|

|

市場調査レポート

商品コード

1327312

デジタルツインの世界市場:用途別(予知保全、業務最適化、性能監視、在庫管理)、業界別(自動車・輸送、ヘルスケア、エネルギー・公益事業)、企業別、地域別-2028年までの予測Digital Twin Market by Application (Predictive Maintenance, Business Optimization, Performance Monitoring, Inventory Management), Industry (Automotive & Transportation, Healthcare, Energy & Utilities), Enterprise and Geography - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| デジタルツインの世界市場:用途別(予知保全、業務最適化、性能監視、在庫管理)、業界別(自動車・輸送、ヘルスケア、エネルギー・公益事業)、企業別、地域別-2028年までの予測 |

|

出版日: 2023年07月13日

発行: MarketsandMarkets

ページ情報: 英文 281 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

デジタルツインの市場規模は、2023年の101億米ドルから2028年には1,101億米ドルに成長し、予測期間中のCAGRは61.3%になると予測されています。

デジタルツイン市場の成長は、主にヘルスケア産業におけるデジタルツインの需要の高まりと、予知保全への注目の高まりによってもたらされます。

ヘルスケア産業向けデジタルツイン市場は、予測期間中に最高のCAGRで成長する見込みです。デジタルツインは、ヘルスケアにおける患者の転帰と医療提供を改善する計り知れない可能性を提供します。物理的な資産やプロセス、さらには個人の仮想レプリカを作成することで、ヘルスケアプロバイダーは貴重な洞察を得て、ワークフローを最適化し、意思決定を強化することができます。デジタルツインによって、リアルタイムのモニタリング、予測分析、個別化された治療が可能になり、より効果的で効率的なヘルスケアの実践につながります。さらに、ヘルスケア業界におけるデジタルツイン市場の成長には、技術の進歩が大きな役割を果たしています。モノのインターネット(IoT)デバイス、クラウドコンピューティング、人工知能、ビッグデータ分析の普及により、膨大なヘルスケア関連データの収集と処理が容易になっています。このデータを活用してデジタルツインモデルを構築・改良することで、ヘルスケア専門家がさまざまなシナリオをシミュレーション・テストし、潜在的な問題を特定し、的を絞った介入策を開発できるようになります。

予知保全分野が、予測期間を通じてデジタルツイン市場の最大規模を占めると予測されています。予知保全は、コスト削減と運用効率の面で大きなメリットをもたらします。デジタルツインテクノロジーを活用することで、組織は資産の性能をリアルタイムで継続的に監視できます。これにより、異常を検出し、潜在的な機器の故障を特定し、メンテナンス活動のスケジュールを積極的に立てることができます。企業は、コストのかかる故障やダウンタイムに発展する前にメンテナンスの必要性に対処することで、混乱を最小限に抑え、資産の利用率を最適化し、全体的なメンテナンスコストを削減することができます。さらに、予知保全は、モノのインターネット(IoT)デバイスやセンサーの採用が拡大していることとうまく整合しています。これらの接続されたデバイスは、資産の性能、環境条件、使用パターンに関する膨大なデータを生成します。デジタルツインを活用することで、組織はこのデータを統合・分析し、資産の健全性に関する洞察を得て、故障確率を予測し、予防措置を処方することができます。このデータ主導のアプローチにより、メンテナンススケジュールの最適化、計画外ダウンタイムの削減、資産の信頼性向上が可能になります。

北米のデジタルツイン市場は、予測期間中に最も高いCAGRで成長すると予測されます。北米には強固な技術インフラがあり、デジタルツインソリューション市場は成熟しています。この地域には、数多くの技術企業、研究機関、革新的な新興企業があり、様々な産業でデジタルツイン技術を積極的に開発・導入しています。高度な技術、専門知識、研究開発への投資が可能であることから、北米はデジタルツイン市場のフロントランナーとして位置づけられています。さらに北米は、製造業、ヘルスケア、自動車、航空宇宙、防衛など、デジタルツイン技術に大きく依存する主要産業で強い存在感を示しています。これらの産業は、オペレーションの最適化、製品開発の改善、メンテナンスプロセスの強化、イノベーションの推進においてデジタルツインの価値を認識しています。これらの産業でデジタルツインの採用が増加しており、地域別市場の成長に大きく貢献すると予想されます。

当レポートでは、世界のデジタルツイン市場について調査し、用途別、業界別、企業別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- 生態系マッピング

- 価格分析

- 顧客のビジネスに影響を与える動向/混乱

- 技術分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 2023年~2024年の主要な会議とイベント

- 関税と規制状況

第6章 さまざまなプロセス、コンポーネント、製品、およびシステムにおけるデジタルツインの採用

- イントロダクション

- コンポーネントデジタルツイン

- 製品デジタルツイン

- プロセスデジタルツイン

- システムデジタルツイン

第7章 デジタルツインモデル

- イントロダクション

- プラットフォーム・アズ・ア・サービス(PAAS)

- ソフトウェア・アズ・ア・サービス(SAAS)

第8章 デジタルツイン市場、企業規模別

- イントロダクション

- 大企業

- 中小企業

第9章 デジタルツイン市場、用途別

- イントロダクション

- 製品の設計と開発

- 性能監視

- 予知保全

- 在庫管理

- 業務最適化

- その他

第10章 デジタルツイン市場、業界別

- イントロダクション

- 自動車・輸送

- エネルギー・公共事業

- インフラ

- ヘルスケア

- 航空宇宙

- 石油・ガス

- 電気通信

- 農業

- 小売

- その他

第11章 地域分析

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第12章 競合情勢

- 概要

- 主要参入企業が採用した戦略

- 上位企業の5年間の収益分析(2018~2022年)

- 市場シェア分析、2022年

- デジタルツイン市場:企業評価マトリックス、2022年

- デジタルツイン市場:企業のフットプリント

- デジタルツイン市場:スタートアップ/中小企業評価マトリックス、2022年

- 主要な新興企業/中小企業の詳細リスト

- 競争シナリオと動向

第13章 企業プロファイル

- 主要参入企業

- GENERAL ELECTRIC

- MICROSOFT

- SIEMENS

- AMAZON WEB SERVICES, INC.(AWS)

- DASSAULT SYSTEMES

- ANSYS, INC.

- IBM CORPORATION

- PTC

- SAP SE

- ORACLE

- ROBERT BOSCH GMBH

- その他の企業

- EMERSON ELECTRIC CO.

- ABB

- HONEYWELL INTERNATIONAL INC.

- SCHNEIDER ELECTRIC

- NAVVIS

- DNV AS

- AUTODESK INC.

- ANDRITZ AG

- SOFTWARE AG

- BENTLEY SYSTEMS, INCORPORATED

- RIVER LOGIC, INC.

- ALTAIR ENGINEERING INC.

- JOHNSON CONTROLS

- NSTREAM

第14章 隣接市場および関連市場

第15章 付録

The digital twin market is expected to grow from USD 10.1 billion in 2023 to USD 110.1 billion by 2028, at a CAGR of 61.3% during the forecast period. The growth of the digital twin market is driven mainly by the growing demand for digital twin in the healthcare industry and the growing focus on predictive maintenance.

"The digital twin market for the healthcare industry is expected to grow at the highest CAGR during the forecast period"

The digital twin market for the healthcare industry is expected to grow at the highest CAGR during the forecast period. Digital twins offer immense potential to improve patient outcomes and healthcare delivery in healthcare. By creating virtual replicas of physical assets, processes, or even individuals, healthcare providers can gain valuable insights, optimize workflows, and enhance decision-making. Digital twins enable real-time monitoring, predictive analytics, and personalized treatments, leading to more effective and efficient healthcare practices. Furthermore, technological advancements play a significant role in driving the growth of the digital twin market in the healthcare industry. The proliferation of Internet of Things (IoT) devices, cloud computing, artificial intelligence, and big data analytics has made it easier to collect and process vast amounts of healthcare-related data. This data can be leveraged to build and refine digital twin models, enabling healthcare professionals to simulate and test various scenarios, identify potential issues, and develop targeted interventions.

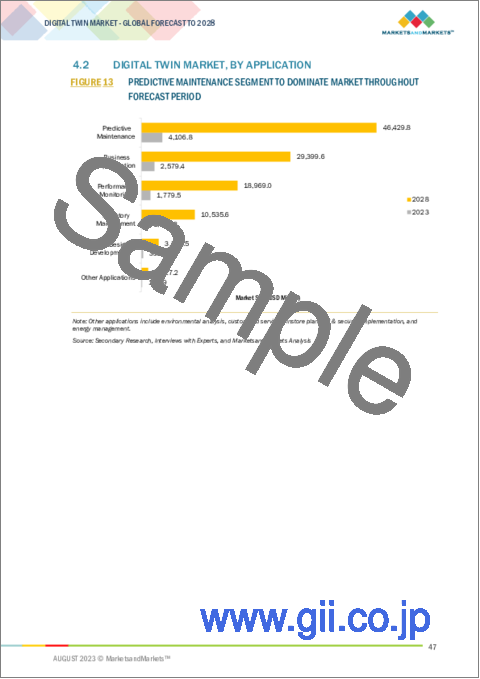

"Predictive maintenance segment is expected to dominate the digital twin market throughout the forecast period"

The predictive maintenance application is expected to account for the largest size of the digital twin market throughout the forecast period. Predictive maintenance offers significant advantages in terms of cost savings and operational efficiency. By utilizing digital twin technology, organizations can continuously monitor the performance of their assets in real-time. This enables them to detect anomalies, identify potential equipment failures, and proactively schedule maintenance activities. Organizations can minimize disruptions, optimize asset utilization, and reduce overall maintenance costs by addressing maintenance needs before they escalate into costly breakdowns or downtime. In addition, predictive maintenance aligns well with the growing adoption of Internet of Things (IoT) devices and sensors. These connected devices generate vast data regarding asset performance, environmental conditions, and usage patterns. By leveraging digital twins, organizations can integrate and analyze this data to gain insights into asset health, predict failure probabilities, and prescribe preventive measures. This data-driven approach allows for optimized maintenance schedules, reduced unplanned downtime, and improved asset reliability.

"Digital twin market in North America region to register highest CAGR between 2023 and 2028"

The digital twin market in North America is expected to grow at the highest CAGR during the forecast period. North America has a robust technological infrastructure and a mature market for digital twin solutions. The region has numerous technology companies, research institutions, and innovative startups actively developing and implementing digital twin technologies across various industries. The availability of advanced technologies, expertise, and investments in research and development positions North America as a frontrunner in the digital twin market. Furthermore, North America has a strong presence in key industries that heavily rely on digital twin technologies, such as manufacturing, healthcare, automotive, aerospace, and defense. These industries recognize the value of digital twins in optimizing operations, improving product development, enhancing maintenance processes, and driving innovation. The increasing adoption of digital twins in these industries is expected to contribute significantly to regional market growth.

Breakdown of primaries

In determining and verifying the market size for several segments and subsegments gathered through secondary research, extensive primary interviews have been conducted with key industry experts in the digital twin market space. The break-up of primary participants for the report has been shown below:

- By Company Type: Tier 1 - 45%, Tier 2 - 25%, and Tier 3 - 30%

- By Designation: C-level Executives - 40%, Directors - 25%, and Others - 35%

- By Region: North America -40%, Europe- 25%, Asia Pacific - 20%, and Rest of the World - 10%

Key players in the digital twin market are General Electric (US), Microsoft (US), Siemens (Germany), Amazon Web Services (US), ANSYS (US), Dassault Systemes (France), PTC (US), Robert Bosch (Germany), and others.

The digital twin market has been segmented into enterprise, application, industry, and region. The digital twin market has been studied in North America, Europe, Asia Pacific, and the Rest of the World.

Reasons to buy the report:

The report will help the market leaders/new entrants with information on the closest approximate revenues for the digital twin and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (rising emphasis on digital twin in manufacturing industries to reduce cost and improve supply chain operations, increasing demand for digital twin from the healthcare industry, and growing focus on predictive maintenance), restraints (high investments associated with implementation of digital twin technology and susceptibility of digital twin to cyberattacks), opportunities (rising emphasis on advanced real-time data analytics, increasing adoption of industry 4.0 principles, and development of human-centered digital twins), and challenges (complexities associated with data collection and mathematical models and lack of skilled workforce and awareness regarding cost benefit offered by digital twins).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the digital twin market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the digital twin market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the digital twin market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like General Electric (US), Microsoft (US), Siemens (Germany), Amazon Web Services (US), ANSYS (US), Dassault Systemes (France), PTC (US), Robert Bosch (Germany), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- FIGURE 1 DIGITAL TWIN MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 GEOGRAPHICAL SCOPE

- 1.3.4 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

- 1.7.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 DIGITAL TWIN MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- FIGURE 3 DIGITAL TWIN MARKET: RESEARCH APPROACH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 Primary interviews with experts

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to capture market size using bottom-up analysis (demand side)

- FIGURE 4 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to capture market size using top-down analysis (supply side)

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: (DEMAND SIDE) REVENUE GENERATED BY COMPANIES IN DIGITAL TWIN MARKET

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 PARAMETERS CONSIDERED TO ANALYZE IMPACT OF RECESSION ON DIGITAL TWIN MARKET

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

- FIGURE 8 PREDICTIVE MAINTENANCE SEGMENT TO HOLD LARGEST MARKET SHARE OF DIGITAL TWIN MARKET, BY APPLICATION, IN 2028

- FIGURE 9 SMALL & MEDIUM ENTERPRISES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 AUTOMOTIVE & TRANSPORTATION INDUSTRY TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 11 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DIGITAL TWIN MARKET

- FIGURE 12 RISING ADOPTION OF DIGITAL TWIN SOLUTIONS BY MANUFACTURING FIRMS TO FUEL MARKET GROWTH

- 4.2 DIGITAL TWIN MARKET, BY APPLICATION

- FIGURE 13 PREDICTIVE MAINTENANCE SEGMENT TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- 4.3 DIGITAL TWIN MARKET IN NORTH AMERICA, BY INDUSTRY AND COUNTRY

- FIGURE 14 AUTOMOTIVE & TRANSPORTATION INDUSTRY AND US TO SECURE LARGEST MARKET SHARE OF NORTH AMERICAN MARKET IN 2028

- 4.4 DIGITAL TWIN MARKET, BY INDUSTRY

- FIGURE 15 AUTOMOTIVE & TRANSPORTATION INDUSTRY TO CAPTURE LARGEST MARKET SHARE IN 2023

- 4.5 DIGITAL TWIN MARKET, BY COUNTRY

- FIGURE 16 CHINA TO REGISTER HIGHEST CAGR IN GLOBAL DIGITAL TWIN MARKET DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 DIGITAL TWIN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Growing use of digital twin technology to reduce costs and improve supply chain operations

- 5.2.1.2 Surging demand for digital twin technology from healthcare industry

- 5.2.1.3 Increasing adoption of predictive maintenance model across industries

- FIGURE 18 DIGITAL TWIN MARKET: IMPACT OF DRIVERS

- 5.2.2 RESTRAINTS

- 5.2.2.1 High capital requirement to implement digital twin technology

- 5.2.2.2 Susceptibility of digital twin technology to cyberattacks

- FIGURE 19 DIGITAL TWIN MARKET: IMPACT OF RESTRAINTS

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Surging demand for advanced real-time data analytics

- 5.2.3.2 Increasing adoption of Industry 4.0 principles

- 5.2.3.3 Development of human-centered digital twins

- FIGURE 20 DIGITAL TWIN MARKET: IMPACT OF OPPORTUNITIES

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities associated with data collection and mathematical models

- 5.2.4.2 Shortage of skilled workforce

- FIGURE 21 DIGITAL TWIN MARKET: IMPACT OF CHALLENGES

- 5.3 VALUE CHAIN ANALYSIS

- FIGURE 22 DIGITAL TWIN MARKET: VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM MAPPING

- FIGURE 23 ECOSYSTEM ANALYSIS

- TABLE 1 ROLE OF KEY PLAYERS IN DIGITAL TWIN ECOSYSTEM

- 5.5 PRICING ANALYSIS

- 5.5.1 DIGITAL TWIN PRICING, BY APPLICATION

- FIGURE 24 AVERAGE SELLING PRICE OF DIGITAL TWIN SOLUTIONS OFFERED BY KEY COMPANIES, BY GEOGRAPHY

- TABLE 2 AVERAGE SELLING PRICE OF DIGITAL TWIN SOLUTIONS, BY REGION

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 25 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN DIGITAL TWIN MARKET

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 IOT AND IIOT

- 5.7.2 AI AND ML

- 5.7.3 AUGMENTED REALITY, VIRTUAL REALITY, AND MIXED REALITY

- 5.7.4 5G

- 5.7.5 CLOUD COMPUTING AND EDGE COMPUTING

- 5.7.6 BLOCKCHAIN

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 DIGITAL TWIN MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 BARGAINING POWER OF SUPPLIERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE INDUSTRIES

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY INDUSTRY

- 5.9.2 BUYING CRITERIA

- FIGURE 28 KEY BUYING CRITERIA OF TOP THREE INDUSTRIES

- TABLE 4 KEY BUYING CRITERIA, BY END USER

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 TEMPLE UNIVERSITY, US, USES DIGITAL TWIN TECHNOLOGY TO ENHANCE OPERATIONS ACROSS CAMPUS

- 5.10.2 FAURECIA ADOPTS 3DEXPERIENCE DIGITAL TWIN PLATFORM TO OPTIMIZE AGV INBOUND LOGISTICS

- 5.10.3 DOOSAN OPTIMIZES ENERGY OUTPUT IN WIND FARMS BY IMPLEMENTING AZURE DIGITAL TWINS

- 5.10.4 IBM INCORPORATES DIGITAL TWINS TO IMPROVE SPARE PART INVENTORY

- 5.10.5 USE HEALTHCARE PROFESSIONALS USE DIGITAL TWINS TO DEVELOP PERSONALIZED AND BETTER CARE PLANS

- 5.11 TRADE ANALYSIS

- FIGURE 29 IMPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 851769, BY COUNTRY, 2018-2022 (USD MILLION)

- FIGURE 30 EXPORT DATA FOR PRODUCTS COVERED UNDER HS CODE 851769, BY COUNTRY, 2018-2022 (USD MILLION)

- 5.12 PATENT ANALYSIS

- FIGURE 31 TOP 10 COMPANIES WITH LARGEST NUMBER OF PATENT APPLICATIONS FOR DIGITAL TWINS, 2013-2022

- TABLE 5 TOP 20 PATENT OWNERS IN LAST 10 YEARS, 2013-2022

- FIGURE 32 NUMBER OF PATENTS GRANTED FROM 2013 TO 2022

- TABLE 6 DIGITAL TWIN MARKET: INNOVATIONS AND PATENT REGISTRATIONS, 2021-2022

- 5.13 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 7 DIGITAL TWIN MARKET: LIST OF CONFERENCES AND EVENTS

- 5.14 TARIFFS AND REGULATORY LANDSCAPE

- 5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.2 STANDARDS AND REGULATIONS RELATED TO DIGITAL TWIN TECHNOLOGY

- TABLE 12 DIGITAL TWIN: STANDARDS AND REGULATIONS

6 DIGITAL TWIN ADOPTION IN DIFFERENT PROCESSES, COMPONENTS, PRODUCTS, AND SYSTEMS

- 6.1 INTRODUCTION

- 6.2 COMPONENT DIGITAL TWIN

- 6.3 PRODUCT DIGITAL TWIN

- 6.4 PROCESS DIGITAL TWIN

- 6.5 SYSTEM DIGITAL TWIN

7 DIGITAL TWIN MODELS

- 7.1 INTRODUCTION

- 7.2 PLATFORM AS A SERVICE (PAAS)

- 7.3 SOFTWARE AS A SERVICE (SAAS)

8 DIGITAL TWIN MARKET, BY ENTERPRISE SIZE

- 8.1 INTRODUCTION

- FIGURE 33 DIGITAL TWIN MARKET FOR SMALL & MEDIUM ENTERPRISES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 13 DIGITAL TWIN MARKET, BY ENTERPRISE SIZE, 2019-2022 (USD MILLION)

- TABLE 14 DIGITAL TWIN MARKET, BY ENTERPRISE SIZE, 2023-2028 (USD MILLION)

- 8.2 LARGE ENTERPRISES

- 8.2.1 RAPID DEPLOYMENT OF BLOCKCHAIN TECHNOLOGY IN HEALTHCARE SECTOR TO DRIVE MARKET

- TABLE 15 LARGE ENTERPRISES: DIGITAL TWIN MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 16 LARGE ENTERPRISES: DIGITAL TWIN MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3 SMALL & MEDIUM ENTERPRISES (SMES)

- 8.3.1 SUBSCRIPTION-BASED DIGITAL TWIN SERVICES TO BOOST SEGMENTAL GROWTH

- TABLE 17 SMALL & MEDIUM ENTERPRISES: DIGITAL TWIN MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 18 SMALL & MEDIUM ENTERPRISES: DIGITAL TWIN MARKET, BY REGION, 2023-2028 (USD MILLION)

9 DIGITAL TWIN MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- FIGURE 34 DIGITAL TWIN MARKET, BY APPLICATION

- FIGURE 35 PREDICTIVE MAINTENANCE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 19 DIGITAL TWIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 20 DIGITAL TWIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- 9.2 PRODUCT DESIGN & DEVELOPMENT

- 9.2.1 RISING FOCUS OF PRODUCT DESIGNERS TO VISUALIZE AND ANALYZE PRODUCTS VIRTUALLY TO BOOST SEGMENTAL GROWTH

- TABLE 21 PRODUCT DESIGN & DEVELOPMENT: DIGITAL TWIN MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 22 PRODUCT DESIGN & DEVELOPMENT: DIGITAL TWIN MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 9.3 PERFORMANCE MONITORING

- 9.3.1 GREATER EMPHASIS OF INDUSTRY PLAYERS ON MITIGATING COSTLY EQUIPMENT FAILURES TO DRIVE SEGMENTAL GROWTH

- TABLE 23 PERFORMANCE MONITORING: DIGITAL TWIN MARKET, BY INDUSTRY 2019-2022 (USD MILLION)

- TABLE 24 PERFORMANCE MONITORING: DIGITAL TWIN MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 9.4 PREDICTIVE MAINTENANCE

- 9.4.1 GROWING FOCUS OF MANUFACTURING FIRMS ON COST SAVING TO CONTRIBUTE TO SEGMENTAL GROWTH

- TABLE 25 PREDICTIVE MAINTENANCE: DIGITAL TWIN MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 26 PREDICTIVE MAINTENANCE: DIGITAL TWIN MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 9.5 INVENTORY MANAGEMENT

- 9.5.1 INCREASING ADOPTION OF DIGITAL TWIN TO AVOID STOCKOUTS TO SUPPORT SEGMENTAL GROWTH

- TABLE 27 INVENTORY MANAGEMENT: DIGITAL TWIN MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 28 INVENTORY MANAGEMENT: DIGITAL TWIN MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 9.6 BUSINESS OPTIMIZATION

- 9.6.1 STRONG FOCUS ON COST-EFFECTIVE AND FASTER PRODUCTIVE DEVELOPMENT TO DRIVE SEGMENTAL GROWTH

- TABLE 29 BUSINESS OPTIMIZATION: DIGITAL TWIN MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 30 BUSINESS OPTIMIZATION: DIGITAL TWIN MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 9.7 OTHER APPLICATIONS

- TABLE 31 OTHER APPLICATIONS: DIGITAL TWIN MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 32 OTHER APPLICATIONS: DIGITAL TWIN MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

10 DIGITAL TWIN MARKET, BY INDUSTRY

- 10.1 INTRODUCTION

- FIGURE 36 DIGITAL TWIN MARKET, BY INDUSTRY

- FIGURE 37 HEALTHCARE SEGMENT TO DISPLAY HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 33 DIGITAL TWIN MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 34 DIGITAL TWIN MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- 10.2 AUTOMOTIVE & TRANSPORTATION

- 10.2.1 NEED TO OPTIMIZE AND ENHANCE TIME-CONSUMING PROCESSES IN VEHICLE MANUFACTURING TO BOOST ADOPTION OF DIGITAL TWINS

- TABLE 35 AUTOMOTIVE & TRANSPORTATION: DIGITAL TWIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 36 AUTOMOTIVE & TRANSPORTATION: DIGITAL TWIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 37 AUTOMOTIVE & TRANSPORTATION: DIGITAL TWIN MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 38 AUTOMOTIVE & TRANSPORTATION: DIGITAL TWIN MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3 ENERGY & UTILITIES

- 10.3.1 RISING APPLICATION OF DIGITAL TWIN TECHNOLOGY IN WIND FARMS TO BENEFIT MARKET

- TABLE 39 ENERGY & UTILITIES: DIGITAL TWIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 40 ENERGY & UTILITIES: DIGITAL TWIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 41 ENERGY & UTILITIES: DIGITAL TWIN MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 42 ENERGY & UTILITIES: DIGITAL TWIN MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4 INFRASTRUCTURE

- 10.4.1 SMART CITY PROJECTS AND SMART TRANSPORTATION INITIATIVES TO DRIVE MARKET

- TABLE 43 INFRASTRUCTURE: DIGITAL TWIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 44 INFRASTRUCTURE: DIGITAL TWIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 45 INFRASTRUCTURE: DIGITAL TWIN MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 46 INFRASTRUCTURE: DIGITAL TWIN MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.5 HEALTHCARE

- 10.5.1 DIGITAL TRANSFORMATION IN HEALTHCARE INDUSTRY TO DRIVE MARKET

- TABLE 47 HEALTHCARE: DIGITAL TWIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 48 HEALTHCARE: DIGITAL TWIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 49 HEALTHCARE: DIGITAL TWIN MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 50 HEALTHCARE: DIGITAL TWIN MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.6 AEROSPACE

- 10.6.1 PRESSING NEED FOR REAL-TIME TELEMETRY DATA TO AVOID DANGEROUS SITUATIONS TO ACCELERATE DEMAND FOR DIGITAL TWIN TECHNOLOGY

- TABLE 51 AEROSPACE: DIGITAL TWIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 52 AEROSPACE: DIGITAL TWIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 53 AEROSPACE: DIGITAL TWIN MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 54 AEROSPACE: DIGITAL TWIN MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.7 OIL & GAS

- 10.7.1 INCREASING USE OF DIGITAL TWIN OPTIMIZE OIL AND GAS PLANT OPERATIONS TO DRIVE MARKET

- TABLE 55 OIL & GAS: DIGITAL TWIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 56 OIL & GAS: DIGITAL TWIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 57 OIL & GAS: DIGITAL TWIN MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 58 OIL & GAS: DIGITAL TWIN MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.8 TELECOMMUNICATIONS

- 10.8.1 RISING IMPLEMENTATION OF DIGITAL TWIN SOLUTIONS TO ENHANCE NETWORK OPTIMIZATION AND 5G DEPLOYMENT TO STRENGTHEN MARKET

- TABLE 59 TELECOMMUNICATIONS: DIGITAL TWIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 60 TELECOMMUNICATIONS: DIGITAL TWIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 61 TELECOMMUNICATIONS: DIGITAL TWIN MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 62 TELECOMMUNICATIONS: DIGITAL TWIN MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.9 AGRICULTURE

- 10.9.1 INCREASED FOCUS ON REAL-TIME MONITORING OF CROPS AND DECISION-MAKING TO BOOST DIGITAL TWIN ADOPTION TO CONTRIBUTE TO MARKET GROWTH

- TABLE 63 AGRICULTURE: DIGITAL TWIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 64 AGRICULTURE: DIGITAL TWIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 65 AGRICULTURE: DIGITAL TWIN MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 66 AGRICULTURE: DIGITAL TWIN MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.10 RETAIL

- 10.10.1 SURGING ADOPTION OF DIGITAL TWIN SOLUTIONS TO IMPROVE CUSTOMER ENGAGEMENT AND SATISFACTION TO PROPEL MARKET

- TABLE 67 RETAIL: DIGITAL TWIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 68 RETAIL: DIGITAL TWIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 69 RETAIL: DIGITAL TWIN MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 70 RETAIL: DIGITAL TWIN MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.11 OTHER INDUSTRIES

- TABLE 71 OTHER APPLICATIONS: DIGITAL TWIN MARKET, BY APPLICATION, 2019-2022 (USD MILLION)

- TABLE 72 OTHER APPLICATIONS: DIGITAL TWIN MARKET, BY APPLICATION, 2023-2028 (USD MILLION)

- TABLE 73 OTHER APPLICATIONS: DIGITAL TWIN MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 74 OTHER APPLICATIONS: DIGITAL TWIN MARKET, BY REGION, 2023-2028 (USD MILLION)

11 REGIONAL ANALYSIS

- 11.1 INTRODUCTION

- FIGURE 38 DIGITAL TWIN MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 39 NORTH AMERICA TO DOMINATE DIGITAL TWIN MARKET DURING FORECAST PERIOD

- TABLE 75 DIGITAL TWIN MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 76 DIGITAL TWIN MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 NORTH AMERICA

- 11.3 NORTH AMERICA: RECESSION IMPACT

- FIGURE 40 NORTH AMERICA: DIGITAL TWIN MARKET SNAPSHOT

- TABLE 77 NORTH AMERICA: DIGITAL TWIN MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: DIGITAL TWIN MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: DIGITAL TWIN MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 80 NORTH AMERICA: DIGITAL TWIN MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: DIGITAL TWIN MARKET, BY ENTERPRISE SIZE, 2019-2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: DIGITAL TWIN MARKET, BY ENTERPRISE SIZE, 2023-2028 (USD MILLION)

- 11.3.1 US

- 11.3.1.1 Implementation of 3D models and digital technologies across several industries to drive market

- 11.3.2 CANADA

- 11.3.2.1 Lowest business tax burden to attract digital twin technology providers

- 11.3.3 MEXICO

- 11.3.3.1 Thriving automotive sector to support market growth

- 11.4 EUROPE

- 11.4.1 EUROPE: RECESSION IMPACT

- FIGURE 41 EUROPE: DIGITAL TWIN MARKET SNAPSHOT

- TABLE 83 EUROPE: DIGITAL TWIN MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 84 EUROPE: DIGITAL TWIN MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 85 EUROPE: DIGITAL TWIN MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 86 EUROPE: DIGITAL TWIN MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 87 EUROPE: DIGITAL TWIN MARKET, BY ENTERPRISE SIZE, 2019-2022 (USD MILLION)

- TABLE 88 EUROPE: DIGITAL TWIN MARKET, BY ENTERPRISE SIZE, 2023-2028 (USD MILLION)

- 11.4.2 GERMANY

- 11.4.2.1 Increasing adoption of inclination of manufacturing firms toward automation to fuel market growth

- 11.4.3 FRANCE

- 11.4.3.1 Significant contribution of automotive and aerospace industries in technology adoption to drive market

- 11.4.4 UK

- 11.4.4.1 Steady development of renewable energy infrastructure and adoption of 5G and IoT to boost demand

- 11.4.5 REST OF EUROPE

- 11.5 ASIA PACIFIC

- 11.5.1 ASIA PACIFIC: RECESSION IMPACT

- FIGURE 42 ASIA PACIFIC: DIGITAL TWIN MARKET SNAPSHOT

- TABLE 89 ASIA PACIFIC: DIGITAL TWIN MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 90 ASIA PACIFIC: DIGITAL TWIN MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- TABLE 91 ASIA PACIFIC: DIGITAL TWIN MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 92 ASIA PACIFIC: DIGITAL TWIN MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 93 ASIA PACIFIC: DIGITAL TWIN MARKET, BY ENTERPRISE SIZE, 2019-2022 (USD MILLION)

- TABLE 94 ASIA PACIFIC: DIGITAL TWIN MARKET, BY ENTERPRISE SIZE, 2023-2028 (USD MILLION)

- 11.5.2 CHINA

- 11.5.2.1 Increasing adoption of automation technologies to propel market

- 11.5.3 JAPAN

- 11.5.3.1 Rising use of IoT devices to create opportunities for digital twin technology providers

- 11.5.4 INDIA

- 11.5.4.1 Make in India and Digital India initiatives undertaken by governments to drive market

- 11.5.5 SOUTH KOREA

- 11.5.5.1 Government-led R&D initiatives in IoT technology to boost adoption of digital twins

- 11.5.6 REST OF ASIA PACIFIC

- 11.6 ROW

- 11.6.1 ROW: RECESSION IMPACT

- FIGURE 43 ROW: DIGITAL TWIN MARKET SNAPSHOT

- TABLE 95 ROW: DIGITAL TWIN MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 96 ROW: DIGITAL TWIN MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 97 ROW: DIGITAL TWIN MARKET, BY INDUSTRY, 2019-2022 (USD MILLION)

- TABLE 98 ROW: DIGITAL TWIN MARKET, BY INDUSTRY, 2023-2028 (USD MILLION)

- TABLE 99 ROW: DIGITAL TWIN MARKET, BY ENTERPRISE SIZE, 2019-2022 (USD MILLION)

- TABLE 100 ROW: DIGITAL TWIN MARKET, BY ENTERPRISE SIZE, 2023-2028 (USD MILLION)

- 11.6.2 SOUTH AMERICA

- 11.6.2.1 Surging adoption of IIoT in mining and other industries to drive market

- 11.6.3 MIDDLE EAST

- TABLE 101 MIDDLE EAST: DIGITAL TWIN MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 102 MIDDLE EAST: DIGITAL TWIN MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 11.6.3.1 Saudi Arabia

- 11.6.3.1.1 Growing focus of oil & gas companies on safe and efficient operations to boost demand for digital twin solutions

- 11.6.3.2 UAE

- 11.6.3.2.1 Inclination of industry players toward smart manufacturing to drive market

- 11.6.3.3 Rest of Middle East

- 11.6.3.1 Saudi Arabia

- 11.6.4 AFRICA

- 11.6.4.1 Increasing demand for telecom and power supply devices to fuel market growth

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES ADOPTED BY MAJOR PLAYERS

- TABLE 103 OVERVIEW OF STRATEGIES ADOPTED BY DIGITAL TWIN PROVIDERS

- 12.3 FIVE-YEAR REVENUE ANALYSIS OF TOP COMPANIES, 2018-2022

- FIGURE 44 SEGMENTAL REVENUE OF KEY PLAYERS, 2018-2022

- 12.4 MARKET SHARE ANALYSIS, 2022

- TABLE 104 DIGITAL TWIN MARKET: DEGREE OF COMPETITION

- FIGURE 45 MARKET SHARE ANALYSIS, 2022

- 12.5 DIGITAL TWIN MARKET: COMPANY EVALUATION MATRIX, 2022

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- FIGURE 46 DIGITAL TWIN MARKET: COMPANY EVALUATION MATRIX, 2022

- 12.6 DIGITAL TWIN MARKET: COMPANY FOOTPRINT

- TABLE 105 COMPANY FOOTPRINT

- TABLE 106 INDUSTRY FOOTPRINT

- TABLE 107 ENTERPRISE FOOTPRINT

- TABLE 108 REGION FOOTPRINT

- 12.7 DIGITAL TWIN MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- FIGURE 47 DIGITAL TWIN MARKET: STARTUPS/SMES EVALUATION MATRIX, 2022

- 12.8 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 109 DIGITAL TWIN MARKET: DETAILED LIST OF KEY STARTUPS

- TABLE 110 DIGITAL TWIN MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 12.9 COMPETITIVE SCENARIOS AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- TABLE 111 DIGITAL TWIN MARKET: PRODUCT LAUNCHES, 2020-2023

- 12.9.2 DEALS

- TABLE 112 DIGITAL TWIN MARKET: DEALS, 2020-2023

- 12.9.3 OTHERS

- TABLE 113 DIGITAL TWIN MARKET: OTHERS, 2020-2023

13 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 13.1 KEY PLAYERS

- 13.1.1 GENERAL ELECTRIC

- TABLE 114 GENERAL ELECTRIC: BUSINESS OVERVIEW

- FIGURE 48 GENERAL ELECTRIC: COMPANY SNAPSHOT

- TABLE 115 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.2 MICROSOFT

- TABLE 116 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 49 MICROSOFT: COMPANY SNAPSHOT

- TABLE 117 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.3 SIEMENS

- TABLE 118 SIEMENS: BUSINESS OVERVIEW

- FIGURE 50 SIEMENS: COMPANY SNAPSHOT

- TABLE 119 SIEMENS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.4 AMAZON WEB SERVICES, INC. (AWS)

- TABLE 120 AMAZON WEB SERVICES, INC.: BUSINESS OVERVIEW

- FIGURE 51 AMAZON WEB SERVICES, INC.: COMPANY SNAPSHOT

- TABLE 121 AMAZON WEB SERVICES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.5 DASSAULT SYSTEMES

- TABLE 122 DASSAULT SYSTEMES: BUSINESS OVERVIEW

- FIGURE 52 DASSAULT SYSTEMES: COMPANY SNAPSHOT

- TABLE 123 DASSAULT SYSTEMES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.6 ANSYS, INC.

- TABLE 124 ANSYS, INC.: BUSINESS OVERVIEW

- FIGURE 53 ANSYS, INC.: COMPANY SNAPSHOT

- TABLE 125 ANSYS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.7 IBM CORPORATION

- TABLE 126 IBM CORPORATION: BUSINESS OVERVIEW

- FIGURE 54 IBM CORPORATION: COMPANY SNAPSHOT

- TABLE 127 IBM CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.8 PTC

- TABLE 128 PTC: BUSINESS OVERVIEW

- FIGURE 55 PTC: COMPANY SNAPSHOT

- TABLE 129 PTC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.9 SAP SE

- TABLE 130 SAP SE: BUSINESS OVERVIEW

- FIGURE 56 SAP SE: COMPANY SNAPSHOT

- TABLE 131 SAP SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.10 ORACLE

- TABLE 132 ORACLE: BUSINESS OVERVIEW

- FIGURE 57 ORACLE: COMPANY SNAPSHOT

- TABLE 133 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.1.11 ROBERT BOSCH GMBH

- TABLE 134 ROBERT BOSCH GMBH: BUSINESS OVERVIEW

- FIGURE 58 ROBERT BOSCH GMBH: COMPANY SNAPSHOT

- TABLE 135 ROBERT BOSCH GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 13.2 OTHER KEY PLAYERS

- 13.2.1 EMERSON ELECTRIC CO.

- 13.2.2 ABB

- 13.2.3 HONEYWELL INTERNATIONAL INC.

- 13.2.4 SCHNEIDER ELECTRIC

- 13.2.5 NAVVIS

- 13.2.6 DNV AS

- 13.2.7 AUTODESK INC.

- 13.2.8 ANDRITZ AG

- 13.2.9 SOFTWARE AG

- 13.2.10 BENTLEY SYSTEMS, INCORPORATED

- 13.2.11 RIVER LOGIC, INC.

- 13.2.12 ALTAIR ENGINEERING INC.

- 13.2.13 JOHNSON CONTROLS

- 13.2.14 NSTREAM

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 ADJACENT AND RELATED MARKETS

- 14.1 INDUSTRIAL ROBOTICS MARKET

- 14.2 STUDY LIMITATIONS

- 14.3 INDUSTRIAL ROBOTICS MARKET, BY PAYLOAD

- FIGURE 59 INDUSTRIAL ROBOTICS WITH PAYLOAD CAPACITY RANGING OF 16.01 TO 60.00 KG TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 136 INDUSTRIAL ROBOTICS MARKET, BY PAYLOAD, 2019-2022 (USD MILLION)

- TABLE 137 INDUSTRIAL ROBOTICS MARKET, BY PAYLOAD, 2023-2028 (USD MILLION)

- TABLE 138 INDUSTRIAL ROBOTICS MARKET, BY PAYLOAD, 2019-2022 (THOUSAND UNITS)

- TABLE 139 INDUSTRIAL ROBOTICS MARKET, BY PAYLOAD, 2023-2028 (THOUSAND UNITS)

- 14.4 UP TO 16.00 KG

- 14.4.1 HIGH ACCURACY AND FLEXIBILITY OF ROBOTS TO DRIVE DEMAND IN FOOD & BEVERAGES AND AUTOMOTIVE VERTICALS

- TABLE 140 TYPES OF INDUSTRIAL ROBOTS WITH UP TO 16. OO KG PAYLOAD CAPACITY

- 14.5 16.01-60.00 KG

- 14.5.1 AUTOMOTIVE INDUSTRY TO OFFER LUCRATIVE OPPORTUNITIES FOR PLAYERS

- TABLE 141 TYPES OF INDUSTRIAL ROBOTS WITH 16.01-60.00 KG PAYLOAD CAPACITY

- 14.6 60.01-225.00 KG

- 14.6.1 GROWING ADOPTION OF ROBOTS TO AUTOMATE ASSEMBLING AND PACKAGING OF CONSUMER ELECTRONICS TO DRIVE MARKET

- TABLE 142 TYPES OF INDUSTRIAL ROBOTS WITH 60.01-225.00 KG PAYLOAD CAPACITY

- 14.7 MORE THAN 225.00 KG

- 14.7.1 STRONG FOCUS ON IMPROVING PRODUCTIVITY AND WORKPLACE SAFETY TO ACCELERATE MARKET GROWTH

- TABLE 143 TYPES OF INDUSTRIAL ROBOTS WITH MORE THAN 225.00 KG PAYLOAD CAPACITY

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 AVAILABLE CUSTOMIZATIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS