|

|

市場調査レポート

商品コード

1309763

熱可塑性テープの世界市場:繊維の種類別 (ガラス、炭素)・樹脂の種類別 (PAEK、PA、PPS、PP)・用途別 (航空宇宙・防衛、自動車・輸送、石油・ガス、スポーツ用品、医療・ヘルスケア)・地域別の将来予測 (2028年まで)Thermoplastic Tapes Market by Fiber Type (Glass, Carbon), Resin Type (PAEK, PA, PPS, PP), Application (Aerospace & Defense, Automotive & Transportation, Oil & Gas, Sporting Goods, Medical & Healthcare), and Region - Global Forecasts to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 熱可塑性テープの世界市場:繊維の種類別 (ガラス、炭素)・樹脂の種類別 (PAEK、PA、PPS、PP)・用途別 (航空宇宙・防衛、自動車・輸送、石油・ガス、スポーツ用品、医療・ヘルスケア)・地域別の将来予測 (2028年まで) |

|

出版日: 2023年07月11日

発行: MarketsandMarkets

ページ情報: 英文 186 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の熱可塑性テープの市場規模は、予測期間中に10.5%のCAGRで成長し、2023年の27億米ドルから、2028年には44億米ドルに成長すると予測されています。

炭素繊維は、その化学的不活性・減衰特性・低コスト性により、高温などの過酷な条件下での利用を対象に、軽量マトリックスとの複合材料として使用されています。炭素繊維熱可塑性テープの使用は、コストが高いため、主に航空宇宙・防衛や高級自動車などの最終用途に限られていました。しかし、長年にわたり、新技術の登場と加工サイクルタイムの短縮により、これらのテープのコストは劇的に低下し、顧客基盤が拡大しました。

人工衛星や航空機の製造工場では、炭素繊維テープが製品の軽量化と燃費効率向上のために使用されています。また、炭素繊維製の熱可塑性テープは、製品の耐久性を向上させます。ゴルフシャフト・野球バット・ホッケースティック・テニスラケットなどのスポーツ用品にも使われています。様々な産業からの需要が市場成長を牽引しています。

"PAEKが、予測期間中に樹脂の種類別で最も高いCAGRを達成する"

熱可塑性テープで最も一般的に使用されている樹脂の一つがPAEKです。この材料は、高強度、優れた耐衝撃性、難燃性などの望ましい特性を誇っています。PEEK、PEK、PEKK、PEKEKKなど、熱可塑性樹脂の一群を代表する材料です。これらの熱可塑性プラスチックテープは、高温、化学薬品への暴露、疲労に耐えることができるため、航空機の内装、ブラケット、シートなど様々な用途に使用されています。

PEKK複合材は耐傷性、耐摩耗性に優れているため、自動車、船舶、医療、エレクトロニクス、航空宇宙産業での使用に適しています。軽量航空機への要求の高まりが、PAEKプリプレグの需要を押し上げています。

"北米地域の熱可塑性テープ市場は、予測期間中に金額ベースで2番目に高い市場シェアを記録する"

北米地域の熱可塑性テープ市場の成長は、主に航空宇宙・防衛や自動車・運輸セクターの成長が牽引しています。低金利、既存企業の存在、厳しい環境規制、軽量複合材料の使用重視も市場を牽引するとみられます。同地域には、Hexcel CorporationやSolvayといった熱可塑性プラスチックテープの大手メーカーがあります。これらの企業は、航空宇宙・防衛、自動車・輸送、石油・ガス、スポーツ用品、医療・ヘルスケア産業で使用される高品質の熱可塑性テープを製造しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- ポーターのファイブフォース分析

- サプライチェーン分析

- 価格分析

- 主要な利害関係者と購入基準

- 技術分析

- 主要な会議とイベント (2023年~2024年)

- 規制状況

- エコシステムマッピング

- バリューチェーン分析

- 輸出入シナリオ

- ケーススタディ分析

- 顧客のビジネスに影響を与える動向と混乱

- 特許分析

第6章 熱可塑性テープ市場:繊維の種類別

- イントロダクション

- ガラス繊維

- 炭素繊維

- その他の繊維

第7章 熱可塑性テープ市場:最終用途産業別

- イントロダクション

- 航空宇宙・防衛

- 自動車・輸送

- 石油・ガス

- スポーツ用品

- 医療・ヘルスケア

- その他の最終用途産業

- 建設・インフラ

- パイプ・タンク

- エネルギー

第8章 熱可塑性テープ市場:樹脂の種類別

- イントロダクション

- ポリアリールエーテルケトン (PAEK)

- ポリアミド (PA)

- ポリフェニレンスルフィド (PPS)

- ポリプロピレン (PP)

- その他の種類の樹脂

第9章 熱可塑性テープ市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- 韓国

- オーストラリア

- 台湾

- その他のアジア太平洋

- 中東・アフリカ

- アラブ首長国連邦

- 南アフリカ

- その他の中東・アフリカ

- ラテンアメリカ

- ブラジル

- メキシコ

- その他のラテンアメリカ

第10章 競合情勢

- イントロダクション

- 市場シェア分析

- 主要企業のランキング

- 上位企業の収益分析

- 企業評価マトリックス

- 市場評価の枠組み

- 競合ベンチマーキング

- 中小企業の評価マトリックス

第11章 企業プロファイル

- 主要企業

- EVONIK INDUSTRIES AG

- SOLVAY

- TORAY INDUSTRIES, INC.

- MITSUI CHEMICALS, INC.

- SABIC

- HEXCEL CORPORATION

- TEIJIN LIMITED

- ARKEMA

- SGL CARBON

- BASF SE

- その他の企業

- 3M

- PARK AEROSPACE CORP.

- CHOMARAT

- SIGMATEX

- DSM

- CELANESE CORPORATION

- AVIENT

- TCR COMPOSITES, INC.

- VICTREX PLC

- COMPTAPE

- MITSUBISHI CHEMICAL GROUP

第12章 付録

The thermoplastic tapes market is projected to grow from USD 2.7 billion in 2023 to USD 4.4 billion by 2028, at a CAGR of 10.5% during the forecast period. Carbon fibers are used in composites with a lightweight matrix for applications in extreme conditions such as high temperatures due to its chemical inertness, damping properties, and low cost. The use of carbon fiber thermoplastic tapes was majorly restricted to high-end applications such as aerospace & defense and luxury automobiles due to their high cost. However, over the years, the cost of these tapes has reduced drastically due to the advent of new technologies and a decreased cycle time for processing, thereby increasing their customer base.

In satellites and aeronautics manufacturing plants, carbon fiber tapes are used to make products lightweight and fuel efficient. Carbon fiber thermoplastic tapes also provide longer durability to the products. They are also used in sporting goods such as golf shafts, baseball bats, hockey sticks, and tennis rackets. The demand from various industries are driving the growth of carbon fiber in the market.

''The PAEK resin type is projected to register the highest CAGR during the forecasted year''

One of the most commonly used resins in thermoplastic tapes is PAEK. This material boasts high strength, good impact resistance, and flame retardance, among other desirable properties. It represents a whole family of thermoplastics, including PEEK, PEK, PEKK, and PEKEKK. These thermoplastic tapes are used for various applications, such as aircraft interiors, brackets, and seats, due to their ability to withstand high temperatures, chemical exposure, and fatigue.

PEKK composites are highly scratch and abrasion-resistant, making them suitable for use in the automotive, marine, medical, electronics, and aerospace industries. The increasing requirement of light weight aircraft is boosting the demand of PAEK prepregs.

"During the forecast period, the thermoplastic tapes market in North America region is projected to register the second highest market share, in terms of value"

The growth of the thermoplastic tapes market in the North America region is mainly driven by the growing aerospace & defense and automotive & transportation sectors. Low interest rates, presence of established players, stringent environmental regulations, and emphasizing the use of lightweight composite materials are also expected to drive the market. The region is home to some of the prominent manufacturers of thermoplastic tapes, such as Hexcel Corporation and Solvay. These companies manufacture high-quality thermoplastic tapes used in aerospace & defense, automotive & transportation, oil & gas, sporting goods, and medical & healthcare industries.

The demand for thermoplastic tapes is increasing due to their growing consumption by Boeing in its aircraft, which is one of the major aircraft manufacturers in the North American region. Thermoplastic tapes are used in primary and secondary structures of the aircraft, mainly in wing spars, wing skins, fuselage skin, access panels, rib stiffeners, brackets, conduit, and flooring.

This study has been validated through primary interviews with industry experts globally. These primary sources have been divided into the following three categories:

- By Company Type- Tier 1- 37%, Tier 2- 33%, and Tier 3- 30%

- By Designation- C Level- 50%, Director Level- 20%, and Others- 30%

- By Region- Europe- 50%, Asia Pacific (APAC) - 20%, North America- 15%, Middle East & Africa (MEA)-10%, Latin America- 5%,

The report provides a comprehensive analysis of company profiles:

Prominent companies include Toray Industries, Inc.(Japan), Teijin Limited (Japan), SGL Carbon (Germany), Solvay (Belgium), Hexcel Corporation (US), , SABIC (Saudi Arabia), Mitsui Chemicals, Inc. (Japan), Evonik Industries AG (Germany), Arkema (Netherlands), and BASF SE (US), among others.

Research Coverage

This research report categorizes the thermoplastic tapes market by fiber type (Carbon, Glass, and Others), resin type (PAEK, PA, PPS, PP, Others), application (Aerospace & Defense, Automotive & Transportation, Oil & Gas, Medical & Healthcare, Sporting Goods, and Others) & region (North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America). The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the thermoplastic tapes market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, and services; key strategies; Contracts, partnerships, agreements. new product & service launches, mergers and acquisitions, and recent developments associated with the thermoplastic tapes market. Competitive analysis of upcoming startups in the thermoplastic tapes market ecosystem is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall thermoplastic tapes market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and to plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Wide application in primary and secondary aircraft structures, High durability and fatigue resistance, reduced fuel consumption and carbon emission, easy recyclability), restraints (high processing and manufacturing cost), opportunities (Increased demand from various industries, rising need for electric vehicles, reduced carbon fiber cost), and challenges (development of low cost technologies, limited use of carbon fiber in high temperature applications) influencing the growth of the thermoplastic tapes market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the thermoplastic tapes market

- Market Development: Comprehensive information about lucrative markets - the report analyses the thermoplastic tapes market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the thermoplastic tapes market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players like Toray Industries, Inc.(Japan), Teijin Limited (Japan), SGL Carbon (Germany), Solvay (Belgium), Hexcel Corporation (US), SABIC (Saudi Arabia), Mitsui Chemicals, Inc. (Japan) among others in the fiberglass market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- FIGURE 1 THERMOPLASTIC TAPES MARKET SEGMENTATION

- 1.3.1 REGIONS COVERED

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- FIGURE 2 THERMOPLASTIC TAPES MARKET: RESEARCH DESIGN

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key primary participants

- 2.1.2.3 Breakdown of primary interviews

- 2.1.2.4 Key industry insights

- 2.2 BASE NUMBER CALCULATION

- 2.2.1 APPROACH 1: DEMAND-SIDE ANALYSIS

- 2.2.2 APPROACH 2: SUPPLY-SIDE ANALYSIS

- 2.3 FORECAST NUMBER CALCULATION

- 2.3.1 SUPPLY SIDE

- 2.3.2 DEMAND SIDE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

- 2.5 DATA TRIANGULATION

- FIGURE 5 THERMOPLASTIC TAPES MARKET: DATA TRIANGULATION

- 2.6 RECESSION IMPACT

- 2.7 FACTOR ANALYSIS

- 2.8 ASSUMPTIONS

- 2.9 LIMITATIONS AND RISKS

3 EXECUTIVE SUMMARY

- FIGURE 6 AEROSPACE & DEFENSE END-USE INDUSTRY TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 7 CARBON FIBER ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- FIGURE 8 PAEK RESIN DOMINATED MARKET IN 2022

- FIGURE 9 EUROPE TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN THERMOPLASTIC TAPES MARKET

- FIGURE 10 HIGH DEMAND FOR THERMOPLASTIC TAPES FROM AEROSPACE & DEFENSE SECTOR TO DRIVE MARKET

- 4.2 THERMOPLASTIC TAPES MARKET, BY RESIN TYPE

- FIGURE 11 PAEK ACCOUNTED FOR LARGEST MARKET SHARE IN 2022

- 4.3 THERMOPLASTIC TAPES MARKET, BY FIBER TYPE

- FIGURE 12 CARBON FIBER DOMINATED MARKET IN 2022

- 4.4 THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY

- FIGURE 13 AUTOMOTIVE & TRANSPORTATION RECORDED HIGHEST GROWTH DURING FORECAST PERIOD 2023-2028

- 4.5 THERMOPLASTIC TAPES MARKET, BY KEY COUNTRY

- FIGURE 14 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Wide application in primary and secondary aircraft structures

- 5.2.1.2 High durability and fatigue resistance

- 5.2.1.3 Reduced fuel consumption and carbon emission

- 5.2.1.4 Increasing adoption of eco-friendly products

- 5.2.2 RESTRAINTS

- 5.2.2.1 High processing and manufacturing costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increased demand from various industries

- 5.2.3.2 Rising need for electric vehicles

- 5.2.3.3 Reduced carbon fiber cost

- 5.2.4 CHALLENGES

- 5.2.4.1 Development of low-cost technologies

- 5.2.4.2 Limited use of carbon fiber tapes in high-temperature applications

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- FIGURE 16 PORTER'S FIVE FORCES ANALYSIS: THERMOPLASTIC TAPES MARKET

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- TABLE 1 PORTER'S FIVE FORCES ANALYSIS OF THERMOPLASTIC TAPES MARKET

- 5.4 SUPPLY CHAIN ANALYSIS

- TABLE 2 THERMOPLASTIC TAPES MARKET: SUPPLY CHAIN

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE, BY END-USE INDUSTRY

- FIGURE 17 AVERAGE SELLING PRICE OF KEY PLAYERS BY TOP THREE END-USE INDUSTRIES (USD/KG)

- 5.5.2 AVERAGE SELLING PRICE, BY FIBER TYPE

- FIGURE 18 AVERAGE SELLING PRICE BY FIBER TYPE (USD/KG)

- 5.5.3 AVERAGE SELLING PRICE, BY RESIN TYPE

- FIGURE 19 AVERAGE SELLING PRICE BY RESIN TYPE (USD/KG)

- 5.5.4 AVERAGE SELLING PRICE, BY REGION

- TABLE 3 AVERAGE SELLING PRICE OF THERMOPLASTIC TAPES BY REGION

- 5.6 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 20 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USE INDUSTRIES

- TABLE 4 IMPACT OF STAKEHOLDERS ON BUYING PROCESS

- 5.6.2 BUYING CRITERIA

- FIGURE 21 KEY BUYING CRITERIA FOR TOP THREE END-USE INDUSTRIES

- TABLE 5 KEY BUYING CRITERIA FOR TOP THREE END USERS

- 5.7 TECHNOLOGY ANALYSIS

- 5.8 KEY CONFERENCES AND EVENTS, 2023-2024

- TABLE 6 THERMOPLASTIC TAPES MARKET: KEY CONFERENCES AND EVENTS, 2023-2024

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10 ECOSYSTEM MAPPING

- FIGURE 22 THERMOPLASTIC TAPES MARKET: ECOSYSTEM MAP

- 5.10.1 RAW MATERIAL ANALYSIS

- 5.10.2 MANUFACTURING PROCESS ANALYSIS

- 5.10.3 FINAL PRODUCT ANALYSIS

- 5.11 VALUE CHAIN ANALYSIS

- FIGURE 23 VALUE CHAIN ANALYSIS: THERMOPLASTIC TAPES MARKET

- 5.12 IMPORT-EXPORT SCENARIO

- 5.12.1 JAPAN

- 5.12.2 US

- 5.12.3 GERMANY

- 5.12.4 FRANCE

- 5.12.5 CHINA

- 5.13 CASE STUDY ANALYSIS

- 5.14 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 24 REVENUE SHIFT OF THERMOPLASTIC TAPES MARKET

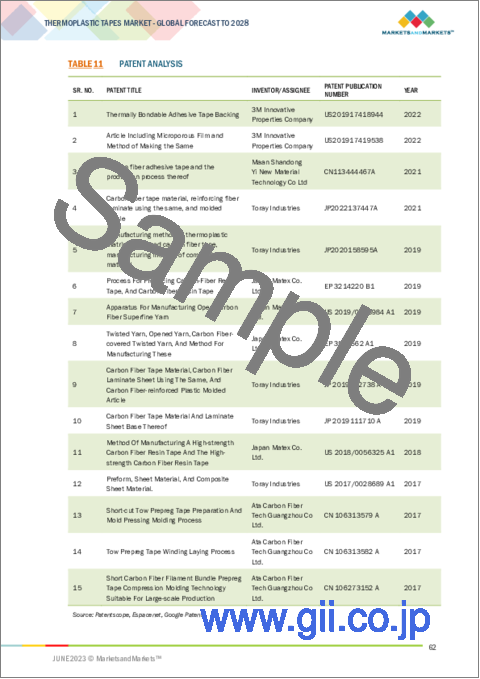

- 5.15 PATENT ANALYSIS

- 5.15.1 METHODOLOGY

- 5.15.2 DOCUMENT TYPES

- TABLE 10 THERMOPLASTIC TAPES MARKET: GLOBAL PATENTS

- FIGURE 25 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 26 GLOBAL PATENT PUBLICATION TRENDS, 2012-2022

- 5.15.3 INSIGHTS

- 5.15.4 LEGAL STATUS

- FIGURE 27 THERMOPLASTIC TAPES MARKET: LEGAL STATUS OF PATENTS

- 5.15.5 JURISDICTION ANALYSIS

- FIGURE 28 GLOBAL JURISDICTION ANALYSIS

- 5.15.6 TOP APPLICANTS

- FIGURE 29 ZHEJIANG UNIVERSITY REGISTERED HIGHEST NUMBER OF PATENTS

- TABLE 11 PATENT ANALYSIS

6 THERMOPLASTIC TAPES MARKET, BY FIBER TYPE

- 6.1 INTRODUCTION

- FIGURE 30 CARBON FIBER SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- TABLE 12 THERMOPLASTIC TAPES MARKET, BY FIBER TYPE, 2021-2028 (USD MILLION)

- TABLE 13 THERMOPLASTIC TAPES MARKET, BY FIBER TYPE, 2021-2028 (KILOTON)

- 6.2 GLASS FIBERS

- 6.2.1 USED TO BUILD PARTS & MOLDS

- TABLE 14 GLASS FIBER: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 15 GLASS FIBER: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (KILOTON)

- 6.3 CARBON FIBERS

- 6.3.1 USED IN SPORTING GOODS

- TABLE 16 CARBON FIBER: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 17 CARBON FIBER: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (KILOTON)

- 6.4 OTHER FIBERS

- TABLE 18 OTHER FIBERS: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 19 OTHER FIBERS: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (KILOTON)

7 THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY

- 7.1 INTRODUCTION

- FIGURE 31 AEROSPACE & DEFENSE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- TABLE 20 THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 21 THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- 7.2 AEROSPACE & DEFENSE

- 7.2.1 NEED FOR FUEL-EFFICIENT AND ADVANCED AIRCRAFT TO DRIVE MARKET

- FIGURE 32 EUROPE TO LEAD MARKET IN AEROSPACE & DEFENSE SEGMENT

- TABLE 22 AEROSPACE & DEFENSE: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 23 AEROSPACE & DEFENSE: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (KILOTON)

- 7.3 AUTOMOTIVE & TRANSPORTATION

- 7.3.1 RISING DEMAND FOR LIGHTWEIGHT VEHICLES TO REDUCE FUEL CONSUMPTION

- TABLE 24 AUTOMOTIVE & TRANSPORTATION: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 25 AUTOMOTIVE & TRANSPORTATION: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (KILOTON)

- 7.4 OIL & GAS

- 7.4.1 USE OF THERMOPLASTIC TAPES IN DEEP-SEA OIL FACILITIES TO PROPEL MARKET

- TABLE 26 OIL & GAS: THERMOPLASTIC TAPES MARKET, REGION, 2021-2028 (USD MILLION)

- TABLE 27 OIL & GAS: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (KILOTON)

- 7.5 SPORTING GOODS

- 7.5.1 USE OF SMALL TOW CARBON FIBERS TO BOOST MARKET

- TABLE 28 SPORTING GOODS: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 29 SPORTING GOODS: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (KILOTON)

- 7.6 MEDICAL & HEALTHCARE

- 7.6.1 INCREASING INVESTMENT IN MEDICAL AND PHARMA INDUSTRIES TO PROPEL MARKET

- TABLE 30 MEDICAL & HEALTHCARE: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 31 MEDICAL & HEALTHCARE: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (KILOTON)

- 7.7 OTHER END-USE INDUSTRIES

- 7.7.1 CONSTRUCTION & INFRASTRUCTURE

- 7.7.2 PIPES & TANKS

- 7.7.3 ENERGY

- TABLE 32 OTHER END-USE INDUSTRIES: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 33 OTHER END-USE INDUSTRIES: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (KILOTON)

8 THERMOPLASTIC TAPES MARKET, BY RESIN TYPE

- 8.1 INTRODUCTION

- FIGURE 33 PAEK SEGMENT TO DOMINATE THERMOPLASTIC TAPES MARKET

- TABLE 34 THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021-2028 (USD MILLION)

- TABLE 35 THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021-2028 (KILOTON)

- 8.2 POLYARYLETHERKETONE

- 8.2.1 GOOD THERMAL STABILITY AND LOW FRICTION COEFFICIENT

- TABLE 36 PAEK: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 37 PAEK: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (KILOTON)

- 8.3 POLYAMIDE

- 8.3.1 HIGH RESISTANCE TO HEAT AND CHEMICAL ATTACK

- TABLE 38 PA: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 39 PA: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (KILOTON)

- 8.4 POLYPHENYLENE SULFIDE

- 8.4.1 THERMALLY STABLE AND CORROSION RESISTANT

- TABLE 40 PPS: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 41 PPS: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (KILOTON)

- 8.5 POLYPROPYLENE

- 8.5.1 OFFERS SUPERIOR STRENGTH AND CHEMICAL RESISTANCE

- TABLE 42 PP: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 43 PP: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (KILOTON)

- 8.6 OTHER RESIN TYPES

- TABLE 44 OTHER RESINS: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 45 OTHER RESINS: THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (KILOTON)

9 THERMOPLASTIC TAPES MARKET, BY REGION

- 9.1 INTRODUCTION

- FIGURE 34 CHINA TO RECORD FASTEST GROWTH IN CARBON FIBER MARKET DURING FORECAST PERIOD

- TABLE 46 THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (USD MILLION)

- TABLE 47 THERMOPLASTIC TAPES MARKET, BY REGION, 2021-2028 (KILOTON)

- 9.2 NORTH AMERICA

- FIGURE 35 NORTH AMERICA: THERMOPLASTIC TAPES MARKET SNAPSHOT

- TABLE 48 NORTH AMERICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- TABLE 50 NORTH AMERICA: THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021-2028 (USD MILLION)

- TABLE 51 NORTH AMERICA: THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021-2028 (KILOTON)

- TABLE 52 NORTH AMERICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- TABLE 54 NORTH AMERICA: THERMOPLASTIC TAPES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: THERMOPLASTIC TAPES MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- 9.2.1 US

- 9.2.1.1 Presence of well-established players to drive market

- TABLE 56 US: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 57 US: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- 9.2.2 CANADA

- 9.2.2.1 Growth of manufacturing sector to propel market

- TABLE 58 CANADA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 59 CANADA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- 9.3 EUROPE

- FIGURE 36 EUROPE: THERMOPLASTIC TAPES MARKET SNAPSHOT

- TABLE 60 EUROPE: THERMOPLASTIC TAPES MARKET, BY FIBER TYPE, 2021-2028 (USD MILLION)

- TABLE 61 EUROPE: THERMOPLASTIC TAPES MARKET, BY FIBER TYPE, 2021-2028 (KILOTON)

- TABLE 62 EUROPE: THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021-2028 (USD MILLION)

- TABLE 63 EUROPE: THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021-2028 (KILOTON)

- TABLE 64 EUROPE: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 65 EUROPE: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- TABLE 66 EUROPE: THERMOPLASTIC TAPES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 67 EUROPE: THERMOPLASTIC TAPES MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- 9.3.1 GERMANY

- 9.3.1.1 Strong manufacturing base and infrastructure to drive market

- TABLE 68 GERMANY: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 69 GERMANY: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- 9.3.2 FRANCE

- 9.3.2.1 Increasing demand in aerospace & defense sector to propel market

- TABLE 70 FRANCE: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 71 FRANCE: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- 9.3.3 UK

- 9.3.3.1 High demand for fuel-efficient and lightweight vehicles to boost market

- TABLE 72 UK: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 73 UK: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- 9.3.4 ITALY

- 9.3.4.1 Growth of automotive & transportation sector to fuel demand for thermoplastic tapes

- TABLE 74 ITALY: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 75 ITALY: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- 9.3.5 SPAIN

- 9.3.5.1 Use of composites in aircraft to boost market

- TABLE 76 SPAIN: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 77 SPAIN: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- 9.3.6 REST OF EUROPE

- TABLE 78 REST OF EUROPE: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 79 REST OF EUROPE: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- 9.4 ASIA PACIFIC

- FIGURE 37 ASIA PACIFIC: THERMOPLASTIC TAPES MARKET SNAPSHOT

- TABLE 80 ASIA PACIFIC: THERMOPLASTIC TAPES MARKET, BY FIBER TYPE, 2021-2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: THERMOPLASTIC TAPES MARKET, BY FIBER TYPE, 2021-2028 (KILOTON)

- TABLE 82 ASIA PACIFIC: THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021-2028 (USD MILLION)

- TABLE 83 ASIA PACIFIC: THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021-2028 (KILOTON)

- TABLE 84 ASIA PACIFIC: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 85 ASIA PACIFIC: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- TABLE 86 ASIA PACIFIC: THERMOPLASTIC TAPES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 87 ASIA PACIFIC: THERMOPLASTIC TAPES MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- 9.4.1 CHINA

- 9.4.1.1 Demand for sporting goods to drive market

- TABLE 88 CHINA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 89 CHINA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- 9.4.2 JAPAN

- 9.4.2.1 Production of high-quality thermoplastic tapes to drive market

- TABLE 90 JAPAN: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 91 JAPAN: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- 9.4.3 SOUTH KOREA

- 9.4.3.1 Presence of major automotive companies to boost market

- TABLE 92 SOUTH KOREA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 93 SOUTH KOREA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- 9.4.4 AUSTRALIA

- 9.4.4.1 Increasing demand for electric vehicles to propel market

- TABLE 94 AUSTRALIA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 95 AUSTRALIA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- 9.4.5 TAIWAN

- 9.4.5.1 Growth of sporting goods industry to drive market

- TABLE 96 TAIWAN: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 97 TAIWAN: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- 9.4.6 REST OF ASIA PACIFIC

- TABLE 98 REST OF ASIA PACIFIC: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 99 REST OF ASIA PACIFIC: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- 9.5 MIDDLE EAST & AFRICA

- TABLE 100 MIDDLE EAST & AFRICA: THERMOPLASTIC TAPES MARKET, BY FIBER TYPE, 2021-2028 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: THERMOPLASTIC TAPES MARKET, BY FIBER TYPE, 2021-2028 (KILOTON)

- TABLE 102 MIDDLE EAST & AFRICA: THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021-2028 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021-2028 (KILOTON)

- TABLE 104 MIDDLE EAST & AFRICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- TABLE 106 MIDDLE EAST & AFRICA: THERMOPLASTIC TAPES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 107 MIDDLE EAST & AFRICA: THERMOPLASTIC TAPES MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- 9.5.1 UAE

- 9.5.1.1 Investment by leading players to fuel market growth

- TABLE 108 UAE: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 109 UAE: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- 9.5.2 SOUTH AFRICA

- 9.5.2.1 Growth of automotive & transportation sector to drive market

- TABLE 110 SOUTH AFRICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 111 SOUTH AFRICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- 9.5.3 REST OF MIDDLE EAST & AFRICA

- TABLE 112 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 113 REST OF MIDDLE EAST & AFRICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- 9.6 LATIN AMERICA

- TABLE 114 LATIN AMERICA: THERMOPLASTIC TAPES MARKET, BY FIBER TYPE, 2021-2028 (USD MILLION)

- TABLE 115 LATIN AMERICA: THERMOPLASTIC TAPES MARKET, BY FIBER TYPE, 2021-2028 (KILOTON)

- TABLE 116 LATIN AMERICA: THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021-2028 (USD MILLION)

- TABLE 117 LATIN AMERICA: THERMOPLASTIC TAPES MARKET, BY RESIN TYPE, 2021-2028 (KILOTON)

- TABLE 118 LATIN AMERICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 119 LATIN AMERICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- TABLE 120 LATIN AMERICA: THERMOPLASTIC TAPES MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 121 LATIN AMERICA: THERMOPLASTIC TAPES MARKET, BY COUNTRY, 2021-2028 (KILOTON)

- 9.6.1 BRAZIL

- 9.6.1.1 Growth of aerospace & defense sector to boost market

- TABLE 122 BRAZIL: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 123 BRAZIL: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- 9.6.2 MEXICO

- 9.6.2.1 Expansion of automotive & transportation sector to propel market

- TABLE 124 MEXICO: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 125 MEXICO: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

- 9.6.3 REST OF LATIN AMERICA

- TABLE 126 REST OF LATIN AMERICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (USD MILLION)

- TABLE 127 REST OF LATIN AMERICA: THERMOPLASTIC TAPES MARKET, BY END-USE INDUSTRY, 2021-2028 (KILOTON)

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 MARKET SHARE ANALYSIS

- FIGURE 38 MARKET SHARE ANALYSIS OF TOP COMPANIES IN THERMOPLASTIC TAPES MARKET, 2022

- TABLE 128 DEGREE OF COMPETITION: THERMOPLASTIC TAPES MARKET

- 10.3 RANKING OF KEY PLAYERS

- FIGURE 39 RANKING OF TOP FIVE PLAYERS IN THERMOPLASTIC TAPES MARKET

- 10.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

- FIGURE 40 REVENUE ANALYSIS OF TOP PLAYERS IN THERMOPLASTIC TAPES MARKET

- 10.5 COMPANY EVALUATION MATRIX

- TABLE 129 COMPANY PRODUCT FOOTPRINT

- TABLE 130 COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 131 COMPANY REGION FOOTPRINT

- 10.5.1 STARS

- 10.5.2 PERVASIVE PLAYERS

- 10.5.3 PARTICIPANTS

- 10.5.4 EMERGING LEADERS

- FIGURE 41 THERMOPLASTIC TAPES MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- 10.6 MARKET EVALUATION FRAMEWORK

- TABLE 132 THERMOPLASTIC TAPES MARKET: PRODUCT DEVELOPMENTS, 2018-2023

- TABLE 133 THERMOPLASTIC TAPES MARKET: DEALS, 2018-2023

- TABLE 134 THERMOPLASTIC TAPES MARKET: OTHER DEVELOPMENTS, 2018-2023

- 10.7 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 135 THERMOPLASTIC TAPES MARKET: KEY STARTUPS/SMES

- TABLE 136 THERMOPLASTIC TAPES MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.8 SME EVALUATION MATRIX

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- FIGURE 42 THERMOPLASTIC TAPES MARKET: SME EVALUATION MATRIX, 2022

11 COMPANY PROFILES

- (Business overview, Products/Solutions/Services offered, Recent Developments, MNM view)**

- 11.1 KEY PLAYERS

- 11.1.1 EVONIK INDUSTRIES AG

- TABLE 137 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- FIGURE 43 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- TABLE 138 EVONIK INDUSTRIES AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 139 EVONIK INDUSTRIES AG: OTHER DEVELOPMENTS

- 11.1.2 SOLVAY

- TABLE 140 SOLVAY: COMPANY OVERVIEW

- FIGURE 44 SOLVAY: COMPANY SNAPSHOT

- TABLE 141 SOLVAY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 142 SOLVAY: DEALS

- TABLE 143 SOLVAY: OTHER DEVELOPMENTS

- 11.1.3 TORAY INDUSTRIES, INC.

- TABLE 144 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- FIGURE 45 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- TABLE 145 TORAY INDUSTRIES, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 146 TORAY INDUSTRIES, INC.: DEALS

- TABLE 147 TORAY INDUSTRIES, INC.: OTHER DEVELOPMENTS

- 11.1.4 MITSUI CHEMICALS, INC.

- TABLE 148 MITSUI CHEMICALS, INC.: COMPANY OVERVIEW

- FIGURE 46 MITSUI CHEMICALS, INC.: COMPANY SNAPSHOT

- TABLE 149 MITSUI CHEMICALS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 150 MITSUI CHEMICALS, INC.: DEALS

- 11.1.5 SABIC

- TABLE 151 SABIC: COMPANY OVERVIEW

- FIGURE 47 SABIC: COMPANY SNAPSHOT

- TABLE 152 SABIC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 153 SABIC: OTHER DEVELOPMENTS

- 11.1.6 HEXCEL CORPORATION

- TABLE 154 HEXCEL CORPORATION: COMPANY OVERVIEW

- FIGURE 48 HEXCEL CORPORATION: COMPANY SNAPSHOT

- TABLE 155 HEXCEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 156 HEXCEL CORPORATION: DEALS

- 11.1.7 TEIJIN LIMITED

- TABLE 157 TEIJIN LIMITED: COMPANY OVERVIEW

- FIGURE 49 TEIJIN LIMITED: COMPANY SNAPSHOT

- TABLE 158 TEIJIN LIMITED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 TEIJIN LIMITED: DEALS

- TABLE 160 TEIJIN LIMITED: OTHER DEVELOPMENTS

- 11.1.8 ARKEMA

- TABLE 161 ARKEMA: COMPANY OVERVIEW

- FIGURE 50 ARKEMA: COMPANY SNAPSHOT

- TABLE 162 ARKEMA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 ARKEMA: DEALS

- 11.1.9 SGL CARBON

- TABLE 164 SGL CARBON: COMPANY OVERVIEW

- FIGURE 51 SGL CARBON: COMPANY SNAPSHOT

- TABLE 165 SGL CARBON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- 11.1.10 BASF SE

- TABLE 166 BASF SE: COMPANY OVERVIEW

- FIGURE 52 BASF SE: COMPANY SNAPSHOT

- TABLE 167 BASF SE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 168 BASF SE: DEALS

- *Details on Business overview, Products/Solutions/Services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

- 11.2 OTHER PLAYERS

- 11.2.1 3M

- 11.2.2 PARK AEROSPACE CORP.

- 11.2.3 CHOMARAT

- 11.2.4 SIGMATEX

- 11.2.5 DSM

- 11.2.6 CELANESE CORPORATION

- 11.2.7 AVIENT

- 11.2.8 TCR COMPOSITES, INC.

- 11.2.9 VICTREX PLC

- 11.2.10 COMPTAPE

- 11.2.11 MITSUBISHI CHEMICAL GROUP

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS