|

|

市場調査レポート

商品コード

1323875

ハイブリッドパワーソリューションの世界市場:システムタイプ別(太陽-化石燃料、風力-化石燃料、太陽-風力-化石燃料、太陽-風力、その他)、グリッド接続別(オングリッド、オフグリッド)、容量別、エンドユーザー別、地域別-2028年までの予測Hybrid Power Solutions Market by System Type (Solar-Fossil, Wind-Fossil, Solar-Wind-Fossil, Solar-Wind, Others), Grid Connectivity (On-Grid, Off-Grid), Capacity (Upto 100kW, 100kW-1MW, Above 1MW), End User & Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| ハイブリッドパワーソリューションの世界市場:システムタイプ別(太陽-化石燃料、風力-化石燃料、太陽-風力-化石燃料、太陽-風力、その他)、グリッド接続別(オングリッド、オフグリッド)、容量別、エンドユーザー別、地域別-2028年までの予測 |

|

出版日: 2023年07月27日

発行: MarketsandMarkets

ページ情報: 英文 188 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

ハイブリッドパワーソリューションの市場規模は、2023年の24億米ドルから2028年には40億米ドルに成長すると予測され、予測期間中のCAGRは10.4%と見込まれています。

住宅、商業、工業など多様な分野で持続可能で信頼性の高いエネルギーソリューションに対する需要が増加しているため、急成長を遂げています。

商業用エンドユーザーは、企業による持続可能性とエネルギー効率への関心の高まりと急速な都市化により、ハイブリッドパワーソリューション市場で成長しています。ハイブリッド・システムは、信頼性の高い電力供給を確保しながら運用コストとカーボンフットプリントを削減することを可能にし、環境意識の高い、コスト意識の高い企業にとって魅力的な選択肢となっています。

容量ベースでは、1MW以上のセグメントは、大規模な産業・商業からの需要の高まりにより、最大セグメントになると予想されます。これらの分野では、エネルギー需要を効率的かつ持続的に満たすため、より大きな電力容量が必要とされます。さらに、技術の進歩や大規模設備の費用対効果も成長に寄与しています。

中東・アフリカはハイブリッドパワーソリューション市場において2番目に大きな地域に浮上すると予想されています。

当レポートでは、世界のハイブリッドパワーソリューション市場について調査し、市場の概要とともに、システムタイプ別、グリッド接続別、容量別、エンドユーザー別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向/混乱

- エコシステム分析

- バリューチェーン分析

- 価格分析

- 技術分析

- 関税、法規、および規制

- 特許分析

- 貿易分析

- 2023年~2024年の主要な会議とイベント

- ケーススタディ分析

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

第6章 ハイブリッドパワーソリューション市場、システムタイプ別

- イントロダクション

- 太陽-化石燃料

- 風力-化石燃料

- 太陽-風力-化石燃料

- 太陽-風力

- その他

第7章 ハイブリッドパワーソリューション市場、容量別

- イントロダクション

- 100KW未満

- 100KW~1MW

- 1MW超

第8章 ハイブリッドパワーソリューション市場、グリッド接続別

- イントロダクション

- オングリッド

- オフグリッド

第9章 ハイブリッドパワーソリューション市場、エンドユーザー別

- イントロダクション

- 住宅

- 商業

- 産業

第10章 ハイブリッドパワーソリューション市場、地域別

- イントロダクション

- アジア太平洋

- 中東・アフリカ

- 欧州

- 北米

- 南米

第11章 競合情勢

第12章 企業プロファイル

- 主要参入企業

- VERTIV GROUP CORP.

- GENERAL ELECTRIC

- SIEMENS ENERGY

- VESTAS

- WARTSILA

- SMA SOLAR TECHNOLOGY AG

- HUAWEI TECHNOLOGIES CO., LTD.

- ZTE CORPORATION

- DELTA ELECTRONICS, INC.

- LONGI

- CHINT GROUP

- VERGNET SA

- FRONIUS INTERNATIONAL GMBH

- PFISTERER HOLDING AG

- MAN ENERGY SOLUTIONS

- その他の企業

- DANVEST BV

- SILVER POWER SYSTEMS

- WUXI CHWAY TECHNOLOGY CO., LTD.

- FOSHAN TANFON ENERGY CO., LTD.

- CLEAR BLUE TECHNOLOGIES INC.

第13章 付録

The hybrid power solutions market is estimated to grow from USD 2.4 Billion in 2023 to USD 4.0 Billion by 2028; it is expected to record a CAGR of 10.4% during the forecast period. The hybrid power solutions market is witnessing rapid growth owing to the increasing demand for sustainable and reliable energy solutions in diverse sectors, such as residential, commercial and industrial.

"Commercial: The second-fastest segment of the hybrid power solutions market, by end user"

Based on end user, the hybrid power solutions market has been split into three types: residential, commercial, and industrial. The commercial end user is growing in the hybrid power solutions market due to increasing focus on sustainability and energy efficiency by businesses as well as rapid urbanization. Hybrid systems enable companies to reduce operational costs and carbon footprints while ensuring reliable power supply, making them an attractive choice for environmentally conscious and cost-conscious businesses.

"Above 1 MW segment is expected to emerge as the largest segment based on capacity"

Based on capacity, the hybrid power solutions market has been segmented into upto 100kW, 100kW-1MW, and above 1 MW. The above 1 MW segment is expected to be the largest segment owing to urge in demand from large-scale industrial and commercial applications. They require higher power capacities to meet energy needs efficiently and sustainably. Additionally, advancements in technology and cost-effectiveness of larger installations contributes to the growth.

"Middle East and Africa is expected to emerge as the second-largest region based on hybrid power solutions market"

By region, the hybrid power solutions market has been segmented into Asia Pacific, North America, South America, Europe, and Middle East & Africa. In the region, the hybrid power solutions market is driven by the need to expand energy access, especially in rural and remote areas with limited or no grid connectivity. international partnerships and collaborations have further accelerated the adoption of hybrid power solutions in the Middle East & Africa region. Investments from international organizations and development agencies have facilitated the implementation of projects and the transfer of knowledge and technology.

Off-Grid is expected to be the second-largest segment based on the grid connectivity

Off-Grid is expected to be the second-largest segment in the hybrid power solutions market between 2023-2028 due to the need for reliable power supply, continuous operations, and reduced dependency on fossil fuels while achieving sustainability goals. Integrating renewable energy with grid connectivity offers a cost-effective and sustainable solution, reducing reliance on fossil fuels.

Breakdown of Primaries:

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information, as well as to assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1- 45%, Tier 2- 30%, and Tier 3- 25%

By Designation: C-Level- 35%, Director Levels- 25%, and Others- 40%

By Region: North America- 10%, Europe- 15%, Asia Pacific- 60%, the Middle East & Africa- 10%, and South America- 5%

Note: Others include product engineers, product specialists, and engineering leads.

Note: The tiers of the companies are defined on the basis of their total revenues as of 2021. Tier 1: > USD 1 billion, Tier 2: From USD 500 million to USD 1 billion, and Tier 3: < USD 500 million

The hybrid power solutions market is dominated by a few major players that have a wide regional presence. The leading players in the high voltage cables and accessories market are General Electric (US), Vertiv Group Corp. (US), Vestas (Denmark), Wartsila (Finland), and SMA Solar Technology AG (Germany).

Research Coverage:

The report defines, describes, and forecasts the hybrid power solutions market, by system type, power rating, grid connectivity, end user, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the hybrid power solutions market.

Key Benefits of Buying the Report

- Increased power generation from hybrid power plants in off-grid locations and cost efficiency due to adoption of hybrid power solutions drive the demand. Factors such as high initial investment costs and longer payback periods hinder market growth. The growing need for uninterrupted power supply in telecom infrastructure, coupled with a focus on reducing carbon emissions offer lucrative opportunities in this market. Complex system integration and the occurrence of solar panel failures are major challenges faced by countries in this market.

- Product Development/ Innovation: The trends such as solar-wind, solar-wind-fossil, solar-fossil have led to more efficient, reliable, durable, and high power generation. The focus on hybrid power solutions has also led to the expectation that it would minimize the operating costs and will contribute more sustainable environment.

- Market Development: The global scenario of hybrid power solution in power generation is evolving rapidly, with trends towards hybrid plants as they offer a balanced and reliable energy supply, utilizing the strengths of both systems i.e., renewable and conventionals.

- Market Diversification: Huawei Technologies Co. Ltd. product Power-S offers a seamless solar hybrid power and backup solution designed generally for commercial and industrial environments, delivering reliable and high-quality power supply.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like General Electric (US), Vertiv Group Corp. (US), Vestas (Denmark), Wartsila (Finland), and SMA Solar Technology AG (Germany) among others in the hybrid power solution market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- TABLE 1 HYBRID POWER SOLUTIONS MARKET: INCLUSIONS AND EXCLUSIONS, BY SYSTEM TYPE

- TABLE 2 HYBRID POWER SOLUTIONS MARKET: INCLUSIONS AND EXCLUSIONS, BY CAPACITY

- TABLE 3 HYBRID POWER SOLUTIONS MARKET: INCLUSIONS AND EXCLUSIONS, BY GRID CONNECTIVITY

- TABLE 4 HYBRID POWER SOLUTIONS MARKET: INCLUSIONS AND EXCLUSIONS, BY END USER

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 RECESSION IMPACT

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 HYBRID POWER SOLUTIONS MARKET: RESEARCH DESIGN

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- FIGURE 2 DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Breakdown of primaries

- 2.3 SCOPE

- FIGURE 3 MAIN METRICS CONSIDERED TO ANALYZE AND ASSESS DEMAND FOR HYBRID POWER SOLUTIONS

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4.3 DEMAND-SIDE ANALYSIS

- 2.4.3.1 Regional analysis

- 2.4.3.2 Country-level analysis

- 2.4.3.3 Assumptions for demand-side analysis

- 2.4.3.4 Calculations for demand-side analysis

- 2.4.4 SUPPLY-SIDE ANALYSIS

- FIGURE 6 KEY STEPS CONSIDERED TO ASSESS SUPPLY OF HYBRID POWER SOLUTIONS

- FIGURE 7 HYBRID POWER SOLUTIONS MARKET: SUPPLY-SIDE ANALYSIS

- 2.4.4.1 Calculations for supply-side analysis

- 2.4.4.2 Assumptions for supply-side analysis

- 2.4.5 FORECAST

- 2.5 RISK ASSESSMENT

- 2.6 IMPACT OF RECESSION

3 EXECUTIVE SUMMARY

- TABLE 5 HYBRID POWER SOLUTIONS MARKET SNAPSHOT

- FIGURE 8 SOUTH AMERICA TO REGISTER HIGHEST CAGR IN HYBRID POWER SOLUTIONS MARKET DURING FORECAST PERIOD

- FIGURE 9 ABOVE 1 MW SEGMENT TO LEAD HYBRID POWER SOLUTIONS MARKET DURING FORECAST PERIOD

- FIGURE 10 ON-GRID TO BE DOMINANT SEGMENT IN HYBRID POWER SOLUTIONS MARKET DURING FORECAST PERIOD

- FIGURE 11 INDUSTRIAL SEGMENT TO LEAD HYBRID POWER SOLUTIONS MARKET DURING FORECAST PERIOD

- FIGURE 12 SOLAR-WIND SEGMENT TO LEAD HYBRID POWER SOLUTIONS MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN HYBRID POWER SOLUTIONS MARKET

- FIGURE 13 RISING ADOPTION OF RENEWABLE SOURCES IN POWER GENERATION

- 4.2 HYBRID POWER SOLUTIONS MARKET, BY REGION

- FIGURE 14 SOUTH AMERICAN HYBRID POWER SOLUTIONS MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 NORTH AMERICAN HYBRID POWER SOLUTIONS MARKET, BY END USER AND COUNTRY

- FIGURE 15 INDUSTRIAL SEGMENT AND US HELD LARGEST SHARES OF NORTH AMERICAN HYBRID POWER SOLUTIONS MARKET IN 2022

- 4.4 HYBRID POWER SOLUTIONS MARKET, BY SYSTEM TYPE

- FIGURE 16 SOLAR-WIND SEGMENT TO DOMINATE HYBRID POWER SOLUTIONS MARKET IN 2028

- 4.5 HYBRID POWER SOLUTIONS MARKET, BY END USER

- FIGURE 17 INDUSTRIAL SEGMENT TO ACCOUNT FOR LARGEST SHARE OF HYBRID POWER SOLUTIONS MARKET IN 2028

- 4.6 HYBRID POWER SOLUTIONS MARKET, BY GRID CONNECTIVITY

- FIGURE 18 ON-GRID SEGMENT TO ACCOUNT FOR LARGER SHARE OF HYBRID POWER SOLUTIONS MARKET IN 2028

- 4.7 HYBRID POWER SOLUTIONS MARKET, BY CAPACITY

- FIGURE 19 ABOVE 1 MW SEGMENT TO ACCOUNT FOR LARGEST SHARE OF HYBRID POWER SOLUTIONS MARKET IN 2028

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 20 HYBRID POWER SOLUTIONS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increased hybrid power generation in off-grid locations

- FIGURE 21 OFF-GRID CAPACITY, BY SOURCE, 2019-2021

- FIGURE 22 OFFSHORE WIND INSTALLATION CAPACITY (GW), BY REGION, 2018-2050

- 5.2.1.2 Lower operating costs than conventional diesel generators

- FIGURE 23 FLUCTUATIONS IN GLOBAL FUEL PRICES, 2015-2019

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investments

- FIGURE 24 CAPITAL COST ASSOCIATED WITH SOLAR-DIESEL-BASED HYBRID POWER SOLUTIONS, BY COMPONENT (%)

- 5.2.2.2 Higher payback time than conventional diesel generators

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Reduction in carbon emissions

- TABLE 6 EMISSION REDUCTION TARGETS

- 5.2.3.2 Growing requirement for uninterrupted power from telecom infrastructure operators

- 5.2.4 CHALLENGES

- 5.2.4.1 Complex system integration

- 5.2.4.2 Solar panel failures

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 25 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR PLAYERS IN HYBRID POWER SOLUTIONS MARKET

- 5.4 ECOSYSTEM ANALYSIS

- TABLE 7 HYBRID POWER SOLUTIONS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 26 HYBRID POWER SOLUTIONS MARKET: ECOSYSTEM ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 27 HYBRID POWER SOLUTIONS MARKET: VALUE CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL PROVIDERS/SUPPLIERS/COMPONENT MANUFACTURERS

- 5.5.2 HYBRID POWER SOLUTION MANUFACTURERS/ASSEMBLERS

- 5.5.3 SYSTEM INTEGRATORS

- 5.5.4 DISTRIBUTORS/RESELLERS

- 5.5.5 PROJECT DEVELOPERS AND ENGINEERING, PROCUREMENT, AND CONSTRUCTION (EPC) COMPANIES

- 5.5.6 END USERS

- 5.5.7 MAINTENANCE AND SERVICE PROVIDERS

- 5.6 PRICING ANALYSIS

- FIGURE 28 AVERAGE SELLING PRICE (ASP) OF HYBRID POWER SOLUTIONS, BY SYSTEM TYPE

- TABLE 8 AVERAGE SELLING PRICE (ASP) OF HYBRID POWER SOLUTIONS, BY SYSTEM TYPE (USD THOUSAND/MW)

- TABLE 9 AVERAGE SELLING PRICE (ASP) ANALYSIS, BY REGION (2021 AND 2028)

- FIGURE 29 AVERAGE SELLING PRICE (ASP) ANALYSIS, BY REGION (2021 AND 2028)

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 SMART MICROGRID

- 5.8 TARIFFS, CODES, AND REGULATIONS

- 5.8.1 TARIFF RELATED TO HYBRID POWER SOLUTION UNITS

- TABLE 10 TARIFF RELATED TO ELECTRIC MOTORS AND GENERATORS

- TABLE 11 TARIFF RELATED TO HYDROGEN

- 5.8.2 CODES AND REGULATIONS RELATED TO HYBRID POWER SOLUTIONS

- 5.8.3 CARBON-REDUCTION POLICY TRENDS IN ENERGY INDUSTRY

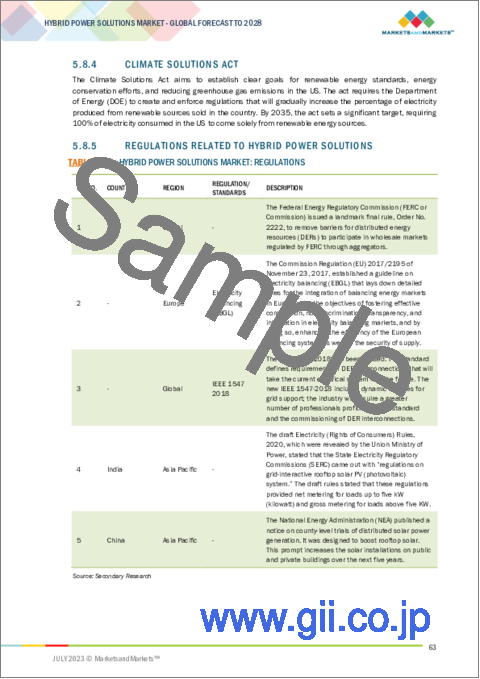

- 5.8.4 CLIMATE SOLUTIONS ACT

- 5.8.5 REGULATIONS RELATED TO HYBRID POWER SOLUTIONS

- TABLE 12 HYBRID POWER SOLUTIONS MARKET: REGULATIONS

- 5.9 PATENT ANALYSIS

- TABLE 13 HYBRID POWER SOLUTIONS MARKET: INNOVATIONS AND PATENT REGISTRATIONS

- 5.10 TRADE ANALYSIS

- 5.10.1 EXPORT SCENARIO FOR ELECTRIC MOTORS AND GENERATORS

- TABLE 14 EXPORT SCENARIO FOR HS CODE: 8501, BY COUNTRY, 2020-2022 (USD THOUSAND)

- 5.10.2 IMPORT SCENARIO FOR ELECTRIC MOTORS AND GENERATORS

- TABLE 15 IMPORT SCENARIO FOR HS CODE: 8501, BY COUNTRY, 2020-2022 (USD THOUSAND)

- 5.11 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 16 HYBRID POWER SOLUTIONS MARKET: LIST OF CONFERENCES AND EVENTS

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 MAN ENERGY SOLUTIONS TACKLED CHALLENGE OF RELIABLE POWER SUPPLY BY COMBINING RENEWABLE ENERGY SOURCES WITH HIGHLY ADAPTABLE GENSETS

- 5.12.2 MAN ENERGY SOLUTIONS BUILT NEW HYBRID POWER SYSTEM FOR MINING INDUSTRY

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- TABLE 17 HYBRID POWER SOLUTIONS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 30 HYBRID POWER SOLUTIONS MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF SUBSTITUTES

- 5.13.2 BARGAINING POWER OF SUPPLIERS

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 THREAT OF NEW ENTRANTS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 31 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END USER (%)

- 5.14.2 BUYING CRITERIA

- FIGURE 32 KEY BUYING CRITERIA, BY END USER

- TABLE 19 KEY BUYING CRITERIA, BY END USER

6 HYBRID POWER SOLUTIONS MARKET, BY SYSTEM TYPE

- 6.1 INTRODUCTION

- FIGURE 33 HYBRID POWER SOLUTIONS MARKET, BY SYSTEM TYPE, 2022

- TABLE 20 HYBRID POWER SOLUTIONS MARKET, BY SYSTEM TYPE, 2021-2028 (USD MILLION)

- 6.2 SOLAR-FOSSIL

- 6.2.1 INCREASING DEMAND FOR CLEAN ENERGY TO COMBAT CLIMATE CHANGE AND REDUCE GREENHOUSE GAS EMISSIONS

- TABLE 21 SOLAR-FOSSIL: HYBRID POWER SOLUTIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.3 WIND-FOSSIL

- 6.3.1 CAPABILITY TO ADDRESS INTERMITTENCY OF WIND ENERGY AND ENSURE STABLE AND RELIABLE ELECTRICITY SUPPLY

- TABLE 22 WIND-FOSSIL: HYBRID POWER SOLUTIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.4 SOLAR-WIND-FOSSIL

- 6.4.1 HIGH EFFICIENCY AND ABILITY TO OVERCOME CHALLENGES OF INTERMITTENT SOLAR AND WIND ENERGY

- TABLE 23 SOLAR-WIND-FOSSIL: HYBRID POWER SOLUTIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.5 SOLAR-WIND

- 6.5.1 RISING DEVELOPMENT OF LARGE-SCALE POWER PLANTS

- TABLE 24 SOLAR-WIND: HYBRID POWER SOLUTIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 6.6 OTHERS

- TABLE 25 OTHERS: HYBRID POWER SOLUTIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

7 HYBRID POWER SOLUTIONS MARKET, BY CAPACITY

- 7.1 INTRODUCTION

- FIGURE 34 HYBRID POWER SOLUTIONS MARKET, BY CAPACITY, 2022

- TABLE 26 HYBRID POWER SOLUTIONS MARKET, BY CAPACITY, 2021-2028 (USD MILLION)

- 7.2 UP TO 100 KW

- 7.2.1 HIGH ADOPTION IN RESIDENTIAL SECTOR

- TABLE 27 UP TO 100 KW: HYBRID POWER SOLUTIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.3 100 KW-1 MW

- 7.3.1 VERSATILITY AND ABILITY TO MEET SPECIFIC ENERGY NEEDS

- TABLE 28 100 KW-1 MW: HYBRID POWER SOLUTIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 7.4 ABOVE 1 MW

- 7.4.1 INCREASING INVESTMENTS IN LARGE-SCALE HYBRID POWER PLANTS

- TABLE 29 ABOVE 1 MW: HYBRID POWER SOLUTIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

8 HYBRID POWER SOLUTIONS MARKET, BY GRID CONNECTIVITY

- 8.1 INTRODUCTION

- FIGURE 35 HYBRID POWER SOLUTIONS MARKET, BY GRID CONNECTIVITY, 2022

- TABLE 30 HYBRID POWER SOLUTIONS MARKET, BY GRID CONNECTIVITY, 2021-2028 (USD MILLION)

- 8.2 ON-GRID

- 8.2.1 GROWING NEED TO REDUCE POWER PEAK DEMAND AND GREENHOUSE GAS EMISSIONS

- TABLE 31 ON-GRID: HYBRID POWER SOLUTIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.3 OFF-GRID

- 8.3.1 INCREASING REQUIREMENT FOR RELIABLE POWER IN REMOTE AREAS

- TABLE 32 OFF-GRID: HYBRID POWER SOLUTIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

9 HYBRID POWER SOLUTIONS MARKET, BY END USER

- 9.1 INTRODUCTION

- FIGURE 36 HYBRID POWER SOLUTIONS MARKET, BY END USER, 2022

- TABLE 33 HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 9.2 RESIDENTIAL

- 9.2.1 RISING NEED TO REDUCE RELIANCE ON TRADITIONAL GRID ELECTRICITY

- TABLE 34 RESIDENTIAL: HYBRID POWER SOLUTIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.3 COMMERCIAL

- 9.3.1 GROWING ADOPTION TO MEET ENERGY NEEDS AND REDUCE OPERATIONAL COSTS

- TABLE 35 COMMERCIAL: HYBRID POWER SOLUTIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

- 9.4 INDUSTRIAL

- 9.4.1 HIGH POWER REQUIREMENT IN REMOTE LOCATIONS

- TABLE 36 INDUSTRIAL: HYBRID POWER SOLUTIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

10 HYBRID POWER SOLUTIONS MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 37 SOUTH AMERICAN HYBRID POWER SOLUTIONS MARKET TO REGISTER HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 38 HYBRID POWER SOLUTIONS MARKET, BY REGION, 2022 (%)

- TABLE 37 HYBRID POWER SOLUTIONS MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 38 HYBRID POWER SOLUTIONS MARKET, BY REGION, 2021-2028 (MW)

- 10.2 ASIA PACIFIC

- FIGURE 39 ASIA PACIFIC: SNAPSHOT OF HYBRID POWER SOLUTIONS MARKET

- 10.2.1 ASIA PACIFIC: RECESSION IMPACT

- 10.2.2 BY SYSTEM TYPE

- TABLE 39 ASIA PACIFIC: HYBRID POWER SOLUTIONS MARKET, BY SYSTEM TYPE, 2021-2028 (USD MILLION)

- 10.2.3 BY CAPACITY

- TABLE 40 ASIA PACIFIC: HYBRID POWER SOLUTIONS MARKET, BY CAPACITY, 2021-2028 (USD MILLION)

- 10.2.4 BY END USER

- TABLE 41 ASIA PACIFIC: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.5 BY GRID CONNECTIVITY

- TABLE 42 ASIA PACIFIC: HYBRID POWER SOLUTIONS MARKET, BY GRID CONNECTIVITY, 2021-2028 (USD MILLION)

- 10.2.6 BY COUNTRY

- TABLE 43 ASIA PACIFIC: HYBRID POWER SOLUTIONS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.2.6.1 China

- 10.2.6.1.1 Rising emphasis on diversifying energy sources and reducing reliance on traditional fossil fuels

- 10.2.6.1 China

- TABLE 44 CHINA: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.6.2 India

- 10.2.6.2.1 Adoption of renewable energy and sustainable practices to address energy security and environmental concerns

- 10.2.6.2 India

- TABLE 45 INDIA: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.6.3 Japan

- 10.2.6.3.1 Government-led policies, feed-in tariffs, and subsidies

- 10.2.6.3 Japan

- TABLE 46 JAPAN: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.6.4 Australia

- 10.2.6.4.1 Abundance of renewable energy resources and electrification of remote off-grid locations

- 10.2.6.4 Australia

- TABLE 47 AUSTRALIA: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.6.5 South Korea

- 10.2.6.5.1 Rapid industrialization and urbanization

- 10.2.6.5 South Korea

- TABLE 48 SOUTH KOREA: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.6.6 Taiwan

- 10.2.6.6.1 Presence of favorable government policies

- 10.2.6.6 Taiwan

- TABLE 49 TAIWAN: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.2.6.7 Rest of Asia Pacific

- TABLE 50 REST OF ASIA PACIFIC: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3 MIDDLE EAST & AFRICA

- FIGURE 40 MIDDLE EAST & AFRICA: SNAPSHOT OF HYBRID POWER SOLUTIONS MARKET

- 10.3.1 MIDDLE EAST & AFRICA: RECESSION IMPACT

- 10.3.2 BY SYSTEM TYPE

- TABLE 51 MIDDLE EAST & AFRICA: HYBRID POWER SOLUTIONS MARKET, BY SYSTEM TYPE, 2021-2028 (USD MILLION)

- 10.3.3 BY CAPACITY

- TABLE 52 MIDDLE EAST & AFRICA: HYBRID POWER SOLUTIONS MARKET, BY CAPACITY, 2021-2028 (USD MILLION)

- 10.3.4 BY END USER

- TABLE 53 MIDDLE EAST & AFRICA: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.5 BY GRID CONNECTIVITY

- TABLE 54 MIDDLE EAST & AFRICA: HYBRID POWER SOLUTIONS MARKET, BY GRID CONNECTIVITY, 2021-2028 (USD MILLION)

- 10.3.6 BY COUNTRY

- TABLE 55 MIDDLE EAST & AFRICA: HYBRID POWER SOLUTIONS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.3.6.1 Egypt

- 10.3.6.1.1 Growing adoption of sustainable energy practices

- 10.3.6.1 Egypt

- TABLE 56 EGYPT: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.6.2 Nigeria

- 10.3.6.2.1 Renewable energy commitments

- 10.3.6.2 Nigeria

- TABLE 57 NIGERIA: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.6.3 Senegal

- 10.3.6.3.1 Renewable energy initiatives to diversify energy sources, reduce carbon emissions, and enhance energy security

- 10.3.6.3 Senegal

- TABLE 58 SENEGAL: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.6.4 South Africa

- 10.3.6.4.1 Rapid urbanization and rising number of renewable energy projects

- 10.3.6.4 South Africa

- TABLE 59 SOUTH AFRICA: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.3.6.5 Rest of Middle East & Africa

- TABLE 60 REST OF MIDDLE EAST & AFRICA: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4 EUROPE

- FIGURE 41 EUROPE: SNAPSHOT OF HYBRID POWER SOLUTIONS MARKET

- 10.4.1 RECESSION IMPACT: EUROPE

- 10.4.2 BY SYSTEM TYPE

- TABLE 61 EUROPE: HYBRID POWER SOLUTIONS MARKET, BY SYSTEM TYPE, 2021-2028 (USD MILLION)

- 10.4.3 BY CAPACITY

- TABLE 62 EUROPE: HYBRID POWER SOLUTIONS MARKET, BY CAPACITY, 2021-2028 (USD MILLION)

- 10.4.4 BY END USER

- TABLE 63 EUROPE: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.5 BY GRID CONNECTIVITY

- TABLE 64 EUROPE: HYBRID POWER SOLUTIONS MARKET, BY GRID CONNECTIVITY, 2021-2028 (USD MILLION)

- 10.4.6 BY COUNTRY

- TABLE 65 EUROPE: HYBRID POWER SOLUTIONS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.4.6.1 UK

- 10.4.6.1.1 Strong commitment toward sustainable future and technological advancements

- 10.4.6.1 UK

- TABLE 66 UK: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.6.2 Germany

- 10.4.6.2.1 Shift toward renewable energy sources to decrease carbon emissions

- 10.4.6.2 Germany

- TABLE 67 GERMANY: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.6.3 Sweden

- 10.4.6.3.1 Rising focus on reducing carbon emissions

- 10.4.6.3 Sweden

- TABLE 68 SWEDEN: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.6.4 France

- 10.4.6.4.1 Rising number of hybrid projects

- 10.4.6.4 France

- TABLE 69 FRANCE: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.6.5 Netherlands

- 10.4.6.5.1 Advancements in hybrid power technologies

- 10.4.6.5 Netherlands

- TABLE 70 NETHERLANDS: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.6.6 Spain

- 10.4.6.6.1 Declining costs of renewable energy technologies and favorable environment for solar-wind hybrid systems

- 10.4.6.6 Spain

- TABLE 71 SPAIN: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.4.6.7 Rest of Europe

- TABLE 72 REST OF EUROPE: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5 NORTH AMERICA

- 10.5.1 NORTH AMERICA: RECESSION IMPACT

- 10.5.2 BY SYSTEM TYPE

- TABLE 73 NORTH AMERICA: HYBRID POWER SOLUTIONS MARKET, BY SYSTEM TYPE, 2021-2028 (USD MILLION)

- 10.5.3 BY CAPACITY

- TABLE 74 NORTH AMERICA: HYBRID POWER SOLUTIONS MARKET, BY CAPACITY, 2021-2028 (USD MILLION)

- 10.5.4 BY END USER

- TABLE 75 NORTH AMERICA: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.5 BY GRID CONNECTIVITY

- TABLE 76 NORTH AMERICA: HYBRID POWER SOLUTIONS MARKET, BY GRID CONNECTIVITY, 2021-2028 (USD MILLION)

- 10.5.6 BY COUNTRY

- TABLE 77 NORTH AMERICA: HYBRID POWER SOLUTIONS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.5.6.1 US

- 10.5.6.1.1 Presence of sustainable energy landscape and increasing investments in hybrid projects

- 10.5.6.1 US

- TABLE 78 US: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.6.2 Canada

- 10.5.6.2.1 Increasing investments in renewable energy sources attributed to supportive government policies, incentives, and grants

- 10.5.6.2 Canada

- TABLE 79 CANADA: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.5.6.3 Mexico

- 10.5.6.3.1 Technological advancements and decreasing renewable energy costs

- 10.5.6.3 Mexico

- TABLE 80 MEXICO: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.6 SOUTH AMERICA

- 10.6.1 SOUTH AMERICA: RECESSION IMPACT

- 10.6.2 BY SYSTEM TYPE

- TABLE 81 SOUTH AMERICA: HYBRID POWER SOLUTIONS MARKET, BY SYSTEM TYPE, 2021-2028 (USD MILLION)

- 10.6.3 BY CAPACITY

- TABLE 82 SOUTH AMERICA: HYBRID POWER SOLUTIONS MARKET, BY CAPACITY, 2021-2028 (USD MILLION)

- 10.6.4 BY END USER

- TABLE 83 SOUTH AMERICA: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.6.5 BY GRID CONNECTIVITY

- TABLE 84 SOUTH AMERICA: HYBRID POWER SOLUTIONS MARKET, BY GRID CONNECTIVITY, 2021-2028 (USD MILLION)

- 10.6.6 BY COUNTRY

- TABLE 85 SOUTH AMERICA: HYBRID POWER SOLUTIONS MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- 10.6.6.1 Brazil

- 10.6.6.1.1 Government-led regulations and initiatives to combat climate change

- 10.6.6.1 Brazil

- TABLE 86 BRAZIL: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.6.6.2 Chile

- 10.6.6.2.1 Rising focus on reducing dependence on imported fossil fuels

- 10.6.6.2 Chile

- TABLE 87 CHILE: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

- 10.6.6.3 Rest of South America

- TABLE 88 REST OF SOUTH AMERICA: HYBRID POWER SOLUTIONS MARKET, BY END USER, 2021-2028 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.1.1 KEY STRATEGIES ADOPTED BY MAJOR PLAYERS

- TABLE 89 HYBRID POWER SOLUTIONS MARKET: KEY STRATEGIES ADOPTED BY MAJOR PLAYERS, 2018-2022

- 11.2 MARKET SHARE ANALYSIS, 2022

- FIGURE 42 HYBRID POWER SOLUTIONS MARKET SHARE ANALYSIS, 2022

- 11.3 REVENUE ANALYSIS, 2018-2022

- FIGURE 43 HYBRID POWER SOLUTIONS MARKET: REVENUE ANALYSIS, 2018-2022

- 11.4 COMPANY EVALUATION MATRIX, 2022

- 11.4.1 STARS

- 11.4.2 PERVASIVE PLAYERS

- 11.4.3 EMERGING LEADERS

- 11.4.4 PARTICIPANTS

- FIGURE 44 HYBRID POWER SOLUTIONS MARKET: COMPANY EVALUATION MATRIX, 2022

- 11.5 COMPETITIVE BENCHMARKING

- TABLE 90 SYSTEM TYPE: COMPANY FOOTPRINT

- TABLE 91 END USER: COMPANY FOOTPRINT

- TABLE 92 CAPACITY: COMPANY FOOTPRINT

- TABLE 93 GRID CONNECTIVITY: COMPANY FOOTPRINT

- TABLE 94 REGION: COMPANY FOOTPRINT

- TABLE 95 COMPANY FOOTPRINT

- 11.6 COMPETITIVE SCENARIOS AND TRENDS

- TABLE 96 HYBRID POWER SOLUTIONS MARKET: PRODUCT LAUNCHES, JANUARY 2019-JANUARY 2023

- TABLE 97 HYBRID POWER SOLUTIONS MARKET: DEALS, JANUARY 2019-JANUARY 2023

- TABLE 98 HYBRID POWER SOLUTIONS MARKET: OTHERS, JANUARY 2019-JANUARY 2023

12 COMPANY PROFILES

- (Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))**

- 12.1 KEY PLAYERS

- 12.1.1 VERTIV GROUP CORP.

- TABLE 99 VERTIV GROUP CORP.: COMPANY OVERVIEW

- FIGURE 45 VERTIV GROUP CORP.: COMPANY SNAPSHOT

- TABLE 100 VERTIV GROUP CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.2 GENERAL ELECTRIC

- TABLE 101 GENERAL ELECTRIC: COMPANY OVERVIEW

- FIGURE 46 GENERAL ELECTRIC: COMPANY SNAPSHOT

- TABLE 102 GENERAL ELECTRIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 103 GENERAL ELECTRIC: PRODUCT LAUNCHES

- TABLE 104 GENERAL ELECTRIC: DEALS

- TABLE 105 GENERAL ELECTRIC: OTHERS

- 12.1.3 SIEMENS ENERGY

- TABLE 106 SIEMENS ENERGY: COMPANY OVERVIEW

- FIGURE 47 SIEMENS ENERGY: COMPANY SNAPSHOT

- TABLE 107 SIEMENS ENERGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 108 SIEMENS ENERGY: DEALS

- 12.1.4 VESTAS

- TABLE 109 VESTAS: COMPANY OVERVIEW

- FIGURE 48 VESTAS: COMPANY SNAPSHOT

- TABLE 110 VESTAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 111 VESTAS: OTHERS

- 12.1.5 WARTSILA

- TABLE 112 WARTSILA: COMPANY OVERVIEW

- FIGURE 49 WARTSILA: COMPANY SNAPSHOT

- TABLE 113 WARTSILA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 114 WARTSILA: PRODUCT LAUNCHES

- TABLE 115 WARTSILA: DEALS

- TABLE 116 WARTSILA: OTHERS

- 12.1.6 SMA SOLAR TECHNOLOGY AG

- TABLE 117 SMA SOLAR TECHNOLOGY AG: COMPANY OVERVIEW

- FIGURE 50 SMA SOLAR TECHNOLOGY AG: COMPANY SNAPSHOT

- TABLE 118 SMA SOLAR TECHNOLOGY AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.7 HUAWEI TECHNOLOGIES CO., LTD.

- TABLE 119 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY OVERVIEW

- TABLE 120 HUAWEI TECHNOLOGIES CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 121 HUAWEI TECHNOLOGIES CO. LTD.: PRODUCT LAUNCHES

- 12.1.8 ZTE CORPORATION

- TABLE 122 ZTE CORPORATION: COMPANY OVERVIEW

- FIGURE 51 ZTE CORPORATION: COMPANY SNAPSHOT

- TABLE 123 ZTE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.9 DELTA ELECTRONICS, INC.

- TABLE 124 DELTA ELECTRONICS, INC.: COMPANY OVERVIEW

- FIGURE 52 DELTA ELECTRONICS, INC.: COMPANY SNAPSHOT

- TABLE 125 DELTA ELECTRONICS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 126 DELTA ELECTRONICS, INC.: DEALS

- 12.1.10 LONGI

- TABLE 127 LONGI: COMPANY OVERVIEW

- FIGURE 53 LONGI: COMPANY SNAPSHOT

- TABLE 128 LONGI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 LONGI: DEALS

- 12.1.11 CHINT GROUP

- TABLE 130 CHINT GROUP: COMPANY OVERVIEW

- TABLE 131 CHINT GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.12 VERGNET SA

- TABLE 132 VERGNET SA: COMPANY OVERVIEW

- TABLE 133 VERGNET SA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.13 FRONIUS INTERNATIONAL GMBH

- TABLE 134 FRONIUS INTERNATIONAL GMBH: COMPANY OVERVIEW

- TABLE 135 FRONIUS INTERNATIONAL GMBH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.14 PFISTERER HOLDING AG

- TABLE 136 PFISTERER HOLDING AG: COMPANY OVERVIEW

- TABLE 137 PFISTERER HOLDING AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.1.15 MAN ENERGY SOLUTIONS

- TABLE 138 MAN ENERGY SOLUTIONS: COMPANY OVERVIEW

- TABLE 139 MAN ENERGY SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 12.2 OTHER PLAYERS

- 12.2.1 DANVEST BV

- 12.2.2 SILVER POWER SYSTEMS

- 12.2.3 WUXI CHWAY TECHNOLOGY CO., LTD.

- 12.2.4 FOSHAN TANFON ENERGY CO., LTD.

- 12.2.5 CLEAR BLUE TECHNOLOGIES INC.

- *Details on Business Overview, Products/Solutions/Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS