|

|

市場調査レポート

商品コード

1310549

アルファオレフィンの世界市場:タイプ別、用途別、地域別 - 予測(~2028年)Alpha Olefins Market by Type, Application (Poly-olefine Comonomer, Surfactants and Intermediates, Lubricants, Fine Chemicals, Oil Field Chemicals), and Region (North America, Europe, APAC, MEA, South America) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| アルファオレフィンの世界市場:タイプ別、用途別、地域別 - 予測(~2028年) |

|

出版日: 2023年07月13日

発行: MarketsandMarkets

ページ情報: 英文 160 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界のアルファオレフィンの市場規模は、2023年の推定71億米ドルから2028年に93億米ドルに達し、予測期間中にCAGRで5.6%の成長が予測されています。

建設活動の増加が、パイプ、窓枠、床材などのプラスチックの建築製品の需要を促進し、アルファオレフィンの需要を増加させる可能性があります。

"1-ブテンが最速のセグメントとして台頭する見込みです。"

1-ブテン市場は、予測期間中にもっとも高い成長を記録すると推定されています。1-ブテンは主にポリエチレンとポリプロピレンの生産に使用され、いずれも石油化学業界における主な構成要素と考えられています。さらに、HDPE、LLDPE、LDPEといったプラスチックへのニーズの増加も、その領域における成長に寄与しています。また、それはさまざまなポリプロピレン樹脂の提供に役立っています。これらの理由が、予測期間における需要の増加に寄与しています。

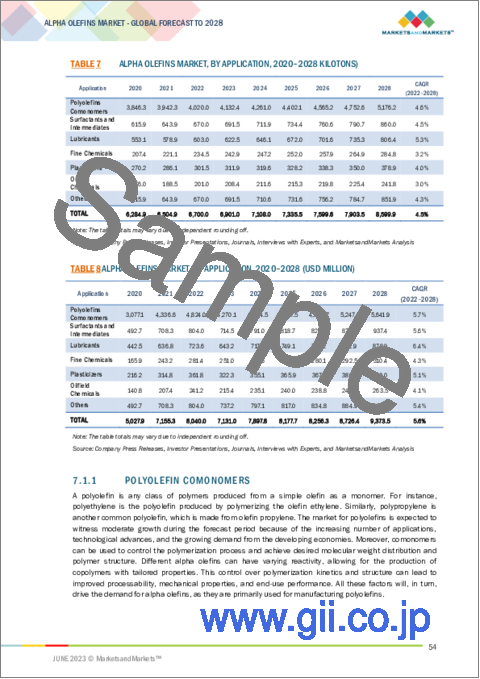

"アルファオレフィン市場の最大のセグメント:用途別"

ポリオレフィンコモノマー用途の市場が最大のセグメントになると予想されます。ポリオレフィンは主に、LLDPE、HDPE、LDPE、PPといった主なプラスチックの製造に使用されます。これらのプラスチックの需要は主に、アジア太平洋、中欧、中東の新興経済国によって促進され、北米と欧州の先進経済国における需要も安定して増加しています。これらの要因が、ポリオレフィンコモノマー用途におけるアルファオレフィン市場の成長に寄与する見込みです。

"北米は予測期間中、2番目に大きな市場になると予想されます。"

北米の市場規模は24億8,280万米ドルと推定され、2028年までに28億6,500万米ドルに達すると予測されています。高い消費のポテンシャル、成長する生産能力、競争力のある製造コスト、高い経済成長が市場を牽引しています。北米は、アルファオレフィン市場のさまざまなセグメントにおける継続的な技術革新が特徴です。同地域における市場の高成長は、環境に優しい製品への意識の向上と、プラスチック業界からの需要の増加に支えられる可能性があります。

当レポートでは、世界のアルファオレフィン市場について調査分析し、市場力学、地域とセグメントの分析、企業プロファイルなどを提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主要考察

- アルファオレフィン市場の企業にとっての魅力的な機会

- アルファオレフィン市場:地域別

- アルファオレフィン市場:タイプ別

- アルファオレフィン市場:用途別

- アジア太平洋:アルファオレフィン市場:用途別、国別

第5章 市場の概要

- イントロダクション

- 市場力学

- アルファオレフィン市場の促進要因、抑制要因、機会、課題

- 促進要因

- 機会

- 課題

- 抑制要因

- ポーターのファイブフォース分析

第6章 業界の動向

- マクロ経済指標

- 石油・ガス産業

- 貿易分析

- 輸出シナリオ

- 輸入シナリオ

第7章 アルファオレフィン市場:タイプ別

- イントロダクション

- 1-ブテン

- 1-ヘキセン

- 1-オクテン

- その他

第8章 アルファオレフィン市場:用途別

- イントロダクション

- ポリオレフィンコモノマー

- 界面活性剤・中間体

- 潤滑剤

- ファインケミカル

- 可塑剤

- 油田用化学品

- その他

第9章 アルファオレフィン市場:地域別

- イントロダクション

- 北米

- 景気後退の影響

- 米国

- カナダ

- メキシコ

- 欧州

- 景気後退の影響

- ドイツ

- ベルギー

- イタリア

- フランス

- オランダ

- ロシア

- アジア太平洋

- 景気後退の影響

- 中国

- 日本

- 韓国

- インド

- 中東・アフリカ

- 景気後退の影響

- サウジアラビア

- トルコ

- その他の中東・アフリカ

- 南米

- 景気後退の影響

- ブラジル

- アルゼンチン

第10章 競合情勢

- イントロダクション

- 市場シェア分析

- 主な市場企業のランキング(2022年)

- 主要企業の市場シェア

- 収益分析

- 企業の評価の象限マトリックス(2022年)

- 新興企業/中小企業の評価の象限マトリックス(2022年)

- 競合ベンチマーキング

- アルファオレフィン市場:企業のフットプリント

- 競合のシナリオと動向

第11章 企業プロファイル

- 主要企業

- ROYAL DUTCH SHELL

- CHEVRON PHILLIPS CHEMICAL COMPANY

- INEOS GROUP LIMITED

- SABIC

- SASOL LIMITED

- EVONIK INDUSTRIES

- DOW CHEMICAL COMPANY

- EXXONMOBIL

- QATAR CHEMICAL COMPANY

- PJSC NIZHNEKAMSKNEFTEKHIM

- その他の企業

- MITSUBISHI CHEMICAL CORPORATION

- IDEMITSU PETROCHEMICAL COMPANY

- SINOPEC BEIJING YASHAN COMPANY

- PETRO RABIGH

- MITSUI CHEMICALS INC.

- MERCK GROUP

- NPC IRAN

- JAM PETROCHEMICAL COMPANY

- TPC GROUP

- OIL AND GAS NATIONAL CORPORATION

- SAUDI ARAMCO TOTAL REFINING AND PETROCHEMICAL COMPANY (SATORP)

- LYONDELLBASELL INDUSTRIES N.V.

- PETROCHINA COMPANY LIMITED

- TOKYO CHEMICAL INDUSTRY COMPANY LIMITED

- ALFA AESAR

第12章 付録

The Alpha olefins market is expected to grow at a CAGR of 5.6% during the forecast period, from an estimated USD 7.1 Billion in 2023 to USD 9.3 Billion in 2028. Increased construction activity can drive demand for plastic building products, such as pipes, window frames, and flooring, thereby increasing demand for alpha olefins. Alpha olefins find wide-ranging applications in different industries, primarily as intermediates in the production of various chemicals and plastic materials. They are used as co-monomers in the manufacturing of polyethylene (PE), synthetic lubricants, detergents, and plasticizers.

"1-butene is expected to emerge as the fastest segment."

The market for 1-Butene is estimated to register the highest growth during the forecast year. It is primarily used in the production of polyethylene and polypropylene, both of which are considered as the major building blocks in the petrochemical industry. Moreover, the increasing need for plastics such as HDPE, LLDPE, and LDPE is also contributing to its growth in the region. In addition, it helps provide a versatile range of polypropylene resins. All these reasons are accounted for its increasing demand in the forecast period.

"The largest segment for the Alpha olefins market, by Application. "

The market for polyolefin comonomers applications is expected to be the largest segment. Polyolefins are mainly used for manufacturing major plastics such as LLDPE, HDPE, LDPE, and PP. The demand for these plastics will be driven primarily by the rapidly growing economies of Asia-Pacific, Central Europe, and the Middle East, along with the steady increase in demand in the developed economies of North America and Europe. All these factors will contribute to the growth of the alpha olefins market in the polyolefin comonomers application.

"North America is expected to be the second largest market during the forecast period."

The North American market was estimated at USD 2,482.8 million and is expected to reach USD 2,865.0 million by 2028. High consumption potential, growing production capacities, competitive manufacturing costs, and high economic growth are the main driving forces of the market in the region. North America is characterized by continuous technical innovation in various segments of the alpha olefins market. The high growth of the alpha olefins market in the region is likely to be backed by the increasing demand from the plastics industry coupled with the rising awareness of environment-friendly products.

The break-up of the profile of primary participants in the C4ISR market:

- By Company Type: Tier 1 - 65%, Tier 2 - 24%, and Tier 3 - 11%

- By Designation: C Level - 30%, Director Level - 25%, Others-45%

- By Region: America - 27%, Europe - 20%, Asia Pacific - 33%, Middle East - 20%

The Alpha Olefins market is dominated by a few major players that have a significant regional presence. The leading players in the Alpha olefins market are. Royal Dutch Shell (Netherlands), ExxonMobil (US), Evonik Industries (Germany), Dow chemical company (Michigan), and SABIC (Saudi Arabia).

Research Coverage:

The report defines, describes, and forecasts the global Alpha olefins market, by type, by Application. The report provides a comprehensive review of the market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates in terms of value, and future trends in the Alpha Olefins market.

Key Benefits of Buying the Report

1. The report identifies and addresses the key markets for alpha olefins, which would help manufacturers review the growth in demand.

2. The report helps system providers understand the pulse of the market and provides insights into drivers, restraints, opportunities, and challenges.

3. The report will help key players understand the strategies of their competitors better and help them in making better strategic decisions.

Reasons to buy this report:

This report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the over all Alpha olefins market and subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to the position their businesses better and to plan suitable go to market strategies. The report also helps stakeholders understand the pulse of the market and provide them with the information on the key market drivers, restraints, challenges and opportunities.

The report provides insights on the fillowing pointers

- Analysis of the Key drivers( Growing demand in Polyethylene Production, Shift towards synthetic lubricants, Growth in oilfield Chemicals, Surging Demand for Plastomers and Elastomers), Restraints (volatility in feedstock prices, substitution by other chemicals, environmental concerns and regulations), Opportunities( Growing demand for speciality application), Challenges ( the Development and commercialization of alternative technologies and processes pose a challenge) influencing the growth of Alpha olefins Market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the C4ISR market

- Market Development: Comprehensive information about lucrative markets - the report analyses the Alpha Olefins market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the Alpha Olefins Market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Chevron Phillips Chemical Company(US), Royal dutch (Netherlands), SABIC, Dow Chemicals Company (Michigan), INESO Group (UK) among others in the Alpa Olefins Market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 REGIONS COVERED

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 1 ALPHA OLEFINS MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- FIGURE 2 KEY INDUSTRY INSIGHTS

- 2.1.2.2 Breakdown of primaries

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.2 DATA TRIANGULATION

- FIGURE 4 DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.3.3 DEMAND-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE CALCULATION

- FIGURE 8 METRICS CONSIDERED FOR ANALYZING AND ASSESSING DEMAND FOR ALPHA OLEFINS

- 2.3.4 GROWTH FORECAST

3 EXECUTIVE SUMMARY

- TABLE 1 ALPHA OLEFINS: MARKET SNAPSHOT

- FIGURE 9 ASIA PACIFIC TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 10 POLYOLEFINS COMONOMERS APPLICATION TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- FIGURE 11 1-BUTENE TO BE LARGEST TYPE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ALPHA OLEFINS MARKET

- FIGURE 12 INCREASING AWARENESS REGARDING SUSTAINABLE TECHNOLOGY TO DRIVE MARKET

- 4.2 ALPHA OLEFINS MARKET, BY REGION

- FIGURE 13 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- 4.3 ALPHA OLEFINS MARKET, BY TYPE

- FIGURE 14 1-BUTENE SEGMENT TO ACCOUNT FOR LARGEST SHARE BY 2028

- 4.4 ALPHA OLEFINS MARKET, BY APPLICATION

- FIGURE 15 POLYOLEFINS COMONOMERS SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2028

- 4.5 ASIA PACIFIC: ALPHA OLEFINS MARKET, BY APPLICATION AND COUNTRY

- FIGURE 16 POLYOLEFINS COMONOMERS AND CHINA ACCOUNTED FOR SIGNIFICANT SHARE IN 2023

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN ALPHA OLEFINS MARKET

- 5.2.2 DRIVERS

- 5.2.2.1 Discovery of shale gas

- 5.2.2.2 Growth of end-use industries

- 5.2.2.3 Increase in demand for PAO-based synthetic lubricants

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth in R&D investments for development of alpha olefins from different sources

- 5.2.4 CHALLENGES

- 5.2.4.1 Volatile raw material prices

- 5.2.5 RESTRAINTS

- 5.2.5.1 Environmental concerns

- 5.2.5.2 Technological & infrastructural challenges

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- TABLE 2 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 17 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 BARGAINING POWER OF SUPPLIERS

- 5.3.2 BARGAINING POWER OF BUYERS

- 5.3.3 THREAT OF NEW ENTRANTS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

6 INDUSTRY TRENDS

- 6.1 MACROECONOMIC INDICATORS

- 6.1.1 OIL & GAS INDUSTRY

- TABLE 3 CRUDE OIL PRODUCTION STATISTICS, BY COUNTRY, 2015-2022 (MILLION TONNES)

- TABLE 4 NATURAL GAS PRODUCTION STATISTICS, BY COUNTRY, 2015-2022 (BILLION CUBIC METERS)

- 6.2 TRADE ANALYSIS

- 6.2.1 EXPORT SCENARIO

- FIGURE 18 EXPORT SCENARIO FOR HS CODE 390290, BY KEY COUNTRY, 2019-2022

- 6.2.2 IMPORT SCENARIO

- FIGURE 19 IMPORT SCENARIO FOR HS CODE 390290, BY KEY COUNTRY, 2019-2022

7 ALPHA OLEFINS MARKET, BY TYPE

- 7.1 INTRODUCTION

- FIGURE 20 1-BUTENE TO BE LARGEST MARKET DURING FORECAST PERIOD

- TABLE 5 ALPHA OLEFINS MARKET, BY TYPE, 2020-2028 (KILOTON)

- TABLE 6 ALPHA OLEFINS MARKET, BY TYPE, 2020-2028 (USD MILLION)

- 7.1.1 1-BUTENE

- 7.1.1.1 Catalytic nature to drive growth of 1-Butene in alpha olefins market

- 7.1.2 1-HEXENE

- 7.1.2.1 Numerous applications, including oligomerization and production of LLDPE & HDPE to drive growth

- 7.1.3 1-OCTENE

- 7.1.3.1 High reactivity and versatile chemical properties to drive market

- 7.1.4 OTHERS

- 7.1.4.1 1-Decene

- 7.1.4.2 1-Dodecene

- 7.1.4.3 1-Tetradecene

- 7.1.4.4 1-Hexadecene

- 7.1.4.5 1-Octadecene

- 7.1.4.6 Others

8 ALPHA OLEFINS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- FIGURE 21 POLYOLEFINS COMONOMERS TO BE LARGEST SEGMENT DURING FORECAST PERIOD

- TABLE 7 ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 KILOTONS)

- TABLE 8 ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 8.1.1 POLYOLEFIN COMONOMERS

- 8.1.2 SURFACTANTS AND INTERMEDIATES

- 8.1.3 LUBRICANTS

- 8.1.4 FINE CHEMICALS

- 8.1.5 PLASTICIZERS

- 8.1.6 OILFIELD CHEMICALS

- 8.1.7 OTHERS

9 ALPHA OLEFINS MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 22 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- TABLE 9 ALPHA OLEFINS MARKET, BY REGION, 2020-2028 (KILOTON)

- TABLE 10 ALPHA OLEFINS MARKET, BY REGION, 2020-2028 (USD MILLION)

- 9.2 NORTH AMERICA

- 9.2.1 RECESSION IMPACT

- FIGURE 23 NORTH AMERICA: ALPHA OLEFINS MARKET SNAPSHOT

- TABLE 11 NORTH AMERICA: ALPHA OLEFINS MARKET, BY COUNTRY, 2020-2028 (KILOTON)

- TABLE 12 NORTH AMERICA: ALPHA OLEFINS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 13 NORTH AMERICA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 14 NORTH AMERICA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.2.2 US

- 9.2.2.1 Increasing demand from packaging and plastic industries to drive market

- TABLE 15 US: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 16 US: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.2.3 CANADA

- 9.2.3.1 Growing plastic, chemical, and lubricant industries to drive growth

- TABLE 17 CANADA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 18 CANADA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.2.4 MEXICO

- 9.2.4.1 Packaging industry to drive demand for alpha olefins

- TABLE 19 MEXICO: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 20 MEXICO: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.3 EUROPE

- 9.3.1 RECESSION IMPACT

- FIGURE 24 EUROPE: ALPHA OLEFINS MARKET SNAPSHOT

- TABLE 21 EUROPE: ALPHA OLEFINS MARKET, BY COUNTRY, 2020-2028 (KILOTON)

- TABLE 22 EUROPE: ALPHA OLEFINS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 23 EUROPE: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 24 EUROPE: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.3.2 GERMANY

- 9.3.2.1 Booming automotive and electronics industries to drive demand for alpha olefins

- TABLE 25 GERMANY: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 26 GERMANY: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.3.3 BELGIUM

- 9.3.3.1 Packaging industry, coupled with sustainable practices by government, to drive demand for alpha olefins

- TABLE 27 BELGIUM: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 28 BELGIUM: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.3.4 ITALY

- 9.3.4.1 Well-developed chemical & petrochemical industry to drive demand for alpha olefins

- TABLE 29 ITALY: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 30 ITALY: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.3.5 FRANCE

- 9.3.5.1 Growing medical and automotive industries to drive growth

- TABLE 31 FRANCE: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 32 FRANCE: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.3.6 NETHERLANDS

- 9.3.6.1 Government initiatives to create revenue pockets for alpha olefins market

- TABLE 33 NETHERLANDS: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 34 NETHERLANDS: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.3.7 RUSSIA

- 9.3.7.1 Presence of huge chemical and oil & gas industries to drive growth

- TABLE 35 RUSSIA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 36 RUSSIA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.3.7.2 Rest of Europe

- TABLE 37 REST OF EUROPE: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 38 REST OF EUROPE: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.4 ASIA PACIFIC

- 9.4.1 RECESSION IMPACT

- FIGURE 25 ASIA PACIFIC: ALPHA OLEFINS MARKET SNAPSHOT

- TABLE 39 ASIA PACIFIC: ALPHA OLEFINS MARKET, BY COUNTRY, 2020-2028 (KILOTON)

- TABLE 40 ASIA PACIFIC: ALPHA OLEFINS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 41 ASIA PACIFIC: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 42 ASIA PACIFIC: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.4.2 CHINA

- 9.4.2.1 Rising automotive sector, coupled with agrochemical industry, to be major drivers

- TABLE 43 CHINA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 44 CHINA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.4.3 JAPAN

- 9.4.3.1 Automotive and pharmaceutical industries to drive demand

- TABLE 45 JAPAN: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 46 JAPAN: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.4.4 SOUTH KOREA

- 9.4.4.1 Government initiatives, coupled with major chemical industry, to drive market

- TABLE 47 SOUTH KOREA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 48 SOUTH KOREA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.4.5 INDIA

- 9.4.5.1 Growing chemical industry to drive demand

- TABLE 49 INDIA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 50 INDIA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.4.5.2 Rest of Asia Pacific

- TABLE 51 REST OF ASIA PACIFIC: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 52 REST OF ASIA PACIFIC: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 RECESSION IMPACT

- FIGURE 26 MIDDLE EAST AND AFRICA: ALPHA OLEFINS MARKET SNAPSHOT

- TABLE 53 MIDDLE EAST AND AFRICA: ALPHA OLEFINS MARKET, BY COUNTRY, 2020-2028 (KILOTON)

- TABLE 54 MIDDLE EAST AND AFRICA: ALPHA OLEFINS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 55 MIDDLE EAST AND AFRICA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 56 MIDDLE EAST AND AFRICA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.5.2 SAUDI ARABIA

- 9.5.2.1 Major oil and petrochemical industries contributing to growth

- TABLE 57 SAUDI ARABIA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 58 SAUDI ARABIA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.5.3 TURKEY

- 9.5.3.1 Major petrochemical industry to drive market

- TABLE 59 TURKEY: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 60 TURKEY: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.5.4 REST OF MIDDLE EAST & AFRICA

- TABLE 61 REST OF MIDDLE EAST & AFRICA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 62 REST OF MIDDLE EAST & AFRICA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.6 SOUTH AMERICA

- 9.7 RECESSION IMPACT

- FIGURE 27 SOUTH AMERICA: ALPHA OLEFINS MARKET SNAPSHOT

- TABLE 63 SOUTH AMERICA: ALPHA OLEFINS MARKET, BY COUNTRY, 2020-2028 (KILOTON)

- TABLE 64 SOUTH AMERICA: ALPHA OLEFINS MARKET, BY COUNTRY, 2020-2028 (USD MILLION)

- TABLE 65 SOUTH AMERICA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 66 SOUTH AMERICA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.7.1 BRAZIL

- 9.7.1.1 Major food & beverages industry to lead growth

- TABLE 67 BRAZIL: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 68 BRAZIL: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.7.2 ARGENTINA

- 9.7.2.1 Oil & gas industry and automotive sector to drive demand

- TABLE 69 ARGENTINA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 70 ARGENTINA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

- 9.7.2.2 Rest of South America

- TABLE 71 REST OF SOUTH AMERICA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (KILOTON)

- TABLE 72 REST OF SOUTH AMERICA: ALPHA OLEFINS MARKET, BY APPLICATION, 2020-2028 (USD MILLION)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- TABLE 73 REVIEW OF STRATEGIES ADOPTED BY KEY MANUFACTURERS OF ALPHA OLEFINS

- 10.2 MARKET SHARE ANALYSIS

- 10.2.1 RANKING OF KEY MARKET PLAYERS, 2022

- FIGURE 28 MARKET SHARE ANALYSIS OF TOP 5 PLAYERS IN ALPHA OLEFINS MARKET, 2022

- 10.2.2 MARKET SHARE OF KEY PLAYERS

- TABLE 74 ALPHA OLEFINS MARKET: DEGREE OF COMPETITION

- 10.3 REVENUE ANALYSIS

- FIGURE 29 REVENUE ANALYSIS OF TOP 5 PLAYERS IN ALPHA OLEFINS MARKET 2022

- 10.4 COMPANY EVALUATION QUADRANT MATRIX, 2022

- 10.4.1 STARS

- 10.4.2 PERVASIVE PLAYERS

- 10.4.3 EMERGING LEADERS

- 10.4.4 PARTICIPANTS

- FIGURE 30 ALPHA OLEFINS MARKET: COMPANY EVALUATION QUADRANT, 2022

- 10.5 START-UPS/SMES EVALUATION QUADRANT MATRIX, 2022

- 10.5.1 PROGRESSIVE COMPANIES

- 10.5.2 RESPONSIVE COMPANIES

- 10.5.3 DYNAMIC COMPANIES

- 10.5.4 STARTING BLOCKS

- FIGURE 31 ALPHA OLEFINS MARKET: STARTUPS/SMES EVALUATION QUADRANT, 2022

- 10.6 COMPETITIVE BENCHMARKING

- TABLE 75 ALPHA OLEFINS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 76 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY APPLICATION

- TABLE 77 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, BY REGION

- 10.7 ALPHA OLEFINS MARKET: COMPANY FOOTPRINT

- TABLE 78 APPLICATION: COMPANY FOOTPRINT

- TABLE 79 TYPE : COMPANY FOOTPRINT

- TABLE 80 REGION: COMPANY FOOTPRINT

- TABLE 81 COMPANY FOOTPRINT

- 10.8 COMPETITIVE SCENARIOS & TRENDS

- TABLE 82 ALPHA OLEFINS MARKET: PRODUCT LAUNCHES, 2020-2023

- TABLE 83 ALPHA OLEFINS MARKET: DEALS, APRIL 2019- JUNE 2022

11 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 11.1 KEY PLAYERS

- 11.1.1 ROYAL DUTCH SHELL

- TABLE 84 ROYAL DUTCH SHELL: COMPANY OVERVIEW

- FIGURE 32 ROYAL DUTCH SHELL: COMPANY SNAPSHOT

- TABLE 85 ROYAL DUTCH SHELL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 86 ROYAL DUTCH SHELL: DEALS

- TABLE 87 ROYAL DUTCH SHELL: EXPANSION/MERGER/ACQUISITION

- 11.1.2 CHEVRON PHILLIPS CHEMICAL COMPANY

- TABLE 88 CHEVRON PHILLIPS CHEMICAL COMPANY: COMPANY OVERVIEW

- FIGURE 33 CHEVRON PHILLIPS CHEMICAL COMPANY: COMPANY SNAPSHOT

- TABLE 89 CHEVRON PHILLIPS CHEMICAL COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 90 CHEVRON PHILLIPS CHEMICAL COMPANY: DEALS

- 11.1.3 INEOS GROUP LIMITED

- TABLE 91 INEOS GROUP LIMITED: COMPANY OVERVIEW

- FIGURE 34 INEOS GROUP LIMITED: COMPANY SNAPSHOT

- TABLE 92 INEOS GROUP LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 93 INEOS GROUP LIMITED: DEALS

- TABLE 94 INEOS GROUP LIMITED: PRODUCT LAUNCHES

- 11.1.4 SABIC

- TABLE 95 SABIC: COMPANY OVERVIEW

- FIGURE 35 SABIC: COMPANY SNAPSHOT

- TABLE 96 SABIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 97 SABIC: DEALS

- TABLE 98 SABIC: PRODUCT LAUNCHES

- 11.1.5 SASOL LIMITED

- TABLE 99 SASOL LIMITED: COMPANY OVERVIEW

- FIGURE 36 SASOL LIMITED: COMPANY SNAPSHOT

- TABLE 100 SASOL LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 101 SASOL LIMITED:EXPANSION

- TABLE 102 SASOL LIMITED: DEALS

- 11.1.6 EVONIK INDUSTRIES

- TABLE 103 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- FIGURE 37 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- TABLE 104 EVONIK INDUSTRIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 105 EVONIK INDUSTRIES AG: EXPANSION

- TABLE 106 EVONIK INDUSTRIES AG: DEALS

- 11.1.7 DOW CHEMICAL COMPANY

- TABLE 107 DOW CHEMICAL COMPANY: COMPANY OVERVIEW

- FIGURE 38 DOW CHEMICAL COMPANY: COMPANY SNAPSHOT

- TABLE 108 DOW CHEMICAL COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 109 DOW CHEMICAL COMPANY: DEALS

- 11.1.8 EXXONMOBIL

- TABLE 110 EXXONMOBIL: COMPANY OVERVIEW

- FIGURE 39 EXXONMOBIL: COMPANY SNAPSHOT

- TABLE 111 EXXONMOBIL: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 112 EXXONMOBIL: DEALS

- TABLE 113 EXXONMOBIL: PRODUCT LAUNCHES

- 11.1.9 QATAR CHEMICAL COMPANY

- TABLE 114 QATAR CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 115 QATAR CHEMICAL COMPANY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 116 QATAR CHEMICAL COMPANY: DEALS

- 11.1.10 PJSC NIZHNEKAMSKNEFTEKHIM

- TABLE 117 PJSC NIZHNEKAMSKNEFTEKHIM: COMPANY OVERVIEW

- TABLE 118 PJSC NIZHNEKAMSKNEFTEKHIM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 119 PJSC NIZHNEKAMSKNEFTEKHIM: DEALS

- 11.2 OTHER PLAYERS

- 11.2.1 MITSUBISHI CHEMICAL CORPORATION

- 11.2.2 IDEMITSU PETROCHEMICAL COMPANY

- 11.2.3 SINOPEC BEIJING YASHAN COMPANY

- 11.2.4 PETRO RABIGH

- 11.2.5 MITSUI CHEMICALS INC.

- 11.2.6 MERCK GROUP

- 11.2.7 NPC IRAN

- 11.2.8 JAM PETROCHEMICAL COMPANY

- 11.2.9 TPC GROUP

- 11.2.10 OIL AND GAS NATIONAL CORPORATION

- 11.2.11 SAUDI ARAMCO TOTAL REFINING AND PETROCHEMICAL COMPANY (SATORP)

- 11.2.12 LYONDELLBASELL INDUSTRIES N.V.

- 11.2.13 PETROCHINA COMPANY LIMITED

- 11.2.14 TOKYO CHEMICAL INDUSTRY COMPANY LIMITED

- 11.2.15 ALFA AESAR

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS