTROLUBE

- WAKEFIELD THERMAL, INC.

- INDIUM CORPORATION

- BYOD

- AOS THERMAL COMPOUNDS LLC

- EPOXY TECHNOLOGY, INC.

- GELEST INC.

第13章 付録

The global thermally conductive filler dispersants market size is projected to reach USD 0.4 billion by 2028 from USD 0.3 billion in 2023, at a CAGR of 10.2% during the forecast period. The ever-increasing demand for conductive filler dispersants in emerging markets owing to rising demand of LI-ion batteries to improve performance and high-density electronic products. Additionally, the demand for conductive filler dispersants in emerging countries such as Asia Pacific, North America, and Middle East & Africa, is increasing due to the rising demand for compact, high performance, and high-density electronic products, increasing adoption of electric vehicle, and growth in consumer electronics has fueled the conductive filler dispersants market during the forecast period.

"Silicone is the second largest in terms of value amongst other dispersant types in the thermally conductive filler dispersants market, in 2022."

Silicone-based thermally conductive filler dispersants are widely used in various industries such as electronics, automotive, healthcare, aerospace, and telecommunication for heat dissipation applications. They are dispensed to fill air gaps and voids in electronic components. They work with heat sinks or metal cases to dissipate heat from critical electronic parts. These non-adhesive curing silicones form a soft, stress-absorbing interface and fill uneven areas to improve cooling.

"Metal fillers are the third largest in terms of value amongst other filler materials in the thermally conductive filler dispersants market, in 2022."

Metal fillers such as silver, copper, and aluminum have high thermal conductivity, which is essential for efficient heat dissipation in various industries. They offer controllable heat conducting efficiency, which is important for applications where specific thermal conductivity requirements need to be met. In addition, these filler materials comprise metal particles with diameters less than 20 μm, which is important for achieving uniform dispersion and optimal thermal conductivity in thermally conductive polymer composites.

"Energy is projected to be the third largest in terms of value amongst other end-use industries in the thermally conductive filler dispersants market, in 2022."

Conductive fillers have been filled into dispersants to create electrically conductive composites (ECCs) that are used in printed electronics. Surface engineering techniques have been developed to modify the conductive fillers, enabling tailor-made surface functionalities and charges. The use of thermally conductive filler dispersants can help to achieve efficient heat dissipation in the energy sector for various applications. In addition, metal particles such as copper, aluminum, and silver are common thermal conductive fillers that can be used in thermally conductive filler dispersants for energy applications. They offer high heat conducting efficiency and controllable thermal conductivity.

"Europe is the third largest in the thermally conductive filler dispersants market in 2022."

Europe is the third largest region amongst others in the thermally conductive filler dispersants market in 2022, in terms of value. The growing medical device industry, increase in innovation and development in TIMs, rising production base of the medical device and electronics industry are expected to enhance market growth during the forecast. Thermal insulation glue is the largest segment of the thermally conductive filler dispersants market in Europe. They are used as they can spread a very thin bond line. Therefore, if the co-planarity of the substrate allows, a much lower thermal resistance can be achieved. Phase change materials are the fastest-growing sub-segment in the European market due to their easy application and increased use in computers application. All these factors are projected to drive the thermally conductive filler dispersants market in the region.

The breakdown of primary interviews has been given below.

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C Level Executives - 20%, Director Level - 10%, Others - 70%

- By Region: North America - 20%, Europe - 30%, Asia Pacific - 30%, Middle East & Africa - 10%, South America-10%.

The key players in the thermally conductive filler dispersants market BYK (Germany), Shin-Etsu Chemical (Japan), Dow Chemical Company (US), JNC Corporation (Japan), Momentive Performance Materials (US), Kusumoto Chemicals (Japan), Evonik (Germany), Croda International (UK), Lubrizol Corporation (US), and Wacker Chemie (Germany) among others. The thermally conductive filler dispersants market report analyzes the key growth strategies, such as new product launches, investments & expansions, agreements, partnerships, and mergers & acquisitions to strengthen their market positions.

Research Coverage

This report provides detailed segmentation of the thermally conductive filler dispersants market and forecasts its market size until 2028. The market has been segmented based on dispersant type (silicone, non-silicone), filler material (ceramic, metal, carbon), application (thermal insulation glue, potting glue, plastic, rubber, heat dissipation ceramic, coatings), end-use industry (electronics, automotive, energy, building & construction, industrial, aerospace) and region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and mergers & acquisitions associated with the market for the thermally conductive filler dispersants market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the thermally conductive filler dispersants market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Growing demand for consumer electronics products, Increasing demand from the automotive industry for electric vehicles), restraints (Complexity in controlling filler dispersion, Cost considerations, Technological limitations), opportunities (Development of new and improved fillers, Increasing demand for fuel-efficient and high-end home appliance products), and challenges (Filler content and processing, Compatibility with different polymers) influencing the growth of the thermally conductive filler dispersants market.

- Market Penetration: Comprehensive information on the thermally conductive filler dispersants market offered by top players in the global thermally conductive filler dispersants market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the thermally conductive filler dispersants market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for thermally conductive filler dispersants market across regions.

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the thermally conductive filler dispersants market.

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- TABLE 1 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: INCLUSIONS AND EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 THERMALLY CONDUCTIVE FILLER DISPERSANTS: MARKET SEGMENTATION

- 1.4.1 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

- 1.8 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary list

- 2.1.2.1.1 Demand and supply sides

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.1.2.1 Primary list

- 2.2 MARKET SIZE ESTIMATION

- FIGURE 3 DEMAND SIDE: MARKET SIZE ESTIMATION APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 4 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- FIGURE 6 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

- 2.5.1 SUPPLY SIDE

- 2.5.2 DEMAND SIDE

- 2.6 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 7 SILICONE SEGMENT TO REGISTER HIGHEST CAGR OF OVERALL THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET

- FIGURE 8 CERAMIC TO BE FASTEST-GROWING FILLER MATERIAL OF THERMALLY CONDUCTIVE FILLER DISPERSANTS DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO BE FASTEST-GROWING REGION DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET

- FIGURE 10 EMERGING ECONOMIES TO OFFER ATTRACTIVE OPPORTUNITIES IN THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET DURING FORECAST PERIOD

- 4.2 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE

- FIGURE 11 NON-SILICONE SEGMENT TO LEAD THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET DURING FORECAST PERIOD

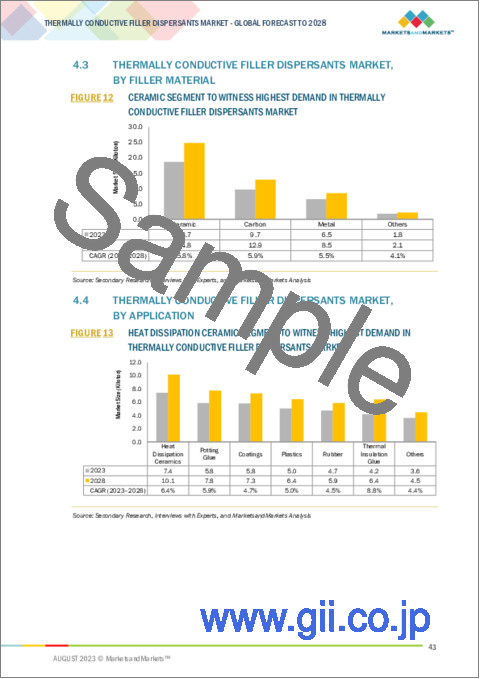

- 4.3 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL

- FIGURE 12 CERAMIC SEGMENT TO WITNESS HIGHEST DEMAND IN THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET

- 4.4 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION

- FIGURE 13 HEAT DISSIPATION CERAMIC SEGMENT TO WITNESS HIGHEST DEMAND IN THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET

- 4.5 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY

- FIGURE 14 ELECTRONICS SEGMENT TO WITNESS HIGHEST DEMAND IN THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET

- 4.6 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY

- FIGURE 15 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET IN INDIA TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 RECESSION IMPACT

- 5.3 MARKET DYNAMICS

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET

- 5.3.1 DRIVERS

- 5.3.1.1 Rising demand for miniaturization of electronic devices

- 5.3.1.2 Rising demand from new applications

- 5.3.2 RESTRAINTS

- 5.3.2.1 Stringent government regulations and environmental constraints

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Emergence of IoT and 5G technology

- 5.3.3.2 Rising advancements in nanotechnology

- 5.3.4 CHALLENGES

- 5.3.4.1 Selection and optimization of thermal interface materials

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 17 OVERVIEW OF THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET VALUE CHAIN

- 5.4.1 RAW MATERIAL SUPPLIERS

- 5.4.2 MANUFACTURERS OF DISPERSANT

- 5.4.3 DISTRIBUTORS

- 5.4.4 END-USE INDUSTRIES

- TABLE 2 THERMALLY CONDUCTIVE FILLER DISPERSANTS: VALUE CHAIN STAKEHOLDERS

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT OF SUBSTITUTES

- 5.5.2 BARGAINING POWER OF SUPPLIERS

- 5.5.3 THREAT OF NEW ENTRANTS

- 5.5.4 BARGAINING POWER OF BUYERS

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 3 THERMALLY CONDUCTIVE FILLER DISPERSANTS: PORTER'S FIVE FORCES ANALYSIS

- 5.6 MACROECONOMIC INDICATORS

- 5.6.1 GLOBAL GDP TRENDS

- TABLE 4 TRENDS OF PER CAPITA GDP (USD) 2020-2022

- TABLE 5 GDP GROWTH ESTIMATE AND PROJECTION, BY KEY COUNTRY, 2023-2027

- 5.7 TARIFFS & REGULATIONS

- 5.7.1 REGULATIONS

- 5.7.1.1 Europe

- 5.7.1.2 US

- 5.7.1.3 China

- 5.7.2 STANDARDS

- 5.7.1 REGULATIONS

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 ENHANCING LED COOLING WITH THERMAL CONDUCTIVE FILLER DISPERSANTS BY THERMALTECH SOLUTIONS

- 5.8.2 ENHANCING EFFICIENCY IN HIGH-PERFORMANCE ELECTRONICS BY ELECTROTECH SOLUTIONS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 NEW TECHNOLOGIES: THERMALLY CONDUCTIVE FILLER DISPERSANTS

- 5.10 ECOSYSTEM MAPPING

- FIGURE 19 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET ECOSYSTEM

- 5.11 KEY CONFERENCES & EVENTS IN 2023-2024

- TABLE 6 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- 5.12 KEY FACTORS AFFECTING BUYING DECISION

- 5.12.1 QUALITY

- 5.12.2 SERVICE

- FIGURE 20 SUPPLIER SELECTION CRITERION

- 5.13 AVERAGE SELLING PRICE ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE, BY REGION

- FIGURE 21 AVERAGE SELLING PRICE, BY REGION (USD/KILOTON)

- 5.13.2 AVERAGE SELLING PRICE, BY DISPERSANT TYPE

- TABLE 7 AVERAGE SELLING PRICE, BY DISPERSANT TYPE (USD/KILOTON)

- 5.13.3 AVERAGE SELLING PRICE, BY FILLER MATERIAL

- TABLE 8 AVERAGE SELLING PRICE, BY FILLER MATERIAL (USD/KILOTON)

- 5.14 PATENT ANALYSIS

- 5.14.1 INTRODUCTION

- 5.14.2 DOCUMENT TYPE

- FIGURE 22 PATENTS REGISTERED, 2012-2022

- 5.14.3 PUBLICATION TRENDS - LAST 10 YEARS

- FIGURE 23 NUMBER OF PATENTS IN LAST 10 YEARS

- 5.14.4 INSIGHT

- 5.14.5 JURISDICTION ANALYSIS

- FIGURE 24 TOP JURISDICTIONS

- 5.14.6 TOP COMPANIES/APPLICANTS

- FIGURE 25 TOP APPLICANTS' ANALYSIS

- TABLE 9 LIST OF PATENTS BY FUJIFILM CORPORATION

- TABLE 10 LIST OF PATENTS BY 3M INNOVATIVE PROPERTIES COMPANY

- TABLE 11 LIST OF PATENTS BY MITSUBISHI CHEMICAL CORPORATION

- TABLE 12 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

6 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE

- 6.1 INTRODUCTION

- FIGURE 26 NON-SILICONE TO BE LARGEST DISPERSANT TYPE SEGMENT DURING FORECAST PERIOD

- TABLE 13 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019-2022 (USD MILLION)

- TABLE 14 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023-2028 (USD MILLION)

- TABLE 15 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019-2022 (TON)

- TABLE 16 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023-2028 (TON)

- 6.2 SILICONE

- 6.2.1 SUITABLE FOR WIDE RANGE OF APPLICATIONS

- 6.3 NON-SILICONE

- 6.3.1 EASY OPERABILITY, SHATTER RESISTANCE, AND LIGHTWEIGHT PROPERTIES

- 6.3.2 POLYMERIC

- 6.3.3 CARBOXYL

- 6.3.4 AMINE

- 6.4 OTHER DISPERSANT TYPES

7 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL

- 7.1 INTRODUCTION

- FIGURE 27 CERAMIC FILLER MATERIAL TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- TABLE 17 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019-2022 (USD MILLION)

- TABLE 18 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023-2028 (USD MILLION)

- TABLE 19 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019-2022 (TON)

- TABLE 20 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023-2028 (TON)

- 7.2 CERAMIC FILLERS

- 7.2.1 EXCELLENT THERMAL CONDUCTIVITY AND ELECTRICAL INSULATION MAKE THEM SUITABLE FOR WIDE RANGE OF APPLICATIONS

- 7.2.2 ALUMINA (AL2O3)

- 7.2.3 MAGNESIUM OXIDE (MGO)

- 7.2.4 ALUMINUM HYDROXIDE (AL(OH)3)

- 7.2.5 BORON NITRIDE (BN)

- 7.3 METAL FILLERS

- 7.3.1 METAL FILLERS SUITABLE FOR ENHANCING THERMAL CONDUCTIVITY OF POLYMER/CERAMIC COMPOSITES

- 7.3.2 ALUMINUM NITRIDE (ALN)

- 7.3.3 OTHER METAL FILLERS

- 7.4 CARBON-BASED FILLERS

- 7.4.1 EXCELLENT THERMAL CONDUCTIVITY PROPERTY MAKES THEM SUITABLE FOR ENHANCING HEAT TRANSFER WITHIN COMPOSITE

- 7.4.2 CARBON FIBER

- 7.4.3 CARBON BLACK

- 7.4.4 GRAPHITE

- 7.4.5 CARBON NANOTUBE

- 7.5 OTHER FILLER MATERIALS

8 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 28 THERMAL INSULATION GLUE TO BE LARGEST APPLICATION SEGMENT DURING FORECAST PERIOD

- TABLE 21 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 22 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 23 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019-2022 (KILOTON)

- TABLE 24 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023-2028 (KILOTON)

- 8.2 THERMAL INSULATION GLUE

- 8.3 POTTING GLUE

- 8.4 PLASTIC

- 8.5 RUBBER

- 8.6 HEAT DISSIPATION CERAMICS

- 8.7 COATINGS

- 8.8 OTHERS

9 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- FIGURE 29 ELECTRONICS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- TABLE 25 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 26 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 27 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (KILOTON)

- TABLE 28 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (KILOTON)

- 9.2 ELECTRONICS

- 9.2.1 DISPERSANTS HELP MAINTAIN CONSISTENT THERMAL PROPERTIES ACROSS INTERFACE, ENSURING EFFICIENT HEAT FLOW

- 9.2.2 LITHIUM-ION BATTERY

- 9.2.3 SENSORS

- 9.2.4 THERMAL INTERFACE MATERIALS

- 9.3 AUTOMOTIVE

- 9.3.1 ELECTRIC VEHICLES UTILIZE LITHIUM-ION BATTERIES THAT GENERATE HEAT DURING CHARGING AND DISCHARGING

- 9.4 ENERGY

- 9.4.1 EFFICIENT HEAT EXCHANGE CRUCIAL FOR OPTIMAL ENERGY CONVERSION IN CONVENTIONAL POWER PLANTS

- 9.5 BUILDING & CONSTRUCTION

- 9.5.1 INCORPORATION INTO INSULATION MATERIALS TO ENHANCE THERMAL CONDUCTIVITY

- 9.6 INDUSTRIAL

- 9.6.1 NUMEROUS BENEFITS RELATED TO HEAT MANAGEMENT, EQUIPMENT EFFICIENCY, AND OVERALL OPERATIONAL PERFORMANCE

- 9.7 AEROSPACE

- 9.8 OTHER END-USE INDUSTRIES

10 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 30 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 29 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 30 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 31 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY REGION, 2019-2022 (TON)

- TABLE 32 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY REGION, 2023-2028 (TON)

- 10.2 ASIA PACIFIC

- 10.2.1 RECESSION IMPACT

- FIGURE 31 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET SNAPSHOT

- TABLE 33 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 34 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2019-2022 (TON)

- TABLE 36 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 37 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019-2022 (USD MILLION)

- TABLE 38 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023-2028 (USD MILLION)

- TABLE 39 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019-2022 (TON)

- TABLE 40 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023-2028 (TON)

- TABLE 41 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019-2022 (USD MILLION)

- TABLE 42 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023-2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019-2022 (TON)

- TABLE 44 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023-2028 (TON)

- TABLE 45 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 46 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 48 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 49 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 50 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 52 ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.2.2 CHINA

- 10.2.2.1 Largest producer and exporter of consumer electronics globally

- TABLE 53 CHINA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 54 CHINA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 55 CHINA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 56 CHINA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.2.3 JAPAN

- 10.2.3.1 Nine fully operational nuclear power plants to drive market

- TABLE 57 JAPAN: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 58 JAPAN: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 59 JAPAN: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 60 JAPAN: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.2.4 INDIA

- 10.2.4.1 Rapid industrialization in energy and power generation end-use industries to boost demand

- TABLE 61 INDIA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 62 INDIA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 63 INDIA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 64 INDIA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.2.5 SOUTH KOREA

- 10.2.5.1 Growth of construction industry in industrial and commercial infrastructural development

- TABLE 65 SOUTH KOREA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 66 SOUTH KOREA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 67 SOUTH KOREA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 68 SOUTH KOREA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.2.6 REST OF ASIA PACIFIC

- TABLE 69 REST OF ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 70 REST OF ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 71 REST OF ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 72 REST OF ASIA PACIFIC: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.3 NORTH AMERICA

- 10.3.1 RECESSION IMPACT

- FIGURE 32 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET SNAPSHOT

- TABLE 73 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2019-2022 (TON)

- TABLE 76 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 77 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019-2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023-2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019-2022 (TON)

- TABLE 80 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023-2028 (TON)

- TABLE 81 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019-2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023-2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019-2022 (TON)

- TABLE 84 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023-2028 (TON)

- TABLE 85 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 88 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 89 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 92 NORTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.3.2 US

- 10.3.2.1 Automotive industry to generate high demand

- TABLE 93 US: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 94 US: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 95 US: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 96 US: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.3.3 CANADA

- 10.3.3.1 Manufacturing presence of major automotive companies to drive demand

- TABLE 97 CANADA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 98 CANADA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 99 CANADA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 100 CANADA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.3.4 MEXICO

- 10.3.4.1 Leading manufacturing center for electronics

- TABLE 101 MEXICO: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 102 MEXICO: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 103 MEXICO: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 104 MEXICO: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.4 EUROPE

- 10.4.1 RECESSION IMPACT

- FIGURE 33 ELECTRONICS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 105 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 106 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 107 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2019-2022 (TON)

- TABLE 108 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 109 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019-2022 (USD MILLION)

- TABLE 110 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023-2028 (USD MILLION)

- TABLE 111 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019-2022 (TON)

- TABLE 112 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023-2028 (TON)

- TABLE 113 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019-2022 (USD MILLION)

- TABLE 114 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023-2028 (USD MILLION)

- TABLE 115 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019-2022 (TON)

- TABLE 116 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023-2028 (TON)

- TABLE 117 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 118 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 119 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 120 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 121 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 122 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 123 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 124 EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.4.2 GERMANY

- 10.4.2.1 Export-driven economy and leading exporter of industrial machinery and automobiles

- TABLE 125 GERMANY: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 126 GERMANY: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 127 GERMANY: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 128 GERMANY: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.4.3 FRANCE

- 10.4.3.1 Introduction of electro-drive vehicles to drive demand

- TABLE 129 FRANCE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 130 FRANCE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 131 FRANCE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 132 FRANCE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.4.4 UK

- 10.4.4.1 Growing demand for home appliances and mobile phones to boost market

- TABLE 133 UK: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 134 UK: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 135 UK: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 136 UK: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.4.5 ITALY

- 10.4.5.1 Commitment to sustainable climate and energy future to drive market

- TABLE 137 ITALY: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 138 ITALY: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 139 ITALY: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 140 ITALY: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.4.6 SPAIN

- 10.4.6.1 High demand of thermally conductive filler dispersants for effective heat dissipation

- TABLE 141 SPAIN: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 142 SPAIN: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 143 SPAIN: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 144 SPAIN: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.4.7 REST OF EUROPE

- TABLE 145 REST OF EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 146 REST OF EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 147 REST OF EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 148 REST OF EUROPE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 RECESSION IMPACT

- TABLE 149 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 150 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 151 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2019-2022 (TON)

- TABLE 152 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 153 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019-2022 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023-2028 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019-2022 (TON)

- TABLE 156 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023-2028 (TON)

- TABLE 157 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019-2022 (USD MILLION)

- TABLE 158 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023-2028 (USD MILLION)

- TABLE 159 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019-2022 (TON)

- TABLE 160 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023-2028 (TON)

- TABLE 161 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 162 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 163 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 164 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 165 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 166 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 167 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 168 MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.5.2 SAUDI ARABIA

- 10.5.2.1 Growth of industrial sector to drive market

- TABLE 169 SAUDI ARABIA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 170 SAUDI ARABIA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 171 SAUDI ARABIA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 172 SAUDI ARABIA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.5.3 UAE

- 10.5.3.1 Focus on energy efficiency and sustainability to drive market

- TABLE 173 UAE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 174 UAE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 175 UAE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 176 UAE: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.5.4 SOUTH AFRICA

- 10.5.4.1 Adoption of advanced technologies and electric vehicles to drive market

- TABLE 177 SOUTH AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 178 SOUTH AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 179 SOUTH AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 180 SOUTH AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.5.5 REST OF MIDDLE EAST & AFRICA

- TABLE 181 REST OF MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 182 REST OF MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 183 REST OF MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 184 REST OF MIDDLE EAST & AFRICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.6 SOUTH AMERICA

- 10.6.1 RECESSION IMPACT

- TABLE 185 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 186 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 187 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2019-2022 (TON)

- TABLE 188 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY COUNTRY, 2023-2028 (TON)

- TABLE 189 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019-2022 (USD MILLION)

- TABLE 190 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023-2028 (USD MILLION)

- TABLE 191 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2019-2022 (TON)

- TABLE 192 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY DISPERSANT TYPE, 2023-2028 (TON)

- TABLE 193 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019-2022 (USD MILLION)

- TABLE 194 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023-2028 (USD MILLION)

- TABLE 195 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2019-2022 (TON)

- TABLE 196 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY FILLER MATERIAL, 2023-2028 (TON)

- TABLE 197 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 198 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 199 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2019-2022 (TON)

- TABLE 200 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY APPLICATION, 2023-2028 (TON)

- TABLE 201 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 202 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 203 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 204 SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.6.2 BRAZIL

- 10.6.2.1 Growing industrialization to have positive impact on demand

- TABLE 205 BRAZIL: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 206 BRAZIL: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 207 BRAZIL: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 208 BRAZIL: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.6.3 ARGENTINA

- 10.6.3.1 Flourishing end-use industries to drive market

- TABLE 209 ARGENTINA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 210 ARGENTINA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 211 ARGENTINA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 212 ARGENTINA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

- 10.6.4 REST OF SOUTH AMERICA

- TABLE 213 REST OF SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 214 REST OF SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 215 REST OF SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2019-2022 (TON)

- TABLE 216 REST OF SOUTH AMERICA: THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET, BY END-USE INDUSTRY, 2023-2028 (TON)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- FIGURE 34 COMPANIES ADOPTED INVESTMENTS & EXPANSIONS AS KEY GROWTH STRATEGY BETWEEN 2018 AND 2023

- 11.3 REVENUE ANALYSIS

- TABLE 217 REVENUE ANALYSIS OF KEY COMPANIES, 2020-2022

- 11.4 RANKING OF KEY PLAYERS

- FIGURE 35 RANKING OF TOP FIVE PLAYERS IN THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET

- 11.4.1 THE DOW CHEMICAL COMPANY

- 11.4.2 HENKEL AG & CO. KGAA

- 11.4.3 BYK

- 11.4.4 SHIN-ETSU CHEMICAL CO., LTD.

- 11.4.5 EVONIK INDUSTRIES

- 11.5 MARKET SHARE ANALYSIS

- FIGURE 36 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET SHARE, BY COMPANY (2022)

- TABLE 218 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 11.6 COMPANY EVALUATION MATRIX (TIER 1)

- 11.6.1 STARS

- 11.6.2 PERVASIVE PLAYERS

- 11.6.3 EMERGING LEADERS

- 11.6.4 PARTICIPANTS

- FIGURE 37 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: COMPANY EVALUATION MATRIX FOR TIER 1 COMPANIES, 2022

- 11.7 START-UPS AND SMES EVALUATION MATRIX

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 STARTING BLOCKS

- 11.7.4 DYNAMIC COMPANIES

- FIGURE 38 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: COMPANY EVALUATION MATRIX FOR START-UPS AND SMES, 2022

- 11.8 COMPETITIVE BENCHMARKING

- TABLE 219 DETAILED LIST OF COMPANIES

- TABLE 220 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY DISPERSANT STRUCTURE

- TABLE 221 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY FILLER MATERIAL

- TABLE 222 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY END-USE INDUSTRY

- TABLE 223 THERMALLY CONDUCTIVE FILLER DISPERSANTS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY REGION

- 11.9 COMPETITIVE SITUATIONS AND TRENDS

- 11.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 224 PRODUCT LAUNCHES/DEVELOPMENTS, 2018-2023

- 11.9.2 DEALS

- TABLE 225 DEALS, 2018-2023

- 11.9.3 OTHERS

- TABLE 226 OTHERS, 2018-2023

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- (Business overview, Products/Solutions/Services offered, Recent developments, Product launches, MnM view, Key strengths, Strategic choices, and Weaknesses and competitive threats)**

- 12.1.1 BYK

- TABLE 227 BYK: COMPANY OVERVIEW

- FIGURE 39 BYK: COMPANY SNAPSHOT

- TABLE 228 BYK: PRODUCT OFFERINGS

- TABLE 229 BYK: PRODUCT LAUNCHES

- TABLE 230 BYK: OTHER DEVELOPMENTS

- 12.1.2 THE DOW CHEMICAL COMPANY

- TABLE 231 THE DOW CHEMICAL COMPANY: COMPANY OVERVIEW

- FIGURE 40 THE DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

- TABLE 232 THE DOW CHEMICAL COMPANY: PRODUCT OFFERINGS

- TABLE 233 THE DOW CHEMICAL COMPANY: PRODUCT LAUNCHES

- TABLE 234 THE DOW CHEMICAL COMPANY: OTHER DEVELOPMENTS

- 12.1.3 SHIN-ETSU CHEMICAL CO., LTD.

- TABLE 235 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY OVERVIEW

- FIGURE 41 SHIN-ETSU CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- TABLE 236 SHIN-ETSU CHEMICAL CO., LTD.: PRODUCT OFFERINGS

- TABLE 237 SHIN-ETSU CHEMICAL CO., LTD.: PRODUCT LAUNCHES

- TABLE 238 SHIN-ETSU CHEMICAL CO., LTD.: OTHER DEVELOPMENTS

- 12.1.4 HENKEL AG & CO. KGAA

- TABLE 239 HENKEL AG & CO. KGAA: COMPANY OVERVIEW

- FIGURE 42 HENKEL AG & CO. KGAA: COMPANY SNAPSHOT

- TABLE 240 HENKEL AG & CO. KGAA: PRODUCT OFFERINGS

- TABLE 241 HENKEL AG & CO. KGAA: PRODUCT LAUNCHES

- TABLE 242 HENKEL AG & CO. KGAA: DEALS

- 12.1.5 MOMENTIVE PERFORMANCE MATERIALS, INC.

- TABLE 243 MOMENTIVE PERFORMANCE MATERIALS, INC.: COMPANY OVERVIEW

- TABLE 244 MOMENTIVE PERFORMANCE MATERIALS, INC.: PRODUCT OFFERINGS

- TABLE 245 MOMENTIVE PERFORMANCE MATERIALS, INC.: DEALS

- TABLE 246 MOMENTIVE PERFORMANCE MATERIALS, INC.: PRODUCT LAUNCHES

- TABLE 247 MOMENTIVE PERFORMANCE MATERIALS, INC.: OTHER DEVELOPMENTS

- 12.1.6 JNC CORPORATION

- TABLE 248 JNC CORPORATION: COMPANY OVERVIEW

- TABLE 249 JNC CORPORATION: PRODUCT OFFERINGS

- TABLE 250 JNC CORPORATION: PRODUCT LAUNCHES

- 12.1.7 KUSUMOTO CHEMICALS, LTD.

- TABLE 251 KUSUMOTO CHEMICALS, LTD.: COMPANY OVERVIEW

- TABLE 252 KUSUMOTO CHEMICALS, LTD.: PRODUCT OFFERINGS

- TABLE 253 KUSUMOTO CHEMICALS, LTD.: PRODUCT LAUNCHES

- TABLE 254 KUSUMOTO CHEMICALS, LTD.: OTHER DEVELOPMENTS

- 12.1.8 EVONIK INDUSTRIES

- TABLE 255 EVONIK INDUSTRIES: COMPANY OVERVIEW

- FIGURE 43 EVONIK INDUSTRIES: COMPANY SNAPSHOT

- TABLE 256 EVONIK INDUSTRIES: PRODUCT OFFERINGS

- TABLE 257 EVONIK INDUSTRIES: DEALS

- TABLE 258 EVONIK INDUSTRIES: OTHER DEVELOPMENTS

- 12.1.9 CRODA INTERNATIONAL

- TABLE 259 CRODA INTERNATIONAL: COMPANY OVERVIEW

- FIGURE 44 CRODA INTERNATIONAL: COMPANY SNAPSHOT

- TABLE 260 CRODA INTERNATIONAL: PRODUCT OFFERINGS

- 12.1.10 THE LUBRIZOL CORPORATION

- TABLE 261 THE LUBRIZOL CORPORATION: COMPANY OVERVIEW

- TABLE 262 THE LUBRIZOL CORPORATION: PRODUCT OFFERINGS

- TABLE 263 THE LUBRIZOL CORPORATION: PRODUCT LAUNCHES

- TABLE 264 THE LUBRIZOL CORPORATION: OTHER DEVELOPMENTS

- 12.1.11 WACKER CHEMIE AG

- TABLE 265 WACKER CHEMIE AG: COMPANY OVERVIEW

- FIGURE 45 WACKER CHEMIE AG: COMPANY SNAPSHOT

- TABLE 266 WACKER CHEMIE AG: PRODUCT OFFERINGS

- TABLE 267 WACKER CHEMIE AG: DEALS

- TABLE 268 WACKER CHEMIE AG: OTHER DEVELOPMENTS

- 12.2 OTHER PLAYERS

- 12.2.1 3M

- TABLE 269 3M: COMPANY OVERVIEW

- 12.2.2 PARKER HANNIFIN CORP. (LORD CORPORATION)

- TABLE 270 PARKER HANNIFIN CORP. (LORD CORPORATION): COMPANY OVERVIEW

- 12.2.3 DUPONT (LAIRD TECHNOLOGIES, INC.)

- TABLE 271 DUPONT (LAIRD TECHNOLOGIES, INC.): COMPANY OVERVIEW

- 12.2.4 H.B. FULLER COMPANY

- TABLE 272 H.B. FULLER COMPANY: COMPANY OVERVIEW

- 12.2.5 SANYO CHEMICAL INDUSTRIES, LTD.

- TABLE 273 SANYO CHEMICAL INDUSTRIES, LTD.: COMPANY OVERVIEW

- 12.2.6 FUJIPOLY AMERICA CORPORATION

- TABLE 274 FUJIPOLY AMERICA CORPORATION: COMPANY OVERVIEW

- 12.2.7 MASTER BOND INC.

- TABLE 275 MASTER BOND INC.: COMPANY OVERVIEW

- 12.2.8 ELECTROLUBE

- TABLE 276 ELECTROLUBE: COMPANY OVERVIEW

- 12.2.9 WAKEFIELD THERMAL, INC.

- TABLE 277 WAKEFIELD THERMAL, INC.: COMPANY OVERVIEW

- 12.2.10 INDIUM CORPORATION

- TABLE 278 INDIUM CORPORATION: COMPANY OVERVIEW

- 12.2.11 BYOD

- TABLE 279 BYOD: COMPANY OVERVIEW

- 12.2.12 AOS THERMAL COMPOUNDS LLC

- TABLE 280 AOS THERMAL COMPOUNDS LLC: COMPANY OVERVIEW

- 12.2.13 EPOXY TECHNOLOGY, INC.

- TABLE 281 EPOXY TECHNOLOGY, INC.: COMPANY OVERVIEW

- 12.2.14 GELEST INC.

- TABLE 282 GELEST INC.: COMPANY OVERVIEW

- *Details on Business overview, Products/Solutions/Services offered, Recent developments, Product launches, MnM view, Key strengths, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS