|

|

市場調査レポート

商品コード

1327329

近赤外線吸収材料の世界市場 (~2028年):材料 (有機材料・無機材料)・機能 (高透明性・吸収性・耐熱性)・赤外線領域 (700-1,000nm・1,000nm)・エンドユーザー産業・地域別Near Infrared Absorbing Materials Market by Material (Organic Materials, Inorganic Materials), Function (High Transparency, Absorption, Heat Resistance), Absorption Range (700-1000nm, 1000nm), End Use Industry, Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 近赤外線吸収材料の世界市場 (~2028年):材料 (有機材料・無機材料)・機能 (高透明性・吸収性・耐熱性)・赤外線領域 (700-1,000nm・1,000nm)・エンドユーザー産業・地域別 |

|

出版日: 2023年07月24日

発行: MarketsandMarkets

ページ情報: 英文 190 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の近赤外線吸収材料の市場規模は、2023年の3億800万米ドルから、予測期間中は7.9%のCAGRで推移し、2028年には4億5,300万米ドルの規模に成長すると予測されています。

無機材料の使用の増加が市場を牽引しています。また、近赤外線吸収材料は、エレクトロニクス産業や通信産業でさまざまな用途があり、独自の機能性と性能上の利点を提供しています。近赤外線吸収材料は、電子機器や通信システム用の光学フィルターやセンサーの製造に使用されています。

機能別で見ると、高透明性の部門が2022年に第2位のシェアを示しています。高い透明性は、不要な散乱や反射を最小限に抑えながら近赤外線光を効率的に透過させるため、近赤外線吸収材料の重要な機能です。

赤外線領域別では、1,000nm超の部門が予測期間中、金額ベースで最大のCAGRを示す見通しです。多くの化合物がこの領域に特徴的な吸収ピークを持つため、この領域は分子振動のセンシングや分析によく使用されています。

地域別では、欧州が2022年に金額ベースで第2位の規模を示しました。同地域の成長は、先進的な技術インフラ、強力な製造基盤、持続可能性への注力によって牽引されています。ドイツは同地域で最大のシェアを持ち、8.46%のCAGRで急成長しています。

当レポートでは、世界の近赤外線吸収材料の市場を調査し、市場概要、市場影響因子および市場機会の分析、技術・特許の動向、関連法規制、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

第6章 産業動向

- 景気後退の影響

- バリューチェーン分析

- マクロ経済指標

- 市場規制

- 貿易分析

- 顧客の事業に影響を与える動向/ディスラプション

- エコシステム/市場マップ

- 技術分析

- 主要ステークホルダーと購入基準

- 特許分析

- 主要な会議とイベント

第7章 近赤外線吸収材料市場:機能別

- 高透明性

- 吸収性

- 耐熱性

- 溶解度

- その他

第8章 近赤外線吸収材料市場:材料別

- 有機材料

- 染料

- ポリマー

- オリゴマー

- その他

- 無機材料

- アンチモン錫酸化物

- インジウム錫酸化物

- 量子ドット

- ドープ酸化タングステン

- その他

第9章 近赤外線吸収材料市場:赤外線領域別

- 700~1,000nm

- 1,000nm超

第10章 近赤外線吸収材料市場:エンドユーザー産業別

- エレクトロニクス・通信

- 工業

- 防衛・セキュリティ

- 太陽光発電

- その他

第11章 近赤外線吸収材料市場:地域別

- 北米

- 欧州

- アジア太平洋

- 中東・アフリカ

- 南米

第12章 競合情勢

- 主要企業の採用戦略

- 上位5社の市場シェア分析

- 企業収益分析

- 企業評価マトリックス

- スタートアップ/中小企業の評価マトリックス

- 競合ベンチマーキング

- 企業のフットプリント

- 競合シナリオ・動向

第13章 企業プロファイル

- 主要企業

- SUMITOMO METAL MINING CO. LTD.

- NANOPHASE TECHNOLOGIES CORPORATION

- KEELING & WALKER LIMITED

- EDMUND OPTICS INC

- NIPPON SHOKUBAI CO., LTD.

- THE HERAEUS GROUP

- 3M

- MERCK KGAA

- ADVANCED NANO PRODUCTS CO., LTD.

- RESONAC HOLDINGS CORPORATION

- その他の企業

- YAMADA CHEMICAL CO., LTD.

- TOYO VISUAL SOLUTIONS CO., LTD.

- AMERICAN DYE SOURCE, INC.

- EPOLIN LLC

- VIAVI SOLUTIONS INC.

- AMERICAN ELEMENTS

- EKSMA OPTICS

- TOKYO CHEMICAL INDUSTRY PVT. LTD(TCI)

- UBIQUITOUS ENERGY, INC.

- FUJI PIGMENT CO., LTD

- NANOCO GROUP PLC

- INFRAMAT ADVANCED MATERIALS, LLC

- KRIYA MATERIALS B.V.

- FEW CHEMICALS GMBH

- DELTACHEM(QINGDAO)CO. LTD.

第14章 付録

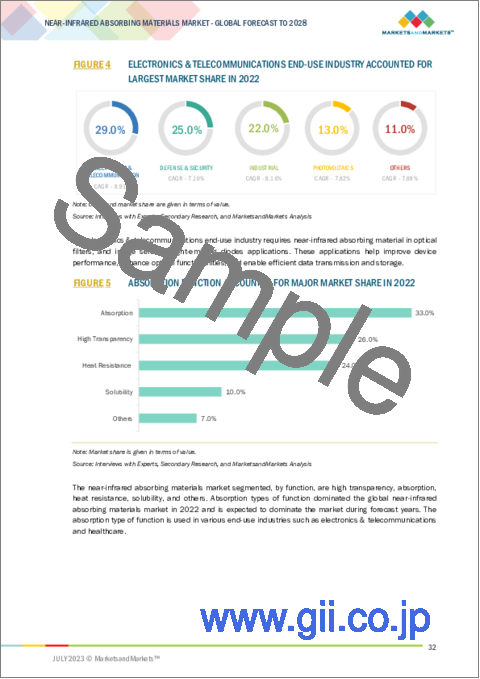

The Near Infrared Absorbing materials Market is projected to reach USD 453 million by 2028, at a CAGR of 7.9% from USD 308 million in 2023. The increasing use of inorganic materials different chemicals drives the market. In addition, Near-infrared (NIR) absorbing materials find various applications in the electronic and telecommunication industries, offering unique functionalities and performance advantages. NIR absorbing materials are used in the fabrication of optical filters and sensors for electronic devices and telecommunications systems.

"High Transparency, by function accounts for the second-largest market share in 2022"

High transparency is a crucial function of NIR absorbing materials as it allows for the efficient transmission of NIR light while minimizing unwanted scattering or reflection. This transparency enables the materials to be seamlessly integrated into optical systems, sensors, and devices where precise control of NIR wavelengths is essential. This function is of utmost importance in various applications where precise control and manipulation of NIR light are required.

" 1000nm above IR range is expected to be the fastest growing at CAGR for Near IR absorbing materials market during the forecast period, in terms of value."

This IR range has unique properties and applications that make it valuable in various fields. In terms of optical characteristics, the 1000nm and above IR range exhibits higher absorption compared to shorter IR wavelengths. This range is often used for sensing and analysis of molecular vibrations, as many chemical compounds have characteristic absorption peaks in this region. The MIR range allows for the identification and characterization of organic and inorganic molecules, making it suitable for application

"Based on region, Europe was the second largest market for Near IR absorbing materials in 2022, in terms of value."

Europe is a prominent region in the near-infrared absorbing material market, driven by its advanced technological infrastructure, strong manufacturing base, and focus on sustainability. The region is characterized by a diverse range of end-use industries that extensively utilize near-infrared absorbing materials. The Germany has maximum share of this market and fastest growing country at the CAGR 8.46% in this market

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees are as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-Level - 20%, Director Level - 10%, and Others - 70%

- By Region: Asia Pacific - 30%, Europe -30%, North America - 20%, Middle East & Africa - 10%, and South America-10%

The key players in this market Sumitomo Metal Mining Co., Ltd. (Japan), Nanophase Technologies Corporation (US), Heraeus Holding (Germany), Keeling & Walker (UK), Edmund Optics (US), Merck (US), 3M (US), (Japan), Resonac Holdings Corporation (Japan), Advanced nano products co ltd (South Korea), Nippon Shokubai Co., Ltd.(Japan).

Research Coverage

This report segments the market for the near-infrared absorbing material market on the basis of IR range, Material type, function and end use industry, and region. It provides estimations for the overall value of the market across various regions. A detailed analysis of key industry players has been conducted to provide insights into their business overviews, products & services, key strategies, new product launches, expansions, and mergers & acquisition associated with the market for the near-infrared absorbing material market.

Key benefits of buying this report

This research report is focused on various levels of analysis - industry analysis (industry trends), market ranking analysis of top players, and company profiles, which together provide an overall view on the competitive landscape; emerging and high-growth segments of the the near-infrared absorbing material market; high-growth regions; and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers: Increasing demand for advanced technologies, Energy Efficiency and Sustainability.

- Market Penetration: Comprehensive information on the near infrared absorbing material market offered by top players in the global the near infrared absorbing material market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the the near infrared absorbing material market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for the the near infrared absorbing material market across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global the near infrared absorbing material market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the the near infrared absorbing material market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS & EXCLUSIONS

- 1.4 MARKET SCOPE

- FIGURE 1 NEAR-INFRARED ABSORBING MATERIALS MARKET SEGMENTATION

- 1.4.1 REGIONS COVERED

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 NEAR-INFRARED ABSORBING MATERIALS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews: Top near-infrared absorbing material manufacturers

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key industry insights

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 APPROACH 1: SUPPLY-SIDE ANALYSIS

- 2.2.2 APPROACH 2: DEMAND-SIDE APPROACH

- 2.2.2.1 Near-infrared absorbing materials market: Industry/country analysis

- 2.3 FORECAST NUMBER CALCULATION

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- FIGURE 3 NEAR-INFRARED ABSORBING MATERIALS MARKET: DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 4 ELECTRONICS & TELECOMMUNICATIONS END-USE INDUSTRY ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 5 ABSORPTION FUNCTION ACCOUNTED FOR MAJOR MARKET SHARE IN 2022

- FIGURE 6 700 TO 1,000 NM IR RANGE SEGMENT ACCOUNTED FOR LARGER SHARE OF NEAR-INFRARED ABSORBING MATERIALS MARKET IN 2022

- FIGURE 7 INORGANIC MATERIALS ACCOUNTED FOR LARGER SHARE OF NEAR-INFRARED ABSORBING MATERIALS MARKET

- FIGURE 8 NORTH AMERICA TO REGISTER HIGHEST GROWTH IN NEAR-INFRARED ABSORBING MATERIALS MARKET

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN NEAR-INFRARED ABSORBING MATERIALS MARKET

- FIGURE 9 EUROPE TO BE SECOND-LARGEST MARKET DURING FORECAST PERIOD

- 4.2 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY INFRARED RANGE

- FIGURE 10 ABOVE 1000 NM ACCOUNTED FOR SIGNIFICANT SHARE IN 2022

- 4.3 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY MATERIAL

- FIGURE 11 ORGANIC MATERIALS ACCOUNTED FOR SIGNIFICANT SHARE IN 2022

- 4.4 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY FUNCTION

- FIGURE 12 HIGH TRANSPARENCY FUNCTION ACCOUNTED FOR SECOND-LARGEST SHARE IN 2022

- 4.5 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY

- FIGURE 13 ELECTRONICS & TELECOMMUNICATIONS END-USE INDUSTRY ACCOUNTED FOR LARGEST SHARE IN 2022

- 4.6 NORTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET: BY END-USE INDUSTRY AND COUNTRY

- FIGURE 14 ELECTRONICS & TELECOMMUNICATIONS END-USE INDUSTRY AND US ACCOUNTED FOR LARGEST SHARES IN NORTH AMERICA

- 4.7 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY COUNTRY

- FIGURE 15 US TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: NEAR-INFRARED ABSORBING MATERIALS MARKET

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for advanced technologies

- 5.2.1.2 Energy efficiency and sustainability

- 5.2.2 RESTRAINTS

- 5.2.2.1 Integration challenges

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing renewable energy sector

- 5.2.3.2 Advancements in electronics and optoelectronics

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost of materials

- 5.2.4.2 Performance limitations

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 1 NEAR-INFRARED ABSORBING MATERIALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 NEAR-INFRARED ABSORBING MATERIALS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREATS OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

6 INDUSTRY TRENDS

- 6.1 RECESSION IMPACT

- 6.2 VALUE CHAIN ANALYSIS

- FIGURE 18 VALUE CHAIN OF NEAR-INFRARED ABSORBING MATERIALS MARKET

- 6.2.1 RAW MATERIALS

- 6.2.2 MANUFACTURING

- 6.2.3 DISTRIBUTORS

- 6.2.4 END USERS

- 6.3 MACROECONOMIC INDICATORS

- 6.3.1 GDP TRENDS AND FORECASTS FOR MAJOR ECONOMIES

- 6.4 MARKET REGULATIONS

- 6.4.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.5 TRADE ANALYSIS

- 6.5.1 IMPORT SCENARIO FOR HS CODE 900211

- FIGURE 19 IMPORT SCENARIO FOR HS CODE 900211, BY KEY COUNTRY, 2019-2022

- 6.5.2 EXPORT SCENARIO FOR HS CODE 900211

- FIGURE 20 EXPORT SCENARIO FOR HS CODE 900211, BY KEY COUNTRY, 2019-2022

- 6.5.3 IMPORT SCENARIO FOR HS CODE 900590

- FIGURE 21 IMPORT SCENARIO FOR HS CODE 900590, BY KEY COUNTRY, 2019-2022

- 6.5.4 EXPORT SCENARIO FOR HS CODE 900590

- FIGURE 22 EXPORT SCENARIO FOR HS CODE 900590, BY KEY COUNTRY, 2019-2022

- 6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.6.1 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN NEAR-INFRARED ABSORBING MATERIALS MARKET

- FIGURE 23 REVENUE SHIFT: NEAR-INFRARED ABSORBING MATERIALS MARKET

- 6.7 ECOSYSTEM/MARKET MAP

- TABLE 6 NEAR-INFRARED ABSORBING MATERIALS MARKET: ECOSYSTEM

- FIGURE 24 NEAR-INFRARED ABSORBING MATERIALS MARKET: ECOSYSTEM

- 6.8 TECHNOLOGY ANALYSIS

- TABLE 7 ADVANTAGES OF TECHNOLOGY

- 6.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 8 INFLUENCE OF INSTITUTIONAL BUYERS ON BUYING PROCESS FOR TOP-THREE END-USE INDUSTRIES

- 6.9.2 BUYING CRITERIA

- FIGURE 26 KEY BUYING CRITERIA FOR TOP-THREE END-USE INDUSTRIES

- TABLE 9 KEY BUYING CRITERIA FOR TOP-THREE END-USE INDUSTRIES

- 6.10 PATENT ANALYSIS

- 6.10.1 INTRODUCTION

- 6.10.2 APPROACH

- 6.10.3 DOCUMENT TYPE

- 6.10.4 PATENT STATUS

- TABLE 10 TOTAL NUMBER OF PATENTS (2017-2022)

- FIGURE 27 PATENTS REGISTERED FOR NEAR-INFRARED ABSORBING MATERIAL, 2017-2022

- FIGURE 28 PATENT PUBLICATION TRENDS FOR NEAR-INFRARED ABSORBING MATERIAL, 2017-2022

- 6.10.5 LEGAL STATUS OF PATENTS

- FIGURE 29 LEGAL STATUS OF PATENTS FILED FOR NEAR-INFRARED ABSORBING MATERIAL

- 6.10.6 JURISDICTION ANALYSIS

- FIGURE 30 HIGHEST NUMBER OF PATENTS FILED IN CHINA

- 6.10.7 TOP APPLICANTS

- FIGURE 31 HEWLETT-PACKARD DEVELOPMENT COMPANY, LP REGISTERED HIGHEST NUMBER OF PATENTS BETWEEN 2017 AND 2022

- TABLE 11 PATENTS BY HEWLETT-PACKARD DEVELOPMENT COMPANY, LP

- TABLE 12 PATENTS BY SUMITOMO METAL MINING CO.

- TABLE 13 PATENTS BY NIPPON KAYAKU KK

- 6.10.8 TOP 10 PATENT OWNERS (US) IN LAST FIVE YEARS

- 6.11 KEY CONFERENCES AND EVENTS, 2023-2024

7 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY FUNCTION

- 7.1 INTRODUCTION

- FIGURE 32 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY FUNCTION, 2022

- TABLE 14 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY FUNCTION, 2019-2022 (USD MILLION)

- TABLE 15 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY FUNCTION, 2023-2028 (USD MILLION)

- 7.2 HIGH TRANSPARENCY

- 7.3 ABSORPTION

- 7.4 HEAT RESISTANCE

- 7.5 SOLUBILITY

- 7.6 OTHERS

8 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY MATERIAL

- 8.1 INTRODUCTION

- FIGURE 33 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY MATERIAL, 2022

- TABLE 16 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY MATERIAL, 2019-2022 (USD MILLION)

- TABLE 17 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY MATERIAL, 2023-2028 (USD MILLION)

- 8.2 ORGANIC MATERIALS

- 8.2.1 DYES

- 8.2.2 POLYMERS

- 8.2.3 OLIGOMERS

- 8.2.4 OTHERS

- 8.3 INORGANIC MATERIALS

- 8.3.1 ANTIMONY TIN OXIDE

- 8.3.2 INDIUM TIN OXIDE

- 8.3.3 QUANTUM DOTS

- 8.3.4 DOPED TUNGSTEN OXIDE

- 8.3.5 OTHER INORGANIC MATERIALS

9 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY INFRARED RANGE

- 9.1 INTRODUCTION

- FIGURE 34 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY INFRARED RANGE

- TABLE 18 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY INFRARED RANGE, 2019-2022 (USD MILLION)

- TABLE 19 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY INFRARED RANGE, 2023-2028 (USD MILLION)

- 9.2 700-1,000 NM

- 9.3 ABOVE 1,000 NM

10 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- FIGURE 35 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2022

- TABLE 20 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 21 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 10.2 ELECTRONICS & TELECOMMUNICATIONS

- 10.3 INDUSTRIAL SECTOR

- 10.4 DEFENSE & SECURITY

- 10.5 PHOTOVOLTAICS

- 10.6 OTHERS

11 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY REGION

- 11.1 INTRODUCTION

- FIGURE 36 NORTH AMERICA TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- TABLE 22 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 23 NEAR-INFRARED ABSORBING MATERIALS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.2.1 RECESSION IMPACT

- FIGURE 37 NORTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET SNAPSHOT

- TABLE 24 NORTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 25 NORTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 26 NORTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 27 NORTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.2.2 US

- 11.2.2.1 Demand for renewable energy sources, particularly solar power, to drive market

- TABLE 28 US: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 29 US: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.2.3 CANADA

- 11.2.3.1 Government initiatives and projects on advanced materials to support market

- TABLE 30 CANADA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 31 CANADA: NEAR-INFRARED ABSORBING MATERIALS MARKET, END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.2.4 MEXICO

- 11.2.4.1 Consumer demand for advanced devices to boost market

- TABLE 32 MEXICO: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 33 MEXICO: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.3 EUROPE

- 11.3.1 RECESSION IMPACT

- FIGURE 38 EUROPE: NEAR-INFRARED ABSORBING MATERIALS MARKET SNAPSHOT

- TABLE 34 EUROPE: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 35 EUROPE: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 36 EUROPE: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 37 EUROPE: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.2 GERMANY

- 11.3.2.1 Increasing adoption of solar power to bolster demand for near-infrared absorbing materials

- TABLE 38 GERMANY: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 39 GERMANY: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.3 FRANCE

- 11.3.3.1 Increased focus on conservation and sustainability to drive market

- TABLE 40 FRANCE: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 41 FRANCE: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.4 SPAIN

- 11.3.4.1 Resurgence in photovoltaic installations to drive market

- TABLE 42 SPAIN: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 43 SPAIN: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.5 ITALY

- 11.3.5.1 Need for advanced healthcare solutions to drive market

- TABLE 44 ITALY: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 45 ITALY: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.6 UK

- 11.3.6.1 Increasing investments in defense sector to contribute to market growth

- TABLE 46 UK: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 47 UK: NEAR-INFRARED ABSORBING MATERIALS MARKET BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.3.7 REST OF EUROPE

- TABLE 48 REST OF EUROPE: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 49 REST OF EUROPE: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.4 ASIA PACIFIC

- 11.4.1 RECESSION IMPACT

- FIGURE 39 ASIA PACIFIC: NEAR-INFRARED ABSORBING MATERIALS MARKET SNAPSHOT

- TABLE 50 ASIA PACIFIC: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 51 ASIA PACIFIC: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 52 ASIA PACIFIC: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 53 ASIA PACIFIC: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.4.2 CHINA

- 11.4.2.1 Increasing need for electronic manufacturing of near-infrared absorbing materials to drive market

- TABLE 54 CHINA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 55 CHINA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.4.3 INDIA

- 11.4.3.1 Increasing focus on aerospace & defense sector to drive demand for near-infrared absorbing materials

- TABLE 56 INDIA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 57 INDIA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.4.4 JAPAN

- 11.4.4.1 Increasing awareness of sustainability goals to drive demand

- TABLE 58 JAPAN: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 59 JAPAN: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.4.5 SOUTH KOREA

- 11.4.5.1 Highly advanced electronics industry to drive market

- TABLE 60 SOUTH KOREA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 61 SOUTH KOREA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.4.6 REST OF ASIA PACIFIC

- TABLE 62 REST OF ASIA PACIFIC: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 63 REST OF ASIA PACIFIC: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 RECESSION IMPACT

- FIGURE 40 MIDDLE EAST & AFRICA: NEAR-INFRARED ABSORBING MATERIALS MARKET SNAPSHOT

- TABLE 64 MIDDLE EAST & AFRICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 65 MIDDLE EAST & AFRICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 66 MIDDLE EAST & AFRICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 67 MIDDLE EAST & AFRICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.5.2 SAUDI ARABIA

- 11.5.2.1 Digital initiatives to drive need for near-infrared absorbing materials

- TABLE 68 SAUDI ARABIA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 69 SAUDI ARABIA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY 2023-2028 (USD MILLION)

- 11.5.3 SOUTH AFRICA

- 11.5.3.1 Extensive photovoltaics applications to drive demand

- TABLE 70 SOUTH AFRICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 71 SOUTH AFRICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.5.4 REST OF MIDDLE EAST & AFRICA

- TABLE 72 REST OF MIDDLE EAST & AFRICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 73 REST OF MIDDLE EAST & AFRICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY 2023-2028 (USD MILLION)

- 11.6 SOUTH AMERICA

- 11.6.1 RECESSION IMPACT

- FIGURE 41 SOUTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET SNAPSHOT

- TABLE 74 SOUTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 75 SOUTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 76 SOUTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 77 SOUTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY 2023-2028 (USD MILLION)

- 11.6.2 BRAZIL

- 11.6.2.1 Expected to hold largest share of market during forecast period

- TABLE 78 BRAZIL: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 79 BRAZIL: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.6.3 ARGENTINA

- 11.6.3.1 Precision agriculture practices and desire for optimized crop management to drive market

- TABLE 80 ARGENTINA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 81 ARGENTINA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.6.4 PERU

- 11.6.4.1 Government initiatives to promote mining to drive market

- TABLE 82 PERU: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 83 PERU: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

- 11.6.5 REST OF SOUTH AMERICA

- TABLE 84 REST OF SOUTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 85 REST OF SOUTH AMERICA: NEAR-INFRARED ABSORBING MATERIALS MARKET, BY END-USE INDUSTRY, 2023-2028 (USD MILLION)

12 COMPETITIVE LANDSCAPE

- 12.1 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 86 STRATEGIES ADOPTED BY KEY MANUFACTURERS

- 12.2 MARKET SHARE ANALYSIS OF TOP FIVE PLAYERS, 2022

- FIGURE 42 MARKET SHARE ANALYSIS OF TOP-FIVE PLAYERS IN NEAR-INFRARED ABSORBING MATERIALS MARKET, 2022

- FIGURE 43 MARKET SHARE ANALYSIS, 2022

- TABLE 87 NEAR-INFRARED ABSORBING MATERIALS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 12.3 COMPANY REVENUE ANALYSIS

- 12.4 COMPANY EVALUATION MATRIX

- 12.4.1 STARS

- 12.4.2 PERVASIVE PLAYERS

- 12.4.3 EMERGING LEADERS

- 12.4.4 PARTICIPANTS

- FIGURE 44 NEAR-INFRARED ABSORBING MATERIALS MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2022

- 12.5 STARTUP/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIX

- 12.5.1 PROGRESSIVE COMPANIES

- 12.5.2 RESPONSIVE COMPANIES

- 12.5.3 DYNAMIC COMPANIES

- 12.5.4 STARTING BLOCKS

- FIGURE 45 NEAR-INFRARED ABSORBING MATERIALS MARKET: STARTUP/SME EVALUATION QUADRANT, 2022

- 12.6 COMPETITIVE BENCHMARKING

- TABLE 88 NEAR-INFRARED ABSORBING MATERIALS MARKET: LIST OF KEY STARTUP/SMES

- TABLE 89 NEAR-INFRARED ABSORBING MATERIALS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 12.7 NEAR-INFRARED ABSORBING MATERIALS MARKET: COMPANY FOOTPRINT

- TABLE 90 END-USE INDUSTRY: COMPANY FOOTPRINT

- TABLE 91 FUNCTION: COMPANY FOOTPRINT

- TABLE 92 MATERIAL: COMPANY FOOTPRINT

- TABLE 93 REGION: COMPANY FOOTPRINT

- TABLE 94 COMPANY FOOTPRINT

- 12.8 COMPETITIVE SCENARIO AND TRENDS (2020-2023)

- 12.8.1 DEALS

- TABLE 95 DEALS, JANUARY 2020-JULY 2023

- 12.8.2 OTHERS

- TABLE 96 OTHERS, JANUARY 2020-JULY 2023

13 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services offered, Recent Developments, Deals, MnM view, Right to win, Strategic choices, Weakness and competitive threats) **

- 13.1 KEY PLAYERS

- 13.1.1 SUMITOMO METAL MINING CO. LTD.

- TABLE 97 SUMITOMO METAL MINING CO. LTD: COMPANY OVERVIEW

- FIGURE 46 SUMITOMO METAL MINING CO. LTD: COMPANY SNAPSHOT

- TABLE 98 SUMITOMO METAL MINING CO. LTD: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 99 SUMITOMO METAL MINING CO. LTD: DEALS

- 13.1.2 NANOPHASE TECHNOLOGIES CORPORATION

- TABLE 100 NANOPHASE TECHNOLOGIES CORPORATION.: COMPANY OVERVIEW

- FIGURE 47 NANOPHASE TECHNOLOGIES CORPORATION.: COMPANY SNAPSHOT

- TABLE 101 NANOPHASE TECHNOLOGIES CORPORATION.: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- 13.1.3 KEELING & WALKER LIMITED

- TABLE 102 KEELING & WALKER LIMITED: COMPANY OVERVIEW

- TABLE 103 KEELING & WALKER LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.4 EDMUND OPTICS INC

- TABLE 104 EDMUND OPTICS INC: COMPANY OVERVIEW

- TABLE 105 EDMUND OPTICS INC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 106 EDMUND OPTICS INC: PRODUCT LAUNCHES

- TABLE 107 EDMUND OPTICS INC: DEALS

- 13.1.5 NIPPON SHOKUBAI CO., LTD.

- TABLE 108 NIPPON SHOKUBAI CO., LTD: COMPANY OVERVIEW

- FIGURE 48 NIPPON SHOKUBAI CO., LTD: COMPANY SNAPSHOT

- TABLE 109 NIPPON SHOKUBAI CO., LTD: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 110 NIPPON SHOKUBAI CO., LTD: DEALS

- 13.1.6 THE HERAEUS GROUP

- TABLE 111 THE HERAEUS GROUP: COMPANY OVERVIEW

- TABLE 112 THE HERAEUS GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 113 THE HERAEUS GROUP: DEALS

- 13.1.7 3M

- TABLE 114 3M: COMPANY OVERVIEW

- FIGURE 49 3M: COMPANY SNAPSHOT

- TABLE 115 3M: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.8 MERCK KGAA

- TABLE 116 MERCK KGAA: COMPANY OVERVIEW

- FIGURE 50 MERCK KGAA: COMPANY SNAPSHOT

- TABLE 117 MERCK KGAA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- 13.1.9 ADVANCED NANO PRODUCTS CO., LTD.

- TABLE 118 ADVANCED NANO PRODUCTS CO., LTD: COMPANY OVERVIEW

- TABLE 119 ADVANCED NANO PRODUCTS CO., LTD: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- 13.1.10 RESONAC HOLDINGS CORPORATION

- TABLE 120 RESONAC HOLDINGS CORPORATION: COMPANY OVERVIEW

- FIGURE 51 RESONAC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- TABLE 121 RESONAC HOLDINGS CORPORATION: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- *Details on Business Overview, Products/Solutions/Services offered, Recent Developments, Deals, MnM view, Right to win, Strategic choices, Weakness and competitive threats might not be captured in case of unlisted companies.

- 13.2 OTHER PLAYERS

- 13.2.1 YAMADA CHEMICAL CO., LTD.

- TABLE 122 YAMADA CHEMICAL CO., LTD: COMPANY OVERVIEW

- 13.2.2 TOYO VISUAL SOLUTIONS CO., LTD.

- TABLE 123 TOYO VISUAL SOLUTIONS CO., LTD: COMPANY OVERVIEW

- 13.2.3 AMERICAN DYE SOURCE, INC.

- TABLE 124 AMERICAN DYE SOURCE, INC: COMPANY OVERVIEW

- 13.2.4 EPOLIN LLC

- TABLE 125 EPOLIN LLC: COMPANY OVERVIEW

- 13.2.5 VIAVI SOLUTIONS INC.

- TABLE 126 VIAVI SOLUTIONS INC: COMPANY OVERVIEW

- 13.2.6 AMERICAN ELEMENTS

- TABLE 127 AMERICAN ELEMENTS: COMPANY OVERVIEW

- 13.2.7 EKSMA OPTICS

- TABLE 128 EKSMA OPTICS: COMPANY OVERVIEW

- 13.2.8 TOKYO CHEMICAL INDUSTRY PVT. LTD (TCI)

- TABLE 129 TOKYO CHEMICAL INDUSTRY PVT. LTD (TCI): COMPANY OVERVIEW

- 13.2.9 UBIQUITOUS ENERGY, INC.

- TABLE 130 UBIQUITOUS ENERGY, INC.: COMPANY OVERVIEW

- 13.2.10 FUJI PIGMENT CO., LTD

- TABLE 131 FUJI PIGMENT CO., LTD: COMPANY OVERVIEW

- 13.2.11 NANOCO GROUP PLC

- TABLE 132 NANOCO GROUP PLC: COMPANY OVERVIEW

- 13.2.12 INFRAMAT ADVANCED MATERIALS, LLC

- TABLE 133 INFRAMAT ADVANCED MATERIALS, LLC: COMPANY OVERVIEW

- 13.2.13 KRIYA MATERIALS B.V.

- TABLE 134 KRIYA MATERIALS B.V.: COMPANY OVERVIEW

- 13.2.14 FEW CHEMICALS GMBH

- TABLE 135 FEW CHEMICALS GMBH: COMPANY OVERVIEW

- 13.2.15 DELTACHEM (QINGDAO) CO. LTD.

- TABLE 136 DELTACHEM (QINGDAO) CO. LTD: COMPANY OVERVIEW

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS