|

|

市場調査レポート

商品コード

1336047

解乳化剤の世界市場:タイプ別、配合別、用途別、地域別 - 2028年までの予測Demulsifier Market by Type Application & Region Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 解乳化剤の世界市場:タイプ別、配合別、用途別、地域別 - 2028年までの予測 |

|

出版日: 2023年08月15日

発行: MarketsandMarkets

ページ情報: 英文 227 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

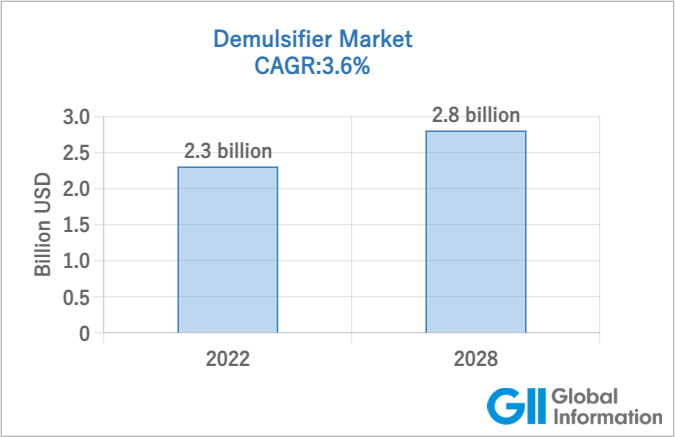

解乳化剤市場は3.6%のCAGRで拡大し、2022年の23億米ドルから2028年には28億米ドルに成長すると予測されています。

オフショア石油・ガス探査活動の拡大が、同市場における解乳化剤の需要を促進すると予想されます。オフショア生産活動は、極端な温度、高圧、塩分濃度の上昇など、厳しい環境と過酷な運転条件によって特徴付けられます。これらの条件はすべて、分離が困難な安定した油水エマルションの形成を頻繁にもたらします。解乳化剤は、このようなエマルジョンを破壊し、水と油の効率的な分離を促進する上で重要な役割を果たしています。

陸上と海洋の両方で石油を抽出する作業は、乳化の難しさを抱えています。オフショアプラットフォームでは、貯留層圧力維持のための水注入プロセスにより、水と油の比率が高くなることが多いです。陸上での操業では、エマルジョンを管理するために油溶性の解乳化剤が使用されます。抽出された原油の品質は、その市場価値に影響します。油溶性解乳化剤を使用した効率的な分離は、より高品質の原油を生産するのに役立ち、これは世界市場においてより望ましいものとなります。

石油精製における解乳化剤の需要は、原油と原料の処理段階でエマルジョンを効果的に分離する必要性によってもたらされます。生産性の向上、生産の最適化、製品品質の改善、運転コストの削減、環境要件の遵守のため、石油精製所には解乳化剤が必要です。製油所がより高い性能と持続可能性を求めて努力を続ける中、効果的な脱乳化ソリューションへのニーズは依然として高いままです。

この地域は石油・ガス産業に大きく関与しており、堅調な石油・精製部門も北米の解乳化剤ニーズに影響を与えています。北米の大規模な石油・ガス生産、最先端技術の採用、精製・石油部門、規制環境、市場競争はすべて、北米の解乳化剤需要に寄与しています。エネルギー情勢が進化し、持続可能性がより重要になるにつれ、効率的な脱乳化ソリューションの必要性は、この地域の石油・ガス事業において引き続き重要な要素となっています。

当レポートでは、世界の解乳化剤市場について調査し、タイプ別、配合別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- ポーターのファイブフォース分析

- マクロ経済指標

第6章 業界の動向

- サプライチェーン分析

- 顧客のビジネスに影響を与える動向と混乱

- 生態系

- ケーススタディ分析

- 技術分析

- 主要な利害関係者と購入基準

- 価格分析

- 貿易分析

- 規制状況

- 2023年~2024年の主要な会議とイベント

- 特許分析

第7章 解乳化剤市場、タイプ別

- イントロダクション

- 油溶性解乳化剤と水溶性解乳化剤の比較

- 油溶性解乳化剤

- 水溶性解乳化剤

第8章 解乳化剤市場、配合別

- イントロダクション

- 解乳化剤、界面活性剤

- 解乳化剤配合物

第9章 解乳化剤市場、用途別

- イントロダクション

- 原油

- 石油精製所

- 潤滑剤の製造

- 石油ベースの発電所

- スラッジ油処理

- その他

第10章 解乳化剤市場、地域別

- イントロダクション

- 中東

- 北米

- 欧州

- アジア太平洋

- アフリカ

- 南米

第11章 競合情勢

- イントロダクション

- 主要参入企業が採用した戦略

- 主要な市場参入企業のランキング

- 市場シェア分析

- 主要企業の過去の収益分析

- 企業の製品フットプリント分析

- 企業評価マトリックス(Tier 1)

- 競合ベンチマーキング

- スタートアップ/中小企業の評価マトリックス

- 競合状況・動向

第12章 企業プロファイル

- 主要参入企業

- BAKER HUGHES COMPANY

- CLARIANT AG

- ECOLAB INC.

- HALLIBURTON COMPANY

- SCHLUMBERGER LIMITED

- NOURYON

- BASF SE

- DOW INC.

- ARKEMA S.A.

- MOMENTIVE PERFORMANCE MATERIALS INC.

- その他の企業

- RIMPRO INDIA

- CARGILL INC.

- DORF KETAL

- NOVA STAR LP

- INNOSPEC INC.

- REDA OILFIELD

- ROEMEX LIMITED

- COCHRAN CHEMICAL COMPANY INC.

- SI GROUP INC.

- MCC CHEMICALS INC

- OIL TECHNICS HOLDINGS LTD.

- CHEMIPHASE LTD

- NATIONAL CHEMICAL & PETROLEUM INDUSTRIES CO. W.L.L.(NCPI)

- EGYPTIAN MUD ENGINEERING AND CHEMICALS COMPANY(EMEC)

- IMPERIAL OILFIELD CHEMICALS PVT.LTD.

第13章 隣接市場および関連市場

第14章 付録

In terms of value, the demulsifier market is estimated to grow from USD 2.3 billion in 2022 to USD 2.8 billion by 2028, at a CAGR of 3.6%. The expansion of offshore oil & gas exploration activities expected to drive the demand for demulsifier in the market. Offshore production operations are characterized by challenging environments and harsh operating conditions, such as extreme temperatures, high pressures, and elevated salinity levels. All these conditions frequently result in the formation of stable oil-water emulsions which is difficult to separate. Demulsifier play a crucial role in breaking these emulsions and facilitating the efficient separation of water from oil.

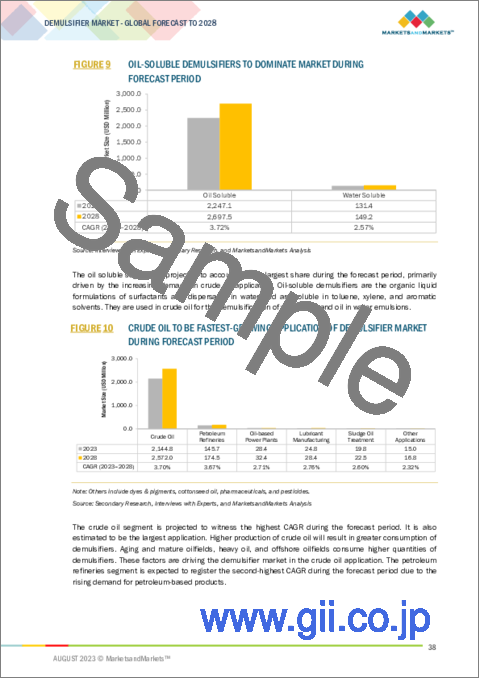

"Oil soluble is expected to be the fastest-growing type of the demulsifier market, in terms of value, during the forecast period."

Operations for extracting oil both onshore and offshore have emulsion difficulties. Offshore platforms often deal with a higher water-to-oil ratio due to water injection processes for reservoir pressure maintenance. Onshore operations also benefit from oil-soluble demulsifier to manage emulsions. The quality of extracted crude oil impacts its market value. Efficient separation using oil-soluble demulsifier helps produce higher-quality crude oil, which is more desirable in global markets.

"Petroleum refineries is expected to be the second largest application of demulsifier market, in terms of value, in 2022."

The demand for demulsifier in petroleum refineries is driven by the need to effectively separate emulsions in the crude oil and feedstock processing stages. In order to increase productivity, optimise production, improve product quality, lower operating costs, and adhere to environmental requirements, petroleum refineries need demulsifier. As refineries continue to strive for higher performance and sustainability, the need for effective demulsification solutions remains strong.

"North America is projected to be the fastest growing region, in terms of value, during the forecast period in the demulsifier market."

The region's major involvement in the oil and gas industry, as well as its robust petroleum and refining sectors, have an impact on the need for demulsifier in North America. North America's large oil and gas production, adoption of cutting-edge technologies, refining and petroleum sectors, regulatory environment, and market competition all contribute to the demand for demulsifier in North America. As the energy landscape evolves and sustainability becomes more important, the need for efficient demulsification solutions remains a critical factor in the region's oil and gas operations.

- By Company Type: Tier 1 - 69%, Tier 2 - 23%, and Tier 3 - 8%

- By Designation: C-Level - 23%, Director Level - 37%, and Others - 40%

- By Region: North America - 32%, Europe - 21%, Asia Pacific - 28%, Middle East & Africa - 12%, South America - 7%

The key players profiled in the report include Baker Hughes (US), Clariant AG (Switzerland), Ecolab Inc. (US), Hallinburton Company (US), Schlumberger Limited (US), Nouryon (Netherlands), BASF SE (Gemany), Dow Inc. (US), Arkema S.A. (France), and Momentive Performance Materials Inc. (US).

Research Coverage

This report segments the market for demulsifier based on type, application, and region and provides estimations of volume (unit) and value (USD thousand) for the overall market size across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, services, key strategies, associated with the market for demulsifier.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the semulsifier market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on demulsifier offered by top players in the global market

- Analysis of key drives: (Increasing oil & gas production, expansion of offshore oil & gas production), restraints (stringent environmental regulations, volatility in crude oil prices), opportunities (growing demand for bio-based demulsifier, growing focus on sustainable and eco friendly solution), and challenges (complex emulsion characteristics, technological advancements and competitors innovation) influencing the growth of demulsifier market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the demulsifier market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for demulsifier across regions

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global demulsifier market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the demulsifier market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 DEMULSIFIER MARKET: INCLUSIONS AND EXCLUSIONS

- 1.2.2 DEMULSIFIER MARKET: DEFINITION AND INCLUSIONS, BY TYPE

- 1.2.3 DEMULSIFIER MARKET: DEFINITION AND INCLUSIONS, BY APPLICATION

- 1.3 MARKET SCOPE

- 1.3.1 DEMULSIFIER MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 DEMULSIFIER MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews - demand and supply sides

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- FIGURE 2 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): COLLECTIVE SHARE OF TOP PLAYERS

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): COLLECTIVE REVENUE OF ALL TYPES OF DEMULSIFIER

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIDE)

- 2.2.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4 - TOP DOWN

- 2.3 DATA TRIANGULATION

- FIGURE 6 DEMULSIFIER MARKET: DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY SIDE

- FIGURE 7 SUPPLY-SIDE MARKET CAGR PROJECTIONS

- 2.4.2 DEMAND SIDE

- FIGURE 8 DEMAND-SIDE MARKET GROWTH PROJECTIONS: DRIVERS AND OPPORTUNITIES

- 2.4.3 ASSUMPTIONS

- 2.5 RECESSION IMPACT

- 2.6 LIMITATIONS

- 2.7 RISK ASSESSMENT

- TABLE 1 DEMULSIFIER MARKET: RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 9 OIL-SOLUBLE DEMULSIFIERS TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 10 CRUDE OIL TO BE FASTEST-GROWING APPLICATION OF DEMULSIFIER MARKET DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICA TO BE FASTEST-GROWING MARKET FOR DEMULSIFIER DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DEMULSIFIER MARKET

- FIGURE 12 MIDDLE EAST TO LEAD DEMULSIFIER MARKET DURING FORECAST PERIOD

- 4.2 DEMULSIFIER MARKET, BY REGION

- FIGURE 13 NORTH AMERICA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 MIDDLE EAST: DEMULSIFIER MARKET, BY APPLICATION AND COUNTRY, 2022

- FIGURE 14 CRUDE OIL SEGMENT AND SAUDI ARABIA ACCOUNTED FOR LARGEST SHARES IN 2022

- 4.4 DEMULSIFIER MARKET, REGION VS. APPLICATION

- FIGURE 15 CRUDE OIL DOMINATED DEMULSIFIER MARKET ACROSS REGIONS

- 4.5 DEMULSIFIER MARKET, BY COUNTRY

- FIGURE 16 IRAQ TO REGISTER HIGHEST CAGR BETWEEN 2023 AND 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing oil & gas production

- 5.2.1.2 Expansion of offshore oil & gas exploration

- 5.2.2 RESTRAINTS

- 5.2.2.1 Stringent environmental regulations

- 5.2.2.2 Volatility in crude oil prices

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for bio-based demulsifiers

- 5.2.3.2 Rising focus on sustainable and eco-friendly solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Complex emulsion characteristics

- 5.2.4.2 Technological advancements and innovations

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 PORTER'S FIVE FORCES ANALYSIS: DEMULSIFIER MARKET

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 2 DEMULSIFIER MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 MACROECONOMIC INDICATORS

- 5.4.1 GDP TRENDS AND FORECAST

- TABLE 3 GDP TRENDS AND FORECAST, BY MAJOR ECONOMY, 2021-2028 (USD BILLION)

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- FIGURE 19 DEMULSIFIER MARKET: SUPPLY CHAIN

- 6.1.1 RAW MATERIALS

- 6.1.2 MANUFACTURERS

- 6.1.3 DISTRIBUTORS

- 6.2 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 20 REVENUE SHIFT & NEW REVENUE POCKETS FOR DEMULSIFIER MARKET

- 6.3 ECOSYSTEM

- FIGURE 21 DEMULSIFIER MARKET: ECOSYSTEM

- TABLE 4 DEMULSIFIER MARKET: ECOSYSTEM

- 6.4 CASE STUDY ANALYSIS

- 6.4.1 EFFECTIVE DEMULSIFIERS IMPROVE CRUDE QUALITY AND REDUCE BACKPRESSURE

- 6.4.2 IMPROVED WATER QUALITY AND REDUCED DOSAGE WITH DEMULSIFIER IN NORTH SEA

- 6.4.3 TRETOLITE CLEAR REDUCES OIL IN INJECTION WATER AND INCREASES ANNUAL REVENUE

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 CLARIANT OIL SERVICES INTRODUCES PHASETREAT WET FOR ENHANCED DEMULSIFICATION EFFICIENCY

- 6.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS (%)

- 6.6.2 BUYING CRITERIA

- FIGURE 23 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- 6.7 PRICING ANALYSIS

- 6.7.1 AVERAGE SELLING PRICE, BY APPLICATION

- FIGURE 24 AVERAGE SELLING PRICES BY KEY PLAYERS FOR TOP THREE APPLICATIONS

- TABLE 7 AVERAGE SELLING PRICES BY KEY PLAYERS FOR TOP THREE APPLICATIONS (USD/KG)

- 6.7.2 AVERAGE SELLING PRICE, BY REGION

- FIGURE 25 AVERAGE SELLING PRICE OF DEMULSIFIERS, BY REGION, 2021-2028

- TABLE 8 AVERAGE SELLING PRICES OF DEMULSIFIERS, BY REGION, 2021-2028 (USD/KG)

- 6.8 TRADE ANALYSIS

- 6.8.1 IMPORT SCENARIO

- FIGURE 26 DEMULSIFIERS IMPORTS, BY KEY COUNTRY, 2013-2022

- TABLE 9 DEMULSIFIERS IMPORTS, BY REGION, 2013-2022 (USD MILLION)

- 6.8.2 EXPORT SCENARIO

- FIGURE 27 DEMULSIFIERS EXPORTS, BY KEY COUNTRY, 2013-2022

- TABLE 10 DEMULSIFIERS EXPORTS, BY REGION, 2013-2022 (USD MILLION)

- 6.9 REGULATORY LANDSCAPE

- 6.9.1 REGULATIONS RELATED TO DEMULSIFIER MARKET

- 6.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 11 DEMULSIFIER MARKET: KEY CONFERENCES AND EVENTS, 2023-2024

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPES

- TABLE 12 DEMULSIFIER MARKET: GLOBAL PATENTS

- FIGURE 28 PATENTS REGISTERED IN DEMULSIFIER MARKET, 2013-2023

- FIGURE 29 PATENT PUBLICATION TRENDS, 2013-2022

- FIGURE 30 LEGAL STATUS OF PATENTS FILED IN DEMULSIFIER MARKET

- 6.11.3 JURISDICTION ANALYSIS

- FIGURE 31 MAXIMUM PATENTS FILED IN JURISDICTION OF US

7 DEMULSIFIER MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 COMPARISON BETWEEN OIL-SOLUBLE AND WATER-SOLUBLE DEMULSIFIER

- FIGURE 32 OIL SOLUBLE SEGMENT TO DOMINATE DEMULSIFIER MARKET DURING FORECAST PERIOD

- TABLE 13 DEMULSIFIER MARKET, BY TYPE, 2018-2021 (TON)

- TABLE 14 DEMULSIFIER MARKET, BY TYPE, 2022-2028 (TON)

- TABLE 15 DEMULSIFIER MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 16 DEMULSIFIER MARKET, BY TYPE, 2022-2028 (USD MILLION)

- 7.3 OIL-SOLUBLE DEMULSIFIER

- 7.3.1 WIDE USE OF ORGANIC LIQUID FORMULATIONS TO DRIVE MARKET

- 7.4 WATER-SOLUBLE DEMULSIFIER

- 7.4.1 SOLUBLE IN CRUDE OIL AND ORGANIC SOLVENTS TO DRIVE MARKET

8 DEMULSIFIER MARKET, BY FORMULATION

- 8.1 INTRODUCTION

- TABLE 17 FORMULATION TYPES OF DEMULSIFIER

- 8.2 DEMULSIFIER, BY TYPE OF SURFACTANT

- 8.2.1 ANIONIC DEMULSIFIER

- 8.2.2 NONIONIC DEMULSIFIER

- 8.2.3 AMPHOTERIC DEMULSIFIER

- 8.2.4 CATIONIC DEMULSIFIER

- 8.3 DEMULSIFIER FORMULATIONS

- 8.3.1 OXYALKYLATED PHENOLIC RESINS

- 8.3.2 POLYMERIZED POLYOLS

- 8.3.3 POLYALKYLENE GLYCOLS

- 8.3.4 POLYOLS ESTERS

- 8.3.5 RESIN ESTERS

- 8.3.6 SULFONATES

- 8.3.7 EO/PO BLOCK POLYMERS

- 8.3.8 POLYAMINES

- 8.3.9 POLYMERIC ELASTOMERS

9 DEMULSIFIER MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- TABLE 18 DEMULSIFIER USED IN OILFIELD

- FIGURE 33 CRUDE OIL SEGMENT TO DOMINATE DEMULSIFIER MARKET DURING FORECAST PERIOD

- TABLE 19 DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 20 DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 21 DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 22 DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 9.2 CRUDE OIL

- 9.2.1 INCREASING CRUDE OIL PRODUCTION TO DRIVE MARKET

- TABLE 23 DEMULSIFIER MARKET IN CRUDE OIL, BY REGION, 2018-2021 (TON)

- TABLE 24 DEMULSIFIER MARKET IN CRUDE OIL, BY REGION, 2022-2028 (TON)

- TABLE 25 DEMULSIFIER MARKET IN CRUDE OIL, BY REGION, 2018-2021 (USD MILLION)

- TABLE 26 DEMULSIFIER MARKET IN CRUDE OIL, BY REGION, 2022-2028 (USD MILLION)

- 9.3 PETROLEUM REFINERIES

- 9.3.1 INCREASING OIL REFINERY CAPACITIES TO DRIVE DEMAND

- TABLE 27 DEMULSIFIER MARKET IN PETROLEUM REFINERIES, BY REGION, 2018-2021 (TON)

- TABLE 28 DEMULSIFIER MARKET IN PETROLEUM REFINERIES, BY REGION, 2022-2028 (TON)

- TABLE 29 DEMULSIFIER MARKET IN PETROLEUM REFINERIES, BY REGION, 2018-2021 (USD MILLION)

- TABLE 30 DEMULSIFIER MARKET IN PETROLEUM REFINERIES, BY REGION, 2022-2028 (USD MILLION)

- 9.4 LUBRICANT MANUFACTURING

- 9.4.1 OPPORTUNITIES IN INDUSTRIAL SECTOR TO DRIVE MARKET

- TABLE 31 DEMULSIFIER MARKET IN LUBRICANT MANUFACTURING, BY REGION, 2018-2021 (TON)

- TABLE 32 DEMULSIFIER MARKET IN LUBRICANT MANUFACTURING, BY REGION, 2022-2028 (TON)

- TABLE 33 DEMULSIFIER MARKET IN LUBRICANT MANUFACTURING, BY REGION, 2018-2021 (USD MILLION)

- TABLE 34 DEMULSIFIER MARKET IN LUBRICANT MANUFACTURING, BY REGION, 2022-2028 (USD MILLION)

- 9.5 OIL-BASED POWER PLANTS

- 9.5.1 INCREASE IN ENERGY DEMAND TO DRIVE MARKET

- TABLE 35 DEMULSIFIER MARKET IN OIL-BASED POWER PLANTS, BY REGION, 2018-2021 (TON)

- TABLE 36 DEMULSIFIER MARKET IN OIL-BASED POWER PLANTS, BY REGION, 2022-2028 (TON)

- TABLE 37 DEMULSIFIER MARKET IN OIL-BASED POWER PLANTS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 38 DEMULSIFIER MARKET IN OIL-BASED POWER PLANTS, BY REGION, 2022-2028 (USD MILLION)

- 9.6 SLUDGE OIL TREATMENT

- 9.6.1 INCREASING NEED OF SLUDGE OIL DISPOSAL TO DRIVE MARKET

- TABLE 39 DEMULSIFIER MARKET IN SLUDGE OIL TREATMENT, BY REGION, 2018-2021 (TON)

- TABLE 40 DEMULSIFIER MARKET IN SLUDGE OIL TREATMENT, BY REGION, 2022-2028 (TON)

- TABLE 41 DEMULSIFIER MARKET IN SLUDGE OIL TREATMENT, BY REGION, 2018-2021 (USD MILLION)

- TABLE 42 DEMULSIFIER MARKET IN SLUDGE OIL TREATMENT, BY REGION, 2022-2028 (USD MILLION)

- 9.7 OTHERS

- TABLE 43 DEMULSIFIER MARKET IN OTHER APPLICATIONS, BY REGION, 2018-2021 (TON)

- TABLE 44 DEMULSIFIER MARKET IN OTHER APPLICATIONS, BY REGION, 2022-2028 (TON)

- TABLE 45 DEMULSIFIER MARKET IN OTHER APPLICATIONS, BY REGION, 2018-2021 (USD MILLION)

- TABLE 46 DEMULSIFIER MARKET IN OTHER APPLICATIONS, BY REGION, 2022-2028 (USD MILLION)

10 DEMULSIFIER MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 34 MIDDLE EAST TO LEAD DEMULSIFIER MARKET DURING FORECAST PERIOD

- TABLE 47 DEMULSIFIER MARKET, BY REGION, 2018-2021 (TON)

- TABLE 48 DEMULSIFIER MARKET, BY REGION, 2022-2028 (TON)

- TABLE 49 DEMULSIFIER MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 50 DEMULSIFIER MARKET, BY REGION, 2022-2028 (USD MILLION)

- 10.2 MIDDLE EAST

- FIGURE 35 MIDDLE EAST: DEMULSIFIER MARKET SNAPSHOT

- 10.2.1 IMPACT OF RECESSION

- 10.2.2 MIDDLE EAST & AFRICA DEMULSIFIER MARKET, BY APPLICATION

- TABLE 51 MIDDLE EAST: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 52 MIDDLE EAST: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 53 MIDDLE EAST: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 54 MIDDLE EAST: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.2.3 MIDDLE EAST & AFRICA DEMULSIFIER MARKET, BY COUNTRY

- TABLE 55 MIDDLE EAST: DEMULSIFIER MARKET, BY COUNTRY, 2018-2021 (TON)

- TABLE 56 MIDDLE EAST: DEMULSIFIER MARKET, BY COUNTRY, 2022-2028 (TON)

- TABLE 57 MIDDLE EAST: DEMULSIFIER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 58 MIDDLE EAST: DEMULSIFIER MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 10.2.3.1 Saudi Arabia

- 10.2.3.1.1 Increasing crude oil production and vast oil reserves to drive market

- 10.2.3.1 Saudi Arabia

- TABLE 59 SAUDI ARABIA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 60 SAUDI ARABIA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 61 SAUDI ARABIA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 62 SAUDI ARABIA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD THOUSAND)

- 10.2.3.2 Iran

- 10.2.3.2.1 Increase in crude oil production as a result of Iranian oil export sanctions lifting to drive market

- 10.2.3.2 Iran

- TABLE 63 IRAN: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 64 IRAN: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 65 IRAN: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 66 IRAN: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD THOUSAND)

- 10.2.3.3 Iraq

- 10.2.3.3.1 Restructuring of oil & gas industry to drive market

- 10.2.3.3 Iraq

- TABLE 67 IRAQ: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 68 IRAQ: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 69 IRAQ: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 70 IRAQ: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD THOUSAND)

- 10.2.3.4 UAE

- 10.2.3.4.1 Plans to expand proven reserves to drive oil & gas industry

- 10.2.3.4 UAE

- TABLE 71 UAE: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 72 UAE: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 73 UAE: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 74 UAE: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD THOUSAND)

- 10.2.3.5 Kuwait

- 10.2.3.5.1 Implementation of EOR techniques and advanced technologies at heavy oilfields to drive market

- 10.2.3.5 Kuwait

- TABLE 75 KUWAIT: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 76 KUWAIT: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 77 KUWAIT: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 78 KUWAIT: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD THOUSAND)

- 10.3 NORTH AMERICA

- FIGURE 36 NORTH AMERICA: DEMULSIFIER MARKET SNAPSHOT

- 10.3.1 IMPACT OF RECESSION

- 10.3.2 NORTH AMERICA DEMULSIFIER MARKET, BY APPLICATION

- TABLE 79 NORTH AMERICA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 80 NORTH AMERICA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 81 NORTH AMERICA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 82 NORTH AMERICA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.3.3 NORTH AMERICA DEMULSIFIER MARKET, BY COUNTRY

- TABLE 83 NORTH AMERICA: DEMULSIFIER MARKET, BY COUNTRY, 2018-2021 (TON)

- TABLE 84 NORTH AMERICA: DEMULSIFIER MARKET, BY COUNTRY, 2022-2028 (TON)

- TABLE 85 NORTH AMERICA: DEMULSIFIER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 86 NORTH AMERICA: DEMULSIFIER MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 10.3.3.1 US

- 10.3.3.1.1 Low-cost and efficient oil extraction processes to drive oil & gas industry

- 10.3.3.1 US

- TABLE 87 US: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 88 US: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 89 US: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 90 US: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD THOUSAND)

- 10.3.3.2 Canada

- 10.3.3.2.1 Major onshore and offshore producer of crude oil to drive market

- 10.3.3.2 Canada

- TABLE 91 CANADA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 92 CANADA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 93 CANADA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 94 CANADA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD THOUSAND)

- 10.3.3.3 Mexico

- 10.3.3.3.1 Decent numbers of conventional onshore and offshore crude oil reserves to drive demand

- 10.3.3.3 Mexico

- TABLE 95 MEXICO: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 96 MEXICO: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 97 MEXICO: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 98 MEXICO: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD THOUSAND)

- 10.4 EUROPE

- FIGURE 37 EUROPE: DEMULSIFIER MARKET SNAPSHOT

- 10.4.1 IMPACT OF RECESSION

- 10.4.2 EUROPE DEMULSIFIER MARKET, BY APPLICATION

- TABLE 99 EUROPE: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 100 EUROPE: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 101 EUROPE: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 102 EUROPE: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.4.3 EUROPE DEMULSIFIER MARKET, BY COUNTRY

- TABLE 103 EUROPE: DEMULSIFIER MARKET, BY COUNTRY, 2018-2021 (TON)

- TABLE 104 EUROPE: DEMULSIFIER MARKET, BY COUNTRY, 2022-2028 (TON)

- TABLE 105 EUROPE: DEMULSIFIER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 106 EUROPE: DEMULSIFIER MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 10.4.3.1 Russia

- 10.4.3.1.1 Development of brownfields and exploration of unconventional greenfields to offer new opportunities

- 10.4.3.1 Russia

- TABLE 107 RUSSIA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 108 RUSSIA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 109 RUSSIA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 110 RUSSIA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD THOUSAND)

- 10.4.3.2 Kazakhstan

- 10.4.3.2.1 Increasing crude oil production from onshore oilfields to offer new opportunities

- 10.4.3.2 Kazakhstan

- TABLE 111 KAZAKHSTAN: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 112 KAZAKHSTAN: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 113 KAZAKHSTAN: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 114 KAZAKHSTAN: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD THOUSAND)

- 10.4.3.3 Norway

- 10.4.3.3.1 Increased foreign investments in exploration activities to drive market

- 10.4.3.3 Norway

- TABLE 115 NORWAY: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 116 NORWAY: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 117 NORWAY: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 118 NORWAY: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD THOUSAND)

- 10.4.3.4 UK

- 10.4.3.4.1 New oil and gas reserve discoveries expected to increase growth

- 10.4.3.4 UK

- TABLE 119 UK: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 120 UK: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 121 UK: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 122 UK: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD THOUSAND)

- 10.5 ASIA PACIFIC

- 10.5.1 IMPACT OF RECESSION

- 10.5.2 ASIA PACIFIC DEMULSIFIER MARKET, BY APPLICATION

- TABLE 123 ASIA PACIFIC: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 124 ASIA PACIFIC: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 125 ASIA PACIFIC: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 126 ASIA PACIFIC: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.5.3 ASIA PACIFIC DEMULSIFIER MARKET, BY COUNTRY

- TABLE 127 ASIA PACIFIC: DEMULSIFIER MARKET, BY COUNTRY, 2018-2021 (TON)

- TABLE 128 ASIA PACIFIC: DEMULSIFIER MARKET, BY COUNTRY, 2022-2028 (TON)

- TABLE 129 ASIA PACIFIC: DEMULSIFIER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 130 ASIA PACIFIC: DEMULSIFIER MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 10.5.3.1 China

- 10.5.3.1.1 Increase in investments by national oil companies in oil & gas exploration to drive market

- 10.5.3.1 China

- TABLE 131 CHINA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 132 CHINA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 133 CHINA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 134 CHINA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD THOUSAND)

- 10.5.3.2 India

- 10.5.3.2.1 Government initiatives to boost oil & gas sector

- 10.5.3.2 India

- TABLE 135 INDIA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 136 INDIA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 137 INDIA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 138 INDIA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD THOUSAND)

- 10.5.3.3 Indonesia

- 10.5.3.3.1 Reorientation of oil & gas sector through government support to increase exploration activities

- 10.5.3.3 Indonesia

- TABLE 139 INDONESIA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 140 INDONESIA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 141 INDONESIA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 142 INDONESIA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD THOUSAND)

- 10.6 AFRICA

- 10.6.1 IMPACT OF RECESSION

- 10.6.2 AFRICA DEMULSIFIER MARKET, BY APPLICATION

- TABLE 143 AFRICA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 144 AFRICA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 145 AFRICA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 146 AFRICA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.6.3 AFRICA DEMULSIFIER MARKET, BY COUNTRY

- TABLE 147 AFRICA: DEMULSIFIER MARKET, BY COUNTRY, 2018-2021 (TON)

- TABLE 148 AFRICA: DEMULSIFIER MARKET, BY COUNTRY, 2022-2028 (TON)

- TABLE 149 AFRICA: DEMULSIFIER MARKET, BY COUNTRY, 2018-2021 (USD MILLION)

- TABLE 150 AFRICA: DEMULSIFIER MARKET, BY COUNTRY, 2022-2028 (USD MILLION)

- 10.6.3.1 Nigeria

- 10.6.3.1.1 Potential onshore and deep-water fields having complex geology to drive market

- 10.6.3.1 Nigeria

- TABLE 151 NIGERIA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 152 NIGERIA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 153 NIGERIA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 154 NIGERIA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD THOUSAND)

- 10.6.3.2 Angola

- 10.6.3.2.1 Legal and regulatory reforms to revive oil & gas sector

- 10.6.3.2 Angola

- TABLE 155 ANGOLA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 156 ANGOLA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 157 ANGOLA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 158 ANGOLA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD THOUSAND)

- 10.6.3.3 Algeria

- 10.6.3.3.1 Improvement in hydrocarbon sector to drive market

- 10.6.3.3 Algeria

- TABLE 159 ALGERIA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 160 ALGERIA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 161 ALGERIA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 162 ALGERIA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD THOUSAND)

- 10.7 SOUTH AMERICA

- 10.7.1 IMPACT OF RECESSION

- 10.7.2 SOUTH AMERICA DEMULSIFIER MARKET, BY APPLICATION

- TABLE 163 SOUTH AMERICA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 164 SOUTH AMERICA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 165 SOUTH AMERICA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD MILLION)

- TABLE 166 SOUTH AMERICA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD MILLION)

- 10.7.3 SOUTH AMERICA DEMULSIFIER MARKET, BY COUNTRY

- TABLE 167 SOUTH AMERICA: DEMULSIFIER MARKET, BY COUNTRY, 2018-2021 (TON)

- TABLE 168 SOUTH AMERICA: DEMULSIFIER MARKET, BY COUNTRY, 2022-2028 (TON)

- TABLE 169 SOUTH AMERICA: DEMULSIFIER MARKET, BY COUNTRY, 2018-2021 (USD THOUSAND)

- TABLE 170 SOUTH AMERICA: DEMULSIFIER MARKET, BY COUNTRY, 2022-2028 (USD THOUSAND)

- 10.7.3.1 Brazil

- 10.7.3.1.1 Discovery of vast offshore oil reserves to drive market

- 10.7.3.1 Brazil

- TABLE 171 BRAZIL: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 172 BRAZIL: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 173 BRAZIL: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 174 BRAZIL: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD THOUSAND)

- 10.7.3.2 Venezuela

- 10.7.3.2.1 Presence of potential oilfields to drive demand

- 10.7.3.2 Venezuela

- TABLE 175 VENEZUELA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (TON)

- TABLE 176 VENEZUELA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (TON)

- TABLE 177 VENEZUELA: DEMULSIFIER MARKET, BY APPLICATION, 2018-2021 (USD THOUSAND)

- TABLE 178 VENEZUELA: DEMULSIFIER MARKET, BY APPLICATION, 2022-2028 (USD THOUSAND)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 179 OVERVIEW OF STRATEGIES ADOPTED BY KEY DEMULSIFIERS MANUFACTURERS

- 11.3 RANKING OF KEY MARKET PLAYERS

- FIGURE 38 RANKING OF TOP FIVE PLAYERS IN DEMULSIFIER MARKET, 2022

- 11.4 MARKET SHARE ANALYSIS

- TABLE 180 DEMULSIFIER MARKET: DEGREE OF COMPETITION

- FIGURE 39 BAKER HUGHES COMPANY LED DEMULSIFIER MARKET IN 2022

- 11.5 HISTORICAL REVENUE ANALYSIS OF KEY COMPANIES

- FIGURE 40 REVENUE ANALYSIS OF KEY COMPANIES DURING PAST FIVE YEARS

- 11.6 COMPANY PRODUCT FOOTPRINT ANALYSIS

- FIGURE 41 DEMULSIFIER MARKET: COMPANY FOOTPRINT

- TABLE 181 DEMULSIFIER MARKET: TYPE FOOTPRINT

- TABLE 182 DEMULSIFIER MARKET: APPLICATION FOOTPRINT

- TABLE 183 DEMULSIFIER MARKET: REGION FOOTPRINT

- 11.7 COMPANY EVALUATION MATRIX (TIER 1)

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PARTICIPANTS

- 11.7.4 PERVASIVE PLAYERS

- FIGURE 42 COMPANY EVALUATION MATRIX FOR DEMULSIFIER MARKET

- 11.8 COMPETITIVE BENCHMARKING

- TABLE 184 DEMULSIFIERS: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 185 DEMULSIFIER MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.9 STARTUP/SME EVALUATION MATRIX

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 RESPONSIVE COMPANIES

- 11.9.3 STARTING BLOCKS

- 11.9.4 DYNAMIC COMPANIES

- FIGURE 43 STARTUP/SME EVALUATION MATRIX FOR DEMULSIFIER MARKET

- 11.10 COMPETITIVE SITUATIONS AND TRENDS

- 11.10.1 PRODUCT LAUNCHES

- TABLE 186 DEMULSIFIER MARKET: PRODUCT LAUNCHES (2020-2022)

- 11.10.2 DEALS

- TABLE 187 DEMULSIFIER MARKET: DEALS (2020-2022)

- 11.10.3 OTHER DEVELOPMENTS

- TABLE 188 DEMULSIFIER MARKET: OTHER DEVELOPMENTS (2020-2022)

12 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MnM view, Right to win, Strategic choices, Weaknesses and competitive threats) **

- 12.1 MAJOR PLAYERS

- 12.1.1 BAKER HUGHES COMPANY

- TABLE 189 BAKER HUGHES COMPANY: COMPANY OVERVIEW

- FIGURE 44 BAKER HUGHES COMPANY: COMPANY SNAPSHOT

- 12.1.2 CLARIANT AG

- TABLE 190 CLARIANT AG: COMPANY OVERVIEW

- FIGURE 45 CLARIANT AG: COMPANY SNAPSHOT

- TABLE 191 CLARIANT AG: PRODUCT LAUNCHES

- TABLE 192 CLARIANT AG: OTHER DEVELOPMENTS

- 12.1.3 ECOLAB INC.

- TABLE 193 ECOLAB INC.: COMPANY OVERVIEW

- FIGURE 46 ECOLAB INC: COMPANY SNAPSHOT

- 12.1.4 HALLIBURTON COMPANY

- TABLE 194 HALLIBURTON COMPANY: COMPANY OVERVIEW

- FIGURE 47 HALLIBURTON: COMPANY SNAPSHOT

- 12.1.5 SCHLUMBERGER LIMITED

- TABLE 195 SCHLUMBERGER LIMITED: COMPANY OVERVIEW

- FIGURE 48 SCHLUMBERGER LIMITED: COMPANY SNAPSHOT

- 12.1.6 NOURYON

- TABLE 196 NOURYON: COMPANY OVERVIEW

- 12.1.7 BASF SE

- TABLE 197 BASF SE: COMPANY OVERVIEW

- FIGURE 49 BASF SE: COMPANY SNAPSHOT

- 12.1.8 DOW INC.

- TABLE 198 DOW INC.: COMPANY OVERVIEW

- FIGURE 50 DOW INC.: COMPANY SNAPSHOT

- 12.1.9 ARKEMA S.A.

- TABLE 199 ARKEMA S.A.: COMPANY OVERVIEW

- FIGURE 51 ARKEMA S.A.: COMPANY SNAPSHOT

- 12.1.10 MOMENTIVE PERFORMANCE MATERIALS INC.

- TABLE 200 MOMENTIVE PERFORMANCE MATERIALS INC.: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent Developments, MNM view, Key strengths, Strategic choices, Weaknesses and competitive threats might not be captured in case of unlisted companies.

- 12.2 OTHER PLAYERS

- 12.2.1 RIMPRO INDIA

- TABLE 201 RIMPRO INDIA: COMPANY OVERVIEW

- 12.2.2 CARGILL INC.

- TABLE 202 CARGILL INC.: COMPANY OVERVIEW

- 12.2.3 DORF KETAL

- TABLE 203 DORF KETAL: COMPANY OVERVIEW

- 12.2.4 NOVA STAR LP

- TABLE 204 NOVA STAR LP: COMPANY OVERVIEW

- 12.2.5 INNOSPEC INC.

- TABLE 205 INNOSPEC INC: COMPANY OVERVIEW

- 12.2.6 REDA OILFIELD

- TABLE 206 REDA OILFIELD: COMPANY OVERVIEW

- 12.2.7 ROEMEX LIMITED

- TABLE 207 ROEMEX LIMITED: COMPANY OVERVIEW

- 12.2.8 COCHRAN CHEMICAL COMPANY INC.

- TABLE 208 COCHRAN CHEMICAL COMPANY INC.: COMPANY OVERVIEW

- 12.2.9 SI GROUP INC.

- TABLE 209 SI GROUP INC.: COMPANY OVERVIEW

- 12.2.10 MCC CHEMICALS INC

- TABLE 210 MCC CHEMICALS INC.: COMPANY OVERVIEW

- 12.2.11 OIL TECHNICS HOLDINGS LTD.

- TABLE 211 OIL TECHNICS HOLDINGS LTD: COMPANY OVERVIEW

- 12.2.12 CHEMIPHASE LTD

- TABLE 212 CHEMIPHASE LTD.: COMPANY OVERVIEW

- 12.2.13 NATIONAL CHEMICAL & PETROLEUM INDUSTRIES CO. W.L.L. (NCPI)

- TABLE 213 NATIONAL CHEMICAL & PETROLEUM INDUSTRIES CO. W.L.L. (NCPI): COMPANY OVERVIEW

- 12.2.14 EGYPTIAN MUD ENGINEERING AND CHEMICALS COMPANY (EMEC)

- TABLE 214 EGYPTIAN MUD ENGINEERING AND CHEMICALS COMPANY (EMEC): COMPANY OVERVIEW

- 12.2.15 IMPERIAL OILFIELD CHEMICALS PVT.LTD.

- TABLE 215 IMPERIAL OILFIELD CHEMICALS PVT. LTD.: COMPANY OVERVIEW

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 SPECIALTY OILFIELD CHEMICALS MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.3 SPECIALTY OILFIELD CHEMICALS MARKET BY REGION

- TABLE 216 SPECIALTY OILFIELD CHEMICALS MARKET, BY REGION, 2017-2020 (USD MILLION)

- TABLE 217 SPECIALTY OILFIELD CHEMICALS MARKET, BY REGION, 2021-2027 (USD MILLION)

- TABLE 218 SPECIALTY OILFIELD CHEMICALS MARKET, BY REGION, 2017-2020 (KILOTON)

- TABLE 219 SPECIALTY OILFIELD CHEMICALS MARKET, BY REGION 2021-2027 (KILOTON)

- 13.3.3.1 North America

- TABLE 220 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 221 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 222 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 223 NORTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021-2027 (KILOTONS)

- 13.3.3.2 Middle East & Africa

- TABLE 224 MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 227 MIDDLE EAST & AFRICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021-2027 (KILOTON)

- 13.3.3.3 Europe

- TABLE 228 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 229 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 230 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 231 EUROPE: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021-2027 (KILOTON)

- 13.3.3.4 Asia Pacific

- TABLE 232 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 233 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 234 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 235 ASIA PACIFIC: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021-2027 (KILOTON)

- 13.3.3.5 South America

- TABLE 236 SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017-2020 (USD MILLION)

- TABLE 237 SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021-2027 (USD MILLION)

- TABLE 238 SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2017-2020 (KILOTON)

- TABLE 239 SOUTH AMERICA: SPECIALTY OILFIELD CHEMICALS MARKET, BY COUNTRY, 2021-2027 (KILOTON)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS