|

|

市場調査レポート

商品コード

1333996

アクリロニトリルブタジエンスチレン(ABS)の世界市場:タイプ別、グレード別、製造プロセス別、技術別、用途別、地域別 - 予測(~2028年)Acrylonitrile Butadiene Styrene Market by Type (Opaque, Transparent, Colored), Grade (High Impact, Heat Resistant, Electroplatable, Flame Retardant, Blended), Manufacturing Process, Technology, Applications, and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| アクリロニトリルブタジエンスチレン(ABS)の世界市場:タイプ別、グレード別、製造プロセス別、技術別、用途別、地域別 - 予測(~2028年) |

|

出版日: 2023年08月08日

発行: MarketsandMarkets

ページ情報: 英文 226 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のアクリロニトリルブタジエンスチレン(ABS)の市場規模は、2023年に286億米ドル、2028年までに399億米ドルに達し、CAGRで6.9%の成長が予測されています。

市場は、主に自動車産業や家電産業における需要の増加、燃料効率に向けた軽量材料への注目、持続可能性やリサイクル可能性に対する意識の高まりといった要因によって、有望な成長が見込まれています。

透明セグメントタイプは、予測期間中に2番目に速いCAGRで成長すると予測されています。

透明ABSは、その多用途性とさまざまな産業における需要の増加により、2番目に急成長しているセグメントです。透明性、半透明性、耐衝撃性などのユニークな特性により、自動車用レンズ、医療機器、ディスプレイケース、照明器具などの用途に好まれています。産業界が見た目に美しく耐久性のある材料を求める中、透明ABSの使用は急増を続け、その急成長と市場の重要性を牽引しています。

連続塊状重合は、市場の製造工程のうちもっとも速く成長すると予測されています。

連続塊状重合は、高い生産効率、コスト効率、安定した製品品質などの利点により、市場でもっとも速く成長すると予測されます。

中東・アフリカは予測期間中、市場で2番目に速く成長する地域となる見込みです。

中東・アフリカは、自動車、建設、電子などのさまざまな最終用途産業におけるABS需要の増加により、市場で2番目に速く成長している地域になると予測されます。同地域の人口の増加、急速な都市化、可処分所得の増加が、消費財と自動車の需要を牽引し、製造工程におけるABSの採用に拍車をかけています。さらに、同地域のインフラ開発プロジェクトが建設用途におけるABSの需要を押し上げ、その大きな成長可能性に寄与しています。

当レポートでは、世界のアクリロニトリルブタジエンスチレン(ABS)市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主要考察

- ABS市場の企業にとっての魅力的な機会

- ABS市場:タイプ別

- ABS市場:技術別

- ABS市場:グレード別

- ABS市場:製造工程別

- ABS市場:用途別

- アジア太平洋のABS市場:エンドユーザー別、国別(2022年)

- ABS市場:地域別

第5章 市場の概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- サプライチェーン分析

- 原材料の分析

- アクリロニトリル

- ブタジエン

- スチレン

- ケーススタディ分析

- マクロ経済指標

- 規制情勢

- 貿易分析

- 技術分析

- 平均販売価格の動向

- エコシステムマッピング

- 顧客のビジネスに影響を与える動向と混乱

- 特許分析

- 主な会議とイベント(2023年~2024年)

- 購入基準

第6章 ABS市場:タイプ別

- イントロダクション

- 不透明ABS

- カラーABS

- 透明ABS

第7章 ABS市場:グレード別

- イントロダクション

- 耐衝撃ABS

- 耐熱ABS

- 電気メッキ可能なABS

- 難燃性ABS

- ブレンドABS

第8章 ABS市場:製造工程別

- イントロダクション

- 乳化重合

- 塊状重合

- 連続塊状重合

- その他

第9章 ABS市場:技術別

- イントロダクション

- 押し出し

- 射出成形

- 中空成形、吹込み成形

- 熱成形

- 3Dプリント

第10章 ABS市場:用途別

- イントロダクション

- コンシューマーエレクトロニクス

- 電気、電子

- 自動車

- 消費財

- 建設

- その他

第11章 ABS市場:地域別

- イントロダクション

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他のアジア太平洋

- 欧州

- ドイツ

- イタリア

- ポーランド

- スペイン

- 英国

- その他の欧州

- 北米

- 米国

- カナダ

- メキシコ

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- その他の中東・アフリカ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

第12章 競合情勢

- 概要

- 主な市場企業のランキングの分析

- 市場シェア分析

- 主要企業の収益の分析

- 市場の評価マトリクス

- 企業の評価マトリクス(2022年)

- スタートアップと中小企業(SMEs)の評価マトリクス

- 企業の最終用途産業フットプリント

- 企業の地域フットプリント

- 製品ポートフォリオの強み

- 事業戦略の優秀性

- 競合シナリオ

第13章 企業プロファイル

- 主要企業

- LG CHEM LTD

- CHIMEI CORPORATION

- INEOS STYROLUTION

- PETROCHINA CO LTD

- FORMOSA CHEMICALS & FIBRE CORPORATION

- SABIC

- TORAY INDUSTRIES, INC.

- LOTTE CHEMICAL

- VERSALIS

- KUMHO PETROCHEMICAL

- BASF SE

- COVESTRO AG

- その他の企業

- TRINSEO

- TECHNO UMG CO LTD.

- TIANJIN DAGU CHEMICAL CO., LTD.

- THE IRAN PETROCHEMICAL COMMERCIAL COMPANY

- SHANGHAI GAOQIAO PETROCHEMICAL COMPANY

- IRPC

- RTP COMPANY

- RAVAGO MANUFACTURING AMERICAS LLC

第14章 付録

The ABS market is projected to reach USD 39.9 billion by 2028, at a CAGR of 6.9% from USD 28.6 billion in 2023. The global ABS market has a promising growth potential driven primarily by factors such as increasing demand in the automotive and appliances industries, a focus on lightweight materials for fuel efficiency, and rising awareness of sustainability and recyclability.

The transparent segment type is projected to grow at the second-fastest CAGR during the forecast period.

Transparent ABS is the second fastest-growing segment due to its versatility and increasing demand in various industries. Its unique properties, including transparency, translucency, and impact resistance, make it a preferred choice for applications such as automotive lenses, medical equipment, display cases, and lighting fixtures. As industries seek visually appealing and durable materials, the usage of transparent ABS continues to surge, driving its rapid growth and market significance.

Continuous mass polymerization is projected to grow at the fastest rate among the manufacturing processes in the ABS market.

Continuous mass polymerization is expected to grow at the fastest rate in the ABS market due to its advantages such as high production efficiency, cost-effectiveness, and consistent product quality. Continuous mass polymerization allows for continuous & uninterrupted production, reducing downtime, and increasing productivity. Additionally, it offers better control over process parameters, resulting in improved product characteristics. These factors contribute to the growing adoption of continuous mass polymerization in the ABS market.

Middle East & Africa is projected to be the second-fastest growing region in the ABS market during the forecast period.

Middle East & Africa is projected to be the second fastest-growing region in the ABS market due to the increasing demand for ABS in various end-use industries, including automotive, construction, and electronics. The region's growing population, rapid urbanization, and rising disposable income are driving the demand for consumer goods and automobiles, fueling the adoption of ABS in manufacturing processes. Additionally, infrastructure development projects in the region are boosting the demand for ABS in construction applications, contributing to its significant growth potential.

Extensive primary interviews were conducted to determine and verify the sizes of several segments and subsegments of the ABS market gathered through secondary research.

The breakdown of primary interviews has been given below.

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C Level Executives - 20%, Director Level - 10%, Others - 70%

- By Region: North America - 20%, Europe - 30%, Asia Pacific - 30%, Middle East & Africa - 10%, South America-10%.

The key players in the ABS market are LG Chem Ltd. (South Korea), ChiMei Corporation (Taiwan), INEOS Styrolution (Germany), PetroChina Co Ltd. (China), Formosa Chemicals & Fibre Corporation (Taiwan), Sabic (Saudi Arabia), Toray Industries Inc. (Japan), Lotte Chemical (South Korea), Versalis (Italy), Kumho Petrochemical (South Korea), BASF SE (Germany), and Covestro AG (Germany), Trinseo(US), Techno UMG Ltd(Japan), Tianjin Dagu Chemical (China) , The Iran Petrochemical Commercial Company (Iran) , Shanghai Gaoqiao Petrochemical Company (China), IRPC (Thailand), RTP Company (USA) and Ravago Manufacturing (USA), among others. The ABS market report analyzes the key growth strategies, such as new product launches, expansions, investments, and acquisitions to strengthen their market positions.

Research Coverage

This report provides detailed segmentation of the ABS market and forecasts its market size until 2028. The market has been segmented based on by type (opaque, transparent, and colored), grade (high impact, heat resistant, electroplatable, flame retardant, and blended), manufacturing process (emulsion polymerization, mass polymerization, and continuous mass polymerization), technology (extrusion, injection molding, blow molding, thermoforming, and 3D printing), applications (appliances, electrical & electronics, automotive, consumer goods, and construction), and region (North America, Europe, Asia Pacific, Middle East & Africa, and South America). A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, partnerships, expansions, and acquisitions associated with the ABS market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the ABS market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (growing demand from end-use industries, surging consumer awareness & preference for high-performance plastics, advancements in manufacturing technologies), restraints (competition from alternative materials, lack of skilled workforce & testing facilities in developing countries), opportunities (advancements in 3D printing, the increasing demand for sustainable packaging solutions), and challenges (the availability and efficiency of recycling infrastructure for ABS waste) influencing the growth of the ABS market

- Market Penetration: Comprehensive information on ABS offered by top players in the global ABS market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and acquisitions in the ABS market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for ABS market across regions.

- Market Diversification: Exhaustive information about partnerships, growing geographies, and recent developments in the ABS market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 1 ABS MARKET: INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 ABS MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 UNITS CONSIDERED

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 IMPACT OF RECESSION

- 2.2 RESEARCH DATA

- FIGURE 2 ABS MARKET: RESEARCH DESIGN

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Major secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.3 PRIMARY INTERVIEWS

- 2.2.3.1 Key industry insights

- 2.2.3.2 Breakdown of primary interviews

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 3 MARKET SIZE ESTIMATION APPROACH

- 2.3.1 REGIONAL ANALYSIS

- FIGURE 4 MARKET SIZE REGIONAL ESTIMATION

- 2.3.2 TOP-DOWN APPROACH

- 2.3.2.1 Arriving at market size using top-down approach

- FIGURE 5 TOP-DOWN APPROACH

- 2.3.3 BOTTOM-UP APPROACH

- 2.3.3.1 Arriving at market size using bottom-up approach

- FIGURE 6 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- FIGURE 7 ABS MARKET: DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY

- FIGURE 8 OPAQUE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 9 HIGH IMPACT GRADE TO LEAD MARKET DURING FORECAST PERIOD

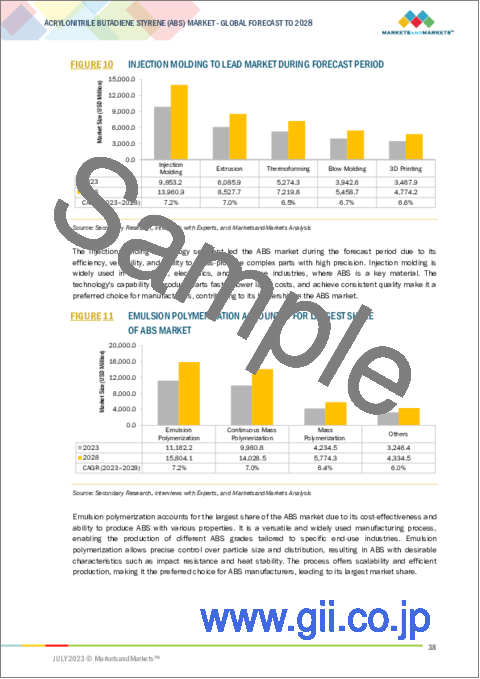

- FIGURE 10 INJECTION MOLDING TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 11 EMULSION POLYMERIZATION ACCOUNTED FOR LARGEST SHARE OF ABS MARKET

- FIGURE 12 AUTOMOTIVE APPLICATIONS ACCOUNTED FOR LARGEST SHARE OF ABS MARKET

- FIGURE 13 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF ABS MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ABS MARKET

- FIGURE 14 ASIA PACIFIC TO OFFER ATTRACTIVE OPPORTUNITIES IN ABS MARKET DURING FORECAST PERIOD

- 4.2 ABS MARKET, BY TYPE

- FIGURE 15 OPAQUE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.3 ABS MARKET, BY TECHNOLOGY

- FIGURE 16 INJECTION MOLDING TO LEAD MARKET DURING FORECAST PERIOD

- 4.4 ABS MARKET, BY GRADE

- FIGURE 17 HIGH IMPACT TO LEAD MARKET DURING FORECAST PERIOD

- 4.5 ABS MARKET, BY MANUFACTURING PROCESS

- FIGURE 18 EMULSION POLYMERIZATION TO LEAD MARKET DURING FORECAST PERIOD

- 4.6 ABS MARKET, BY APPLICATION

- FIGURE 19 AUTOMOTIVE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- 4.7 ABS MARKET IN ASIA PACIFIC, BY END USER AND COUNTRY, 2022

- FIGURE 20 AUTOMOTIVE SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES

- 4.8 ABS MARKET, BY REGION

- FIGURE 21 CHINA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing demand from end-use industries

- 5.2.1.2 Advancements in manufacturing technologies

- 5.2.1.3 Surging consumer awareness and preference for high-performance plastics

- 5.2.2 RESTRAINTS

- 5.2.2.1 Competition from alternative materials

- 5.2.2.2 Lack of skilled workforce and testing facilities in emerging economies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Advancements in 3D printing

- 5.2.3.2 Increasing demand for sustainable packaging solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Availability and efficiency of recycling infrastructure for ABS waste

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 23 ABS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 2 ABS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.4 SUPPLY CHAIN ANALYSIS

- FIGURE 24 ABS MARKET: SUPPLY CHAIN ANALYSIS

- 5.5 RAW MATERIAL ANALYSIS

- 5.5.1 ACRYLONITRILE

- 5.5.2 BUTADIENE

- 5.5.3 STYRENE

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 COST-EFFECTIVE MATERIAL SOLUTION FOR PREMIUM CAR SPEAKER GRILLS

- 5.6.2 DEVELOPING CUSTOMIZED MATERIAL SOLUTION FOR HOME OXYGEN CONCENTRATORS

- 5.6.3 POWER OF ANTIMICROBIAL ABS FOR DAILY LIFE PRODUCTS

- 5.7 MACROECONOMIC INDICATORS

- 5.7.1 GDP TRENDS AND FORECAST

- TABLE 3 GDP TRENDS AND FORECAST, BY MAJOR ECONOMY, 2021-2028 (USD BILLION)

- 5.8 REGULATORY LANDSCAPE

- 5.8.1 REGULATIONS

- 5.8.1.1 Europe

- 5.8.1.2 US

- 5.8.1.3 Others

- 5.8.2 STANDARDS

- 5.8.2.1 Occupational Safety and Health Act of 1970 (OSHA Standards)

- 5.8.2.2 European Committee for Standardization (CEN)

- 5.8.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.1 REGULATIONS

- 5.9 TRADE ANALYSIS

- TABLE 5 MAJOR EXPORTING COUNTRIES - ABS (USD MILLION)

- TABLE 6 MAJOR IMPORTING COUNTRIES- ABS (USD MILLION)

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 ADDITIVE MANUFACTURING/3D PRINTING

- 5.10.2 BIO-BASED ABS

- 5.10.3 SURFACE MODIFICATION TECHNIQUES

- 5.10.4 DIGITALIZATION AND DATA-DRIVEN MANUFACTURING

- 5.10.5 HYBRID ABS COMPOSITES

- 5.11 AVERAGE SELLING PRICE TREND

- TABLE 7 AVERAGE SELLING PRICE, BY REGION (USD/KG)

- TABLE 8 AVERAGE SELLING PRICE, BY KEY PLAYER (USD/KG)

- TABLE 9 AVERAGE SELLING PRICE, BY KEY APPLICATION (USD/KG)

- 5.12 ECOSYSTEM MAPPING

- FIGURE 25 ABS ECOSYSTEM MAPPING

- TABLE 10 ABS MARKET: ECOSYSTEM

- 5.13 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 26 AUTOMOTIVE, CONSUMER GOODS, AND CONSTRUCTION APPLICATIONS TO DRIVE MARKET

- 5.14 PATENT ANALYSIS

- 5.14.1 INTRODUCTION

- 5.14.2 METHODOLOGY

- 5.14.3 DOCUMENT TYPE

- FIGURE 27 TOTAL NUMBER OF PATENTS REGISTERED IN 10 YEARS (2012-2022)

- 5.14.4 PUBLICATION TRENDS, LAST 10 YEARS

- FIGURE 28 NUMBER OF PATENTS YEAR-WISE FROM 2012 TO 2022

- 5.14.5 INSIGHTS

- 5.14.6 LEGAL STATUS OF PATENTS

- FIGURE 29 PATENT ANALYSIS, BY LEGAL STATUS

- 5.14.7 JURISDICTION ANALYSIS

- FIGURE 30 TOP JURISDICTION - BY DOCUMENT

- 5.14.8 TOP COMPANIES/APPLICANTS

- FIGURE 31 TOP 10 PATENT APPLICANTS

- 5.14.8.1 Patents by Seagate Plastics Company

- TABLE 11 PATENTS BY SEAGATE PLASTICS COMPANY

- 5.14.8.2 Patents by LG Chemical LTD

- TABLE 12 PATENTS BY LG CHEMICAL LTD

- 5.14.8.3 Patents by LG Electronics INC

- TABLE 13 PATENTS BY LG ELECTRONICS INC

- 5.14.9 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- TABLE 14 TOP 10 PATENT OWNERS

- 5.15 KEY CONFERENCES & EVENTS IN 2023-2024

- TABLE 15 ABS MARKET: CONFERENCES & EVENTS

- 5.16 BUYING CRITERIA

- FIGURE 32 INFLUENCE OF KEY STAKEHOLDERS IN BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 16 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

6 ABS MARKET, BY TYPE

- 6.1 INTRODUCTION

- FIGURE 33 ABS MARKET, BY TYPE (2023-2028)

- TABLE 17 ABS MARKET, BY TYPE, 2021-2028 (KILOTON)

- TABLE 18 ABS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- 6.2 OPAQUE ABS

- 6.2.1 INCREASED DEMAND FROM VARIOUS END-USE INDUSTRIES TO DRIVE MARKET

- 6.3 COLORED ABS

- 6.3.1 EXCELLENT MECHANICAL PROPERTIES TO DRIVE MARKET

- 6.4 TRANSPARENT ABS

- 6.4.1 VISUAL APPEAL AND STRENGTH TO DRIVE MARKET

7 ABS MARKET, BY GRADE

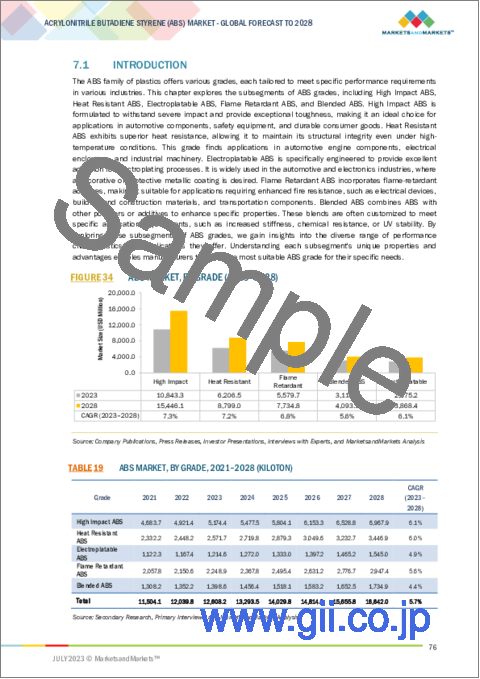

- 7.1 INTRODUCTION

- FIGURE 34 ABS MARKET, BY GRADE (2023-2028)

- TABLE 19 ABS MARKET, BY GRADE, 2021-2028 (KILOTON)

- TABLE 20 ABS MARKET, BY GRADE, 2021-2028 (USD MILLION)

- 7.2 HIGH-IMPACT ABS

- 7.2.1 OUTSTANDING TOUGHNESS TO DRIVE MARKET

- 7.3 HEAT-RESISTANT ABS

- 7.3.1 HIGH DEMAND FROM VARIOUS END-USE INDUSTRIES TO DRIVE MARKET

- 7.4 ELECTROPLATABLE ABS

- 7.4.1 INCREASING DEMAND FROM AUTOMOTIVE AND ELECTRONICS TO DRIVE MARKET

- 7.5 FLAME-RETARDANT ABS

- 7.5.1 ENHANCED FIRE SAFETY PROPERTIES TO DRIVE MARKET

- 7.6 BLENDED ABS

- 7.6.1 ENHANCED PERFORMANCE CAPABILITIES TO DRIVE MARKET

8 ABS MARKET, BY MANUFACTURING PROCESS

- 8.1 INTRODUCTION

- FIGURE 35 ABS MARKET, BY MANUFACTURING PROCESS (2023-2028)

- TABLE 21 ABS MARKET, BY MANUFACTURING PROCESS, 2021-2028 (KILOTON)

- TABLE 22 ABS MARKET, BY MANUFACTURING PROCESS, 2021-2028 (USD MILLION)

- 8.2 EMULSION POLYMERIZATION

- 8.2.1 ENHANCED ABS PROPERTIES TO DRIVE MARKET

- 8.3 MASS POLYMERIZATION

- 8.3.1 ENHANCED IMPACT RESISTANCE AND TENSILE STRENGTH TO DRIVE MARKET

- 8.4 CONTINUOUS MASS POLYMERIZATION

- 8.4.1 CONSISTENT PRODUCT QUALITY THROUGHOUT PRODUCTION PROCESS TO DRIVE MARKET

- 8.5 OTHERS

9 ABS MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- FIGURE 36 ABS MARKET, BY TECHNOLOGY (2023-2028)

- TABLE 23 ABS MARKET, BY TECHNOLOGY, 2021-2028 (KILOTON)

- TABLE 24 ABS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- 9.2 EXTRUSION

- 9.2.1 WIDE PRODUCTION OF ABS SHEETS TO DRIVE MARKET

- 9.3 INJECTION MOLDING

- 9.3.1 HIGH PRODUCTION RATES TO DRIVE MARKET

- 9.4 BLOW MOLDING

- 9.4.1 LARGE-SCALE PRODUCTION OF HOLLOW PLASTIC PRODUCTS TO DRIVE MARKET

- 9.5 THERMOFORMING

- 9.5.1 COST-EFFECTIVE PRODUCTION PROCESS TO DRIVE MARKET

- 9.6 3D PRINTING

- 9.6.1 QUICK AND COST-EFFECTIVE PRINTING TO DRIVE MARKET

10 ABS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- FIGURE 37 ABS MARKET, BY APPLICATION (2023-2028)

- TABLE 25 ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 26 ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 10.2 APPLIANCES

- 10.2.1 EXTENSIVE USE IN APPLIANCES INDUSTRY TO DRIVE MARKET

- 10.2.1.1 Washing machine

- 10.2.1.2 Refrigeration

- 10.2.1.3 Others

- 10.2.1 EXTENSIVE USE IN APPLIANCES INDUSTRY TO DRIVE MARKET

- 10.3 ELECTRICAL AND ELECTRONICS

- 10.3.1 ENHANCED PRODUCT PERFORMANCE TO DRIVE MARKET

- 10.3.1.1 Electronic enclosures

- 10.3.1.2 Computer printer housing

- 10.3.1.3 Others

- 10.3.1 ENHANCED PRODUCT PERFORMANCE TO DRIVE MARKET

- 10.4 AUTOMOTIVE

- 10.4.1 HIGH DEMAND FOR ABS IN AUTOMOTIVE INDUSTRY TO DRIVE MARKET

- 10.4.1.1 Instrument panel

- 10.4.1.2 Dashboard console

- 10.4.1.3 Others

- 10.4.1 HIGH DEMAND FOR ABS IN AUTOMOTIVE INDUSTRY TO DRIVE MARKET

- 10.5 CONSUMER GOODS

- 10.5.1 UNLEASHING VERSATILITY AND DURABILITY TO DRIVE MARKET

- 10.5.1.1 Small domestic appliances

- 10.5.1.2 Protective cases

- 10.5.1.3 Others

- 10.5.1 UNLEASHING VERSATILITY AND DURABILITY TO DRIVE MARKET

- 10.6 CONSTRUCTION

- 10.6.1 EMBRACING ABS FOR CONSTRUCTION EXCELLENCE TO DRIVE MARKET

- 10.6.1.1 Pipes and fittings

- 10.6.1.2 Roofing and membranes

- 10.6.1.3 Others

- 10.6.1 EMBRACING ABS FOR CONSTRUCTION EXCELLENCE TO DRIVE MARKET

- 10.7 OTHERS

11 ABS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 38 CHINA TO BE FASTEST GROWING MARKET DURING FORECAST PERIOD

- TABLE 27 ABS MARKET, BY REGION, 2021-2028 (KILOTON)

- TABLE 28 ABS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 11.2 ASIA PACIFIC

- FIGURE 39 ASIA PACIFIC: ABS MARKET SNAPSHOT

- TABLE 29 ASIA PACIFIC: ABS MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- TABLE 30 ASIA PACIFIC: ABS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 31 ASIA PACIFIC: ABS MARKET, BY TYPE, 2021-2028 (KILOTON)

- TABLE 32 ASIA PACIFIC: ABS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 33 ASIA PACIFIC: ABS MARKET, BY GRADE, 2021-2028 (KILOTON)

- TABLE 34 ASIA PACIFIC: ABS MARKET, BY GRADE, 2021-2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC: ABS MARKET, BY MANUFACTURING PROCESS, 2021-2028 (KILOTON)

- TABLE 36 ASIA PACIFIC: ABS MARKET, BY MANUFACTURING PROCESS, 2021-2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: ABS MARKET, BY TECHNOLOGY, 2021-2028 (KILOTON)

- TABLE 38 ASIA PACIFIC: ABS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 39 ASIA PACIFIC: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 40 ASIA PACIFIC: ABS MARKET SIZE, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.2.1 CHINA

- 11.2.1.1 Increasing demand for passenger cars to drive market

- TABLE 41 CHINA: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 42 CHINA: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.2.2 INDIA

- 11.2.2.1 Strategic government initiatives to drive market

- TABLE 43 INDIA: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 44 INDIA: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.2.3 JAPAN

- 11.2.3.1 Stringent government regulations concerning greenhouse gas emissions to drive market

- TABLE 45 JAPAN: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 46 JAPAN: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.2.4 SOUTH KOREA

- 11.2.4.1 Growth in automotive sector to drive market

- TABLE 47 SOUTH KOREA: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 48 SOUTH KOREA: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.2.5 REST OF ASIA PACIFIC

- TABLE 49 REST OF ASIA PACIFIC: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 50 REST OF ASIA PACIFIC: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.3 EUROPE

- FIGURE 40 EUROPE: ABS MARKET SNAPSHOT

- TABLE 51 EUROPE: ABS MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- TABLE 52 EUROPE: ABS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 53 EUROPE: ABS MARKET, BY TYPE, 2021-2028 (KILOTON)

- TABLE 54 EUROPE: ABS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 55 EUROPE: ABS MARKET, BY GRADE, 2021-2028 (KILOTON)

- TABLE 56 EUROPE: ABS MARKET, BY GRADE, 2021-2028 (USD MILLION)

- TABLE 57 EUROPE: ABS MARKET, BY MANUFACTURING PROCESS, 2021-2028 (KILOTON)

- TABLE 58 EUROPE: ABS MARKET, BY MANUFACTURING PROCESS, 2021-2028 (USD MILLION)

- TABLE 59 EUROPE: ABS MARKET, BY TECHNOLOGY, 2021-2028 (KILOTON)

- TABLE 60 EUROPE: ABS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 61 EUROPE: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 62 EUROPE: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.3.1 GERMANY

- 11.3.1.1 Technological advancements in electronics sector to drive market

- TABLE 63 GERMANY: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 64 GERMANY: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.3.2 ITALY

- 11.3.2.1 Government initiatives to promote sales of electric vehicles to drive market

- TABLE 65 ITALY: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 66 ITALY: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.3.3 POLAND

- 11.3.3.1 Robust manufacturing sector to drive market

- TABLE 67 POLAND: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 68 POLAND: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.3.4 SPAIN

- 11.3.4.1 Accelerating automotive sector to drive market

- TABLE 69 SPAIN: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 70 SPAIN: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.3.5 UK

- 11.3.5.1 Increasing demand for passenger vehicles to drive market

- TABLE 71 UK: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 72 UK: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.3.6 REST OF EUROPE

- TABLE 73 REST OF EUROPE: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 74 REST OF EUROPE: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.4 NORTH AMERICA

- FIGURE 41 NORTH AMERICA: ABS MARKET SNAPSHOT

- TABLE 75 NORTH AMERICA: ABS MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- TABLE 76 NORTH AMERICA: ABS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: ABS MARKET, BY TYPE, 2021-2028 (KILOTON)

- TABLE 78 NORTH AMERICA: ABS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: ABS MARKET, BY GRADE, 2021-2028 (KILOTON)

- TABLE 80 NORTH AMERICA: ABS MARKET, BY GRADE, 2021-2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: ABS MARKET, BY MANUFACTURING PROCESS, 2021-2028 (KILOTON)

- TABLE 82 NORTH AMERICA: ABS MARKET, BY MANUFACTURING PROCESS, 2021-2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: ABS MARKET, BY TECHNOLOGY, 2021-2028 (KILOTON)

- TABLE 84 NORTH AMERICA: ABS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 86 NORTH AMERICA: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.4.1 US

- 11.4.1.1 Increasing demand for electric vehicles to drive market

- TABLE 87 US: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 88 US: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.4.2 CANADA

- 11.4.2.1 Government initiatives for zero-emission electric vehicles to drive market

- TABLE 89 CANADA: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 90 CANADA: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.4.3 MEXICO

- 11.4.3.1 Exports and domestic manufacturing to drive market

- TABLE 91 MEXICO: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 92 MEXICO: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.5 MIDDLE EAST & AFRICA

- FIGURE 42 MIDDLE EAST & AFRICA: ABS MARKET SNAPSHOT

- TABLE 93 MIDDLE EAST & AFRICA: ABS MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- TABLE 94 MIDDLE EAST & AFRICA: ABS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 95 MIDDLE EAST & AFRICA: ABS MARKET, BY TYPE, 2021-2028 (KILOTON)

- TABLE 96 MIDDLE EAST & AFRICA: ABS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 97 MIDDLE EAST & AFRICA: ABS MARKET, BY GRADE, 2021-2028 (KILOTON)

- TABLE 98 MIDDLE EAST & AFRICA: ABS MARKET, BY GRADE, 2021-2028 (USD MILLION)

- TABLE 99 MIDDLE EAST & AFRICA: ABS MARKET, BY MANUFACTURING PROCESS, 2021-2028 (KILOTON)

- TABLE 100 MIDDLE EAST & AFRICA: ABS MARKET, BY MANUFACTURING PROCESS, 2021-2028 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: ABS MARKET, BY TECHNOLOGY, 2021-2028 (KILOTON)

- TABLE 102 MIDDLE EAST & AFRICA: ABS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 104 MIDDLE EAST & AFRICA: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.5.1 UAE

- 11.5.1.1 Increasing demand from construction sector to drive demand

- TABLE 105 UAE: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 106 UAE: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.5.2 SAUDI ARABIA

- 11.5.2.1 Growing construction and manufacturing activities to drive market

- TABLE 107 SAUDI ARABIA: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 108 SAUDI ARABIA: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.5.3 SOUTH AFRICA

- 11.5.3.1 Increasing demand from construction sector to drive market

- TABLE 109 SOUTH AFRICA: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 110 SOUTH AFRICA: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.5.4 REST OF MIDDLE EAST & AFRICA

- TABLE 111 REST OF MIDDLE EAST & AFRICA: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 112 REST OF MIDDLE EAST & AFRICA: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.6 SOUTH AMERICA

- FIGURE 43 SOUTH AMERICA: ABS MARKET SNAPSHOT

- TABLE 113 SOUTH AMERICA: ABS MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- TABLE 114 SOUTH AMERICA: ABS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 115 SOUTH AMERICA: ABS MARKET, BY TYPE, 2021-2028 (KILOTON)

- TABLE 116 SOUTH AMERICA: ABS MARKET, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 117 SOUTH AMERICA: ABS MARKET, BY GRADE, 2021-2028 (KILOTON)

- TABLE 118 SOUTH AMERICA: ABS MARKET, BY GRADE, 2021-2028 (USD MILLION)

- TABLE 119 SOUTH AMERICA: ABS MARKET, BY MANUFACTURING PROCESS, 2021-2028 (KILOTON)

- TABLE 120 SOUTH AMERICA: ABS MARKET, BY MANUFACTURING PROCESS, 2021-2028 (USD MILLION)

- TABLE 121 SOUTH AMERICA: ABS MARKET, BY TECHNOLOGY, 2021-2028 (KILOTON)

- TABLE 122 SOUTH AMERICA: ABS MARKET, BY TECHNOLOGY, 2021-2028 (USD MILLION)

- TABLE 123 SOUTH AMERICA: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 124 SOUTH AMERICA: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.6.1 BRAZIL

- 11.6.1.1 Economic growth to drive market

- TABLE 125 BRAZIL: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 126 BRAZIL: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.6.2 ARGENTINA

- 11.6.2.1 Electronics and automotive sectors to drive market

- TABLE 127 ARGENTINA: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 128 ARGENTINA: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 11.6.3 REST OF SOUTH AMERICA

- TABLE 129 REST OF SOUTH AMERICA: ABS MARKET, BY APPLICATION, 2021-2028 (KILOTON)

- TABLE 130 REST OF SOUTH AMERICA: ABS MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- FIGURE 44 COMPANIES ADOPTED ACQUISITION AND EXPANSION AS KEY GROWTH STRATEGIES BETWEEN 2019 AND 2023

- 12.2 RANKING ANALYSIS OF KEY MARKET PLAYERS

- FIGURE 45 RANKING OF TOP FIVE PLAYERS IN ABS MARKET, 2022

- 12.3 MARKET SHARE ANALYSIS

- FIGURE 46 ABS MARKET SHARE, BY COMPANY (2022)

- TABLE 131 ABS MARKET: DEGREE OF COMPETITION

- 12.4 REVENUE ANALYSIS OF TOP PLAYERS

- TABLE 132 ABS MARKET: REVENUE ANALYSIS (USD BILLION)

- 12.5 MARKET EVALUATION MATRIX

- TABLE 133 MARKET EVALUATION MATRIX

- 12.6 COMPANY EVALUATION MATRIX, 2022

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- FIGURE 47 ABS MARKET: COMPANY EVALUATION MATRIX, 2022

- 12.7 START-UPS AND SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

- 12.7.1 RESPONSIVE COMPANIES

- 12.7.2 STARTING BLOCKS

- 12.7.3 PROGRESSIVE COMPANIES

- 12.7.4 DYNAMIC COMPANIES

- FIGURE 48 ABS MARKET: START-UPS AND SMES MATRIX, 2022

- 12.8 COMPANY END-USE INDUSTRY FOOTPRINT

- 12.9 COMPANY REGION FOOTPRINT

- 12.10 STRENGTH OF PRODUCT PORTFOLIO

- 12.11 BUSINESS STRATEGY EXCELLENCE

- 12.12 COMPETITIVE SCENARIO

- 12.12.1 PRODUCT LAUNCHES

- TABLE 134 PRODUCT LAUNCHES, 2019-2023

- 12.12.2 DEALS

- TABLE 135 DEALS, 2017-2023

- 12.12.3 OTHER DEVELOPMENTS

- TABLE 136 OTHER DEVELOPMENTS, 2019-2023

13 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services offered, Recent Developments, Deals, MnM view, Key strengths, Strategic choices, Weakness and competitive threats) **

- 13.1 KEY PLAYERS

- 13.1.1 LG CHEM LTD

- TABLE 137 LG CHEM LTD: COMPANY OVERVIEW

- FIGURE 49 LG CHEM LTD: COMPANY SNAPSHOT

- TABLE 138 LG CHEM LTD: PRODUCT OFFERED

- TABLE 139 LG CHEM LTD: OTHER DEVELOPMENTS

- 13.1.2 CHIMEI CORPORATION

- TABLE 140 CHIMEI CORPORATION: COMPANY OVERVIEW

- FIGURE 50 CHIMEI CORP: COMPANY SNAPSHOT

- TABLE 141 CHIMEI CORPORATION: PRODUCT OFFERINGS

- TABLE 142 CHIMEI CORPORATION: PRODUCT LAUNCHES

- TABLE 143 CHIMEI CORPORATION: OTHER DEVELOPMENTS

- 13.1.3 INEOS STYROLUTION

- TABLE 144 INEOS STYROLUTION: COMPANY OVERVIEW

- FIGURE 51 INEOS STYROLUTION: COMPANY SNAPSHOT

- TABLE 145 INEOS STYROLUTION: PRODUCTS OFFERED

- TABLE 146 INEOS STYROLUTION: DEALS

- TABLE 147 INEOS STYROLUTION: NEW PRODUCT LAUNCHES

- TABLE 148 INEOS STYROLUTION: OTHER DEVELOPMENTS

- 13.1.4 PETROCHINA CO LTD

- TABLE 149 PETROCHINA CO LTD: COMPANY OVERVIEW

- FIGURE 52 PETROCHEM CO LTD: COMPANY SNAPSHOT

- TABLE 150 PETROCHINA CO LTD: PRODUCTS OFFERED

- TABLE 151 PETROCHINA CO LTD: OTHER DEVELOPMENTS

- 13.1.5 FORMOSA CHEMICALS & FIBRE CORPORATION

- TABLE 152 FORMOSA CHEMICALS & FIBRE CORPORATION: COMPANY OVERVIEW

- FIGURE 53 FORMOSA CHEMICALS & FIBRE CORPORATION: COMPANY SNAPSHOT

- TABLE 153 FORMOSA CHEMICALS & FIBRE CORPORATION: PRODUCTS OFFERED

- TABLE 154 FORMOSA CHEMICALS & FIBRE CORPORATION: OTHER DEVELOPMENTS

- 13.1.6 SABIC

- TABLE 155 SABIC: COMPANY OVERVIEW

- FIGURE 54 SABIC: COMPANY SNAPSHOT

- TABLE 156 SABIC: PRODUCTS OFFERED

- 13.1.7 TORAY INDUSTRIES, INC.

- TABLE 157 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 55 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 158 TORAY INDUSTRIES, INC.: PRODUCTS OFFERED

- TABLE 159 TORAY INDUSTRIES, INC.: OTHER DEVELOPMENTS

- 13.1.8 LOTTE CHEMICAL

- TABLE 160 LOTTE CHEMICAL COMPANY OVERVIEW

- FIGURE 56 LOTTE CHEMICAL: COMPANY SNAPSHOT

- TABLE 161 LOTTE CHEMICAL: PRODUCTS OFFERED

- TABLE 162 LOTTE CHEMICALS: DEALS

- TABLE 163 LOTTE CHEMICALS: OTHER DEVELOPMENTS

- 13.1.9 VERSALIS

- TABLE 164 VERSALILS: COMPANY OVERVIEW

- FIGURE 57 VERSALIS: COMPANY SNAPSHOT

- TABLE 165 VERSALILS: PRODUCTS OFFERED

- TABLE 166 VERSALIS: OTHER DEVELOPMENTS

- 13.1.10 KUMHO PETROCHEMICAL

- TABLE 167 KUMHO PETROCHEMICAL: COMPANY OVERVIEW

- FIGURE 58 KUMHO PETROCHEMICALS: COMPANY SNAPSHOT

- TABLE 168 KUMHO PETROCHEMICAL: PRODUCTS OFFERED

- 13.1.11 BASF SE

- TABLE 169 BASF SE: COMPANY OVERVIEW

- FIGURE 59 BASF SE: COMPANY SNAPSHOT

- 13.1.12 COVESTRO AG

- TABLE 170 COVESTRO AG: COMPANY OVERVIEWS

- FIGURE 60 COVESTRO AG: COMPANY SNAPSHOT

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, Deals, MnM view, Right to win, Strategic choices, Weakness and competitive threats might not be captured in case of unlisted companies.

- 13.2 OTHER PLAYERS

- 13.2.1 TRINSEO

- 13.2.2 TECHNO UMG CO LTD.

- 13.2.3 TIANJIN DAGU CHEMICAL CO., LTD.

- 13.2.4 THE IRAN PETROCHEMICAL COMMERCIAL COMPANY

- 13.2.5 SHANGHAI GAOQIAO PETROCHEMICAL COMPANY

- 13.2.6 IRPC

- 13.2.7 RTP COMPANY

- 13.2.8 RAVAGO MANUFACTURING AMERICAS LLC

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS