|

|

市場調査レポート

商品コード

1638718

AMR (自律走行搬送ロボット) の世界市場 (~2030年):ナビゲーション技術 (レーザー/LiDAR・ビジョンガイダンス・SLAM・RFIDタグ・磁気&慣性センサー)・電池・センサー・アクチュエーター・ペイロード容量 (100kg未満・100~500kg・500kg超) 別Autonomous Mobile Robots (AMR) Market by Navigation Technology (Laser/LiDAR, Vision Guidance, SLAM, RFID Tags, Magnetic & Inertial Sensors), Batteries, Sensors, Actuators, Payload Capacity (<100 kg, 100-500 kg and >500 kg) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| AMR (自律走行搬送ロボット) の世界市場 (~2030年):ナビゲーション技術 (レーザー/LiDAR・ビジョンガイダンス・SLAM・RFIDタグ・磁気&慣性センサー)・電池・センサー・アクチュエーター・ペイロード容量 (100kg未満・100~500kg・500kg超) 別 |

|

出版日: 2025年01月06日

発行: MarketsandMarkets

ページ情報: 英文 290 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のAMR (自律走行搬送ロボット) の市場規模は、2025年の22億5,000万米ドルから、予測期間中は15.1%のCAGRで推移し、2030年には45億6,000万米ドルの規模に成長すると予測されています。

この業界を牽引する要因としては、製造、物流、eコマース部門における自動化需要の拡大、ロボット工学、AI、センサーの技術進歩が挙げられます。マテリアルハンドリング、受注処理、在庫管理へのAMRの採用は、業務効率の向上、人件費の削減、安全性の向上に対する要求が高まるにつれて急速に増加しています。さらに、スマートなIoT対応ロボットや倉庫・物流インフラの世界の拡大傾向が、さまざまな部門におけるAMRの需要を加速させています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021-2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025-2030年 |

| 単位 | 金額(米ドル) |

| 部門別 | 提供区分・ナビゲーション技術・ペイロード容量・産業・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・その他の地域 |

"ハードウェア部門が予測期間中に大きな市場シェアを維持"

ハードウェア部門は、これらのロボットを機能させ、良好に動作させる上で非常に重要な役割を果たしているため、AMR市場において大きな市場シェアを維持する可能性が高いです。ハードウェア部門には、センサー、アクチュエーター、移動システム、電源など、AMRの動作に必要な重要コンポーネントが含まれます。センサーはナビゲーションや障害物回避のためにロボットの環境に関するリアルタイムの情報を提供し、アクチュエーターはロボットの移動や物体の操作を可能にします。マテリアルハンドリング、在庫管理、ロジスティクスなどの用途でAMRを使用する産業が成長するにつれ、高品質のハードウェア部品への需要が高まっています。また、さらなる技術の進歩により、より高度なハードウェアソリューションが開発され、AMRの能力をさまざまな部門に押し上げています。バッテリー技術のさらなる進歩とセンサーの精度の向上により、ハードウェア部門の成長は増大し、AMR市場全体の拡大における主役になると予想されています。

"ペイロード容量別では、100~500kgの部門が予測期間中に大きなシェアを示す"

100~500kgのペイロード容量のAMRは、その汎用性と産業用途の側面から、大きなシェアを占めると予想されています。様々な産業用途に適しており、使用可能です。この範囲のペイロード容量であれば、製造、物流、倉庫プロセスでの材料、商品、部品の運搬が、能力や操縦性を過度に損なうことなくスムーズに進みます。これらのロボットは、マテリアルハンドリング、在庫管理、注文処理など、さまざまな作業を効率的かつ安全に行うことができます。産業界では、中・重量物を自動化するためのより経済的な方法を模索する動向にあり、ペイロード容量100~500kgのAMRは成長を続けており、成長するAMR市場において間違いなく重要な部門の1つになるでしょう。

"レーザー/LiDAR技術は、ナビゲーション機能の強化により大きな市場シェアを獲得"

LiDARシステムは、AMRの作業領域の非常に詳細なリアルタイム3Dマップを構築し、障害物の特定、複雑なエリアの通過、最適なルーティングの戦略を支援します。倉庫、製造施設、配送センターなど、ダイナミックで乱雑な環境において高く評価されています。LiDAR技術は、ナビゲーションの精度と安全性を向上させることがますます求められるようになる様々な産業において、高性能AMRに向けた主要な貢献技術の1つとなり、AMR市場をリードします。

当レポートでは、世界のAMR (自律走行搬送ロボット) の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 顧客の事業に影響を与える動向/ディスラプション

- 投資と資金調達のシナリオ

- 技術分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 主な会議とイベント

- 規制状況

- AIがビジネスに与える影響

第6章 AMR (自律走行搬送ロボット) の用途

- ソーティング

- 輸送

- アセンブリー

- 在庫管理

- その他

第7章 AMR (自律走行搬送ロボット) で使用される電池タイプ

- 鉛電池

- リチウムイオン電池

- ニッケルベース電池

- その他

第8章 AMR (自律走行搬送ロボット) の主なタイプ

- GTP (Goods-to-Person) ロボット

- パレットハンドリングロボット

- 自動運転フォークリフト

- 自動在庫管理ロボット

第9章 AMR (自律走行搬送ロボット) 市場:提供区分別

- ハードウェア

- バッテリー

- センサー

- アクチュエーター

- その他

- ソフトウェア&サービス

第10章 AMR (自律走行搬送ロボット) 市場:ペイロード容量別

- 100キロ未満

- 100~500キロ

- 500キロ超

第11章 AMR (自律走行搬送ロボット) 市場:ナビゲーション技術別

- レーザー/LIDAR

- ビジョンガイダンス

- その他

第12章 AMR (自律走行搬送ロボット) 市場:産業別

- eコマース

- 小売

- 自動車

- 化学薬品

- 半導体・エレクトロニクス

- 航空宇宙

- パルプ・紙

- 医薬品

- 食品・飲料

- ヘルスケア

- ロジスティクス

- その他

第13章 AMR (自律走行搬送ロボット) 市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- 中国

- 韓国

- 日本

- インド

- その他

- その他の地域

- 南米

- アフリカ

- 中東

第14章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価と財務指標

- ブランド比較

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 競合シナリオ

第15章 企業プロファイル

- 主要企業

- ABB

- KUKA AG

- GEEKPLUS TECHNOLOGY CO., LTD.

- OMRON CORPORATION

- MOBILE INDUSTRIAL ROBOTS

- ZEBRA TECHNOLOGIES CORP.

- OTTO MOTORS

- ADDVERB TECHNOLOGIES LIMITED

- AETHON, INC.

- INVIA ROBOTICS, INC.

- LOCUS ROBOTICS

- その他の企業

- BOSTON DYNAMICS

- EIRATECH ROBOTICS LTD.

- GREYORANGE

- MAGAZINO

- ONWARD ROBOTICS

- MATTHEWS AUTOMATION SOLUTION

- MILVUS ROBOTICS

- MOVE ROBOTIC SDN. BHD.

- WUXI QUICKTRON INTELLIGENT TECHNOLOGY CO., LTD.

- ROBOTNIK

- SCALLOG

- SEEGRID

- SESTO ROBOTICS

- VECNA ROBOTICS

- NOVUS HI-TECH ROBOTIC SYSTEMZ

第16章 付録

List of Tables

- TABLE 1 AUTONOMOUS MOBILE ROBOTS MARKET: RESEARCH ASSUMPTIONS

- TABLE 2 AUTONOMOUS MOBILE ROBOTS MARKET: RISK ANALYSIS

- TABLE 3 ROLE OF PLAYERS IN AUTONOMOUS MOBILE ROBOTS ECOSYSTEM

- TABLE 4 INDICATIVE PRICING OF AUTONOMOUS MOBILE ROBOTS PROVIDED BY KEY PLAYERS, BY PAYLOAD CAPACITY, 2024 (USD)

- TABLE 5 AVERAGE SELLING PRICE TREND OF AUTONOMOUS MOBILE ROBOTS, BY PAYLOAD CAPACITY, 2021-2024 (USD)

- TABLE 6 AVERAGE SELLING PRICE TREND OF AUTONOMOUS MOBILE ROBOTS WITH PAYLOAD CAPACITY OF <100 KG, BY REGION, 2021-2024 (USD)

- TABLE 7 AUTONOMOUS MOBILE ROBOTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES (%)

- TABLE 9 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

- TABLE 10 IMPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 11 EXPORT DATA FOR HS CODE 847950-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 12 LIST OF APPLIED/GRANTED PATENTS RELATED TO AUTONOMOUS MOBILE ROBOTS, 2021-2023

- TABLE 13 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 STANDARDS

- TABLE 19 AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2021-2024 (USD MILLION)

- TABLE 20 AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 21 AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2024 (USD MILLION)

- TABLE 22 AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2025-2030 (USD MILLION)

- TABLE 23 AUTONOMOUS MOBILE ROBOTS MARKET, 2021-2024 (THOUSAND UNITS)

- TABLE 24 AUTONOMOUS MOBILE ROBOTS MARKET, 2025-2030 (THOUSAND UNITS)

- TABLE 25 <100 KG: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 26 <100 KG: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 27 100-500 KG: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 28 100-500 KG: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 29 >500 KG: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 30 >500 KG: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 31 AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 32 AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 33 AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 34 AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 35 E-COMMERCE: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2024 (USD MILLION)

- TABLE 36 E-COMMERCE: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2025-2030 (USD MILLION)

- TABLE 37 E-COMMERCE: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 38 E-COMMERCE: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 39 E-COMMERCE: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 40 E-COMMERCE: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 41 E-COMMERCE: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 42 E-COMMERCE: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 43 E-COMMERCE: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 44 E-COMMERCE: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 45 E-COMMERCE: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 46 E-COMMERCE: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2024 (USD MILLION)

- TABLE 48 RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2025-2030 (USD MILLION)

- TABLE 49 RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 50 RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 52 RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 53 RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 54 RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 55 RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 56 RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 57 RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 58 RETAIL: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2024 (USD MILLION)

- TABLE 60 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2025-2030 (USD MILLION)

- TABLE 61 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 64 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 65 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 66 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 67 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 68 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 69 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 AUTOMOTIVE: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 CHEMICAL: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2024 (USD MILLION)

- TABLE 72 CHEMICAL: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2025-2030 (USD MILLION)

- TABLE 73 CHEMICAL: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 74 CHEMICAL: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 CHEMICAL: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 76 CHEMICAL: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 77 CHEMICAL: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 78 CHEMICAL: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 79 CHEMICAL: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 80 CHEMICAL: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 81 CHEMICAL: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 82 CHEMICAL: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 83 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2024 (USD MILLION)

- TABLE 84 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2025-2030 (USD MILLION)

- TABLE 85 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 86 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 88 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 89 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 90 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 91 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 92 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 93 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 94 SEMICONDUCTOR & ELECTRONICS: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 AEROSPACE: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2024 (USD MILLION)

- TABLE 96 AEROSPACE: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2025-2030 (USD MILLION)

- TABLE 97 AEROSPACE: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 AEROSPACE: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 AEROSPACE: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 100 AEROSPACE: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 101 AEROSPACE: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 102 AEROSPACE: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 103 AEROSPACE: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 104 AEROSPACE: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 105 AEROSPACE: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 106 AEROSPACE: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 107 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2024 (USD MILLION)

- TABLE 108 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2025-2030 (USD MILLION)

- TABLE 109 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 110 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 111 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 112 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 113 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 114 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 115 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 116 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 117 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 118 PULP & PAPER: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 119 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2024 (USD MILLION)

- TABLE 120 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2025-2030 (USD MILLION)

- TABLE 121 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 122 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 123 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 124 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 125 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 126 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 127 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 128 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 129 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 130 PHARMACEUTICALS: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 131 FOOD & BEVERAGE: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2024 (USD MILLION)

- TABLE 132 FOOD & BEVERAGE: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2025-2030 (USD MILLION)

- TABLE 133 FOOD & BEVERAGE: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 134 FOOD & BEVERAGE: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 135 FOOD & BEVERAGE: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 136 FOOD & BEVERAGE: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 137 FOOD & BEVERAGE: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 138 FOOD & BEVERAGE: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 139 FOOD & BEVERAGE: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 140 FOOD & BEVERAGE: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 141 FOOD & BEVERAGE: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 142 FOOD & BEVERAGE: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 143 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2024 (USD MILLION)

- TABLE 144 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2025-2030 (USD MILLION)

- TABLE 145 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 146 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 147 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 148 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 149 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 150 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 151 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 152 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 153 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 154 HEALTHCARE: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 155 LOGISTICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2024 (USD MILLION)

- TABLE 156 LOGISTICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2025-2030 (USD MILLION)

- TABLE 157 LOGISTICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 158 LOGISTICS: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 159 LOGISTICS: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 160 LOGISTICS: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 161 LOGISTICS: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 162 LOGISTICS: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 163 LOGISTICS: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 164 LOGISTICS: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 165 LOGISTICS: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 166 LOGISTICS: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 167 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2021-2024 (USD MILLION)

- TABLE 168 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY, 2025-2030 (USD MILLION)

- TABLE 169 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 170 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 171 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 172 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 173 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 174 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 175 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 176 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 177 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 178 OTHER INDUSTRIES: AUTONOMOUS MOBILE ROBOTS MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 179 AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 180 AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 181 NORTH AMERICA: AUTONOMOUS MOBILE ROBOTS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 182 NORTH AMERICA: AUTONOMOUS MOBILE ROBOTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 183 NORTH AMERICA: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 184 NORTH AMERICA: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 185 EUROPE: AUTONOMOUS MOBILE ROBOTS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 186 EUROPE: AUTONOMOUS MOBILE ROBOTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 187 EUROPE: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 188 EUROPE: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 189 ASIA PACIFIC: AUTONOMOUS MOBILE ROBOTS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 190 ASIA PACIFIC: AUTONOMOUS MOBILE ROBOTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 191 ASIA PACIFIC: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 192 ASIA PACIFIC: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 193 ROW: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 194 ROW: AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 195 ROW: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2021-2024 (USD MILLION)

- TABLE 196 ROW: AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY, 2025-2030 (USD MILLION)

- TABLE 197 MIDDLE EAST: AUTONOMOUS MOBILE ROBOTS MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 198 MIDDLE EAST: AUTONOMOUS MOBILE ROBOTS MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 199 AUTONOMOUS MOBILE ROBOTS MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, 2021-2024

- TABLE 200 AUTONOMOUS MOBILE ROBOTS MARKET: DEGREE OF COMPETITION, 2023

- TABLE 201 AUTONOMOUS MOBILE ROBOTS MARKET: REGION FOOTPRINT

- TABLE 202 AUTONOMOUS MOBILE ROBOTS MARKET: NAVIGATION TECHNOLOGY FOOTPRINT

- TABLE 203 AUTONOMOUS MOBILE ROBOTS MARKET: PAYLOAD CAPACITY FOOTPRINT

- TABLE 204 AUTONOMOUS MOBILE ROBOTS MARKET: INDUSTRY FOOTPRINT

- TABLE 205 AUTONOMOUS MOBILE ROBOTS MARKET: DETAILED LIST OF KEY STARTUP/SMES

- TABLE 206 AUTONOMOUS MOBILE ROBOTS MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 207 AUTONOMOUS MOBILE ROBOTS MARKET: PRODUCT LAUNCHES, APRIL 2021-NOVEMBER 2024

- TABLE 208 AUTONOMOUS MOBILE ROBOTS MARKET: DEALS, APRIL 2021-NOVEMBER 2024

- TABLE 209 ABB: COMPANY OVERVIEW

- TABLE 210 ABB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 ABB: PRODUCT LAUNCHES

- TABLE 212 ABB: DEALS

- TABLE 213 KUKA AG: COMPANY OVERVIEW

- TABLE 214 KUKA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 215 KUKA AG: PRODUCT LAUNCHES

- TABLE 216 GEEKPLUS TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 217 GEEKPLUS TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 218 GEEKPLUS TECHNOLOGY CO., LTD.: DEALS

- TABLE 219 OMRON CORPORATION: COMPANY OVERVIEW

- TABLE 220 OMRON CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 OMRON CORPORATION: PRODUCT LAUNCHES

- TABLE 222 OMRON CORPORATION: EXPANSIONS

- TABLE 223 MOBILE INDUSTRIAL ROBOTS: COMPANY OVERVIEW

- TABLE 224 MOBILE INDUSTRIAL ROBOTS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 MOBILE INDUSTRIAL ROBOTS: PRODUCT LAUNCHES

- TABLE 226 MOBILE INDUSTRIAL ROBOTS: DEALS

- TABLE 227 ZEBRA TECHNOLOGIES CORP.: COMPANY OVERVIEW

- TABLE 228 ZEBRA TECHNOLOGIES CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 ZEBRA TECHNOLOGIES CORP.: PRODUCT LAUNCHES

- TABLE 230 ZEBRA TECHNOLOGIES CORP.: DEALS

- TABLE 231 OTTO MOTORS: COMPANY OVERVIEW

- TABLE 232 OTTO MOTORS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 233 OTTO MOTORS: PRODUCT LAUNCHES

- TABLE 234 OTTO MOTORS: DEALS

- TABLE 235 ADDVERB TECHNOLOGIES LIMITED: COMPANY OVERVIEW

- TABLE 236 ADDVERB TECHNOLOGIES LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 ADDVERB TECHNOLOGIES LIMITED: DEALS

- TABLE 238 ADDVERB TECHNOLOGIES LIMITED: EXPANSIONS

- TABLE 239 AETHON, INC.: COMPANY OVERVIEW

- TABLE 240 AETHON, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 241 INVIA ROBOTICS, INC.: COMPANY OVERVIEW

- TABLE 242 INVIA ROBOTICS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 243 INVIA ROBOTICS, INC.: DEALS

- TABLE 244 LOCUS ROBOTICS: COMPANY OVERVIEW

- TABLE 245 LOCUS ROBOTICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 246 LOCUS ROBOTICS: PRODUCT LAUNCHES

- TABLE 247 LOCUS ROBOTICS: DEALS

List of Figures

- FIGURE 1 AUTONOMOUS MOBILE ROBOTS MARKET SEGMENTATION

- FIGURE 2 AUTONOMOUS MOBILE ROBOTS MARKET: RESEARCH DESIGN

- FIGURE 3 AUTONOMOUS MOBILE ROBOTS MARKET: RESEARCH APPROACH

- FIGURE 4 AUTONOMOUS MOBILE ROBOTS MARKET: BOTTOM-UP APPROACH

- FIGURE 5 AUTONOMOUS MOBILE ROBOTS MARKET: TOP-DOWN APPROACH

- FIGURE 6 AUTONOMOUS MOBILE ROBOTS MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 7 AUTONOMOUS MOBILE ROBOTS MARKET: DATA TRIANGULATION

- FIGURE 8 SOFTWARE & SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 9 LASER/LIDAR SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 10 100-500 KG SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 11 E-COMMERCE SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 12 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN AUTONOMOUS MOBILE ROBOTS MARKET DURING FORECAST PERIOD

- FIGURE 13 GROWING DEMAND FOR AUTOMATION AND TECHNOLOGICAL ADVANCEMENTS TO DRIVE MARKET

- FIGURE 14 HARDWARE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

- FIGURE 15 LASER/LIDAR SEGMENT TO SECURE LARGEST MARKET SHARE IN 2030

- FIGURE 16 100-500 KG SEGMENT TO HOLD LARGEST SHARE OF AUTONOMOUS MOBILE ROBOTS MARKET IN 2030

- FIGURE 17 E-COMMERCE SEGMENT TO HOLD LARGEST SHARE OF AUTONOMOUS MOBILE ROBOTS MARKET IN 2030

- FIGURE 18 E-COMMERCE SEGMENT AND CHINA TO HOLD LARGEST SHARE OF ASIA PACIFIC MARKET IN 2030

- FIGURE 19 CHINA TO EXHIBIT HIGHEST CAGR IN GLOBAL AUTONOMOUS MOBILE ROBOTS MARKET DURING FORECAST PERIOD

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 IMPACT ANALYSIS: DRIVERS

- FIGURE 22 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 23 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 24 IMPACT ANALYSIS: CHALLENGES

- FIGURE 25 AUTONOMOUS MOBILE ROBOTS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 AUTONOMOUS MOBILE ROBOTS ECOSYSTEM ANALYSIS

- FIGURE 27 INDICATIVE PRICING OF AUTONOMOUS MOBILE ROBOTS BASED ON PAYLOAD CAPACITY OFFERED BY KEY PLAYERS, 2024

- FIGURE 28 AVERAGE SELLING PRICE TREND OF AUTONOMOUS MOBILE ROBOTS, BY PAYLOAD CAPACITY, 2021-2024

- FIGURE 29 AVERAGE SELLING PRICE TREND OF AUTONOMOUS MOBILE ROBOTS WITH PAYLOAD CAPACITY OF <100 KG, BY REGION, 2021-2024

- FIGURE 30 TRENDS/DISRUPTIONS INFLUENCING CUSTOMERS BUSINESS

- FIGURE 31 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- FIGURE 32 AUTONOMOUS MOBILE ROBOTS MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 33 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 INDUSTRIES

- FIGURE 34 KEY BUYING CRITERIA FOR TOP 3 INDUSTRIES

- FIGURE 35 IMPORT SCENARIO FOR HS CODE 847950-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2019-2023

- FIGURE 36 EXPORT SCENARIO FOR HS CODE 847950-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2019-2023

- FIGURE 37 AUTONOMOUS MOBILE ROBOTS MARKET: PATENT ANALYSIS, 2014-2023

- FIGURE 38 KEY AI USE CASES IN AUTONOMOUS MOBILE ROBOTS MARKET

- FIGURE 39 AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING

- FIGURE 40 HARDWARE SEGMENT TO CAPTURE PROMINENT MARKET SHARE IN 2025

- FIGURE 41 AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY

- FIGURE 42 >500 KG SEGMENT TO EXHIBIT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 43 AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY

- FIGURE 44 VISION GUIDANCE SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 45 AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY

- FIGURE 46 E-COMMERCE SEGMENT TO CAPTURE PROMINENT MARKET SHARE IN 2030

- FIGURE 47 AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION

- FIGURE 48 AUTONOMOUS MOBILE ROBOTS MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2025 TO 2030

- FIGURE 49 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 50 NORTH AMERICA: AUTONOMOUS MOBILE ROBOTS MARKET SNAPSHOT

- FIGURE 51 US TO DOMINATE AUTONOMOUS MOBILE ROBOTS MARKET IN NORTH AMERICA THROUGHOUT FORECAST PERIOD

- FIGURE 52 EUROPE: AUTONOMOUS MOBILE ROBOTS MARKET SNAPSHOT

- FIGURE 53 GERMANY TO BE FASTEST-GROWING MARKET IN EUROPE DURING FORECAST PERIOD

- FIGURE 54 ASIA PACIFIC: AUTONOMOUS MOBILE ROBOTS MARKET SNAPSHOT

- FIGURE 55 CHINA TO LEAD AUTONOMOUS MOBILE ROBOTS IN ASIA PACIFIC THROUGHOUT FORECAST PERIOD

- FIGURE 56 SOUTH AMERICA TO DOMINATE AUTONOMOUS MOBILE ROBOTS MARKET IN ROW THROUGHOUT FORECAST PERIOD

- FIGURE 57 AUTONOMOUS MOBILE ROBOTS MARKET: REVENUE ANALYSIS OF FOUR KEY PLAYERS, 2019-2023

- FIGURE 58 MARKET SHARE ANALYSIS OF COMPANIES OFFERING AUTONOMOUS MOBILE ROBOTS, 2023

- FIGURE 59 COMPANY VALUATION, 2024

- FIGURE 60 FINANCIAL METRICS (EV/EBITDA), 2024

- FIGURE 61 BRAND COMPARISON

- FIGURE 62 AUTONOMOUS MOBILE ROBOTS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 63 AUTONOMOUS MOBILE ROBOTS MARKET: COMPANY FOOTPRINT

- FIGURE 64 AUTONOMOUS MOBILE ROBOTS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 65 ABB: COMPANY SNAPSHOT

- FIGURE 66 KUKA AG: COMPANY SNAPSHOT

- FIGURE 67 OMRON CORPORATION: COMPANY SNAPSHOT

- FIGURE 68 ZEBRA TECHNOLOGIES CORP.: COMPANY SNAPSHOT

The global market for Autonomous Mobile Robots (AMRs) is projected to grow from USD 2.25 billion in 2025 to USD 4.56 billion in 2030, with a CAGR of 15.1%. Drivers in the industry will include growth in demand for automation in the manufacturing, logistics, and e-commerce sectors as well as technological advancement in robotics, artificial intelligence, and sensors. The adoption of AMRs for material handling, order fulfillment, and inventory management is increasing rapidly, as the requirement for enhanced operational efficiency, reduced labor costs, and improved safety is increasing. Further, the growing trend of smart, IoT-enabled robots and warehouse and logistics infrastructure expansion globally has accelerated the demand for AMRs in various sectors.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Navigation Technology, Payload Capacity, Industry and Region |

| Regions covered | North America, Europe, APAC, RoW |

" Hardware segment to maintain significant market share during the forecast period."

The hardware segment is likely to maintain a significant market share in the autonomous mobile robots market as it plays a very vital role in making these robots function and perform well. The hardware segment includes some critical components that are necessary for the operation of AMRs, including sensors, actuators, mobility systems, and power sources. Sensors will offer real-time information regarding the environment of the robot for navigation and obstacle avoidance, while actuators allow the robot to move and manipulate things. With the growth in industries using AMRs for applications such as material handling, inventory management, and logistics, the demand for quality hardware components is growing. In addition, more and more advanced hardware solutions have been developed due to further technology advancements, thereby pushing the capabilities of AMRs into various sectors. Further advancements in battery technology and increased sensor precision are expected to augment the growth of the hardware segment, making it a mainstay in the expansion of the overall AMR market.

"AMRs with 100-500 kg payload capacity is expected to hold a significant share of the autonomous mobile robots market during the forecast period."

The AMRs with payload capacity 100-500 Kg is anticipated to hold a significant share of the AMR market due to its versatility and industrial application aspects, it turns into being well-suited and usable across manifold industrial applications. Material, goods, component carriage during manufacturing, logistical, and warehouse process fitting will go on smoothly without over compromising their capacity and maneuverability by this range of payloads. These robots can perform a multiple tasks including material handling, inventory, and order fulfillment, among others, with efficiency and safety. With the trend of seeking more economical ways to automate medium-to-heavy loads in industries, the 100-500 kg payload capacity AMRs continue to see growth and are bound to become one of the important segments in the growing AMR market.

"Laser/LiDAR technology to capture significant market share in the AMR market driven by enhanced navigation capabilities."

Laser/LiDAR technology is expected to hold a significant share of the AMR market during the forecast period. LiDAR system builds highly detailed real-time 3D maps of the working arena for AMRs, helping identify obstacles, pass through complicated areas, and strategize for optimum routing. It is highly valued in such dynamic and cluttered environments like warehouses, manufacturing facilities, and distribution centers. LiDAR technology will form one of the major contributors toward high-performance autonomous robots across different industries that become increasingly demanding to improve their navigation accuracy and safety, hence leading the market for AMRs.

"Industrial segment is expected to hold largest market share during the forecast period."

E-commerce is expected to hold a significant market share for autonomous mobile robots during the period under consideration, as companies would need to increase their application of automation to optimize the fulfilment process and fulfil greater consumer demand for quick deliveries. AMRs are now widely used in e-commerce warehouses and distribution centres in various tasks, such as order picking, sorting, and transporting material. These robots enhance the efficiency of operations, lower labour costs, and improve accuracy, thus making it possible for e-commerce businesses to scale their operations more effectively. As online shopping expands and logistics automation continues to be more important, the e-commerce sector is going to be one of the largest growth drivers for the AMR market.

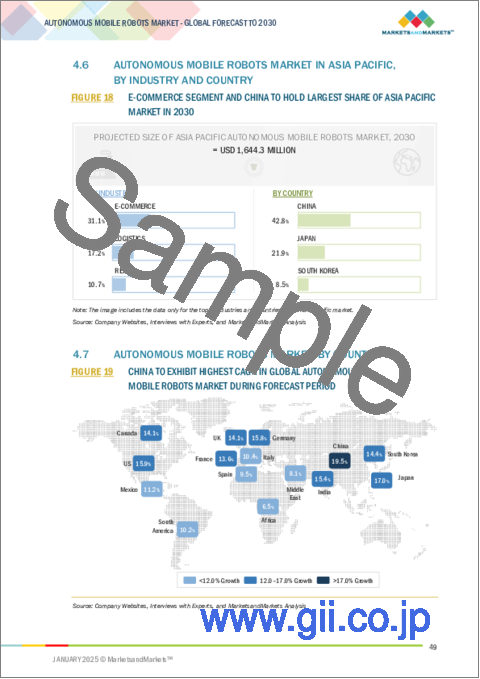

"Asia Pacific to grow at the highest CAGR in the autonomous mobile robot market driven by industrialization and automation adoption."

The Asia Pacific is expected to expand at a significant CAGR for AMR market during the forecast period with growth in the rapid industrialization, adoption of automation technologies by companies, and an e-commerce sector that's gaining a tremendous upward momentum. In such technological infrastructure, the usage is high in manufacturing, warehousing, and logistics areas where China, Japan, and South Korea lead with greater demand for effective cost reduction alternatives. Government initiatives supporting smart manufacturing and automation, coupled with a rising need for reducing labour costs and enhancing operational efficiency, is driving the demand for AMRs in this region. The Asia Pacific AMR market will experience considerable growth due to the increasing emphasis of Asian Pacific businesses on automation.

Breakdown of primaries

A variety of executives from key organizations operating in the autonomous mobile robots market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 -45%, Tier 2 - 30%, and Tier 3 - 25%

- By Designation: C-level Executives - 35%, Directors - 45%, and Others - 20%

- By Region: North America - 30%, Europe - 25%, Asia Pacific - 35%, and RoW - 10%

Major players profiled in this report are as follows: ABB (Switzerland), KUKA AG (Germany), OMRON Corporation (Japan), Mobile Industrial Robots (Denmark), and Geekplus Technology Co., Ltd. (China) and others. These leading companies possess a wide portfolio of products, establishing a prominent presence in established as well as emerging markets.

The study provides a detailed competitive analysis of these key players in the autonomous mobile robots market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

In this report, the autonomous mobile robots market has been segmented based on offering, navigation technology, payload capacity, industry and region. The offering segment consists of hardware and software & services. The navigation technology segment consists of Laser/LiDAR, vision guidance, and others. The payload capacity segment consists of <100Kg, 100-500 Kg and >500 Kg. The industry segment consists of E-Commerce, retail, automotive, chemical, semiconductor and electronics, aerospace, pulp and paper, pharmaceuticals, food & beverage, healthcare, logistics and others. The market has been segmented into four regions-North America, Asia Pacific, Europe, and RoW.

Reasons to buy the report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the autonomous mobile robots market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key drivers (Rapid advancements in robotics and artificial intelligence, Rising demand for warehouse automation, Advancements in Edge Computing and IoT Integration), restraints (High initial cost associated with implementation of autonomous mobile robots, Need for proper infrastructure and constant research and innovation to enhance system capability, Concerns Over Cybersecurity and Data Privacy) opportunities (Rising demand for fast and efficient last-mile delivery, Potential growth in diverse industry-specific applications, Rising Demand for Smart Factories and Industry 4.0 Initiatives), and challenges (Integration of AMRs into existing workflows and systems, Lack of standardization and interoperability issues in autonomous mobile robots, Lack of Skilled Workforce for Implementation and Maintenance) influencing the growth of the autonomous mobile robots market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the autonomous mobile robots market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the autonomous mobile robots market across varied regions.

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the autonomous mobile robots market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like ABB (Switzerland), KUKA AG (Germany), OMRON Corporation (Japan), Mobile Industrial Robots (Denmark), and Geekplus Technology Co., Ltd. (China) and others.

The global market for Autonomous Mobile Robots (AMRs) is projected to grow from USD 2.25 billion in 2025 to USD 4.56 billion in 2030, with a CAGR of 15.1%. Drivers in the industry will include growth in demand for automation in the manufacturing, logistics, and e-commerce sectors as well as technological advancement in robotics, artificial intelligence, and sensors. The adoption of AMRs for material handling, order fulfillment, and inventory management is increasing rapidly, as the requirement for enhanced operational efficiency, reduced labor costs, and improved safety is increasing. Further, the growing trend of smart, IoT-enabled robots and warehouse and logistics infrastructure expansion globally has accelerated the demand for AMRs in various sectors.

" Hardware segment to maintain significant market share during the forecast period."

The hardware segment is likely to maintain a significant market share in the autonomous mobile robots market as it plays a very vital role in making these robots function and perform well. The hardware segment includes some critical components that are necessary for the operation of AMRs, including sensors, actuators, mobility systems, and power sources. Sensors will offer real-time information regarding the environment of the robot for navigation and obstacle avoidance, while actuators allow the robot to move and manipulate things. With the growth in industries using AMRs for applications such as material handling, inventory management, and logistics, the demand for quality hardware components is growing. In addition, more and more advanced hardware solutions have been developed due to further technology advancements, thereby pushing the capabilities of AMRs into various sectors. Further advancements in battery technology and increased sensor precision are expected to augment the growth of the hardware segment, making it a mainstay in the expansion of the overall AMR market.

"AMRs with 100-500 kg payload capacity is expected to hold a significant share of the autonomous mobile robots market during the forecast period."

The AMRs with payload capacity 100-500 Kg is anticipated to hold a significant share of the AMR market due to its versatility and industrial application aspects, it turns into being well-suited and usable across manifold industrial applications. Material, goods, component carriage during manufacturing, logistical, and warehouse process fitting will go on smoothly without over compromising their capacity and maneuverability by this range of payloads. These robots can perform a multiple tasks including material handling, inventory, and order fulfillment, among others, with efficiency and safety. With the trend of seeking more economical ways to automate medium-to-heavy loads in industries, the 100-500 kg payload capacity AMRs continue to see growth and are bound to become one of the important segments in the growing AMR market.

"Laser/LiDAR technology to capture significant market share in the AMR market driven by enhanced navigation capabilities."

Laser/LiDAR technology is expected to hold a significant share of the AMR market during the forecast period. LiDAR system builds highly detailed real-time 3D maps of the working arena for AMRs, helping identify obstacles, pass through complicated areas, and strategize for optimum routing. It is highly valued in such dynamic and cluttered environments like warehouses, manufacturing facilities, and distribution centers. LiDAR technology will form one of the major contributors toward high-performance autonomous robots across different industries that become increasingly demanding to improve their navigation accuracy and safety, hence leading the market for AMRs.

"Industrial segment is expected to hold largest market share during the forecast period."

E-commerce is expected to hold a significant market share for autonomous mobile robots during the period under consideration, as companies would need to increase their application of automation to optimize the fulfilment process and fulfil greater consumer demand for quick deliveries. AMRs are now widely used in e-commerce warehouses and distribution centres in various tasks, such as order picking, sorting, and transporting material. These robots enhance the efficiency of operations, lower labour costs, and improve accuracy, thus making it possible for e-commerce businesses to scale their operations more effectively. As online shopping expands and logistics automation continues to be more important, the e-commerce sector is going to be one of the largest growth drivers for the AMR market.

"Asia Pacific to grow at the highest CAGR in the autonomous mobile robot market driven by industrialization and automation adoption."

The Asia Pacific is expected to expand at a significant CAGR for AMR market during the forecast period with growth in the rapid industrialization, adoption of automation technologies by companies, and an e-commerce sector that's gaining a tremendous upward momentum. In such technological infrastructure, the usage is high in manufacturing, warehousing, and logistics areas where China, Japan, and South Korea lead with greater demand for effective cost reduction alternatives. Government initiatives supporting smart manufacturing and automation, coupled with a rising need for reducing labour costs and enhancing operational efficiency, is driving the demand for AMRs in this region. The Asia Pacific AMR market will experience considerable growth due to the increasing emphasis of Asian Pacific businesses on automation.

Breakdown of primaries

A variety of executives from key organizations operating in the autonomous mobile robots market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1 -45%, Tier 2 - 30%, and Tier 3 - 25%

- By Designation: C-level Executives - 35%, Directors - 45%, and Others - 20%

- By Region: North America - 30%, Europe - 25%, Asia Pacific - 35%, and RoW - 10%

Major players profiled in this report are as follows: ABB (Switzerland), KUKA AG (Germany), OMRON Corporation (Japan), Mobile Industrial Robots (Denmark), and Geekplus Technology Co., Ltd. (China) and others. These leading companies possess a wide portfolio of products, establishing a prominent presence in established as well as emerging markets.

The study provides a detailed competitive analysis of these key players in the autonomous mobile robots market, presenting their company profiles, most recent developments, and key market strategies.

Research Coverage

In this report, the autonomous mobile robots market has been segmented based on offering, navigation technology, payload capacity, industry and region. The offering segment consists of hardware and software & services. The navigation technology segment consists of Laser/LiDAR, vision guidance, and others. The payload capacity segment consists of <100Kg, 100-500 Kg and >500 Kg. The industry segment consists of E-Commerce, retail, automotive, chemical, semiconductor and electronics, aerospace, pulp and paper, pharmaceuticals, food & beverage, healthcare, logistics and others. The market has been segmented into four regions-North America, Asia Pacific, Europe, and RoW.

Reasons to buy the report

The report will help the leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market and the sub-segments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the autonomous mobile robots market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

Key Benefits of Buying the Report

- Analysis of key drivers (Rapid advancements in robotics and artificial intelligence, Rising demand for warehouse automation, Advancements in Edge Computing and IoT Integration), restraints (High initial cost associated with implementation of autonomous mobile robots, Need for proper infrastructure and constant research and innovation to enhance system capability, Concerns Over Cybersecurity and Data Privacy) opportunities (Rising demand for fast and efficient last-mile delivery, Potential growth in diverse industry-specific applications, Rising Demand for Smart Factories and Industry 4.0 Initiatives), and challenges (Integration of AMRs into existing workflows and systems, Lack of standardization and interoperability issues in autonomous mobile robots, Lack of Skilled Workforce for Implementation and Maintenance) influencing the growth of the autonomous mobile robots market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the autonomous mobile robots market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the autonomous mobile robots market across varied regions.

- Market Diversification: Exhaustive information about new products/services, untapped geographies, recent developments, and investments in the autonomous mobile robots market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like ABB (Switzerland), KUKA AG (Germany), OMRON Corporation (Japan), Mobile Industrial Robots (Denmark), and Geekplus Technology Co., Ltd. (China) and others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 YEARS CONSIDERED

- 1.3.3 INCLUSIONS AND EXCLUSIONS

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Key data from primary sources

- 2.1.3.3 Key industry insights

- 2.1.3.4 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS OPERATING IN AUTONOMOUS MOBILE ROBOTS MARKET

- 4.2 AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING

- 4.3 AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY

- 4.4 AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY

- 4.5 AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY

- 4.6 AUTONOMOUS MOBILE ROBOTS MARKET IN ASIA PACIFIC, BY INDUSTRY AND COUNTRY

- 4.7 AUTONOMOUS MOBILE ROBOTS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rapid advances in robotics and artificial intelligence technologies

- 5.2.1.2 Growing emphasis on warehouse automation

- 5.2.1.3 Rising deployment of edge computing and IoT technologies

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial implementation costs

- 5.2.2.2 Increasing risks of cyberattacks

- 5.2.2.3 Shortage of skilled workforce

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Mounting demand for efficient last-mile delivery services

- 5.2.3.2 Increasing demand for AMRs with customizable hardware and programmable software

- 5.2.3.3 Rapid transition of industries toward smart factories and Industry 4.0

- 5.2.4 CHALLENGES

- 5.2.4.1 Data integration complexities and compatibility issues

- 5.2.4.2 Interoperability issues due to lack of standardized protocols, interfaces, and data formats

- 5.2.4.3 Technical barriers for AMRs in dynamic environments

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 INDICATIVE PRICING OF AUTONOMOUS MOBILE ROBOTS OFFERED BY KEY PLAYERS, BY PAYLOAD CAPACITY, 2024

- 5.5.2 AVERAGE SELLING PRICE TREND OF AUTONOMOUS MOBILE ROBOTS, BY PAYLOAD CAPACITY, 2021-2024

- 5.5.3 AVERAGE SELLING PRICE TREND OF AUTONOMOUS MOBILE ROBOTS WITH PAYLOAD CAPACITY OF <100 KG, BY REGION, 2021-2024

- 5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 INVESTMENT AND FUNDING SCENARIO, 2020-2024

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Simultaneous localization and mapping

- 5.8.1.2 LiDAR and 3D mapping

- 5.8.2 ADJACENT TECHNOLOGIES

- 5.8.2.1 Predictive analytics

- 5.8.2.2 Artificial intelligence and machine learning

- 5.8.3 COMPLEMENTARY TECHNOLOGIES

- 5.8.3.1 Human-robot interaction

- 5.8.3.2 Wireless communication

- 5.8.3.3 Industry 4.0

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 DORMAN PRODUCTS ADOPTS ZEBRA TECHNOLOGIES' AMRS TO IMPROVING WAREHOUSE EFFICIENCY

- 5.11.2 SADDLE CREEK DEPLOYS LOCUS ROBOTICS' AMRS TO MEET SURGING E-COMMERCE DEMAND

- 5.11.3 RADIAL EUROPE ADOPTS DEMATIC'S AMRS TO DELIVER GOODS

- 5.11.4 PSYCHO BUNNY EMPLOYS LOCUS ROBOTIC'S AMRS TO AUTOMATE TRANSPORT OF GOODS FROM DOCKS TO STORAGE LOCATIONS

- 5.11.5 AIRBUS IMPLEMENTS KUKA'S OMNIMOVE PLATFORM TO TRANSPORT LARGE AIRCRAFT COMPONENTS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA (HS CODE 847950)

- 5.12.2 EXPORT SCENARIO (HS CODE 847950)

- 5.13 PATENT ANALYSIS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 REGULATORY LANDSCAPE

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 STANDARDS

- 5.15.3 REGULATIONS

- 5.16 IMPACT OF AI ON BUSINESSES

- 5.16.1 INTRODUCTION

- 5.16.2 IMPACT OF AI ON AUTONOMOUS MOBILE ROBOTS MARKET

- 5.16.3 TOP USE CASES AND MARKET POTENTIAL

6 APPLICATIONS OF AUTONOMOUS MOBILE ROBOTS

- 6.1 INTRODUCTION

- 6.2 SORTING

- 6.3 TRANSPORTATION

- 6.4 ASSEMBLY

- 6.5 INVENTORY MANAGEMENT

- 6.6 OTHER APPLICATIONS

7 BATTERY TYPES USED IN AUTONOMOUS MOBILE ROBOTS

- 7.1 INTRODUCTION

- 7.2 LEAD-BASED BATTERY

- 7.3 LI-ION BATTERY

- 7.4 NICKEL-BASED BATTERY

- 7.5 OTHER BATTERY TYPES

8 MAJOR TYPES OF AUTONOMOUS MOBILE ROBOTS

- 8.1 INTRODUCTION

- 8.2 GOODS-TO-PERSON ROBOTS

- 8.3 PALLET-HANDLING ROBOTS

- 8.4 SELF-DRIVING FORKLIFTS

- 8.5 AUTONOMOUS INVENTORY ROBOTS

9 AUTONOMOUS MOBILE ROBOTS MARKET, BY OFFERING

- 9.1 INTRODUCTION

- 9.2 HARDWARE

- 9.2.1 ESSENTIAL ROLE OF HARDWARE COMPONENTS IN SUPPORTING AUTONOMOUS OPERATIONS TO BOOST DEMAND

- 9.2.2 BATTERIES

- 9.2.3 SENSORS

- 9.2.4 ACTUATORS

- 9.2.5 OTHERS

- 9.3 SOFTWARE & SERVICES

- 9.3.1 IMPLEMENTATION OF ADVANCED ALGORITHMS FOR SMOOTH FUNCTIONING TO FUEL MARKET GROWTH

10 AUTONOMOUS MOBILE ROBOTS MARKET, BY PAYLOAD CAPACITY

- 10.1 INTRODUCTION

- 10.2 <100 KG

- 10.2.1 RISING USE IN WAREHOUSING AND LOGISTICS OPERATIONS TO DRIVE MARKET

- 10.3 100-500 KG

- 10.3.1 INCREASING ADOPTION IN MANUFACTURING AND HEALTHCARE APPLICATIONS TO FUEL MARKET GROWTH

- 10.4 >500 KG

- 10.4.1 PRESSING NEED TO CARRY HEAVY-DUTY LOADS IN MANUFACTURING FACILITIES TO FOSTER MARKET GROWTH

11 AUTONOMOUS MOBILE ROBOTS MARKET, BY NAVIGATION TECHNOLOGY

- 11.1 INTRODUCTION

- 11.2 LASER/LIDAR

- 11.2.1 RISING USE OF AUTONOMOUS MOBILE ROBOTS IN DETECTION AND IDENTIFICATION APPLICATIONS TO DRIVE MARKET

- 11.3 VISION GUIDANCE

- 11.3.1 EXCELLENCE IN TRANSFORMING AMR NAVIGATION TO ACCELERATE DEMAND

- 11.4 OTHER NAVIGATION TECHNOLOGIES

12 AUTONOMOUS MOBILE ROBOTS MARKET, BY INDUSTRY

- 12.1 INTRODUCTION

- 12.2 E-COMMERCE

- 12.2.1 RISING TREND OF ONLINE RETAIL AND E-COMMERCE TO DRIVE MARKET

- 12.3 RETAIL

- 12.3.1 INCREASING USE OF AUTONOMOUS ROBOTS TO REPLENISH INVENTORY TO FUEL MARKET GROWTH

- 12.4 AUTOMOTIVE

- 12.4.1 SURGING ADOPTION IN AUTOMOTIVE MANUFACTURING TO FOSTER MARKET GROWTH

- 12.5 CHEMICAL

- 12.5.1 ABILITY TO CONDUCT CHEMICAL SYNTHESIS EXPERIMENTS WITH HIGHER EFFICIENCY TO BOOST DEMAND

- 12.6 SEMICONDUCTOR & ELECTRONICS

- 12.6.1 GREATER EMPHASIS ON AUTOMATION AND PRECISION MANUFACTURING TO DRIVE ADOPTION

- 12.7 AEROSPACE

- 12.7.1 ABILITY TO NAVIGATE COMPLEX ENVIRONMENTS AND CONDUCT QUALITY CONTROL CHECKS TO BOOST DEMAND

- 12.8 PULP & PAPER

- 12.8.1 SIGNIFICANT FOCUS ON ENHANCING MANUFACTURING EFFICIENCY AND SAFETY TO DRIVE DEMAND

- 12.9 PHARMACEUTICALS

- 12.9.1 ACCELERATING AUTOMATION AND SAFETY REQUIREMENTS TO DRIVE ADOPTION

- 12.10 FOOD & BEVERAGE

- 12.10.1 GROWING FOCUS ON QUALITY CONTROL AND REGULATORY COMPLIANCE TO DRIVE ADOPTION

- 12.11 HEALTHCARE

- 12.11.1 RISING EMPHASIS ON SAFETY AND HYGIENE TO BOOST DEMAND

- 12.12 LOGISTICS

- 12.12.1 INCREASING IMPORTANCE OF INVENTORY MANAGEMENT IN LOGISTICS TO FUEL MARKET GROWTH

- 12.13 OTHER INDUSTRIES

13 AUTONOMOUS MOBILE ROBOTS MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Integration of AI-powered robots in warehouses to drive market

- 13.2.3 CANADA

- 13.2.3.1 Intensifying labor shortages to boost demand

- 13.2.4 MEXICO

- 13.2.4.1 Thriving logistics and food & beverage industries to support market growth

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 GERMANY

- 13.3.2.1 Increasing adoption of automation solutions in automotive industry to drive market

- 13.3.3 UK

- 13.3.3.1 Rapid growth of e-commerce and retail sectors to support market growth

- 13.3.4 FRANCE

- 13.3.4.1 Digital transformation in industrial sector to boost adoption

- 13.3.5 ITALY

- 13.3.5.1 Industrial and logistics sectors to contribute to market growth

- 13.3.6 SPAIN

- 13.3.6.1 Surging demand from automotive and logistics companies to create opportunities

- 13.3.7 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 Thriving e-commerce sector to support market growth

- 13.4.3 SOUTH KOREA

- 13.4.3.1 Rising adoption of service robots to improve manufacturing efficiency to foster market growth

- 13.4.4 JAPAN

- 13.4.4.1 Growing automotive and manufacturing industries to contribute to market growth

- 13.4.5 INDIA

- 13.4.5.1 Increasing adoption e-commerce and logistics sectors to drive market

- 13.4.6 REST OF ASIA PACIFIC

- 13.5 ROW

- 13.5.1 MACROECONOMIC OUTLOOK IN ROW

- 13.5.2 SOUTH AMERICA

- 13.5.2.1 Increasing automation in food & beverage industry to boost demand

- 13.5.3 AFRICA

- 13.5.3.1 Rising focus of manufacturing firms on streamlining workflow and improve product quality to create opportunities

- 13.5.4 MIDDLE EAST

- 13.5.4.1 Booming e-commerce industry to drive demand

- 13.5.4.2 GCC

- 13.5.4.3 Rest of Middle East

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 14.3 REVENUE ANALYSIS, 2019-2023

- 14.4 MARKET SHARE ANALYSIS, 2023

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 14.6 BRAND COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Navigation technology footprint

- 14.7.5.4 Payload capacity footprint

- 14.7.5.5 Industry footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 ABB

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches

- 15.1.1.3.2 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths/Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses/Competitive threats

- 15.1.2 KUKA AG

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths/Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses/Competitive threats

- 15.1.3 GEEKPLUS TECHNOLOGY CO., LTD.

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Deals

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths/Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses/Competitive threats

- 15.1.4 OMRON CORPORATION

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches

- 15.1.4.3.2 Expansions

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths/Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses/Competitive threats

- 15.1.5 MOBILE INDUSTRIAL ROBOTS

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches

- 15.1.5.3.2 Deals

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths/Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses/Competitive threats

- 15.1.6 ZEBRA TECHNOLOGIES CORP.

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product launches

- 15.1.6.3.2 Deals

- 15.1.7 OTTO MOTORS

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches

- 15.1.7.3.2 Deals

- 15.1.8 ADDVERB TECHNOLOGIES LIMITED

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Deals

- 15.1.8.3.2 Expansions

- 15.1.9 AETHON, INC.

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.10 INVIA ROBOTICS, INC.

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Deals

- 15.1.11 LOCUS ROBOTICS

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Product launches

- 15.1.11.3.2 Deals

- 15.1.1 ABB

- 15.2 OTHER PLAYERS

- 15.2.1 BOSTON DYNAMICS

- 15.2.2 EIRATECH ROBOTICS LTD.

- 15.2.3 GREYORANGE

- 15.2.4 MAGAZINO

- 15.2.5 ONWARD ROBOTICS

- 15.2.6 MATTHEWS AUTOMATION SOLUTION

- 15.2.7 MILVUS ROBOTICS

- 15.2.8 MOVE ROBOTIC SDN. BHD.

- 15.2.9 WUXI QUICKTRON INTELLIGENT TECHNOLOGY CO., LTD.

- 15.2.10 ROBOTNIK

- 15.2.11 SCALLOG

- 15.2.12 SEEGRID

- 15.2.13 SESTO ROBOTICS

- 15.2.14 VECNA ROBOTICS

- 15.2.15 NOVUS HI-TECH ROBOTIC SYSTEMZ

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS