|

|

市場調査レポート

商品コード

1322924

バーティポートの世界市場:タイプ別(バーティハブ、バーティベース、バーティパッド)、ソリューション別(ランディングパッド、ターミナルゲート、地上支援装置、充電ステーション、地上管制局)、景観別、立地別、トポロジー別、地域別-2030年までの予測Vertiports Market by Type (Vertihubs, Vertibases, Vertipads), Solution (Landing Pads, Terminal Gates, Ground Support Equipment, Charging Stations, Ground Control Stations), Landscape, Location, Topology, Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| バーティポートの世界市場:タイプ別(バーティハブ、バーティベース、バーティパッド)、ソリューション別(ランディングパッド、ターミナルゲート、地上支援装置、充電ステーション、地上管制局)、景観別、立地別、トポロジー別、地域別-2030年までの予測 |

|

出版日: 2023年07月20日

発行: MarketsandMarkets

ページ情報: 英文 193 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

バーティポートの市場規模は、2023年の4億米ドルから2030年には107億米ドルに成長し、2023年から2030年までのCAGRは62.1%になると予測されています。

インフラプロバイダーのビジネスチャンスの拡大や、高度な航空モビリティに対する需要の増加など、さまざまな要因がバーティポート市場を牽引しています。しかし、適地が限られていることや初期投資が高いことが、市場全体の成長を制限しています。

地域型バーティポートセグメントは、2023年に第2位のシェアを占めると予測されています。地域型バーティポートは、高度な航空モビリティに対する需要の高まりに対応する実行可能なソリューションとして台頭してきています。これらの空港は、既存のネットワークとシームレスに統合しながら、交通サービスへの便利なアクセスを提供します。ライドシェアリングやオンデマンド・モビリティ・プラットフォームとの連携が接続性を強化し、地域バーティポートセグメントの成長を促進しています。民間セクターの関心と投資の増加は、地域バーティポートが経済成長、雇用機会、緊急対応能力の向上を提供するのに役立っています。

地上ベースのセグメントは、2023年に第2位のシェアを持つと予測されています。地上ベースのバーティポートのような先進的な航空機動性(AAM)インフラは、先進的な航空機動性運用を可能にするために構築されています。こうしたタイプのバーティポートは地上にあることが多いため、現在の輸送網に組み込むのが容易で、設置や運用の費用対効果も高いです。都市の規模、交通量、地域のインフラに基づき、高度な航空モビリティに適した地域が必要であることが、地上ベースのバーティポートの成長を後押ししています。

充電ステーションセグメントは、2023年に第2位のシェアを持つと予測されています。バーティポートの充電ステーションは、乗客の移動を維持するために電気垂直離着陸(eVTOL)航空機を迅速かつ効果的に充電するため、インフラの重要な構成要素です。eVTOL車両の充電とメンテナンスの必要性をサポートするため、バーティポートはますます多くの充電ステーションを設置しています。これらの充電ステーションには大容量の充電ユニットが含まれており、ダウンタイムを減らし、スムーズな運航を保証するために、慎重に選ばれた場所に設置されています。拡大するeVTOL航空機のフリートに対応する必要性の高まりが、バーティポート市場の充電ステーション・インフラを牽引しています。

欧州は、2023年にバーティポートにおいて第2位のシェアを占めると推定されます。この調査の欧州地域は、英国、ロシア、フランス、イタリア、ドイツ、スイスなどで構成されています。欧州のバーティポートは近年著しい発展を遂げています。このセグメントの成長は、欧州連合航空安全機関(EASA)などの政府機関がバーティポートの設計に積極的な指導を行っているためです。先進的な航空モビリティ航空機メーカーと都市計画当局との協力関係の高まりが、欧州地域におけるバーティポート市場の成長を後押ししています。

当レポートでは、世界のバーティポート市場について調査し、市場の概要とともに、タイプ別、ソリューション別、景観別、立地別、トポロジー別、地域別動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 景気後退の影響分析

- バリューチェーン分析

- 顧客のビジネスに影響を与える動向/混乱

- 市場のエコシステム

- ポーターのファイブフォース分析

- 価格分析

- タイプ別のボリュームデータ

- 関税と規制状況

- 主要な利害関係者と購入基準

- 2023~2024年の主要な会議とイベント

- 技術分析

- 使用事例分析

第6章 業界の動向

- イントロダクション

- 技術動向

- メガトレンドの影響

- イノベーションと特許分析

- バーティポートのロードマップ

第7章 バーティポート市場、ソリューション別

- イントロダクション

- ランディングパッド

- ターミナルゲート

- 地上支援装置

- 充電ステーション

- 地上管制局

- その他

第8章 ベルティポート市場、景観別

- イントロダクション

- 都市のベルティポート

- 地域のバーティポート

第9章 バーティポート市場、タイプ別

- イントロダクション

- バーティハブ

- バーティパッド

- バーティベース

第10章 ベルティポート市場、立地別

- イントロダクション

- 地上ベース

- 屋上/高架

- フローティング

第11章 バーティポート市場、トポロジー別

- イントロダクション

- シングル

- 線形

- 衛星

- 橋脚

第12章 バーティポート市場、地域別

- イントロダクション

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- その他の地域

第13章 競合情勢

- イントロダクション

- ランキング分析、2022年

- 企業評価クアドラント

- スタートアップ/中小企業の評価クアドラント

- 競合シナリオと動向

第14章 企業プロファイル

- イントロダクション

- 主要参入企業

- SKYPORTS INFRASTRUCTURE LIMITED

- GROUPE ADP

- URBANV SPA

- FERROVIAL

- URBAN-AIR PORT LTD.

- EHANG

- LILIUM AVIATION GMBH

- SKYSCAPE INC.

- VOLOCOPTER GMBH

- VARON VEHICLES CORPORATION

- BAYARDS VERTIPORT SOLUTIONS

- VPORTS

- SKYPORTZ

- SKYWAY

- VOLATUS INFRASTRUCTURE LLC

- その他の企業

- VERTIKO MOBILITY INC.

- EVERTISKY

- AIRSIGHT

- BLUENEST

- TAVISTOCK DEVELOPMENT COMPANY

- ALTAPORT INC.

- AEROAUTO LLC

- KOOKIEJAR

- AIRNOVA

- EVERTIPORTS INTERNATIONAL CORPORATION

第15章 付録

The vertiports market is projected to grow from USD 0.4 billion in 2023 to USD 10.7 billion by 2030, at a CAGR of 62.1% from 2023 to 2030. Various factors, such as the growing opportunities for infrastructure providers and increasing demand for advanced air mobility, drive the market for vertiports. However, the limited availability of suitable sites and high initial investments are limiting the overall growth of the market.

"Regional Vertiports: The second largest share in landscape segment in the vertiports market in 2023."

The regional vertiports segment is projected to have the second-largest share in 2023. Regional vertiports are emerging as a viable solution to meet the rising demand for advanced air mobility. These vertiports provide convenient access to transportation services while seamlessly integrating with existing networks. Collaborations with ride-sharing and on-demand mobility platforms enhance connectivity is driving the growth of the regional vertiport segment. The increasing private sector interest and investments are helping regional vertiports offer economic growth, job opportunities, and improved emergency response capabilities.

"Ground-based: The second largest share in location segment in the vertiports market in 2023."

The ground-based segment is projected to have the second-largest share in 2023. Advanced air mobility (AAM) infrastructure, such as ground-based vertiports, is being created to enable advanced air mobility operations. As these types of vertiports are often on the ground, they are easier to incorporate into current transportation networks and are more cost-effective to create and run. The need for appropriate areas for advanced air mobility based on the size of the city, the amount of traffic, and the local infrastructure is driving the growth of ground-based vertiports.

"Charging Stations: The second largest share in solution segment in the vertiports market in 2023."

The charging stations segment is projected to have the second-largest share in 2023. Vertiport charging stations are a crucial component of the infrastructure since they swiftly and effectively charge electric vertical takeoff and landing (eVTOL) aircraft in order to keep passengers moving. To support the charging and maintenance requirements of eVTOL vehicles, vertiports are installing more and more charging stations. These charging stations include high-capacity charging units and are placed in carefully chosen locations to reduce downtime and guarantee smooth operations. The increasing necessity to accommodate the expanding fleet of eVTOL aircraft is driving the charging station infrastructure in the vertiports market.

"The European region is estimated to have the second largest share in the vertiports market in 2023."

Europe is estimated to account for the second-largest share in vertiports in 2023. The European region for this study comprises the UK, Russia, France, Italy, Germany, and Switzerland, among others. Vertiports in Europe have experienced significant development in recent years. The growth of the segment is due to active guidance provided by government agencies such as the European Union Aviation Safety Agency (EASA) to design a vertiport. The increasing collaborations between advanced air mobility aircraft manufacturers and urban planning authorities are driving the growth of the vertiports market in the European region.

The break-up of the profiles of primary participants in the vertiports market is as follows:

- By Company Type: Tier 1 - 49%; Tier 2 - 37%; and Tier 3 - 14%

- By Designation: C-Level Executives - 55%; Directors - 27%; and Others - 18%

- By Region: North America - 32%; Europe - 32%; Asia Pacific - 16%; Latin America - 10%; Rest of the World - 10%

Major Players in the vertiports market are Groupe ADP (France), Volocopter GmbH (Germany), Volatus Infrastructure LLC (US), Skyways (US), Lilium Aviation GmbH (Germany), Ehang (China), Varon Vehicles Corporation (US) and Urban-Air Port Ltd (UK).

Research Coverage

The market study covers the vertiports market across various segments and subsegments. It aims at estimating the size and growth potential of this market across different segments based on Type, location, topology, landscape, solution, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their product and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

Key benefits of buying this report:

This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall vertiports market and its subsegments. The report covers the entire ecosystem of the vertiports industry and will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report will also help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Increasing demand for AAM; Growing technological advancements to develop vertiports; smart city initiatives), restraints (High initial investment; Limited availability of suitable sites), opportunities (Growing opportunities for infrastructure providers; Leveraging intermodal connectivity potential to create sustainable vertiports; Opportunity for software and data solution providers), and challenges (Limited regulatory framework; Lack of skilled labor) influencing the growth of the vertiports market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the vertiports market

- Market Development: Comprehensive information about lucrative markets - the report analyses the vertiports market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the vertiports market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Volocopter GmbH (Germany), Skyports Infrastructure Limited (UK), Urban-Air Port Ltd (UK), Ferrovial (Spain), Vports (Canada) among others in the vertiports market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- TABLE 1 VERTIPORTS MARKET: INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- TABLE 2 USD EXCHANGE RATES

- 1.5 MARKET SCOPE

- 1.5.1 MARKETS COVERED

- FIGURE 1 VERTIPORTS MARKET SEGMENTATION

- 1.5.2 REGIONAL SCOPE

- 1.5.3 YEARS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 RESEARCH PROCESS FLOW

- FIGURE 3 RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary sources

- 2.1.2.2 Key data from primary sources

- FIGURE 4 BREAKDOWN OF PRIMARIES

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.2.4 RECESSION IMPACT ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation and methodology

- FIGURE 5 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

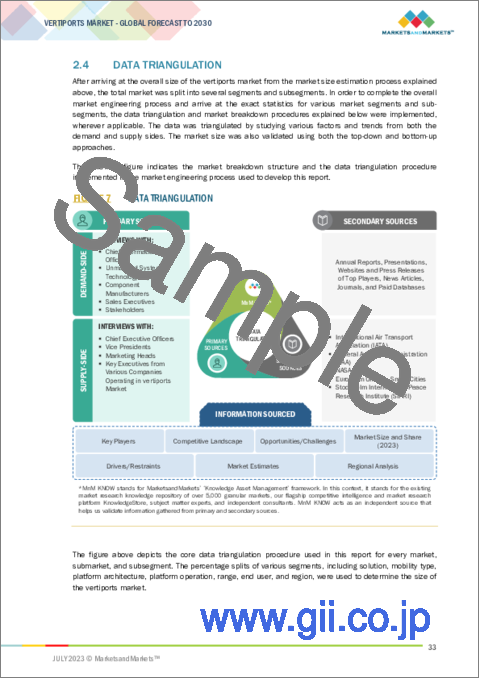

- 2.4 DATA TRIANGULATION

- FIGURE 7 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- FIGURE 8 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

- FIGURE 9 ROOFTOP/ELEVATED SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 10 URBAN VERTIPORTS SEGMENT TO HAVE LARGER MARKET SHARE IN 2023

- FIGURE 11 LANDING PADS TO REGISTER HIGHEST MARKET SHARE IN 2023

- FIGURE 12 VERTIPORTS MARKET IN NORTH AMERICA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN VERTIPORTS MARKET

- FIGURE 13 INCREASED DEMAND FOR ADVANCED AIR MOBILITY (AAM) TO DRIVE MARKET GROWTH

- 4.2 VERTIPORTS MARKET, BY SOLUTION, 2023 (USD MILLION)

- FIGURE 14 LANDING PADS PROJECTED TO DOMINATE MARKET IN 2023

- 4.3 VERTIPORTS MARKET, BY TYPE, 2020-2030 (USD MILLION)

- FIGURE 15 VERTIPADS SEGMENT TO RECORD HIGHEST GROWTH FROM 2020 TO 2030

- 4.4 VERTIPORTS MARKET, BY COUNTRY (2023-2030)

- FIGURE 16 UK MARKET TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 17 VERTIPORTS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for Advanced Air Mobility

- 5.2.1.2 Growing technological advancements to develop vertiports

- 5.2.1.3 Smart city initiatives

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investment

- 5.2.2.2 Limited availability of suitable sites

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing opportunities for infrastructure providers

- 5.2.3.2 Leveraging intermodal connectivity potential to create sustainable vertiports

- 5.2.3.3 Opportunity for software and data solution providers

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of skilled labor

- 5.2.4.2 Limited regulatory framework

- 5.3 RECESSION IMPACT ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

- FIGURE 18 VALUE CHAIN ANALYSIS

- 5.4.1 RAW MATERIALS

- 5.4.2 R&D

- 5.4.3 SOLUTION PROVIDERS

- 5.4.4 VERTIPORT DEVELOPERS

- 5.4.5 END USERS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.5.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR VERTIPORTS MARKET

- FIGURE 19 VERTIPORTS MARKET: REVENUE SHIFT CURVE

- 5.6 VERTIPORTS MARKET ECOSYSTEM

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 PRIVATE AND SMALL ENTERPRISES

- 5.6.3 END USERS

- FIGURE 20 VERTIPORTS MARKET: MARKET ECOSYSTEM MAP

- TABLE 3 VERTIPORTS MARKET ECOSYSTEM

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 VERTIPORTS: PORTER'S FIVE FORCE ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 PRICING ANALYSIS

- TABLE 5 AVERAGE PRICE ANALYSIS OF VERTIPORTS, BY TYPE

- 5.9 VOLUME DATA BY TYPE

- TABLE 6 VERTIPORTS MARKET, BY TYPE (UNITS)

- 5.10 TARIFF AND REGULATORY LANDSCAPE

- 5.10.1 NORTH AMERICA

- TABLE 7 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES IN NORTH AMERICA

- 5.10.2 EUROPE

- TABLE 8 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES IN EUROPE

- 5.10.3 ASIA PACIFIC

- TABLE 9 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER AGENCIES IN ASIA PACIFIC

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING VERTIPORTS, BY SOLUTION

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING VERTIPORTS, BY SOLUTION (%)

- 5.11.2 BUYING CRITERIA

- FIGURE 22 KEY BUYING CRITERIA FOR VERTIPORTS, BY SOLUTION

- TABLE 11 KEY BUYING CRITERIA FOR VERTIPORTS, BY SOLUTION

- 5.12 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 12 VERTIPORTS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- 5.13 TECHNOLOGY ANALYSIS

- 5.13.1 ROBOTICS

- 5.13.2 DATA ANALYTICS AND MANAGEMENT

- 5.14 USE CASE ANALYSIS

- 5.14.1 VERTIPORT AUTOMATION SYSTEM FOR GROUND OPERATIONS

- 5.14.2 SUSTAINABLE VERTIPORTS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 VERTIPORT MANAGEMENT SYSTEMS

- 6.2.2 AUTOMATED GROUND HANDLING

- 6.2.3 REMOTE MAINTENANCE AND MONITORING SYSTEMS

- 6.2.4 INTEGRATION OF ADVANCED DIGITAL INFRASTRUCTURE AND SMART TECHNOLOGIES

- 6.2.5 BLOCKCHAIN TECHNOLOGY

- 6.3 IMPACT OF MEGATRENDS

- 6.3.1 AIR TRAFFIC MANAGEMENT

- 6.3.2 VEHICLE-TO-VERTIPORT COMMUNICATION

- 6.3.3 ARTIFICIAL INTELLIGENCE

- 6.4 INNOVATION AND PATENT ANALYSIS

- TABLE 13 LIST OF MAJOR PATENTS FOR VERTIPORTS

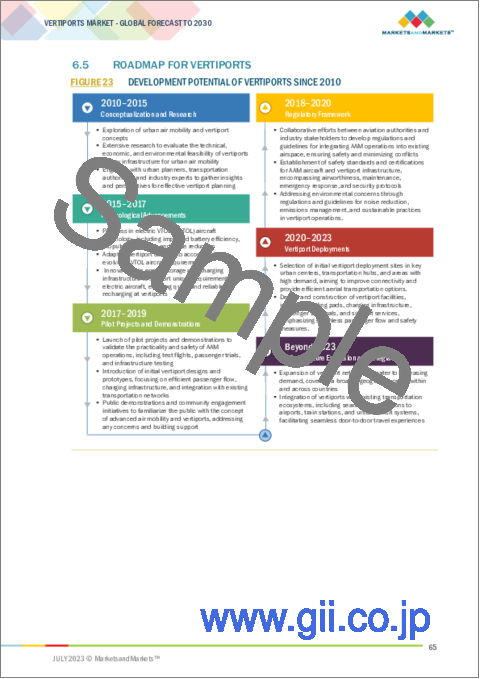

- 6.5 ROADMAP FOR VERTIPORTS

- FIGURE 23 DEVELOPMENT POTENTIAL OF VERTIPORTS SINCE 2010

7 VERTIPORTS MARKET, BY SOLUTION

- 7.1 INTRODUCTION

- FIGURE 24 CHARGING STATIONS SEGMENT PROJECTED TO GROW AT HIGHER CAGR FROM 2023 TO 2030

- TABLE 14 VERTIPORTS MARKET, BY SOLUTION, 2020-2022 (USD MILLION)

- TABLE 15 VERTIPORTS MARKET, BY SOLUTION, 2023-2030 (USD MILLION)

- 7.2 LANDING PADS

- 7.2.1 GROWTH IN ADVANCED AIR MOBILITY TO DRIVE SEGMENT

- 7.3 TERMINAL GATES

- 7.3.1 NEED FOR EFFICIENT PASSENGER MANAGEMENT TO BOOST MARKET

- 7.4 GROUND SUPPORT EQUIPMENT

- 7.4.1 NEED TO SUPPORT VERTIPORT OPERATIONS ON GROUND TO FUEL MARKET

- 7.5 CHARGING STATIONS

- 7.5.1 NEED FOR QUICK AND EFFICIENT CHARGING TO DRIVE MARKET

- 7.6 GROUND CONTROL STATIONS

- 7.6.1 NEED TO MANAGE AND MONITOR AIRCRAFT FOR SAFE AND RELIABLE FLIGHT TO DRIVE MARKET

- 7.7 OTHER SOLUTIONS

- 7.7.1 EFFICIENT MAINTENANCE, SAFETY, AND SECURITY OF VERTIPORTS TO DRIVE SEGMENT

8 VERTIPORTS MARKET, BY LANDSCAPE

- 8.1 INTRODUCTION

- FIGURE 25 URBAN VERTIPORTS SEGMENT PROJECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- TABLE 16 VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 17 VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- 8.2 URBAN VERTIPORTS

- 8.2.1 INCREASED URBAN CONGESTION AND TRAFFIC CHALLENGES TO DRIVE MARKET

- 8.3 REGIONAL VERTIPORTS

- 8.3.1 REDUCED LEAD TIME TO REMOTE AREAS TO BOOST MARKET

9 VERTIPORTS MARKET, BY TYPE

- 9.1 INTRODUCTION

- FIGURE 26 VERTIPADS TO BE DOMINANT SEGMENT DURING FORECAST PERIOD

- TABLE 18 VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 19 VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 9.2 VERTIHUBS

- 9.2.1 INCREASED POSSIBILITY FOR EFFICIENT AND SUSTAINABLE TRANSPORTATION TO FUEL GROWTH

- 9.3 VERTIPADS

- 9.3.1 INCREASED ADOPTION DUE TO COST EFFECTIVENESS TO DRIVE MARKET

- 9.4 VERTIBASES

- 9.4.1 ENHANCED LANDING PAD DESIGNS TO DRIVE MARKET

10 VERTIPORTS MARKET, BY LOCATION

- 10.1 INTRODUCTION

- FIGURE 27 ROOFTOP/ELEVATED SEGMENT PROJECTED TO GROW AT HIGHER CAGR FROM 2023 TO 2030

- TABLE 20 VERTIPORTS MARKET, BY LOCATION, 2020-2022 (USD MILLION)

- TABLE 21 VERTIPORTS MARKET, BY LOCATION, 2023-2030 (USD MILLION)

- 10.2 GROUND-BASED

- 10.2.1 DEMAND TO IMPROVE PRODUCTIVITY AND CONNECTIVITY BETWEEN HUBS TO BOOST MARKET

- 10.3 ROOFTOP/ELEVATED

- 10.3.1 EFFORTLESS TRANSITION BETWEEN DIFFERENT MODES OF TRANSPORTATION TO DRIVE GROWTH

- 10.4 FLOATING

- 10.4.1 DEMAND FOR INCREASED ACCESSIBILITY AND CONNECTIVITY TO URBAN CENTERS TO DRIVE MARKET

11 VERTIPORTS MARKET, BY TOPOLOGY

- 11.1 INTRODUCTION

- 11.2 SINGLE

- 11.2.1 ABILITY TO IMPROVE EMERGENCY RESPONSE AND MEDICAL SERVICES TO DRIVE MARKET

- 11.3 LINEAR

- 11.3.1 SEAMLESS INTEGRATION WITH EXISTING TRANSPORTATION NETWORKS TO FUEL MARKET

- 11.4 SATELLITE

- 11.4.1 NEED FOR SPACE OPTIMIZATION TO DRIVE MARKET

- 11.5 PIER

- 11.5.1 INCREASING URBAN CONGESTION AND AIR TRAFFIC TO FUEL MARKET

12 VERTIPORTS MARKET, BY REGION

- 12.1 INTRODUCTION

- FIGURE 28 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF VERTIPORTS MARKET IN 2023

- TABLE 22 VERTIPORTS MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 23 VERTIPORTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: REGIONAL RECESSION IMPACT ANALYSIS

- 12.2.2 NORTH AMERICA: PESTLE ANALYSIS

- FIGURE 29 NORTH AMERICA: VERTIPORTS MARKET SNAPSHOT

- TABLE 24 NORTH AMERICA: VERTIPORTS MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 25 NORTH AMERICA: VERTIPORTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 26 NORTH AMERICA: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 27 NORTH AMERICA: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 28 NORTH AMERICA: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 29 NORTH AMERICA: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.2.3 US

- 12.2.3.1 Presence of top market leaders to drive market

- TABLE 30 US: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 31 US: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 32 US: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 33 US: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.2.4 CANADA

- 12.2.4.1 GOVERNMENT SUPPORT TO DRIVE MARKET

- TABLE 34 CANADA: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 35 CANADA: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 36 CANADA: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 37 CANADA: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.3 EUROPE

- 12.3.1 EUROPE: REGIONAL RECESSION IMPACT ANALYSIS

- 12.3.2 EUROPE: PESTLE ANALYSIS

- FIGURE 30 EUROPE: VERTIPORTS MARKET SNAPSHOT

- TABLE 38 EUROPE: VERTIPORTS MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 39 EUROPE: VERTIPORTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 40 EUROPE: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 41 EUROPE: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 42 EUROPE: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 43 EUROPE: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.3.3 UK

- 12.3.3.1 Technological advancements in AAM to drive market

- TABLE 44 UK: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 45 UK: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 46 UK: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 47 UK: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.3.4 FRANCE

- 12.3.4.1 Development of comprehensive vertiport network to fuel market

- TABLE 48 FRANCE: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 49 FRANCE: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 50 FRANCE: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 51 FRANCE: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.3.5 GERMANY

- 12.3.5.1 Increasing investments in R&D to drive market

- TABLE 52 GERMANY: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 53 GERMANY: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 54 GERMANY: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 55 GERMANY: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.3.6 ITALY

- 12.3.6.1 Increased adoption of UAVs to drive market

- TABLE 56 ITALY: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 57 ITALY: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 58 ITALY: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 59 ITALY: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.3.7 SWITZERLAND

- 12.3.7.1 Innovation and sustainability to boost market

- TABLE 60 SWITZERLAND: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 61 SWITZERLAND: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 62 SWITZERLAND: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 63 SWITZERLAND: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.3.8 REST OF EUROPE

- 12.3.8.1 Growing focus on smart city initiatives to fuel market

- TABLE 64 REST OF EUROPE: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 65 REST OF EUROPE: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 66 REST OF EUROPE: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 67 REST OF EUROPE: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: REGIONAL RECESSION IMPACT ANALYSIS

- 12.4.2 ASIA PACIFIC: PESTLE ANALYSIS

- FIGURE 31 ASIA PACIFIC: VERTIPORTS MARKET SNAPSHOT

- TABLE 68 ASIA PACIFIC: VERTIPORTS MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 69 ASIA PACIFIC: VERTIPORTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 70 ASIA PACIFIC: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 71 ASIA PACIFIC: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 72 ASIA PACIFIC: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 73 ASIA PACIFIC: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.4.3 CHINA

- 12.4.3.1 Regulatory policies and standards to fuel market

- TABLE 74 CHINA: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 75 CHINA: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 76 CHINA: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 77 CHINA: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.4.4 MALAYSIA

- 12.4.4.1 Development of air taxi infrastructure to drive market

- TABLE 78 MALAYSIA: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 79 MALAYSIA: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 80 MALAYSIA: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 81 MALAYSIA: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.4.5 JAPAN

- 12.4.5.1 Development of unmanned ecosystem to boost market

- TABLE 82 JAPAN: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 83 JAPAN: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 84 JAPAN: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 85 JAPAN: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.4.6 AUSTRALIA

- 12.4.6.1 Increasing demand for cargo air vehicles to boost market

- TABLE 86 AUSTRALIA: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 87 AUSTRALIA: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 88 AUSTRALIA: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 89 AUSTRALIA: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.4.7 SOUTH KOREA

- 12.4.7.1 Growing partnerships to drive market

- TABLE 90 SOUTH KOREA: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 91 SOUTH KOREA: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 92 SOUTH KOREA: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 93 SOUTH KOREA: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.4.8 REST OF ASIA PACIFIC

- 12.4.8.1 Increased investments to drive market

- TABLE 94 REST OF ASIA PACIFIC: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 95 REST OF ASIA PACIFIC: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 96 REST OF ASIA PACIFIC: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 97 REST OF ASIA PACIFIC: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.5 LATIN AMERICA

- 12.5.1 LATIN AMERICA: REGIONAL IMPACT ANALYSIS

- 12.5.2 LATIN AMERICA: PESTLE ANALYSIS

- FIGURE 32 LATIN AMERICA: VERTIPORTS MARKET SNAPSHOT

- TABLE 98 LATIN AMERICA: VERTIPORTS MARKET, BY COUNTRY, 2020-2022 (USD MILLION)

- TABLE 99 LATIN AMERICA: VERTIPORTS MARKET, BY COUNTRY, 2023-2030 (USD MILLION)

- TABLE 100 LATIN AMERICA: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 101 LATIN AMERICA: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 102 LATIN AMERICA: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 103 LATIN AMERICA: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.5.3 BRAZIL

- 12.5.3.1 Rapid urban transportation to drive market

- TABLE 104 BRAZIL: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 105 BRAZIL: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 106 BRAZIL: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 107 BRAZIL: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.5.4 MEXICO

- 12.5.4.1 Increasing demand for sustainable urban mobility to drive market

- TABLE 108 MEXICO: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 109 MEXICO: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 110 MEXICO: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 111 MEXICO: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.5.5 REST OF LATIN AMERICA

- 12.5.5.1 Focused partnerships to deploy and develop AAM infrastructure to propel growth

- TABLE 112 REST OF LATIN AMERICA: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 113 REST OF LATIN AMERICA: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 114 REST OF LATIN AMERICA: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 115 REST OF LATIN AMERICA: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.6 REST OF THE WORLD (ROW)

- 12.6.1 REST OF THE WORLD: REGIONAL RECESSION IMPACT ANALYSIS

- TABLE 116 REST OF THE WORLD: VERTIPORTS MARKET, BY REGION, 2020-2022 (USD MILLION)

- TABLE 117 REST OF THE WORLD: VERTIPORTS MARKET, BY REGION, 2023-2030 (USD MILLION)

- TABLE 118 REST OF THE WORLD: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 119 REST OF THE WORLD: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 120 REST OF THE WORLD: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 121 REST OF THE WORLD: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.6.2 MIDDLE EAST

- 12.6.2.1 Strategic initiatives by infrastructure developers to boost growth

- TABLE 122 MIDDLE EAST: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 123 MIDDLE EAST: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 124 MIDDLE EAST: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 125 MIDDLE EAST: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

- 12.6.3 AFRICA

- 12.6.3.1 R&D investments in AAM technology to drive market

- TABLE 126 AFRICA: VERTIPORTS MARKET, BY LANDSCAPE, 2020-2022 (USD MILLION)

- TABLE 127 AFRICA: VERTIPORTS MARKET, BY LANDSCAPE, 2023-2030 (USD MILLION)

- TABLE 128 AFRICA: VERTIPORTS MARKET, BY TYPE, 2020-2022 (USD MILLION)

- TABLE 129 AFRICA: VERTIPORTS MARKET, BY TYPE, 2023-2030 (USD MILLION)

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- TABLE 130 KEY DEVELOPMENTS BY LEADING PLAYERS IN VERTIPORTS MARKET, 2022-2023

- 13.2 RANKING ANALYSIS, 2022

- FIGURE 33 MARKET RANKING OF TOP FIVE PLAYERS, 2022

- 13.3 COMPANY EVALUATION QUADRANT

- 13.3.1 STARS

- 13.3.2 EMERGING LEADERS

- 13.3.3 PERVASIVE PLAYERS

- 13.3.4 PARTICIPANTS

- FIGURE 34 MARKET COMPETITIVE LEADERSHIP MAPPING, 2022

- 13.4 STARTUP/SME EVALUATION QUADRANT

- 13.4.1 PROGRESSIVE COMPANIES

- 13.4.2 RESPONSIVE COMPANIES

- 13.4.3 DYNAMIC COMPANIES

- 13.4.4 STARTING BLOCKS

- FIGURE 35 STARTUP/SME COMPETITIVE LEADERSHIP MAPPING, 2022

- TABLE 131 VERTIPORTS MARKET: KEY STARTUPS/SMES

- 13.5 COMPETITIVE SCENARIO AND TRENDS

- 13.5.1 DEALS

- TABLE 132 DEALS, 2020-2023

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- (Business overview, Products/services/solutions offered, Recent developments & MnM View)**

- 14.2 KEY PLAYERS

- 14.2.1 SKYPORTS INFRASTRUCTURE LIMITED

- TABLE 133 SKYPORTS INFRASTRUCTURE LIMITED: BUSINESS OVERVIEW

- TABLE 134 SKYPORTS INFRASTRUCTURE LIMITED: PRODUCT/SERVICES/SOLUTIONS OFFERED

- TABLE 135 SKYPORTS INFRASTRUCTURE LIMITED: DEALS

- 14.2.2 GROUPE ADP

- TABLE 136 GROUPE ADP: BUSINESS OVERVIEW

- TABLE 137 GROUPE ADP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- FIGURE 36 GROUPE ADP: COMPANY SNAPSHOT

- TABLE 138 GROUPE ADP: DEALS

- 14.2.3 URBANV SPA

- TABLE 139 URBANV SPA: BUSINESS OVERVIEW

- TABLE 140 URBANV SPA: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 141 URBANV SPA: DEALS

- 14.2.4 FERROVIAL

- TABLE 142 FERROVIAL: BUSINESS OVERVIEW

- TABLE 143 FERROVIAL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- FIGURE 37 FERROVIAL: COMPANY SNAPSHOT

- TABLE 144 FERROVIAL: DEALS

- 14.2.5 URBAN-AIR PORT LTD.

- TABLE 145 URBAN-AIR PORT LTD.: BUSINESS OVERVIEW

- TABLE 146 URBAN-AIR PORT LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 147 URBAN-AIR PORT LTD.: DEALS

- 14.2.6 EHANG

- TABLE 148 EHANG: BUSINESS OVERVIEW

- TABLE 149 EHANG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- FIGURE 38 EHANG: COMPANY SNAPSHOT

- TABLE 150 EHANG: DEALS

- 14.2.7 LILIUM AVIATION GMBH

- TABLE 151 LILIUM AVIATION GMBH: BUSINESS OVERVIEW

- TABLE 152 LILIUM AVIATION GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- FIGURE 39 LILIUM AVIATION GMBH: COMPANY SNAPSHOT

- TABLE 153 LILIUM AVIATION GMBH: DEALS

- 14.2.8 SKYSCAPE INC.

- TABLE 154 SKYSCAPE INC.: BUSINESS OVERVIEW

- TABLE 155 SKYSCAPE INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 156 SKYSCAPE INC.: DEALS

- 14.2.9 VOLOCOPTER GMBH

- TABLE 157 VOLOCOPTER GMBH: BUSINESS OVERVIEW

- TABLE 158 VOLOCOPTER GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 159 VOLOCOPTER GMBH: DEALS

- 14.2.10 VARON VEHICLES CORPORATION

- TABLE 160 VARON VEHICLES CORPORATION: BUSINESS OVERVIEW

- TABLE 161 VARON VEHICLES CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 162 VARON VEHICLES CORPORATION: DEALS

- 14.2.11 BAYARDS VERTIPORT SOLUTIONS

- TABLE 163 BAYARD VERTIPORT SOLUTIONS: BUSINESS OVERVIEW

- TABLE 164 BAYARD VERTIPORT SOLUTIONS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 165 BAYARD VERTIPORT SOLUTIONS: DEALS

- 14.2.12 VPORTS

- TABLE 166 VPORTS: BUSINESS OVERVIEW

- TABLE 167 VPORTS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 168 VPORTS: DEALS

- 14.2.13 SKYPORTZ

- TABLE 169 SKYPORTZ: BUSINESS OVERVIEW

- TABLE 170 SKYPORTZ: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 171 SKYPORTZ: DEALS

- 14.2.14 SKYWAY

- TABLE 172 SKYWAY: BUSINESS OVERVIEW

- TABLE 173 SKYWAY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 174 SKYWAY: DEALS

- 14.2.15 VOLATUS INFRASTRUCTURE LLC

- TABLE 175 VOLATUS INFRASTRUCTURE LLC: BUSINESS OVERVIEW

- TABLE 176 VOLATUS INFRASTRUCTURE LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 177 VOLATUS INFRASTRUCTURE LLC: DEALS

- *Details on Business overview, Products/services/solutions offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 14.3 OTHER PLAYERS

- 14.3.1 VERTIKO MOBILITY INC.

- TABLE 178 VERTIKO MOBILITY INC.: COMPANY OVERVIEW

- 14.3.2 EVERTISKY

- TABLE 179 EVERTISKY: COMPANY OVERVIEW

- 14.3.3 AIRSIGHT

- TABLE 180 AIRSIGHT: COMPANY OVERVIEW

- 14.3.4 BLUENEST

- TABLE 181 BLUENEST: COMPANY OVERVIEW

- 14.3.5 TAVISTOCK DEVELOPMENT COMPANY

- TABLE 182 TAVISTOCK DEVELOPMENT COMPANY: COMPANY OVERVIEW

- 14.3.6 ALTAPORT INC.

- TABLE 183 ALTAPORT INC.: COMPANY OVERVIEW

- 14.3.7 AEROAUTO LLC

- TABLE 184 AEROAUTO LLC: COMPANY OVERVIEW

- 14.3.8 KOOKIEJAR

- TABLE 185 KOOKIEJAR: COMPANY OVERVIEW

- 14.3.9 AIRNOVA

- TABLE 186 AIRNOVA: COMPANY OVERVIEW

- 14.3.10 EVERTIPORTS INTERNATIONAL CORPORATION

- TABLE 187 EVETIPORTS INTERNATIONAL CORPORATION: COMPANY OVERVIEW

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS