|

|

市場調査レポート

商品コード

1337837

コネクテッドシップの世界市場 (~2028年):用途 (船舶交通管理・フリートオペレーション・フリートヘルスモニタリング・その他)・設置 (船上・陸上)・プラットフォーム (船舶・港湾)・フィット (ラインフィット・レトロフィット・ハイブリッドフィット) 別Connected Ship Market by Application (Vessel Traffic Management, Fleet Operation, Fleet Health Monitoring, Other Applications), Installation (Onboard, Onshore), Platform (Ships, Ports) & Fit (Line Fit, Retrofit, Hybrid Fit) and Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| コネクテッドシップの世界市場 (~2028年):用途 (船舶交通管理・フリートオペレーション・フリートヘルスモニタリング・その他)・設置 (船上・陸上)・プラットフォーム (船舶・港湾)・フィット (ラインフィット・レトロフィット・ハイブリッドフィット) 別 |

|

出版日: 2023年08月16日

発行: MarketsandMarkets

ページ情報: 英文 243 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

コネクテッドシップの市場規模は、予測期間中にCAGR 7.7%で推移し、2023年の113億米ドルから、2028年には172億米ドルの規模に成長すると予測されています。

技術の進歩と世界の海上貿易の増加が市場成長を促進しています。

フィット別で見ると、ラインフィットの部門が予測期間中に最大のCAGRを示す見通しです。ラインフィットでは、コネクテッドシップの効率性、安全性、状況認識を向上させるため、造船中に超小型開口ターミナル (VSAT) 、自動識別システム (AIS) 、電子海図ディスプレイ (ECD) などの先進技術の導入を行います。

設置区分別では、船上の部門が市場シェアでリードを示すと予測されています。船上には、統合システム、センサー、データ処理インフラが設置され、安全性、効率性、状況認識を強化するためのリアルタイムデータ収集を強化するナビゲーションおよび自動化システムを提供します。

地域別では、アジア太平洋地域が2023年に最大のシェアを示す見通しです。同地域においては中国が市場をリードしており、多くの企業や新興企業がこの業界で事業を展開しています。同国はコネクテッドシップの進歩や製造において重要な役割を果たしています。フリート管理、セキュリティ、フリートオペレーションを改善するコネクテッドシップシステムの需要により、市場は拡大すると予想されています。

当レポートでは、世界のコネクテッドシップの市場を調査し、市場概要、市場への影響因子および市場機会の分析、法規制環境、技術動向、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 不況がコネクテッドシップ市場に与える影響

- バリューチェーン分析

- 技術の進化

- 顧客の事業に影響を与える動向/ディスラプション

- エコシステムマッピング

- ポーターのファイブフォース分析

- 価格分析

- 関税・規制状況

- 貿易分析

- 特許分析

- 主要なステークホルダーと購入基準

- 主な会議とイベント

- 技術分析

- ケーススタディ分析

- 運用データ

第6章 産業動向

- サプライチェーン分析

- 技術動向

- メガトレンドの影響

第7章 コネクテッドシップ市場:用途別

- 船舶交通管理

- フリートオペレーション

- フリートヘルスモニタリング

- その他

- 乗客との対話

- 貨物追跡

第8章 コネクテッドシップ市場:設置別

- 船上

- ナビゲーションの位置決め・追跡

- 船舶情報管理システム

- コミュニケーション管理システム

- オートメーション

- 船舶間通信システム

- 統合ブリッジシステム

- 陸上

- サーバー

- 船舶データ分析・管理

第9章 コネクテッドシップ市場:プラットフォーム別

- 船舶

- 商用

- 防衛

- 港湾

- グリーンフィールドポート

- ブラウンフィールドポート

第10章 コネクテッドシップ市場:フィット別

- ラインフィット

- レトロフィット

- ハイブリッドフィット

第11章 コネクテッドシップ市場:地域別

- 北米

- 欧州

- アジア太平洋

- その他の地域

第12章 競合情勢

- 市場シェア分析

- ランキング分析

- 収益分析

- 主要企業の採用戦略

- 企業評価マトリックス

- 競合ベンチマーキング

- 新興企業/中小企業の評価マトリックス

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- ABB

- EMERSON ELECTRIC CO.

- KONGSBERG GRUPPEN ASA

- WARTSILA

- THALES GROUP

- GENERAL ELECTRIC

- NORTHROP GRUMMAN CORPORATION

- L3HARRIS TECHNOLOGIES, INC.

- HYUNDAI HEAVY INDUSTRIES

- JASON MARINE GROUP

- MARLINK

- RH MARINE

- ROCKWELL AUTOMATION

- SCHNEIDER ELECTRIC

- SIEMENS

- ULSTEIN

- VALMET

- SAAB AB

- ST ENGINEERING

- HUNTINGTON INGALLS INDUSTRIES

- HANWHA SYSTEMS

- FURUNO ELECTRIC CO. LTD.

- ROLLS ROYCE PLC

- GARMIN INTERNATIONAL

- その他の企業

- IRIDIUM

- INMARSAT

- INTELSAT

第14章 付録

The Connected Ship market is projected to grow from USD 11.3 Billion in 2023 to USD 17.2 Billion by 2028, at a CAGR of 7.7 % during the forecast period. Technological advancements and increase in seaborne trade across the globe are driving the growth of the market.

The Line fit segment is projected to witness the highest CAGR during the forecast period.

Based on Fit, the Line fit segment of the Connected Ship market is projected to hold the highest growth rate during the forecast period. The line fit offers installation of advanced technology for connected ship during its construction , such as the Very Small Aperture Terminal (VSAT), Automatic Identification System (AIS) and Electronic Chart Display (ECD) to improve efficiency, safety and situational awareness for connected ship.

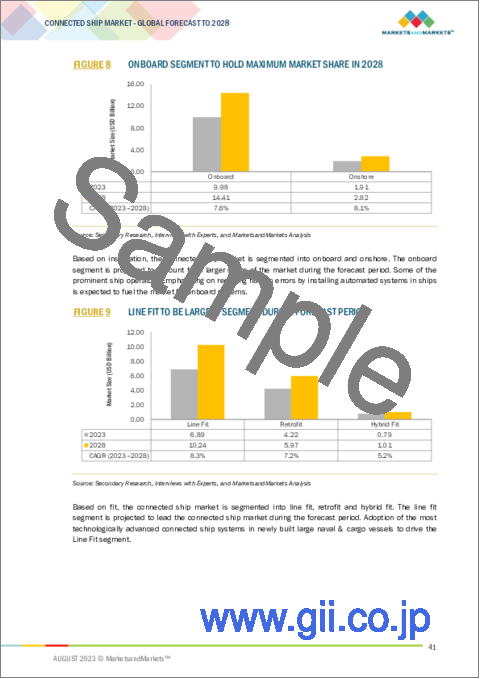

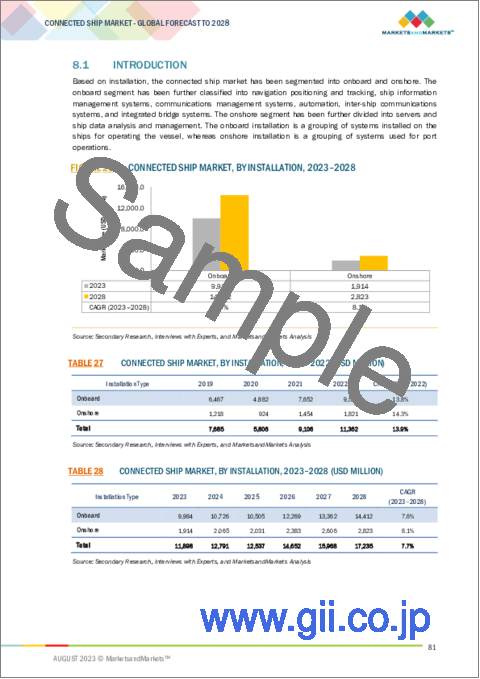

The Onboard segment is projected to dominate the market share by Installation.

Based on Installation, the Onboard segment is projected to dominate the market share during the forecast period. A Onboard installation is integrated systems, sensors, and data processing infrastructure installed on the ship. Onboard installation offers Navigation and automation system to enhanced safety, efficiency and real- time data collection for enhance situational awareness.

Asia Pacific is expected to account for the largest market share in 2023.

The Connected Ship market industry has been studied in North America, Europe, Asia Pacific, Rest of the World. Asia Pacific accounted for the largest market share for connected ship. China leads the market in Asia Pacific with a large number of companies and startups operating in the industry. The country is playing a vital role in the advancement and manufacturing of Connected ship. The market is expected to expand owing to the demand for connected ship system to improve fleet management, security and fleet operation.

The break-up of the profile of primary participants in the CONNECTED SHIP market:

- By Company Type: Tier 1 - 55%, Tier 2 - 20%, and Tier 3 - 25%

- By Designation: C Level - 40%, Managers - 35%, Others-25%

- By Region: North America -10%, Europe - 20%, Asia Pacific - 40%, Rest of the World - 30%

Prominent companies include ABB (Switzerland), Emerson Electric Co. (US), Kongsberg Gruppen ASA (Norway), Wartsila (Finland), and Thales Group (France), among others.

Research Coverage:

This research report categorizes the Connected Ship market by Application (Vessel Traffic Management, Fleet Operation, Fleet Health Monitoring, Other Applications, by Installation (Onboard, Onshore) , by Platform (Ships, Ports) and fit (Line fit, Retrofit, Hybrid fit), and by region (North America, Europe, Asia Pacific, Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the Connected Ship market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, services; key strategies; Contracts, partnerships, and agreements. New product & service launches, mergers and acquisitions, and recent developments associated with the Connected Ship System market. Competitive analysis of upcoming startups in the Connected Ship market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall Connected Ship System market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Incorporation of ICT in marine industry, Increased spending on digitalization of vessels, Increase in global seaborne trade, Need for situational awareness in fleet operations, Growing maritime tourism industry), restraints (High cost of marine broadband connectivity, Digitalization renders connected ships vulnerable to cyber threats), opportunities (Rigorous development of connected autonomous ships Adoption of Vessel Traffic Services (VTS) by shipping companies, Adoption of vessel traffic services by shipping companies, Development of new port cities in emerging economies), and challenges (Limited Internet facilities in connected ships, Lack of skilled personnel to handle and operate connected ships) influencing the growth of the authentication and brand protection market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Connected Ship market

- Market Development: Comprehensive information about lucrative markets - the report analyses the Connected Ship market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Connected Ship market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the Connected Ship market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 CONNECTED SHIP MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 INCLUSIONS AND EXCLUSIONS

- 1.5 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATE

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 RESEARCH PROCESS FLOW

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Industry insights

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Primary sources

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 RESEARCH APPROACH AND METHODOLOGY

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation process

- FIGURE 5 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.5 RECESSION IMPACT ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- TABLE 2 PARAMETRIC ASSUMPTIONS FOR MARKET FORECASTING

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 8 ONBOARD SEGMENT TO HOLD MAXIMUM MARKET SHARE IN 2028

- FIGURE 9 LINE FIT TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 10 VESSEL TRAFFIC MANAGEMENT TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO BE LARGEST MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN CONNECTED SHIP MARKET

- FIGURE 12 INCREASING USE OF AUTONOMOUS SYSTEMS AND INTER-SHIP COMMUNICATIONS SYSTEMS IN LARGE SEAFARING VESSELS

- 4.2 CONNECTED SHIP MARKET, BY PLATFORM

- FIGURE 13 SHIPS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- 4.3 CONNECTED SHIP MARKET, BY SHIP TYPE

- FIGURE 14 COMMERCIAL SHIPS TO SHOW HIGHEST GROWTH DURING FORECAST PERIOD

- 4.4 CONNECTED SHIP MARKET, BY PORT TYPE

- FIGURE 15 GREENFIELD PORTS TO SHOW HIGHEST GROWTH DURING FORECAST PERIOD

- 4.5 CONNECTED SHIP MARKET, BY COUNTRY

- FIGURE 16 CHINA TO BE FASTEST-GROWING COUNTRY DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 CONNECTED SHIP MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Incorporation of ICT in marine industry

- 5.2.1.2 Increased spending on digitalization of vessels

- 5.2.1.3 Surge in global seaborne trade

- 5.2.1.4 Need for situational awareness in fleet operations

- 5.2.1.5 Growing maritime tourism industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of marine broadband connectivity

- TABLE 3 COMPARISON OF HARDWARE AND BROADBAND PLANS

- 5.2.2.2 Vulnerability of connected ships to cyber threats

- FIGURE 18 POTENTIAL CYBERATTACK ROUTES FOR CONNECTED SHIPS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rigorous development of connected autonomous ships

- TABLE 4 DESIGN DEVELOPMENT TARGETS FOR CONNECTED AUTONOMOUS SHIPS

- 5.2.3.2 Adoption of vessel traffic services by shipping companies

- 5.2.3.3 Development of new port cities in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited Internet facilities in connected ships

- 5.2.4.2 Shortage of skilled personnel

- 5.3 IMPACT OF RECESSION ON CONNECTED SHIP MARKET

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 19 VALUE CHAIN ANALYSIS

- 5.5 TECHNOLOGICAL EVOLUTION IN CONNECTED SHIP MARKET

- FIGURE 20 TECHNOLOGICAL EVOLUTION IN CONNECTED SHIP MARKET

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 21 REVENUE SHIFT FOR PLAYERS IN CONNECTED SHIP MARKET

- 5.7 ECOSYSTEM MAPPING

- 5.7.1 PROMINENT COMPANIES

- 5.7.2 PRIVATE AND SMALL ENTERPRISES

- 5.7.3 RESEARCH ORGANIZATIONS

- FIGURE 22 ECOSYSTEM MAPPING

- TABLE 5 ROLE OF KEY PLAYERS IN ECOSYSTEM

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 PORTER'S FIVE FORCE ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 PRICING ANALYSIS

- TABLE 7 AVERAGE PRICE OF CONNECTED SHIP EQUIPMENT PER DEFENSE VESSEL

- TABLE 8 AVERAGE PRICE OF CONNECTED SHIP EQUIPMENT PER COMMERCIAL VESSEL

- 5.10 TARIFF AND REGULATORY LANDSCAPE

- TABLE 9 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 10 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 11 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 12 MIDDLE EAST: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- TABLE 13 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHERS

- 5.11 TRADE ANALYSIS

- TABLE 14 COUNTRY-WISE IMPORTS, 2019-2022 (USD THOUSAND)

- TABLE 15 COUNTRY-WISE EXPORTS, 2019-2022 (USD THOUSAND)

- 5.12 PATENT ANALYSIS

- FIGURE 23 TOP 10 PATENT OWNERS

- TABLE 16 KEY PATENT REGISTRATIONS, 2023

- TABLE 17 OTHER PATENT REGISTRATIONS, 2021-2022

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING CONNECTED SHIPS, BY SHIP TYPE

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING CONNECTED SHIPS, BY SHIP TYPE (%)

- 5.13.2 BUYING CRITERIA

- FIGURE 25 KEY BUYING CRITERIA FOR CONNECTED SHIPS, BY APPLICATION

- TABLE 19 KEY BUYING CRITERIA FOR CONNECTED SHIPS, BY APPLICATION

- 5.14 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 20 KEY CONFERENCES AND EVENTS, 2023-2024

- 5.15 TECHNOLOGY ANALYSIS

- 5.15.1 KEY TECHNOLOGY

- 5.15.1.1 Artificial Intelligence (AI)

- 5.15.2 SUPPORTING TECHNOLOGY

- 5.15.2.1 Internet of Things (IoT)

- 5.15.1 KEY TECHNOLOGY

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 ADVANCED CONNECTIVITY SOLUTIONS

- 5.16.2 SEAVISION BY KONGSBERG MARITIME

- 5.17 OPERATIONAL DATA

- TABLE 21 NEW SHIP DELIVERIES, BY DEFENSE SHIP, 2019-2022

- TABLE 22 NEW SHIP DELIVERIES, BY COMMERCIAL SHIP, 2019-2022

- TABLE 23 MOBILE SATELLITE GROUND STATION VOLUME, BY PLATFORM, 2019-2028

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- FIGURE 26 SUPPLY CHAIN ANALYSIS

- 6.3 TECHNOLOGY TRENDS

- 6.3.1 GLOBAL NAVIGATION SATELLITE SYSTEMS

- 6.3.2 HIGH THROUGHPUT SATELLITES

- 6.3.3 DIGITAL MARINE AUTOMATION SYSTEMS

- 6.3.3.1 Sensor fusion solutions

- 6.3.3.2 Control algorithms

- 6.3.3.3 Conning systems

- 6.3.3.4 Connectivity solutions

- 6.3.3.5 Autopilot

- 6.3.3.6 Mooring control and monitoring systems

- 6.3.3.7 Automated radar plotting aids

- 6.3.3.8 Electronic chart display and information systems

- 6.3.3.9 Communications systems

- 6.3.3.10 Voyage data recorders

- 6.3.3.11 Decision support systems

- 6.3.4 VESSEL TRAFFIC MANAGEMENT SYSTEMS

- FIGURE 27 KEY MILESTONES IN CONNECTED SHIP TECHNOLOGY DEVELOPMENT

- 6.3.5 AUTONOMOUS MARINE VESSELS

- 6.3.6 INTEGRATED SHIP AUTOMATION SYSTEMS

- TABLE 24 COMPARISON BETWEEN MANUAL SHIP SYSTEMS AND INTEGRATED MARINE AUTOMATION SYSTEMS

- 6.4 IMPACT OF MEGATRENDS

- 6.4.1 CLOUD-BASED SOLUTIONS

- 6.4.2 SATELLITE COMMUNICATIONS

7 CONNECTED SHIP MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- FIGURE 28 CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028

- TABLE 25 CONNECTED SHIP MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 26 CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 7.2 VESSEL TRAFFIC MANAGEMENT

- 7.2.1 EMPHASIS ON SAFETY AND EFFICIENCY OF VESSELS TO DRIVE GROWTH

- 7.3 FLEET OPERATION

- 7.3.1 NEED FOR REAL-TIME SITUATIONAL AWARENESS TO DRIVE GROWTH

- 7.4 FLEET HEALTH MONITORING

- 7.4.1 DEMAND FOR REMOTE ENGINE MONITORING SYSTEMS TO DRIVE GROWTH

- 7.5 OTHER APPLICATIONS

- 7.5.1 PASSENGER INTERACTION

- 7.5.2 CARGO TRACKING

8 CONNECTED SHIP MARKET, BY INSTALLATION

- 8.1 INTRODUCTION

- FIGURE 29 CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028

- TABLE 27 CONNECTED SHIP MARKET, BY INSTALLATION, 2019-2022 (USD MILLION)

- TABLE 28 CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028 (USD MILLION)

- 8.2 ONBOARD

- 8.2.1 INCREASED ADOPTION OF AUTOMATION SYSTEMS IN NAVAL AND CARGO VESSELS TO DRIVE GROWTH

- FIGURE 30 AUTOMATION TO HOLD LEADING MARKET POSITION IN 2028

- TABLE 29 ONBOARD: CONNECTED SHIP MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 30 ONBOARD: CONNECTED SHIP MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 8.2.2 NAVIGATION POSITIONING AND TRACKING

- 8.2.2.1 Navigation systems

- 8.2.3 SHIP INFORMATION MANAGEMENT SYSTEMS

- 8.2.3.1 Voyage data recorders

- 8.2.3.2 Data processors

- 8.2.4 COMMUNICATIONS MANAGEMENT SYSTEMS

- 8.2.4.1 Very small aperture terminals

- 8.2.4.2 Mobile satellite systems

- 8.2.5 AUTOMATION

- 8.2.5.1 Surveillance and safety systems

- 8.2.5.2 Power management systems

- 8.2.5.3 Propulsion control systems

- 8.2.5.4 Machinery management systems

- 8.2.5.5 Alarm management systems

- 8.2.5.6 Ballast management systems

- 8.2.5.7 Thruster control systems

- 8.2.6 INTER-SHIP COMMUNICATIONS SYSTEMS

- 8.2.7 INTEGRATED BRIDGE SYSTEMS

- 8.3 ONSHORE

- 8.3.1 WIDESPREAD USE OF ARTIFICIAL INTELLIGENCE AND DATA ANALYTICS IN MARITIME INDUSTRY TO DRIVE GROWTH

- 8.3.2 SERVERS

- 8.3.3 SHIP DATA ANALYSIS AND MANAGEMENT

- 8.3.3.1 Software

- 8.3.3.1.1 Fleet management software

- 8.3.3.1.2 Data analysis software

- 8.3.3.2 Services

- 8.3.3.2.1 Health monitoring services

- 8.3.3.2.2 Navigation assistance services

- 8.3.3.1 Software

9 CONNECTED SHIP MARKET, BY PLATFORM

- 9.1 INTRODUCTION

- FIGURE 31 CONNECTED SHIP MARKET, BY PLATFORM, 2023-2028

- TABLE 31 CONNECTED SHIP MARKET, BY PLATFORM, 2019-2022 (USD MILLION)

- TABLE 32 CONNECTED SHIP MARKET, BY PLATFORM, 2023-2028 (USD MILLION)

- 9.2 SHIPS

- 9.2.1 DEMAND FOR ADVANCED SHIP HEALTH MONITORING SYSTEMS AND AUTOMATION SYSTEMS TO DRIVE GROWTH

- FIGURE 32 CONNECTED SHIP MARKET, BY SHIP TYPE, 2023-2028

- TABLE 33 SHIPS: CONNECTED SHIP MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 34 SHIPS: CONNECTED SHIP MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.2.2 COMMERCIAL

- FIGURE 33 CARGO SHIPS TO HOLD LARGEST MARKET SHARE IN 2028

- TABLE 35 COMMERCIAL: CONNECTED SHIP MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 36 COMMERCIAL: CONNECTED SHIP MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.2.2.1 Passenger ships

- 9.2.2.2 Cargo ships

- FIGURE 34 CONTAINER SHIPS TO HOLD LARGEST MARKET SHARE IN 2028

- TABLE 37 CARGO SHIPS: CONNECTED SHIP MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 38 CARGO SHIPS: CONNECTED SHIP MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.2.2.3 Other ships

- 9.2.2.3.1 Specialized ships

- 9.2.2.3.2 Offshore ships

- 9.2.2.3 Other ships

- 9.2.3 DEFENSE

- FIGURE 35 SUBMARINES TO HOLD LARGEST MARKET SHARE IN 2028

- TABLE 39 DEFENSE: CONNECTED SHIP MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 40 DEFENSE: CONNECTED SHIP MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.2.3.1 Aircraft carriers

- 9.2.3.2 Corvettes

- 9.2.3.3 Frigates

- 9.2.3.4 Submarines

- 9.2.3.5 Destroyers

- 9.2.3.6 Amphibious ships

- 9.3 PORTS

- 9.3.1 TRADE AND TRANSPORTATION APPLICATIONS TO DRIVE GROWTH

- FIGURE 36 CONNECTED SHIP MARKET, BY PORT TYPE, 2023-2028

- TABLE 41 PORTS: CONNECTED SHIP MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 42 PORTS: CONNECTED SHIP MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 9.3.2 GREENFIELD PORTS

- 9.3.3 BROWNFIELD PORTS

10 CONNECTED SHIP MARKET, BY FIT

- 10.1 INTRODUCTION

- FIGURE 37 CONNECTED SHIP MARKET, BY FIT, 2023-2028

- TABLE 43 CONNECTED SHIP MARKET, BY FIT, 2019-2022 (USD MILLION)

- TABLE 44 CONNECTED SHIP MARKET, BY FIT, 2023-2028 (USD MILLION)

- 10.2 LINE FIT

- 10.2.1 RISE IN NEW SHIP DELIVERIES TO DRIVE GROWTH

- 10.3 RETROFIT

- 10.3.1 ACTIVE REPLACEMENT OF OLD CONNECTED SYSTEMS TO DRIVE GROWTH

- 10.4 HYBRID FIT

- 10.4.1 RAPID INTEGRATION OF ADVANCED SYSTEMS IN CONNECTED SHIPS TO DRIVE GROWTH

11 CONNECTED SHIP MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 38 CONNECTED SHIP MARKET, BY REGION, 2023-2028

- TABLE 45 CONNECTED SHIP MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 46 CONNECTED SHIP MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 PESTLE ANALYSIS

- 11.2.2 RECESSION IMPACT ANALYSIS

- FIGURE 39 NORTH AMERICA: NAVAL BUDGET TREND, BY COUNTRY, 2019-2022

- TABLE 47 NORTH AMERICA: RECESSION IMPACT ANALYSIS

- FIGURE 40 NORTH AMERICA: CONNECTED SHIP MARKET SNAPSHOT

- TABLE 48 NORTH AMERICA: CONNECTED SHIP MARKET, BY FIT, 2019-2022 (USD MILLION)

- TABLE 49 NORTH AMERICA: CONNECTED SHIP MARKET, BY FIT, 2023-2028 (USD MILLION)

- TABLE 50 NORTH AMERICA: CONNECTED SHIP MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 51 NORTH AMERICA: CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: CONNECTED SHIP MARKET, BY INSTALLATION, 2019-2022 (USD MILLION)

- TABLE 53 NORTH AMERICA: CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: CONNECTED SHIP MARKET, BY ONBOARD SYSTEM, 2019-2022 (USD MILLION)

- TABLE 55 NORTH AMERICA: CONNECTED SHIP MARKET, BY ONBOARD SYSTEM, 2023-2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: CONNECTED SHIP MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 57 NORTH AMERICA: CONNECTED SHIP MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.2.3 US

- 11.2.3.1 Rise in naval shipbuilding to drive growth

- TABLE 58 US: CONNECTED SHIP MARKET, BY INSTALLATION, 2019-2022 (USD MILLION)

- TABLE 59 US: CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028 (USD MILLION)

- TABLE 60 US: CONNECTED SHIP MARKET, BY FIT, 2019-2022 (USD MILLION)

- TABLE 61 US: CONNECTED SHIP MARKET, BY FIT, 2023-2028 (USD MILLION)

- TABLE 62 US: CONNECTED SHIP MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 63 US: CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.2.4 CANADA

- 11.2.4.1 Emphasis on developing indigenous marine industry to drive growth

- TABLE 64 CANADA: CONNECTED SHIP MARKET, BY INSTALLATION, 2019-2022 (USD MILLION)

- TABLE 65 CANADA: CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028 (USD MILLION)

- TABLE 66 CANADA: CONNECTED SHIP MARKET, BY FIT, 2019-2022 (USD MILLION)

- TABLE 67 CANADA: CONNECTED SHIP MARKET, BY FIT, 2023-2028 (USD MILLION)

- TABLE 68 CANADA: CONNECTED SHIP MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 69 CANADA: CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 PESTLE ANALYSIS

- 11.3.2 RECESSION IMPACT ANALYSIS

- FIGURE 41 EUROPE: NAVAL BUDGET TREND, BY COUNTRY, 2019-2022

- TABLE 70 EUROPE: RECESSION IMPACT ANALYSIS

- FIGURE 42 EUROPE: CONNECTED SHIP MARKET SNAPSHOT

- TABLE 71 EUROPE: CONNECTED SHIP MARKET, BY FIT, 2019-2022 (USD MILLION)

- TABLE 72 EUROPE: CONNECTED SHIP MARKET, BY FIT, 2023-2028 (USD MILLION)

- TABLE 73 EUROPE: CONNECTED SHIP MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 74 EUROPE: CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 75 EUROPE: CONNECTED SHIP MARKET, BY INSTALLATION, 2019-2022 (USD MILLION)

- TABLE 76 EUROPE: CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028 (USD MILLION)

- TABLE 77 EUROPE: CONNECTED SHIP MARKET, BY ONBOARD SYSTEM, 2019-2022 (USD MILLION)

- TABLE 78 EUROPE: CONNECTED SHIP MARKET, BY ONBOARD SYSTEM, 2023-2028 (USD MILLION)

- TABLE 79 EUROPE: CONNECTED SHIP MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 80 EUROPE: CONNECTED SHIP MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.3.3 GERMANY

- 11.3.3.1 Predominance of maritime industry to drive growth

- TABLE 81 GERMANY: CONNECTED SHIP MARKET, BY INSTALLATION, 2019-2022 (USD MILLION)

- TABLE 82 GERMANY: CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028 (USD MILLION)

- TABLE 83 GERMANY: CONNECTED SHIP MARKET, BY FIT, 2019-2022 (USD MILLION)

- TABLE 84 GERMANY: CONNECTED SHIP MARKET, BY FIT, 2023-2028 (USD MILLION)

- TABLE 85 GERMANY: CONNECTED SHIP MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 86 GERMANY: CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.4 ITALY

- 11.3.4.1 Retrofitting of connected ship technologies in vessels to drive growth

- TABLE 87 ITALY: CONNECTED SHIP MARKET, BY INSTALLATION, 2019-2022 (USD MILLION)

- TABLE 88 ITALY: CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028 (USD MILLION)

- TABLE 89 ITALY: CONNECTED SHIP MARKET, BY FIT, 2019-2022 (USD MILLION)

- TABLE 90 ITALY: CONNECTED SHIP MARKET, BY FIT, 2023-2028 (USD MILLION)

- TABLE 91 ITALY: CONNECTED SHIP MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 92 ITALY: CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.5 UK

- 11.3.5.1 Increased investments in marine systems to drive growth

- TABLE 93 UK: CONNECTED SHIP MARKET, BY INSTALLATION, 2019-2022 (USD MILLION)

- TABLE 94 UK: CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028 (USD MILLION)

- TABLE 95 UK: CONNECTED SHIP MARKET, BY FIT, 2019-2022 (USD MILLION)

- TABLE 96 UK: CONNECTED SHIP MARKET, BY FIT, 2023-2028 (USD MILLION)

- TABLE 97 UK: CONNECTED SHIP MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 98 UK: CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.6 RUSSIA

- 11.3.6.1 Procurement of new naval warships and submarines to drive growth

- TABLE 99 RUSSIA: CONNECTED SHIP MARKET, BY INSTALLATION, 2019-2022 (USD MILLION)

- TABLE 100 RUSSIA: CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028 (USD MILLION)

- TABLE 101 RUSSIA: CONNECTED SHIP MARKET, BY FIT, 2019-2022 (USD MILLION)

- TABLE 102 RUSSIA: CONNECTED SHIP MARKET, BY FIT, 2023-2028 (USD MILLION)

- TABLE 103 RUSSIA: CONNECTED SHIP MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 104 RUSSIA: CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.7 FRANCE

- 11.3.7.1 High demand for advanced autonomous systems to drive growth

- TABLE 105 FRANCE: CONNECTED SHIP MARKET, BY INSTALLATION, 2019-2022 (USD MILLION)

- TABLE 106 FRANCE: CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028 (USD MILLION)

- TABLE 107 FRANCE: CONNECTED SHIP MARKET, BY FIT, 2019-2022 (USD MILLION)

- TABLE 108 FRANCE: CONNECTED SHIP MARKET, BY FIT, 2023-2028 (USD MILLION)

- TABLE 109 FRANCE: CONNECTED SHIP MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 110 FRANCE: CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.3.8 REST OF EUROPE

- TABLE 111 REST OF EUROPE: CONNECTED SHIP MARKET, BY INSTALLATION, 2019-2022 (USD MILLION)

- TABLE 112 REST OF EUROPE: CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028 (USD MILLION)

- TABLE 113 REST OF EUROPE: CONNECTED SHIP MARKET, BY FIT, 2019-2022 (USD MILLION)

- TABLE 114 REST OF EUROPE: CONNECTED SHIP MARKET, BY FIT, 2023-2028 (USD MILLION)

- TABLE 115 REST OF EUROPE: CONNECTED SHIP MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 116 REST OF EUROPE: CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4 ASIA PACIFIC

- 11.4.1 PESTLE ANALYSIS

- 11.4.2 RECESSION IMPACT ANALYSIS

- FIGURE 43 ASIA PACIFIC: NAVAL BUDGET TREND, BY COUNTRY, 2019-2022

- TABLE 117 ASIA PACIFIC: RECESSION IMPACT ANALYSIS

- FIGURE 44 ASIA PACIFIC: CONNECTED SHIP MARKET SNAPSHOT

- TABLE 118 ASIA PACIFIC: CONNECTED SHIP MARKET, BY FIT, 2019-2022 (USD MILLION)

- TABLE 119 ASIA PACIFIC: CONNECTED SHIP MARKET, BY FIT, 2023-2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: CONNECTED SHIP MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 121 ASIA PACIFIC: CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: CONNECTED SHIP MARKET, BY INSTALLATION, 2019-2022 (USD MILLION)

- TABLE 123 ASIA PACIFIC: CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: CONNECTED SHIP MARKET, BY ONBOARD SYSTEM, 2019-2022 (USD MILLION)

- TABLE 125 ASIA PACIFIC: CONNECTED SHIP MARKET, BY ONBOARD SYSTEM, 2023-2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: CONNECTED SHIP MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 127 ASIA PACIFIC: CONNECTED SHIP MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.4.3 CHINA

- 11.4.3.1 Expanding domestic ship production to drive growth

- TABLE 128 CHINA: CONNECTED SHIP MARKET, BY INSTALLATION, 2019-2022 (USD MILLION)

- TABLE 129 CHINA: CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028 (USD MILLION)

- TABLE 130 CHINA: CONNECTED SHIP MARKET, BY FIT, 2019-2022 (USD MILLION)

- TABLE 131 CHINA: CONNECTED SHIP MARKET, BY FIT, 2023-2028 (USD MILLION)

- TABLE 132 CHINA: CONNECTED SHIP MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 133 CHINA: CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Increasing adoption of connected ship systems by domestic shipbuilders to drive growth

- TABLE 134 SOUTH KOREA: CONNECTED SHIP MARKET, BY INSTALLATION, 2019-2022 (USD MILLION)

- TABLE 135 SOUTH KOREA: CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028 (USD MILLION)

- TABLE 136 SOUTH KOREA: CONNECTED SHIP MARKET, BY FIT, 2019-2022 (USD MILLION)

- TABLE 137 SOUTH KOREA: CONNECTED SHIP MARKET, BY FIT, 2023-2028 (USD MILLION)

- TABLE 138 SOUTH KOREA: CONNECTED SHIP MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 139 SOUTH KOREA: CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.5 JAPAN

- 11.4.5.1 Government investments in maritime industry to drive growth

- TABLE 140 JAPAN: CONNECTED SHIP MARKET, BY INSTALLATION, 2019-2022 (USD MILLION)

- TABLE 141 JAPAN: CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028 (USD MILLION)

- TABLE 142 JAPAN: CONNECTED SHIP MARKET, BY FIT, 2019-2022 (USD MILLION)

- TABLE 143 JAPAN: CONNECTED SHIP MARKET, BY FIT, 2023-2028 (USD MILLION)

- TABLE 144 JAPAN: CONNECTED SHIP MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 145 JAPAN: CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.6 INDIA

- 11.4.6.1 Rapid development of naval ship components to drive growth

- TABLE 146 INDIA: CONNECTED SHIP MARKET, BY INSTALLATION, 2019-2022 (USD MILLION)

- TABLE 147 INDIA: CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028 (USD MILLION)

- TABLE 148 INDIA: CONNECTED SHIP MARKET, BY FIT, 2019-2022 (USD MILLION)

- TABLE 149 INDIA: CONNECTED SHIP MARKET, BY FIT, 2023-2028 (USD MILLION)

- TABLE 150 INDIA: CONNECTED SHIP MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 151 INDIA: CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.7 AUSTRALIA

- 11.4.7.1 Rising demand for maritime safety to drive growth

- TABLE 152 AUSTRALIA: CONNECTED SHIP MARKET, BY INSTALLATION, 2019-2022 (USD MILLION)

- TABLE 153 AUSTRALIA: CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028 (USD MILLION)

- TABLE 154 AUSTRALIA: CONNECTED SHIP MARKET, BY FIT, 2019-2022 (USD MILLION)

- TABLE 155 AUSTRALIA: CONNECTED SHIP MARKET, BY FIT, 2023-2028 (USD MILLION)

- TABLE 156 AUSTRALIA: CONNECTED SHIP MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 157 AUSTRALIA: CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.4.8 REST OF ASIA PACIFIC

- TABLE 158 REST OF ASIA PACIFIC: CONNECTED SHIP MARKET, BY INSTALLATION, 2019-2022 (USD MILLION)

- TABLE 159 REST OF ASIA PACIFIC: CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028 (USD MILLION)

- TABLE 160 REST OF ASIA PACIFIC: CONNECTED SHIP MARKET, BY FIT, 2019-2022 (USD MILLION)

- TABLE 161 REST OF ASIA PACIFIC: CONNECTED SHIP MARKET, BY FIT, 2023-2028 (USD MILLION)

- TABLE 162 REST OF ASIA PACIFIC: CONNECTED SHIP MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 163 REST OF ASIA PACIFIC: CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5 REST OF THE WORLD

- 11.5.1 PESTLE ANALYSIS

- 11.5.2 RECESSION IMPACT ANALYSIS

- FIGURE 45 REST OF THE WORLD: NAVAL BUDGET TREND, BY COUNTRY, 2019-2022

- TABLE 164 REST OF THE WORLD: RECESSION IMPACT ANALYSIS

- FIGURE 46 REST OF THE WORLD: CONNECTED SHIP MARKET SNAPSHOT

- TABLE 165 REST OF THE WORLD: CONNECTED SHIP MARKET, BY FIT, 2019-2022 (USD MILLION)

- TABLE 166 REST OF THE WORLD: CONNECTED SHIP MARKET, BY FIT, 2023-2028 (USD MILLION)

- TABLE 167 REST OF THE WORLD: CONNECTED SHIP MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 168 REST OF THE WORLD: CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 169 REST OF THE WORLD: CONNECTED SHIP MARKET, BY INSTALLATION, 2019-2022 (USD MILLION)

- TABLE 170 REST OF THE WORLD: CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028 (USD MILLION)

- TABLE 171 REST OF THE WORLD: CONNECTED SHIP MARKET, BY ONBOARD SYSTEM, 2019-2022 (USD MILLION)

- TABLE 172 REST OF THE WORLD: CONNECTED SHIP MARKET, BY ONBOARD SYSTEM, 2023-2028 (USD MILLION)

- TABLE 173 REST OF THE WORLD: CONNECTED SHIP MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 174 REST OF THE WORLD: CONNECTED SHIP MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.5.3 MIDDLE EAST & AFRICA

- 11.5.3.1 National shipbuilding companies to drive growth

- TABLE 175 MIDDLE EAST & AFRICA: CONNECTED SHIP MARKET, BY INSTALLATION, 2019-2022 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: CONNECTED SHIP MARKET, BY FIT, 2019-2022 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: CONNECTED SHIP MARKET, BY FIT, 2023-2028 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: CONNECTED SHIP MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 11.5.4 LATIN AMERICA

- 11.5.4.1 Development of smart ports to drive growth

- TABLE 181 LATIN AMERICA: CONNECTED SHIP MARKET, BY INSTALLATION, 2019-2022 (USD MILLION)

- TABLE 182 LATIN AMERICA: CONNECTED SHIP MARKET, BY INSTALLATION, 2023-2028 (USD MILLION)

- TABLE 183 LATIN AMERICA: CONNECTED SHIP MARKET, BY FIT, 2019-2022 (USD MILLION)

- TABLE 184 LATIN AMERICA: CONNECTED SHIP MARKET, BY FIT, 2023-2028 (USD MILLION)

- TABLE 185 LATIN AMERICA: CONNECTED SHIP MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 186 LATIN AMERICA: CONNECTED SHIP MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 MARKET SHARE ANALYSIS, 2022

- TABLE 187 CONNECTED SHIP MARKET: DEGREE OF COMPETITION

- FIGURE 47 MARKET SHARE OF KEY PLAYERS, 2022

- 12.3 RANKING ANALYSIS, 2022

- FIGURE 48 MARKET RANKING OF KEY PLAYERS, 2022

- 12.4 REVENUE ANALYSIS, 2022

- 12.5 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 188 STRATEGIES ADOPTED BY KEY PLAYERS IN CONNECTED SHIP MARKET, 2019-2023

- 12.6 COMPANY EVALUATION MATRIX

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- FIGURE 49 COMPANY EVALUATION MATRIX, 2022

- 12.7 COMPETITIVE BENCHMARKING

- TABLE 189 SOLUTION FOOTPRINT

- TABLE 190 REGION FOOTPRINT

- 12.8 START-UP/SME EVALUATION MATRIX

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 STARTING BLOCKS

- 12.8.4 DYNAMIC COMPANIES

- TABLE 191 KEY START-UPS/SMES

- FIGURE 50 START-UP/SME EVALUATION MATRIX, 2022

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 MARKET EVALUATION FRAMEWORK

- 12.9.2 PRODUCT LAUNCHES

- TABLE 192 PRODUCT LAUNCHES, 2019-2023

- 12.9.3 DEALS

- TABLE 193 DEALS, 2019-2023

13 COMPANY PROFILES

(Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 13.1 KEY PLAYERS

- FIGURE 51 SNAPSHOT OF KEY MARKET PARTICIPANTS

- 13.1.1 ABB

- TABLE 194 ABB: COMPANY OVERVIEW

- FIGURE 52 ABB: COMPANY SNAPSHOT

- TABLE 195 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 196 ABB: PRODUCT LAUNCHES

- TABLE 197 ABB: DEALS

- 13.1.2 EMERSON ELECTRIC CO.

- TABLE 198 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- FIGURE 53 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- TABLE 199 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 200 EMERSON ELECTRIC CO.: PRODUCT LAUNCHES

- TABLE 201 EMERSON ELECTRIC CO.: DEALS

- 13.1.3 KONGSBERG GRUPPEN ASA

- TABLE 202 KONGSBERG GRUPPEN ASA : COMPANY OVERVIEW

- FIGURE 54 KONGSBERG GRUPPEN ASA: COMPANY SNAPSHOT

- TABLE 203 KONGSBERG GRUPPEN ASA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 KONGSBERG GRUPPEN ASA: PRODUCT LAUNCHES

- TABLE 205 KONGSBERG GRUPPEN ASA: DEALS

- 13.1.4 WARTSILA

- TABLE 206 WARTSILA: COMPANY OVERVIEW

- FIGURE 55 WARTSILA: COMPANY SNAPSHOT

- TABLE 207 WARTSILA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 208 WARTSILA: PRODUCT LAUNCHES

- TABLE 209 WARTSILA: DEALS

- 13.1.5 THALES GROUP

- TABLE 210 THALES GROUP: COMPANY OVERVIEW

- FIGURE 56 THALES GROUP: COMPANY SNAPSHOT

- TABLE 211 THALES GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 212 THALES GROUP: PRODUCT LAUNCHES

- TABLE 213 THALES GROUP: DEALS

- 13.1.6 GENERAL ELECTRIC

- TABLE 214 GENERAL ELECTRIC: COMPANY OVERVIEW

- FIGURE 57 GENERAL ELECTRIC: COMPANY SNAPSHOT

- TABLE 215 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 GENERAL ELECTRIC: PRODUCT LAUNCHES

- TABLE 217 GENERAL ELECTRIC: DEALS

- 13.1.7 NORTHROP GRUMMAN CORPORATION

- TABLE 218 NORTHROP GRUMMAN CORPORATION: COMPANY OVERVIEW

- FIGURE 58 NORTHROP GRUMMAN CORPORATION: COMPANY SNAPSHOT

- TABLE 219 NORTHROP GRUMMAN CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 220 NORTHROP GRUMMAN CORPORATION: PRODUCT LAUNCHES

- TABLE 221 NORTHROP GRUMMAN CORPORATION: DEALS

- 13.1.8 L3HARRIS TECHNOLOGIES, INC.

- TABLE 222 L3HARRIS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- FIGURE 59 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

- TABLE 223 L3HARRIS TECHNOLOGIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 224 L3HARRIS TECHNOLOGIES, INC.: PRODUCT LAUNCHES

- TABLE 225 L3HARRIS TECHNOLOGIES, INC.: DEALS

- 13.1.9 HYUNDAI HEAVY INDUSTRIES

- TABLE 226 HYUNDAI HEAVY INDUSTRIES: COMPANY OVERVIEW

- FIGURE 60 HYUNDAI HEAVY INDUSTRIES: COMPANY SNAPSHOT

- TABLE 227 HYUNDAI HEAVY INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 228 HYUNDAI HEAVY INDUSTRIES: PRODUCT LAUNCHES

- TABLE 229 HYUNDAI HEAVY INDUSTRIES: DEALS

- 13.1.10 JASON MARINE GROUP

- TABLE 230 JASON MARINE GROUP: COMPANY OVERVIEW

- FIGURE 61 JASON MARINE GROUP: COMPANY SNAPSHOT

- TABLE 231 JASON MARINE GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.11 MARLINK

- TABLE 232 MARLINK: COMPANY OVERVIEW

- TABLE 233 MARLINK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 MARLINK: PRODUCT LAUNCHES

- TABLE 235 MARLINK: DEALS

- 13.1.12 RH MARINE

- TABLE 236 RH MARINE: COMPANY OVERVIEW

- TABLE 237 RH MARINE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 RH MARINE: PRODUCT LAUNCHES

- TABLE 239 RH MARINE: DEALS

- 13.1.13 ROCKWELL AUTOMATION

- TABLE 240 ROCKWELL AUTOMATION: COMPANY OVERVIEW

- FIGURE 62 ROCKWELL AUTOMATION: COMPANY SNAPSHOT

- TABLE 241 ROCKWELL AUTOMATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 ROCKWELL AUTOMATION: PRODUCT LAUNCHES

- 13.1.14 SCHNEIDER ELECTRIC

- TABLE 243 SCHNEIDER ELECTRIC: COMPANY OVERVIEW

- FIGURE 63 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 244 SCHNEIDER ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 SCHNEIDER ELECTRIC: PRODUCT LAUNCHES

- TABLE 246 SCHNEIDER ELECTRIC: DEALS

- 13.1.15 SIEMENS

- TABLE 247 SIEMENS: COMPANY OVERVIEW

- FIGURE 64 SIEMENS: COMPANY SNAPSHOT

- TABLE 248 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 249 SIEMENS: PRODUCT LAUNCHES

- TABLE 250 SIEMENS: DEALS

- 13.1.16 ULSTEIN

- TABLE 251 ULSTEIN: COMPANY OVERVIEW

- TABLE 252 ULSTEIN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 253 ULSTEIN: PRODUCT LAUNCHES

- TABLE 254 ULSTEIN: DEALS

- 13.1.17 VALMET

- TABLE 255 VALMET: COMPANY OVERVIEW

- FIGURE 65 VALMET: COMPANY SNAPSHOT

- TABLE 256 VALMET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 257 VALMET: PRODUCT LAUNCHES

- TABLE 258 VALMET: DEALS

- 13.1.18 SAAB AB

- TABLE 259 SAAB AB: COMPANY OVERVIEW

- FIGURE 66 SAAB AB: COMPANY SNAPSHOT

- TABLE 260 SAAB AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 SAAB AB: PRODUCT LAUNCHES

- TABLE 262 SAAB AB: DEALS

- 13.1.19 ST ENGINEERING

- TABLE 263 ST ENGINEERING: COMPANY OVERVIEW

- FIGURE 67 ST ENGINEERING: COMPANY SNAPSHOT

- TABLE 264 ST ENGINEERING: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 265 ST ENGINEERING: PRODUCT LAUNCHES

- TABLE 266 ST ENGINEERING: DEALS

- 13.1.20 HUNTINGTON INGALLS INDUSTRIES

- TABLE 267 HUNTINGTON INGALLS INDUSTRIES: COMPANY OVERVIEW

- FIGURE 68 HUNTINGTON INGALLS INDUSTRIES: COMPANY SNAPSHOT

- TABLE 268 HUNTINGTON INGALLS INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 269 HUNTINGTON INGALLS INDUSTRIES: PRODUCT LAUNCHES

- TABLE 270 HUNTINGTON INGALLS INDUSTRIES: DEALS

- 13.1.21 HANWHA SYSTEMS

- TABLE 271 HANWHA SYSTEMS: COMPANY OVERVIEW

- FIGURE 69 HANWHA SYSTEMS: COMPANY SNAPSHOT

- TABLE 272 HANWHA SYSTEMS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 HANWHA SYSTEMS: PRODUCT LAUNCHES

- TABLE 274 HANWHA SYSTEMS: DEALS

- 13.1.22 FURUNO ELECTRIC CO. LTD.

- TABLE 275 FURUNO ELECTRIC CO. LTD.: COMPANY OVERVIEW

- FIGURE 70 FURUNO ELECTRIC CO. LTD.: COMPANY SNAPSHOT

- TABLE 276 FURUNO ELECTRIC CO. LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 277 FURUNO ELECTRIC CO. LTD.: PRODUCT LAUNCHES

- TABLE 278 FURUNO ELECTRIC CO. LTD.: DEALS

- 13.1.23 ROLLS ROYCE PLC

- TABLE 279 ROLLS ROYCE PLC: COMPANY OVERVIEW

- FIGURE 71 ROLLS ROYCE PLC: COMPANY SNAPSHOT

- TABLE 280 ROLLS ROYCE PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 ROLLS ROYCE PLC: PRODUCT LAUNCHES

- TABLE 282 ROLLS ROYCE PLC: DEALS

- 13.1.24 GARMIN INTERNATIONAL

- TABLE 283 GARMIN INTERNATIONAL: COMPANY OVERVIEW

- FIGURE 72 GARMIN INTERNATIONAL: COMPANY SNAPSHOT

- TABLE 284 GARMIN INTERNATIONAL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 GARMIN INTERNATIONAL: PRODUCT LAUNCHES

- TABLE 286 GARMIN INTERNATIONAL: DEALS

- 13.2 OTHER PLAYERS

- 13.2.1 IRIDIUM

- 13.2.2 INMARSAT

- 13.2.3 INTELSAT

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 APPENDIX

- 14.1 INTRODUCTION

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS