|

|

市場調査レポート

商品コード

1309762

糖化アルブミンアッセイの世界市場:用途別 (境界型糖尿病、1型糖尿病、2型糖尿病)・エンドユーザー別 (病院・糖尿病治療センター、診断検査室)・地域別 (北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ) の将来予測 (2028年まで)Glycated Albumin Assay Market by Application (Prediabetes, Type 1 Diabetes, Type 2 Diabetes), End User (Hospitals & Diabetic Care Center, Diagnostic Laboratory) & Region (North America, Europe, APAC, Latin America, & MENA) - Global Forecast to 2028 |

||||||

カスタマイズ可能

|

|||||||

| 糖化アルブミンアッセイの世界市場:用途別 (境界型糖尿病、1型糖尿病、2型糖尿病)・エンドユーザー別 (病院・糖尿病治療センター、診断検査室)・地域別 (北米、欧州、アジア太平洋、ラテンアメリカ、中東・アフリカ) の将来予測 (2028年まで) |

|

出版日: 2023年07月10日

発行: MarketsandMarkets

ページ情報: 英文 124 Pages

納期: 即納可能

|

- 全表示

- 概要

- 目次

世界の糖化アルブミンアッセイの市場規模は、2023年の2億米ドルから2028年には3億米ドルに達すると予測され、予測期間中のCAGRは8.9%と見込まれています。

市場成長の原動力は、65歳以上の糖尿病患者の増加や、疾病診断に対する政府の取り組みなどの要因です。一方、不利な償還シナリオなどの課題が、市場成長の主な抑制要因となっています。

"境界型糖尿病が予測期間中、用途別で最も成長率が高い"

糖化アルブミンアッセイ市場を用途別に見ると、2022年には境界型糖尿病が市場成長率が最も高くなっています。糖尿病のような生活習慣病の予防への関心の高まり、診断検査室の増加、新興国における医療インフラの改善が、このセグメントの成長に寄与する主な要因です。

"エンドユーザー別では予測期間中、診断検査室の分野が最も高い成長率を達成する"

糖化アルブミンアッセイ市場をエンドユーザー別に見ると、2022年には診断検査室のセグメントが最も成長率が高くなっています。診断検査室は、医療プロバイダーや患者に費用対効果が高く便利な検査オプションを提供します。診断検査室に糖化アルブミン検査を委託することで、医療提供者は内部の検査施設や関連コストの必要性を回避することができます。さらに、患者は入院や専門的な病院を受診することなく、糖化アルブミンアッセイのために診断研究所を訪れることができます。費用対効果と利便性から、診断検査室は魅力的な選択肢であり、需要の増加とセグメントの成長につながります。

"アジア太平洋:糖化アルブミンアッセイ市場で最も成長著しい地域"

世界の糖化アルブミンアッセイ市場を地域別に見ると、予測期間中はアジア太平洋が最も高いCAGRが記録されると予測されています。同地域の糖化アルブミンアッセイ市場は、糖尿病啓発プログラムの増加や政府の医療政策の好影響を受けて拡大しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- 価格分析

- 特許分析

- バリューチェーン分析

- サプライチェーン分析

- エコシステム分析

- ポーターのファイブフォース分析

- 規制状況

- 貿易分析

- 技術分析

- 主要な会議とイベント

- PESTLE分析

- 顧客のビジネスに影響を与える動向/混乱

- 主要な利害関係者と購入基準

- ケーススタディ分析

第6章 糖化アルブミンアッセイ市場:用途別

- イントロダクション

- 2型糖尿病

- 境界型糖尿病

- 1型糖尿病

第7章 糖化アルブミンアッセイ市場:エンドユーザー別

- イントロダクション

- 病院・糖尿病治療センター

- 診断検査室

- その他のエンドユーザー

第8章 糖化アルブミンアッセイ市場:地域別

- イントロダクション

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- その他のアジア太平洋

- ラテンアメリカ

- 中東・アフリカ

第9章 競合情勢

- 概要

- 主要企業の収益シェア分析

- 市場シェア分析

- 糖化アルブミンアッセイ市場:企業評価マトリックス

- 糖化アルブミンアッセイ市場:スタートアップ/中小企業の企業評価マトリックス (2022年)

- 競合ベンチマーキング

第10章 企業プロファイル

- 主要企業

- ASAHI KASEI CORPORATION

- BEIJING STRONG BIOTECHNOLOGIES, INC.

- DIAZYME LABORATORIES, INC.

- DXGEN CORP.

- WELDON BIOTECH, INC.

- HZYMES BIOTECH

第11章 付録

The global glycated albumin assay market is projected to reach USD 0.3 billion by 2028 from USD 0.2 billion in 2023, at a CAGR of 8.9% during the forecast period. Market growth is driven by factors such as the increased number of diabetic patients above the age of 65 years and government initiatives for disease diagnosis. On the other hand, challenges associated with the glycated albumin assay market, like unfavorable reimbursement scenarios, are the major factors restricting market growth.

"The prediabetic segment accounted for the highest growth rate in the glycated albumin assay market, by application, during the forecast period"

The glycated albumin assay market is segmented into prediabetes, type 1 diabetes, and type 2 diabetes. In 2022, the prediabetes segment accounted for the highest glycated albumin assay market growth rate. The increasing focus on the prevention of lifestyle diseases like diabetes, growth in the number of diagnostic laboratories, and improving healthcare infrastructure in emerging countries are major factors contributing to this segment's growth.

"The diagnostic laboratories segment accounted for the highest growth in the glycated albumin assay market, by end-user, during the forecast period"

The glycated albumin assay market is segmented into hospitals and diabetes care centers, diagnostic laboratories, and other end-user based on end users. In 2022, the diagnostic laboratories segment accounted for the highest glycated albumin assay market growth rate. Diagnostics laboratories often offer cost-effective and convenient testing options for healthcare providers and patients. By outsourcing glycated albumin testing to diagnostics laboratories, healthcare providers can avoid the need for in-house testing facilities and associated costs. Additionally, patients can visit diagnostics laboratories for their glycated albumin assays without the need for hospitalization or specialized clinic visits. The cost-effectiveness and convenience of diagnostics laboratories make them an attractive option, leading to increased demand and segment growth.

"Asia Pacific: The fastest-growing region in glycated albumin assay market"

The North American, European, Asia Pacific, Latin American, Middle Eastern, and African regions make up the major segments of the worldwide glycated albumin assay market. The highest CAGR is anticipated to be recorded over the forecast period in the Asia Pacific region. The glycated albumin assay market in this region is expanding as a result of an increase in diabetes awareness programmes and favourable government healthcare policies.

The primary interviews conducted for this report can be categorized as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 27%, D-level - 18%, and Others - 55%

- By Region: North America - 51%, Europe - 21%, Asia Pacific - 18%, Latin America - 6% , and the Middle East & Africa - 4%

List of Companies Profiled in the Report:

- Asahi Kasei Corporation (Japan)

- Beijing Strong Biotechnologies, Inc. (China)

- Diazyme Laboratories, Inc. (US)

- DxGen Corp. (South Korea)

- Weldon Biotech, Inc.(India)

- Hzymes Biotech (China)

Research Coverage:

This report provides a detailed picture of the global glycated albumin assay market. It aims at estimating the size and future growth potential of the market across different segments, such as application, end user, and region. The report also includes an in-depth competitive analysis of the key market players, along with their company profile and key market strategies.

Key Benefits of Buying the Report:

The report will help market leaders/new entrants by providing them with the closest approximations of the revenue numbers for the overall glycated albumin assay market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to better position their business and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 GEOGRAPHICAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 LIMITATIONS

- 1.6 STAKEHOLDERS

- 1.7 RECESSION IMPACT

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 RESEARCH APPROACH

- FIGURE 1 GLYCATED ALBUMIN ASSAY MARKET: RESEARCH DESIGN METHODOLOGY

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Primary sources

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Key industry insights

- 2.2.2.4 Breakdown of primary interviews

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach 1: Company revenue estimation approach

- FIGURE 4 BOTTOM-UP APPROACH: COMPANY REVENUE ESTIMATION APPROACH

- 2.3.1.2 Approach 2: Primary interviews

- 2.3.1.3 Growth forecast

- 2.3.1.4 Glycated Albumin Assay Market: CAGR Projections

- FIGURE 5 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- 2.3.2 TOP-DOWN APPROACH

- FIGURE 6 GLYCATED ALBUMIN ASSAY MARKET: TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION METHODOLOGY

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- 2.5 MARKET SHARE ANALYSIS

- 2.6 STUDY ASSUMPTIONS

- 2.7 STUDY LIMITATIONS

- 2.8 GROWTH RATE ASSUMPTIONS

- 2.9 RISK ASSESSMENT

- 2.9.1 GLYCATED ALBUMIN ASSAY MARKET: RISK ASSESSMENT ANALYSIS

- 2.10 RECESSION IMPACT ANALYSIS

3 EXECUTIVE SUMMARY

- FIGURE 8 GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 9 GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 10 GLYCATED ALBUMIN ASSAY MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

4 PREMIUM INSIGHTS

- 4.1 GLYCATED ALBUMIN ASSAY MARKET OVERVIEW

- FIGURE 11 INCREASING PREVALENCE OF DIABETES TO DRIVE MARKET

- 4.2 GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2023 VS. 2028

- FIGURE 12 TYPE 2 DIABETES SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.3 GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2023 VS. 2028

- FIGURE 13 HOSPITALS AND DIABETIC CARE CENTERS SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- 4.4 GLYCATED ALBUMIN ASSAY MARKET: GEOGRAPHICAL GROWTH OPPORTUNITIES

- FIGURE 14 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- FIGURE 15 GLYCATED ALBUMIN ASSAY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- 5.2.1 DRIVERS

- 5.2.1.1 Rising incidence of diabetes

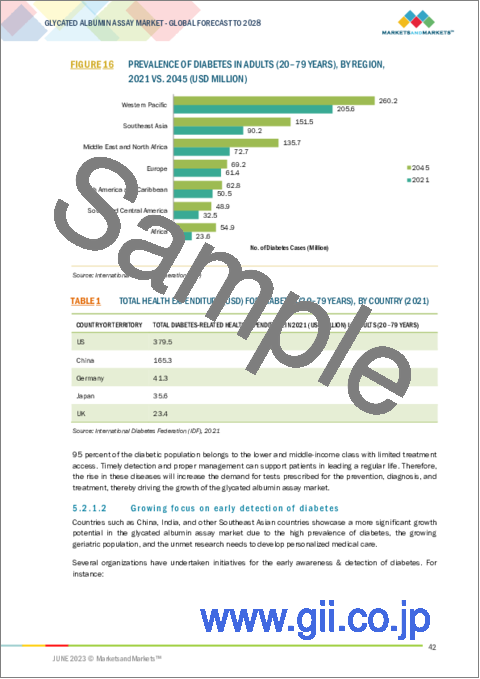

- FIGURE 16 PREVALENCE OF DIABETES IN ADULTS (20-79 YEARS), BY REGION, 2021 VS. 2045 (USD MILLION)

- TABLE 1 TOTAL HEALTH EXPENDITURE (USD) FOR DIABETES (20-79 YEARS), BY COUNTRY (2021)

- 5.2.1.2 Growing focus on early detection of diabetes

- 5.2.1.3 Increase in age-associated diabetic ailments

- 5.2.2 RESTRAINTS

- 5.2.2.1 Unfavorable reimbursement scenario

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising investments in life sciences research

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent regulatory requirements for diagnostic products

- 5.2.4.2 Presence of alternative tests

- 5.3 PRICING ANALYSIS

- TABLE 2 AVERAGE SELLING PRICE OF GLYCATED ALBUMIN ASSAY PRODUCTS

- 5.4 PATENT ANALYSIS

- FIGURE 17 PATENT ANALYSIS FOR GLYCATED ALBUMIN ASSAYS (JANUARY 2013-DECEMBER 2022)

- 5.4.1 GLYCATED ALBUMIN ASSAY MARKET: LIST OF MAJOR PATENTS

- 5.5 VALUE CHAIN ANALYSIS

- FIGURE 18 GLYCATED ALBUMIN ASSAY MARKET: MAJOR VALUE IS ADDED DURING MANUFACTURING & ASSEMBLY PHASES

- 5.6 SUPPLY CHAIN ANALYSIS

- FIGURE 19 GLYCATED ALBUMIN ASSAY MARKET: SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- FIGURE 20 GLYCATED ALBUMIN ASSAY MARKET: ECOSYSTEM MAP

- 5.7.1 GLYCATED ALBUMIN ASSAY MARKET: ECOSYSTEM ROLE

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- TABLE 3 GLYCATED ALBUMIN ASSAY MARKET: PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 BARGAINING POWER OF SUPPLIERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 REGULATORY LANDSCAPE

- TABLE 4 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 MIDDLE EAST: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.1 NORTH AMERICA

- 5.9.1.1 US

- 5.9.1.2 Canada

- 5.9.2 EUROPE

- TABLE 8 EUROPE: CLASSIFICATION OF DEVICES

- 5.9.3 ASIA PACIFIC

- 5.9.3.1 China

- 5.9.3.2 Japan

- 5.9.3.3 India

- 5.9.4 LATIN AMERICA

- 5.9.4.1 Brazil

- 5.9.4.2 Mexico

- 5.9.5 MIDDLE EAST

- 5.9.6 AFRICA

- 5.10 TRADE ANALYSIS

- 5.10.1 TRADE ANALYSIS FOR DIAGNOSTIC AND LABORATORY REAGENTS

- 5.10.1.1 Import data for diagnostic and laboratory reagents, by country, 2018-2022 (USD million)

- 5.10.1.2 Export data for diagnostic and laboratory reagents, by country, 2018-2022 (USD million)

- 5.10.1 TRADE ANALYSIS FOR DIAGNOSTIC AND LABORATORY REAGENTS

- 5.11 TECHNOLOGY ANALYSIS

- 5.12 KEY CONFERENCES AND EVENTS

- TABLE 9 DETAILED LIST OF CONFERENCES AND EVENTS (2022-2023)

- 5.13 PESTLE ANALYSIS

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- FIGURE 21 GLYCATED ALBUMIN ASSAY MARKET: REVENUE SHIFT MAPPING

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR GLYCATED ALBUMIN ASSAYS

- TABLE 10 GLYCATED ALBUMIN ASSAY MARKET: INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- 5.15.2 BUYING CRITERIA

- FIGURE 23 GLYCATED ALBUMIN ASSAY MARKET: KEY BUYING CRITERIA

- TABLE 11 KEY BUYING CRITERIA FOR GLYCATED ALBUMIN ASSAYS, BY END USER

- 5.16 CASE STUDY ANALYSIS

- FIGURE 24 CASE STUDY ANALYSIS: MARKET ASSESSMENT AND CONSUMER BUYING BEHAVIOR IN INDIA

6 GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION

- 6.1 INTRODUCTION

- TABLE 12 GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- 6.2 TYPE 2 DIABETES

- 6.2.1 DIETARY AND LIFESTYLE CHANGES TO CONTRIBUTE TO MARKET GROWTH

- TABLE 13 GLYCATED ALBUMIN ASSAY MARKET FOR TYPE 2 DIABETES, BY REGION, 2021-2028 (USD MILLION)

- 6.3 PREDIABETES

- 6.3.1 INSULIN RESISTANCE AND RISING CASES OF PREDIABETES TO DRIVE MARKET

- TABLE 14 GLYCATED ALBUMIN ASSAY MARKET FOR PREDIABETES, BY REGION, 2021-2028 (USD MILLION)

- 6.4 TYPE 1 DIABETES

- 6.4.1 INCREASING INCIDENCE AMONG CHILDREN AND ADOLESCENTS TO SUPPORT MARKET GROWTH

- TABLE 15 INCIDENCE OF TYPE 1 DIABETES IN CHILDREN AND ADOLESCENTS AGED 0 TO 19, BY REGION, 2021 (THOUSANDS)

- TABLE 16 GLYCATED ALBUMIN ASSAY MARKET FOR TYPE 1 DIABETES, BY REGION, 2021-2028 (USD MILLION)

7 GLYCATED ALBUMIN ASSAY MARKET, BY END USER

- 7.1 INTRODUCTION

- TABLE 17 GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 7.2 HOSPITALS AND DIABETES CARE CENTERS

- 7.2.1 ABILITY TO OFFER RAPID RESULTS IN ACCESSIBLE SETTING TO DRIVE MARKET

- TABLE 18 GLYCATED ALBUMIN ASSAY MARKET FOR HOSPITALS AND DIABETES CARE CENTERS, BY REGION, 2021-2028 (USD MILLION)

- 7.3 DIAGNOSTIC LABORATORIES

- 7.3.1 RISING OUTSOURCING OF RESEARCH ACTIVITIES FOR COST REDUCTION TO DRIVE MARKET

- TABLE 19 GLYCATED ALBUMIN ASSAY MARKET FOR DIAGNOSTIC LABORATORIES, BY REGION, 2021-2028 (USD MILLION)

- 7.4 OTHER END USERS

- TABLE 20 GLYCATED ALBUMIN ASSAY MARKET FOR OTHER END USERS, BY REGION, 2021-2028 (USD MILLION)

8 GLYCATED ALBUMIN ASSAY MARKET, BY REGION

- 8.1 INTRODUCTION

- TABLE 21 GLYCATED ALBUMIN ASSAY MARKET, BY REGION, 2021-2028 (USD MILLION)

- 8.2 NORTH AMERICA

- FIGURE 25 NORTH AMERICA: GLYCATED ALBUMIN ASSAY MARKET SNAPSHOT

- TABLE 22 NORTH AMERICA: GLYCATED ALBUMIN ASSAY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 23 NORTH AMERICA: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 24 NORTH AMERICA: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.2.1 US

- 8.2.1.1 High healthcare expenditure for diabetes treatment & diagnosis to drive market

- TABLE 25 US: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 26 US: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.2.2 CANADA

- 8.2.2.1 Rising awareness of early diabetes detection to support market growth

- TABLE 27 INCIDENCE OF DIABETES IN CANADA, 2019 VS. 2029

- TABLE 28 CANADA: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 29 CANADA: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.2.3 NORTH AMERICA: RECESSION IMPACT

- 8.3 EUROPE

- TABLE 30 PREVALENCE OF DIABETES IN EUROPE, 2021 VS. 2045

- TABLE 31 EUROPE: GLYCATED ALBUMIN ASSAY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 32 EUROPE: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 33 EUROPE: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.3.1 GERMANY

- 8.3.1.1 Provision of healthcare coverage for technologically advanced assays to drive market

- TABLE 34 GERMANY: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 35 GERMANY: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.3.2 UK

- 8.3.2.1 Rising geriatric population and diabetes-associated ailments to drive market

- TABLE 36 UK: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 37 UK: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.3.3 FRANCE

- 8.3.3.1 Increasing R&D expenditure for product commercialization to drive market

- TABLE 38 FRANCE: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 39 FRANCE: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.3.4 ITALY

- 8.3.4.1 Improvements in healthcare infrastructure to support market growth

- TABLE 40 ITALY: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 41 ITALY: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.3.5 SPAIN

- 8.3.5.1 Rising incidence of diabetes among senior women to support market growth

- TABLE 42 SPAIN: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 43 SPAIN: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.3.6 REST OF EUROPE

- TABLE 44 REST OF EUROPE: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 45 REST OF EUROPE: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.3.7 EUROPE: RECESSION IMPACT

- 8.4 ASIA PACIFIC

- FIGURE 26 ASIA PACIFIC: GLYCATED ALBUMIN ASSAY MARKET SNAPSHOT

- TABLE 46 ASIA PACIFIC: GLYCATED ALBUMIN ASSAY MARKET, BY COUNTRY, 2021-2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 48 ASIA PACIFIC: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.4.1 CHINA

- 8.4.1.1 Improving healthcare infrastructure to propel market

- TABLE 49 CHINA: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 50 CHINA: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.4.2 JAPAN

- 8.4.2.1 Universal healthcare reimbursement policy to support market growth

- TABLE 51 JAPAN: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 52 JAPAN: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.4.3 INDIA

- 8.4.3.1 implementation of favorable government initiatives to drive market

- TABLE 53 INDIA: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 54 INDIA: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.4.4 REST OF ASIA PACIFIC

- TABLE 55 REST OF ASIA PACIFIC: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 56 REST OF ASIA PACIFIC: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.4.5 ASIA PACIFIC: RECESSION IMPACT

- 8.5 LATIN AMERICA

- 8.5.1 RISING GOVERNMENT-FUNDED PROGRAMS FOR ACCURATE AND EARLY DISEASE DIAGNOSIS TO DRIVE MARKET

- TABLE 57 LATIN AMERICA: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 58 LATIN AMERICA: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.5.2 LATIN AMERICA: RECESSION IMPACT

- 8.6 MIDDLE EAST & AFRICA

- 8.6.1 EXPANSION OF KEY MARKET PLAYERS TO SUPPORT MARKET GROWTH

- TABLE 59 MIDDLE EAST & AFRICA: GLYCATED ALBUMIN ASSAY MARKET, BY APPLICATION, 2021-2028 (USD MILLION)

- TABLE 60 MIDDLE EAST & AFRICA: GLYCATED ALBUMIN ASSAY MARKET, BY END USER, 2021-2028 (USD MILLION)

- 8.6.2 MIDDLE EAST & AFRICA: RECESSION IMPACT

9 COMPETITIVE LANDSCAPE

- 9.1 OVERVIEW

- 9.2 REVENUE SHARE ANALYSIS OF LEADING MARKET PLAYERS

- FIGURE 27 GLYCATED ALBUMIN ASSAY MARKET: REVENUE SHARE ANALYSIS

- 9.3 MARKET SHARE ANALYSIS

- 9.3.1 GLYCATED ALBUMIN ASSAY MARKET

- FIGURE 28 GLYCATED ALBUMIN ASSAY MARKET SHARE, BY KEY PLAYER (2022)

- TABLE 61 GLYCATED ALBUMIN ASSAY MARKET: INTENSITY OF COMPETITIVE RIVALRY

- 9.4 GLYCATED ALBUMIN ASSAY MARKET: COMPANY EVALUATION MATRIX

- 9.4.1 STARS

- 9.4.2 EMERGING LEADERS

- 9.4.3 PERVASIVE PLAYERS

- 9.4.4 PARTICIPANTS

- FIGURE 29 GLYCATED ALBUMIN ASSAY MARKET: COMPANY EVALUATION MATRIX (2022)

- 9.5 GLYCATED ALBUMIN ASSAY MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)

- 9.5.1 PROGRESSIVE COMPANIES

- 9.5.2 STARTING BLOCKS

- 9.5.3 RESPONSIVE COMPANIES

- 9.5.4 DYNAMIC COMPANIES

- FIGURE 30 GLYCATED ALBUMIN ASSAY MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS/SMES (2022)

- 9.6 COMPETITIVE BENCHMARKING

- 9.6.1 PRODUCT AND REGIONAL FOOTPRINT ANALYSIS

- FIGURE 31 GLYCATED ALBUMIN ASSAY MARKET: PRODUCT AND REGIONAL FOOTPRINT ANALYSIS

- TABLE 62 GLYCATED ALBUMIN ASSAY MARKET: COMPETITIVE EVALUATION OF KEY PLAYERS

- TABLE 63 GLYCATED ALBUMIN ASSAY MARKET: COMPANY PRODUCT FOOTPRINT

- TABLE 64 GLYCATED ALBUMIN ASSAY MARKET: COMPANY REGIONAL FOOTPRINT

10 COMPANY PROFILES

- (Business overview, Products offered, Recent Developments, MNM view)**

- 10.1 KEY PLAYERS

- 10.1.1 ASAHI KASEI CORPORATION

- TABLE 65 ASAHI KASEI CORPORATION: BUSINESS OVERVIEW

- FIGURE 32 ASAHI KASEI CORPORATION: COMPANY SNAPSHOT (2022)

- 10.1.2 BEIJING STRONG BIOTECHNOLOGIES, INC.

- TABLE 66 BEIJING STRONG BIOTECHNOLOGIES, INC.: BUSINESS OVERVIEW

- FIGURE 33 BEIJING STRONG BIOTECHNOLOGIES, INC.: COMPANY SNAPSHOT (2022)

- 10.1.3 DIAZYME LABORATORIES, INC.

- TABLE 67 DIAZYME LABORATORIES, INC.: COMPANY OVERVIEW

- 10.1.4 DXGEN CORP.

- TABLE 68 DXGEN CORP: COMPANY OVERVIEW

- 10.1.5 WELDON BIOTECH, INC.

- TABLE 69 WELDON BIOTECH, INC.: COMPANY OVERVIEW

- 10.1.6 HZYMES BIOTECH

- TABLE 70 HZYMES BIOTECH: COMPANY OVERVIEW

- *Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

11 APPENDIX

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS