|

|

市場調査レポート

商品コード

1333997

ゴム引布の世界市場 (~2028年):タイプ・用途 (防護服&手袋・ボート&乗船通路用ベローズ・伝動&コンベアベルト)・エンドユーザー (防護服・産業用・輸送・船舶)・地域別Rubber Coated Fabric Market by Type, Application (Protective Suits & Gloves, Boats & Gangway Bellows, Transmission & Conveyor Belts), End-use (Protective Clothing, Industrial, Transportation & Watercraft), and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| ゴム引布の世界市場 (~2028年):タイプ・用途 (防護服&手袋・ボート&乗船通路用ベローズ・伝動&コンベアベルト)・エンドユーザー (防護服・産業用・輸送・船舶)・地域別 |

|

出版日: 2023年08月08日

発行: MarketsandMarkets

ページ情報: 英文 192 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

ゴム引布の市場規模は、2023年の63億5,700万米ドルから、予測期間中は4.1%のCAGRで推移し、2028年には77億8,700万米ドルの規模に成長すると予測されています。

ゴム引布の市場は、防護服&手袋、ボート&乗船通路用ベローズ、伝動ベルト&コンベアベルト、アウトドアギア&レインウェア、ガスケット&ダイヤフラムなど、さまざまな用途があることから、急成長しています。

タイプ別で見ると、天然ゴム引布が予測期間中に2番目に大きな部門になると予想されています。環境の持続可能性がますます強調される中で、環境に優しい素材へのニーズが高まっています。天然ゴム引布の製造に使用されるゴムの木のラテックスは、再生可能で生分解可能な資源と見なされています。環境に優しいソリューションを求める産業界や消費者が天然ゴム引布の需要を牽引しています。

用途別では、防護服・手袋の部門が予測期間中に最大のCAGRで示す見通しです。化学品製造、製薬、ヘルスケア、建設、農業は、有害物質、化学物質、生物学的薬剤にさらされる産業です。ゴム引布は、物理的、化学的、浸透性の懸念に対する耐性を提供し、これらの職業上のリスクに対するバリアとして機能します。これらの信頼性の高い保護への要望が同部門の成長を牽引しています。

地域別では、欧州が2023年に金額ベースで第2位の市場になると推定されています。欧州の多くの産業では、特定の用途に特化したゴム引布を必要としています。例えば、海洋・海上産業ではオイルフェンス、防舷材システム、ボートカバーに必要とされています。また、航空宇宙産業では、航空機のガスケット、翼用シール材、燃料タンクのガスケットなどに使われています。これらの用途における特殊なゴム引布のニーズが同地域における市場の拡大を後押ししています。

当レポートでは、世界のゴム引布の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、ケーススタディ、関連法規制、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- ケーススタディ

- 貿易分析

- 価格分析

- エコシステム

- バリューチェーン分析

- 技術分析

- 関税と規制状況

- 主要な会議とイベント

- 特許分析

- 主要なステークホルダーと購入基準

第6章 ゴム引布市場:コーティングタイプ別

- 押出コーティング

- ローラーコーティング

- ディップコーティング

- スプレーコーティング

第7章 ゴム引布市場:タイプ別

- 合成ゴム

- 天然ゴム

第8章 ゴム引布市場:用途別

- 防護服・手袋

- ボート・乗船通路用ベローズ

- 伝動ベルト・コンベアベルト

- アウトドアギア・レインウェア

- ガスケット・ダイヤフラム

- その他

第9章 ゴム引布市場:エンドユーザー別

- 防護服

- 産業用

- 輸送・船舶

- レクリエーション・レジャー

- その他

第10章 ゴム引布市場:地域別

- アジア太平洋

- 北米

- 欧州

- 中東・アフリカ

- 南米

第11章 競合情勢

- 主要企業の採用戦略

- 市場シェア分析

- 企業の製品フットプリント分析

- 企業評価マトリックス(Tier 1)

- 競合ベンチマーキング

- スタートアップ/中小企業の評価クアドラント

- 競合シナリオ

第12章 企業プロファイル

- 主要企業

- CONTINENTAL AG

- TRELLEBORG AB

- SAINT-GOBAIN S.A.

- COLMANT COATED FABRICS

- FABRI COTE

- THE RUBBER COMPANY

- WHITE CROSS RUBBER PRODUCTS LIMITED

- CAODETEX S.A.

- AUBURN MANUFACTURING, INC.

- FOTHERGILL GROUP

- ARVILLE TEXTILES LIMITED

- ZENITH RUBBER

- BOBET COMPANY

- その他の主要企業

- UNIRUB TECHNO INDIA PRIVATE LIMITED

- KURWA RUBBER & VALVES

- RAVASCO TRANSMISSION AND PACKING PRIVATE LIMITED

- AMERICAN FABRIC FILTER

- POLYMERTECHNIK ORTRAND GMBH

- NEETA BELLOWS

- KANHA VANIJYA PVT LTD.

第13章 隣接市場および関連市場

第14章 付録

The rubber coated fabric market is projected to grow from USD 6,357 million in 2023 to USD 7,787 million by 2028, at a CAGR of 4.1% from 2023 to 2028. The rubber coated fabric contactor market is on the way to intense growth due to different applications, including protective suits & gloves, boats & gangway bellows, transmission and conveyor belts, outdoor gear & rainwear, and gaskets & diaphragms.

"By type, the natural rubber coated fabric is expected to be the second larger segment during 2023 to 2028."

The need for eco-friendly materials is rising as environmental sustainability is being stressed more and more. The latex of rubber trees, which is used to make natural rubber coated fabric, is regarded as a renewable and biodegradable resource. Industries and consumers looking for environmental-friendly solutions is driving demand for natural rubber coated fabric.

"By application, protective suits & gloves segment is estimated to grow at the highest CAGR during 2023 to 2028."

Chemical production, pharmaceuticals, healthcare, construction, and agriculture are some of the few industries which are exposed to harmful materials, chemicals, and biological agents. Rubber coated fabric offers resistance to physical, chemical, and penetrating concerns, acting as a barrier against these occupational risks. Thus, the desire for reliable protection drives the market for rubber coated fabric in protective suits and gloves.

"By end-use, protective clothing was the largest segment in 2022, by volume."

Chemical production, pharmaceuticals, healthcare, construction, and agriculture are some of the few industries which are exposed to harmful materials, chemicals, and biological agents. Rubber coated fabric offers resistance to physical, chemical, and penetrating concerns, acting as a barrier against these occupational risks. Thus, the desire for reliable protection drives the market for rubber coated fabric in protective suits and gloves.

"By region, Europe is expected to be the second largest market in 2023, by value."

Many industries in Europe need specialized rubber coated fabric for particular applications. For instance, rubber coated cloth is required by the marine and offshore industries for oil containment booms, fender systems, and boat covers. Rubber coated fabric is used by the aerospace industry for gaskets, wing seals, and fuel tank gaskets on aircraft. Thus, the need for specialized rubber coated fabric in these applications fuels the market's expansion in the region.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: C-level Executives - 25%, Directors - 30%, and Others - 45%

- By Region: North America - 20%, Europe - 15%, Asia Pacific - 55%, Middle East & Africa - 3%, South America - 7%

The rubber coated fabric contactor report is dominated by players, such as Continental AG (Germany), Trelleborg AB (Sweden), Saint-Gobain S.A (France), Colmant Coated Fabrics (France), The Rubber Company (England), White Cross Rubber Products Limited (England), Caodetex S.A. (Argentina), Auburn Manufacturing, Inc. (US), Fothergill Group (England), Arville Textiles Limited (England), Zenith Rubber (India), Bobet Company (France), and others.

Research Coverage:

The report defines, segments, and projects the size of the rubber coated fabric contactor market based on type, application, end-use, and region. It strategically profiles the key players and comprehensively analyzes their market share and core competencies. It also tracks and analyzes competitive developments, such as product launch, agreement, acquisition, and investments undertaken by them in the market.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants in the market by providing them with the closest approximations of revenue numbers of the rubber coated fabric contactor market and its segments. This report is also expected to help stakeholders obtain an improved understanding of the competitive landscape of the market, gain insights to improve the position of their businesses and make suitable go-to-market strategies. It also enables stakeholders to understand the pulse of the market and provide them information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (stringent regulatory requirements for worker's safety), restraints (availability of substitute), opportunities (technological advancement), and challenges (fluctuating raw material prices) influencing the growth of the rubber coated fabric contactor market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the rubber coated fabric contactor market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the rubber coated fabric contactor market across varied regions.

- Market Diversification: Exhaustive information about new products, various production technologies, untapped geographies, recent developments, and investments in the rubber coated fabric contactor market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as Continental AG (Germany), Trelleborg AB (Sweden), Saint-Gobain S.A (France), Colmant Coated Fabrics (France), The Rubber Company (England), White Cross Rubber Products Limited (England), Caodetex S.A. (Argentina), Auburn Manufacturing, Inc. (US), Fothergill Group (England), Arville Textiles Limited (England), Zenith Rubber (India), Bobet Company (France), among others in the rubber coated fabric contactor market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 1 RUBBER COATED FABRIC MARKET: INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- FIGURE 1 RUBBER COATED FABRIC MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.6.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RUBBER COATED FABRIC MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Companies participating in primary research

- 2.1.2.3 Breakdown of primary interviews

- 2.2 DEMAND-SIDE MATRIX CONSIDERED

- FIGURE 3 MAIN MATRIX CONSIDERED TO CONSTRUCT AND ASSESS DEMAND FOR RUBBER COATED FABRICS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- 2.4 METHODOLOGY FOR SUPPLY-SIDE SIZING OF RUBBER COATED FABRIC MARKET (1/2)

- 2.5 METHODOLOGY FOR SUPPLY-SIDE SIZING OF RUBBER COATED FABRIC MARKET (2/2)

- 2.5.1 CALCULATIONS FOR SUPPLY-SIDE ANALYSIS

- 2.6 DATA TRIANGULATION

- FIGURE 6 RUBBER COATED FABRIC MARKET: DATA TRIANGULATION

- 2.6.1 GROWTH FORECAST

- 2.6.2 GROWTH RATE ASSUMPTIONS

- 2.7 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ANALYSIS

- 2.9.1 IMPACT OF RECESSION

3 EXECUTIVE SUMMARY

- TABLE 2 RUBBER COATED FABRIC MARKET SNAPSHOT: 2023 VS. 2028

- FIGURE 7 SYNTHETIC RUBBER SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

- FIGURE 8 PROTECTIVE SUITS & GLOVES SEGMENT TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 9 TRANSPORTATION & WATERCRAFT SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 NORTH AMERICA TO DOMINATE MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 11 INCREASING DEMAND FROM VARIOUS END-USE APPLICATIONS TO DRIVE MARKET

- 4.2 RUBBER COATED FABRIC MARKET, BY REGION

- FIGURE 12 MIDDLE EAST & AFRICA TO REGISTER HIGHEST CAGR, BY VOLUME, FROM 2023 TO 2028

- 4.3 RUBBER COATED FABRIC MARKET, BY TYPE

- FIGURE 13 SYNTHETIC RUBBER SEGMENT HELD LARGER MARKET SHARE, BY VOLUME, IN 2022

- 4.4 RUBBER COATED FABRIC MARKET, BY APPLICATION

- FIGURE 14 PROTECTIVE SUITS & GLOVES SEGMENT TO HOLD LARGEST MARKET SHARE BETWEEN 2023-2028

- 4.5 RUBBER COATED FABRIC MARKET, BY END USE

- FIGURE 15 PROTECTIVE CLOTHING SEGMENT TO REGISTER HIGHEST CAGR, BY VOLUME, DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- FIGURE 16 MARKET DYNAMICS

- 5.1.1 DRIVERS

- 5.1.1.1 Increasing safety measures in transportation application

- 5.1.1.2 Stringent regulatory requirements for worker safety

- TABLE 3 US: PPE PROVISIONS AND STANDARDS

- 5.1.2 RESTRAINTS

- 5.1.2.1 Release of pollutants during manufacturing process

- 5.1.2.2 Availability of low-cost substitutes

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Potential for new applications due to technological advancements

- 5.1.3.2 Growing demand across industries

- 5.1.4 CHALLENGES

- 5.1.4.1 Fluctuating raw material prices

- FIGURE 17 RUBBER PRICE FROM JUNE 2018 - DECEMBER 2023

- 5.1.4.2 Stringent industry standards and regulations

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 18 PORTER'S FIVE FORCES ANALYSIS OF RUBBER COATED FABRIC MARKET

- 5.2.1 THREAT OF NEW ENTRANTS

- 5.2.2 THREAT OF SUBSTITUTES

- 5.2.3 BARGAINING POWER OF BUYERS

- 5.2.4 BARGAINING POWER OF SUPPLIERS

- 5.2.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 4 RUBBER COATED FABRIC MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3 CASE STUDY

- 5.3.1 PROBLEM STATEMENT

- 5.4 TRADE ANALYSIS

- 5.4.1 IMPORT-EXPORT SCENARIO

- TABLE 5 RUBBER TEXTILE FABRIC IMPORT TRADE DATA

- TABLE 6 RUBBER TEXTILE FABRIC EXPORT TRADE DATA

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE, BY APPLICATION

- FIGURE 19 AVERAGE SELLING PRICE FOR TOP THREE APPLICATIONS

- TABLE 7 AVERAGE SELLING PRICE FOR TOP THREE APPLICATIONS (USD/KG)

- 5.5.2 AVERAGE SELLING PRICE, BY REGION

- FIGURE 20 AVERAGE SELLING PRICE OF RUBBER COATED FABRIC, BY REGION, 2021-2028

- TABLE 8 AVERAGE SELLING PRICE OF RUBBER COATED FABRIC, BY REGION, 2021-2028 (USD/KG)

- 5.6 ECOSYSTEM

- FIGURE 21 ECOSYSTEM MAP OF RUBBER COATED FABRIC MARKET

- TABLE 9 RUBBER COATED FABRIC MARKET: ECOSYSTEM

- 5.7 VALUE CHAIN ANALYSIS

- FIGURE 22 VALUE CHAIN ANALYSIS OF RUBBER COATED FABRIC MARKET

- 5.7.1 RAW MATERIAL ACQUISITION

- 5.7.2 PROCESSING AND COATING

- 5.7.3 MANUFACTURING

- 5.7.4 DISTRIBUTION TO END USERS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 GROWING INFLUENCE OF NANOCOATING TECHNOLOGY

- 5.8.2 WEARABLE TECHNOLOGY INTEGRATION

- 5.9 TARIFF AND REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 REGULATIONS RELATED TO RUBBER COATED FABRIC MARKET

- 5.10 KEY CONFERENCES AND EVENTS, 2023

- TABLE 10 RUBBER COATED FABRIC MARKET: CONFERENCES AND EVENTS, 2023

- 5.11 PATENT ANALYSIS

- FIGURE 23 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

- FIGURE 24 PUBLICATION TRENDS IN LAST 10 YEARS

- 5.11.1 INSIGHTS

- FIGURE 25 LEGAL STATUS OF PATENTS

- FIGURE 26 TOP JURISDICTIONS, BY DOCUMENT

- FIGURE 27 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- TABLE 11 PATENTS: BANDO CHEMICAL INDUSTRIES, LTD.

- TABLE 12 PATENTS: CONTITECH USA INC.

- TABLE 13 TOP PATENT OWNERS DURING LAST 10 YEARS

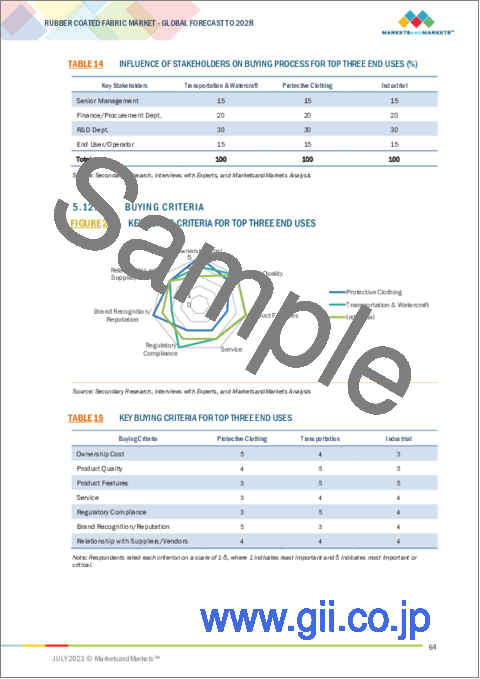

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES

- TABLE 14 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USES (%)

- 5.12.2 BUYING CRITERIA

- FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE END USES

- TABLE 15 KEY BUYING CRITERIA FOR TOP THREE END USES

6 RUBBER COATED FABRIC MARKET, BY COATING TYPE

- 6.1 INTRODUCTION

- 6.2 EXTRUSION COATING

- 6.2.1 PROVIDES UNIFORMITY AND DURABILITY

- 6.3 ROLLER COATING

- 6.3.1 OFFERS MULTIPLE SURFACE FINISHES

- 6.4 DIP COATING

- 6.4.1 SIMPLE AND COST-EFFECTIVE METHOD

- 6.5 SPRAY COATING

- 6.5.1 RESULTS IN LOWER MATERIAL WASTAGE

7 RUBBER COATED FABRIC MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 30 SYNTHETIC RUBBER SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 16 RUBBER COATED FABRIC MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 17 RUBBER COATED FABRIC MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 18 RUBBER COATED FABRIC MARKET, BY TYPE, 2019-2022 (KILOTONS)

- TABLE 19 RUBBER COATED FABRIC MARKET, BY TYPE, 2023-2028 (KILOTONS)

- 7.2 SYNTHETIC RUBBER

- 7.2.1 OFFERS VERSATILITY AND DURABILITY

- 7.3 NATURAL RUBBER

- 7.3.1 PROVIDES EXCELLENT WATER RESISTANCE AND FLEXIBILITY

8 RUBBER COATED FABRIC MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 31 PROTECTIVE SUITS & GLOVES SEGMENT TO RECORD HIGHEST GROWTH RATE DURING FORECAST PERIOD

- TABLE 20 RUBBER COATED FABRIC MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 21 RUBBER COATED FABRIC MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 22 RUBBER COATED FABRIC MARKET, BY APPLICATION, 2019-2022 (KILOTONS)

- TABLE 23 RUBBER COATED FABRIC MARKET, BY APPLICATION, 2023-2028 (KILOTONS)

- 8.2 PROTECTIVE SUITS & GLOVES

- 8.2.1 ENSURES WORKER SAFETY IN HAZARDOUS ENVIRONMENTS

- 8.3 BOATS & GANGWAY BELLOWS

- 8.3.1 PROVIDES DURABILITY AND FLEXIBILITY

- 8.4 TRANSMISSION & CONVEYOR BELTS

- 8.4.1 PROTECTS AGAINST CONSTANT WEAR AND TEAR

- 8.5 OUTDOOR GEAR & RAINWEAR

- 8.5.1 OFFERS RELIABLE PROTECTION AGAINST RAIN AND MOISTURE

- 8.6 GASKETS & DIAPHRAGMS

- 8.6.1 HELPS MAINTAIN INTEGRITY OF INDUSTRIAL SYSTEMS

- 8.7 OTHERS

9 RUBBER COATED FABRIC MARKET, BY END USE

- 9.1 INTRODUCTION

- FIGURE 32 TRANSPORTATION & WATERCRAFT SEGMENT TO HOLD LARGEST MARKET DURING FORECAST PERIOD

- TABLE 24 RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 25 RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 26 RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 27 RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- 9.2 PROTECTIVE CLOTHING

- 9.2.1 PROVIDES RELIABLE PROTECTION IN HAZARDOUS ENVIRONMENTS

- 9.3 INDUSTRIAL

- 9.3.1 SUITED FOR DIVERSE INDUSTRIAL APPLICATIONS

- 9.4 TRANSPORTATION & WATERCRAFT

- 9.4.1 IMPROVES SAFETY AND EXTENDS LIFE OF VESSELS

- 9.5 RECREATION & LEISURE

- 9.5.1 OFFERS PROTECTION FOR OUTDOOR ACTIVITIES

- 9.6 OTHERS

10 RUBBER COATED FABRIC MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 33 ASIA PACIFIC TO DRIVE MARKET DURING FORECAST PERIOD

- TABLE 28 RUBBER COATED FABRIC MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 29 RUBBER COATED FABRIC MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 30 RUBBER COATED FABRIC MARKET, BY REGION, 2019-2022 (KILOTONS)

- TABLE 31 RUBBER COATED FABRIC MARKET, BY REGION, 2023-2028 (KILOTONS)

- 10.2 ASIA PACIFIC

- 10.2.1 RECESSION IMPACT ON ASIA PACIFIC

- FIGURE 34 ASIA PACIFIC: RUBBER COATED FABRIC MARKET SNAPSHOT

- TABLE 32 ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 33 ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 34 ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 35 ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- TABLE 36 ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 37 ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 38 ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2019-2022 (KILOTONS)

- TABLE 39 ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2023-2028 (KILOTONS)

- 10.2.1.1 China

- 10.2.1.1.1 Rising textile exports to propel market

- 10.2.1.1 China

- TABLE 40 CHINA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 41 CHINA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 42 CHINA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 43 CHINA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- 10.2.1.2 India

- 10.2.1.2.1 Growth in industrial sector to fuel demand

- 10.2.1.2 India

- TABLE 44 INDIA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 45 INDIA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 46 INDIA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 47 INDIA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- 10.2.1.3 Japan

- 10.2.1.3.1 Rising demand for protective clothing to drive market

- 10.2.1.3 Japan

- TABLE 48 JAPAN: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 49 JAPAN: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 50 JAPAN: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 51 JAPAN: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- 10.2.1.4 South Korea

- 10.2.1.4.1 Growing transportation & watercraft activities to boost demand

- 10.2.1.4 South Korea

- TABLE 52 SOUTH KOREA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 53 SOUTH KOREA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 54 SOUTH KOREA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 55 SOUTH KOREA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- 10.2.2 REST OF ASIA PACIFIC

- TABLE 56 REST OF ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 57 REST OF ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 58 REST OF ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 59 REST OF ASIA PACIFIC: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- 10.3 NORTH AMERICA

- 10.3.1 RECESSION IMPACT ON NORTH AMERICA

- FIGURE 35 NORTH AMERICA: RUBBER COATED FABRIC MARKET SNAPSHOT

- TABLE 60 NORTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 61 NORTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 63 NORTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- TABLE 64 NORTH AMERICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2019-2022 (KILOTONS)

- TABLE 67 NORTH AMERICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2023-2028 (KILOTONS)

- 10.3.1.1 US

- 10.3.1.1.1 Stringent worker safety regulations to drive demand

- 10.3.1.1 US

- TABLE 68 US: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 69 US: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 70 US: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 71 US: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- 10.3.1.2 Canada

- 10.3.1.2.1 Demand from recreation & leisure industry to boost market

- 10.3.1.2 Canada

- TABLE 72 CANADA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 73 CANADA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 74 CANADA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 75 CANADA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- 10.3.1.3 Mexico

- 10.3.1.3.1 Increasing demand from automotive industry to boost market

- 10.3.1.3 Mexico

- TABLE 76 MEXICO: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 77 MEXICO: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 78 MEXICO: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 79 MEXICO: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- 10.4 EUROPE

- 10.4.1 RECESSION IMPACT ON EUROPE

- FIGURE 36 EUROPE: RUBBER COATED FABRIC MARKET SNAPSHOT

- TABLE 80 EUROPE: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 81 EUROPE: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 82 EUROPE: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 83 EUROPE: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- TABLE 84 EUROPE: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 85 EUROPE: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 86 EUROPE: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2019-2022 (KILOTONS)

- TABLE 87 EUROPE: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2023-2028 (KILOTONS)

- 10.4.1.1 Germany

- 10.4.1.1.1 Growing automotive sector to drive demand

- 10.4.1.1 Germany

- TABLE 88 GERMANY: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 89 GERMANY: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 90 GERMANY: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 91 GERMANY: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- 10.4.1.2 Italy

- 10.4.1.2.1 Large textile industry to fuel market growth

- 10.4.1.2 Italy

- TABLE 92 ITALY: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 93 ITALY: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 94 ITALY: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 95 ITALY: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- 10.4.1.3 UK

- 10.4.1.3.1 Enforcement of health and safety laws to drive market

- 10.4.1.3 UK

- TABLE 96 UK: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 97 UK: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 98 UK: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 99 UK: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- 10.4.1.4 France

- 10.4.1.4.1 Growing transportation & watercraft industry to propel demand

- 10.4.1.4 France

- TABLE 100 FRANCE: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 101 FRANCE: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 102 FRANCE: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 103 FRANCE: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- 10.4.1.5 Spain

- 10.4.1.5.1 Strong automotive sector to boost market growth

- 10.4.1.5 Spain

- TABLE 104 SPAIN: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 105 SPAIN: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 106 SPAIN: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 107 SPAIN: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- 10.4.2 REST OF EUROPE

- TABLE 108 REST OF EUROPE: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 109 REST OF EUROPE: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 110 REST OF EUROPE: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 111 REST OF EUROPE: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 RECESSION IMPACT ON MIDDLE EAST & AFRICA

- TABLE 112 MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 115 MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- TABLE 116 MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2019-2022 (KILOTONS)

- TABLE 119 MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2023-2028 (KILOTONS)

- 10.5.1.1 Turkey

- 10.5.1.1.1 Large automotive and transportation industries to propel demand

- 10.5.1.1 Turkey

- TABLE 120 TURKEY: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 121 TURKEY: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 122 TURKEY: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 123 TURKEY: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- 10.5.1.2 Saudi Arabia

- 10.5.1.2.1 Increasing demand for protective clothing to boost market growth

- 10.5.1.2 Saudi Arabia

- TABLE 124 SAUDI ARABIA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 125 SAUDI ARABIA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 126 SAUDI ARABIA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 127 SAUDI ARABIA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- 10.5.1.3 UAE

- 10.5.1.3.1 Growing recreation & leisure industry to drive demand

- 10.5.1.3 UAE

- TABLE 128 UAE: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 129 UAE: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 130 UAE: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 131 UAE: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- 10.5.2 REST OF MIDDLE EAST & AFRICA

- TABLE 132 REST OF MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 133 REST OF MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 134 REST OF MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 135 REST OF MIDDLE EAST & AFRICA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- 10.6 SOUTH AMERICA

- 10.6.1 RECESSION IMPACT ON SOUTH AMERICA

- TABLE 136 SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 137 SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 138 SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 139 SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- TABLE 140 SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 141 SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 142 SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY COUNTRY, 2019-2022 (KILOTONS)

- TABLE 143 SOUTH AMERICA: RUBBER COATED FABRICS MARKET, BY COUNTRY, 2023-2028 (KILOTONS)

- 10.6.1.1 Brazil

- 10.6.1.1.1 Large transportation industry to fuel demand

- 10.6.1.1 Brazil

- TABLE 144 BRAZIL: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 145 BRAZIL: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 146 BRAZIL: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 147 BRAZIL: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- 10.6.1.2 Argentina

- 10.6.1.2.1 Growth in textile industry to drive market

- 10.6.1.2 Argentina

- TABLE 148 ARGENTINA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 149 ARGENTINA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 150 ARGENTINA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 151 ARGENTINA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

- 10.6.2 REST OF SOUTH AMERICA

- TABLE 152 REST OF SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (USD MILLION)

- TABLE 153 REST OF SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (USD MILLION)

- TABLE 154 REST OF SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2019-2022 (KILOTONS)

- TABLE 155 REST OF SOUTH AMERICA: RUBBER COATED FABRIC MARKET, BY END USE, 2023-2028 (KILOTONS)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS

- 11.3 MARKET SHARE ANALYSIS

- 11.3.1 RANKING OF KEY MARKET PLAYERS, 2022

- FIGURE 37 RANKING OF KEY PLAYERS IN RUBBER COATED FABRIC MARKET, 2022

- 11.3.2 MARKET SHARE OF KEY PLAYERS

- FIGURE 38 RUBBER COATED FABRIC MARKET SHARE ANALYSIS

- TABLE 156 RUBBER COATED FABRIC MARKET: DEGREE OF COMPETITION

- 11.3.2.1 Continental AG

- 11.3.2.2 Trelleborg AB

- 11.3.2.3 Saint-Gobain S.A.

- 11.3.2.4 Colmant Coated Fabrics

- 11.3.2.5 Fabric Cote

- 11.3.3 REVENUE ANALYSIS OF TOP FIVE PLAYERS

- FIGURE 39 REVENUE ANALYSIS OF KEY COMPANIES, 2018-2022

- 11.4 COMPANY PRODUCT FOOTPRINT ANALYSIS

- FIGURE 40 RUBBER COATED FABRIC MARKET: COMPANY FOOTPRINT

- TABLE 157 RUBBER COATED FABRIC MARKET: TYPE FOOTPRINT

- TABLE 158 RUBBER COATED FABRIC MARKET: END USE FOOTPRINT

- TABLE 159 RUBBER COATED FABRIC MARKET: COMPANY REGION FOOTPRINT

- 11.5 COMPANY EVALUATION MATRIX (TIER 1)

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- FIGURE 41 COMPANY EVALUATION QUADRANT: RUBBER COATED FABRIC MARKET (TIER 1 COMPANIES)

- 11.6 COMPETITIVE BENCHMARKING

- TABLE 160 RUBBER COATED FABRIC MARKET: KEY STARTUPS/SMES

- TABLE 161 RUBBER COATED FABRIC MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 11.7 STARTUP/SME EVALUATION QUADRANT

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- FIGURE 42 STARTUP/SME EVALUATION QUADRANT: RUBBER COATED FABRIC MARKET

- 11.8 COMPETITIVE SCENARIO

- 11.8.1 PRODUCT LAUNCHES

- TABLE 162 RUBBER COATED FABRIC MARKET: PRODUCT LAUNCHES, 2019-2023

- 11.8.2 DEALS

- TABLE 163 RUBBER COATED FABRIC MARKET: DEALS, 2019-2023

- 11.8.3 OTHER DEVELOPMENTS

- TABLE 164 RUBBER COATED FABRIC MARKET: EXPANSIONS AND INVESTMENTS, 2019-2023

12 COMPANY PROFILES

- 12.1 MAJOR PLAYERS

- (Business Overview, Products offered, Recent Developments, MnM View)**

- 12.1.1 CONTINENTAL AG

- FIGURE 43 CONTINENTAL AG: COMPANY SNAPSHOT

- TABLE 165 CONTINENTAL AG: COMPANY OVERVIEW

- TABLE 166 CONTINENTAL AG: PRODUCTS OFFERED

- TABLE 167 CONTINENTAL AG: PRODUCT LAUNCHES

- 12.1.2 TRELLEBORG AB

- FIGURE 44 TRELLEBORG AB: COMPANY SNAPSHOT

- TABLE 168 TRELLEBORG AB: COMPANY OVERVIEW

- TABLE 169 TRELLEBORG AB: PRODUCTS OFFERED

- TABLE 170 TRELLEBORG AB: DEALS

- 12.1.3 SAINT-GOBAIN S.A.

- FIGURE 45 SAINT-GOBAIN S.A.: COMPANY SNAPSHOT

- TABLE 171 SAINT-GOBAIN S.A.: COMPANY OVERVIEW

- TABLE 172 SAINT-GOBAIN S.A.: PRODUCTS OFFERED

- TABLE 173 SAINT-GOBAIN S.A.: PRODUCT LAUNCHES

- 12.1.4 COLMANT COATED FABRICS

- TABLE 174 COLMANT COATED FABRICS: COMPANY OVERVIEW

- TABLE 175 COLMANT COATED FABRICS: PRODUCTS OFFERED

- 12.1.5 FABRI COTE

- TABLE 176 FABRI COTE: COMPANY OVERVIEW

- TABLE 177 FABRI COTE: PRODUCTS OFFERED

- TABLE 178 FABRI COTE: DEALS

- 12.1.6 THE RUBBER COMPANY

- TABLE 179 THE RUBBER COMPANY: COMPANY OVERVIEW

- TABLE 180 THE RUBBER COMPANY: PRODUCTS OFFERED

- 12.1.7 WHITE CROSS RUBBER PRODUCTS LIMITED

- TABLE 181 WHITE CROSS RUBBER PRODUCTS LIMITED: COMPANY OVERVIEW

- TABLE 182 WHITE CROSS RUBBER PRODUCTS LIMITED: PRODUCTS OFFERED

- 12.1.8 CAODETEX S.A.

- TABLE 183 CAODETEX S.A.: COMPANY OVERVIEW

- TABLE 184 CAODETEX S.A.: PRODUCTS OFFERED

- 12.1.9 AUBURN MANUFACTURING, INC.

- TABLE 185 AUBURN MANUFACTURING, INC.: COMPANY OVERVIEW

- TABLE 186 AUBURN MANUFACTURING, INC.: PRODUCTS OFFERED

- 12.1.10 FOTHERGILL GROUP

- TABLE 187 FOTHERGILL GROUP: COMPANY OVERVIEW

- TABLE 188 FOTHERGILL GROUP: PRODUCTS OFFERED

- 12.1.11 ARVILLE TEXTILES LIMITED

- TABLE 189 ARVILLE TEXTILES LIMITED: COMPANY OVERVIEW

- TABLE 190 ARVILLE TEXTILES LIMITED: PRODUCTS OFFERED

- TABLE 191 ARVILLE TEXTILES LIMITED: DEALS

- TABLE 192 ARVILLE TEXTILES LIMITED: OTHERS

- 12.1.12 ZENITH RUBBER

- TABLE 193 ZENITH RUBBER: COMPANY OVERVIEW

- TABLE 194 ZENITH RUBBER: PRODUCTS OFFERED

- 12.1.13 BOBET COMPANY

- TABLE 195 BOBET COMPANY: COMPANY OVERVIEW

- TABLE 196 BOBET COMPANY: PRODUCTS OFFERED

- 12.2 OTHER KEY MARKET PLAYERS

- 12.2.1 UNIRUB TECHNO INDIA PRIVATE LIMITED

- TABLE 197 UNIRUB TECHNO INDIA PRIVATE LIMITED: COMPANY OVERVIEW

- 12.2.2 KURWA RUBBER & VALVES

- TABLE 198 KURWA RUBBER & VALVES: COMPANY OVERVIEW

- 12.2.3 RAVASCO TRANSMISSION AND PACKING PRIVATE LIMITED

- TABLE 199 RAVASCO TRANSMISSION AND PACKING PRIVATE LIMITED: COMPANY OVERVIEW

- 12.2.4 AMERICAN FABRIC FILTER

- TABLE 200 AMERICAN FABRIC FILTER: COMPANY OVERVIEW

- 12.2.5 POLYMERTECHNIK ORTRAND GMBH

- TABLE 201 POLYMERTECHNIK ORTRAND GMBH: COMPANY OVERVIEW

- 12.2.6 NEETA BELLOWS

- TABLE 202 NEETA BELLOWS: COMPANY OVERVIEW

- 12.2.7 KANHA VANIJYA PVT LTD.

- TABLE 203 KANHA VANIJYA PVT LTD.: COMPANY OVERVIEW

- *Details on Business Overview, Products offered, Recent Developments, MnM View might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.2.1 RUBBER COATED FABRIC INTERCONNECTED MARKETS

- 13.2.2 COATED FABRICS MARKET

- 13.2.2.1 Market Definition

- 13.2.2.2 Market Overview

- 13.2.2.3 Coated Fabrics Market, By Application

- 13.2.2.3.1 Transportation

- 13.2.2.3.2 Protective Clothing

- 13.2.2.3.3 Industrial

- 13.2.2.3.4 Roofing, Awnings & Canopies

- 13.2.2.3.5 Furniture & Seating

- 13.2.2.3.6 Others

- TABLE 204 COATED FABRICS MARKET, BY APPLICATION, 2018-2022 (USD MILLION)

- TABLE 205 COATED FABRICS MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 206 COATED FABRICS MARKET, BY APPLICATION, 2018-2022 (KILOTONS)

- TABLE 207 COATED FABRICS MARKET, BY APPLICATION, 2023-2028 (KILOTONS)

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS