|

|

市場調査レポート

商品コード

1322919

モニタリングツールの世界市場:提供別、タイプ別、業界別、地域別 - 予測(~2028年)Monitoring Tools Market by Offering (Software (by Deployment) & Services), Type (Infrastructure Monitoring, Application Performance Monitoring, Security Monitoring and End User Experience Monitoring), Vertical and Region - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| モニタリングツールの世界市場:提供別、タイプ別、業界別、地域別 - 予測(~2028年) |

|

出版日: 2023年07月26日

発行: MarketsandMarkets

ページ情報: 英文 381 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のモニタリングツールの市場規模は、2023年に245億米ドル、2028年までに637億米ドルに達し、予測期間中にCAGRで21.1%の成長が予測されています。

技術への依存の高まりと効率的なITインフラの必要性により、産業全体でモニタリングツールの採用が拡大しています。

業界別では、BFSIが予測期間中に最大の市場となる見通しです。

タイプ別では、インフラモニタリングツールセグメントが予測期間中にもっとも高いCAGRで成長すると予測されています。

提供別では、ソフトウェアセグメントが予測期間中に最大の市場規模を占めると予測されています。

予測期間中、北米が最大の市場規模を占める見込みです。

当レポートでは、世界のモニタリングツール市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主要考察

- モニタリングツール市場の企業にとっての魅力的な機会

- モニタリングツール市場:産業別

- モニタリングツール市場:地域別

- モニタリングツール市場:製品別、産業別

第5章 市場の概要と産業動向

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ケーススタディ分析

- モニタリングツールの進化の略歴

- エコシステム分析

- バリューチェーン分析

- 価格モデルの分析

- 特許分析

- 技術分析

- ポーターのファイブフォース分析

- 主な会議とイベント(2023年~2024年)

- モニタリングツールのビジネスモデル

- 主なステークホルダーと購入基準

- モニタリングツール市場のベストプラクティス

- モニタリングツール市場のバイヤー/クライアントに影響を与える混乱

- モニタリングツール市場の将来の方向性

- エージェントベースのモニタリングツールとエージェントレスモニタリングツールの比較

- モニタリングツール市場のステージ

- オープンソースとクローズドソースのモニタリングツールの比較:タイプ別

- オープンソースモニタリングツールの価格設定

第6章 モニタリングツール市場:提供別

- イントロダクション

- ソフトウェア

- サービス

- プロフェッショナルサービス

- マネージドサービス

第7章 モニタリングツール市場:タイプ別

- イントロダクション

- インフラモニタリングツール

- アプリケーションパフォーマンスモニタリングツール

- セキュリティモニタリングツール

- エンドユーザーエクスペリエンスモニタリングツール

第8章 モニタリングツール市場:インフラモニタリング別

- イントロダクション

- ネットワークモニタリング

- ストレージモニタリング

- サーバーモニタリング

- クラウドインフラモニタリング

- その他のインフラのモニタリング

第9章 モニタリングツール市場:アプリケーションパフォーマンスモニタリング別

- イントロダクション

- データベースモニタリング

- Webアプリケーションモニタリング

- モバイルアプリケーションモニタリング

- コードレベルモニタリング

- その他のアプリケーションパフォーマンスモニタリング

第10章 モニタリングツール市場:セキュリティモニタリング別

- イントロダクション

- 侵入検知防御システム(IDPS)

- ログのモニタリングと分析

- 脆弱性の評価と管理

- その他のセキュリティモニタリング

第11章 モニタリングツール市場:エンドユーザーエクスペリエンスモニタリング別

- イントロダクション

- シンセティックモニタリング

- リアルユーザーモニタリング

- その他のエンドユーザーエクスペリエンスモニタリング

第12章 モニタリングツール市場:業界別

- イントロダクション

- BFSI

- 小売、eコマース

- 医療、ライフサイエンス

- IT/ITES

- メディア、エンターテインメント

- 製造

- 自動車、輸送、ロジスティクス

- 通信

- その他の業界

第13章 モニタリングツール市場:地域別

- イントロダクション

- 北米

- 北米:モニタリングツール市場の促進要因

- 北米:不況の影響

- 米国

- カナダ

- 欧州

- 欧州:モニタリングツール市場の促進要因

- 欧州:不況の影響

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- ベネルクス

- 北欧諸国

- その他の欧州

- アジア太平洋

- アジア太平洋:モニタリングツール市場の促進要因

- アジア太平洋:不況の影響

- 中国

- 日本

- インド

- ニュージーランド

- 韓国

- ASEAN

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカ:モニタリングツール市場の促進要因

- 中東・アフリカ:不況の影響

- サウジアラビア王国

- アラブ首長国連邦

- イスラエル

- トルコ

- カタール

- 南アフリカ

- その他の中東・アフリカ

- ラテンアメリカ

- ラテンアメリカ:モニタリングツール市場の促進要因

- ラテンアメリカ:不況の影響

- ブラジル

- メキシコ

- アルゼンチン

- その他のラテンアメリカ

第14章 競合情勢

- 概要

- 主要企業が採用した戦略

- 収益分析

- 市場シェア分析

- 主要企業の評価マトリクス

- 中小企業/スタートアップの評価マトリクス

- 競合ベンチマーキング

- モニタリングツール:製品情勢

- 競合シナリオ

- 主要ベンダーの評価と財務指標

- 主要ベンダーの年初来のプライストータルリターンと株価のベータ

第15章 企業プロファイル

- イントロダクション

- 主要企業

- MICROSOFT

- AWS

- IBM

- CISCO

- DYNATRACE

- SPLUNK

- SOLARWINDS

- NETSCOUT

- NEW RELIC

- LOGICMONITOR

- PAESSLER AG

- NETREO

- MANAGEENGINE

- IDERA

- SEMATEXT

- DATADOG

- ICINGA

- NAGIOS

- ZABBIX

- その他の企業

- SENTRY

- UPTIMEROBOT

- ATERA

- BETTER STACK

- SUMO LOGIC

- CHECKMK

- EXOPRISE

- ITRS

- RIVERBED TECHNOLOGY

- NLYTE SOFTWARE

第16章 隣接市場と関連市場

- ネットワークモニタリング市場 - 世界の予測(~2027年)

- 予測分析市場 - 世界の予測(~2026年)

- エンドユーザーエクスペリエンスモニタリング市場 - 世界の予測(~2023年)

第17章 付録

The market for Monitoring tools is estimated to grow from USD 24.5 billion in 2023 to USD 63.7 billion by 2028, at a CAGR of 21.1% during the forecast period. Monitoring tools' adoption has grown across industries due to increased reliance on technology and the need for efficient IT infrastructure. They are widely used in IT, finance, healthcare, telecom, manufacturing, e-commerce, transportation, energy, education, and government sectors. These tools ensure smooth operations, optimize performance, enhance security, and improve customer experiences. As technology advances and monitoring tools become more accessible, their adoption is expected to continue growing, facilitating proactive IT management and reliable service delivery in various industries.

The BFSI vertical is projected to be the largest market during the forecast period

The BFSI (Banking, Financial Services, and Insurance) vertical plays a crucial role in the global economy, and effective monitoring of its operations is of utmost importance. The BFSI Monitoring Tools market encompasses a range of solutions specifically designed to meet the unique requirements and challenges faced by the industry. These tools enable organizations operating in the BFSI sector to monitor their systems, applications, networks, and infrastructure in real-time, ensuring smooth operations and proactive issue resolution. One of the key drivers behind the growth of the BFSI Monitoring Tools market is the increasing complexity of banking and financial processes. With the advent of digital transformation, BFSI institutions are adopting advanced technologies such as cloud computing, big data analytics, artificial intelligence, and machine learning. These technologies bring efficiency and innovation but also introduce new vulnerabilities and risks. Monitoring tools provide continuous visibility into critical systems and processes, allowing organizations to detect and respond to any anomalies or security breaches promptly.

Among type, Infrastructure Monitoring Tools segment is registered to grow at the highest CAGR during the forecast period

Infrastructure monitoring tools are driving the growth of the monitoring tools market as businesses grapple with the increasing complexity of IT infrastructure. These tools provide real-time visibility into networks, servers, and infrastructure components, enabling proactive issue detection and resolution. By setting up thresholds and alerts, organizations can detect potential issues before they impact operations, minimizing downtime and optimizing performance. Infrastructure monitoring tools also assist in capacity planning and resource optimization, helping businesses make informed decisions about resource allocation and scaling. Their scalability and adaptability make them well-suited for modern IT environments, including cloud-based resources and distributed systems. Furthermore, these tools integrate with other monitoring domains such as security, end-user experience, and application performance monitoring, providing a holistic view of the IT environment and enhancing troubleshooting capabilities.

Among offering, software segment is anticipated to account for the largest market size during the forecast period

The market for monitoring tool software is experiencing significant growth driven by several key factors. Businesses are adopting these tools to address the increasing complexity of their IT infrastructure, enabling them to track performance, availability, and security across systems, networks, applications, and cloud services. Real-time visibility is crucial, and monitoring tools provide organizations with timely metrics, alerts, and notifications to promptly address any issues or performance degradation. Advanced analytics and AI capabilities offered by monitoring tools allow businesses to derive actionable insights from large amounts of monitoring data, automating troubleshooting and prediction of potential issues. The rise of DevOps and agile practices has further fueled the demand for monitoring tools that align with continuous integration, continuous delivery, and rapid deployment processes. Cloud computing and microservices architectures require specialized monitoring solutions to track the performance and health of dynamic and scalable environments.

North America to account for the largest market size during the forecast period

North America is estimated to account for the largest share of the Monitoring tools market. The global market for Monitoring tools is dominated by North America. Organizations in North America are adopting new monitoring tools, both proprietary and open source, to keep up with the complexity of IT infrastructure. Infrastructure monitoring solutions are being implemented to improve operational efficiency and reduce downtime, providing system-wide insights into the health, performance, and potential issues of the infrastructure. The media monitoring tools market is also predicted to be led by North America. Network monitoring is a critical IT process that tracks network components and endpoints and provides faults, performance, and traffic monitoring. Network monitoring tools help IT admins reduce the meantime to repair (MTTR) to solve real-time network performance issues with instant alerting and data in the form of tables, charts, graphs, dashboards, and reports. North American businesses rely on networks, making network monitoring tools essential for maintaining optimal network operations. Overall, North America is actively adopting monitoring tools to optimize performance, enhance security, and leverage emerging technologies for improved efficiency and productivity.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the Monitoring tools market.

- By Company: Tier I: 35%, Tier II: 45%, and Tier III: 20%

- By Designation: C-Level Executives: 35%, Directors: 25%, and Others: 40%

- By Region: North America: 40%, Europe: 20%, APAC: 30%, MEA: 5%, Latin America: 5%

Major vendors offering Monitoring tools solutions and services across the globe are Microsoft (US), Google (US), AWS (US), IBM (US), Cisco (US), Dynatrace (US), Splunk (US), Solarwinds (US), Netscout (US), New Relic (US), Logic Monitor (US), Paessler AG (Germany), Netreo (US), ManageEngine (US), Idera (US), Sematext (US), Datadog (US), Icinga (Germany), Nagios (US), Zabbix (Latvia), Sentry (US), UptimeRobot (Malta), Atera (Israel), Better Stack (Czech Republic), Sumo Logic (US), Checkmk (Germany), Exporise (US), ITRS (UK), Riverbed Technology (US), Nlyte Software (US).

Research Coverage

The market study covers Monitoring tools across segments. It aims at estimating the market size and the growth potential across different segments, such as offering, application, vertical, and region. It includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall market for Monitoring tools and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights better to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

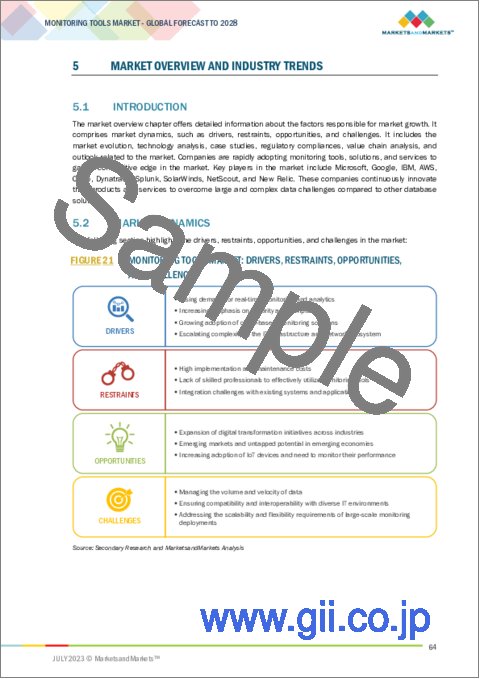

- Analysis of key drivers (Rising demand for real-time monitoring and analytics, Increasing emphasis on security and compliance, Growing adoption of cloud-based monitoring solutions, Escalating complexity in the IT infrastructure and network ecosystem), restraints (High implementation and maintenance costs, Lack of skilled professionals to effectively utilize monitoring tools, Integration challenges with existing systems and applications), opportunities (Expansion of digital transformation initiatives across industries, Emerging markets and untapped potential in developing regions, Increasing adoption of Internet of Things (IoT) devices and the need for monitoring their performance), and challenges (Managing the volume and velocity of data, Ensuring compatibility and interoperability with diverse IT environments , Addressing the scalability and flexibility requirements of large-scale monitoring deployments) influencing the growth of the Monitoring tools market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the Monitoring tools market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the Monitoring tools market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in Monitoring tools market strategies; the report also helps stakeholders understand the pulse of the Monitoring tools market and provides them with information on key market drivers, restraints, challenges, and opportunities

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as IBM (US), Google (US), AWS(US), Microsoft (US), Cisco (US), among others in the Monitoring tools market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- TABLE 1 USD EXCHANGE RATE, 2020-2022

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 MONITORING TOOLS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key industry insights

- 2.2 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- FIGURE 2 MONITORING TOOLS MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- FIGURE 3 APPROACH 1 (SUPPLY-SIDE): REVENUE FROM OFFERING OF MONITORING TOOLS MARKET

- FIGURE 4 APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM OFFERINGS OF MONITORING TOOLS PLAYERS

- FIGURE 5 APPROACH 3, BOTTOM-UP (SUPPLY SIDE): REVENUE AND SUBSEQUENT MARKET ESTIMATION FROM OFFERINGS OF MONITORING TOOLS

- FIGURE 6 APPROACH 4, BOTTOM-UP (DEMAND SIDE): SHARE OF MONITORING TOOLS OFFERING THROUGH OVERALL MONITORING TOOLS SPENDING

- 2.4 MARKET FORECAST

- TABLE 2 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 LIMITATIONS AND RISK ASSESSMENT

- 2.7 RECESSION IMPACT ON MONITORING TOOLS MARKET

- TABLE 3 RECESSION IMPACT ON MONITORING TOOLS MARKET

3 EXECUTIVE SUMMARY

- TABLE 4 MONITORING TOOLS MARKET SIZE AND GROWTH RATE, 2017-2022 (USD MILLION, Y-O-Y%)

- TABLE 5 MONITORING TOOLS MARKET SIZE AND GROWTH RATE, 2023-2028 (USD MILLION, Y-O-Y%)

- FIGURE 7 SOFTWARE SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 8 PROFESSIONAL SERVICES SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 9 CONSULTING SERVICES SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 10 INFRASTRUCTURE MONITORING SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 11 NETWORK MONITORING SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 12 DATABASE MONITORING SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 13 INTRUSION DETECTION AND PREVENTION SYSTEMS (IDPS) SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 14 SYNTHETIC MONITORING SEGMENT TO ACCOUNT FOR LARGEST SIZE IN 2023

- FIGURE 15 IT/ITES SEGMENT TO LEAD MARKET IN 2023

- FIGURE 16 NORTH AMERICA TO LEAD MONITORING TOOLS MARKET IN 2023

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MONITORING TOOLS MARKET

- FIGURE 17 INCREASE IN NUMBER OF AI- AND ML-BASED MONITORING TOOLS AND SOFTWARE TO DRIVE MARKET GROWTH

- 4.2 MONITORING TOOLS MARKET, BY VERTICAL

- FIGURE 18 SECURITY MONITORING TOOLS SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- 4.3 MONITORING TOOLS MARKET, BY REGION

- FIGURE 19 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE BY 2028

- 4.4 MONITORING TOOLS MARKET, BY OFFERING AND VERTICAL

- FIGURE 20 SOFTWARE AND IT/ITES SEGMENTS TO ACCOUNT FOR SIGNIFICANT SHARE BY 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 21 MONITORING TOOLS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for real-time monitoring and analytics

- 5.2.1.2 Increasing emphasis on security and compliance

- 5.2.1.3 Growing adoption of cloud-based monitoring solutions

- 5.2.1.4 Escalating complexity in IT infrastructure and network ecosystem

- 5.2.2 RESTRAINTS

- 5.2.2.1 High implementation and maintenance cost

- 5.2.2.2 Lack of skilled professionals

- 5.2.2.3 Differences in infrastructure, data formats, security protocols, and connectivity requirements

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of digital transformation initiatives across industries

- 5.2.3.2 Emerging markets and untapped potential in emerging economies

- 5.2.3.3 Increasing adoption of IoT devices and need to monitor their performance

- 5.2.4 CHALLENGES

- 5.2.4.1 Managing volume and velocity of data

- 5.2.4.2 Ensuring compatibility and interoperability with diverse IT environment

- 5.2.4.3 Addressing scalability and flexibility requirements of large-scale monitoring deployments

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 MANUFACTURING

- 5.3.1.1 Improving manufacturing app performance in remote factories with NETSCOUT

- 5.3.1.2 Skyworks stays ahead of global demand for connectivity with Dynatrace

- 5.3.1.3 Major manufacturer ensures reliable WAN connectivity and quality user experiences with NETSCOUT

- 5.3.2 ENERGY AND UTILITY

- 5.3.2.1 NETSCOUT smart edge monitoring validates quality performance of new SD-WAN

- 5.3.2.2 Energy utility assures cost-effective design strategy with NETSCOUT propagation modeling

- 5.3.3 AUTOMOTIVE & TRANSPORTATION

- 5.3.3.1 U-Haul gets automatic and intelligent observability with Dynatrace

- 5.3.4 EDUCATION

- 5.3.4.1 Improved and enhanced IT infrastructure with Paessler AG

- 5.3.4.2 Dine selects Netreo to increase quality and reduce downtime and cost

- 5.3.5 HEALTHCARE & LIFESCIENCES

- 5.3.5.1 Major healthcare organization reduces monitoring footprint by 97% through Netreo

- 5.3.6 GOVERNMENT

- 5.3.6.1 State of Minnesota boosts citizen trust and workforce retention with Dynatrace

- 5.3.7 HOSPITALITY

- 5.3.7.1 Mitchells & Butlers creates new digital revenue streams with Dynatrace

- 5.3.1 MANUFACTURING

- 5.4 BRIEF HISTORY OF EVOLUTION OF MONITORING TOOLS

- FIGURE 22 EVOLUTION OF MONITORING TOOLS

- 5.4.1 MONITORING TOOLS: DESKTOP WORLD

- 5.4.2 MONITORING TOOLS: NETWORK MONITORING

- 5.4.3 MONITORING TOOLS: INTERNET ERA

- 5.4.4 MONITORING TOOLS: ONLINE COMMERCE

- 5.4.5 MONITORING TOOLS: SHIFT TO BUSINESS-ORIENTED PRIORITIES

- 5.4.6 MONITORING TOOLS: CLOUD

- 5.4.7 MONITORING TOOLS: DEALING WITH DATA

- 5.5 ECOSYSTEM ANALYSIS

- FIGURE 23 ECOSYSTEM ANALYSIS

- TABLE 6 MONITORING TOOLS MARKET: SOLUTION PROVIDERS

- TABLE 7 MONITORING TOOLS MARKET: SERVICE PROVIDERS

- TABLE 8 MONITORING TOOLS MARKET: TECHNOLOGY PROVIDERS

- TABLE 9 MONITORING TOOLS MARKET: INTEGRATORS

- TABLE 10 MONITORING TOOLS MARKET: REGULATORY BODIES

- TABLE 11 MONITORING TOOLS MARKET: END USERS

- 5.6 VALUE CHAIN ANALYSIS

- FIGURE 24 VALUE CHAIN ANALYSIS

- 5.6.1 RESEARCH & DEVELOPMENT

- 5.6.2 SOFTWARE DEVELOPMENT

- 5.6.3 SOLUTION PROVIDERS

- 5.6.4 SYSTEM INTEGRATION

- 5.6.5 DISTRIBUTORS AND SUPPLIERS

- 5.6.6 END USERS

- 5.7 PRICING MODEL ANALYSIS

- TABLE 12 MONITORING TOOLS MARKET: PRICING LEVELS

- 5.8 PATENT ANALYSIS

- 5.8.1 METHODOLOGY

- 5.8.2 DOCUMENT TYPE

- TABLE 13 PATENTS FILED, 2013-2023

- 5.8.3 INNOVATION AND PATENT APPLICATIONS

- FIGURE 25 TOTAL NUMBER OF PATENTS GRANTED, 2013-2023

- 5.8.3.1 Top applicants

- FIGURE 26 TOP TEN COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2013-2023

- FIGURE 27 REGIONAL ANALYSIS OF PATENTS GRANTED, 2013-2023

- TABLE 14 TOP 20 PATENT OWNERS, 2013-2023

- TABLE 15 LIST OF PATENTS ASSOCIATED WITH MARKET, 2021-2023

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 RELATED TECHNOLOGIES

- 5.9.1.1 Artificial Intelligence (AI)

- 5.9.1.2 Machine learning (ML)

- 5.9.1.3 Cloud Computing

- 5.9.1.4 Big Data Analytics

- 5.9.1.5 Edge Computing

- 5.9.1.6 Internet of Things (IoT)

- 5.9.1.7 Containers and Microservices

- 5.9.1.8 Automation and Orchestration

- 5.9.1.9 Chatbots and Virtual Assistance

- 5.9.1 RELATED TECHNOLOGIES

- 5.10 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 28 PORTER'S FIVE FORCES ANALYSIS

- TABLE 16 PORTER'S FIVE FORCES ANALYSIS

- 5.10.1 THREAT OF NEW ENTRANTS

- 5.10.2 THREAT OF SUBSTITUTES

- 5.10.3 BARGAINING POWER OF BUYERS

- 5.10.4 BARGAINING POWER OF SUPPLIERS

- 5.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.11 KEY CONFERENCES & EVENTS, 2023-2024

- TABLE 17 DETAILED LIST OF CONFERENCES & EVENTS, 2023-2024

- 5.12 BUSINESS MODELS OF MONITORING TOOLS

- 5.12.1 SUBSCRIPTION MODEL

- 5.12.2 FREEMIUM MODEL

- 5.12.3 PAY-PER-USE MODEL

- 5.12.4 ON-DEMAND MODEL

- 5.12.5 WHITE-LABEL MODEL

- 5.12.6 OEM MODEL

- 5.12.7 FREE TRIAL MODEL

- 5.13 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 18 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS (%)

- 5.13.2 BUYING CRITERIA

- FIGURE 30 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 19 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- 5.14 BEST PRACTICES IN MONITORING TOOLS MARKET

- TABLE 20 BEST PRACTICES IN MONITORING TOOLS MARKETS

- 5.15 DISRUPTIONS IMPACTING BUYERS/CLIENTS IN MONITORING TOOLS MARKET

- FIGURE 31 AUTOMATED MACHINE LEARNING MARKET: DISRUPTIONS IMPACTING BUYERS/CLIENTS

- 5.16 FUTURE DIRECTION OF MONITORING TOOLS MARKET

- TABLE 21 SHORT-TERM ROADMAP, 2023-2025

- TABLE 22 MID-TERM ROADMAP, 2026-2028

- TABLE 23 LONG-TERM ROADMAP, 2029-2030

- 5.17 COMPARISON OF AGENT-BASED AND AGENTLESS MONITORING TOOLS

- TABLE 24 COMPARISON OF AGENT-BASED AND AGENTLESS MONITORING TOOLS

- 5.18 STAGES IN MONITORING TOOLS MARKET

- FIGURE 32 STAGES IN MONITORING TOOLS MARKET

- 5.18.1 SYSTEM CONFIGURATION

- 5.18.1.1 Data Sources

- 5.18.2 MONITORING SYSTEMS

- 5.18.3 DATA COLLECTORS

- 5.18.4 ANALYSIS ENGINES

- 5.18.5 DECISION ENGINES

- 5.19 COMPARISON OF OPEN-SOURCE & CLOSED-SOURCE MONITORING TOOLS, BY TYPE

- TABLE 25 COMPARISON OF OPEN-SOURCE & CLOSED-SOURCE MONITORING TOOLS BY TYPE

- 5.20 PRICING OF OPEN-SOURCE MONITORING TOOLS

- TABLE 26 PRICING OF OPEN-SOURCE MONITORING TOOLS

6 MONITORING TOOLS MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: MONITORING TOOLS MARKET DRIVERS

- FIGURE 33 SOLUTIONS SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 27 MONITORING TOOLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 28 MONITORING TOOLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- 6.2 SOFTWARE

- TABLE 29 SOFTWARE: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 30 SOFTWARE: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.1 SOFTWARE: MONITORING TOOLS MARKET, BY DEPLOYMENT

- FIGURE 34 ON-PREMISES SEGMENT TO ACHIEVE HIGHER GROWTH DURING FORECAST PERIOD

- TABLE 31 MONITORING TOOLS MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 32 MONITORING TOOLS MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- 6.2.1.1 On-premises

- 6.2.1.1.1 Need to exercise direct control over geospatial data to boost market

- 6.2.1.1 On-premises

- TABLE 33 ON-PREMISES: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 34 ON-PREMISES: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.2.1.2 Cloud

- 6.2.1.2.1 Demand for scalable deployment model in organizations to drive market growth

- 6.2.1.2 Cloud

- TABLE 35 CLOUD: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 36 CLOUD: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3 SERVICES

- FIGURE 35 DEPLOYMENT & INTEGRATION SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- TABLE 37 MONITORING TOOLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 38 MONITORING TOOLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 39 SERVICES: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 40 SERVICES: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Ability to help businesses effectively adopt and utilize monitoring tools to fuel demand for professional services

- FIGURE 36 DEPLOYMENT & INTEGRATION SEGMENT TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- TABLE 41 MONITORING TOOLS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 42 MONITORING TOOLS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 43 PROFESSIONAL SERVICES: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 44 PROFESSIONAL SERVICES: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1.2 Consulting Services

- TABLE 45 CONSULTING SERVICES: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 46 CONSULTING SERVICES: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1.3 Deployment & Integration

- TABLE 47 DEPLOYMENT & INTEGRATION: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 48 DEPLOYMENT & INTEGRATION: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.1.4 Training, Support, and Maintenance

- TABLE 49 TRAINING, SUPPORT, AND MAINTENANCE: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 50 TRAINING, SUPPORT, AND MAINTENANCE: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Demand for continuous performance optimization, resource utilization, and operational efficiency to drive market growth

- TABLE 51 MANAGED SERVICES: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 52 MANAGED SERVICES: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

7 MONITORING TOOLS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.1.1 TYPE: MONITORING TOOLS MARKET DRIVERS

- FIGURE 37 APPLICATION PERFORMANCE MONITORING SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- TABLE 53 MONITORING TOOLS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 54 MONITORING TOOLS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 7.2 INFRASTRUCTURE MONITORING TOOLS

- 7.2.1 SCALABILITY AND ADAPTABILITY SUITED FOR MODERN IT ENVIRONMENTS TO DRIVE MARKET GROWTH

- TABLE 55 INFRASTRUCTURE MONITORING TOOLS: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 56 INFRASTRUCTURE MONITORING TOOLS: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.3 APPLICATION PERFORMANCE MONITORING TOOLS

- 7.3.1 NEED TO ENHANCE USER EXPERIENCE BY CAPTURING DATA TO DRIVE MARKET GROWTH

- TABLE 57 APPLICATION PERFORMANCE MONITORING TOOLS: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 58 APPLICATION PERFORMANCE MONITORING TOOLS: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.4 SECURITY MONITORING TOOLS

- 7.4.1 NEED TO MAINTAIN ROBUST SECURITY INFRASTRUCTURE TO FUEL MARKET

- TABLE 59 SECURITY MONITORING TOOLS: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 60 SECURITY MONITORING TOOLS: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 7.5 END-USER EXPERIENCE MONITORING TOOLS

- 7.5.1 DEMAND FOR END-USER EXPERIENCE MONITORING TOOLS TO RISE

- TABLE 61 END-USER EXPERIENCE MONITORING TOOLS: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 62 END-USER EXPERIENCE MONITORING TOOLS: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

8 MONITORING TOOLS MARKET, BY INFRASTRUCTURE MONITORING

- 8.1 INTRODUCTION

- 8.1.1 INFRASTRUCTURE MONITORING: MONITORING TOOLS MARKET DRIVERS

- FIGURE 38 NETWORK MONITORING TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 63 MONITORING TOOLS MARKET, BY INFRASTRUCTURE MONITORING, 2017-2022 (USD MILLION)

- TABLE 64 MONITORING TOOLS MARKET, BY INFRASTRUCTURE MONITORING, 2023-2028 (USD MILLION)

- TABLE 65 INFRASTRUCTURE MONITORING: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 66 INFRASTRUCTURE MONITORING: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2 NETWORK MONITORING

- 8.2.1 IMPLEMENTING NETWORK MONITORING TO ENABLE ORGANIZATIONS MANAGE NETWORKS, ENSURE OPTIMAL PERFORMANCE, AND MAINTAIN SERVICE AVAILABILITY

- TABLE 67 NETWORK MONITORING: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 68 NETWORK MONITORING: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.2.2 NETWORK TRAFFIC MONITORING

- 8.2.3 NETWORK BANDWIDTH MONITORING

- 8.2.4 NETWORK SECURITY MONITORING

- 8.2.5 NETWORK DEVICE MONITORING

- 8.2.6 OTHERS

- 8.3 STORAGE MONITORING

- 8.3.1 STORAGE MONITORING TO ENHANCE RESOURCE EFFICIENCY AND OPTIMIZE END-USER EXPERIENCE

- TABLE 69 STORAGE MONITORING: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 70 STORAGE MONITORING: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.3.2 STORAGE CAPACITY MONITORING

- 8.3.3 STORAGE UTILIZATION MONITORING

- 8.3.4 DISK PERFORMANCE MONITORING

- 8.3.5 RAID HEALTH MONITORING

- 8.3.6 OTHERS

- 8.4 SERVER MONITORING

- 8.4.1 GROWING DEMAND TO IDENTIFY POTENTIAL BOTTLENECKS AFFECTING PERFORMANCE IN SERVER MONITORING TO DRIVE MARKET

- TABLE 71 SERVER MONITORING: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 72 SERVER MONITORING: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.4.2 CPU USAGE MONITORING

- 8.4.3 MEMORY USAGE MONITORING

- 8.4.4 DISK SPACE MONITORING

- 8.4.5 OTHERS

- 8.5 CLOUD INFRASTRUCTURE MONITORING

- 8.5.1 PROVIDING REAL-TIME INSIGHTS INTO AVAILABILITY AND PERFORMANCE OF CLOUD INFRASTRUCTURE TO BOOST MARKET

- TABLE 73 CLOUD INFRASTRUCTURE MONITORING: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 74 CLOUD INFRASTRUCTURE MONITORING: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 8.5.2 CLOUD RESOURCE AVAILABILITY MONITORING

- 8.5.3 CLOUD RESOURCE UTILIZATION MONITORING

- 8.5.4 CLOUD SERVICE PERFORMANCE MONITORING

- 8.5.5 OTHERS

- 8.6 OTHER INFRASTRUCTURE MONITORING

- TABLE 75 OTHER INFRASTRUCTURE MONITORING: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 76 OTHER INFRASTRUCTURE MONITORING: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

9 MONITORING TOOLS MARKET, BY APPLICATION PERFORMANCE MONITORING

- 9.1 INTRODUCTION

- 9.1.1 APPLICATION PERFORMANCE MONITORING: MONITORING TOOLS MARKET DRIVERS

- FIGURE 39 DATABASE MONITORING TOOLS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 77 MONITORING TOOLS MARKET, BY APPLICATION PERFORMANCE MONITORING, 2017-2022 (USD MILLION)

- TABLE 78 MONITORING TOOLS MARKET, BY APPLICATION PERFORMANCE MONITORING, 2023-2028 (USD MILLION)

- TABLE 79 APPLICATION PERFORMANCE MONITORING: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 80 APPLICATION PERFORMANCE MONITORING: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2 DATABASE MONITORING

- 9.2.1 GROWING NEED FOR DATABASE MONITORING TO ENSURE OPTIMAL PERFORMANCE AND USER EXPERIENCE TO DRIVE MARKET

- TABLE 81 DATABASE MONITORING: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 82 DATABASE MONITORING: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.2.2 QUERY PERFORMANCE ANALYSIS

- 9.2.3 DATABASE RESPONSE TIME MONITORING

- 9.2.4 RESOURCE UTILIZATION TRACKING

- 9.2.5 OTHERS

- 9.3 WEB APPLICATION MONITORING

- 9.3.1 RISING DEMAND FOR REAL-TIME INSIGHTS TO DRIVE MARKET GROWTH

- TABLE 83 WEB APPLICATION MONITORING: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 84 WEB APPLICATION MONITORING: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.3.2 PERFORMANCE MONITORING

- 9.3.3 INTERNAL NETWORK MONITORING

- 9.3.4 SERVICE-LEVEL AGREEMENT (SLA) MONITORING

- 9.3.5 OTHERS

- 9.4 MOBILE APPLICATION MONITORING

- 9.4.1 GROWING DEMAND FOR OPTIMAL PERFORMANCE OF BUSINESSES TO DRIVE MARKET

- TABLE 85 MOBILE APPLICATION MONITORING: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 86 MOBILE APPLICATION MONITORING: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.4.2 APP STORE MONITORING

- 9.4.3 BATTERY MONITORING SYSTEMS

- 9.4.4 DEVICE COMPATIBILITY TESTING

- 9.4.5 PUSH NOTIFICATION MONITORING

- 9.4.6 OTHERS

- 9.5 CODE-LEVEL MONITORING

- 9.5.1 GROWING DEMAND FOR SEAMLESS INTEGRATION OF DIVERSE GEOSPATIAL DATASETS TO DRIVE MARKET

- TABLE 87 CODE-LEVEL MONITORING: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 88 CODE-LEVEL MONITORING: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 9.5.2 DEEP CODE-LEVEL DIAGNOSTICS

- 9.5.3 CODE PROFILING AND ANALYSIS

- 9.5.4 EXCEPTION TRACKING AND ANALYSIS

- 9.5.5 OTHERS

- 9.6 OTHER APPLICATION PERFORMANCE MONITORING

- TABLE 89 OTHER APPLICATION PERFORMANCE MONITORING: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 90 OTHER APPLICATION PERFORMANCE MONITORING: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

10 MONITORING TOOLS MARKET, BY SECURITY MONITORING

- 10.1 INTRODUCTION

- 10.1.1 SECURITY MONITORING: MONITORING TOOLS MARKET DRIVERS

- FIGURE 40 INTRUSION DETECTION & PREVENTION SYSTEMS (IDPS) TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 91 MONITORING TOOLS MARKET, BY SECURITY MONITORING, 2017-2022 (USD MILLION)

- TABLE 92 MONITORING TOOLS MARKET, BY SECURITY MONITORING, 2023-2028 (USD MILLION)

- TABLE 93 SECURITY MONITORING: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 94 SECURITY MONITORING: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2 INTRUSION DETECTION AND PREVENTION SYSTEMS (IDPS)

- 10.2.1 GROWING NEED TO DETECT AND PREVENT UNAUTHORIZED ACCESS TO DRIVE MARKET GROWTH

- TABLE 95 INTRUSION DETECTION AND PREVENTION SYSTEMS (IDPS): MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 96 INTRUSION DETECTION AND PREVENTION SYSTEMS (IDPS): MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.2.2 NETWORK-BASED IDPS

- 10.2.3 HOST-BASED IDPS

- 10.2.4 BEHAVIOR-BASED IDPS

- 10.2.5 SIGNATURE-BASED IDPS

- 10.2.6 OTHERS

- 10.3 LOG MONITORING AND ANALYSIS

- 10.3.1 LOG MONITORING AND ANALYSIS TO DRIVE MARKET BY PROVIDING SECURITY AND OPERATIONAL EFFICIENCY

- TABLE 97 LOG MONITORING AND ANALYSIS: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 98 LOG MONITORING AND ANALYSIS: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.3.2 SECURITY EVENT LOG MONITORING

- 10.3.3 SECURITY INFORMATION AND EVENT MANAGEMENT (SIEM)

- 10.3.4 LOG CORRELATION AND ANALYSIS

- 10.3.5 THREAT INTELLIGENCE INTEGRATION

- 10.3.6 OTHERS

- 10.4 VULNERABILITY ASSESSMENT AND MANAGEMENT

- 10.4.1 GROWING DEMAND FOR VALUABLE INSIGHTS INTO SECURITY POSTURE OF ORGANIZATIONS TO PROPEL MARKET GROWTH

- TABLE 99 VULNERABILITY ASSESSMENT AND MANAGEMENT: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 100 VULNERABILITY ASSESSMENT AND MANAGEMENT: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 10.4.2 VULNERABILITY SCANNING

- 10.4.3 VULNERABILITY PRIORITIZATION

- 10.4.4 PATCH MANAGEMENT

- 10.4.5 VULNERABILITY REMEDIATION TRACKING

- 10.4.6 OTHERS

- 10.5 OTHER SECURITY MONITORING

- TABLE 101 OTHER SECURITY MONITORING: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 102 OTHER SECURITY MONITORING: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

11 MONITORING TOOLS MARKET, BY END-USER EXPERIENCE MONITORING

- 11.1 INTRODUCTION

- 11.1.1 END-USER EXPERIENCE MONITORING: MONITORING TOOLS MARKET DRIVERS

- FIGURE 41 SYNTHETIC MONITORING TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

- TABLE 103 MONITORING TOOLS MARKET, BY END-USER EXPERIENCE MONITORING, 2017-2022 (USD MILLION)

- TABLE 104 MONITORING TOOLS MARKET, BY END-USER EXPERIENCE MONITORING, 2023-2028 (USD MILLION)

- TABLE 105 END-USER EXPERIENCE MONITORING: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 106 END-USER EXPERIENCE MONITORING: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2 SYNTHETIC MONITORING

- 11.2.1 GROWING NEED FOR SYNTHETIC MONITORING FOR IDENTIFICATION AND RESOLUTION OF POTENTIAL ISSUES TO BOOST MARKET GROWTH

- TABLE 107 SYNTHETIC MONITORING: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 108 SYNTHETIC MONITORING: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.2.2 TRANSACTION MONITORING

- 11.2.3 GEO-DISTRIBUTED MONITORING

- 11.2.4 SYNTHETIC USER BEHAVIOR SIMULATION

- 11.2.5 BROWSER COMPATIBILITY TESTING

- 11.2.6 THIRD-PARTY SERVICES MONITORING

- 11.2.7 OTHERS

- 11.3 REAL USER MONITORING

- 11.3.1 USAGE OF REAL USER MONITORING TO GATHER DATA OF DIFFERENT METRICS TO BOOST MARKET

- TABLE 109 REAL USER MONITORING (RUM): MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 110 REAL USER MONITORING (RUM): MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 11.3.2 USER BEHAVIOR TRACKING

- 11.3.3 CONVERSION FUNNEL ANALYSIS

- 11.3.4 USER FLOW VISUALIZATION

- 11.3.5 USER EXPERIENCE METRICS

- 11.3.6 PERFORMANCE METRICS

- 11.3.7 OTHERS

- 11.4 OTHER END-USER EXPERIENCE MONITORING

- TABLE 111 OTHER END-USER EXPERIENCE MONITORING: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 112 OTHER END-USER EXPERIENCE MONITORING: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

12 MONITORING TOOLS MARKET, BY VERTICAL

- 12.1 INTRODUCTION

- 12.1.1 VERTICALS: MONITORING TOOLS MARKET DRIVERS

- FIGURE 42 IT/ITES SEGMENT TO ACHIEVE HIGHEST GROWTH DURING FORECAST PERIOD

- TABLE 113 MONITORING TOOLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 114 MONITORING TOOLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- 12.2 BFSI

- 12.2.1 INCREASING COMPLEXITY OF BANKING AND FINANCIAL PROCESSES IN BFSI TO DRIVE MARKET

- TABLE 115 BFSI: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 116 BFSI: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 117 MONITORING TOOLS MARKET IN BFSI VERTICAL, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 118 MONITORING TOOLS MARKET IN BFSI VERTICAL, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.2.2 FRAUD DETECTION AND PREVENTION

- 12.2.3 ANOMALY DETECTION AND FORECASTING

- 12.2.4 BUDGETING AND EXPENSE TRACKING

- 12.2.5 INCIDENT RESPONSE REMEDIATION

- 12.2.6 RISK ASSESSMENT AND MANAGEMENT

- 12.2.7 OTHER APPLICATIONS

- 12.3 RETAIL & ECOMMERCE

- 12.3.1 NEED TO RESOLVE ISSUES AND REDUCE REVENUE LOSS & DOWNTIME IN EXPANDING RETAIL & ECOMMERCE INDUSTRY TO BOOST MARKET DEMAND

- TABLE 119 RETAIL & ECOMMERCE: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 120 RETAIL & ECOMMERCE: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 121 MONITORING TOOLS MARKET IN RETAIL & ECOMMERCE VERTICAL, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 122 MONITORING TOOLS MARKET IN RETAIL & ECOMMERCE VERTICAL, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.3.2 CUSTOMER SERVICE MONITORING

- 12.3.3 WEBSITE UPTIME MONITORING

- 12.3.4 APPLICATION PERFORMANCE MONITORING

- 12.3.5 TRANSACTION MONITORING

- 12.3.6 ORDER TRACKING AND DELIVERY MONITORING

- 12.3.7 COMPETITOR MONITORING

- 12.3.8 OTHER APPLICATIONS

- 12.4 HEALTHCARE & LIFESCIENCES

- 12.4.1 PROVIDING EFFICIENT PATIENT CARE, OPTIMIZING PROCESSES, AND ENHANCING OVERALL OPERATIONAL EFFECTIVENESS IN HEALTHCARE & LIFE SCIENCES TO BOOST MARKET

- TABLE 123 HEALTHCARE & LIFE SCIENCES: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 124 HEALTHCARE & LIFE SCIENCES: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 125 MONITORING TOOLS MARKET IN HEALTHCARE & LIFE SCIENCES VERTICAL, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 126 MONITORING TOOLS MARKET IN HEALTHCARE & LIFE SCIENCES VERTICAL, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.4.2 ELECTRONIC HEALTH RECORD (EHR) MONITORING

- 12.4.3 PATIENT MONITORING SYSTEMS

- 12.4.4 CLINICAL DECISION SUPPORT SYSTEM (CDSS) MONITORING

- 12.4.5 DRUG DISPENSING SYSTEM MONITORING

- 12.4.6 OTHER APPLICATIONS

- 12.5 IT/ITES

- 12.5.1 GROWING COMPLEXITY OF IT ENVIRONMENT TO DRIVE MARKET

- TABLE 127 IT/ITES: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 128 IT/ITES: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 129 MONITORING TOOLS MARKET IN IT/ITES VERTICAL, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 130 MONITORING TOOLS MARKET IN IT/ITES VERTICAL, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.5.2 SERVER MONITORING

- 12.5.3 IT INFRASTRUCTURE MONITORING

- 12.5.4 DATABASE MONITORING

- 12.5.5 LOG MONITORING AND ANALYSIS

- 12.5.6 BACKUP AND RECOVERY MONITORING

- 12.5.7 OTHER APPLICATIONS

- 12.6 MEDIA & ENTERTAINMENT

- 12.6.1 INDUSTRY'S ACCEPTANCE OF MONITORING TOOLS FOR OPTIMIZING CONTENT DELIVERY AND ENHANCING USER EXPERIENCE TO DRIVE MARKET

- TABLE 131 MEDIA & ENTERTAINMENT: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 132 MEDIA & ENTERTAINMENT: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 133 MONITORING TOOLS MARKET IN MEDIA & ENTERTAINMENT VERTICAL, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 134 MONITORING TOOLS MARKET IN MEDIA & ENTERTAINMENT VERTICAL, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.6.2 REAL-TIME ANALYTICS

- 12.6.3 ASSET AND CONTENT MANAGEMENT

- 12.6.4 RISK AND COMPLIANCE

- 12.6.5 CONTENT MANAGEMENT

- 12.6.6 OTHER APPLICATIONS

- 12.7 MANUFACTURING

- 12.7.1 OPTIMIZING PERFORMANCE, ENHANCING SECURITY, AND LEVERAGING EMERGING TECHNOLOGIES FOR IMPROVED EFFICIENCY AND PRODUCTIVITY TO DRIVE MARKET

- TABLE 135 MANUFACTURING: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 136 MANUFACTURING: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 137 MONITORING TOOLS MARKET IN MANUFACTURING VERTICAL, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 138 MONITORING TOOLS MARKET IN MANUFACTURING VERTICAL, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.7.2 PROCESS CONTROL MONITORING

- 12.7.3 REAL-TIME DATA ANALYTICS

- 12.7.4 SUPPLY CHAIN MANAGEMENT

- 12.7.5 INVENTORY OPTIMIZATION

- 12.7.6 QUALITY CONTROL MONITORING

- 12.7.7 PRODUCTION MONITORING

- 12.7.8 OTHER APPLICATIONS

- 12.8 AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS

- 12.8.1 INCREASING ADOPTION OF AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS TO DRIVE MARKET

- TABLE 139 AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 140 AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 141 MONITORING TOOLS MARKET IN AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS VERTICALS, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 142 MONITORING TOOLS MARKET IN AUTOMOTIVE, TRANSPORTATION, AND LOGISTICS VERTICALS, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.8.2 ROUTE OPTIMIZATION

- 12.8.3 FLEET MONITORING

- 12.8.4 FUEL MONITORING

- 12.8.5 SHIPMENT TRACKING AND DELIVERY MONITORING

- 12.8.6 COMPLIANCE MONITORING

- 12.8.7 OTHER APPLICATIONS

- 12.9 TELECOM

- 12.9.1 LEVERAGING MONITORING TOOLS FOR ENHANCED PERFORMANCE AND SECURITY TO DRIVE MARKET

- TABLE 143 TELECOM: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 144 TELECOM: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- TABLE 145 MONITORING TOOLS MARKET IN TELECOM VERTICAL, BY APPLICATION, 2017-2022 (USD MILLION)

- TABLE 146 MONITORING TOOLS MARKET IN TELECOM VERTICAL, BY APPLICATION, 2023-2028 (USD MILLION)

- 12.9.2 SERVICE QUALITY MONITORING

- 12.9.3 NETWORK CONFIGURATION MONITORING

- 12.9.4 CAPACITY PLANNING

- 12.9.5 NETWORK OUTAGE MONITORING

- 12.9.6 OTHER APPLICATIONS

- 12.10 OTHER VERTICALS

- TABLE 147 OTHER VERTICALS: MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 148 OTHER VERTICALS: MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

13 MONITORING TOOLS MARKET, BY REGION

- 13.1 INTRODUCTION

- FIGURE 43 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- TABLE 149 MONITORING TOOLS MARKET, BY REGION, 2017-2022 (USD MILLION)

- TABLE 150 MONITORING TOOLS MARKET, BY REGION, 2023-2028 (USD MILLION)

- 13.2 NORTH AMERICA

- 13.2.1 NORTH AMERICA: MONITORING TOOLS MARKET DRIVERS

- 13.2.2 NORTH AMERICA: RECESSION IMPACT

- FIGURE 45 NORTH AMERICA: MARKET SNAPSHOT

- TABLE 151 NORTH AMERICA: MONITORING TOOLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 152 NORTH AMERICA: MONITORING TOOLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 153 NORTH AMERICA: MONITORING TOOLS MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 154 NORTH AMERICA: MONITORING TOOLS MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 155 NORTH AMERICA: MONITORING TOOLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 156 NORTH AMERICA: MONITORING TOOLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 157 NORTH AMERICA: MONITORING TOOLS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 158 NORTH AMERICA: MONITORING TOOLS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 159 NORTH AMERICA: MONITORING TOOLS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 160 NORTH AMERICA: MONITORING TOOLS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 161 NORTH AMERICA: MONITORING TOOLS MARKET, BY INFRASTRUCTURE MONITORING, 2017-2022 (USD MILLION)

- TABLE 162 NORTH AMERICA: MONITORING TOOLS MARKET, BY INFRASTRUCTURE MONITORING, 2023-2028 (USD MILLION)

- TABLE 163 NORTH AMERICA: MONITORING TOOLS MARKET, BY APPLICATION PERFORMANCE MONITORING, 2017-2022 (USD MILLION)

- TABLE 164 NORTH AMERICA: MONITORING TOOLS MARKET, BY APPLICATION PERFORMANCE MONITORING, 2023-2028 (USD MILLION)

- TABLE 165 NORTH AMERICA: MONITORING TOOLS MARKET, BY SECURITY MONITORING, 2017-2022 (USD MILLION)

- TABLE 166 NORTH AMERICA: MONITORING TOOLS MARKET, BY SECURITY MONITORING, 2023-2028 (USD MILLION)

- TABLE 167 NORTH AMERICA: MONITORING TOOLS MARKET, BY EXPERIENCE, 2017-2022 (USD MILLION)

- TABLE 168 NORTH AMERICA: MONITORING TOOLS MARKET, BY END-USER EXPERIENCE MONITORING, 2023-2028 (USD MILLION)

- TABLE 169 NORTH AMERICA: MONITORING TOOLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 170 NORTH AMERICA: MONITORING TOOLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 171 NORTH AMERICA: MONITORING TOOLS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 172 NORTH AMERICA: MONITORING TOOLS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 13.2.3 US

- 13.2.3.1 Investment in AI and automation technologies to spur market growth

- TABLE 173 US: MONITORING TOOLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 174 US: MONITORING TOOLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 175 US: MONITORING TOOLS MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 176 US: MONITORING TOOLS MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 177 US: MONITORING TOOLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 178 US: MONITORING TOOLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 179 US: MONITORING TOOLS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 180 US: MONITORING TOOLS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 181 US: MONITORING TOOLS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 182 US: MONITORING TOOLS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 13.2.4 CANADA

- 13.2.4.1 Rising adoption of cloud infrastructures in different realms to drive market

- 13.3 EUROPE

- 13.3.1 EUROPE: MONITORING TOOLS MARKET DRIVERS

- 13.3.2 EUROPE: IMPACT OF RECESSION

- TABLE 183 EUROPE: MONITORING TOOLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 184 EUROPE: MONITORING TOOLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 185 EUROPE: MONITORING TOOLS MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 186 EUROPE: MONITORING TOOLS MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 187 EUROPE: MONITORING TOOLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 188 EUROPE: MONITORING TOOLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 189 EUROPE: MONITORING TOOLS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 190 EUROPE: MONITORING TOOLS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 191 EUROPE: MONITORING TOOLS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 192 EUROPE: MONITORING TOOLS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 193 EUROPE: MONITORING TOOLS MARKET, BY INFRASTRUCTURE MONITORING, 2017-2022 (USD MILLION)

- TABLE 194 EUROPE: MONITORING TOOLS MARKET, BY INFRASTRUCTURE MONITORING, 2023-2028 (USD MILLION)

- TABLE 195 EUROPE: MONITORING TOOLS MARKET, BY APPLICATION PERFORMANCE MONITORING, 2017-2022 (USD MILLION)

- TABLE 196 EUROPE: MONITORING TOOLS MARKET, BY APPLICATION PERFORMANCE MONITORING, 2023-2028 (USD MILLION)

- TABLE 197 EUROPE: MONITORING TOOLS MARKET, BY SECURITY MONITORING, 2017-2022 (USD MILLION)

- TABLE 198 EUROPE: MONITORING TOOLS MARKET, BY SECURITY MONITORING, 2023-2028 (USD MILLION)

- TABLE 199 EUROPE: MONITORING TOOLS MARKET, BY EXPERIENCE, 2017-2022 (USD MILLION)

- TABLE 200 EUROPE: MONITORING TOOLS MARKET, BY END-USER EXPERIENCE MONITORING, 2023-2028 (USD MILLION)

- TABLE 201 EUROPE: MONITORING TOOLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 202 EUROPE: MONITORING TOOLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 203 EUROPE: MONITORING TOOLS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 204 EUROPE: MONITORING TOOLS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 13.3.3 UK

- 13.3.3.1 Government support to strengthen cybersecurity, promote digital transformation, and foster innovation to drive market growth

- TABLE 205 UK: MONITORING TOOLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 206 UK: MONITORING TOOLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 207 UK: MONITORING TOOLS MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 208 UK: MONITORING TOOLS MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 209 UK: MONITORING TOOLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 210 UK: MONITORING TOOLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 211 UK: MONITORING TOOLS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 212 UK: MONITORING TOOLS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 213 UK: MONITORING TOOLS SOLUTIONS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 214 UK: MONITORING TOOLS SOLUTIONS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 13.3.4 GERMANY

- 13.3.4.1 Rising focus on IT efficiency and security to drive market growth

- 13.3.5 FRANCE

- 13.3.5.1 Strong position of France in transportation and construction sectors to drive market

- 13.3.6 ITALY

- 13.3.6.1 Evolution of advanced technologies and incentives to promote market growth

- 13.3.7 SPAIN

- 13.3.7.1 Rising technology advancements to drive market

- 13.3.8 BENELUX

- 13.3.8.1 Growing adoption of monitoring tools to drive market

- 13.3.9 NORDIC COUNTRIES

- 13.3.9.1 Proactive stance toward harnessing technology to drive market growth

- 13.3.10 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 ASIA PACIFIC: MONITORING TOOLS MARKET DRIVERS

- 13.4.2 ASIA PACIFIC: IMPACT OF RECESSION

- FIGURE 46 ASIA PACIFIC: MARKET SNAPSHOT

- TABLE 215 ASIA PACIFIC: MONITORING TOOLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 216 ASIA PACIFIC: MONITORING TOOLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 217 ASIA PACIFIC: MONITORING TOOLS MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 218 ASIA PACIFIC: MONITORING TOOLS MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 219 ASIA PACIFIC: MONITORING TOOLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 220 ASIA PACIFIC: MONITORING TOOLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 221 ASIA PACIFIC: MONITORING TOOLS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 222 ASIA PACIFIC: MONITORING TOOLS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 223 ASIA PACIFIC: MONITORING TOOLS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 224 ASIA PACIFIC: MONITORING TOOLS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 225 ASIA PACIFIC: MONITORING TOOLS MARKET, BY INFRASTRUCTURE MONITORING, 2017-2022 (USD MILLION)

- TABLE 226 ASIA PACIFIC: MONITORING TOOLS MARKET, BY INFRASTRUCTURE MONITORING, 2023-2028 (USD MILLION)

- TABLE 227 ASIA PACIFIC: MONITORING TOOLS MARKET, BY APPLICATION PERFORMANCE MONITORING, 2017-2022 (USD MILLION)

- TABLE 228 ASIA PACIFIC: MONITORING TOOLS MARKET, BY APPLICATION PERFORMANCE MONITORING, 2023-2028 (USD MILLION)

- TABLE 229 ASIA PACIFIC: MONITORING TOOLS MARKET, BY SECURITY MONITORING, 2017-2022 (USD MILLION)

- TABLE 230 ASIA PACIFIC: MONITORING TOOLS MARKET, BY SECURITY MONITORING, 2023-2028 (USD MILLION)

- TABLE 231 ASIA PACIFIC: MONITORING TOOLS MARKET, BY EXPERIENCE, 2017-2022 (USD MILLION)

- TABLE 232 ASIA PACIFIC: MONITORING TOOLS MARKET, BY END-USER EXPERIENCE MONITORING, 2023-2028 (USD MILLION)

- TABLE 233 ASIA PACIFIC: MONITORING TOOLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 234 ASIA PACIFIC: MONITORING TOOLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 235 ASIA PACIFIC: MONITORING TOOLS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 236 ASIA PACIFIC: MONITORING TOOLS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 13.4.3 CHINA

- 13.4.3.1 China to witness substantial growth and transformation through digitalization and technological advancements

- TABLE 237 CHINA: MONITORING TOOLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 238 CHINA: MONITORING TOOLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 239 CHINA: MONITORING TOOLS MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 240 CHINA: MONITORING TOOLS MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 241 CHINA: MONITORING TOOLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 242 CHINA: MONITORING TOOLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 243 CHINA: MONITORING TOOLS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 244 CHINA: MONITORING TOOLS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 245 CHINA: MONITORING TOOLS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 246 CHINA: MONITORING TOOLS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- 13.4.4 JAPAN

- 13.4.4.1 Rising demand for data security and compliance to drive market growth

- 13.4.5 INDIA

- 13.4.5.1 Increasing use of IoT devices, big data, and AI-powered applications to drive market

- 13.4.6 ANZ

- 13.4.6.1 Increasing importance of real-time insights to fuel market growth

- 13.4.7 SOUTH KOREA

- 13.4.7.1 Seamless integration of monitoring data in cloud-based solutions to drive market

- 13.4.8 ASEAN

- 13.4.8.1 Increasing shift towards cloud-based infrastructure to fuel market growth

- 13.4.9 REST OF ASIA PACIFIC

- 13.5 MIDDLE EAST & AFRICA

- 13.5.1 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET DRIVERS

- 13.5.2 MIDDLE EAST & AFRICA: IMPACT OF RECESSION

- TABLE 247 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 248 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 249 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 250 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 251 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 252 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 253 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 254 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 255 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 256 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 257 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY INFRASTRUCTURE MONITORING, 2017-2022 (USD MILLION)

- TABLE 258 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY INFRASTRUCTURE MONITORING, 2023-2028 (USD MILLION)

- TABLE 259 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY APPLICATION PERFORMANCE MONITORING, 2017-2022 (USD MILLION)

- TABLE 260 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY APPLICATION PERFORMANCE MONITORING, 2023-2028 (USD MILLION)

- TABLE 261 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY SECURITY MONITORING, 2017-2022 (USD MILLION)

- TABLE 262 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY SECURITY MONITORING, 2023-2028 (USD MILLION)

- TABLE 263 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY EXPERIENCE, 2017-2022 (USD MILLION)

- TABLE 264 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY END-USER EXPERIENCE MONITORING, 2023-2028 (USD MILLION)

- TABLE 265 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 266 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 267 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 268 MIDDLE EAST & AFRICA: MONITORING TOOLS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 13.5.3 KINGDOM OF SAUDI ARABIA

- 13.5.3.1 Active investment in IT and infrastructure to drive market

- 13.5.4 UAE

- 13.5.4.1 Adopting innovative technologies promoted by government to drive market

- 13.5.5 ISRAEL

- 13.5.5.1 Government support for technological innovations to drive market

- 13.5.6 TURKEY

- 13.5.6.1 Increasing adoption of cloud services to drive market growth

- 13.5.7 QATAR

- 13.5.7.1 Strong emphasis on technological advancements to drive market

- 13.5.8 SOUTH AFRICA

- 13.5.8.1 Growing adoption of cloud services to manage and secure cloud-based infrastructures and applications to propel market

- 13.5.9 REST OF MIDDLE EAST AND AFRICA

- 13.6 LATIN AMERICA

- 13.6.1 LATIN AMERICA: MONITORING TOOLS MARKET DRIVERS

- 13.6.2 LATIN AMERICA: IMPACT OF RECESSION

- TABLE 269 LATIN AMERICA: MONITORING TOOLS MARKET, BY OFFERING, 2017-2022 (USD MILLION)

- TABLE 270 LATIN AMERICA: MONITORING TOOLS MARKET, BY OFFERING, 2023-2028 (USD MILLION)

- TABLE 271 LATIN AMERICA: MONITORING TOOLS MARKET, BY DEPLOYMENT, 2017-2022 (USD MILLION)

- TABLE 272 LATIN AMERICA: MONITORING TOOLS MARKET, BY DEPLOYMENT, 2023-2028 (USD MILLION)

- TABLE 273 LATIN AMERICA: MONITORING TOOLS MARKET, BY SERVICE, 2017-2022 (USD MILLION)

- TABLE 274 LATIN AMERICA: MONITORING TOOLS MARKET, BY SERVICE, 2023-2028 (USD MILLION)

- TABLE 275 LATIN AMERICA: MONITORING TOOLS MARKET, BY PROFESSIONAL SERVICE, 2017-2022 (USD MILLION)

- TABLE 276 LATIN AMERICA: MONITORING TOOLS MARKET, BY PROFESSIONAL SERVICE, 2023-2028 (USD MILLION)

- TABLE 277 LATIN AMERICA: MONITORING TOOLS MARKET, BY TYPE, 2017-2022 (USD MILLION)

- TABLE 278 LATIN AMERICA: MONITORING TOOLS MARKET, BY TYPE, 2023-2028 (USD MILLION)

- TABLE 279 LATIN AMERICA: MONITORING TOOLS MARKET, BY INFRASTRUCTURE MONITORING, 2017-2022 (USD MILLION)

- TABLE 280 LATIN AMERICA: MONITORING TOOLS MARKET, BY INFRASTRUCTURE MONITORING, 2023-2028 (USD MILLION)

- TABLE 281 LATIN AMERICA: MONITORING TOOLS MARKET, BY APPLICATION PERFORMANCE MONITORING, 2017-2022 (USD MILLION)

- TABLE 282 LATIN AMERICA: MONITORING TOOLS MARKET, BY APPLICATION PERFORMANCE MONITORING, 2023-2028 (USD MILLION)

- TABLE 283 LATIN AMERICA: MONITORING TOOLS MARKET, BY SECURITY MONITORING, 2017-2022 (USD MILLION)

- TABLE 284 LATIN AMERICA: MONITORING TOOLS MARKET, BY SECURITY MONITORING, 2023-2028 (USD MILLION)

- TABLE 285 LATIN AMERICA: MONITORING TOOLS MARKET, BY EXPERIENCE, 2017-2022 (USD MILLION)

- TABLE 286 LATIN AMERICA: MONITORING TOOLS MARKET, BY END-USER EXPERIENCE MONITORING, 2023-2028 (USD MILLION)

- TABLE 287 LATIN AMERICA: MONITORING TOOLS MARKET, BY VERTICAL, 2017-2022 (USD MILLION)

- TABLE 288 LATIN AMERICA: MONITORING TOOLS MARKET, BY VERTICAL, 2023-2028 (USD MILLION)

- TABLE 289 LATIN AMERICA: MONITORING TOOLS MARKET, BY COUNTRY, 2017-2022 (USD MILLION)

- TABLE 290 LATIN AMERICA: MONITORING TOOLS MARKET, BY COUNTRY, 2023-2028 (USD MILLION)

- 13.6.3 BRAZIL

- 13.6.3.1 Government incentives and support to encourage adoption of technology solutions to drive market

- 13.6.4 MEXICO

- 13.6.4.1 Rapid adoption of monitoring tools for security-related concerns to drive market

- 13.6.5 ARGENTINA

- 13.6.5.1 Growing use of tools to analyze data in various sectors to fuel market growth

- 13.6.6 REST OF LATIN AMERICA

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 291 STRATEGIES ADOPTED BY KEY PLAYERS

- 14.3 REVENUE ANALYSIS

- FIGURE 47 REVENUE ANALYSIS FOR KEY COMPANIES, 2018-2022

- 14.4 MARKET SHARE ANALYSIS

- FIGURE 48 MARKET SHARE ANALYSIS FOR KEY PLAYERS, 2022

- TABLE 292 MONITORING TOOLS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 14.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERS

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- FIGURE 49 EVALUATION QUADRANT MATRIX FOR KEY PLAYERS, 2023

- 14.6 COMPANY EVALUATION MATRIX FOR SMES/STARTUPS

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- FIGURE 50 EVALUATION QUADRANT MATRIX FOR SMES/STARTUPS, 2023

- 14.7 COMPETITIVE BENCHMARKING

- TABLE 293 COMPETITIVE BENCHMARKING FOR KEY PLAYERS, 2023

- TABLE 294 DETAILED LIST OF KEY SMES/STARTUPS

- TABLE 295 COMPETITIVE BENCHMARKING OF SMES/STARTUPS, 2023

- 14.8 MONITORING TOOLS: PRODUCT LANDSCAPE

- 14.8.1 COMPARATIVE ANALYSIS OF MONITORING TOOL PRODUCTS

- TABLE 296 COMPARATIVE ANALYSIS OF MONITORING TOOL PRODUCTS

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES

- TABLE 297 MONITORING TOOLS MARKET: PRODUCT LAUNCHES, 2020-2023

- 14.9.2 DEALS

- TABLE 298 MONITORING TOOLS MARKET: DEALS, 2020-2023

- 14.9.3 OTHERS

- TABLE 299 MONITORING TOOLS MARKET: OTHERS, 2020-2022

- 14.10 VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- FIGURE 51 VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 14.11 YTD PRICE TOTAL RETURN AND STOCK BETA OF KEY VENDORS

- FIGURE 52 YTD PRICE TOTAL RETURN AND STOCK BETA OF KEY VENDORS

15 COMPANY PROFILES

- 15.1 INTRODUCTION

- (Business overview, Products/Solutions/Services offered, Recent developments & MnM View)**

- 15.2 KEY PLAYERS

- 15.2.1 MICROSOFT

- TABLE 300 MICROSOFT: BUSINESS OVERVIEW

- FIGURE 53 MICROSOFT: COMPANY SNAPSHOT

- TABLE 301 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 302 MICROSOFT: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 303 MICROSOFT: DEALS

- 15.2.2 GOOGLE

- TABLE 304 GOOGLE: BUSINESS OVERVIEW

- FIGURE 54 GOOGLE: COMPANY SNAPSHOT

- TABLE 305 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 306 GOOGLE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 307 GOOGLE: DEALS

- 15.2.3 AWS

- TABLE 308 AWS: BUSINESS OVERVIEW

- FIGURE 55 AWS: COMPANY SNAPSHOT

- TABLE 309 AWS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 310 AWS: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 311 AWS: DEALS

- 15.2.4 IBM

- TABLE 312 IBM: BUSINESS OVERVIEW

- FIGURE 56 IBM: COMPANY SNAPSHOT

- TABLE 313 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 314 IBM: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 315 IBM: DEALS

- 15.2.5 CISCO

- TABLE 316 CISCO: BUSINESS OVERVIEW

- FIGURE 57 CISCO: COMPANY SNAPSHOT

- TABLE 317 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 318 CISCO: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 319 CISCO: DEALS

- 15.2.6 DYNATRACE

- TABLE 320 DYNATRACE: BUSINESS OVERVIEW

- FIGURE 58 DYNATRACE: COMPANY SNAPSHOT

- TABLE 321 DYNATRACE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 322 DYNATRACE: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 323 DYNATRACE: DEALS

- 15.2.7 SPLUNK

- TABLE 324 SPLUNK: BUSINESS OVERVIEW

- FIGURE 59 SPLUNK: COMPANY SNAPSHOT

- TABLE 325 SPLUNK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 326 SPLUNK: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 327 SPLUNK: DEALS

- 15.2.8 SOLARWINDS

- TABLE 328 SOLARWINDS: BUSINESS OVERVIEW

- FIGURE 60 SOLARWINDS: COMPANY SNAPSHOT

- TABLE 329 SOLARWINDS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 330 SOLARWINDS: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 331 SOLARWINDS: DEALS

- 15.2.9 NETSCOUT

- TABLE 332 NETSCOUT: BUSINESS OVERVIEW

- FIGURE 61 NETSCOUT: COMPANY SNAPSHOT

- TABLE 333 NETSCOUT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 334 NETSCOUT: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 335 NETSCOUT: DEALS

- 15.2.10 NEW RELIC

- TABLE 336 NEW RELIC: BUSINESS OVERVIEW

- FIGURE 62 NEW RELIC: COMPANY SNAPSHOT

- TABLE 337 NEW RELIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 338 NEW RELIC: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 339 NEW RELIC: DEALS

- 15.2.11 LOGICMONITOR

- TABLE 340 LOGIC MONITOR: BUSINESS OVERVIEW

- TABLE 341 LOGIC MONITOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 342 LOGIC MONITOR: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 343 LOGIC MONITOR: DEALS

- TABLE 344 LOGIC MONITOR: OTHERS

- 15.2.12 PAESSLER AG

- TABLE 345 PAESSLER AG: BUSINESS OVERVIEW

- TABLE 346 PAESSLER AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 347 PAESSLER AG: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 348 PAESSLER AG: DEALS

- 15.2.13 NETREO

- TABLE 349 NETREO: BUSINESS OVERVIEW

- TABLE 350 NETREO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 351 NETREO: PRODUCT LAUNCHES/ENHANCEMENTS

- TABLE 352 NETREO: DEALS

- 15.2.14 MANAGEENGINE

- TABLE 353 MANAGEENGINE: BUSINESS OVERVIEW

- TABLE 354 MANAGEENGINE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 355 MANAGEENGINE: PRODUCT LAUNCHES

- TABLE 356 MANAGEENGINE: DEALS

- 15.2.15 IDERA

- TABLE 357 IDERA: BUSINESS OVERVIEW

- TABLE 358 IDERA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 359 IDERA: PRODUCT LAUNCHES AND ENHANCEMENTS

- 15.2.16 SEMATEXT

- TABLE 360 SEMATEXT: BUSINESS OVERVIEW

- TABLE 361 SEMATEXT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 362 SEMATEXT: PRODUCT LAUNCHES AND ENHANCEMENTS

- 15.2.17 DATADOG

- 15.2.18 ICINGA

- 15.2.19 NAGIOS

- 15.2.20 ZABBIX

- *Details on Business overview, Products/Solutions/Services offered, Recent developments & MnM View might not be captured in case of unlisted companies.

- 15.3 OTHER PLAYERS

- 15.3.1 SENTRY

- 15.3.2 UPTIMEROBOT

- 15.3.3 ATERA

- 15.3.4 BETTER STACK

- 15.3.5 SUMO LOGIC

- 15.3.6 CHECKMK

- 15.3.7 EXOPRISE

- 15.3.8 ITRS

- 15.3.9 RIVERBED TECHNOLOGY

- 15.3.10 NLYTE SOFTWARE

16 ADJACENT AND RELATED MARKETS

- 16.1 NETWORK MONITORING MARKET-GLOBAL FORECAST TO 2027

- 16.1.1 MARKET DEFINITION

- 16.1.2 MARKET OVERVIEW

- 16.1.3 NETWORK MONITORING MARKET, BY OFFERING

- TABLE 363 NETWORK MONITORING MARKET, BY OFFERING, 2018-2021 (USD MILLION)

- TABLE 364 NETWORK MONITORING MARKET, BY OFFERING, 2022-2027 (USD MILLION)

- TABLE 365 NETWORK MONITORING MARKET, BY EQUIPMENT, 2018-2021 (USD MILLION)

- TABLE 366 NETWORK MONITORING MARKET, BY EQUIPMENT, 2022-2027 (USD MILLION)

- TABLE 367 NETWORK TAP: NETWORK MONITORING MARKET, BY TYPE, 2018-2021 (USD MILLION)

- TABLE 368 NETWORK TAP: NETWORK MONITORING MARKET, BY TYPE, 2022-2027 (USD MILLION)

- 16.1.4 NETWORK MONITORING MARKET, BY BANDWIDTH

- TABLE 369 NETWORK MONITORING MARKET, BY BANDWIDTH, 2018-2021 (USD MILLION)

- TABLE 370 NETWORK MONITORING MARKET, BY BANDWIDTH, 2022-2027 (USD MILLION)

- 16.1.5 NETWORK MONITORING MARKET, BY TECHNOLOGY

- TABLE 371 NETWORK MONITORING MARKET, BY TECHNOLOGY, 2018-2021 (USD MILLION)

- TABLE 372 NETWORK MONITORING MARKET, BY TECHNOLOGY, 2022-2027 (USD MILLION)

- 16.1.6 NETWORK MONITORING MARKET, BY END USER

- TABLE 373 NETWORK MONITORING MARKET, BY END USER, 2018-2021 (USD MILLION)

- TABLE 374 NETWORK MONITORING MARKET, BY END USER, 2022-2027 (USD MILLION)

- 16.1.7 NETWORK MONITORING MARKET, BY REGION

- TABLE 375 NETWORK MONITORING MARKET, BY REGION, 2018-2021 (USD MILLION)

- TABLE 376 NETWORK MONITORING MARKET, BY REGION, 2022-2027 (USD MILLION)

- 16.2 PREDICTIVE ANALYTICS MARKET-GLOBAL FORECAST TO 2026

- 16.2.1 MARKET DEFINITION

- 16.2.2 MARKET OVERVIEW

- TABLE 377 PREDICTIVE ANALYTICS MARKET SIZE AND GROWTH RATE, 2015-2020 (USD MILLION, Y-O-Y%)

- TABLE 378 PREDICTIVE ANALYTICS MARKET SIZE AND GROWTH RATE, 2021-2026 (USD MILLION, Y-O-Y%)

- 16.2.3 PREDICTIVE ANALYTICS MARKET, BY COMPONENT

- TABLE 379 PREDICTIVE ANALYTICS MARKET, BY COMPONENT, 2015-2020 (USD MILLION)

- TABLE 380 PREDICTIVE ANALYTICS MARKET, BY COMPONENT, 2021-2026 (USD MILLION)

- TABLE 381 PREDICTIVE ANALYTICS MARKET, BY SOLUTION, 2015-2020 (USD MILLION)

- TABLE 382 PREDICTIVE ANALYTICS MARKET, BY SOLUTION, 2021-2026 (USD MILLION)

- TABLE 383 PREDICTIVE ANALYTICS MARKET, BY SERVICE, 2015-2020 (USD MILLION)

- TABLE 384 PREDICTIVE ANALYTICS MARKET, BY SERVICE, 2021-2026 (USD MILLION)

- 16.2.4 PREDICTIVE ANALYTICS MARKET, BY DEPLOYMENT MODE

- TABLE 385 PREDICTIVE ANALYTICS MARKET, BY DEPLOYMENT MODE, 2015-2020 (USD MILLION)

- TABLE 386 PREDICTIVE ANALYTICS MARKET SIZE, BY DEPLOYMENT MODE, 2021-2026 (USD MILLION)

- 16.2.5 PREDICTIVE ANALYTICS MARKET, BY ORGANIZATION SIZE

- TABLE 387 PREDICTIVE ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2015-2020 (USD MILLION)

- TABLE 388 PREDICTIVE ANALYTICS MARKET SIZE, BY ORGANIZATION SIZE, 2021-2026 (USD MILLION)

- 16.2.6 PREDICTIVE ANALYTICS MARKET, BY VERTICAL

- TABLE 389 PREDICTIVE ANALYTICS MARKET, BY VERTICAL, 2015-2020 (USD MILLION)

- TABLE 390 PREDICTIVE ANALYTICS MARKET, BY VERTICAL, 2021-2026 (USD MILLION)

- 16.2.7 PREDICTIVE ANALYTICS MARKET, BY REGION

- TABLE 391 PREDICTIVE ANALYTICS MARKET, BY REGION, 2015-2020 (USD MILLION)

- TABLE 392 PREDICTIVE ANALYTICS MARKET, BY REGION, 2021-2026 (USD MILLION)

- 16.3 END-USER EXPERIENCE MONITORING MARKET-GLOBAL FORECAST TO 2023

- 16.3.1 MARKET DEFINITION

- 16.3.2 MARKET OVERVIEW

- 16.3.3 END-USER EXPERIENCE MONITORING MARKET, BY COMPONENT

- TABLE 393 END-USER EXPERIENCE MONITORING MARKET, BY COMPONENT, 2016-2023 (USD MILLION)

- TABLE 394 END-USER EXPERIENCE MONITORING MARKET, BY PRODUCT, 2016-2023 (USD MILLION)

- TABLE 395 END-USER EXPERIENCE MONITORING MARKET, BY SERVICE, 2016-2023 (USD MILLION)

- 16.3.4 END-USER EXPERIENCE MONITORING MARKET, BY ACCESS TYPE

- TABLE 396 END-USER EXPERIENCE MONITORING MARKET, BY ACCESS TYPE, 2016-2023 (USD MILLION)

- 16.3.5 END-USER EXPERIENCE MONITORING MARKET, BY ORGANIZATION SIZE

- TABLE 397 END-USER EXPERIENCE MONITORING MARKET, BY ORGANIZATION SIZE, 2016-2023 (USD MILLION)

- 16.3.6 END-USER EXPERIENCE MONITORING MARKET, BY DEPLOYMENT TYPE

- TABLE 398 END-USER EXPERIENCE MONITORING MARKET, BY DEPLOYMENT TYPE, 2016-2023 (USD MILLION)

- 16.3.7 END-USER EXPERIENCE MONITORING MARKET, BY VERTICAL

- TABLE 399 END-USER EXPERIENCE MONITORING MARKET, BY VERTICAL, 2016-2023 (USD MILLION)

- 16.3.8 END-USER EXPERIENCE MONITORING MARKET, GEOGRAPHIC ANALYSIS

- TABLE 400 END-USER EXPERIENCE MONITORING MARKET, BY REGION, 2016-2023 (USD MILLION)

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS