|

|

市場調査レポート

商品コード

1630475

ビデオ監視におけるAIの世界市場:オファリング別、展開別、機能別、技術別、業界別、地域別 - 2030年までの予測AI in Video Surveillance Market by Offering (AI Camera, Video Management System, Video Analytics), Deployment (Cloud, Edge), Technology (Machine Learning, Deep Learning, GenAI, Computer Vision, Natural Language Processing) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| ビデオ監視におけるAIの世界市場:オファリング別、展開別、機能別、技術別、業界別、地域別 - 2030年までの予測 |

|

出版日: 2024年12月20日

発行: MarketsandMarkets

ページ情報: 英文 286 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

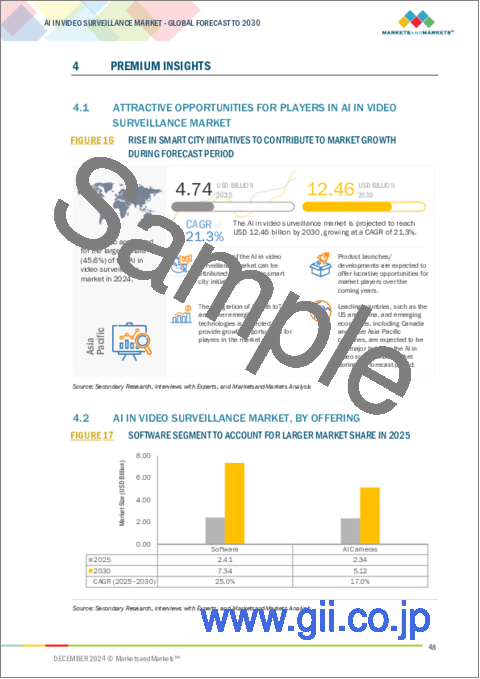

ビデオ監視におけるAIの市場規模は、2024年の39億米ドルから、2030年には124億6,000万米ドルに達すると予測され、2025年から2030年までのCAGRは21.3%になるとみられています。

犯罪率やテロの脅威が拡大し続けるなか、政府や企業も国民を守るために高度な監視機器に巨額の投資を行っています。刑事司法評議会によると、2023年の財産犯罪に関する一般的動向を2019年と比較すると、住宅強盗と窃盗は減少していますが、非住宅強盗は増加、自動車窃盗は105%増加、薬物関連犯罪は27%減少しています。国連薬物犯罪事務所の第4回世界殺人調査によると、2021年の意図的殺人被害者数が最も多い地域はアフリカで17万6,000人、次いで南北アメリカ15万4,000人、アジア10万9,000人、欧州1万7,000人、オセアニア1,000人となっており、2022年には改善が見られます。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2023年 |

| 予測期間 | 2024年~2030年 |

| 検討単位 | 金額(10億米ドル) |

| セグメント別 | オファリング別、展開別、機能別、技術別、業界別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

クラウド分野は、主に中小企業で採用が増加しているクラウドベースのソリューションが牽引しており、その主な理由は、組織が必要とする柔軟性、拡張性、費用対効果の機能を提供するためです。加えて、クラウドベースの展開に対応した高度なセキュリティソリューションの開発スピードは、データプライバシーに関する問題への回答を提供するため、大規模な構内インフラに投資することなくAIを導入しようとする企業を惹きつけています。

ビデオ監視におけるAI市場は、エッジまたはニアエッジデバイスで直接実行可能な洞察によって牽引され、予測期間中に最大の市場シェアを保持します。推論は、集中型データセンターに依存することなく、オブジェクトの検出、顔認識、異常検出のための迅速なビデオストリーム解析を可能にし、待ち時間と帯域幅の利用を削減します。この機能は、公共安全、交通監視、小売分析などのリアルタイム・アプリケーションにとって重要であり、イベントへのタイムリーな対応が業務効率とセキュリティ成果を大幅に改善する可能性があります。

中国政府は、武器検知機能を備えたAIビデオ監視システムを推進しています。この広範な推進は、公共空間における顔認識と監視カメラのためのものです。交通機関、法執行機関、公共サービスなどの分野におけるAI主導の監視の成長は、技術革新と社会の安全に対する国の戦略的目標と一致し、市場成長を促進するもう1つの要因です。

当レポートでは、世界のビデオ監視におけるAI市場について調査し、オファリング別、展開別、機能別、技術別、業界別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- バリューチェーン分析

- エコシステム分析

- 顧客ビジネスに影響を与える動向/混乱

- 技術分析

- 投資と資金調達のシナリオ

- ポーターのファイブフォース分析

- 主な利害関係者と購入基準

- ケーススタディ分析

- 貿易分析

- 特許分析

- 2024年~2025年の主な会議とイベント

- 関税と規制状況

- 価格分析

第6章 AIを活用したビデオ監視システムのユースケース

- イントロダクション

- 銃器検出

- 産業用温度監視

- 異常検出と行動認識

- 顔認識/人物検索

- 物体検出と追跡

- 侵入検知と境界保護

- 煙と火災の検知

- 交通流分析と事故検知

- 誤報フィルタリング

- 駐車監視

- 車両識別とナンバープレート認識

第7章 ビデオ監視におけるAIの応用

- イントロダクション

- セキュリティと公共の安全

- 交通監視と管理

- インテリジェント交通システム

- 小売管理

- 都市計画とスマートシティ

第8章 ビデオ監視におけるAI市場、オファリング別

- イントロダクション

- AIカメラ

- ソフトウェア

第9章 ビデオ監視におけるAI市場、展開別

- イントロダクション

- エッジベース

- クラウドベース

第10章 ビデオ監視におけるAI市場、機能別

- イントロダクション

- トレーニング

- 推論

第11章 ビデオ監視におけるAI市場、技術別

- イントロダクション

- 機械学習

- 生成AI

- コンピュータービジョン

- 自然言語処理

第12章 ビデオ監視におけるAI市場、業界別

- イントロダクション

- 住宅

- 商業

- 軍事・防衛

- 政府および公共施設

- 工業

- 重要インフラ

第13章 ビデオ監視におけるAI市場、地域別

- イントロダクション

- 北米

- 北米のマクロ経済見通し

- 米国

- カナダ

- メキシコ

- 欧州

- 欧州のマクロ経済見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他

- アジア太平洋

- アジア太平洋のマクロ経済見通し

- 中国

- 日本

- 韓国

- インド

- その他

- その他の地域

- その他の地域のマクロ経済見通し

- 中東

- アフリカ

- 南米

第14章 競合情勢

- 概要

- 主要参入企業の戦略/強み、2020年~2024年

- 収益分析、2019年~2023年

- 市場シェア分析、2023年

- 企業評価と財務指標、2024年

- ブランド比較

- 企業評価マトリックス:主要参入企業、2023年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- 競合シナリオ

第15章 企業プロファイル

- 主要参入企業

- HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.

- DAHUA TECHNOLOGY CO., LTD.

- AXIS COMMUNICATIONS AB

- MOTOROLA SOLUTIONS, INC.(AVIGILON CORPORATION)

- HANWHA VISION CO., LTD.

- MILESTONE SYSTEMS A/S

- SENSETIME

- IRISITY

- NEC CORPORATION

- GENETEC INC.

- BRIEFCAM

- MOBOTIX AG

- TELEDYNE TECHNOLOGIES INCORPORATED

- HONEYWELL INTERNATIONAL INC.

- VIVOTEK INC.

- その他の企業

- VERKADA INC.

- MORPHEAN SA

- BOSCH SICHERHEITSSYSTEME GMBH

- IPRO

- CAMCLOUD

- IVIDEON

- HAKIMO, INC.

- PROMISEQ GMBH

- RHOMBUS SYSTEMS

- UMBO COMPUTER VISION INC.

第16章 付録

List of Tables

- TABLE 1 AI IN VIDEO SURVEILLANCE MARKET: RISK ANALYSIS

- TABLE 2 ROLE OF COMPANIES IN AI IN VIDEO SURVEILLANCE ECOSYSTEM

- TABLE 3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 5 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 6 IMPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 7 EXPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023 (USD THOUSAND)

- TABLE 8 LIST OF MAJOR PATENTS, 2023

- TABLE 9 LIST OF KEY CONFERENCES AND EVENTS, 2024-2025

- TABLE 10 MFN TARIFF FOR HS CODE 852580-COMPLIANT PRODUCTS EXPORTED BY US, 2022

- TABLE 11 MFN TARIFF FOR HS CODE 852580-COMPLIANT PRODUCTS EXPORTED BY CHINA, 2022

- TABLE 12 MFN TARIFF FOR HS CODE 852580-COMPLIANT PRODUCTS EXPORTED BY JAPAN, 2022

- TABLE 13 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 INDICATIVE PRICING OF AI CAMERA OFFERINGS, BY KEY PLAYER, 2024 (USD)

- TABLE 18 AVERAGE SELLING PRICE TREND OF AI CAMERAS, BY REGION, 2020-2023 (USD)

- TABLE 19 AI IN VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD BILLION)

- TABLE 20 AI IN VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2030 (USD BILLION)

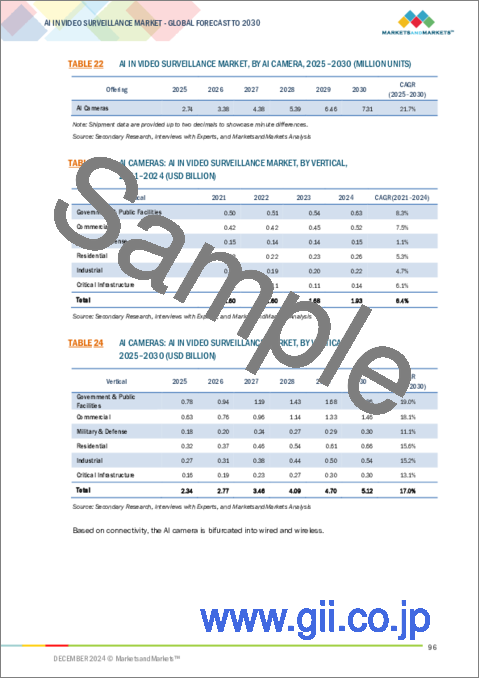

- TABLE 21 AI IN VIDEO SURVEILLANCE MARKET, BY AI CAMERA, 2021-2024 (MILLION UNITS)

- TABLE 22 AI IN VIDEO SURVEILLANCE MARKET, BY AI CAMERA, 2025-2030 (MILLION UNITS)

- TABLE 23 AI CAMERAS: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD BILLION)

- TABLE 24 AI CAMERAS: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD BILLION)

- TABLE 25 AI CAMERAS: AI IN VIDEO SURVEILLANCE MARKET, BY CONNECTIVITY, 2021-2024 (USD BILLION)

- TABLE 26 AI CAMERAS: AI IN VIDEO SURVEILLANCE MARKET, BY CONNECTIVITY, 2025-2030 (USD BILLION)

- TABLE 27 SOFTWARE: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD BILLION)

- TABLE 28 SOFTWARE: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD BILLION)

- TABLE 29 SOFTWARE: AI IN VIDEO SURVEILLANCE MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 30 SOFTWARE: AI IN VIDEO SURVEILLANCE MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 31 AI-DRIVEN VIDEO ANALYTICS: AI IN VIDEO SURVEILLANCE MARKET, BY TYPE, 2021-2024 (USD BILLION)

- TABLE 32 AI-DRIVEN VIDEO ANALYTICS: AI IN VIDEO SURVEILLANCE MARKET, BY TYPE, 2025-2030 (USD BILLION)

- TABLE 33 AI IN VIDEO SURVEILLANCE MARKET, BY DEPLOYMENT, 2021-2024 (USD BILLION)

- TABLE 34 AI IN VIDEO SURVEILLANCE MARKET, BY DEPLOYMENT, 2025-2030 (USD BILLION)

- TABLE 35 EDGE-BASED: AI IN VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 36 EDGE-BASED: AI IN VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 37 CLOUD-BASED: AI IN VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 38 CLOUD-BASED: AI IN VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 39 AI IN VIDEO SURVEILLANCE MARKET, BY FUNCTION, 2021-2024 (USD BILLION)

- TABLE 40 AI IN VIDEO SURVEILLANCE MARKET, BY FUNCTION, 2025-2030 (USD BILLION)

- TABLE 41 AI IN VIDEO SURVEILLANCE MARKET, BY TECHNOLOGY, 2021-2024 (USD BILLION)

- TABLE 42 AI IN VIDEO SURVEILLANCE MARKET, BY TECHNOLOGY, 2025-2030 (USD BILLION)

- TABLE 43 AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD BILLION)

- TABLE 44 AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD BILLION)

- TABLE 45 RESIDENTIAL: AI IN VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD BILLION)

- TABLE 46 RESIDENTIAL: AI IN VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2030 (USD BILLION)

- TABLE 47 RESIDENTIAL: AI IN VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 48 RESIDENTIAL: AI IN VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 RESIDENTIAL: AI IN VIDEO SURVEILLANCE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 50 RESIDENTIAL: AI IN VIDEO SURVEILLANCE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 51 RESIDENTIAL: AI IN VIDEO SURVEILLANCE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 52 RESIDENTIAL: AI IN VIDEO SURVEILLANCE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 53 RESIDENTIAL: AI IN VIDEO SURVEILLANCE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 54 RESIDENTIAL: AI IN VIDEO SURVEILLANCE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 55 RESIDENTIAL: AI IN VIDEO SURVEILLANCE MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 56 RESIDENTIAL: AI IN VIDEO SURVEILLANCE MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 COMMERCIAL: AI IN VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD BILLION)

- TABLE 58 COMMERCIAL: AI IN VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2030 (USD BILLION)

- TABLE 59 COMMERCIAL: AI IN VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 60 COMMERCIAL: AI IN VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 61 COMMERCIAL: AI IN VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 62 COMMERCIAL: AI IN VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 COMMERCIAL: AI IN VIDEO SURVEILLANCE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 64 COMMERCIAL: AI IN VIDEO SURVEILLANCE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 65 COMMERCIAL: AI IN VIDEO SURVEILLANCE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 66 COMMERCIAL: AI IN VIDEO SURVEILLANCE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 67 COMMERCIAL: AI IN VIDEO SURVEILLANCE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 68 COMMERCIAL: AI IN VIDEO SURVEILLANCE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 69 COMMERCIAL: AI IN VIDEO SURVEILLANCE MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 70 COMMERCIAL: AI IN VIDEO SURVEILLANCE MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 MILITARY & DEFENSE: AI IN VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD BILLION)

- TABLE 72 MILITARY & DEFENSE: AI IN VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2030 (USD BILLION)

- TABLE 73 MILITARY & DEFENSE: AI IN VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 74 MILITARY & DEFENSE: AI IN VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 75 MILITARY & DEFENSE: AI IN VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 76 MILITARY & DEFENSE: AI IN VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 MILITARY & DEFENSE: AI IN VIDEO SURVEILLANCE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 78 MILITARY & DEFENSE: AI IN VIDEO SURVEILLANCE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 79 MILITARY & DEFENSE: AI IN VIDEO SURVEILLANCE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 80 MILITARY & DEFENSE: AI IN VIDEO SURVEILLANCE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 81 MILITARY & DEFENSE: AI IN VIDEO SURVEILLANCE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 82 MILITARY & DEFENSE: AI IN VIDEO SURVEILLANCE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 83 MILITARY & DEFENSE: AI IN VIDEO SURVEILLANCE MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 84 MILITARY & DEFENSE: AI IN VIDEO SURVEILLANCE MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 GOVERNMENT & PUBLIC FACILITIES: AI IN VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD BILLION)

- TABLE 86 GOVERNMENT & PUBLIC FACILITIES: AI IN VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2030 (USD BILLION)

- TABLE 87 GOVERNMENT & PUBLIC FACILITIES: AI IN VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 88 GOVERNMENT & PUBLIC FACILITIES: AI IN VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 89 GOVERNMENT & PUBLIC FACILITIES: AI IN VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 90 GOVERNMENT & PUBLIC FACILITIES: AI IN VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 GOVERNMENT & PUBLIC FACILITIES: AI IN VIDEO SURVEILLANCE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 92 GOVERNMENT & PUBLIC FACILITIES: AI IN VIDEO SURVEILLANCE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 93 GOVERNMENT & PUBLIC FACILITIES: AI IN VIDEO SURVEILLANCE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 94 GOVERNMENT & PUBLIC FACILITIES: AI IN VIDEO SURVEILLANCE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 95 GOVERNMENT & PUBLIC FACILITIES: AI IN VIDEO SURVEILLANCE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 96 GOVERNMENT & PUBLIC FACILITIES: AI IN VIDEO SURVEILLANCE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 GOVERNMENT & PUBLIC FACILITIES: AI IN VIDEO SURVEILLANCE MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 98 GOVERNMENT & PUBLIC FACILITIES: AI IN VIDEO SURVEILLANCE MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 99 INDUSTRIAL: AI IN VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD BILLION)

- TABLE 100 INDUSTRIAL: AI IN VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2030 (USD BILLION)

- TABLE 101 INDUSTRIAL: AI IN VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 102 INDUSTRIAL: AI IN VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 103 INDUSTRIAL: AI IN VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 104 INDUSTRIAL: AI IN VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 105 INDUSTRIAL: AI IN VIDEO SURVEILLANCE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 106 INDUSTRIAL: AI IN VIDEO SURVEILLANCE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 107 INDUSTRIAL: AI IN VIDEO SURVEILLANCE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 108 INDUSTRIAL: AI IN VIDEO SURVEILLANCE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 109 INDUSTRIAL: AI IN VIDEO SURVEILLANCE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 110 INDUSTRIAL: AI IN VIDEO SURVEILLANCE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 111 INDUSTRIAL: AI IN VIDEO SURVEILLANCE MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 112 INDUSTRIAL: AI IN VIDEO SURVEILLANCE MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 113 CRITICAL INFRASTRUCTURE: AI IN VIDEO SURVEILLANCE MARKET, BY OFFERING, 2021-2024 (USD BILLION)

- TABLE 114 CRITICAL INFRASTRUCTURE: AI IN VIDEO SURVEILLANCE MARKET, BY OFFERING, 2025-2030 (USD BILLION)

- TABLE 115 CRITICAL INFRASTRUCTURE: AI IN VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2021-2024 (USD MILLION)

- TABLE 116 CRITICAL INFRASTRUCTURE: AI IN VIDEO SURVEILLANCE MARKET, BY APPLICATION, 2025-2030 (USD MILLION)

- TABLE 117 CRITICAL INFRASTRUCTURE: AI IN VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 118 CRITICAL INFRASTRUCTURE: AI IN VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 119 CRITICAL INFRASTRUCTURE: AI IN VIDEO SURVEILLANCE MARKET IN NORTH AMERICA, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 120 CRITICAL INFRASTRUCTURE: AI IN VIDEO SURVEILLANCE MARKET IN NORTH AMERICA, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 121 CRITICAL INFRASTRUCTURE: AI IN VIDEO SURVEILLANCE MARKET IN EUROPE, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 122 CRITICAL INFRASTRUCTURE: AI IN VIDEO SURVEILLANCE MARKET IN EUROPE, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 123 CRITICAL INFRASTRUCTURE: AI IN VIDEO SURVEILLANCE MARKET IN ASIA PACIFIC, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 124 CRITICAL INFRASTRUCTURE: AI IN VIDEO SURVEILLANCE MARKET IN ASIA PACIFIC, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 125 CRITICAL INFRASTRUCTURE: AI IN VIDEO SURVEILLANCE MARKET IN ROW, BY REGION, 2021-2024 (USD MILLION)

- TABLE 126 CRITICAL INFRASTRUCTURE: AI IN VIDEO SURVEILLANCE MARKET IN ROW, BY REGION, 2025-2030 (USD MILLION)

- TABLE 127 AI IN VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (USD BILLION)

- TABLE 128 AI IN VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2030 (USD BILLION)

- TABLE 129 NORTH AMERICA: AI IN VIDEO SURVEILLANCE MARKET, BY DEPLOYMENT, 2021-2024 (USD BILLION)

- TABLE 130 NORTH AMERICA: AI IN VIDEO SURVEILLANCE MARKET, BY DEPLOYMENT, 2025-2030 (USD BILLION)

- TABLE 131 NORTH AMERICA: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 132 NORTH AMERICA: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 133 NORTH AMERICA: AI IN VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 134 NORTH AMERICA: AI IN VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 135 US: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 136 US: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 137 CANADA: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 138 CANADA: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 139 MEXICO: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 140 MEXICO: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 141 EUROPE: AI IN VIDEO SURVEILLANCE MARKET, BY DEPLOYMENT, 2021-2024 (USD BILLION)

- TABLE 142 EUROPE: AI IN VIDEO SURVEILLANCE MARKET, BY DEPLOYMENT, 2025-2030 (USD BILLION)

- TABLE 143 EUROPE: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 144 EUROPE: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 145 EUROPE: AI IN VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 146 EUROPE: AI IN VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 147 UK: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 148 UK: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 149 GERMANY: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 150 GERMANY: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 151 FRANCE: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 152 FRANCE: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 153 REST OF EUROPE: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 154 REST OF EUROPE: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 155 ASIA PACIFIC: AI IN VIDEO SURVEILLANCE MARKET, BY DEPLOYMENT, 2021-2024 (USD BILLION)

- TABLE 156 ASIA PACIFIC: AI IN VIDEO SURVEILLANCE MARKET, BY DEPLOYMENT, 2025-2030 (USD BILLION)

- TABLE 157 ASIA PACIFIC: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 158 ASIA PACIFIC: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 159 ASIA PACIFIC: AI IN VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 160 ASIA PACIFIC: AI IN VIDEO SURVEILLANCE MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 161 CHINA: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 162 CHINA: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 163 JAPAN: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 164 JAPAN: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 165 SOUTH KOREA: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 166 SOUTH KOREA: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 167 INDIA: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 168 INDIA: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 171 ROW: AI IN VIDEO SURVEILLANCE MARKET, BY DEPLOYMENT, 2021-2024 (USD BILLION)

- TABLE 172 ROW: AI IN VIDEO SURVEILLANCE MARKET, BY DEPLOYMENT, 2025-2030 (USD BILLION)

- TABLE 173 ROW: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 174 ROW: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 175 ROW: AI IN VIDEO SURVEILLANCE MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 176 ROW: AI IN VIDEO SURVEILLANCE MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 177 MIDDLE EAST: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 178 MIDDLE EAST: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 179 AFRICA: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 180 AFRICA: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 181 SOUTH AMERICA: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2021-2024 (USD MILLION)

- TABLE 182 SOUTH AMERICA: AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 183 AI IN VIDEO SURVEILLANCE MARKET: OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2020-NOVEMBER 2024

- TABLE 184 AI IN VIDEO SURVEILLANCE MARKET: DEGREE OF COMPETITION, 2023

- TABLE 185 AI IN VIDEO SURVEILLANCE MARKET: REGION FOOTPRINT

- TABLE 186 AI IN VIDEO SURVEILLANCE MARKET: OFFERING FOOTPRINT

- TABLE 187 AI IN VIDEO SURVEILLANCE MARKET: DEPLOYMENT FOOTPRINT

- TABLE 188 AI IN VIDEO SURVEILLANCE MARKET: FUNCTION FOOTPRINT

- TABLE 189 AI IN VIDEO SURVEILLANCE MARKET: VERTICAL FOOTPRINT

- TABLE 190 AI IN VIDEO SURVEILLANCE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 191 AI IN VIDEO SURVEILLANCE MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 192 AI IN VIDEO SURVEILLANCE MARKET: PRODUCT LAUNCHES/DEVELOPMENTS, JANUARY 2020-NOVEMBER 2024

- TABLE 193 AI IN VIDEO SURVEILLANCE MARKET: DEALS, JANUARY 2020-NOVEMBER 2024

- TABLE 194 AI IN VIDEO SURVEILLANCE MARKET: OTHER DEVELOPMENTS, JANUARY 2020-NOVEMBER 2024

- TABLE 195 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 196 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 197 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 198 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: DEALS

- TABLE 199 DAHUA TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 200 DAHUA TECHNOLOGY CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 DAHUA TECHNOLOGY CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 202 AXIS COMMUNICATIONS AB: COMPANY OVERVIEW

- TABLE 203 AXIS COMMUNICATIONS AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 204 AXIS COMMUNICATIONS AB: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 205 AXIS COMMUNICATIONS AB: DEALS

- TABLE 206 AXIS COMMUNICATIONS AB: OTHER DEVELOPMENTS

- TABLE 207 MOTOROLA SOLUTIONS, INC. (AVIGILON CORPORATION): COMPANY OVERVIEW

- TABLE 208 MOTOROLA SOLUTIONS, INC. (AVIGILON CORPORATION): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 MOTOROLA SOLUTIONS, INC. (AVIGILON CORPORATION): PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 210 MOTOROLA SOLUTIONS, INC. (AVIGILON CORPORATION): DEALS

- TABLE 211 HANWHA VISION CO., LTD.: COMPANY OVERVIEW

- TABLE 212 HANWHA VISION CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 213 HANWHA VISION CO., LTD.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 214 HANWHA VISION CO., LTD.: DEALS

- TABLE 215 MILESTONE SYSTEMS A/S: COMPANY OVERVIEW

- TABLE 216 MILESTONE SYSTEMS A/S: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 217 MILESTONE SYSTEMS A/S: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 218 MILESTONE SYSTEMS A/S: DEALS

- TABLE 219 SENSETIME: COMPANY OVERVIEW

- TABLE 220 SENSETIME: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 221 SENSETIME: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 222 SENSETIME: DEALS

- TABLE 223 IRISITY: COMPANY OVERVIEW

- TABLE 224 IRISITY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 225 IRISITY: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 226 IRISITY: DEALS

- TABLE 227 NEC CORPORATION: COMPANY OVERVIEW

- TABLE 228 NEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 229 NEC CORPORATION: DEALS

- TABLE 230 GENETEC INC.: COMPANY OVERVIEW

- TABLE 231 GENETEC INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 232 GENETEC INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 233 BRIEFCAM: COMPANY OVERVIEW

- TABLE 234 BRIEFCAM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 235 BRIEFCAM: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 236 MOBOTIX AG: COMPANY OVERVIEW

- TABLE 237 MOBOTIX AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 238 MOBOTIX AG: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 239 MOBOTIX AG: DEALS

- TABLE 240 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY OVERVIEW

- TABLE 241 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 242 TELEDYNE TECHNOLOGIES INCORPORATED: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 243 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 244 HONEYWELL INTERNATIONAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 245 HONEYWELL INTERNATIONAL INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 246 VIVOTEK INC.: COMPANY OVERVIEW

- TABLE 247 VIVOTEK INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 VIVOTEK INC.: PRODUCT LAUNCHES/DEVELOPMENTS

- TABLE 249 VIVOTEK INC.: DEALS

- TABLE 250 VERKADA INC.: COMPANY OVERVIEW

- TABLE 251 MORPHEAN SA: COMPANY OVERVIEW

- TABLE 252 BOSCH SICHERHEITSSYSTEME GMBH: COMPANY OVERVIEW

- TABLE 253 IPRO: COMPANY OVERVIEW

- TABLE 254 CAMCLOUD: COMPANY OVERVIEW

- TABLE 255 IVIDEON: COMPANY OVERVIEW

- TABLE 256 HAKIMO, INC.: COMPANY OVERVIEW

- TABLE 257 PROMISEQ GMBH: COMPANY OVERVIEW

- TABLE 258 RHOMBUS SYSTEMS: COMPANY OVERVIEW

- TABLE 259 UMBO COMPUTER VISION INC.: COMPANY OVERVIEW

List of Figures

- FIGURE 1 AI IN VIDEO SURVEILLANCE MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 AI IN VIDEO SURVEILLANCE MARKET: RESEARCH DESIGN

- FIGURE 3 AI IN VIDEO SURVEILLANCE MARKET: RESEARCH FLOW

- FIGURE 4 AI IN VIDEO SURVEILLANCE MARKET: BOTTOM-UP APPROACH

- FIGURE 5 AI IN VIDEO SURVEILLANCE MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 6 AI IN VIDEO SURVEILLANCE MARKET: TOP-DOWN APPROACH

- FIGURE 7 AI IN VIDEO SURVEILLANCE MARKET: DATA TRIANGULATION

- FIGURE 8 AI IN VIDEO SURVEILLANCE MARKET: RESEARCH ASSUMPTIONS

- FIGURE 9 AI IN VIDEO SURVEILLANCE MARKET: RESEARCH LIMITATIONS

- FIGURE 10 SOFTWARE SEGMENT TO DOMINATE MARKET FROM 2025 TO 2030

- FIGURE 11 CLOUD-BASED SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 12 INFERENCE SEGMENT TO CAPTURE LARGER MARKET SHARE IN 2030

- FIGURE 13 COMPUTER VISION SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2025

- FIGURE 14 GOVERNMENT & PUBLIC FACILITIES SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 15 ASIA PACIFIC TO RECORD HIGHEST CAGR IN AI IN VIDEO SURVEILLANCE MARKET BETWEEN 2025 AND 2030

- FIGURE 16 RISE IN SMART CITY INITIATIVES TO CONTRIBUTE TO MARKET GROWTH DURING FORECAST PERIOD

- FIGURE 17 SOFTWARE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2025

- FIGURE 18 EDGE-BASED SEGMENT TO DOMINATE MARKET BETWEEN 2025 AND 2030

- FIGURE 19 INFERENCE SEGMENT TO HOLD LARGER MARKET SHARE THAN TRAINING SEGMENT IN 2030

- FIGURE 20 EDGE-BASED SEGMENT AND CHINA HELD LARGEST SHARES OF AI IN VIDEO SURVEILLANCE MARKET IN ASIA PACIFIC IN 2024

- FIGURE 21 INDIA TO EXHIBIT HIGHEST CAGR IN GLOBAL AI IN VIDEO SURVEILLANCE MARKET FROM 2025 TO 2030

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 IMPACT ANALYSIS OF DRIVERS

- FIGURE 24 IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 25 IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 26 IMPACT ANALYSIS OF CHALLENGES

- FIGURE 27 VALUE CHAIN ANALYSIS

- FIGURE 28 ECOSYSTEM ANALYSIS

- FIGURE 29 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO, 2023-2024

- FIGURE 31 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 33 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 34 IMPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 35 EXPORT DATA FOR HS CODE 852580-COMPLIANT PRODUCTS, BY COUNTRY, 2019-2023

- FIGURE 36 PATENT ANALYSIS, 2013-2023

- FIGURE 37 AVERAGE SELLING PRICE TREND OF AI CAMERAS, BY REGION, 2020-2023

- FIGURE 38 SOFTWARE SEGMENT TO DOMINATE AI IN VIDEO SURVEILLANCE MARKET FROM 2025 TO 2030

- FIGURE 39 NUMBER OF PRIVATE RETAIL TRADE ESTABLISHMENTS IN US, 2019-2023 (MILLION)

- FIGURE 40 EDGE-BASED SEGMENT TO DOMINATE MARKET FROM 2025 TO 2030

- FIGURE 41 INFERENCE SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2030

- FIGURE 42 COMPUTER VISION SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 43 GOVERNMENT & PUBLIC FACILITY SEGMENT TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 44 ASIA PACIFIC TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 45 NORTH AMERICA: AI IN VIDEO SURVEILLANCE MARKET SNAPSHOT

- FIGURE 46 US TO ACCOUNT FOR LARGEST SHARE OF NORTH AMERICAN AI IN VIDEO SURVEILLANCE MARKET IN 2030

- FIGURE 47 EUROPE: AI IN VIDEO SURVEILLANCE MARKET SNAPSHOT

- FIGURE 48 GERMANY TO DOMINATE EUROPEAN AI IN VIDEO SURVEILLANCE MARKET IN 2025

- FIGURE 49 ASIA PACIFIC: AI IN VIDEO SURVEILLANCE MARKET SNAPSHOT

- FIGURE 50 CHINA TO ACCOUNT FOR LARGEST SHARE OF ASIA PACIFIC AI IN VIDEO SURVEILLANCE MARKET IN 2025

- FIGURE 51 MIDDLE EAST TO REGISTER HIGHEST CAGR IN ROW AI IN VIDEO SURVEILLANCE MARKET DURING FORECAST PERIOD

- FIGURE 52 AI IN VIDEO SURVEILLANCE MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2019-2023

- FIGURE 53 MARKET SHARE ANALYSIS OF KEY PLAYERS OFFERING AI VIDEO SURVEILLANCE PRODUCTS, 2023

- FIGURE 54 COMPANY VALUATION, 2024

- FIGURE 55 FINANCIAL METRICS, 2024

- FIGURE 56 BRAND COMPARISON

- FIGURE 57 AI IN VIDEO SURVEILLANCE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 58 AI IN VIDEO SURVEILLANCE MARKET: COMPANY FOOTPRINT

- FIGURE 59 AI IN VIDEO SURVEILLANCE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 60 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 61 DAHUA TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 62 MOTOROLA SOLUTIONS, INC. (AVIGILON CORPORATION): COMPANY SNAPSHOT

- FIGURE 63 MILESTONE SYSTEMS A/S: COMPANY SNAPSHOT

- FIGURE 64 SENSETIME: COMPANY SNAPSHOT

- FIGURE 65 IRISITY: COMPANY SNAPSHOT

- FIGURE 66 NEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 67 MOBOTIX AG: COMPANY SNAPSHOT

- FIGURE 68 TELEDYNE TECHNOLOGIES INCORPORATED: COMPANY SNAPSHOT

- FIGURE 69 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 70 VIVOTEK INC.: COMPANY SNAPSHOT

The AI in video surveillance market is projected to grow from USD 3.90 billion in 2024 and is expected to reach USD 12.46 billion by 2030, growing at a CAGR of 21.3% from 2025 to 2030. As crime rates and terrorism threats continue to swell, governments and enterprises are also investing a fortune in highly advanced surveillance equipment to safeguard the public. According to the Council of Criminal Justice, the general trends regarding property crime in 2023 compared with 2019 show declines in residential burglaries and larcenies; however, nonresidential burglaries increased, motor vehicle thefts increased by 105 percent, and drug-related offenses decreased by 27 percent. According to the 4th global homicide study of the United Nations Office on Drugs and Crime, Africa was the region with the highest intentional homicide rate at 176,000 victims in 2021, followed by the Americas at 154,000, Asia at 109,000, Europe at 17,000, and Oceania at 1,000 victims, with improvement observed in 2022.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Offering, Deployment, Technology and Region |

| Regions covered | North America, Europe, APAC, RoW |

"The cloud segment in the AI in video surveillance market is to witness a higher growth rate during the forecast period."

The cloud segment is mainly driven by cloud-based solutions that are increasingly adopted by small and medium enterprises, primarily because they provide the flexibility, scalability, and cost-effectiveness features that the organizations require. In addition, the speed at which sophisticated security solutions for cloud-based deployment are developed offers answers to issues that exist regarding data privacy and thus attracts businesses seeking to adopt AI without investing in big premises-based infrastructure.

"Market for inference in the AI in video surveillance market to hold the largest market share during the forecast period."

Inference in the AI in video surveillance market to hold the largest market share during the forecast period driven by actionable insights directly at the edge or near-edge devices. Inference allows rapid video stream analysis to detect objects, face recognition, and anomaly detection without relying on centralized data centers, reducing latency and bandwidth utilization. This capability is important for real-time applications such as public safety, traffic monitoring, and retail analytics, where timely responses to events may significantly improve operational efficiency and security outcomes.

"China is expected to hold the largest market size in the Asia Pacific region during the forecast period."

The Chinese government is promoting AI video surveillance systems with weapon detection capabilities. This broader push is for facial recognition and surveillance cameras in public spaces. The growth of AI-driven surveillance in sectors like transportation, law enforcement, and public services is another factor fueling market growth, aligning with the country's strategic goals for technological innovation and societal safety.

- By Company Type: Tier 1 - 20%, Tier 2 - 35%, and Tier 3 - 45%

- By Designation: C-level Executives - 15%, Directors -20%, and Others - 65%

- By Region: North America -20%, Europe - 15%, Asia Pacific- 60%, and RoW - 5%

Prominent players profiled in this report include Hikvision Digital Technology Co., Ltd. (China), Dahua Technology Co., Ltd. (China), Motorola Solutions, Inc. (US), Milestone Systems A/S (Denmark), SenseTime (Hong Kong), Irisity (Sweden), NEC Corporation (Japan), Axis Communications AB (Sweden), Genetec Inc. (Canada), Hanwha Vision Co., Ltd., (South Korea) among a few other key companies in the AI in video surveillance market.

Report Coverage

The report defines, describes, and forecasts the AI in video surveillance market based on use case, offering, deployment, function, technology, application, vertical, and region. It provides detailed information regarding drivers, restraints, opportunities, and challenges influencing the market's growth. It also analyzes competitive developments such as acquisitions, product launches, expansions, and actions carried out by the key players to grow in the market.

Reasons to Buy This Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue for the overall AI in video surveillance market and the subsegments. The report will help stakeholders understand the competitive landscape and gain more insight to position their business better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market's pulse and provides information on key drivers, restraints, opportunities, and challenges.

The report will provide insights into the following pointers:

- Analysis of key drivers (Rise of smart city initiatives), restraints (Privacy and security issues in AI-powered systems), opportunities (Integration of AI with IoT and other emerging technologies), and challenges (Data inaccuracy and reliability issues in video analytics) of the AI in video surveillance market.

- Product development /Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the AI in video surveillance market.

- Market Development: Comprehensive information about lucrative markets; the report analyses the AI in video surveillance market across various regions.

- Market Diversification: Exhaustive information about new products launched, untapped geographies, recent developments, and investments in the AI in video surveillance market.

- Competitive Assessment: In-depth assessment of market share, growth strategies, and offering of leading players like Hikvision Digital Technology Co., Ltd. (China), Dahua Technology Co., Ltd. (China), Motorola Solutions, Inc. (US), Milestone Systems A/S (Denmark), SenseTime (Hong Kong) among others in the AI in video surveillance market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ANALYSIS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AI IN VIDEO SURVEILLANCE MARKET

- 4.2 AI IN VIDEO SURVEILLANCE MARKET, BY OFFERING

- 4.3 AI IN VIDEO SURVEILLANCE MARKET, BY DEPLOYMENT

- 4.4 AI IN VIDEO SURVEILLANCE MARKET, BY FUNCTION

- 4.5 AI IN VIDEO SURVEILLANCE MARKET IN ASIA PACIFIC, BY DEPLOYMENT AND COUNTRY

- 4.6 AI IN VIDEO SURVEILLANCE MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for advanced security solutions

- 5.2.1.2 Advancements in deep learning and computer vision technologies

- 5.2.1.3 Rising crime rate

- 5.2.1.4 Deployment of sophisticated surveillance systems in smart cities

- 5.2.2 RESTRAINTS

- 5.2.2.1 Privacy and security issues in AI-powered systems

- 5.2.2.2 High costs associated with implementing and maintaining AI-powered video surveillance systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of AI with IoT devices

- 5.2.3.2 Growing adoption of smart home technologies

- 5.2.3.3 Deployment of AI in retail and transportation sectors

- 5.2.3.4 Integration of AI cameras with ML algorithms

- 5.2.3.5 Adoption of Gen AI technologies in developing countries

- 5.2.4 CHALLENGES

- 5.2.4.1 Complex and varied data protection laws across different regions

- 5.2.4.2 Occurrence of false negatives

- 5.2.4.3 Vulnerability to cyberattacks

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 ML

- 5.6.1.2 Computer vision

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 IoT

- 5.6.2.2 5G connectivity

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Smart home automation

- 5.6.1 KEY TECHNOLOGIES

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.8.2 BARGAINING POWER OF SUPPLIERS

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 THREAT OF SUBSTITUTES

- 5.8.5 THREAT OF NEW ENTRANTS

- 5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 CASE STUDY ANALYSIS

- 5.10.1 MOBOTIX ASSISTED REAL-TIME CRIME CENTER IN ENHANCING COVERAGE AND REDUCING COSTS USING S74 CAMERAS

- 5.10.2 BRIEFCAM HELPED US-BASED HOSPITAL WITH VIDEO SYNOPSIS TO DETECT SECURITY BREACHES EFFICIENTLY

- 5.10.3 MINISO ADOPTED HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.'S CENTRALLY MANAGED SECURITY SYSTEM TO BOOST SURVEILLANCE

- 5.10.4 KYRGYZSTAN BANK INTEGRATED DAHUA TECHNOLOGY'S HYBRID SURVEILLANCE SOLUTION TO IMPROVE IMAGE QUALITY

- 5.10.5 MOTOROLA HELPED LONG BEACH HOUSING AUTHORITY DEPLOY HD CAMERAS TO BOOST MONITORING CAPABILITIES AND OFFER REMOTE ACCESS FOR BETTER OVERSIGHT

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO (HS CODE 852580)

- 5.11.2 EXPORT SCENARIO (HS CODE 852580)

- 5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2024-2025

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- 5.14.1 TARIFF ANALYSIS

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.14.3 STANDARDS

- 5.14.4 REGULATIONS

- 5.15 PRICING ANALYSIS

- 5.15.1 INDICATIVE PRICING OF AI CAMERA OFFERINGS, BY KEY PLAYER, 2024

- 5.15.2 AVERAGE SELLING PRICE TREND, BY REGION, 2020-2023

6 USE CASES OF AI-POWERED VIDEO SURVEILLANCE SYSTEMS

- 6.1 INTRODUCTION

- 6.2 GUN DETECTION

- 6.3 INDUSTRIAL TEMPERATURE MONITORING

- 6.4 ANOMALY DETECTION & BEHAVIOR RECOGNITION

- 6.5 FACIAL RECOGNITION/PERSON SEARCH

- 6.6 OBJECT DETECTION & TRACKING

- 6.7 INTRUSION DETECTION & PERIMETER PROTECTION

- 6.8 SMOKE & FIRE DETECTION

- 6.9 TRAFFIC FLOW ANALYSIS & ACCIDENT DETECTION

- 6.10 FALSE ALARM FILTERING

- 6.11 PARKING MONITORING

- 6.12 VEHICLE IDENTIFICATION & NUMBER PLATE RECOGNITION

7 APPLICATIONS OF AI IN VIDEO SURVEILLANCE

- 7.1 INTRODUCTION

- 7.2 SECURITY & PUBLIC SAFETY

- 7.3 TRAFFIC MONITORING & MANAGEMENT

- 7.4 INTELLIGENT TRANSPORTATION SYSTEM

- 7.5 RETAIL MANAGEMENT

- 7.6 URBAN PLANNING & SMART CITIES

8 AI IN VIDEO SURVEILLANCE MARKET, BY OFFERING

- 8.1 INTRODUCTION

- 8.2 AI CAMERAS

- 8.2.1 WIRED

- 8.2.1.1 Rising adoption to enable long-distance data transmission to fuel segmental growth

- 8.2.2 WIRELESS

- 8.2.2.1 Increasing implementation to cater to changing surveillance needs to accelerate segmental growth

- 8.2.1 WIRED

- 8.3 SOFTWARE

- 8.3.1 AI-DRIVEN VIDEO MANAGEMENT SYSTEMS

- 8.3.1.1 Ability to provide real-time monitoring, playback, and advanced analytics to boost segmental growth

- 8.3.2 AI-DRIVEN VIDEO ANALYTICS

- 8.3.2.1 Edge analytics

- 8.3.2.1.1 Ability to minimize latency and reduce bandwidth usage to augment segmental growth

- 8.3.2.2 Server analytics

- 8.3.2.2.1 Focus on handling complex tasks using robust computational power to fuel segmental growth

- 8.3.2.1 Edge analytics

- 8.3.1 AI-DRIVEN VIDEO MANAGEMENT SYSTEMS

9 AI IN VIDEO SURVEILLANCE MARKET, BY DEPLOYMENT

- 9.1 INTRODUCTION

- 9.2 EDGE-BASED

- 9.2.1 INCREASING DEMAND FOR HIGHLY CUSTOMIZABLE, AI-INTEGRATED SURVEILLANCE SOLUTIONS TO ACCELERATE SEGMENTAL GROWTH

- 9.3 CLOUD-BASED

- 9.3.1 RISING PREFERENCE FOR REMOTE ACCESSIBILITY AND REAL-TIME MONITORING TO BOOST SEGMENTAL GROWTH

10 AI IN VIDEO SURVEILLANCE MARKET, BY FUNCTION

- 10.1 INTRODUCTION

- 10.2 TRAINING

- 10.2.1 INCREASING COMPLEXITY OF SURVEILLANCE TASKS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 10.3 INFERENCE

- 10.3.1 RISING DEMAND FOR REAL-TIME THREAT DETECTION TO AUGMENT SEGMENTAL GROWTH

11 AI IN VIDEO SURVEILLANCE MARKET, BY TECHNOLOGY

- 11.1 INTRODUCTION

- 11.2 MACHINE LEARNING

- 11.2.1 ABILITY TO INTELLIGENTLY ANALYZE AND INTERPRET VIDEO DATA TO BOLSTER SEGMENTAL GROWTH

- 11.2.2 DEEP LEARNING

- 11.2.3 CONVOLUTIONAL NEURAL NETWORKS

- 11.3 GENERATIVE AI

- 11.3.1 STRONG FOCUS ON ENHANCING TRAINING, SIMULATION, AND PREDICTIVE CAPABILITIES TO ACCELERATE SEGMENTAL GROWTH

- 11.3.2 RULE-BASED MODELS

- 11.3.3 STATISTICAL MODELS

- 11.4 COMPUTER VISION

- 11.4.1 NEED FOR ADVANCED PROCESSING CAPABILITIES TO BOOST SEGMENTAL GROWTH

- 11.5 NATURAL LANGUAGE PROCESSING

- 11.5.1 ABILITY TO ENHANCE VIDEO SURVEILLANCE SYSTEMS TO EXPEDITE SEGMENTAL GROWTH

12 AI IN VIDEO SURVEILLANCE MARKET, BY VERTICAL

- 12.1 INTRODUCTION

- 12.2 RESIDENTIAL

- 12.2.1 RISING ADOPTION OF SMART CITY INITIATIVES TO BOLSTER SEGMENTAL GROWTH

- 12.3 COMMERCIAL

- 12.3.1 RETAIL STORES & MALLS

- 12.3.1.1 Requirement for comprehensive surveillance across large areas using advanced tools to fuel segmental growth

- 12.3.2 BANKING & FINANCIAL BUILDINGS

- 12.3.2.1 Emphasis on safeguarding data and infrastructure to contribute to segmental growth

- 12.3.3 HOSPITALITY CENTERS

- 12.3.3.1 Increased demand for enhanced guest security solutions to stimulate segmental growth

- 12.3.1 RETAIL STORES & MALLS

- 12.4 MILITARY & DEFENSE

- 12.4.1 BORDER SURVEILLANCE

- 12.4.1.1 Rising focus on preventing smuggling and other illegal activities to foster segmental growth

- 12.4.2 COASTAL SURVEILLANCE

- 12.4.2.1 Growing intrusion and maritime threats to boost segmental growth

- 12.4.1 BORDER SURVEILLANCE

- 12.5 GOVERNMENT & PUBLIC FACILITIES

- 12.5.1 LAW ENFORCEMENT BUILDINGS

- 12.5.1.1 Increasing adoption of AI and ML in video surveillance systems to accelerate segmental growth

- 12.5.2 TRANSPORTATION FACILITIES

- 12.5.2.1 Rising integration of AI with real-time traffic monitoring solutions to foster segmental growth

- 12.5.3 CITY SURVEILLANCE

- 12.5.3.1 Growing emphasis on enhancing public safety and law enforcement to foster market growth

- 12.5.4 HEALTHCARE FACILITIES

- 12.5.4.1 Increasing installation of intelligent video surveillance systems for threat detection to augment segmental growth

- 12.5.5 EDUCATIONAL FACILITIES

- 12.5.5.1 Growing investment in AI systems to enhance security to fuel segmental growth

- 12.5.6 RELIGIOUS FACILITIES

- 12.5.6.1 Rising need to safeguard artifacts and prevent firearm threats to contribute to segmental growth

- 12.5.1 LAW ENFORCEMENT BUILDINGS

- 12.6 INDUSTRIAL

- 12.6.1 MANUFACTURING

- 12.6.1.1 Rising integration of advanced technologies to optimize workflows and ensure safety compliance to drive market

- 12.6.2 ENERGY & UTILITIES

- 12.6.2.1 Escalating use of motion detection, automated alerts, and high-resolution cameras to accelerate segmental growth

- 12.6.3 CONSTRUCTION SITES

- 12.6.3.1 Increasing focus on meeting safety regulations to drive market

- 12.6.1 MANUFACTURING

- 12.7 CRITICAL INFRASTRUCTURE

- 12.7.1 DATA CENTERS

- 12.7.1.1 Growing adoption of surveillance cameras to safeguard critical assets to fuel segmental growth

- 12.7.2 TELECOMMUNICATIONS

- 12.7.2.1 Rising need for enhanced security and operational efficiency to augment segmental growth

- 12.7.1 DATA CENTERS

13 AI IN VIDEO SURVEILLANCE MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 13.2.2 US

- 13.2.2.1 Rising demand for smart surveillance systems in smart cities to foster market growth

- 13.2.3 CANADA

- 13.2.3.1 Increasing break-and-enter cases to boost market growth

- 13.2.4 MEXICO

- 13.2.4.1 Growing affordability of AI CCTV technology to fuel market growth

- 13.3 EUROPE

- 13.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 13.3.2 UK

- 13.3.2.1 Rising public-private collaborations to offer lucrative growth opportunities

- 13.3.3 GERMANY

- 13.3.3.1 Growing demand for efficient and effective surveillance solutions to stimulate market growth

- 13.3.4 FRANCE

- 13.3.4.1 Growing emphasis on smart urban development to fuel market growth

- 13.3.5 ITALY

- 13.3.5.1 Rising integration of advanced AI-driven analytics into surveillance systems to drive market

- 13.3.6 SPAIN

- 13.3.6.1 Increasing deployment of 5G-enabled facial recognition surveillance systems to boost market growth

- 13.3.7 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 13.4.2 CHINA

- 13.4.2.1 Surging need for real-time threat detection to foster market growth

- 13.4.3 JAPAN

- 13.4.3.1 Expanding commercial establishments to accelerate demand

- 13.4.4 SOUTH KOREA

- 13.4.4.1 Increasing demand for IP security solutions to support market growth

- 13.4.5 INDIA

- 13.4.5.1 Rising emphasis on developing smart cities to fuel market growth

- 13.4.6 REST OF ASIA PACIFIC

- 13.5 ROW

- 13.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 13.5.2 MIDDLE EAST

- 13.5.2.1 Rising need to boost security due to terrorist attacks to fuel market growth

- 13.5.3 AFRICA

- 13.5.3.1 Rising emphasis on enhancing public safety and modernizing urban infrastructure to fuel market growth

- 13.5.4 SOUTH AMERICA

- 13.5.4.1 Growing focus on leveraging technologies for crime prevention and security enhancement to boost market growth

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 14.3 REVENUE ANALYSIS, 2019-2023

- 14.4 MARKET SHARE ANALYSIS, 2023

- 14.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 14.6 BRAND COMPARISON

- 14.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 14.7.1 STARS

- 14.7.2 EMERGING LEADERS

- 14.7.3 PERVASIVE PLAYERS

- 14.7.4 PARTICIPANTS

- 14.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.7.5.1 Company footprint

- 14.7.5.2 Region footprint

- 14.7.5.3 Offering footprint

- 14.7.5.4 Deployment footprint

- 14.7.5.5 Function footprint

- 14.7.5.6 Vertical footprint

- 14.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.8.1 PROGRESSIVE COMPANIES

- 14.8.2 RESPONSIVE COMPANIES

- 14.8.3 DYNAMIC COMPANIES

- 14.8.4 STARTING BLOCKS

- 14.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

- 14.8.5.1 Detailed list of key startups/SMEs

- 14.8.5.2 Competitive benchmarking of key startups/SMEs

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 14.9.2 DEALS

- 14.9.3 OTHER DEVELOPMENTS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Solutions/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches/developments

- 15.1.1.3.2 Deals

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths/Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses/Competitive threats

- 15.1.2 DAHUA TECHNOLOGY CO., LTD.

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Solutions/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches/developments

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths/Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses/Competitive threats

- 15.1.3 AXIS COMMUNICATIONS AB

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Solutions/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches/developments

- 15.1.3.3.2 Deals

- 15.1.3.3.3 Other developments

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths/Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses/Competitive threats

- 15.1.4 MOTOROLA SOLUTIONS, INC. (AVIGILON CORPORATION)

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Solutions/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches/developments

- 15.1.4.3.2 Deals

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths/Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses/Competitive threats

- 15.1.5 HANWHA VISION CO., LTD.

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Solutions/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches/developments

- 15.1.5.3.2 Deals

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths/Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses/Competitive threats

- 15.1.6 MILESTONE SYSTEMS A/S

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Solutions/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product launches/developments

- 15.1.6.3.2 Deals

- 15.1.7 SENSETIME

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Solutions/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches/developments

- 15.1.7.3.2 Deals

- 15.1.8 IRISITY

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Solutions/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product launches/developments

- 15.1.8.3.2 Deals

- 15.1.9 NEC CORPORATION

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Solutions/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.10 GENETEC INC.

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Solutions/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Product launches/developments

- 15.1.11 BRIEFCAM

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Solutions/Services offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Product launches/developments

- 15.1.12 MOBOTIX AG

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Solutions/Services offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Product launches/developments

- 15.1.12.3.2 Deals

- 15.1.13 TELEDYNE TECHNOLOGIES INCORPORATED

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Solutions/Services offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Product launches/developments

- 15.1.14 HONEYWELL INTERNATIONAL INC.

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Solutions/Services offered

- 15.1.14.3 Recent developments

- 15.1.14.3.1 Product launches/developments

- 15.1.15 VIVOTEK INC.

- 15.1.15.1 Business overview

- 15.1.15.2 Products/Solutions/Services offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Product launches/developments

- 15.1.15.3.2 Deals

- 15.1.1 HANGZHOU HIKVISION DIGITAL TECHNOLOGY CO., LTD.

- 15.2 OTHER PLAYERS

- 15.2.1 VERKADA INC.

- 15.2.2 MORPHEAN SA

- 15.2.3 BOSCH SICHERHEITSSYSTEME GMBH

- 15.2.4 IPRO

- 15.2.5 CAMCLOUD

- 15.2.6 IVIDEON

- 15.2.7 HAKIMO, INC.

- 15.2.8 PROMISEQ GMBH

- 15.2.9 RHOMBUS SYSTEMS

- 15.2.10 UMBO COMPUTER VISION INC.

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS