|

|

市場調査レポート

商品コード

1336041

校正サービスの世界市場:校正別(社内、OEM、サードパーティーベンダー)、サービスタイプ別(機械、電気、寸法、熱力学)、用途別(産業・オートメーション、エレクトロニクス、航空宇宙・防衛)、地域別-2030年までの予測Calibration Services Market by Proofreading (In-house, OEM, Third-party Vendor), Application (Mechanical, Electrical, Dimensional, Thermodynamics), Application (Industrial & Automation, Electronics, Aerospace & Defence) and Region - Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| 校正サービスの世界市場:校正別(社内、OEM、サードパーティーベンダー)、サービスタイプ別(機械、電気、寸法、熱力学)、用途別(産業・オートメーション、エレクトロニクス、航空宇宙・防衛)、地域別-2030年までの予測 |

|

出版日: 2023年08月11日

発行: MarketsandMarkets

ページ情報: 英文 251 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

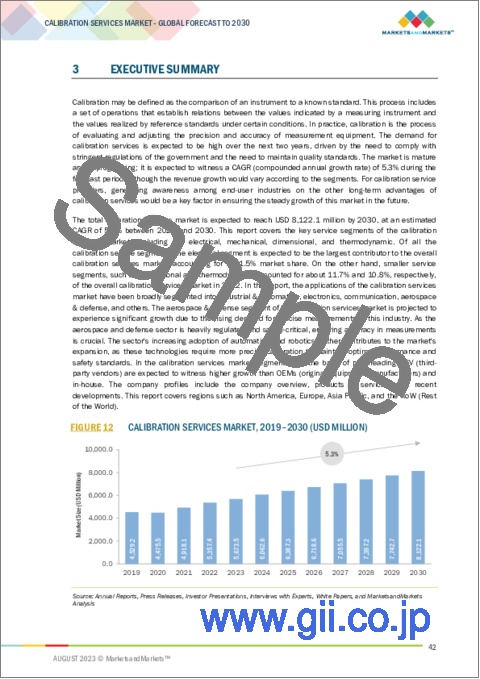

世界の校正サービスの市場規模は、2023年の57億米ドルから2030年には81億米ドルに成長し、予測期間中のCAGRは5.3%になると予測されています。

市場の成長は主に、寸法、電気、機械、その他の校正サービスに対する需要の高まりに後押しされています。校正サービスには、長さや幅などの測定のための寸法校正、電圧・電流計のための電気校正、温度計のための温度校正、ゲージのための圧力校正、流量計のための流量校正、はかりのための質量校正、ロードセルのための力校正、時計やカウンターのための時間・周波数校正、レンチのためのトルク校正、湿度計のための湿度校正、分光計のための光学校正、マイクロホンのための音響校正など、さまざまな種類があり、多様な産業や用途にわたって正確な測定と機器の信頼性を保証しています。さらに、エレクトロニクス、工業・オートメーション、航空宇宙・防衛、通信など、さまざまな用途で校正サービスの採用が拡大していることも、市場の成長軌道をさらに後押ししています。

予測期間中、校正市場におけるサードパーティーベンダーの校正分野は、さまざまな要因によって顕著な成長を遂げるとみられています。業界を問わず、企業はコンプライアンス、品質、業務効率の維持において正確な校正が果たす重要な役割を認識するようになっています。機器や装置の複雑さが増すにつれ、校正手順の校正における専門知識の必要性が明らかになりつつあります。第三者ベンダーは公平で専門的なサービスを提供し、他の方法では見落とされる可能性のある潜在的なエラーや不整合に対処します。このようなアウトソーシングの動向により、企業は校正プロセスの精度を確保しながら、中核業務に集中することができます。規制上の要求と技術の進歩が続く中、サードパーティーベンダーの校正分野は継続的な成長が見込まれており、校正サービス市場全体の拡大に貢献しています。

電子機器製造業界における校正サービスには、最終製品の校正、インフラ機械の定期的な校正、指定された動作使用時間の完了時の校正などが含まれます。その膨大な業務内容を考慮すると、校正サービスは電子製造業界でかなりの需要があると思われます。校正サービスは、すべての電子機器製造工場で、定期的な活動を監視し、標準値に従って機器を調整するために頻繁に使用されています。電子機器製造工場では、工業用ラジオグラフィ、フェーズドアレイ超音波、X線コンピュータ断層撮影などの検査サービスを利用する傾向が高まっているため、このような検査・測定装置の校正も、業界内の予防保守に欠かせないものとなっています。民生用電子機器では、機器の正確で信頼性の高い機能を確保し、製品の品質と業界標準への準拠を維持し、生産工程を検証するために、校正サービスが不可欠です。校正サービスは、ユーザー体験を向上させ、電子製品に対する消費者の信頼を築く上で重要な役割を果たしています。

北米地域は堅調な業界情勢と厳格な品質基準により、校正サービス市場で大きく成長しています。航空宇宙、ヘルスケア、自動車、製造業などの業界では、規制に準拠するために正確な測定が求められます。技術の進歩により機器はますます複雑化しており、正確な校正が必要とされています。さらに、北米では技術革新が重視され、精密な製造方法が採用されていることも、校正サービス部門を後押ししています。企業が正確さとコンプライアンスを追求する中、この地域の高度なインフラと品質管理への取り組みは、校正サービス市場の拡大を推進する上で重要な役割を果たしています。

当レポートでは、世界の校正サービス市場について調査し、校正別、サービスタイプ別、用途別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- 生態系マッピング

- 価格分析

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 特許分析

- 主要な会議とイベント

- 関税と規制状況。

- 規制機関、政府機関、その他の組織

第6章 校正サービス市場、サービスタイプ別

- イントロダクション

- 機械

- 電気

- 寸法

- 熱力学

第7章 校正サービス市場、校正別

- イントロダクション

- 社内

- OEM

- サードパーティベンダー

第8章 校正サービス市場、用途別

- イントロダクション

- 産業・オートメーション

- エレクトロニクス

- 航空宇宙・防衛

- 通信

- その他

第9章 校正サービス市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第10章 競合情勢

第11章 企業プロファイル

- 主要参入企業

- KEYSIGHT TECHNOLOGIES

- HEXAGON AB

- ROHDE & SCHWARZ .

- TEKTRONIX, INC.

- VIAVI SOLUTIONS INC.

- OMEGA ENGINEERING, INC.

- RENISHAW PLC.

- TRESCAL, INC.

- MICRO PRECISION CALIBRATION

- OCTAGON PRECISION INDIA PVT. LTD.

- TANSON INSTRUMENT

- MSI VIKING

- その他の企業

- MITUTOYO CORPORATION

- MASTER GAGE & TOOL CO.

- PRATT AND WHITNEY MEASUREMENT SYSTEMS, INC.

- ADVANTEST CORPORATION

- NATIONAL INSTRUMENTS CORPORATION

- ANRITSU

- KOLB & BAUMANN GMBH & CO KG.

- FEINMESS SUHL GMBH

- TESA BROWN & SHARPE(PART OF HEXAGON AB)

- METTLER TOLEDO .

- TESTO SE & CO. KGAA

- TRADINCO INSTRUMENTS

- TGCI GROUP .

- MAHR GMBH

- ESSCO CALIBRATION LABORATORY

第12章 付録

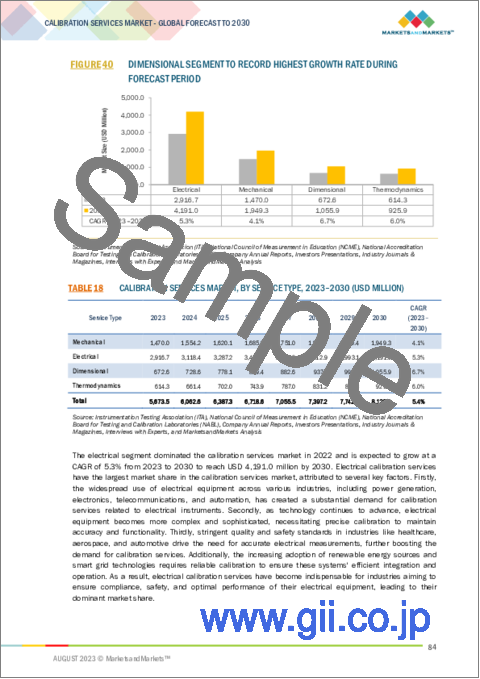

The global calibration services market is projected to grow from USD 5.7 billion in 2023 to USD 8.1 billion by 2030, registering a CAGR of 5.3% during the forecast period. The market's growth is primarily propelled by the escalating demand for dimensional, electrical, mechanical, among other calibration services. Calibration services encompass a range of types, including dimensional calibration for measurements like length and width, electrical calibration for voltage and current instruments, temperature calibration for thermometers, pressure calibration for gauges, flow calibration for flow meters, mass calibration for scales, force calibration for load cells, time and frequency calibration for clocks and counters, torque calibration for wrenches, humidity calibration for hygrometers, optical calibration for spectrometers, acoustic calibration for microphones, ensuring accurate measurements and instrument reliability across diverse industries and applications. Furthermore, the expanding adoption of calibration services in various applications, such as electronics, industrial and automation, aerospace and defense and communication, further fuels the market's growth trajectory.

The third-party vendor proofreading segment is expected to hold a significant market share in the overall calibration services market

During the forecast period, third-party vendor proofreading segment in the calibration market is likely to experience notable growth driven by various factors. Companies across industries increasingly recognize the critical role of accurate calibration in maintaining compliance, quality, and operational efficiency. As the complexity of instruments and equipment rises, the need for specialized expertise in proofreading calibration procedures becomes evident. Third-party vendors offer impartial and specialized services, addressing potential errors or inconsistencies that might otherwise be overlooked. This outsourcing trend allows businesses to focus on their core operations while ensuring precision in calibration processes. As regulatory demands and technological advancements persist, the third-party vendor proofreading segment is poised for continued growth, contributing to the overall expansion of the calibration services market.

The electronics application is expected to grow at a significant growth rate during the forecast period

The calibration services within the electronic manufacturing industry include the calibration of final products, periodic calibration of infrastructural machinery, and calibration on completion of specified operational usage time. Considering its vast nature of operations, calibration services are likely to have a considerable demand in the electronic manufacturing industry. Calibration services are frequently used in all electronic manufacturing plants to monitor the regular activities and regulate the equipment according to standard values. With the growing trend of using inspection services such industrial radiography, phased array ultrasonic, and X-ray computed tomography in electronic manufacturing plants, the calibration of such test and measurement devices has also become vital aspect of preventive maintenance within the industry. Calibration services are essential in consumer electronics to ensure accurate and reliable functionality of devices, maintain product quality and compliance with industry standards, and verify production processes. They play a critical role in enhancing user experiences and building consumer trust in electronic products.

North America is projected to have the significant growth rate during the forecast period

The North American region has grown substantially in the calibration services market due to its robust industrial landscape and stringent quality standards. Industries spanning aerospace, healthcare, automotive, and manufacturing demand precise measurements to comply with regulations. Technological advancements have led to increasingly complex instruments, necessitating accurate calibration. Moreover, North America's emphasis on innovation and adoption of precision manufacturing practices has propelled the calibration services sector. As businesses strive for accuracy and compliance, the region's advanced infrastructure and commitment to quality control contribute to its significant role in driving the calibration services market's expansion.

Breakdown of profiles of primary participants:

- By Company Type: Tier 1 = 30%, Tier 2 = 50%, and Tier 3 = 20%

- By Designation: C-level Executives = 25%, Directors = 35%, and Others = 40%

- By Region: North America = 35%, Europe = 30%, APAC = 25%, and Rest of the World = 10%

The major companies in the calibration services market are Keysight Technologies (US), Hexagon AB (Sweden), Rohde & Schwarz (Germany), Tektronix, Inc. (US), and VIAVI Solutions Inc. (US).

Research Coverage

The report segments the calibration services market and forecasts its size, by value, based on region ( North America, Europe, Asia Pacific, and Rest of the World), proofreading (in-house, OEM, third-party vendor), application (mechanical, electrical, dimensional, thermodynamics), and end user (industrial & automation, electronics, communication, aerospace & defence, others).

The report also comprehensively reviews market drivers, restraints, opportunities, and challenges in the calibration services market. The report also covers qualitative aspects in addition to the quantitative aspects of these markets.

Reasons to Buy the Report:

- Analysis of key drivers (growing demand for quality and inspection equipment in precision manufacturing, increased need for interoperability testing owing to growing deployment of iot and connected devices, strict regulatory standards imposed by governments to ensure product safety and environmental protection), restraints (lack of highly skilled calibration and maintenance technicians, high competition due to increased price sensitivity), opportunities (the advent of 5G technology and deployment of LTE and LTE-Advanced (4G) networks), and challenges (built-in self-calibration feature of electrical & electronic instrument) influencing the growth of the calibration services market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the calibration services market

- Market Development: Comprehensive information about lucrative markets - the report analyses the calibration services market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the calibration services market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Keysight Technologies (US), Hexagon AB (Sweden), Rohde & Schwarz (Germany), Tektronix, Inc. (US), VIAVI Solutions Inc. (US), Omega Engineering, Inc. (US), Advantest Corporation (Japan), National Instruments Corporation (US), Anritsu (Japan), Trescal, Inc. (France), Pratt and Whitney Measurement Systems, Inc. (US), Kolb & Baumann GmbH & Co KG. (Germany), Renishaw plc. (UK), Feinmess Suhl GmbH (Germany), Octagon Precision India Pvt. Ltd. (India), TESA Brown & Sharpe (Part of Hexagon AB) (Switzerland), Mitutoyo (Japan), MSI Viking (US), Master Gage & Tool Co. (US), Tanson Instrument (India), and Micro Precision Calibration (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 GEOGRAPHICAL SCOPE

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Key industry insights

- 2.1.3.3 Key data from primary sources

- 2.2 MARKET SIZE ESTIMATION

- 2.3 FACTOR ANALYSIS

- 2.3.1 SUPPLY-SIDE ANALYSIS

- 2.3.2 DEMAND-SIDE ANALYSIS

- 2.3.3 BOTTOM-UP APPROACH .

- 2.3.3.1 Estimation of market size using bottom-up approach (demand side) .

- 2.3.4 TOP-DOWN APPROACH.

- 2.3.4.1 Estimation of market size using top-down approach (supply side) .

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RISK ASSESSMENT

- 2.6 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON CALIBRATION SERVICES MARKET . 40

- 2.7 RESEARCH ASSUMPTIONS AND LIMITATIONS .

- 2.7.1 ASSUMPTIONS .

- 2.7.2 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR MARKET PLAYERS IN CALIBRATION SERVICES MARKET .

- 4.2 CALIBRATION SERVICES MARKET, BY PROOFREADING

- 4.3 CALIBRATION SERVICES MARKET, BY SERVICE TYPE

- 4.4 CALIBRATION SERVICES MARKET, BY APPLICATION

- 4.5 CALIBRATION SERVICES MARKET, BY REGION .

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand for high-quality inspection equipment in precision manufacturing

- 5.2.1.2 Increasing requirement for interoperability testing with rising adoption of IoT devices .

- 5.2.1.3 Strict government regulations to ensure product safety and environmental protection

- 5.2.1.4 Growing adoption of electronic devices

- 5.2.2 RESTRAINTS

- 5.2.2.1 Shortage of skilled technicians to carry out calibration and maintenance tasks

- 5.2.2.2 High competition due to increased price sensitivity

- 5.2.2.3 Complexities in calibration standards

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advent of 5G technology and deployment of LTE and LTE-advanced (4G) networks

- 5.2.3.2 Rapid penetration of IoT devices

- 5.2.3.3 Constant technological changes and advancements

- 5.2.4 CHALLENGES .

- 5.2.4.1 Difficulties faced by vendors in keeping up with constantly changing technologies

- 5.2.4.2 Emergence of electrical and electronic instruments with in-built self-calibration feature

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS .

- 5.4 ECOSYSTEM MAPPING .

- 5.5 PRICING ANALYSIS .

- 5.5.1 AVERAGE SELLING PRICE, BY SERVICE TYPE (KEY PLAYERS)

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 COMMERCIALIZATION OF IOT TECHNOLOGY

- 5.7.2 COMBINING CMM WITH INDUSTRIAL INTERNET OF THINGS (IIOT)

- 5.7.3 SMART IN-LINE CT INSPECTION SYSTEMS .

- 5.7.4 ARTIFICIAL INTELLIGENCE IN INDUSTRIAL METROLOGY

- 5.7.5 3D MEASUREMENT SENSORS

- 5.7.6 SMART SENSORS .

- 5.7.7 VIDEO MEASUREMENT SYSTEMS

- 5.8 PORTERS FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA .

- 5.10 CASE STUDY ANALYSIS .

- 5.10.1 KEYSIGHT TECHNOLOGIES DEMONSTRATES ITS N54B PNA NETWORK ANALYZER TO DEVELOP 5G ANTENNA MODULE .

- 5.10.2 SAMSUNG FOUNDRY ADOPTS KEYSIGHT EB ADVANCED LOWFREQUENCY NOISE ANALYZER TO MEASURE AND ANALYZE FLICKER NOISE .

- 5.10.3 EXFO INC. PROVIDES OX1 TO CONVERGE ICT SOLUTIONS THAT EASE TROUBLESHOOTING .

- 5.11 TRADE ANALYSIS

- 5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, – .

- 5.14 TARIFFS AND REGULATORY LANDSCAPE .

- 5.14.1 TARIFFS .

- 5.14.2 STANDARDS.

- 5.14.3 REGULATORY LANDSCAPE

- 5.15 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS .

- 5.15.1 REGULATORY FRAMEWORK

- 5.15.1.1 Canada .

- 5.15.1.2 US

- 5.15.1.3 Europe

- 5.15.1.4 Asia Pacific .

- 5.15.1 REGULATORY FRAMEWORK

6 CALIBRATION SERVICES MARKET, BY SERVICE TYPE

- 6.1 INTRODUCTION

- 6.2 MECHANICAL .

- 6.2.1 CONTRIBUTION TO BETTER PRODUCT QUALITY TO DRIVE MARKET

- 6.3 ELECTRICAL .

- 6.3.1 GROWING DEMAND FOR ELECTRICAL EQUIPMENT WITH GLOBALIZATION AND URBANIZATION TO DRIVE DEMAND .

- 6.4 DIMENSIONAL

- 6.4.1 GROWING COMPLEXITY IN MANUFACTURING PROCESSES TO DRIVE DEMAND

- 6.4.2 COORDINATE MEASURING MACHINES (CMM) .

- 6.4.2.1 Fixed CMM

- 6.4.2.1.1 Bridge CMM

- 6.4.2.1.2 Gantry CMM

- 6.4.2.1.3 Horizontal arm CMM .

- 6.4.2.1.4 Cantilever CMM

- 6.4.2.2 Portable CMM .

- 6.4.2.2.1 Articulated arm CMM

- 6.4.2.1 Fixed CMM

- 6.4.3 MEASURING INSTRUMENTS .

- 6.4.3.1 Measuring microscope

- 6.4.3.2 Profile projector

- 6.4.3.3 Autocollimator

- 6.4.3.4 Vision system

- 6.4.3.5 Multisensory measuring system .

- 6.4.4 FORM MEASUREMENT EQUIPMENT

- 6.5 THERMODYNAMICS

- 6.5.1 NEED TO MAINTAIN CONSISTENT AND RELIABLE MEASUREMENTS TO DRIVE MARKET .

7 CALIBRATION SERVICES MARKET, BY PROOFREADING

- 7.1 INTRODUCTION

- 7.2 IN-HOUSE

- 7.3 BETTER TRACEABILITY OF CALIBRATION DATA TO DRIVE MARKET .

- 7.4 OEMS.

- 7.4.1 REDUCED DOWNTIME AND COMPLIANCE WITH INDUSTRY STANDARDS TO DRIVE MARKET .

- 7.5 THIRD-PARTY VENDORS

- 7.5.1 TECHNICAL PROFICIENCY AND ADHERENCE TO RECOGNIZED CALIBRATION PROCEDURES TO DRIVE MARKET

8 CALIBRATION SERVICES MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 INDUSTRIAL & AUTOMATION .

- 8.2.1 ADVANCEMENT IN MANUFACTURING SECTOR TO DRIVE MARKET

- 8.3 ELECTRONICS

- 8.3.1 GROWING TREND OF USING INSPECTION SERVICES SUCH AS INDUSTRIAL RADIOGRAPHY TO DRIVE MARKET .

- 8.4 AEROSPACE & DEFENSE

- 8.4.1 ASSURITY OF DESIGN CORRECTNESS WITH REGARD TO AERODYNAMICS AND COMMUNICATION TO DRIVE MARKET

- 8.5 COMMUNICATION

- 8.5.1 GROWING NUMBER OF MOBILE COMMUNICATION DEVICES TO DRIVE MARKET .

- 8.6 OTHERS .

9 CALIBRATION SERVICES MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: RECESSION IMPACT .

- 9.2.2 US .

- 9.2.2.1 Presence of established players from various sectors to boost market growth.

- 9.2.3 CANADA

- 9.2.3.1 Rising demand for broadband services and communication testing to drive market expansion

- 9.2.4 MEXICO

- 9.2.4.1 Government-led green energy initiatives to benefit market

- 9.3 EUROPE

- 9.3.1 EUROPE: IMPACT OF RECESSION

- 9.3.2 UK

- 9.3.2.1 Increased demand for test and measurement equipment in automotive industry to support demand for calibration services

- 9.3.3 GERMANY

- 9.3.3.1 Established automotive industry to propel market growth

- 9.3.4 FRANCE

- 9.3.4.1 Increasing use of test and measurement tools in aerospace & defense to boost market

- 9.3.5 ITALY

- 9.3.5.1 Initiatives taken to develop defense sector to drive market

- 9.3.6 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: IMPACT OF RECESSION

- 9.4.2 CHINA

- 9.4.2.1 Manufacturing hub for various industries to boost demand for calibration services

- 9.4.3 JAPAN

- 9.4.3.1 Growing adoption of automation in calibration to drive market

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Presence of major electronics and semiconductor manufacturers to drive market

- 9.4.5 INDIA

- 9.4.5.1 Increasing FDIs and government-led initiatives to benefit market

- 9.4.6 REST OF ASIA PACIFIC

- 9.5 ROW

- 9.5.1 ROW: IMPACT OF RECESSION

- 9.5.2 MIDDLE EAST & AFRICA

- 9.5.2.1 Presence of robust healthcare infrastructure to boost market

- 9.5.3 SOUTH AMERICA

- 9.5.3.1 Expanding manufacturing and mining sector to benefit market significantly

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- 10.3 MARKET SHARE ANALYSIS,

- 10.4 FIVE-YEAR REVENUE ANALYSIS OF TOP COMPANIES, –

- 10.5 CALIBRATION SERVICES MARKET: COMPANY EVALUATION MATRIX,

- 10.5.1 STARS

- 10.5.2 PERVASIVE PLAYERS

- 10.5.3 EMERGING LEADERS

- 10.5.4 PARTICIPANTS

- 10.5.5 CALIBRATION SERVICES MARKET: COMPANY FOOTPRINT

- 10.6 CALIBRATION SERVICES MARKET: STARTUPS/SMES EVALUATION MATRIX,

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES .

- 10.6.4 STARTING BLOCKS .

- 10.7 CALIBRATION SERVICES MARKET: COMPETITIVE BENCHMARKING

- 10.8 COMPETITIVE SCENARIOS AND TRENDS

- 10.8.1 CALIBRATION SERVICES MARKET .

- 10.8.1.1 Product launches

- 10.8.1.2 Deals

- 10.8.1 CALIBRATION SERVICES MARKET .

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 KEYSIGHT TECHNOLOGIES

- 11.1.1.1 Business overview .

- 11.1.1.2 Products/Solutions/Services offered .

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats .

- 11.1.2 HEXAGON AB

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered .

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats .

- 11.1.3 ROHDE & SCHWARZ .

- 11.1.3.1 Business overview .

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats .

- 11.1.4 TEKTRONIX, INC.

- 11.1.4.1 Business overview .

- 11.1.4.2 Products/Solutions/Services offered .

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths/Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats .

- 11.1.5 VIAVI SOLUTIONS INC.

- 11.1.5.1 Business overview .

- 11.1.5.2 Products/Solutions/Services offered .

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths/Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats .

- 11.1.6 OMEGA ENGINEERING, INC.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered .

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.7 RENISHAW PLC.

- 11.1.7.1 Business overview .

- 11.1.7.2 Products/Solutions/Services offered .

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.7.3.2 Deals

- 11.1.8 TRESCAL, INC.

- 11.1.8.1 Business overview .

- 11.1.8.2 Products/Solutions/Services offered .

- 11.1.8.2.1 Deals

- 11.1.9 MICRO PRECISION CALIBRATION

- 11.1.9.1 Business overview .

- 11.1.9.2 Products/Solutions/Services offered .

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.10 OCTAGON PRECISION INDIA PVT. LTD.

- 11.1.10.1 Business overview .

- 11.1.10.2 Products/Solutions/Services offered .

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.11 TANSON INSTRUMENT

- 11.1.11.1 Business overview .

- 11.1.11.2 Products/Solutions/Services offered .

- 11.1.12 MSI VIKING

- 11.1.12.1 Business overview .

- 11.1.12.2 Products/Solutions/Services offered .

- 11.1.1 KEYSIGHT TECHNOLOGIES

- 11.2 OTHER PLAYERS .

- 11.2.1 MITUTOYO CORPORATION

- 11.2.2 MASTER GAGE & TOOL CO.

- 11.2.3 PRATT AND WHITNEY MEASUREMENT SYSTEMS, INC.

- 11.2.4 ADVANTEST CORPORATION

- 11.2.5 NATIONAL INSTRUMENTS CORPORATION

- 11.2.6 ANRITSU

- 11.2.7 KOLB & BAUMANN GMBH & CO KG.

- 11.2.8 FEINMESS SUHL GMBH

- 11.2.9 TESA BROWN & SHARPE (PART OF HEXAGON AB)

- 11.2.10 METTLER TOLEDO .

- 11.2.11 TESTO SE & CO. KGAA

- 11.2.12 TRADINCO INSTRUMENTS

- 11.2.13 TGCI GROUP .

- 11.2.14 MAHR GMBH

- 11.2.15 ESSCO CALIBRATION LABORATORY

12 APPENDIX

- 12.1 INSIGHTS FROM INDUSTRY EXPERTS

- 12.2 DISCUSSION GUIDE .

- 12.3 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL .

- 12.4 CUSTOMIZATION OPTIONS

- 12.5 RELATED REPORTS .

- 12.6 AUTHOR DETAILS