|

|

市場調査レポート

商品コード

1322927

航空機用燃料電池の世界市場:燃料タイプ別(水素、炭化水素、その他)、出力別(0~100kW、100kW~1MW、1MW超)、航空機タイプ別(固定翼、回転翼、UAV、AAM)、地域別(北米、欧州、アジア太平洋、その他の地域)-2035年までの予測Aircraft Fuel Cells Market by Fuel Type (Hydrogen, Hydrocarbon, Others), Power Output (0-100kW, 100 kW- 1MW, 1MW & Above), Aircraft Type (Fixed-Wing, Rotary Wing, UAVs, AAMs) and Region (North America, Europe, APAC, RoW) - Global Forecast to 2035 |

||||||

カスタマイズ可能

|

|||||||

| 航空機用燃料電池の世界市場:燃料タイプ別(水素、炭化水素、その他)、出力別(0~100kW、100kW~1MW、1MW超)、航空機タイプ別(固定翼、回転翼、UAV、AAM)、地域別(北米、欧州、アジア太平洋、その他の地域)-2035年までの予測 |

|

出版日: 2023年07月26日

発行: MarketsandMarkets

ページ情報: 英文 203 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

航空機用燃料電池の市場規模は、予測期間中に10.8%のCAGRで拡大し、16億米ドルから2035年には57億米ドルに達すると予測されています。

市場の拡大は、厳しい環境規制、持続可能性への取り組みの高まり、運用コストの削減重視の高まり、燃料電池技術の進歩、航空機の運用におけるエネルギー効率と航続距離の向上に対するニーズなどの要因によって推進されるとみられます。

国際民間航空機関(ICAO)のような国際機関が定める排出基準など、環境規制の厳格化が航空機用燃料電池の市場拡大を後押ししています。これらの規制は、二酸化炭素排出量を削減し、気候変動の懸念に対処することを目的としています。低排出またはゼロ排出の燃料電池は、こうした規制の遵守を可能にし、環境目標の達成に努める航空会社や航空機運航会社にとって魅力的な選択肢となっています。持続可能性と企業の社会的責任に対する航空業界の関心の高まりは、航空機用燃料電池市場の拡大を促す重要な要因となっています。航空会社や航空利害関係者は、環境への影響を最小限に抑えるため、持続可能な取り組みを積極的に採用しています。燃料電池は、クリーンでグリーンなエネルギーソリューションを提供し、持続可能性への取り組みに合致し、責任あるエコフレンドリーな運営に対する業界の評判を高めています。このような持続可能性の重視の高まりは、航空機用燃料電池の需要を促進し、市場の拡大に寄与しています。

航空会社や航空機運航会社は、収益性を高めるために運航コストの削減にますます力を入れるようになっています。燃料は航空業界にとって大きな出費であり、燃料価格の上昇は運航予算に影響を与えます。燃料電池は、従来の燃焼エンジンと比べてエネルギー効率が高いため、コスト削減の可能性があります。燃料消費と従来の燃料への依存を減らすことで、燃料電池は航空会社の運航コスト削減を実現し、魅力的な投資先として市場拡大を後押しすることができます。

当レポートは、世界の航空機用燃料電池市場について調査し、市場の概要とともに、燃料タイプ別、出力別、航空機タイプ別、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 価格分析

- バリューチェーン

- 航空機燃料電池市場のエコシステム

- 貿易データ統計

- 航空機用燃料電池市場の技術動向

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向/混乱

- ポーターのファイブフォース分析

- 主要な利害関係者と購入基準

- 2023年~2024年の主な会議とイベント

- 航空宇宙産業の関税と規制状況

第6章 業界の動向

- イントロダクション

- 航空機燃料電池の技術進歩

- 航空機燃料電池製造における新たな動向

- サプライチェーン分析

- 使用例

- 特許分析

第7章 航空機用燃料電池市場、燃料タイプ別

- イントロダクション

- 水素燃料電池

- 炭化水素燃料電池

- その他

第8章 航空機用燃料電池市場、出力別

- イントロダクション

- 10KW~100KW

- 100KW~1MW

- 1MW超

第9章 航空機燃料電池市場、航空機タイプ別

- イントロダクション

- 固定翼

- 回転翼

- UAV

- AAM

第10章 航空機用燃料電池市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- その他の地域

第11章 競合情勢

第12章 企業プロファイル

- 主要参入企業

- DOOSAN MOBILITY INNOVATION

- ZEROAVIA, INC.

- AIRBUS

- AEROVIRONMENT, INC.

- POWERCELL SWEDEN AB

- APUS GROUP

- UNIVERSAL HYDROGEN CO.

- INTELLIGENT ENERGY LIMITED

- EMBRAER

- GKN AEROSPACE SERVICES LIMITED

- HYPOINT INC.

- PIASECKI AIRCRAFT CORPORATION

- H3 DYNAMICS

- PLUG POWER INC.

- AVIO AERO

- その他の企業

- FUEL CELL STORE

- FLYKA

- HONEYWELL INTERNATIONAL INC.

- SHANGHAI PEARL HYDROGEN ENERGY TECHNOLOGY CO., LTD.

- URBAN AERONAUTICS LTD.

- PIPISTREL D.O.O.

- ALAKA'I TECHNOLOGIES

- AERODELFT

- ACCELERA

- SFC ENERGY AG

第13章 付録

The aircraft fuel cell market is expected to grow from USD 1.6 billion at a CAGR of 10.8% during the forecast period, reaching USD 5.7 billion by 2035. Market expansion is likely to be driven by factors such as stringent environmental regulations, growing sustainability initiatives, increasing emphasis on reducing operational costs, advancements in fuel cell technology, and the need for enhanced energy efficiency and range in aircraft operations.

" Stringent Environment Regulations and need for sustainable aviation practices to increase the adoption of fuel cells. "

Increasingly stringent environmental regulations, such as emission standards set by international bodies like the International Civil Aviation Organization (ICAO), are driving the market expansion of aircraft fuel cells. These regulations aim to reduce carbon emissions and address climate change concerns. Fuel cells, with their low or zero emissions profile, enable compliance with these regulations, making them an attractive choice for airlines and aircraft operators striving to meet environmental targets. The aviation industry's growing focus on sustainability and corporate social responsibility is a significant factor driving the expansion of the aircraft fuel cells market. Airlines and aviation stakeholders are actively adopting sustainable practices to minimize their environmental impact. Fuel cells offer a clean and green energy solution, aligning with sustainability initiatives and enhancing the industry's reputation for responsible and eco-friendly operations. This growing emphasis on sustainability drives the demand for aircraft fuel cells and contributes to their market expansion. Airlines and aircraft operators are increasingly focused on reducing operational costs to enhance profitability. Fuel is a significant expense for the aviation industry, and rising fuel prices impact operational budgets. Fuel cells, with their higher energy efficiency compared to traditional combustion engines, offer cost-saving potential. By reducing fuel consumption and dependency on conventional fuels, fuel cells can help airlines achieve operational cost savings, making them an attractive investment and driving market expansion.

"Based on Fuel Type, the Hydrogen Fuel Cell segment accounts for the largest market size during the forecast period."

Based on fuel type, the aircraft fuel cell market has been segmented into hydrogen fuel cells, hydrocarbon fuel cells, and others. The hydrogen fuel cell segment is expected to dominate the aircraft fuel cell market for several significant reasons. Firstly, hydrogen fuel cells offer a clean and sustainable energy source, aligning with the aviation industry's increasing focus on reducing carbon emissions and achieving environmental sustainability targets. By utilizing hydrogen as a fuel, fuel cells generate electricity without producing harmful emissions, supporting compliance with stringent emission regulations. Moreover, continuous advancements in hydrogen infrastructure and storage technologies have facilitated the integration of hydrogen fuel cells in aircraft, driving their market dominance. These factors make hydrogen fuel cells an attractive solution for aircraft propulsion, contributing to their leading position in the market.

"Based on the Power Output, the 0-100 kW segment is projected to hold the highest market share during the forecast period."

Based on power output, the aircraft fuel cell market has been segmented into 0-100 kW, 100 kW- 1 MW, and 1 MW & above. The 0-100kW segment is poised to hold a greater market share in the aircraft fuel cell market in the upcoming years, driven by several key factors. Firstly, the rising demand for smaller aircraft and unmanned aerial vehicles (UAVs) across various industries is fueling the need for compact and lightweight power solutions. The 0-100kW segment perfectly aligns with the power requirements of these aircraft, offering an optimal balance between power output and size. Moreover, advancements in fuel cell technology have improved the efficiency and performance of fuel cells within this power range, making them a reliable and cost-effective choice for auxiliary power units (APUs), emergency power systems, and other essential aircraft operations. As the market for smaller aircraft and UAVs continues to grow, the 0-100kW segment is expected to capture a larger market share in the aircraft fuel cell industry.

"Asia Pacific is projected to grow at the highest CAGR during the forecast period."

The APAC region is estimated to account for a larger share aircraft fuel cell market in 2023. In this region, the aircraft fuel cell market has been studied for China, India, Japan, Australia, South Korea, and the Rest of APAC. Countries in the Asia Pacific region are upgrading their capabilities by undergoing developments in the field of aircraft fuel cells. The APAC region is also one of the fastest-growing regions in the world for air travel. As the number of air passengers increases, so too will the demand for fuel-efficient aircraft. Fuel cells offer a significant advantage in terms of fuel efficiency, and as a result, they are seen as a promising technology for the future of air travel. The APAC region also has a strong manufacturing base that is capable of producing fuel cells at a competitive cost. This is another important factor, as the cost of fuel cells is a key factor in their adoption by the aviation industry. APAC is home to some of the world's fastest-growing aviation markets, with increasing air travel demand and a rising number of commercial aircraft. This growth presents a substantial opportunity for the adoption of aircraft fuel cells. The governments in APAC countries are actively investing in clean energy technologies and sustainable aviation initiatives. These initiatives include the development of hydrogen infrastructure, research and development programs, and supportive policies for the deployment of fuel cell technology.

The break-up of the profile of primary participants in the ultralight and light aircraft market:

- By Company Type: Tier 1 - 49%, Tier 2 - 37%, and Tier 3 - 14%

- By Designation: C Level - 55%, Director Level - 27%, and Others - 18%

- By Region: North America - 45%, Europe - 26%, Asia Pacific -16%, Rest of the World- 13%.

Major players operating in the aircraft fuel cell market are ZeroAvia Inc. (US), Intelligent Energy Limited (UK), Piasecki Aircraft Corporation (US), Doosan Mobility Innovation (South Korea), and H3 Dynamics (Singapore), among others.

Research Coverage:

This research report categorizes the aircraft fuel cell market basis on Fuel Type (hydrogen fuel cells, hydrocarbon fuel cells, and others), By Power Output (0-100 kW, 100 kW - 1 MW, 1 MW & Above), Aircraft Type (Fixed Wing, Rotary Wing, UAVs, AAM), in these segments have been mapped across major Regions (North America, Europe, Asia Pacific, and Rest of the World). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the aircraft fuel cell market. A detailed analysis of the key industry players has been done to provide insights into their business overviews; solutions and services; key strategies; agreements, collaborations, new product launches, contracts, expansion, acquisitions, and partnerships associated with the aircraft fuel cell market. Competitive analysis of upcoming startups in the aircraft fuel cell market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall aircraft fuel cell market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on aircraft fuel cells offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the aircraft fuel cell market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the aircraft fuel cell market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the aircraft fuel cell market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the aircraft fuel cell market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 AIRCRAFT FUEL CELL MARKET SEGMENTATION

- 1.3.2 REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATES

- 1.5 STAKEHOLDERS

- 1.6 INCLUSIONS AND EXCLUSIONS

- TABLE 2 AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 REPORT PROCESS FLOW

- FIGURE 2 AIRCRAFT FUEL CELL MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources: by company type, designation, and region

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.2.1 Increasing environmental regulations

- 2.2.2.2 Rising fuel costs

- 2.2.2.3 Increasing focus on sustainable aviation

- 2.2.3 SUPPLY-SIDE ANALYSIS

- 2.2.3.1 Advancements in technology

- 2.2.3.2 Increasing fuel cell manufacturing

- 2.2.3.3 Cost reduction initiatives

- 2.2.3.4 Collaboration between industry stakeholders

- 2.3 MARKET DEFINITION AND SCOPE

- 2.3.1 SEGMENTS AND SUBSEGMENTS

- 2.3.2 EXCLUSIONS

- 2.3.3 PRIMARY INTERVIEWEE DETAILS

- 2.4 MARKET SIZE ESTIMATION AND METHODOLOGY

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.1.1 Aircraft fuel cell market for aircraft type 1

- 2.4.1.2 Aircraft fuel cell market for aircraft type 2

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.4.1 BOTTOM-UP APPROACH

- 2.5 TRIANGULATION AND VALIDATION

- FIGURE 5 DATA TRIANGULATION

- 2.5.1 TRIANGULATION THROUGH PRIMARY AND SECONDARY RESEARCH

- 2.6 MARKET SIZING AND FORECASTING

- 2.7 RECESSION IMPACT ANALYSIS

- 2.7.1 RESEARCH ASSUMPTIONS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISKS

- 2.10 GROWTH FORECAST

3 EXECUTIVE SUMMARY

- FIGURE 6 PEMFC SEGMENT TO HAVE LARGEST MARKET SHARE FROM 2023 TO 2035

- FIGURE 7 10 KW-100 KW SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 8 NORTH AMERICA ACCOUNTED FOR LARGEST MARKET SHARE IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AIRCRAFT FUEL CELL MARKET

- FIGURE 9 INCREASE IN RETROFITTING OF FUEL CELLS IN AIRCRAFT TO DRIVE MARKET

- 4.2 AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE

- FIGURE 10 UAV SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- 4.3 AIRCRAFT FUEL CELL MARKET, BY COUNTRY/REGION

- FIGURE 11 CANADA TO REGISTER HIGHEST CAGR FROM 2023 TO 2035

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 12 AIRCRAFT FUEL CELL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising conventional fuel prices

- 5.2.1.2 Rising focus on sustainable aviation

- 5.2.1.3 Technological advancements and cost reductions in aircraft fuel cells

- 5.2.2 RESTRAINTS

- 5.2.2.1 Hydrogen storage and cooling

- 5.2.2.2 Premium charge for fuel cells hinders widespread adoption

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Innovation in HTPEM technology

- 5.2.3.2 Reduced noise levels

- 5.2.3.3 Leveraging fuel cell technology to power smaller aircraft

- 5.2.4 CHALLENGES

- 5.2.4.1 Overcoming commercial feasibility challenges of hydrogen for fuel cell adoption

- 5.2.4.2 Overcoming architectural challenges for fuel cell integration in larger aircraft

- 5.2.4.3 Improving heat removal capabilities of LTPEM fuel cells for effective integration in aircraft systems

- 5.3 PRICING ANALYSIS

- TABLE 3 AVERAGE SELLING PRICE RANGE: AIRCRAFT FUEL CELLS, BY TYPE (USD)

- 5.4 VALUE CHAIN

- FIGURE 13 AIRCRAFT FUEL CELL MARKET: VALUE CHAIN ANALYSIS

- 5.5 AIRCRAFT FUEL CELL MARKET ECOSYSTEM

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- TABLE 4 AIRCRAFT FUEL CELL MARKET ECOSYSTEM MAP

- FIGURE 14 AIRCRAFT FUEL CELL MARKET ECOSYSTEM

- 5.6 TRADE DATA STATISTICS

- TABLE 5 TRADE DATA TABLE FOR AIRCRAFT FUEL CELLS

- 5.7 TECHNOLOGY TRENDS IN AIRCRAFT FUEL CELL MARKET

- 5.7.1 ADVANCEMENTS IN FUEL CELL TECHNOLOGY

- 5.7.2 FUEL CELL HYBRID SYSTEMS

- 5.7.3 UTILIZATION OF ALTERNATIVE FUELS

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 ZEROAVIA: HYDROGEN-ELECTRIC AIRCRAFT

- 5.8.2 BOEING: FUEL-CELL POWERED UAV

- 5.8.3 AIRBUS: E-FAN X HYBRID-ELECTRIC AIRCRAFT

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.9.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR AIRCRAFT FUEL CELL PRODUCT AND SOLUTION MANUFACTURERS

- FIGURE 15 REVENUE SHIFT IN AIRCRAFT FUEL CELL MARKET

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- TABLE 6 AIRCRAFT FUEL CELL MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 16 AIRCRAFT FUEL CELL MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF SUPPLIERS

- 5.10.4 BARGAINING POWER OF BUYERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AIRCRAFT FUEL CELL PRODUCTS AND SYSTEMS

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF AIRCRAFT FUEL CELL PRODUCTS AND SYSTEMS (%)

- 5.11.2 BUYING CRITERIA

- FIGURE 18 KEY BUYING CRITERIA FOR AIRCRAFT FUEL CELL PRODUCTS AND SYSTEMS

- TABLE 8 KEY BUYING CRITERIA FOR AIRCRAFT FUEL CELL PRODUCTS AND SYSTEMS

- 5.12 KEY CONFERENCES AND EVENTS IN 2023-2024

- TABLE 9 AIRCRAFT FUEL CELL MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.13 TARIFF AND REGULATORY LANDSCAPE FOR AEROSPACE INDUSTRY

- TABLE 10 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGICAL ADVANCEMENTS IN AIRCRAFT FUEL CELLS

- 6.2.1 HIGH POWER DENSITY OFFERED BY SOLID-OXIDE FUEL CELLS TO EXPAND OPPORTUNITIES IN FUTURISTIC AIR MOBILITY SOLUTIONS

- 6.2.2 BLOCKCHAIN

- 6.2.3 HYDROGEN INFRASTRUCTURE DEVELOPMENT

- 6.2.4 LOW-TEMPERATURE PROTON EXCHANGE MEMBRANE FUEL CELLS

- 6.3 EMERGING TRENDS IN AIRCRAFT FUEL CELL MANUFACTURING

- 6.3.1 3D PRINTING

- 6.3.2 BIG DATA

- 6.3.3 PREDICTIVE MAINTENANCE

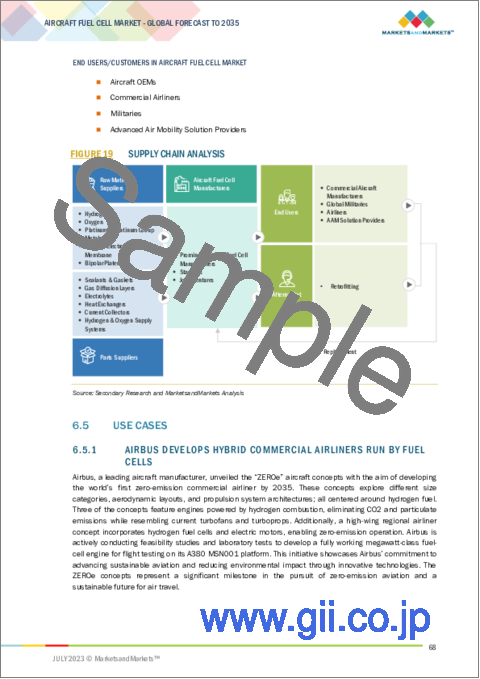

- 6.4 SUPPLY CHAIN ANALYSIS

- FIGURE 19 SUPPLY CHAIN ANALYSIS

- 6.5 USE CASES

- 6.5.1 AIRBUS DEVELOPS HYBRID COMMERCIAL AIRLINERS RUN BY FUEL CELLS

- 6.5.2 HYPOINT AND PIASECKI AIRCRAFT CORPORATION: COLLABORATION ON ZERO CARBON-EMISSION HYDROGEN FUEL CELL SYSTEMS FOR EVTOLS

- 6.5.3 ZEROAVIA AND ALASKA AIRLINES: COLLABORATION ON HYDROGEN-ELECTRIC POWERTRAIN FOR REGIONAL AIRCRAFT

- 6.6 PATENT ANALYSIS

- TABLE 14 INNOVATIONS AND PATENT REGISTRATIONS

7 AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE

- 7.1 INTRODUCTION

- FIGURE 20 AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 15 AIRCRAFT FUEL CELL MARKET FOR HYDROGEN FUEL CELLS, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 16 AIRCRAFT FUEL CELL MARKET FOR HYDROGEN FUEL CELLS, BY FUEL TYPE, 2023-2035 (USD MILLION)

- 7.2 HYDROGEN FUEL CELLS

- 7.2.1 PROTON EXCHANGE MEMBRANE FUEL CELLS

- 7.2.1.1 Favorable characteristics to drive demand for PEM Fuel Cells

- 7.2.2 SOLID OXIDE FUEL CELLS

- 7.2.2.1 Potential applications of SOFC in aircraft fuel cells to drive market

- 7.2.3 OTHERS

- 7.2.1 PROTON EXCHANGE MEMBRANE FUEL CELLS

- 7.3 HYDROCARBON FUEL CELLS

- 7.3.1 VERSATILITY AND EASE OF USE WITH ADVANCEMENTS IN TECHNOLOGY TO DRIVE DEMAND

- 7.4 OTHERS

8 AIRCRAFT FUEL CELL MARKET, BY POWER OUTPUT

- 8.1 INTRODUCTION

- FIGURE 21 AIRCRAFT FUEL CELL MARKET, BY POWER OUTPUT, 2023-2035 (USD MILLION)

- TABLE 17 AIRCRAFT FUEL CELL MARKET, BY POWER OUTPUT, 2019-2022 (USD MILLION)

- TABLE 18 AIRCRAFT FUEL CELL MARKET, BY POWER OUTPUT, 2023-2035 (USD MILLION)

- 8.2 10 KW-100 KW

- 8.2.1 INCREASING DEMAND FOR FUEL CELL SYSTEMS FOR SMALL AIRCRAFT TO DRIVE SEGMENT

- 8.3 100 KW-1 MW

- 8.3.1 REQUIREMENT FOR FUEL CELL SYSTEMS FOR LARGER AIRCRAFT TO DRIVE SEGMENT

- 8.4 1 MW & ABOVE

- 8.4.1 TECHNOLOGICAL ADVANCEMENTS AND HIGH-POWER OUTPUT REQUIREMENTS TO DRIVE DEMAND

9 AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE

- 9.1 INTRODUCTION

- FIGURE 22 AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023-2035 (USD MILLION)

- TABLE 19 AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 20 AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- 9.2 FIXED-WING

- 9.2.1 ONGOING DEVELOPMENTS TO DRIVE FIXED-WING SEGMENT

- TABLE 21 FIXED-WING: AIRCRAFT FUEL CELL MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 22 FIXED-WING: AIRCRAFT FUEL CELL MARKET, BY TYPE, 2023-2035 (USD MILLION)

- 9.3 ROTARY-WING

- 9.3.1 UNDERDEVELOPMENT PROJECTS, ONCE COMPLETED, TO DRIVE ROTARY-WING SEGMENT

- TABLE 23 ROTARY-WING: AIRCRAFT FUEL CELL MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 24 ROTARY-WING: AIRCRAFT FUEL CELL MARKET, BY TYPE, 2023-2035 (USD MILLION)

- 9.4 UNMANNED AERIAL VEHICLE

- 9.4.1 EXPANDING CAPABILITIES TO DRIVE DEMAND FOR UNMANNED AERIAL VEHICLES

- 9.5 ADVANCED AIR MOBILITY

- 9.5.1 INTEGRATION OF FUEL CELL TECHNOLOGY TO DRIVE MARKET FOR ADVANCED AIR MOBILITY

- TABLE 25 ADVANCED AIR MOBILITY: AIRCRAFT FUEL CELL MARKET, BY TYPE, 2019-2022 (USD MILLION)

- TABLE 26 ADVANCED AIR MOBILITY: AIRCRAFT FUEL CELL MARKET, BY TYPE, 2023-2035 (USD MILLION)

10 AIRCRAFT FUEL CELL MARKET, BY REGION

- 10.1 INTRODUCTION

- FIGURE 23 AIRCRAFT FUEL CELL MARKET: REGIONAL SNAPSHOT

- TABLE 27 AIRCRAFT FUEL CELL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 28 AIRCRAFT FUEL CELL MARKET, BY REGION, 2023-2035 (USD MILLION)

- 10.2 NORTH AMERICA

- FIGURE 24 NORTH AMERICA: AIRCRAFT FUEL CELL MARKET SNAPSHOT

- 10.2.1 PESTLE ANALYSIS: NORTH AMERICA

- TABLE 29 NORTH AMERICA: AIRCRAFT FUEL CELL MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 30 NORTH AMERICA: AIRCRAFT FUEL CELL MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 31 NORTH AMERICA: AIRCRAFT FUEL CELL MARKET, BY HYDROGEN FUEL CELL TYPE, 2019-2022 (USD MILLION)

- TABLE 32 NORTH AMERICA: AIRCRAFT FUEL CELL MARKET, BY HYDROGEN FUEL CELL TYPE, 2023-2035 (USD MILLION)

- TABLE 33 NORTH AMERICA: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 34 NORTH AMERICA: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023-2035 (USD MILLION)

- 10.2.2 US

- 10.2.2.1 Presence of leading aircraft fuel cell manufacturers to drive market

- TABLE 35 US: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 36 US: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 37 US: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 38 US: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023-2035 (USD MILLION)

- 10.2.3 CANADA

- 10.2.3.1 Investments in R&D of new materials to drive market

- TABLE 39 CANADA: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 40 CANADA: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 41 CANADA: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 42 CANADA: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023-2035 (USD MILLION)

- 10.3 EUROPE

- 10.3.1 PESTLE ANALYSIS: EUROPE

- FIGURE 25 EUROPE: AIRCRAFT FUEL CELL MARKET SNAPSHOT

- TABLE 43 EUROPE: AIRCRAFT FUEL CELL MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 44 EUROPE: AIRCRAFT FUEL CELL MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 45 EUROPE: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 46 EUROPE: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 47 EUROPE: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 48 EUROPE: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023-2035 (USD MILLION)

- 10.3.2 UK

- 10.3.2.1 Increase in air travel to drive market

- TABLE 49 UK: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 50 UK: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 51 UK: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 52 UK: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023-2035 (USD MILLION)

- 10.3.3 FRANCE

- 10.3.3.1 Considerable investments in aerospace systems and components to drive market

- TABLE 53 FRANCE: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 54 FRANCE: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 55 FRANCE: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 56 FRANCE: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023-2035 (USD MILLION)

- 10.3.4 GERMANY

- 10.3.4.1 Growing investment in aerospace technology and air connectivity to drive market

- TABLE 57 GERMANY: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 58 GERMANY: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 59 GERMANY: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 60 GERMANY: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023-2035 (USD MILLION)

- 10.3.5 REST OF EUROPE

- TABLE 61 REST OF EUROPE: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 62 REST OF EUROPE: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 63 REST OF EUROPE: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 64 REST OF EUROPE: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023-2035 (USD MILLION)

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: PESTLE ANALYSIS

- FIGURE 26 ASIA PACIFIC: AIRCRAFT FUEL CELL MARKET SNAPSHOT

- TABLE 65 ASIA PACIFIC: AIRCRAFT FUEL CELL MARKET, BY COUNTRY, 2019-2022 (USD MILLION)

- TABLE 66 ASIA PACIFIC: AIRCRAFT FUEL CELLS MARKET, BY COUNTRY, 2023-2035 (USD MILLION)

- TABLE 67 ASIA PACIFIC: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 68 ASIA PACIFIC: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 69 ASIA PACIFIC: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 70 ASIA PACIFIC: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2023-2035 (USD MILLION)

- 10.4.2 CHINA

- 10.4.2.1 Large-scale domestic manufacturing to boost market

- TABLE 71 CHINA: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 72 CHINA: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 73 CHINA: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 74 CHINA: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2023-2035 (USD MILLION)

- 10.4.3 INDIA

- 10.4.3.1 Rising government focus on military and defense to propel market

- TABLE 75 INDIA: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 76 INDIA: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 77 INDIA: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 78 INDIA: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2023-2035 (USD MILLION)

- 10.4.4 JAPAN

- 10.4.4.1 Increased demand from air force to support market growth

- TABLE 79 JAPAN: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 80 JAPAN: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 81 JAPAN: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 82 JAPAN: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2023-2035 (USD MILLION)

- 10.4.5 AUSTRALIA

- 10.4.5.1 Increasing demand from airlines to boost market

- TABLE 83 AUSTRALIA: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 84 AUSTRALIA: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 85 AUSTRALIA: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 86 AUSTRALIA: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2023-2035 (USD MILLION)

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Rising security concerns from neighboring countries to drive market

- TABLE 87 SOUTH KOREA: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 88 SOUTH KOREA: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 89 SOUTH KOREA: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 90 SOUTH KOREA: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2023-2035 (USD MILLION)

- 10.4.7 REST OF ASIA PACIFIC

- TABLE 91 REST OF ASIA PACIFIC: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: AIRCRAFT FUEL CELLS MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: AIRCRAFT FUEL CELLS MARKET, BY AIRCRAFT TYPE, 2023-2035 (USD MILLION)

- 10.5 REST OF THE WORLD

- 10.5.1 PESTLE ANALYSIS: REST OF THE WORLD

- FIGURE 27 REST OF THE WORLD: AIRCRAFT FUEL CELL MARKET SNAPSHOT

- TABLE 95 REST OF THE WORLD: AIRCRAFT FUEL CELL MARKET, BY REGION, 2019-2022 (USD MILLION)

- TABLE 96 REST OF THE WORLD: AIRCRAFT FUEL CELL MARKET, BY REGION, 2023-2035 (USD MILLION)

- TABLE 97 REST OF THE WORLD: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 98 REST OF THE WORLD: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 99 REST OF THE WORLD: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 100 REST OF THE WORLD: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023-2035 (USD MILLION)

- 10.5.2 MIDDLE EAST

- 10.5.2.1 New start-ups to drive market

- TABLE 101 MIDDLE EAST: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 102 MIDDLE EAST: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 103 MIDDLE EAST: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 104 MIDDLE EAST: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023-2035 (USD MILLION)

- 10.5.3 AFRICA

- 10.5.3.1 Government support to drive market

- TABLE 105 AFRICA: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 106 AFRICA: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 107 AFRICA: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 108 AFRICA: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023-2035 (USD MILLION)

- 10.5.4 LATIN AMERICA

- 10.5.4.1 Growing focus on sustainability to drive market

- TABLE 109 LATIN AMERICA: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2019-2022 (USD MILLION)

- TABLE 110 LATIN AMERICA: AIRCRAFT FUEL CELL MARKET, BY FUEL TYPE, 2023-2035 (USD MILLION)

- TABLE 111 LATIN AMERICA: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2019-2022 (USD MILLION)

- TABLE 112 LATIN AMERICA: AIRCRAFT FUEL CELL MARKET, BY AIRCRAFT TYPE, 2023-2035 (USD MILLION)

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 RANKING OF LEADING PLAYERS, 2023

- FIGURE 28 MARKET RANKING OF LEADING PLAYERS IN AIRCRAFT FUEL CELL MARKET, 2023

- 11.3 MARKET SHARE ANALYSIS, 2023

- FIGURE 29 MARKET SHARE OF TOP PLAYERS IN AIRCRAFT FUEL CELL MARKET, 2023

- 11.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2023

- FIGURE 30 REVENUE ANALYSIS OF TOP FIVE MARKET PLAYERS IN AIRCRAFT FUEL CELLS MARKET

- 11.5 COMPETITIVE OVERVIEW

- TABLE 113 KEY DEVELOPMENTS BY LEADING PLAYERS IN AIRCRAFT FUEL CELL MARKET BETWEEN 2021 AND 2023

- TABLE 114 COMPANY AIRCRAFT TYPE FOOTPRINT

- TABLE 115 COMPANY REGION FOOTPRINT

- 11.6 COMPANY EVALUATION MATRIX

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- FIGURE 31 AIRCRAFT FUEL CELL MARKET: COMPANY EVALUATION MATRIX, 2023

- 11.7 COMPANY PRODUCT FOOTPRINT ANALYSIS

- TABLE 116 COMPANY FOOTPRINT

- 11.8 START-UP/SME EVALUATION MATRIX

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- FIGURE 32 AIRCRAFT FUEL CELL MARKET: START-UP/SME EVALUATION MATRIX, 2023

- 11.8.5 COMPETITIVE BENCHMARKING

- TABLE 117 AIRCRAFT FUEL CELL MARKET: DETAILED LIST OF KEY START-UPS/SMES

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 DEALS

- TABLE 118 DEALS, 2021-2023

12 COMPANY PROFILES

- (Business Overview, Products Offered, Recent Developments, MnM View Right to win, Strategic choices made, Weaknesses and competitive threats) **

- 12.1 KEY PLAYERS

- 12.1.1 DOOSAN MOBILITY INNOVATION

- TABLE 119 DOOSAN MOBILITY INNOVATION: COMPANY OVERVIEW

- TABLE 120 DOOSAN MOBILITY INNOVATION: PRODUCTS OFFERED**

- TABLE 121 DOOSAN MOBILITY INNOVATION: DEALS

- 12.1.2 ZEROAVIA, INC.

- TABLE 122 ZEROAVIA, INC.: COMPANY OVERVIEW

- TABLE 123 ZEROAVIA, INC.: PRODUCTS OFFERED**

- TABLE 124 ZEROAVIA, INC.: DEALS

- 12.1.3 AIRBUS

- TABLE 125 AIRBUS: COMPANY OVERVIEW

- FIGURE 33 AIRBUS: COMPANY SNAPSHOT

- TABLE 126 AIRBUS: PRODUCTS OFFERED**

- TABLE 127 AIRBUS: DEALS

- 12.1.4 AEROVIRONMENT, INC.

- TABLE 128 AEROVIRONMENT, INC.: COMPANY OVERVIEW

- FIGURE 34 AEROVIRONMENT, INC.: COMPANY SNAPSHOT

- TABLE 129 AEROVIRONMENT, INC.: PRODUCTS OFFERED**

- TABLE 130 AEROVIRONMENT, INC.: DEALS

- 12.1.5 POWERCELL SWEDEN AB

- TABLE 131 POWERCELL SWEDEN AB: COMPANY OVERVIEW

- FIGURE 35 POWERCELL SWEDEN AB: COMPANY SNAPSHOT

- TABLE 132 POWERCELL SWEDEN AB: PRODUCTS OFFERED**

- TABLE 133 POWERCELL SWEDEN AB: DEALS

- 12.1.6 APUS GROUP

- TABLE 134 APUS GROUP: COMPANY OVERVIEW

- TABLE 135 APUS GROUP: PRODUCTS OFFERED**

- 12.1.7 UNIVERSAL HYDROGEN CO.

- TABLE 136 UNIVERSAL HYDROGEN CO.: COMPANY OVERVIEW

- TABLE 137 UNIVERSAL HYDROGEN CO.: PRODUCTS OFFERED**

- TABLE 138 UNIVERSAL HYDROGEN CO.: DEALS

- 12.1.8 INTELLIGENT ENERGY LIMITED

- TABLE 139 INTELLIGENT ENERGY LIMITED: COMPANY OVERVIEW

- TABLE 140 INTELLIGENT ENERGY LIMITED: PRODUCTS OFFERED**

- TABLE 141 INTELLIGENT ENERGY LIMITED: DEALS

- 12.1.9 EMBRAER

- TABLE 142 EMBRAER: COMPANY OVERVIEW

- FIGURE 36 EMBRAER: COMPANY SNAPSHOT

- TABLE 143 EMBRAER: PRODUCTS OFFERED**

- TABLE 144 EMBRAER: DEALS

- 12.1.10 GKN AEROSPACE SERVICES LIMITED

- TABLE 145 GKN AEROSPACE SERVICES LIMITED: COMPANY OVERVIEW

- TABLE 146 GKN AEROSPACE SERVICES LIMITED: PRODUCTS OFFERED**

- TABLE 147 GKN AEROSPACE SERVICES LIMITED: DEALS

- 12.1.11 HYPOINT INC.

- TABLE 148 HYPOINT INC.: COMPANY OVERVIEW

- TABLE 149 HYPOINT INC.: PRODUCTS OFFERED**

- TABLE 150 HYPOINT INC.: DEALS

- 12.1.12 PIASECKI AIRCRAFT CORPORATION

- TABLE 151 PIASECKI AIRCRAFT CORPORATION: COMPANY OVERVIEW

- TABLE 152 PIASECKI AIRCRAFT CORPORATION: PRODUCTS OFFERED**

- TABLE 153 PIASECKI AIRCRAFT CORPORATION: DEALS

- 12.1.13 H3 DYNAMICS

- TABLE 154 H3 DYNAMICS: COMPANY OVERVIEW

- TABLE 155 H3 DYNAMICS: PRODUCTS OFFERED**

- TABLE 156 H3 DYNAMICS: DEALS

- 12.1.14 PLUG POWER INC.

- TABLE 157 PLUG POWER INC.: COMPANY OVERVIEW

- FIGURE 37 PLUG POWER INC.: COMPANY SNAPSHOT

- TABLE 158 PLUG POWER INC.: PRODUCTS OFFERED**

- 12.1.15 AVIO AERO

- TABLE 159 AVIO AERO: COMPANY OVERVIEW

- TABLE 160 AVIO AERO: PRODUCTS OFFERED**

- 12.2 OTHER PLAYERS

- 12.2.1 FUEL CELL STORE

- 12.2.2 FLYKA

- 12.2.3 HONEYWELL INTERNATIONAL INC.

- 12.2.4 SHANGHAI PEARL HYDROGEN ENERGY TECHNOLOGY CO., LTD.

- 12.2.5 URBAN AERONAUTICS LTD.

- 12.2.6 PIPISTREL D.O.O.

- 12.2.7 ALAKA'I TECHNOLOGIES

- 12.2.8 AERODELFT

- 12.2.9 ACCELERA

- 12.2.10 SFC ENERGY AG

- *Details on Business Overview, Products Offered, Recent Developments, MnM View, Right to win, Strategic choices made, Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS