|

|

市場調査レポート

商品コード

1328578

幹細胞製造の世界市場 (~2028年):製品 (消耗品・機器・幹細胞株)・用途 (研究・臨床・細胞組織&バンキング)・エンドユーザー・地域別Stem Cell Manufacturing Market by Product (Consumables, Instruments, Stem Cell Lines), Application (Research, Clinical, Cell Tissue & Banking), End User, Region (North America, Europe, APAC, Latin America, MEA) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 幹細胞製造の世界市場 (~2028年):製品 (消耗品・機器・幹細胞株)・用途 (研究・臨床・細胞組織&バンキング)・エンドユーザー・地域別 |

|

出版日: 2023年07月26日

発行: MarketsandMarkets

ページ情報: 英文 300 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

幹細胞製造の市場規模は、2023年の127億米ドルから、予測期間中は11.3%のCAGRで推移し、2028年には218億米ドルの規模に成長すると予測されています。

遺伝性疾患の増加や幹細胞治療に関する規制当局の認可の増加が同市場の成長を促進すると予想されています。

製品別で見ると、消耗品の部門が最大のシェアを示しています。幹細胞を用いた研究に対する需要の高まり、政府からの資金提供やイニシアチブの増加、学術機関と製薬企業との共同研究の増加により、成長率が高まっています。

また、用途別では、研究用途が最大のシェアを示しています。同部門の成長は、細胞学・病態生理学研究への注目の高まり、研究者や医療従事者の間で幹細胞の治療能力に対する認識が高まっていること、幹細胞製品の開発と商業化を支援する官民の資金援助が拡大していること、幹細胞製品の効率的な製造拡大に関する技術進歩などの要因が背景にあると考えられています。

地域別では、北米地域が最大のシェアを示しています。北米地域の大きなシェアは、高度なインフラ、最先端の研究機関、幹細胞研究を専門とするバイオテクノロジー企業やCROの強力なエコシステムなど、同地域で確立されたヘルスケアおよびバイオテクノロジー産業に起因しています。北米には、幹細胞研究に特化したプログラムや専門知識を有するトップクラスの学術機関や非公開会社が存在し、幹細胞製造市場の成長に寄与しています。

また、アジア太平洋地域は予測期間中に最大のCAGRで成長すると予測されています。この背景には、個別化医療に対する需要の高まりや、幹細胞を用いた治療法の進歩があります。アジア太平洋地域の幹細胞製造市場のもう一つの主要促進要因は、同地域の人口の多さとその急速な増加です。

当レポートでは、世界の幹細胞製造の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、ケーススタディ、関連法規制、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 技術分析

- 顧客の事業に影響を与える動向/ディスラプション

- サプライチェーン分析

- バリューチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 規制分析

- 価格分析

- 特許分析

- 主な会議とイベント

- 主要なステークホルダーと購入基準

第6章 幹細胞製造市場:製品別

- 消耗品

- 培地

- その他の消耗品

- 機器

- バイオリアクター・インキュベーター

- セルソーター

- その他

- 幹細胞株

- 造血幹細胞

- 間葉系幹細胞

- 人工多能性幹細胞

- ES細胞

- 神経幹細胞

- 多能性成人前駆幹細胞

第7章 幹細胞製造市場:用途別

- 研究

- ライフサイエンス研究

- 創薬・開発

- 臨床

- 同種幹細胞療法

- 自家幹細胞療法

- 細胞および組織バンキング

第8章 幹細胞製造市場:エンドユーザー別

- 製薬およびバイオテクノロジー企業

- 学術機関・研究・CRO

- 病院・外科センター

- 細胞バンク・組織バンク

- その他

第9章 幹細胞製造市場:地域別

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第10章 競合情勢

- 企業の採用戦略

- 上位5社の収益シェア分析

- 上位5社の市場シェア分析

- 主要企業の企業評価クアドラント

- 新興企業/中小企業向けの企業評価クアドラント

- 競合ベンチマーキング

- 新興企業/中小企業の競合ベンチマーキング

- 競合シナリオと動向

第11章 企業プロファイル

- 主要企業

- THERMO FISHER SCIENTIFIC, INC.

- MERCK KGAA

- LONZA GROUP

- DANAHER CORPORATION

- SARTORIUS AG

- BECTON, DICKINSON AND COMPANY

- EPPENDORF SE

- CORNING INCORPORATED

- BIO-RAD LABORATORIES, INC.

- TAKARA BIO INC.

- FUJIFILM HOLDINGS CORPORATION

- GETINGE AB

- TERUMO CORPORATION

- BIO-TECHNE CORPORATION

- HIMEDIA LABORATORIES PVT. LTD.

- その他の企業

- STEMCELL TECHNOLOGIES, INC.

- MILTENYI BIOTEC GMBH

- PROMOCELL

- ANTEROGEN CO. LTD.

- CELLGENIX GMBH

- PLURISTEM THERAPEUTICS INC.

- DAIICHI SANKYO

- ORGANOGENESIS HOLDINGS INC.

- VERICEL CORP.

- AMERICAN CRYOSTEM CORP.

第12章 付録

The stem cell manufacturing market is projected to reach USD 21.8 billion by 2028 from USD 12.7 billion in 2023, at a CAGR of 11.3% during the forecast period. The major factors driving the increasing prevalence of genetic diseases and increasing regulatory approvals on stem cell therapies are expected to propel the growth of the market. However, the high costs of research and manufacturing are expected to restrain market growth to a certain extent.

The stem cell manufacturing market has been segmented based on product, application, end-user, and region.

"By-products, the consumables segment accounted for the largest share of the stem cell manufacturing market."

Based on products, the stem cell manufacturing market is categorized into consumables, instruments, and stem cell lines. The consumables segment dominated the market in 2023, owing to rising demand for stem cell-based research, increasing government funding and initiatives, and the rising number of collaborations between academic institutions and pharmaceutical companies has led to a higher growth rate for products in the stem cell manufacturing market.

"By application, research application segment accounted for the largest share in the stem cell manufacturing market."

Based on application, the stem cell manufacturing market is segmented into research applications, clinical applications, and cell & tissue banking applications. In 2023, the research application segment accounted for a larger share of the stem cell manufacturing market. Growth in this market segment can be attributed to a rising focus on stem cell cytology & pathophysiology research, growing awareness about the therapeutic potency of stem cells among researchers and healthcare professionals, growing public-private funding to support stem cell product development and commercialization, and technological advancements related to the effective production scale-up for stem cell products.

"North America: the largest share of the stem cell manufacturing market"

North America accounted for the largest share of the stem cell manufacturing market. The large share of the North American region can be attributed to a well-established healthcare and biotechnology industry in the region, with advanced infrastructure, cutting-edge research institutions, and a strong ecosystem of biotechnology companies and CROs specializing in stem cell research. The presence of top academic institutions and private companies in North America with dedicated stem cell research programs and expertise has contributed to the growth of the stem cell manufacturing market.

"Asia Pacific: The fastest-growing region in the stem cell manufacturing market."

The Asia Pacific stem cell manufacturing market is projected to grow at the highest CAGR during the forecast period. This is attributed to the increasing demand for personalized medicine and advancements in stem cell-based therapies. Another key driver for the Asia Pacific stem cell manufacturing market is the region's large and rapidly increasing population.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply Side- 63% and Demand Side- 37%

- By Designation: C Level Executives - 45%, Director Level- 30%, and Others - 25%

- By Country: North America- 40%, Europe- 25%, Asia Pacific- 20%, Latin America - 10%, and Middle East Africa- 5%

Prominent Players

- Thermo Fisher Scientific, Inc. (US)

- Merck KGaA (Germany)

- Lonza Group (Switzerland)

- Danaher Corporation (US)

- Sartorius AG (Germany)

- Becton, Dickinson, and Company (US)

- Eppendorf AG (Germany)

- Corning Inc. (US)

- Bio-Rad Laboratories (US)

- Takara Bio Group (Japan)

- Fujifilm Holdings Corporation (Japan)

- Getinge AB (Sweden)

- Terumo Corporation (Japan)

- Bio-Techne Corporation (US)

- HiMedia Laboratories (India)

- StemCell Technologies, Inc. (Canada)

- Miltenyi Biotec GmBH (Germany)

- PromoCell (Germany), Anterogen Co. Ltd. (South Korea)

- CellGenix GmBH (India)

- Pluristem Therapeutics Inc. (Israel)

- Daiichi Sankyo (Japan)

- Organogenesis Holdings Inc. (US)

- Vericel Corporation (US)

- American Cryostem Corporation (US)

Research Coverage:

This report provides a detailed picture of the stem cell manufacturing market. It aims at estimating the size and future growth potential of the market across different segments, such as the product (Consumables (culture media, and other consumables), instruments (Bioreactors & Incubators, cell sorters, and other instruments), and stem cell lines (hematopoietic stem cells, mesenchymal stem cells, induced pluripotent stem cells, embryonic stem cells, neural stem cells, and multipotent adult progenitor stem cells), application(research applications (life science research, and drug discovery and development), clinical applications (allogeneic stem cell therapy, and autologous stem cell therapy), and cell & tissue banking applications), and end-user (hospitals & surgical centers, pharmaceutical & biotechnology companies, cell & tissue banks, academic institutes, research laboratories, and CROs, and other end users) and region (North America, Europe, Asia Pacific, Latin America, and Middle East Africa). The report also includes an in-depth competitive analysis of the key market players, along with their company profiles, recent developments, and key market strategies.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants by providing them with the closest approximations of the revenue numbers for the overall stem cell manufacturing market and its segments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, trends, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (growing venture capital investments in stem cell research, increasing awareness about the therapeutic potency of stem cell products, and technological advancements in stem cell manufacturing), restraints (significant operational costs associated with stem cell manufacturing and banking), opportunities (development of new vaccine and treatment of genetic diseases in Asia Pacific region, government initiatives to boost the biotechnology and biopharmaceutical industries, and increased market focus on mesenchymal stem cells and induced pluripotent stem cells), and challenges (technical limitations associated with manufacturing scale-up, and socio-ethical concerns related to the use of allogeneic and human embryonic stem cells) influencing the growth of the stem cell manufacturing market.

- Product Development/ Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the stem cell manufacturing market.

- Market Development: Comprehensive information about lucrative markets- the report analyses the stem cell manufacturing market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the stem cell manufacturing market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Merck KGaA (Germany), Lonza Group (Switzerland), and Danaher Corporation (US), among others, in the stem cell manufacturing market strategies. The report also helps stakeholders understand the pulse of the stem cell manufacturing market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY

- 1.6 RESEARCH LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

- 1.9 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 STEM CELL MANUFACTURING MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- FIGURE 2 STEM CELL MANUFACTURING MARKET: BREAKDOWN OF PRIMARIES

- 2.2 MARKET ESTIMATION METHODOLOGY

- FIGURE 3 MARKET SIZE ESTIMATION: APPROACH 1 (COMPANY REVENUE ANALYSIS-BASED ESTIMATION), 2022

- FIGURE 4 STEM CELL MANUFACTURING MARKET SIZE (2022)

- FIGURE 5 STEM CELL MANUFACTURING MARKET: FINAL CAGR PROJECTIONS (2023-2028)

- FIGURE 6 STEM CELL MANUFACTURING MARKET: CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 2.3 MARKET DATA ESTIMATION AND TRIANGULATION

- 2.3.1 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- 2.4 INDUSTRY INSIGHTS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 STEM CELL MANUFACTURING MARKET: GLOBAL RECESSION IMPACT

- TABLE 1 GLOBAL INFLATION RATE PROJECTIONS, 2021-2027 (% GROWTH)

- TABLE 2 US HEALTH EXPENDITURE, 2019-2022 (USD MILLION)

- TABLE 3 US HEALTH EXPENDITURE, 2023-2027 (USD MILLION)

3 EXECUTIVE SUMMARY

- FIGURE 8 STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 STEM CELL MANUFACTURING MARKET: GEOGRAPHICAL SNAPSHOT

4 PREMIUM INSIGHTS

- 4.1 STEM CELL MANUFACTURING MARKET OVERVIEW

- FIGURE 11 GROWING INVESTMENTS IN STEM CELL-BASED RESEARCH TO DRIVE MARKET GROWTH

- 4.2 NORTH AMERICA: STEM CELL MANUFACTURING MARKET, BY PRODUCT AND COUNTRY (2023)

- FIGURE 12 CONSUMABLES TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- 4.3 STEM CELL MANUFACTURING MARKET, BY END USER (2023 VS. 2028)

- FIGURE 13 PHARMACEUTICAL & BIOTECH COMPANIES TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 14 STEM CELL MANUFACTURING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- TABLE 4 STEM CELL MANUFACTURING MARKET: IMPACT ANALYSIS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing venture capital investments in stem cell research

- 5.2.1.2 Increasing awareness about therapeutic potency of stem cell products

- 5.2.1.3 Technological advancements in stem cell manufacturing

- 5.2.2 RESTRAINTS

- 5.2.2.1 Significant operational costs associated with stem cell manufacturing and banking

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Supportive regulatory framework across developing economies

- 5.2.3.2 Government initiatives to boost biotechnology and biopharmaceutical industries

- 5.2.3.3 Increased market focus on mesenchymal stem cells and induced pluripotent stem cells

- 5.2.4 CHALLENGES

- 5.2.4.1 Technical limitations associated with manufacturing scale-up

- 5.2.4.2 Socio-ethical concerns related to use of allogeneic and human embryonic stem cells

- 5.3 TECHNOLOGY ANALYSIS

- TABLE 5 SINGLE-USE BIOREACTORS VS. STAINLESS STEEL BIOREACTORS

- 5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 15 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.5 SUPPLY CHAIN ANALYSIS

- FIGURE 16 STEM CELL MANUFACTURING MARKET: SUPPLY CHAIN ANALYSIS

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 17 STEM CELL MANUFACTURING MARKET: VALUE CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- FIGURE 18 STEM CELL MANUFACTURING MARKET: ECOSYSTEM ANALYSIS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 STEM CELL MANUFACTURING MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.8.2 BARGAINING POWER OF SUPPLIERS

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 THREAT OF SUBSTITUTES

- 5.8.5 THREAT OF NEW ENTRANTS

- 5.9 REGULATORY ANALYSIS

- 5.9.1 FDA APPROVALS

- 5.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10 PRICING ANALYSIS

- TABLE 12 AVERAGE SELLING PRICE OF PRODUCTS OFFERED BY KEY PLAYERS

- 5.10.1 AVERAGE SELLING PRICE TREND ANALYSIS

- 5.11 PATENT ANALYSIS

- FIGURE 19 GRANTED PATENTS FOR STEM CELL MANUFACTURING, 2011-2023**

- TABLE 13 TOP OWNERS OF STEM CELL MANUFACTURING PATENTS

- 5.12 KEY CONFERENCES & EVENTS IN 2023-2024

- TABLE 14 STEM CELL MANUFACTURING CONFERENCES (2023-2024)

- 5.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 20 STEM CELL MANUFACTURING MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- 5.13.2 STEM CELL MANUFACTURING MARKET: BUYING CRITERIA

- FIGURE 21 KEY BUYING CRITERIA FOR END USERS

6 STEM CELL MANUFACTURING MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- TABLE 15 STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- 6.2 CONSUMABLES

- TABLE 16 STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 17 STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 18 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 19 EUROPE: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 20 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.1 CULTURE MEDIA

- 6.2.1.1 Rising stem cell research and increasing demand for stem cell therapies to boost adoption of culture media

- TABLE 21 STEM CELL MANUFACTURING MARKET FOR CULTURE MEDIA, BY REGION, 2021-2028 (USD MILLION)

- TABLE 22 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR CULTURE MEDIA, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 23 EUROPE: STEM CELL MANUFACTURING MARKET FOR CULTURE MEDIA, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 24 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CULTURE MEDIA, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.2.2 OTHER CONSUMABLES

- TABLE 25 STEM CELL MANUFACTURING MARKET FOR OTHER CONSUMABLES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 26 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR OTHER CONSUMABLES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 27 EUROPE: STEM CELL MANUFACTURING MARKET FOR OTHER CONSUMABLES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 28 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR OTHER CONSUMABLES, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3 INSTRUMENTS

- TABLE 29 STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 30 STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 31 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 32 EUROPE: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 33 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.1 BIOREACTORS & INCUBATORS

- 6.3.1.1 Introduction of advanced bioreactors and incubators to contribute to market growth

- TABLE 34 STEM CELL MANUFACTURING MARKET FOR BIOREACTORS & INCUBATORS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 35 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR BIOREACTORS & INCUBATORS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 36 EUROPE: STEM CELL MANUFACTURING MARKET FOR BIOREACTORS & INCUBATORS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 37 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR BIOREACTORS & INCUBATORS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.2 CELL SORTERS

- 6.3.2.1 Development of novel cell sorting technologies such as microfluidics to drive market

- TABLE 38 STEM CELL MANUFACTURING MARKET FOR CELL SORTERS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 39 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR CELL SORTERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 40 EUROPE: STEM CELL MANUFACTURING MARKET FOR CELL SORTERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CELL SORTERS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.3.3 OTHER INSTRUMENTS

- TABLE 42 STEM CELL MANUFACTURING MARKET FOR OTHER INSTRUMENTS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 43 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR OTHER INSTRUMENTS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 44 EUROPE: STEM CELL MANUFACTURING MARKET FOR OTHER INSTRUMENTS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 45 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR OTHER INSTRUMENTS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4 STEM CELL LINES

- TABLE 46 STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 47 STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 48 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 49 EUROPE: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4.1 HEMATOPOIETIC STEM CELLS

- 6.4.1.1 Increasing adoption of cord blood banking to boost market

- TABLE 51 STEM CELL MANUFACTURING MARKET FOR HEMATOPOIETIC STEM CELLS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR HEMATOPOIETIC STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 53 EUROPE: STEM CELL MANUFACTURING MARKET FOR HEMATOPOIETIC STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 54 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR HEMATOPOIETIC STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4.2 MESENCHYMAL STEM CELLS

- 6.4.2.1 Ease of cell harvesting, processing, and preservation to drive adoption of MSCs

- TABLE 55 STEM CELL MANUFACTURING MARKET FOR MESENCHYMAL STEM CELLS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR MESENCHYMAL STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 57 EUROPE: STEM CELL MANUFACTURING MARKET FOR MESENCHYMAL STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 58 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR MESENCHYMAL STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4.3 INDUCED PLURIPOTENT STEM CELLS

- 6.4.3.1 Increased adoption of iPSCs in research on cell therapies & regenerative medicine to fuel growth

- TABLE 59 STEM CELL MANUFACTURING MARKET FOR INDUCED PLURIPOTENT STEM CELLS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR INDUCED PLURIPOTENT STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 61 EUROPE: STEM CELL MANUFACTURING MARKET FOR INDUCED PLURIPOTENT STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 62 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR INDUCED PLURIPOTENT STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4.4 EMBRYONIC STEM CELLS

- 6.4.4.1 Rising research activity in cancer precision medicine to contribute to segmental growth

- TABLE 63 STEM CELL MANUFACTURING MARKET FOR EMBRYONIC STEM CELLS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR EMBRYONIC STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 65 EUROPE: STEM CELL MANUFACTURING MARKET FOR EMBRYONIC STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 66 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR EMBRYONIC STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4.5 NEURAL STEM CELLS

- 6.4.5.1 Introduction of novel isolation and expansion techniques for NSCs to drive market

- TABLE 67 STEM CELL MANUFACTURING MARKET FOR NEURAL STEM CELLS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR NEURAL STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 69 EUROPE: STEM CELL MANUFACTURING MARKET FOR NEURAL STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 70 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR NEURAL STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

- 6.4.6 MULTIPOTENT ADULT PROGENITOR STEM CELLS

- 6.4.6.1 Rising awareness of role of MAPCs in research to propel market

- TABLE 71 STEM CELL MANUFACTURING MARKET FOR MULTIPOTENT ADULT PROGENITOR STEM CELLS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 72 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR MULTIPOTENT ADULT PROGENITOR STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

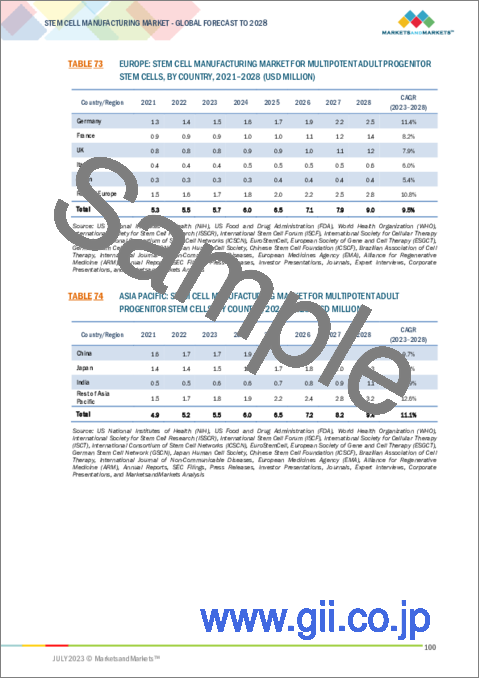

- TABLE 73 EUROPE: STEM CELL MANUFACTURING MARKET FOR MULTIPOTENT ADULT PROGENITOR STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 74 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR MULTIPOTENT ADULT PROGENITOR STEM CELLS, BY COUNTRY, 2021-2028 (USD MILLION)

7 STEM CELL MANUFACTURING MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- TABLE 75 STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 7.2 RESEARCH APPLICATIONS

- TABLE 76 STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 77 STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 79 EUROPE: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 80 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.1 LIFE SCIENCE RESEARCH

- 7.2.1.1 Increasing research focus on stem cell cytology & pathology to boost market

- TABLE 81 STEM CELL MANUFACTURING MARKET FOR LIFE SCIENCE RESEARCH, BY REGION, 2021-2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR LIFE SCIENCE RESEARCH, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 83 EUROPE: STEM CELL MANUFACTURING MARKET FOR LIFE SCIENCE RESEARCH, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR LIFE SCIENCE RESEARCH, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.2.2 DRUG DISCOVERY & DEVELOPMENT

- 7.2.2.1 Increasing research expenditure by pharma and biotech companies to contribute to market growth

- TABLE 85 STEM CELL MANUFACTURING MARKET FOR DRUG DISCOVERY & DEVELOPMENT, BY REGION, 2021-2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR DRUG DISCOVERY & DEVELOPMENT, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 87 EUROPE: STEM CELL MANUFACTURING MARKET FOR DRUG DISCOVERY & DEVELOPMENT, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 88 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR DRUG DISCOVERY & DEVELOPMENT, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3 CLINICAL APPLICATIONS

- TABLE 89 STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 90 STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 92 EUROPE: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.1 ALLOGENEIC STEM CELL THERAPY

- 7.3.1.1 Wide therapeutic applications of stem cell lines to drive growth

- TABLE 94 STEM CELL MANUFACTURING MARKET FOR ALLOGENEIC STEM CELL THERAPY, BY REGION, 2021-2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR ALLOGENEIC STEM CELL THERAPY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 96 EUROPE: STEM CELL MANUFACTURING MARKET FOR ALLOGENEIC STEM CELL THERAPY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR ALLOGENEIC STEM CELL THERAPY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.3.2 AUTOLOGOUS STEM CELL THERAPY

- 7.3.2.1 Increasing patient preference for autologous stem cell therapy to drive segmental growth

- TABLE 98 STEM CELL MANUFACTURING MARKET FOR AUTOLOGOUS STEM CELL THERAPY, BY REGION, 2021-2028 (USD MILLION)

- TABLE 99 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR AUTOLOGOUS STEM CELL THERAPY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 100 EUROPE: STEM CELL MANUFACTURING MARKET FOR AUTOLOGOUS STEM CELL THERAPY, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR AUTOLOGOUS STEM CELL THERAPY, BY COUNTRY, 2021-2028 (USD MILLION)

- 7.4 CELL & TISSUE BANKING APPLICATIONS

- 7.4.1 RISING DEMAND FOR CORD BLOOD STEM CELL BANKING TO FAVOR MARKET GROWTH

- TABLE 102 STEM CELL MANUFACTURING MARKET FOR CELL & TISSUE BANKING APPLICATIONS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 103 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR CELL & TISSUE BANKING APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 104 EUROPE: STEM CELL MANUFACTURING MARKET FOR CELL & TISSUE BANKING APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 105 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CELL & TISSUE BANKING APPLICATIONS, BY COUNTRY, 2021-2028 (USD MILLION)

8 STEM CELL MANUFACTURING MARKET, BY END USER

- 8.1 INTRODUCTION

- TABLE 106 STEM CELL MANUFACTURING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 8.2.1 INCREASING PRIVATE INVESTMENTS FOR STEM CELL-BASED RESEARCH TO DRIVE MARKET GROWTH

- TABLE 107 STEM CELL MANUFACTURING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2021-2028 (USD MILLION)

- TABLE 108 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 109 EUROPE: STEM CELL MANUFACTURING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.3 ACADEMIC INSTITUTES, RESEARCH LABORATORIES, AND CONTRACT RESEARCH ORGANIZATIONS

- 8.3.1 INCREASED PUBLIC FUNDING FOR RESEARCH ACTIVITIES TO BOOST MARKET

- TABLE 111 STEM CELL MANUFACTURING MARKET FOR ACADEMIC INSTITUTES, RESEARCH LABORATORIES, AND CROS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 112 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR ACADEMIC INSTITUTES, RESEARCH LABORATORIES, AND CROS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 113 EUROPE: STEM CELL MANUFACTURING MARKET FOR ACADEMIC INSTITUTES, RESEARCH LABORATORIES, AND CROS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR ACADEMIC INSTITUTES, RESEARCH LABORATORIES, AND CROS, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.4 HOSPITALS & SURGICAL CENTERS

- 8.4.1 IMPROVED HEALTHCARE INFRASTRUCTURE TO PROPEL GROWTH

- TABLE 115 STEM CELL MANUFACTURING MARKET FOR HOSPITALS & SURGICAL CENTERS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 116 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR HOSPITALS & SURGICAL CENTERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 117 EUROPE: STEM CELL MANUFACTURING MARKET FOR HOSPITALS & SURGICAL CENTERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR HOSPITALS & SURGICAL CENTERS, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.5 CELL & TISSUE BANKS

- 8.5.1 GROWING APPLICATION OF STEM CELLS IN DISEASE TREATMENT TO FAVOR MARKET GROWTH

- TABLE 119 STEM CELL MANUFACTURING MARKET FOR CELL & TISSUE BANKS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 120 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR CELL & TISSUE BANKS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 121 EUROPE: STEM CELL MANUFACTURING MARKET FOR CELL & TISSUE BANKS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CELL & TISSUE BANKS, BY COUNTRY, 2021-2028 (USD MILLION)

- 8.6 OTHER END USERS

- TABLE 123 STEM CELL MANUFACTURING MARKET FOR OTHER END USERS, BY REGION, 2021-2028 (USD MILLION)

- TABLE 124 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR OTHER END USERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 125 EUROPE: STEM CELL MANUFACTURING MARKET FOR OTHER END USERS, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 126 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR OTHER END USERS, BY COUNTRY, 2021-2028 (USD MILLION)

9 STEM CELL MANUFACTURING MARKET, BY REGION

- 9.1 INTRODUCTION

- TABLE 127 STEM CELL MANUFACTURING MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- FIGURE 22 NORTH AMERICA: STEM CELL MANUFACTURING MARKET SNAPSHOT

- TABLE 128 NORTH AMERICA: STEM CELL MANUFACTURING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 129 NORTH AMERICA: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 130 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 131 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 132 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 133 NORTH AMERICA: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 134 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 135 NORTH AMERICA: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 136 NORTH AMERICA: STEM CELL MANUFACTURING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.1 US

- 9.2.1.1 Continued focus to strengthen R&D to drive market in US

- TABLE 137 US: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 138 US: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 139 US: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 140 US: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 141 US: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 142 US: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 143 US: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 144 US: STEM CELL MANUFACTURING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.2 CANADA

- 9.2.2.1 Rising government investments to drive market in Canada

- TABLE 145 CANADA: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 146 CANADA: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 147 CANADA: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 148 CANADA: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 149 CANADA: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 150 CANADA: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 151 CANADA: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 152 CANADA: STEM CELL MANUFACTURING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2.3 NORTH AMERICA: IMPACT OF RECESSION

- 9.3 EUROPE

- TABLE 153 EUROPE: STEM CELL MANUFACTURING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 154 EUROPE: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 155 EUROPE: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 156 EUROPE: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 157 EUROPE: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 158 EUROPE: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 159 EUROPE: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 160 EUROPE: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 161 EUROPE: STEM CELL MANUFACTURING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.1 GERMANY

- 9.3.1.1 Strong growth in biotechnology industry to drive market

- TABLE 162 GERMANY: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 163 GERMANY: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 164 GERMANY: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 165 GERMANY: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 166 GERMANY: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 167 GERMANY: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 168 GERMANY: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 169 GERMANY: STEM CELL MANUFACTURING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.2 FRANCE

- 9.3.2.1 Government support in stem cell manufacturing to drive market

- TABLE 170 FRANCE: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 171 FRANCE: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 172 FRANCE: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 173 FRANCE: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 174 FRANCE: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 175 FRANCE: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 176 FRANCE: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 177 FRANCE: STEM CELL MANUFACTURING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.3 UK

- 9.3.3.1 Growing focus on innovation to increase demand for stem cell-based therapeutics

- TABLE 178 UK: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 179 UK: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 180 UK: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 181 UK: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 182 UK: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 183 UK: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 184 UK: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 185 UK: STEM CELL MANUFACTURING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.4 ITALY

- 9.3.4.1 Initiatives encouraging development of cell & gene therapy to boost demand for stem cell manufacturing

- TABLE 186 ITALY: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 187 ITALY: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 188 ITALY: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 189 ITALY: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 190 ITALY: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 191 ITALY: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 192 ITALY: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 193 ITALY: STEM CELL MANUFACTURING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.5 SPAIN

- 9.3.5.1 Increasing demand for precision medicine to drive growth

- TABLE 194 SPAIN: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 195 SPAIN: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 196 SPAIN: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 197 SPAIN: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 198 SPAIN: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 199 SPAIN: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 200 SPAIN: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 201 SPAIN: STEM CELL MANUFACTURING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.6 REST OF EUROPE

- TABLE 202 REST OF EUROPE: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 203 REST OF EUROPE: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 204 REST OF EUROPE: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 205 REST OF EUROPE: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 206 REST OF EUROPE: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 207 REST OF EUROPE: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 208 REST OF EUROPE: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 209 REST OF EUROPE: STEM CELL MANUFACTURING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.3.7 EUROPE: IMPACT OF RECESSION

- 9.4 ASIA PACIFIC

- FIGURE 23 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET SNAPSHOT

- TABLE 210 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 211 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 212 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 213 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 214 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 215 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 216 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 217 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 218 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.1 CHINA

- 9.4.1.1 Increasing clinical trials for stem cells and innovations to drive market

- TABLE 219 CHINA: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 220 CHINA: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 221 CHINA: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 222 CHINA: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 223 CHINA: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 224 CHINA: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 225 CHINA: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 226 CHINA: STEM CELL MANUFACTURING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.2 JAPAN

- 9.4.2.1 Growing collaborations for stem cell research to drive growth

- TABLE 227 JAPAN: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 228 JAPAN: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 229 JAPAN: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 230 JAPAN: STEM CELL MANUFACTURING MARKET FOR S

- 9.4 ASIA PACIFIC

- FIGURE 23 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET SNAPSHOT

- TABLE 210 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 211 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 212 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 213 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 214 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 215 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 216 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 217 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 218 ASIA PACIFIC: STEM CELL MANUFACTURING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.1 CHINA

- 9.4.1.1 Increasing clinical trials for stem cells and innovations to drive market

- TABLE 219 CHINA: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 220 CHINA: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 221 CHINA: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 222 CHINA: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 223 CHINA: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 224 CHINA: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 225 CHINA: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 226 CHINA: STEM CELL MANUFACTURING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.2 JAPAN

- 9.4.2.1 Growing collaborations for stem cell research to drive growth

- TABLE 227 JAPAN: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 228 JAPAN: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 229 JAPAN: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 230 JAPAN: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 231 JAPAN: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 232 JAPAN: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 233 JAPAN: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 234 JAPAN: STEM CELL MANUFACTURING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.3 INDIA

- 9.4.3.1 Increasing prevalence of genetic disorders to support growth

- TABLE 235 INDIA: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 236 INDIA: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 237 INDIA: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 238 INDIA: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 239 INDIA: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 240 INDIA: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 241 INDIA: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 242 INDIA: STEM CELL MANUFACTURING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.4 REST OF ASIA PACIFIC

- TABLE 243 REST OF ASIA PACIFIC: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 244 REST OF ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 245 REST OF ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 246 REST OF ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 247 REST OF ASIA PACIFIC: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 248 REST OF ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 249 REST OF ASIA PACIFIC: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 250 REST OF ASIA PACIFIC: STEM CELL MANUFACTURING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.4.5 ASIA PACIFIC: IMPACT OF RECESSION

- 9.5 LATIN AMERICA

- 9.5.1 GROWING PHARMACEUTICAL INDUSTRY IN REGION TO DRIVE MARKET GROWTH

- TABLE 251 LATIN AMERICA: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 252 LATIN AMERICA: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 253 LATIN AMERICA: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 254 LATIN AMERICA: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 255 LATIN AMERICA: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 256 LATIN AMERICA: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 257 LATIN AMERICA: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 258 LATIN AMERICA: STEM CELL MANUFACTURING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.5.2 LATIN AMERICA: IMPACT OF RECESSION

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 INCREASING FUNDING AND COLLABORATIONS TO DRIVE MARKET GROWTH

- TABLE 259 MIDDLE EAST & AFRICA: STEM CELL MANUFACTURING MARKET, BY PRODUCT, 2021-2028 (USD MILLION)

- TABLE 260 MIDDLE EAST & AFRICA: STEM CELL MANUFACTURING MARKET FOR CONSUMABLES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 261 MIDDLE EAST & AFRICA: STEM CELL MANUFACTURING MARKET FOR INSTRUMENTS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 262 MIDDLE EAST & AFRICA: STEM CELL MANUFACTURING MARKET FOR STEM CELL LINES, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 263 MIDDLE EAST & AFRICA: STEM CELL MANUFACTURING MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 264 MIDDLE EAST & AFRICA: STEM CELL MANUFACTURING MARKET FOR RESEARCH APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 265 MIDDLE EAST & AFRICA: STEM CELL MANUFACTURING MARKET FOR CLINICAL APPLICATIONS, BY TYPE, 2021-2028 (USD MILLION)

- TABLE 266 MIDDLE EAST & AFRICA: STEM CELL MANUFACTURING MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.6.2 MIDDLE EAST & AFRICA: IMPACT OF RECESSION

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY STRATEGIES ADOPTED BY PLAYERS

- FIGURE 24 STEM CELL MANUFACTURING MARKET: STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 REVENUE SHARE ANALYSIS OF TOP 5 PLAYERS

- FIGURE 25 REVENUE SHARE ANALYSIS FOR TOP 5 COMPANIES (2020-2022)

- 10.4 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS

- FIGURE 26 STEM CELL MANUFACTURING MARKET: MARKET SHARE ANALYSIS OF TOP 5 PLAYERS (2022)

- 10.5 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS

- FIGURE 27 STEM CELL MANUFACTURING MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS (2022)

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.6 COMPANY EVALUATION QUADRANT FOR START-UPS/SMES

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 STARTING BLOCKS

- 10.6.3 RESPONSIVE COMPANIES

- 10.6.4 DYNAMIC COMPANIES

- FIGURE 28 STEM CELL MANUFACTURING MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES (2022)

- 10.7 COMPETITIVE BENCHMARKING

- 10.7.1 STEM CELL MANUFACTURING MARKET: DETAILED LIST OF START-UPS/SMES

- TABLE 267 STEM CELL MANUFACTURING MARKET: DETAILED LIST OF START-UPS/SMES

- 10.8 STEM CELL MANUFACTURING MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- TABLE 268 STEM CELL MANUFACTURING MARKET: COMPETITIVE BENCHMARKING OF START-UPS/SMES

- 10.9 COMPETITIVE SCENARIO AND TRENDS

- TABLE 269 STEM CELL MANUFACTURING MARKET: PRODUCT LAUNCHES (2021-2023)

- TABLE 270 STEM CELL MANUFACTURING MARKET: DEALS (2021-2023)

- TABLE 271 STEM CELL MANUFACTURING MARKET: OTHER DEVELOPMENTS (2021-2023)

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- *Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

- 11.1.1 THERMO FISHER SCIENTIFIC, INC.

- TABLE 272 THERMO FISHER SCIENTIFIC, INC.: COMPANY OVERVIEW

- FIGURE 29 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2022)

- 11.1.2 MERCK KGAA

- TABLE 273 MERCK KGAA: COMPANY OVERVIEW

- FIGURE 30 MERCK KGAA: COMPANY SNAPSHOT (2022)

- 11.1.3 LONZA GROUP

- TABLE 274 LONZA GROUP: COMPANY OVERVIEW

- FIGURE 31 LONZA GROUP: COMPANY SNAPSHOT (2022)

- 11.1.4 DANAHER CORPORATION

- TABLE 275 DANAHER CORPORATION: COMPANY OVERVIEW

- FIGURE 32 DANAHER CORPORATION: COMPANY SNAPSHOT (2022)

- 11.1.5 SARTORIUS AG

- TABLE 276 SARTORIUS AG: COMPANY OVERVIEW

- FIGURE 33 SARTORIUS AG: COMPANY SNAPSHOT (2022)

- 11.1.6 BECTON, DICKINSON AND COMPANY

- TABLE 277 BECTON, DICKINSON AND COMPANY: COMPANY OVERVIEW

- FIGURE 34 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2022)

- 11.1.7 EPPENDORF SE

- TABLE 278 EPPENDORF SE: COMPANY OVERVIEW

- FIGURE 35 EPPENDORF SE: COMPANY SNAPSHOT (2022)

- 11.1.8 CORNING INCORPORATED

- TABLE 279 CORNING INCORPORATED: COMPANY OVERVIEW

- FIGURE 36 CORNING INCORPORATED: COMPANY SNAPSHOT (2022)

- 11.1.9 BIO-RAD LABORATORIES, INC.

- TABLE 280 BIO-RAD LABORATORIES, INC.: COMPANY OVERVIEW

- FIGURE 37 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT (2022)

- 11.1.10 TAKARA BIO INC.

- TABLE 281 TAKARA BIO INC.: COMPANY OVERVIEW

- FIGURE 38 TAKARA BIO INC.: COMPANY SNAPSHOT (2022)

- 11.1.11 FUJIFILM HOLDINGS CORPORATION

- TABLE 282 FUJIFILM HOLDINGS CORPORATION: COMPANY OVERVIEW

- FIGURE 39 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT (2022)

- 11.1.12 GETINGE AB

- TABLE 283 GETINGE AB: COMPANY OVERVIEW

- FIGURE 40 GETINGE AB: COMPANY SNAPSHOT (2022)

- 11.1.13 TERUMO CORPORATION

- TABLE 284 TERUMO CORPORATION: COMPANY OVERVIEW

- FIGURE 41 TERUMO CORPORATION: COMPANY SNAPSHOT (2022)

- 11.1.14 BIO-TECHNE CORPORATION

- TABLE 285 BIO-TECHNE CORPORATION: COMPANY OVERVIEW

- FIGURE 42 BIO-TECHNE CORPORATION: COMPANY SNAPSHOT (2022)

- 11.1.15 HIMEDIA LABORATORIES PVT. LTD.

- TABLE 286 HIMEDIA LABORATORIES PVT. LTD.: COMPANY OVERVIEW

- 11.2 OTHER PLAYERS

- 11.2.1 STEMCELL TECHNOLOGIES, INC.

- 11.2.2 MILTENYI BIOTEC GMBH

- 11.2.3 PROMOCELL

- 11.2.4 ANTEROGEN CO. LTD.

- 11.2.5 CELLGENIX GMBH

- 11.2.6 PLURISTEM THERAPEUTICS INC.

- 11.2.7 DAIICHI SANKYO

- 11.2.8 ORGANOGENESIS HOLDINGS INC.

- 11.2.9 VERICEL CORP.

- 11.2.10 AMERICAN CRYOSTEM CORP.

- (Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

12 APPENDIX

- 12.1 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.2 CUSTOMIZATION OPTIONS

- 12.3 RELATED REPORTS

- 12.4 AUTHOR DETAILS